Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Boardwalk Pipeline Partners, LP | bwp16q410kex322.htm |

| EX-32.1 - EXHIBIT 32.1 - Boardwalk Pipeline Partners, LP | bwp16q410kex321.htm |

| EX-31.2 - EXHIBIT 31.2 - Boardwalk Pipeline Partners, LP | bwp16q410kex312.htm |

| EX-31.1 - EXHIBIT 31.1 - Boardwalk Pipeline Partners, LP | bwp16q410kex311.htm |

| EX-23.1 - EXHIBIT 23.1 - Boardwalk Pipeline Partners, LP | bwp16q410kex231.htm |

| EX-21.1 - EXHIBIT 21.1 - Boardwalk Pipeline Partners, LP | bwp16q410kex211.htm |

| EX-12.1 - EXHIBIT 12.1 - Boardwalk Pipeline Partners, LP | bwp16q410kex121.htm |

| EX-10.6 - EXHIBIT 10.6 - Boardwalk Pipeline Partners, LP | bwp16q410kex106.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

Commission file number: 01-32665 | ||

BOARDWALK PIPELINE PARTNERS, LP | ||

(Exact name of registrant as specified in its charter) | ||

DELAWARE | ||

(State or other jurisdiction of incorporation or organization) | ||

20-3265614 | ||

(I.R.S. Employer Identification No.) | ||

9 Greenway Plaza, Suite 2800 Houston, Texas 77046 (866) 913-2122 | ||

(Address and Telephone Number of Registrant’s Principal Executive Office) | ||

Securities registered pursuant to Section 12(b) of the Act: | ||

Title of each class | Name of each exchange on which registered | |

Common Units Representing Limited Partner Interests | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: NONE | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one)

Large accelerated filer ý Accelerated filer o Non-accelerated filer o Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No ý

The aggregate market value of the common units of the registrant held by non-affiliates as of June 30, 2016, was approximately $2.2 billion. As of February 15, 2017, the registrant had 250,296,782 common units outstanding.

Documents incorporated by reference. None.

TABLE OF CONTENTS

2016 FORM 10-K

BOARDWALK PIPELINE PARTNERS, LP

2

PART I

Item 1. Business

Unless the context otherwise requires, references in this Report to “we,” “our,” “us” or like terms refer to the business of Boardwalk Pipeline Partners, LP and its consolidated subsidiaries.

