Attached files

| file | filename |

|---|---|

| 8-K - CUSTOMERS BANCORP, INC. FORM 8-K - Customers Bancorp, Inc. | customers8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Customers Bancorp, Inc. | ex99-1.htm |

Exhibit 99.2

Acquisition of Student Checking Customers, New Customer Acquisition Model and Refund Management Disbursement Business Investor PresentationDecember 15, 2015NYSE: CUBI Member FDIC A division of Customers Bank

Forward-Looking Statements This presentation as well as other written or oral communications made from time to time by us, may contain certain forward-looking information within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. These statements relate to future events or future predictions, including events or predictions relating to our future financial performance, and are generally identifiable by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “plan,” “intend,” “target,” or “anticipates” or the negative thereof or comparable terminology, or by discussion of strategy or goals that involve risks and uncertainties. These forward-looking statements are only predictions and estimates regarding future events and circumstances and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. This information is based on various assumptions by us that may not prove to be correct. Important factors to consider and evaluate in such forward-looking statements include:changes in the external competitive market factors that might impact our results of operations;changes in laws and regulations, including without limitation changes in capital requirements under the federal prompt corrective action regulations;changes in our business strategy or an inability to execute our strategy due to the occurrence of unanticipated events;our ability to identify potential candidates for, and consummate, acquisition or investment transactions;the timing of acquisition or investment transactions;constraints on our ability to consummate an attractive acquisition or investment transaction because of significant competition for these opportunities;the failure of the Bank to complete any or all of the transactions described herein on the terms currently contemplated;local, regional and national economic conditions and events and the impact they may have on us and our customers;ability to attract deposits and other sources of liquidity;changes in the financial performance and/or condition of our borrowers;changes in the level of non-performing and classified assets and charge-offs;changes in estimates of future loan loss reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements;inflation, interest rate, securities market and monetary fluctuations;the timely development and acceptance of new banking products and services and perceived overall value of these products and services by users;changes in consumer spending, borrowing and saving habits;technological changes; the ability to increase market share and control expenses;

Forward-Looking Statements continued volatility in the credit and equity markets and its effect on the general economy;the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard setters;the businesses of the Bank and any acquisition targets or merger partners and subsidiaries not integrating successfully or such integration being more difficult, time-consuming or costly than expected;material differences in the actual financial results of merger and acquisition activities compared with expectations, such as with respect to the full realization of anticipated cost savings and revenue enhancements within the expected time frame; revenues following any merger being lower than expected;deposit attrition, operating costs, customer loss and business disruption following the merger, including, without limitation, difficulties in maintaining relationships with employees being greater than expected.These forward-looking statements are subject to significant uncertainties and contingencies, many of which are beyond our control. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Accordingly, there can be no assurance that actual results will meet expectations or will not be materially lower than the results contemplated in this presentation. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this document or, in the case of documents referred to or incorporated by reference, the dates of those documents. We do not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events, except as may be required under applicable law.This presentation is for discussion purposes only, and shall not constitute any offer to sell or the solicitation of an offer to buy any security, nor is it intended to give rise to any legal relationship between Customers Bancorp, Inc. (the "Company") and you or any other person, nor is it a recommendation to buy any securities or enter into any transaction with the Company. This presentation also includes certain estimated guidance regarding our earnings per share. The guidance consists solely of estimates prepared by management based on currently available information and assumptions of future performance of the company and the general economy. Our independent registered public accounting firm has not audited, reviewed or performed any procedures with respect to the guidance and, accordingly, does not express an opinion or any other form of assurance with respect to this data. Our actual results may differ from the guidance, and any such differences could be material. Accordingly, undue reliance should not be placed on this information. The factors discussed above should be considered and evaluated with respect to our guidance.

Executive Summary Strategically compelling acquisition for CUBI and transformational transaction for , making it one of the top digital banks in the USBusiness to be combined with platform marking inflection point in its developmentAssume servicing of ~2mm new student checking customers holding over $500mm in non-interest bearing depositsImmediately accelerates evolution from investment phase to shareholder return phasePowerful customer acquisition model drives maximum lifetime customer valueProven and sustainable business model; 14 year operating history and over $70bn in payments processedGenerates over 500,000 new student checking accounts annuallyPositions as the primary banking relationship as students evolve to young professionals and target retail consumer base changes from Gen X to millennialsCUBI uniquely positioned to capitalize on low risk transactionCustomers Bank has a deep understanding of the business given existing Higher One relationship coupled with extensive due diligenceDeal structured to address past regulatory and reputational risk of legacy practices Extensive dialogue with relevant regulators to preview transaction and go-forward operating modelFinancially attractive transaction to CUBI shareholders while creating one of the most technologically advanced businesses in banking todayAccretive to core EPS in first full year following closeLimited TBVPS dilution with rapid breakeven despite 100% cash transactionPractically all payments to Higher One are tax deductibleHighly attractive IRR CUBI Agrees to Acquire Student Checking Customers & Refund Disbursement Business (“Disbursements”) from Higher One

