Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Corium International, Inc. | Financial_Report.xls |

| EX-23.1 - EX-23.1 - Corium International, Inc. | a2222351zex-23_1.htm |

| EX-32.2 - EX-32.2 - Corium International, Inc. | a2222351zex-32_2.htm |

| EX-31.2 - EX-31.2 - Corium International, Inc. | a2222351zex-31_2.htm |

| EX-31.1 - EX-31.1 - Corium International, Inc. | a2222351zex-31_1.htm |

| EX-32.1 - EX-32.1 - Corium International, Inc. | a2222351zex-32_1.htm |

| EX-10.27 - EX-10.27 - Corium International, Inc. | a2222351zex-10_27.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý |

Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

|

For the fiscal year ended September 30, 2014 |

||

OR |

||

o |

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

|

For the transition period from to . |

||

Commission File Number: 001-36375

![]()

Corium International, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

38-3230774 (I.R.S. Employer Identification Number) |

Corium International, Inc.

235 Constitution Drive

Menlo Park, California 94025

(Address of principal executive offices and zip code)

(650) 298-8255

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Common stock, par value $0.001 per share | The NASDAQ Global Market |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of Act. Yes o No ý

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

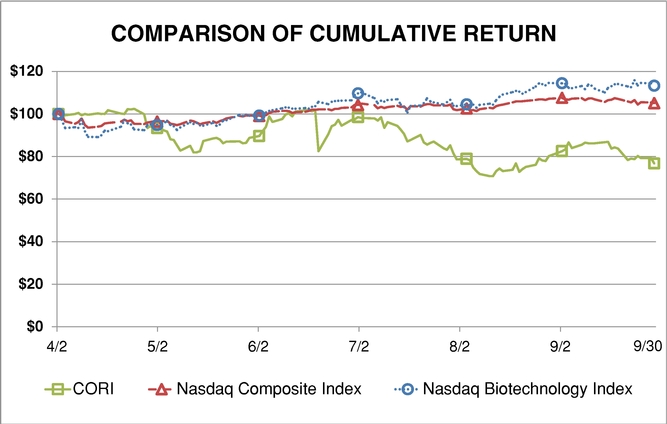

The aggregate market value of the voting stock held by non-affiliates of the Registrant on April 3, 2014, based upon the closing price of $8.00 of the Registrant's common stock as reported on the NASDAQ Global Market, was approximately $69.3 million. The Registrant has elected to use April 3, 2014 as the calculation date, which was the initial trading date of the Registrant's common stock on the NASDAQ Global Market because the Registrant was a privately-held company on March 31, 2014 (the last business day of the Registrant's second fiscal quarter).

As of December 11, 2014, there were approximately 18,070,838 shares of the Registrant's common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant's definitive proxy statement for its 2015 Annual Meeting of Stockholders (the "Proxy Statement"), to be filed within 120 days of the Registrant's fiscal year ended September 30, 2014, are incorporated by reference in Part II and Part III of this Report on Form 10-K. Except with respect to information specifically incorporated by reference in this Form 10-K, the Proxy Statement is not deemed to be filed as part of this Form 10-K.

i

NOTE ABOUT FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this report other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans and our objectives for future operations, are forward-looking statements. The words "believe," "may," "will," "potentially," "estimate," "continue," "anticipate," "intend," "could," "would," "project," "plan," "expect," "seek" and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in the "Risk Factors" section and elsewhere in this report. Moreover, we operate in a very competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this report to conform these statements to actual results or to changes in our expectations, except as required by law.

As used in this report, the terms "Corium," "we," "us," and "our" mean Corium International, Inc. unless the context indicates otherwise.

ii

Overview

We are a commercial stage biopharmaceutical company focused on the development, manufacture and commercialization of specialty pharmaceutical products that leverage our broad experience in transdermal and transmucosal delivery systems. Together with our partners, we have successfully developed six marketed products in the prescription drug and consumer markets, and we are the sole commercial supplier of each of those products for our marketing partners. These marketed products are Clonidine Transdermal Delivery System, or TDS, Fentanyl TDS and four Crest Advanced Seal Whitestrips products. We use our novel transdermal and transmucosal approaches to bring new products to markets that present significant opportunities. Our development platforms enable transdermal delivery of large molecules, or biologics, including vaccines, peptides and proteins, as well as small molecules that are otherwise difficult to deliver in a transdermal dosage form. Our pipeline includes two partnered products that are the subject of pending drug marketing applications to the U.S. Food and Drug Administration, or FDA. In addition, we have 12 partner- or self-funded programs at earlier stages.

We have built significant know-how and experience in the development, scale-up and manufacture of complex specialty products and have formed relationships with our partners that include both the development of new product formulations and our manufacture of the resulting products. Our partners include The Procter & Gamble Company, or P&G, Par Pharmaceutical, Inc., Teva Pharmaceuticals USA, Inc. and Agile Therapeutics, Inc., as well as several other multinational pharmaceutical companies. We have the capability to develop and manufacture our own product candidates and are one of only a few independent companies that develops and manufactures transdermal products for other parties.

Transdermal drug delivery is the transport of drugs through the skin for absorption into the body. We have developed two proprietary technology platforms, Corplex™ and MicroCor®, that we believe offer significant competitive advantages over existing transdermal approaches. Corplex and MicroCor are designed to be adapted broadly for use in multiple drug categories and indications. We use our Corplex technology to create advanced transdermal and transmucosal systems for small molecules that utilize less of the active ingredient while achieving the same or better therapeutic effect, that can adhere well to either wet or dry surfaces, and that can hold additional ingredients required to aid the diffusion of low-solubility molecules through the skin without losing adhesion. Our MicroCor technology is a biodegradable microstructure system currently in development that enables the painless and convenient delivery of biologics that otherwise must be delivered via injection. Biodegradable microstructures integrate drug molecules and a biocompatible polymer. With slight external pressure, the microstructures penetrate the outer layers of the skin and dissolve to release the drug for local or systemic absorption. MicroCor is designed to expand the market for transdermal delivery of biologics, which cannot currently be delivered by other FDA-approved transdermal technologies.

In addition to commercialized products, we have a number of products in late stages of development. The most advanced clinical stage product in our pipeline is AG200-15, which is in Phase 3 development by our partner Agile. AG200-15 is a combination hormonal contraceptive patch designed to deliver two hormones, ethinyl estradiol and levonorgestrel, at levels comparable to low-dose oral contraceptives, through the skin in an easy-to-use format over seven days. Agile has filed a New Drug Application, or NDA, for approval of this product by the FDA, which is required before marketing a new drug in the United States. The FDA has indicated that Agile's NDA was not sufficient for approval as originally submitted. Agile is conducting a confirmatory Phase 3 clinical trial based on this guidance, and intends to submit the results of the additional Phase 3 clinical trial to the FDA.