Introduction

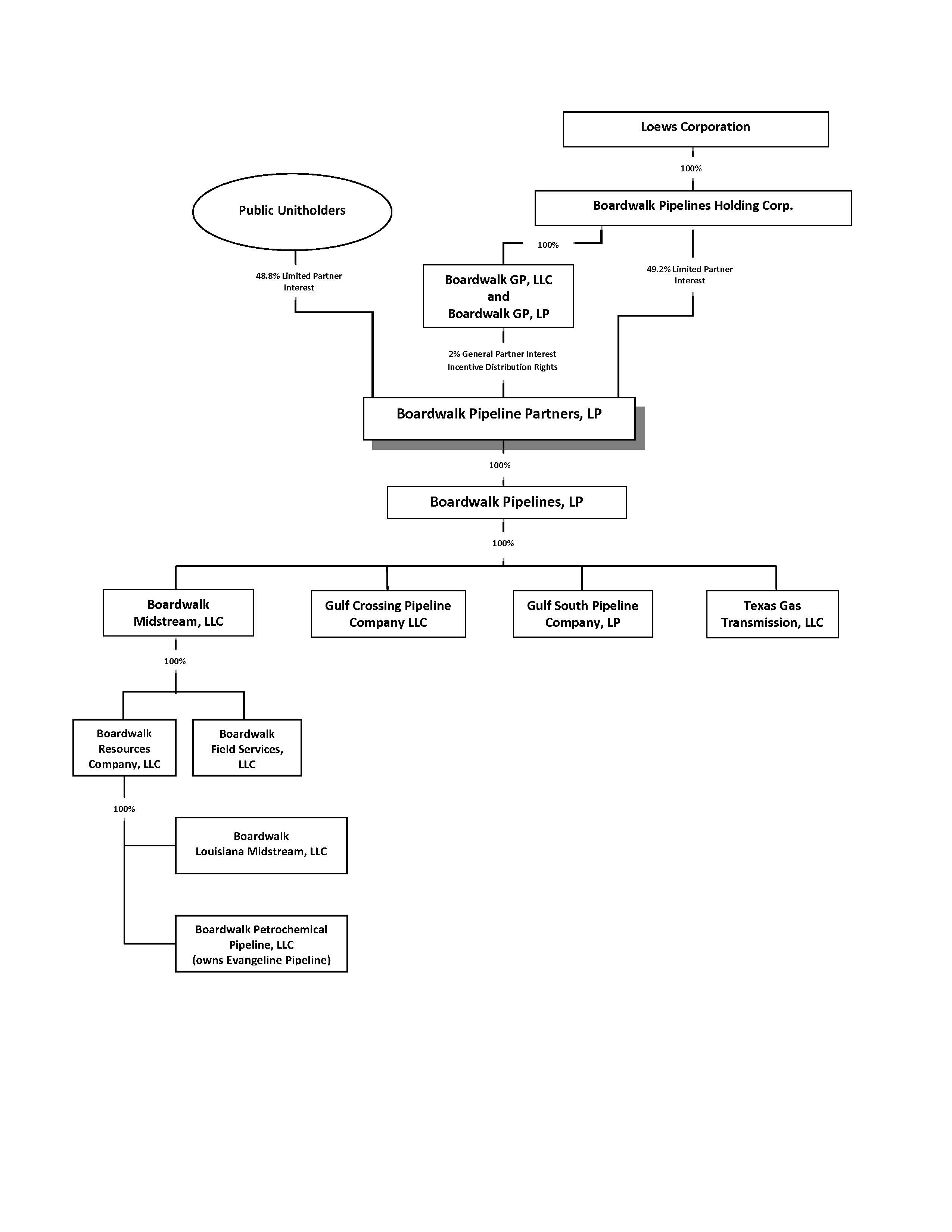

We are a Delaware limited partnership formed in 2005. Our business, which is conducted by our primary subsidiary, Boardwalk Pipelines, LP (Boardwalk Pipelines) and its operating subsidiaries, as shown in the diagram below (together, the operating subsidiaries), consists of integrated natural gas and natural gas liquids and other hydrocarbons (herein referred to together as NGLs) pipeline and storage systems. All of our operations are conducted by the operating subsidiaries. Boardwalk Pipelines Holding Corp. (BPHC), a wholly-owned subsidiary of Loews Corporation (Loews), owns 125.6 million of our common units and, through Boardwalk GP, LP (Boardwalk GP), an indirect wholly-owned subsidiary of BPHC, our 2% general partner interest and all of our incentive distribution rights (IDRs). As of February 13, 2017, the common units and general partner interest owned by BPHC represent approximately 51% of our equity interests, excluding the IDRs. Our Partnership Interests, as described in Part II, Item 5 of this Report, contains more information on how we calculate BPHC’s equity ownership. Our common units are traded under the symbol “BWP” on the New York Stock Exchange (NYSE).

3

The following diagram reflects a simplified version of our current organizational structure:

4

Our Business

We are a master limited partnership operating in the midstream portion of the natural gas and NGLs industry, providing transportation and storage for those commodities. We own approximately 14,365 miles of natural gas and NGLs pipelines and underground storage caverns having aggregate capacity of approximately 205.0 billion cubic feet (Bcf) of working natural gas and 24.0 million barrels (MMBbls) of NGLs. Our natural gas pipeline systems are located in the Gulf Coast region, Oklahoma, Arkansas and the Midwestern states of Tennessee, Kentucky, Illinois, Indiana and Ohio, and our NGLs pipelines and storage facilities are located in Louisiana and Texas.

We serve a broad mix of customers, including producers of natural gas, local distribution companies (LDCs), marketers, electric power generators, industrial users and interstate and intrastate pipelines. We provide a significant portion of our natural gas pipeline transportation and storage services through firm contracts under which our customers pay monthly capacity reservation fees, which are fees owed regardless of actual pipeline or storage capacity utilization. Other fees are based on actual utilization of the capacity under firm contracts and contracts for interruptible services. Contracts for our NGLs services are generally fee-based or based on minimum volume requirements, while others are dependent on actual volumes transported or stored. For the year ended December 31, 2016, approximately 81% of our revenues were derived from capacity reservation fees under firm contracts, approximately 12% of our revenues were derived from fees based on utilization under firm contracts and approximately 7% of our revenues were derived from interruptible transportation, interruptible storage, parking and lending (PAL) and other services. Part II, Item 6 of this Report contains a summary of our revenues from external customers, net income and total assets, all of which were attributable to our pipeline and storage systems operating in one reportable segment.

The maximum rates we can charge for most of our natural gas transportation services, as well as the general terms and conditions of those services, are established by, and subject to review and revision by, the Federal Energy Regulatory Commission (FERC). These rates are based upon certain assumptions to allow us the opportunity to recover the cost of providing these services and earn a reasonable return on equity. However, it is possible that we may not recover all of our costs or earn a return. We are authorized to charge market-based rates for the majority of our natural gas storage capacity pursuant to authority granted by the FERC. The Surface Transportation Board (STB), a division of the United States (U.S.) Department of Transportation (DOT), has authority to regulate the rates we charge for service on certain of our ethylene pipelines, while the Louisiana Public Service Commission (LPSC) regulates the rates we charge for service on our other NGL pipelines. The STB and LPSC require that our transportation rates are reasonable and that our practices cannot unreasonably discriminate among our shippers.

Our Pipeline and Storage Systems

We own and operate approximately 13,930 miles of interconnected natural gas pipelines, directly serving customers in thirteen states and indirectly serving customers throughout the northeastern and southeastern U.S. through numerous interconnections with unaffiliated pipelines. We also own and operate more than 435 miles of NGLs pipelines in Louisiana and Texas. In 2016, our pipeline systems transported approximately 2.3 trillion cubic feet (Tcf) of natural gas and approximately 64.8 MMBbls of NGLs. Average daily throughput on our natural gas pipeline systems during 2016 was approximately 6.3 Bcf. Our natural gas storage facilities are comprised of fourteen underground storage fields located in four states with aggregate working gas capacity of approximately 205.0 Bcf and our NGLs storage facilities consist of nine salt-dome caverns located in Louisiana with an aggregate storage capacity of approximately 24.0 MMBbls. We also own three salt-dome caverns and a brine pond for use in providing brine supply services and to support the NGLs storage operations.

The principal sources of supply for our natural gas pipeline systems are regional supply hubs and market centers located in the Gulf Coast and Mid-Continent regions, including offshore Louisiana, the Perryville, Louisiana, area, the Henry Hub in Louisiana and the Carthage, Texas, area. Our pipelines in the Carthage, Texas, area provide access to natural gas supplies from the Barnett and Haynesville Shales and other natural gas producing regions in eastern Texas and northern Louisiana. The Henry Hub serves as the designated delivery point for natural gas futures contracts traded on the New York Mercantile Exchange. Our pipeline systems also have access to unconventional supplies such as the Woodford Shale in southeastern Oklahoma, the Fayetteville Shale in Arkansas, the Eagle Ford Shale in southern Texas and wellhead supplies in northern and southern Louisiana and Mississippi, and we also receive gas in the Lebanon, Ohio, area from the Marcellus and Utica Shales located in the northeastern U.S. Our NGLs pipeline systems access the Gulf Coast petrochemical industry through our operations at our Choctaw Hub in the Mississippi River corridor area of Louisiana and the Sulphur Hub in the Lake Charles, Louisiana, area. We also access ethylene supplies at Port Neches, Texas, which we deliver to petrochemical-industry customers in Louisiana.

