Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MEREDITH CORP | fy16ubs-dec2015.htm |

| 8-K - PDF - MEREDITH CORP | fy16ubsdec2015.pdf |

1 Filing under Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934 Filing by: Meredith Corporation Subject Company: Meredith Corporation Commission File No.: 001-05128

UBS 43rd Annual Global Media and Communications Conference December 7, 2015

FORWARD LOOKING STATEMENTS & SAFE HARBOR This document contains forward-looking statements. You can generally identify forward-looking statements by the use of forward-looking terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “explore,” “evaluate,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” or “will,” or the negative thereof or other variations thereon or comparable terminology. These forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Media General, Meredith and Meredith Media General's control. Statements in this document regarding Media General, Meredith and the combined company that are forward-looking, including projections as to the anticipated benefits of the proposed transaction, the methods that will be used to finance the transaction, the impact of the transaction on anticipated financial results, the synergies from the proposed transaction, and the closing date for the proposed transaction, are based on management’s estimates, assumptions and projections, and are subject to significant uncertainties and other factors, many of which are beyond the control of Media General and Meredith. In particular, projected financial information for the combined company is based on management’s estimates, assumptions and projections and has not been prepared in conformance with the applicable accounting requirements of Regulation S-X relating to pro forma financial information, and the required pro forma adjustments have not been applied and are not reflected therein. None of this information should be considered in isolation from, or as a substitute for, the historical financial statements of Media General or Meredith. Important risk factors could cause actual future results and other future events to differ materially from those currently estimated by management, including, but not limited to: the timing to consummate the proposed transaction; the risk that a condition to closing of the proposed transaction may not be satisfied and the transaction may not close; the risk that a regulatory approval that may be required for the proposed transaction is delayed, is not obtained or is obtained subject to conditions that are not anticipated; the combined company’s ability to achieve the synergies and value creation contemplated by the proposed transaction; management’s ability to promptly and effectively integrate the businesses of the two companies; the diversion of management time on transaction-related issues; change in national and regional economic conditions, the competitiveness of political races and voter initiatives, pricing fluctuations in local and national advertising, future regulatory actions and conditions in the television stations’ operating areas, competition from others in the broadcast television markets served by Media General and Meredith, volatility in programming costs, the effects of governmental regulation of broadcasting, industry consolidation, technological developments and major world news events. For more discussion of important risk factors that may materially affect Media General, Meredith and Meredith Media General, please see the risk factors contained in Media General's Annual Report on Form 10-K for its fiscal year ended December 31, 2014 and Meredith's Annual Report on Form 10-K for its fiscal year ended June 30, 2015, both of which are on file with the SEC. You should also read Meredith's and Media General's Quarterly Report on Form 10-Q for the quarter ended September 30, 2015. Except as specifically noted, information on, or accessible from, any website to which this website contains a hyperlink is not incorporated by reference into this website and does not constitute a part of this website. No assurances can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do occur, what impact they will have on the results of operations, financial condition or cash flows of Media General, Meredith or the combined company. None of Media General, Meredith nor Meredith Media General assumes any duty to update or revise forward-looking statements, whether as a result of new information, future events or otherwise, as of any future date. 3

No Offer or Solicitation This communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. ADDITIONAL INFORMATION AND WHERE TO FIND IT This communication is not a solicitation of a proxy from any shareholder of Media General, Inc. (“Media General”) or Meredith Corporation (“Meredith”). In connection with the Agreement and Plan of Merger by and among Media General, Montage New Holdco, Inc. (to be renamed Meredith Media General Corporation after closing) (“Meredith Media General”), Meredith and the other parties thereto (the “Merger”), Media General, Meredith Media General and Meredith intend to file relevant materials with the Securities and Exchange Commission ("SEC"), including a Registration Statement on Form S-4 filed by Meredith Media General that will contain a joint proxy statement/prospectus. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THESE MATERIALS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT MEDIA GENERAL, MEREDITH, MEREDITH MEDIA GENERAL AND THE MERGER. The Form S-4, including the joint proxy statement/prospectus, and other relevant materials (when they become available), and any other documents filed by Media General, Meredith and Meredith Media General with the SEC, may be obtained free of charge at the SEC’s web site at www.sec.gov. The documents filed by Media General and Meredith Media General may also be obtained for free from Media General’s Investor Relations web site (http://www.mediageneral.com/investor/index.htm) or by directing a request to Media General’s Investor Relations contact, Courtney Guertin, Director of Marketing & Communications, at 401-457-9501. The documents filed by Meredith may also be obtained for free from Meredith’s Investor Relations web site (http://ir.meredith.com) or by directing a request to Meredith’s Shareholder/Financial Analyst contact, Mike Lovell, Director of Investor Relations, at 515-284-3622. PARTICIPANTS IN THE SOLICITATION Media General and Meredith and their respective executive officers and directors may be deemed to be participants in the solicitation of proxies from the security holders of either Media General or Meredith in connection with the Merger. Information about Media General’s directors and executive officers is available in Media General’s definitive proxy statement, dated March 13, 2015, for its 2015 annual meeting of shareholders. Information about Meredith’s directors and executive officers is available in Meredith’s definitive proxy statement, dated September 26, 2014, for its 2014 annual meeting of shareholders. Other information regarding the participants and description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Form S-4 and the joint proxy statement/prospectus regarding the Merger that Meredith Media General will file with the SEC when it becomes available. 4

Strong Investment ThesisToday’s Agenda Meredith Overview National Media Group Strategies Putting it Together: Case Study Local Media Group Strategies Current events 5