3

We are developing several additional products utilizing our proprietary technologies that we plan to advance into Phase 1 and 2 trials in fiscal 2015. MicroCor hPTH(1-34) utilizes our MicroCor technology to deliver parathyroid hormone, a peptide for treating osteoporosis that is currently available only in a refrigerated injectable form. Our programs in Alzheimer's and Parkinson's diseases have advanced into in vivo pharmacokinetic testing. We are actively pursuing two product candidates in parallel for the transdermal treatment of Alzheimer's disease, incorporating two of the drugs already approved by the FDA, donepezil and memantine. Pending successful preclinical results, our current plan is to take both candidates into human clinical trials. Additionally, we are pursuing a program for the transdermal treatment of Parkinson's disease, also incorporating drugs already approved by the FDA, ropinirole and pramipexole. We are planning to take at least one of these candidates into human clinical trials. Tamsulosin TDS is a patch that we have been developing to deliver tamsulosin to patients with benign prostatic hyperplasia, or enlarged prostate. It is designed to deliver a controlled dose over several days and to reduce side effects compared to currently marketed products. We have decided to reallocate capital from our Tamsulosin TDS development program to our Alzheimer's and Parkinson's disease programs, with any further investment in Tamsulosin to be dependent on potential partnering activities and external funding.

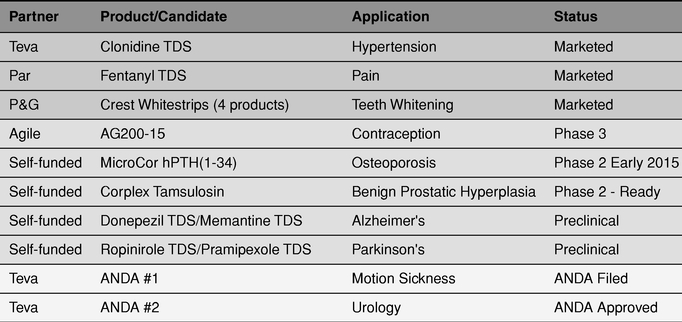

The following table identifies the products we have developed that are marketed by our partners, products in our proprietary pipeline and products currently awaiting FDA approval.

Transdermal Drug Delivery Industry

Patients have benefited from the use of transdermal delivery systems since the first commercially approved transdermal product, ALZA Corporation's Transderm Scop for the prevention of motion sickness was approved in 1979. To date, we are aware of approximately 20 drugs that have been successfully formulated and approved by the FDA for delivery in transdermal patches, though the market is growing. According to Datamonitor, the global value of the market for systemic transdermal products, including patches, was approximately $20 billion in 2010 and is expected to grow to approximately $30 billion by 2015. We believe this growth is driven by the increasing availability of transdermal systems for important therapeutic applications and changing disease demographics.

Transdermal delivery and transmucosal delivery, or delivery through mucous membranes, offer patients more convenient, non-invasive and comfortable methods of drug delivery. The benefits of transdermal and transmucosal delivery systems over other dosage forms generally include enhancing the

4

efficacy and reducing the side effects of a drug by controlling the rate of delivery and absorption, avoiding the undesirable breakdown of drugs in the liver associated with gastrointestinal absorption, and improving the level of patient compliance and long-term adherence to therapy.

Despite the benefits of current transdermal delivery products, many key challenges prevent broader use and applicability:

- •

- Skin Irritation and Adhesion: A number of patches cause

skin irritation and sensitization, often brought on by the inclusion of skin-permeating ingredients necessary to overcome the limitations of traditional patch technologies. Some patches also

experience adhesion failure resulting from excess moisture or heat while worn by the patient, for example when swimming, bathing or during other normal daily activities.

- •

- Safety and Drug Loading: In order to enable effective

diffusion of sufficient amounts of drug through the skin, many transdermal delivery systems must incorporate large amounts of drug in the patch. After use, a large residual amount of the drug remains

and must be disposed of carefully, especially if the drug is potent or toxic. In some cases, only a small amount of the total drug loaded in a patch is actually delivered into the bloodstream.

- •

- Delivery Limitation: The pharmaceutical industry has been unable to formulate certain drugs, especially biologics, for transdermal drug delivery, given the size and complexity of the molecules. These drugs generally are delivered by injection, which causes pain and often requires administration by a medical professional. In addition, these drugs generally must be refrigerated, require biohazard disposal and present the risk of accidental needle sticks. Many small molecules are also difficult to deliver transdermally, especially those that are not soluble in water or are unstable in the presence of air or water.

One of the greatest opportunities in transdermal drug delivery is the ability to deliver biologics, including vaccines, peptides and proteins without the use of an injection. A number of companies have attempted to develop technologies to address this challenge, but many have experienced commercial and development failures due to the formulation, scale-up and manufacturing complexities. Some of these systems have relied upon large, complex and costly devices, usually with external power sources, which adversely impact their usability and reproducibility.

We are developing and commercializing advanced transdermal drug delivery products that are intended to expand the number and types of drugs that can be delivered transdermally. We believe our technologies can be applied to improve the therapeutic value of many drugs by controlling the levels of drug delivered over a longer period of time. They are also designed to eliminate the need for injections of certain drugs and to improve adhesion and skin irritation profiles. Our technologies also allow us to create cost-effective products, especially by eliminating the need for complex devices and refrigeration throughout the supply chain. Our two proprietary platforms, Corplex and MicroCor, separately address some of the primary shortcomings of traditional transdermal drug delivery. We believe our track record within the industry demonstrates our ability to develop commercially successful products.

Corplex Technology

Corplex is a novel technology incorporating combinations of materials that utilize the properties of both traditional pressure-sensitive adhesives, or PSAs, as well as bioadhesives, to enable the transdermal delivery of small molecules. Corplex encompasses combinations and blends of polymers to provide a range of properties that improve adhesion and delivery of active ingredients that may otherwise be difficult to formulate for transdermal delivery. We use our Corplex technology in the Crest Whitestrips products and in several of our therapeutic products in development. Our Corplex

5

transdermal delivery systems provide advanced custom solutions for small molecules and feature the following benefits:

- •

- Flexibility: Corplex is adaptable and provides the

ability to formulate adhesives to complement a drug's unique properties, enabling new drug dosage forms and delivery options. As a result, Corplex systems can be formulated in several dosage forms

ranging from liquids (sprays, film-forming liquids), to semi-solids (gels, creams and ointments) to solids (powders, particles, dry and wet films, and patches).

- •

- Ease-of-Use: Our Corplex systems are designed to improve

patient compliance by being easy to use, self-administered and discreet. In addition, Corplex products are suitable for long-term skin contact and are designed to be easily removed with minimal damage

to skin and without leaving a residue. Corplex incorporates unique compositions and blends of polymers to provide a range of hydrophilic to hydrophobic properties, enabling excellent adhesion to both

dry and wet surfaces with a variety of wear times, ranging from seconds to up to seven days.

- •

- Compatibility: Corplex can incorporate liquid-based

components that improve stability and diffusion of the drug without compromising adhesion. As a result, Corplex is compatible with many chemically diverse drugs, including compounds that are highly

soluble or highly insoluble in water, as well as a wide range of solubilizing agents and enhancers that enable the delivery of these molecules, thereby expanding the universe of drugs that can be

delivered transdermally.

- •

- Efficient and Controlled Drug Delivery: Because Corplex

enables drugs to diffuse more easily through the skin, we can design Corplex products to require less drug to achieve the desired therapeutic result. In some cases, patch sizes can also be smaller

than conventional patches, reducing costs and improving the user experience. Additionally, Corplex allows for development of products with drug delivery profiles ranging from immediate release to

sustained release or a combination of fast-acting and long-lasting types of release.

