Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - GelTech Solutions, Inc. | gltc_8k.htm |

EXHIBIT 99.1

2016 Annual Shareholders Meeting January 22, 2016Jupiter, FL

Cautionary Note Regarding Forward Looking Statements This presentation [and responses to various questions] contains forward-looking statements including our strategy and opportunities, developing accounts with utility companies across the U.S., potential pilot programs, and generating revenue. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. Forward-looking statements are based on our current expectations and assumptions regarding our business and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. We caution you therefore against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. Important factors that could cause actual results to differ materially from those in the forward-looking statements include the failure to receive material orders from utility and mining companies, global and domestic economic conditions, budgetary pressures facing state and local governments, our failure to receive or the potential delay of anticipated orders for our products, failure to receive acceptance of FireIce® by State and Local governments and an adverse result in our pending litigation. Further information on our risk factors is contained in our filings with the SEC, including the Prospectus dated November 5, 2013. Any forward-looking statement made by us in this presentation speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

Highlights WelcomeOperationsFiscal ReviewFour Key Business SegmentsWildland/Biomass/Agricultural FiresUtilities/Industrial/Communication TowersMunicipal Police/Fire/EMS (FireIce Solutions)Agriculture, Mining & ConstructionNew Products / Research & DevelopmentQ&A Product Families

Over 25 years experience turning around underperforming companiesOwner / Advisor of companies ranging from $50 million to over $1 billionRetail / Wholesale / Sourcing / DistributionConsumer Products / Home Goods / Apparel / ServicesIntroduced to Mike Reger in late 2014Came aboard May 2015 with a mandate to make fundamental changes in how the company operates and to prepare for the growth aheadKeywords: Focus / Timelines / Discipline / Accountability / Systems Recently extended through the end of 2016Oversee day-to-day operations Operations (Priorities)

Operations (Priorities) PROJECT DRIVENExamples . . .Initiated monthly Sales ForecastingCleaning up Sales Rep & Distributor NetworkRe-set MSRP pricingBrought focus and discipline to R&D activities: Product Worksheets Task Lists Product costing and lead times In-house manufacturing protocols and QC proceduresBreaking silos to become more collaborative

PROJECT DRIVENExamples . . .Upgrading inventory controls (on hand, on order, committed, pick/pack slips, etc.)Reducing costs by eliminating non-performing and under-performing positionsStreamlining Content & Style of Sales and Marketing DocumentsOutsourcing manufacturing for larger-scale projectsStreamlining website experience with easier navigation and cleaner contentUpgraded Owner’s Manuals and Added “Quick Start Guides” Operations (Priorities)