The following is a summary of each of our principal operating subsidiaries:

Gulf South Pipeline Company, LP (Gulf South): Our Gulf South pipeline system is located along the Gulf Coast in the states of Texas, Louisiana, Mississippi, Alabama and Florida. The on-system markets directly served by the Gulf South system

5

are generally located in eastern Texas, Louisiana, southern Mississippi, southern Alabama and the Florida Panhandle. These markets include LDCs and municipalities located across the system, including New Orleans, Louisiana; Jackson, Mississippi; Mobile, Alabama; and Pensacola, Florida, and other end-users located across the system, including the Baton Rouge to New Orleans industrial corridor and Lake Charles, Louisiana. Gulf South also has indirect access to off-system markets through numerous interconnections with unaffiliated interstate and intrastate pipelines and storage facilities. These pipeline interconnections provide access to markets throughout the northeastern and southeastern U.S.

Gulf South has ten natural gas storage facilities. The two natural gas storage facilities located in Bistineau, Louisiana, and Jackson, Mississippi, have approximately 83.5 Bcf of working gas storage capacity from which Gulf South offers firm and interruptible storage service, including no-notice service (NNS), and support pipeline operations. Gulf South also owns and operates eight high deliverability salt-dome natural gas storage caverns in Forrest County, Mississippi, having approximately 46.0 Bcf of total storage capacity, of which approximately 29.6 Bcf is working gas capacity, and owns undeveloped land which is suitable for up to five additional storage caverns.

Texas Gas Transmission, LLC (Texas Gas): Our Texas Gas pipeline system is located in Louisiana, East Texas, Arkansas, Mississippi, Tennessee, Kentucky, Indiana and Ohio, with smaller diameter lines extending into Illinois. Texas Gas directly serves LDCs, municipalities and power generators in its market area, which encompasses eight states in the South and Midwest and includes the Memphis, Tennessee; Louisville, Kentucky; Cincinnati and Dayton, Ohio; and Evansville and Indianapolis, Indiana, metropolitan areas. Texas Gas also has indirect market access to, and receives supply from, the Northeast through interconnections with unaffiliated pipelines. A large portion of the gas delivered by the Texas Gas system is used for heating during the winter months.

Texas Gas owns nine natural gas storage fields, of which it owns the majority of the working and base gas. Texas Gas uses this gas to meet the operational requirements of its transportation and storage customers and the requirements of its NNS customers. Texas Gas also uses its storage capacity to offer firm and interruptible storage services.

Gulf Crossing Pipeline Company LLC (Gulf Crossing): Our Gulf Crossing pipeline system is located near Sherman, Texas, and proceeds to the Perryville, Louisiana, area. The market areas are in the Midwest, Northeast and Southeast, including Florida, through interconnections with Gulf South, Texas Gas and unaffiliated pipelines.

Boardwalk Louisiana Midstream, LLC and Boardwalk Petrochemical Pipeline, LLC (collectively, Louisiana Midstream):

Louisiana Midstream provides transportation and storage services for natural gas, NGLs and ethylene, fractionation services for NGLs and brine supply services for producers and consumers of petrochemicals through two hubs in southern Louisiana - the Choctaw Hub in the Mississippi River Corridor area and the Sulphur Hub in the Lake Charles area. These assets provide approximately 71.4 MMBbls of salt-dome storage capacity, including approximately 7.6 Bcf of working natural gas storage capacity; significant brine supply infrastructure; and approximately 270 miles of pipeline assets, including an extensive ethylene distribution system. Louisiana Midstream also owns and operates the Evangeline Pipeline (Evangeline), an approximately 180-mile interstate ethylene pipeline that is capable of transporting approximately 2.6 billion pounds of ethylene per year between Port Neches, Texas, and Baton Rouge, Louisiana, where it interconnects with the ethylene distribution system and storage facilities at the Choctaw Hub. Throughput for Louisiana Midstream was 64.8 MMBbls for the year ended December 31, 2016.

Boardwalk Field Services, LLC (Field Services): Field Services operates natural gas gathering, compression, treating and processing infrastructure primarily in South Texas.

The following table provides information for our pipeline and storage systems as of February 15, 2017:

Pipeline and Storage Systems | Miles of Pipeline | Working Gas Storage Capacity (Bcf) | Liquids Storage Capacity (MMBbls) | Peak-day Delivery Capacity (Bcf/d) (1) | Average Daily Throughput (Bcf/d) (1) | ||||||||||

Gulf South | 7,225 | 113.1 | — | 8.3 | 2.7 | ||||||||||

Texas Gas | 6,025 | 84.3 | — | 5.2 | 2.4 | ||||||||||

Gulf Crossing | 375 | — | — | 1.9 | 1.1 | ||||||||||

Louisiana Midstream | 450 | 7.6 | 24.0 | — | — | ||||||||||

Field Services | 290 | — | — | — | 0.1 | ||||||||||

(1) Bcf per day (Bcf/d)

6

Current Growth Projects

In response to changes in the natural gas industry and growth in the petrochemical industry, we are currently engaged in several growth projects, which are described below. Several of our growth projects were placed into service in 2016, including the Ohio to Louisiana Access project, the Southern Indiana Lateral, the Western Kentucky Market Lateral and a power plant project in South Texas. These projects were completed on time at an aggregate cost which was approximately $30.0 million lower than the $350.0 million originally estimated. The estimated total costs of our remaining growth projects are expected to be approximately as follows (in millions):

Estimated Total Cost(1) | Expected in-service date(1) | Approximate weighted-average contract life (in years) | |||||||

Northern Supply Access | $ | 230.0 | Second quarter 2017 | 16 | |||||

Sulphur Storage and Pipeline Expansion | 145.0 | Fourth quarter 2017 | Confidential | ||||||

Coastal Bend Header | 720.0 | First half 2018 | 20 | ||||||

Other growth projects (2) | 170.0 | Second half 2017-2019 | Various | ||||||

(1) | Estimates are based on internally developed financial models and time-lines. Factors in the estimates include, but are not limited to, those related to pipeline costs based on mileage, size and type of pipe, materials and construction and engineering costs. |

(2) | Other growth projects consist of projects in Louisiana comprised of three ethylene transportation and storage projects to serve industrial customers, the development of storage wells and associated facilities for brine supply services and a natural gas transportation project to serve a power plant. The power plant project remains subject to customer and FERC approvals. |

Refer to Liquidity and Capital Resources in Part II, Item 7 of this Report for further discussion of capital expenditures and financing.