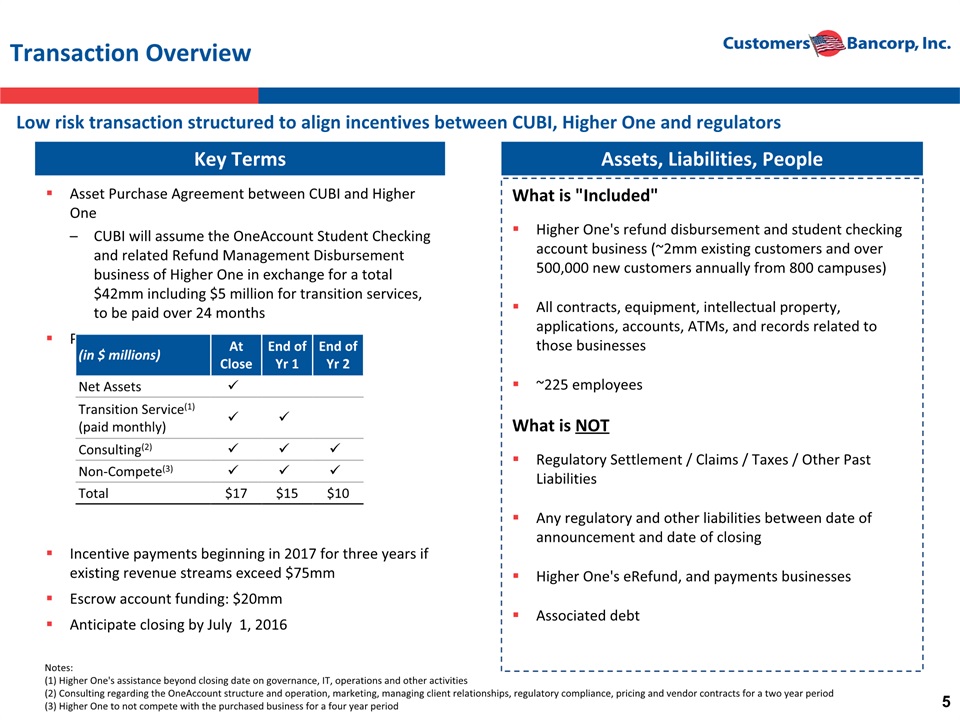

Key Terms Asset Purchase Agreement between CUBI and Higher OneCUBI will assume the OneAccount Student Checking and related Refund Management Disbursement business of Higher One in exchange for a total $42mm including $5 million for transition services, to be paid over 24 monthsPayments Incentive payments beginning in 2017 for three years if existing revenue streams exceed $75mmEscrow account funding: $20mm Anticipate closing by July 1, 2016 Transaction Overview Assets, Liabilities, People What is "Included"Higher One's refund disbursement and student checking account business (~2mm existing customers and over 500,000 new customers annually from 800 campuses) All contracts, equipment, intellectual property, applications, accounts, ATMs, and records related to those businesses~225 employeesWhat is NOTRegulatory Settlement / Claims / Taxes / Other Past LiabilitiesAny regulatory and other liabilities between date of announcement and date of closingHigher One's eRefund, and payments businessesAssociated debt (in $ millions) AtClose End of Yr 1 End of Yr 2 Net Assets Transition Service(1) (paid monthly) Consulting(2) Non-Compete(3) Total $17 $15 $10 Notes:(1) Higher One's assistance beyond closing date on governance, IT, operations and other activities(2) Consulting regarding the OneAccount structure and operation, marketing, managing client relationships, regulatory compliance, pricing and vendor contracts for a two year period(3) Higher One to not compete with the purchased business for a four year period Low risk transaction structured to align incentives between CUBI, Higher One and regulators

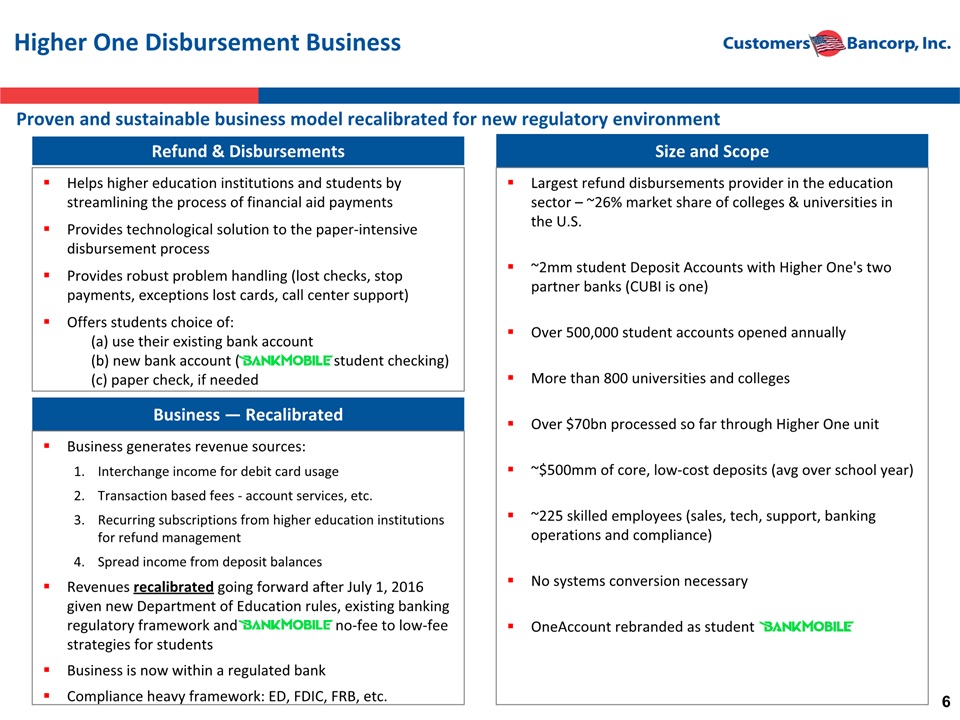

Higher One Disbursement Business Size and Scope Refund & Disbursements Helps higher education institutions and students by streamlining the process of financial aid paymentsProvides technological solution to the paper-intensive disbursement processProvides robust problem handling (lost checks, stop payments, exceptions lost cards, call center support)Offers students choice of: (a) use their existing bank account (b) new bank account ( student checking) (c) paper check, if needed Largest refund disbursements provider in the education sector – ~26% market share of colleges & universities in the U.S.~2mm student Deposit Accounts with Higher One's two partner banks (CUBI is one)Over 500,000 student accounts opened annuallyMore than 800 universities and collegesOver $70bn processed so far through Higher One unit~$500mm of core, low-cost deposits (avg over school year)~225 skilled employees (sales, tech, support, banking operations and compliance)No systems conversion necessaryOneAccount rebranded as student Business — Recalibrated Business generates revenue sources:Interchange income for debit card usageTransaction based fees - account services, etc.Recurring subscriptions from higher education institutions for refund managementSpread income from deposit balancesRevenues recalibrated going forward after July 1, 2016 given new Department of Education rules, existing banking regulatory framework and no-fee to low-fee strategies for students Business is now within a regulated bankCompliance heavy framework: ED, FDIC, FRB, etc. Proven and sustainable business model recalibrated for new regulatory environment

