Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PBF Energy Inc. | a8-kpbfenergytoattendindus.htm |

PBF Energy Inc. (NYSE: PBF) Investor Presentation January 2016

2 Safe Harbor Statements This presentation contains forward-looking statements made by PBF Energy Inc. (“PBF Energy”), the indirect parent of PBF Logistics LP (“PBFX” and together with PBF Energy, the “Companies”, or “PBF”), and their management teams. Such statements are based on current expectations, forecasts and projections, including, but not limited to, anticipated financial and operating results, plans, objectives, expectations and intentions that are not historical in nature. Forward-looking statements should not be read as a guarantee of future performance or results, and may not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved. Forward-looking statements are based on information available at the time, and are subject to various risks and uncertainties that could cause the Companies’ actual performance or results to differ materially from those expressed in such statements. Factors that could impact such differences include, but are not limited to, changes in general economic conditions; volatility of crude oil and other feedstock prices; fluctuations in the prices of refined products; the impact of disruptions to crude or feedstock supply to any of our refineries, including disruptions due to problems with third party logistics infrastructure; effects of litigation and government investigations; the timing and announcement of any potential acquisitions (including the pending acquisition of the Torrance Refinery and related logistics assets, the “Torrance Acquisition”) and subsequent impact of any future acquisitions on our capital structure, financial condition or results of operations; changes or proposed changes in laws or regulations or differing interpretations or enforcement thereof affecting our business or industry, including any lifting by the federal government of the restrictions on exporting U.S. crude oil; actions taken or non-performance by third parties, including suppliers, contractors, operators, transporters and customers; adequacy, availability and cost of capital; work stoppages or other labor interruptions; operating hazards, natural disasters, weather-related delays, casualty losses and other matters beyond our control; inability to complete capital expenditures, or construction projects that exceed anticipated or budgeted amounts; ability to consummate pending acquisitions, the timing for the closing of any such acquisition and our plans for financing any acquisition; unforeseen liabilities associated with any pending acquisition; inability to successfully integrate acquired refineries or other acquired businesses or operations; effects of existing and future laws and governmental regulations, including environmental, health and safety regulations; and, various other factors. Forward-looking statements reflect information, facts and circumstances only as of the date they are made. The Companies assume no responsibility or obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information after such date.

3 PBF Energy Company Profile Market capitalization of ~$3.8 billion(1) BB / Ba3 credit ratings – upgraded by S&P in Q4-15 Currently operates four oil refineries in Ohio, Delaware, New Jersey and Louisiana, and has entered into an agreement to acquire an additional refinery in California(2) PBF's core strategy is to grow and diversify through acquisitions PBF indirectly owns 100% of the general partner and 54% of the limited partner interests of PBF Logistics LP (NYSE: PBFX), and 100% of the PBFX incentive distribution rights (“IDRs”) PBFX market capitalization of ~$650 million(1) Region Throughput Capacity (bpd) Nelson Complexity Mid-continent 170,000 9.2 East Coast 370,000 12.2 Gulf Coast 189,000 12.7 West Coast(2,3) 155,000 14.9 Total (2,3) 884,000 12.2 ___________________________ 1. As of 12/31/2015. 2. The Torrance (California) Refinery acquisition is scheduled to close in Q2 2016. 3. Pro forma the close of the Torrance Acquistion. Paulsboro Toledo Chalmette Torrance PADD 2 PADD 3 PADD 5 Delaware City PADD 4 PADD 1

4 Fourth largest independent refiner with significantly enhanced asset base 884,000 bpd of crude oil capacity across five refineries¹ Recent acquisition of Chalmette and pending Torrance acquisition demonstrate disciplined growth Geographic diversity with presence in PADDs 1, 2, 3 and 5¹ Second most complex refiner in the U.S. with average Nelson Complexity of 12.2¹ Proven Track Record Proven track record of implementing organic projects that drive margin improvement Recent investments in high-return petrochemical projects in Toledo Successful permitting of a new hydrogen plant in Delaware City Financial Flexibility Financial flexibility to execute disciplined growth strategy Conservative balance sheet (pre- and post-notes offering) and robust liquidity position Focused on maintaining capital discipline with >$1 billion of liquidity2 Access to low cost-of-capital with strategic PBFX relationship Generate cash proceeds from drop-downs to reinvest in / de-lever PBF Experienced Leadership Team Decades of experience operating and managing refining assets Long and successful track record of executing profitable acquisitions and driving growth Focused on growth by acquisition Enhanced Asset Base Investment Highlights ___________________________ 1. Pro forma for the close of the Torrance Acquisition that is located in PADD 5. 2. Subsequent to the closing of the Chalmette acquisition in November 2015, PBF paid down the Revolving Loan balance to $0.

