Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - SECOND SIGHT MEDICAL PRODUCTS INC | s100869_ex31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - SECOND SIGHT MEDICAL PRODUCTS INC | s100869_ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - SECOND SIGHT MEDICAL PRODUCTS INC | s100869_ex32-1.htm |

| EX-21.1 - EXHIBIT 21.1 - SECOND SIGHT MEDICAL PRODUCTS INC | s100869_ex21-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_____________________________________

FORM 10-K

_____________________________________

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2014

OR

£ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________

Commission File Number 333-198073

_____________________________________

Second Sight Medical Products,

Inc.

(Exact name of

Registrant as specified in its charter)

_____________________________________

|

California |

02-0692322 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

12744

San Fernando Road, Building 3, Sylmar, CA

91342

(Address of

principal executive offices, including zip code)

Registrant’s telephone number, including area code: (818) 833-5000

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Each Exchange on Which Registered |

|

Common Stock, without par value |

|

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes £ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes £ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No £

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes x No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer £ |

Accelerated filer £ |

Non-accelerated filer x |

Smaller reporting company £ |

|

(Do not check if a smaller reporting company) |

|||

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes £ No x

As of June 30, 2014, the last business day of the registrant’s most recently completed second quarter, the registrant’s common shares were not publicly traded. The aggregate market value of the common shares held by non-affiliates of the registrant (treating all executive officers and directors of the registrant and holders of 10% or more of the common shares outstanding, for this purpose, as if they may be affiliates of the registrant) was approximately $131,172,000 on December 31, 2014, based on a closing price of $10.26 per common share as reported on the NASDAQ Exchange on such date.

As of March 13, 2015, the number of shares of the Registrant’s common stock outstanding was 35,339,994.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Proxy Statement for the 2015 Annual Meeting of Stockholders are incorporated herein by reference in Part III of this Annual Report on Form 10-K to the extent stated herein. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant's fiscal year ended December 31, 2014.

SECOND SIGHT MEDICAL PRODUCTS INC.

FORM 10-K

TABLE OF CONTENTS

|

|

|

Page |

|

|

|

|

|

|

|

|

|

Item 1. |

1 |

|

|

Item 1A. |

21 |

|

|

Item 1B. |

37 |

|

|

Item 2. |

37 |

|

|

Item 3. |

37 |

|

|

Item 4. |

37 |

|

|

|

|

|

|

PART II |

||

|

|

|

|

|

Item 5. |

37 |

|

|

Item 6. |

38 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

39 |

|

Item 7A. |

49 |

|

|

Item 8. |

50 |

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

50 |

|

Item 9A. |

50 |

|

|

Item 9B. |

51 |

|

|

|

|

|

|

|

|

|

|

Item 10. |

51 |

|

|

Item 11. |

51 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters |

51 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

51 |

|

Item 14. |

52 |

|

|

|

|

|

|

|

|

|

|

Item 15. |

52 |

|

|

|

|

|

|

53 |

||

i

Overview

Second Sight Medical Products, Inc. is a medical device company that develops, manufactures and markets implantable visual prosthetics to restore some functional vision to blind patients. Our current product, the Argus® II System, treats outer retinal degenerations, such as retinitis pigmentosa, which we refer to as RP in this Form 10-K. RP is a hereditary disease, affecting an estimated 1.5 million people worldwide including about 100,000 people in the United States, that causes a progressive degeneration of the light-sensitive cells of the retina, leading to significant visual impairment and ultimately blindness. The Argus II System is the only retinal prosthesis approved in the United States by the Food and Drug Administration, or FDA, and the first approved retinal prosthesis in the world. By restoring some functional vision in patients who otherwise have total sight loss, the Argus II System can provide benefits which include:

• improving patients’ orientation and mobility, such as locating doors and windows, avoiding obstacles, and seeing the lines of a crosswalk,

• allowing patients to feel more connected with people in their surroundings, such as seeing when someone is approaching or moving away,

• providing patients with enjoyment from being “visual” again, such as locating the moon, tracking groups of players as they move around a field, and watching the moving streams of lights from fireworks, and

• improving patients’ well-being and ability to perform activities of daily living.

The Argus II System provides an artificial form of vision that differs from the vision that normally sighted people have. It does not restore normal vision and it does not slow or reverse the progression of the disease. Results vary among patients. While the majority of patients receive a benefit from the Argus II, some patients report receiving little or no benefit.

Our Company

We were founded in 1998 with the mission to develop, manufacture, and market implantable prosthetic devices that can restore sight to the blind. In 2002, we began a clinical trial of our proof-of-concept device, the Argus I retinal prosthesis, at the University of Southern California. Six human subjects were implanted with the Argus I retinal prosthesis in a study that was designed to demonstrate the feasibility and safety of long-term electrical stimulation of the retina and its ability to restore some functional vision. By 2006, we developed a second generation device, the Argus II Retinal Prosthesis System that, among other attributes, is smaller, has more stimulating electrodes, and is easier to install surgically than the Argus I retinal prosthesis. In that year, we conducted a small pilot study in Mexico, and we utilized data from this pilot study to obtain FDA approval to begin an Investigational Device Exemption (IDE) clinical trial at six hospitals in the US during 2007. In 2008 we expanded the trial to include sites in three European countries. We completed enrollment for this study in August 2009. Based on the long-term results of this study, which demonstrated the benefits of Argus II System, we obtained CE Mark approval in EU in February 2011, and FDA marketing approval, under a Humanitarian Device Exemption, in February 2013. To our knowledge the Argus II System currently is the only retinal prosthesis to be commercialized anywhere in the world and currently is the only such product to obtain FDA marketing approval in the US.

Currently, after more than 15 years of research and development, more than $130 million of investment and over $29 million of direct federal grants received in support of our technology development, we employ over 100 people in the development (engineering and clinical), manufacture, and commercialization of the Argus II System and future products.

Our Markets

Second Sight is the global leader in vision restoration to the blind. We believe that our competitive advantage and ability to maintain market share in the future will be bolstered by the following:

• We have extensive IP, or intellectual property, protection that covers every major aspect of the technology we have developed. We have over 300 granted patents and over 170 patent applications on a worldwide basis. We believe that

1

our IP and our technical approach, which does not rely on light getting to the implant, will result in a device that can deliver cortical stimulation to the brain. Subject to additional research and development, this IP and technology may result in a device that can treat nearly all forms of blindness.

• We have regulatory leadership in that, to our knowledge, we currently possess the only device that is both FDA approved and CE-marked to restore some functional vision to individuals who are or will become blind as a result of RP.

• We continue to achieve meaningful reimbursement levels for the Argus II System in the US and some European countries. We are currently working to expand the number of countries that reimburse us for the Argus II System.

• We plan to offer periodic software upgrades to enhance our customers’ experience, which arise from our strong engineering, research and clinical programs. We plan to offer the next upgrade in late 2016.

• We expect to expand the numbers of eligible blind persons who will benefit from the Argus II System through additional clinical trials, to treat patients blinded age-related macular degeneration (or AMD). Recruitment for this study began in December 2014 and we plan to begin implanting in the study in the first half of 2015.

• We intend to develop a new device, the Orion I visual prosthesis, over approximately the next 24 months that we expect may favorably address almost all other forms of blindness.

