Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - VASCULAR SOLUTIONS INC | ex23_1.htm |

| EX-31.2 - EXHIBIT 31.2 - VASCULAR SOLUTIONS INC | ex31_2.htm |

| EX-32.2 - EXHIBIT 32.2 - VASCULAR SOLUTIONS INC | ex32_2.htm |

| EX-31.1 - EXHIBIT 31.1 - VASCULAR SOLUTIONS INC | ex31_1.htm |

| EX-32.1 - EXHIBIT 32.1 - VASCULAR SOLUTIONS INC | ex32_1.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

(Mark One)

|

|||

|

☒

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

||

| For the fiscal year ended December 31, 2015 | |||

| OR | |||

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

||

|

For the transition period from _______ to ________

|

|||

Commission file number: 0-27605

VASCULAR SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

|

Minnesota

|

41-1859679

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(IRS Employer Identification No.)

|

6464 Sycamore Court North

Minneapolis, Minnesota 55369

(Address of principal executive offices, including zip code)

(763) 656-4300

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class:

|

Name of each exchange on which registered:

|

|

|

Common Stock, par value $.01 per share

|

The NASDAQ Global Select Market

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (section 229.406 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated, or a smaller reporting company. See the definitions of “large accelerated filer,” accelerated filer,” and smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☒

|

Non-accelerated filer ☐

|

Smaller reporting company ☐

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold on June 30, 2015 was $576,467,340.

As of January 18, 2016, the number of shares outstanding of the registrant’s common stock was 17,356,911.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement for its 2016 Annual Meeting of Shareholders to be held on April 29, 2016 are incorporated by reference in Part III of this Annual Report on Form 10-K.

PART I

Overview

Vascular Solutions, Inc. (we, us, the company, or Vascular Solutions) is an innovative medical device company focused on bringing clinically advanced solutions to the market for treating coronary and peripheral vascular disease. The company’s product line consists of more than 90 devices and services that are sold to interventional cardiologists, interventional radiologists, electrophysiologists, and vein practices worldwide.

As a vertically-integrated company, we generate ideas, create new minimally-invasive medical devices, and then deliver these products and related services to the physicians who treat vascular disease. In the United States, we sell our products through a 103-person direct sales force. Outside the U.S., we work through a network of 41 independent distribution companies that cover 57 countries.

We intend to continue to develop and market a vast array of products that serve the needs of interventional physicians. Currently, we have a particular focus in our R&D and corporate development programs on three areas: complex interventions, radial artery catheterizations, and embolization procedures. We believe these three segments of the vascular interventions market have the greatest need for new specialized products and also represent some of the best opportunities for growth.

One of our highest-priority R&D programs is a collaboration with the United States Army to develop freeze-dried plasma for the treatment of battlefield trauma. The product we have developed, RePlas™ freeze-dried plasma, is the result of our long-standing expertise in the lyophilization (freeze-drying) of biologic materials. The U.S. Army has agreed to sponsor, conduct, and fund the clinical development of RePlas, and we will retain all rights to market the product after FDA approval.

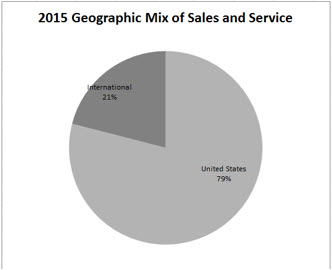

During 2015, approximately 79% of our product and service sales were generated in the U.S., while international sales accounted for approximately 21%.

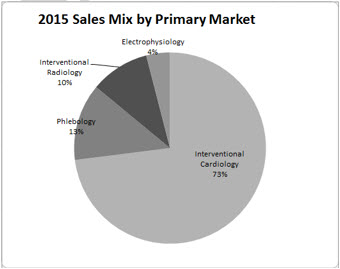

We estimate that during 2015 approximately 73% of our sales were of products and services used in the interventional cardiology market, 13% in the phlebology market, 10% in the interventional radiology market, and 4% in the electrophysiology market.

2

History

We were incorporated in the state of Minnesota in December 1996 and began operations in February 1997. In 2000, we received FDA clearance for our first product, the Duett™ sealing device, which was used to seal the puncture site following catheterization procedures. In 2001, we made the strategic decision to develop additional products and to de-emphasize our Duett product, which we discontinued during 2013. We have grown from net revenue of $6.2 million in 2000 solely from sales of our Duett product to net revenue of $147.2 million in 2015 from sales of over 90 additional products we have developed, licensed, or acquired since our inception. This increase in revenue represents a compound annual growth rate of 24% and is driven by our commitment to the development and launch of multiple new devices to diagnose and treat vascular conditions.

Interventional Cardiology and Interventional Radiology Industry Background

According to data from the United States Centers for Disease Control and Prevention (CDC), an estimated 80 million Americans have one or more types of cardiovascular disease—diseases of the heart and blood vessels. The CDC data indicate that cardiovascular disease is the number one cause of death in the United States and is replacing infectious disease as the world’s pre-eminent health risk. Advances in medicine have enabled physicians to perform an increasing number of diagnostic and therapeutic treatments of cardiovascular disease using minimally invasive methods, such as catheters placed inside the arteries, instead of highly invasive open surgery.

Cardiologists and radiologists use diagnostic procedures, such as angiography, to confirm, and interventional procedures, such as angioplasty and stenting, to treat, diseases of the coronary and peripheral arteries. Each angiographic procedure using a catheter requires a puncture in an artery, usually the femoral artery in the groin area and sometimes the radial artery in the wrist, to gain access for the catheter. The catheter then is deployed through an introducer sheath into the vessel to be diagnosed or treated. Upon completion of the procedure and removal of the catheter, the physician must seal this puncture in the artery and the tissue tract that leads from the skin surface to the artery to stop bleeding. Based on industry statistics, we estimate that cardiologists and radiologists performed over nine million diagnostic and interventional catheterization procedures worldwide in 2015.

During the past few years, the number of catheterization procedures performed worldwide has been declining gradually due to a number of factors – among them, the effects of weak economies on overall health care utilization rates, efforts by third-party payers to lower costs associated with medical procedures, investigations by government agencies into potential over-utilization of procedures, the implementation by hospitals of policies designed to reduce the incidence of unnecessary procedures in the wake of these outside investigations, and new diagnostic imaging and functional assessment modalities that more effectively screen patients to determine the need for treatment. Although worldwide demographic factors, including the growing incidence of cardiovascular disease, seem to favor long-term growth in the number of interventional procedures, we believe that the recent structural pressures on utilization rates are likely to continue and to result in relatively flat catheterization volumes for the foreseeable future. Based on our analysis of the publicly-available sales figures from selected companies that participate in the cardiovascular device sector, we estimate the worldwide market for interventional medical devices used in cardiovascular procedures in 2015 exceeded $15 billion.

