Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BROCADE COMMUNICATIONS SYSTEMS INC | brcd-8keprxfy16q1.htm |

| EX-99.1 - PRESS RELEASE - BROCADE COMMUNICATIONS SYSTEMS INC | brcd-8keprxfy16q1xex991.htm |

|

Q1 FY 2016 Earnings

Prepared Comments and Slides

February 17, 2016

Michael Iburg

Investor Relations

Phone: 408-333-0233

miburg@Brocade.com

Ed Graczyk

Media Relations

Phone: 408-333-1836

egraczyk@Brocade.com

NASDAQ: BRCD

Brocade Q1 FY 2016 Earnings 2/17/2016

|

Prepared comments provided by Michael Iburg, Investor Relations

Thank you for your interest in Brocade’s Q1 Fiscal 2016 earnings presentation, which includes prepared remarks, cautionary statements and disclosures, slides, and a press release detailing fiscal first quarter 2016 results. The press release, along with these prepared comments and slides, has been furnished to the SEC on Form 8-K and has been made available on the Brocade Investor Relations website at www.brcd.com. The press release will be issued subsequently via Marketwired.

© 2016 Brocade Communications Systems, Inc. Page 2 of 22

Brocade Q1 FY 2016 Earnings 2/17/2016

|

© 2016 Brocade Communications Systems, Inc. Page 3 of 22

Brocade Q1 FY 2016 Earnings 2/17/2016

|

Today’s prepared comments include remarks by Lloyd Carney, Brocade CEO, regarding the company’s quarterly results, its strategy, and a review of operations, as well as industry trends and market/technology drivers related to its business; and by Dan Fairfax, Brocade CFO, who will provide a financial review.

A management discussion and live question and answer conference call will be webcast at

2:30 p.m. Pacific Time on February 17 at www.brcd.com and will be archived on the Brocade Investor Relations website.

© 2016 Brocade Communications Systems, Inc. Page 4 of 22

Brocade Q1 FY 2016 Earnings 2/17/2016

|

Prepared comments provided by Lloyd Carney, CEO

© 2016 Brocade Communications Systems, Inc. Page 5 of 22

Brocade Q1 FY 2016 Earnings 2/17/2016

|

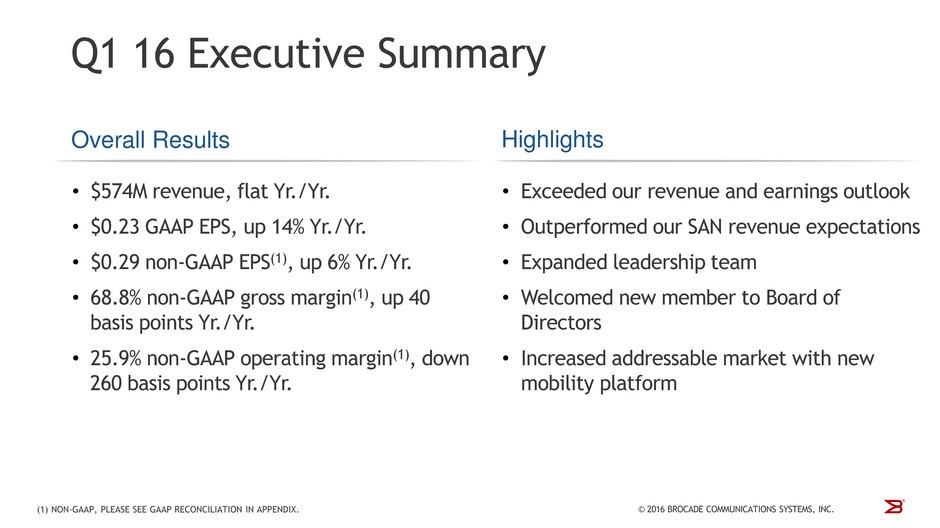

We delivered another solid quarter, exceeding our revenue and earnings expectations. In particular, storage networking product revenue exceeded our outlook range, underscoring the continued demand for Fibre Channel connectivity in both traditional and flash-based storage networking environments. IP Networking revenue was within the outlook range provided in November, though at the lower end, primarily driven by a more pronounced seasonal decline in the U.S. federal market. We exceeded our gross margin, operating margin, and cash flow targets for the quarter, and repurchased more than $140M of common stock.

