Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MKS INSTRUMENTS INC | d25375d8k.htm |

| EX-99.1 - EX-99.1 - MKS INSTRUMENTS INC | d25375dex991.htm |

| EX-10.1 - EX-10.1 - MKS INSTRUMENTS INC | d25375dex101.htm |

| EX-2.1 - EX-2.1 - MKS INSTRUMENTS INC | d25375dex21.htm |

MKS to Acquire Newport Corporation February 23, 2016 Exhibit 99.2

Safe Harbor for Forward-Looking Statements Statements in this presentation regarding the proposed transaction between MKS Instruments, Inc. (“MKS”) and Newport Corporation (“Newport”), the expected timetable for completing the transaction, future financial and operating results, benefits and synergies of the transaction, future opportunities for the combined company and any other statements about MKS or Newport managements’ future expectations, beliefs, goals, plans or prospects constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements that are not statements of historical fact (including statements containing the words “will,” “projects,” “intends,” “believes,” “plans,” “anticipates,” “expects,” “estimates,” “forecasts,” “continues” and similar expressions) should also be considered to be forward-looking statements. There are a number of important factors that could cause actual results or events to differ materially from those indicated by such forward-looking statements, including: (1) the ability to consummate the transaction; (2) risks that the conditions to the closing of the transaction are not satisfied, including the risk that required approvals for the transaction from governmental authorities or the stockholders of Newport are not obtained; (3) litigation relating to the transaction; (4) the ability of MKS to successfully integrate Newport’s operations and employees; (5) unexpected costs, charges or expenses resulting from the transaction; (6) risks that the proposed transaction disrupts the current plans and operations of MKS and Newport; (7) the ability to realize anticipated synergies and cost savings; (8) competition from larger and more established companies in Newport’s markets; (9) MKS’ ability to successfully grow Newport’s business; (10) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction; (11) the availability and terms of the financing to be incurred in connection with the transaction; (12) the retention of key employees; (13) legislative, regulatory and economic developments, including changing business conditions in the semiconductor industry overall and the economy in general as well as financial performance and expectations of MKS’ and Newport’s existing and prospective customers, and the other factors described in MKS’ Annual Report on Form 10-K for the year ended December 31, 2014 and its most recent quarterly report filed with the SEC and in Newport’s Annual Report on Form 10-K for the year ended January 3, 2015 and its most recent quarterly report filed with the SEC. MKS and Newport disclaim any intention or obligation to update any forward-looking statements as a result of developments occurring after the date of this presentation.

Important Additional Information Will be Filed With the SEC Newport plans to file with the SEC and mail to its stockholders a Proxy Statement in connection with the transaction. Additionally, Newport will file other relevant materials with the SEC in connection with the transaction. The Proxy Statement will contain important information about MKS, Newport, the transaction and related matters. Investors and security holders are urged to read the Proxy Statement carefully when it is available. Investors and security holders will be able to obtain free copies of the Proxy Statement and other documents filed with the SEC by MKS and Newport through the web site maintained by the SEC at www.sec.gov. In addition, investors and security holders will be able to obtain free copies of the Proxy Statement from Newport by contacting Chris Toth at 949-331-0337. MKS and Newport, and their respective directors and executive officers, may be deemed to be participants in the solicitation of proxies in respect of the transactions contemplated by the Merger Agreement. Information regarding MKS’ directors and executive officers is contained in MKS’ Form 10-K for the year ended December 31, 2014 and its proxy statement dated March 13, 2015, which are filed with the SEC. Information regarding Newport’s directors and executive officers is contained in Newport’s Form 10-K for the year ended January 3, 2015 and its proxy statement dated April 8, 2015, which are filed with the SEC. To the extent holdings of securities by such directors or executive officers have changed since the amounts printed in the 2015 proxy statements, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the participants in the solicitation of proxies in respect of the transactions contemplated by the Merger Agreement and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC when they become available.

