Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GT Advanced Technologies Inc. | gtat8-kxfebruary52016.htm |

UNITED STATES BANKRUPTCY COURT DISTRICT OF NEW HAMPSHIRE X In re: : Chapter 11 : GT ADVANCED TECHNOLOGIES INC., et. al., : Case No. 14-11916 (HJB) : : Jointly Administered X DEBTORS' ADDRESS: 243 Daniel Webster Highway Merrimack, NH 03054 DEBTORS' ATTORNEYS: PAUL HASTINGS LLP Park Avenue Tower 75 East 55th Street, First Floor New York, New York 10022 Telephone: (212) 318-6000 Facsimile: (212) 319-4090 Luc A. Despins, Esq. Andrew V. Tenzer, Esq. James T. Grogan, Esq. February 1, 2016 Kanwardev Raja Singh Bal Date Vice President and Chief Financial Officer Notes: [2] The Monthly Operating Report covers a period coinciding with the Debtors' standard reporting period. [1] The Debtors, along with the last four digits of each debtor’s tax identification number, as applicable, are: GT Advanced Technologies Inc. (6749), GTAT Corporation (1760), GT Advanced Equipment Holding LLC (8329), GT Equipment Holdings, Inc. (0040), Lindbergh Acquisition Corp. (5073), GT Sapphire Systems Holding LLC (4417), GT Advanced Cz LLC (9815), GT Sapphire Systems Group LLC (5126), and GT Advanced Technologies Limited (1721). The Debtors’ corporate headquarters are located at 243 Daniel Webster Highway, Merrimack, NH 03054. Monthly Operating Report For the Period of November 29, 2015 to December 31, 2015 [2] This Monthly Operating Report ("MOR") has been prepared solely for the purposes of complying with the monthly reporting requirements applicable in these Chapter 11 cases and is in a format that the Debtors believe is acceptable to the United States Trustee. The financial information contained herein is limited in scope and covers a limited time period. Moreover, such information is preliminary and unaudited, and is not prepared in accordance with accounting principles generally accepted in the United States ("GAAP"). I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the attached documents are true and correct to the best of my knowledge and belief. Page 1 of 20

UNITED STATES BANKRUPTCY COURT DISTRICT OF NEW HAMPSHIRE In re GT ADVANCED TECHNOLOGIES INC. et al., Case No. 14-11916 Reporting Period 11/29/15 - 12/31/15 MONTHLY OPERATING REPORT REQUIRED DOCUMENTS Form No. Document Attached Explanation Attached Monthly Reporting Questionnaire MOR-1 Yes No Schedule of Cash Receipts and Disbursements MOR-2 Yes No Bank Account Reconciliation MOR-2 (Cont) Yes No Copies of Debtor's Bank Reconciliations No No Copies of Debtor's Bank Statements No No Copies of Cash Disbursements Journals No No Statement of Operations MOR-3 Yes No Balance Sheet MOR-4 Yes No Schedule of Post-Petition Liabilities MOR-5 Yes No Copies of IRS Form 6123 or payment receipt No No Copies of tax returns filed during reporting period No No Detailed listing of aged accounts payables No No Accounts Receivable Reconciliation and Aging MOR-6 Yes No Cover Page Page 1 of 19

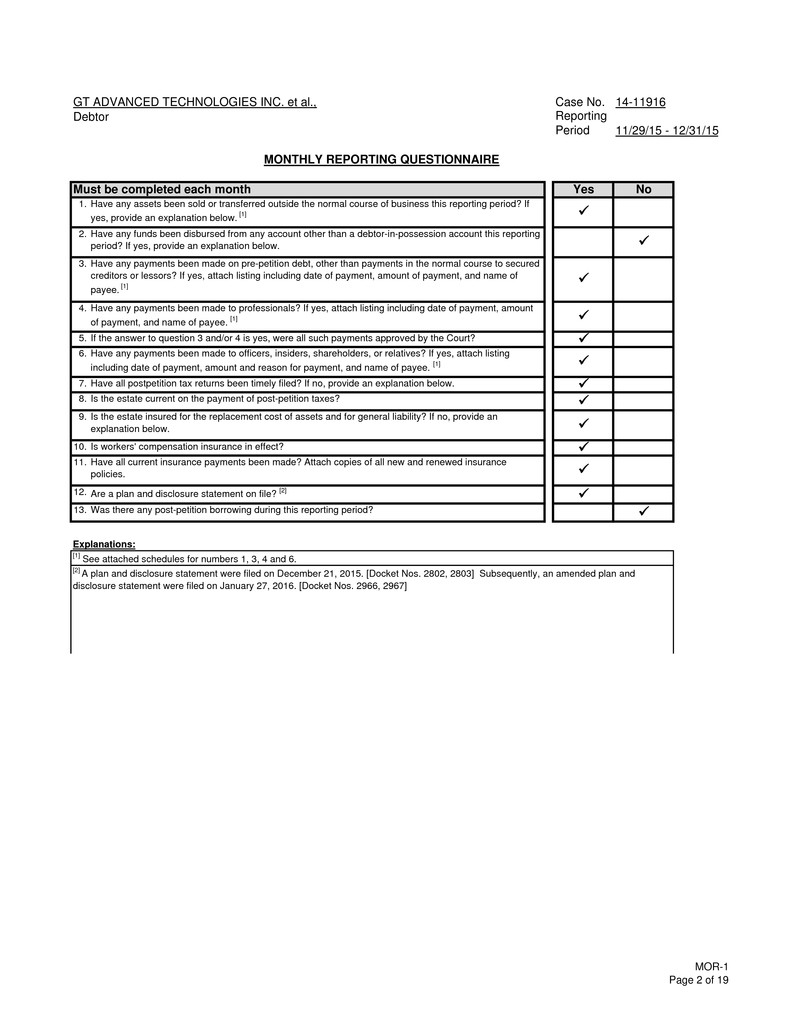

GT ADVANCED TECHNOLOGIES INC. et al., Case No. 14-11916 Debtor Reporting Period 11/29/15 - 12/31/15 MONTHLY REPORTING QUESTIONNAIRE Must be completed each month Yes No 5. If the answer to question 3 and/or 4 is yes, were all such payments approved by the Court? 7. Have all postpetition tax returns been timely filed? If no, provide an explanation below. 8. Is the estate current on the payment of post-petition taxes? 10. Is workers' compensation insurance in effect? 12. Are a plan and disclosure statement on file? [2] 13. Was there any post-petition borrowing during this reporting period? Explanations: 1. 2. Have any assets been sold or transferred outside the normal course of business this reporting period? If yes, provide an explanation below. [1] Have any funds been disbursed from any account other than a debtor-in-possession account this reporting period? If yes, provide an explanation below. 11. Have any payments been made to professionals? If yes, attach listing including date of payment, amount of payment, and name of payee. [1] Have any payments been made to officers, insiders, shareholders, or relatives? If yes, attach listing including date of payment, amount and reason for payment, and name of payee. [1] Is the estate insured for the replacement cost of assets and for general liability? If no, provide an explanation below. Have any payments been made on pre-petition debt, other than payments in the normal course to secured creditors or lessors? If yes, attach listing including date of payment, amount of payment, and name of payee. [1] [1] See attached schedules for numbers 1, 3, 4 and 6. [2] A plan and disclosure statement were filed on December 21, 2015. [Docket Nos. 2802, 2803] Subsequently, an amended plan and disclosure statement were filed on January 27, 2016. [Docket Nos. 2966, 2967] 6. 4. Have all current insurance payments been made? Attach copies of all new and renewed insurance policies. 3. 9. MOR-1 Page 2 of 19