Northern Supply Access Project: Our Northern Supply Access project will increase the peak-day transmission capacity on our Texas Gas system by the addition of compression facilities and other system modifications to make this portion of the system bi-directional. This project is supported by precedent agreements for approximately 0.3 Bcf/d of peak-day transmission capacity.

Sulphur Storage and Pipeline Expansion Project: We executed a long-term agreement to provide liquids transportation and storage services to support the development of a new ethane cracker plant in the Lake Charles, Louisiana, area. The project will involve significant storage and infrastructure development to serve petrochemical customers near our Sulphur Hub.

Coastal Bend Header Project: This project is supported by precedent agreements with foundation shippers to transport natural gas to serve a planned liquefied natural gas (LNG) liquefaction terminal in Freeport, Texas. As part of the project, we will construct an approximately 65-mile pipeline supply header with an approximate 1.4 Bcf/d of capacity to serve the terminal. Additionally, we will expand and modify our existing Gulf South pipeline facilities that will provide access to additional supply sources through various interconnects in South Texas and in the Louisiana area.

Nature of Contracts

We contract with our customers to provide transportation and storage services on a firm and interruptible basis. We also provide bundled firm transportation and storage services, which we provide to our natural gas customers as NNS, interruptible PAL services for our natural gas customers, gathering and processing services for our natural gas customers and brine supply services for certain petrochemical customers and fractionation services.

Transportation Services: We offer natural gas transportation services on both a firm and interruptible basis. Our natural gas customers choose, based upon their particular needs, the applicable mix of services depending upon availability of pipeline capacity, the price of services and the volume and timing of customer requirements. Our natural gas firm transportation customers reserve a specific amount of pipeline capacity at specified receipt and delivery points on our system. Firm natural gas customers generally pay fees based on the quantity of capacity reserved regardless of use, plus a commodity and a fuel charge paid on the volume of natural gas actually transported. Capacity reservation revenues derived from a firm service contract are generally consistent during the contract term, but can be higher in winter periods than the rest of the year, especially for NNS agreements.

7

Firm transportation contracts generally range in term from one to twenty years, although we may enter into shorter- or longer-term contracts. In providing interruptible natural gas transportation service, we agree to transport natural gas for a customer when capacity is available. Interruptible natural gas transportation service customers pay a commodity charge only for the volume of gas actually transported, plus a fuel charge. Interruptible transportation agreements have terms ranging from day-to-day to multiple years, with rates that change on a daily, monthly or seasonal basis. Our NGLs transportation services are generally fee-based or based on minimum volume requirements.

Storage Services: We offer natural gas storage services on both a firm and interruptible basis. Firm storage customers reserve a specific amount of storage capacity, including injection and withdrawal rights, while interruptible customers receive storage capacity and injection and withdrawal rights when available. Similar to firm transportation customers, firm storage customers generally pay fees based on the quantity of capacity reserved plus an injection and withdrawal fee. Firm storage contracts typically range in term from one to ten years. Interruptible storage customers pay for the volume of gas actually stored plus injection and withdrawal fees. Generally, interruptible storage agreements are for monthly terms. We are able to charge market-based rates for the majority of our natural gas storage capacity pursuant to authority granted by the FERC. Our NGLs storage rates are market-based, and the contracts for NGLs services are typically fixed-price arrangements with escalation clauses.

No-Notice Services: NNS consist of a combination of firm natural gas transportation and storage services that allow customers to inject or withdraw natural gas from storage with little or no notice. Customers pay a reservation charge based upon the capacity reserved plus a commodity and a fuel charge based on the volume of gas actually transported. In accordance with its tariff, Texas Gas loans stored gas to certain of its no-notice customers who are obligated to repay the gas in-kind.

Parking and Lending Service: PAL is an interruptible service offered to customers providing them the ability to park (inject) or borrow (withdraw) natural gas into or out of our pipeline systems at a specific location for a specific period of time. Customers pay for PAL services in advance or on a monthly basis depending on the terms of the agreement.

Customers and Markets Served

We contract directly with producers of natural gas and with end-use customers, including LDCs, marketers, electric power generators, industrial users and interstate and intrastate pipelines, who, in turn, provide transportation and storage services for end-users. Based on our 2016 transportation, storage and PAL revenues, net of fuel, our customer mix was as follows: natural gas producers (46%), power generators (18%), LDCs (16%), marketers (14%) and industrial end-users and others (6%). Based upon our 2016 transportation, storage and PAL revenues, net of fuel, our deliveries were as follows: pipeline interconnects (50%), LDCs (18%), industrial end-users (10%), power generators (10%), storage activities (9%) and others (3%). No customer comprises 10% or more of our 2016 operating revenues.

Natural Gas Producers: Producers of natural gas use our services to transport gas supplies from producing areas, including shale natural gas production areas, to supply pools and to other customers on and off of our systems. Producers contract with us for storage services to store excess production and to optimize the ultimate sales prices for their gas.

Power Generators: Our natural gas pipelines are directly connected to 47 natural-gas-fired power generation facilities in nine states. The demand of the power generating customers generally peaks during the summer cooling season which is counter to the winter season peak demands of the LDCs, although recently we have begun to see an increase in demand from power generators in the winter months as well, due to the overall increase in the use of natural gas over other sources such as coal to generate electricity. Our power-generating customers can use a combination of no-notice, firm and interruptible transportation services.

Local Distribution Companies: Most of our LDC customers use firm natural gas transportation services, including NNS. We serve approximately 168 LDCs at more than 300 delivery locations across our pipeline systems. The demand of these customers peaks during the winter heating season.

Marketers: Natural gas marketing companies utilize our services to provide services to our other customer groups as well as to customer groups in off-system markets. The services may include combined gas transportation and storage services to support the needs of the other customer groups. Some of the marketers are sponsored by LDCs or producers.