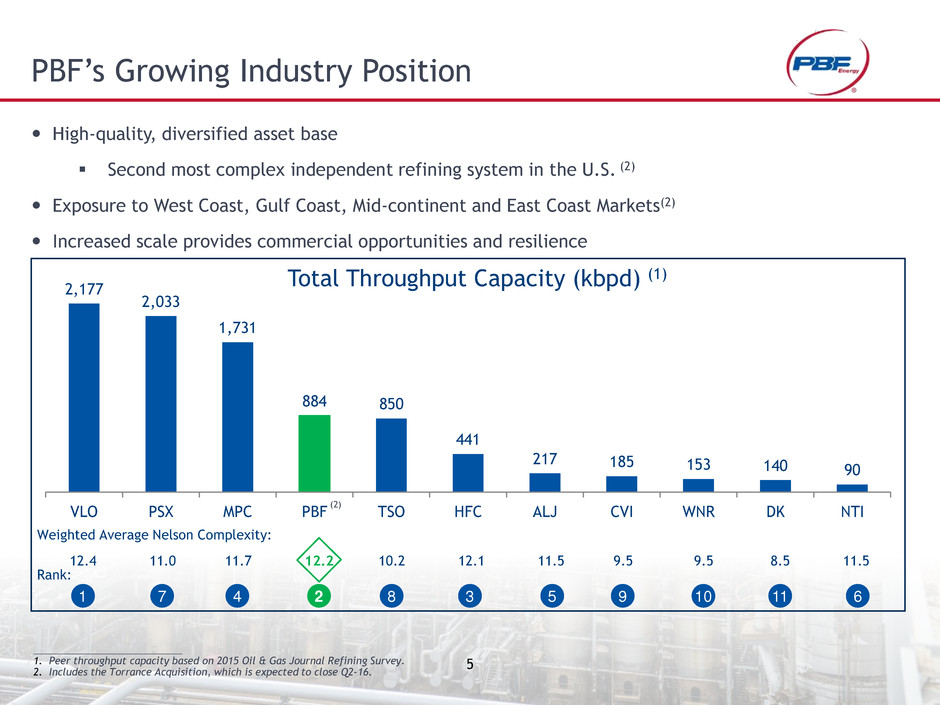

5 PBF’s Growing Industry Position 2,177 2,033 1,731 884 850 441 217 185 153 140 90 VLO PSX MPC PBF TSO HFC ALJ CVI WNR DK NTI Total Throughput Capacity (kbpd) (1) Weighted Average Nelson Complexity: 12.4 11.0 11.7 12.2 10.2 12.1 11.5 9.5 9.5 8.5 11.5 High-quality, diversified asset base Second most complex independent refining system in the U.S. (2) Exposure to West Coast, Gulf Coast, Mid-continent and East Coast Markets(2) Increased scale provides commercial opportunities and resilience ___________________________ 1. Peer throughput capacity based on 2015 Oil & Gas Journal Refining Survey. 2. Includes the Torrance Acquisition, which is expected to close Q2-16. 1 2 3 4 5 6 7 8 9 10 11 Rank: (2)

6 Attractive Purchase Price of Recent Acquisitions(1) $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 R e fi n e ry Co st , $ /Com p le x it y -B a rr e l Denotes PBF Refinery ___________________________ 1. Includes the Torrance Acquisition, which is expected to close Q2-16.