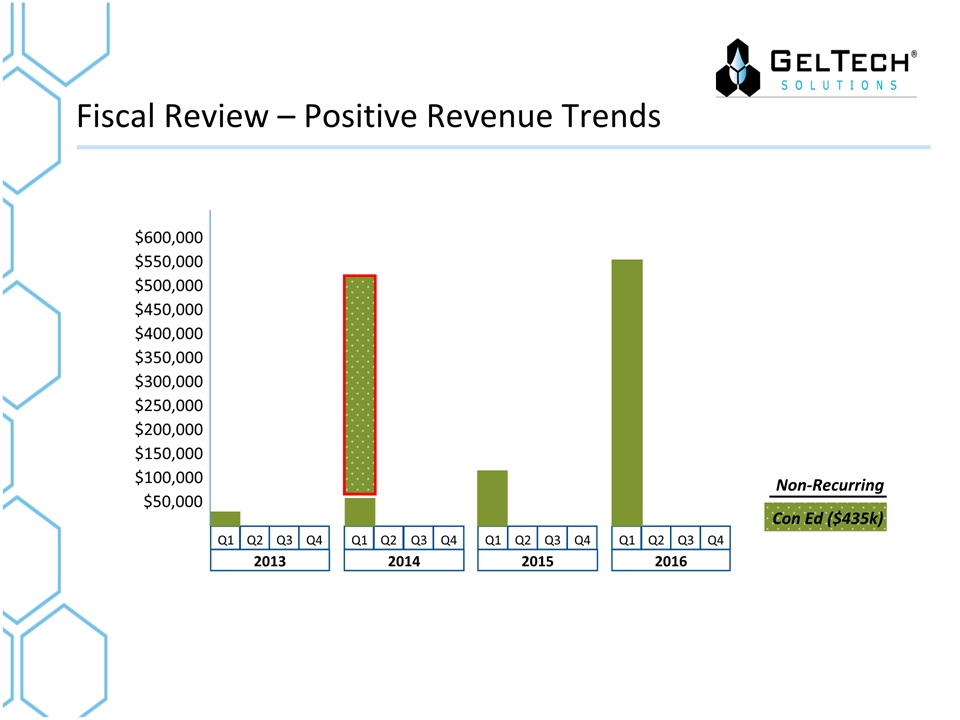

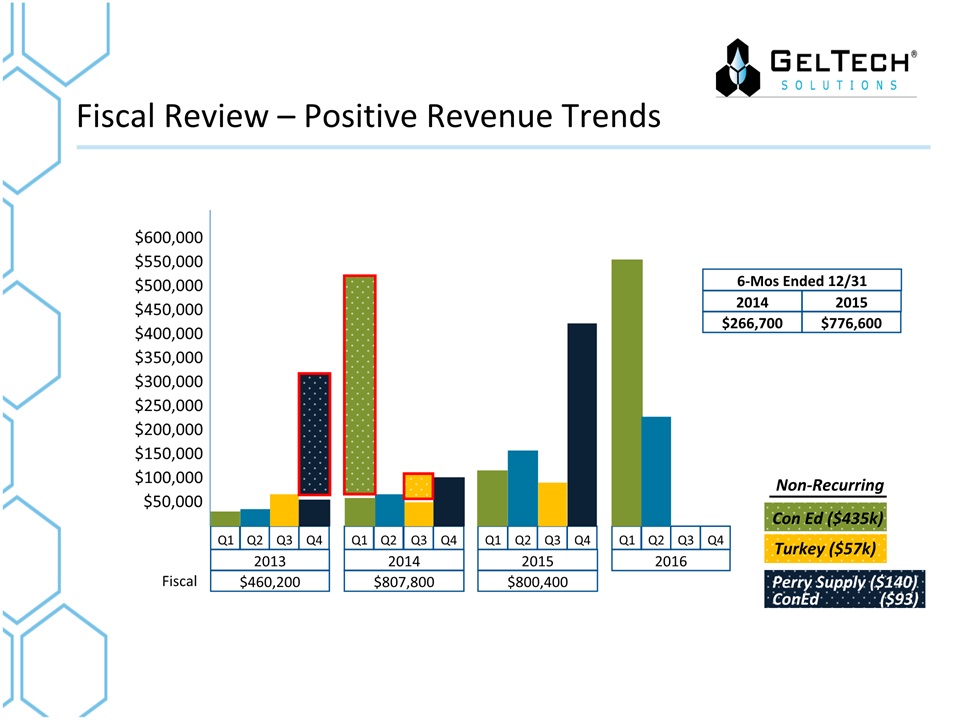

Fiscal Review – Positive Revenue Trends $600,000$550,000$500,000$450,000$400,000$350,000$300,000$250,000$200,000$150,000$100,000$50,000 2013 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2014 2015 Q1 Q2 Q3 Q4 2016 Con Ed ($435k) Non-Recurring