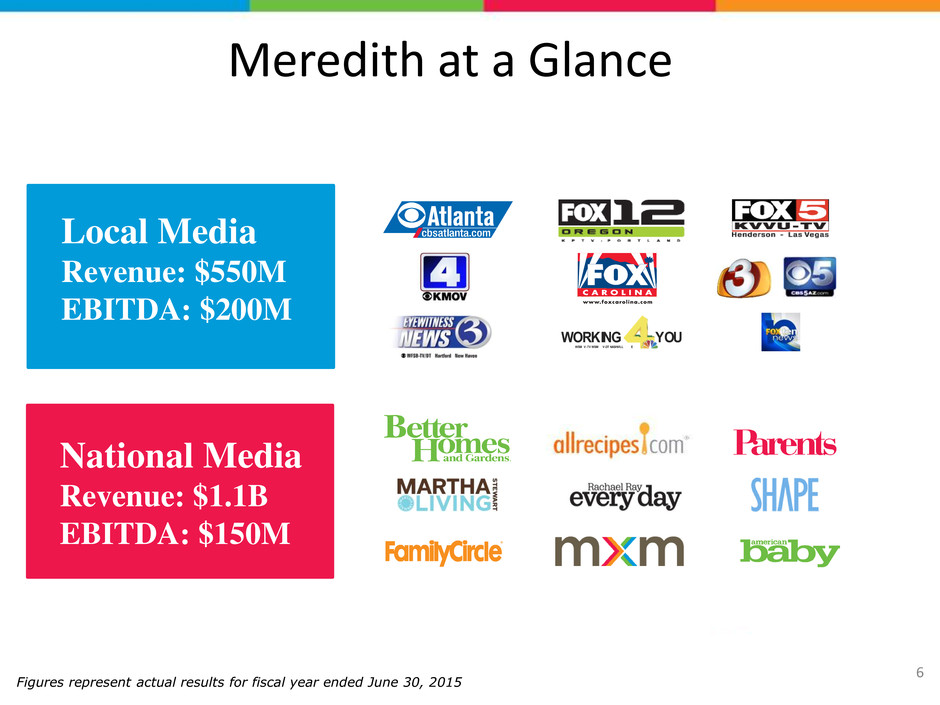

Meredith at a Glance National Media Revenue: $1.1B EBITDA: $150M Local Media Revenue: $550M EBITDA: $200M Figures represent actual results for fiscal year ended June 30, 2015 WORKING YOU WSM V -TV WSM V-DT NASHVILL E 6

A Year of Accomplishments Record broadcast revenue and EBITDA Successful integration of 4 additional television stations Rapid growth in digital, mobile, video and social platforms Expanded scale with Martha Stewart, Shape media brands; entered wedding category and added ad tech platforms Grew dividend for 22nd straight year Agreement with Media General to create powerful multiplatform and diversified media company 7

Strong Investment ThesisToday’s Agenda Meredith Overview National Media Group Strategies Putting it Together: Case Study Local Media Group Strategies Current events 8

INGREDIENTS FOR Something Special National Media Group Footprint Reaches 100 Million Unduplicated American Women Monthly 70 Million Unique Visitors | More than 60% of Millennial Women 9 YOUNG WOMEN YOUNG FAMILIES ESTABLISHED FAMILIES WOMEN OF WORTHNEW NESTERS

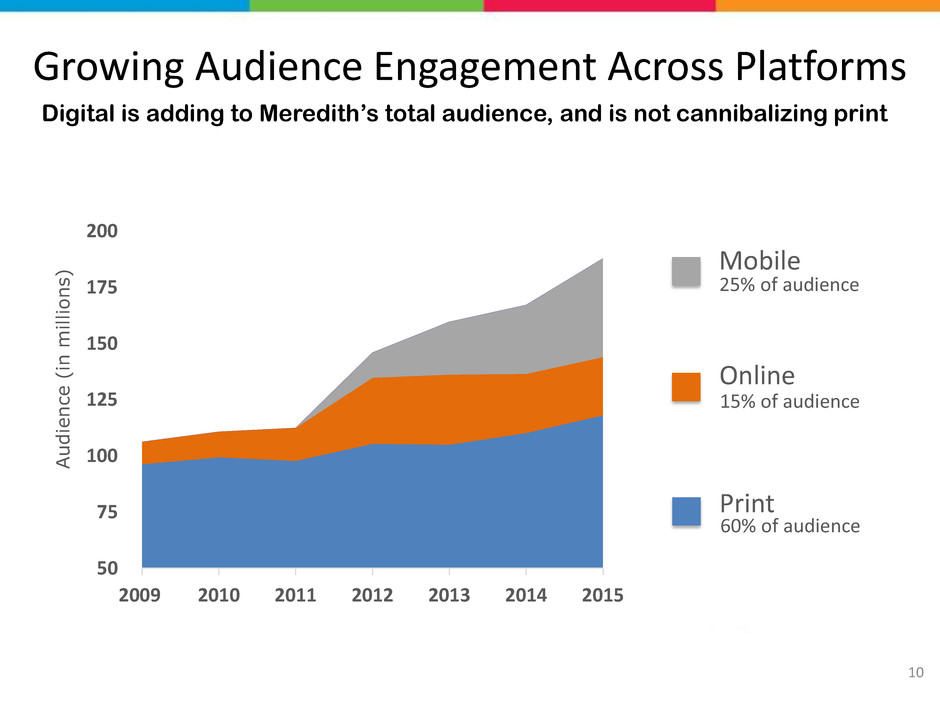

Growing Audience Engagement Across Platforms 50 75 100 125 150 175 200 2009 2010 2011 2012 2013 2014 2015 A ud ienc e ( in m il li on s ) Print Online Mobile 25% of audience 15% of audience 60% of audience Digital is adding to Meredith’s total audience, and is not cannibalizing print 10

