Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Cape Bancorp, Inc. | d108433d8k.htm |

Announces Agreement to Acquire Cape Bancorp, Inc. January 5, 2016 OceanFirst Financial Corp. 49 133 156 147 205 221 31 73 125 255 204 102 75 172 198 0 128 128 Exhibit 99.1

OceanFirst Financial Corp. Forward-Looking Statements This communication contains forward-looking statements. These forward-looking statements may include: management plans relating to the transaction; the expected timing of the completion of the transaction; the ability to complete the transaction; the ability to obtain any required regulatory, shareholder or other approvals; any statements of the plans and objectives of management for future operations, products or services, including the execution of integration plans; any statements of expectation or belief; projections related to certain financial metrics; and any statements of assumptions underlying any of the foregoing. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project” and other similar words and expressions. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time and are beyond our control. Forward-looking statements speak only as of the date they are made. Neither OceanFirst nor Cape assumes any duty and does not undertake to update forward-looking statements. Because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those that OceanFirst or Cape anticipated in its forward-looking statements and future results could differ materially from historical performance. Factors that could cause or contribute to such differences include, but are not limited to, those included under Item 1A “Risk Factors” in OceanFirst’s Annual Report on Form 10-K, those included under Item 1A “Risk Factors” in Cape’s Annual Report on Form 10-K, those disclosed in OceanFirst’s and Cape’s respective other periodic reports filed with the Securities and Exchange Commission (the “SEC”), as well as the possibility: that expected benefits may not materialize in the timeframe expected or at all, or may be more costly to achieve; that the transaction may not be timely completed, if at all; that prior to the completion of the transaction or thereafter, OceanFirst’s and Cape’s respective businesses may not perform as expected due to transaction-related uncertainty or other factors; that the parties are unable to successfully implement integration strategies; that required regulatory, shareholder or other approvals are not obtained or other customary closing conditions are not satisfied in a timely manner or at all; reputational risks and the reaction of the companies’ customers, employees and other constituents to the transaction; and diversion of management time on merger-related matters. For any forward-looking statements made in this communication or in any documents, OceanFirst and Cape claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. 49 133 156 147 205 221 31 73 125 255 204 102 75 172 198 0 128 128

OceanFirst Financial Corp. Additional Information about the Transaction This communication is being made in respect of the proposed transaction involving OceanFirst and Cape. This material is not a solicitation of any vote or approval of OceanFirst’s or Cape’s shareholders and is not a substitute for the joint proxy statement/prospectus or any other documents which OceanFirst and Cape may send to their respective shareholders in connection with the proposed merger. This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities. In connection with the proposed transaction, OceanFirst intends to file a registration statement on Form S-4 containing a joint proxy statement/prospectus and other documents regarding the proposed transaction with the SEC. Before making any voting or investment decision, the respective investors and shareholders of OceanFirst and Cape are urged to carefully read the entire joint proxy statement/prospectus when it becomes available and any other relevant documents filed by either company with the SEC, as well as any amendments or supplements to those documents, because they will contain important information about OceanFirst, Cape and the proposed merger. Investors and security holders are also urged to carefully review and consider each of OceanFirst’s and Cape’s public filings with the SEC, including but not limited to their Annual Reports on Form 10-K, their proxy statements, their Current Reports on Form 8-K and their Quarterly Reports on Form 10-Q. When available, copies of the joint proxy statement/prospectus will be mailed to the respective shareholders of OceanFirst and Cape. When available, copies of the joint proxy statement/prospectus also may be obtained free of charge at the SEC's web site at http://www.sec.gov, or by directing a request to OceanFirst Financial Corp., 975 Hooper Avenue, Toms River, New Jersey 08753, Attn: Christopher D. Maher; or Cape Bancorp, Inc., 225 North Main Street, Cape May Court House, NJ 08210, Attn: Michael D. Devlin, President and Chief Executive Officer. Participants in the Solicitation OceanFirst, Cape and certain of their respective directors and executive officers, under the SEC’s rules, may be deemed to be participants in the solicitation of proxies of OceanFirst’s and Cape’s shareholders in connection with the proposed transaction. Information about the directors and executive officers of OceanFirst and their ownership of OceanFirst common stock is set forth in the proxy statement for OceanFirst’s 2015 Annual Meeting of Shareholders, as filed with the SEC on Schedule 14A on March 27, 2015. Information about the directors and executive officers of Cape and their ownership of Cape’s common stock is set forth in the proxy statement for Cape’s 2015 Annual Meeting of Shareholders, as filed with the SEC on a Schedule 14A on March 24, 2015. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the joint proxy statement/prospectus regarding the proposed transaction when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. 49 133 156 147 205 221 31 73 125 255 204 102 75 172 198 0 128 128

