Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Endo International plc | d118634d8k.htm |

Endo International plc 34th Annual J.P. Morgan Healthcare Conference January 11, 2016 ©2016 Endo Pharmaceuticals Inc. All rights reserved. Exhibit 99.1

Forward Looking Statements; Non-GAAP Financial Measures This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and Canadian securities legislation. Statements including words such as “believes,” “expects,” “anticipates,” “intends,” “estimates,” “plan,” “will,” “may,” “look forward,” “intend,” “guidance,” “future” or similar expressions are forward-looking statements. Because these statements reflect our current views, expectations and beliefs concerning future events, these forward-looking statements involve risks and uncertainties. Although Endo believes that these forward-looking statements and information are based upon reasonable assumptions and expectations, readers should not place undue reliance on them, or any other forward looking statements or information in this news release. Investors should note that many factors, as more fully described in the documents filed by Endo with securities regulators in the United States and Canada including under the caption “Risk Factors” in Endo’s Form 10-K, Form 10-Q and Form 8-K filings, as applicable, with the Securities and Exchange Commission and with securities regulators in Canada on System for Electronic Document Analysis and Retrieval (“SEDAR”) and as otherwise enumerated herein or therein, could affect Endo’s future financial results and could cause Endo’s actual results to differ materially from those expressed in any forward-looking statements. The forward-looking statements in this presentation are qualified by these risk factors. Endo assumes no obligation to publicly update any forward-looking statements, whether as a result of new information, future developments or otherwise, except as may be required under applicable securities law. This presentation may refer to non-GAAP financial measures, including adjusted diluted EPS, that are not prepared in accordance with accounting principles generally accepted in the United States and that may be different from non-GAAP financial measures used by other companies. Investors are encouraged to review Endo’s current report on Form 8-K furnished to the SEC for Endo’s reasons for including those non-GAAP financial measures in this presentation. ©2016 Endo Pharmaceuticals Inc. All rights reserved.

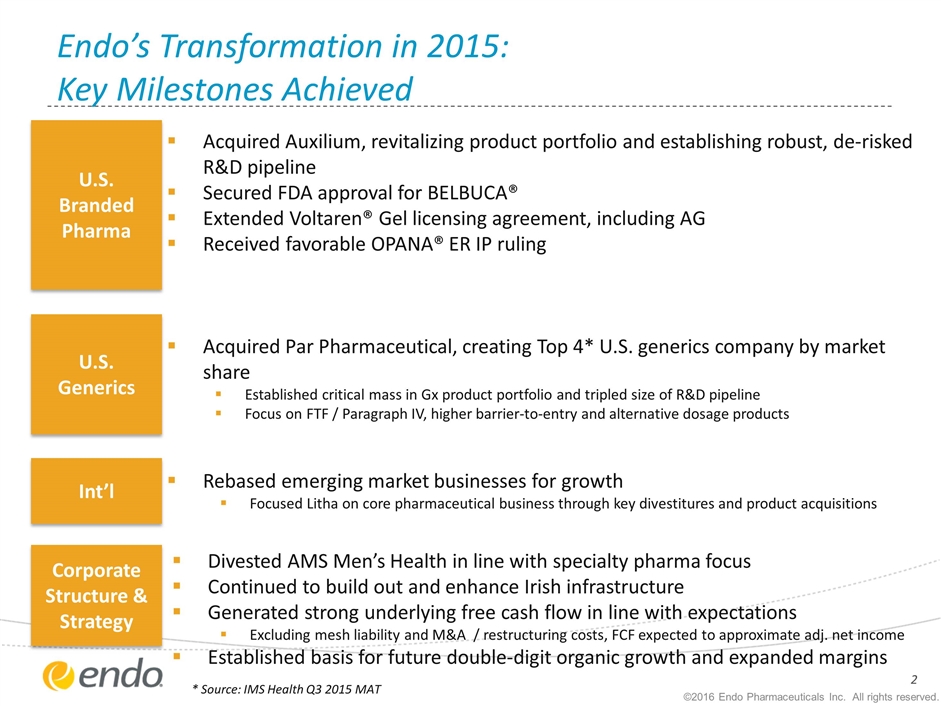

Acquired Auxilium, revitalizing product portfolio and establishing robust, de-risked R&D pipeline Secured FDA approval for BELBUCA® Extended Voltaren® Gel licensing agreement, including AG Received favorable OPANA® ER IP ruling Acquired Par Pharmaceutical, creating Top 4* U.S. generics company by market share Established critical mass in Gx product portfolio and tripled size of R&D pipeline Focus on FTF / Paragraph IV, higher barrier-to-entry and alternative dosage products Rebased emerging market businesses for growth Focused Litha on core pharmaceutical business through key divestitures and product acquisitions Divested AMS Men’s Health in line with specialty pharma focus Continued to build out and enhance Irish infrastructure Generated strong underlying free cash flow in line with expectations Excluding mesh liability and M&A / restructuring costs, FCF expected to approximate adj. net income Established basis for future double-digit organic growth and expanded margins Endo’s Transformation in 2015: Key Milestones Achieved Int’l U.S. Generics U.S. Branded Pharma Corporate Structure & Strategy * Source: IMS Health Q3 2015 MAT ©2016 Endo Pharmaceuticals Inc. All rights reserved.