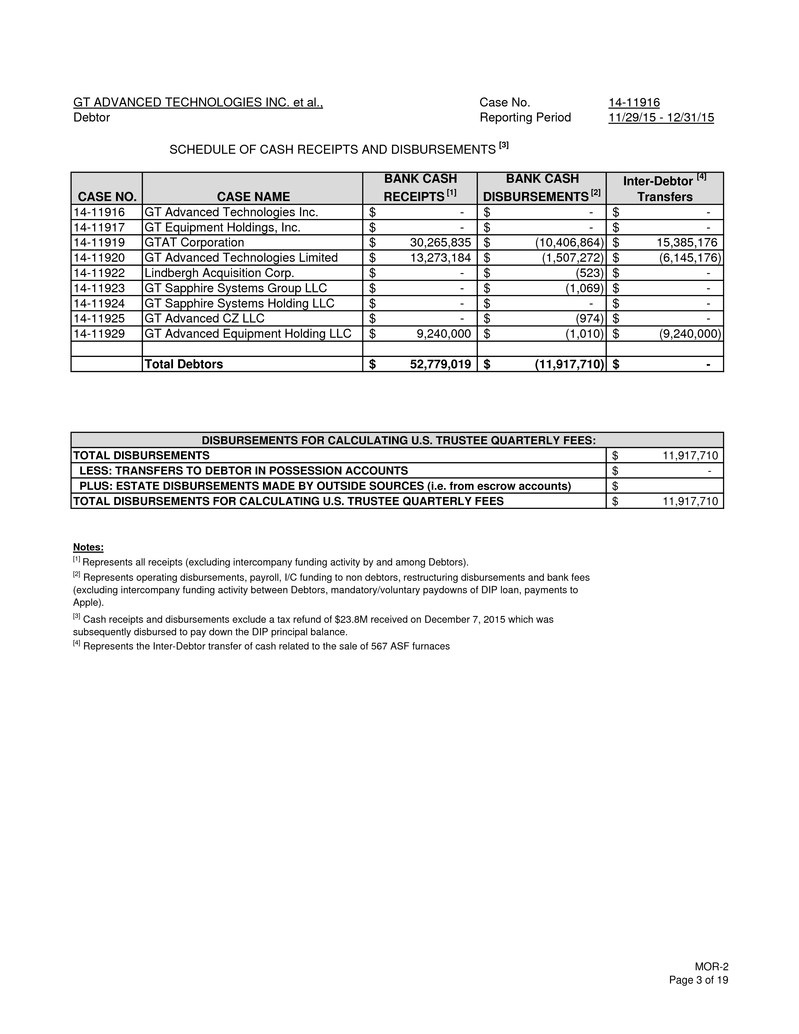

GT ADVANCED TECHNOLOGIES INC. et al., Case No. 14-11916 Debtor Reporting Period 11/29/15 - 12/31/15 SCHEDULE OF CASH RECEIPTS AND DISBURSEMENTS [3] CASE NO. CASE NAME BANK CASH RECEIPTS [1] BANK CASH DISBURSEMENTS [2] Inter-Debtor [4] Transfers 14-11916 GT Advanced Technologies Inc. -$ -$ -$ 14-11917 GT Equipment Holdings, Inc. -$ -$ -$ 14-11919 GTAT Corporation 30,265,835$ (10,406,864)$ 15,385,176$ 14-11920 GT Advanced Technologies Limited 13,273,184$ (1,507,272)$ (6,145,176)$ 14-11922 Lindbergh Acquisition Corp. -$ (523)$ -$ 14-11923 GT Sapphire Systems Group LLC -$ (1,069)$ -$ 14-11924 GT Sapphire Systems Holding LLC -$ -$ -$ 14-11925 GT Advanced CZ LLC -$ (974)$ -$ 14-11929 GT Advanced Equipment Holding LLC 9,240,000$ (1,010)$ (9,240,000)$ Total Debtors 52,779,019$ (11,917,710)$ -$ TOTAL DISBURSEMENTS 11,917,710$ LESS: TRANSFERS TO DEBTOR IN POSSESSION ACCOUNTS -$ PLUS: ESTATE DISBURSEMENTS MADE BY OUTSIDE SOURCES (i.e. from escrow accounts) $ TOTAL DISBURSEMENTS FOR CALCULATING U.S. TRUSTEE QUARTERLY FEES 11,917,710$ Notes: [1] Represents all receipts (excluding intercompany funding activity by and among Debtors). [2] Represents operating disbursements, payroll, I/C funding to non debtors, restructuring disbursements and bank fees (excluding intercompany funding activity between Debtors, mandatory/voluntary paydowns of DIP loan, payments to Apple). DISBURSEMENTS FOR CALCULATING U.S. TRUSTEE QUARTERLY FEES: [3] Cash receipts and disbursements exclude a tax refund of $23.8M received on December 7, 2015 which was subsequently disbursed to pay down the DIP principal balance. [4] Represents the Inter-Debtor transfer of cash related to the sale of 567 ASF furnaces MOR-2 Page 3 of 19