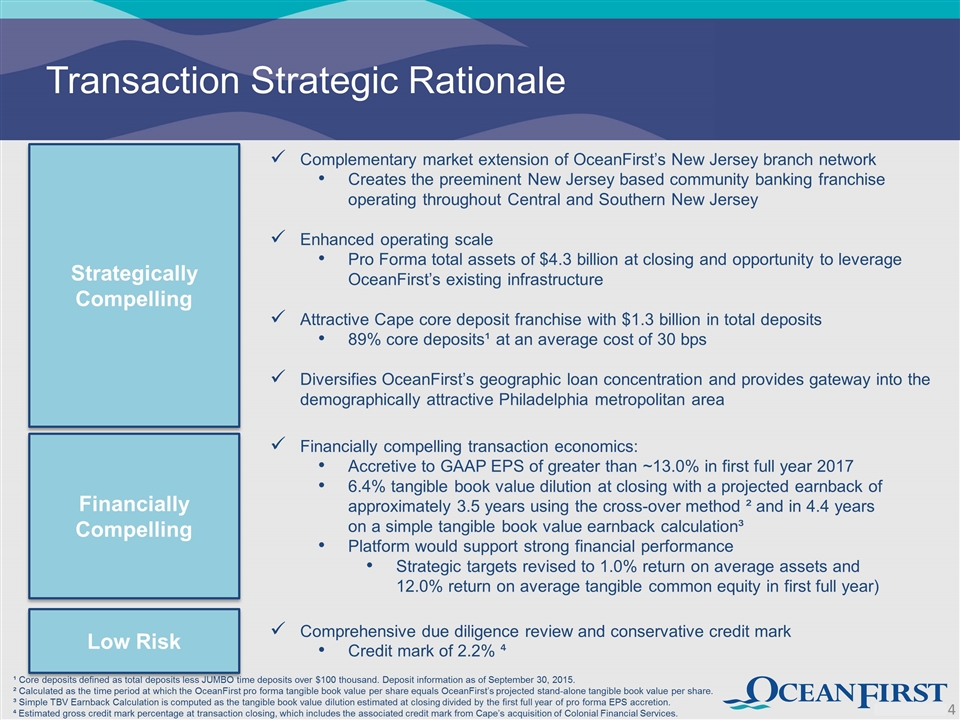

Strategically Compelling Complementary market extension of OceanFirst’s New Jersey branch network Creates the preeminent New Jersey based community banking franchise operating throughout Central and Southern New Jersey Enhanced operating scale Pro Forma total assets of $4.3 billion at closing and opportunity to leverage OceanFirst’s existing infrastructure Attractive Cape core deposit franchise with $1.3 billion in total deposits 89% core deposits¹ at an average cost of 30 bps Diversifies OceanFirst’s geographic loan concentration and provides gateway into the demographically attractive Philadelphia metropolitan area Financially Compelling Financially compelling transaction economics: Accretive to GAAP EPS of greater than ~13.0% in first full year 2017 6.4% tangible book value dilution at closing with a projected earnback of approximately 3.5 years using the cross-over method ² and in 4.4 years on a simple tangible book value earnback calculation³ Platform would support strong financial performance Strategic targets revised to 1.0% return on average assets and 12.0% return on average tangible common equity in first full year) 49 133 156 147 205 221 31 73 125 255 204 102 75 172 198 0 128 128 Low Risk Comprehensive due diligence review and conservative credit mark Credit mark of 2.2% ⁴ ¹ Core deposits defined as total deposits less JUMBO time deposits over $100 thousand. Deposit information as of September 30, 2015. ² Calculated as the time period at which the OceanFirst pro forma tangible book value per share equals OceanFirst’s projected stand-alone tangible book value per share. ³ Simple TBV Earnback Calculation is computed as the tangible book value dilution estimated at closing divided by the first full year of pro forma EPS accretion. ⁴ Estimated gross credit mark percentage at transaction closing, which includes the associated credit mark from Cape’s acquisition of Colonial Financial Services. Transaction Strategic Rationale