7 189,000 bpd high-complexity, high-conversion refinery Crude Supply Agreement with PDVSA Product off-take agreements with Exxon Mobil and other first-class counterparties 12.7 Nelson Complexity The Chalmette Refinery generated YTD 9/30/2015 EBITDA of ~$329 million Refined products include gasoline, diesel (ULSD), heating oil, LPG’s, petrochemicals and petroleum coke Expands PBF’s existing commercial footprint Margin improvement opportunities associated with optimization of existing assets and restart of idled units Strong logistics connectivity for raw material sourcing and product distribution Provides geographic diversification into PADD 3; increased PBF’s refining capacity by 35% Scale and diversification opportunities from potential transactions with PBFX Chalmette Refinery – PADD 3

8 Torrance Acquisition Highlights – PADD 5 $537.5 million purchase price for Torrance Refinery and associated logistics assets Assets to be acquired include 155,000 bpd high-complexity Torrance Refinery, multiple crude and product pipelines, two product terminals, and crude oil and product storage facilities; Nelson Complexity of 14.9 Market-based crude supply and product off-take agreements with ExxonMobil Provides geographic diversification into PADD 5; increases PBF’s refining capacity by over 20% PBF believes the Torrance acquisition will be immediately accretive to earnings Further expands PBF’s existing commercial footprint Added scale and diversification increases opportunities for transactions with PBFX Acquired assets include sophisticated Southern California logistics system

9 PBF’s Focus on Margin Improvement Investments PBF has a history of making disciplined, high-return investments in its facilities Created East Coast refining system to optimize hardware at both Delaware City and Paulsboro; invested capital to increase the production of high-value product Upgrade 2000ppm Heating Oil into Ultra Low Sulfur Diesel (ULSD) and Ultra Low Sulfur Heating Oil (ULSHO) Received permits to construct a new hydrogen plant at Delaware City; will improve conversion capacity and provide opportunities to increase unit run rates which is expected to generate an additional ~$85 million in EBITDA once placed in service Successfully executed major turnaround at the Toledo Refinery in 2014; invested capital to: Improve FCC reliability and product yield Increase production of high-value petrochemicals Increase overall throughput to ~170,000 barrels per day Invested in new crude truck unloading facilities and tankage in Toledo to increase access to high- quality, locally-sourced (cost-advantaged) crude

10 Crude cost advantages for complex, medium and heavy, sour refineries like Delaware City, Paulsboro and Chalmette translate to increased profitability Coking refineries, such as PBF’s three coastal refineries, have the flexibility to run a wide variety of crudes and can realize improved margins in low flat-price environments Based on the illustrative example, enhanced gross margin of ~$650 million on 175 million barrels of throughput versus a light/sweet refinery Refining dynamics in the Atlantic Basin have dramatically shifted ~2.6 million bpd of refining capacity has been or is scheduled to be rationalized in the Atlantic Basin 320 kbpd shut down in Delaware/Pennsylvania Regional Basin Additional refineries could be at risk Paulsboro and Delaware City have transportation advantage vs. incoming pipelines and waterborne products NEW JERSEY PENNSYLVANIA Philadelphia Delaware/Pennsylvania Basin Refining Landscape Refinery Capacity Delaware City 190,000 Paulsboro 180,000 Trainer (Delta) 185,000 Philadelphia (PES) 330,000 Marcus Hook (CLOSED) 175,000 Eagle Point (CLOSED) 145,000 Refinery Complexity Advantage $- $1 $2 $3 $4 $5 $6 $7 $8 $9 $10 PBF East Coast Crude Cost Advantage Lower Clean Product Yield Low-value Products (Sulfur, Pet Coke, CO2) Heavy/Sour COGS Advantage Illustrative Heavy / Sour COGS Advantage ($0.75) ($4.50) $9.00 $3.75 (1) 1. Comprised of $5/bbl premium for landed cost of light, sweet crude vs. ($4/bbl) discount for medium and heavy, sour crude to Dated Brent which represents a total crude advantage for refineries that are able to process medium and heavy, sour barrels