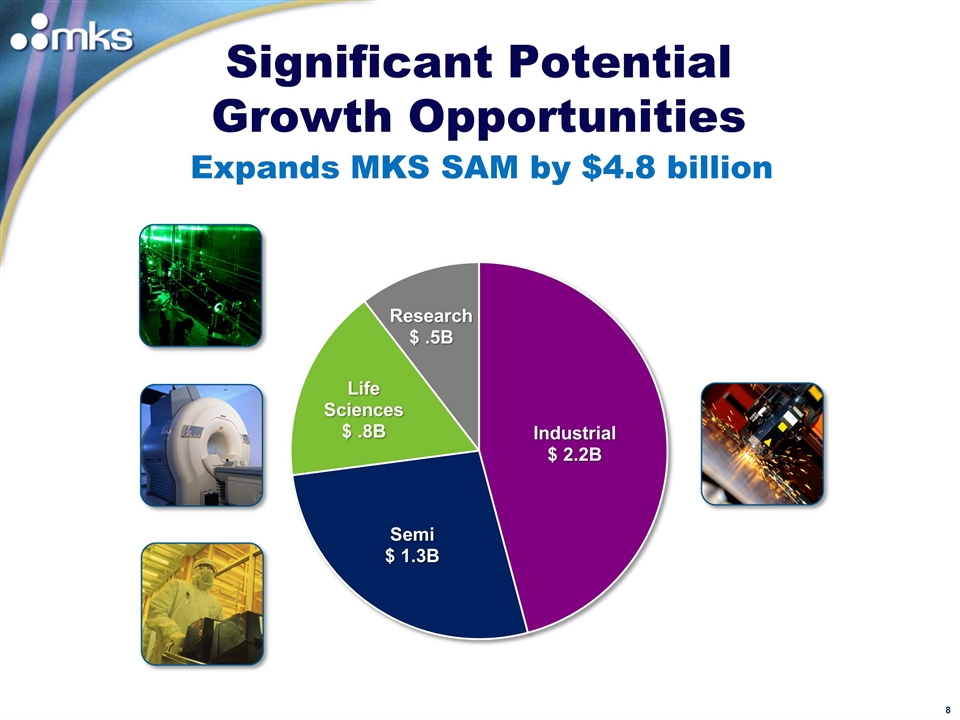

Acquiring a market leading technology company that serves common markets with complementary customer solutions Expands MKS’ addressable market by $4.8 billion Strengthens presence in key strategic markets – Semiconductor, Industrial, Research and Life Sciences Expected to realize $35M in annualized cost synergies within 18-36 months Expected to be accretive to Non-GAAP earnings and free cash flow in the first 12 months MKS to Acquire Newport Corporation $23.00 Per Share All Cash Transaction

