Attached files

| file | filename |

|---|---|

| 8-K - BWP 2015 12 8K ENERGY SYMPOSIUM - Boardwalk Pipeline Partners, LP | bwp15128kenergysymposium.htm |

October 11, 2013 Boardwalk Annual Customer Meeting Nashville Customer Meeting Boardwalk’s Response to the Changing Market Kathy Kirk, Senior Vice President Marketing & Origination Presentation for 2015 Wells Fargo Energy Symposium December 2015 1 Boardwalk Louisiana Midstream: Sulphur Hub S utheast Market Expansion: Jasper, For est & Moss Point Compressor Station

2 Important Information Forward-looking statements disclosure Statements made at this conference or in the materials distributed in conjunction with this conference that contain "forward-looking statements" include, but are not limited to, statements using the words “believe”, “expect”, “plan”, “intend”, “anticipate”, “estimate”, “project”, “should” and similar expressions, as well as other statements concerning our future plans, objectives, and expected performance, including statements with respect to the completion, cost, timing and financial performance of growth projects. Such statements are inherently subject to a variety of risks and uncertainties that could cause actual results to differ materially from those projected. Forward-looking statements speak only as of the date they are made, and the company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statement contained herein or made at this conference to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. For information about important Risk Factors that could cause our actual results to differ from those expressed in the forward-looking statements contained in this presentation or discussed at this conference please see “Available Information and Risk Factors,” below. Given the Risk Factors referred to below, investors and analysts should not place undue reliance on forward-looking statements. Available Information and Risk Factors We file annual, quarterly and current reports and other information with the Securities and Exchange Commission, or “SEC”. Our SEC filings are available to the public over the internet at our website, www.bwpmlp.com, and at the SEC’s website www.sec.gov. Our filings with the SEC contain important information which anyone considering the purchase of our limited partnership units should read. Our business faces many risks. We have described in our SEC filings some of the more material risks we face. There may be additional risks that we do not yet know or that we do not currently perceive to be material that may also impact our business. Each of the risks and uncertainties described in our SEC filings could lead to events or circumstances that may have a material adverse effect on our business, financial condition, results of operations or cash flows, including our ability to make distributions to our unitholders. Our limited partnership units are listed on the New York Stock Exchange under the trading symbol “BWP”.

October 11, 2013 Boardwalk Annual Customer Meeting Nashville Customer Meeting Boardwalk’s Response to the Changing Market Kathy Kirk, Senior Vice President Marketing & Origination Boardwalk Company Overview Southeast Market Expansion: Jasper, Forrest & Moss Point Compressor Station

4 Large and Diverse Platform of Infrastructure Assets Texas Gas Transmission Texas Gas storage facilities Gulf South Pipeline Gulf South storage facilities Gulf Crossing Pipeline Boardwalk Louisiana Midstream Hubs Boardwalk Storage Company Evangeline Ethylene Pipeline South Texas Gathering System Flag City Gas Processing Plant Boardwalk Operational Highlights Pipelines: We own and operate approximately 14,625 miles of natural gas and liquids pipelines Storage capacity: Our storage facilities have an aggregate working gas capacity of approximately 208 Bcf of natural gas and 18 MMbbls of liquids Boardwalk is a diversified midstream MLP that transports, stores, gathers and processes natural gas and liquids

Organizational Structure 5 49% L.P. interest* 2% G.P. interest 49% L.P. interest BPHC Loews Corporation Subsidiary Boardwalk Pipeline Partners, LP NYSE: BWP Public Unitholders Boardwalk Pipelines, LP *As of September 30, 2015 and excluding the incentive distribution rights Boardwalk Midstream, LLC Texas Gas Transmission, LLC (Texas Gas) Gulf Crossing Pipeline Company LLC (Gulf Crossing) Gulf South Pipeline Company, LP (Gulf South) Petal Gas Storage was rolled into Gulf South effective 1/1/15 Boardwalk Field Services, LLC (BFS) Boardwalk Louisiana Midstream, LLC (BLM) Boardwalk Storage Company, LLC Boardwalk Petrochemical Pipeline, LLC Evangeline – acquired 10/8/14

Introduction to Boardwalk’s General Partner 6 Our general partner is a wholly-owned subsidiary of Loews Corporation, which is one of the largest diversified corporations in the United States Principal subsidiaries and percent of ownership: Financial strength Credit rating S&P: A+ Moody’s: A2 Fitch: A Equity market capitalization: $13.5 Billion(2) Cash and Investments: $4.8 Billion(2) (1) Excluding the incentive distribution rights as of September 30, 2015 (2) As of September 30, 2015 100% 51%(1) 90% 52%

Boardwalk Strategy 7 Leverage and Strengthen Existing Assets Continue to attach to new end-use markets and supply sources Further diversify within the midstream energy sector Continue to expand into areas such as transportation, storage and fractionation of liquids and gathering and processing Optimize Asset Base Continue to identify and implement new uses for assets, including changing natural gas flow patterns Minimize commodity and credit risks Secure growth projects with long-term, take-or-pay contracts with credit-worthy customers

