Attached files

| file | filename |

|---|---|

| EX-21 - EXHIBIT 21 - SUBSIDIARIES - MEREDITH CORP | fy14q4exhibit21.htm |

| EX-23 - EXHIBIT 23 - CONSENT - MEREDITH CORP | fy14q4exhibit23.htm |

| EX-31.1 - EXHIBIT 31.1 CEO CERTIFICATION - MEREDITH CORP | fy14q4exhibit311.htm |

| EX-31.2 - EXHIBIT 31.2 CFO CERTIFICATION - MEREDITH CORP | fy14q4exhibit312.htm |

| EX-32 - EXHIBIT 32 - SECTION 906 CERTIFICATION OF CEO AND CFO - MEREDITH CORP | fy14q4exhibit32.htm |

| 10-K - PDF OF ENTIRE SUBMISSION - MEREDITH CORP | fy14q4form10k.pdf |

| EXCEL - IDEA: XBRL DOCUMENT - MEREDITH CORP | Financial_Report.xls |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

FORM 10-K |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) |

OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2014 | Commission file number 1-5128 |

MEREDITH CORPORATION | |

(Exact name of registrant as specified in its charter) | |

Iowa | 42-0410230 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

1716 Locust Street, Des Moines, Iowa | 50309-3023 |

(Address of principal executive offices) | (ZIP Code) |

Registrant's telephone number, including area code: (515) 284-3000 | |

Securities registered pursuant to Section 12(b) of the Act: | ||||

Title of each class | Name of each exchange on which registered | |||

Common Stock, par value $1 | New York Stock Exchange | |||

Securities registered pursuant to Section 12(g) of the Act: | ||||||||

Title of class | ||||||||

Class B Common Stock, par value $1 | ||||||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer o Non-accelerated filer o Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The registrant estimates that the aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant at December 31, 2013, was $1,846,000,000 based upon the closing price on the New York Stock Exchange at that date.

Shares of stock outstanding at July 31, 2014 | ||

Common shares | 36,778,633 | |

Class B shares | 7,699,516 | |

Total common and Class B shares | 44,478,149 | |

DOCUMENT INCORPORATED BY REFERENCE | ||||

Certain portions of the Registrant's Proxy Statement for the Annual Meeting of Shareholders to be held on November 12, 2014, are incorporated by reference in Part III to the extent described therein. | ||||

TABLE OF CONTENTS | ||||

Page | ||||

Part I | ||||

Business | ||||

Description of Business | ||||

Local Media | ||||

National Media | ||||

Executive Officers of the Company | ||||

Employees | ||||

Other | ||||

Available Information | ||||

Forward Looking Statements | ||||

Risk Factors | ||||

Unresolved Staff Comments | ||||

Properties | ||||

Legal Proceedings | ||||

Mine Safety Disclosures | ||||

Part II | ||||

Market for Registrant's Common Equity, Related Shareholder | ||||

Matters, and Issuer Purchases of Equity Securities | ||||

Selected Financial Data | ||||

Management's Discussion and Analysis of Financial | ||||

Condition and Results of Operations | ||||

Quantitative and Qualitative Disclosures About Market Risk | ||||

Financial Statements and Supplementary Data | ||||

Changes in and Disagreements with Accountants on | ||||

Accounting and Financial Disclosure | ||||

Controls and Procedures | ||||

Other Information | ||||

Part III | ||||

Directors, Executive Officers, and Corporate Governance | ||||

Executive Compensation | ||||

Security Ownership of Certain Beneficial Owners and | ||||

Management and Related Stockholder Matters | ||||

Certain Relationships and Related Transactions and | ||||

Director Independence | ||||

Principal Accounting Fees and Services | ||||

Part IV | ||||

Exhibits and Financial Statement Schedules | ||||

Meredith Corporation and its consolidated subsidiaries are referred to in this Annual Report on Form 10-K (Form 10-K) as Meredith, the Company, we, our, and us. | ||||

PART I | ||

ITEM 1. BUSINESS

GENERAL

Meredith Corporation has been committed to service journalism for more than 110 years. Meredith began in 1902 as an agricultural publisher. In 1924, the Company published the first issue of Better Homes and Gardens. The Company entered the television broadcasting business in 1948. Today, Meredith uses multiple media outlets—including print, broadcast television, digital, mobile, tablets, and video—to provide consumers with content they desire and to deliver the messages of its advertising and marketing partners. The Company is incorporated under the laws of the State of Iowa. Our common stock is listed on the New York Stock Exchange under the ticker symbol MDP.

The Company operates two business segments: local media and national media. Our local media segment consists of 14 owned television stations and one operated television station located across the United States (U.S.) in mostly fast growing markets, related digital and mobile media, and a national video creation unit. The owned television stations consist of seven CBS affiliates, three FOX affiliates, two MyNetworkTV affiliates, one NBC affiliate, and one independent station. Local media's digital presence includes 12 websites, 2 mobile-optimized websites, and 27 applications (apps) focused on news, sports, and weather-related information.

Our national media segment includes leading national consumer media brands delivered via multiple media platforms including print magazines and digital and mobile media, brand licensing activities, database-related activities, and business-to-business marketing products and services. It focuses on the home and family market and is a leading publisher of magazines serving women. In fiscal 2014, we published in print twenty-one subscription magazines, including Better Homes and Gardens, Parents, Family Circle, Allrecipes, EveryDay with Rachael Ray, and FamilyFun, and approximately 120 special interest publications. Twenty of our brands are also available as digital editions on various platforms. The national media segment's extensive digital media presence consists of more than 40 websites, almost 30 mobile-optimized websites, and nearly 20 apps. Of those websites and apps, the Allrecipes' brand accounts for 19 websites and 19 mobile sites serving 23 countries in 12 languages, and 3 mobile apps across multiple countries and platforms. The national media segment also includes digital and customer relationship marketing, which provides specialized marketing products and services to some of America's leading companies; a large consumer database; brand licensing activities; and other related operations.

Financial information about industry segments can be found in Item 7-Management's Discussion and Analysis of Financial Condition and Results of Operations and in Item 8-Financial Statements and Supplementary Data under Note 15.

The Company's largest revenue source is advertising. National and local economic conditions affect the magnitude of our advertising revenues. Both local media and national media revenues and operating results can be affected by changes in the demand for advertising and consumer demand for our products. Television advertising is seasonal and cyclical to some extent, traditionally generating higher revenues in the second and fourth fiscal quarters and during key political contests and major sporting events. Magazine circulation revenues are generally affected by national and regional economic conditions and competition from other forms of media.

1

BUSINESS DEVELOPMENTS

In February 2014, Meredith completed its acquisition of KMOV, the CBS affiliate in St. Louis, Missouri, the nation's 21st largest television market. In June 2014, the Company completed its acquisition of KTVK, an independent station in Phoenix, Arizona, the nation's 12th largest television market.

Starting with a December 2013 issue, Meredith launched Allrecipes magazine, the print extension of Allrecipes.com, the world's most popular digital food destination. The Allrecipes magazine is being published six times a year and started with an initial rate base of 500,000. The rate base was increased to 650,000 beginning with the April 2014 issue.