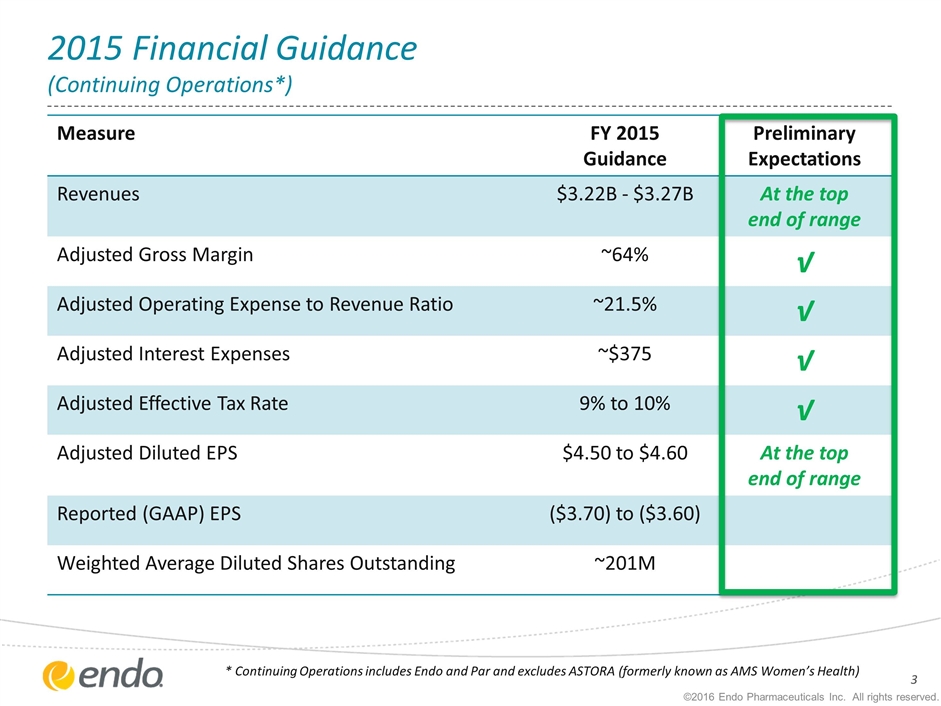

2015 Financial Guidance (Continuing Operations*) Measure FY 2015 Guidance Preliminary Expectations Revenues $3.22B - $3.27B At the top end of range Adjusted Gross Margin ~64% √ Adjusted Operating Expense to Revenue Ratio ~21.5% √ Adjusted Interest Expenses ~$375 √ Adjusted Effective Tax Rate 9% to 10% √ Adjusted Diluted EPS $4.50 to $4.60 At the top end of range Reported (GAAP) EPS ($3.70) to ($3.60) Weighted Average Diluted Shares Outstanding ~201M * Continuing Operations includes Endo and Par and excludes ASTORA (formerly known as AMS Women’s Health) ©2016 Endo Pharmaceuticals Inc. All rights reserved.