8 Strategy Execution and Recent Events Date Event December 2011 through January 2015 Completed $2.1 billion of acquisitions and growth projects, on time and on budget February 2014 Reduced quarterly cash distribution to help fund growth and reduce leverage February 2014 through August 2015 Announced ~$1.6 billion of growth projects backed by long-term firm agreements with a weighted-average contract life of ~18 years (expected in service dates: Q4-2015 to 2018) June 2015 through December 2015 + Evangeline Ethylene Pipeline system back in full service with improved integrity and reliability + Uncontested settlement for Gulf South rate case filed with FERC (certified by the Administrative Law Judge to the FERC Commissioners on November 30, 2015 and pending FERC approval) + Began construction of Ohio to Louisiana project (expected in-service date: Q2-2016)

9 Growth Project/Acquisition Scope Strategy Timing Capex ($MM) Acquisition of Petal Gas Storage Acquired approx. 23 Bcf of working gas capacity and 105 miles of natural gas pipelines Petal Gas Storage was rolled into Gulf South effective 1/1/15 Leverage Existing Assets Closed Dec. 2011 $545 Acquisition of Boardwalk Louisiana Midstream NGL storage and transportation assets in two hubs (Choctaw and Sulphur) in southern Louisiana – supported by fee-based contracts Diversification Closed Oct. 2012 620 Boardwalk Louisiana Midstream Expansion Projects Expansion of brine services at our Choctaw Hub (including construction of 1 MMBbl brine pond and 26- mile, 12-inch pipeline from facilities to customer’s petrochemical plant and brine sales) Construction of propane storage and transportation assets at our Sulphur Hub Diversification and Leverage Existing Assets 2013 75 Construction of South Texas Eagle Ford Expansion 150 MMcf/d cryogenic gas processing plant near Edna, TX and approximately 400 miles of pipeline with gathering capacity of 300 MMcf/d Initial 7-year, fee-based contracts for 50% of plant capacity Diversification and Optimize Asset Base June 2013 180 Expansion of Gas Storage Salt-Dome Cavern Approx. 6 Bcf of additional working gas capacity Potential for five additional caverns Leverage Existing Assets Sept. 2013 23 Construction of Facilities to Support New Electric Power Generation Projects Approx. 67,000 MMBtu/d, 7-year EFT commitment (100,000 MMBtu/d FT equivalent) to serve plant in the Baton Rouge/River Corridor area Approx. 125,000 MMBtu/d, 20-year FT commitment to serve plant in north Texas Leverage Existing Assets Dec. 2013 Dec 2013/ June 2014 50 Southeast Market Expansion Project Capacity of 550,000 MMbtu/d by utilizing existing 42” line, installing additional compression and constructing approx. 70 miles of new pipeline Contracted with initial 10-year firm agreements Serves industrial and power generation markets in Mississippi, Alabama and Florida Leverage Existing Assets and Optimize Asset Base Oct. 2014 300 Acquisition of Evangeline Ethylene Pipeline from Chevron The Evangeline system is a 176-mile interstate pipeline capable of transporting approximately 2.6 billion pounds of ethylene per year, when fully operational, and is supported by long-term, fee-based contracts Evangeline transports ethylene between Port Neches, TX and Baton Rouge, LA, where it interconnects with our ethylene distribution system that includes storage facilities at the Choctaw Hub Plans to connect to storage facilities at our Sulphur Hub in the Lake Charles area Diversification and Leverage Existing Assets Oct. 2014 295 Flag City Processing Plant Executed 5-year agreement for an additional 30 MMcf/d of firm gathering and processing capacity at Flag City processing plant in South Texas Increases plant’s firm contracted capacity to 70% Constructing lateral from existing gathering lines to new customer’s Eagle Ford production Diversification and Leverage Existing Assets Q1-15 14 Completed $2.1 billion of Projects and Acquisitions . . .