The interventional medical device industry is characterized by intense competition, cost-containment efforts by hospitals and payors, rapidly-evolving technology, and a high degree of government regulation. To grow our business, we have focused on continually developing and commercializing new products and services. Looking ahead, we expect our business may be impacted by the following trends and opportunities:

| · | The future regulatory approval of newly-developed products. Any new product that we develop must be approved by the Food and Drug Administration (FDA) in the United States and by similar regulatory bodies in other countries before it can be sold. The requirements for obtaining product approval have undergone change, and the FDA frequently implements changes to the product approval process. We monitor the changing regulatory landscape and modify our regulatory submissions as necessary to obtain product approvals. |

3

| · | Successfully integrating acquired and distributed products and services into our existing operations. The acquisition of products, product distribution rights and services complementary to our existing product portfolio and customer call points provides an additional business opportunity, but is dependent on the successful integration of the acquired or distributed products into our existing business structure. Since 2010, we have acquired or licensed more than 10 products and services. |

| · | Managing intellectual property. The interventional medical device industry is characterized by numerous patent filings and litigation claims made to protect new and evolving product ideas. To maximize the profitability of new product ideas, we seek patent protection for those product design and method concepts which we believe have the potential to provide substantial product revenue. On October 14, 2013, we reached an agreement with Terumo Corporation and Terumo Medical Corporation (Terumo) to settle a patent and trademark infringement lawsuit brought by Terumo against us related to a prior version of our Vasc Band™ radial compression device in exchange for a one-time payment to Terumo in the amount of $812,500. On July 30, 2014, we reached an agreement with Boston Scientific Corporation to settle a patent and copyright infringement lawsuit brought by us against Boston Scientific Corporation related to a competitive product to our GuideLiner® guide extension product on confidential terms. Managing intellectual property assets and claims is a significant challenge for our business. |

| · |

Managing greater government regulation and scrutiny. Our products and business activities are subject to rigorous regulation, including by the U.S. FDA, Department of Justice, and numerous other federal, state, and foreign governmental authorities. These authorities have been increasing scrutiny of our industry and enforcement actions related to companies in it. Managing compliance with existing and future regulation of our industry and fulfilling regulatory disclosure requirements is a significant challenge for our business.

|

Products and Services

Since the company’s inception, we have launched more than 100 products and services that we sell to interventional cardiologists, interventional radiologists, electrophysiologists, and vein specialists through our direct U.S. sales force and international independent distributor network. The competitive advantages of our products and services are enhanced by the experience of our sales and marketing teams, the experience of our management, and our dedication to bringing clinically unique solutions to the markets we serve.

For information about our revenue, profits and total assets, see our Consolidated Financial Statements included in Item 8 of Part II of this Annual Report on Form 10-K for the year ended December 31, 2015.

Top Products

In order to provide a detailed product-specific revenue analysis, in the first quarter of 2015 we began reporting net revenue for each of our top product lines. During 2015, our top eight products represented 79% of our total revenue and grew by 16% on a year-over-year basis. The following table sets forth, for the periods indicated, net revenue by product line along with the percentage change from the previous period presented for each of our top products by net revenue:

|

Year ended December 31,

|

|||||||||||||

|

2015

|

2014

|

||||||||||||

|

Product

|

Primary Market

|

Net Revenue

|

Percent

Change

|

Net Revenue

|

|||||||||

|

(dollars in thousands)

|

|||||||||||||

|

GuideLiner catheters

|

Interventional cardiology

|

$

|

45,409

|

43

|

%

|

$

|

31,836

|

||||||

|

Pronto® catheters

|

Interventional cardiology

|

14,970

|

(17

|

%)

|

17,998

|

||||||||

|

Vein catheter reprocessing

|

Phlebology

|

12,602

|

23

|

%

|

10,207

|

||||||||

|

Micro-introducer kits

|

Interventional radiology

|

12,337

|

18

|

%

|

10,416

|

||||||||

|

Hemostatic patches

|

Interventional cardiology

|

11,998

|

(3

|

%)

|

12,416

|

||||||||

|

Radial access products

|

Interventional cardiology

|

7,436

|

27

|

%

|

5,839

|

||||||||

|

Langston® catheters

|

Interventional cardiology

|

6,590

|

8

|

%

|

6,109

|

||||||||

|

D-Stat® Flowable hemostat

|

Electrophysiology

|

5,322

|

(3

|

%)

|

5,462

|

||||||||

4

GuideLiner catheters

Our highest-selling product is the GuideLiner guide extension catheter device, which had 2015 sales of $45.4 million, representing growth of 43% from the 2014 level of $31.8 million. With the introduction of the GuideLiner catheter in 2009, Vascular Solutions pioneered the interventional technique of rapid exchange guide extension. The GuideLiner catheter is designed to greatly increase backup support and allow deep-seating of the guide catheter for coaxial alignment, distal device delivery, and selective delivery of contrast. The device is especially useful in complex interventions. Based on our belief that GuideLiner could be applicable to approximately 10% of all cardiac catheterization procedures, we estimate the annual worldwide market opportunity for GuideLiner to be approximately $75 million.

We received CE Mark and launched GuideLiner in Europe in October 2009, and we received 510(k) clearance and launched the device in the U.S. in November 2009. In December 2011, we launched the second generation of our GuideLiner catheter with increased flexibility, a smaller size version, and a longer extension. In August 2013, we launched the third generation version, GuideLiner V3, which features a polymer “half-pipe” collar to enhance stent and wire deployment. In December 2013, our Japanese distributor, Japan Lifeline, received Shonin approval from the Japanese Ministry of Health, Labour and Welfare (MHLW) to permit sales of the GuideLiner in Japan. Japan Lifeline commenced sales to Japanese hospitals in January of 2014.

Pronto catheters

Our Pronto extraction catheters are designed to remove fresh, soft thrombus and emboli from the arteries of patients suffering a heart attack. The Pronto catheters feature a proprietary distal tip and large extraction lumen that can be delivered into arteries to remove blood clots using simple vacuum suction. Sales of Pronto in 2015 were $15.0 million, a decline of 17% from the 2014 level of $18.0 million. The market for extraction catheters is mature, with numerous competitors and significant price erosion. Based on industry data, we believe the worldwide annual market potential for manual extraction catheters is approximately $50 million.

The original Pronto extraction catheter was developed by Dr. Pedro Silva of Milan, Italy, who exclusively licensed the design to us in 2002. We received CE Mark approval and commenced international sales of the Pronto in August 2003, and received FDA clearance in December 2003 and commenced sales in the United States in early 2004. In the fourth quarter of 2005, we launched the third generation design of Pronto, named the Pronto V3. In January 2011, we commenced the launch of the Pronto V4, which utilizes an embedded longitudinal wire for maximum extraction with enhanced deliverability and kink resistance. On January 6, 2012, we purchased the intellectual property relating to the Pronto extraction catheter from Dr. Silva and his affiliates in exchange for $3.25 million, which thereby eliminated royalty payments on sales of Pronto catheters occurring after December 31, 2011.

In addition to the Pronto V3 and V4, we have developed and launched four additional versions of extractions catheters: the Pronto-Short, Pronto 035, Pronto LP, and Pronto XL. The Pronto-Short is a shorter catheter with a larger diameter, designed for use in clotted dialysis grafts, which was launched in August 2005. The Pronto 035 is a larger version, designed for use in large vessels, which was launched in August 2007. The Pronto LP is a low-profile version, designed for use in smaller vessels, which was launched in January 2008. The Pronto XL extraction catheter is an even larger version with either a straight or pigtail tip, designed for use in very large vessels, which was launched in January 2012.