DESCRIPTION OF BUSINESS

Local Media

Local media contributed 27 percent of Meredith's consolidated revenues and 50 percent of the combined operating profit from local media and national media operations in fiscal 2014. Information about the Company's television stations at June 30, 2014, follows:

Station, Market | DMA National Rank 1 | Network Affiliation | Channel | Expiration Date of FCC License | Average Audience Share 2 |

WGCL-TV | 9 | CBS | 46 | 4-1-2005 (3 | 4.5 % |

Atlanta, GA | |||||

KPHO-TV | 12 | CBS | 5 | 10-1-2006 3) | 6.0 % |

Phoenix, AZ | |||||

KTVK | 12 | Independent | 3 | 10-1-2014 | 3.0 % |

Phoenix, AZ | |||||

KMOV | 21 | CBS | 4 | 2-1-2022 | 9.7 % |

St. Louis, MO | |||||

KPTV | 22 | FOX | 12 | 2-1-2007 (3) | 5.8 % |

Portland, OR | |||||

KPDX | 22 | MyNetworkTV | 49 | 2-1-2015 | 2.3 % |

Portland, OR | |||||

WSMV-TV | 29 | NBC | 4 | 8-1-2005 (3) | 9.7 % |

Nashville, TN | |||||

WFSB | 30 | CBS | 3 | 4-1-2015 | 10.5 % |

Hartford, CT | |||||

New Haven, CT | |||||

KCTV | 31 | CBS | 5 | 2-1-2006 (3) | 10.0 % |

Kansas City, MO | |||||

KSMO-TV | 31 | MyNetworkTV | 62 | 2-1-2014 (3) | 1.0 % |

Kansas City, MO | |||||

2

Station, Market | DMA National Rank 1 | Network Affiliation | Channel | Expiration Date of FCC License | Average Audience Share 2 |

WHNS | 37 | FOX | 21 | 12-1-2004 (3) | 4.0 % |

Greenville, SC | |||||

Spartanburg, SC | |||||

Asheville, NC | |||||

Anderson, SC | |||||

KVVU-TV | 42 | FOX | 5 | 10-1-2006 (3) | 4.8 % |

Las Vegas, NV | |||||

WNEM-TV | 68 | CBS | 5 | 10-1-2005 (3) | 15.6 % |

Flint, MI | |||||

Saginaw, MI | |||||

Bay City, MI | |||||

WSHM-LD | 114 | CBS | 3 | 4-1-2015 | 6.7 % |

Springfield, MA | |||||

Holyoke, MA | |||||

1 Designated Market Area (DMA) is a registered trademark of, and is defined by, Nielsen Media Research. The national rank is from the 2013-2014 DMA ranking. | |||||

2 Average audience share represents the estimated percentage of households using television tuned to the station in the DMA. The percentages shown reflect the average total day shares (6:00 a.m. to 2:00 a.m.) for the November 2013, February 2014, and May 2014 measurement periods. | |||||

3 Renewal application pending. Under FCC rules, a license is automatically extended pending FCC processing and granting of the renewal application. We have no reason to believe that these licenses will not be renewed by the FCC. | |||||

Operations

The principal sources of the local media segment's revenues are: 1) local non-political advertising focusing on the immediate geographic area of the stations; 2) national non-political advertising; 3) political advertising which is seasonal with peaks occurring in our odd fiscal years (e.g. fiscal 2013, fiscal 2015) and particularly in our second fiscal quarter of those years; 4) retransmission of our television signal by satellite and cable systems and telecommunications companies; 5) station operation management fees; 6) digital advertising on the stations' websites and mobile websites; and 7) payments by advertisers for other services, such as the production of advertising materials.

The stations sell commercial time to both local/regional and national advertisers. Rates for spot advertising are influenced primarily by the market size, number of in-market broadcasters, audience share, and audience demographics. The larger a station's audience share in any particular daypart, the more leverage a station has in setting advertising rates. Generally, as the market fluctuates with supply and demand, so does a station's advertising rates. Most national advertising is sold by an independent representative firm. The sales staff at each station generates local/regional advertising revenues.

Typically 30 to 40 percent of a market's television advertising revenue is generated by local newscasts. Station personnel are continually working to grow their news ratings, which in turn will augment revenues. The Company broadcasts local newscasts in high definition in nine of our markets and in wide screen format in our other two markets.

The national network affiliations of Meredith's 13 network-affiliated television stations also influence advertising rates. Generally, a network affiliation agreement provides a station the exclusive right to broadcast network programming in its local service area. In return, the network has the right to sell most of the commercial advertising aired during network programs.

3

Our CBS affiliation agreements expire in April 2016 and August 2017. Our two MyNetworkTV affiliation agreements expire in September 2016. Our NBC affiliation agreement and our Fox affiliation agreements each expire in December 2017. Programming fees paid to NBC increased significantly in fiscal 2014. These payments are in essence a portion of the retransmission fees that Meredith receives from cable, satellite, and telecommunications service providers, which pay Meredith to carry our local television programming in their markets. These stations generally also pay networks for certain programming and services such as marquee sports (professional football, college basketball, and Olympics) and news services. The Company's Fox affiliates also pay the Fox network for additional advertising spots during prime-time programming. While Meredith's relations with the networks historically have been very good, the Company can make no assurances they will remain so over time.

Retransmission revenue is generated from cable, satellite and telecommunications service providers who pay Meredith for access to our television station signals so that they may retransmit our signals and charge their subscribers for this programming. These fees increased in fiscal 2014 primarily due to having a full year of benefit from agreements that were renegotiated in fiscal 2013.

The Federal Communications Commission (FCC) has permitted broadcast television station licensees to use their digital spectrum for a wide variety of services such as high-definition television programming, audio, data, mobile applications, and other types of communication, subject to the requirement that each broadcaster provide at least one free video channel equal in quality to the current technical standards. Several of our stations are broadcasting a second programming stream on their digital channel. Our Las Vegas, Phoenix, Hartford and Greenville stations currently broadcast a news/weather channel, our other Phoenix station broadcasts This TV Network, Flint-Saginaw has a MyNetworkTV affiliate, St. Louis broadcasts MeTV, Nashville has a Heartland Channel affiliate, and Kansas City airs MundoFox, an American Spanish language broadcast television network.

The costs of television programming are significant. In addition to network affiliation fees, there are two principal programming costs for Meredith: locally produced programming, including local news; and purchased syndicated programming. The Company continues to increase our locally produced news and entertainment programming to control content and costs and to attract advertisers. Syndicated programming costs are based largely on demand from stations in the market and can fluctuate significantly.

Meredith Video Studios (MVS) is our development, production, and multiplatform distribution company that produces video for use by Meredith's television stations and our local and national media websites, and is producing custom video for clients as well. Sponsorship opportunities include video billboards, product integration, channel sponsorships, and custom videos.

Produced by MVS, The Better Show, our daily lifestyle television show, currently airs every weekday in more than 160 markets reaching 80 percent of U.S. television households, including Top 10 markets such as New York, Los Angeles, Philadelphia, Dallas, Boston, and Atlanta. Meredith recently renewed The Better Show for an eighth season.

Competition

Meredith's television stations compete directly for advertising dollars and programming in their respective markets with other local television stations, radio stations, and cable television providers. Other mass media providers such as newspapers and their websites are also competitors. Advertisers compare market share, audience demographics, and advertising rates, and take into account audience acceptance of a station's programming, whether local, network, or syndicated.

Regulation

The ownership, operation, and sale of broadcast television and radio stations, including those licensed to the Company, are subject to the jurisdiction of the FCC, which engages in extensive regulation of the broadcasting industry under authority granted by the Communications Act of 1934, as amended (Communications Act), including authority to promulgate rules and regulations governing broadcasting. The Communications Act requires

4

broadcasters to serve the public interest. Among other things, the FCC assigns frequency bands; determines stations' locations and operating parameters; issues, renews, revokes, and modifies station licenses; regulates and limits changes in ownership or control of station licenses; regulates equipment used by stations; regulates station employment practices; regulates certain program content, including commercial matters in children's programming; has the authority to impose penalties for violations of its rules or the Communications Act; and imposes annual fees on stations. Reference should be made to the Communications Act, as well as to the FCC's rules, public notices, and rulings for further information concerning the nature and extent of federal regulation of broadcast stations.

Broadcast licenses are granted for eight-year periods. The Communications Act directs the FCC to renew a broadcast license if the station has served the public interest and is in substantial compliance with the provisions of the Communications Act and FCC rules and policies. Management believes the Company is in substantial compliance with all applicable provisions of the Communications Act and FCC rules and policies and knows of no reason why Meredith's broadcast station licenses will not be renewed.

The FCC has, on occasion, changed the rules related to local ownership of media assets, including rules relating to the ownership of one or more television stations in a market. The FCC's media ownership rules are subject to further review by the FCC, various court appeals, petitions for reconsideration before the FCC, and possible actions by Congress. We cannot predict the impact of any of these developments on our business.