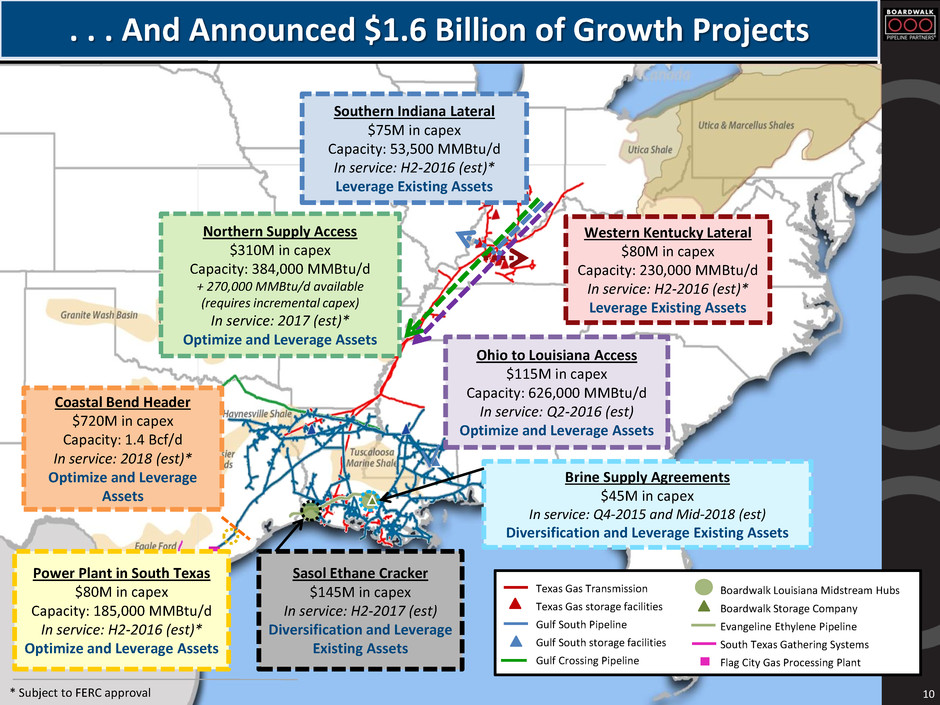

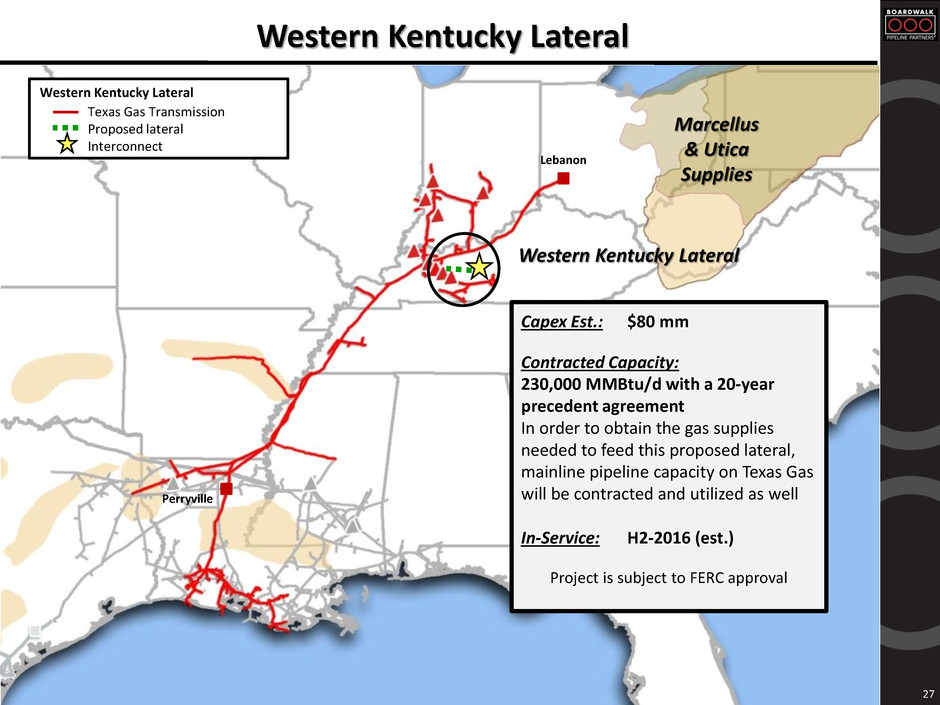

10 Ohio to Louisiana Access $115M in capex Capacity: 626,000 MMBtu/d In service: Q2-2016 (est) Optimize and Leverage Assets Northern Supply Access $310M in capex Capacity: 384,000 MMBtu/d + 270,000 MMBtu/d available (requires incremental capex) In service: 2017 (est)* Optimize and Leverage Assets Sasol Ethane Cracker $145M in capex In service: H2-2017 (est) Diversification and Leverage Existing Assets Southern Indiana Lateral $75M in capex Capacity: 53,500 MMBtu/d In service: H2-2016 (est)* Leverage Existing Assets Texas Gas Transmission Texas Gas storage facilities Gulf South Pipeline Gulf South storage facilities Gulf Crossing Pipeline Boardwalk Louisiana Midstream Hubs Boardwalk Storage Company Evangeline Ethylene Pipeline South Texas Gathering Systems Flag City Gas Processing Plant Western Kentucky Lateral $80M in capex Capacity: 230,000 MMBtu/d In service: H2-2016 (est)* Leverage Existing Assets * Subject to FERC approval Brine Supply Agreements $45M in capex In service: Q4-2015 and Mid-2018 (est) Diversification and Leverage Existing Assets Coastal Bend Header $720M in capex Capacity: 1.4 Bcf/d In service: 2018 (est)* Optimize and Leverage Assets Power Plant in South Texas $80M in capex Capacity: 185,000 MMBtu/d In service: H2-2016 (est)* Optimize and Leverage Assets . . . And Announced $1.6 Billion of Growth Projects