During the quarter, we added a number of acclaimed thought leaders to our management team, attracting domain experts in key areas such as mobility, machine learning, massively scalable systems, and security. In November, we announced that Hadi Nahari joined Brocade as vice president and security chief technology officer, with more than 20 years of technology experience, including his most recent position as chief security architect of mobile and software platforms at NVIDIA. We also announced that industry sales veteran Pete Peterson joined Brocade as vice president of worldwide channel sales, bringing significant sales and leadership experience, including 20 years in senior management positions at Tech Data Corporation.

In addition to broadening our corporate leadership team, we were also very pleased to welcome Kim Goodman to our Board of Directors. Kim brings significant experience in strategic planning, finance and operations through executive-level positions at American Express Company, as well as a wealth of networking and software knowledge from her accomplished career at Dell. I am excited to add such a respected member to our already outstanding Board of Directors as we execute on our strategy of enabling open, software-enabled New IP networks.

We were excited to announce yesterday an advanced, software-centric mobility platform, vision, and ecosystem for building open, New IP networks that support new services and new business models for mobile network operators as 5G approaches. Over the next several quarters, we plan to introduce a number of innovative new products that we expect will enhance our capabilities, expand our addressable market, and help drive growth.

© 2016 Brocade Communications Systems, Inc. Page 6 of 22

Brocade Q1 FY 2016 Earnings 2/17/2016

|

Storage networking revenue surpassed our expectations, underscoring our belief that continued growth in overall Fibre Channel storage array capacity, as predicted by IDC and Gartner, is a solid indicator of the ongoing durability of our storage networking business. Our year-over-year revenue performance in Q1 was primarily driven by continued growth in directors, offset by declines in our switch and embedded revenue.

As part our strategy to grow and diversify our SAN partnerships, during Q1 we broadened our relationship with Inspur Group, a top cloud-based infrastructure provider in China. Inspur will leverage Brocade Fibre Channel products to support its new generation of Inspur 19000 blade servers.

We continue to drive new revenue opportunities that leverage our sizable installed base of Fibre Channel customers. During the quarter, we recognized our first revenue from the recently announced Brocade Analytics Monitoring Platform (AMP), an innovative new SAN monitoring and analytics solution. This solution is resonating well with customers because it offers concrete business value and a tangible return on investment.

In December 2015, Brocade and Qlogic demonstrated the industry’s first non-volatile memory express (NVMe) solution leveraging Brocade’s Fibre Channel fabric technology. NVMe provides a standards-based approach for PCI Express solid state drive access that significantly improves performance by reducing latency and streamlining the command set. This demonstration is another proof point of Fibre Channel’s importance for enabling exciting new storage technologies as well Brocade’s leadership within the storage networking market.

In the first half of this year, we expect to launch our Gen 6 Fibre Channel technology, with advanced capabilities specifically designed to address the performance, reliability and scalability requirements for virtualization, flash-based storage networking environments, and new data center architectures. Our technology roadmap continues to set the standard for innovation in the industry, and we are excited to honor that heritage with a full portfolio of leading-edge solutions for next-generation storage networking.

© 2016 Brocade Communications Systems, Inc. Page 7 of 22

Brocade Q1 FY 2016 Earnings 2/17/2016

|

IP Networking revenue in Q1 was within our outlook range, but below the midpoint, primarily the result of a more pronounced seasonal decline within the U.S. federal market. As a result, we are maintaining a more modest view of our IP Networking business in the first half of the year. However, we do expect significant improvement in the second half as the U.S. federal market becomes seasonally stronger and new products provide an opportunity to accelerate growth.

We continue to expand our portfolio of fabric offerings with two new fabric technologies for data networking. In December, we released our new campus fabric offering. As a software upgrade to the existing Brocade ICX® switch product family, Brocade Campus Fabric collapses access and aggregation network layers into a single logical device, combining the power of a “distributed chassis” design with the flexibility and cost-effectiveness of fixed form factor switches. In February, we released Brocade IP Fabric technology on the Brocade VDX® switch family. Brocade IP Fabric delivers new levels of scalability for large-to-megascale data centers by leveraging a cloud-proven, standard BGP-based architecture. This new offering complements our existing VCS® Fabric offering and allows us to address new customer types, use cases and application environments.

Brocade also delivered another highly differentiated NFV offering targeting the access edge for service providers with our release of a virtual customer premise solution known as virtual CPE. This open architecture allows operators to simplify connectivity and accelerate the creation of service chains for enterprise-class campus and branch connectivity.

We also expanded our software footprint in hyperscale clouds with the availability of our vADC solution now in three leading hyperscale cloud providers. As enterprise customers initiate application workloads in these fast-growing clouds, they can select Brocade software from these online marketplaces and activate it with the click of a button.

