Attached files

| file | filename |

|---|---|

| 10-Q - 10-Q - Corium International, Inc. | cori-20151231x10q.htm |

| EX-32.2 - EX-32.2 - Corium International, Inc. | cori-20151231ex3220a197c.htm |

| EX-10.2 - EX-10.2 - Corium International, Inc. | cori-20151231ex102f92818.htm |

| EX-32.1 - EX-32.1 - Corium International, Inc. | cori-20151231ex321446a51.htm |

| EX-31.2 - EX-31.2 - Corium International, Inc. | cori-20151231ex312cf2e5a.htm |

| EX-31.1 - EX-31.1 - Corium International, Inc. | cori-20151231ex3111b345e.htm |

NNN L E A S E

ARDENWOOD RESEARCH CENTER

FREMONT, CALIFORNIA

LANDLORD:

LBA REALTY FUND III-COMPANY VII, LLC,

a Delaware limited liability company

TENANT:

CORIUM INTERNATIONAL, INC.,

a Delaware corporation

TABLE OF CONTENTS

|

|

Page |

|

|

|

|

ARTICLE 1 - LEASE SUMMARY AND PROPERTY SPECIFIC PROVISIONS |

1 |

|

ARTICLE 2 - LEASE |

8 |

|

ARTICLE 3 - PREMISES |

8 |

|

ARTICLE 4 - TERM AND POSSESSION |

8 |

|

ARTICLE 5 - RENT |

9 |

|

ARTICLE 6 - LETTER OF CREDIT |

10 |

|

ARTICLE 7 - OPERATING EXPENSES/UTILITIES/SERVICES |

12 |

|

ARTICLE 8 - MAINTENANCE AND REPAIR |

12 |

|

ARTICLE 9 - USE |

13 |

|

ARTICLE 10 - HAZARDOUS MATERIALS |

13 |

|

ARTICLE 11 - PARKING |

14 |

|

ARTICLE 12 - TENANT SIGNS |

14 |

|

ARTICLE 13 - ALTERATIONS |

15 |

|

ARTICLE 14 - TENANT’S INSURANCE |

16 |

|

ARTICLE 15 - LANDLORD’S INSURANCE |

17 |

|

ARTICLE 16 - INDEMNIFICATION AND EXCULPATION |

17 |

|

ARTICLE 17 - CASUALTY DAMAGE/DESTRUCTION |

18 |

|

ARTICLE 18 - CONDEMNATION |

19 |

|

ARTICLE 19 - WAIVER OF CLAIMS; WAIVER OF SUBROGATION |

20 |

|

ARTICLE 20 - ASSIGNMENT AND SUBLETTING |

20 |

|

ARTICLE 21 - SURRENDER AND HOLDING OVER |

22 |

|

ARTICLE 22 - DEFAULTS |

22 |

|

ARTICLE 23 - REMEDIES OF LANDLORD |

23 |

|

ARTICLE 24 - ENTRY BY LANDLORD |

24 |

|

ARTICLE 25 - LIMITATION ON LANDLORD’S LIABILITY |

24 |

|

ARTICLE 26 - SUBORDINATION |

24 |

|

ARTICLE 27 - ESTOPPEL CERTIFICATE |

24 |

|

ARTICLE 28 - RELOCATION OF PREMISES |

24 |

|

ARTICLE 29 - MORTGAGEE PROTECTION |

25 |

|

ARTICLE 30 - QUIET ENJOYMENT |

25 |

|

ARTICLE 31 - MISCELLANEOUS PROVISIONS |

25 |

|

EXHIBITS: |

|

|

|

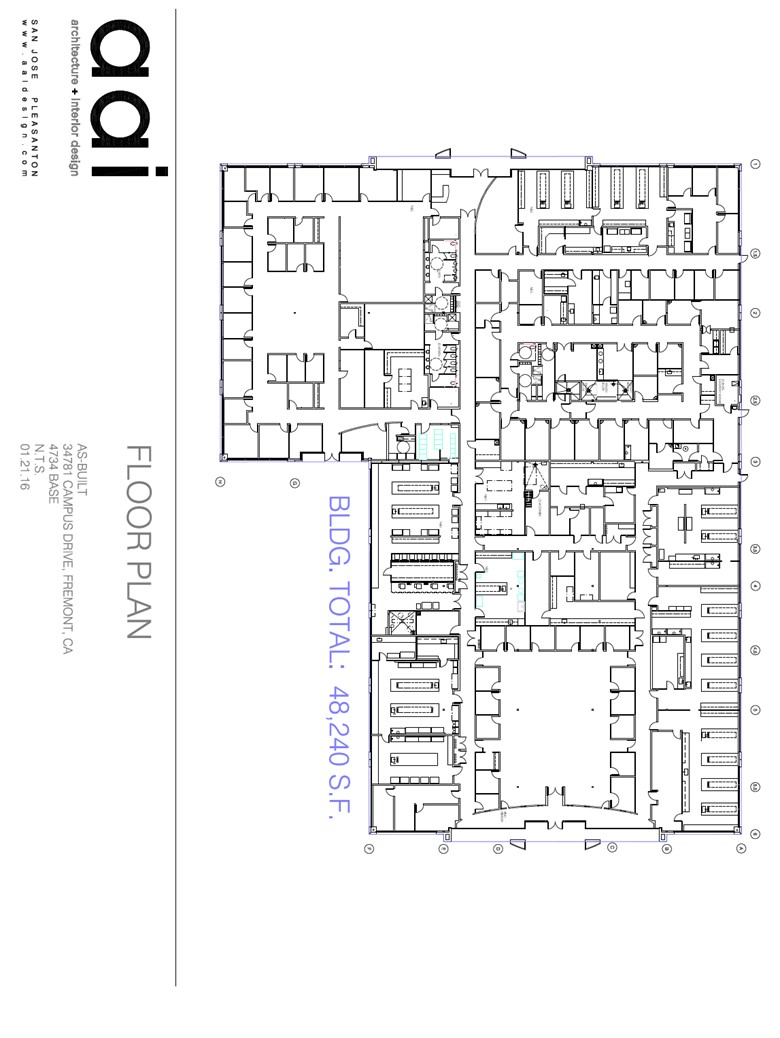

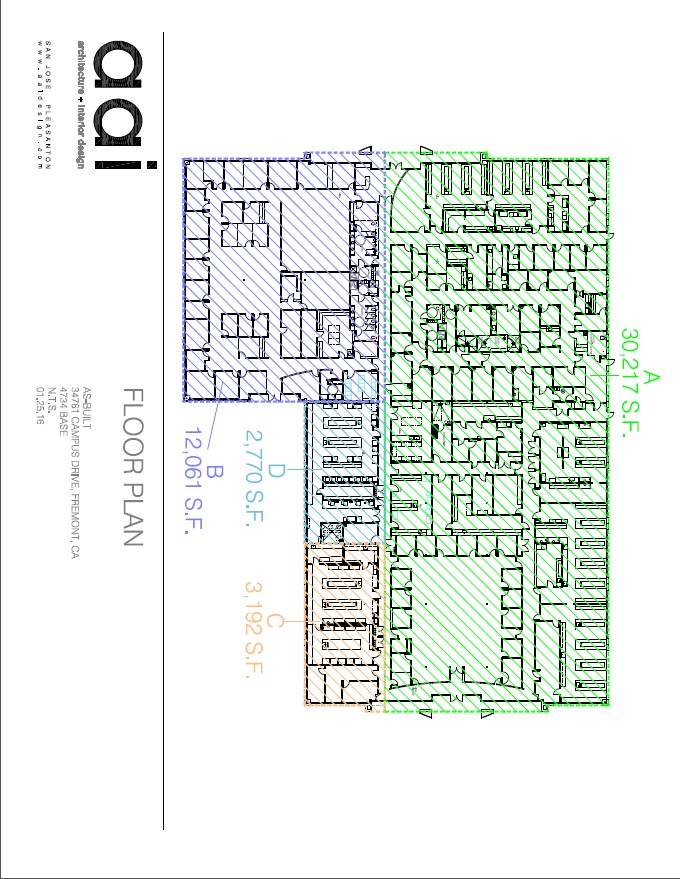

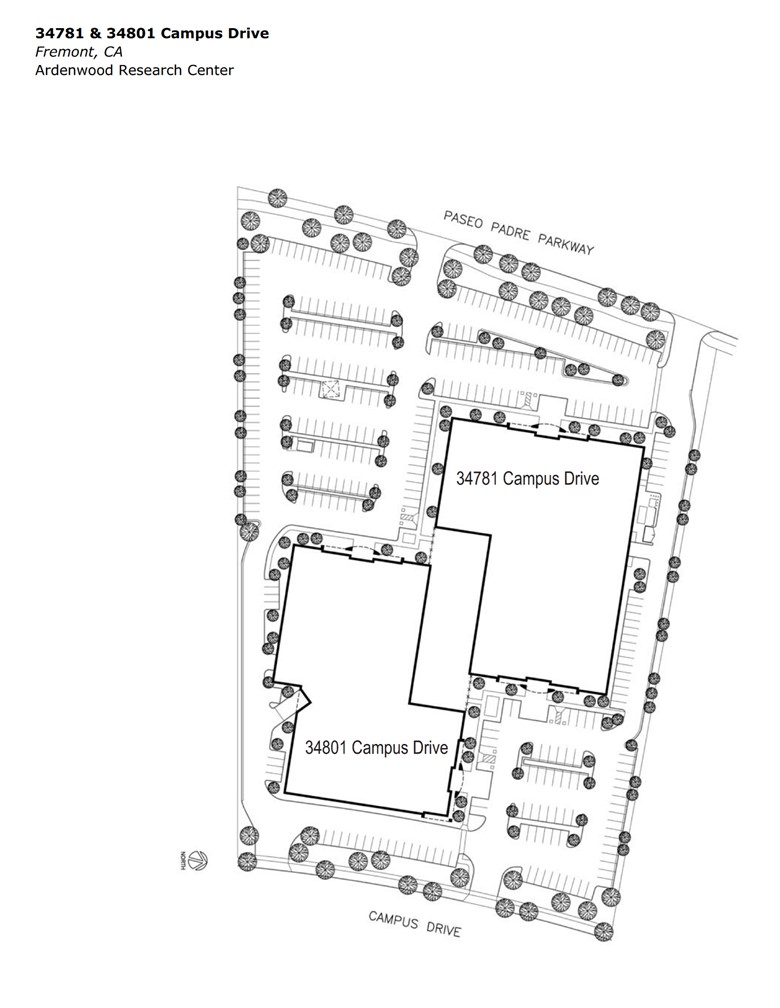

Exhibit A |

Premises Floor Plan |

|

|

Exhibit B |

Site Plan |

|

|

Exhibit C |

Work Letter |

|

|

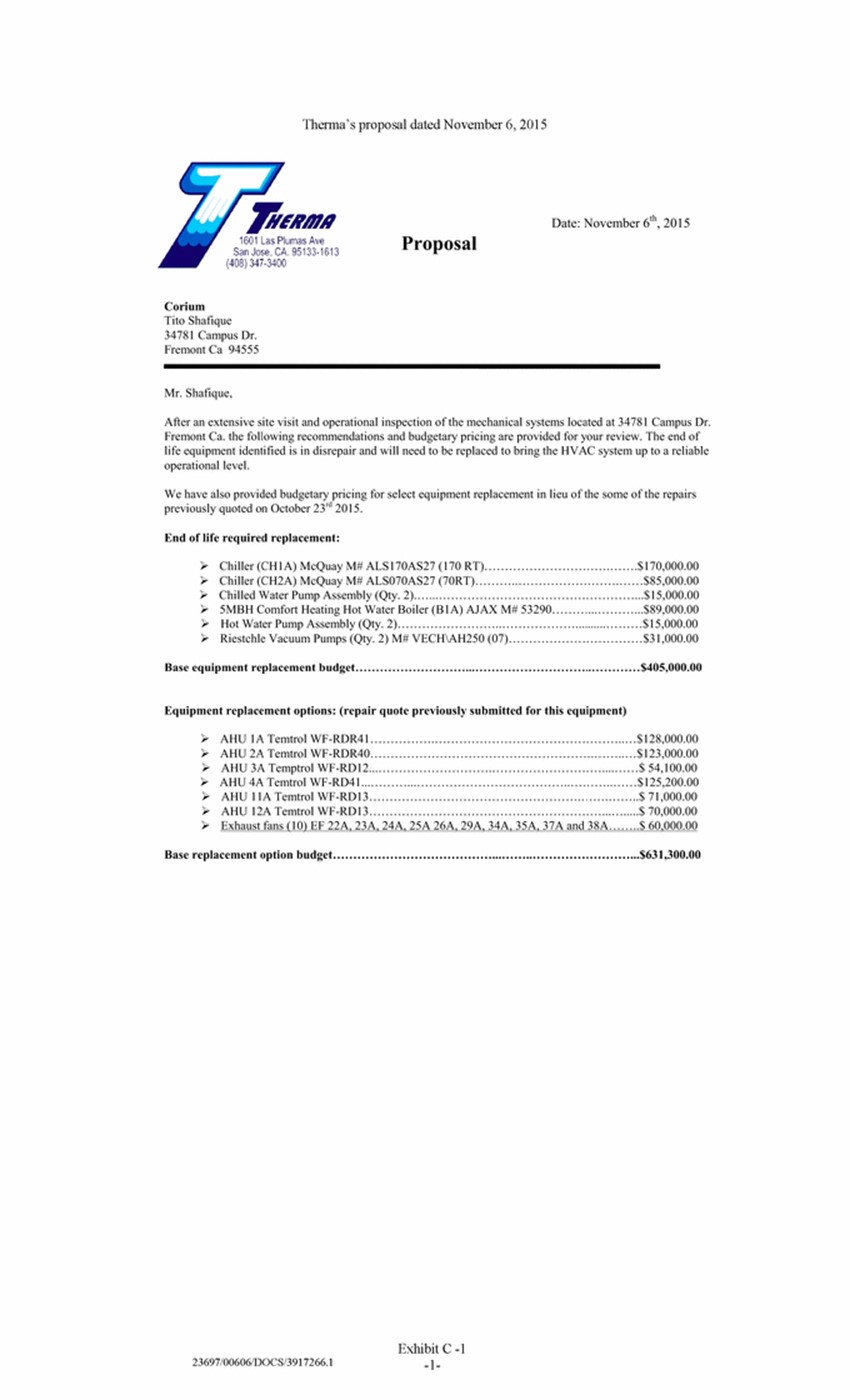

Exhibit C-1 |

Landlord Work Letter |

|

|

Exhibit D |

Notice of Lease Term Dates |

|

|

Exhibit E |

Rules and Regulations |

|

|

Exhibit F |

Estoppel Certificate |

|

|

Exhibit G |

Environmental Questionnaire and Disclosure Statement |

|

|

Exhibit H |

Form Letter of Credit |

|

|

|

|

|

|

|

|

|

|

RIDERS: |

|

|

|

Rider No. 1 |

Extension Option |

|

|

Rider No. 2 |

Fair Market Rental Rate |

|

- i -

THIS LEASE, entered into as of this 12th day of February, 2016 for reference purposes (“Effective Date”), is by and between LBA REALTY FUND III-COMPANY VII, LLC, a Delaware limited liability company, hereinafter referred to as “Landlord”, and CORIUM INTERNATIONAL, INC., a Delaware corporation, hereinafter referred to as “Tenant”.

ARTICLE 1 - LEASE SUMMARY AND PROPERTY SPECIFIC PROVISIONS

|

1.1 Landlord’s Address: |