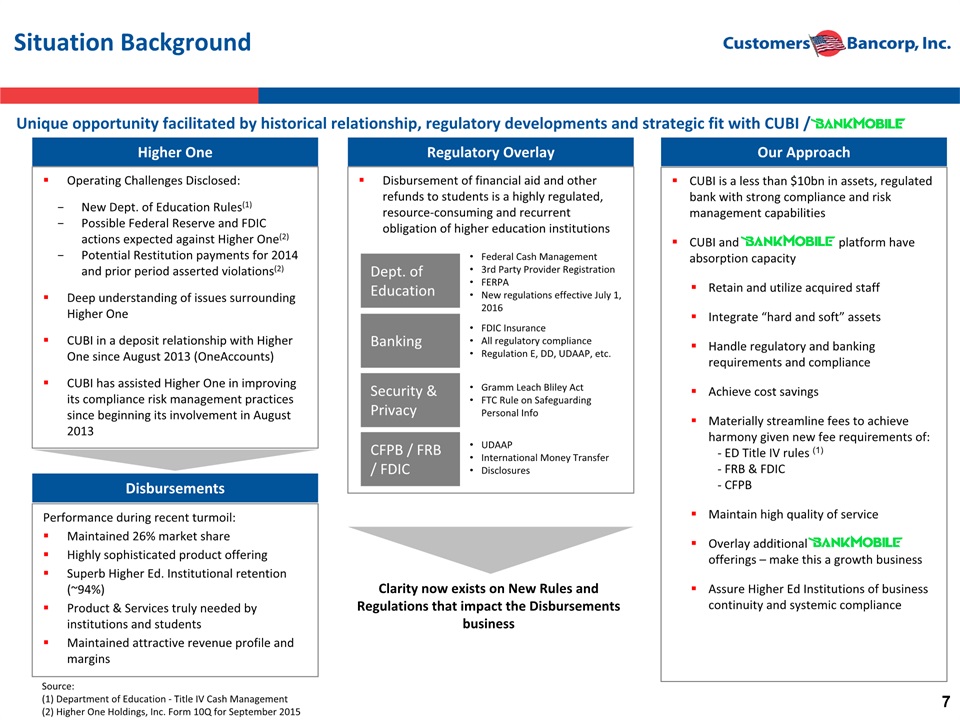

Situation Background Higher One Operating Challenges Disclosed:New Dept. of Education Rules(1)Possible Federal Reserve and FDIC actions expected against Higher One(2)Potential Restitution payments for 2014 and prior period asserted violations(2)Deep understanding of issues surrounding Higher OneCUBI in a deposit relationship with Higher One since August 2013 (OneAccounts)CUBI has assisted Higher One in improving its compliance risk management practices since beginning its involvement in August 2013 Regulatory Overlay Disbursement of financial aid and other refunds to students is a highly regulated, resource-consuming and recurrent obligation of higher education institutions Disbursements Performance during recent turmoil:Maintained 26% market shareHighly sophisticated product offeringSuperb Higher Ed. Institutional retention (~94%)Product & Services truly needed by institutions and studentsMaintained attractive revenue profile and margins Dept. of Education Federal Cash Management3rd Party Provider RegistrationFERPANew regulations effective July 1, 2016 Banking FDIC InsuranceAll regulatory complianceRegulation E, DD, UDAAP, etc. Security & Privacy Gramm Leach Bliley ActFTC Rule on SafeguardingPersonal Info CFPB / FRB / FDIC UDAAPInternational Money TransferDisclosures Our Approach CUBI is a less than $10bn in assets, regulated bank with strong compliance and risk management capabilitiesCUBI and platform have absorption capacityRetain and utilize acquired staffIntegrate “hard and soft” assetsHandle regulatory and banking requirements and complianceAchieve cost savingsMaterially streamline fees to achieve harmony given new fee requirements of: - ED Title IV rules (1) - FRB & FDIC - CFPB Maintain high quality of serviceOverlay additional offerings – make this a growth businessAssure Higher Ed Institutions of business continuity and systemic compliance Clarity now exists on New Rules and Regulations that impact the Disbursements business Source: (1) Department of Education - Title IV Cash Management(2) Higher One Holdings, Inc. Form 10Q for September 2015 Unique opportunity facilitated by historical relationship, regulatory developments and strategic fit with CUBI /

