Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SECOND SIGHT MEDICAL PRODUCTS INC | s102684_8k.htm |

Exhibit 99.1

NASDAQ: EYES Investor Presentation 2016 NASDAQ: EYES

NASDAQ: EYES Forward Looking Statements This presentation contains certain forward - looking information about Second Sight that is intended to be covered by the safe harbor for "forward - looking statements" provided by the Private Securities Litigation Reform Act of 1995, as amended. Forward - looking statements are statements that are not historical facts. Words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” “strong,” “up coming,” and similar expressions are intended to identify forward - looking statements. These statements include, but are not limited to, statements regarding our ability to successfully develop and commercialize our products; our ability to expand our long - term business opportunities; financial projections and estimates and their underlying assumptions; and future performance. In this document, we refer to information regarding potential markets for products and other industry data. We believe that all such information has been obtained from reliable sources that are customarily relied upon by companies in our industry. However, we have not independently verified any such information. Forward - looking statements may address the following subjects among others: expected products, applications, customers, technologies and performance, coverage and insurance reimbursements, results of clinical studies, success of research and development and our expectations concerning our business strategy. Forward - looking statements involve inherent risks and uncertainties which could cause actual results to differ materially from those in the forward - looking statements, as a result of various factors including those risks and uncertainties referred to in the Risk Factors and in Management's Discussion and Analysis of Financial Condition and Results of Operations sections of our Annual Report on Form 10 - K as filed on March 17, 2015 and our other reports filed from time to time with the Securities and Exchange Commission. The audience is cautioned not to place undue reliance on these forward - looking statements that speak only as of the date hereof, and we do not undertake any obligation to revise and disseminate forward - looking statements to reflect events or circumstances after the date hereof, or to reflect the occurrence of or non - occurrence of any events. 2

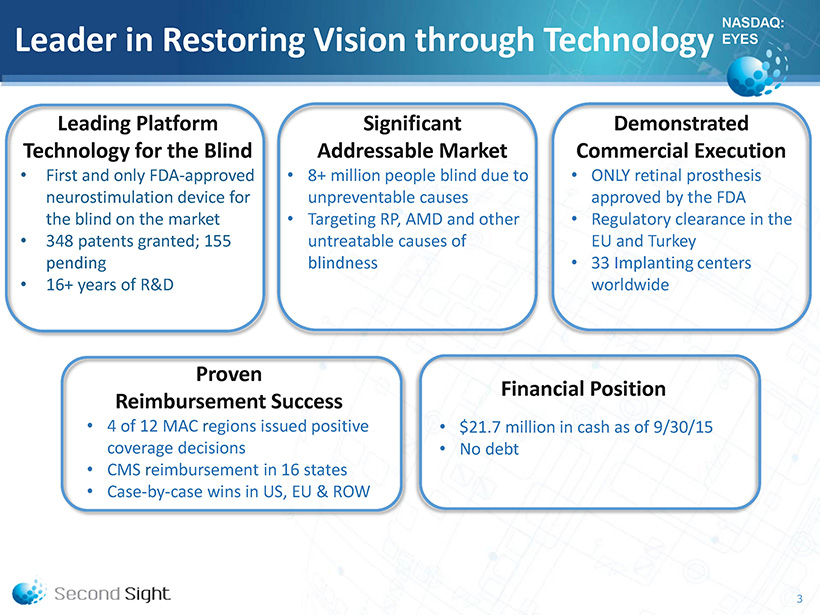

NASDAQ: EYES Leader in Restoring Vision through Technology 3 Leading Platform Technology for the Blind • First and only FDA - approved neurostimulation device for the blind on the market • 348 patents granted; 155 pending • 16+ years of R&D Significant Addressable Market • 8+ million people blind due to unpreventable causes • Targeting RP, AMD and other untreatable causes of blindness Demonstrated Commercial Execution • ONLY retinal prosthesis approved by the FDA • Regulatory clearance in the EU and Turkey • 33 I mplanting centers worldwide Proven Reimbursement Success • 4 of 12 MAC regions issued positive coverage decisions • CMS r eimbursement in 16 states • Case - by - case wins in US, EU & ROW Financial Position • $21.7 million in cash as of 9/30/15 • No debt