LBA REALTY FUND III-COMPANY VII, LLC |

|

|

c/o LBA Realty |

|

|

160 W. Santa Clara Street, Suite 950 |

|

|

San Jose, California 95113 |

|

|

Attn: Regional Operations Manager – Campus Drive, Fremont |

|

|

Telephone: [omitted] |

|

|

Facsimile: [omitted] |

|

|

|

|

With copies to: |

LBA Realty |

|

|

3347 Michelson Drive, Suite 200 |

|

|

Irvine, California 92612 |

|

|

Attn: SVP - Operations |

|

|

Telephone: [omitted] |

|

|

E-mail: [omitted] |

|

|

|

|

For payment of Rent: |

LBA REALTY FUND III-COMPANY VII, LLC |

|

|

|

|

|

LBA Realty Fund III Co VII LLC |

|

|

PO Box 745805 |

|

|

Los Angeles, CA 90074-5805 |

|

|

|

|

1.2 Tenant’s Address: |

Corium International, Inc. |

|

|

235 Constitution Drive |

|

|

Menlo Park, CA 94025 |

|

|

Attn: Robert Breuil, CFO |

|

|

Telephone: [omitted] |

|

|

E-mail: [omitted] |

|

|

|

|

Tenant Billing Address: |

Corium International, Inc. |

|

|

4558 50th St. |

|

|

Grand Rapids, Michigan 49512 |

|

|

Attn: Timothy Sweemer, Chief Accounting Officer |

|

|

E-mail: [omitted] |

1.3Building: The Building commonly known as 34781 Campus Drive, Fremont, California. The Building, together with all other buildings, improvements and facilities, now or subsequently located upon the land (the “Site”) as shown on the Site Plan attached hereto as Exhibit B (as such area may be expanded or reduced from time to time) is referred to herein as the “Property”. The Property is commonly known as Ardenwood Research Center. Landlord and Tenant stipulate and agree that the Property contains 92,250 rentable square feet in the aggregate and the Building contains 48,240 rentable square feet, for all purposes of this Lease.

1.4Premises: The entire Building, as outlined on the Premises Floor Plan attached hereto as Exhibit A. Landlord and Tenant stipulate and agree that the Premises contains 48,240 rentable square feet, for all purposes of this Lease.

1.5City: The City of Fremont, County of Alameda, State of California.

1.6Commencement Date: The date for commencement of the Term, to be determined pursuant to the Work Letter attached as Exhibit C hereto. Estimated Commencement Date: August 1, 2016.

1.7Term: One hundred twenty (120) months, plus any partial month at the beginning of the Term, commencing on the Commencement Date and ending on the last day of the one hundred twentieth (120th) full calendar month following the Commencement Date (“Expiration Date”).

1.8Monthly Base Rent:

|

|

|

|

|

|

|

Months or Period |

|

Monthly Base Rent |

|

|

|

*1 – 12 |

|

$ |

72,360.00 |

|

|

13 – 24 |

|

$ |

110,952.00 |

|

|

25 – 36 |

|

$ |

114,328.80 |

|

|

37 – 48 |

|

$ |

117,705.60 |

|

|

49 – 60 |

|

$ |

121,082.40 |

|

|

61 – 72 |

|

$ |

124,941.60 |

|

|

73 – 84 |

|

$ |

128,800.80 |

|

|

85 – 96 |

|

$ |

132,660.00 |

|

|

97 – 108 |

|

$ |

136,519.20 |

|

|

109 – 120 |

|

$ |

140,378.40 |

|

- 1 -

*Including any partial month at the beginning of the Term and measured from the Commencement Date.

1.9Letter of Credit Amount: $665,712.00.

1.10Permitted Use: Administrative, office, research and development, laboratory, and clean room manufacturing and ancillary related uses, subject to the provisions set forth in this Lease and as permitted by law.