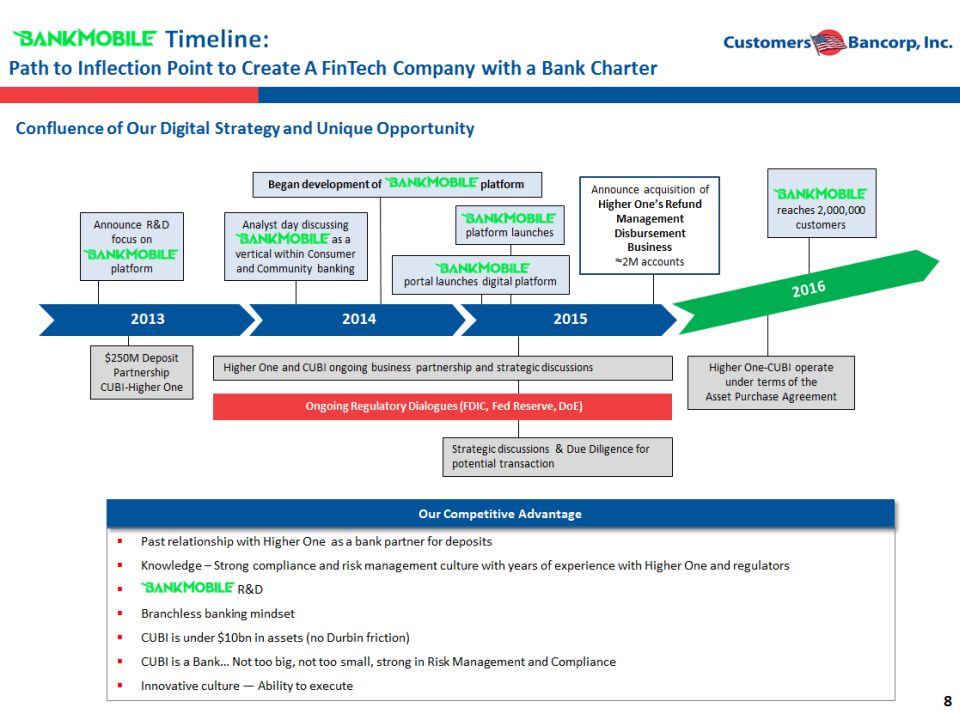

platform launches Timeline:Path to Inflection Point to Create A FinTech Company with a Bank Charter Confluence of Our Digital Strategy and Unique Opportunity $250M Deposit Partnership CUBI-Higher One Higher One-CUBI operate under terms of theAsset Purchase Agreement Higher One and CUBI ongoing business partnership and strategic discussions Announce R&D focus on platform Analyst day discussing as a vertical within Consumer and Community banking portal launches digital platform reaches 2,000,000 customers Announce acquisition of Higher One’s Refund Management Disbursement Business≈2M accounts Strategic discussions & Due Diligence for potential transaction Ongoing Regulatory Dialogues (FDIC, Fed Reserve, DoE) 2013 2014 2015 2016 Our Competitive Advantage Past relationship with Higher One as a bank partner for depositsKnowledge – Strong compliance and risk management culture with years of experience with Higher One and regulators R&DBranchless banking mindsetCUBI is under $10bn in assets (no Durbin friction)CUBI is a Bank… Not too big, not too small, strong in Risk Management and ComplianceInnovative culture — Ability to execute Began development of platform