11 Gulf South Rate Case Settlement Highlights Financial Profile Uncontested settlement agreement filed with FERC on September 25 (certified by the Administrative Law Judge to the FERC Commissioners on November 30 and pending FERC approval) Interim rates implemented November 1, 2015(1) Expected net revenues due to rate increases and based on current contracted capacities: approx. $20 million in 2015 and approx. $30 million in 2016 No-Notice Service (NNS) customers agreed to extend contracts through 2023 with limited reduction rights Resolves all issues in the proceeding with the exception of segmentation(2) Changes rate design to “Postage Stamp” (system wide)(3) Fuel tracker to be implemented April 1, 2016 Rate case moratorium until May 1, 2023(4) (1) Expect FERC approval in Spring 2016. (2) Physical segmentation allows a shipper to split its contract within a defined path thus creating smaller segments of its overall capacity with receipt and delivery points within each segment. The necessary requirement for segmentation is the ability to define a consistent physical flow path for a contract. (3) With exception of Lake Charles and Small Customers. (4) Exceptions include segmentation and implementation of PHMSA and other cost tracker.

October 11, 2013 Boardwalk Annual Customer Meeting Nashville Customer Meeting Boardwalk’s Response to the Changing Market Kathy Kirk, Senior Vice President Marketing & Origination Financial Overview 12 Southeast Market Expansion: Jasper, Forrest & Moss Point Compressor Station

13 Financial Highlights Financial Profile Substantially a long-term, fixed-fee revenue base Significant portion of revenues backed by firm contracts with primarily investment-grade customers Financing strategy: – Utilize internally-generated cash flow, in excess of distributions, to help fund growth projects – Manage annualized Debt/EBITDA ratio below 5.5x during construction period to help maintain investment grade credit ratings – Target Debt/EBITDA ratio of low 4x

Boardwalk Revenue Profile Backed by Firm, Long-term Contracts 14 Majority of revenues are under firm contracts Capacity reservation charges are received monthly regardless of utilization Weighted-average contract life of approximately 5 years for firm transportation agreements that are currently in service Going into service in the future: approximately $1.6 billion investment in growth projects anchored by agreements with a weighted-average contract life of approximately 18 years* FIRM CONTRACTS Capacity Reservation Charges FIRM CONTRACTS Utilization Charges INTERRUPTIBLE Services & Other * Subject to regulatory approvals $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 Re ve n u e ($ M M ) $1,206 $1,143 $1,117 78% 15% 7% 82% 14% 4% $1,185 6% 11% 83% 81% 12% 7% $1,234 9% 13% 78% 2010 2011 2012 2013 2014

Revenue Estimates: Capacity Reservation and Min. Bill Charges 15 Estimated Revenues from Capacity Reservation and Minimum Bill Charges under Committed Firm Transportation Agreements Estimates as of December 2, 2015 Projected revenues do not include utilization revenues or any expected revenues for periods after the expiration dates of the existing agreements Notes: • The estimated capacity reservation charges and minimum bill charges for the years ending December 31, 2016 and 2017 include approximately $3 million and $30 million that are anticipated under executed precedent agreements for projects that are subject to regulatory approval to commence construction. • Per the Gulf South settlement agreement, the amount of capacity reservation revenues included from the Gulf South rate case, due to rate increases and based on current contracted capacities, is approximately $20 million, $30 million and $40 million for the years ending December 31, 2015, 2016 and 2017, respectively. Also included are revenues due to no-notice contract extensions resulting from the Gulf South rate case, which are are expected to be approximately $20 million and $30 million for the years ending December 31, 2016 and 2017. The Gulf South rate case settlement has been certified by the Administrative Law Judge to the FERC Commissioners and is pending FERC approval. • Please refer to Boardwalk’s 2014 Form 10-K filed with the SEC on February 20, 2015 for additional disclosures related to projected revenues from capacity reservation and minimum bill charges under committed firm transportation agreements, market conditions and contract renewals. $940 $1,010 $1,030 $500 $600 $700 $800 $900 $1,000 $1,100 2015 2016 2017 $ ( in m il lio n s) Previous estimates as of December 31, 2014 and disclosed in Boardwalk’s 2014 Form 10-K: 2015 = $910 2016 = $900