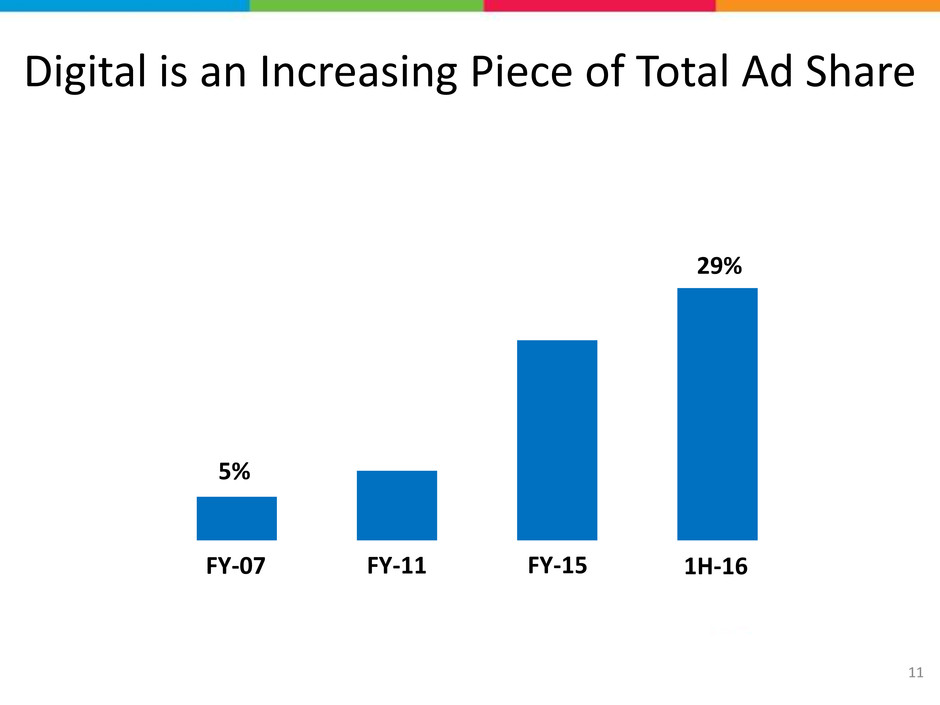

Digital Advertising Revenue Growing as Percent of Total 5% 29% Digital is an Increasing Piece of Total Ad Share FY-07 FY-11 FY-15 1H-16 11

Drive audience growth and engagement across platforms Protect and grow share of advertising revenues Increase revenue and profit contribution from circulation Leverage and strengthen brand licensing Maximize Meredith Xcelerated Marketing Strengthen portfolio through investment and acquisitions Accelerate digital platform growth National Media Group Strategies 12

National Media Group Digital Strategies Develop best-in-class branded content and products Increase audience engagement across platforms Leverage data to improve ROI and consumer experience Strengthen advertising pricing and revenue mix 13

Engaged and Growing Audience of 70 Million 14

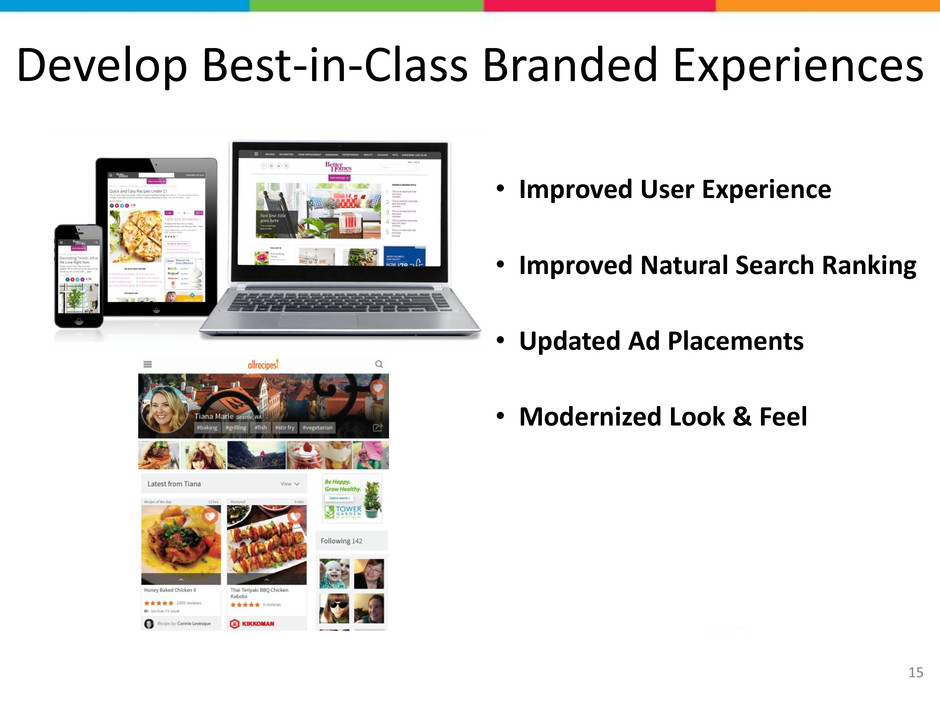

Develop Best-in-Class Branded Experiences • Improved User Experience • Improved Natural Search Ranking • Updated Ad Placements • Modernized Look & Feel 15

Leveraging Data to Improve ROI • We focus on women at scale: ― 100 million consumers ― 70 million unique visitors • 1st party data is based on direct behavioral engagement • We operate across platforms • Data is our DNA ― Team of expert data analysts ― Identify trends and consumer intent ― Used to find, inform and reach consumers throughout purchase path 16

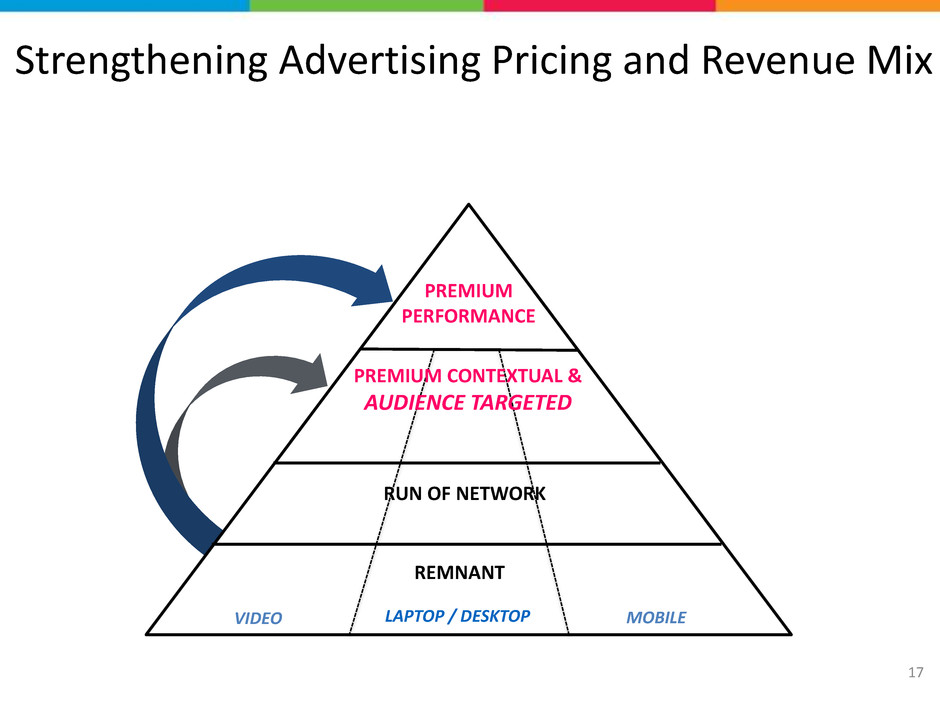

Strengthening Advertising Pricing and Revenue Mix Enterp VIDEO LAPTOP / DESKTOP MOBILE PREMIUM PERFORMANCE PREMIUM CONTEXTUAL & AUDIENCE TARGETED RUN OF NETWORK REMNANT 17