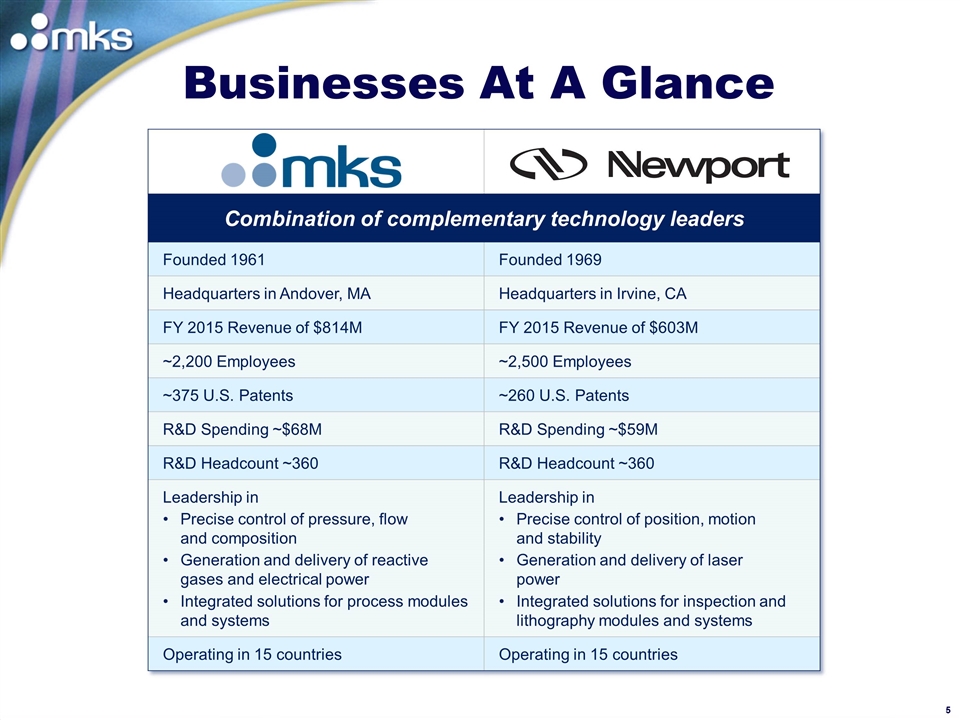

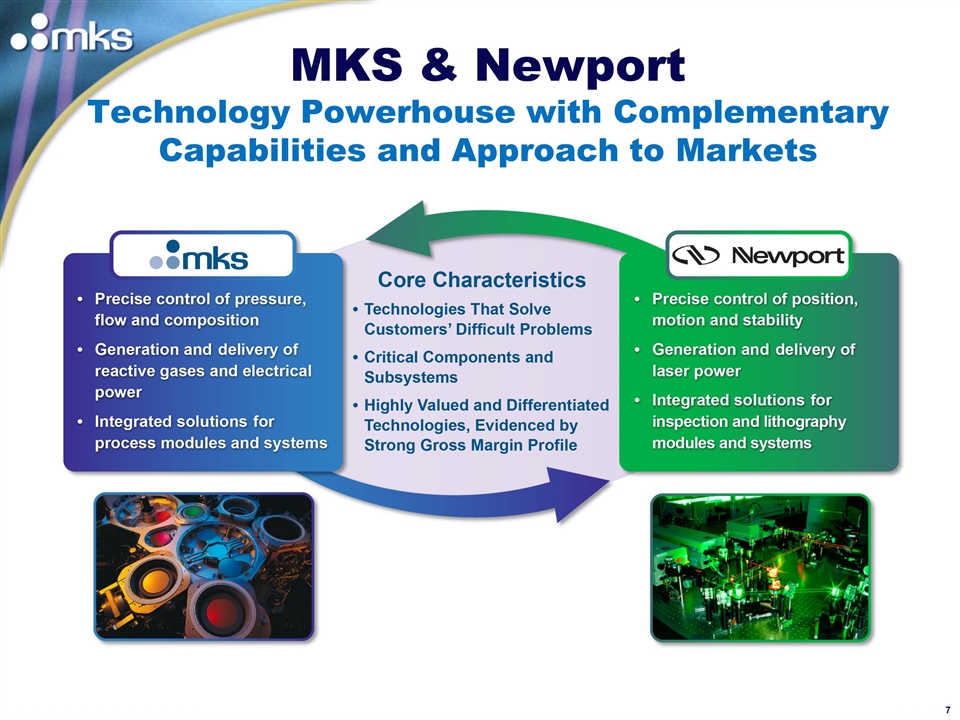

Businesses At A Glance Combination of complementary technology leaders Founded 1961 Founded 1969 Headquarters in Andover, MA Headquarters in Irvine, CA FY 2015 Revenue of $814M FY 2015 Revenue of $603M ~2,200 Employees ~2,500 Employees ~375 U.S. Patents ~260 U.S. Patents R&D Spending ~$68M R&D Spending ~$59M R&D Headcount ~360 R&D Headcount ~360 Leadership in • Precise control of pressure, flow and composition •Generation and delivery of reactive gases and electrical power •Integrated solutions for process modulesand systems Leadership in • Precise control of position, motion and stability •Generation and delivery of laser power •Integrated solutions for inspection andlithography modules and systems Operating in 15 countries Operating in 15 countries