1.11Parking: One hundred eighty-three (183) unreserved parking spaces, subject to the terms of Article 11 of the Standard Lease Provisions.

1.12Brokers: CBRE, Inc., representing Tenant, and Jones Lang LaSalle, representing Landlord.

1.13Interest Rate: The lesser of: (a) Ten percent (10%) or (b) the maximum rate permitted by law in the State where the Property is located.

1.14Insurance Amounts:

a.Commercial General Liability Insurance: General liability of not less than One Million Dollars ($1,000,000.00) per occurrence and Two Million Dollars ($2,000,000.00) in the aggregate.

b.Commercial Automobile Liability Insurance: Limit of liability of not less than One Million Dollars ($1,000,000.00) per accident.

c.Worker’s Compensation and Employers Liability Insurance: With limits as mandated pursuant to the laws in the State in which the Property is located, or One Million Dollars ($1,000,000.00) per person and accident, whichever is greater.

d.Umbrella Insurance: Limits of not less than Three Million Dollars ($3,000,000.00) per occurrence.

e.Loss of Income, Extra Expense and Business Interruption Insurance: In such amounts as will reimburse Tenant for 6 months of direct or indirect loss of earnings attributable to the Premises location and for all perils commonly insured against by prudent tenants or attributable to prevention of access to the Premises, Tenant’s parking areas or to the Building as a result of such perils.

1.15Tenant Improvements: The improvements previously installed in the Premises, if any, and the tenant improvements to be installed in the Premises by Tenant, as described in the Work Letter attached hereto as Exhibit C (the “Work Letter”), and the Landlord Work Letter attached hereto as Exhibit C-1 (the “Landlord Work Letter”). Landlord hereby grants to Tenant an allowance of up to $50.00 per rentable square foot of the Premises (i.e. $2,412,000.00 based on the Premises consisting of approximately 48,240 rentable square feet) (the “Allowance”), to be applied as provided in the Work Letter.

1.16Tenant’s Percentage: 100%, which is the ratio that the rentable square footage of the Premises bears to the rentable square footage of the Building. Building Percentage of Property: 52.29%, which is the ratio that the rentable square footage of the Building bears to the rentable square footage of all buildings within the Property as of the date hereof (hereinafter, the “Building Percentage”). Accordingly, as more particularly provided in Section 1.18 hereof, Operating Expenses include the Building Percentage of all such items which are common to the entire Property.

1.17Common Areas; Definitions; Tenant’s Rights. During the Term, Tenant shall have the non-exclusive right to use, in common with other tenants in the Property, and subject to the Rules and Regulations referred to in Article 9 of the Standard Lease Provisions, those portions of the Property (the “Common Areas”) not leased or designated for lease to tenants that are provided for use in common by Landlord, Tenant and any other tenants of the Property (or by the sublessees, agents, employees, customers invitees, guests or licensees of any such party), whether or not those areas are open to the general public. The Common Areas shall include, without limitation, all areas of the Building outside of the Premises and outside of any premises leased or designated for lease to tenants, the common entrances, lobbies, common restrooms, access ways, loading docks, ramps, drives and platforms and any passageways and service ways thereto to the extent not exclusively serving another tenant or contained within another tenant’s premises, and the common pipes, conduits, wires and appurtenant equipment serving the Premises, the parking areas (subject to Article 11 of the Standard Lease Provisions), loading and unloading areas, trash areas, roadways, sidewalks, walkways, parkways, driveways and landscaped areas appurtenant to the Building, fixtures, systems, decor, facilities and landscaping contained, maintained or used in connection with those areas, and shall be deemed to include any city sidewalks adjacent to the Property, any pedestrian walkway system, park or other facilities located on the Site and open to the general public.

- 2 -

1.18Operating Expenses.

a.Triple Net Lease. Except as otherwise provided herein, all Rent (as that term is defined under Section 5.2 of the Standard Lease Provisions) shall be absolutely net to Landlord so that this Lease shall yield net to Landlord the Rent to be paid each month during the Term of this Lease. Accordingly, and except as otherwise provided in this Lease, all costs, expenses and obligations of every kind or nature whatsoever relating to the Premises which may arise or become due during the Term of this Lease including, without limitation, all costs and expenses of maintenance and repairs, insurance and taxes, shall be paid by Tenant. Nothing herein contained shall be deemed to require Tenant to pay or discharge any liens or mortgages of any character whatsoever which may exist or hereafter be placed upon the Premises by an affirmative act or omission of Landlord.

b.Operating Expenses. In addition to the Monthly Base Rent, Tenant shall pay to Landlord Tenant’s Percentage of Operating Expenses (which includes the Building Percentage of all costs and expenses of operation and maintenance of the Common Areas and the Site), in the manner and at the times set forth in the following provisions of this Section 1.18. “Operating Expenses” shall consist of all costs and expenses of operation, maintenance and repair of the Building and Common Areas as determined by standard accounting practices and calculated assuming the Building is at least ninety-five percent (95%) occupied, together with the Building Percentage of all costs and expenses of operation and maintenance of the Common Areas and the Site as determined by standard accounting practices and calculated assuming the Property is at least ninety-five percent (95%) occupied. Operating Expenses include the following costs by way of illustration but not limitation: (i) any and all assessments imposed with respect to the Building, Common Areas, and/or Site pursuant to any covenants, conditions and restrictions affecting the Property; (ii) costs, levies or assessments resulting from statutes or regulations promulgated by any government authority in connection with the use or occupancy of the Site, Building or the Premises; (iii) all costs of utilities serving the Common Areas and any costs of utilities for the Premises which are not separately metered, (iv) all Taxes and Insurance Costs as defined in the Standard Lease Provisions, (v) waste disposal; (vi) security, if any; (vii) costs incurred in the management of the Site, Building and Common Areas, including, without limitation: (1) supplies, materials, equipment and tools, (2) wages, salaries, benefits, pension payments, fringe benefits, (and payroll taxes, insurance and similar governmental charges related thereto) of employees to the extent actually used in the operation and maintenance of the Site, Building and Common Areas, (3) the rental of personal property used by Landlord’s personnel to the extent actually used in the maintenance, repair and operation of the Property, (4) accounting fees, legal fees and real estate consultant’s fees, and (5) a market management/administrative fee not to exceed in the aggregate two percent (2%) of Monthly Base Rent plus Operating Expenses (collectively, “Gross Rent”); (viii) repair and maintenance of other portions of the Building other than such portions as are maintained by Tenant, including the elevators (if any), restrooms (if any), structural and non-structural portions of the Building, and the plumbing, heating, ventilating, air-conditioning and electrical systems installed or furnished by Landlord and not maintained by Tenant pursuant to Section 8.2 of the Standard Lease Provisions; (ix) maintenance, costs and upkeep of all parking and Common Areas; (x) amortization on a straight-line basis over the useful life together with interest at the Interest Rate (as defined in Section 1.13 of the Lease Summary) on the unamortized balance of all costs of a capital nature (including, without limitation, capital improvements, capital replacements, capital repairs, capital equipment and capital tools): (1) reasonably intended to produce a reduction in operating charges or energy consumption; or (2) first required after the date of this Lease under any Law that was not applicable to the Building at the time it was originally constructed; or (3) for repair or replacement of any equipment or improvements needed to operate and/or maintain the Building, the Common Areas and/or the Site at the same quality levels as prior to the repair or replacement; (xi) costs and expenses of gardening and landscaping; (xii) maintenance of signs (other than signs of tenants of the Site); (xiii) personal property taxes levied on or attributable to personal property used in connection with the Building, the Common Areas and/or the Site; and (xiv) costs and expenses of repairs, resurfacing, repairing, maintenance, painting, lighting and similar items. Landlord shall have the right, from time to time, to equitably allocate some or all of the Operating Expenses among different tenants and/or different buildings and/or difference premises of the Property based upon differing levels of use, demand, risk or other distinctions among such parties, premises or Buildings (the “Cost Pools”). Such Cost Pools may include, for example, all office space tenants or industrial/R&D space tenants in the Property and may be modified to take into account the addition of any additional buildings within the Property. Accordingly, in the event of such allocations into Cost Pools, Tenant’s Percentage shall be appropriately adjusted to reflect such allocation. In addition, if Landlord does not furnish a particular service or work (the cost of which, if furnished by Landlord would be included in Operating Expenses) to a tenant (other than Tenant) that has undertaken to perform such service or work in lieu of receiving it from Landlord, then Operating Expenses, Insurance Costs, costs of utilities and/or Taxes, as applicable, shall be considered to be increased by an amount equal to the additional Operating Expenses, Insurance Costs, costs of utilities and/or Taxes that Landlord would reasonably have incurred had Landlord furnished such service or work to that tenant.

c.Exclusions from Operating Expenses. Notwithstanding anything to the contrary contained elsewhere in this Section 1.18, the following items shall be excluded from Operating Expenses: (i) Costs of decorating, redecorating, or special cleaning or other services provided to certain tenants and not provided on a regular basis to all tenants of the Building; (ii) Any charge for depreciation of the Building or equipment and any interest or other financing charge; (iii) All costs relating to activities for the marketing, solicitation, negotiation and execution of leases of space in the Building, including without limitation, costs of tenant improvements; (iv) All costs for which Tenant or any other tenant in the Building is being charged other than pursuant to the operating expense clauses of leases for the Building; (v) The cost of correcting defects in the construction of the Building or in the building equipment, except that conditions (not occasioned by construction defects) resulting from ordinary wear and tear will not be deemed defects for the purpose of this category; (vi) To the extent Landlord is reimbursed by third parties, the cost of repair made by Landlord because of the total or partial destruction of the Building or the condemnation of a portion of the Building; (vii) The cost of any items for which Landlord is reimbursed by insurance or otherwise compensated by parties other than tenants of the Building pursuant to clauses similar to this paragraph; (viii) Any operating expense representing an amount paid to a related corporation, entity, or person which is in excess of the amount which would be paid in the absence of such relationship; (ix) The cost of any work

or service performed for or facilities furnished to any tenant of the Building to a greater extent or in a manner more favorable to such tenant than that performed for or furnished to Tenant; (x) The cost of alterations of space in the Building leased to other tenants; (xi) Ground rent or similar payments to a ground lessor; (xii) Legal fees and related expenses incurred by Landlord (together with any damages awarded against Landlord) due to the negligence or willful misconduct of Landlord; (xiii) Costs arising from the presence of any Hazardous Materials within, upon or beneath the Property; (xiv) Salaries and compensation of ownership and management personnel to the extent that such persons provide services to properties other than the Building; and (xv) Costs of selling or refinancing Landlord’s interest in the Building.