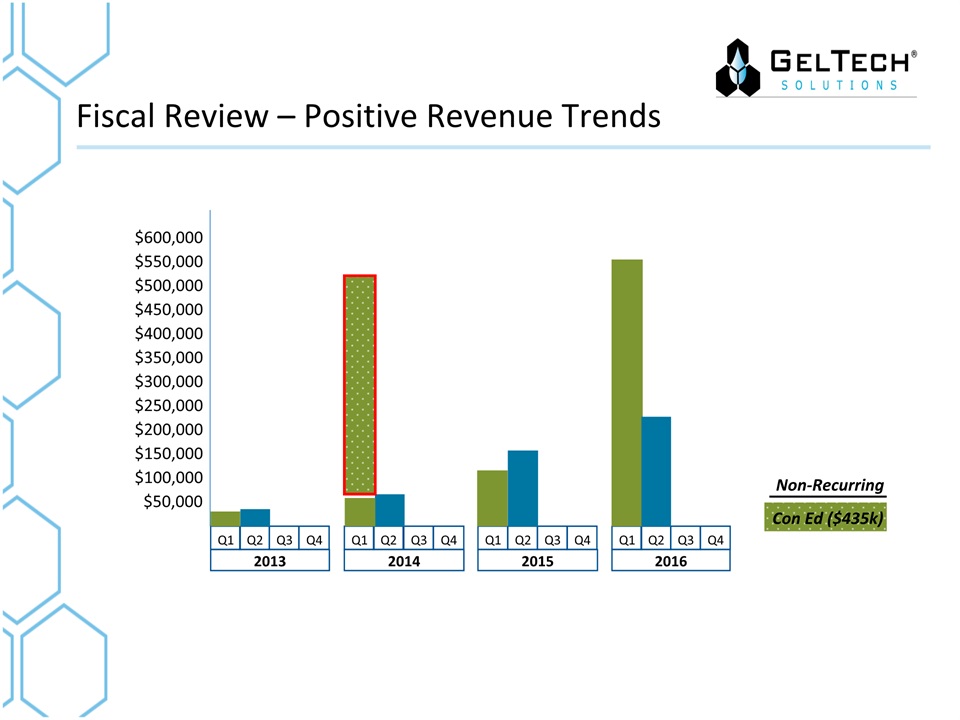

Fiscal Review – Positive Revenue Trends $600,000$550,000$500,000$450,000$400,000$350,000$300,000$250,000$200,000$150,000$100,000$50,000 2013 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2014 2015 Q1 Q2 Q3 Q4 2016 Con Ed ($435k) Non-Recurring

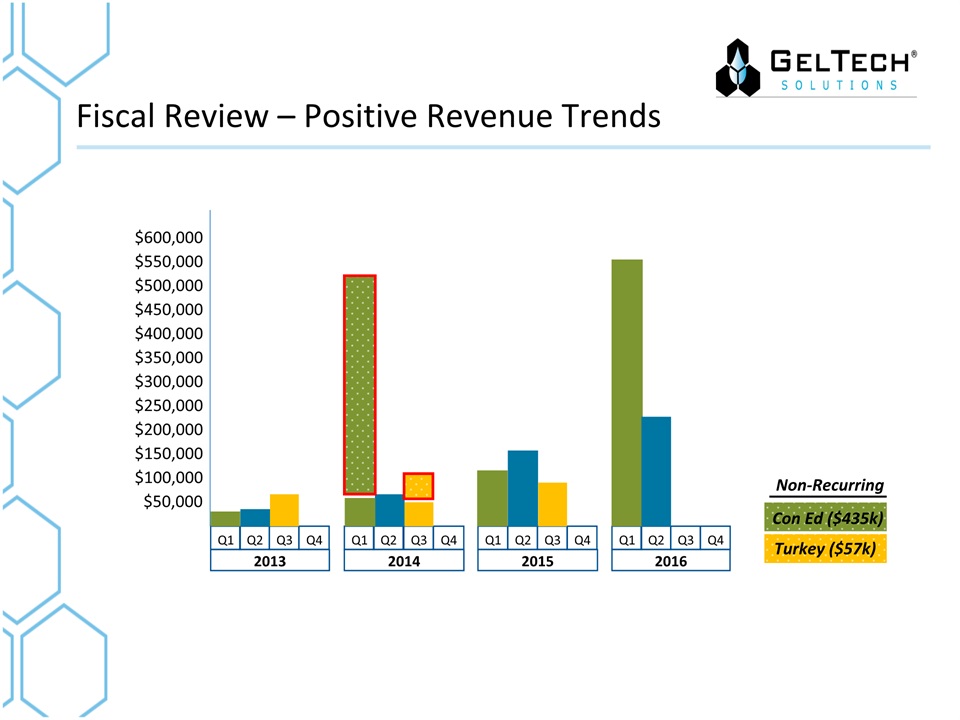

Fiscal Review – Positive Revenue Trends $600,000$550,000$500,000$450,000$400,000$350,000$300,000$250,000$200,000$150,000$100,000$50,000 2013 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2014 2015 Q1 Q2 Q3 Q4 2016 Turkey ($57k) Con Ed ($435k) Non-Recurring