Vein catheter reprocessing

Sales from our vein catheter reprocessing service for radiofrequency vein ablation catheters were $12.6 million during 2015, an increase of 23% from the 2014 level of $10.2 million. We estimate the annual worldwide market potential for our RF vein ablation service to be approximately $20 million.

On December 22, 2011, we entered into an exclusive license agreement with Northeast Scientific, Inc. (NES), under which we sell a reprocessing service to customers utilizing the ClosureFAST® radiofrequency catheter in the treatment of varicose veins in the United States. We commenced marketing this service to vein clinics in the U.S. in January of 2012. The ClosureFAST catheter is owned and marketed by a subsidiary of Medtronic plc, and our reprocessing service is not licensed by or associated with Medtronic. Under the reprocessing service provided by NES, the customer sends used ClosureFAST catheters to NES, where they are inspected, cleaned, tested, repackaged, resterilized, and shipped back to the customer. In addition to this basic reprocessing service, we also purchase used ClosureFAST catheters from vein clinics and have them reprocessed by NES for sale to customers in the U.S.

5

In August of 2015, we signed a revised agreement with NES that grants us exclusive rights to market the ClosureFAST reprocessing service in the U.S. through December 31, 2021. From the inception of our ClosureFAST reprocessing service in January 2012 through December 31, 2015, NES had successfully reprocessed more than 100,000 ClosureFAST catheters for our customers.

Micro-Introducer Kits

Sales of micro-introducer kits in 2015 were $12.3 million, representing growth of 18% from the 2014 level of $10.4 million. Micro-introducers are access kit products used to gain percutaneous access to the vasculature for performing arterial and venous catheterization procedures. Based on industry data, we estimate the annual worldwide market potential for micro-introducers to be approximately $75 million.

In July 2003, we launched a variety of introducer products, including a full line of kits and a variety of specialty guidewires. In recent years, our focus has been on transitioning our micro-introducer business to internal manufacturing, cost reductions, and product line expansion. This strategy has resulted in lower prices for our customers and increased gross margins and higher market share for Vascular Solutions.

Hemostatic patches

Sales of hemostatic patches in 2015 were $12.0 million, representing a decline of 3% from $12.4 million in 2014. Based on industry data, we believe the annual worldwide market for hemostat patches used in catheterization procedures is approximately $50 million. The market for hemostat patches, used to stop bleeding of femoral artery punctures, is mature, with multiple competitors and ongoing pricing pressures. In addition, two trends are negatively affecting the demand for our D-Stat® and Thrombix® patches: the recent slowdown in growth of catheterization procedures in general and the movement toward greater reliance on using the radial artery in the arm, rather than the femoral artery in the leg, as the access site for diagnostic and interventional procedures.

Our hemostat products primarily utilize thrombin, a powerful bovine-derived blood clotting protein, to deliver a rapid seal of bleeding with a variety of shelf-stable configurations. We have developed a proprietary manufacturing process to terminally sterilize our thrombin-based hemostats, which has resulted in our ability to create unique advantages in storage, shipping, preparation, and application of our hemostat products.

Our most popular hemostat product is the D-Stat Dry hemostat bandage. In September 2003, we received regulatory clearance and commenced sales of our D-Stat Dry hemostat bandage in the United States and international markets. The D-Stat Dry is a version of our proprietary blood clotting substance that is lyophilized (freeze-dried) into a gauze pad and combined with an adhesive bandage for application. D-Stat Dry is used as an adjunct to manual compression for managing bleeding after catheterization procedures.

In the third quarter of 2006, we received FDA clearance of our claim that the D-Stat Dry product reduces the time-to-hemostasis in diagnostic catheterizations. This claim was based on our 376-patient, five-center randomized clinical study that demonstrated a 50% reduction in the median time-to-hemostasis when using the D-Stat Dry bandage compared to simple manual compression alone. In the first quarter of 2008, we received FDA clearance and began selling two new versions of the original D-Stat Dry. The first, D-Stat Dry Clear, is packaged with a clear bandage that allows for better visibility of the puncture site while the bandage is in place. The second, Thrombix, uses a lower-cost manufacturing process that offers price flexibility within the product line.

6

In the first quarter of 2009, we received FDA clearance and began selling a new version of the original D-Stat Dry bandage, D-Stat Dry Wrap, which contains a pre-cut slit in the bandage, specifically designed for the control of bleeding around indwelling lines. In May 2011, we received FDA clearance and began selling a new version of our D-Stat Dry bandages with silver chloride impregnated into the gauze pad to help prevent the colonization of microorganisms on the pad. In January 2014, we received FDA clearance and launched in the U.S. our ThrombiDisc™ topical hemostat, a thrombin-based pad used as an adjunct to manual compression to control surface bleeding from vascular access sites and percutaneous catheters or tubes up to 12F in diameter. ThrombiDisc also contains the antimicrobial ingredient silver chloride, designed to prevent microorganisms commonly encountered in the clinical setting from colonizing on the pad.

Radial Access Products

During 2015, sales of our products used in radial artery access catheterizations totaled $7.4 million, an increase of 27% from the 2014 level of $5.8 million. Based on industry data, we estimate that our collection of products for the radial catheterization market addresses an annual U.S. market opportunity of approximately $90 million.

Radial artery access, otherwise known as transradial access, is undergoing rapid adoption in the U.S. According to industry data, the proportion of U.S. procedures performed using radial artery access grew from just 1% during the first quarter of 2007 to 16% by the third quarter of 2013. The level of penetration for radial access in the U.S. is still far behind most other parts of the world – such as Canada at nearly 60%, Japan at 60%, and the average throughout Europe at approximately 50%. Based on projected continued growth in radial access, we believe the number of radial artery access procedures performed in the U.S. will grow to approximately one million by the end of 2016, representing approximately 27% of all diagnostic and interventional cardiac catheterizations.

During 2012, we implemented our strategy of launching products that address the significant growth opportunity in the radial access market. In June 2012, we acquired the Accumed™ wrist positioning splint device from Accumed Systems, Inc. The Accumed wrist positioning splint consists of a molded plastic brace that simplifies access to the radial artery by holding the hand, wrist, and forearm in an appropriate, comfortable position. In May of 2013, we launched the Vasc Band radial compression device under an exclusive U.S. distribution agreement with LePu Medical Technology (Beijing) Co., Ltd. (“LePu Medical”). The Vasc Band is placed around the patient’s wrist after a radial catheterization procedure and uses an inflatable compression band to assist hemostasis. In December 2014, we expanded our relationship with LePu Medical to include exclusive U.S. distribution rights to a line of introducer sheaths designed for use in radial catheterizations. LePu Medical manufactures the product, which we sell in the U.S. under the name VSI Radial™ Introducer Sheath. In April of 2015, we entered into an agreement with All Of It Scandinavia AB to distribute a radial arm board in the U.S. under the name Xtend™ Radial Arm Board.

Langston catheters

Sales of our Langston catheter in 2015 were $6.6 million, an increase of 8% from the 2014 level of $6.1 million. We believe the annual sales opportunity for this device is in excess of $10 million.