Industrial End-Users: We provide approximately 190 industrial facilities with a combination of firm and interruptible natural gas and NGLs transportation and storage services. Our pipeline systems are directly connected to industrial facilities in the Baton Rouge to New Orleans industrial corridor; Lake Charles, Louisiana; Mobile, Alabama; and Pensacola, Florida. We can also access the Houston Ship Channel through third-party natural gas pipelines.

8

Competition

We compete with numerous other pipelines that provide transportation, storage and other services at many locations along our pipeline systems. We also compete with pipelines that are attached to natural gas supply sources that are closer to some of our traditional natural gas market areas. In addition, regulators’ continuing efforts to increase competition in the natural gas industry have increased the natural gas transportation options of our traditional customers. For example, as a result of regulators’ policies, capacity segmentation and capacity release have created an active secondary market which increasingly competes with our own natural gas pipeline services. Further, natural gas competes with other forms of energy available to our customers, including electricity, coal, fuel oils and other alternative fuel sources.

The principal elements of competition among pipelines are availability of capacity, rates, terms of service, access to gas supplies, flexibility and reliability of service. In many cases, the elements of competition, in particular flexibility, terms of service and reliability, are key differentiating factors between competitors. This is especially the case with capacity being sold on a longer-term basis. We are focused on finding opportunities to enhance our competitive profile in these areas by increasing the flexibility of our pipeline systems, such as modifying them to allow for bi-directional flows, to meet the demands of customers such as power generators and industrial users, and are continually reviewing our services and terms of service to offer customers enhanced service options.

Seasonality

Our revenues can be affected by weather, natural gas price levels, gas price differentials between locations on our pipeline systems (basis spreads), gas price differentials between time periods, such as winter to summer (time period price spreads), and natural gas price volatility. Weather impacts natural gas demand for heating needs and power generation, which in turn influences the short-term value of transportation and storage across our pipeline systems. Colder than normal winters can result in an increase in the demand for natural gas for heating needs and warmer than normal summers can impact cooling needs, both of which typically result in increased pipeline transportation revenues and throughput. While traditionally peak demand for natural gas occurs during the winter months driven by heating needs, the increased use of natural gas for cooling needs during the summer months has partially reduced the seasonality of our revenues. During 2016, approximately 53% of our operating revenues were recognized in the first and fourth quarters of the year.

Government Regulation

Federal Energy Regulatory Commission: The FERC regulates our natural gas operating subsidiaries under the Natural Gas Act of 1938 and the Natural Gas Policy Act of 1978. The FERC regulates, among other things, the rates and charges for the transportation and storage of natural gas in interstate commerce and the extension, enlargement or abandonment of facilities under its jurisdiction. Where required, our interstate natural gas pipeline subsidiaries hold certificates of public convenience and necessity issued by the FERC covering certain of their facilities, activities and services. The FERC also prescribes accounting treatment for our interstate natural gas pipeline subsidiaries which is separately reported pursuant to forms filed with the FERC. The regulatory books and records and other activities of our subsidiaries that operate under the FERC's jurisdiction may be periodically audited by the FERC.

The maximum rates that may be charged by our operating subsidiaries that operate under the FERC's jurisdiction for all aspects of the natural gas transportation services they provide are established through the FERC’s cost-of-service rate-making process. Key determinants in the FERC’s cost-of-service rate-making process are the costs of providing service, the volumes of gas being transported, the rate design, the allocation of costs between services, the capital structure and the rate of return a pipeline is permitted to earn. The maximum rates that may be charged by us for storage services on Texas Gas, with the exception of services associated with a portion of the working gas capacity on that system, are also established through the FERC’s cost-of-service rate-making process. The FERC has authorized us to charge market-based rates for firm and interruptible storage services for the majority of our natural gas storage facilities. None of our FERC-regulated entities has an obligation to file a new rate case, and Gulf South is prohibited from filing a rate case until May 1, 2023, subject to certain exceptions.

U.S. Department of Transportation: We are regulated by DOT, through the Pipeline and Hazardous Material Safety Administration (PHMSA), under the Natural Gas Pipeline Safety Act of 1968, as amended (NGPSA), and the Hazardous Liquids Pipeline Safety Act of 1979, as amended (HLPSA). The NGPSA and HLPSA govern the design, installation, testing, construction, operation, replacement and management of interstate natural gas and NGLs pipeline facilities. We have received authority from PHMSA to operate certain natural gas pipeline assets under special permits that will allow us to operate those pipeline assets at higher than normal operating pressures of up to 0.80 of the pipe’s Specified Minimum Yield Strength (SMYS). Operating at higher than normal operating pressures will allow us to transport all of the volumes we have contracted for with our customers. PHMSA retains discretion whether to grant or maintain authority for us to operate our natural gas pipeline assets at higher pressures. PHMSA

9

has also developed regulations that require transportation pipeline operators to implement integrity management programs to comprehensively evaluate certain high risk areas, known as high consequence areas (HCAs), along our pipelines and take additional measures to protect pipeline segments located in those areas, including highly populated areas. The NGPSA and HLPSA were most recently amended by the Pipeline Safety, Regulatory Certainty, and Job Creation Act of 2011 (2011 Act) in 2012. The 2011 Act increased the penalties for safety violations, established additional safety requirements for newly constructed pipelines and required studies of safety issues that could result in the adoption of new regulatory requirements by PHMSA for existing pipelines. More recently, in June 2016, the NGPSA and HLPSA were amended by the Protecting Our Infrastructure of Pipelines and Enhancing Safety Act of 2016 (2016 Act), extending PHMSA’s statutory mandate through 2019 and, among other things, requiring PHMSA to complete certain of its outstanding mandates under the 2011 Act and developing new safety standards for natural gas storage facilities by June 22, 2018. The 2016 Act also empowers PHMSA to address imminent hazards by imposing emergency restrictions, prohibitions and safety measures on owners and operators of gas or hazardous liquid pipeline facilities without prior notice or an opportunity for a hearing. PHMSA issued interim regulations in October 2016 to implement the agency's expanded authority to address unsafe pipeline conditions or practices that pose an imminent hazard to life, property or the environment.