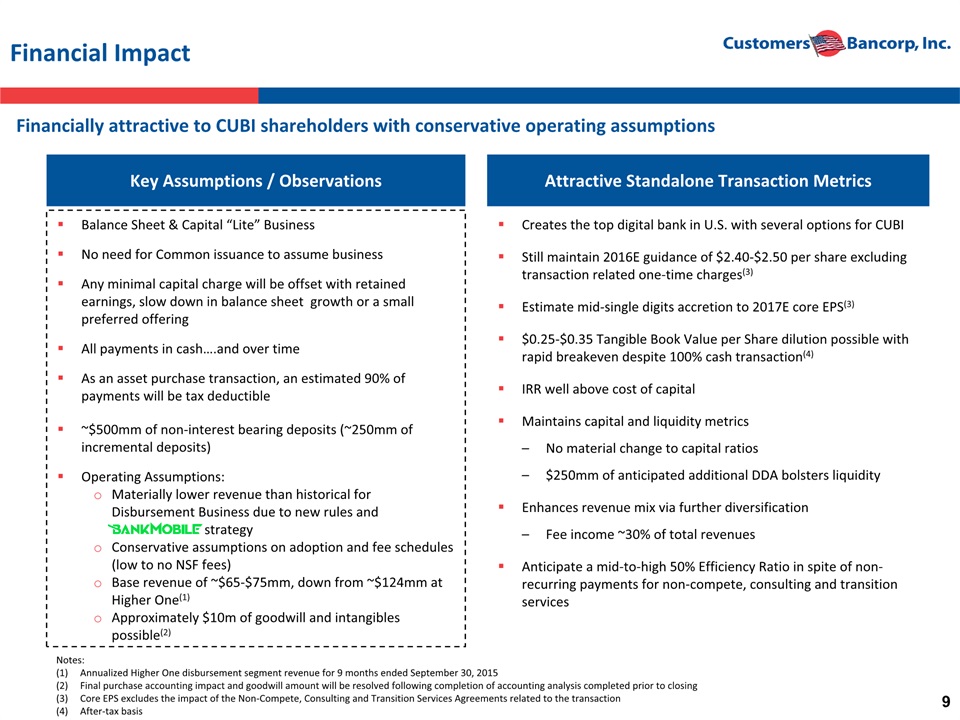

Attractive Standalone Transaction Metrics Creates the top digital bank in U.S. with several options for CUBIStill maintain 2016E guidance of $2.40-$2.50 per share excluding transaction related one-time charges(3) Estimate mid-single digits accretion to 2017E core EPS(3) $0.25-$0.35 Tangible Book Value per Share dilution possible with rapid breakeven despite 100% cash transaction(4)IRR well above cost of capitalMaintains capital and liquidity metricsNo material change to capital ratios$250mm of anticipated additional DDA bolsters liquidityEnhances revenue mix via further diversificationFee income ~30% of total revenuesAnticipate a mid-to-high 50% Efficiency Ratio in spite of non-recurring payments for non-compete, consulting and transition services Financial Impact Key Assumptions / Observations Balance Sheet & Capital “Lite” BusinessNo need for Common issuance to assume businessAny minimal capital charge will be offset with retained earnings, slow down in balance sheet growth or a small preferred offeringAll payments in cash….and over timeAs an asset purchase transaction, an estimated 90% of payments will be tax deductible~$500mm of non-interest bearing deposits (~250mm of incremental deposits)Operating Assumptions:Materially lower revenue than historical for Disbursement Business due to new rules and strategyConservative assumptions on adoption and fee schedules (low to no NSF fees)Base revenue of ~$65-$75mm, down from ~$124mm at Higher One(1)Approximately $10m of goodwill and intangibles possible(2) Notes:(1) Annualized Higher One disbursement segment revenue for 9 months ended September 30, 2015(2) Final purchase accounting impact and goodwill amount will be resolved following completion of accounting analysis completed prior to closing(3) Core EPS excludes the impact of the Non-Compete, Consulting and Transition Services Agreements related to the transaction(4) After-tax basis Financially attractive to CUBI shareholders with conservative operating assumptions

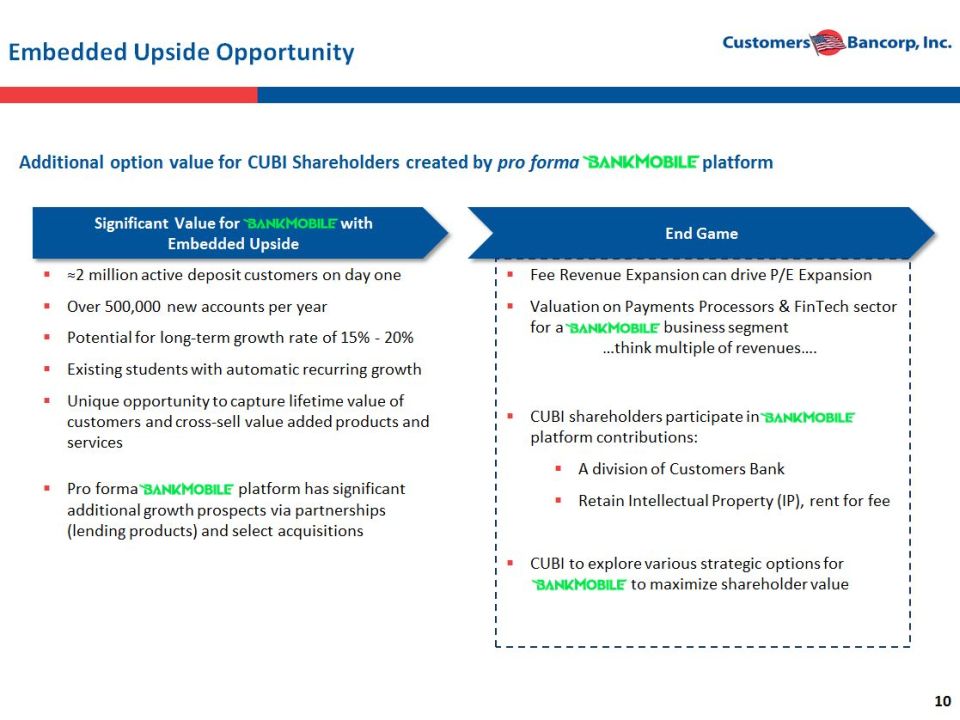

Additional option value for CUBI Shareholders created by pro forma platform Significant Value for with Embedded Upside ≈2 million active deposit customers on day oneOver 500,000 new accounts per yearPotential for long-term growth rate of 15% - 20%Existing students with automatic recurring growthUnique opportunity to capture lifetime value of customers and cross-sell value added products and servicesPro forma platform has significant additional growth prospects via partnerships (lending products) and select acquisitions Embedded Upside Opportunity End Game Fee Revenue Expansion can drive P/E ExpansionValuation on Payments Processors & FinTech sector for a business segment …think multiple of revenues….CUBI shareholders participate in platform contributions:A division of Customers BankRetain Intellectual Property (IP), rent for feeCUBI to explore various strategic options for to maximize shareholder value