Capitalization 16 (1) We also have access to a $300 million subordinated loan. As of September 30, 2015, there were no borrowings outstanding and we do not expect to borrow under the agreement this year. We recently executed an amendment that extends the borrowing period through the end of 2016. • Issued $350 million of 4.95% notes in November 2014 and additional $250 million of 4.95% notes in March 2015 to refinance 2015 maturities of Gulf South and Texas Gas notes, respectively • In 2015, issued approximately 7 million common units under ATM program with net proceeds of approximately $115 million (including GP contribution of approximately $2.3 million) • In May 2015, extended revolving credit facility expiration date to 2020 and increased the borrowing capacity to $1.5 billion ($ in millions, except ratio data) Gulf South 5.05% Notes due Feb 2015 $ 275 (275) $ - Texas Gas 4.60% Notes due June 2015 250 (250) - Boardwalk 5.88% Notes due Nov 2016 250 - 250 Boardwalk 5.50% Notes due Feb 2017 300 - 300 Gulf South 6.30% Notes due Aug 2017 275 - 275 Boardwalk 5.20% Notes due Jun 2018 185 - 185 Boardwalk 5.75% Notes due Sep 2019 350 - 350 Texas Gas 4.50% Notes due Feb 2021 440 - 440 Gulf South 4.00% Notes due Jun 2022 300 - 300 Boardwalk 3.375% Notes due Feb 2023 300 - 300 Boardwalk 4.95% Notes due Dec 2024 350 250 600 Texas Gas 7.25% Debentures due Jul 2027 100 - 100 Total notes and debentures 3,375 (275) 3,100 Boardwalk Acquisition Company 200 (200) - Boardwalk Pipelines - - - Gulf Crossing 120 245 365 Gulf South - - - Texas Gas - - - Total revolving credit facility 120 245 365 - - - 10 (1) 9 3,705 (231) 3,474 Less: unamortized debt discount (15) - (15) $ 3,690 $ (231) $ 3,459 $ 4,102 $ 193 $ 4,295 $ 7,792 $ (38) $ 7,754 $ 7 $ (2) $ 5 47.4% 44.6% Debt to EBITDA Ratio 5.4x 5.0x Total Long-Term Debt Total Equity Total Capitalization Cash and Cash Equivalents Long-Term Debt to Total Capitalization Ratio Term Loan: Revolving Credit Facility: Capital Lease Obligation: Subordinated Loan Agreement with BPHC (1) Debt: December 31, 2014 Adjustments for 2015 Financing Activities September 30, 2015

$0 $100 $200 $300 $400 $500 $600 $700 $800 $900 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 Boardwalk Gulf South Texas Gas Term Loan Reduced Refinancing Risk for Senior Unsecured Notes 17 $ in m ill io n s 2015 Gulf South and Texas Gas notes refinanced to 2024 maturity under Boardwalk* *Issued $350 million of 4.95% notes in November 2014 and additional $250 million of 4.95% notes in March 2015 to refinance 2015 maturities of Gulf South and Texas Gas, respectively Note: Boardwalk has a revolving credit facility (RCA) with aggregate lending commitments of $1.5 billion and a maturity date in May 2020. As of September 30, 2015, Boardwalk had $365 million borrowed under the RCA. Term Loan was paid in full in May 2015

October 11, 2013 Boardwalk Annual Customer Meeting Nashville Customer Meeting Boardwalk’s Response to the Changing Market Kathy Kirk, Senior Vice President Marketing & Origination Market Fundamentals and Boardwalk Growth Projects Southeast Market Expansion: Jasper, Forrest & Moss Point Compressor Station

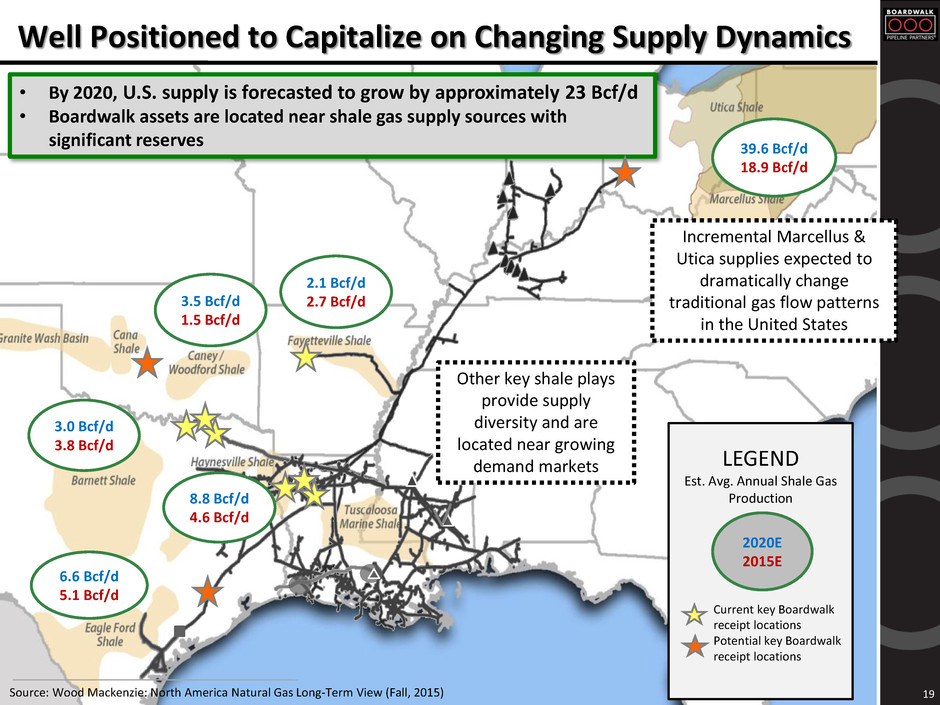

19 Well Positioned to Capitalize on Changing Supply Dynamics Source: Wood Mackenzie: North America Natural Gas Long-Term View (Fall, 2015) Incremental Marcellus & Utica supplies expected to dramatically change traditional gas flow patterns in the United States • By 2020, U.S. supply is forecasted to grow by approximately 23 Bcf/d • Boardwalk assets are located near shale gas supply sources with significant reserves LEGEND Est. Avg. Annual Shale Gas Production 2020E 2015E Current key Boardwalk receipt locations Potential key Boardwalk receipt locations 2.1 Bcf/d 2.7 Bcf/d 3.0 Bcf/d 3.8 Bcf/d 8.8 Bcf/d 4.6 Bcf/d 6.6 Bcf/d 5.1 Bcf/d 3.5 Bcf/d 1.5 Bcf/d 39.6 Bcf/d 18.9 Bcf/d Other key shale plays provide supply diversity and are located near growing demand markets