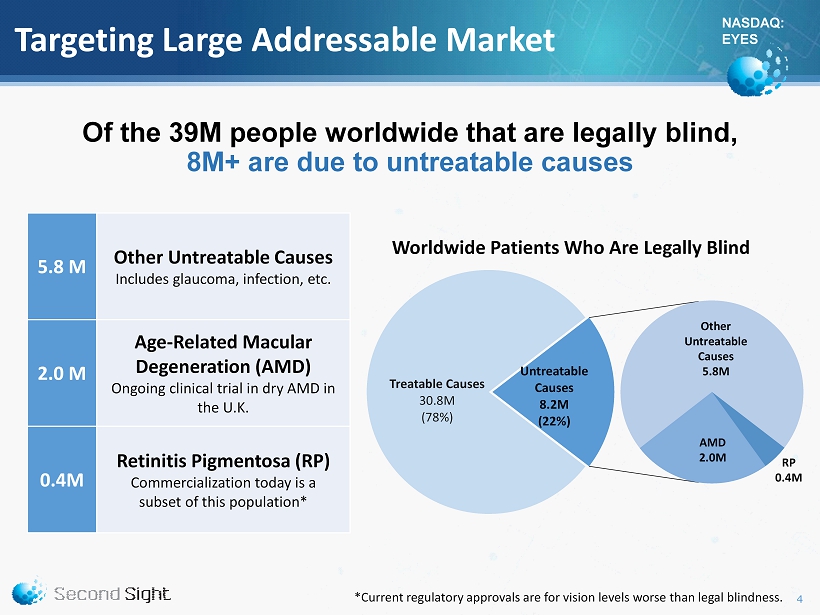

NASDAQ: EYES Targeting Large Addressable Market Of the 39M people worldwide that are legally blind, 8M+ are due to untreatable causes 4 Treatable Causes 30.8M (78%) Untreatable Causes 8.2M (22%) Worldwide Patients Who Are Legally Blind RP 0.4M Other Untreatable Causes 5.8M AMD 2.0M 5.8 M Other Untreatable Causes Includes glaucoma, infection, etc. 2.0 M Age - Related Macular Degeneration (AMD) Ongoing clinical trial in dry AMD in the U.K. 0.4M Retinitis Pigmentosa (RP) Commercialization today is a subset of this population* *Current regulatory approvals are for vision levels worse than legal blindness.

NASDAQ: EYES 16+ years of R&D 170+ implants since 2002 Argus® II – Restoring Useful Vision Key Benefits: » Improved orientation and mobility » Enhanced connection to surroundings » Improved Quality of Life » Enhanced ability to perform daily activities 5 http://www.bloomberg.com/news/videos/2015 - 05 - 21/bionic - eyes - give - second - sight - to - the - blind