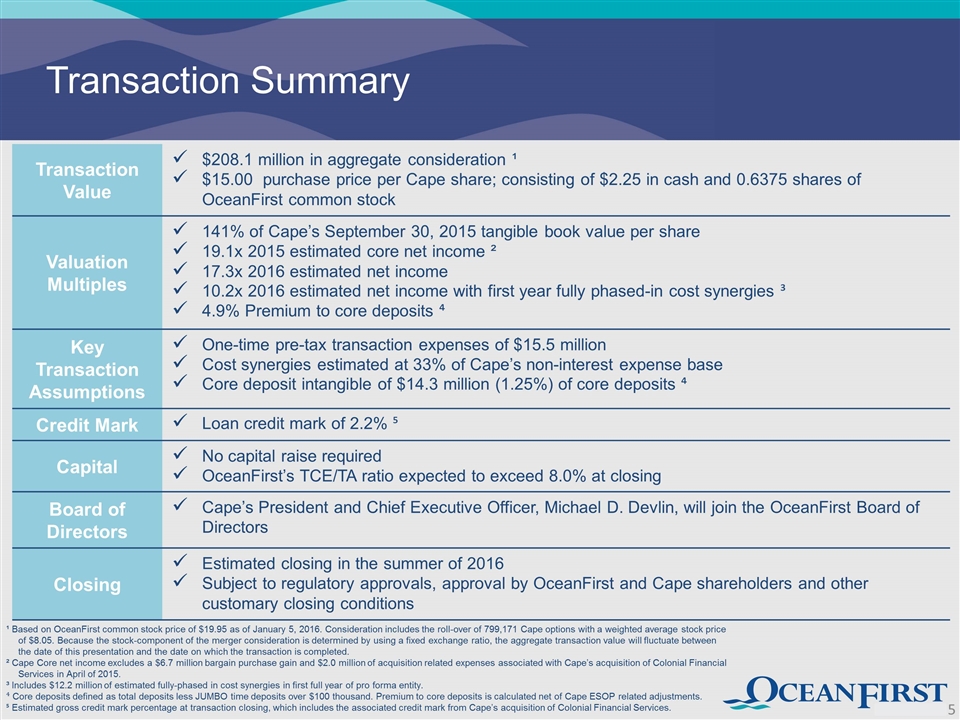

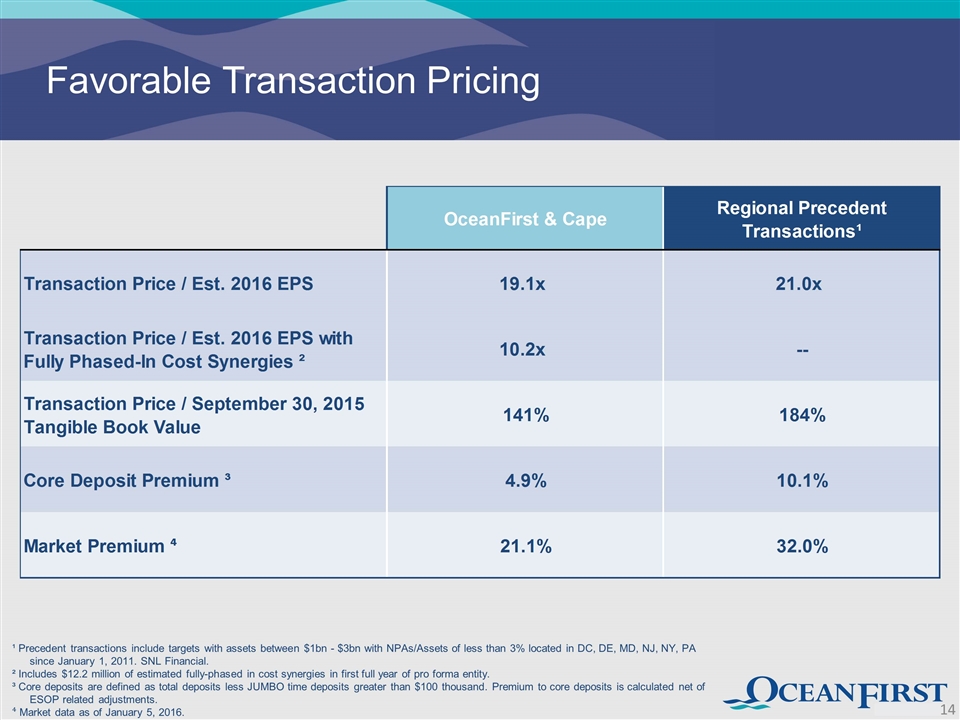

Transaction Value $208.1 million in aggregate consideration ¹ $15.00 purchase price per Cape share; consisting of $2.25 in cash and 0.6375 shares of OceanFirst common stock Valuation Multiples 141% of Cape’s September 30, 2015 tangible book value per share 19.1x 2015 estimated core net income ² 17.3x 2016 estimated net income 10.2x 2016 estimated net income with first year fully phased-in cost synergies ³ 4.9% Premium to core deposits ⁴ Key Transaction Assumptions One-time pre-tax transaction expenses of $15.5 million Cost synergies estimated at 33% of Cape’s non-interest expense base Core deposit intangible of $14.3 million (1.25%) of core deposits ⁴ Credit Mark Loan credit mark of 2.2% ⁵ Capital No capital raise required OceanFirst’s TCE/TA ratio expected to exceed 8.0% at closing Board of Directors Cape’s President and Chief Executive Officer, Michael D. Devlin, will join the OceanFirst Board of Directors Closing Estimated closing in the summer of 2016 Subject to regulatory approvals, approval by OceanFirst and Cape shareholders and other customary closing conditions 49 133 156 147 205 221 31 73 125 255 204 102 75 172 198 0 128 128 ¹ Based on OceanFirst common stock price of $19.95 as of January 5, 2016. Consideration includes the roll-over of 799,171 Cape options with a weighted average stock price of $8.05. Because the stock-component of the merger consideration is determined by using a fixed exchange ratio, the aggregate transaction value will fluctuate between the date of this presentation and the date on which the transaction is completed. ² Cape Core net income excludes a $6.7 million bargain purchase gain and $2.0 million of acquisition related expenses associated with Cape’s acquisition of Colonial Financial Services in April of 2015. ³ Includes $12.2 million of estimated fully-phased in cost synergies in first full year of pro forma entity. ⁴ Core deposits defined as total deposits less JUMBO time deposits over $100 thousand. Premium to core deposits is calculated net of Cape ESOP related adjustments. ⁵ Estimated gross credit mark percentage at transaction closing, which includes the associated credit mark from Cape’s acquisition of Colonial Financial Services. Transaction Summary

