Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STAAR SURGICAL CO | v428726_8k.htm |

Exhibit 99.1

Investor Update January 11 & 12, 2016 1 NASDAQ : STAA

All statements in this presentation that are not statements of historical fact are forward - looking statements, including statements about any of the following: any projections of earnings, revenue, sales, profit margins, cash, effective tax rate or any other financial items; the plans, strategies, an d o bjectives of management for future operations or prospects for achieving such plans; statements regarding new, existing, or improved products, including but not limited to, expectations for success of new, existing, or improved products in the U.S. or international markets or government approval of new or improved products (including the Tori c I CL in the U.S.); the nature, timing and likelihood of resolving issues cited in the FDA’s 2014 Warning Letter or 2015 FDA Form 483; future economic conditions or size of market opportunities; expected costs of quality system or FDA remediation; statements of belief, including as to achieving 2015 plans; expected regulatory activities and approvals, product launches, and any statements of assumptions underlying any of the foregoing. Important additional factors that could cause actual results to d iff er materially from those indicated by such forward - looking statements are set forth in the company’s Annual Report on Form 10 - K for the year ended January 2 , 2015 under the caption “Risk Factors,” which is on file with the Securities and Exchange Commission and available in the “Investor Information” section of the company’s website unde r t he heading “SEC Filings .” These statements are based on expectations and assumptions as of the date of this presentation and are subject to numerous risks and uncertainties, which could cause actual results to differ materially from those described in the forward - looking statements. The risks and uncertainties include the following : our limited capital resources and limited access to financing; the negative effect of unstable global economic conditions on sales of products, especially products suc h a s the ICL used in non - reimbursed elective procedures; the challenge of managing our foreign subsidiaries; backlog or supply delays as we fully integrate our manufactur ing facility consolidation; the risk of unfavorable changes in currency exchange rates; the discretion of regulatory agencies to approve or reject new, existing or improved products, or to require additional actions before approval (including but not limited to FDA requirements regarding the TICL and/or actions related to the 2014 FDA Warning Letter or 2015 FDA Form 483); the risk that research and development efforts will not be successful or may be delayed in delivering products for launch; the purchasing patterns distributors carrying inventory in the market; the willingness of surgeons and patients to adopt a new or improved product and procedure; patterns of Visian ICL use th at have typically limited our penetration of the refractive procedure market, negative media coverage in different regions regarding refractive procedures, and a general decline in the demand for refractive surgery particularly in the U.S. and the Asia Pacific region, which STAAR believes has resulted from both concerns about the safety a nd effectiveness of laser procedures and current economic conditions. The Visian Toric ICL and the Visian ICL with CentraFLOW are not yet approved for sale in the United Sta tes . In addition, to supplement the GAAP numbers, this presentation includes supplemental non - GAAP financial information, which STAAR believes investors will find helpful in understanding its operating performance. “Adjusted Net Income” excludes the following items that are included in “Net Income (L oss)” as calculated in accordance with U.S. generally accepted accounting principles (“GAAP”): manufacturing consolidation expenses, gain or loss on foreign currency transactions , stock - based compensation expenses and FDA panel and remediation expenses. A table reconciling the GAAP information to the non - GAAP information is included in our financial release which can b e found in our Form 8 - K filed on October 28, 2015 and also available on our website . 2 FORWARD - LOOKING STATEMENTS

STAAR® SURGICAL IS… 3 … a Leading Developer, Manufacturer and Marketer of Premium Implantable L enses for Refractive V ision Correction • Implantable Collamer® Lens or “ ICL”™ - A Premium R efractive P rocedure Delivering Visual Freedom to the Patient - > 550,000 Visian® ICLs I mplanted 70% Q3 YTD 2015 Lenses

STAAR SURGICAL IS… 4 … a Developer, Manufacturer and Marketer of Premium Implantable L enses for Cataract L ens Replacement (Assessing Strategy in 2016) • Intraocular L ens (IOL) - U sed to Replace the Natural L ens after Cataract S urgery 30% Q3 YTD 2015 Lenses