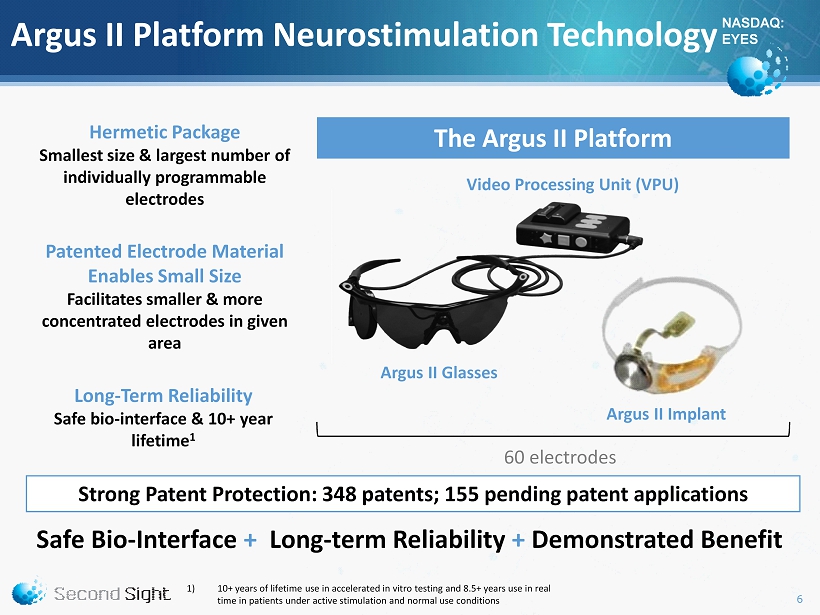

NASDAQ: EYES 60 electrodes Argus II Platform Neurostimulation Technology Hermetic Package Smallest size & largest number of individually programmable electrodes Patented Electrode Material Enables Small Size Facilitates smaller & more concentrated electrodes in given area Long - Term Reliability Safe bio - interface & 10+ year lifetime 1 Safe Bio - Interface + Long - term Reliability + Demonstrated Benefit Argus II Implant Video Processing Unit (VPU) Argus II Glasses The Argus II Platform 1) 10+ years of lifetime use in accelerated in vitro testing and 8.5+ years use in real time in patients under active stimulation and normal use conditions Strong Patent Protection: 348 patents; 155 pending patent applications 6

NASDAQ: EYES Major Awards & Recognition 7

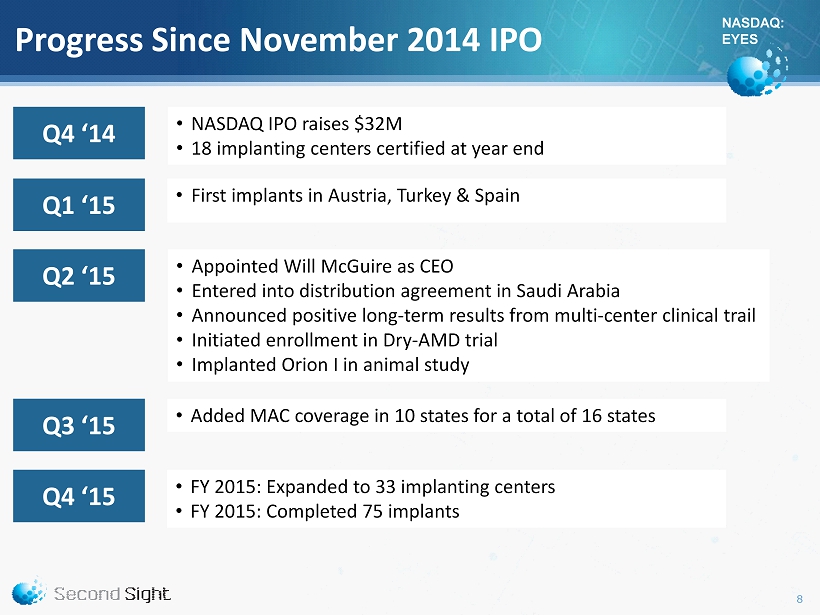

NASDAQ: EYES Progress Since November 2014 IPO • NASDAQ IPO raises $32M • 18 implanting centers certified at year end • FY 2015: Expanded to 33 implanting centers • FY 2015: Completed 75 implants • Added MAC coverage in 10 states for a total of 16 states • Appointed Will McGuire as CEO • Entered into distribution agreement in Saudi Arabia • Announced positive long - term results from multi - center clinical trail • Initiated enrollment in Dry - AMD trial • Implanted Orion I in animal study 8 • First implants in Austria, Turkey & Spain Q4 ‘14 Q1 ‘15 Q2 ‘15 Q3 ‘15 Q4 ‘15

NASDAQ: EYES Our Strategy Grow Commercial Footprint & Expand Reimbursement Coverage Enhance Argus II Technology Enter AMD Market Expand into Direct Cortical Stimulation Build organizational foundation supporting operational excellence and sustained long - term growth Goal : 9

NASDAQ: EYES Growing Commercial Footprint • 33 centers of excellence worldwide • Direct sales: 9 field sales reps & clinical specialists • Distribution partners: Spain, Turkey, Saudi Arabia & Argentina • New markets under consideration in Asia/Pacific & Latin America North America 15 Centers ROW 18 Centers Add new centers where we have established reimbursement Goal : 10