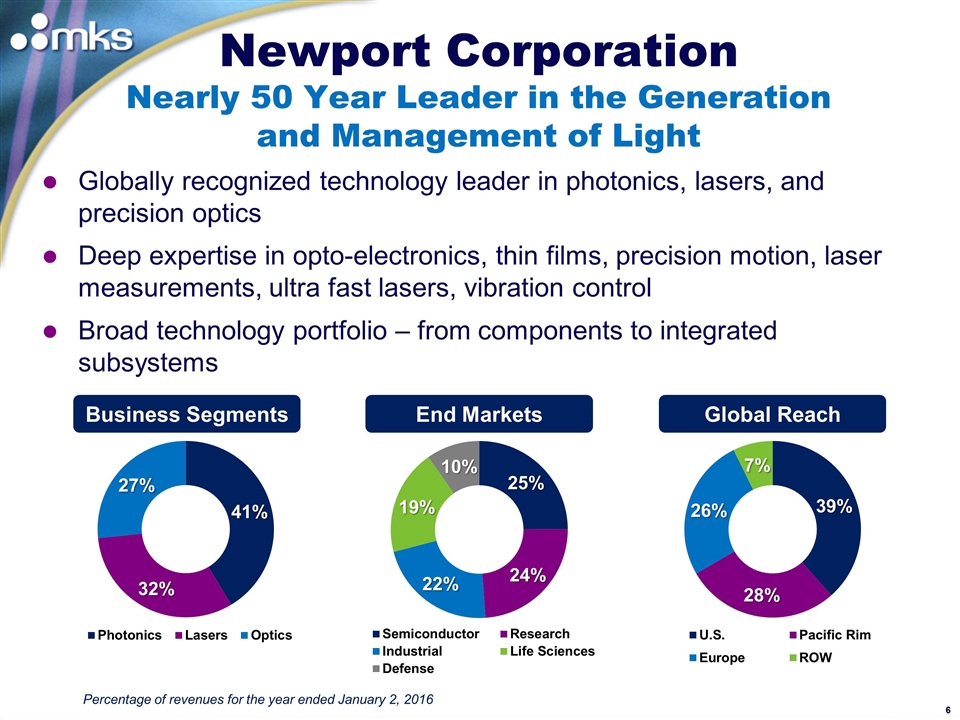

Globally recognized technology leader in photonics, lasers, and precision optics Deep expertise in opto-electronics, thin films, precision motion, laser measurements, ultra fast lasers, vibration control Broad technology portfolio – from components to integrated subsystems Newport Corporation Nearly 50 Year Leader in the Generation and Management of Light Business Segments End Markets Global Reach Percentage of revenues for the year ended January 2, 2016

MKS & Newport Technology Powerhouse with Complementary Capabilities and Approach to Markets

Expands MKS SAM by $4.8 billion Significant Potential Growth Opportunities

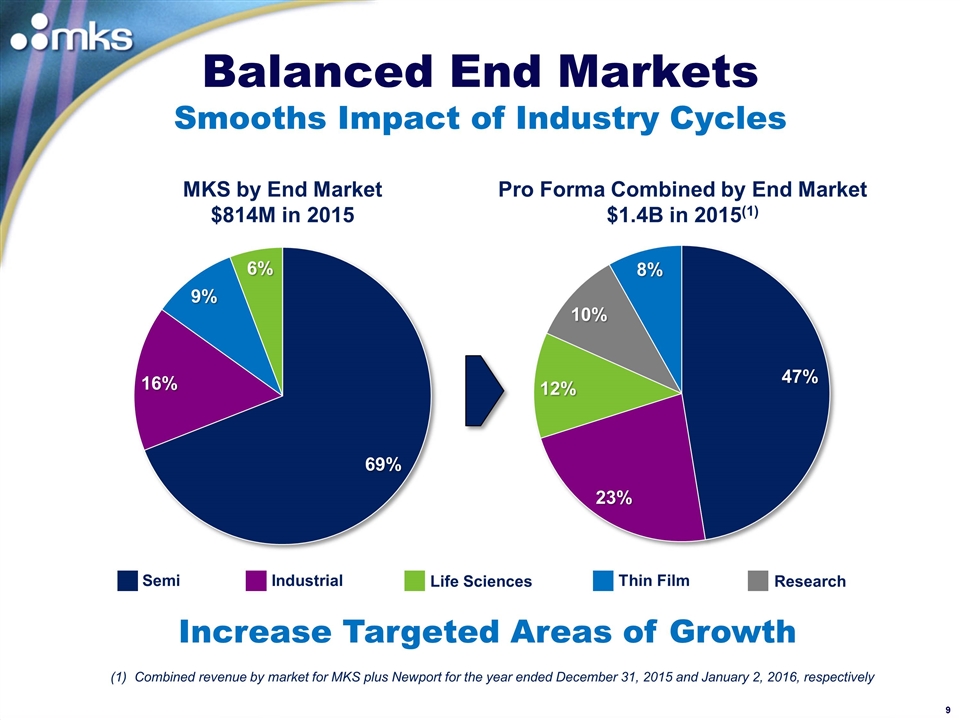

Balanced End Markets Smooths Impact of Industry Cycles MKS by End Market $814M in 2015 Semi Industrial Life Sciences Thin Film Research Increase Targeted Areas of Growth Pro Forma Combined by End Market $1.4B in 2015(1) Combined revenue by market for MKS plus Newport for the year ended December 31, 2015 and January 2, 2016, respectively