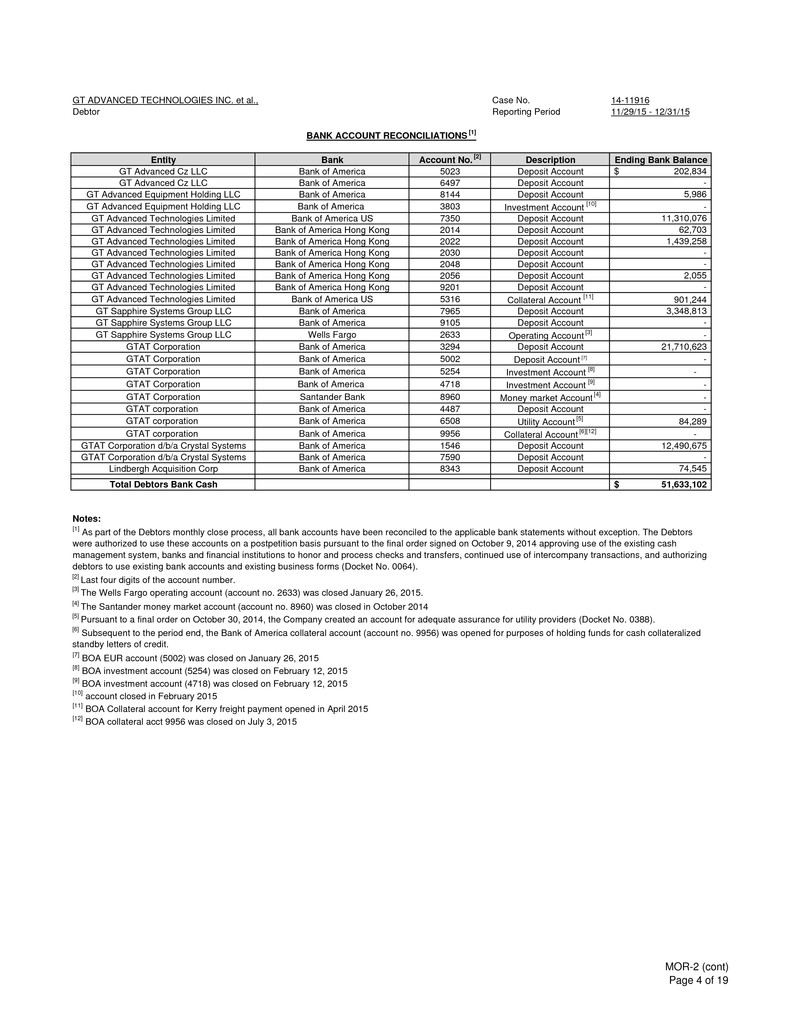

GT ADVANCED TECHNOLOGIES INC. et al., Case No. 14-11916 Debtor Reporting Period 11/29/15 - 12/31/15 BANK ACCOUNT RECONCILIATIONS [1] Entity Bank Account No. [2] Description Ending Bank Balance GT Advanced Cz LLC Bank of America 5023 Deposit Account 202,834$ GT Advanced Cz LLC Bank of America 6497 Deposit Account - GT Advanced Equipment Holding LLC Bank of America 8144 Deposit Account 5,986 GT Advanced Equipment Holding LLC Bank of America 3803 Investment Account [10] - GT Advanced Technologies Limited Bank of America US 7350 Deposit Account 11,310,076 GT Advanced Technologies Limited Bank of America Hong Kong 2014 Deposit Account 62,703 GT Advanced Technologies Limited Bank of America Hong Kong 2022 Deposit Account 1,439,258 GT Advanced Technologies Limited Bank of America Hong Kong 2030 Deposit Account - GT Advanced Technologies Limited Bank of America Hong Kong 2048 Deposit Account - GT Advanced Technologies Limited Bank of America Hong Kong 2056 Deposit Account 2,055 GT Advanced Technologies Limited Bank of America Hong Kong 9201 Deposit Account - GT Advanced Technologies Limited Bank of America US 5316 Collateral Account [11] 901,244 GT Sapphire Systems Group LLC Bank of America 7965 Deposit Account 3,348,813 GT Sapphire Systems Group LLC Bank of America 9105 Deposit Account - GT Sapphire Systems Group LLC Wells Fargo 2633 Operating Account [3] - GTAT Corporation Bank of America 3294 Deposit Account 21,710,623 GTAT Corporation Bank of America 5002 Deposit Account [7] - GTAT Corporation Bank of America 5254 Investment Account [8] - GTAT Corporation Bank of America 4718 Investment Account [9] - GTAT Corporation Santander Bank 8960 Money market Account [4] - GTAT corporation Bank of America 4487 Deposit Account - GTAT corporation Bank of America 6508 Utility Account [5] 84,289 GTAT corporation Bank of America 9956 Collateral Account [6][12] - GTAT Corporation d/b/a Crystal Systems Bank of America 1546 Deposit Account 12,490,675 GTAT Corporation d/b/a Crystal Systems Bank of America 7590 Deposit Account - Lindbergh Acquisition Corp Bank of America 8343 Deposit Account 74,545 Total Debtors Bank Cash 51,633,102$ Notes: [7] BOA EUR account (5002) was closed on January 26, 2015 [8] BOA investment account (5254) was closed on February 12, 2015 [9] BOA investment account (4718) was closed on February 12, 2015 [10] account closed in February 2015 [11] BOA Collateral account for Kerry freight payment opened in April 2015 [12] BOA collateral acct 9956 was closed on July 3, 2015 [6] Subsequent to the period end, the Bank of America collateral account (account no. 9956) was opened for purposes of holding funds for cash collateralized standby letters of credit. [5] Pursuant to a final order on October 30, 2014, the Company created an account for adequate assurance for utility providers (Docket No. 0388). [1] As part of the Debtors monthly close process, all bank accounts have been reconciled to the applicable bank statements without exception. The Debtors were authorized to use these accounts on a postpetition basis pursuant to the final order signed on October 9, 2014 approving use of the existing cash management system, banks and financial institutions to honor and process checks and transfers, continued use of intercompany transactions, and authorizing debtors to use existing bank accounts and existing business forms (Docket No. 0064). [2] Last four digits of the account number. [4] The Santander money market account (account no. 8960) was closed in October 2014 [3] The Wells Fargo operating account (account no. 2633) was closed January 26, 2015. MOR-2 (cont) Page 4 of 19

GT ADVANCED TECHNOLOGIES INC. et al., Case No. 14-11916 Debtor Reporting Period 11/29/15 - 12/31/15 STATEMENT OF OPERATIONS See Exhbit A. MOR-3 Page 5 of 19

GT ADVANCED TECHNOLOGIES INC. et al., Case No. 14-11916 Debtor Reporting Period 11/29/15 - 12/31/15 BALANCE SHEET See Exhbit A. MOR-4 Page 6 of 19