The Communications Act and the FCC also regulate relationships between television broadcasters and cable and satellite television providers. Under these provisions, most cable systems must devote a specified portion of their channel capacity to the carriage of the signals of local television stations that elect to exercise this right to mandatory carriage. Alternatively, television stations may elect to restrict cable systems from carrying their signals without their written permission, referred to as retransmission consent. Congress and the FCC have established and implemented generally similar market-specific requirements for mandatory carriage of local television stations by satellite television providers when those providers choose to provide a market's local television signals.

The FCC has proposed a plan, called the National Broadband Plan, to increase the amount of spectrum available in the United States for wireless broadband use. In furtherance of the National Broadband Plan, Congress enacted and the President signed into law legislation authorizing the FCC to conduct a “reverse auction” for which television broadcast licensees could submit bids to receive compensation in return for relinquishing all or a portion of their rights in the television spectrum of their full service and/or Class A stations. Under the new law, the FCC may hold one reverse auction, and another auction for the newly freed spectrum. The FCC must complete both auctions by 2022. In May 2014, the FCC adopted a Report and Order setting forth the basic framework for the reverse auction and the subsequent repacking of broadcast television signals into a new television band plan.

Even if a television licensee does not participate in the reverse auction, the results of the auction could materially impact a station's operations. The FCC has the authority to force a television station to change channels and/or modify its coverage area to allow the FCC to rededicate certain channels within the television band for wireless broadband use. We cannot predict whether or how this will affect the Company or its television stations.

In addition to the National Broadband Plan, Congress and the FCC have under consideration, and in the future may adopt, new laws, regulations, and policies regarding a wide variety of other matters that also could affect, directly or indirectly, the operation, ownership transferability, and profitability of the Company's broadcast stations and affect the ability of the Company to acquire additional stations. In addition to the matters noted above, these could include spectrum usage fees, regulation of political advertising rates, restrictions on the advertising of certain products (such as alcoholic beverages), program content restrictions, and ownership rule changes.

Other matters that could potentially affect the Company's broadcast properties include technological innovations and developments generally affecting competition in the mass communications industry for viewers or advertisers, such as home video recording devices and players, satellite radio and television services, cable television systems, newspapers, outdoor advertising, and internet-delivered video programming services.

5

The information provided in this section is not intended to be inclusive of all regulatory provisions currently in effect. Statutory provisions and FCC regulations are subject to change, and any such changes could affect future operations and profitability of the Company's local media segment. Management cannot predict what regulations or legislation may be adopted, nor can management estimate the effect any such changes would have on the Company's television broadcasting operations.

National Media

National media contributed 73 percent of Meredith's consolidated revenues and 50 percent of the combined operating profit from local media and national media operations in fiscal 2014. Better Homes and Gardens magazine, our flagship brand, continues to account for a significant percentage of revenues and operating profit of the national media segment and the Company.

Magazines

Information for our major magazine titles as of June 30, 2014, follows:

Title | Description | Frequency per Year | Year-end Rate Base | 1 | |

Better Homes and Gardens | Women's service | 12 | 7,600,000 | ||

Family Circle | Women's service | 12 | 4,000,000 | ||

Parents | Parenthood | 12 | 2,200,000 | ||

FamilyFun | Parenthood | 10 | 2,100,000 | ||

American Baby | Parenthood | 12 | 2,000,000 | ||

EveryDay with Rachael Ray | Women's lifestyle and food | 10 | 1,700,000 | ||

Fitness | Women's lifestyle | 10 | 1,500,000 | ||

More | Women's lifestyle (age 40+) | 10 | 1,300,000 | ||

Midwest Living | Travel and lifestyle | 6 | 950,000 | ||

Ser Padres | Hispanic parenthood | 8 | 850,000 | ||

Traditional Home | Home decorating | 8 | 850,000 | ||

EatingWell | Women's lifestyle and food | 6 | 750,000 | ||

Allrecipes | Food | 6 | 650,000 | ||

Siempre Mujer | Hispanic women's lifestyle | 6 | 550,000 | ||

Wood | Woodworking | 7 | 450,000 | ||

Successful Farming | Farming business | 13 | 420,000 | ||

1 | Rate base is the circulation guaranteed to advertisers. Actual circulation generally exceeds rate base and for most of the Company's titles is tracked by the Alliance for Audited Media, which issues periodic statements for audited magazines. | |

In addition to these major magazine titles, we published approximately 120 special interest publications under approximately 80 titles in fiscal 2014, primarily under the Better Homes and Gardens brand. The titles are issued from one to six times annually and sold primarily on newsstands. A limited number of subscriptions are also sold to certain special interest publications. The following titles were published quarterly or more frequently: American Patchwork & Quilting, Country Gardens, Diabetic Living, Do It Yourself, Kitchen and Bath Ideas, and Quilts & More.

Magazine Advertising—Advertising revenues are generated primarily from sales to clients engaged in consumer marketing. Many of Meredith's larger magazines offer regional and demographic editions that contain similar editorial content but allow advertisers to customize messages to specific markets or audiences. The Company sells two primary types of magazine advertising: display and direct-response. Advertisements are either run-of-press

6

(printed along with the editorial portions of the magazine) or inserts (preprinted pages). Most of the national media segment's advertising revenues are derived from run-of-press display advertising. Meredith also possesses a strategic marketing unit, Meredith 360°, which provides clients and their agencies with access to all of Meredith’s media platforms and capabilities, including print, television, digital, video, mobile, consumer events and custom marketing. Our team of creative and marketing experts delivers innovative solutions across multiple media channels that meet each client's unique advertising and promotional requirements.

Magazine Circulation—Subscriptions obtained through direct-mail solicitation, agencies, insert cards, the internet, and other means are Meredith's largest source of circulation revenues. All of our subscription magazines, except American Baby, Ser Padres, and Successful Farming, are also sold by single copy. Single copies sold on newsstands are distributed primarily through magazine wholesalers, who have the right to receive credit from the Company for magazines returned to them by retailers.

Digital and Mobile Media

We have 20 of our brands available as digital tablet editions, with an audience of approximately 690,000. Paid digital customers represent 3 percent of our total rate base. For four of our brands, we offer digital editions that are enhanced for the tablet to include bonus content.

National media's more than 40 websites and nearly 30 mobile-optimized websites provide ideas and inspiration. These branded websites focus on the topics that women care about most—food, home, entertaining, and meeting the needs of moms—and on delivering powerful content geared toward lifestyle topics such as health, beauty, style, and wellness. Our apps, which focus on the same topics, reached nearly 31 million cumulative downloads during fiscal 2014. Digital traffic across our various platforms averaged 51 million unique monthly visitors in fiscal 2014, reaching an all-time high of 58 million during the fiscal year. Our brands have a strong social networking presence as well. In fiscal 2014, national media reached over 13 million Facebook fans, over 2 million Twitter followers, and nearly 2 million Pintrest followers.

In fiscal 2014, we generated 7 million digital orders for print magazine subscriptions, an increase of 18 percent over the prior year. We now receive over one-third of our orders from digital sources.

Other Sources of Revenues

Other revenues are derived from digital and customer relationship marketing, other custom publishing projects, brand licensing agreements, ancillary products and services, and book sales.

Meredith Xcelerated Marketing—Meredith Xcelerated Marketing (MXM) is a leading content-powered, customer engagement agency that provides fully-integrated marketing solutions for some of the world's top brands, including Kraft, Lowe's, Honda, Chrysler, Kia, and Allergan. Through its rich 45-year history, MXM has established itself as the dominant force in content marketing with deep expertise in mobile, social media, customer relationship management, and advanced analytics. Its revenue is independent of advertising and circulation, though sometimes its services are sold as part of larger programs that include advertising components.

MXM employs over 600 people in eight offices globally: New York; Los Angeles; Washington, D.C.; Dallas; Des Moines; Detroit; Windsor, Canada; and Hyderabad, India. In addition, the Meredith-iris Global Network, Meredith's partnership with iris Nation Worldwide Limited, serves the increasing global needs of MXM's domestic clients while also opening the doors to new clients in the European and Asia-Pacific markets.

