Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SRC Energy Inc. | a3967843_1.htm |

NYSE MKT: SYRG At Home In the Wattenberg Corporate Presentation– December 2015

Key Statistics Stock Price (12/07/15) $9.92 52 Week High/Low $13.50-$8.14 Shares Outstanding (08/31/15) Diluted 105 M Public Float ~95 M Avg. Daily Vol. (3 month) 1.4M Market Capitalization ~$1 B Insider & Employee Holdings, est. ~10% Fiscal Year End August 31 Cash & Cash Equivalents (08/31/15) $134 M Total Outstanding Debt* (08/31/15) $78 M Forward Looking Statements & Key Statistics This presentation contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. The use of words such as "believes," "expects," "anticipates," "intends," "plans," "estimates," "should," "likely" or similar expressions, indicates a forward-looking statement. These statements are subject to risks and uncertainties and are based on the beliefs and assumptions of management, and information currently available to management. The actual results could differ materially from a conclusion, forecast or projection in the forward-looking information. Certain material factors or assumptions were applied in drawing a conclusion or making a forecast or projection as reflected in the forward-looking information. The identification in this presentation of factors that may affect the company’s future performance and the accuracy of forward-looking statements is meant to be illustrative and by no means exhaustive. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. Factors that could cause the company’s actual results to differ materially from those expressed or implied by forward- looking statements include, but are not limited to: the success of the company’s exploration and development efforts; the price of oil and gas; the worldwide economic situation; changes in interest rates or inflation; the ability of the company to transport gas; willingness and ability of third parties to honor their contractual commitments; the company’s ability to raise additional capital, as it may be affected by current conditions in the stock market and competition in the oil and gas industry for risk capital; the company’s capital costs, which may be affected by delays or cost overruns; costs of production; environmental and other regulations, as the same presently exist or may later be amended; the company’s ability to identify, finance and integrate any future acquisitions; and the volatility of the company’s stock price; and other factors described in the company’s filings with the SEC, which are incorporated herein by reference. The company undertakes no obligation to update any forward‐looking statements in order to reflect any event or circumstance occurring after the date of this presentation or currently unknown facts or conditions. Resource estimates and estimates of non‐proved reserves include potentially recoverable quantities that are subject to substantially greater risk than proved reserves. 2 *$163 Million Borrowing Base on Reserve Based Credit Facility as of 8/31/15 Sources: Company estimates. In USD