During clinical studies the Argus II System generally demonstrated clear and significant improvement in visual function both in the clinic and in patient’s daily lives. Based on these data, the Argus II Retinal Prosthesis System has been approved for marketing in Europe, the US, Canada, Turkey, and at one medical center in Saudi Arabia. We have submitted an application for full regulatory approval in Saudi Arabia. Our current approval is limited to one hospital, and no assurance can be given that we will receive full regulatory approval.

The Argus II System is intended to restore some useful vision to patients who are blind and have lost most or all of their vision due to retinitis pigmentosa (which is the approved US indication for use) or due to outer retinal degeneration (which is the broader CE mark indication for use). While there are several diseases and syndromes that comprise outer retinal degeneration, the two most prominent of these are RP and AMD. We believe that future product development of the Orion I visual prosthesis will expand the market for our products to include nearly all forms of blindness.

Retinitis Pigmentosa (RP)

RP is a group of inherited disorders that affect the retina. The retina is a layer of nerve cells at the back of the eye. RP is a disease that gradually robs relatively young people of their vision over time. Onset of RP is often noted in the teen years or early twenties, typically as night blindness. This is followed by a period of peripheral vision loss, until the patient is left with a tunnel of vision and then no remaining sight. Although there are various genetic causes (over 100) and thus variability in the disease progression, many people with advanced RP have lost all functional vision by their 40s or 50s. The Argus II System works by bypassing rods and cones which are defunct in these patients and sending electrical signals directly to the retina’s remaining healthy cells.

Although there are reported trials for other treatments underway, to our knowledge the Argus II System remains the only approved therapeutic option for end-stage RP in the US, and to our knowledge it is the only treatment option currently commercialized anywhere in the world.

Worldwide, an estimated 1.5 million people suffer from RP,1 which includes about 100,000 in the US.2 Pan-European data is not readily available, but we believe it is reasonable to estimate that the average prevalence throughout Europe is similar to the average prevalence within the US, and so the ratio of populations could be used to estimate the number of Europeans affected as

__________

1 Weleber, R.G. and Gregory-Evans, K. (2001) ‘Retinitis Pigmentosa and allied disorders.’ In Ryan, S.J. (ed.), Retina. Mosby, St. Louis, pp, 362-470.

2 Foundation Fighting Blindness estimates that about 100,000 Americans are affected by RP or similar diseases. (http://www.ffb.ca/documents/File/rp_guide/Guide_to_RP_and_Other_Related_Diseases.pdf)

2

167,000 in the 28 EU countries.3,4 Approximately 25% of people with RP in the US have vision that is 20/200 or worse (legally blind).5 Since the bare light perception or worse vision criterion for the US indication is worse than 20/200, we believe that the subset of patients that can be treated by the Argus II System is less than 25,000 in the US. In Europe, the indicated vision loss is severe to profound which, while better than bare light perception, remains somewhat worse than 20/200. We estimate that the subset of RP patients that can be treated in Europe to be somewhat smaller than 42,000. Worldwide, we estimate that 375,000 people are legally blind due to RP, and that a portion of these would be candidates for the Argus II System.

Age Related Macular Degeneration (AMD)

AMD is a relatively common eye condition and the leading cause of vision loss among people age 65 and older.6 The macula is a small spot near the center of the retina and its damage results in loss of central vision. AMD can start as a blurred area near the center of vision and over time it can grow larger until loss of central vision occurs. Central vision is extremely important for everyday tasks such as reading, writing, and face recognition.

There are three stages of AMD defined in part by the size of drusen (yellow deposits) under the retina. Early and intermediate stage AMD has few symptoms or vision loss. These earlier stages of the disease are usually left untreated or dealt with using diet supplementation. People with advanced AMD have vision loss from damage to the macula. There are two types of late stage AMD:

• Dry AMD or geographic atrophy: There is a breakdown of light sensitive cells in the macula that send visual information to the brain, and the supporting tissue beneath the macula. This damage causes vision loss.

• Wet AMD or neovascular AMD: Blood vessels grow underneath the retina, these vessels might leak blood which may lead to swelling and damage of the macula. This damage may be severe and can progress quickly.

Treatments for AMD:

• The Implantable Miniature Telescope (VisionCare Ophthalmic Technologies, Inc.), a magnifying device that is implanted in the eye, is approved for use in patients with severe to profound vision impairment (best corrected visual acuity of 20/160 to 20/800) due to dry AMD. Some patients who are candidates for the Argus II device may also be candidates for the implantable telescope.

• There are currently no other treatments for AMD after the disease has caused severe to profound vision loss.

• There are currently no established treatments that delay or reverse the progression of Dry AMD other than supplements.

• Therapies exist for Wet AMD that delay the progression of visual impairment or slightly improve the vision, rather than completely curing or reversing its course. These therapies are approved in many regions throughout the world, including the US and EU.

Worldwide, between 20 and 25 million people suffer from vision loss due to AMD,7 and of these about 2 million have vision that is considered legally blind, or worse.8 In the US, just over two million people experience vision loss due to AMD according to a 2010 study by the National Eye Institute. Of the 1.3 million legally blind Americans,9 we estimate that 42.5% (or 552,500) are due to AMD.10 Applying this percent of legally blind due to AMD (42.5%) to the total number of legally blind people in

__________

3 Eurostat. Retrieved 1 January 2013.

4 Haim M. Epidemiology of Retinitis Pigmentosa in Denmark. Acta Ophthalmol Scand Suppl 2002; 1-34.

5 Grover et al., ‘Visual Acuity Impairment in Patients with Retinitis Pigmentosa at Age 45 Years or Older’, Ophthalmology. 1999 Sept; 106(9):1780-5.

6 The Eye Diseases Prevalence Research Group, 2004a; CDC, 2009.

7 Choptar, A., Chakravarthy, U., and Verma, D. ‘Age Related Macular Degeneration’. BJM 2003;326:485.

8 Global Data on Visual Impairments 2010, World Health Organization.

9 National Eye Institute ( http://www.nei.nih.gov/eyedata/blind.asp)

10 Congdon N, O’Colmain B, Klaver CC, et al. Causes and prevalence of visual impairment among adults in the United States. Arch Ophthalmol. Apr 2004;122(4):477-485. This percent amount was derived from the rates of different causes of blindness by different races and racial demographic data from 2010 US Census data.

3

Europe (2.55 million),11 we estimate the population of legally blind individuals from AMD to be about 1.08 million individuals in Europe. We believe the Argus II System may be able to help a subset of these legally blind AMD patients who have severe to profound vision loss.

To date, we have not yet implanted any AMD patients with the Argus II device. We are planning to conduct a five subject feasibility study of the use of the Argus II System in patients with dry AMD. This feasibility study will be conducted in the United Kingdom and approval to conduct the study has been obtained from the UK Competent Authority, the Medicines and Healthcare Products Regulatory Agency or MHRA. Patient recruitment in this study began in December 2014. We expect to perform these implants in the first half of 2015. After positive follow-up data have been collected from these five subjects, we intend to conduct a larger pivotal study, of up to 30 subjects, in the US and Europe to collect safety and efficacy data to support market approval for this expanded indication for use for the Argus II System.

We intend to seek FDA approval in the US for use of the Argus II System for AMD. We also intend to explicitly add AMD to our CE label for the use of the Argus II System in patients with AMD in Europe. Our approach will be to implant the electrode array in the central vision area where patients have vision loss and leave any peripheral vision largely unchanged.