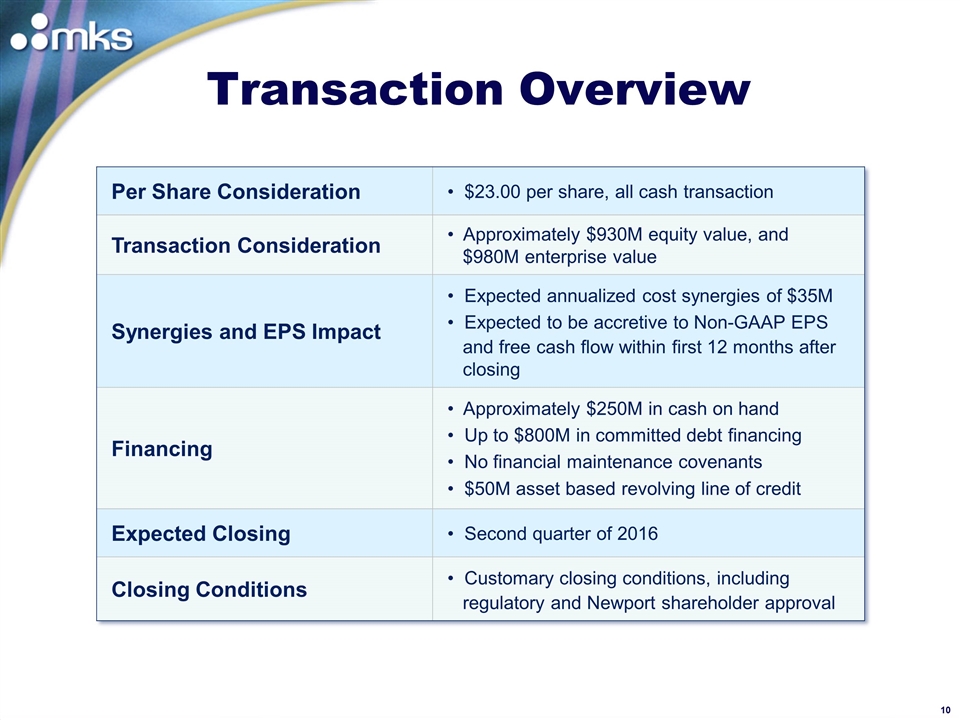

Transaction Overview Per Share Consideration • $23.00 per share, all cash transaction Transaction Consideration • Approximately $930M equity value, and $980M enterprise value Synergies and EPS Impact • Expected annualized cost synergies of $35M • Expected to be accretive to Non-GAAP EPS and free cash flow within first 12 months after closing Financing • Approximately $250M in cash on hand • Up to $800M in committed debt financing • No financial maintenance covenants • $50M asset based revolving line of credit Expected Closing • Second quarter of 2016 Closing Conditions • Customary closing conditions, including regulatory and Newport shareholder approval