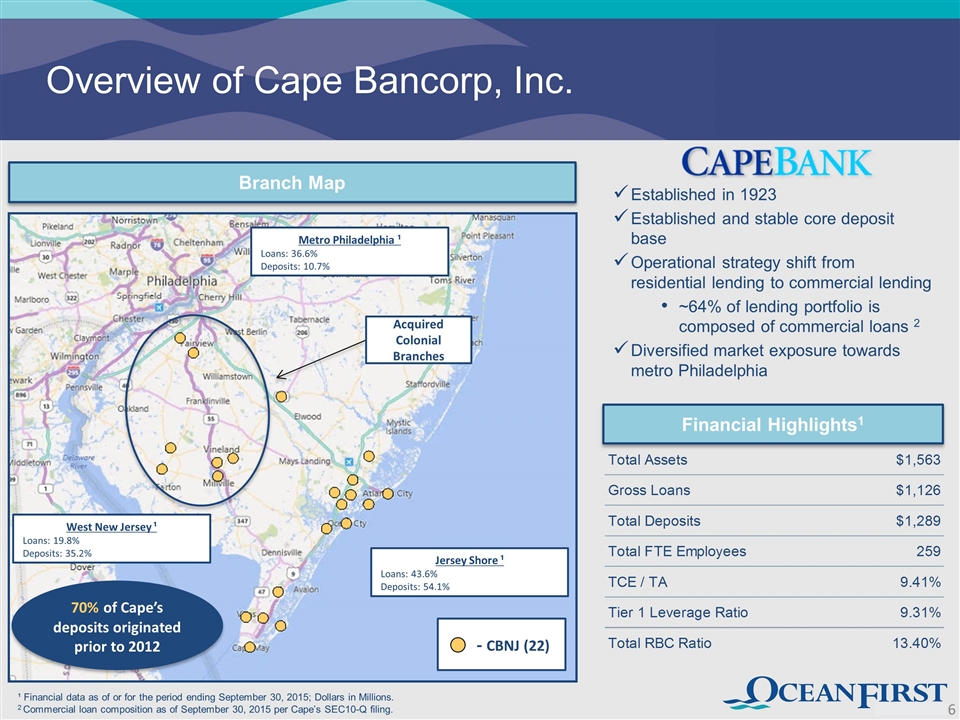

49 133 156 147 205 221 31 73 125 255 204 102 75 172 198 0 128 128 Branch Map ¹ Financial data as of or for the period ending September 30, 2015; Dollars in Millions. 2 Commercial loan composition as of September 30, 2015 per Cape’s SEC10-Q filing. - CBNJ (22) Acquired Colonial Branches Metro Philadelphia ¹ Loans: 36.6% Deposits: 10.7% West New Jersey ¹ Loans: 19.8% Deposits: 35.2% Jersey Shore ¹ Loans: 43.6% Deposits: 54.1% Established in 1923 Established and stable core deposit base Operational strategy shift from residential lending to commercial lending ~64% of lending portfolio is composed of commercial loans 2 Diversified market exposure towards metro Philadelphia Financial Highlights1 70% of Cape’s deposits originated prior to 2012 Overview of Cape Bancorp, Inc.