GT ADVANCED TECHNOLOGIES INC. et al., Case No. 14-11916 Debtor Reporting Period 11/29/15 - 12/31/15 STATUS OF POST-PETITION TAXES [1] [2] Beginning Amount Ending Tax Withheld or Amount Date Check No. Tax Liability Accrued Paid Paid or EFT Liability Federal Income Tax Withholding -$ 354,205$ (354,205)$ on pay date Various -$ FICA-Employee - 59,405 (59,405) on pay date Various - FICA-Employer - 59,355 (59,355) on pay date Various - Unemployment - 50 (50) on pay date Various - Income - - Various Various - Other: - - Various Various - Total Federal Taxes -$ 473,015$ (473,015)$ -$ State and Local Income Tax Withholding -$ 64,576$ (64,576)$ on pay date Various -$ Sales 4,309 19,796 Various Various 24,105 Use - Various Various - Excise - Various Various - Unemployment - 472 (472) on pay date Various - Real Property - 14,336 (14,336) Various Various - Personal Property 155,618 44,575 (28,672) Various Various 171,521 Other: - 840 (840) on pay date Various - Total State and Local 159,927$ 144,595$ (108,897)$ 195,625$ Withholding for Employee Healthcare [3] - - - - Premiums, Pensions & Other Benefits [3] - - - - Total Taxes 159,927$ 617,610$ (581,911)$ 195,625$ SUMMARY OF UNPAID POST-PETITION DEBTS Number of Days Past Due Current 0-30 [8] 31-60 [8] 61-90 [8] Over 90 [8] Total Accounts Payable [4], [5] 2,759,689$ 107,730$ 41,291$ (821)$ 590,310$ 3,498,198$ Amounts Due to Insiders [6] [7] - - - - - - Total Postpetition Debts 2,759,689$ 107,730$ 41,291$ (821)$ 590,310$ 3,498,198$ Notes: [1] Copies of IRS Form 6123 and all state, local and federal tax forms and returns can be provided to the UST upon request. [2] This schedule excludes any taxes related to the Hong Kong entity GT Advanced Technologies Limited. [3] The Company does withhold premiums for various benefit programs but there were no taxes related to these amounts. [8] Amounts reflected as past due are based upon standard invoice terms for the vendor. In some instances, a past due amount is a result of enhanced terms (typically 45 days from date of invoice) that have been negotiated with the majority of these vendors and they are being paid consistent with past practices. In some instances, past due amounts relate to pending motions, pending discovery, alleged possessory liens, ongoing settlement negotiations, or other legal issues that require further analysis by the Debtor. [7] Excludes any accrued but unpaid amounts related to compensation, expense reimbursements and benefits. [4] Reflects only trade related payables. Aging schedule excludes accruals and unbilled inventory. [5] As of the filing of this report, the Company has not fully completed the bifurcation of pre and post-petition invoices. As such, the aging may include certain prepetition amounts. [6] Solely, for purposes of this monthly operating report, the Debtors define “insiders” to include the following: (a) members of the board of directors of GT Advanced Technologies Inc.; and (b) statutory “officers” under section 16 of the Securities Exchange Act. The Debtors do not take any position with respect to: (a) such person’s influence over the control of the Debtors; (b) the management responsibilities or functions of such individual; (c) the decision-making or corporate authority of such individual; or (d) whether such individual could successfully argue that he or she, at the time of receipt of any transfers, was not an “insider” under applicable law (including for the purposes of section 503(c) of the Bankruptcy Code), including the federal securities laws, or with respect to any theories of liability or for any other purpose. MOR-5 Page 7 of 19

GT ADVANCED TECHNOLOGIES INC. et al., Case No. 14-11916 Debtor Reporting Period 11/29/15 - 12/31/15 ACCOUNTS RECEIVABLE RECONCILIATION AND AGING Accounts Receivable Reconciliation Amount Total Accounts Receivable at the beginning of the reporting period 5,460,955$ + Amounts billed during the period 32,320,385 - Amounts collected during the period (Book Cash Receipts) (27,937,994) Total Accounts Receivable at the end of the reporting period 9,843,346$ Accounts Receivable Aging Amount 0 - 30 days old 6,292,204$ 31 - 60 days old 262,175 61 - 90 days old 30,932 91+ days old 3,258,035 Total Accounts Receivable 9,843,346$ Amount considered uncollectible (Bad Debt) (3,143,614) Accounts Receivable (Net) 6,699,733$ MOR-6 Page 8 of 19

GT ADVANCED TECHNOLOGIES INC. et al., Case No. 14-11916 Debtor Reporting Period 11/29/15 - 12/31/15 ASSETS SOLD OR TRANSFERRED Monthly Reporting Questionnaire - #1 Entity Buyer Description Sale Proceeds GTAT Corporation various Fab & ancillary equipment [1] 898,440$ GTAT Corporation GrayBar Surplus Metal Scrap Sales 3,000$ Total 901,440$ [1] On April 16, 2015 the Bankruptcy Court entered an order authorizing the Debtors to sell certain excess assets via an online auction free and clear of all liens, claims, encumbrances, and interests. The $898,440 represents net proceeds received from buyers after payment of commissions to the auctioneer for the sale of excess assets at the Debtor's Mesa facility. MORQ-#1 Page 9 of 19

GT ADVANCED TECHNOLOGIES INC. et al., Case No. 14-11916 Debtor Reporting Period 11/29/15 - 12/31/15 PRE-PETITION DEBT PAYMENTS Monthly Reporting Questionnaire - #3 Vendor Name Reference Date Amount GTAT Corporation Apple Inc. A 12/7/2015 13,220,423$ 13,220,423$ A Entity Total Key: Paid pursuant to the Order, Pursuant to Bankruptcy Code Sections 105, 363, And 554, Bankruptcy Rules 2002, 6004, 9007, And 9019, And Local Bankruptcy Rule 6004-1: (I) Approving Settlement with Apple Related to ASF Furnaces; (II) Authorizing Debtors to Sell ASF Furnaces and Related Equipment Located in Mesa Facility Through Auction Free and Clear of All Liens, Claims, Encumbrances, and Interests; (III) Authorizing Debtors to Abandon ASF Furnaces and Related Equipment Not Sold or Removed From Mesa Facility; (IV) Making Conforming Modifications to Intercompany Settlement Agreement, Dated July 20, 2015; (V) Making Modifications to DIP Credit Agreement; and (VI) Granting Related Relief [Docket No. 2672]. MORQ-#3 Page 10 of 19