We continue to expand our presence in targeted areas that offer additional business opportunities for Brocade. For example, we were pleased to announce our partnership with Nutanix in which Brocade VDX switches with Brocade VCS fabric technology provide a scalable high-performance networking solution for Nutanix hyperconverged infrastructure solutions. Nutanix joins our existing hyperconverged partners, such as EMC and HDS, in bringing innovative solutions to this segment of the market.

© 2016 Brocade Communications Systems, Inc. Page 8 of 22

Brocade Q1 FY 2016 Earnings 2/17/2016

|

We are expanding our TAM to include new markets for Brocade where technology transitions are creating incremental revenue opportunities. For example, yesterday we announced a mobility platform and vision for building open, New IP networks that can support new services and business models for mobile network operators as 5G approaches. These innovative offerings are expected to open an incremental addressable market for Brocade and uniquely position us as a disrupter, as mobile operators enter the next wave of infrastructure investment. Brocade’s existing software investments in SDN and NFV, as well as its data center portfolio, are well suited to address mobile operators’ goals of virtualized, distributed, disaggregated, and programmable end-to-end infrastructure.

Brocade’s perspective on the future of mobile networks, including 4G and the realization of 5G, is rooted firmly in building networks that are open, software-defined, virtualized, and highly programmable. We have the solutions, architecture and partner ecosystem to help mobile network operators simplify their infrastructure and begin the transformation to 5G today. While our competitors are vying to protect billions of dollars of legacy, closed and proprietary hardware devices in the network, Brocade is well positioned to disrupt this model with our industry-leading SDN and NFV technologies and differentiated offerings of vEPC, mobile edge computing and network visibility. Our solutions are purpose-built for virtualized environments and ideally suited for emerging mobile services such as machine-to-machine, Internet of Things, enterprise private mobile services, and mobile virtual network operators.

In conjunction, we also announced collaboration with 14 technology partners, thus enabling mobile operators to accelerate the adoption of SDN, NFV, and mobile edge computing and transform their operations to achieve increased automation and service agility. We will be demonstrating these new offerings in our booth at Mobile World Congress, Feb. 22-25 in Barcelona, Spain. Our solutions will also be featured in demonstrations with more than a dozen partners, thus doubling our presence again this year at this influential industry event.

© 2016 Brocade Communications Systems, Inc. Page 9 of 22

Brocade Q1 FY 2016 Earnings 2/17/2016

|

In closing, our first quarter accomplishments highlight our continued execution against our business plan and strategy, with solid financial performance, strong profitability and expansion into targeted new markets.

Our SAN business continues to demonstrate resilience, in keeping with the strong growth in overall Fibre Channel storage array capacity, and we are cultivating new revenue streams across our IP Networking end markets.

As we move further into fiscal year 2016, I look forward to an exciting year of product and technology announcements in many of our key markets. We also expect to broaden our reach with incremental opportunities that complement our strong business foundation, and enhance our innovative roadmap in open, software-enabled New IP architectures.

© 2016 Brocade Communications Systems, Inc. Page 10 of 22

Brocade Q1 FY 2016 Earnings 2/17/2016

|

Prepared comments provided by Dan Fairfax, CFO

© 2016 Brocade Communications Systems, Inc. Page 11 of 22

Brocade Q1 FY 2016 Earnings 2/17/2016

|

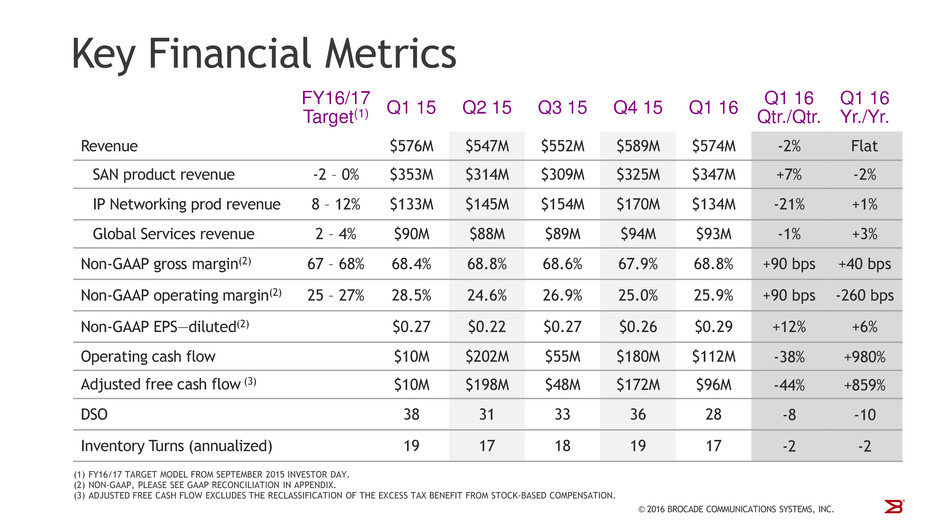

Fiscal Q1 16 followed normal quarterly seasonal patterns with a sequential increase in SAN revenue and a sequential decrease in IP Networking revenue.