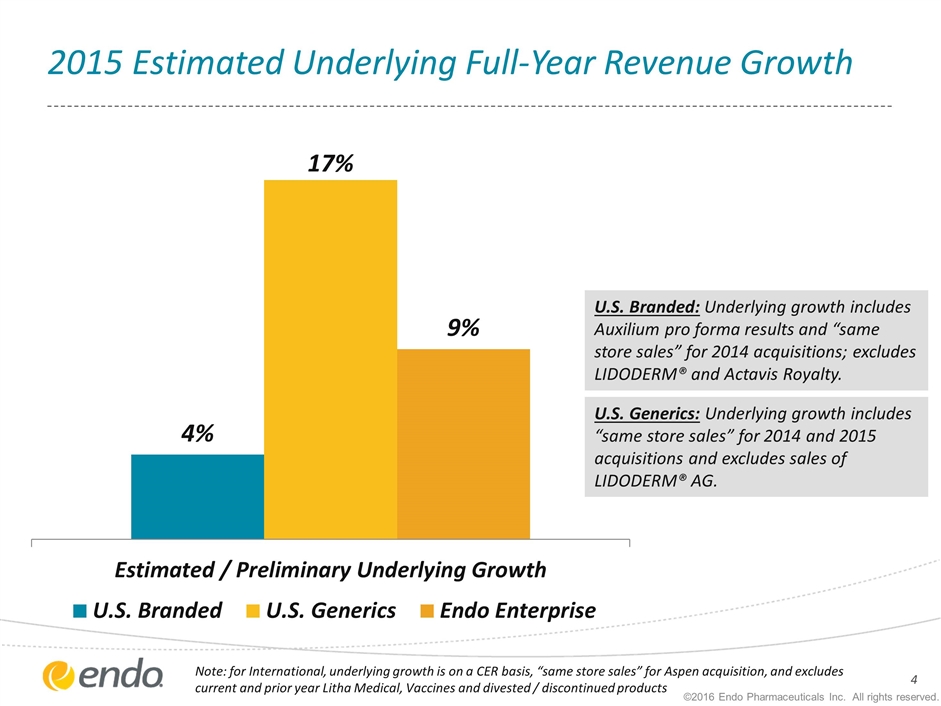

2015 Estimated Underlying Full-Year Revenue Growth U.S. Branded: Underlying growth includes Auxilium pro forma results and “same store sales” for 2014 acquisitions; excludes LIDODERM® and Actavis Royalty. U.S. Generics: Underlying growth includes “same store sales” for 2014 and 2015 acquisitions and excludes sales of LIDODERM® AG. ©2016 Endo Pharmaceuticals Inc. All rights reserved. Note: for International, underlying growth is on a CER basis, “same store sales” for Aspen acquisition, and excludes current and prior year Litha Medical, Vaccines and divested / discontinued products

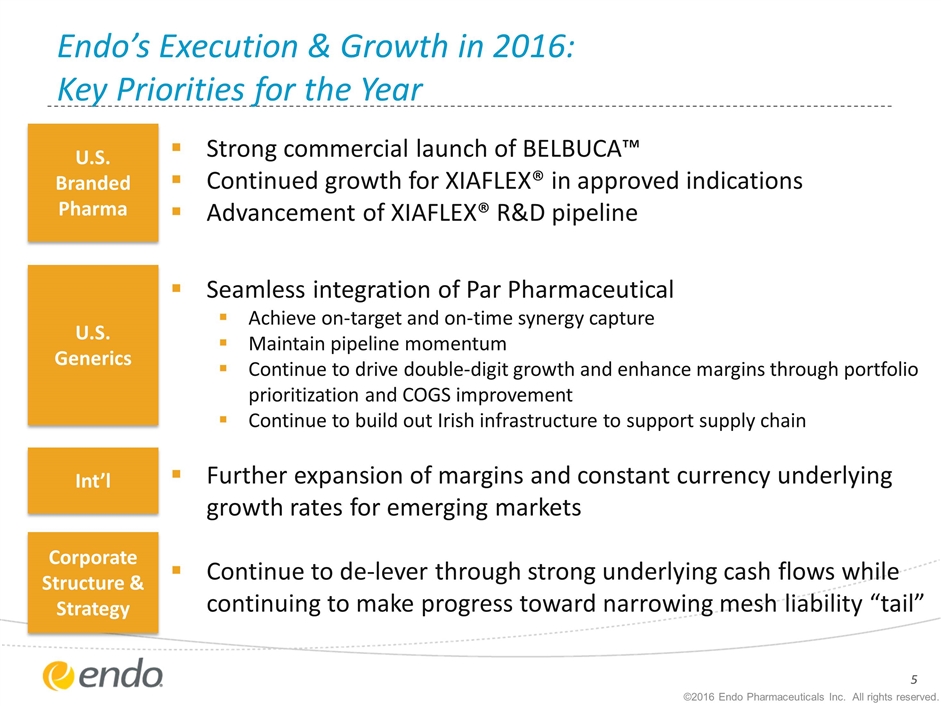

Strong commercial launch of BELBUCA™ Continued growth for XIAFLEX® in approved indications Advancement of XIAFLEX® R&D pipeline Seamless integration of Par Pharmaceutical Achieve on-target and on-time synergy capture Maintain pipeline momentum Continue to drive double-digit growth and enhance margins through portfolio prioritization and COGS improvement Continue to build out Irish infrastructure to support supply chain Further expansion of margins and constant currency underlying growth rates for emerging markets Continue to de-lever through strong underlying cash flows while continuing to make progress toward narrowing mesh liability “tail” Endo’s Execution & Growth in 2016: Key Priorities for the Year Int’l U.S. Generics U.S. Branded Pharma Corporate Structure & Strategy ©2016 Endo Pharmaceuticals Inc. All rights reserved.