Other diseases resulting in blindness that may be treated by Orion I visual prosthesis

Many diseases outside of RP and AMD can also cause blindness. Many of the largest causes of visual impairment (i.e. refractive error and cataracts) are avoidable or curable, and their prolonged or untreated impact on vision is largely observed in developing nations. Some other causes of blindness, such as brain trauma, may also not be suitable for treatment by a cortical stimulator. However, the remaining causes of severe vision loss which include glaucoma, diabetic retinopathy, eye trauma, retinopathy of prematurity and many others can result in severe visual impairment that may prove to be treatable by an Orion I visual prosthesis.

According to the World Health Organization (WHO),12 285 million people suffer from vision loss worldwide. Of these, 39 million people are considered legally blind. The WHO further estimates that 80% of legal blindness is avoidable, leaving 7.8 million legally blind individuals, including those blind due to AMD and RP, or 5.8 million excluding AMD and RP. In the US, 1.3 million people are legally blind,9 of which we estimate 44.3%, or 575,900, are legally blind due to causes other than preventable/treatable conditions, RP or AMD.10

The potentially addressable market for the Orion I visual prosthesis is a subset of the legally blind population cited here, or less than 5.8 million worldwide, approximately 575,900 in the US, and about 1.13 million in Europe.

We intend to use a portion of the proceeds we received from our IPO, completed in November 2014, to support the research and development of the Orion I visual prosthesis. We plan to complete the pre-clinical development of the Orion I device by mid-2016 and currently anticipate conducting our first-in-human study by the end of 2016.

Our Technology

We developed the Argus II System primarily in-house following its clinical conception in the early 1990s by a handful of leading retinal doctors, vision scientists, and engineers, and the subsequent formation of the company in 1998. During this development period we created long term safety, reliability and clinical benefit as we encountered, solved and frequently patented solutions to, a number of significant clinical and engineering challenges. These include:

• Development of an electrode array that can rest on and interface with the delicate retina for multiple years without causing damage to the underlying neurons;

• Miniaturization of the implantable micro-electronics package under the constraints of requiring it to be water tight, durable, biocompatible, and biostable, while featuring over 60 electrical connections;

• Development of a flexible polymer based electrode array that does not break down and leak in-vivo for a period of up to decades as demonstrated by accelerated life tests and over five years of continuous use in patients;

__________

11 Global Data on Visual Impairments 2010, World Health Organization.

12 WHO Fact Sheet number 282, updated October 2013.

4

• Development of a biocompatible and stable connection to join the polymer array to the micro-electronics package;

• Development of an electrode material that can withstand higher charge densities than the known best neurostimulation industry standard (platinum) - thereby enabling the use of smaller (and hence more in a given area) stimulating electrodes;

• Development of a wireless power and data link that meets international standards and produces stable device function with a moving eye;

• Development of stimulation and rehabilitation methods that improve patients’ outcomes; and

• MRI conditional status, that is safe for the patients to undergo MRI under specified conditions.

The Argus II Retinal Prosthesis System consists of an implant, a small portable computer and a pair of glasses with a miniature video camera.

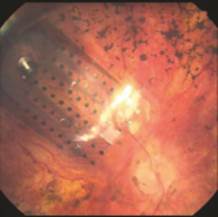

Implant

Our implant is an epiretinal (that is, the retinal surface is the site of stimulation) prosthesis that includes a receiver coil (antenna), electronics, and an electrode array. It is implanted in and around the eye. The array has 60 platinum gray electrodes arranged in a 6x10 grid. Each electrode is 200 µm (0.008”) in diameter. The array covers about 20° of visual field (diagonally). The flexible polymer thin-film electrode array, which follows the curvature of the retina, is attached to the retina over the macula with a retinal tack. The extra-ocular portion of the Argus II Implant is secured to the eye by means of a scleral band and sutures.

|

|

| Figure 1: Schematic of Argus II implant as implanted (surgical implantation is typically performed in 2 to 4 hours) | Figure 2: Electrode array. Current version contains 60 platinum gray electrodes |

Figure 3: Argus II implant.

5

Externals

The external equipment consists of a pair of glasses and a video processing unit or VPU. The glasses include a miniature video camera and a transmitter coil. The Argus II Clinician Programming Kit is used to program the Argus II System stimulation parameters and video processing strategies for each patient. The software provides modules for electrode control, permitting the clinicians to program the amplitude, pulse-with, and frequency of the stimulation waveform of each electrode.

Figure 4: External Components of the Argus II System

How it works

In a healthy eye, the photoreceptors (rods and cones) on the retina convert light into tiny electrochemical impulses that are sent through the optic nerve and to the brain, where they are decoded into images. If the photoreceptors no longer function correctly (as in RP and AMD), the first step in this process is disrupted and the visual system cannot transform light into images, causing blindness. The Argus II System is designed to bypass damaged photoreceptors altogether and provides real-time visual information to blind patients. The miniature video camera captures a scene and the video is sent to the small VPU where it is processed and transformed into instructions that are sent back to the glasses. These instructions are transmitted wirelessly to the receiver coil in the implant. The signals are then sent to the electrode array, which emits small pulses of electricity. These pulses bypass the damaged photoreceptors and stimulate the retina’s remaining cells, which transmit the visual information along the optic nerve to the brain. This process is intended to create the perception of patterns of light which patients can learn to interpret as real-time visual patterns.

Figure 5: The patient perceives patterns of light created by electrical stimulation.

Long-Term Reliability

The Argus II System has been extensively tested at the component, sub-assembly, and system levels for long term reliability. The hermetic electronics case has been demonstrated to prevent moisture accumulation inside the device for many years. The Argus II implant is specified to last a minimum of five years, however, in vitro tests and actual clinical data suggest the device should last much longer. Production implants have reached more than ten years of lifetime use in accelerated in vitro testing and more than seven years use in real time in patients under active stimulation and normal use conditions.

6

Our Research and Development

Our research and development staff is focused on improving the level of vision that the Argus II System can provide to blind patients and adapting the technology to help a broader audience of blind individuals. A portion of the proceeds from our IPO will go toward supporting the research and development efforts described below.

Increasing Resolution

We believe that increasing the resolution of the system should enhance the user experience, which would increase the value and benefits of the technology to the patient. We believe that we will be able to increase the system resolution by:

• Developing enhanced image processing: Through enhanced image processing, including contrast enhancement and electronic ‘zoom’, one patient so far tested has achieved 20/200 level vision as measured by a grating acuity test.13

• Creating multiple virtual electrodes: we believe we can use software to electronically create a number of virtual electrodes between the physical ones in the Argus II electrode array. This development could potentially enhance the resolution of existing devices by more than one order of magnitude. Although similar approaches have been successful in other neural stimulators, this approach has not yet been tested clinically on the retina.

We expect to spend a portion of the proceeds received from our IPO over the next 24 months on increasing resolution of and other performance enhancing improvements to the Argus II system.

Cortical Stimulator – Orion I

Developing a cortical stimulator is central to our strategy of maintaining our world leadership in restoring sight to those who are blind. There are different diseases that damage the optic nerve or impair the total functioning of the retina. We believe that a cortical stimulator will permit us to bypass the eye and the optic nerve, thereby allowing treatment for a wider variety of disease-related blindness.