- •

- Improved Therapeutic Profile: By achieving a steady dosage level, Corplex systems are designed to minimize side effects that otherwise result from peak concentrations of the drug when delivered with oral or other dosage forms. Corplex allows us to minimize the use of ingredients that can cause skin irritation and sensitization, two of the most common side effects of transdermal drug delivery. In our Corplex systems, we use materials that are well established for use in medical products by the FDA.

We believe the combination of these benefits make Corplex well-suited for the development of a variety of healthcare products that require adhesive properties, including prescription transdermal drug products, personal care, oral care, wound care, medical device and diagnostics products.

MicroCor Technology

MicroCor is a biodegradable microstructure patch technology that we are developing to enable transdermal delivery of biologics, in a disruptive platform that reduces the need for needles and syringes and enables global distribution of biologics without requiring refrigeration. Because biologics cannot diffuse through the skin due to their size, some mechanism is required to introduce these molecules beyond the outer layer of the skin, or stratum corneum, where they can be absorbed into the body. The further a delivery system penetrates beyond the stratum corneum, the more likely it is to cause pain, bleeding and bruising. By integrating active ingredients directly into arrays of biodegradable microstructures, our MicroCor technology is designed to penetrate only the stratum corneum to release the drug for local or systemic absorption, while eliminating the pain, bleeding and bruising that can be caused by needles and other active delivery devices.

6

We believe MicroCor will offer the following advantages over other delivery technologies in development for biologics:

- •

- Minimal Discomfort: Our MicroCor systems feature an array

of microstructures that penetrate the stratum corneum to only a few hundred microns in depth, deep enough for effective delivery without causing pain, bruising or bleeding.

- •

- Dose Sparing: MicroCor needles are biodegradable and

dissolve in the skin once the system is applied. In our clinical studies to date, we determined that over 90% of the drug contained in a single use of a MicroCor system was delivered into the skin

each time the system was administered. We expect our MicroCor systems to reduce drug waste and the costs associated with the excess drug that may be required in less efficient delivery technologies.

- •

- Thermally Stable: Our MicroCor systems do not contain

moisture, and therefore are designed to be room temperature stable, enabling both stockpiling and worldwide delivery without refrigeration, thereby minimizing drug or product spoilage.

- •

- No Biohazard Disposal: Because MicroCor needles

completely dissolve in the skin, no sharps remain after use. We believe this feature will allow disposal of the system in a traditional trash receptacle without risk of accidental needle sticks or

abuse associated with residual drug left in the delivery system.

- •

- Ease-of-Use: MicroCor products are designed to be

self-administered, fully-integrated, single-use systems that are worn for only a few minutes. Unlike other delivery systems, MicroCor requires no additional parts, electrical power or complex external

enabling devices to effectively deliver the drug or product.

- •

- Cost-Effective: In addition to the cost savings associated with dose sparing and thermal stability, MicroCor's fundamental design and our proprietary molding process also minimize costs associated with manufacturing MicroCor systems. Our process allows us to reduce waste of active ingredients used in manufacturing, as compared to needle coating processes used by other delivery technologies for large molecules.

Material Relationships

Our partners are critical to our success. We currently have material relationships with the following companies, as well as earlier-stage relationships with a number of other companies. This diversified mix of partnerships provides multiple potential sources of revenue growth in the future. In each of fiscal 2014 and 2013, we derived nearly all of our revenues from our partners P&G, Teva, and Par. In fiscal 2014, we received $11.7 million of our revenues from P&G, $13.6 million from Teva, and $13.0 million from Par, or 28%, 32%, and 31%, respectively. In fiscal 2013, we received $11.8 million of our revenues from P&G, $16.7 million from Teva, and $16.6 million from Par, or 23%, 33%, and 33%, respectively.

The Procter & Gamble Company

In June 2005, we entered into a multi-faceted strategic arrangement with P&G, one of the largest consumer products companies in the world. Our relationship includes a worldwide license to P&G for the use of our Corplex technology in products in the general field of consumer products. This field does not include rights in the prescription drug, foot care and wound care fields. P&G paid us fees for the license, and agreed to pay additional future milestone payments for products that we develop for P&G. In addition, we entered into a long term joint development agreement under which we perform numerous research and development activities for P&G based upon agreed-upon statements of work and budgets. We also have a commercial supply agreement in place, under which we are responsible for the production and supply to P&G of four oral care products. Our supply agreement with P&G currently extends through January 2017. The supply agreement can be expanded to include any

7

additional products that move into commercial supply. We believe that we have unique capabilities and know-how related to the manufacture of Corplex-based Crest Whitestrips, which would be difficult for another party to duplicate.

We have developed and commercialized four oral care products for P&G sold under the brand name Crest Whitestrips. The four products are Advanced Vivid, Professional Effects, One Hour Express and Flex-Fit. We have developed all of these products under the joint development agreement and are currently supplying each product in an intermediate, not final packaging, stage to P&G. In addition, we have other products in development for the oral care business at P&G as well as certain products in development for other businesses at P&G.

In addition to contract research and development and product revenues, from the inception of our collaborations with P&G, we have received a total of $3.2 million in license fees and $2.0 million in milestone payments from P&G. None of our arrangements with P&G require a royalty to be paid to us.

Teva Pharmaceuticals, USA Inc.

In 2004, we entered into a development, manufacturing and commercialization agreement with Barr Laboratories, Inc. for four generic transdermal drug products. We entered into three separate agreements with Barr, one in 2006 and two in 2007, to develop and commercialize additional ANDA transdermal patch products. In 2008, Teva Pharmaceuticals, Inc. acquired Barr. Following this acquisition and its review of resource allocations and potential conflicts, Teva continued three of these development programs. These programs have resulted in an approved product marketed as Clonidine TDS, a urology patch approved in March 2014 and a motion sickness patch that is the subject of a pending ANDA.

Under our agreements with Teva, we are the exclusive suppliers of the products that are the subject of each development program. We receive compensation for developing the product, plus a manufacturing margin, expressed as a margin above costs, and a profit share based on Teva's net profits on the products. Teva has an exclusive license to use certain of our intellectual property to the extent necessary to commercialize, make, use or sell the ANDA product.

The Teva product contracts extend for ten years beyond the respective product launch dates, with provisions for automatic annual renewal thereafter. The contracts may be terminated, with three months' notice before the end of a renewal period, or for uncured material breach, bankruptcy, or certain conditions preceding ANDA filing. If Teva were to terminate the agreement, it would be required to obtain FDA approval for an alternate manufacturing site before it could obtain additional supply of the product, a process that generally takes two years or more.

Clonidine TDS was the first product under our partnership with Teva to be approved by the FDA. Teva launched the product in 2010, and currently has the largest share of the clonidine patch market. We also have a motion sickness patch that is the subject of a pending ANDA.

In addition to contract research and development revenues and product revenues, from the inception of our collaborations with Teva and its predecessor, we have received no license fees and $0.2 million in milestone payments. Under our current agreements, we are not eligible for additional milestone payments. We also receive a profit share equal to a low tens percentage of Teva's net sales of Clonidine TDS, after deducting certain selling-related expenses.

Par Pharmaceutical, Inc.