d.Estimate Statement and Payment of Tenant’s Percentage of Operating Expenses. By the first day of April (or as soon as practicable thereafter) of each calendar year during the Term, Landlord shall use commercially reasonable efforts to deliver to Tenant a statement (“Estimate Statement”) estimating the total amount of Tenant’s Percentage of Operating Expenses for the current calendar year. If at any time during the Term, but not more often than quarterly, Landlord reasonably determines that the estimated amount of Tenant’s Percentage of Operating Expenses payable by Tenant for the current calendar year will be greater or less than the amount set forth in the then current Estimate Statement, Landlord may issue a revised Estimate Statement and, if the revised amount owed by Tenant is greater, Tenant agrees to pay Landlord, within ten (10) days of receipt of the revised Estimate Statement, the difference between the amount owed by Tenant under such revised Estimate Statement and the amount owed by Tenant under the original Estimate Statement for the portion of the then current calendar year which has expired. Thereafter Tenant agrees to pay Tenant’s Percentage of Operating Expenses based on such revised Estimate Statement until Tenant receives the next calendar year’s Estimate Statement or a new revised Estimate Statement for the current calendar year. If the revised amount owed by Tenant is lower, Landlord shall reduce the amount of each payment payable by Tenant thereafter to the lower amount and further by the amount of excess paid by Tenant prior to such adjustment. Tenant’s Percentage of Operating Expenses shown on the Estimate Statement (or revised Estimate Statement, as applicable) shall be divided into twelve (12) equal monthly installments, and Tenant shall pay to Landlord, concurrently with the regular monthly Rent payment next due following the receipt of the Estimate Statement (or revised Estimate Statement, as applicable), an amount equal to one (1) monthly installment of such Tenant’s Percentage of Operating Expenses multiplied by the number of months from January in the calendar year in which such statement is submitted to the month of such payment, both months inclusive (less any amounts previously paid by Tenant with respect to any previously delivered Estimate Statement or revised Estimate Statement for such calendar year). Subsequent installments shall be paid concurrently with the regular monthly Rent payments for the balance of the calendar year and shall continue until the next calendar year’s Estimate Statement (or current calendar year’s revised Estimate Statement) is received.

e.Actual Statement. By the first day of June (or as soon as practicable thereafter) of each subsequent calendar year during the Term, Landlord shall use commercially reasonable efforts to deliver to Tenant a statement (“Actual Statement”) which states the Tenant’s Percentage of actual Operating Expenses payable by Tenant for the immediately preceding calendar year. If the Actual Statement reveals that the Tenant’s Percentage of actual Operating Expenses was more than the Tenant’s Percentage of estimated Operating Expenses paid by Tenant with respect to the preceding calendar year, Tenant agrees to pay Landlord the difference in a lump sum within thirty (30) days of receipt of the Actual Statement. Such obligation will be a continuing one which will survive the expiration or earlier termination of this Lease. If the Actual Statement reveals that the Tenant’s Percentage of actual Operating Expenses was less than the Operating Expenses paid by Tenant with respect to the preceding calendar year, Landlord will credit any overpayment toward the next monthly installment(s) of Rent due from Tenant. Prior to the expiration or sooner termination of the Term and Landlord’s acceptance of Tenant’s surrender of the Premises, Landlord will have the right to estimate the Tenant’s Percentage of actual Operating Expenses for the then current calendar year and to collect from Tenant prior to Tenant’s surrender of the Premises, any excess of such Tenant’s Percentage of actual Operating Expenses over the Tenant’s Percentage of estimated Operating Expenses paid by Tenant in such calendar year, subject to the parties reconciling in the manner described above after the end of the calendar year during which the expiration or termination occurs and making appropriate payments as described above.

f.No Release. Any delay or failure by Landlord in delivering any Estimate Statement or Actual Statement pursuant to this Section 1.18 shall not constitute a waiver of its right to receive Tenant’s payment of Tenant’s Percentage of Operating Expenses, nor shall it relieve Tenant of its obligations to pay Operating Expenses pursuant to this Section 1.18, except that Tenant shall not be obligated to make any payments based on such Estimate or Actual Statement until thirty (30) days after receipt of such statement.

1.19Utilities and Services.

a.Utilities and Services. As used in this Lease, “Premises Utilities Costs” shall mean all actual charges for utilities for the Premises of any kind, including but not limited to water, sewer and electricity, telecommunications and cable service, and the costs of heating, ventilating and air conditioning and other utilities as well as related fees, assessments and surcharges. Tenant shall contract directly for all utilities services for the Premises and shall pay all Premises Utilities Costs directly to the various utility service providers providing such utility services to the Premises. Should Landlord elect to supply any or all of such utilities, Tenant agrees to purchase and pay for the same as Additional Rent. Tenant shall reimburse Landlord within ten (10) days of receipt of billing invoices from Landlord for fixture charges and/or water tariffs, if applicable, which are charged to Landlord by local utility companies. Landlord will notify Tenant of this charge as soon as it becomes known. This charge will increase or decrease with current charges being levied against Landlord, the Premises or the Building by the local utility company, and will be due as Additional Rent. In no event shall Landlord be liable for any interruption or failure in the supply of any such utility or other services to Tenant unless resulting from Landlord’s negligence. In no event shall any Rent owed Landlord under this Lease be abated by reason of the failure to furnish, delay in furnishing, unavailability or diminution in quality or quantity of any such utility or other services or

- 3 -

interference with Tenant’s business operations as a result of any such occurrence; nor shall any such occurrence constitute an actual or constructive eviction of Tenant or a breach of an implied warranty by Landlord.

b.Maintenance/Janitorial/Service Contracts. Tenant shall, at its sole cost and expense, repair and maintain, and enter into a regularly scheduled preventive maintenance/service contract with a maintenance contractor to service, all hot water, heating and air conditioning systems and equipment (“HVAC”) within the Premises, or which serve the Premises exclusively, including, without limitation, any rooftop package HVAC units, distribution lines and internal venting systems. Such repair and maintenance shall include any and all services required to conform and maintain the HVAC units in compliance with current ASHRAE Standards. As used herein, “ASHRAE Standards” shall mean those standards established by the American Society of Heating, Refrigerating and Air-Conditioning Engineers, Inc. (ASHRAE) and Air Conditioning Contractors of America (ACCA) Standard Practice for Inspection and Maintenance of Commercial Building HVAC Systems, ANSI/ASHRAE/ACCA Standard 180-2008, as the same may be amended from time to time. All cleaning and janitorial services, including regular removal of trash and debris, for the Premises shall be performed and obtained, at Tenant’s sole cost and expense, exclusively by or through Tenant or Tenant’s janitorial contractors. The maintenance contractor and janitorial contractor and the contracts for same must be approved in writing by Landlord in advance. All maintenance/service contracts shall include all services recommended by the equipment manufacturer within the operation/maintenance manual and all services required to conform and maintain the HVAC in compliance with current ASHRAE Standards, and shall become effective (and a copy thereof delivered to Landlord) within thirty (30) days following the date Tenant takes possession of the Premises. Landlord reserves the right, upon notice to Tenant, to procure and maintain any or all of such service contracts, and if Landlord so elects, Tenant shall reimburse Landlord, as Additional Rent, upon demand, for the cost therefor.

c.Tenant’s Obligations. Tenant shall cooperate fully at all times with Landlord, and abide by current ASHRAE Standards and all reasonable regulations and reasonable requirements which Landlord may prescribe for the proper functioning and protection of the Building’s services and systems. Tenant shall not connect any conduit, pipe, apparatus or other device to the Building’s water, waste or other supply lines or systems for any purpose, except as approved in writing by Landlord in advance. Neither Tenant nor its employees, agents, contractors, licensees or invitees shall at any time enter, adjust, tamper with, touch or otherwise in any manner affect the mechanical installations or facilities of the Building. Additionally, Tenant hereby consents to any applicable utility company providing utility consumption information for the Premises to Landlord, and if requested, shall promptly sign any documentation requested by the utility company to evidence such consent.

d.Landlord’s Obligations. In addition to any repair obligations of Landlord set forth elsewhere in this Lease, Landlord, at Landlord’s cost (subject to inclusion as part of Operating Expenses), shall repair, maintain and replace as necessary, the foundation and structural elements of the Building (including structural load bearing walls and roof structure), and utility meters, electrical lines, pipes and conduits serving the Building and the Premises, and all Common Areas of the Property; provided, however, to the extent such maintenance, repairs or replacements are required as a result of any negligent act or negligent omission of Tenant or any of Tenant’s Parties, Tenant shall pay to Landlord, as Additional Rent, the costs of such maintenance, repairs and replacements.