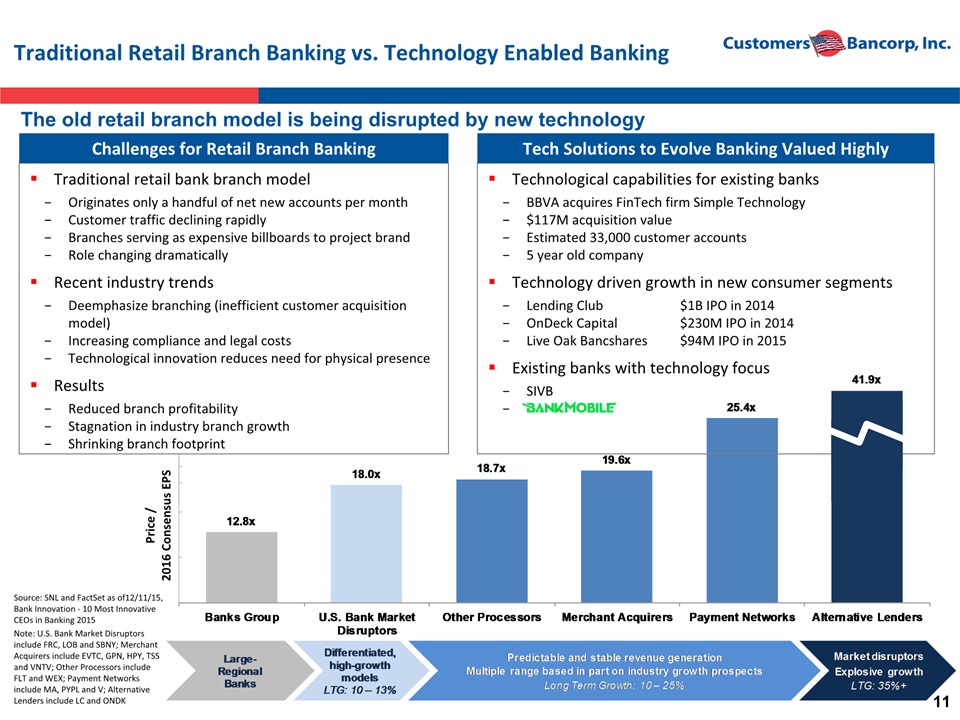

Technological capabilities for existing banksBBVA acquires FinTech firm Simple Technology$117M acquisition valueEstimated 33,000 customer accounts5 year old companyTechnology driven growth in new consumer segmentsLending Club $1B IPO in 2014OnDeck Capital $230M IPO in 2014Live Oak Bancshares $94M IPO in 2015Existing banks with technology focusSIVB Traditional Retail Branch Banking vs. Technology Enabled Banking Tech Solutions to Evolve Banking Valued Highly Source: SNL and FactSet as of12/11/15, Bank Innovation - 10 Most Innovative CEOs in Banking 2015Note: U.S. Bank Market Disruptors include FRC, LOB and SBNY; Merchant Acquirers include EVTC, GPN, HPY, TSS and VNTV; Other Processors include FLT and WEX; Payment Networks include MA, PYPL and V; Alternative Lenders include LC and ONDK Price /2016 Consensus EPS Traditional retail bank branch modelOriginates only a handful of net new accounts per monthCustomer traffic declining rapidlyBranches serving as expensive billboards to project brandRole changing dramaticallyRecent industry trendsDeemphasize branching (inefficient customer acquisition model)Increasing compliance and legal costsTechnological innovation reduces need for physical presenceResultsReduced branch profitabilityStagnation in industry branch growthShrinking branch footprint The old retail branch model is being disrupted by new technology Challenges for Retail Branch Banking

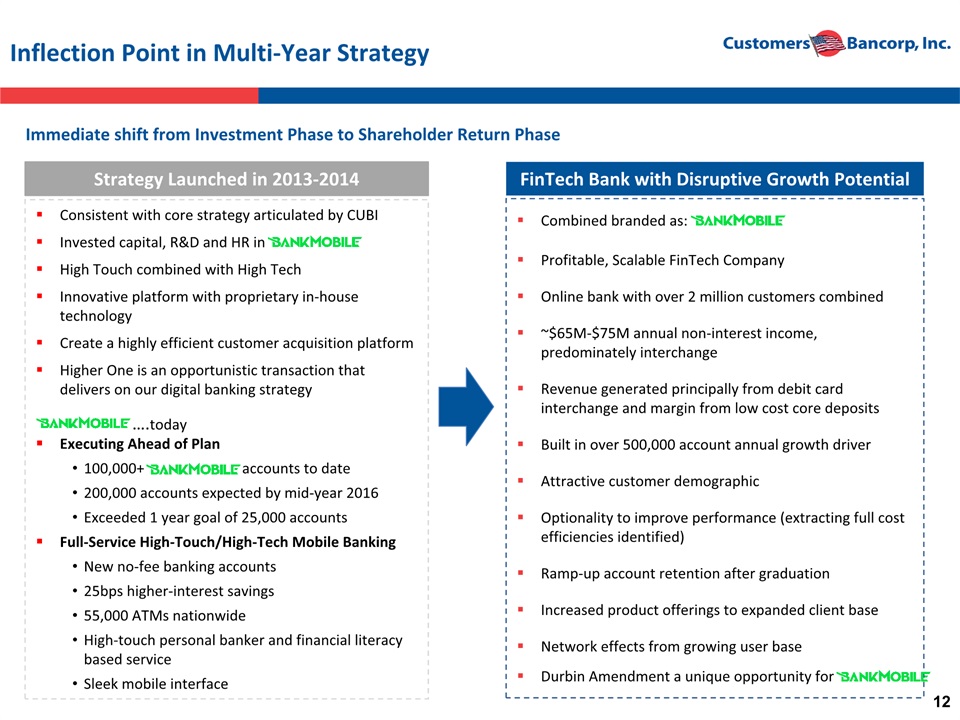

Consistent with core strategy articulated by CUBIInvested capital, R&D and HR inHigh Touch combined with High TechInnovative platform with proprietary in-house technologyCreate a highly efficient customer acquisition platform Higher One is an opportunistic transaction that delivers on our digital banking strategyExecuting Ahead of Plan100,000+ accounts to date200,000 accounts expected by mid-year 2016Exceeded 1 year goal of 25,000 accountsFull-Service High-Touch/High-Tech Mobile BankingNew no-fee banking accounts25bps higher-interest savings55,000 ATMs nationwideHigh-touch personal banker and financial literacy based serviceSleek mobile interface Combined branded as:Profitable, Scalable FinTech CompanyOnline bank with over 2 million customers combined~$65M-$75M annual non-interest income, predominately interchangeRevenue generated principally from debit card interchange and margin from low cost core depositsBuilt in over 500,000 account annual growth driverAttractive customer demographicOptionality to improve performance (extracting full cost efficiencies identified)Ramp-up account retention after graduationIncreased product offerings to expanded client baseNetwork effects from growing user baseDurbin Amendment a unique opportunity for Inflection Point in Multi-Year Strategy FinTech Bank with Disruptive Growth Potential Immediate shift from Investment Phase to Shareholder Return Phase ….today Strategy Launched in 2013-2014