In 2002, we entered into a product development, collaboration and license agreement and in 2003 we entered into a manufacturing and supply agreement with Abrika LLLP for a generic equivalent of Duragesic, a fentanyl transdermal product marketed by Johnson & Johnson. In 2007, Abrika was

8

acquired by Actavis, Inc. In 2007, the FDA approved and Actavis launched our Fentanyl TDS product. In 2012, Par Pharmaceuticals, or Par, acquired the fentanyl business from Actavis, and Par currently markets Fentanyl TDS as our partner. Under the manufacturing and supply agreement, we are the exclusive supplier of Fentanyl TDS to Par.

Abrika and Actavis paid us for the development of Fentanyl TDS and we also receive a manufacturing margin and a royalty on net sales of the products by Par. The 2002 agreement may be terminated for uncured material breach, bankruptcy, or certain conditions preceding ANDA filing. If Par were to terminate the agreement, it would be required to obtain FDA approval for an alternate manufacturing site before it could obtain additional supply of the product, a process that generally takes two years or more.

In addition to contract research and development revenues and product revenues, from the inception of our collaborations with Par and its predecessors, we have received no license fees and $0.5 million in milestone payments from Par. Under our current agreements, we are not eligible for additional milestone payments. We receive a royalty equal to a mid single digit percentage of Par's net sales of Fentanyl TDS.

Agile Therapeutics, Inc.

In 2006, we entered into a development, license and commercialization agreement with Agile Therapeutics, Inc., a privately-owned company that focuses on development of women's healthcare products. As part of our relationship, we are the exclusive supplier of the AG200-15 combined hormonal contraceptive patch, which was designed by Agile using its formulation technology and is proprietary to Agile. Under our agreement with Agile, we have performed substantial work, funded by Agile, on the process development and scale-up of the manufacturing process for AG200-15, and we have manufactured the product for each of Agile's clinical trials. Our agreement also includes an additional Agile product, AG890, which is a progestin-only contraceptive patch in Phase 2 of clinical development.

In anticipation of the approval and commercial launch of the AG200-15 product, we have worked in partnership with Agile to prepare facilities and equipment at our Grand Rapids manufacturing site for commercial production of the product. The primary production equipment specifically designed for manufacture of this product has been purchased and is owned by Agile and we are responsible for operating and maintaining that equipment.

Our exclusive right to manufacture AG200-15 and AG890 extends until we have commercially produced an agreed-upon quantity of patches, currently projected to occur no earlier than five years following commercial launch of AG200-15. The contract may be terminated for uncured material breach. Following the end of the exclusivity period, if Agile were to seek a second source of supply, Agile would be required to obtain FDA approval for an additional manufacturing site, a process that generally takes two years or more, and make substantial investments in new facilities and equipment.

In addition to contract research and development revenues, from the inception of our collaborations with Agile, we have received no license fees and $3.5 million in milestone payments from Agile. We are not currently eligible for any future milestone payments, and the terms of our supply agreement do not entitle us to receive a royalty.

Products and Pipeline

We have six commercial products and two products awaiting FDA approval, and we are developing additional undisclosed prescription drug products with partners. We have ongoing feasibility agreements with several major pharmaceutical companies involving our MicroCor technology, and are currently in active discussions with other companies for additional feasibility projects.

9

Marketed Products:

In fiscal 2014, we received a total of $32.2 million in product revenues from our three marketed products: $10.8 million from Clonidine TDS, $11.7 million from Fentanyl TDS, and $9.7 million from Crest Whitestrips, representing 34%, 36% and 30% of total product revenues, respectively.

Clonidine TDS is a treatment for hypertension that we developed under an ANDA as a generic version of the branded drug known as Catapres TTS. Clonidine TDS was launched in 2010 and is marketed by Teva and manufactured by us exclusively for Teva.

Fentanyl TDS is a treatment for management of chronic pain, including cancer-related pain, under specified conditions. We developed this product for approval under an ANDA as a generic version of the branded product known as Duragesic. Our Fentanyl TDS was approved in 2007 and is currently marketed by Par and manufactured by us exclusively for Par.

Crest Whitestrips are a series of four products for oral care that we co-developed with P&G as part of a broad relationship relating to consumer products. These products utilize our Corplex polymer technology and are sold under the brands Advanced Vivid, Professional Effects, One Hour Express and Flex-Fit. We are the sole supplier of the oral care system marketed as Crest Whitestrips for P&G.

Pipeline Products:

AG200-15 is a combination hormonal contraceptive patch that contains the active ingredients ethinyl estradiol (an estrogen) and levonorgestrel (a progestin), both of which have an established history of efficacy and safety in currently marketed combination contraceptives. AG200-15 is designed to deliver both hormones at levels comparable to low-dose oral contraceptives. By delivering these active ingredients over seven days, this product is designed to promote enhanced compliance by patients with a convenient, easy-to-use format. The patch is applied once weekly for three weeks, followed by a week without a patch. The product, which was designed by Agile and for which we have done process development and manufacturing, will, if approved, be packaged with three patches per carton to provide a cycle (month) of therapy.

In February 2013, Agile received a Complete Response Letter from the FDA, indicating that the results from the completed Phase 3 studies would not be sufficient for approval, and proposing that Agile conduct an additional Phase 3 study. In September of 2014, Agile initiated the additional study as requested by FDA, which it anticipates completing by early 2016. This study has been designed to address key issues that arose in the previous studies, including enhanced patient enrollment criteria and processes, and close monitoring of compliance with the study protocol. There can be no assurance that this additional study will be successful in demonstrating efficacy and safety of the product. However, assuming successful completion of this additional study, Agile would plan to submit the results of the confirmatory study to the FDA in early 2016. Assuming a six-month review by the FDA, approval would occur late in 2016

We are the exclusive supplier of the AG200-15 product to Agile. In fiscal 2014, we received a total of $1.0 million in contract research and development revenues from Agile, representing 11% of our total contract research and development revenues.

MicroCor hPTH(1-34) is a transdermal system designed to use our MicroCor technology to provide simplified delivery of parathyroid hormone, the active ingredient of Forteo, an injectable product marketed by Eli Lilly and Company for the treatment of severe osteoporosis. hPTH(1-34) is a shortened version of the naturally occurring parathyroid hormone that promotes bone growth. With a simple one-step application process, short wear time and a favorable pharmacokinetic profile, MicroCor hPTH(1-34) represents, if approved, an opportunity to effectively deliver an improved anabolic therapy and increase patient compliance in the osteoporosis market.

10

We have completed a Phase 1 safety and pharmacokinetic study of MicroCor hPTH(1-34) in healthy women. In this study, MicroCor hPTH(1-34) was shown to be safe and well tolerated with comparable drug exposure to that achieved with the commercially available subcutaneous injections. The product achieved rapid systemic delivery of hPTH with a short wear time of five minutes. On the basis of these results, we are planning further clinical development of MicroCor hPTH(1-34) under a 505(b)(2) regulatory pathway that leverages existing hPTH safety and efficacy data from the approved dosage form of parathyroid hormone. The clinical plan will consist of a Phase 2a pharmacokinetic study, which we plan to complete in the first half of 2015. This will be followed by a six-month Phase 2b efficacy/safety and dose finding study in osteoporosis patients and a one-year Phase 3 trial, each measuring change in bone mineral density as a primary endpoint.

MicroCor hPTH(1-34) has demonstrated a favorable safety profile in multiple nonclinical biocompatibility and microbial studies. The product has also demonstrated favorable room temperature stability. Following the completion of our clinical trials, we anticipate partnering with a company active in bone health, women's health or endocrinology to distribute and sell the product, if approved.