We received regulatory clearance in the United States for the Langston dual lumen pigtail catheter during the third quarter of 2004. The Langston catheter is used for the measurement of intravascular pressure gradients, primarily to diagnose aortic valve stenosis. We believe our Langston catheter is the only dual lumen pigtail catheter on the U.S. market that is designed specifically for this clinical purpose. In March 2011, we launched a second version of the Langston catheter with improved pressure measurement and reduced kinking. With the current growth in percutaneous aortic valve replacement procedures, our Langston catheter continues to benefit from an expanding market.

7

D-Stat Flowable hemostat

In 2015, sales of our D-Stat Flowable hemostat were $5.3 million, which represented a 3% decrease from the $5.5 million in 2014. We estimate the annual sales potential for D-Stat Flowable at approximately $10 million.

We began selling D-Stat Flowable worldwide in February 2002. This hemostat product is a thick yet flowable mixture of collagen, thrombin, and diluent that can be used to control active bleeding. In December 2006, we received FDA approval of our premarket approval (PMA) supplement for the use of D-Stat Flowable in the prepectoral pockets created in pacemaker and implantable cardioverter defibrillator (ICD) implants. Our PMA supplement was supported by the results of our 269-patient “Pocket Protector” clinical study that demonstrated a 48% reduction in the incidence of clinically relevant hematomas through the use of D-Stat Flowable compared to the standard of care. We discontinued international sales of D-Stat Flowable in 2015 for commercial business reasons.

The amount of total revenue contributed by geographic areas for the last three fiscal years is set forth in Note 10 to our Consolidated Financial Statements in Item 8 of Part II of this Annual Report on Form 10-K for the year ended December 31, 2015.

Agreements with King Pharmaceuticals, Inc.

In January 2007, we entered into a License Agreement with King Pharmaceuticals, Inc. (King), which is now a subsidiary of Pfizer, Inc. Under the terms of the License Agreement, we granted to King an exclusive, royalty-free, fully-paid up, perpetual, worldwide right and license to all of our patents and know-how relating to the development, manufacture, use, sale, importation or other exploitation of our Thrombi-Pad™ trauma bandage, Thrombi-Gel® hemostats, Thrombi-Paste ™ hemostat (collectively, the “Products”) and all future medical devices having application in the Field (as defined below) and intended to produce hemostasis by accelerating the clotting process of blood (a “hemostat device”). The “Field” is defined as all applications of hemostat devices in all areas other than catheterization laboratories (cardiac and peripheral), electrophysiology laboratories and holding and recovery rooms for such laboratories. Upon execution of the License Agreement, King paid us a one-time payment of $6.0 million. No other payments are due from King to us under the License Agreement. The term of the License Agreement commenced on January 9, 2007 and continues until the later of the expiration of each licensed patent or King’s relinquishment of its license rights under the licensed know-how.

Also in January 2007, we entered into a Thrombin-JMI® Supply Agreement with King. Under the terms of the Thrombin-JMI Supply Agreement, King agreed to manufacture and supply thrombin to us on a non-exclusive basis. King agreed to supply us with such quantity of thrombin as we may order for use in devices not intended for sale by King in the Field at a fixed price throughout the term of the Thrombin-JMI Supply Agreement as adjusted for inflation, variations in potency and other factors. King also agreed to provide thrombin to us under the Thrombin-JMI Supply Agreement at no cost for incorporation into Products and hemostat devices intended for sale in the Field by King. The Thrombin-JMI Supply Agreement has an initial term of 10 years, followed by successive automatic one-year extensions, subject to termination by the parties under certain circumstances, including (1) termination by King without cause any time after the fifth anniversary of its execution upon five years prior written notice to us and (2) termination by us without cause any time after the fifth anniversary of its execution upon five years prior written notice to King, provided that a Device Supply Agreement we entered into with King in January 2007 has expired on its terms or the parties have agreed to terminate it.

8

Business Strategy

Our primary objective is to establish ourselves as a leading supplier of clinically superior medical devices and services for substantial, unique opportunities within interventional medicine worldwide. The key steps in achieving our primary objective are the following:

| · | Maintain and Improve our Clinically-Oriented Direct Sales Force in the United States. During 2000, we commenced sales of our products in the United States through a direct sales force of clinically trained account managers who sell and train interventional cardiologists, radiologists and catheterization laboratory personnel on the use of our products. As our product lines have increased, we have increased the size of our sales force to 103 at the end of 2015, which provides substantially complete geographic coverage of the United States. |

| · | Expand the Markets and Revenue of our International Distribution. We sell our products into international markets through 41 independent distributors that cover 57 countries at the end of 2015. Our sales in markets outside the United States increased from 18% of our revenue in 2014 to 21% of our revenue in 2015. Over time, we expect to increase our international sales as a percentage of revenue by continuing to increase the number of countries where our products are sold and increasing the volume of our products sold in international markets. |

| · | Develop New Devices and Services to be Sold to our Existing Customers. Since we launched our initial product, we have created and developed over 100 new medical devices sold to and used by interventional physicians. We intend to continue to leverage our direct sales force and international distributor organization by creating, developing and launching additional new products and services for interventional physicians. |

| · | Acquire Additional Products or Services to be Sold to our Existing Customers. We intend to continue to leverage our distribution capabilities by offering additional new products and services through acquisitions and distribution agreements. Over the past three years, we have acquired products, product distribution rights and services from multiple companies (see Note 14 to our Consolidated Financial Statements in Item 8 of Part II of this Annual Report on Form 10-K for the year ended December 31, 2015), and we expect to continue to acquire complementary products and services and to enter into distribution agreements for the distribution of other companies’ products. |

| · | Explore Corporate Relationships to Augment our Distribution Capabilities. When we develop versions of our products that are intended to be used by physicians outside of our target market, (such as our Thrombi-Gel and Thrombi-Pad products) and in other situations where we believe synergistic sales can result from an expanded distribution network, we intend to enter into corporate relationships to broaden our products’ reach and increase our revenues without distracting our sales force. |

Sales, Marketing and Distribution

In 2000, we commenced sales of our first product, the Duett sealing device, in the United States through our direct sales organization. As of December 31, 2015, our U.S. direct sales force consisted of 103 employees, all of whom sell our entire line of products and services. We believe that the majority of interventional catheterization procedures in the United States are performed in high volume catheterization laboratories, and that these institutions can be served by our focused direct sales force.

Our international sales and marketing strategy has been to sell to interventional cardiologists and interventional radiologists through established independent distributors in major international markets, subject to required regulatory approvals. As of December 31, 2015, we have agreements with 41 independent distributors that cover 57 countries. We have entered into multi-year written distribution agreements with each of our independent distributors, and we ship our products to these distributors upon receipt of purchase orders. Each of our independent distributors has the exclusive right to sell our products within a defined territory. These distributors also market other medical products, although generally they have agreed not to sell directly competitive products. Our independent distributors purchase our products from us at a discount from list price and resell the device to hospitals and clinics. Sales to international distributors are denominated in United States dollars, with the exception of sales of our Guardian valve product from our subsidiary in Ireland and sales to our German distributor, which are both denominated in Euros. The end-user price is determined by the distributor and varies from country to country.