Research described in 1968 reported that it was possible for a blind subject to experience light though phosphenes (appearance of light) when the visual cortical region (surface) of the brain was electronically stimulated – just as the Argus II System does in the eye.14 Functional vision corresponding to visual acuities up to 20/1200 was reported in the early 2000s, and two subjects were reported to have a prototype of a functional prosthesis implanted for more than 20 years without infections or other severe medical reactions.15Though these human experiments demonstrated proof of principle, no reliable implantable neurostimulator with a large number of electrodes was available before we developed and introduced the Argus II System.

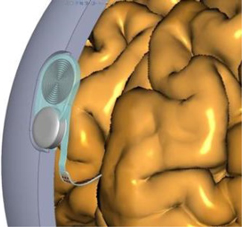

By implementing relatively minor modifications to the Argus II technology, we believe that the Orion I visual prosthesis can be implanted directly on the surface of the brain in the visual cortex and may be able successfully to restore some functional vision in almost all cases of disease related blindness. Our small electronics case will be implanted under the scalp and the electronic array placed in the visual cortex region of the brain. A transmitter coil similar to the one in current production will send power and signals to the implanted device. We plan to place our electrode array against the medial surface of the visual cortex.

We anticipate that many of the challenges that we encountered and solved in the process of developing the Argus II System are largely the same challenges in developing a product intended for enabling some functional vision through directly stimulating the brain. For example, a robust implant with a large number of electrodes is required for a cortical or retinal visual prosthesis. We believe the knowledge and technology gained in the development of the Argus II System will contribute to accelerating the development of a cortical stimulator directed at treating blindness.

We can also leverage public information learned from other electrical stimulation implants that are FDA-approved for use in the brain such as Medtronic’s Activa deep brain stimulator for Parkinson’s, Essential Tremor and Dystonia and more recently

__________

13 Sahel JA, Mohand-Said S, Stanga PE, Caspi A, Greenberg RJ. Acuboost™: Enhancing the maximum acuity of the Argus II Retinal Prosthesis System. IOVS 2013 May; 1389. ARVO E-Abstract.

14 Brindley, G.S. and W.S. Lewin, The sensations produced by electrical stimulation of the visual cortex. J Physiology 1968. 196(2): p. 479-93.

15 Dobelle, W.H. Artificial vision for the blind by connecting a television camera to the visual cortex. ASAIO J 2000;46:3-9.

7

NeuroPace’s RNS® brain stimulator for epilepsy. Furthermore, we believe that our specific experience obtaining regulatory approval for these types of devices in the United States and other regions will prove to be helpful in our effort to expand and get new products, such as Orion I visual prosthesis, approved throughout the world.

A: Placement of array against the medial surface of the visual cortex. Array is in blue, the electronics capsule in dark gray and the receiver coil in light gray on the outer surface of the skull.

Clinical Trials

Second Sight completed a pre-market clinical trial of the Argus II System and data from this trial supported both the FDA (US) and CE Mark (EU) approval of the Argus II device. Second Sight is currently conducting post-market studies of the Argus II System to continue to collect data regarding the long-term safety and benefit of the Argus II System in patients with severe to profound RP/outer retinal degeneration. We began recruitment for a study to support expanding the indications for use of the Argus II System to Age-Related Macular Degeneration (AMD) in the fourth quarter 2014, and we plan to begin implants in the first half of 2015. We are planning to begin a feasibility study of the Orion I visual cortical prosthesis in the fourth quarter of 2016.

Pre-market Clinical Trial of the Argus II System for Retinitis Pigmentosa/Outer Retinal Degeneration

The Argus II System, indicated for patients with severe to profound outer retinal degeneration (limited to RP in the United States), was studied in a clinical trial of 30 subjects in the U.S and EU. The study is registered at www.clinicaltrials.gov under study ID NCT00407602. The study began in 2007 and as of January 2015, there were over 180 subject-years in the clinical trial. As part of post-market surveillance, this study is continuing and we intend to follow subjects for a total of ten years each.

Data collected in this trial demonstrated that the Argus II System has a reasonable safety profile for an ophthalmic device that requires vitreoretinal surgery to implant. There were no unexpected adverse events. The most common, serious adverse events were conjunctival erosion/dehiscence, hypotony (low eye pressure), endophthalmitis (infection in the eye), retinal tear or detachment, and re-tacking. It was also demonstrated that the device can be safely removed: one implant, including the retinal tack, was safely explanted to resolve an adverse event, and three retinal tacks were safely removed during elective revision surgeries to reposition arrays. All adverse events were treatable with standard practices utilized by ophthalmologists. In general, these events did not adversely affect performance with the Argus II System.16 Furthermore, since approval, we have observed a decrease in the rate of adverse events, most likely in our view due to increased surgical experience with the technology.17

The Argus II System provides visual information that can range, depending on the patient, from light detection to form detection. A sub-study of Argus II System clinical trial patients demonstrated that 72% of patients could identify closed set letters, and a subgroup of six patients was able to consistently read letters of reduced size, the smallest measuring 0.9 cm (1.7°)

__________

16 Sponsor Executive Summary, FDA Ophthalmic Devices Advisory Panel, September 28, 2012. (http://www.fda.gov/AdvisoryCommittees/Calendar/ucm312582.htm).

17 Humayun, M.S., da Cruz L., Dagnelie G., Stanga PE, Ho AC, Greenberg RJ, Birch DG, Duncan JL, Sahel JA. An update on the Argus II epiretinal implant. IOVS 2014 May; 5968. ARVO E-Abstract.

8

at 30 cm and four patients correctly identified unrehearsed two-, three- and four-letter words.18 Patients are able to use this visual information to perform functional tasks (such as, locating windows and doors, following lines in a cross walk), to allow them to feel more connected with others (for example, seeing when a person approaches them or when someone walks away), and to simply enjoy visual perception again (such as, seeing the changing light levels on a TV, tracking groups of players as they move around the field at an athletic event and being able to locate the moon). For people with bare or no light perception, even limited restoration of vision can make a significant difference in their lives. 22

In the clinical trial, the Argus II System provided all 30 subjects with benefit as measured by high-contrast visual function tests. The degree of benefit varied from subject to subject. The Argus II System was also able to provide subjects with clinical benefit as measured by objectively-scored functional vision tests. Subjects performed better with the Argus II system on vs. off on orientation and mobility tests (finding a door and following a line) and on functional vision tasks (sorting white, black and grey socks; following an outdoor sidewalk; and determining the direction of a person walking by).22

An assessment of Argus II System subjects’ functional vision in and around their home by independent, certified low‑vision rehabilitation specialists was also performed. The assessment was called the Functional Low-vision Observer Rated Assessment, or FLORA®. In no cases, did the low vision specialists report that the Argus II System had a negative impact on subjects. In 77% of cases, low vision specialists determined that the subject was receiving (or had received at one time) functional vision and/or well-being benefit from the Argus II System.22 The results from this clinical trial demonstrated that the Argus II System provided benefits for these blind subjects in terms of visual function (how the eye works), functional vision (performance in vision related activities), and well-being. The study also demonstrated that the Argus II System does not pose an unacceptable risk to blind patients with severe to profound RP with bare or no light perception in both eyes. In 2012, after an in depth review of the clinical trial data, a 22 person (19 voting) FDA-convened panel of experts voted unanimously that the benefits of the Argus II System outweighed the risks.19

Post-Market Clinical Trials

Following CE Mark and FDA approval for the Argus II System, Second Sight is conducting two post-market studies of the device (one in EU and one in the US) to collect additional long-term data on the use of the Argus II System in patients with severe to profound outer retinal degeneration (or RP in the United States). Post-market studies are typically conditions of market approval for medical devices.