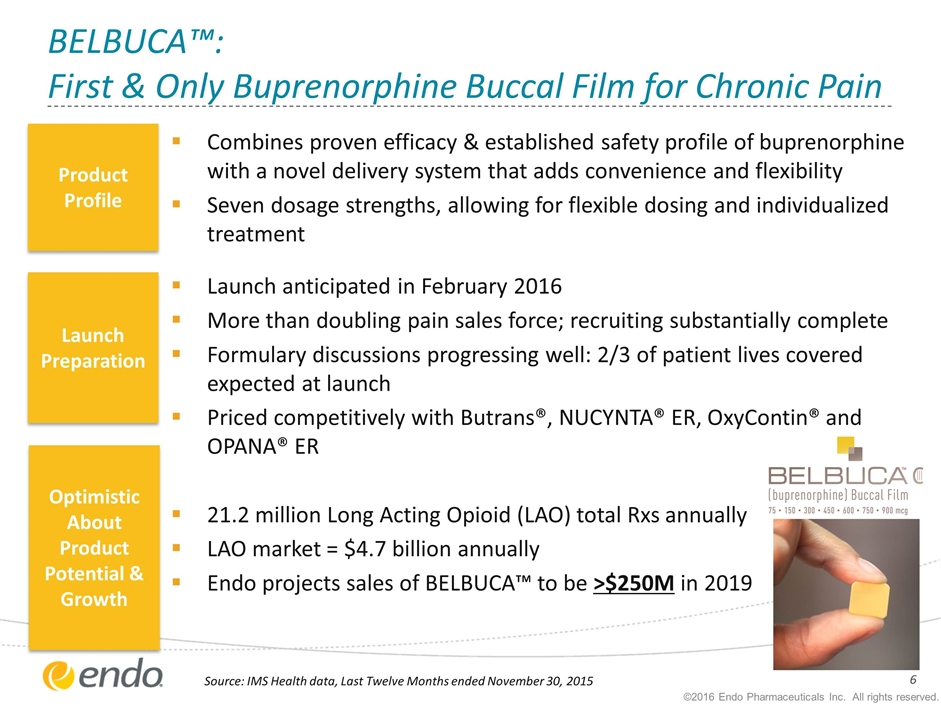

BELBUCA™: First & Only Buprenorphine Buccal Film for Chronic Pain Combines proven efficacy & established safety profile of buprenorphine with a novel delivery system that adds convenience and flexibility Seven dosage strengths, allowing for flexible dosing and individualized treatment Launch anticipated in February 2016 More than doubling pain sales force; recruiting substantially complete Formulary discussions progressing well: 2/3 of patient lives covered expected at launch Priced competitively with Butrans®, NUCYNTA® ER, OxyContin® and OPANA® ER 21.2 million Long Acting Opioid (LAO) total Rxs annually LAO market = $4.7 billion annually Endo projects sales of BELBUCA™ to be >$250M in 2019 Product Profile Launch Preparation Optimistic About Product Potential & Growth Source: IMS Health data, Last Twelve Months ended November 30, 2015 ©2016 Endo Pharmaceuticals Inc. All rights reserved.