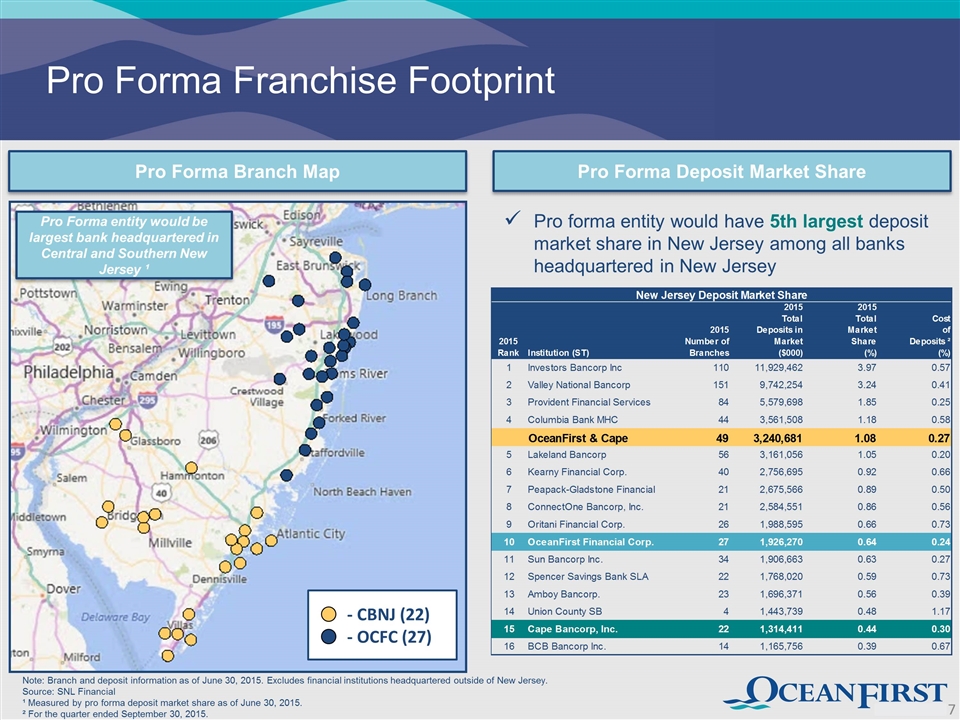

49 133 156 147 205 221 31 73 125 255 204 102 75 172 198 0 128 128 Pro Forma Branch Map Note: Branch and deposit information as of June 30, 2015. Excludes financial institutions headquartered outside of New Jersey. Source: SNL Financial ¹ Measured by pro forma deposit market share as of June 30, 2015. ² For the quarter ended September 30, 2015. Pro Forma Deposit Market Share - CBNJ (22) - OCFC (27) Pro Forma entity would be largest bank headquartered in Central and Southern New Jersey ¹ Pro Forma Franchise Footprint Pro forma entity would have 5th largest deposit market share in New Jersey among all banks headquartered in New Jersey

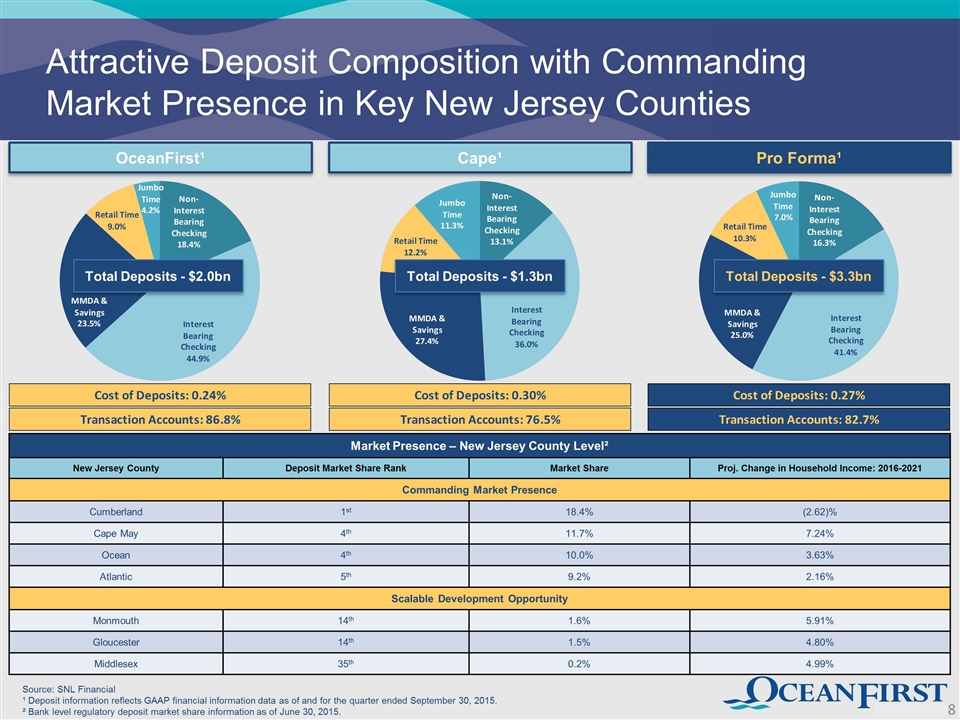

49 133 156 147 205 221 31 73 125 255 204 102 75 172 198 0 128 128 OceanFirst¹ Cape¹ Pro Forma¹ Market Presence – New Jersey County Level² New Jersey County Deposit Market Share Rank Market Share Proj. Change in Household Income: 2016-2021 Commanding Market Presence Cumberland 1st 18.4% (2.62)% Cape May 4th 11.7% 7.24% Ocean 4th 10.0% 3.63% Atlantic 5th 9.2% 2.16% Scalable Development Opportunity Monmouth 14th 1.6% 5.91% Gloucester 14th 1.5% 4.80% Middlesex 35th 0.2% 4.99% Source: SNL Financial ¹ Deposit information reflects GAAP financial information data as of and for the quarter ended September 30, 2015. ² Bank level regulatory deposit market share information as of June 30, 2015. Total Deposits - $2.0bn Total Deposits - $1.3bn Total Deposits - $3.3bn Attractive Deposit Composition with Commanding Market Presence in Key New Jersey Counties