20 Changing Demand Dynamics: LNG Exports Freeport Sabine Pass Cameron LNG FERC Approved, Proposed or Potential U.S. LNG Export Facilities Source: FERC (October 20, 2015) *Subject to FERC approval Corpus Christi We have executed long- term, firm precedent agreements* for approximately 1.7 Bcf/d of capacity for deliveries to LNG export facilities under construction on the Gulf Coast Bcf/d LNG Facilities by Location Approved Proposed (Pending Application) Proposed (Pre-filing) Texas 3.9 2.4 8.6 Louisiana 5.9 6.1 4.2 Mississippi - 1.5 - Grand Total 9.8 10.0 12.8

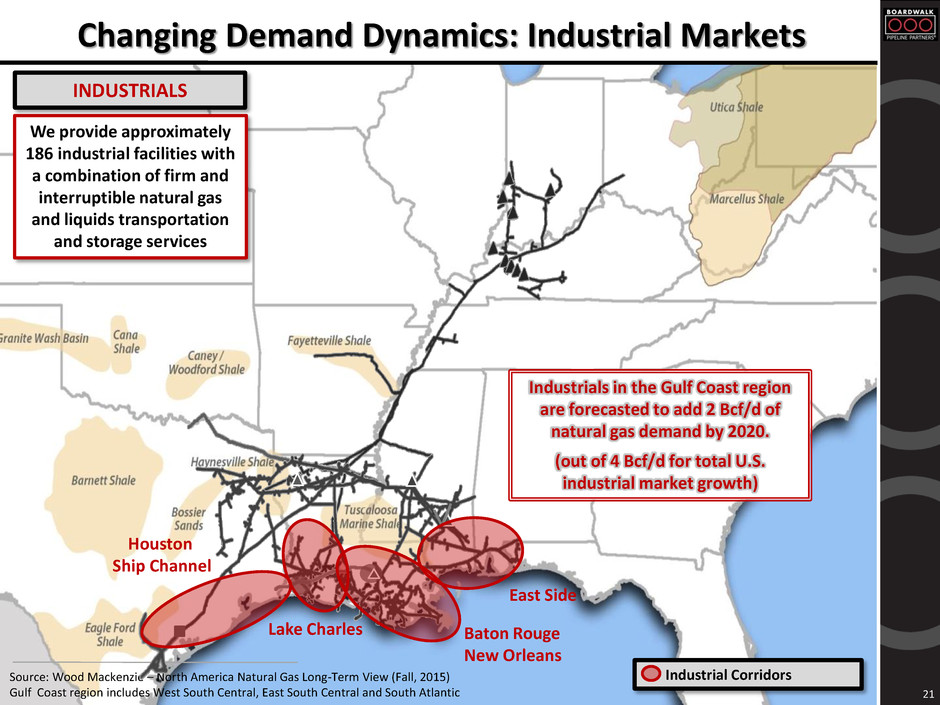

21 Changing Demand Dynamics: Industrial Markets We provide approximately 186 industrial facilities with a combination of firm and interruptible natural gas and liquids transportation and storage services INDUSTRIALS Houston Ship Channel Source: Wood Mackenzie – North America Natural Gas Long-Term View (Fall, 2015) Gulf Coast region includes West South Central, East South Central and South Atlantic Lake Charles Baton Rouge New Orleans East Side Industrials in the Gulf Coast region are forecasted to add 2 Bcf/d of natural gas demand by 2020. (out of 4 Bcf/d for total U.S. industrial market growth) Industrial Corridors

Forecasted U.S. Coal Retirements Over the Next 15 Years 22 Source: BWP and Velocity Suite, 4/20/15; Wood Mackenzie – North America Natural Gas Long-Term View (Fall, 2015) South includes West South Central, West South Central and South Atlantic Year Forecasted megawatts (MWs) 2015 14,883 2016-2019 19,973 2020-2029 9,842 Total MWs 44,698 Legend Coal-fired plants forecasted to retire during 2015 Coal-fired plants forecasted to retire between 2016 and 2019 Coal-fired plants forecasted to retire between 2020 and 2029 New power plant projects or power plants with increased revenues from past 5 years We are directly connected to 39 natural-gas-fired power generation facilities in nine states. POWER PLANTS Natural gas-fired power plants are forecasted to add 4 Bcf/d U.S. natural gas demand by 2020, with 2 Bcf/d from the South. Our percentage of revenues from power plant customers has more than doubled over the last five years, to 9% in 2014