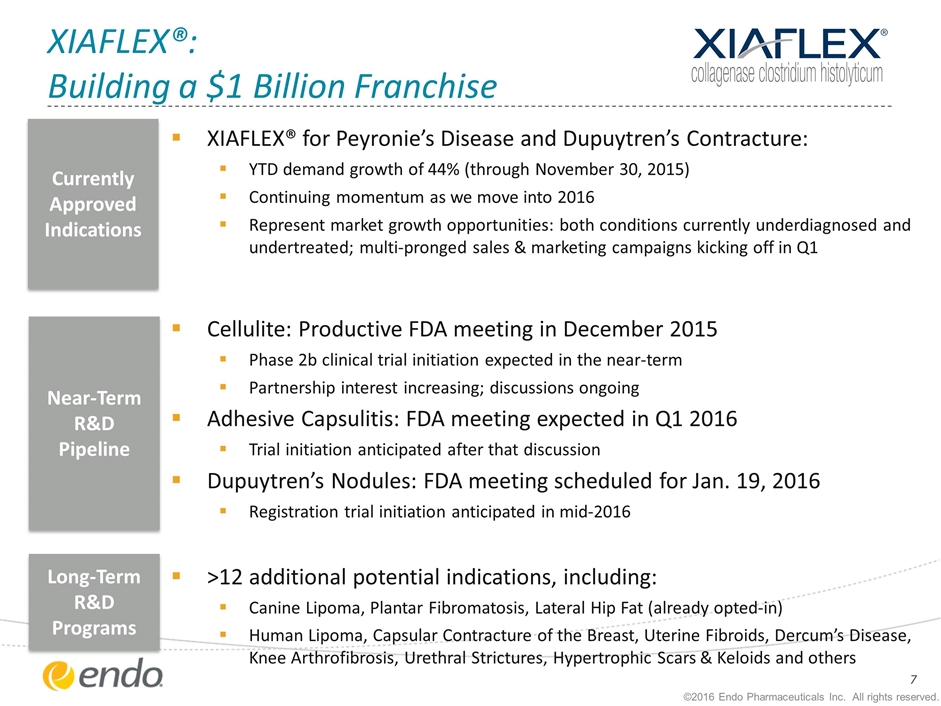

XIAFLEX®: Building a $1 Billion Franchise XIAFLEX® for Peyronie’s Disease and Dupuytren’s Contracture: YTD demand growth of 44% (through November 30, 2015) Continuing momentum as we move into 2016 Represent market growth opportunities: both conditions currently underdiagnosed and undertreated; multi-pronged sales & marketing campaigns kicking off in Q1 Cellulite: Productive FDA meeting in December 2015 Phase 2b clinical trial initiation expected in the near-term Partnership interest increasing; discussions ongoing Adhesive Capsulitis: FDA meeting expected in Q1 2016 Trial initiation anticipated after that discussion Dupuytren’s Nodules: FDA meeting scheduled for Jan. 19, 2016 Registration trial initiation anticipated in mid-2016 >12 additional potential indications, including: Canine Lipoma, Plantar Fibromatosis, Lateral Hip Fat (already opted-in) Human Lipoma, Capsular Contracture of the Breast, Uterine Fibroids, Dercum’s Disease, Knee Arthrofibrosis, Urethral Strictures, Hypertrophic Scars & Keloids and others Currently Approved Indications Near-Term R&D Pipeline Long-Term R&D Programs ©2016 Endo Pharmaceuticals Inc. All rights reserved.

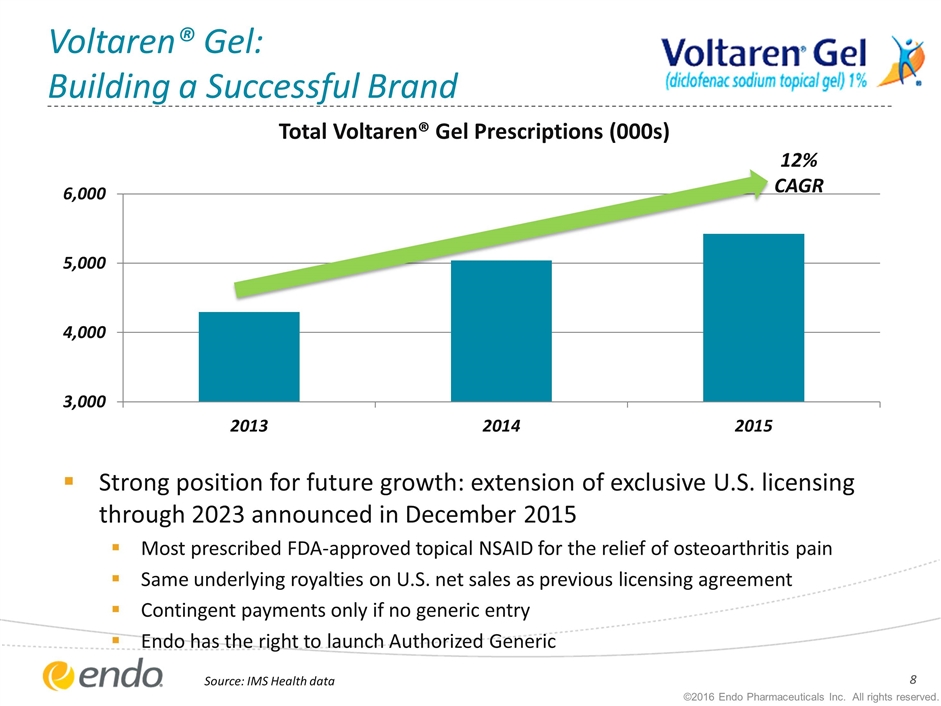

Voltaren® Gel: Building a Successful Brand Strong position for future growth: extension of exclusive U.S. licensing through 2023 announced in December 2015 Most prescribed FDA-approved topical NSAID for the relief of osteoarthritis pain Same underlying royalties on U.S. net sales as previous licensing agreement Contingent payments only if no generic entry Endo has the right to launch Authorized Generic Source: IMS Health data 12% CAGR ©2016 Endo Pharmaceuticals Inc. All rights reserved.

24% underlying growth 2015 YTD through Q3 Driven by volume and product mix Acquisition drove enhanced efficiency and corporate structure On track to achieve $175M in financial synergies Expanded portfolio, pipeline and manufacturing capabilities Projected double-digit underlying growth Revenue: double-digit CAGR for pro forma revenue in the near- to mid-term Ongoing pipeline & portfolio optimization process Durable pipeline fueling launches in 2016-2019 >110 launches expected, representing ~$30B in market value Includes 20 FTF opportunities Key First-to-File generic launches could include: Zetia®, Seroquel®, Afinitor®, Zytiga®, Ciprodex® and Kuvan® U.S. Generic Pharmaceuticals: Driving Organic Growth 2016 Outlook 2015 Progress & Milestones ©2016 Endo Pharmaceuticals Inc. All rights reserved.