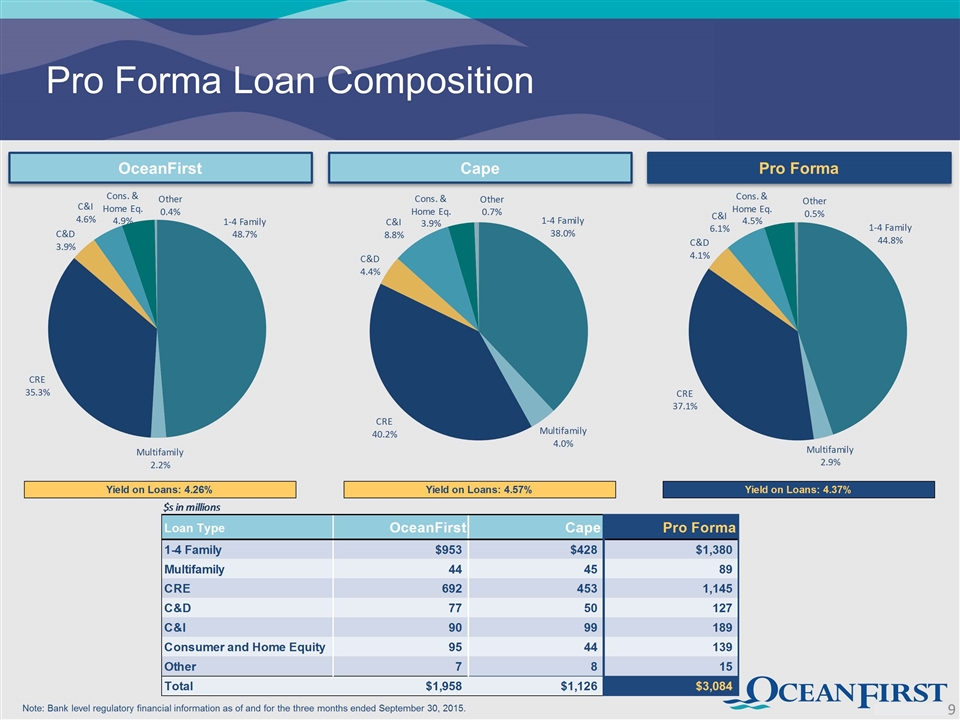

49 133 156 147 205 221 31 73 125 255 204 102 75 172 198 0 128 128 Note: Bank level regulatory financial information as of and for the three months ended September 30, 2015. OceanFirst Cape Pro Forma Pro Forma Loan Composition

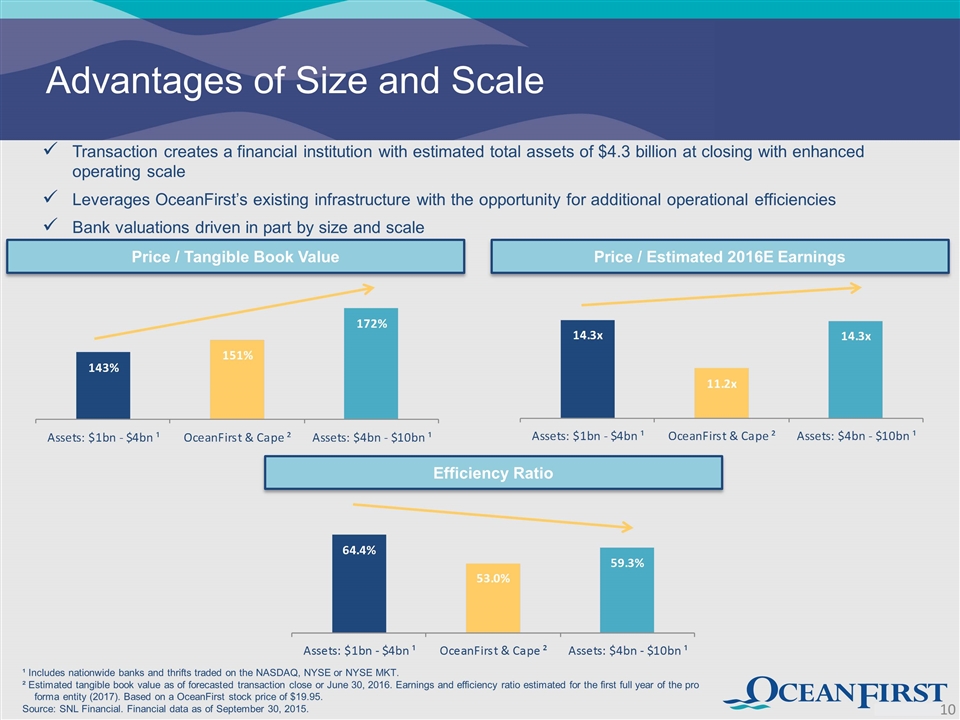

49 133 156 147 205 221 31 73 125 255 204 102 75 172 198 0 128 128 ¹ Includes nationwide banks and thrifts traded on the NASDAQ, NYSE or NYSE MKT. ² Estimated tangible book value as of forecasted transaction close or June 30, 2016. Earnings and efficiency ratio estimated for the first full year of the pro forma entity (2017). Based on a OceanFirst stock price of $19.95. Source: SNL Financial. Financial data as of September 30, 2015. Price / Tangible Book Value Price / Estimated 2016E Earnings Efficiency Ratio Transaction creates a financial institution with estimated total assets of $4.3 billion at closing with enhanced operating scale Leverages OceanFirst’s existing infrastructure with the opportunity for additional operational efficiencies Bank valuations driven in part by size and scale Advantages of Size and Scale