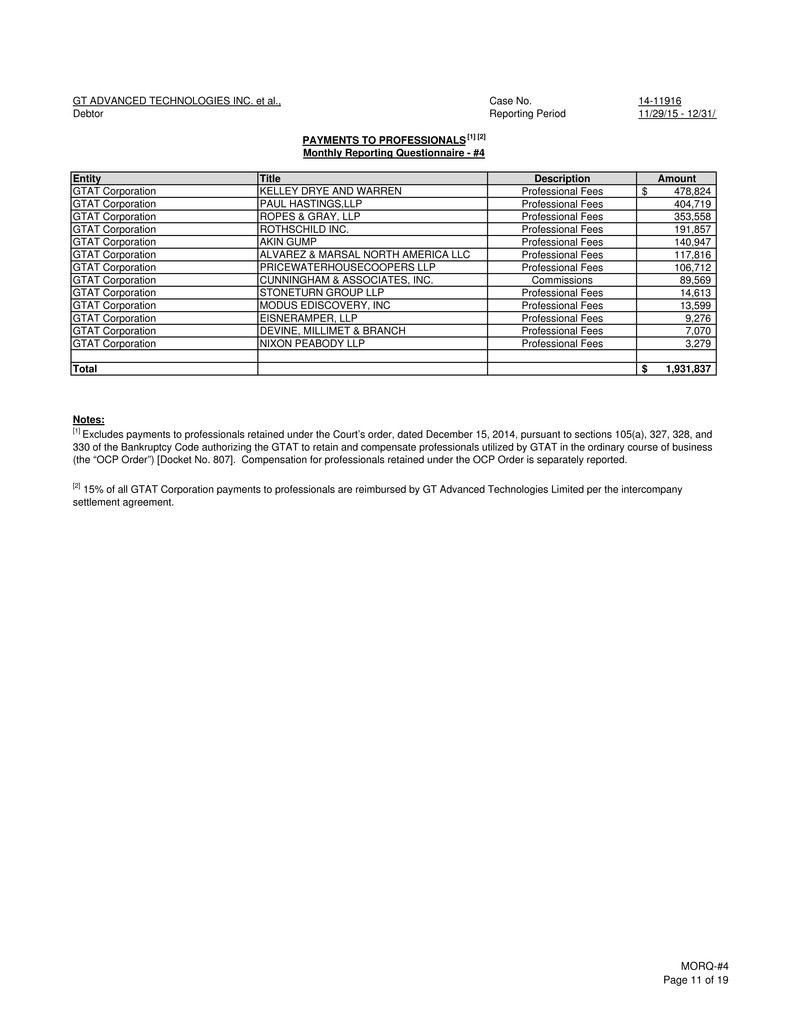

GT ADVANCED TECHNOLOGIES INC. et al., Case No. 14-11916 Debtor Reporting Period 11/29/15 - 12/31/1 Entity Title Description Amount GTAT Corporation KELLEY DRYE AND WARREN Professional Fees 478,824$ GTAT Corporation PAUL HASTINGS,LLP Professional Fees 404,719 GTAT Corporation ROPES & GRAY, LLP Professional Fees 353,558 GTAT Corporation ROTHSCHILD INC. Professional Fees 191,857 GTAT Corporation AKIN GUMP Professional Fees 140,947 GTAT Corporation ALVAREZ & MARSAL NORTH AMERICA LLC Professional Fees 117,816 GTAT Corporation PRICEWATERHOUSECOOPERS LLP Professional Fees 106,712 GTAT Corporation CUNNINGHAM & ASSOCIATES, INC. Commissions 89,569 GTAT Corporation STONETURN GROUP LLP Professional Fees 14,613 GTAT Corporation MODUS EDISCOVERY, INC Professional Fees 13,599 GTAT Corporation EISNERAMPER, LLP Professional Fees 9,276 GTAT Corporation DEVINE, MILLIMET & BRANCH Professional Fees 7,070 GTAT Corporation NIXON PEABODY LLP Professional Fees 3,279 Total 1,931,837$ Notes: [1] Excludes payments to professionals retained under the Court’s order, dated December 15, 2014, pursuant to sections 105(a), 327, 328, and 330 of the Bankruptcy Code authorizing the GTAT to retain and compensate professionals utilized by GTAT in the ordinary course of business (the “OCP Order”) [Docket No. 807]. Compensation for professionals retained under the OCP Order is separately reported. Monthly Reporting Questionnaire - #4 PAYMENTS TO PROFESSIONALS [1] [2] [2] 15% of all GTAT Corporation payments to professionals are reimbursed by GT Advanced Technologies Limited per the intercompany settlement agreement. MORQ-#4 Page 11 of 19

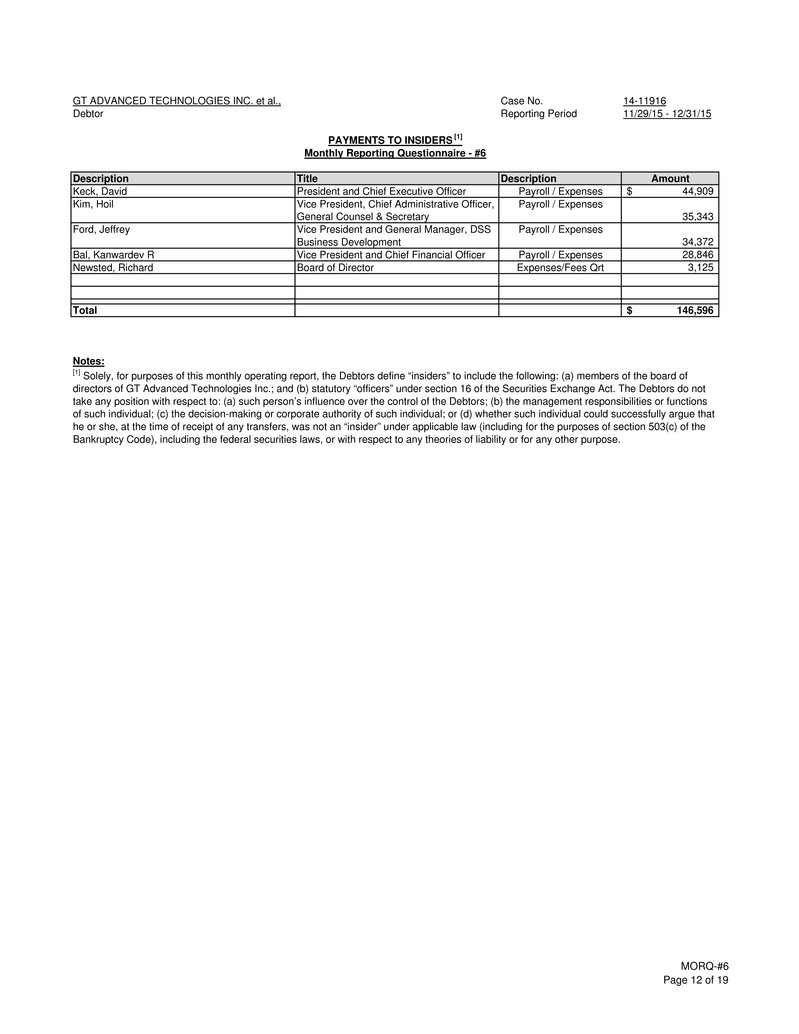

GT ADVANCED TECHNOLOGIES INC. et al., Case No. 14-11916 Debtor Reporting Period 11/29/15 - 12/31/15 PAYMENTS TO INSIDERS [1] Monthly Reporting Questionnaire - #6 Description Title Description Amount Keck, David President and Chief Executive Officer Payroll / Expenses 44,909$ Kim, Hoil Vice President, Chief Administrative Officer, General Counsel & Secretary Payroll / Expenses 35,343 Ford, Jeffrey Vice President and General Manager, DSS Business Development Payroll / Expenses 34,372 Bal, Kanwardev R Vice President and Chief Financial Officer Payroll / Expenses 28,846 Newsted, Richard Board of Director Expenses/Fees Qrt 3,125 Total 146,596$ Notes: [1] Solely, for purposes of this monthly operating report, the Debtors define “insiders” to include the following: (a) members of the board of directors of GT Advanced Technologies Inc.; and (b) statutory “officers” under section 16 of the Securities Exchange Act. The Debtors do not take any position with respect to: (a) such person’s influence over the control of the Debtors; (b) the management responsibilities or functions of such individual; (c) the decision-making or corporate authority of such individual; or (d) whether such individual could successfully argue that he or she, at the time of receipt of any transfers, was not an “insider” under applicable law (including for the purposes of section 503(c) of the Bankruptcy Code), including the federal securities laws, or with respect to any theories of liability or for any other purpose. MORQ-#6 Page 12 of 19