Strong Investment ThesisToday’s Agenda Meredith Overview National Media Group Strategies Putting it Together: Case Study Local Media Group Strategies Current events 18

world’s largest digital food brand leading destination for active moms largest magazine media brand The Trusted Experts For 100 Million Women Meredith brands offer guidance at every life stage and across her passions. #1 in active-lifestyle, millennial women America’s favorite hostess 19

Organic Brand Alignment Meredith is best positioned to connect marketers with their target audience 20 baby health food lifestyle

IDEATE CREATE FILTER DISTRIBUTE VALIDATE Meredith’s Content Ecosystem An end-to-end solution for brand and agency partners 21

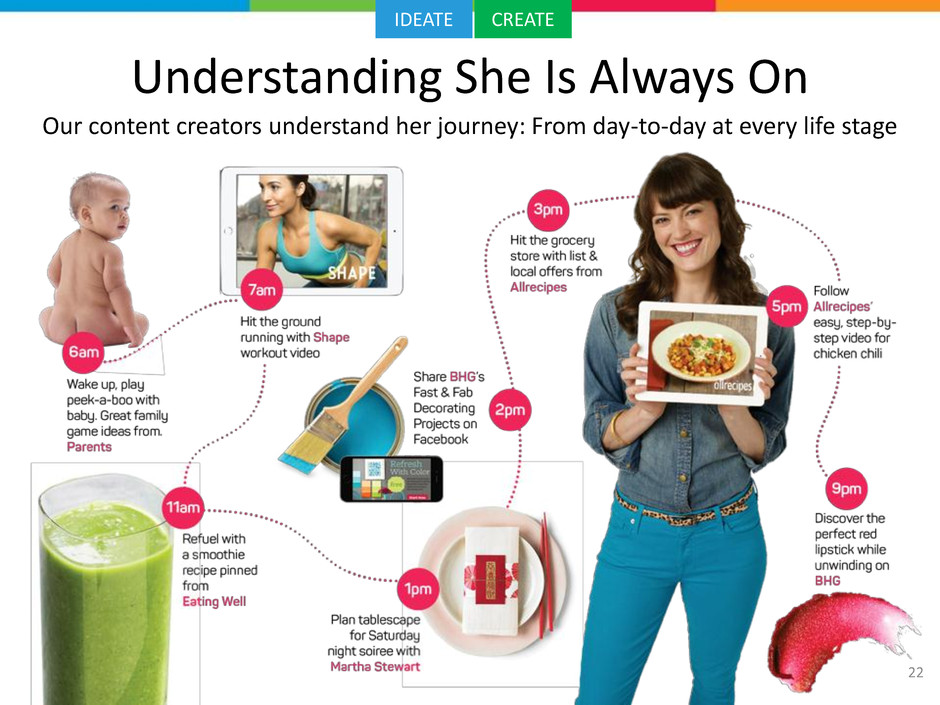

Understanding She Is Always On Our content creators understand her journey: From day-to-day at every life stage IDEATE CREATE 22

Meredith can filter your brand’s program through our audience segments to more precisely reach the right consumers; eliminate waste and maximize return Audience Targeting > Millennial Moms > Pregnant Women > Parents w/ kids 0-2 > Parents w/ toddlers > Babies R Us Shoppers > Baby Product Shoppers > Haute (New) Mamas MEREDITH REACHES MORE MOMS THAN ANY OTHER MEDIA COMPANY Ours is the largest U.S. media database with 100MM consumers and 800 data points per person FILTER Client targeting mothers 23

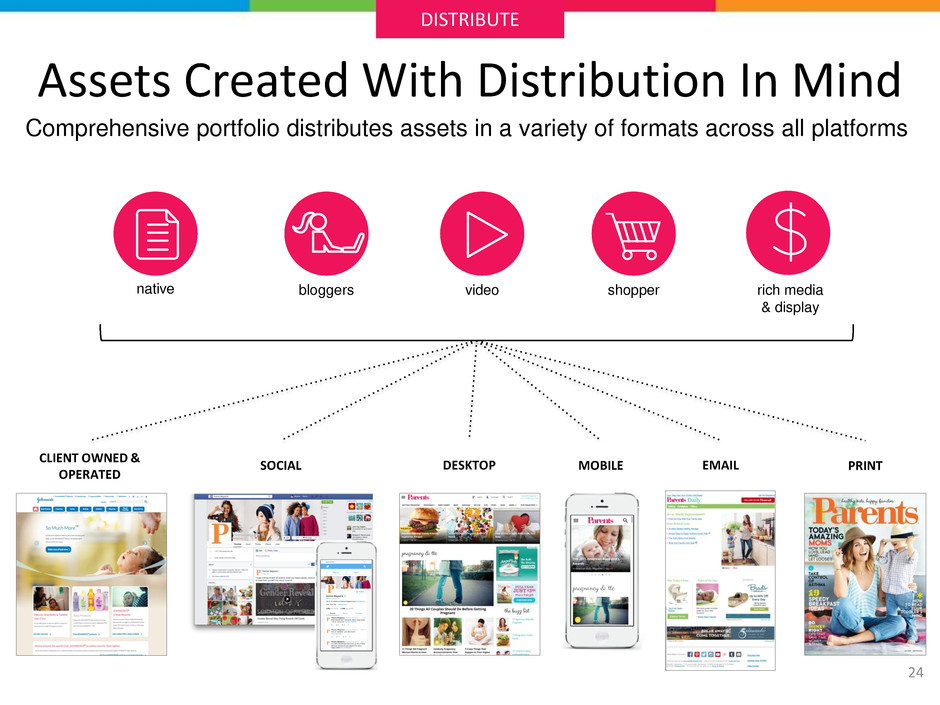

Assets Created With Distribution In Mind native bloggers video rich media & display shopper Comprehensive portfolio distributes assets in a variety of formats across all platforms EMAILSOCIAL MOBILE CLIENT OWNED & OPERATED DESKTOP PRINT DISTRIBUTE 24