In the United States, the study is designed to enroll 53 subjects and will follow each subject for five years. Adverse events, visual function, and functional vision data are being collected for all study participants. Enrollment began in February 2014 and seven subjects have been enrolled as of January 31, 2015. The study is registered at www.clinicaltrials.gov under study ID NCT01860092.

In Europe, Second Sight is conducting a post-market study that is designed to enroll 45 subjects and will follow each subject for three years. Adverse events, visual function, and functional vision data are being collected for all study participants. Enrollment began in December 2011 and 36 subjects have been enrolled as of January 31, 2015. The study is registered at www.clinicaltrials.gov under study ID NCT01490827.

In France, Second Sight was selected to receive the first “Forfait Innovation” (Innovation Bundle Payment) from the Ministry of Health, which is a special funding for breakthrough procedures to be introduced into clinical practice. As part of this program Second Sight is conducting a post market study in France which will enroll 18 subjects and follow them for two years. Enrollment began in November 2014 and 2 subjects have been enrolled as of January 31, 2015. The study is registered at www.clinicaltrials.gov under study ID NCT02303288.

Pre-market Clinical Trial of the Argus II System for Age-Related Macular Degeneration

We have begun recruitment in a pilot study of the Argus II System for use in patients with age-related macular degeneration, or AMD. In this study, the Argus II System is being used in its current RP configuration, without any significant modifications. We will be enrolling five subjects in the pilot study who have central vision loss due to dry AMD; the subjects will be followed for three years. The study

__________

18 da Cruz L, Coley BF, Dorn J, et al. The Argus II epiretinal prosthesis system allows letter and word reading and long-term function in patients with profound vision loss. Br J Ophthalmology 2013;97:632-6.

19 Sponsor Executive Summary, FDA Ophthalmic Devices Advisory Panel, September 28, 2012.

9

will be conducted at a single center in the UK. The study is registered at www.clinicaltrials.gov under study ID NCT02227498. Recruitment for this study began in December 2014 and we plan to begin implanting in the study in the first half of 2015.

Assuming the early results from this pilot study are positive, we intend to apply for approval to conduct a larger study of AMD (both wet and dry) in the United States and EU in late 2015. This larger study, which we anticipate will begin in early 2016, will be used to support efforts to obtain regulatory approval to expand the label for the Argus II System to include AMD in its indications for use. The study would also be used to support efforts to obtain reimbursement in the United States and EU for this expanded indication for use. However, there can be no assurance that this pilot study will be successful, and further research and development may be needed.

Future Clinical Trials

Cortical Prosthesis

Following completion of the development effort associated with the Orion I, including verification and validation of the design, we intend to conduct a feasibility clinical trial to assess the safety and benefit of the device in blind individuals. We expect that this feasibility study will begin in 2016.

Our Commercialization Plan

We launched the Argus II System in Italy and Germany in late 2011. We have, since early in 2012, also launched the Argus II System in France, the UK, the Netherlands, Spain and Saudi Arabia. In 2013, the Argus II System received FDA approval, and the product was launched in the US in January 2014, after receiving a required FCC Grant of Equipment Authorization late in 2013. Also in 2014, an investigator-sponsored study in Toronto, Canada has resulted in two unit sales to that Toronto center. We obtained approval for the Argus II System from Health Canada at the end of 2014 and we intend to begin commercializing the device within Canada during 2015. In this early stage of commercialization, we focused on a controlled launch to ensure adequate service to the centers and to integrate new knowledge gained so as to make necessary adjustments to our products and services in the following larger commercial launch. We currently are poised for a broader launch phase, where the treatment will be made available to a larger population of eligible patients. We expect to use up to $4 million of the proceeds from our IPO over the next 18 months to expand the commercial roll out of the Argus II System.

Our successful commercialization of this technology and therapy is dependent on implementing our sales and marketing strategy, and obtaining reimbursement of the Argus II System by payers.

Sales Strategy

During our commercial launch, we are employing a Centers of Excellence sales strategy and deploying the Argus II System at prominent and reputable eye clinics. We believe this strategy represents an efficient use of our capital after giving consideration to the following factors:

• The size of the RP patient population.

• The complexity of the technology, surgery, and treatment paradigm.

• The cost of selecting, qualifying, training and supporting new centers.

When selecting new sites, we focus on high quality health providers utilizing the following considerations:

• Geographic desirability,

• Facility and Surgeon skill and reputation,

• Access to patients,

• Regulatory pathway, and

• Reimbursement environment from government agencies or contractors and third party insurers.

10

In the United States and Canada, as of January 31, 2015, we have 11 centers that have implanted the Argus II retinal prosthesis. Additionally, we have 18 other centers that have been selected as potential implanting centers and that are somewhere in the process of becoming active centers in 2015. We anticipate opening other new centers in subsequent years. We believe that we will be able to serve the domestic RP market by having about 70-80 implanting centers across the US.

In Europe and the Middle East, we currently have 12 centers that actively are implanting and/or recruiting patients to schedule their Argus II retinal prosthesis surgeries (six in Germany, three in France, one in Saudi Arabia, and two in Italy). Additionally, we have 15 other centers that are either preparing to implant patients or are in the qualification process. We intend to continue recruiting additional centers in 2015 to yield further active centers in 2016. We anticipate that annual new center recruitment, in subsequent years will prove to be an important driver of our implant and revenue growth in foreign markets. We believe that we will be able to serve the European markets for RP by having about 100-120 centers across Europe.

To date, we have employed direct sales to service our initial markets during our controlled launch phase. We believe we can more efficiently support centers that are located at distances from our US and European headquarters by securing distributors in several key markets in order to expand our reach of client marketing and support. To date, we have appointed distributors in Spain and Turkey. We expect that our distributors will commit to providing support services that include marketing, market access, reimbursement, sales and service and also commit to annual minimum quantities and volume targets depending on their territories.

To date, we have not faced traditional sales challenges in any of our markets, largely due to the currently unmet clinical need and the lack of any other approved device or competitive treatment for RP caused blindness. Due to pending reimbursement approvals in the United States, many doctors and facilities have expressed interest in providing the Argus II System for their patients but have been unable to do so. We have over 1,700 potential patients with verified contact information in a database as a result of media coverage and news of awards that we have received. Our patient pipeline has over 60 US patients deemed currently eligible by implanting physicians and awaiting reimbursement authorization to be implanted. No assurance can be provided that all these reimbursement authorizations will be received or when these patients might be implanted. Please see ‘Reimbursement’ below.

Due to the high cost of the system, government reimbursement (coding, coverage, and payment) is paramount to being able to provide this device to our patients. Please see ‘Reimbursement’ below. We anticipate that our primary challenges in pursuing and implementing sales efforts will be to maintain a growing patient pipeline while expanding reimbursement coverage.

Marketing Strategy

To date, and for the foreseeable future, our marketing efforts have been primarily focused on promoting both our brand (for both the product and the company) and on raising awareness amongst and educating certain target groups which include the following:

• Potential patients,

• Potential implanting physicians and medical centers, and

• Potential referring physicians (general practitioners, ophthalmologists, optometrists, and low-vision specialists).