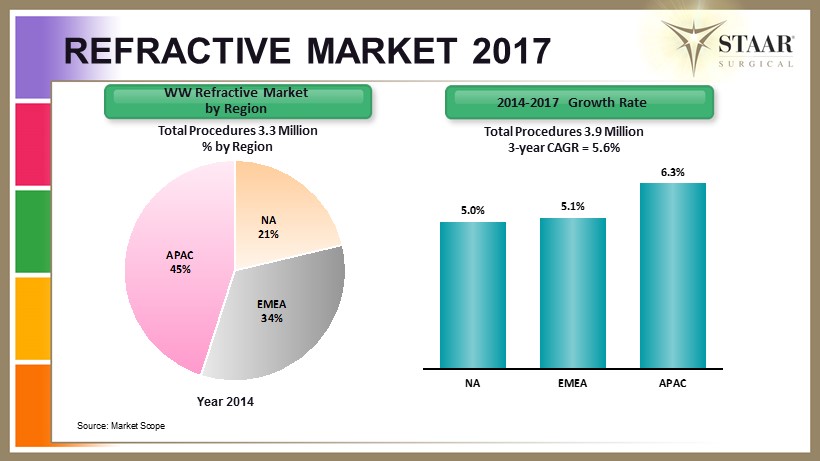

Year 2014 Source: Market Scope Total Procedures 3.3 Million % by Region WW Refractive Market by Region 2014 - 2017 Growth Rate Total Procedures 3.9 Million 3 - year CAGR = 5.6% REFRACTIVE MARKET 2017 NA 21% EMEA 34% APAC 45% 5.0% 5.1% 6.3% NA EMEA APAC

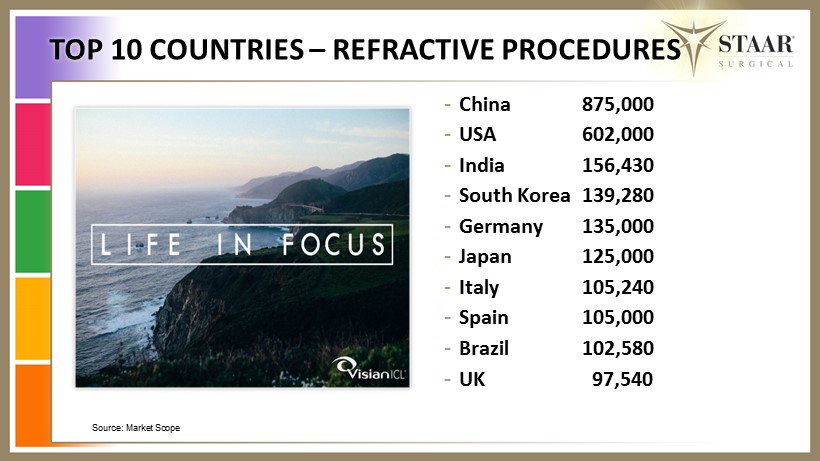

TOP 10 COUNTRIES – REFRACTIVE PROCEDURES - China 875,000 - USA 602,000 - India 156,430 - South Korea 139,280 - Germany 135,000 - Japan 125,000 - Italy 105,240 - Spain 105,000 - Brazil 102,580 - UK 97,540 Source: Market Scope

• Focused on Lenses Inserted into the Eye and Delivery Systems Therefor • Two Large Market Opportunities • Rapid Cadence of New ICL and IOL Products - Focus on Top 12 Markets for ICLs - Selective approach with IOLs in 8 main markets based on market opportunity for premium prices and STAAR business structure 7 STAAR APPROACH TO THE MARKET • Focused on Lenses Inserted into the Eye with Companion Delivery Systems Delighting Surgeons and Their Patients… the premium and primary choice • Three Large Vision Enhancement Market Opportunities • Build and Brand the Visual Freedom Market - Focus and Effectively Target All Global Markets for ICLs… apply surgeon and patient choice paradigm - Treat Cataract Care Lens Development (IOL) as a Required Vision Choice and Determine Best Approach to Market… with d istinct a dvantages and affordability 2014 Now