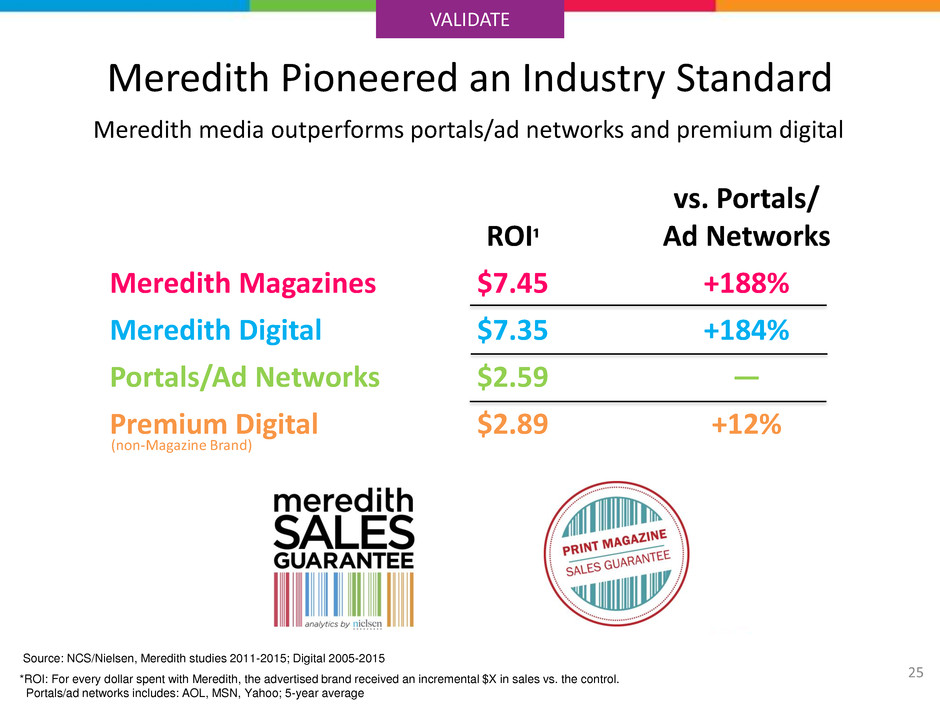

Meredith Pioneered an Industry Standard VALIDATE 25 Meredith media outperforms portals/ad networks and premium digital *ROI: For every dollar spent with Meredith, the advertised brand received an incremental $X in sales vs. the control. Portals/ad networks includes: AOL, MSN, Yahoo; 5-year average Source: NCS/Nielsen, Meredith studies 2011-2015; Digital 2005-2015 ROI¹ vs. Portals/ Ad Networks Meredith Magazines $7.45 +188% Meredith Digital $7.35 +184% Portals/Ad Networks $2.59 ― Premium Digital $2.89 +12% (non-Magazine Brand)

Strong Investment ThesisToday’s Agenda Meredith Overview National Media Group Strategies Putting it Together: Case Study Local Media Group Strategies Current events 26

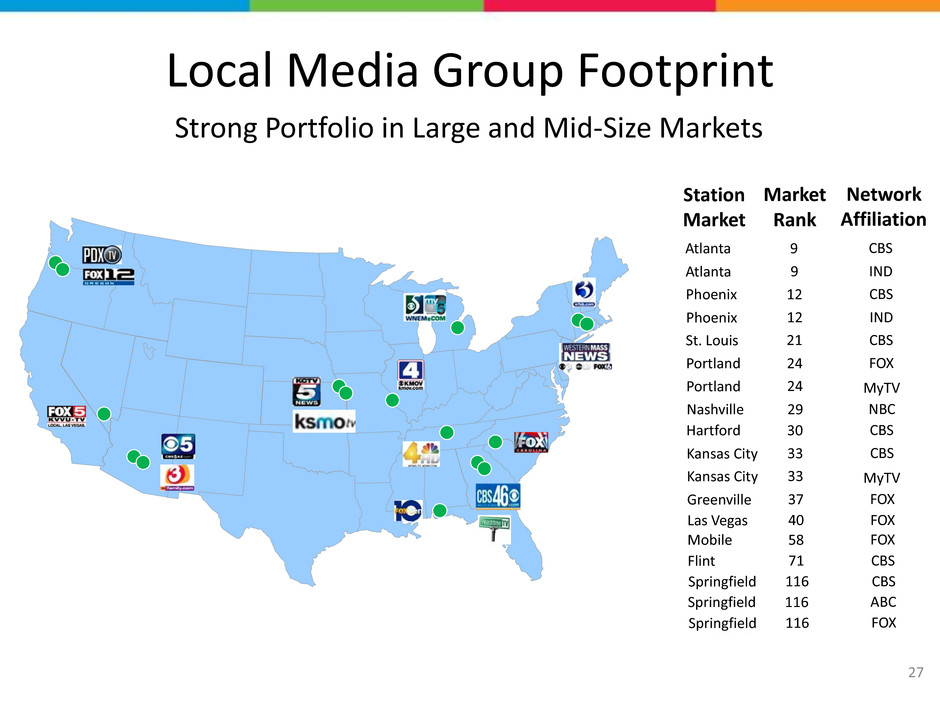

Local Media Group Footprint Strong Portfolio in Large and Mid-Size Markets Station Market Market Rank Network Affiliation Atlanta 9 CBS Atlanta 9 IND Phoenix 12 CBS Phoenix 12 IND St. Louis 21 CBS Portland 24 FOX Portland 24 MyTV Nashville 29 NBC Hartford 30 CBS Kansas City 33 CBS Kansas City 33 Greenville 37 FOX MyTV Las Vegas 40 FOX Mobile 58 FOX Flint 71 CBS Springfield 116 CBS Springfield 116 ABC Springfield 116 FOX 27