Brand Licensing—Brand licensing consists of the licensing of various proprietary trademarks in connection with retail programs conducted through a number of retailers and manufacturers, and multiple licensing agreements that extend several of Meredith's brands internationally.

Meredith's largest licensing agreement is for Better Homes and Gardens branded products at Wal-Mart Stores, Inc. (Walmart). During fiscal 2014, we continued to expand the scope of Better Homes and Gardens branded products at Walmart stores. Our current licensing agreement with Walmart continues through 2016.

7

Meredith also has a long-term agreement to license the Better Homes and Gardens brand to Realogy Corporation (Realogy), which continues to build a residential real estate franchise system based on the Better Homes and Gardens brand. The network now includes more than 250 offices across the United States and Canada and more than 8,300 agents.

Meredith's titles are currently distributed in more than 70 countries—including more than 25 licensed local editions in countries such as Australia, China, Indonesia, Italy, Russia, and Turkey. During fiscal 2014, Meredith renewed and expanded several agreements that expanded the reach of our popular media brands in Greece, Philippines, and Russia.

The Company continues to pursue brand extensions that will serve consumers and advertisers alike and also extend and strengthen the reach and vitality of our brands.

Meredith Books—Meredith has licensed exclusive global rights to publish and distribute books based on our consumer-leading brands, including the powerful Better Homes and Gardens imprint, to a book publisher. Meredith creates book content and retains all approval and content rights while the publisher is responsible for book layout and design, printing, sales and marketing, distribution, and inventory management. Meredith receives royalties based on net sales subject to a guaranteed minimum.

Production and Delivery

Paper, printing, and postage costs accounted for 31 percent of the national media segment's fiscal 2014 operating expenses.

Coated publication paper is the major raw material essential to the national media segment. We directly purchase all of the paper for our magazine production and custom publishing business. The Company has contractual agreements with major paper manufacturers to ensure adequate supplies for planned publishing requirements. The price of paper is driven by overall market conditions and is therefore difficult to predict. In fiscal 2014, average paper prices decreased 4 percent. They declined 5 percent in fiscal 2013. Average paper prices increased 3 percent in fiscal 2012. Management anticipates paper prices will fall in the low to mid-single digits during fiscal 2015 and that fiscal 2015 average paper prices will be down in the low to mid-single digits compared to fiscal 2014.

Meredith has printing contracts with two major domestic printers for our magazines.

Postage is a significant expense of the national media segment. We continually seek the most economical and effective methods for mail delivery, including cost-saving strategies that leverage work-sharing opportunities offered within the postal rate structure. Periodical postage accounts for 78 percent of Meredith's postage costs, while other mail items—direct mail, replies, and bills—account for 22 percent. The Governors of the United States Postal Service (USPS) review prices for mailing services annually and adjust postage rates periodically. Though prices and price increases for various USPS products vary, overall average price increases are capped by law at the rate of inflation as measured by the Consumer Price Index, which was 1.7 percent in fiscal 2014. However, the USPS obtained approval for an additional increase of 4.3 percent, effective in January 2014, to cover recent financial losses, bringing the total price increase to 6.0 percent. The additional rate increase is currently set to phase out once losses have been recovered but may become permanent depending on the outcome of court appeals. Postage prices have risen in each of Meredith's last four fiscal years. Over the longer term, prices have increased in eight of the last nine fiscal years for Meredith.

Meredith continues to work independently and with others to encourage and help the USPS find and implement efficiencies to contain rate increases. We cannot, however, predict future changes in the postal rates or the impact they will have on our national media business.

Subscription fulfillment services for Meredith's national media segment are provided by third parties. National magazine newsstand distribution services are provided by third parties through multi-year agreements.

8

Competition

Publishing is a highly competitive business. The Company's magazines and related publishing products and services compete with other mass media, including the internet and many other leisure-time activities. Competition for advertising dollars is based primarily on advertising rates, circulation levels, reader demographics, advertiser results, and sales team effectiveness. Competition for readers is based principally on editorial content, marketing skills, price, and customer service. While competition is strong for established titles, gaining readership for newer magazines and specialty publications is especially competitive.

EXECUTIVE OFFICERS OF THE COMPANY

Executive officers are elected to one year terms each November. The current executive officers of the Company are:

Stephen M. Lacy—Chairman, President, and Chief Executive Officer (2010 - present) and a director of the Company since 2004. Formerly President and Chief Executive Officer (2006 - 2010). Age 60.

Thomas H. Harty—President-National Media Group (2010 - present). Formerly President-Consumer Magazines (2009 - 2010) and Vice President-Magazine Group (2004 - 2009). Age 51.

Paul A. Karpowicz—President-Local Media Group (2005 - present). Age 61.

Joseph H. Ceryanec—Vice President-Chief Financial Officer (2008 - present). Age 53.

John S. Zieser—Chief Development Officer/General Counsel and Secretary (2006 - present). Age 55.

EMPLOYEES

As of June 30, 2014, the Company had approximately 3,500 full-time and 100 part-time employees. Only a small percentage of our workforce is unionized. We consider relations with our employees to be good.

OTHER

Name recognition and the public image of the Company's trademarks (e.g., Better Homes and Gardens and Parents) and television station call letters are vital to the success of our ongoing operations and to the introduction of new businesses. The Company protects our brands by aggressively defending our trademarks and call letters.

The Company had no material expenses for research and development during the past three fiscal years. Revenues from individual customers and revenues, operating profits, and identifiable assets of foreign operations were not significant. Compliance with federal, state, and local provisions relating to the discharge of materials into the environment and to the protection of the environment had no material effect on capital expenditures, earnings, or the Company's competitive position.

AVAILABLE INFORMATION

The Company's corporate website is meredith.com. The content of our website is not incorporated by reference into this Form 10-K. Meredith makes available free of charge through our website our Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished to the Securities and Exchange Commission (SEC) pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practical after such documents are electronically filed with or furnished to the SEC. Meredith also

9

makes available on our website our corporate governance information including charters of all of our Board Committees, our Corporate Governance Guidelines, our Code of Business Conduct and Ethics, our Code of Ethics for CEO and Senior Financial Officers, and our Bylaws. Copies of such documents are also available free of charge upon written request.

FORWARD LOOKING STATEMENTS

This Form 10-K, including the sections titled Item 1-Business, Item 1A-Risk Factors, and Item 7-Management's Discussion and Analysis of Financial Condition and Results of Operations, contains forward-looking statements that relate to future events or our future financial performance. We may also make written and oral forward-looking statements in our SEC filings and elsewhere. By their nature, forward-looking statements involve risks, trends, and uncertainties that could cause actual results to differ materially from those anticipated in any forward-looking statements. Such factors include, but are not limited to, those items described in Item 1A-Risk Factors below, those identified elsewhere in this document, and other risks and factors identified from time to time in our SEC filings. We have tried, where possible, to identify such statements by using words such as believe, expect, intend, estimate, may, anticipate, will, likely, project, plan, and similar expressions in connection with any discussion of future operating or financial performance. Any forward-looking statements are and will be based upon our then-current expectations, estimates, and assumptions regarding future events and are applicable only as of the dates of such statements. Readers are cautioned not to place undue reliance on such forward-looking statements that are part of this filing; actual results may differ materially from those currently anticipated. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

ITEM 1A. RISK FACTORS

In addition to the other information contained or incorporated by reference into this Form 10-K, investors should consider carefully the following risk factors when investing in our securities. In addition to the risks described below, there may be additional risks that we have not yet perceived or that we currently believe are immaterial.

Advertising represents the largest portion of our revenues. In fiscal 2014, 53 percent of our revenues were derived from advertising. Advertising constitutes 45 percent of our national media revenues and 73 percent of our local media revenues. Demand for advertising is highly dependent upon the strength of the U.S. economy. During an economic downturn, demand for advertising may decrease. The growth in alternative forms of media, particularly electronic media including those based on the internet, has increased the competition for advertising dollars, which could in turn reduce expenditures for magazine and television advertising or suppress advertising rates.