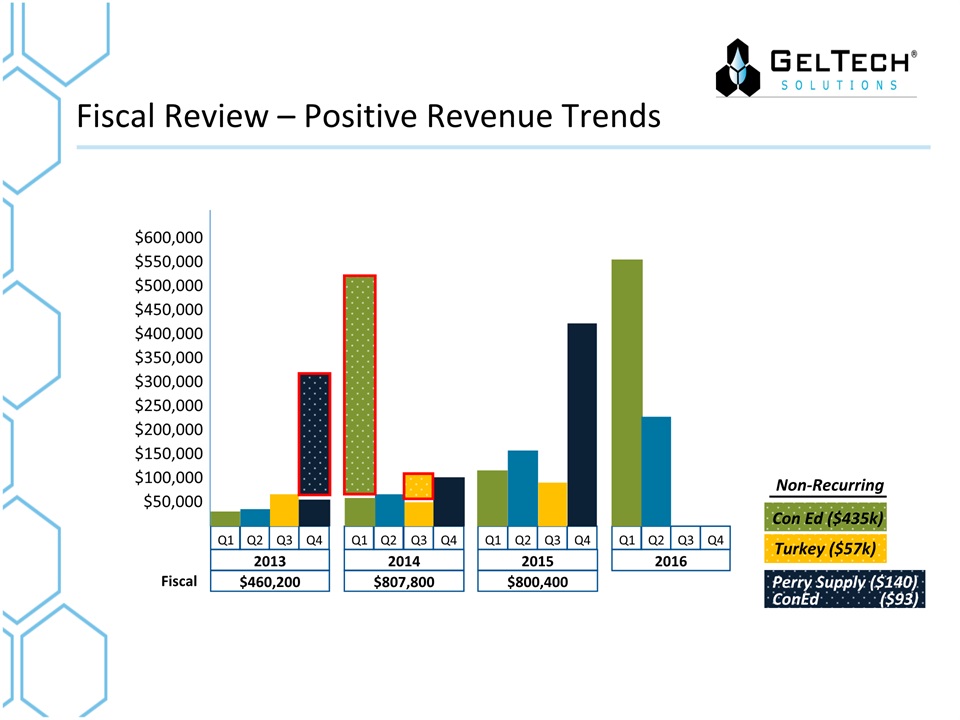

Fiscal Review – Positive Revenue Trends $600,000$550,000$500,000$450,000$400,000$350,000$300,000$250,000$200,000$150,000$100,000$50,000 2013 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2014 2015 Q1 Q2 Q3 Q4 2016 $460,200 $807,800 $800,400 Fiscal Perry Supply ($140)ConEd ($93) Con Ed ($435k) Turkey ($57k) Non-Recurring