• Increasing IP Position with New Technologies • Provide sufficient clinical data to HCPs that supports STAAR products • Increasing emphasis on growing the consumer demand for ICLs; expand to presbyopic patients for V6 models • Selective adjustments to business structure based on market opportunity and distributor performance 8 STAAR APPROACH TO THE MARKET • Materially Strengthen and Expand IP Patent Estate, Continually Secure Trade Secrets • Build Global Clinical Validation, Clinical Utility and Patient Registries as Best in Class • Become a Consumer Facing Company Highlighting the Patient Experience by Patients and for Surgeons… Focus on Visual Freedom for all Ages • Aggressively Develop Global Go - to - Market to Include Direct, Distributor, Centers of Excellence and Corporate Account Partnerships 2014 Now

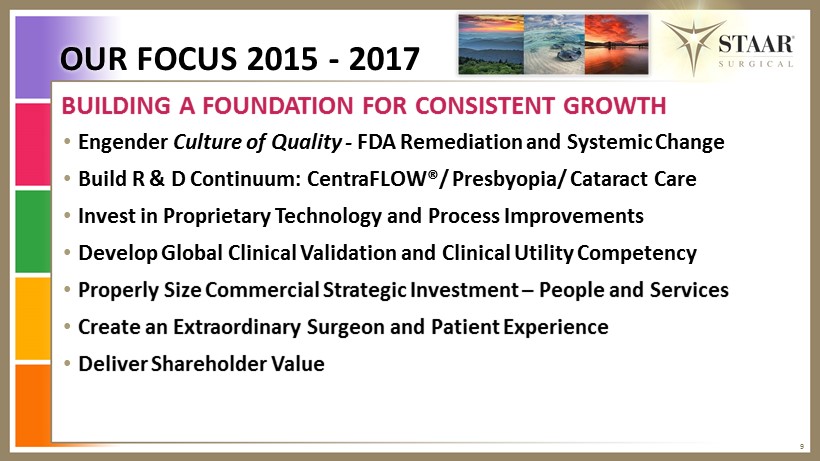

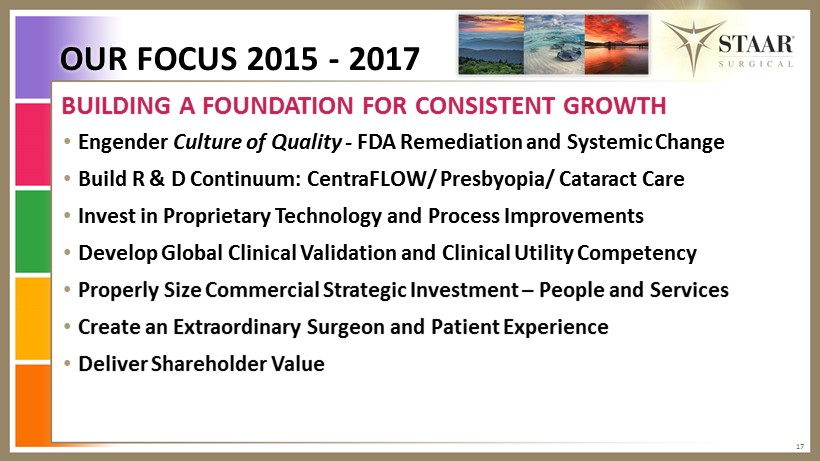

• Engender Culture of Quality - FDA Remediation and Systemic Change • Build R & D Continuum: CentraFLOW®/ Presbyopia/ Cataract Care • Invest in Proprietary Technology and Process Improvements • Develop Global Clinical Validation and Clinical Utility Competency • Properly Size Commercial Strategic Investment – People and Services • Create an Extraordinary Surgeon and Patient Experience • Deliver Shareholder Value 9 BUILDING A FOUNDATION FOR CONSISTENT GROWTH OUR FOCUS 2015 - 2017