Q1 16 revenue of $574M was flat Yr./Yr. primarily driven by increased Global Services and IP Networking revenue offset by lower SAN sales. SAN product revenue was down 2% Yr./Yr. as the director revenue increase of 7% was offset by a decline in switch and embedded revenue of 8% and 7%, respectively. IP Networking product revenue was up 1% Yr./Yr. due to stronger switch and software sales, partially offset by lower router sales.

Non-GAAP gross margin was 68.8% in Q1 16, up 40 basis points year-over-year due primarily to a favorable product mix. Non-GAAP operating margin was 25.9% in Q1 16, down 260 basis points from Q1 15, primarily due to higher operating expenses associated with acquisition-related headcount.

Q1 16 non-GAAP diluted EPS was $0.29, up 6% year-over-year with $0.02 of the improvement coming from tax benefits related to the extension of the R&D tax credit. The R&D tax credit is now permanent and will become part of our ongoing annual tax rate.

Operating cash flow and adjusted free cash flow were above the forecasted ranges of $50-70M and $30-50M, respectively, as DSOs improved significantly from the prior quarter. DSOs were 28 days in Q1 16, which was an improvement from 36 days in Q4 15.

Inventory turns decreased slightly year-over-year.

From a total revenue perspective, including SAN and IP Networking, our channels to market have remained relatively stable over time. Total OEM revenue was 67%, flat year-over-year, with the balance coming from Channel and Direct routes to market.

© 2016 Brocade Communications Systems, Inc. Page 12 of 22

Brocade Q1 FY 2016 Earnings 2/17/2016

|

Revenue from our total SAN business, including hardware products and SAN-based support and services, in Q1 16 was $402M, down 1% from Q1 15 as overall product revenue was down 2% and global service revenue was up 2%.

Our SAN product revenue was $347M in the quarter, down 2% Yr./Yr. as director revenue was up 7% but offset by an 8% decline in switch revenue and a 7% decline in embedded revenue year-over-year.

SAN-based global services revenue was $55M, up 2% Yr./Yr.

© 2016 Brocade Communications Systems, Inc. Page 13 of 22

Brocade Q1 FY 2016 Earnings 2/17/2016

|

Revenue from our total IP Networking business, including hardware and IP-based support and services, was $173M, up 2% Yr./Yr. Geographically, the Yr./Yr. revenue improvement was across several regions with the Americas (excluding U.S. federal) up 5%, Asia Pacific up 27%, and Japan up 35%. This was offset by a revenue decline in EMEA of 17% and U.S. federal of 5%.

Q1 16 IP Networking product revenue was $134M, up 1% Yr./Yr. We experienced strong year-over-year growth in Ethernet switch sales, up 19%, while router sales were down 25%. The routing decline was primarily due to a lower volume of next-gen line card sales into service providers.

In an effort to make our Routing and Ethernet Switch revenue breakout more comparable to other vendors in the industry, we have removed the Other IP Networking category. The revenue formerly associated with the Other IP Networking category has been mapped into either Routing or Ethernet Switch.

IP-based Global Services revenue was $39M, up 5% Yr./Yr. due primarily to the incremental maintenance volume associated with the recently acquired virtual application delivery software.

We track our IP Networking business based on the identification of customer use cases. Although it is difficult to identify all end users and their specific network deployments due to our two-tier distribution channel, we provide estimates of the split of our IP Networking business. Our data center customers(1) represented approximately 53% of IP Networking revenue in Q1 16, compared with 53% in Q1 15 and 60% in Q4 15.

(1)The estimated percentage of revenue coming from data center IP Networking customers may fluctuate quarter-to-quarter due to the timing of large data center customer transactions, minor changes to classification from improved visibility of actual customer deployments, as well as the seasonality of the public sector, including federal. Other use cases, such as enterprise campus and carrier networks (MAN/WAN) represent the balance of the business.