1.20Additional Hazardous Materials Requirements. In addition to Tenant’s obligations under Article 10 of the Standard Lease Provisions, Tenant shall comply with the following provisions with respect to Hazardous Materials (as that term is defined in Article 10):

a.Environmental Questionnaire; Disclosure. Prior to the execution of this Lease, Tenant shall complete, execute and deliver to Landlord an Environmental Questionnaire and Disclosure Statement (the “Environmental Questionnaire”) in the form of Exhibit G, and Tenant shall certify to Landlord all information contained in the Environmental Questionnaire as true and correct to the best of Tenant’s knowledge and belief. The completed Environmental Questionnaire shall be deemed incorporated into this Lease for all purposes, and Landlord shall be entitled to rely fully on the information contained therein. On each anniversary of the Commencement Date (each such date is hereinafter referred to as a “Disclosure Date”), until and including the first Disclosure Date occurring after the expiration or sooner termination of this Lease, Tenant shall disclose to Landlord in writing the names and amounts of all Hazardous Materials, or any combination thereof, that were stored, generated, used or disposed of on, under or about the Premises for the twelve (12) month period prior to each Disclosure Date, and that Tenant intends to store, generate, use or dispose of on, under or about the Premises through the next Disclosure Date. At Landlord’s request, Tenant’s disclosure obligations under this Section 1.20 shall include a requirement that Tenant update, execute and deliver to Landlord the Environmental Questionnaire, as the same may be reasonably modified by Landlord from time to time; provided, however, Tenant shall not be required to update the Environmental Questionnaire more than once per year unless an environmental event of default has occurred or Tenant has materially changed its business. In addition to the foregoing, Tenant shall promptly notify Landlord of, and shall promptly provide Landlord with true, correct, complete and legible copies of, all of the following environmental items relating to the Premises: reports filed pursuant to any self-reporting requirements; reports filed pursuant to any Environmental Laws or this Lease; all permit applications, permits, monitoring reports, workplace exposure and community exposure warnings or notices, and all other reports, disclosures, plans or documents (even those that may be characterized as confidential) relating to water discharges, air pollution, waste generation or disposal, underground storage tanks or Hazardous Materials; all orders, reports, notices, listings and correspondence (even those that may be considered confidential) of or concerning the release, investigation, compliance, clean up, remedial and corrective actions, and abatement of Hazardous Materials whether or not required by Environmental Laws; and all complaints, pleadings and other legal documents filed against Tenant related to Tenant’s use, handling, storage or disposal of Hazardous Materials.

- 4 -

b.Inspection; Compliance. Landlord and Landlord’s Parties (as that term is defined in Article 10) shall have the right, but not the obligation, to inspect, investigate, sample and/or monitor the Premises, including any air, soil, water, groundwater or other sampling, and any other testing, digging, drilling or analyses, at any time to determine whether Tenant is complying with the terms of this Section 1.20 and Article 10, and in connection therewith, Tenant shall provide Landlord with access to all relevant facilities, records and personnel. If Tenant is not in compliance with any of the provisions of this Section 1.20 and Article 10, or in the event of a release, for which Tenant is responsible in accordance with this Lease, of any Tenant Hazardous Materials (as defined below) on, under, from or about the Premises, Landlord and Landlord’s Parties shall have the right, but not the obligation, without limitation on any of Landlord’s other rights and remedies under this Lease, to immediately enter upon the Premises and to discharge Tenant’s obligations under this Section 1.20 and Article 10 at Tenant’s expense, including without limitation the taking of emergency or long term remedial action. Landlord and Landlord’s Parties shall endeavor to minimize interference with Tenant’s business but shall not be liable for any such interference. In addition, Landlord, at Tenant’s sole cost and expense, shall have the right, but not the obligation, to join and participate in any legal proceedings or actions initiated in connection with any claims or causes of action arising out of the storage, generation, use or disposal by Tenant or Tenant’s Parties of Tenant Hazardous Materials on, under, from or about the Premises. All sums reasonably disbursed, deposited or incurred by Landlord in connection herewith, including, but not limited to, all costs, expenses and actual attorneys’ fees, shall be due and payable by Tenant to Landlord, as an item of Additional Rent, on demand by Landlord, together with interest thereon at the Interest Rate from the date of such demand until paid by Tenant. Landlord agrees that if any testing proves that the Tenant or Tenant’s Parties have no responsibility for the presence of said Hazardous Materials, Tenant shall not be liable for any costs or expenses in connection with such inspection, testing and monitoring.

c.Tenant Obligations. If the presence of any Tenant Hazardous Materials on, under or about the Premises caused or permitted by Tenant or Tenant’s Parties results in (i) injury to any person, (ii) injury to or contamination of the Premises, or (iii) injury to or contamination of any real or personal property wherever situated, Tenant, at its sole cost and expense, shall promptly take all actions necessary to remediate such injury and to satisfy all applicable Environmental Laws. Without limiting any other rights or remedies of Landlord under this Lease, Tenant shall pay the cost of any cleanup work performed on, under or about the Premises as required by this Lease or any Environmental Laws in connection with the removal, disposal, neutralization or other treatment of such Hazardous Materials caused or permitted by Tenant or Tenant’s Parties. If Landlord has reason to believe that Tenant or Tenant’s Parties may have caused or permitted the release of any Tenant Hazardous Materials on, under, from or about the Premises, then Landlord may require Tenant, at Tenant’s sole cost and expense, to conduct monitoring activities on or about the Premises satisfactory to Landlord, in its sole and absolute judgment, concerning such release of Tenant Hazardous Materials on, under, from or about the Premises. Notwithstanding anything to the contrary contained in the foregoing, Tenant shall not, without Landlord’s prior written consent, take any remedial action in response to the presence of any Tenant Hazardous Materials on, under or about the Premises, or enter into any settlement agreement, consent decree or other compromise with any governmental agency with respect to any Tenant Hazardous Materials claims; provided, however, Landlord’s prior written consent shall not be necessary in the event that the presence of Tenant Hazardous Materials on, under or about the Premises (i) poses an immediate threat to the health, safety or welfare of any individual, or (ii) is of such a nature that an immediate remedial response is necessary and it is not possible to obtain Landlord’s consent before taking such action. Tenant’s failure to timely comply with this Section 1.20 shall constitute a Default under this Lease.

d.Tenant’s Responsibility at Conclusion of Lease. Promptly upon the expiration or sooner termination of this Lease, Tenant shall represent to Landlord in writing that (i) Tenant has made a diligent effort to determine whether any Tenant Hazardous Materials are on, under or about the Premises, as a result of any acts or omissions of Tenant or Tenant’s Parties and (ii) no such Tenant Hazardous Materials exist on, under or about the Premises, other than as specifically identified to Landlord by Tenant in writing. If Tenant discloses the existence of Tenant Hazardous Materials on, under or about the Premises or if Landlord at any time discovers that Tenant or Tenant’s Parties caused or permitted the release of any Tenant Hazardous Materials on, under, from or about the Premises, Tenant shall, at Landlord’s request, immediately prepare and submit to Landlord within thirty (30) days after such request a comprehensive plan, subject to Landlord’s approval, specifying the actions to be taken by Tenant to remediate the Premises promptly as provided in Section 1.20 c. Upon Landlord’s approval of such remediation plan, Tenant shall, at Tenant’s sole cost and expense, without limitation on any rights and remedies of Landlord under this Lease or at law or in equity, promptly implement such plan and proceed to remediate Tenant Hazardous Materials in accordance with all Environmental Laws and as required by such plan and this Lease.

1.21Additional Sign Rights. Subject to and in accordance with the terms and conditions of Article 12 of the Standard Lease Provisions below, subject to Landlord’s prior approval as to location, style, design, color, materials, lighting and Tenant’s plans and specifications (which approval shall not be unreasonably withheld, conditioned or delayed), and subject to Tenant’s compliance with any sign criteria for the Building and all applicable laws, including the requirement that Tenant obtain all permits and approvals required by the City of Fremont, Tenant shall be entitled to one (1) panel on that certain monument sign facing Paseo Padre Parkway and a second panel on the monument sign facing Campus Drive in the location previously occupied by Wafergen. Tenant shall also be entitled to mount its company name and logo on the exterior of the Building facing each of Paseo Padre Parkway and Campus Drive, comprising illuminated characters of similar size and vertical location to that of the existing “WAFERGEN” signage located above the main entrance facing Paseo Padre Parkway, subject to the provisions of Article 12. Tenant shall have no right to place any other sign elsewhere on the Premises. Landlord shall install all sign rights granted to Tenant under this Section 1.21. Tenant shall be responsible, at its sole cost and expense, for all costs associated with the design, fabrication, permitting, installation, utility usage, insurance, repair, maintenance, replacement, and removal of all Tenant’s sign granted under this Section 1.21 and the repair of any damage to the Building or monument resulting from the removal of such signage. The sign rights granted herein are personal to the original Tenant executing this Lease or a Permitted

- 5 -

Transferee and may not be assigned, voluntarily or involuntarily, by any person or entity other than the original Tenant executing this Lease or a Permitted Transferee; provided, however, that the name of such Permitted Transferee or Transferee is not an Objectionable Name. “Objectionable Name” shall mean any name which relates to an entity which is of a character or reputation, or is associated with a political orientation or faction, which is inconsistent with the quality of the Building, or which would otherwise reasonably offend landlords of comparable buildings in the vicinity of the Facility. The sign rights granted to the original Tenant hereunder are not assignable separate and apart from the Lease, nor may any sign right granted herein be separated from the Lease in any manner, either by reservation or otherwise without Landlord’s consent or as otherwise expressly permitted in this Lease.