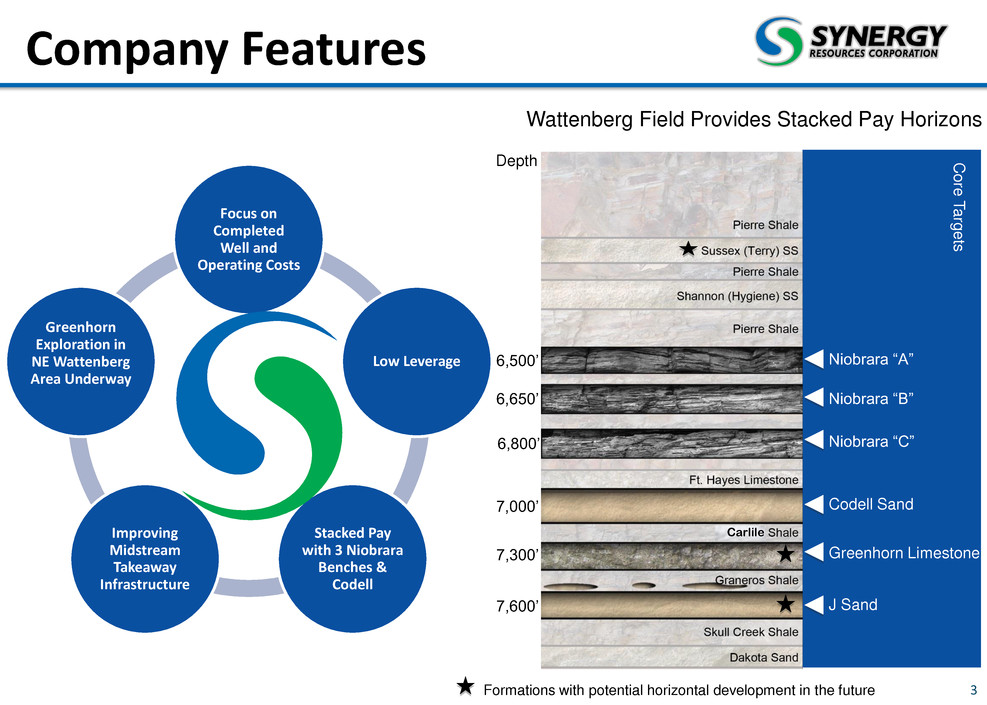

Company Features 3 Focus on Completed Well and Operating Costs Low Leverage Stacked Pay with 3 Niobrara Benches & Codell Improving Midstream Takeaway Infrastructure Greenhorn Exploration in NE Wattenberg Area Underway Wattenberg Field Provides Stacked Pay Horizons Formations with potential horizontal development in the future Niobrara “A” Niobrara “B” Niobrara “C” Codell Sand Greenhorn Limestone J Sand Cor e T a rg e ts 6,500’ 6,650’ 6,800’ 7,000’ 7,300’ 7,600’ Depth Carlile

Synergy’s acreage position in the Wattenberg comparable to core Midland Basin players in several metrics: − Benefit from similar cash margins and high returns − Core acreage positions enable profitable development in volatile commodity price environments − Liquids-rich production profile − Wattenberg and Midland Basin both have multiple zones to target for horizontal drilling 4 Synergy Acreage Position Analogous to Core Permian Operators Cash Margin(1) • Summary • Multiple Target Zones Wattenberg Midland Basin Sussex Middle Spraberry Niobrara A Jo Mill Niobrara B Lower Spraberry Niobrara C Dean Codell Wolfcamp A J-Sand Wolfcamp C Greenhorn Wolfcamp B Wolfcamp D (Cline) Note: Permian peers include FANG, LPI, PE and RSPP. Broader DJ Basin Players include BBG, BCEI, CRZO and PDCE. Peers not presented in order of reference. (1) Cash margin (excluding hedges) based on realized price per boe (excluding hedges) less LOE, ad valorem & severance taxes and cash G&A divided by realized price per boe (excluding hedges). Excludes impact of non-E&P revenue and expenses. Calculated based on actual 1H 2015. Synergy Resources 1H is calculated by using the data from Fiscal Q315 and Q215, ending on May 31, 2015 and February 28, 2015, respectively. 69% 66% 65% 58% 57% 53% 50% 49% 48% P1 SYRG P3 DJ3 DJ2 P2 DJ4 DJ5 P4 Permian Basin DJ Basin

SYRG Has 93,000 Net Acres In The Greater Wattenberg Area (~ 85% of Current Production Operated) Wattenberg Position 5 Synergy Leasehold Focus on Core Wattenberg Area ~ 41,000 Net Acres NE Wattenberg Extension Area ~ 52,000 Net Acres Note: Offset operator acreage positions reflect approximations, are not meant to depict entire leasehold, and may contain inaccuracies.