We have in place pilot facilities for manufacture of MicroCor products for early clinical testing. We also have extensive experience with process development and commercial scale-up for transdermal products. In preparation for Phase 3 clinical trials of MicroCor hPTH(1-34), we have developed an aseptic manufacturing plan for large scale manufacturing and we have designed the manufacturing process for MicroCor systems to be streamlined, robust and cost effective.

Corplex Tamsulosin is a transdermal patch designed to use our Corplex technology to provide controlled delivery of tamsulosin, the active ingredient in the leading once-daily capsule product for treatment of benign prostatic hyperplasia, or BPH, marketed under the brand name Flomax. Tamsulosin is a drug that relaxes smooth muscle cells in the prostate and bladder neck, thereby decreasing the blockage of urine flow that occurs with an enlarged prostate. By providing a controlled and relatively steady level of drug over an extended time, Corplex Tamsulosin is intended to alleviate the side effects associated with peak blood concentrations of the drug in its current oral formulation and to provide a consistent level of efficacy.

We have completed a Phase 1 safety and pharmacokinetic study of Corplex Tamsulosin in healthy men. In this study, Corplex Tamsulosin demonstrated a favorable safety profile, was well-tolerated and the drug exposure of the once-weekly patch was comparable to daily oral Flomax capsules. The clinical plan would consist of a one month Phase 2 efficacy/safety and dose finding study in 90 patients and a three month (with open label extension of six to nine months) Phase 3 trial in patients, using an American Urology Association symptom score or International Prostrate Symptom Score as the primary end point. We have decided to reallocate capital from this development program to our Alzheimer's and Parkinson's disease programs, with any further investment in this product to be dependent on potential partnering activities and external funding.

Additional ANDA Products:

Motion Sickness Patch. We have developed a generic transdermal product for the prevention of nausea and vomiting associated with motion sickness. We developed a three-day patch for Teva that is currently the subject of a pending ANDA. We have completed all of the development, scale-up and clinical activities and expect this product to launch in 2015, if approved.

In fiscal 2014, we received a total of $1.6 million in contract research and development revenues from Teva for this product, representing 18% of our total contract research and development revenues.

11

Urology Patch. We have developed a generic transdermal product for treatment of a urologic condition. We developed a three-to-four-day patch for Teva under an ANDA, and Teva received approval in March 2014. Teva is currently reviewing the strategy and potential timing for launch of this product. We did not receive contract research and development revenues for this product in fiscal 2014.

Development Pipeline Products:

Alzheimer's Disease (Donepezil and Memantine)

Alzheimer's disease, the leading cause of dementia, is characterized by the progressive loss of memory, thinking and ability to perform activities of daily living, such as bathing, feeding and self-care, as well as significant behavioral disturbances such as agitation, aggression, delusions and hallucinations. According to industry sources, Alzheimer's disease currently affects approximately 5.3 million people in the United States, including as many as 13% of people aged 65 and older and approximately 50% of those 85 and older. We have initiated preclinical development work on advanced transdermal patches for the treatment of Alzheimer's disease incorporating proven and approved molecules, one of which is the active ingredient in Aricept. We anticipate developing these patches under a 505(b)(2) regulatory pathway, which we believe will allow for reduced nonclinical and clinical study cost and time. The product candidates are designed to decrease the side effects of the current therapies, including nausea and vomiting, and to improve patient adherence and compliance.

Parkinson's Disease (Ropinirole and Pramipexole)

Parkinson's disease is the second most common neurodegenerative disorder after Alzheimer's disease. Approximately one million people in the United States and from four to six million people worldwide suffer from this disease, which is commonly treated with dopamine replacement therapies such as levodopa and dopamine agonists, which are molecules that mimic the action of dopamine. We have initiated preclinical development work on advanced transdermal therapies incorporating proven and approved molecules for treating Parkinson's disease under a 505(b)(2) regulatory pathway, which we believe will allow for reduced nonclinical and clinical study cost and time. Because Parkinson's patients have trouble swallowing pills, we believe a transdermal or film product would address an unmet need recognized by patients and physicians alike.

MicroCor Feasibility Programs include partner-funded feasibility programs that we have completed or are currently in progress. Additional programs are in the planning process. In the programs performed to date, we have collaborated with leading biopharmaceutical companies to formulate their proprietary active molecules in our MicroCor technology and demonstrate delivery of the drug in animal models. The active molecules in these studies have been primarily large biologic molecules, including vaccines, peptides, proteins and monoclonal antibodies. After completing a number of these programs successfully, we are now advancing certain programs into later stages of development, including new vaccine and therapeutic applications.

Future Pipeline Programs include additional undisclosed ANDAs that have been partnered with various pharmaceutical companies. These products are in development and we expect the ANDAs to be filed in late 2015 and thereafter. We also are developing skin care and cosmetics products utilizing our Corplex and MicroCor technologies for our partners.

In fiscal 2014, we received an aggregate total of $4.4 million in contract research and development revenues from our collaboration partners for these programs, representing 48% of our total contract research and development revenues.

Research and Development

Our research and development operations are located in a 25,000 square foot laboratory and office facility in Menlo Park, California that is configured for transdermal and transmucosal systems

12

development. We conduct proprietary drug delivery research utilizing our extensive experience in polymer blending, formulations and system engineering to produce innovative products with high drug delivery efficiency. Our research and development team has full early product development capabilities, including:

- •

- Formulation, system design and engineering;

- •

- Analytical method development and validations;

- •

- Prototyping and pilot manufacturing;

- •

- Early stage quality assurance and quality control;

- •

- Nonclinical and early stage clinical development; and

- •

- Regulatory affairs.

In addition, our Menlo Park site operates a pilot facility capable of making products in accordance with cGMP requirements for Phase 1 and Phase 2 clinical studies.

Our Menlo Park research and development team includes 35 scientists and engineers, some of whom were original inventors of transdermal patches. We perform the formulation system design, analytical method development and prototyping for all of our transdermal products. Our research and development team works in collaboration with the process scale-up team in our manufacturing operations early in the product development cycle. This early coordination helps assure streamlined technology transfer success in the final scale-up and commercial manufacture of each product, leading to more robust development programs and greater manufacturing efficiencies.

Manufacturing

Our commercial manufacturing facilities are located in Grand Rapids, Michigan in three buildings comprising approximately 200,000 square feet. We have a full range of development and manufacturing capabilities, from complete process development and scale-up services to commercial manufacture. We have made significant investments in our manufacturing technology that allow us to automate many of our processes and maximize the productivity of our labor force. We employ multiple manufacturing techniques, including solvent cast and extrusion manufacturing processes that minimize the thickness of our patches and reduce the costs of our products. Solvent casting is well-suited for manufacturing films containing heat-sensitive molecules because the temperatures required to remove the solvents are relatively low compared to those needed for a hot-melt extrusion process. Hot-melt extrusion is not suitable for ingredients that could be thermally degraded in the process, but is environmentally friendly, cost effective and more flexible than solvent cast-only processes.