To achieve these objectives we have employed a mix of marketing plans and approaches which includes media relations, trade and professional show attendance, exhibition, and podium presence, sponsoring medical symposia, conducting regional education sessions, partnering with patient advocacy groups focused on blindness and retinal degeneration, and a limited amount of advertising. We employ two in-house marketing professionals currently and a number of specialized consultants.

Reimbursement

Reimbursement, which is third party coverage and payment for health care services rendered to patients by government and private insurance providers, varies significantly in form and function across countries.

United States

In the US, hospitals or ambulatory surgery centers, known as ASCs, are the primary purchasers of the Argus II System. Hospitals, ASCs and physicians bill third-party payers, including Medicare, Medicare Advantage and private payers for costs

11

associated with providing the services and acquiring the Argus II System. Regardless of age, Medicare provides coverage to the blind simply on the basis of their disability. While the majority of patients for the Argus II System are insured by Medicare or Medicare Advantage plans, Medicare does not currently universally reimburse for the Argus II System

In order to have adequate reimbursement for devices and services, we are required to obtain coding, coverage, and payment. Additionally, the required codes and payment vary based on the site of service such as in-patient hospital, out-patient hospital, ASC, or physician’s office. Most Argus II System procedures are performed on an out-patient basis, while a small number may be performed in an in-patient setting. We have obtained required codes and payment (for both the procedure and device) from the national office of Medicare in both settings of care.

Reimbursement in the U.S. consists of three basic components: “coding, payment and coverage.”

Coding

Providers use systems of codes to communicate with the payer the patient conditions and diagnoses, services provided, procedures performed, and devices used to treat the patient. These codes include American Medical Association Current Procedural Terminology (CPT) codes, Healthcare Common Procedure Coding System (HCPCS) codes, and International Classification of Diseases-9th Revision (ICD-9) codes.

Second Sight has obtained the required coding from Centers for Medicare and Medicaid Services (CMS) and CPT, including:

• CPT code for the retinal implantation procedure (CPT 0100T), which is utilized by physicians, hospital outpatient departments and ambulatory surgery centers;

• HCPCS Code specific to the Argus II retinal prosthesis implant device (and external components) (HCPCS code C1841) which is utilized by hospital outpatient departments and ambulatory surgery centers; and

• ICD-9 procedure code for the retinal implantation procedure (ICD-9 code 14.81), which is utilized by hospital inpatient departments.

Payment

CMS has established specific Medicare payment rates for the implantation procedure in the hospital inpatient setting, hospital outpatient setting and ambulatory surgery center setting. In addition, Second Sight has been successful in obtaining additional transitional pass-through payment for the Argus II retinal prosthesis device (and external components) which is reimbursed to the hospital outpatient department or ambulatory surgery center. While the majority of these procedures are likely to be performed in a hospital outpatient setting, Second Sight has also obtained new technology add-on payment which provides additional reimbursement if the procedure is performed on an inpatient basis. We expect that specific physician payment rates will be established when CPT 0100T is formally valued by the American Medical Association. Until that time, reimbursement to physicians is based on charges submitted to the payer.

Coverage

Coverage is the process, criteria, and policy used by payers (insurers) to determine whether to pay for a medical procedure or product. Payers make decisions on coverage for a procedure or service based on a number of factors, including medical necessity, effectiveness, and outcomes. We anticipate that the majority of patients receiving the Argus II retinal prosthesis will be insured by Medicare due to age or the nature of their disability. Medicare insures over 47 million beneficiaries for items and services that are “reasonable and necessary for the diagnosis or treatment of an illness or to improve the functioning of a malformed body member”.20 These beneficiaries include people age 65 or older, people under age 65 with certain disabilities and people of all ages with end-stage renal disease.

Currently one regional Medicare Administrative Contractor, or MAC, in the Mid-Atlantic region provides coverage for the Argus II System. We are actively working with seven other MACs and Medicare Advantage Plans to obtain favorable coverage. Several commercial payers and Medicare Advantage Plans cover the Argus II System either through formal policy or

__________

20 Social Security Act §1862 (a)

12

on a case-by-case basis, including Health Net, Independence Blue Cross, AmeriHealth, Priority Health Medicare Advantage, BCBSS of Arkansas, AV Med, Medica, among others. Second Sight is actively engaging the dissenting plans to obtain favorable coverage for the Argus II System through either a formal coverage policy or on a case-by-case basis. Although we expect an increasing number of payers to agree to cover the Argus II System, there can be no assurance that all other MACs, Medicare Advantage Plans or private payers will cover and reimburse our product and the procedures to implant them in whole or in part in the future or that payment rates will be adequate.

Europe

After obtaining the regulatory approval (CE mark) in Europe, innovative medical devices go through a fragmented public reimbursement system across Europe. Many European countries use a Diagnosis Related Group, DRG, or similar type reimbursement coding system for the lump sum payment of in-patient medical procedures. Medical devices are generally included in the lump sum DRG payment. To apply for the creation of a new reimbursement code a new medical device first needs to be in widespread use as part of a hospital medical procedure. Typically it may require two or more years from application to obtain a new DRG code. A common way for these medical devices to be made available in the public healthcare setting, is through hospital research/ innovation budgets/other routes. However, these budgets are small in size, limited to a few hospitals, and quite difficult to access, thereby limiting patient access to new treatments. To address this problem, many countries in Europe have created temporary reimbursement programs for innovative medical products to bridge the time to collect convincing clinical and economic evidence to get a new DRG code. While these programs offer a reasonable opportunity for new medical products to get faster reimbursement, they have stringent requirements of clinical and economic evidence that may vary from country to country, leading to slow adoption rates of reimbursement approvals. Such short-term reimbursement programs, such as “NUB” in Germany, “Forfait Innovation” in France, Local/Regional funding in Italy and “Coverage through Evaluation” in England, can be generally grouped as “coverage with evidence” programs.

Second Sight achieved reimbursement for the Argus II System in Germany in 2011 with a process dedicated to innovative procedures referred to as NUB (Neue Untersuchung und Behandlungsmethoden). This reimbursement under NUB is valid for one year in a specific number of hospitals. Under the NUB program, each hospital negotiates the payment for the procedure with the insurance companies for “additional costs associated with the innovative treatment,” and in 2011 two hospitals managed to get a sustainable funding to start the first procedures. Since 2011, the funding was renewed five times and the number of hospitals obtaining funding increased from two to seven. Over the next few years we expect our Argus II therapy to be covered under the standard payment system which would mean the device would be reimbursed at all centers and the annual negotiation would no longer be necessary. In January 2015 we received renewal of our NUB status for an additional one year term.

In France, we were selected to receive the first “Forfait Innovation” (Innovation Bundle Payment) from the Ministry of Health, which is a special funding for breakthrough procedures to be introduced into clinical practice. France commissioned this program for the first time in 2014, and to our knowledge the Argus II System is one of only two products that were selected for this funding after rigorous healthcare technology assessment by “haute authorité de santé” (French Health Technology Assessment authority). In the longer term, we expect Argus II therapy to be covered under the standard payment system (GHM‑LPP system).

In Italy the Argus II System has been available in the Tuscany region since 2011 under a hospital/regional funding program. Beginning in 2015, it is also available in the Veneto region. We expect that the Argus II System will be available in several other regions as well under similar funding programs. Patients across Italy will then have a possibility of treatment in these centers with prior government approvals required in some of these regions. Within the next several years, we expect the Argus II System to be accessible across Italy with funding from national or regional governments.