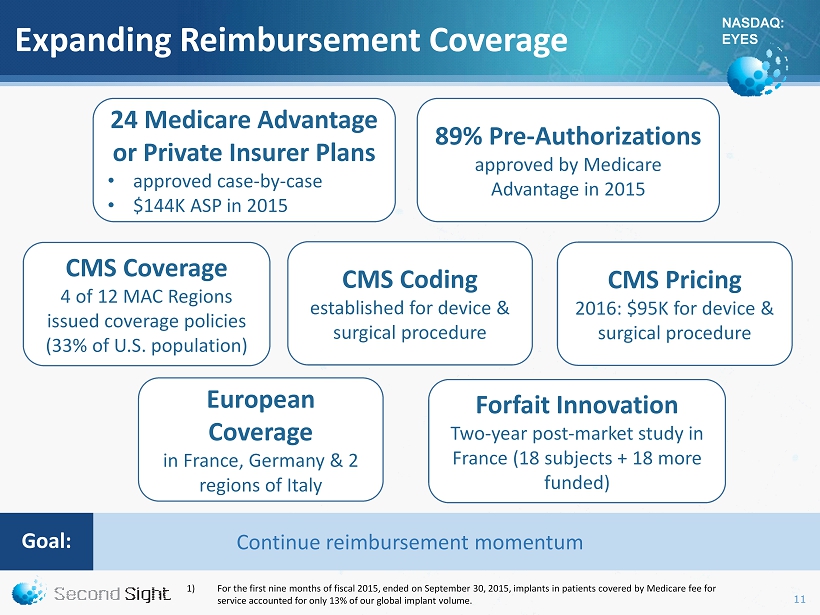

NASDAQ: EYES Expanding Reimbursement Coverage CMS Coverage 4 of 12 MAC Regions issued coverage policies (33% of U.S. population) 89% Pre - Authorizations approved by Medicare Advantage in 2015 24 Medicare Advantage or Private I nsurer Plans • approved case - by - case • $144K ASP in 2015 CMS Pricing 2016: $95K for device & surgical procedure CMS Coding established for device & surgical procedure Forfait Innovation Two - year post - market study in France (18 subjects + 18 more funded) European Coverage i n France, Germany & 2 regions of Italy 1) For the first nine months of fiscal 2015, ended on September 30, 2015, implants in patients covered by Medicare fee for service accounted for only 13 % of our global implant volume. Continue reimbursement momentum Goal : 11

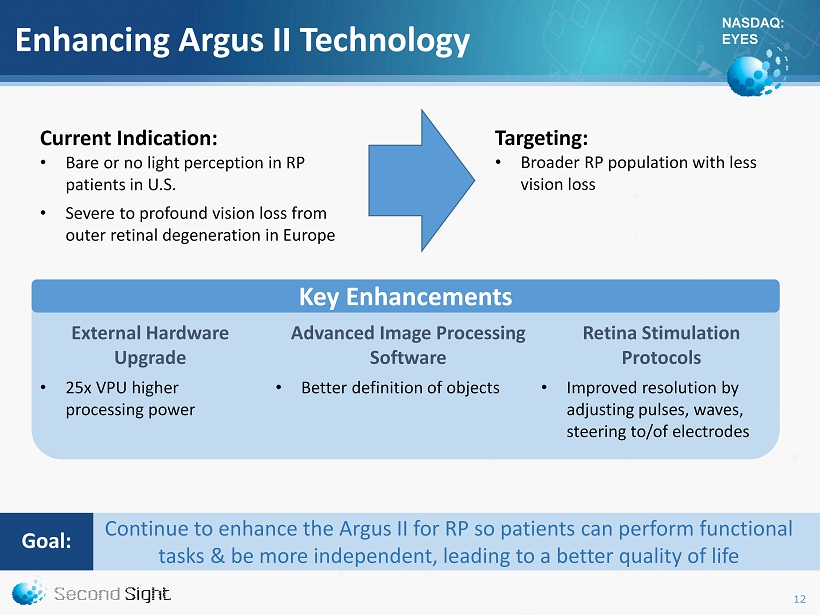

NASDAQ: EYES Enhancing Argus II Technology Current Indication: • Bare or no light perception in RP patients in U.S. • Severe to profound vision loss from outer retinal degeneration in Europe External Hardware Upgrade • 25x VPU higher processing power Advanced Image Processing Software • Better definition of objects Retina Stimulation Protocols • Improved resolution by adjusting pulses, waves, steering to/of electrodes Targeting: • Broader RP population with less vision loss Key Enhancements Continue to enhance the Argus II for RP so patients can perform functional tasks & be more independent, leading to a better quality of life Goal : 12