Our manufacturing platform includes:

- •

- Process development through commercial product manufacture, including final finishing and cartoning;

- •

- Multiple-use equipment providing flexibility for small volume manufacture and dedicated equipment for large volume production;

- •

- High accuracy coating for pressure sensitive adhesives, acrylics and polyisobutylene, or PIB;

- •

- Automated solvent casting and extrusion capabilities;

- •

- Automated high-speed, high-accuracy die cutting, and integrated die cutting and pouching;

- •

- Physical testing and analytical method capabilities;

- •

- The licensing required to handle scheduled drugs and compounds requiring special handling;

13

- •

- The ability to manufacture drug and device combination products with high accuracy assembly for multiple and complex components; and

- •

- Manufacturing capabilities for proprietary MicroCor biodegradable microstructures, including specialty coating, curing, drying and assembly processes.

Our facilities are FDA and DEA registered, and ISO9001 and ISO13485 certified. Our manufacturing facilities in Grand Rapids are licensed to manufacture OTC products, consumer products, prescription transdermal, dermal and mucosal products, as well as wound care products. Our Grand Rapids facilities also have the capacity to produce well over 100 million patches annually and can be expanded as our needs grow. A number of our equipment lines have been fully funded by our partners to support the development of partnered products. In these cases, the partners retain title to those equipment lines, while we retain responsibility for maintaining and operating them. Our operations include on-site quality control laboratories and testing procedures, quality assurance systems, and internal audit procedures for our processes and equipment.

Intellectual Property

Our success depends on our ability to obtain patents and protect our trade secrets and know-how. We must be able to operate without infringing on any other company's intellectual property and we must prevent others from infringing our intellectual property. Our strategy is to protect our intellectual property by filing both U.S. and international patents related to our proprietary technologies, products, inventions and improvements that are important to our business. As of September 30, 2014, we held 42 U.S. issued patents and 160 foreign issued patents (which include granted European patents rights that have been validated in various EU member states) and 30 U.S. pending patents and 56 foreign pending patents relating to our Corplex and MicroCor technologies and products. Of the issued U.S. patents, 32 relate to composition of matter and 10 relate to use or process. Of the pending U.S. patents, 25 relate to composition of matter and 5 relate to use or process. Our foreign patents generally include both composition of matter and use or process claims. Our issued U.S. patents and patent applications will expire between 2019 and 2035. Some of the issued patents and pending patent applications, if issued, may also be eligible for patent term adjustment and patent term restoration, thereby extending their patent terms.

Proprietary rights for our products in development and our potential products will be protected from use by third parties only to the extent that they are covered by valid and enforceable patents or are effectively maintained as trade secrets. Patents owned by us (or licensed by us) may not protect us from competition in the future and our pending patent applications may not result in patent rights being issued. In addition, the laws of certain foreign countries may not protect our intellectual property rights to the same extent as they do under U.S. law.

The patent positions of pharmaceutical, drug delivery and biotechnology companies are complex and enforcement cannot be predicted with certainty. Our patents or patent applications, if issued, may be challenged or invalidated and the rights granted may not provide proprietary protection or competitive advantages over our competitors with similar technologies. Our competitors may also develop similar technologies to ours, or in fact duplicate our technologies. Because the regulatory timeline is quite long and expensive to develop the types of products that we develop, it is possible that before any of our products are commercialized, any related patent may expire or exist for only a short period of time following commercialization. This could negatively impact our ability to protect our future products and consequently our operating results and financial position.

Our products in development may be covered by third party patents or other intellectual property rights, in which case we would need to obtain a license to continue to develop and/or market these products. Such licenses may not be available on acceptable terms and such licenses may not be attainable, which could delay product launches if we are required to design around a patent. Litigation

14

may be necessary to defend against or assert claims of infringement to enforce patents, protect trade secrets or know-how or to determine validity in order to freely sell a product in the marketplace. In addition, interference, derivation, post-grant oppositions or other proceedings may be necessary to determine rights to inventions in our patents. Litigation could entail substantial financial costs and may have a material adverse effect on our business, financial condition or results of operations.

In certain circumstances, we rely on trade secrets to protect our technology. Trade secrets are difficult to protect. Generally we protect our proprietary processes and manufacturing as trade secrets and we secure confidentiality agreements from all of our employees, contractors, consultants and advisors. We cannot assure that the agreements will not be breached, or that we will be able to remedy such a breach, or that our trade secrets will not become known in the public domain and be discovered by our competitors. Disputes may also arise with respect to know-how and inventions created by our employees, contractors and consultants. See the section entitled "Risk Factors—Risks Related to Our Intellectual Property."

Regulatory

Food and Drug Administration. The FDA and comparable regulatory agencies in state and local jurisdictions and in foreign countries impose substantial requirements upon the clinical development, manufacture and marketing of pharmaceutical and consumer cosmetic products. These agencies and other federal, state and local entities regulate research and development activities and the testing, manufacture, quality control, safety, effectiveness, labeling, storage, distribution, record keeping, approval, advertising and promotion of our products. Many of our products are combination drug-device products that are regulated as drugs by the FDA, with consultations from the device center in the FDA. Others, such as consumer teeth whitening products, are regulated by the FDA as cosmetics. Failure to comply with applicable FDA or other requirements may subject a company to a variety of administrative or judicial sanctions, such as the FDA's refusal to approve pending applications, a clinical hold, warning letters, recall or seizure of products, partial or total suspension of production, withdrawal of the product from the market, injunctions, fines, civil penalties or criminal prosecution.

FDA Regulation of Drugs. The process required by the FDA under the new drug provisions of the Federal Food, Drug, and Cosmetic Act, or the FFDC Act, before our investigational drugs may be marketed in the U.S. generally involves the following:

- •

- Completion of extensive preclinical laboratory tests and preclinical animal studies, all performed in accordance with the FDA's Good

Laboratory Practice, or GLP, regulations;

- •

- Submission of an Investigational New Drug application, or IND, which must become effective before clinical trials may begin;

- •

- Performance of adequate and well-controlled human clinical trials to establish the safety and efficacy of the investigational drug for

each proposed indication in accordance with the FDA's current good clinical practice, or GCP, requirements;

- •

- Submission to the FDA of a New Drug Application, or NDA, after completion of all pivotal clinical trials;

- •

- Satisfactory completion of an FDA pre-approval inspection of the manufacturing facilities at which the drug will be produced, to

assess compliance with current good manufacturing practice, or cGMP, regulations, or, for our medical device components, the Quality System Regulation, or QSR; and

- •

- FDA review and approval of an NDA prior to any commercial marketing or sale of the drug in the United States.

15

Preclinical tests include laboratory evaluation of the investigational drug, its chemistry, formulation and stability, as well as animal studies to assess its potential safety and efficacy. For human clinical trials to be conducted in the United States, we must generally submit the results of the preclinical tests, together with manufacturing information and analytical data, to the FDA as part of an IND, which must become effective before we may begin human clinical trials. An IND automatically becomes effective 30 days after receipt by the FDA, unless the FDA, within the 30-day time period, raises concerns or questions about the conduct of the trials as outlined in the IND and imposes a clinical hold. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before clinical trials can begin. Our submission of an IND may not result in FDA authorization to commence clinical trials. Further, an independent Institutional Review Board, or IRB, at each medical center proposing to conduct the clinical trials must review and approve any clinical study as well as the related informed consent forms and authorization forms that permit us to use individually identifiable health information of study participants.