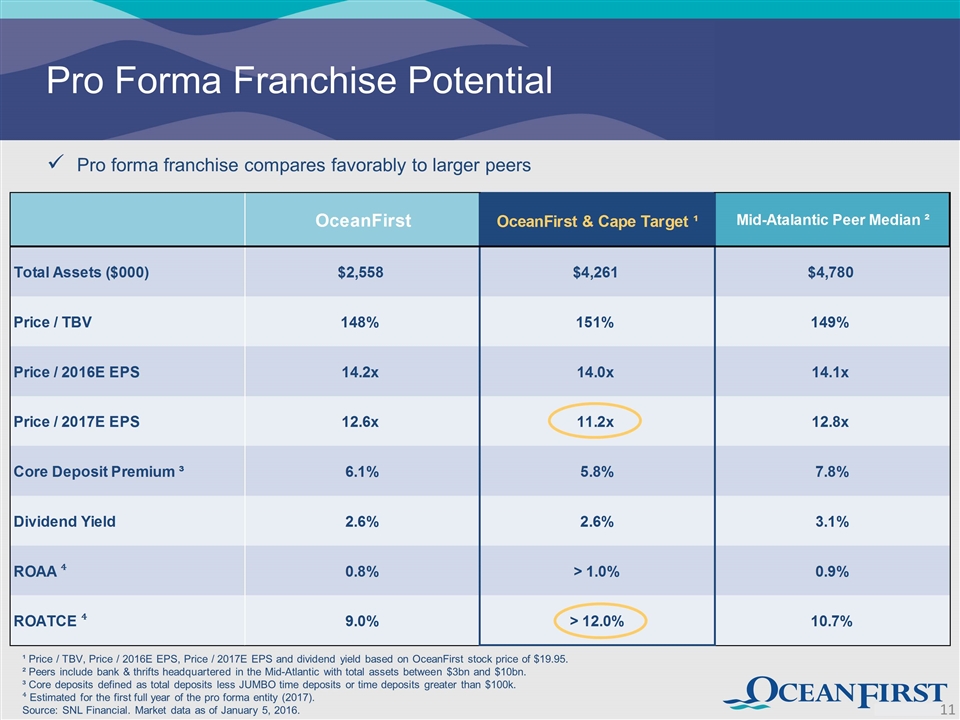

49 133 156 147 205 221 31 73 125 255 204 102 75 172 198 0 128 128 ¹ Price / TBV, Price / 2016E EPS, Price / 2017E EPS and dividend yield based on OceanFirst stock price of $19.95. ² Peers include bank & thrifts headquartered in the Mid-Atlantic with total assets between $3bn and $10bn. ³ Core deposits defined as total deposits less JUMBO time deposits or time deposits greater than $100k. ⁴ Estimated for the first full year of the pro forma entity (2017). Source: SNL Financial. Market data as of January 5, 2016. Pro Forma Franchise Potential Pro forma franchise compares favorably to larger peers