Local Media Growth Strategies Own #1 or #2 rated stations in our markets Grow non-political and political advertising revenues Protect and grow retransmission revenues Expand mobile and other digital platforms Maximize shareholder value in spectrum auction Continue to add strong stations in fast-growing markets 28

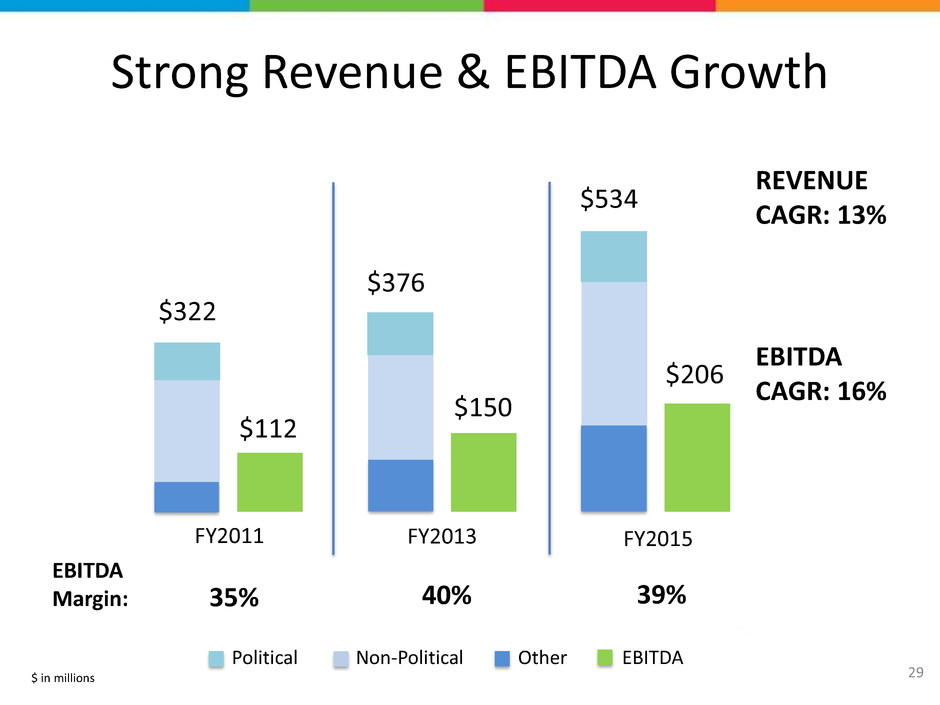

Non-Political EBITDAPolitical Other FY2011 FY2013 FY2015 $322 $376 $534 $112 EBITDA Margin: $150 $206 40% 39% Strong Revenue & EBITDA Growth 35% 29 EBITDA CAGR: 16% REVENUE CAGR: 13% $ in millions

Track Record of Successful Station Acquisitions Powerful station that produces most news in Arizona Phoenix: Market 12 St. Louis: Market 21 CBS affiliate with highly-ranked newscasts ABC and Fox affiliates strengthens competitive position Springfield, MA Fox affiliate in fast-growing region Mobile: Market 59 30

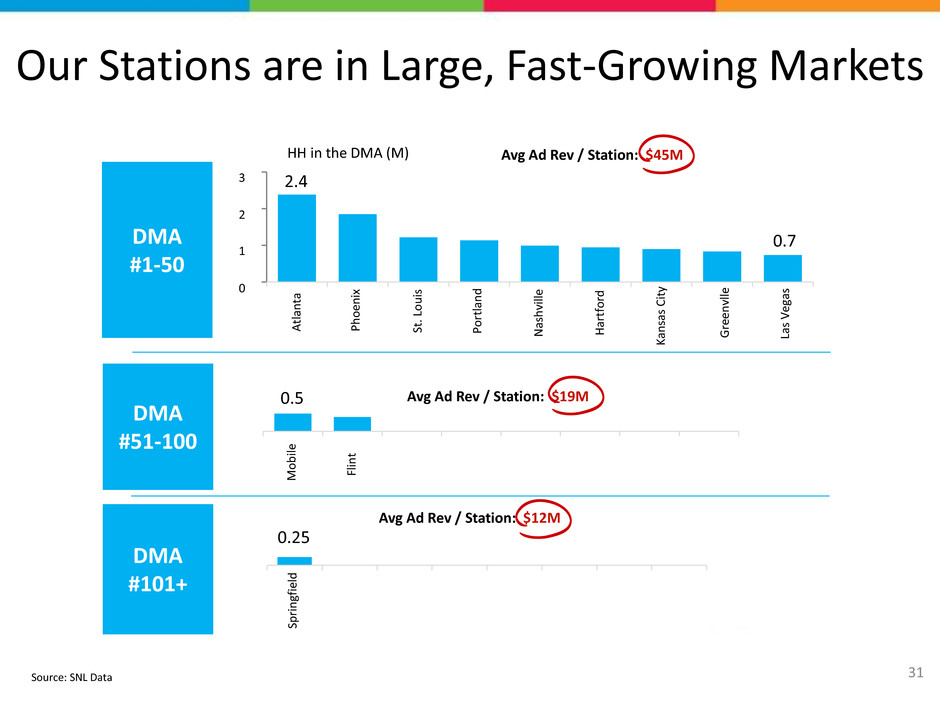

Our Stations are in Large, Fast-Growing Markets 3 2 1 0 HH in the DMA (M) La s Vega s 0.7 G re en vl le Ka n sas C it y H ar tfor d N as h vi lle P o rtl an d St. L o u is P h o en ix Atl an ta 2.4 Fl in t M o b ile 0.5 DMA #1-50 DMA #51-100 DMA #101+ Avg Ad Rev / Station: $45M Avg Ad Rev / Station: $19M Sp ri n gf ie ld 0.25 Avg Ad Rev / Station: $12M Source: SNL Data 31