Surface Transportation Board and Louisiana Public Service Commission: The STB has authority to regulate the rates we charge for service on certain of our ethylene pipelines, while the LPSC regulates the rates we charge for service on our other NGL pipelines. The STB and LPSC require that our transportation rates are reasonable and that our practices cannot unreasonably discriminate among our shippers.

Other: Our operations are also subject to extensive federal, state and local laws and regulations relating to protection of the environment. Such laws and regulations impose, among other things, restrictions, liabilities and obligations in connection with the generation, handling, use, storage, transportation, treatment and disposal of hazardous substances and waste and in connection with spills, releases, discharges and emissions of various substances into the environment. Environmental regulations also require that our facilities, sites and other properties be operated, maintained, abandoned and reclaimed to the satisfaction of applicable regulatory authorities. The laws, as amended from time to time, that our operations are subject to include, for example:

• | the Clean Air Act (CAA) and analogous state laws, which impose obligations related to air emission pollutants, greenhouse gas (GHG) emissions and regulations affecting reciprocating engines subject to Maximum Achievable Control Technology standards; |

• | the Federal Water Pollution Control Act, commonly referred to as the Clean Water Act, and analogous state laws, which regulate discharge of wastewater from our facilities into state and federal waters; |

• | the Comprehensive Environmental Response, Compensation and Liability Act, commonly referred to as CERCLA, or the Superfund law, and analogous state laws, which regulate the cleanup of hazardous substances that may have been released at properties currently or previously owned or operated by us or locations to which we have sent wastes for disposal; |

• | the Resource Conservation and Recovery Act and analogous state laws, which impose requirements for the handling and discharge of solid and hazardous waste from our facilities; and |

• | the Occupational Safety and Health Act (OSHA) and analogous state laws, which establish workplace standards for the protection of the health and safety of employees, including the implementation of hazard communications programs designed to inform employees about hazardous substances in the workplace, potential harmful effects of these substances and appropriate control measures. |

Many states where we operate also have, or are developing, similar environmental or occupational health and safety legal requirements governing many of the same types of activities and those requirements can be more stringent than those adopted under federal laws and regulations. Failure to comply with these federal, state and local laws and regulations may result in the assessment of administrative, civil and criminal penalties, the imposition of corrective or remedial obligations, the occurrence of delays in the development or expansion of projects and the issuance of orders enjoining performance of some or all of our operations in affected areas. Historically, our environmental compliance costs have not had a material adverse effect on our results of operations, but there can be no assurance that continued compliance with existing requirements will not materially affect us or that the current regulatory standards will not become more onerous in the future, resulting in more significant costs to maintain compliance or increased exposure to significant liabilities, which could diminish our ability to make distributions to our unitholders.

Effects of Compliance with Environmental Regulations

Note 4 in Part II, Item 8 of this Report contains information regarding environmental compliance.

10

Employee Relations

At December 31, 2016, we had approximately 1,280 employees, approximately 110 of whom are included in collective bargaining units. A satisfactory relationship exists between management and labor. We maintain various defined contribution plans covering substantially all of our employees and various other plans which provide regular active employees with medical, life and disability coverage. We also have a non-contributory, defined benefit pension plan and a postretirement medical plan which covers Texas Gas employees hired prior to certain dates. Note 11 in Part II, Item 8 of this Report contains further information regarding our employee benefits.

Available Information

Our website is located at www.bwpmlp.com. We make available free of charge through our website our Annual Reports on Form 10-K, which include our audited financial statements, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (Exchange Act) as soon as we electronically file such material with the Securities and Exchange Commission (SEC). These documents are also available at the SEC's Public Reference Room at 100 F Street, NE, Washington, District of Columbia 20549 or at the SEC's website at www.sec.gov. You can obtain additional information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Additionally, copies of these documents, excluding exhibits, may be requested at no cost by contacting Investor Relations, Boardwalk Pipeline Partners, LP, 9 Greenway Plaza, Suite 2800, Houston, TX 77046.

We also make available within the “Governance” section of our website our corporate governance guidelines, the charter of our Audit Committee and our Code of Business Conduct and Ethics. Requests for copies may be directed in writing to: Boardwalk Pipeline Partners, LP, 9 Greenway Plaza, Suite 2800, Houston, TX 77046, Attention: Corporate Secretary.

Interested parties may contact the chairpersons of any of our Board committees, our Board’s independent directors as a group or our full Board in writing by mail to Boardwalk Pipeline Partners, LP, 9 Greenway Plaza, Suite 2800, Houston, TX 77046, Attention: Corporate Secretary. All such communications will be delivered to the director or directors to whom they are addressed.

11

Item 1A. Risk Factors

Our business faces many risks and uncertainties. We have described below the most significant risks facing us. These risks and uncertainties could lead to events or circumstances that may have a material adverse effect on our business, financial condition, results of operations or cash flows, including our ability to make distributions to our unitholders.

All of the information included in this Report and any subsequent reports we may file with the SEC or make available to the public should be carefully considered and evaluated before investing in any securities issued by us.

Business Risks

We may not be able to replace expiring natural gas transportation contracts at attractive rates or on a long-term basis and may not be able to sell short-term services at attractive rates or at all due to market conditions.

Each year, a portion of our firm natural gas transportation contracts expire and need to be renewed or replaced. Over the past several years, we have renewed some expiring contracts at lower rates and for shorter terms than in the past, and in some cases we remarketed the capacity to other customers. We expect this trend to continue, including for the contracts we entered into in 2008 and 2009 related to our East Texas Pipeline, Southeast Expansion, Gulf Crossing Pipeline, and Fayetteville and Greenville Lateral growth projects. These projects are supported by firm transportation agreements, typically having a term of ten years and priced based on then current market conditions. As the terms of these contracts expire in 2018 and 2019, we will have significantly more transportation contract expirations than we have had during the past several years. We cannot predict what market conditions will prevail when these contracts expire. If these contracts are renewed, we expect that the new contracts will be at lower rates and for shorter contract terms than our current contracts. If these contracts are renewed at current market rates, the revenues earned from these transportation contracts would be materially lower than they are today.