10 2016: Continuing Growth & Investment Growth of the ICL : Expected Double Digit Unit Growth and Expanding Gross Margins Continuing Investment: 2016 Another Investment Year for STAAR - Phase 2 of 3 Year Plan • FDA Remediation and Continuation of Quality System Overhaul : $3M • Create the Visual Freedom Consumer Market for Implantable Lenses : $2M • Rebranding of STAAR and ICL • Close Large Blocks of Corporate Accounts Business - Agreements Signed 1/1/2016 : • Aier Eye Hospital Group, China (60 hospitals with expansion plans to reach 200 hospitals by 2020) • Memira Eye Clinics, Sweden (49 clinics – largest eye surgery group in Scandinavia)

11 2016: Continuing Growth & Investment Growth of the ICL : Expected Double Digit Unit Growth and Expanding Gross Margins Continuing Investment: 2016 Another Investment Year for STAAR – Phase 2 of 3 Year Plan • Establish Centers of Excellence : New Training by and Recognition of World’s Best ICL Surgeons • Begin Clinical Validation – Regulatory Rebirth : Rigorous Clinical Trials with Compelling Data – Retrospective Data on 200,000 CentraFLOW ICL Lenses Implanted Supports Clinical Efficacy and Safety • Innovate and Develop Products, Delivery Systems, Materials : Presbyopic ICL, Next Generation ICL and Delivery Systems, New Collamer® • Continue Infrastructure and Systems Renovation : $4M

12 Selling Implantable Lenses as a Procedure for LASIK Rejects… 10% of the Eyes STAAR SURGICAL WAS… 2014

13 Creating the Visual Freedom Market for Implantable Lenses “ICL” STAAR SURGICAL IS … 2016

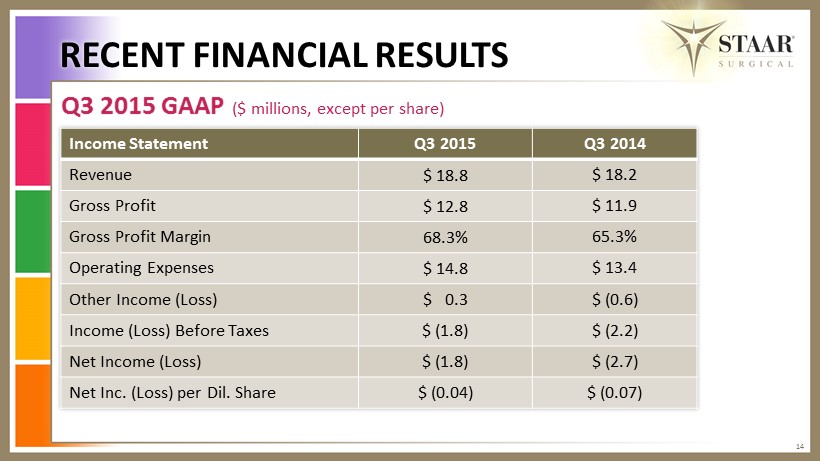

Q3 2015 GAAP ($ millions, except per share) RECENT FINANCIAL RESULTS 14 Income Statement Q3 2015 Q3 2014 Revenue $ 18.8 $ 18.2 Gross Profit $ 12.8 $ 11.9 Gross Profit Margin 68.3% 65.3% Operating Expenses $ 14.8 $ 13.4 Other Income (Loss) $ 0.3 $ (0.6) Income (Loss) Before Taxes $ (1.8) $ (2.2) Net Income (Loss) $ ( 1.8) $ (2.7) Net Inc. (Loss) per Dil. Share $ (0.04) $ (0.07)