Circulation revenues represent a significant portion of our revenues. Magazine circulation is another significant source of revenue, representing 22 percent of total revenues and 31 percent of national media revenues. Preserving circulation is critical for maintaining advertising sales. Magazines face increasing competition from alternative forms of media and entertainment. As a result, sales of magazines through subscriptions and at the newsstand could decline. As publishers compete for subscribers, subscription prices could decrease and marketing expenditures may increase.

Technology in the media industry continues to evolve rapidly. Advances in technology have led to an increasing number of alternative methods for the delivery of content and have driven consumer demand and expectations in unanticipated directions. If we are unable to exploit new and existing technologies to distinguish our products and services from those of our competitors or adapt to new distribution methods that provide optimal user experiences, our business, financial condition, and prospects may be adversely affected. Technology developments also pose

10

other challenges that could adversely affect our revenues and competitive position. New delivery platforms may lead to pricing restrictions, the loss of distribution control, and the loss of a direct relationship with consumers. We may also be adversely affected if the use of technology developed to block the display of advertising on websites proliferates. In addition, new and emerging technologies such as subscription streaming media services and mobile video are increasing competition for household audiences and advertisers. This competition may make it difficult for us to grow or maintain our print and broadcasting revenues, which we believe may challenge us to expand the contribution of our online and other digital businesses.

Our websites and internal networks may be vulnerable to unauthorized persons accessing our systems, which could disrupt our operations. The Company uses computers in substantially all aspects of its business operations. Our website activities involve the storage and transmission of proprietary information, which we endeavor to protect from unauthorized access. However, it is possible that unauthorized persons may be able to circumvent our protections and misappropriate proprietary information or cause interruptions or malfunctions in our digital operations. We invest in security resources and technology to protect our data and business processes against risk of data security breaches and cyber-attack, but the techniques used to attempt attacks are constantly changing. A breach or successful attack could have a negative impact on our operations or business reputation.

World events may result in unexpected adverse operating results for our local media segment. Our local media results could be affected adversely by world events such as wars, political unrest, acts of terrorism, and natural disasters. Such events can result in significant declines in advertising revenues as the stations will not broadcast or will limit broadcasting of commercials during times of crisis. In addition, our stations may have higher newsgathering costs related to coverage of the events.

Our local media operations are subject to FCC regulation. Our broadcasting stations operate under licenses granted by the FCC. The FCC regulates many aspects of television station operations including employment practices, political advertising, indecency and obscenity, programming, signal carriage, and various technical matters. Violations of these regulations could result in penalties and fines. Changes in these regulations could impact the results of our operations. The FCC also regulates the ownership of television stations. Changes in the ownership rules could affect our ability to consummate future transactions. Details regarding regulation and its impact on our local media operations are provided in Item 1-Business beginning on page 4.

Loss of or changes in affiliation agreements could adversely affect operating results for our local media segment. Due to the quality of the programming provided by the networks, stations that are affiliated with a network generally have higher ratings than unaffiliated independent stations in the same market. As a result, it is important for stations to maintain their network affiliations. Most of our stations have network affiliation agreements. Seven are affiliated with CBS, three with Fox, two with MyNetworkTV, and one with NBC. These television networks produce and distribute programming in exchange for each of our stations' commitment to air the programming at specified times and for commercial announcement time during the programming. In most cases, we also make cash payments to the networks. These payments are in essence a portion of the retransmission fees that Meredith receives from cable, satellite, and telecommunications service providers, which pay Meredith to carry its local television programming in their markets. The non-renewal or termination of any of our network affiliation agreements would prevent us from being able to carry programming of the affiliate network. This loss of programming would require us to obtain replacement programming, which may involve higher costs and/or which may not be as attractive to our audiences, resulting in reduced revenues. Our CBS affiliation agreements expire in April 2016 and August 2017. Our two MyNetworkTV affiliation agreements expire in September 2016. Our NBC affiliation agreement and our Fox affiliation agreements each expire in December 2017.

Client relationships are important to our brand licensing and consumer relationship marketing businesses. Our ability to maintain existing client relationships and generate new clients depends significantly on the quality of our products and services, our reputation, and the continuity of Company and client personnel. Dissatisfaction with our products and services, damage to our reputation, or changes in key personnel could result in a loss of business.

11

Paper and postage prices are difficult to predict and control. Paper and postage represent significant components of our total cost to produce, distribute, and market our printed products. In fiscal 2014, these expenses accounted for 22 percent of national media's operating costs. Paper is a commodity and its price has been subject to significant volatility. All of our paper supply contracts currently provide for price adjustments based on prevailing market prices; however, we historically have been able to realize favorable paper pricing through volume discounts. The USPS distributes substantially all of our magazines and many of our marketing materials. Postal rates are dependent on the operating efficiency of the USPS and on legislative mandates imposed upon the USPS. Although we work with others in the industry and through trade organizations to encourage the USPS to implement efficiencies that will minimize rate increases, we cannot predict with certainty the magnitude of future price changes for paper and postage. Further, we may not be able to pass such increases on to our customers.

Acquisitions pose inherent financial and other risks and challenges. As a part of our strategic plan, we have acquired businesses and we expect to continue acquiring businesses in the future. These acquisitions can involve a number of risks and challenges, any of which could cause significant operating inefficiencies and adversely affect our growth and profitability. Such risks and challenges include underperformance relative to our expectations and the price paid for the acquisition; unanticipated demands on our management and operational resources; difficulty in integrating personnel, operations, and systems; retention of customers of the combined businesses; assumption of contingent liabilities; and acquisition-related earnings charges. If our acquisitions are not successful, we may record impairment charges. Our ability to continue to make acquisitions will depend upon our success at identifying suitable targets, which requires substantial judgment in assessing their values, strengths, weaknesses, liabilities and potential profitability, as well as the availability of suitable candidates at acceptable prices, and whether restrictions are imposed by regulations. Moreover, competition for certain types of acquisitions is significant, particularly in the fields of broadcast stations and interactive media. Even if successfully negotiated, closed, and integrated, certain acquisitions may not advance our business strategy and may fall short of expected return on investment targets.

Impairment of goodwill and intangible assets is possible, depending upon future operating results and the value of the Company's stock. We test our goodwill and intangible assets, including FCC licenses, for impairment during the fourth quarter of every fiscal year and on an interim basis if indicators of impairment exist. Factors which influence the evaluation include the Company's stock price and expected future operating results. If the carrying value of a reporting unit or an intangible asset is no longer deemed to be recoverable, a potentially material impairment charge could be incurred. At June 30, 2014, goodwill and intangible assets totaled $1.7 billion, or 66 percent of Meredith's total assets, with $955.3 million in the national media segment and $721.8 million in the local media segment. The review of goodwill is performed at the reporting unit level. The Company has three reporting units, local media, magazine brands, and MXM. As of May 31, 2014, the date that management last performed its annual review of impairment of goodwill and intangible assets, the fair value of the local media reporting unit significantly exceeded its net assets, the fair value of the magazine brands reporting unit exceeded its net assets by 20 percent, and the fair value of the MXM reporting unit exceeded its net assets by more than 40 percent. Changes in key assumptions about the economy or business prospects used to estimate fair value or other changes in market conditions could result in an impairment charge. Although these charges would be non-cash in nature and would not affect the Company's operations or cash flow, they would adversely affect stockholders' equity and reported results of operations in the period charged.

We have two classes of stock with different voting rights. We have two classes of stock: common stock and Class B stock. Holders of common stock are entitled to one vote per share and account for approximately 30 percent of the voting power. Holders of Class B stock are entitled to ten votes per share and account for the remaining 70 percent of the voting power. There are restrictions on who can own Class B stock. The majority of Class B shares are held by members of Meredith's founding family. Control by a limited number of holders may make the Company a less attractive takeover target, which could adversely affect the market price of our common stock. This

voting control also prevents other shareholders from exercising significant influence over certain of the Company's business decisions.