Changing Flow Patterns Impacting Basis Spreads to Henry Hub 23 23 Source: Platts Gas Daily (Historical prices); OTC Global as of 11/25/15 (2015 prices) LEGEND Average Annual Spread CENTERPOINT EAST HOUSTON SHIP CHANNEL CARTHAGE HUB KOSCI TRANSCO STATION 85 FLORIDA GAS ZONE 3 $(0.09) $(0.07) $(0.46) WAHA COLUMBIA GULF MAINLINE $(0.11) $(0.10) $(0.62) $(0.03) $(0.03) $(0.17) $(0.04) $(0.07) $(0.34) $(0.08) $(0.05) $(0.00) $2.21 $3.72 $3.92 $(0.06) $(0.06) $0.06 $(0.00) $(0.00) $0.06 $0.02 $0.05 $0.06 2015 2013 2009 DOMINION SOUTH POINT $(0.70) $(0.21) $0.31

Coastal Bend Header Project to Serve Planned Freeport Liquefaction Export Terminal 24 Capex Est.: $720 mm Contracted Capacity: ~1.4 Bcf/d with 20-year firm precedent agreements In-Service: 2018 (est.) Project is subject to FERC approval Coastal Bend Header Project Legend

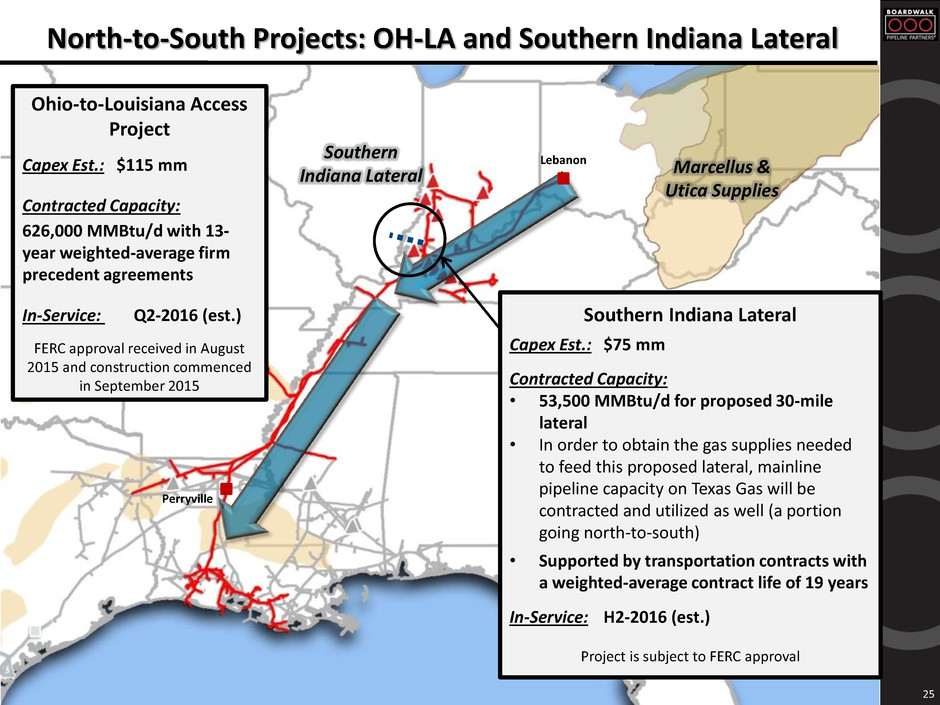

North-to-South Projects: OH-LA and Southern Indiana Lateral 25 Lebanon Perryville Marcellus & Utica Supplies Ohio-to-Louisiana Access Project Capex Est.: $115 mm Contracted Capacity: 626,000 MMBtu/d with 13- year weighted-average firm precedent agreements In-Service: Q2-2016 (est.) FERC approval received in August 2015 and construction commenced in September 2015 Southern Indiana Lateral Capex Est.: $75 mm Contracted Capacity: • 53,500 MMBtu/d for proposed 30-mile lateral • In order to obtain the gas supplies needed to feed this proposed lateral, mainline pipeline capacity on Texas Gas will be contracted and utilized as well (a portion going north-to-south) • Supported by transportation contracts with a weighted-average contract life of 19 years In-Service: H2-2016 (est.) Project is subject to FERC approval Southern Indiana Lateral

Additional North-to-South Projects Marcellus & Utica Supplies Texas Gas Mainline to End-Use Markets and Perryville Exchange 26 Lebanon Perryville Northern Supply Access Project Capex Est.: $310 mm Contracted Capacity: 384,000 MMBtu/d with 16-year weighted-average precedent agreements* In Service: 2017 (est.) Project is subject to FERC approval *A customer that had reserved 100,000 MMBtu/d of capacity (~$13 mm of annual revenue) is not current with its required credit support under the precedent agreement; we are working with that customer and exploring all options for that capacity Additional Capacity Being Marketed Approx. +270,000 MMBtu/d of available capacity remaining (requires incremental capex)