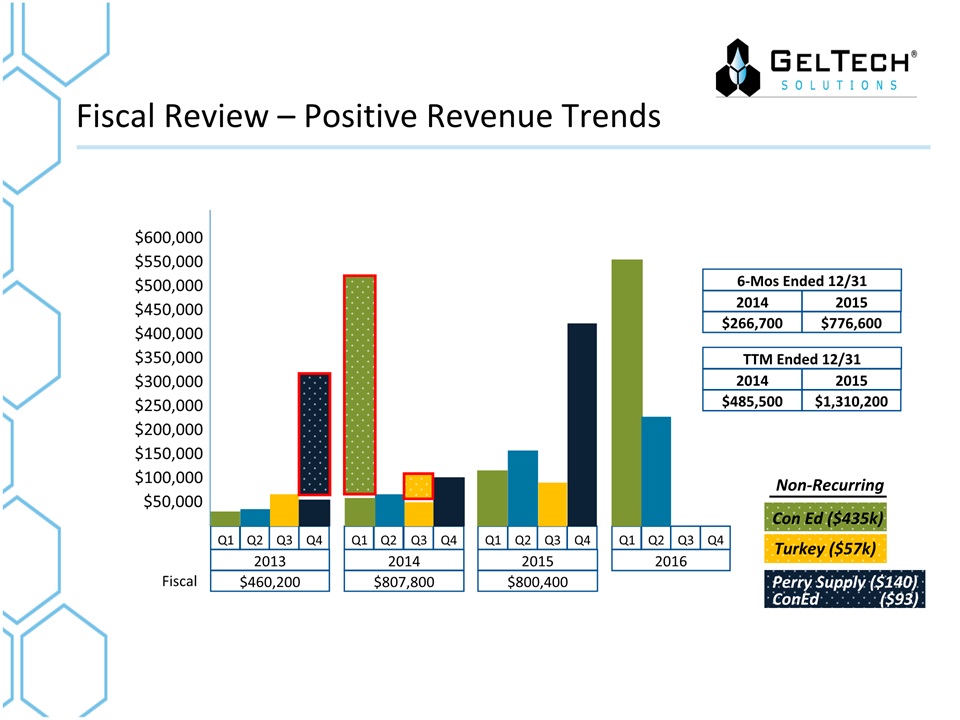

$600,000$550,000$500,000$450,000$400,000$350,000$300,000$250,000$200,000$150,000$100,000$50,000 2013 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2014 2015 $460,200 $807,800 $800,400 Q1 Q2 Q3 Q4 2016 Fiscal 6-Mos Ended 12/31 $266,700 $776,600 2014 2015 Perry Supply ($140)ConEd ($93) Con Ed ($435k) Turkey ($57k) Non-Recurring Fiscal Review – Positive Revenue Trends

$600,000$550,000$500,000$450,000$400,000$350,000$300,000$250,000$200,000$150,000$100,000$50,000 2013 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2014 2015 $460,200 $807,800 $800,400 Q1 Q2 Q3 Q4 2016 Fiscal 6-Mos Ended 12/31 $266,700 $776,600 2014 2015 TTM Ended 12/31 $485,500 $1,310,200 2014 2015 Perry Supply ($140)ConEd ($93) Con Ed ($435k) Turkey ($57k) Non-Recurring Fiscal Review – Positive Revenue Trends

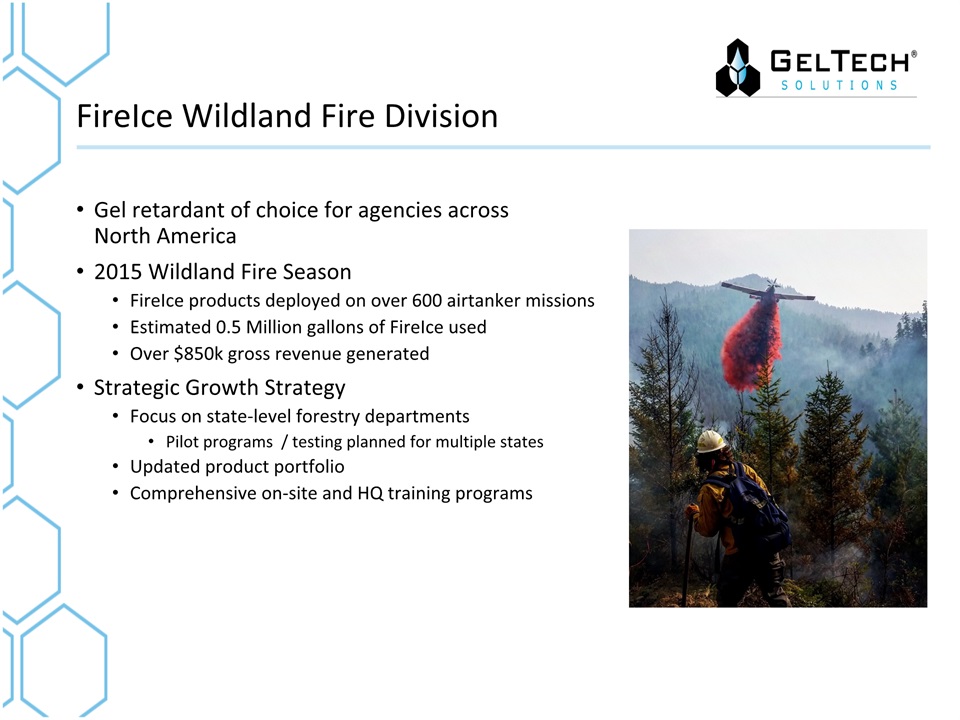

FireIce Wildland Division

FireIce Wildland Fire Division Gel retardant of choice for agencies across North America2015 Wildland Fire SeasonFireIce products deployed on over 600 airtanker missions Estimated 0.5 Million gallons of FireIce usedOver $850k gross revenue generatedStrategic Growth StrategyFocus on state-level forestry departmentsPilot programs / testing planned for multiple statesUpdated product portfolioComprehensive on-site and HQ training programs