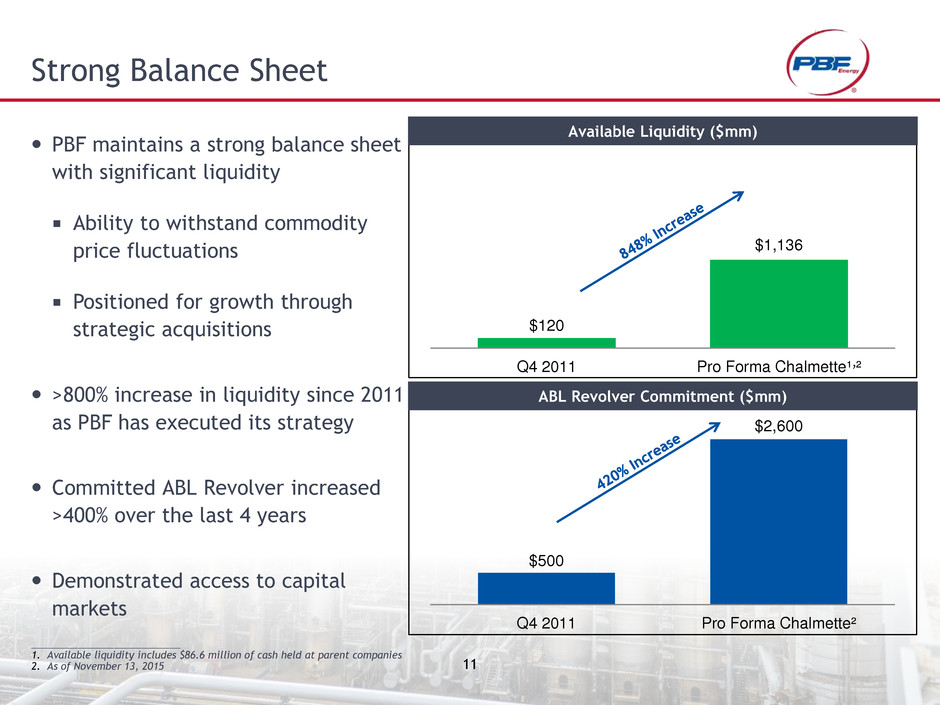

11 $120 $1,136 Q4 2011 Pro Forma Chalmette¹ ² $500 $2,600 Q4 2011 Pro Forma Chalmette² Strong Balance Sheet Available Liquidity ($mm) PBF maintains a strong balance sheet with significant liquidity Ability to withstand commodity price fluctuations Positioned for growth through strategic acquisitions >800% increase in liquidity since 2011 as PBF has executed its strategy Committed ABL Revolver increased >400% over the last 4 years Demonstrated access to capital markets ABL Revolver Commitment ($mm) ___________________________ 1. Available liquidity includes $86.6 million of cash held at parent companies 2. As of November 13, 2015 ,

12 PBFX is a Strategic and Valuable Partner to PBF Vehicle allows PBF to drop down logistics assets and to use the net proceeds to reinvest in refining or de-lever Since PBFX's IPO in May 2014, PBFX has purchased ~$443 million of assets from PBF PBF's drop-down EBITDA backlog increased significantly with addition of logistics-related assets at Chalmette and Torrance Acquisition(1) PBF believes it has over $280 million(1) of MLP- qualifying EBITDA suitable for drop-downs to PBFX Provides low-cost capital to grow logistics asset base Stable cash flows supported by long-term, take-or-pay Minimum Volume Commitments No direct commodity exposure Hard asset base consisting of crude and product storage, pipelines, and distribution and unloading facilities Summary of Executed Drop-Downs Announcement Date Asset Projected Annual EBITDA ($mm) Gross Sale Price ($mm) 9/15/2014 Delaware City Heavy Crude Unloading Rack $15 $150 12/2/2014 Toledo Storage Facility $15 $150 5/15/2015 Delaware City Pipeline / Truck Rack $14 $143 Total $44 $443 ___________________________ 1. Includes the Torrance Acquisition, which is expected to close Q2-16.