Western Kentucky Lateral 27 Lebanon Perryville Capex Est.: $80 mm Contracted Capacity: 230,000 MMBtu/d with a 20-year precedent agreement In order to obtain the gas supplies needed to feed this proposed lateral, mainline pipeline capacity on Texas Gas will be contracted and utilized as well In-Service: H2-2016 (est.) Project is subject to FERC approval Western Kentucky Lateral Texas Gas Transmission Proposed lateral Interconnect Marcellus & Utica Supplies Western Kentucky Lateral

28 Project to Serve Power Plant in South Texas Capex Est.: $80mm Contracted Capacity: 185,000 MMBtu/d with a 20- year precedent agreement to serve new combined-cycle power plant in South Texas In-Service: H2-2016 Project is subject to FERC approval

29 Incremental Loads to End-Use Markets IN SERVICE Connection to power plant in Kentucky • Firm transportation and no-notice service agreements to serve new combined-cycle power plant in Kentucky began November 1, 2014 • Commitment to deliver approximately 105,000 MMBtu/d with weighted-average contract life of approximately 9 years EXECUTED AGREEMENT Connection to power plant in Indiana • Executed 5-year firm and no-notice service agreements to serve new gas-fired power plant in Indiana with targeted in-service date of Q2-2017 • Commitments to deliver approximately 105,000 MMBtu/d EXECUTED AGREEMENT Connection to industrial plant in Louisiana • Executed 11-year firm transportation agreement to serve a new industrial plant in Louisiana with targeted in-service date of Q1-2016 • Firm commitment to deliver approximately 100,000 MMBtu/d of natural gas EXECUTED AGREEMENT Connection to industrial plant in Louisiana • Executed long-term precedent agreement with an industrial end-user (subject to customer receiving FID on plant) with targeted in-service date of Q1-2018 • Firm commitment to deliver 80,000 MMBtu/d Projects and new contracts to provide approximately 570,000 MMBtu/d of natural gas deliveries to power and industrial plants EXECUTED AGREEMENT Incremental firm load to power plant in Indiana • Executed 5+-year firm agreement to serve an existing power plant connected to Texas Gas with a start date of January 1, 2016 • Firm commitment to deliver approximately 180,000 MMBtu/d

Evangeline Ethylene Pipeline 30 Evangeline receipt points in Port Neches, TX Evangeline delivery points in Baton Rouge area BLM Operations Operating Hubs Evangeline Pipeline Evangeline bidirectional meters in Orange, TX and Lake Charles, LA BLM Sulphur Hub Provides ethylene, ethane and propane transportation and storage services BLM Choctaw Hub Provides ethylene, ethane, natural gas and brine transportation and storage services Evangeline Ethylene Pipeline provides ethylene transportation from East TX/West LA to the Mississippi River Corridor • Acquired in October 2014 for approximately $295 million • Approx. 180 mile, 16” interstate ethylene pipeline • Capacity: ~2.6 billion lbs/yr (expandable to 3.5 billion lbs/yr if capital spent to redesign the current Delivery Point configuration plus potential for further expansions with additional pump stations) • Contracts: Ship-or-pay contracts for 2.0 billion lbs/yr with investment grade customers – weighted-average term ~5 years • Placed back into service in June 2015 with improved integrity and reliability, following outages that began in October 2014; received PHMSA approval to return to full operating pressure in August 2015

Boardwalk Louisiana Midstream Growth Projects 31 Lake Charles Lafayette New Orleans Sulphur Choctaw Area Facilities Sulphur Area Facilities Ethylene Pipeline Propylene Pipeline Natural Gas Pipeline Brine Pipeline E/P Pipeline PL Midstream Hubs Baton Rouge Sulphur Area Facilities Choctaw Area Facilities Project Scope In-Service Date Capex ($ in millions) Expansion to Serve Sasol’s Ethane Cracker • BLM to provide ethane and ethylene transportation and storage services to Sasol’s ethane cracker under construction near BLM’s Sulphur Hub • Subject to regulatory approvals H2-2017 $145 Brine Supply Agreements with Petrochemical Customer in Louisiana • 3-year agreement to construct 4-mile pipeline from BLM’s existing brine infrastructure to supply brine to customer’s petrochemical plant • 15-year agreement to develop several new brine production wells to supply additional volumes of brine to customer’s petrochemical plant • Both agreements provide for the customer to purchase a minimum quantity of brine • Subject to regulatory approvals Q4-2015 Mid-2018 $45 (combined for two projects) BLM Sulphur Hub Provides ethylene, ethane and propane transportation and storage services BLM Choctaw Hub Provides ethylene, ethane, natural gas and brine transportation and storage services

October 11, 2013 Boardwalk Annual Customer Meeting Nashville Customer Meeting Boardwalk’s Response to the Changing Market Kathy Kirk, Senior Vice President Marketing & Origination Presentation for 2015 Wells Fargo Energy Symposium December 2015 32 Southeast Market Expansion: Jasper, Forrest & Moss Point Compressor Station