Clinical trials involve the administration of the investigational drug to human subjects under the supervision of qualified investigators in accordance with GCP requirements, which include the requirement that all research subjects provide their informed consent for their participation in any clinical trial. Clinical trials are conducted under protocols detailing, among other things, the objective of the study, the parameters to be used in monitoring safety, and the efficacy criteria to be evaluated. A protocol for each clinical trial and any subsequent protocol amendments must be submitted to the FDA as part of the IND. The IRB must monitor the study until completed. There are also requirements governing the reporting of ongoing clinical trial results to public registries.

The foregoing discussion of clinical trials applies to clinical trials conducted under an IND. In some instances, we may conduct clinical trials outside of the United States, which may require different or additional regulatory submissions depending on the country in which the trial is conducted.

Human clinical trials are typically conducted in three sequential phases which may overlap or be combined:

- •

- Phase 1: Includes the initial introduction of an investigational drug into humans. Phase 1 studies are typically closely

monitored and may be conducted in patients or normal volunteer subjects. Phase 1 studies are designed to determine the metabolism and pharmacologic actions of the drug in humans, the side

effects associated with increasing doses, and, if possible, to gain early evidence of effectiveness. During these studies, sufficient information about the drug's pharmacokinetics and pharmacological

effects should be obtained to permit the design of well-controlled, scientifically valid, Phase 2 studies. These studies may include studies of drug metabolism, structure-activity

relationships, and mechanism of action in humans, as well as studies in which investigational drugs are used as research tools to explore biological phenomena or disease processes.

- •

- Phase 2: Includes controlled clinical studies conducted to evaluate the effectiveness of the drug for a particular indication

or indications in patients with the disease or condition under study, and to determine the common short-term side effects and risks associated with the drug.

- •

- Phase 3: When Phase 2 clinical trials suggest effectiveness of a drug, Phase 3 clinical trials are undertaken to gather the additional information about effectiveness and safety that is needed to evaluate the overall benefit-risk relationship of the drug and to provide an adequate basis for physician labeling.

We cannot be certain that we will successfully complete Phase 1, Phase 2 or Phase 3 clinical trials of our investigational drugs within any specific time period, if at all. Furthermore, the FDA or the IRB or the sponsor may suspend or terminate clinical trials at any time on various grounds, including a finding that the subjects or patients are being exposed to an unacceptable health risk. Sponsors of clinical trials may also suspend or terminate a clinical trial based on evolving business objectives and/or

16

competitive climate. During the clinical development of products, sponsors may meet and consult with the FDA in an effort to ensure that the design of their studies will likely provide data both sufficient and relevant for later regulatory approval; however, no assurance of approvability can be given by the FDA.

The results of product development, preclinical studies and clinical studies are submitted to the FDA as part of an NDA for approval of the marketing and commercial shipment of the product. Submission of an NDA requires the payment of a substantial user fee to the FDA, and although the agency has defined user fee goals that govern the length of an NDA's review time, we cannot assure that the FDA will make a review decision in any particular timeframe. After the FDA evaluates the NDA and conducts inspections of manufacturing facilities where the drug product and/or its active pharmaceutical ingredient, or API, will be produced, it may issue an approval letter or a Complete Response Letter. An approval letter authorizes commercial marketing of the drug with specific prescribing information for specific indications. A Complete Response Letter indicates that the review cycle of the application is complete but the application is not ready for approval. A Complete Response Letter may require additional clinical data and/or one or more additional clinical trials, as FDA has required of our partner Agile, and/or other requirements related to clinical trials, preclinical studies or manufacturing, any of which may be expensive and require considerable time to complete. Even if such data are submitted, the FDA may ultimately decide that the NDA does not satisfy the criteria for approval.

After approving a drug, the FDA may withdraw product approval if compliance with regulatory standards is not maintained or if safety problems occur after the product reaches the market. Requirements for additional Phase 4 studies (post-approval marketing studies) to confirm safety and effectiveness in a broader commercial use population may be imposed as a condition of marketing approval. In addition, the FDA requires surveillance programs to monitor approved products that have been commercialized, and the agency has the power to require changes in labeling or to prevent further marketing of a product based on the results of these post-marketing programs.

Satisfaction of FDA requirements or similar requirements of state, local and foreign regulatory agencies typically takes several years, and the actual time required may vary substantially based upon the type, complexity and novelty of the pharmaceutical product. Government regulation may delay or prevent marketing of potential products for a considerable period of time and impose costly procedures upon our activities. We cannot be certain that the FDA or any other regulatory agency will grant approval for any of our pharmaceutical systems under development on a timely basis, if at all. Success in preclinical or early stage clinical trials does not assure success in later stage clinical trials. Data obtained from preclinical and clinical activities is not always conclusive and may be susceptible to varying interpretations which could delay, limit or prevent regulatory approval. Evolving safety concerns can result in the imposition of new requirements for expensive and time consuming tests. Even if a product receives regulatory approval, the approval may be significantly limited to specific indications. Further, even after regulatory approval is obtained, later discovery of previously unknown problems with a product may result in restrictions on the product or even complete withdrawal of the product from the market. Any pharmaceutical systems that we may develop and obtain approval for would also be subject to adverse findings of the active drug ingredients being marketed in different dosage forms and formulations. Delays in obtaining, or failures to obtain regulatory approvals would have a material adverse effect on our business. Marketing our pharmaceutical systems abroad will require similar regulatory approvals and is subject to similar risks. In addition, we cannot predict what adverse governmental regulations may arise from future U.S. or foreign governmental action. Currently, our partners are the NDA and ANDA holders of products that we develop, and therefore our partners communicate with FDA with respect to the applications.

17

Any drug products manufactured or distributed by us pursuant to FDA approvals are subject to pervasive and continuing regulation by the FDA, including cGMP requirements, and reporting of adverse experiences with the drug. Drug manufacturers and their subcontractors are required to register their establishments with the FDA and state agencies, and are subject to periodic announced and unannounced inspections by the FDA and state agencies for compliance with cGMP regulations, which impose procedural and documentation requirements upon us and our third party manufacturers. In addition, changes to the manufacturing process are strictly regulated, and, depending on the significance of the change, may require prior FDA approval before being implemented. FDA regulations also require investigation and correction of any deviations from cGMP and impose reporting and documentation requirements upon us and any third-party manufacturers that we may decide to use. Accordingly, manufacturers must continue to expend time, money and effort in the area of production and quality control to maintain compliance with cGMP and other aspects of regulatory compliance. We cannot be certain that we or our present or future suppliers will be able to comply with the cGMP regulations and other FDA regulatory requirements.

Future FDA and state inspections may identify compliance issues at our facilities or at the facilities of our suppliers of raw materials that may disrupt production or distribution, or require substantial resources to correct. In addition, discovery of previously unknown problems with a product or the failure to comply with applicable requirements may result in restrictions on a product, manufacturer or holder of an approved NDA, including withdrawal or recall of the product from the market or other voluntary, FDA-initiated or judicial action that could delay or prohibit further marketing. For example, in 2008 and 2010 we conducted recalls of our fentanyl products and were inspected by the FDA. These inspections led to the issuance of FDA Forms 483 identifying inspectional observations. The most recent FDA inspection of our facility was a Pre-Approval Inspection for a product that is the subject of pending ANDA. The FDA issued a Form 483 with one observation, which we addressed as part of our ongoing obligations under the FDA's quality system regulation.