EXHIBIT A Page 13 of 19

NOTES AND SPECIFIC DISCLOSURES REGARDING DEBTORS’ STATEMENTS OF OPERATIONS AND BALANCE SHEET 1. Basis of Presentation The accompanying consolidated financial statements of the Debtors have been prepared solely for the purpose of complying with the monthly reporting requirements of the U.S. Bankruptcy Court of the District of New Hampshire (referred to herein as the "Monthly Operating Report"). The Monthly Operating Report is limited in scope, covers a limited time period and the schedules contained herein were not audited or reviewed by independent accountants nor are they intended to reconcile to any financial statements otherwise prepared or distributed by the Debtors or any of the Debtors' affiliates. Furthermore, because the Debtors’ accounting systems, policies, and practices were developed with a view to producing consolidated financial reporting on a quarterly basis, rather than by legal entity on a monthly basis, it is possible that not all assets or liabilities have been recorded at the correct legal entity of either the Debtors or the non-Debtor affiliates. The Debtors reserve all rights to supplement or amend any schedules contained in this Monthly Operating Report. The information presented herein is unaudited, subject to further review and material adjustments, and has not been subject to all procedures that would typically be applied to financial information presented in accordance with Generally Accepted Accounting Principles in the United States of America (“US GAAP”), including, but not limited to, accruals, impairment adjustments, fair value assessments (including fair value adjustment required to present the post petition Debtor In Possession financing in accordance with GAAP), tax provision, and other recurring adjustments considered necessary by the Debtors to fairly state the financial position and results of operations for the interim period(s) presented. As part of this Monthly Operating Report, intangibles, fixed assets and other long lived assets have not been formally tested for impairment as required pursuant to US GAAP. However, certain assets reflect the Debtors view of estimated fair value. If a formal US GAAP impairment test was completed at a later date, the results may lead to material adjustments. See additional discussion in Note 3. This Monthly Operating Report does not reflect certain quarter-end and year-end adjustments to assets, liabilities and operating results; such adjustments would be reflected in future Monthly Operating Reports. As part of their restructuring efforts, the Debtors are reviewing their assets and liabilities on an ongoing basis, including without limitation with respect to intercompany claims and obligations, and nothing contained in this Monthly Operating Report shall constitute a waiver of any of the Debtors’ rights with respect to such assets, liabilities, claims and obligations that may exist. The Debtors caution readers not to place undue reliance upon the information contained in this Monthly Operating Report. The results herein are not necessarily indicative of results which may be expected from any other period or for the full year and may not necessarily reflect the combined results and financial position of the Debtors in the future. 2. Treatment of Intercompany Transactions The Monthly Operating Report does not include intercompany balances because the Debtors and their advisors are continuing to review the Debtors’ books and records to determine the accuracy of certain intercompany charges that may be contained in or missing from those books and records. For example, prior to the Petition Date, the parent company, GT Advanced Technologies Inc., did not maintain a ledger of intercompany transactions. Furthermore, the Debtors have not made any determination that tax refunds or attributes are assets or liabilities of a particular Debtor and the Debtors reserve all of their rights on this issue. While the Debtors have not finalized their analysis they do expect it to result in significant adjustments to previously disclosed intercompany balances. Pursuant to Bankruptcy Code Sections 105(A), 345(B), 363(C)(1), 364(A), 364(B), and 503(B)(1), Bankruptcy Rules 6003 and 6004, (A) Authorizing Debtors to Use Existing Cash Management System, (B) Authorizing and Directing Banks and Financial Institutions to Honor and Process Checks and Transfers, (C) Authorizing Continued Use of Intercompany Transactions, (D)Waiving Requirements of Section 345(B) of Bankruptcy Code and (E) Authorizing Debtors to Use Existing Bank Accounts and Existing Business Forms [Docket No. 64], the Debtors have kept detailed information on all post-Petition Date transfers of cash among the Debtors and such transfers amounted to approximately $15.4 million during the period covered by the Monthly Operating Report, and are laid out in further detail on page 4. Page 14 of 19

NOTES AND SPECIFIC DISCLOSURES REGARDING DEBTORS’ STATEMENTS OF OPERATIONS AND BALANCE SHEET (cont.) 3. Treatment of Certain Assets, Liabilities and GAAP Disclosures The Monthly Operating Report does not contain all disclosures that would be required for presentation in accordance with US GAAP and there can be no assurance that, from the perspective of an investor or potential investor, the Monthly Operating Report is complete. The Debtors provide the following general and limited comments regarding certain assets and liabilities which should be considered by parties reviewing this Monthly Operating Report. Notes regarding certain liabilities: • Pursuant to the Order, Pursuant to Bankruptcy Code Sections 105, 361, 362, 363(B), 363(C), 363(E), 364, 503(B), and 507 and Bankruptcy Rules 2002, 4001, 6004(H), and 9014: (I) Authorizing Debtors to Obtain Postpetition Financing; (Ii) Granting Liens and Super-Priority Claims; (III) Authorizing Debtors to Pay Put Option Premium and Expenses in Connection with Postpetition Financing Commitment; (IV) Approving Information Sharing Obligations and Indemnity Thereunder; and (V) Granting Related Relief, the Debtor was authorized to obtain post-petition financing, consisting of a senior secured superpriority term loan facility in an aggregate principal amount of up to $95M. The amount represented on the balance sheet includes the principal amount of borrowings, net of the original issue discount, plus any PIK interest accrued through December 31, 2015. An amendment to the DIP Credit Agreement was approved on December 2, 2015. • Pursuant to the amendment to the DIP Credit Agreement, the Company repaid $70.9M of the principal balance in December which includes a $45M amendment paydown, a $23.8M tax refund received on December 7, 2015, and $2.1M related to ASF furnace sales to Vast Billions. • The 2017 and 2020 convertible notes with a principal balance of $220M and $214M are recorded at a carrying value of $177M and $123M, respectively. The amount represented in the liabilities subject to compromise is net of $7M of deferred financing costs. The difference between the carrying value and principal balances reflect fair value adjustments. • The Company sold 567 ASF furnaces in December. In accordance with the Amended Mesa Settlement Agreement, $13.2M of the sale proceeds was paid to Apple; thereby reducing the Debtors' contingent liability to $12.1M as of December 31, 2015. • For the period commencing on October 6, 2014 and thereafter, the Debtors stopped accruing interest on both series of the Convertible Notes. • Share-based compensation expenses for employee awards are reflected in the Statement of Operations in the third month of each quarter. Prior to the second calendar quarter share-based compensation was recorded each month. Such expenses have been calculated using a methodology consistent with past practice. Share-based compensation expense will continue to be recognized until the final outcome of the equity awards is determined. Notes regarding certain assets: • As of December 31, 2015, the Debtors have not yet completed an analysis of goodwill and intangibles in accordance with US GAAP. However, based upon the Debtors’ reasonable judgement, certain intangibles relating to previous acquisitions and goodwill have been written down to zero. As of December 31, 2015, after these adjustments, the Debtors maintain asset values of $1.2M for intangibles and zero for goodwill. Page 15 of 19

