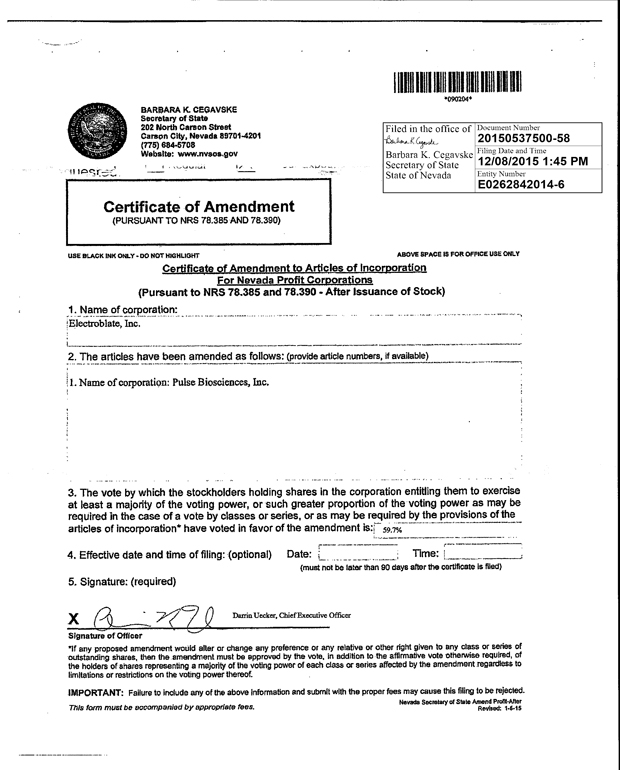

Attached files

Exhibit 3.1

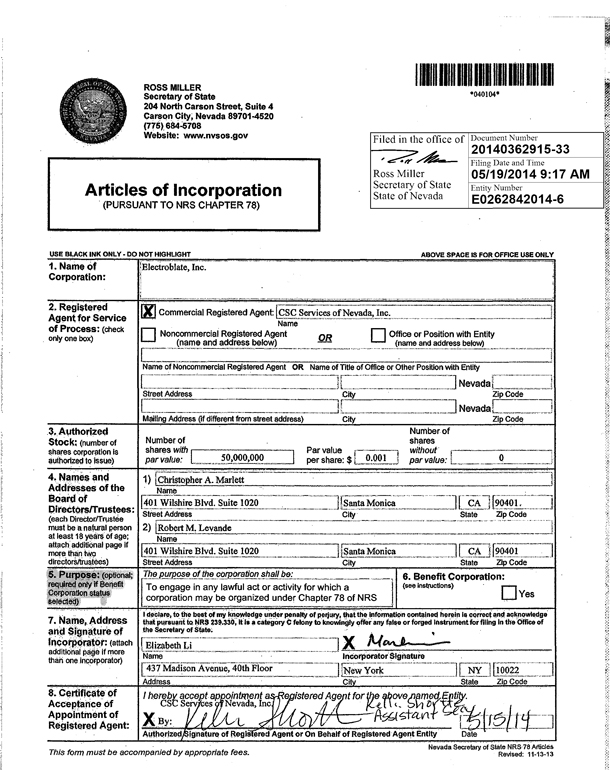

Attachment to the Articles of Incorporation of Electroblate, Inc.

Authorized Stock

The total number of shares of stock which the Corporation shall have the authority to issue is 50,000,000, which are divided into 45,000,000 shares of common stock, par value $0.001 per share, and 5,000,000 shares of preferred stock, par value $0.001 per share (“Preferred Stock”). The board of directors of the Corporation (the “Board of Directors”) is expressly granted authority to issue one or more series of Preferred Stock and with respect to any such series to fix by resolution or resolutions the numbers, powers, designations, preferences and relative, participating, optional or other rights, and such qualifications, limitations or restrictions thereof, including, but without limiting the generality of the foregoing, the following:

(i) The number of shares to constitute such series and the distinctive designations thereof;

(ii) The dividend rate to which such shares shall be entitled and the restrictions, limitations and conditions upon the payment of such dividends, whether dividends shall be cumulative, the date or dates from which dividends (if cumulative) shall accumulate and the dates on which dividends (if declared) shall be payable;

(iii) Whether or not the shares of such series shall be redeemable and, if so, the terms, limitations and restrictions with respect to such redemption, including without limitation the manner of selecting shares for redemption if less than all shares are to be redeemed, and the amount, if any, in addition to any accrued dividends thereon, which the holders of shares of such series shall be entitled to receive upon the redemption thereof, which amount may vary at different redemption dates and may be different with respect to shares redeemed through the operation of any purchase, retirement or sinking fund and with respect to shares otherwise redeemed;

(iv) The amount in addition to any accrued dividends thereon which the holders of shares of such series shall be entitled to receive upon the voluntary or involuntary liquidation, dissolution or winding up of the Corporation, which amount may vary at different dates and may vary depending on whether such liquidation, dissolution or winding up is voluntary or involuntary;

(v) Whether or not the shares of such series shall be subject to the operation of a purchase, retirement or sinking fund and, if so, the terms, limitations and restrictions with respect thereto, including without limitation whether such purchase, retirement or sinking fund shall be cumulative or non-cumulative, the extent to and the manner in which such fund shall be applied to the purchase, retirement or redemption of the shares of such series for retirement or to other corporate purposes and the terms and provisions relative to the operation thereof;

(vi) Whether or not the shares of such series shall have conversion privileges and, if so, prices or rates of conversion and the method, if any, of adjusting the same;

(vii) The voting powers, if any, of such series; and

(viii) Any other relative rights, preferences and limitations pertaining to such series.

Additional Director

Amy Wang, 401 Wilshire Blvd., Suite 1020, Santa Monica, CA 90401.

Indemnification

The Corporation shall have the power to indemnify and advance expenses to any person to the fullest extent permitted by the Nevada Revised Statutes Chapter 78 as it now exists or as it may hereafter be amended. The indemnification and advancement of expenses provided by this Article shall not be deemed exclusive of any other rights to which those seeking indemnification or advancement of expenses may be entitled under any by-law, agreement, vote of stockholders or disinterested directors or otherwise, both as to action in such person’s official capacity and as to action in another capacity while holding such office, and shall continue as to persons who have ceased to be a director, officer, employee or agent and shall inure to the benefit of the heirs, executors and administrators of such persons.

Director’s Liability

To the fullest extent permitted by the Nevada Revised Statutes Chapter 78, as the same exists or may hereafter be amended, a director shall not be liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as director. No amendment to or repeal of this provision shall apply to or have any effect on the liability or alleged liability of any director of the Corporation for or with respect to any acts or omissions of such director occurring prior to such amendment or repeal.