The narrowing of the price differentials between natural gas supplies and market demand for natural gas has reduced the transportation rates that we can charge.

The transportation rates we are able to charge customers are heavily influenced by market trends (both short and longer term), including the available supply, geographical location of natural gas production, the competition between producing basins, the demand for gas by end-users such as power plants, petrochemical facilities and LNG export facilities and the price differentials between the gas supplies and the market demand for the gas (basis differentials). Current market conditions have resulted in a sustained narrowing of basis differentials on certain portions of our pipeline system, which has reduced transportation rates that can be charged in the affected areas and adversely affected the contract terms we can secure from our customers for available transportation capacity and for contracts being renewed or replaced. The prevailing market conditions may also lead some of our customers to seek to renegotiate existing contracts to terms that are less attractive to us; for example, seeking a current price reduction in exchange for an extension of the contract term. We expect these market conditions to continue.

We are exposed to credit risk relating to default or bankruptcy by our customers.

Credit risk relates to the risk of loss resulting from the default by a customer of its contractual obligations or the customer filing bankruptcy. We have credit risk with both our existing customers and those supporting our growth projects.

Natural gas producers comprise a significant portion of our revenues and support several of our growth projects. In 2016, approximately 46% of our revenues were generated from contracts with natural gas producers. For existing customers on our interstate pipelines, our FERC gas tariffs only allow us to require limited credit support. During 2016, the prices of oil and natural gas remained volatile. If gas prices continue to remain volatile for a sustained period of time, our producer customers will be adversely affected, which could lead some customers to default on their obligations to us or file for bankruptcy.

Credit risk also exists in relation to our growth projects, both because the foundation customers make long-term firm capacity commitments to us for such projects and certain of those foundation customers agree to provide credit support as construction for such projects progresses. If a customer fails to post the required credit support during the growth project process, overall returns on the project may be reduced to the extent an adjustment to the scope of the project results or we are unable to replace the defaulting customer.

Our credit exposure also includes receivables for services provided, future performance under firm agreements and volumes of gas owed by customers for imbalances or gas loaned by us to them under certain NNS and PAL services.

12

In 2016, the credit ratings of several of our producer customers, including some of those supporting our growth projects, were downgraded. The downgrades may restrict liquidity for those customers and indicate a greater likelihood of nonperformance of their contractual obligations, including failure to make future payments, or the failure to post required letters of credit or other forms of credit support. In addition, our customers that file for bankruptcy protection may also seek to have their contracts with us rejected in the bankruptcy proceedings. During 2016, several of our customers declared bankruptcy. While the overall impact of these bankruptcies was not material to our 2016 financial performance, one of the bankruptcies did negatively affect one of our growth projects.

We rely on a limited number of customers for a significant portion of revenues.

For 2016, while no customer comprised 10% or more of our operating revenues, our top ten customers comprised approximately 42% of our revenues. If any of our significant customers have credit or financial problems which result in bankruptcy, a delay or failure to pay for services provided by us, to post the required credit support for construction associated with our growth projects or existing contracts or to repay the gas they owe us, it could have a material adverse effect on our revenues.

Our actual construction and development costs could exceed our forecasts, our anticipated cash flow from construction and development projects will not be immediate and our construction and development projects may not be completed on time or at all.

We are engaged in multiple significant construction projects involving our existing assets and the construction of new facilities for which we have expended or will expend significant capital. We expect to continue to engage in the construction of additional growth projects and modifications of our system. When we build a new pipeline or expand or modify an existing facility, the design, construction and development occurs over an extended period of time, and we will not receive any revenue or cash flow from that project until after it is placed in service. Typically, there are several years between when the project is announced and when customers begin using the new facilities. During this period we spend capital and incur costs without receiving any of the financial benefits associated with the projects. The construction of new assets involves regulatory, environmental, activist, legal, political, materials and labor costs, as well as operational and other risks that are difficult to predict and beyond our control. Any of these projects may not be completed on time or at all due to a variety of factors, may be impacted by significant cost overruns or may be materially changed prior to completion as a result of developments or circumstances that we are not aware of when we commit to the project, including the inability of any shipper to provide adequate credit support or to otherwise perform their obligations under any precedent agreements. Any of these events could result in material unexpected costs or have a material adverse effect on our ability to realize the anticipated benefits from our growth projects.

Legislative and regulatory initiatives relating to pipeline safety that require the use of new or more prescriptive compliance activities, substantial changes to existing integrity management programs, or withdrawal of regulatory waivers could subject us to increased capital and operating costs and operational delays.

Our interstate pipelines are subject to regulation by PHMSA which is part of DOT. PHMSA regulates the design, installation, testing, construction, operation, replacement and management of existing interstate natural gas and NGLs pipeline facilities. PHMSA regulation currently requires pipeline operators to implement integrity management programs, including frequent inspections, correction of certain identified anomalies and other measures to promote pipeline safety in HCAs, such as high population areas, areas unusually sensitive to environmental damage and commercially navigable waterways. States have jurisdiction over certain of our intrastate pipelines and have adopted regulations similar to existing PHMSA regulations. State regulations may impose more stringent requirements than found under federal law. Compliance with these rules has resulted in an overall increase in our maintenance costs. PHMSA has issued notices of proposed rulemaking in April 2015 and March 2016, which have proposed new, more prescriptive regulations related to the overall operations of our interstate natural gas and NGLs pipelines which, if adopted as proposed, will cause us to incur increased capital and operating costs, experience operational delays, and result in potential adverse impacts to our ability to reliably serve our customers. Additionally, requirements that are imposed under the 2011 Act and 2016 Act may also increase our capital and operating costs or impact the operation of our pipeline.