NOTES AND SPECIFIC DISCLOSURES REGARDING DEBTORS’ STATEMENTS OF OPERATIONS AND BALANCE SHEET (cont.) 3. Treatment of Certain Assets, Liabilities and GAAP Disclosures (cont.) Notes regarding Income Taxes: • The company received a US Federal Tax Refund of $23.8 million on December 7, 2015. The refund resulted from losses generated in CY2014 carried back to CY2012. The cash received was used to pay down the Debtor In Possession principal borrowings. Notes regarding Income (Loss) from Discontinued Operations: • As of December 31, 2015, the Company reported $5,934 thousand net loss from discontinued operations, which represents the costs of the wind down after offset from sales of equipment at the Mesa facility. The Debtors’ financial statements presented herein have been prepared on a going concern basis, which contemplates continuity of operations, realization of assets and liquidation of liabilities in the ordinary course of business. Certain prepetition liabilities have been reclassified as liabilities subject to compromise. Liabilities subject to compromise currently include debt obligations, amounts due to third parties for goods and services received prior to October 6, 2014, (the date of the voluntary bankruptcy petition) and certain known potential settlement claim amounts. The Debtors continue to analyze and reconcile assets and liabilities included on the balance sheet, and, therefore, the amounts reflected herein are current estimates and subject to material change as additional analysis and decisions are Page 16 of 19

STATEMENTS OF OPERATIONS EXCLUDING INTERCOMPANY ACTIVITY FOR THE PERIOD ENDED DECEMBER 31, 2015 ($ in 000's) Case No. 14-11916 14-11919 14-11929 14-11917 14-11922 14-11925 14-11924 14-11923 14-11920 GT Advanced Technologies Inc. GTAT Corporation GT Advanced Equipment Holding LLC GT Equipment Holdings, Inc. Lindberg Acquisition Corp GT Advanced Cz LLC GT Sapphire Systems Holdings LLC GT Sapphire Systems Group LLC GT Advanced Technologies Limited [1] Non-Debtor Entities Consolidated Revenue - 16,166 - - - - - - 15,978 57 32,201 Total Cost of revenue - 16,371 - - - - - - 16,941 (232) 33,079 Gross (loss) Profit - (205) - - - - - - (963) 290 (878) Research and development - 647 - - - - - - - - 647 Selling and marketing - 165 - - - - - - 33 53 251 General and administrative - 1,409 1 - - 1 - 1 51 125 1,589 Contingent consideration (income) expense - - - - - - - - - - - Impairment of goodwill - - - - - - - - - - - Restructuring charges and asset impairments - (5,283) - - - - - - - 1 (5,282) Amortization of Intangible Assets - 62 - - - - - - - - 62 Total Operating Expenses - (3,000) 1 - - 1 - 1 84 180 (2,732) Income (loss) from Operations [2] - 2,795 (1) - - (1) - (1) (1,048) 110 1,854 Interest Income - 86 - - - - - - - 0 86 Interest (Expense) - (1,290) - - - - - - 1 (6) (1,295) Reorganization Items, income (expense) - (5,215) - - - - - - (182) - (5,397) Other Inc (Exp) - (732) - - - - - - 278 409 (44) Income (loss) before Tax - (4,356) (1) - - (1) - (1) (951) 514 (4,797) (Benefit) provision for income taxes - - - - - - - - - 102 102 Net Income (loss) from continuing operations - (4,356) (1) - - (1) - (1) (951) 411 (4,899) Income (loss) from discontinued operations, net of tax - (5,934) - - - - - - - - (5,934) Net Income (loss) - (10,290) (1) - - (1) - (1) (951) 411 (10,833) Notes: [1] Includes immaterial amounts from GT Advanced Technologies GmbH, a non-debtor entity. [2] Does not include any share-based compensation expense. Share-based compensation is recorded in the third month of each fiscal quarter. These financial statements and accompanying notes do not purport to represent financial statements prepared in accordance with Generally Accepted Accounting Principles in the United States of America, nor are they intended to be fully reconciled to any financial statements otherwise prepared or distributed by the Debtors or any of the Debtors’ affiliates. This information is unaudited and is subject to further review and potential adjustments. The accompanying disclaimers and notes are an integral part of these financial statements. Page 17 of 19