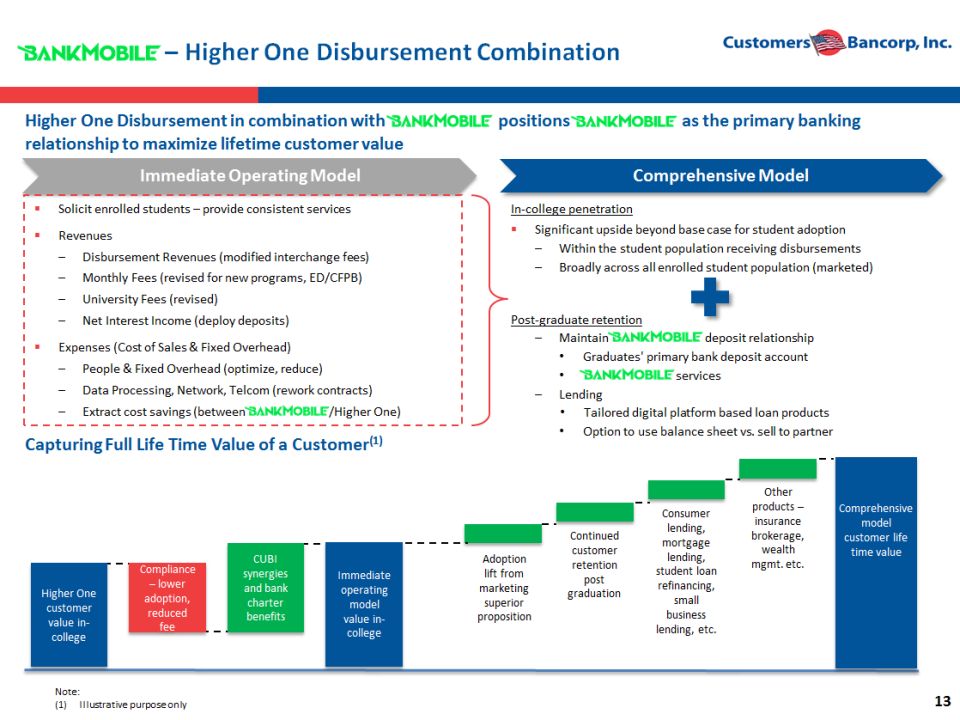

Immediate Operating Model Comprehensive Model Solicit enrolled students – provide consistent servicesRevenuesDisbursement Revenues (modified interchange fees)Monthly Fees (revised for new programs, ED/CFPB)University Fees (revised)Net Interest Income (deploy deposits)Expenses (Cost of Sales & Fixed Overhead)People & Fixed Overhead (optimize, reduce)Data Processing, Network, Telcom (rework contracts)Extract cost savings (between /Higher One) In-college penetrationSignificant upside beyond base case for student adoptionWithin the student population receiving disbursementsBroadly across all enrolled student population (marketed) Post-graduate retentionMaintain deposit relationshipGraduates' primary bank deposit account servicesLending Tailored digital platform based loan productsOption to use balance sheet vs. sell to partner Higher One Disbursement in combination with positions as the primary banking relationship to maximize lifetime customer value – Higher One Disbursement Combination Capturing Full Life Time Value of a Customer(1) Higher One customer value in-college Compliance – lower adoption, reduced fee CUBI synergies and bank charter benefits Immediate operating model value in-college Adoption lift from marketing superior proposition Continued customer retention post graduation Consumer lending, mortgage lending, student loan refinancing, small business lending, etc. Other products – insurance brokerage, wealth mgmt. etc. Note:Illustrative purpose only Comprehensive modelcustomer life time value

Analyst Day: February 2016 — New York, NYDiscuss the core strategy of as a business bank and opportunities for future gainsA deep dive into the platform and strategic options for value creationPrior to Acquisition ClosingRefine pricing strategies for certain productsAny further regulatory actions related to Higher One resolvedED Title IV Cash Management rules go into effect July 1, 2016Copious testing and complianceOngoing, open discussions with regulatorsAnticipate closing by July 1, 2016 What is Next for CUBI and ? Milestone Events & Activities

Summary Conclusions Customers Bank remains committed to its core business banking strategy"High-touch, supported by high-tech" and “Single Point of Contact” value proposition with branch-lite model from Boston to Philadelphia footprintHistory of robust organic growth, profitability and efficient operations supported by diversified client baseEmphasis on strong risk management and compliance cultureThe acquisition is a crystallization of CUBI's consumer banking strategyUnique opportunity facilitated by focus on branch lite or branchless banking model, strong risk culture, historical relationship with Higher One, regulatory communications and strategic fitAccelerates evolution of from investment phase to shareholder return phasePowerful, proven customer acquisition model drives maximum lifetime customer value, with positioned as the primary banking relationshipCUBI uniquely positioned to capitalize on low risk, financially attractive dealTransaction structured to align incentives between CUBI and Higher OneFinancially attractive to CUBI shareholders with conservative operating assumptionsAdditional upside for shareholders created by pro forma platform