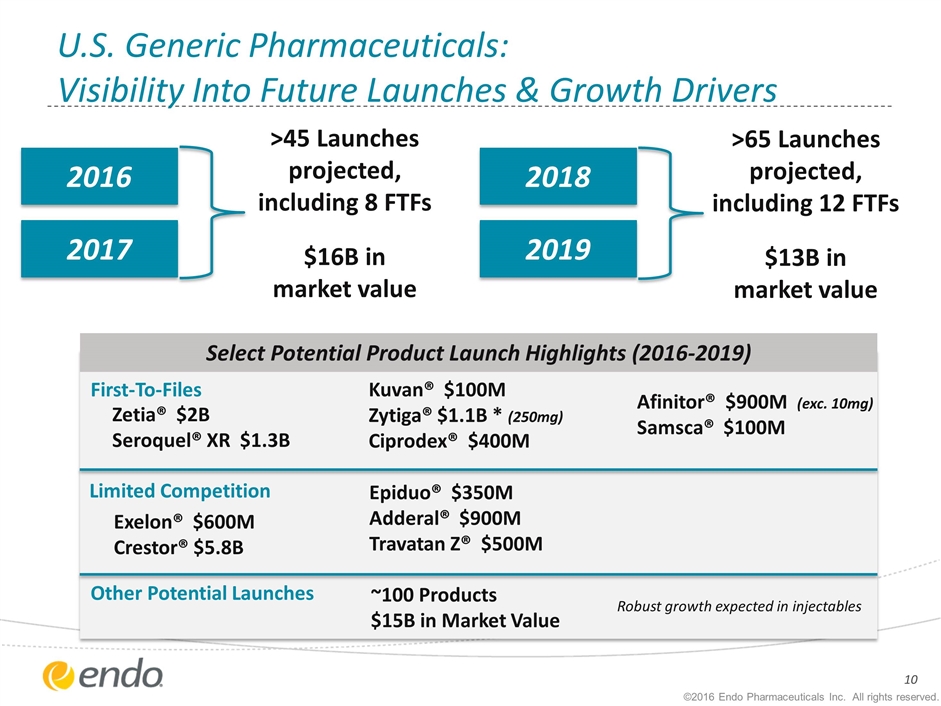

U.S. Generic Pharmaceuticals: Visibility Into Future Launches & Growth Drivers 2016 2017 2018 2019 >45 Launches projected, including 8 FTFs $16B in market value >65 Launches projected, including 12 FTFs $13B in market value Select Potential Product Launch Highlights (2016-2019) First-To-Files Limited Competition Zetia® $2B Seroquel® XR $1.3B Exelon® $600M Crestor® $5.8B Kuvan® $100M Zytiga® $1.1B * (250mg) Ciprodex® $400M Epiduo® $350M Adderal® $900M Travatan Z® $500M Afinitor® $900M (exc. 10mg) Samsca® $100M Other Potential Launches ~100 Products $15B in Market Value Robust growth expected in injectables ©2016 Endo Pharmaceuticals Inc. All rights reserved.

International Pharmaceuticals: Transforming Emerging Markets, Accelerating Growth Projecting substantially improved adjusted operating margins High single-digit underlying revenue growth expected in 2016 Transformed into a core pharmaceuticals business Acquisition of product portfolio from Aspen closed in Q3 2015 bringing 60 new products and 70 R&D programs Divestiture of device, vaccine and additional non-core, low-margin product lines expected to close in early 2016 Projecting substantially improved adjusted operating margins Double-digit underlying revenue growth expected in 2016 ©2016 Endo Pharmaceuticals Inc. All rights reserved.