The Argus II System is going through a review process under National Specialized Services program in England, as well as under other funding programs in other markets across the EU and Middle East. We expect the Argus II System to become eligible for reimbursement at the national or regional level for eligible patients during the next several years in some of these markets.

A multi-market economic evaluation (Anil Vaidya, Elio Borgonovi, Rod S Taylor, José-Alain Sahel, Stanislao Rizzo, Paulo Eduardo Stanga, Amit Kukreja, Peter Walter; BMC Ophthalmology 2014; 14: 49. Published online 2014 April 14. doi: 10.1186/1471-2415-14-49) conducted on the Argus II System affirms that the Argus II System is a cost-effective intervention compared to the usual care of RP patients. The lifetime analysis ICER (Incremental Cost Effectiveness Ratio) for

13

the Argus II System falls below the published societal willingness to pay in EU. According to this assessment, the Argus II System treatment has a cost that we believe is reasonably priced for a technology addressing a rare population such as retinitis pigmentosa.

Warranty

We generally provide a standard limited warranty for the Argus II System covering replacement over the following periods after implant:

• three years on implanted epiretinal prosthesis

• two years on external components other than batteries and chargers, and

• three months on batteries and chargers.

Based on our experience to date, the Argus II System has proven to be a reliable device generally performing as intended. We have accrued warranty expense of $555,972 as of December 31, 2014, which we believe to be adequate.

Our Competition

The US life sciences industry is highly competitive and well-positioned for future growth. The treatment of blindness varies based on the cause; generally there are seven categories of treatments in development for the treatment of blindness from retinal disease:

• Retinal Prostheses: aimed at giving more visual ability to a blind patient via implanting a device in the eye to stimulate remaining retina cells. Electrical neurostimulation technology has seen growing use in recent years for numerous applications– such as chronic pain, Parkinson’s, Essential tremor, Epilepsy, and others.

• Transplants: transplanting retinal tissue to stimulate remaining retina cells.

• Genetics and Gene Therapy: involves identifying a specific gene that is causing retinal problems (there are over 120 for retinitis pigmentosa alone) resulting in visual impairments and blindness; and inserting healthy genes into an individual’s cells using a virus to treat the diseases.

• Stem Cells: generally involves implanting immature retinal support cells aimed at slowing retinal degeneration.

• Optogenetics Therapy: aimed at slowing down, reversing, and/or eliminating the process by which photoreceptors in the eye are compromised. This therapy also requires infecting the patient’s cells with a virus. However, instead of fixing a gene defect, this approach would cause cells within the eye to become light sensitive. Animal work has shown that these cells are not sensitive enough to respond to ambient light, so this approach currently also requires a light amplifier outside the body to increase light delivered to the retina.

• Nutritional Therapy: involves diets or supplements that are thought to prevent or slow the progress of vision loss.

• Implantable Telescope: VisionCare, Ophthalmic Technologies, Inc. offers an FDA approved implantable minature telescope for AMD, a magnifying device that is implanted in the eye. The VisonCare telescope is approved for use in patients with severe to profound vision impairment (best corrected visual acuity of 20/160 to 20/800) due to dry AMD.

Projects in these six areas are still undergoing either animal or early clinical trials; some, like gene therapy, stem cell therapy and optogenetics remain highly speculative for most conditions. We believe that it is currently unlikely that gene therapy and stem cell therapy will prove effective in end stage RP patients in the near term.

In the area of retinal prosthetics, there are a number of competing efforts underway. We believe that most, if not all of these efforts, are not as advanced as the Argus II System in terms of commercialization, especially in the United States.

Commercial efforts by others include:

• Retina Implant AG: A German company that is developing the Alpha IMS, a wireless sub-retinal implant using the image from the eye’s own optical system Retina Implant AG has a CE mark and to our knowledge expects to seek commercialization of its product during 2015 in EU. To our knowledge, Retina Implant has not applied for or obtained FDA approval to begin a clinical trial in the US as of the date of this report.

14

• Pixium Vision S.A.: A French company that is developing the IRIS (Intelligent Retinal Implant System) that is surgically placed into the eye and attached to the surface of the retina. Similar to our Argus II technology, its system uses a camera and a wireless transmitter. Pixium is reported to be in clinical studies with IRIS and we believe plans to submit a CE mark application in 2015.21 To our knowledge, Pixium Vision has not applied for or obtained FDA approval to begin a clinical trial in the US as of the date of this report.

• NanoRetina Inc., a company based in Israel, and several other early stage companies are reported to have developed intellectual property or technology that may improve retinal prostheses in the future, but to our knowledge none of these efforts has resulted in a completed system that has been tested clinically in patients anywhere.

Academic entities are also working on vision restoring implants. To our knowledge these include Bionic Vision Australia (an early prototype device has been developed and to our knowledge implanted in three human subjects), Boston Retinal Implant project (preclinical phase) and Stanford University (preclinical). Of these projects, we believe most have not yet demonstrated a working implant, only one has begun long-term clinical work in humans, and to our knowledge none has received FDA approval to begin clinical trials in the US.

No other device to our knowledge has been successful in long-term human trials, currently making the Argus II System the sole implant being marketed for treating RP in the US, EU, and Saudi Arabia. We anticipate that our identified competitors are unlikely to obtain significant commercial traction in EU (even should they obtain CE Marks) until they have developed in depth clinical data showing the reliability, effectiveness, and safety of their devices. Based on current FDA guidance for retinal prostheses, we estimate any other competitor is at a minimum five years away from obtaining FDA approval in the US.

Government Regulations

The Argus II System is regulated within the category of medical devices. Medical device products are subject to rigorous FDA and other governmental agency regulations in the United States and as well as in foreign countries. Noncompliance with applicable requirements can result in import detentions, fines, civil penalties, injunctions, suspensions or losses of regulatory approvals or clearances, recall or seizure of products, operating restrictions, denial of export applications, governmental prohibitions on entering into supply contracts, and criminal prosecution. Failure to obtain regulatory approvals or the restriction, suspension or revocation of regulatory approvals or clearances, as well as any other failure to comply with regulatory requirements, would have a material adverse effect on our business, financial condition and results of operations.

The FDA regulates, among other things, the clinical testing, design, manufacture, labeling, packaging, marketing, distribution, post-market surveillance, and record-keeping for these products to ensure that medical products distributed in the United States are safe and effective for their intended uses.

In the United States, the Argus II System is classified as a Class III device, which is reserved for life-sustaining, life‑supporting and implantable devices. The most common path to market approval for Class III devices in the US is the Pre-Market Approval (PMA) process. To obtain PMA approval, the manufacturer must demonstrate that a device is safe and effective for its intended use. Class III devices intended for rare patient populations may also be approved under an alternative regulatory pathway, called the Humanitarian Device Exemption (HDE). To utilize the HDE approval process, a device must be designated a Humanitarian Use Device (HUD). To qualify as a humanitarian use device, the device must be used to treat or diagnose a disease or condition that manifests itself in fewer than 4,000 individuals per year in the United States, and there must be no alternative treatments available in the United States. To obtain HDE approval, the manufacturer is required to demonstrate that a device is safe and provides a probable benefit for its intended use.