Appendix

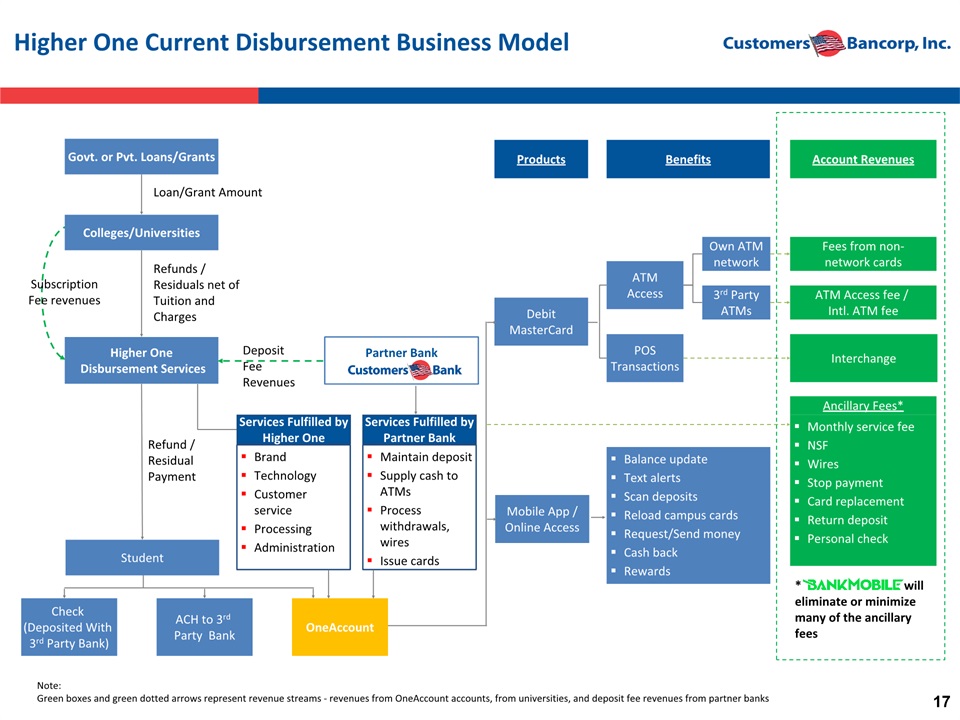

Govt. or Pvt. Loans/Grants Loan/Grant Amount Colleges/Universities Refunds / Residuals net ofTuition and Charges SubscriptionFee revenues Higher One Disbursement Services Student Check (Deposited With 3rd Party Bank) ACH to 3rd Party Bank OneAccount Partner Bank Mobile App / Online Access Debit MasterCard ATMAccess Ancillary Fees* Balance updateText alertsScan depositsReload campus cardsRequest/Send moneyCash backRewards Monthly service feeNSFWiresStop paymentCard replacementReturn depositPersonal check POSTransactions Own ATMnetwork 3rd PartyATMs Interchange Fees from non-network cards ATM Access fee / Intl. ATM fee Benefits Services Fulfilled by Partner Bank BrandTechnology Customer serviceProcessingAdministration Maintain depositSupply cash to ATMsProcess withdrawals, wiresIssue cards Services Fulfilled by Higher One Account Revenues Higher One Current Disbursement Business Model Refund / Residual Payment Products Deposit Fee Revenues Note:Green boxes and green dotted arrows represent revenue streams - revenues from OneAccount accounts, from universities, and deposit fee revenues from partner banks * will eliminate or minimize many of the ancillary fees

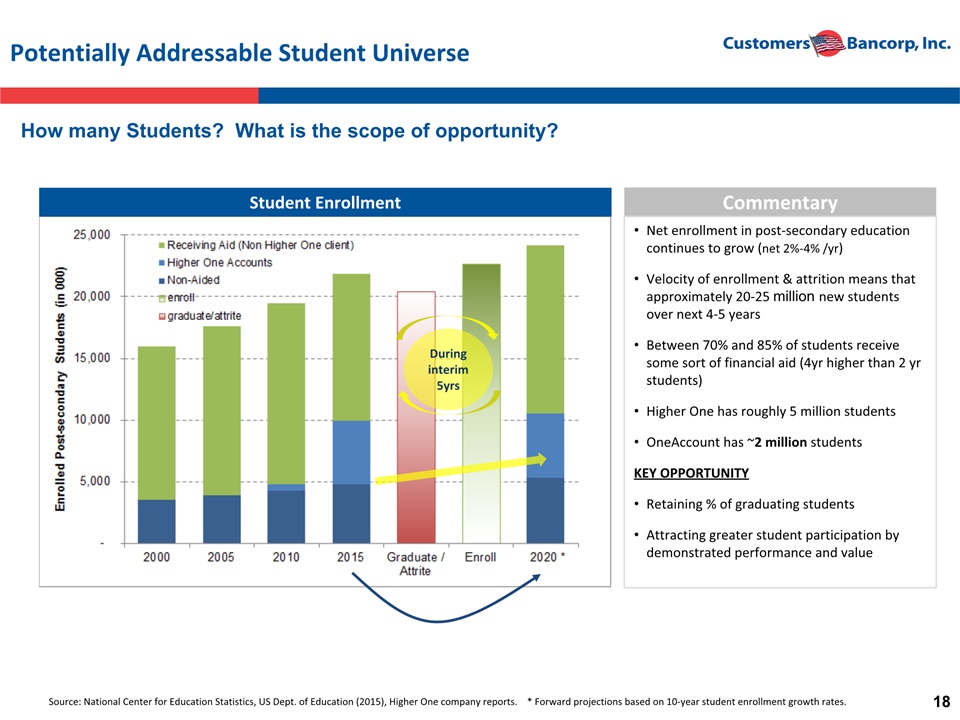

Potentially Addressable Student Universe Commentary Source: National Center for Education Statistics, US Dept. of Education (2015), Higher One company reports. * Forward projections based on 10-year student enrollment growth rates. Student Enrollment During interim 5yrs Net enrollment in post-secondary education continues to grow (net 2%-4% /yr)Velocity of enrollment & attrition means that approximately 20-25 million new students over next 4-5 yearsBetween 70% and 85% of students receive some sort of financial aid (4yr higher than 2 yr students)Higher One has roughly 5 million studentsOneAccount has ~2 million studentsKEY OPPORTUNITYRetaining % of graduating studentsAttracting greater student participation by demonstrated performance and value How many Students? What is the scope of opportunity?

Contacts Company:Robert Wahlman, CFO Tel: 610-743-8074 rwahlman@customersbank.comwww.customersbank.com Jay SidhuChairman & CEOTel: 610-301-6476 jsidhu@customersbank.comwww.customersbank.com