The preceding risk factors should not be construed as a complete list of factors that may affect our future operations and financial results. | ||

12

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Meredith is headquartered in Des Moines, IA. The Company owns buildings at 1716 and 1615 Locust Street and is the sole occupant of these buildings. The Company believes these facilities are adequate for their intended use.

The local media segment operates from facilities in the following locations: Atlanta, GA; Phoenix, AZ; Beaverton, OR; Rocky Hill, CT; Nashville, TN; Fairway, KS; St. Louis, MO; Greenville, SC; Henderson, NV; Springfield, MA; Saginaw, MI; and New York, NY. The Company believes these properties are adequate for their intended use. The properties in St. Louis, Springfield, and New York are leased, while the other properties are owned by the Company. Each of the broadcast stations also maintains one or more owned or leased transmitter sites.

The national media segment operates mainly from the Des Moines offices and from a leased facility in New York, NY. The New York facility is used primarily as advertising sales offices for all Meredith magazines and as headquarters for Family Circle, Parents, FamilyFun, American Baby, EveryDay with Rachael Ray, Fitness, More, and Siempre Mujer properties. Allrecipes.com operates out of leased space in Seattle, WA. We have also entered into leases for magazine editorial offices, customer relationship marketing operations, and national media sales offices in the states of California, Illinois, Massachusetts, Michigan, Texas, Vermont, and Virginia. The Company believes these facilities are sufficient to meet our current and expected future requirements.

ITEM 3. LEGAL PROCEEDINGS

There are various legal proceedings pending against the Company arising from the ordinary course of business. In the opinion of management, liabilities, if any, arising from existing litigation and claims are not expected to have a material effect on the Company's earnings, financial position, or liquidity.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

13

PART II | ||

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES

MARKET INFORMATION, DIVIDENDS, AND HOLDERS

The principal market for trading Meredith's common stock is the New York Stock Exchange (trading symbol MDP). There is no separate public trading market for Meredith's Class B stock, which is convertible share for share at any time into common stock. Holders of both classes of stock receive equal dividends per share.

The range of trading prices for the Company's common stock and the dividends per share paid during each quarter of the past two fiscal years are presented below.

High | Low | Dividends | |||||||||

Fiscal 2014 | |||||||||||

First Quarter | $ | 49.10 | $ | 42.44 | $ | 0.4075 | |||||

Second Quarter | 53.84 | 46.70 | 0.4075 | ||||||||

Third Quarter | 52.45 | 40.11 | 0.4325 | ||||||||

Fourth Quarter | 48.45 | 43.01 | 0.4325 | ||||||||

High | Low | Dividends | |||||||||

Fiscal 2013 | |||||||||||

First Quarter | $ | 37.84 | $ | 30.00 | $ | 0.3825 | |||||

Second Quarter | 35.79 | 29.27 | 0.3825 | ||||||||

Third Quarter | 45.95 | 33.52 | 0.4075 | ||||||||

Fourth Quarter | 48.37 | 36.06 | 0.4075 | ||||||||

Meredith stock became publicly traded in 1946, and quarterly dividends have been paid continuously since 1947. Meredith has increased our dividend for 21 consecutive years. It is currently anticipated that comparable dividends will continue to be paid in the future.

On July 31, 2014, there were approximately 1,165 holders of record of the Company's common stock and 605 holders of record of Class B stock.

COMPARISON OF SHAREHOLDER RETURN

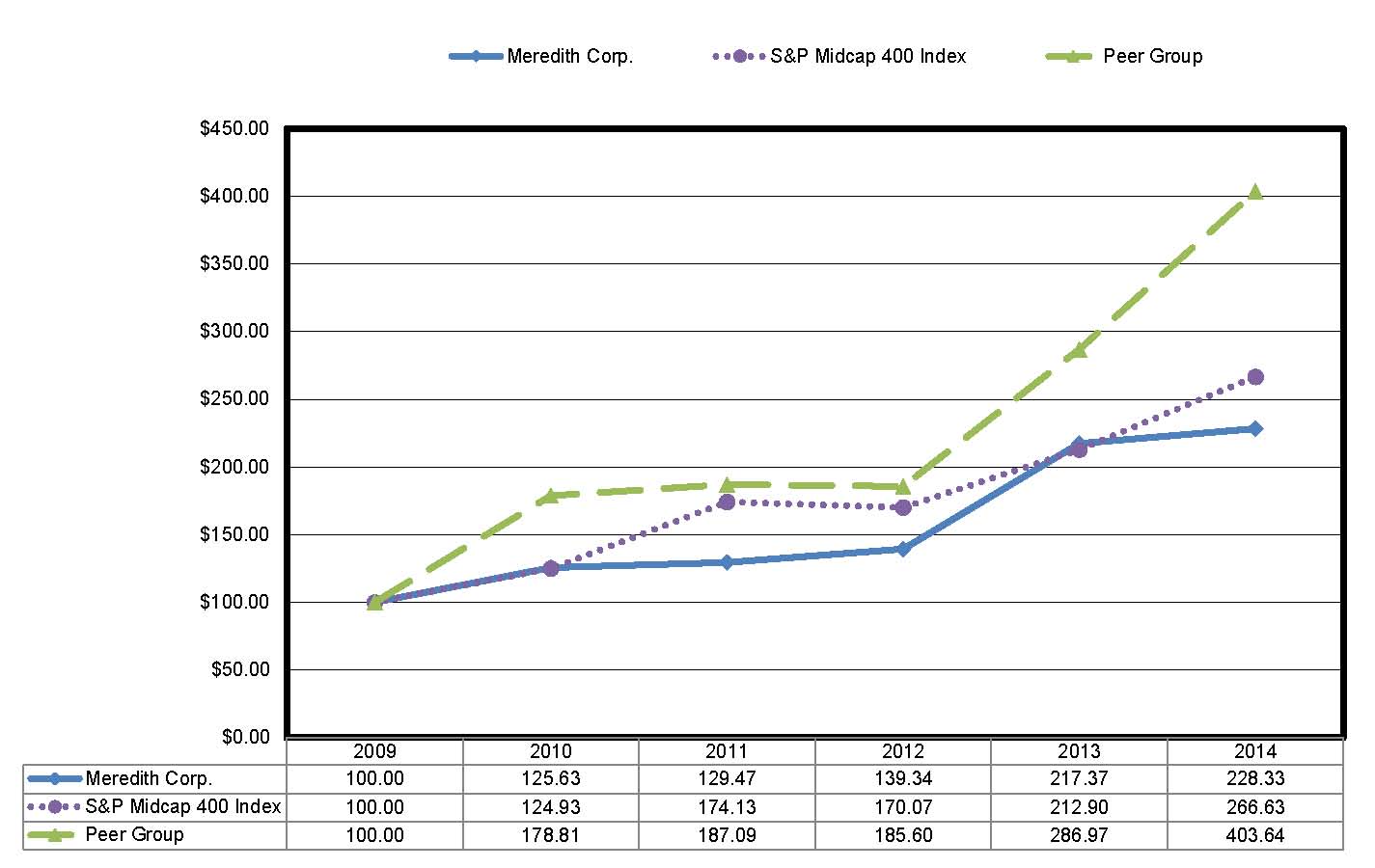

The following graph compares the performance of the Company's common stock during the period July 1, 2009, to June 30, 2014, with the Standard and Poor's (S&P) MidCap 400 Index and with a peer group of companies engaged in multimedia businesses primarily with publishing and/or television broadcasting in common with the Company.

The S&P MidCap 400 Index is comprised of 400 mid-sized U.S. companies with a market cap in the range of $1.2 billion to $5.1 billion in the financial, information technology, industrial, and consumer discretionary industries covering more than 7 percent of the U.S. equities market and is weighted by market capitalization. The Peer Group

14

selected by the Company for comparison, which is also weighted by market capitalization, is comprised of Gannett Co., Inc.; Graham Holding Company (formerly The Washington Post Company); Martha Stewart Living Omnimedia, Inc.; Media General, Inc.; and The E.W. Scripps Company. Belo Corp. was removed from our Peer group as it was acquired by Gannett Co., Inc. during fiscal 2014.