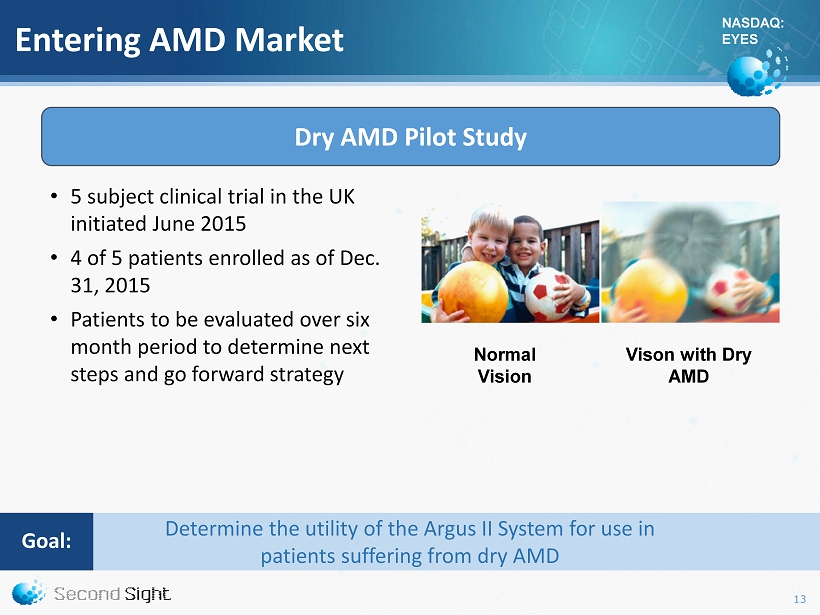

NASDAQ: EYES Entering AMD Market • 5 subject clinical trial in the UK initiated June 2015 • 4 of 5 patients enrolled as of Dec. 31, 2015 • Patients to be evaluated over six month period to determine next steps and go forward strategy 13 Dry AMD Pilot Study Normal Vision Vison with Dry AMD Determine the utility of the Argus II System for use in patients suffering from dry AMD Goal :

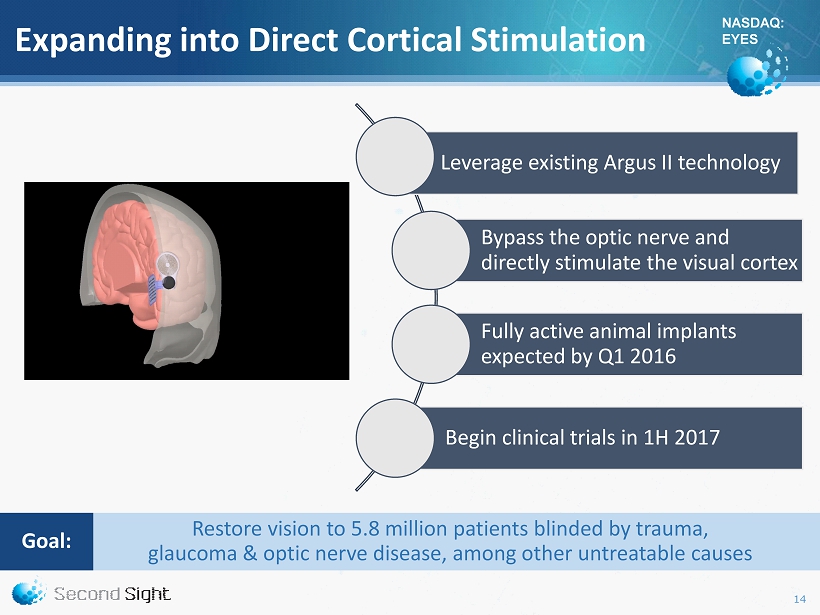

NASDAQ: EYES Expanding into Direct Cortical Stimulation 14 Leverage existing Argus II technology Bypass the optic nerve and directly stimulate the visual cortex Fully active animal implants expected by Q1 2016 Begin clinical trials in 1H 2017 Restore vision to 5.8 million patients blinded by trauma , glaucoma & optic nerve disease, among other untreatable causes Goal :