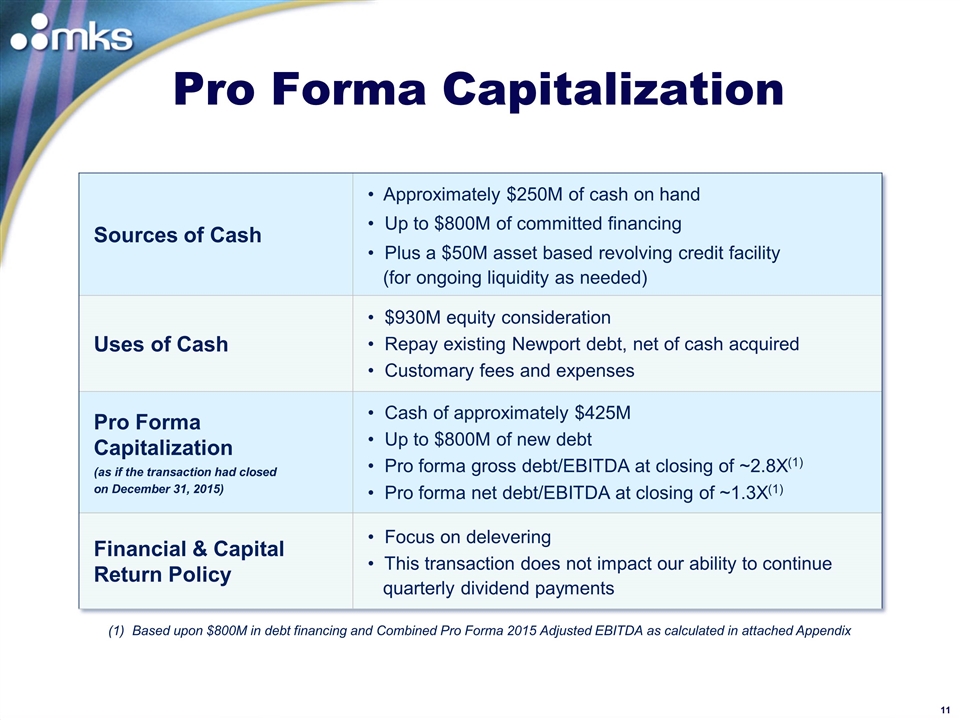

Pro Forma Capitalization Sources of Cash • Approximately $250M of cash on hand • Up to $800M of committed financing • Plus a $50M asset based revolving credit facility (for ongoing liquidity as needed) Uses of Cash • $930M equity consideration • Repay existing Newport debt, net of cash acquired • Customary fees and expenses Pro Forma Capitalization (as if the transaction had closed on December 31, 2015) • Cash of approximately $425M • Up to $800M of new debt • Pro forma gross debt/EBITDA at closing of ~2.8X(1) • Pro forma net debt/EBITDA at closing of ~1.3X(1) Financial & Capital Return Policy • Focus on delevering • This transaction does not impact our ability to continue quarterly dividend payments Based upon $800M in debt financing and Combined Pro Forma 2015 Adjusted EBITDA as calculated in attached Appendix

Since 2013, MKS increased its target operating model Non-GAAP EPS by almost 50% Measurable improvements to profitability with strategic actions across a variety of functions, regions and activities such as: Leverage low cost country sourcing Leverage income tax planning opportunities (400 basis point improvement in effective income tax rate since 2013) Infrastructure savings by combining similar locations Reinvested savings into strategic R&D, sales and marketing MKS’ Proven Record of Profit Improvement

Investors Expands MKS’ addressable markets by $4.8 billion Expected to realize $35M in annualized cost synergies plus opportunity for revenue synergies Expected to be accretive to Non-GAAP EPS and free cash flow in first 12 months Strong cash flow history and intent to delever quickly Customers Complementary skills, technologies and product capabilities to deliver innovative and cost-effective solutions Global manufacturing, applications, support and service presence Employees Creates premier, global, billion dollar technology company to attract and retain talent Opportunity to work on the industries’ most cutting edge and complex challenges A Compelling Transaction For All Stakeholders