The graph depicts the results for investing $100 in the Company's common stock, the S&P MidCap 400 Index and the Peer Group at closing prices on June 30, 2009, assuming dividends were reinvested.

15

ISSUER PURCHASES OF EQUITY SECURITIES

The following table sets forth information with respect to the Company's repurchases of common stock during the quarter ended June 30, 2014.

Period | (a) Total number of shares purchased 1, 2, 3 | (b) Average price paid per share | (c) Total number of shares purchased as part of publicly announced programs | (d) Approximate dollar value of shares that may yet be purchased under the programs | |||||||||||

(in thousands) | |||||||||||||||

April 1 to April 30, 2014 | 6,948 | $ | 45.12 | 3,692 | $ | 15,628 | |||||||||

May 1 to May 31, 2014 | 154,071 | 45.00 | 94,889 | 111,375 | |||||||||||

June 1 to June 30, 2014 | 70,656 | 44.70 | 70,076 | 108,243 | |||||||||||

Total | 231,675 | 44.92 | 168,657 | ||||||||||||

1 | Total number of shares purchased includes the purchase of 282 shares of Class B common stock in June 2014. |

2 | The number of shares purchased includes 3,692 shares in April 2014, 9,237 shares in May 2014, and 93 shares in June 2014 delivered or deemed to be delivered to us in satisfaction of tax withholding on option exercises and the vesting of restricted shares. These shares are included as part of our repurchase program and reduce the repurchase authority granted by our Board. The number of shares repurchased excludes shares we reacquired pursuant to forfeitures of restricted stock. |

3 | The number of shares purchased includes 3,256 shares in April 2014, 59,182 shares in May 2014, and 580 shares in June 2014 deemed to be delivered to us on tender of stock in payment for the exercise price of options. Effective July 1, 2013, these shares are no longer included as part of our repurchase program and thus they do not reduce the repurchase authority granted by our Board. |

In October 2011, the Board of Directors authorized the repurchase of up to $100.0 million in shares of the Company's stock through public and private transactions. In May 2014, the Board authorized an additional $100.0 million in shares for repurchase.

Effective July 1, 2013, shares that are deemed to be delivered to us on tender of stock in payment for the exercise price of options do not reduce the repurchase authority granted by our Board. Shares delivered or deemed to be delivered to us in satisfaction of tax withholding on option exercises and the vesting of restricted shares continue to reduce the repurchase authority granted by our Board.

For more information on the Company's share repurchase program, see Item 7-Management's Discussion and Analysis of Financial Condition and Results of Operations, under the heading "Share Repurchase Program" on page 33.

ITEM 6. SELECTED FINANCIAL DATA

Selected financial data for the fiscal years 2010 through 2014 is contained under the heading "Five-Year Financial History with Selected Financial Data" beginning on page 79 and is derived from consolidated financial statements for those years. Information contained in that table is not necessarily indicative of results of operations in future years and should be read in conjunction with Item 7-Management's Discussion and Analysis of Financial Condition and Results of Operations and Item 8-Financial Statements and Supplementary Data of this Form 10-K.

16

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A) consists of the following sections:

MD&A should be read in conjunction with the other sections of this Form 10-K, including Item 1-Business, Item 6-Selected Financial Data, and Item 8-Financial Statements and Supplementary Data. MD&A contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based upon our current expectations and could be affected by many risks, uncertainties, and changes in circumstances including the uncertainties and risk factors described throughout this filing, particularly in Item 1A-Risk Factors. Important factors that could cause actual results to differ materially from those described in forward-looking statements are set forth under the heading “Forward Looking Statements." in Item 1-Business.

EXECUTIVE OVERVIEW

Meredith Corporation has been committed to service journalism for more than 110 years. Today, Meredith uses multiple media outlets—including print, broadcast television, digital, mobile, tablets, and video—to provide consumers with content they desire and to deliver the messages of its advertising and marketing partners.

Meredith operates two business segments. The local media segment includes 15 owned or operated television stations reaching 10 percent of U.S. households. Meredith’s portfolio is concentrated in large, fast-growing markets, with seven stations in the nation’s Top 25—including Atlanta, Phoenix, and Portland—and 13 in Top 50 markets. Meredith’s stations produce approximately 525 hours of local news and entertainment content each week, and operate leading local digital destinations. Additionally, MVS produces The Better Show, a syndicated daily lifestyle television program reaching 80 percent of U.S. TV households.

Meredith’s national media segment reaches 100 million unduplicated American women, including 60 percent of millennial women. Meredith is the leader in creating content across media platforms in key consumer interest areas such as food, home, parenthood, and health through well-known brands such as Better Homes and Gardens, Parents, and Allrecipes. The national media segment features robust brand licensing activities, including over 3,000 SKUs of branded products at 4,000 Walmart stores across the U.S. MXM provides expertise in mobile, social media, customer relationship management, and advanced analytics for many of the nation’s top companies and brands.

Both segments operate primarily in the U.S. and compete against similar media and other types of media on both a local and national basis. In fiscal 2014, the national media segment accounted for 73 percent of the Company's $1.5 billion in revenues while local media segment revenues contributed 27 percent.

17

Meredith's balanced portfolio consistently generates substantial free cash flow, and the Company is committed to growing Total Shareholder Return (TSR) through dividend payments, share repurchases, and strategic business investments. Meredith’s current annualized dividend of $1.73 per share yields approximately 4 percent. Meredith has paid a dividend for 67 straight years and increased it for 21 consecutive years.

In Fiscal 2014, we aggressively executed on our TSR strategy by deploying capital in high cash flow businesses and growing the amount of cash returned to our shareholders. For example, we added great new television stations to our local media portfolio; executed a number of initiatives to strengthen and grow our national media segment; increased our dividend; and expanded our share repurchase program. Fiscal 2014 highlights include:

Strengthening of our portfolio of media businesses through acquisitions and new launches. For example, we:

• | Executed agreements to buy the broadcast assets of stations in three markets - KTVK, an independent station in Phoenix, the nation's 12th largest television market; KMOV, the CBS affiliate in St. Louis, the nation’s 21st largest television market; and WGGB, the ABC affiliate in Springfield, Massachusetts. The KTVK and KMOV acquisitions closed in fiscal 2014 and the WGGB acquisition is expected to close in the first quarter of fiscal 2015. |

• | Successfully launched Allrecipes magazine, which Media Industry Newsletter called the “Hottest Launch of the Year.” |

• | Strengthened our parenthood activities by integrating the Parenting and Baby Talk brands that we acquired late in fiscal 2013. In the spring of fiscal 2015, we expect to launch an English-language parenting magazine for U.S. Hispanic moms called Parents Latina. |

Growing revenues and operating profit from activities that are not dependent on advertising. We delivered significant growth in retransmission-related revenues and profit in our local media segment. Within our national media segment, we grew revenues related to circulation and brand licensing, while MXM solidified its relationship with its top 10 clients.

Proving the effectiveness of advertising on both broadcast and print platforms. Broadcast television continues to demonstrate its unique effectiveness to local advertisers as we delivered 8 percent growth in local media non-political advertising. Our national media segment was named “Advertisers’ Favorite Media Company” for the second time in four years by Advertiser Perceptions, which annually surveys thousands of leading advertising agencies and marketers.

Finally, in fiscal 2014 we again successfully executed our TSR strategy. We increased our dividend another 6 percent in fiscal 2014 and we repurchased 1.6 million shares. We also invested more than $400 million in growing the television side of our business.

Going forward, we are aggressively pursuing these parallel paths designed to accelerate revenue growth and increase operating profit margins and cash flow over time:

• | First, we are working to grow our existing businesses organically. This includes our magazine, television, digital, licensing, and marketing services businesses. |

• | Second, we are pursuing opportunities to add to our portfolio in both our national and local media groups. |

• | Third, we are aggressively managing costs; and |

• | Finally, we are executing our TSR Strategy, as highlighted by our established pattern of dividend increases and corresponding very attractive yield; share repurchase authorizations and buybacks; and our accretive acquisitions in both segments. |

18

LOCAL MEDIA

Local media derives the majority of its revenues—73 percent in fiscal 2014—from the sale of advertising both over the air and on our stations' websites and apps. The remainder comes from television retransmission fees, station operation management fees, television production services, and other services.