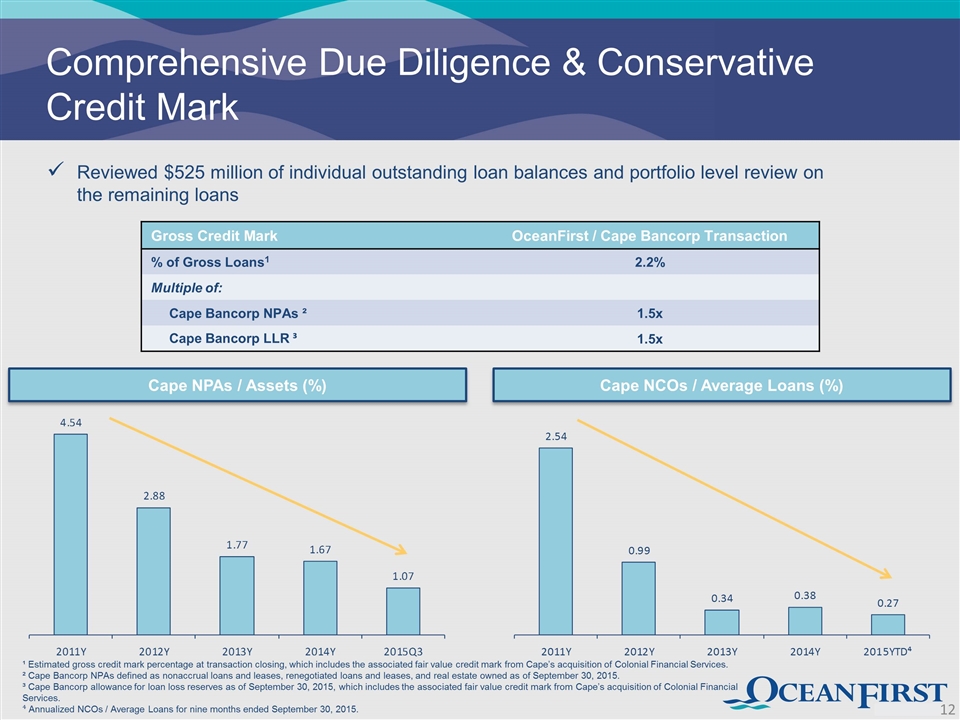

49 133 156 147 205 221 31 73 125 255 204 102 75 172 198 0 128 128 ¹ Estimated gross credit mark percentage at transaction closing, which includes the associated fair value credit mark from Cape’s acquisition of Colonial Financial Services. ² Cape Bancorp NPAs defined as nonaccrual loans and leases, renegotiated loans and leases, and real estate owned as of September 30, 2015. ³ Cape Bancorp allowance for loan loss reserves as of September 30, 2015, which includes the associated fair value credit mark from Cape’s acquisition of Colonial Financial Services. ⁴ Annualized NCOs / Average Loans for nine months ended September 30, 2015. Gross Credit Mark OceanFirst / Cape Bancorp Transaction % of Gross Loans1 2.2% Multiple of: Cape Bancorp NPAs ² 1.5x Cape Bancorp LLR ³ 1.5x Cape NPAs / Assets (%) Cape NCOs / Average Loans (%) Comprehensive Due Diligence & Conservative Credit Mark Reviewed $525 million of individual outstanding loan balances and portfolio level review on the remaining loans

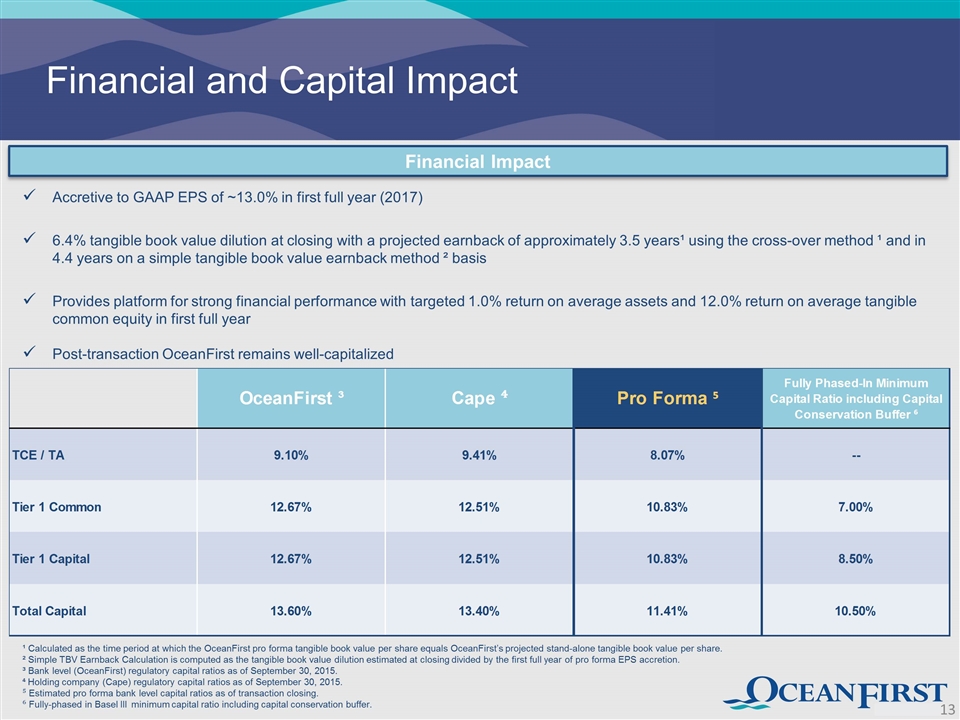

49 133 156 147 205 221 31 73 125 255 204 102 75 172 198 0 128 128 ¹ Calculated as the time period at which the OceanFirst pro forma tangible book value per share equals OceanFirst’s projected stand-alone tangible book value per share. ² Simple TBV Earnback Calculation is computed as the tangible book value dilution estimated at closing divided by the first full year of pro forma EPS accretion. ³ Bank level (OceanFirst) regulatory capital ratios as of September 30, 2015. ⁴ Holding company (Cape) regulatory capital ratios as of September 30, 2015. ⁵ Estimated pro forma bank level capital ratios as of transaction closing. ⁶ Fully-phased in Basel III minimum capital ratio including capital conservation buffer. Financial Impact Accretive to GAAP EPS of ~13.0% in first full year (2017) 6.4% tangible book value dilution at closing with a projected earnback of approximately 3.5 years¹ using the cross-over method ¹ and in 4.4 years on a simple tangible book value earnback method ² basis Provides platform for strong financial performance with targeted 1.0% return on average assets and 12.0% return on average tangible common equity in first full year Post-transaction OceanFirst remains well-capitalized Financial and Capital Impact

49 133 156 147 205 221 31 73 125 255 204 102 75 172 198 0 128 128 ¹ Precedent transactions include targets with assets between $1bn - $3bn with NPAs/Assets of less than 3% located in DC, DE, MD, NJ, NY, PA since January 1, 2011. SNL Financial. ² Includes $12.2 million of estimated fully-phased in cost synergies in first full year of pro forma entity. ³ Core deposits are defined as total deposits less JUMBO time deposits greater than $100 thousand. Premium to core deposits is calculated net of ESOP related adjustments. ⁴ Market data as of January 5, 2016. Favorable Transaction Pricing