1 3 Appendix

14 PBF Energy 2016 Guidance Guidance provided constitutes forward-looking information and is based on current PBF Energy operating plans, company assumptions and company configuration. All figures are subject to change based on market and macroeconomic factors, as well as company strategic decision-making and overall company performance. Guidance does not include any assumptions for the Torrance refinery acquisition which is expected to close in Q2-2016. (Figures in millions except per barrel amounts) FY 2016E Q1-2016E East Coast Throughput 340,000 – 360,000 bpd 340,000 – 360,000 bpd Mid-Continent Throughput 155,000 – 165,000 bpd 155,000 – 165,000 bpd Gulf Coast Throughput 175,000 – 185,000 bpd 175,000 – 185,000 bpd Total Throughput 670,000 – 710,000 bpd 670,000 – 710,000 bpd Operating expenses $4.50 - $4.75 /bbl SG&A expenses* $95 - $115 D&A* $200 - $210 Interest expense, net* $150 - $160 Capital expenditures* $475 - $500 Turnaround Schedule Period Duration Delaware City – Coker Spring 35 – 45 days Paulsboro – FCC/Alky Fall 35 – 45 days * Guidance figures include consolidated expenses in respective categories for PBF Logistics LP

15 170,000 bpd light, sweet crude refinery located on a 282- acre site near Toledo, Ohio 9.2 Nelson Complexity Refined products include a high percentage of gasoline and diesel (USLD) High-conversion refinery; ~88% distillate and gasoline yield High-value petrochemical slate ~5% of total yield (Nonene, Tetramer, Toluene, Xylene and Benzene) Mid-Continent location and historic transportation rights provide access to major U.S. production basins and Western Canada Active in regional production plays with growth potential, including Utica (transload) and Lower Michigan (truck) Structurally competitive asset; 101% total yield Toledo Refinery – PADD 2

16 190,000 bpd refinery situated on a 5,000-acre site adjacent to the Delaware River 11.3 Nelson Complexity Refined products include gasoline, diesel (ULSD), heating oil, jet fuel, LPG’s, petrochemicals and petroleum coke Connected to major Northeast pipeline systems (Buckeye and Colonial) Medium and heavy sour crude refinery 18,000 bpd hydrocracker 47,000 bpd fluid coker (64% of East Coast coking capacity) Flexible crude sourcing from international and domestic producers utilized to maximize refining margins Export capability through Delaware River terminal complex Delaware City Refinery – PADD 1

17 180,000 bpd refinery located on 950 acres adjacent to the Delaware River Complex refinery; 13.2 Nelson Complexity Refined products include gasoline, jet fuel and heating oil, asphalt, as well as Group I lubricating oil Group I lubricant production of ~7,000 bpd; lubes and light products contract with ExxonMobil Connected to major Northeast pipeline systems (Buckeye and Colonial) Dedicated jet fuel pipeline to the Philadelphia Airport Reconfigured in 2012 to focus on a simplified crude slate Swing between asphalt and pet-coke production Export capability through Delaware River terminal complex Paulsboro Refinery – PADD 1

18 Non-GAAP Financial Measures Our management uses EBITDA (earnings before interest, income taxes, depreciation and amortization) as a measure of operating performance to assist in comparing performance from period to period on a consistent basis and to readily view operating trends, as a measure for planning and forecasting overall expectations and for evaluating actual results against such expectations, and in communications with our board of directors, creditors, analysts and investors concerning our financial performance. EBITDA is not a presentation made in accordance with U.S. generally accepted accounting principles (“GAAP”) and our computation of EBITDA may vary from others in our industry. EBITDA should not be considered as an alternative to operating income or net income as a measure of operating performance. In addition, EBITDA is not presented as, and should not be considered, an alternative to cash flows from operations as a measure of liquidity. EBITDA also has limitations as an analytical tool and should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP. Note – figures in table are pro forma estimates and subject to change based on actual operating performance, market conditions and other factors $ in thousands 2014YE PBF 2014YE PF Nine Months Ended Nine Months Ended (except where noted) Standalone Chalmette 30-Sep-15 30-Sep-15 Standalone PF Chalmette Net Income $78,271 $29,795 $317,074 $473,271 Depreciation and amortization expense 180,382 202,179 144,401 160,749 Interest expense 98,764 187,250 77,094 133,104 Income Tax expense benefit (22,412) 19,686 151,072 253,242 EBITDA $335,005 $438,910 $689,641 $1,020,366 Special Items: Add: Non-cash LCM inventory adjustment 690,110 690,110 81,147 81,147 BITDA (excluding s ecial items) $1,025,115 $1,129,020 $770,788 $1,101,513