9

As part of our sales strategy, our direct U.S. sales force and international independent distributors are clinically trained to be able to train physicians and other healthcare personnel on the use of our products and services. We believe that effective training is a key factor in encouraging physicians to use interventional medical devices and services. We have created, and will continue to work to improve, an in-the-field training program for the use of all of our products and services. We also develop and maintain close working relationships with our customers to continue to receive input concerning our product and service development plans.

We are focused on building market awareness and acceptance of our products and services. Our marketing department provides a wide range of programs, materials and events that support our sales force. These include product and service training, conference and trade show appearances and sales literature and promotional materials.

New Product and Service Development

Our growth depends in large part on the continuous introduction of new and innovative products and services, together with ongoing enhancements to our existing products and services, through internal product development, technology licensing and strategic alliances. We recognize the importance of, and intend to continue to make investments in, research and development. We incurred expenses of $18,358,000 in 2015, $13,441,000 in 2014, and $13,191,000 in 2013 for research and development activities, which constituted 12.5%, 11%, and 12%, respectively, of net sales. R&D activities include research, product development and intellectual property development. We expect that our R&D expenditures will be approximately 11.5 to 12.5% of net sales in 2016.

Our research and product development group works closely with our sales force to incorporate customer feedback into our development and design process. We believe that we have a reputation within interventional cardiology and interventional radiology as a good partner for product and service development because of our tradition of close physician collaboration, dedicated market focus, responsiveness and execution capabilities for product and service development and commercialization.

To further leverage our efficiencies, our research and development group continues to develop in-house capabilities to manufacture several components currently produced by outside vendors.

We expect our research and development activities to continue to expand to include evaluation of new concepts, products and services for the interventional cardiology and interventional radiology field. We believe that there are many potential new interventional products and services that would fit within the development, clinical, manufacturing and distribution network we have created for our existing products and services.

Manufacturing

We manufacture our products in our facilities located in the suburbs of Minneapolis, Minnesota and in the country of Ireland. Manufacturing and packaging processes occur in controlled environments and most sterile product manufacturing and packaging processes occur in a certified clean room environment. Our quality system, manufacturing facilities and processes have been certified to be compliant with the European Medical Device Directive 93/42/EEC, EN/ISO 13485:2012, the Canadian Medical Device Regulations SOR/98-282, and they comply with FDA Quality System Regulations.

10

We purchase components from various suppliers and rely on single sources for several parts of our products. We purchase our thrombin (a component in all of the D-Stat products) for use in manufacturing products sold in the U.S. under the Thrombin-JMI® Supply Agreement with King. To date, we have not experienced any significant adverse effects resulting from shortages of components.

The manufacture and sale of our products entails significant risk of product liability claims. Although we have product liability insurance coverage in an amount which we consider reasonable, it may not be adequate to cover potential claims. Any product liability claims asserted against us could result in costly litigation, reduced sales and significant liabilities and divert the attention of our technical and management personnel away from the development and marketing of our products for significant periods of time.

Competition

We encounter significant competition across our product lines and in each market in which our products are sold. These markets are characterized by rapid change resulting from technological advances and scientific discoveries. We face competitors ranging from large manufacturers with multiple business lines to small manufacturers that offer a limited selection of products.

Our primary competitors include: Medtronic plc., Boston Scientific Corporation, Merit Medical Systems, Inc., Marine Polymer Technologies, Inc., Cook Medical Inc., the Abbott Vascular division of Abbott Laboratories, Asahi Intecc Co., Ltd., AngioDynamics, Inc., and Terumo Corporation.

Many of our competitors have substantially greater financial, technological, research and development, regulatory, marketing, sales and personnel resources than we do. Competitors may also have greater experience in developing products, obtaining regulatory approvals, and manufacturing and marketing such products. Additionally, competitors may obtain patent protection or regulatory approval or clearance, or achieve product commercialization before us, any of which could materially adversely affect us. We compete on the basis of our clinically differentiated products and services and focused opportunities within this interventional medical device and service market.

In each of our product and service areas, we believe that several other companies are developing new devices and services. The medical device industry is characterized by rapid and significant technological changes as well as the frequent emergence of new technologies. There are likely to be research and development projects related to these market areas of which we are currently unaware. A new technology, product or service may emerge that results in a reduced need for our products and services or results in a product or service that renders our product or service noncompetitive.

Regulatory Requirements

United States

Our products and services are regulated in the United States as medical devices by the FDA under the Federal Food, Drug and Cosmetic Act. The FDA classifies medical devices and services into one of three classes based upon controls the FDA considers necessary to reasonably ensure their safety and effectiveness. Class I devices are subject to general controls such as labeling, adherence to good manufacturing practices and maintenance of product complaint records, and are usually exempt from premarket notification requirements. Class II devices are subject to the same general controls and also are subject to special controls such as performance standards, require premarket notification (510k clearance) prior to commercialization, and may also require clinical testing prior to clearance. Class III devices are subject to the highest level of controls because they are used in life-sustaining or life-supporting implantable devices. Class III devices require rigorous clinical testing prior to their approval and generally require a premarket approval (PMA) or supplement application prior to commercialization.

11

If a medical device manufacturer can establish that a device is “substantially equivalent” to a legally marketed Class I or Class II device, or to an unclassified device, or to a Class III device for which the FDA has not called for PMAs, the manufacturer may seek clearance from the FDA to market the device by filing a 510(k) premarket notification. The 510(k) notification must be supported by appropriate data establishing the claim of substantial equivalence to the satisfaction of the FDA.

Manufacturers must file an investigational device exemption (IDE) application if human clinical studies of a device are required and if the FDA considers experimental use of the device to represent significant risk to the patient. The IDE application must be supported by data, typically including the results of animal and mechanical testing of the device. If the IDE application is approved by the FDA, human clinical studies may begin at a specific number of investigational sites with a maximum number of patients, as approved by the FDA. The clinical studies must be conducted under the review of an independent institutional review board to ensure the protection of patient rights.

Generally, upon completion of human clinical studies, a manufacturer seeks approval of a Class III medical device from the FDA by submitting a PMA application. A PMA application must be supported by extensive data, including the results of the clinical studies, as well as literature to establish the safety and effectiveness of the device.

Our D-Stat Flowable is classified as both a Class III and Class II device based on the three distinct indications for use that have been assigned to this product.

Our remaining products generally are classified as Class II products and therefore require FDA clearance of a 510(k) notification prior to being sold in the United States. Each of our Class II product lines was initially subject to a 510(k) notification and determined to be “substantially equivalent” to a legally marketed predicate device by the FDA, thereby allowing commercial marketing in the United States. In some instances, we are able to launch a modified product without filing a new 510(k) with the FDA.

We also are subject to FDA regulations concerning manufacturing processes and reporting obligations. These regulations require that manufacturing operations be performed according to FDA standards and in accordance with documentation, control and testing standards. We are subject to inspection by the FDA on an on-going basis. We are required to provide information to the FDA on adverse events and maintain a document and record keeping system in accordance with FDA regulations. The advertising of our products is subject to both FDA and Federal Trade Commission jurisdiction. If the FDA believes that we are not in compliance with any aspect of the law, it can institute proceedings to detain or seize products, issue a recall, stop future violations and assess civil and criminal penalties against us, our officers and our employees.