© 2016 Brocade Communications Systems, Inc. Page 14 of 22

Brocade Q1 FY 2016 Earnings 2/17/2016

|

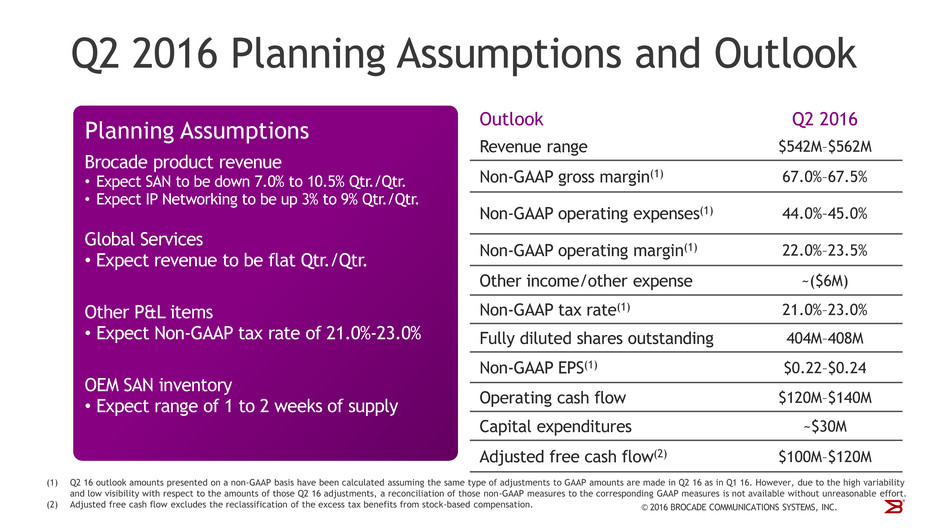

Looking forward to Q2 16, we considered a number of factors, including the following, in setting our outlook:

• | For Q2 16, we expect SAN product revenue to be down 7.0% to 10.5% Qtr./Qtr. as we typically see a seasonally weak fiscal Q2 in our SAN business. |

• | We expect our Q2 16 IP Networking product revenue to be up 3% to 9% Qtr./Qtr. as our IP Networking business is traditionally stronger in our fiscal Q2 versus Q1. |

• | We expect our Global Services revenue to be flat Qtr./Qtr. |

• | We expect Q2 16 non-GAAP gross margin to be between 67.0% to 67.5%, and non-GAAP operating margin to be between 22.0% to 23.5%, primarily reflecting the expected mix of SAN and IP revenues. |

• | Operating cash flow is expected to be in the range of $120M - $140M in fiscal Q2 16. We expect DSOs to increase from the Q1 16 level of 28 days. |

• | At the end of Q1 16, OEM SAN inventory declined to approximately 1.1 weeks of supply from 1.3 weeks of supply based on SAN business revenue. We expect inventory to be between one to two weeks in Q2 16. |

© 2016 Brocade Communications Systems, Inc. Page 15 of 22

Brocade Q1 FY 2016 Earnings 2/17/2016

|

Prepared comments provided by Michael Iburg, Investor Relations

That concludes Brocade’s prepared comments. At 2:30 p.m. Pacific Time on February 17, Brocade will host a webcast conference call at www.brcd.com.

Thank you for your interest in Brocade.

© 2016 Brocade Communications Systems, Inc. Page 16 of 22

Brocade Q1 FY 2016 Earnings 2/17/2016

|

© 2016 Brocade Communications Systems, Inc. Page 17 of 22

Brocade Q1 FY 2016 Earnings 2/17/2016

|

© 2016 Brocade Communications Systems, Inc. Page 18 of 22

Brocade Q1 FY 2016 Earnings 2/17/2016

|

Additional Financial Information:

Q1 15 | Q4 15 | Q1 16 | ||||

GAAP product gross margin | 69.2 | % | 68.5 | % | 70.1 | % |

Non-GAAP product gross margin | 69.7 | % | 69.3 | % | 70.9 | % |

GAAP services gross margin | 59.3 | % | 58.8 | % | 55.6 | % |

Non-GAAP services gross margin | 61.4 | % | 60.7 | % | 57.6 | % |

© 2016 Brocade Communications Systems, Inc. Page 19 of 22

Brocade Q1 FY 2016 Earnings 2/17/2016

|

© 2016 Brocade Communications Systems, Inc. Page 20 of 22

Brocade Q1 FY 2016 Earnings 2/17/2016

|

© 2016 Brocade Communications Systems, Inc. Page 21 of 22

Brocade Q1 FY 2016 Earnings 2/17/2016

|

© 2016 Brocade Communications Systems, Inc. Page 22 of 22