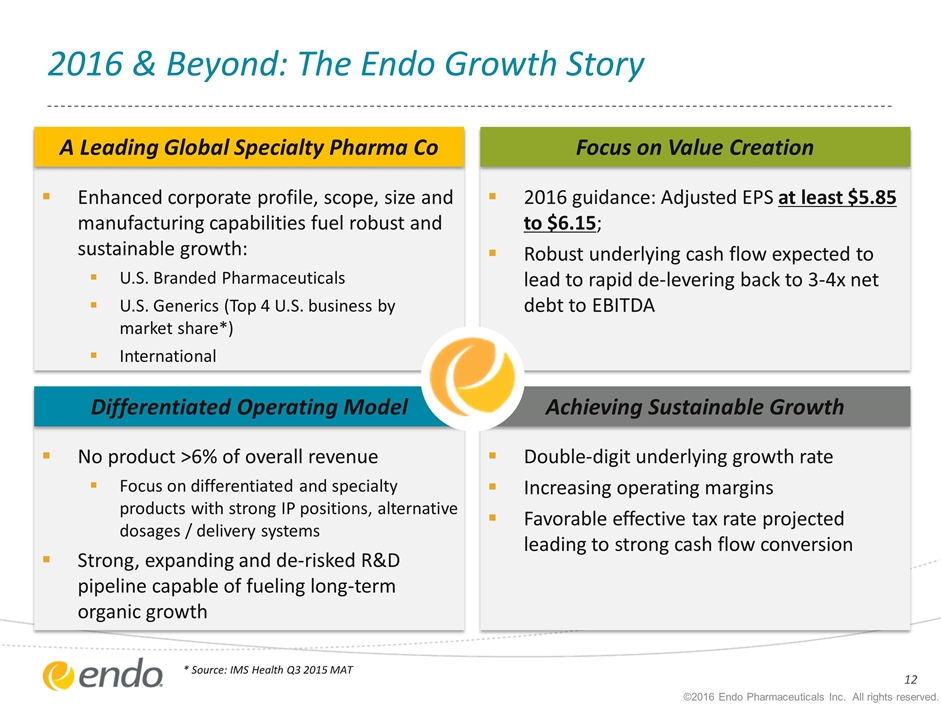

2016 & Beyond: The Endo Growth Story * Source: IMS Health Q3 2015 MAT Achieving Sustainable Growth A Leading Global Specialty Pharma Co Differentiated Operating Model Focus on Value Creation Enhanced corporate profile, scope, size and manufacturing capabilities fuel robust and sustainable growth: U.S. Branded Pharmaceuticals U.S. Generics (Top 4 U.S. business by market share*) International Double-digit underlying growth rate Increasing operating margins Favorable effective tax rate projected leading to strong cash flow conversion No product >6% of overall revenue Focus on differentiated and specialty products with strong IP positions, alternative dosages / delivery systems Strong, expanding and de-risked R&D pipeline capable of fueling long-term organic growth 2016 guidance: Adjusted EPS at least $5.85 to $6.15; Robust underlying cash flow expected to lead to rapid de-levering back to 3-4x net debt to EBITDA ©2016 Endo Pharmaceuticals Inc. All rights reserved.

Appendix ©2016 Endo Pharmaceuticals Inc. All rights reserved.