International

The European Union has adopted rules which require that medical products receive the right to affix the CE mark, an international symbol of adherence to quality standards and compliance with applicable European medical device directives. As part of CE mark certification, manufacturers are required to comply with certain product-essential requirements and quality systems standards. We received CE mark certification for our first product and certification of our quality system in July 1998, and we have subsequently received CE mark certification for other products we distribute in the European Union.

Our hemostatic products contain bovine-derived thrombin and are subject to additional regulatory review within the European Union to minimize the risk of exposure to viral and Bovine Spongiform Encephalopathy (BSE) pathogens. The regulations in this area continue to evolve and our products may be subject to additional regulatory scrutiny in the future.

International sales of our products are subject to the regulatory requirements of each country in which we sell. These requirements vary from country to country, but generally are less stringent than those in the United States. Regulatory approvals are obtained, usually by our distributors, where required to sell our products in those countries.

12

Third Party Reimbursement

In the United States, healthcare providers that purchase medical devices generally rely on third-party payors, principally the Centers for Medicare and Medicaid Services or CMS and private health insurance plans, to reimburse all or part of the cost of catherization procedures. We believe that in the current United States reimbursement system, all of our products are subject to reimbursement rules depending on the specific medical procedure in which they are utilized.

Market acceptance of our products in international markets is dependent in part upon the availability of reimbursement from healthcare payment systems. Reimbursement and healthcare payment systems in international markets vary significantly by country. The main types of healthcare payment systems in international markets are government-sponsored healthcare and private insurance. Countries with government-sponsored healthcare, such as the United Kingdom, have a centralized, nationalized healthcare system. New devices are brought into the system through negotiations between departments at individual hospitals at the time of budgeting. In most foreign countries, there are also private insurance systems that may offer payments for alternative therapies.

Intellectual Property: Patents, Trade Secrets, and Trademarks

We file and prosecute patent applications to protect technological innovations related to new medical devices and improvements on existing medical devices that are significant to the development of our business, and we use trade secrets and trademarks to supplement this protection and protect other areas of our business. We currently own or exclusively license 29 issued U.S. patents and 26 additional U.S. patent applications relating to our GuideLiner catheters, Pronto extraction catheters, Langston dual lumen catheters, Venture catheters, Turnpike® catheters, Replas freeze-dried plasma and multiple other products on the market or in development. We also have obtained issued international patents and are currently pursuing additional international patent applications. Our 29 issued U.S. patents have expiration dates ranging from May 2018 to April 2033.

The interventional medical device market is characterized by frequent and substantial intellectual property litigation. Intellectual property litigation in recent years has proven to be complex and expensive, and the outcome of such litigation is difficult to predict. The interpretation of patents, for example, involves complex and evolving legal and factual questions.

Currently, we are not involved in any patent litigation. We may become the subject of intellectual property litigation in the future related to our products or services. Our defense of any intellectual property litigation claims, regardless of the merits of the complaint, could divert the attention of our technical and/or management personnel away from the development and marketing of our products and services for significant periods of time. The costs incurred to defend these claims could be substantial and adversely affect us, even if we are ultimately successful. Similarly, if we assert any of our intellectual property against a third party, the attention of our technical and/or management personnel may be diverted and substantial costs could be incurred.

We rely on trade secret protection for certain aspects of our technology. We typically require our employees, consultants and vendors for major components to execute confidentiality agreements upon their commencing services with us or before we disclose confidential information to them. These agreements generally provide that all confidential information developed or otherwise made known to the other party, during the course of that party’s relationship with us, is to be kept confidential and not disclosed to third parties, except in special circumstances. The agreements with our employees also provide that all inventions conceived or developed in the course of providing services to us shall be our exclusive property.

13

We register trademarks for certain products in the United States and use unregistered trademarks for other products. We current own 33 active U.S. registered trademarks and 25 unregistered trademarks. United States trademark registrations are generally for a term of 10 years, renewable every 10 years as long as the trademark is used in the regular course of business.

We also use certain third party trademarks in association with products or services that we sell. “ClosureFAST” is a registered trademark of Covidien LP. “OptiSeal” is a registered trademark of Greatbatch Ltd. “PolarCath” is a trademark of NuCryo Vascular LLC. “VeinSite” is a registered trademark of VueTek Scientific LLC. “Xtend” is a trademark of All of It Scandinavia AB. “ZigiWire” is a trademark of Vadiswire Corp.

Employees

As of December 31, 2015, we had 568 full-time employees. Of these employees, 259 were in manufacturing activities, 150 were in sales and marketing activities, 38 were in regulatory, quality assurance and clinical research activities, 77 were in research and development activities, and 44 were in general and administrative functions. We have never had a work stoppage and none of our employees are covered by collective bargaining agreements. We believe our employee relations are good. We are an Equal Opportunity Employer.

Executive Officers of the Registrant

Our executive officers as of January 22, 2016 are as follows:

|

Name

|

Age

|

Position

|

|

Howard Root

|

55

|

Chief Executive Officer and Director

|

|

James Hennen

|

43

|

Chief Financial Officer and Senior Vice President of Finance

|

|

Brent Binkowski

|

47

|

Senior Vice President of Operations

|

|

Chad Kugler

|

44

|

Senior Vice President of Research and Development

|

|

Carrie Powers

|

41

|

Senior Vice President of Marketing

|

|

William Rutstein

|

63

|

Senior Vice President of International Sales

|

|

Charmaine Sutton

|

56

|

Senior Vice President, Regulatory & Quality Assurance

|

Howard Root has served as Chief Executive Officer and a member of our Board of Directors since he co-founded Vascular Solutions in February 1997. From 1990 to 1995, Mr. Root was employed by ATS Medical, Inc., a mechanical heart valve company, most recently as Vice President and General Counsel. Prior to joining ATS Medical, Mr. Root practiced corporate law, specializing in representing emerging growth companies, at the law firm of Dorsey & Whitney LLP for over five years.

James Hennen has served as our Chief Financial Officer since January 2004. Mr. Hennen served as our Controller & Director of Finance from February 2002 through December 2003. Prior to joining us, Mr. Hennen served in various accounting positions, most recently as International Controller with WAM!NET, Inc., a globally networked information technology company for media transfer, where he worked from December 1997 through February 2002. From October 1995 through December 1997, Mr. Hennen was an auditor for Ernst & Young, LLP. Mr. Hennen is a Certified Public Accountant (inactive).

Brent Binkowski has served as our Senior Vice President of Operations since June 2015. Prior to joining us, Mr. Binkowski served as Vice President of Operations for CeloNova BioSciences, Inc., a medical device company focused on embolization and vascular devices, from February 2013 to June 2015. Mr. Binkowski was employed by American Medical Systems, a medical device company focused principally on the urology market, since 2003, serving as Senior Director of Operations from January 2011 to February 2013, and Value Stream Director from February 2008 to January 2011.

Chad Kugler has served as our Senior Vice President of Research and Development since March 2014. Prior to joining us, he was the Co-Founder, President and General Manager of BridgePoint Medical, a company that developed a proprietary, catheter-based system to treat coronary chronic total occlusions, from 2005 until its acquisition by Boston Scientific in 2012. From 2003 to 2005 Mr. Kugler was part of the founding team at Torax Medical, which developed a treatment for acid reflux disease. From 1997 to 2001 Mr. Kugler was the Director of Research and Development at Teramed, an aortic endovascular graft company acquired by Cordis in 2001. Mr. Kugler began his career as an engineer with SCIMED/Boston Scientific in 1992.