Significant changes to existing products and new products, such as the cortical stimulation to be utilized by the Orion I visual prosthesis, must be approved by the FDA prior to distribution. Modifications or enhancements that could significantly affect the safety or effectiveness of the device or that constitute a major change to the intended use of the device will require new PMA or HDE application and approval. Other changes may require a supplement or other change notification that must be reviewed and approved by the FDA. Modified devices for which a new PMA or HDE application, supplement or notification is required cannot be distributed until the application is approved by the FDA. An adverse determination or a request for additional information could delay the market introduction of new products, such as Orion I visual prosthesis, which could have

__________

21 http://www.lerevenu.com/bourse/biotechs-et-medtechs/l-actualite-du-secteur/201405285385f194c6854/pixium-vision-interview-du-pdg-bernard-gilly

15

a material adverse effect on our business, financial condition and results of operations. We may not be able to obtain PMA or HDE approval in a timely manner, if at all, for Orion I visual prosthesis or any future devices or modifications to Orion I visual prosthesis or such devices for which we may submit a PMA or HDE application.

PMA and HDE applications must contain valid scientific evidence to support the safety and effectiveness (or probable benefit for an HDE) of the device, which includes the results of clinical trials, all relevant bench tests, and laboratory and animal studies. The application must also contain a complete description of the device and its components, as well as a detailed description of the methods, facilities and controls used for its manufacture, including, where appropriate, the method of sterilization and its assurance. In addition, the application must include proposed labeling, advertising literature and any required training methods.

If human clinical trials of a device are required in connection with an application and the device presents a significant risk, the sponsor of the trial is required to file an application for an Investigational Device Exemption (IDE) before beginning human clinical trials. Usually, the manufacturer or distributor of the device is the sponsor of the trial. The IDE application must be supported by data, typically including the results of animal and laboratory testing, and a description of how the device will be manufactured. If the application is reviewed and approved by the FDA and one or more appropriate Institutional Review Boards (IRBs), human clinical trials may begin at a specified number of investigational sites with a specified number of patients. If the device presents a non-significant risk to the patient, a sponsor may begin clinical trials after obtaining approval for the study by one or more appropriate institutional review boards, but FDA approval for the commencement of the study is not required. Sponsors of clinical trials are permitted to sell those devices distributed in the course of the study if the compensation received does not exceed the costs of manufacture, research, development and handling. A supplement for an Investigational Device Exemption must be submitted to and approved by the FDA before a sponsor or an investigator may make a significant change to the investigational plan that may affect the plan’s scientific soundness or the rights, safety or welfare of human subjects.

Upon receipt of a PMA or HDE application, the FDA makes a threshold determination as to whether the application is sufficiently complete to permit a substantive review. If the FDA makes this determination, it will accept the application for filing. Once the submission is accepted for filing, the FDA begins an in-depth review of the application. An FDA review of a PMA application generally takes one to two years from the date the application is accepted for filing; review of an HDE application can be shorter than a PMA. However, this review period is often significantly extended by requests for more information or clarification of information already provided in the submission. During the review period, the submission may be sent to an FDA-selected scientific advisory panel composed of physicians and scientists with expertise in the particular field. The FDA scientific advisory panel issues a recommendation to the FDA that may include conditions for approval. The FDA is not bound by the recommendations of the advisory panel. Toward the end of the PMA or HDE application review process, the FDA will conduct an inspection of the manufacturer’s facilities to ensure that the facilities are in compliance with applicable good manufacturing practice. If the FDA evaluations of both the PMA/HDE application and the manufacturing facilities are favorable, the FDA will issue a letter. This letter usually contains a number of conditions, which must be met in order to secure final approval of the application. When those conditions have been fulfilled to the satisfaction of the FDA, the agency will issue an approval letter authorizing commercial marketing of the device for specified indications and intended uses.

The PMA/HDE application review process can be expensive, uncertain and lengthy. A number of devices for which PMA/HDE approval has been sought have never been approved for marketing. The FDA may also determine that additional clinical trials are necessary, in which case the approval may be significantly delayed while trials are conducted and data is submitted in an amendment to the PMA/HDE application. Modifications to the design, labeling or manufacturing process of a device that has received PMA/HDE approval may require the FDA to approve supplements or new applications. Supplements to a PMA/HDE application often require the submission of additional information of the same type required for an initial premarket approval, to support the proposed change from the product covered by the original application. The FDA generally does not call for an advisory panel review for PMA/HDE supplements, though applicants may request one. If any PMAs/HDEs are required for our products, we may not be able to meet the FDA’s requirements or we may not receive any necessary approvals. Failure to comply with regulatory requirements or to receive any necessary approvals would have a material adverse effect on our business, financial condition and results of operations.

Regulatory approvals, if granted, may include significant labeling limitations and limitations on the indicated uses for which the product may be marketed. Conditions of approval for a PMA/HDE application also often include the requirement to conduct a post-market study or studies. In addition, to obtain regulatory approvals and clearances, the FDA and some foreign regulatory authorities impose numerous other requirements with which medical device manufacturers must comply. FDA enforcement policy strictly prohibits the marketing of approved medical devices for unapproved uses. Any products we manufacture or distribute under FDA clearances or approvals are subject to pervasive and continuing regulation by the FDA.

16

The FDA also requires us to provide it with information on death and serious injuries alleged to have been associated with the use of our products, as well as any malfunctions that would likely cause or contribute to death or serious injury.

The FDA requires us to register as a medical device manufacturer and list our products. We are also subject to inspections by the FDA to confirm compliance with good manufacturing practice. These regulations require that we manufacture our products and maintain documents in a prescribed manner with respect to manufacturing, testing, quality assurance and quality control activities.

We are also subject to a variety of other controls that affect our business. Labeling and promotional activities are subject to scrutiny by the FDA and, in some instances, by the Federal Trade Commission. The FDA actively enforces regulations prohibiting marketing of products for unapproved users. We are also subject, as are our products, to a variety of state and local laws and regulations in those states and localities where our products are or will be marketed. Any applicable state or local regulations may hinder our ability to market our products in those regions. Manufacturers are also subject to numerous federal, state and local laws relating to matters such as safe working conditions, manufacturing practices, environmental protection, fire hazard control and disposal of hazardous or potentially hazardous substances. We may be required to incur significant costs to comply with these laws and regulations now or in the future. These laws or regulations may have a material adverse effect on our ability to do business.

International sales of our products are subject to the regulatory requirements of each country in which we market our products. The regulatory review process varies from country to country. In EU, the European Union has promulgated rules that require medical products to affix the CE mark, an international symbol of adherence to quality assurance standards and compliance with applicable European medical directives. Once the CE mark has been duly applied to a device, the manufacturer may commercially distribute the product in all countries that are members of the European Union, and in several other countries that recognize the CE Mark, such as Switzerland and Turkey. Similar to the US, once the device has received the CE mark, companies are required to report certain serious adverse events, are required to conduct post-market surveillance, and in some countries are required to register or list the products.

To obtain the CE Mark for the Argus II System, we were required to demonstrate compliance with several European directives and standards, including the Active Implantable Medical Device Directive (AIMDD), and ISO 13485:2003 (“Medical devices, Quality management systems, and Requirements for regulatory purposes”). Second Sight contracts with a European Notified Body, an organization that reviews design documentation for our device and audits us annually to ensure compliance to the AIMDD directive and the ISO 13485 standard. In addition, significant changes to our device design, and new devices or new indications for existing products, would need to be reviewed and approved by the Notified Body, prior to allowing us to apply the CE mark to the new product. Losing the right to affix the CE mark to our Argus II device or any future products could have a material adverse effect on our business, financial condition and results of operations.