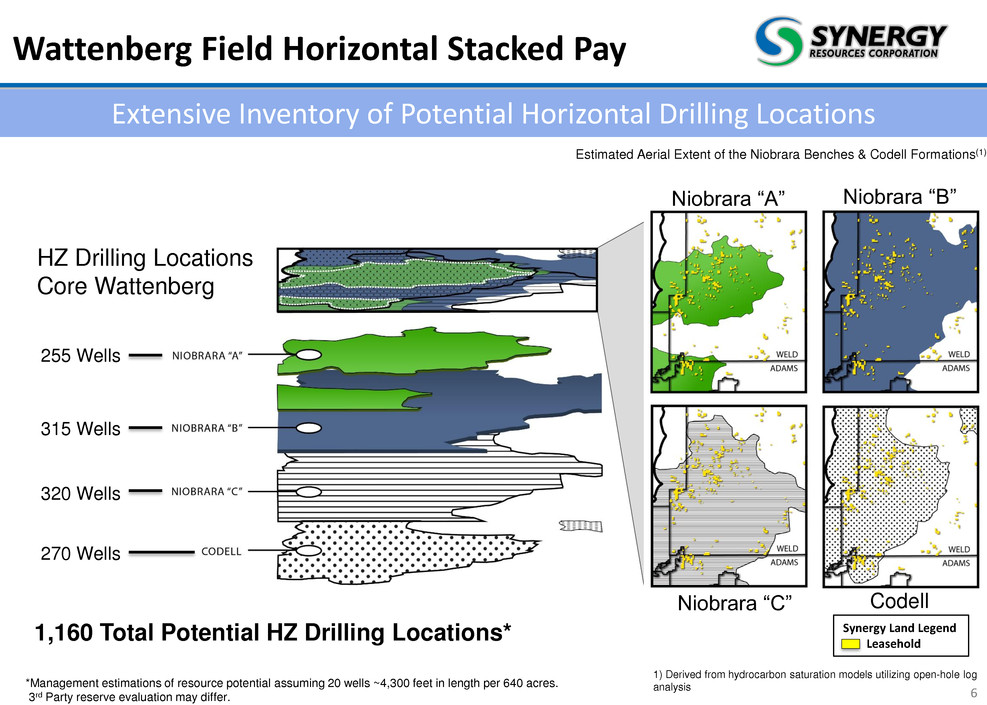

Wattenberg Field Horizontal Stacked Pay 6 *Management estimations of resource potential assuming 20 wells ~4,300 feet in length per 640 acres. 3rd Party reserve evaluation may differ. Extensive Inventory of Potential Horizontal Drilling Locations Estimated Aerial Extent of the Niobrara Benches & Codell Formations(1) HZ Drilling Locations Core Wattenberg 255 Wells 315 Wells 320 Wells 270 Wells 1,160 Total Potential HZ Drilling Locations* 1) Derived from hydrocarbon saturation models utilizing open-hole log analysis Synergy Land Legend Leasehold Niobrara “A” Niobrara “B” Niobrara “C” Codell

7 Core Wattenberg Operated HZ Wells Colorado 75 Operated HZ wells on 11 pads 8 wells in completion on Wind Pad 8 wells drilled uncompleted on Weideman Pad 10 wells being drilled on Vista Pad Synergy Land Legend Leasehold Operated pads with producing wells. Drilled Uncompleted In Completion Weideman Pad Drilling Vista Pad Wind Pad 2014-2015 2016 Long Term Plan Drilling More Mid. & Extended Laterals 10-15% ~50% >60%

DCP Midstream & Oil Pipeline Infrastructure 8 Lucerne 2 Plant, 200 MMcf/d capacity is online Grand Parkway Phase 1 scheduled for Q1 2016, Phase 2 Rights of Way and Permitting In Process Synergy has secured oil take away capacity under long term contracts on the White Cliff Pipeline and on the planned Grand Mesa Pipeline NGP Outlet to Mt. Belvieu Compressor Sites Processing Plants Planned Grand Parkway Lines Oil Pipelines - - - PHASE 1 PHASE 2 Lucerne 2 Plant Synergy Leasehold O’Connor Plant PHASE 3 Grand Mesa White Cliff

9 Track Record of Improving Operating Efficiency • Completed Well Costs • Drilling Days 13-15 days 9-11 days 7-9 days 5-7 days Source: Company data. Note: Drilling days and completed well costs are representative of a standard length lateral well and include all costs for drilling & completion, as well as all costs for surface and production facilities, but do not include leasehold and corporate overhead. (1) Well costs indicative of 15% more frac stages. (1) Reduced drilling days by >50% over the last 12 months Reduced completed well costs by >40% over the last 12 months $4.4MM $3.6MM $2.75MM $2.5MM 12 months ago 6 months ago 3 months ago 2016E 12 months ago 6 months ago Current 2016E