14

Carrie Powers has served as our Senior Vice President of Marketing since January 2016. Ms. Powers previously served as our Vice President of Marketing from July 2009 to December 2015, Senior Director of Product Management and Training from July 2008 to June 2009, Director of Training from March 2007 to July 2008, Product Manager for the Hemostasis Product Line from July 2006 to March 2007 and began her employment with us as an Associate Product Manager for the Hemostasis Product Line from January 2006 to July 2006. Prior to joining us, Ms. Powers was employed by St. Mary’s Hospital in Madison, Wisconsin from 2002 to 2006, most recently as a Registered Nurse in the Interventional Cardiac Catheterization Lab.

William Rutstein has served as our Senior Vice President of International Sales since January 2015. Mr. Rutstein previously served as our Senior Vice President of Worldwide Sales from July 2010 to January 2015, Vice President of International Sales from October 2008 to July 2010, Senior Director of International Sales from January 2008 to October 2008, and Director of International Sales upon joining Vascular Solutions in August 1999 until January 2008. Prior to joining us, Mr. Rutstein was the Business Unit Director for the cardiosurgery division of Minntech Corporation, a medical device company, from April 1997 to July 1999. From November 1988 to March 1997, Mr. Rutstein worked for Daig Corporation (a St. Jude Medical Company), a medical device company specializing in cardiology and electrophysiology catheters, where he served as Regional Sales Manager, National Sales Manager, OEM Sales Manager and International Sales Manager.

Charmaine Sutton has served as our Senior Vice President, Regulatory & Quality Assurance since August 2015. Ms. Sutton served as our Senior Vice President of Operations from March 2010 to August 2015. Ms. Sutton previously served on our Board of Directors from July 2007 to March 2010. From 1991 to 2011, Ms. Sutton was principal consultant and co-founder of The Tamarack Group, an association of consultants assisting developers and manufacturers of medical devices, diagnostics, pharmaceuticals, biologics and combination products with regulatory and quality system activities. Prior to co-founding The Tamarack Group, Ms. Sutton held Director and VP level Engineering, Regulatory, Quality and Clinical positions in start-up companies, and was a research scientist in the laser fusion program at Lawrence Livermore National Laboratory. From 2006 to 2011 Ms. Sutton was an adjunct instructor for the Regulatory Affairs and Services graduate program at St. Cloud State University.

Available Information

We make available free of charge on or through our website at www.vasc.com our Annual Reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, required Interactive Data files and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission.

ITEM 1A. RISK FACTORS

The risks and uncertainties described below are not the only ones facing our company. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. If any of the following risks occur, our business, financial condition or results of operations could be seriously harmed.

15

We will not be successful if the interventional medical device community does not adopt our new products or services.

We have launched over 100 new products or services since our inception. Our success will depend on the continued launch of new products and services and the medical community’s acceptance of our new products and services. We cannot predict how quickly, if at all, the medical community will accept our new products and services, or, if accepted, the continuation or extent of their use. Our potential customers must:

| · | believe that our products or services offer benefits compared to the methodologies and/or devices that they are currently using; |

| · | use our products or services and obtain acceptable clinical outcomes; |

| · | believe that our products or services are worth the price that they will be asked to pay; and |

| · | be willing to commit the time and resources required to change their current methodology. |

Because we are often selling a new technology, we have limited ability to predict the level of growth or timing of sales of these products or services. If we encounter difficulties in growing our sales of our new medical devices or services, our business will be seriously harmed.

We and our Chief Executive Officer are defendants in a criminal indictment that could result in a substantial disruption to our business.

The products and business activities of medical device companies are subject to rigorous regulation by the FDA and other federal, state and international governmental authorities under statutes and regulations governing health care fraud. The U.S. Attorney’s Offices have increased their scrutiny over the medical device industry in recent years. The U.S. Congress, Department of Justice, Office of Inspector General of the Department of Health and Human Services, and Department of Defense have all issued subpoenas and other requests for information to conduct investigations of, and commenced civil and criminal litigation against, medical device manufacturers, primarily related to financial arrangements with health care providers, regulatory compliance and product promotional practices.

During 2012, the U.S. Attorney’s Office for the Western District of Texas intervened in a qui tam civil lawsuit initiated against us involving allegations of off-label promotion of our Vari-Lase Short Kit endovenous laser product (see Item 3 – Legal Proceedings: Government Litigation of Part I of this Annual Report on Form 10-K for the year ended December 31, 2015). Subsequently, we learned that the U.S. Attorney’s Office also had commenced a criminal investigation of the same matter. On January 22, 2014, we agreed with the U.S. Attorney’s Office to settle the civil lawsuit, and the settlement agreement was executed on July 28, 2014. Under the terms of the settlement agreement, we made a payment of $520,000, we made no admission of fault or liability, and the U.S. Attorney’s Office dismissed the civil lawsuit with prejudice and released all civil claims brought against us in the civil lawsuit.

Settlement of the civil lawsuit had no effect upon the criminal investigation, and on November 13, 2014, the U.S. Department of Justice filed a criminal indictment in the United States District Court for the Western District of Texas related to the Vari-Lase Short Kit investigation. The original indictment alleged that we and our Chief Executive Officer introduced adulterated and misbranded medical devices into interstate commerce and conspired to introduce adulterated and misbranded medical devices into interstate commerce through the alleged off-label promotion of the Vari-Lase Short Kit product. On December 2, 2015, a superseding indictment was issued that removed the allegations related to introducing adulterated medical devices. We believe the remaining allegations are false and are contesting them vigorously.

16

A trial on the indictment is scheduled to commence on February 1, 2016 in San Antonio, Texas. Continuing to defend ourselves against the indictment entails costs that are material and requires significant attention from our management. If we were to be convicted of the crimes alleged in the indictment, remedies could include fines, penalties, forfeitures and compliance conditions. We cannot estimate the amount or range of loss if we were to be convicted; however, it would likely be material. If we were to be convicted of a crime related to the delivery of an item or service under Title XVIII of the Social Security Act, or a felony related to health care fraud, we would become automatically excluded by the Department of Health and Human Services (“HHS”) from participation in U.S. government health care programs, including Medicare and Medicaid. If we were to be convicted of a misdemeanor related to health care fraud, we could be immediately excluded by HHS from participation in U.S. government health care programs, including Medicare and Medicaid. Exclusion from participation in U.S. government health care programs would substantially prevent us from continuing to sell our products in the U.S., and thereby would seriously damage our business. Conviction of our Chief Executive Officer of a crime under statutes related to misbranding and health care fraud could require the termination of his employment with us. The consequences of the current criminal litigation, as well as consequences of any future governmental investigation or lawsuit of any related or unrelated matter, could have a material adverse effect on our business, results of operations and stock price.

We may become subject to shareholder litigation, which could divert the attention of management from the day-to-day operation of our business or result in us incurring substantial costs and liabilities.