Appendix

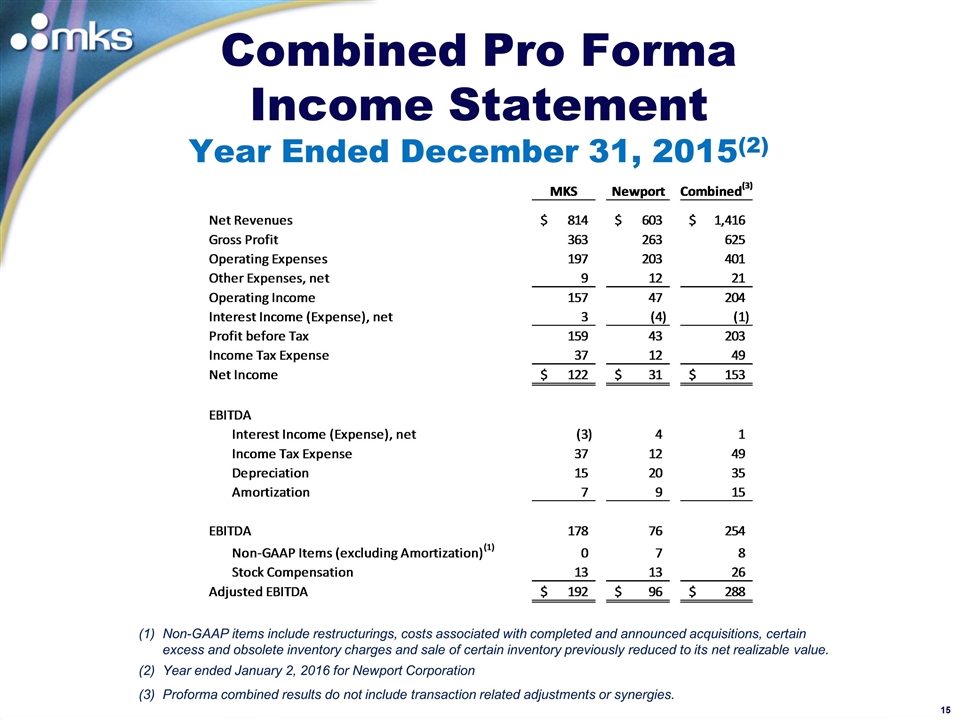

Combined Pro Forma Income Statement Year Ended December 31, 2015(2) Non-GAAP items include restructurings, costs associated with completed and announced acquisitions, certain excess and obsolete inventory charges and sale of certain inventory previously reduced to its net realizable value. Year ended January 2, 2016 for Newport Corporation Proforma combined results do not include transaction related adjustments or synergies. Combined EBITDA Non GAAP Adjustments Non-GAAP MKS Newport Combined(3) MKS Photon MKS Photon Combined Net Revenues $813.5 $602.69100000000003 $1,416.191 $813.5 $602.69100000000003 $1,416.191 Gross Profit 362.87200000000001 262.52 625.39200000000005 -1.6099999999999999 3.952 361.262 266.47199999999998 627.73399999999992 Operating Expenses 197.392 203.40600000000001 400.798 197.392 203.40600000000001 400.798 Other Expenses, net 8.8410000000000011 11.725000000000001 20.566000000000003 -8.8410000000000011 -11.725000000000001 0 0 0 Operating Income 156.63900000000001 47.388999999999974 204.02800000000005 163.87 63.065999999999974 226.93599999999992 Interest Income (Expense), net 2.8560000000000003 -4.3230000000000004 -1.4670000000000001 2.8560000000000003 -4.3230000000000004 -1.4670000000000001 Profit before Tax 159.495 43.065999999999974 202.56100000000004 166.726 58.742999999999974 225.46899999999991 Income Tax Expense 37.170999999999999 11.945 49.116 10.481999999999999 47.652999999999999 19.681000000000001 67.334000000000003 Net Income $122.32400000000001 $31.120999999999974 $153.44500000000005 $119.07300000000001 $39.061999999999969 $158.13499999999991 EBITDA Interest Income (Expense), net -2.8560000000000003 4.3230000000000004 1.4670000000000001 -2.8560000000000003 4.3230000000000004 1.4670000000000001 Income Tax Expense 37.170999999999999 11.945 49.116 47.652999999999999 19.681000000000001 67.334000000000003 Depreciation 15 19.826999999999998 34.826999999999998 15 19.826999999999998 34.826999999999998 Amortization 6.8 8.5220000000000002 15.321999999999999 0 EBITDA 178.43900000000002 75.737999999999985 254.17700000000008 178.87 82.892999999999972 261.76299999999992 Non-GAAP Items (excluding Amortization)(1) 0.43100000000000138 7.1540000000000008 7.5850000000000026 0 0 0 Stock Compensation 13.013 13.234999999999999 26.247999999999998 13.013 13.234999999999999 26.247999999999998 Adjusted EBITDA $191.88300000000004 $96.126999999999981 $288.01000000000005 $191.88300000000001 $96.127999999999972 $288.01099999999991