36 38 47 16 16 17 10 Well Economics 2016 Drilling Program has ~50% mid and extended reach laterals Cash-on-Cash Payout Focus Note: The EUR amounts above represent an estimated mid-point for the different gas-to-oil ratio (GOR) areas encountered in the Wattenberg Field Assumed differentials: oil = $9.00 / gas = $0.50 Flat commodity case uses $60 WTI and $3.00 Henry Hub Year end WTI price/bbl based on strip used as of 11/20/15: 2015 = $41.00 / 2016 = $48.18 / 2017 = $51.15 / $56 flat starting July 2020 Year end Henry Hub price/mcf based on strip used as of 11/20/15: 2015 = $2.28 / 2016 = $2.82 / 2017 = $3.02 / $3.00 flat starting July 2020 NGLs @ 10% of WTI in strip case and 25% of WTI in $60 flat case (1) Well Cost estimates include all drilling and completions costs, as well as all surface and production facilities, but do not include leasehold or corporate overhead. (2) Estimated EURs may not correspond to estimates of reserves as defined under SEC rules. (3) Rate of return and payout estimates do not reflect lease acquisition costs or corporate, general and administrative expenses. Payout estimates calculated from first month of production. Months to Payout PV-10 ($MM) IRR Extended Length Mid-Length Standard Length Well cost ($MM) $4.5 $3.5 $2.5 EUR (Mboe) 750 550 350 (1) (2) (3) (3) 24.7% 23.3% 15.2% 64.1% 62.8% 55.6% $1.6 $1.1 $0.3 $4.0 $2.9 $1.5 Strip $60 / $3.00 Product Prices

2,117 4,290 8,725 11,000 est. 0 2,000 4,000 6,000 8,000 10,000 12,000 Daily Net Production FY 2013 FY 2014 FY 2015 Est. FY 2016 0 10,000 20,000 30,000 40,000 50,000 60,000 Up 133% Up 76% Rapidly Growing Reserves and Production 11 * Proved Reserves as of 8/31/2015 (Ryder Scott 3rd Party Reserve Engineers) Compound Annual Increase in Production B O EP D R ese rv es MMB o e 32 MMBoe 14 MMBoe 57 MMBoe * PUD PDNP PDP 8/31/2013 8/31/2014 8/31/2015

Revenues and EBITDA 12 Average Realized Sales Price per Fiscal Year Fiscal Years FY-13 FY-14 FY-15 Oil (Bbls) $85.95 $89.98 $50.75 Gas & Liquids (Mcf) $4.75 $5.21 $3.39 Uplift from NGLs (%) 25% 16% 8% BOE $59.83 $66.56 $39.09 $46 $104 $125 $33 $77 $118 $0 $15 $30 $45 $60 $75 $90 $105 $120 $135 FY 2013 FY 2014 FY 2015 Revenue & Adjusted EBITDA* Revenues Adj. EBITDA $ M M *See slide 18 for Adjusted EBITDA (a NON GAAP financial measure) Reconciliation for 2014 and 2015 fiscal years. + Includes gains on commodity hedges. +

Fiscal 8/31/16 Cash CAPEX Budget $115-$135 Million* 13 Operated Horizontal Wells $90 - $100 Million Non-Operated Horizontal Wells $10 - $15 Million Land Leasing $12 - $15 Million NE Extension & Other $3 - $5 Million (Optional TBD) Balance Sheet and Cash Flow Supports Discretionary Operated Drilling Program Wattenberg Field Focused *Acquisition costs not included

14 Key Takeaways Target Rich Asset Acquisition Environment Current Balance Sheet is Net Cash Operational and Financial Flexibility Low Interest Rate on Debt (~2.5%) 2016 Operated CAPEX Funded By Cash and Estimated Internally Generated Cash Flow

15 Appendix

NE Wattenberg Extension Area 16 ~ 52,000 Net Acres, Synergy has a 100% working interest. Conrad well, a standard 4,300 foot horizontal well targeting the Greenhorn Formation has been drilled and completed, evaluation underway. Tight hole status. Note: Offset operator acreage positions reflect approximations and not entire leasehold. Synergy Land Legend Leasehold Greenhorn Characteristics (1) Depth (Ft) 6,183 Thickness (Ft) 90 TOC 3.5% Thermal Maturity TMAX (in degrees) ~444 SEM demonstrates there is abundant pore storage in the grain stones and chalks 1. Company estimates based on logs and core sample analysis Red Tail Project East Pony Conrad Well