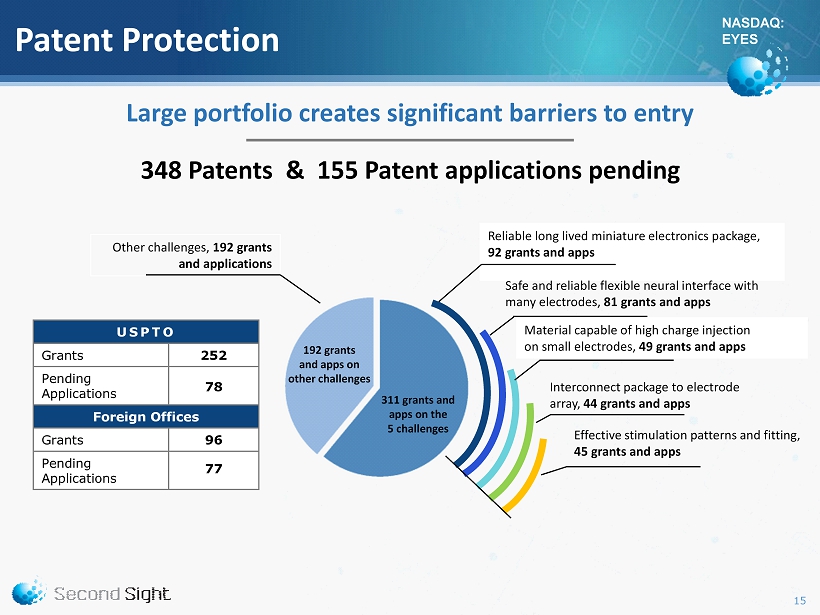

NASDAQ: EYES Patent Protection Other challenges, 192 grants and applications Reliable long lived miniature electronics package, 92 grants and apps Safe and reliable flexible neural interface with many electrodes, 81 grants and apps Interconnect package to electrode array, 44 grants and apps Material capable of high charge injection on small electrodes, 49 grants and apps Effective stimulation patterns and fitting, 45 grants and apps USPTO Grants 252 Pending Applications 78 Foreign Offices Grants 96 Pending Applications 77 Large portfolio creates significant barriers to entry 192 grants a nd apps on other challenges 311 grants and apps on the 5 challenges 15 348 Patents & 155 Patent applications pending