Following the announcement on November 13, 2014 of the criminal indictment of Vascular Solutions and our Chief Executive Officer, several law firms publicly stated that they were conducting investigations of us or our officers and directors for potential securities law and shareholder derivative action lawsuits. Such investigations often result in litigation. Although no securities law or shareholder derivative action lawsuit has been filed against the Company to date, such a lawsuit may be filed in the future. If securities or shareholder derivative litigation were to be commenced against us, our defense of such litigation could divert the attention of management from the day-to-day operation of our business or result in us incurring substantial costs and liabilities, irrespective of the merits of the litigation.

We may face intellectual property litigation, which could prevent us from manufacturing and selling our products or services or result in us incurring substantial costs and liabilities.

The interventional medical device industry is characterized by numerous patent filings. As a result, participants in the industry frequently experience substantial intellectual property litigation. While we are not currently involved in any intellectual property litigation, in the recent past we have been involved in litigation concerning multiple products.

Some companies in the interventional medical device industry have employed intellectual property litigation in an attempt to gain a competitive advantage. In addition, non-practicing patent assertion entities have accumulated patent rights related to the medical device industry and are asserting them against operating companies in attempt to collect settlements or licensing fees. Intellectual property litigation has proven to be very complex, and the outcome of such litigation is difficult to predict. While we do not believe that any of our products or services infringe any existing patent or other intellectual property right, we previously have been involved in substantial intellectual property litigation and expect to continue to become subject to intellectual property claims with respect to our new or existing products or services.

An adverse determination in any intellectual property litigation or interference proceedings against us could prohibit us from selling a product or service, subject us to significant immediate payments to third parties and require us to seek licenses from third parties. The costs associated with these license arrangements may be substantial and could include substantial up-front payments and ongoing royalties. Furthermore, the necessary licenses may not be available to us on satisfactory terms, if at all. Adverse determinations in a judicial or administrative proceeding or failure to obtain necessary licenses could prevent us from manufacturing and selling a product or service.

Our involvement in any future intellectual property claims, regardless of the merits of any asserted claim against us, could divert the attention of our technical and management personnel away from the development and marketing of our products and services for significant periods of time. Furthermore, the penalties involved with an adverse outcome may be severe, and the costs incurred related to defending such claims could have a material adverse effect on our results of operations or financial condition, even if we ultimately prevail in them.

17

Our future operating results are difficult to predict and may vary significantly from quarter to quarter, which may adversely affect the price of our common stock.

The ongoing introduction of new products and services that affect our overall product mix make the prediction of future operating results difficult. You should not rely on our past revenue growth as any indication of future growth rates or operating results. The price of our common stock will likely fall in the event that our operating results do not meet the expectations of analysts and investors. Comparisons of our operating results between quarters are an unreliable indication of our future performance because they are likely to vary significantly based on many factors, including:

| · | the level of sales of our products and services in our markets; |

| · | our ability to introduce new products or services and enhancements in a timely manner; |

| · | the demand for, and acceptance of, our products and services; |

| · | the success of our competition and the introduction of alternative products or services; |

| · | our ability to command favorable pricing for our products and services; |

| · | the growth of the market for our products and services; |

| · | the expansion and rate of success of our direct sales force in the United States and our independent distributors internationally; |

| · | actions relating to ongoing FDA compliance; |

| · | the effects of intellectual property disputes; |

| · | the effects of government investigations and litigation; |

| · | the size and timing of orders from independent distributors or customers; |

| · | the attraction and retention of key personnel, particularly in sales and marketing, regulatory, manufacturing and research and development; |

| · | unanticipated delays or an inability to control costs; |

| · | general economic conditions, as well as those specific to our customers and markets; and |

| · | seasonal fluctuations in revenue due to the elective nature of some procedures. |

We may face product liability claims that could result in costly litigation and significant liabilities.

The manufacture and sale of medical products entails significant risk of product liability claims. Any product liability claims, with or without merit, could result in costly litigation, reduced sales, cause us to incur significant liabilities and divert our management’s time, attention and resources. We cannot be sure that our product liability insurance coverage is adequate or that it will continue to be available to us on acceptable terms, if at all.

18

The market for interventional medical devices and services is highly competitive and will likely become more competitive, and our competitors may be able to respond more quickly to new or emerging technologies and changes in customer requirements that may render our products or services obsolete.

The existing market for interventional medical devices and services is intensely competitive. We expect competition to increase further as companies develop new products and services or modify their existing products and services to compete directly with ours. Each of our products and services encounters competition from several medical device companies, including Medtronic plc., Boston Scientific Corporation, Terumo Corporation, and Cook Medical Inc., the Abbott Vascular division of Abbott Laboratories, and Asahi Intecc Co., Ltd. Each of these companies has:

| · | better name recognition; |

| · | broader product lines; |

| · | greater sales, marketing and distribution capabilities; |

| · | significantly greater financial resources; |

| · | larger research and development staffs and facilities; and |

| · | existing relationships with some of our potential customers. |

We may not be able to effectively compete with these companies. In addition, broad product lines may allow our competitors to negotiate exclusive, long-term supply contracts and offer comprehensive pricing for their products or services. Broader product lines may also provide our competitors with a significant advantage in marketing competing products or services to group purchasing organizations and other managed care organizations that are increasingly seeking to reduce costs through centralized purchasing. Greater financial resources and product development capabilities may allow our competitors to respond more quickly to new or emerging technologies and changes in customer requirements that may render our products or services obsolete.

We rely on continued development and improvement of our products and service, which if not successful, may have an adverse effect on our financial condition and results of operations.

We are continually engaged in developing new products and services and improving our existing products and services. New or improved products and services represent a significant component of our sales growth. We dedicate significant financial and managerial resources to product and services development and improvement. We may not achieve our development objectives within our schedule and budget, or at all, due to technical or operational challenges. Failure to achieve our development objectives on schedule may increase our development expenses and adversely impact our revenues. If we do achieve our development objectives, we may not be able to obtain regulatory approval for new or improved products or services, and we may not be successful in marketing and selling such products or services. Failure to obtain regulatory approval or successfully market and sell new or improved products and services could adversely impact our revenues and results of operations.

Constraints or interruption in production from any of our key suppliers may have a material adverse effect on our business, financial condition and results of operations.

In the interest of operational efficiency and due to quality considerations, we obtain some of the components for the products that we manufacture from a sole source. If the availability of components from a sole source of supply is constrained or interrupted, there is no assurance that we could find an alternative source of supply quickly and cost effectively, if at all. In addition, due to the stringent regulations and requirements of the FDA and equivalent regulatory entities regarding the manufacture of our products, we may not be able to quickly establish additional or replacement sources for some components or materials. Unavailability of components could have a material adverse effect on our ability to manufacture and sell products and our results of operations.

19

We also distribute finished products that are available only from their manufacturer. In addition, the reprocessing services that we offer are performed by a single provider. Operational, quality or regulatory issues of the manufacturers of the products we distribute, or the provider of our reprocessing services, could constrain or interrupt the availability of those products or services. Any constraint or interruption in supply of finished products that we distribute, or the reprocessing services that we offer, could have a material adverse effect on our ability to sell products and services to customers, our financial condition and our results of operations.