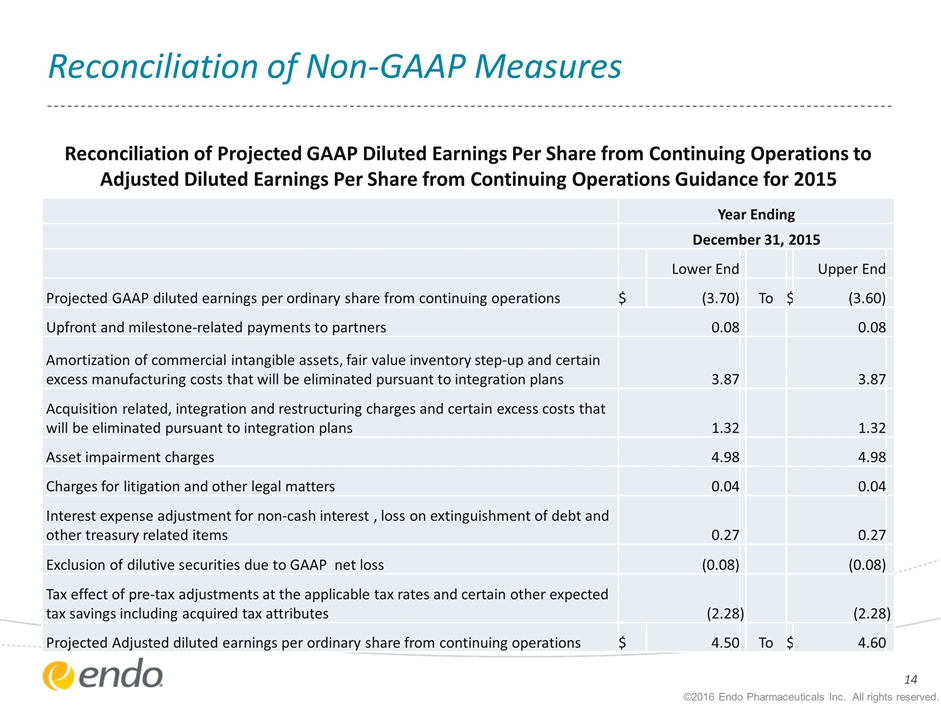

Reconciliation of Non-GAAP Measures Year Ending December 31, 2015 Lower End Upper End Projected GAAP diluted earnings per ordinary share from continuing operations $ (3.70) To $ (3.60) Upfront and milestone-related payments to partners 0.08 0.08 Amortization of commercial intangible assets, fair value inventory step-up and certain excess manufacturing costs that will be eliminated pursuant to integration plans 3.87 3.87 Acquisition related, integration and restructuring charges and certain excess costs that will be eliminated pursuant to integration plans 1.32 1.32 Asset impairment charges 4.98 4.98 Charges for litigation and other legal matters 0.04 0.04 Interest expense adjustment for non-cash interest , loss on extinguishment of debt and other treasury related items 0.27 0.27 Exclusion of dilutive securities due to GAAP net loss (0.08) (0.08) Tax effect of pre-tax adjustments at the applicable tax rates and certain other expected tax savings including acquired tax attributes (2.28 ) (2.28 ) Projected Adjusted diluted earnings per ordinary share from continuing operations $ 4.50 To $ 4.60 Reconciliation of Projected GAAP Diluted Earnings Per Share from Continuing Operations to Adjusted Diluted Earnings Per Share from Continuing Operations Guidance for 2015 ©2016 Endo Pharmaceuticals Inc. All rights reserved.

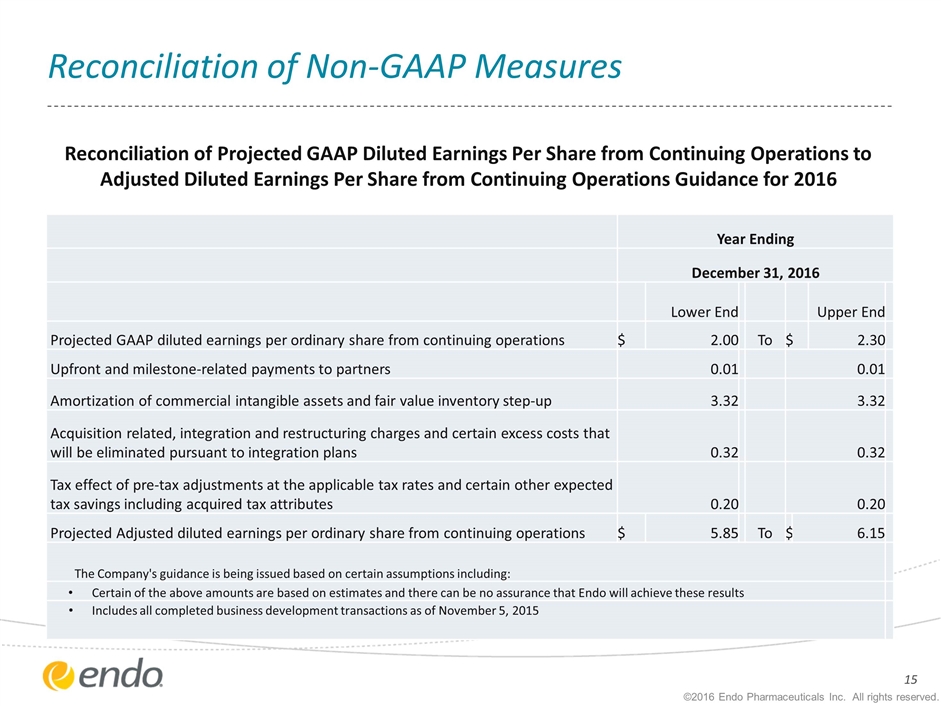

Reconciliation of Non-GAAP Measures Year Ending December 31, 2016 Lower End Upper End Projected GAAP diluted earnings per ordinary share from continuing operations $ 2.00 To $ 2.30 Upfront and milestone-related payments to partners 0.01 0.01 Amortization of commercial intangible assets and fair value inventory step-up 3.32 3.32 Acquisition related, integration and restructuring charges and certain excess costs that will be eliminated pursuant to integration plans 0.32 0.32 Tax effect of pre-tax adjustments at the applicable tax rates and certain other expected tax savings including acquired tax attributes 0.20 0.20 Projected Adjusted diluted earnings per ordinary share from continuing operations $ 5.85 To $ 6.15 The Company's guidance is being issued based on certain assumptions including: Certain of the above amounts are based on estimates and there can be no assurance that Endo will achieve these results Includes all completed business development transactions as of November 5, 2015 Reconciliation of Projected GAAP Diluted Earnings Per Share from Continuing Operations to Adjusted Diluted Earnings Per Share from Continuing Operations Guidance for 2016 ©2016 Endo Pharmaceuticals Inc. All rights reserved.

Endo International plc 34th Annual J.P. Morgan Healthcare Conference January 11, 2016 ©2016 Endo Pharmaceuticals Inc. All rights reserved.