[REST OF PAGE INTENTIONALLY BLANK]

- 6 -

STANDARD LEASE PROVISIONS

2.1Lease Elements; Definitions; Exhibits. The Lease is comprised of the Lease Summary and Property Specific Provisions (the “Summary”), these Standard Lease Provisions (“Standard Lease Provisions”) and all exhibits, and riders attached hereto (collectively, “Exhibits”), all of which are incorporated together as part of one and the same instrument. All references in any such documents and instruments to “Lease” means the Summary, these Standard Lease Provisions and all Exhibits attached hereto. All terms used in this Lease shall have the meanings ascribed to such terms in the Summary, these Standard Lease Provisions and any Exhibits. To the extent of any inconsistency between the terms and conditions of the Summary, these Standard Lease Provisions, or any Exhibits attached hereto, the Summary and any Exhibits attached hereto shall control over these Standard Lease Provisions.

3.1Lease of Premises. Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, the Premises, upon and subject to, the terms, covenants and conditions of this Lease. Each party covenants and agrees, as a material part of the consideration for this Lease, to keep and perform their respective obligations under this Lease.

3.2Landlord’s Reserved Rights. Landlord reserves the right from time to time to do any of the following, provided that Landlord shall give Tenant reasonable advance notice thereof: (a) expand the Building and construct or alter other buildings or improvements on the Property as long as Tenant’s parking ratio is not substantially and adversely impacted; (b) make any changes, additions, improvements, maintenance, repairs or replacements in or to the Property, Common Areas and/or the Building (including the Premises if required to do so by any applicable Laws or to the extent necessary in conjunction with any improvements to the Property, Common Areas and/or the Building, provided that Tenant’s use of the Premises is not materially and adversely affected), and the fixtures and equipment thereof, including, without limitation: (i) maintenance, replacement and relocation of pipes, ducts, conduits, wires and meters and equipment above the ceiling surfaces, below the floor surfaces and within the walls of the Building and the Premises; and (ii) changes in the location, size, shape and number of driveways, entrances, stairways, elevators, loading and unloading areas, ingress, egress, direction of traffic, landscaped areas and walkways, easements, parking spaces and parking areas as long as Tenant’s parking ratio is not substantially and adversely impacted; (c) close temporarily any of the Property while engaged in making repairs, improvements or alterations to the Property; and (d) perform such other acts and make such other changes with respect to the Property, as Landlord may, in the exercise of good faith business judgment, deem to be appropriate. If Landlord is required to reconfigure the Premises as a result of any changes to the Property, Common Areas and/or the Building as a result of Landlord’s exercise of its rights under this Section 3.2, Landlord shall provide Tenant with reasonable advance written notice of the construction schedule to the extent that the Premises are affected, and Landlord shall endeavor to minimize, as reasonably practicable, the interference with Tenant’s business as a result of any such construction. All measurements of rentable area in this Lease shall be deemed to be correct.

ARTICLE 4 - TERM AND POSSESSION

4.1Term; Notice of Lease Dates. The Term shall be for the period designated in the Summary commencing on the Commencement Date and ending on the Expiration Date, unless the Term is sooner terminated or extended as provided in this Lease. If the Commencement Date falls on any day other than the first day of a calendar month then the Term will be measured from the first day of the month following the month in which the Commencement Date occurs. Within ten (10) business days after Landlord’s written request, Tenant shall execute a written confirmation of the Commencement Date and Expiration Date of the Term in the form of the Notice of Lease Term Dates attached hereto as Exhibit D. The Notice of Lease Term Dates shall be binding upon Tenant unless Tenant reasonably objects thereto in writing within such ten (10) business day period.

4.2Possession. Tenant hereby acknowledges that the Premises is currently occupied by an existing tenant (the “Existing Tenant”), and that Landlord will deliver possession of the Premises on a phased basis in accordance with the schedule below subject to the Existing Tenant’s surrender of the various portions of the Premises comprising such phases which remain occupied by the Existing Tenant (each portion of the Premises as and when delivered to Tenant free and clear of the Existing Tenant’s occupancy being a “Phase”). Immediately following the Effective Date of this Lease, Landlord will deliver to Tenant approximately 30,217 rentable square feet of the Premises (currently unoccupied by the Existing Tenant) as shown on Exhibit A-2 attached hereto (“Phase A”). Within ninety (90) days following the Effective Date of this Lease, Landlord will deliver to Tenant an additional approximately 12,061 rentable square feet of the Premises as shown on Exhibit A-2 attached hereto (“Phase B”) for an aggregate of 42,278 rentable square feet delivered. Within one hundred twenty (120) days following the Effective Date of this Lease, Landlord will deliver to Tenant an additional approximately 2,770 rentable square feet of the Premises as shown on Exhibit A-2 attached hereto (“Phase C”) for an aggregate of 45,048 rentable square feet delivered. Within one hundred fifty (150) days following the Effective Date of this Lease, Landlord will deliver to Tenant the balance of the Premises consisting of approximately 3,192 square feet as shown on Exhibit A-2 attached hereto (the “Phase D”) for an aggregate of 48,240 rentable square feet delivered. The dates upon which Landlord anticipates delivering each Phase of the Premises are each referred to herein as an “Estimated Turnover Date”). The actual date upon which Landlord turns over possession of each phase of the Premises to Tenant shall each be referred to as a “Turnover Date.” Notwithstanding the foregoing, Landlord will not be obligated to deliver possession of Phase A of the Premises to Tenant until Landlord has received from Tenant all of the following: (i) a copy of this Lease fully executed by Tenant; (ii) any Security Deposit, Guaranty and/or

- 7 -

Letter of Credit required hereunder and the first installment of Monthly Base Rent and Additional Rent, if any, due under this Lease; and (iii) copies of Tenant’s insurance certificates as required hereunder. Landlord shall use its commercially reasonable efforts to ensure that the Existing Tenant timely and properly surrenders the Premises to Landlord, including without limitation through the timely initiation and prosecution of an unlawful detainer action, if necessary. Tenant agrees that if Landlord is unable to deliver possession of any Phase of the Premises to Tenant on or prior to the applicable Estimated Turnover Date, whether due to the late surrender of such Phase of the Premises by the Existing Tenant or otherwise, this Lease will not be void or voidable, nor will Landlord be liable to Tenant for any loss or damage resulting therefrom; however, if, for reasons other than delays caused by Tenant, Landlord has not delivered to Tenant possession of Phase B of the Premises in the condition set forth in Section 4.3 below by June 1, 2016, then the Commencement Date shall be extended for one (1) day, and Tenant shall receive one (1) day of abated Rent, for each day of delay in Landlord’s delivery of Phase B beyond June 1, 2016 until Landlord shall deliver Phase B of the Premises to Tenant. If, for reasons other than delays caused by Tenant, Landlord has not delivered Phase B of the Premises in the condition set forth in Section 4.3 below by July 1, 2016, then the Commencement Date shall be further extended, and the Rent abatement specified above shall continue, on a day-for-day basis, and in addition, Tenant shall have the right to terminate this Lease by delivery of a written termination notice on or before the date upon which Landlord delivers Phase B of the Premises to Tenant, which shall be effective upon delivery. If, for reasons other than delays caused by Tenant, Landlord has not delivered all Phases of the Premises in the condition set forth in Section 4.3 below by August 1, 2016 and Tenant has not exercised its termination rights as specified above, then the Commencement Date shall be further extended, and the Rent abatement specified above shall continue, on a day-for day basis until Landlord shall deliver the Premises to Tenant; provided, however, if for reasons other than delays caused by Tenant, Landlord has not delivered all Phases of the Premises by November 1, 2016, the Commencement Date shall be further extended, and the Rent abatement specified above shall continue, on a day-for day basis until Landlord shall deliver the Premises to Tenant, and Tenant shall also have the right to terminate this Lease by delivery of a written termination notice on or before the later of (a) December 31, 2016, and (b) the date on which Landlord delivers all Phases of the Premises to Tenant, which shall be effective upon delivery. Upon any such termination, neither party shall have any obligation to the other party under this Lease except that Landlord shall immediately return to Tenant all amounts previously paid to Landlord by Tenant.

4.3Condition of Premises. Landlord shall deliver each Phase of the Premises to Tenant in broom-clean condition and free of debris and all personal property and equipment of the Existing Tenant. Landlord shall deliver all of the Premises to Tenant with the existing Building-standard plumbing, lighting, and HVAC systems (collectively, the “Operating Systems”) in good operating order and in good condition. If any of such Operating Systems or elements should malfunction or fail within the warranty period below, as Tenant’s sole remedy for Landlord’s breach of this warranty, Landlord shall, as Landlord’s sole obligation, promptly after receipt of written notice from Tenant setting forth with specificity the nature and extent of such non-compliance, malfunction or failure, repair same at Landlord’s sole expense; provided, however, Landlord shall have no liability hereunder for repairs or replacements necessitated by the acts or omissions of Tenant and/or any of Tenant’s Parties. The warranty period shall be one hundred eighty (180) days after delivery of the Premises to Tenant, under Section 4.4 below. If Tenant does not give Landlord the required notice within said warranty period, correction of any such non-compliance, malfunction or failure shall be the obligation of Tenant at Tenant’s sole cost and expense, provided that this provision shall not cover latent defects. Tenant acknowledges that, except as otherwise expressly set forth in this Lease and the Work Letter, if any, (i) neither Landlord nor any agent of Landlord has made any representation or warranty with respect to the Premises, the Building or the Property or their condition, or with respect to the suitability thereof for the conduct of Tenant’s business, and Tenant shall accept the Premises in its then as-is condition on delivery by Landlord, except as expressly provided to the contrary in this Lease, and (ii) the acceptance of possession of the Premises by Tenant shall establish, except as expressly provided to the contrary in this Lease, that the Premises, the Building and the Property were at such time complete and in good, sanitary and satisfactory condition and repair with all work required to be performed by Landlord, if any, pursuant to the Work Letter completed and without any obligation on Landlord’s part to make any further alterations, upgrades or improvements thereto, subject only to completion of minor punch-list items identified by the parties to be corrected by Landlord, if any, as provided in the Work Letter. Pursuant to Section 1938 of the California Civil Code, Landlord hereby advises Tenant that as of the date of this Lease neither, the Premises nor the Building have undergone inspection by a Certified Access Specialist. Pursuant to Section 1938 of the California Civil Code, Landlord hereby advises Tenant that as of the date of this Lease neither the Premises, the Building nor the Property have undergone inspection by a Certified Access Specialist.