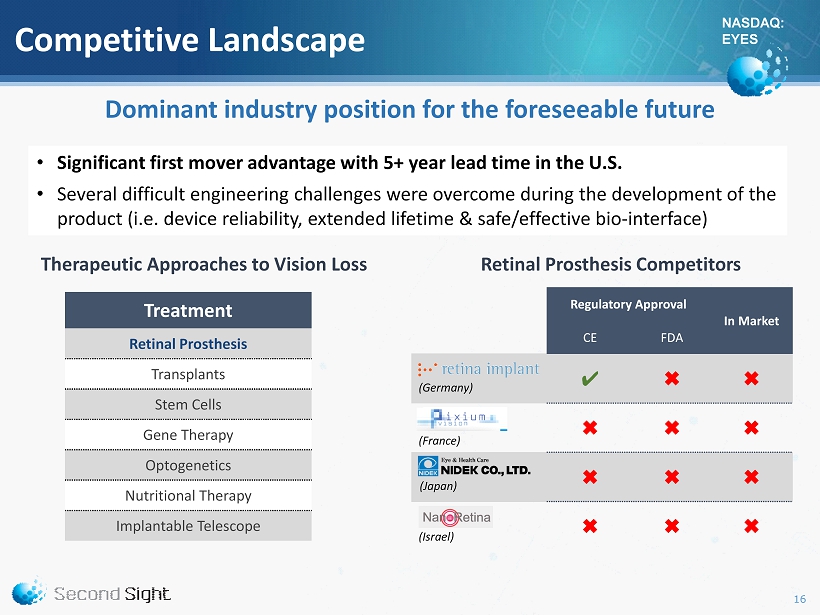

NASDAQ: EYES Competitive Landscape Regulatory Approval In Market CE FDA ✔ ✖ ✖ ✖ ✖ ✖ ✖ ✖ ✖ ✖ ✖ ✖ Dominant industry position for the foreseeable future (Germany) (France) (Japan) (Israel) Therapeutic Approaches to Vision Loss • Significant first mover advantage with 5 + year lead time in the U.S. • Several difficult engineering challenges were overcome during the development of the product (i.e. device reliability, extended lifetime & safe/effective bio - interface) Retinal Prosthesis Competitors Treatment Retinal Prosthesis Transplants Stem Cells Gene Therapy Optogenetics Nutritional Therapy Implantable Telescope 16

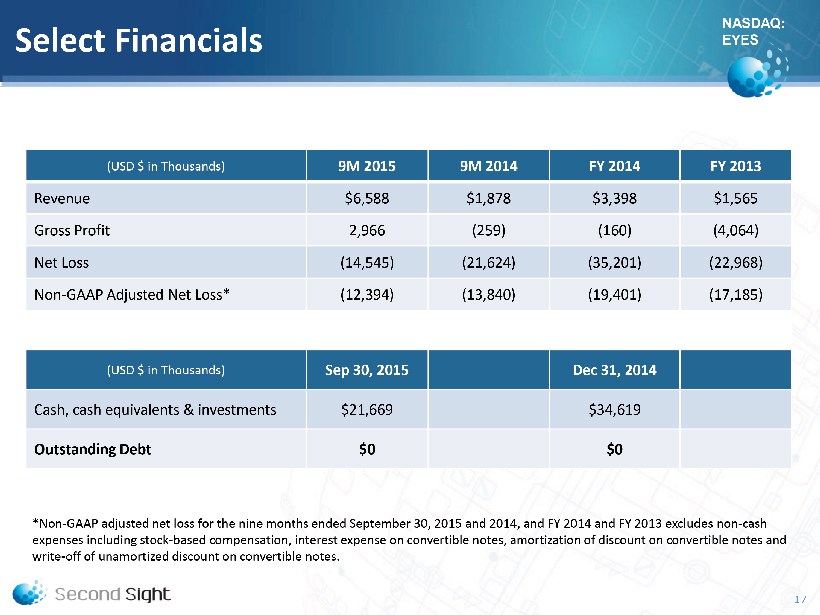

NASDAQ: EYES Select Financials (USD $ in Thousands) 9M 2015 9M 2014 FY 2014 FY 2013 Revenue $6,588 $1,878 $3,398 $1,565 Gross Profit 2,966 (259) (160) (4,064) Net L oss (14,545) (21,624) (35,201) (22,968) Non - GAAP Adjusted Net Loss* (12,394) (13,840) (19,401) (17,185) (USD $ in Thousands) Sep 30, 2015 Dec 31, 2014 Cash, cash equivalents & investments $21,669 $34,619 Outstanding Debt $0 $0 *Non - GAAP adjusted net loss for the nine months ended September 30 , 2015 and 2014, and FY 2014 and FY 2013 excludes non - cash expenses including stock - based compensation, interest expense on convertible notes, amortization of discount on convertible notes and write - off of unamortized discount on convertible notes. 17

NASDAQ: EYES Investment Highlights • First mover advantage with leading Argus II platform technology to restore vision to the blind • Only U.S. FDA approved retinal prosthesis • 33 implanting centers & 170+ implants worldwide • Successful execution of reimbursement strategy in U.S. & Europe • Targeting significant addressable market of 8M+ people • Securing our market leading position with strong patent protection • Financial flexibility to execute strategic objectives (strong balance sheet & no debt) 18

NASDAQ: EYES Retail Investor Relations Matt Hayden Chairman MZ North America Direct: 949 - 259 - 4986 Matt.Hayden@mzgroup.us Second Sight Medical Products, Inc. 12744 San Fernando Road Suite 400 Sylmar, CA 91342 Main: 818 - 833 - 5000 www.secondsight.com Institutional Investor Relations Lisa Wilson President In - Site Communications, Inc. Direct: 212 - 452 - 2793 lwilson@insitecony.com Contact Robert Greenberg Chairman Direct: 818 - 833 - 5050 bob@secondsight.com 19