Management Team • Edward Holloway, co-CEO • 33 years as an executive of oil and gas companies focused on the Wattenberg Field in the D-J Basin • Built three Wattenberg companies and sold each of them to larger, public companies • William Scaff, Jr., co-CEO • Over 30 years of management in the oil and gas industry with focus on the D-J Basin • Lynn Peterson, President • Mr. Peterson is the former co-founder, President and CEO of Kodiak Oil & Gas which was sold in 2014, over 30 years of experience in executive management of oil and gas companies • James P. Henderson, EVP of Finance and CFO • More than 25 years of finance and management experience with oil & gas exploration and production companies including Western Gas Resources, Anadarko Petroleum Corp. and Kodiak Oil & Gas • Craig Rasmuson, COO • Joined SYRG in 2008 and has 9 years in the oil and gas industry all focused on the D-J Basin • Jon Kruljac, VP, Capital Markets & Investor Relations • 30 years of experience in capital markets including 23 years of focus on small cap, Rocky Mountain based E&P companies Experienced in Managing and Monetizing Wattenberg Field Assets 17

Adjusted EBITDA Reconciliation 18 SYNERGY RESOURCES CORPORATION RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (unaudited, in thousands) Three Months Ended Twelve Months Ended August 31, August 31, August 31, August 31, ADJUSTED EBITDA 2015 2014 2015 2014 Net income $ (5,280) $ 10,432 $ 18,042 $ 28,853 Depreciation, depletion, and amortization 17,512 11,852 65,869 32,958 Full cost ceiling impairment 13,000 - 16,000 - Income tax expense (benefit) (1,441) 6,173 11,677 15,014 Stock based compensation 4,361 1,399 7,691 2,968 Change in fair value - derivatives 3,788 (1,807) (1,790) (2,459) Interest , net 104 (12) 159 (82) Adjusted EBITDA $ 32,044 $ 28,037 $ 117,648 $ 77,252

Hedging Summary as of 12/01/15 19 Crude Oil and Natural Gas Hedges Month Oil (Bbl) Gas HH (MMBtu) Gas CIG (MMBtu) Oil (Bbl) Gas HH (MMBtu) Gas CIG (MMBtu) December, 2015 - 72,000 100,000 $4.15 - $4.49 $2.20 - $3.05 January 1 to December 31, 2016 240,000 480,000 1,200,000 $45.00 - $65.00 $3.99 - $4.39 $2.65 - $3.10 January 1 to December 31, 2017 240,000 - 840,000 $45.00 - $70.00 - $2.64 - $3.48 Month Oil (Bbl) Gas HH (MMBtu) Gas CIG (MMBtu) Oil (Bbl) Gas HH (MMBtu) Gas CIG (MMBtu) December, 2015 50,000 - - 51.00$ - - January 1 to December 31, 2016 420,000 - - 48.57$ - - January 1 to August 31, 2017 160,000 - - 52.50$ - - (1) Oil price is based on NYMEX WTI and gas price is based on NYMEX Henry Hub or CIG. Collar Volumes Average Collar Prices (1) Put Volumes Average Option Put Prices (1) Disclosure on Derivative Instruments The Company has entered, or may enter in the future, into commodity derivative instruments utilizing, price swaps, collars, put or call options to reduce the effect of price changes on a portion of future oil and gas production. The Company’s commodity derivative instruments are measured at fair value and are included in the condensed balance sheet as derivative assets and liabilities. All derivative positions are carried at their fair value on the condensed balance sheet and are marked-to-market at the end of each period. Both the unrealized and realized gains and losses resulting from the contract settlement of derivatives are recorded in the gain on derivatives line on the condensed statement of operations. The Company has a master netting agreement on each of the individual oil and gas contracts and therefore the current asset and liability are netted on the condensed balance sheet and the non-current asset and liability are netted on the condensed balance sheet.