4.4Early Access. Tenant’s access to the individual Phases of the Premises prior to the Commencement Date shall be subject to all terms and conditions of this Lease, except that Tenant shall not be obligated to pay Rent during such periods of early access until the Commencement Date. Tenant agrees not to interfere with Landlord in the completion of any Landlord’s Work in the Premises pursuant to the Work Letter (the “Landlord’s Work”) during any such periods of occupancy by Tenant prior to the Commencement Date. Should Landlord reasonably determine any such early access materially interferes with Landlord’s Work, Landlord may deny Tenant access to the applicable Phase of the Premises until Landlord’s Work is substantially completed. In such event, Tenant shall promptly surrender any keys or other means of access to such Phase of the Premises and otherwise comply with such denial.

5.1Monthly Base Rent. Tenant agrees to pay Landlord, the Monthly Base Rent as designated in the Summary. Monthly Base Rent and recurring monthly charges of Additional Rent (defined below) shall be paid by Tenant in advance on the first day of each and every calendar month (“Due Date”) during the Term, except that the first full month’s Monthly Base Rent and Additional Rent, if any, shall be paid upon Tenant’s execution and

- 8 -

delivery of this Lease to Landlord. Monthly Base Rent for any partial month shall be prorated in the proportion that the number of days this Lease is in effect during such month bears to the actual number of days in such month.

5.2Additional Rent. All amounts and charges payable by Tenant under this Lease in addition to Monthly Base Rent, if any, including, without limitation, payments for Operating Expenses, Taxes, Insurance Costs and Premises Utilities Costs to the extent payable by Tenant under this Lease shall be considered “Additional Rent”, and the word “Rent” in this Lease shall include Monthly Base Rent and all such Additional Rent unless the context specifically states or clearly implies that only Monthly Base Rent is referenced. Rent shall be paid to Landlord, without any prior notice or demand therefor and without any notice, deduction or offset, in lawful money of the United States of America.

5.3Late Charges & Interest Rate. If Landlord does not receive Rent or any other payment due from Tenant on the Due Date, Tenant shall pay to Landlord a late charge equal to five percent (5%) of such past due Rent or other payment. Tenant agrees that this late charge represents a fair and reasonable estimate of the cost Landlord will incur by reason of Tenant’s late payment. If any installment of Monthly Base Rent or Additional Rent, or any other amount payable by Tenant hereunder is not received by Landlord by the Due Date, it shall bear interest at the Interest Rate set forth in the Summary from the Due Date until paid. All interest, and any late charges imposed pursuant to this Section 5.3, shall be considered Additional Rent due from Tenant to Landlord under the terms of this Lease.

6.1General Provisions. Concurrently with Tenant’s execution of this Lease, Tenant shall deliver to Landlord, as additional collateral for the full performance by Tenant of all of its obligations under this Lease and for all losses and damages Landlord may suffer as a result of any default by Tenant under this Lease, including, but not limited to, any post lease termination damages under section 1951.2 of the California Civil Code, a standby, unconditional, irrevocable, transferable letter of credit (the “Letter of Credit”) (substantially in the form of Exhibit H attached hereto or otherwise in a form acceptable to Landlord) and containing the terms required herein, in the face amount of Six Hundred Sixty-Five Thousand Seven Hundred Twelve and No/100 Dollars ($665,712.00) (the “Letter of Credit Amount”), naming Landlord as beneficiary, issued by Silicon Valley Bank or another financial institution acceptable to Landlord in Landlord’s sole discretion, permitting multiple and partial draws thereon, and otherwise in form acceptable to Landlord in its sole discretion. Tenant shall cause the Letter of Credit to be continuously maintained in effect (whether through replacement, renewal or extension) in the Letter of Credit Amount (as the same may be reduced or increased as described in Section 6.6 and 6.7 below) through the date (the “Final LC Expiration Date”) that is 120 days after the scheduled expiration date of the Term or any Option Term of this Lease. If the Letter of Credit held by Landlord expires earlier than the Final LC Expiration Date (whether by reason of a stated expiration date or a notice of termination or non‑renewal given by the issuing bank), Tenant shall deliver a new Letter of Credit or certificate of renewal or extension to Landlord not later than thirty (30) days prior to the expiration date of the Letter of Credit then held by Landlord. Any renewal or replacement Letter of Credit shall comply with all of the provisions of this Section 6.1, shall be irrevocable, transferable and shall remain in effect (or be automatically renewable) through the Final LC Expiration Date upon the same terms as the expiring Letter of Credit or such other terms as may be acceptable to Landlord in its sole discretion.

6.2Drawings under Letter of Credit. Landlord shall have the immediate right to draw upon the Letter of Credit, in whole or in part, at any time and from time to time: (i) If a Default occurs and is not cured within the applicable cure period provided for such Default in this Lease; or (ii) If the Letter of Credit held by Landlord expires (or is set to expire) earlier than the Final LC Expiration Date (whether by reason of a stated expiration date or a notice of termination or non-renewal given by the issuing bank), and Tenant fails to deliver to Landlord, at least ten (10) days prior to the expiration date of the Letter of Credit then held by Landlord, a renewal or substitute Letter of Credit that is in effect and that complies with the provisions of this Article 6. No condition or term of this Lease shall be deemed to render the Letter of Credit conditional to justify the issuer of the Letter of Credit in failing to honor a drawing upon such Letter of Credit in a timely manner. Tenant hereby acknowledges and agrees that Landlord is entering into this Lease in material reliance upon the ability of Landlord to draw upon the Letter of Credit upon the occurrence of any Default by Tenant under this Lease or upon the occurrence of any of the other events described above in this Article 6.

6.3Use of Proceeds by Landlord. The proceeds of the Letter of Credit shall constitute Landlord’s sole and separate property (and not Tenant’s property or the property of Tenant’s bankruptcy estate) and Landlord may immediately upon any draw (and without notice to Tenant) apply or offset the proceeds of the Letter of Credit: (i) against any rent payable by Tenant under this Lease that is not paid when due; (ii) against all losses and damages that Landlord has suffered or that Landlord reasonably estimates that it may suffer as a result of any default by Tenant under this Lease, including any damages arising under section 1951.2 of the California Civil Code following termination of the Lease; (iii) against any costs incurred by Landlord in connection with this Lease (including attorneys’ fees to the extent actually paid by Landlord); and (iv) against any other amount that Landlord may spend or become obligated to spend by reason of Tenant’s Default. Provided Tenant has not been in Default under this Lease, Landlord agrees to pay to Tenant within thirty (30) days after the Final LC Expiration Date the amount of any proceeds of the Letter of Credit received by Landlord and not applied as allowed above; provided, that if prior to the Final LC Expiration Date a voluntary petition is filed by Tenant, or an involuntary petition is filed against Tenant by any of Tenant’s creditors, under the Federal Bankruptcy Code, then Landlord shall not be obligated to make such payment in the amount of the unused Letter of Credit proceeds until either all preference issues relating to payments under this Lease have been resolved in such bankruptcy or reorganization case or such bankruptcy or reorganization case has been dismissed, in each case pursuant to a final court order not subject to appeal or any stay pending appeal. Notwithstanding the foregoing, in the event that Landlord has incurred costs in accordance with Section 6.3(iii) above and Tenant is not found to be in Default with respect to such costs, then Landlord shall not be

- 9 -

permitted to consider such costs when determining Landlord’s payment obligation to Tenant in accordance with the prior sentence.

6.4Additional Covenants of Tenant. If, as result of any application or use by Landlord of all or any part of the Letter of Credit, the amount of the Letter of Credit shall be less than the Letter of Credit Amount, Tenant shall, within five (5) business days after receipt by Tenant of Landlord’s written invoice, provide Landlord with additional letter(s) of credit in an amount equal to the deficiency (or a replacement letter of credit in the total Letter of Credit Amount), and any such additional (or replacement) letter of credit shall comply with all of the provisions of this Section 6.4, and if Tenant fails to comply with the foregoing, notwithstanding anything to the contrary contained in this Lease, the same shall, at Landlord’s election, constitute an uncurable event of Default by Tenant. Tenant further covenants and warrants that it will neither assign nor encumber the Letter of Credit or any part thereof and that neither Landlord nor its successors or assigns will be bound by any such assignment, encumbrance, attempted assignment or attempted encumbrance.

6.5Transfer of Letter of Credit. Landlord may, at any time and without notice to Tenant and without first obtaining Tenant’s consent thereto, transfer all or any portion of its interest in and to the Letter of Credit to another party, person or entity, including Landlord’s mortgagee and/or to have the Letter of Credit reissued in the name of Landlord’s mortgagee. If Landlord transfers its interest in the Building and transfers the Letter of Credit (or any proceeds thereof then held by Landlord) in whole or in part to the transferee, Landlord shall, without any further agreement between the parties hereto, thereupon be released by Tenant from all liability therefor provided that the transferee assumes such liability. The provisions hereof shall apply to every transfer or assignment of all or any part of the Letter of Credit to a new landlord. In connection with any such transfer of the Letter of Credit by Landlord, Tenant shall, at Tenant’s sole cost and expense, execute and submit to the issuer of the Letter of Credit such applications, documents and instruments as may be necessary to effectuate such transfer. Tenant shall be responsible for paying the issuer’s transfer and processing fees in connection with any transfer of the Letter of Credit and, if Landlord advances any such fees (without having any obligation to do so), Tenant shall reimburse Landlord for any such transfer or processing fees within ten days after receipt of Landlord’s written request therefor.