The stations sell advertising to both local/regional and national accounts. Political advertising revenues are cyclical in that they are significantly greater during biennial election campaigns (which take place primarily in odd-numbered fiscal years) than at other times. MVS produces video content for Meredith stations, non-Meredith stations, online distribution, and corporate customers. We have generated additional revenues from internet activities and programs focused on local interests such as community events and college and professional sports.

Changes in advertising revenues tend to correlate with changes in the level of economic activity in the U.S. and in the local markets in which we operate stations, and with the cyclical changes in political advertising discussed previously. Programming content, audience share, audience demographics, and the advertising rates charged relative to other available advertising opportunities also affect advertising revenues. On occasion, unusual events necessitate uninterrupted television coverage and will adversely affect spot advertising revenues.

Local media's major expense categories are employee compensation and programming fees paid to the networks. Employee compensation represented 44 percent of local media's operating expenses in fiscal 2014. Compensation expense is affected by salary and incentive levels, the number of employees, the costs of our various employee benefit plans, and other factors. Programming fees paid to the networks represented 16 percent of this segment's fiscal 2014 expenses. Sales and promotional activities, costs to produce local news programming, and general overhead costs for facilities and technical resources accounted for most of the remaining 40 percent of local media's fiscal 2014 operating expenses.

NATIONAL MEDIA

Advertising revenues made up 45 percent of fiscal 2014 national media revenues. These revenues were generated from the sale of advertising space in our magazines and on our websites to clients interested in promoting their brands, products, and services to consumers. Changes in advertising revenues tend to correlate with changes in the level of economic activity in the U.S. Indicators of economic activity include changes in the level of gross domestic product, consumer spending, housing starts, unemployment rates, auto sales, and interest rates. Circulation levels of Meredith's magazines, reader demographic data, and the advertising rates charged relative to other comparable available advertising opportunities also affect the level of advertising revenues.

Circulation revenues accounted for 31 percent of fiscal 2014 national media revenues. Circulation revenues result from the sale of magazines to consumers through subscriptions and by single copy sales on newsstands in print form, primarily at major retailers and grocery/drug stores, and in digital form on tablets and other media devices. In the short term, subscription revenues, which accounted for 81 percent of circulation revenues, are less susceptible to economic changes because subscriptions are generally sold for terms of one to three years. The same economic factors that affect advertising revenues also can influence consumers' response to subscription offers and result in lower revenues and/or higher costs to maintain subscriber levels over time. A key factor in our subscription success is our industry-leading database. It contains approximately 100 million entries that include information on about three-quarters of American homeowners, which includes 60 percent of millennial women, providing an average of 800 data points for each name. The size and depth of our database is a key to our circulation model and allows more precise consumer targeting. Newsstand revenues are more volatile than subscription revenues and can vary significantly month to month depending on economic and other factors.

The remaining 24 percent of national media revenues came from a variety of activities that included the sale of customer relationship marketing products and services and books as well as brand licensing, product sales, and other related activities. MXM offers integrated promotional, database management, relationship, and direct

19

marketing capabilities for corporate customers, both in printed and digital forms. These other revenues are generally affected by changes in the level of economic activity in the U.S. including changes in the level of gross domestic product, consumer spending, unemployment rates, and interest rates.

National media's major expense categories are production and delivery of publications and promotional mailings and employee compensation costs. Paper, postage, and production charges represented 31 percent of the segment's operating expenses in fiscal 2014. The price of paper can vary significantly on the basis of worldwide demand and supply for paper in general and for specific types of paper used by Meredith. The printing of our publications is outsourced. We typically have multi-year contracts for the printing of our magazines, a practice which reduces price fluctuations over the contract term. Postal rates are dependent on the operating efficiency of the USPS and on legislative mandates imposed on the USPS. The USPS increased rates most recently in January 2014. At this time, the USPS has not proposed any future rate increases other than making permanent a previous rate increase of 4.3 percent that is currently set to phase out once USPS loses have been recovered. Meredith works with others in the industry and through trade organizations to encourage the USPS to implement efficiencies and contain rate increases.

Employee compensation, which includes benefits expense, represented 26 percent of national media's operating expenses in fiscal 2014, and is affected by the same factors noted for local media.The remaining 43 percent of fiscal 2014 national media expenses included costs for magazine newsstand and book distribution, advertising and promotional efforts, and overhead costs for facilities and technology services.

FISCAL 2014 FINANCIAL OVERVIEW

• | Meredith completed its acquisition of KMOV, the CBS affiliate in St. Louis, Missouri in February 2014 and completed its acquisition of KTVK, an independent station in Phoenix, Arizona in June 2014. |

• | In February 2014, the Company entered into a $150 million note purchase agreement. Proceeds were used for the acquisition of KMOV. |

• | In March 2014, Meredith entered into a credit agreement that provides a revolving credit facility of $200 million and a term loan of $250 million, both of which expire in March 2019. The term loan was used to fund the purchase of the acquisition of the KTVK and an interest in certain of KASW's broadcast assets. Our prior revolving credit facility was paid off in March 2014. |

• | Local media revenues increased 7 percent in fiscal 2014 as revenues from the station acquisitions and strong increases in other revenues more than offset a $34.1 million reduction in political advertising, which is expected in a non-political year. Local media operating profit declined 9 percent in fiscal 2014. The local media segment recorded $5.5 million in acquisition costs that were expensed during the year. |

• | National media revenues declined 3 percent from the prior year as declines in our magazine operations of $29.1 million and in our integrated marketing operations of $5.2 million more than offset increased revenues in our licensing operations of $3.9 million. National media operating profit declined 18 percent due primarily to a larger restructuring charge in the current year of $20.8 million as compared to the prior year restructuring charge of $6.4 million. In addition, decreases in the operating profit of our magazine operations of $23.8 million more than offset improved operating results in our interactive media operations of $8.6 million and our licensing operations of $3.9 million. |

• | During fiscal 2014, management committed to several performance improvement plans related primarily to business realignments including integration of local media acquisitions, converting Ladies' Home Journal from a monthly subscription magazine to a newsstand only quarterly special interest publication, the closing of our medical sales force training business, and other selected workforce reductions. In connection with these plans, the Company recorded a pre-tax restructuring charge of $24.5 million. This charge |

20

includes $11.9 million for severance and related benefit costs, $10.3 million for the impairment of intangible assets, the write-down of fixed assets of $0.9 million, vacated building and lease accruals of $0.7 million, and other accruals and write-downs of $0.7 million. The Company also recorded $1.4 million in reversals of excess restructuring reserves accrued in prior years.

• | Diluted earnings per share decreased 9 percent to $2.50 from $2.74 in fiscal 2013. |

• | In fiscal 2014, we generated $178.1 million in operating cash flows, invested $417.5 million in acquisitions of and investments in businesses, and invested $24.8 million in capital improvements. |

RESULTS OF OPERATIONS

Years ended June 30, | 2014 | Change | 2013 | Change | 2012 | ||||||||||||

(In millions except per share data) | |||||||||||||||||

Total revenues | $ | 1,468.7 | 0 | % | $ | 1,471.3 | 7 | % | $ | 1,376.7 | |||||||

Costs and expenses | 1,222.3 | 1 | % | 1,215.1 | 6 | % | 1,146.6 | ||||||||||

Depreciation and amortization | 59.9 | 32 | % | 45.4 | 2 | % | 44.3 | ||||||||||

Total operating expenses | 1,282.2 | 2 | % | 1,260.5 | 6 | % | 1,190.9 | ||||||||||

Income from operations | $ | 186.5 | (12 | )% | $ | 210.8 | 13 | % | $ | 185.8 | |||||||

Net earnings | $ | 113.5 | (8 | )% | $ | 123.7 | 18 | % | $ | 104.4 | |||||||

Diluted earnings per share | 2.50 | (9 | )% | 2.74 | 19 | % | 2.31 | ||||||||||

OVERVIEW