The FDA regulates drug labeling and promotion activities. The FDA has actively enforced regulations prohibiting the marketing of products for unapproved uses, and federal and state authorities are also actively litigating against sponsors who promote their drugs for unapproved uses under various fraud and abuse and false claims act statutes. We and our pharmaceutical systems are also subject to a variety of state laws and regulations in those states or localities where our pharmaceutical systems are or will be marketed. Any applicable state or local regulations may constrain our ability to market our pharmaceutical systems in those states or localities. We are also subject to numerous federal, state and local laws relating to such matters as safe working conditions, manufacturing practices, environmental protection, fire hazard control, and disposal of hazardous or potentially hazardous substances. We may incur significant costs to comply with such laws and regulations now or in the future.

The FDA's policies may change and additional government regulations may be enacted which could prevent or delay regulatory approval of our drug product candidates. Moreover, increased attention to the containment of health care costs in the U.S. and in foreign markets could result in new government regulations that could have a material adverse effect on our business. We cannot predict the likelihood, nature or extent of adverse governmental regulation that might arise from future legislative or administrative action, either in the U.S. or abroad.

The FDA also has the authority to require a risk evaluation and mitigation strategy (REMS) to ensure the safe use of the drug. The FDA has authority to require a REMS under the Food and Drug Administration Amendments Act of 2007, or FDAAA, when necessary to ensure that the benefits of a drug outweigh the risks. In determining whether a REMS is necessary, the FDA must consider the size of the population likely to use the drug, the seriousness of the disease or condition to be treated, the expected benefit of the drug, the duration of treatment, the seriousness of known or potential adverse events, and whether the drug is a new molecular entity. If the FDA determines a REMS is necessary, the drug sponsor must agree to the REMS plan at the time of approval. A REMS may be required to

18

include various elements, such as a medication guide or patient package insert, a communication plan to educate health care providers of the drug's risks, limitations on who may prescribe or dispense the drug, or other measures that the FDA deems necessary to assure the safe use of the drug. In addition, the REMS must include a timetable to assess the strategy at 18 months, three years, and seven years after the strategy's approval. The FDA may also impose a REMS requirement on a drug already on the market if the FDA determines, based on new safety information, that a REMS is necessary to ensure that the drug's benefits outweigh its risks.

On July 9, 2012, the FDA approved a REMS for extended-release and long-acting opioid medications. Several of our currently marketed drug products and investigational drugs, including fentanyl, are subject to the REMS. There may be increased cost, administrative burden and potential liability associated with the marketing and sale of drugs subject to the REMS requirement, which could negatively impact the commercial benefits to us and our partners from the sale of these drug products and, if approved, drug product candidates. Our partners, as the holders of the marketing applications for the affected drugs, are responsible for compliance with the opioid REMS requirements.

Hatch-Waxman Act. Section 505 of the FFDC Act describes three types of NDAs that may be submitted to the FDA to request marketing authorization for a new drug. A Section 505(b)(1) NDA is an application that contains full reports of investigations of safety and effectiveness. The Drug Price Competition and Patent Term Restoration Act of 1984, also known as the Hatch-Waxman Act, created two additional marketing pathways under Sections 505(b)(2) and 505(j) of the FFDC Act. A 505(b)(2) NDA is an application that contains full reports of investigations of safety and effectiveness but where at least some of the information required for approval comes from studies not conducted by or for the applicant and for which the applicant has not obtained a right of reference. This regulatory pathway enables the applicant to rely, in part, on the FDA's findings of safety and efficacy for an existing product, or published literature, in support of its application. Section 505(j) establishes an abbreviated approval process for a generic version of approved drug products through the submission of an Abbreviated New Drug Application, or ANDA. An ANDA provides for marketing of a generic drug product that has the same active ingredients, dosage form, strength, route of administration, labeling, performance characteristics and intended use, among other things, to a previously approved product. ANDAs are termed "abbreviated" because they are generally not required to include preclinical (animal) and clinical (human) data to establish safety and effectiveness. Instead, generic applicants must scientifically demonstrate that their product is bioequivalent to (i.e., performs in the same manner as) the innovator drug. The generic version generally must deliver approximately the same amount of active ingredients into a patient's bloodstream in the same amount of time as the innovator drug.

Upon submission of an ANDA or a 505(b)(2) NDA, an applicant must certify to the FDA that (1) no patent information on the drug product that is the subject of the application has been submitted to the FDA; (2) such patent has expired; (3) the date on which such patent expires; or (4) such patent is invalid or will not be infringed upon by the manufacture, use or sale of the drug product for which the application is submitted. This last certification is known as a paragraph IV certification. If the paragraph IV certification is challenged by an NDA holder or the patent owner(s) asserts a patent challenge to the paragraph IV certification, the FDA may not approve that application until the earlier of 30 months from the receipt of the notice of the paragraph IV certification, the expiration of the patent, when the infringement case concerning each such patent was favorably decided in the applicant's favor or such shorter or longer period as may be ordered by a court. This prohibition is generally referred to as the 30-month stay. In instances where an ANDA or 505(b)(2) NDA applicant files a paragraph IV certification, the NDA holder or patent owner(s) regularly take action to trigger the 30 month stay, recognizing that the related patent litigation may take many months or years to resolve. Thus, approval of an ANDA or 505(b)(2) NDA could be delayed for a significant period of time depending on the patent certification the applicant makes and the reference drug sponsor's decision to initiate patent litigation.

19

The Hatch-Waxman Act establishes periods of regulatory exclusivity for certain approved drug products, during which the FDA cannot approve (or in some cases accept) an ANDA or 505(b)(2) application that relies on the branded reference drug. For example, the holder of an NDA may obtain five years of exclusivity upon approval of a new drug containing a new chemical entity, or NCE, that has not been previously approved by the FDA. The Hatch-Waxman Act also provides three years of marketing exclusivity to the holder of an NDA (including a 505(b)(2) NDA) for a particular condition of approval, or change to a marketed product, such as a new formulation for a previously approved product, if one or more new clinical studies (other than bioavailability or bioequivalence studies) was essential to the approval of the application and was conducted/sponsored by the applicant. This three-year exclusivity period protects against FDA approval of ANDAs and 505(b)(2) NDA for drugs that include the innovation that required the new clinical data.

We expect that some of our drug candidates will utilize the section 505(b)(2) regulatory pathway. Even though several of our drug products utilize active drug ingredients that are commercially marketed in the United States in other dosage forms, we need to establish safety and effectiveness of those active ingredients in the formulation and dosage forms that we are developing. We also have several partnered products that are approved pursuant to ANDAs or will be filed under the ANDA pathway. All approved products, both innovator and generic, are listed in FDA's Approved Drug Products with Therapeutic Equivalence Evaluations (Orange Book).

The Drug Enforcement Administration. Certain of our products, including our fentanyl patch, are regulated as a "controlled substance" as defined in the Controlled Substances Act of 1970, or CSA, which establishes registration, security, recordkeeping, reporting, storage, distribution and other requirements administered by the Drug Enforcement Administration, or DEA. The DEA is concerned with the control and handling of controlled substances, and with the equipment and raw materials used in their manufacture and packaging, in order to prevent loss and diversion into illicit channels of commerce.