BALANCE SHEET EXCLUDING INTERCOMPANY BALANCES AS OF DECEMBER 31, 2015 ($ in 000's) Case No. 14-11916 14-11919 14-11929 14-11917 14-11922 14-11925 14-11924 14-11923 14-11920 GT Advanced Technologies Inc. GTAT Corporation GT Advanced Equipment Holding LLC GT Equipment Holdings, Inc. Lindbergh Acquisition Corp. GT Advanced Cz LLC GT Sapphire Systems Holdings LLC GT Sapphire Systems Group LLC GT Advanced Technologies Limited [1] Non-Debtor Entities Consolidated Current Assets Cash and cash equivalents - 34,068 6 - - 277 - 3,349 13,728 951 52,380 Restricted cash - 84 - - - - - - - - 84 Accounts receivable, net - 3,421 - - - - - 0 3,152 127 6,700 Inventories - 21,971 - - - - - - 2,664 736 25,371 Deferred costs - 2,218 - - - - - - 2,540 - 4,758 Vendor advances - 2,953 - - - - - - 7,693 50 10,696 Deferred income taxes - - - - - - - - - 1,296 1,296 Refundable income taxes - 2,272 - - - (1) - - - - 2,271 Prepaid expenses and other current assets - 6,849 - - - - - - 325 179 7,354 Total current assets - 73,836 6 - - 276 - 3,349 30,102 3,340 110,910 Property, plant and equipment, net [4] - 10,709 - - - 0 - - 5,013 194 15,916 Intangible assets, net [4] - 1,159 - - - - - - - - 1,159 Goodwill - - - - - - - - - - - Deferred cost - 0 - - - - - - 27,710 - 27,710 Other assets - 10,153 - - - 9 - - 58,553 289 69,004 Total Assets [2] [3] - 95,857 6 - - 285 - 3,349 121,378 3,823 224,699 Current Liabilities Prepayment obligation - - - - - - - - - - Debtor In Possession Term Loan 22,443 - - - - - - - - 22,443 Accounts payable - 3,817 - - - (0) - - 165 179 4,162 Accrued expenses and other current liabilities - 13,969 - - - - - - 2,694 832 17,495 Contingent consideration - 5,080 - - - - - - - 2,958 8,037 Customer deposits - 718 - - - - - - - 52 770 Deferred revenue - 14,023 - - - - - 175 7,470 - 21,668 Accrued income taxes (8,787) - - - 8,608 - - 2 133 (44) Total current liabilities - 51,263 - - - 8,608 - 175 10,331 4,154 74,531 Liabilities Subject to Compromise 292,557 122,712 - - - 6,912 - 1,735 61,055 - 484,971 Convertible notes - - - - - - - - - - - Deferred income taxes - (0) - - - - - - - (35) (35) Customer deposits - - - - - - - - 55,598 - 55,598 Deferred revenue - 151 - - - - - - 41,335 - 41,486 Contingent consideration - 7,000 - - - - - - - 209 7,209 Other non-current liabilities - (0) - - - - - - - - (0) Accrued Income Taxes - 5,424 - - - - - - - - 5,424 Total Non-Current Liabilities - 12,575 - - - - - - 96,933 174 109,682 Stockholder's Equity - (199,132) 30 - - (44,575) - (16,366) (57,439) (127,003) (444,484) Total Liabilities and Stockholder's Equity [3] 292,557 (12,582) 30 - - (29,055) - (14,457) 110,880 (122,675) 224,699 Notes: $293 $108 ($) $ $ $29 $ $18 $10 $126 ($) [1] Includes immaterial amounts from GT Advanced Technologies GmbH, a non-debtor entity. [2] It would be prohibitively expensive, unduly burdensome, and an inefficient use of estate assets for the Debtors to obtain current market valuation of each of their assets. Accordingly, unless otherwise indicated, this monthly operating report reflect net book values as of the period end. Parties are also cautioned that book value is not, in any way, indicative of the fair market value of any of the Debtors’ assets. [3] Due to the exclusion of intercompany balances, Total Assets may not equal Total Liabilities and Stockholder's Equity. [4] Reflects Management's estimated Fair Value. These financial statements and accompanying notes do not purport to represent financial statements prepared in accordance with Generally Accepted Accounting Principles in the United States of America, nor are they intended to be fully reconciled to any financial statements otherwise prepared or distributed by the Debtors or any of the Debtors’ affiliates. This information is unaudited and is subject to further review and potential adjustments. The accompanying disclaimers and notes are an integral part of these financial statements. Page 18 of 19

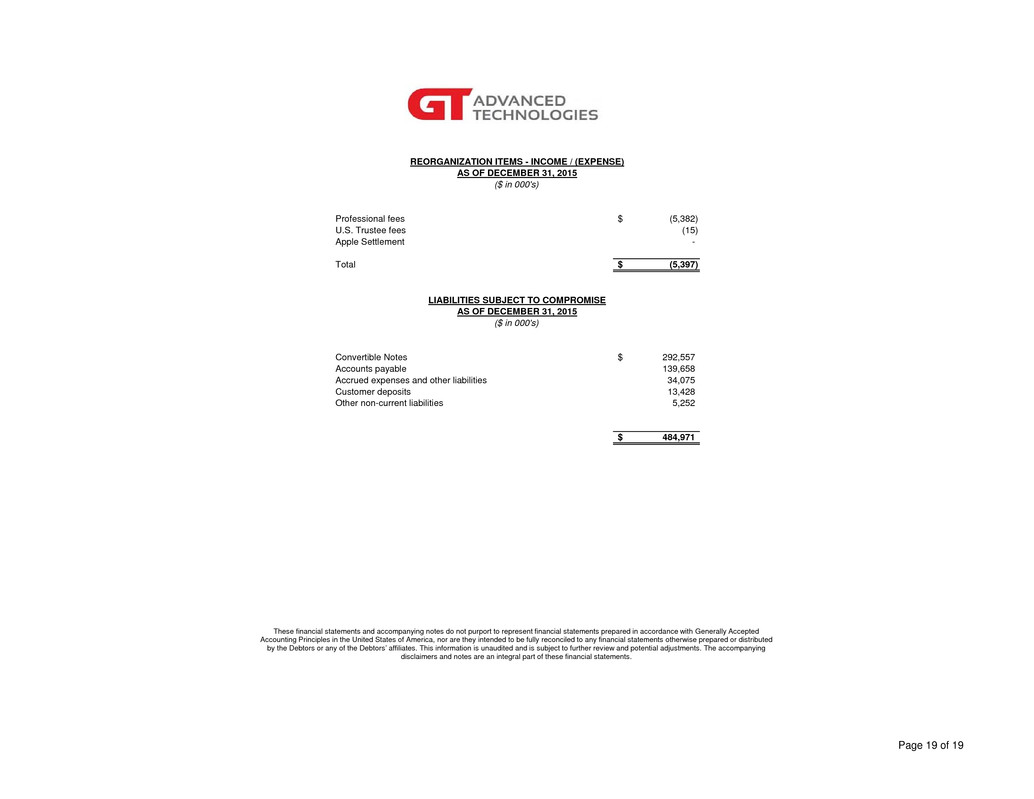

REORGANIZATION ITEMS - INCOME / (EXPENSE) AS OF DECEMBER 31, 2015 ($ in 000's) Professional fees (5,382)$ U.S. Trustee fees (15) Apple Settlement - Total (5,397)$ LIABILITIES SUBJECT TO COMPROMISE AS OF DECEMBER 31, 2015 ($ in 000's) Convertible Notes 292,557$ Accounts payable 139,658 Accrued expenses and other liabilities 34,075 Customer deposits 13,428 Other non-current liabilities 5,252 484,971$ These financial statements and accompanying notes do not purport to represent financial statements prepared in accordance with Generally Accepted Accounting Principles in the United States of America, nor are they intended to be fully reconciled to any financial statements otherwise prepared or distributed by the Debtors or any of the Debtors’ affiliates. This information is unaudited and is subject to further review and potential adjustments. The accompanying disclaimers and notes are an integral part of these financial statements. Page 19 of 19