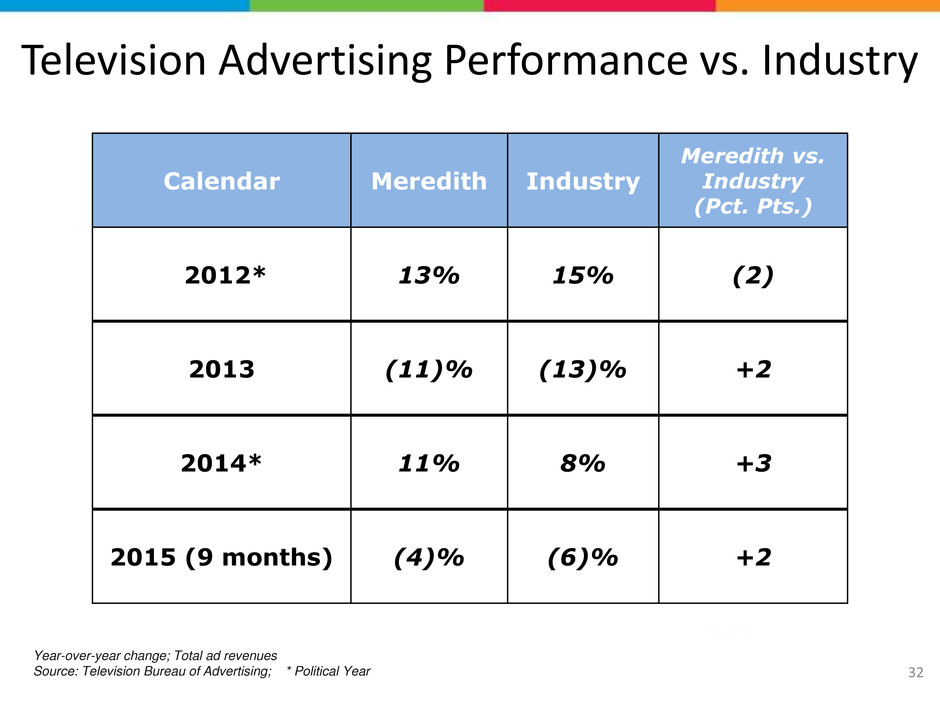

Television Advertising Performance vs. Industry Calendar Meredith Industry Meredith vs. Industry (Pct. Pts.) 2012* 13% 15% (2) 2013 (11)% (13)% +2 2014* 11% 8% +3 2015 (9 months) (4)% (6)% +2 Year-over-year change; Total ad revenues Source: Television Bureau of Advertising; * Political Year 32

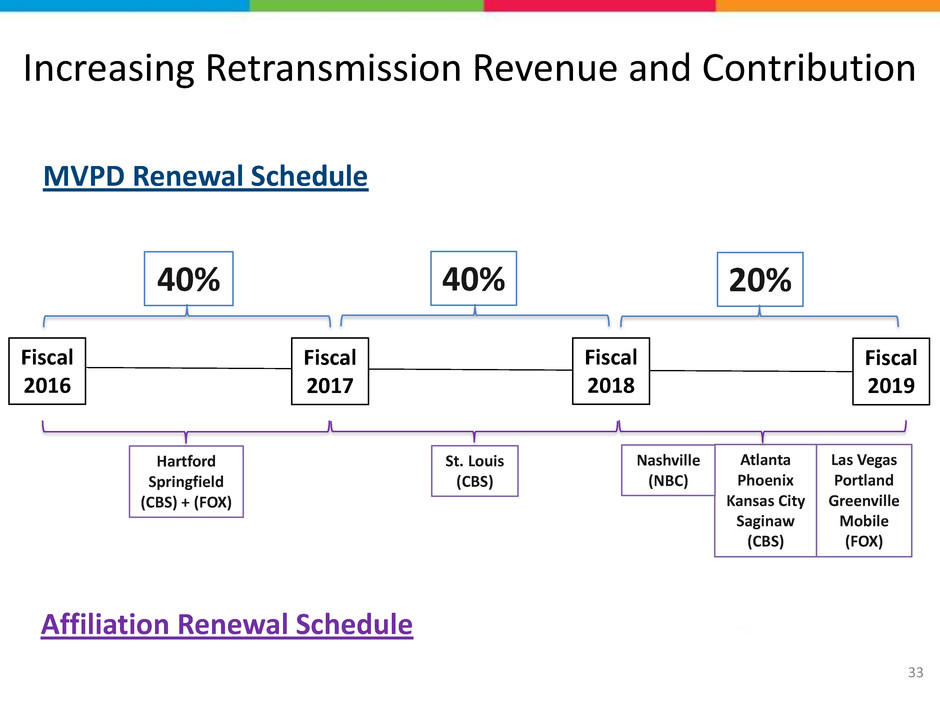

40% Hartford Springfield (CBS) + (FOX) St. Louis (CBS) Atlanta Phoenix Kansas City Saginaw (CBS) Las Vegas Portland Greenville Mobile (FOX) Fiscal 2019 MVPD Renewal Schedule Affiliation Renewal Schedule Nashville (NBC) Increasing Retransmission Revenue and Contribution Fiscal 2017 Fiscal 2018 Fiscal 2016 40% 20% 33

Strong Investment ThesisToday’s Agenda Meredith Overview National Media Group Strategies Putting it Together: Case Study Local Media Group Strategies Current events 34