Wildland Fire: Industry Adoption OverallAt least 12 wildland fire agencies using FireIce products during 2016 seasonThere are significant growth opportunities for revenue, even within existing customersState AgenciesLeveraging existing, formal agreements between states to develop synergies for the agencies Provincial Agencies (CAN)Working with a number of other agencies to utilize scooper and ground loaded airtankersFederal AgenciesFireIce was used by several federal agencies in airtankers and ground enginesMajor demonstration of FireIce to the US Forest Service completed in late 2014InternationalClosely working with distributor in AustraliaDeveloping tactical strategy for Europe

Wildland Fire: Operations Seasonal industry with extremely short delivery timeframesSufficient inventory required for high demand periodsHighly specialized third-party blenders contracted for manufacturingNetwork of low-cost warehousesstrategically located throughoutNorth AmericaJupiter, FLAtlanta, GAPhiladelphia, PASt. Louis, MOVancouver, WAPhoenix, AZ

Wildland Fire: Strategic Partnerships Formal and informal relationships with strategic partners in the industryUtilize existing economies of scale and industry expertise Airtanker vendorsDesign & engineering firmsBlending facilitiesWarehouse facilities

FireIce Agriculture / Biomass Market New Market 2015$73k RevenueFireIce for suppression and inventory protectionCalifornia Agriculture MarketAlmond Hulls / Hay / TimberBio-Mass MarketSecured first significant sale to a major biomass plant in IowaAddressing a new market; limited existing competition

FireIce: Growth as a Brand FireIce Original – an outstanding product with an endless supply of opportunityDeveloping new, groundbreaking and propriety productsGoal #1: To develop the next generation of our existing productsGoal #2: To develop a pipeline of products that augment the current portfolio Customer Centric vs. Product CentricProducts will satisfy market demand and gaps for current and future customers

FireIce: Growth as a Brand FireIce Wildland FireIce Shield FireIce Extinguishers FireIce High Visibility Orange (HVO-F) FireIce Shield – First Responders FireIce UL Approved Class - A FireIce High Visibility Blue (HVB-F) FireIce Shield – Welding & Cutting New Product in Pipeline 2 New Products in Pipeline FireIce Shield CTP FireIce Brand

Soil2O: Market Overview Strategic focusWhite Cap / HD Supply primary distributor West CoastMunicipalities for dust control - maintenanceAgriculture / farming dust control

Municipal Police/Fire/EMS FireIce Solutions First three months of operations: Over twenty fire, police, hazmat and other municipalities $500,000 commitmentBoston Fire Department Lunenberg Fire Department St. Anselm CollegeDublin Fire Department Manchester Fire Department Stoddard Fire DepartmentDublin School Massachusetts Department of Transportation Stow Fire DepartmentGoffstown Fire Department Medway Police Department Sudbury Fire DepartmentLincoln Fire Department Rumney Fire Department Town of RindgeLittleton Fire Department Raynham Fire Department Westford Fire DepartmentLittleton Power and Light Norfolk Police Department Wright Patterson Air Force Base Paxton Fire DepartmentUnexpected opportunities: Colleges UL-rated FireIce fire extinguishers; Eductor systems for enginesOver 500 FireIce fire extinguishers delivered thus far; another 500 units ordered

New Products / Research & Development FireIce Shield Subsurface Vault Containment UnitFireIce Shield CTP SystemFireIce Shield Cutting & WeldingLi-ion Battery Suppression/Hazmat ShippingLarge Industrial Client Opportunity

For More Information Product Specs Press Releases Management Product Videos

For More Information Mr. Michael Porter7 Pennsylvania PlazaNew York, NY 10001Phone: (212) 564-4700mike@plrinvest.com

For More Information Introduction to GelTech SolutionsShareholders LetterRecent Press ReleasesProduct Sell SheetsProduct Videos

2016 Annual Shareholders Meeting Q&A

2016 Annual Shareholders Meeting Thank You for Your Support