6.6Increase in Letter of Credit Amount. Provided Tenant elects to use all or any portion of the Additional Allowance (as defined in the Work Letter attached hereto as Exhibit C) Tenant shall cause the Letter of Credit Amount to be increased by an amount equal to fifty percent (50%) of the Additional Allowance (the “Additional Letter of Credit Amount”), as additional collateral for the full performance by Tenant of all of its obligations under this Lease and for all losses and damages Landlord may suffer as a result of any default by Tenant under this Lease, including, but not limited to, any post lease termination damages under section 1951.2 of the California Civil Code. For example, if Tenant elects to use to utilize the full Additional Allowance, the Letter of Credit Amount shall be increased by Two Hundred Forty-One Thousand Two Hundred and No/100 Dollars ($241,200.00) to Nine Hundred Six Thousand Nine Hundred Twelve and 00/11 Dollars ($906,912.00) in the aggregate.

6.7Reduction in Letter of Credit Amount. Subject to the provisions of this Section 6.7 and provided the Letter of Credit has been increased by the Additional Letter of Credit Amount in accordance with Section 6.6 of this Lease, and that Tenant is not then in actual Default of any provision of this Lease beyond the applicable notice and cure period, and provided that no event of Default has occurred at any time prior to the forty-eighth (48th) full calendar month of the Term, Tenant shall then be entitled to reduce the Letter of Credit by the Additional Allowance Letter of Credit Amount on the last day (the “Reduction Date”) of the forty-eighth (48th) full calendar month of the Term and Landlord shall reasonably cooperate to enable Tenant to effect such reduction, at which point the Letter of Credit shall remain in place in the original Letter of Credit Amount for the remainder of the Term.

If Tenant is entitled to reduce the Letter of Credit on the Reduction Date, Landlord shall execute any documents reasonably requested by Tenant and the issuing bank to effectuate the applicable reduction of the Letter of Credit (which may include cancellation of the existing Letter of Credit and re-issuance of a new Letter of Credit in the original Letter of Credit Amount), within fifteen (15) days after Tenant submits such documents to Landlord for execution provided Tenant is not then in Default under this Lease.

6.8Nature of Letter of Credit. Landlord and Tenant (i) acknowledge and agree that in no event or circumstance shall the Letter of Credit or any renewal thereof or substitute therefor or any proceeds thereof be deemed to be or treated as a “security deposit” under any Law applicable to security deposits in the commercial context including Section 1950.7 of the California Civil Code, as such section now exists or as may be hereafter amended or succeeded (“Security Deposit Laws”), (ii) acknowledge and agree that the Letter of Credit (including any renewal thereof or substitute therefor or any proceeds thereof) is not intended to serve as a security deposit, and the Security Deposit Laws shall have no applicability or relevancy thereto, and (iii) waive any and all rights, duties and obligations either party may now or, in the future, will have relating to or arising from the Security Deposit Laws. Tenant hereby waives the provisions of Section 1950.7 of the California Civil Code and all other provisions of Law, now or hereafter in effect, which (A) establish the time frame by which Landlord must refund a security deposit under a lease, and/or (B) provide that Landlord may claim from the Security Deposit only those sums reasonably necessary to remedy defaults in the payment of rent, to repair damage caused by Tenant or to clean the Premises, it being agreed that Landlord may, in addition, claim those sums specified in this Section 6.8 and/or those sums reasonably necessary to compensate Landlord for any loss or damage caused by Tenant’s breach of this Lease or the acts or omissions of Tenant, including any damages Landlord suffers following termination of this Lease.

- 10 -

ARTICLE 7 - OPERATING EXPENSES/UTILITIES/SERVICES

7.1Operating Expenses. Tenant shall contribute to the costs of operation, maintenance, repair and replacement of the Premises, Building and Property as provided in the Summary.

7.2Utilities and Services. Utilities and services to the Premises and the Property are described in the Summary.

7.3Taxes. As used in this Lease, the term “Taxes” means: All real property taxes and assessments, possessory interest taxes, sales taxes, personal property taxes, business or license taxes or fees, gross receipts taxes, license or use fees, excises, transit charges, and other impositions of any kind (including fees “in-lieu” or in substitution of any such tax or assessment) which are now or hereafter assessed, levied, charged or imposed by any public authority upon the Building, Site, Property and/or Premises or any portion thereof, its operations or the Rent derived therefrom (or any portion or component thereof, or the ownership, operation, or transfer thereof), and any and all costs and expenses (including, without limitation, reasonable attorneys’ fees) incurred in attempting to protest, reduce or minimize the same. Taxes shall not include inheritance or estate taxes imposed upon or assessed against the interest of Landlord, gift taxes, excess profit taxes, franchise taxes, or similar taxes on Landlord’s business or any other taxes computed upon the basis of the net income of Landlord. If it shall not be lawful for Tenant to reimburse Landlord for any such Taxes, the Monthly Base Rent payable to Landlord under this Lease shall be revised to net Landlord the same net rent after imposition of any such Taxes by Landlord as would have been payable to Landlord prior to the payment of any such Taxes. Tenant shall pay for or contribute to Taxes as provided in the Summary. Notwithstanding anything herein to the contrary, Tenant shall be liable for all taxes levied or assessed against personal property, furniture, fixtures, above-standard Tenant Improvements and alterations, additions or improvements placed by or for Tenant in the Premises. Furthermore, Tenant shall pay prior to delinquency any (i) rent tax or sales tax, service tax, transfer tax or value added tax, or any other applicable tax on the rent or services provided herein or otherwise respecting this Lease, (ii) taxes assessed upon or with respect to the possession, leasing, operation, management, maintenance, alteration, repair, use or occupancy by Tenant of the Premises or any portion of the Property; or (iii) taxes assessed upon this transaction or any document to which Tenant is a party creating or transferring an interest or an estate in the Premises.

7.4Insurance Costs. As used in this Lease, “Insurance Costs” means the cost of insurance obtained by Landlord pursuant to Article 15. Tenant shall pay for or contribute to Insurance Costs as provided in the Summary.

7.5Interruption of Utilities. Subject to Section 7.6 below, Landlord shall have no liability to Tenant for any interruption in utilities or services to be provided to the Premises when such failure is caused by all or any of the following: (a) accident, breakage or repairs; (b) strikes, lockouts or other labor disturbances or labor disputes of any such character; (c) governmental regulation, moratorium or other governmental action; (d) inability, despite the exercise of reasonable diligence, to obtain electricity, water or fuel; (e) service interruptions or any other unavailability of utilities resulting from causes beyond Landlord’s control including without limitation, any electrical power “brown-out” or “black-out”; or (f) any other cause beyond Landlord’s reasonable control. In addition, in the event of any such interruption in utilities or services, Tenant shall not be entitled to any abatement or reduction of Rent (except as expressly provided in Articles 17 and 18 if such failure is a result of any casualty damage or taking described therein), no eviction of Tenant shall result, and Tenant shall not be relieved from the performance of any covenant or agreement in this Lease. In the event of any stoppage or interruption of services or utilities which are not obtained directly by Tenant, Landlord shall diligently attempt to resume such services or utilities as promptly as practicable. Tenant hereby waives the provisions of any applicable existing or future Law, ordinance or governmental regulation permitting the termination of this Lease due to an interruption, failure or inability to provide any services (including, without limitation, to the extent the Premises are located in California, the provisions of California Civil Code Section 1932(1)).

7.6Abatement. Notwithstanding anything to the contrary contained in this Lease, if Tenant’s use of all or a material part of the Premises is materially impaired due to an interruption of utility or mechanical services to the Premises to the extent resulting from the wrongful act or negligence of Landlord (and expressly excluding any service provider initiated “brown-out,” “black-out,” or other interruption in service), and such disruption materially interferes with the conduct of Tenant’s business in the Premises for three (3) consecutive business days or twenty (20) days in any twelve (12) month period (such three (3) consecutive business day period or twenty (20) day period, as applicable, is referred to herein as the “Eligibility Period”), as any such Eligibility Period may be extended due to Force Majeure Delays (as defined in Section 31.17 of this Lease), then Tenant shall be entitled to an equitable abatement of Monthly Base Rent and Additional Rent under this Lease based upon the portion of the Premises affected thereby (provided that if the operation of Tenant’s business from the remainder of the Premises not affected thereby is not reasonably practicable under the circumstances and Tenant in fact does not operate for business from the remainder of the Premises, all Monthly Base Rent and Additional Rent under this Lease shall be subject to such abatement) from the expiration of the Eligibility Period until the applicable material impairment is cured; provided, however, that if Landlord is diligently pursuing the repair of such utilities or services and Landlord provides substitute services reasonably suitable for Tenant’s purposes, such as for example, bringing in portable air-conditioning equipment, then there shall not be any abatement of Rent. The provisions of this Section 7.6 shall not apply in the event of a casualty governed by the provisions of Article 17 below or in the event of a taking or condemnation governed by the provisions of Article 18 below.

ARTICLE 8 - MAINTENANCE AND REPAIR

8.1Landlord’s Repair Obligations. Except as otherwise expressly provided in this Lease, Landlord shall have no obligation to alter, remodel, improve, repair, renovate, redecorate or paint all or any part of the

- 11 -

Premises. Except as otherwise stated in the Summary, Tenant waives the right to make repairs at Landlord’s expense under any applicable Laws (including, without limitation, to the extent the Premises are located in California, the provisions of California Civil Code Sections 1941 and 1942 and any successor statutes or laws of a similar nature). All other repair and maintenance of the Premises, Building and Property to be performed by Landlord, if any, shall be as provided in the Summary.