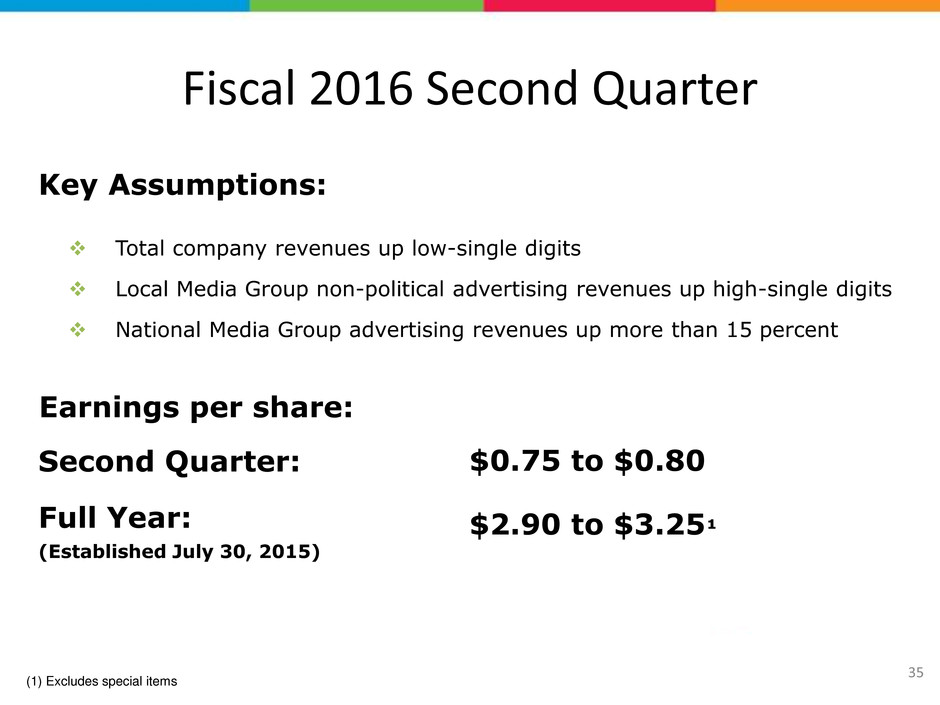

Total company revenues up low-single digits Local Media Group non-political advertising revenues up high-single digits National Media Group advertising revenues up more than 15 percent Fiscal 2016 Second Quarter Second Quarter: $0.75 to $0.80 Full Year: $2.90 to $3.25¹ (Established July 30, 2015) Key Assumptions: Earnings per share: (1) Excludes special items 35

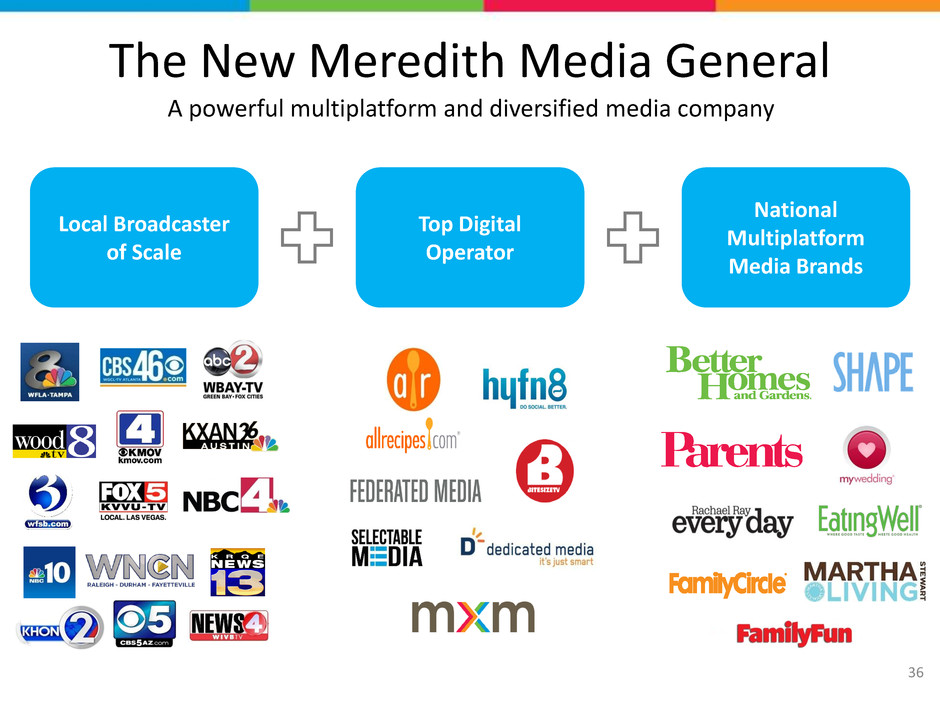

The New Meredith Media General Local Broadcaster of Scale National Multiplatform Media Brands Top Digital Operator A powerful multiplatform and diversified media company 36

• A powerful competitor in the media industry with $3 billion in revenues, over $920 million of EBITDA, and at least $1 billion in pro-forma cumulative free cash flow in the first two calendar years post-closing. • At least $85 million of verified synergies, which could climb even higher as the two companies move forward with integration activities. • More than 80 television stations across 54 markets that reach 34 million U.S. TV households. These high-quality local broadcast assets will include 25 Big Four network- affiliated TV stations in the Top 50 DMAs, making Meredith Media General the largest owner of Big Four stations in Top 50 markets. • Powerful digital platform reaching more than 200 million monthly unique visitors via a combination of leading national and local consumer sites and business-to-business digital capabilities in key growth sectors such as content, mobile, social, video and native advertising. • Leading multiplatform national media brands with a top female reach of 100 million unduplicated American women and over 60 percent of U.S. Millennial women across multiple platforms including print, digital, mobile, video and brand licensing. It will also possess a profitable marketing services business. Meredith Media General Strategic Rationale 37

Meredith Media General Positioned for Growth 38 Meredith Media General’s 30 percent TV household reach provides for further expansion in the television space, as it is well below the government-mandated 39 percent ownership cap. Meredith Media General will possess a powerful digital business, with projected first-year revenues of approximately $500 million and tremendous growth potential. Meredith has an established and profitable digital business and is well-positioned to maximize opportunities inherent in Media General’s current digital activities. • Meredith Media General will build on Meredith’s success in generating revenues not dependent on advertising via its high-margin brand licensing and its nationally recognized and profitable marketing services businesses.

Meredith Media General Merger Update 39 Meredith understands Media General Board’s fiduciary responsibility to respond to the unsolicited Nexstar proposal consistent with our binding merger agreement. Meredith still remains confident that the combination of Meredith and Media General will generate superior shareholder value – over both the near- and long-term – as compared to a potential Nexstar transaction. It is important to remember that: ― Our binding agreement to merge with Media General remains in place with fully- committed financing of $2.8 billion ― We are making significant progress on achieving key regulatory approvals needed to complete the transaction ― Our joint integration work has already identified additional synergies ― Meredith and Media General Boards of Directors continue to recommend the Meredith-Media General transaction Under the terms of our binding merger agreement, Meredith will have the opportunity to review – and propose an alternative superior proposal – to a potential agreement Media General might reach with a third-party.

UBS 43rd Annual Global Media and Communications Conference December 7, 2015