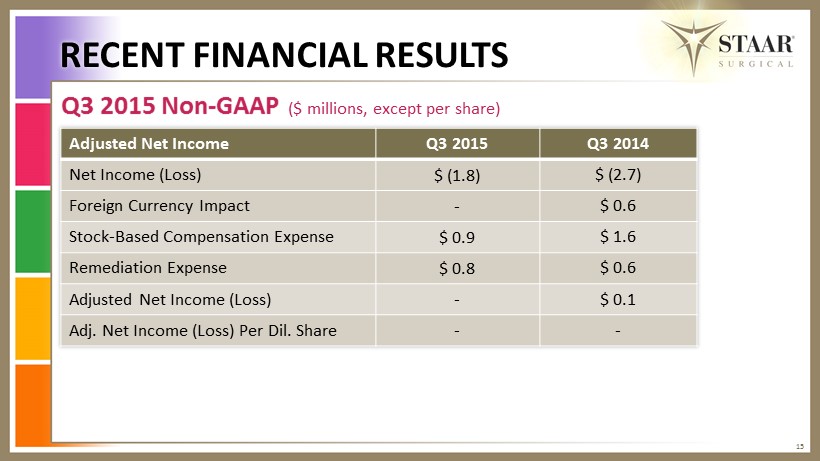

Q3 2015 Non - GAAP ($ millions, except per share) RECENT FINANCIAL RESULTS 15 Adjusted Net Income Q3 2015 Q3 2014 Net Income (Loss) $ (1.8) $ (2.7) Foreign Currency Impact - $ 0.6 Stock - Based Compensation Expense $ 0.9 $ 1.6 Remediation Expense $ 0.8 $ 0.6 Adjusted Net Income (Loss) - $ 0.1 Adj. Net Income (Loss) Per Dil. Share - -

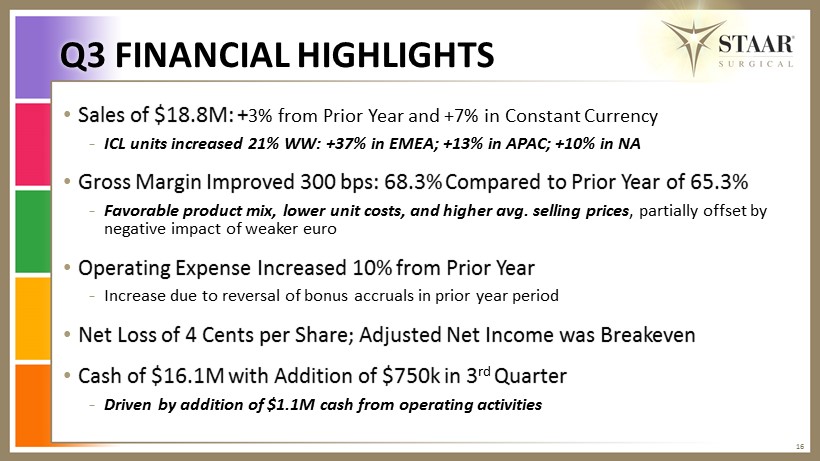

Q3 FINANCIAL HIGHLIGHTS 16 • Sales of $18.8M: + 3% from Prior Y ear and +7% in Constant C urrency - ICL units increased 21% WW: +37% in EMEA; +13% in APAC; +10% in NA • Gross Margin I mproved 300 bps: 68.3% C ompared to Prior Y ear of 65.3% - Favorable product mix, lower unit costs, and higher avg. selling prices , partially offset by negative impact of weaker euro • Operating Expense Increased 10% from Prior Y ear - Increase due to reversal of bonus accruals in prior year period • Net Loss of 4 C ents p er S hare; Adjusted Net Income was B reakeven • Cash of $16.1M with Addition of $750k in 3 rd Q uarter - Driven by addition of $1.1M cash from operating activities

• Engender Culture of Quality - FDA Remediation and Systemic Change • Build R & D Continuum: CentraFLOW/ Presbyopia/ Cataract Care • Invest in Proprietary Technology and Process Improvements • Develop Global Clinical Validation and Clinical Utility Competency • Properly Size Commercial Strategic Investment – People and Services • Create an Extraordinary Surgeon and Patient Experience • Deliver Shareholder Value 17 BUILDING A FOUNDATION FOR CONSISTENT GROWTH OUR FOCUS 2015 - 2017

Investor Update January 11 & 12, 2016 18 NASDAQ : STAA