We have entered into firm transportation contracts with shippers on certain of our expansion projects that utilize the design capacity of certain of our pipeline assets, based upon the authority we received from PHMSA to operate those pipelines at higher than normal operating pressures of up to 0.80 of the pipeline's SMYS. PHMSA retains discretion to withdraw or modify this authority. If PHMSA were to withdraw or materially modify such authority, it could affect our ability to transport all of our contracted quantities of natural gas on these pipeline assets and we could incur significant additional costs to reinstate this authority or to develop alternate ways to meet our contractual obligations.

13

Changes in energy prices, including natural gas, oil and NGLs, impact the supply of and demand for those commodities, which impact our business.

Our customers, especially producers, are directly impacted by changes in commodity prices. The prices of natural gas, oil and NGLs fluctuate in response to changes in supply and demand, market uncertainty and a variety of additional factors. The declines in the levels of natural gas, oil and NGLs prices experienced in 2015 and 2016 have adversely affected the businesses of our producer customers and reduced the demand for our services and could result in defaults or the non-renewal of our contracted capacity when existing contracts expire. Future increases in the price of natural gas and NGLs could make alternative energy and feedstock sources more competitive and reduce demand for natural gas and NGLs. A reduced level of demand for natural gas and NGLs could reduce the utilization of capacity on our systems and reduce the demand for our services.

Our revolving credit facility contains operating and financial covenants that restrict our business and financing activities.

Our revolving credit facility contains operating and financial covenants that may restrict our ability to finance future operations or capital needs or to expand or pursue business activities. Our credit agreement limits our ability to make loans or investments, make material changes to the nature of our business, merge, consolidate or engage in asset sales, or grant liens or make negative pledges. This agreement also requires us to maintain a ratio of consolidated debt to consolidated EBITDA (as defined in the agreement) of not more than 5.0 to 1.0, or up to 5.5 to 1.0 for the three quarters following an acquisition, which limits the amount of additional indebtedness we can incur to grow our business, and could require us to reduce indebtedness if our earnings before interest, income taxes, depreciation and amortization (EBITDA) decreases to a level that would cause us to breach this covenant. Future financing agreements we may enter into could contain similar or more restrictive covenants or may not be as favorable as those under our existing indebtedness.

Our ability to comply with the covenants and restrictions contained in our credit agreement may be affected by events beyond our control, including economic, financial and market conditions. If market, economic conditions or our financial performance deteriorate, our ability to comply with these covenants may be impaired. If we are not able to incur additional indebtedness we may need to sell additional equity securities to raise needed capital, which could be dilutive to our existing equity holders, or to seek other sources of funding that may be on less favorable terms. If we default under our credit agreement or another financing agreement, significant additional restrictions may become applicable, including a restriction on our ability to make distributions to unitholders. In addition, a default could result in a significant portion of our indebtedness becoming immediately due and payable, and our lenders could terminate their commitment to make further loans to us. If such event occurs, we would not have, and may not be able to obtain, sufficient funds to make these accelerated payments.

A significant portion of our debt will mature over the next five years and will need to be paid or refinanced and changes to the debt and equity markets could adversely affect our business.

A significant portion of our debt is set to mature in the next five years, including our revolving credit facility. We may not be able to refinance our maturing debt on commercially reasonable terms, or at all, depending on numerous factors, including our financial condition and prospects at the time and the then current state of the banking and capital markets in the U.S.

Limited access to the debt and equity markets could adversely affect our business.

Our current strategy is to fund our announced growth projects through currently available financing options, including utilizing cash generated from operations, borrowings under our revolving credit facility, accessing proceeds from our Subordinated Loan Agreement with BPHC (Subordinated Loan) and accessing the capital markets. Changes in the debt and equity markets, including market disruptions, limited liquidity, and interest rate volatility, may increase the cost of financing as well as the risks of refinancing maturing debt. Instability in the financial markets may increase our cost of capital while reducing the availability of funds. This may affect our ability to raise capital and reduce the amount of cash available to fund our operations or growth projects. If the debt and equity markets were not available, it is not certain if other adequate financing options would be available to us on terms and conditions that we would find acceptable.

Any disruption in the capital markets could require us to take additional measures to conserve cash until the markets stabilize or until we can arrange alternative credit arrangements or other funding for our business needs. Such measures could include reducing or delaying business activities, reducing our operations to lower expenses and reducing other discretionary uses of cash. We may be unable to execute our growth strategy or take advantage of certain business opportunities, any of which could negatively impact our business.

14

Climate change legislation and regulations restricting emissions of GHGs could result in increased operating and capital costs and reduced demand for our pipeline and storage services.

Climate change continues to attract considerable public and scientific attention. As a result, numerous proposals have been made and are likely to continue to be made at the international, national, regional and state levels of government to monitor and limit emissions of GHGs. While no comprehensive climate change legislation has been implemented at the federal level, the Environmental Protection Agency (EPA) and states or groupings of states have pursued legal initiatives in recent years that seek to reduce GHG emissions through efforts that include consideration of cap-and-trade programs, carbon taxes and GHG reporting and tracking programs, and regulations that directly limit GHG emissions from certain sources.

In particular, the EPA has adopted rules that, among other things, establish certain permit reviews for GHG emissions from certain large stationary sources, which reviews could require securing permits at covered facilities emitting GHGs and meeting defined technological standards for those GHG emissions. The EPA has also adopted rules requiring the monitoring and annual reporting of GHG emissions from certain petroleum and natural gas system sources in the U.S., including, among others, onshore processing, transmission, storage and distribution facilities as well as gathering, compression and boosting facilities and blowdowns of natural gas transmission pipelines.

Federal agencies also have begun directly regulating emissions of methane, a GHG, from oil and natural gas operations. In June 2016, the EPA published regulations requiring certain new, modified or reconstructed facilities in the oil and natural gas sector to reduce these methane gas and volatile organic compound emissions and, in November 2016, the EPA began seeking additional information on methane emissions from certain existing facilities and operations in the oil and natural gas sector that could be developed into federal guidelines that states must consider in developing their own rules for regulating sources within their borders. In December 2015, the U.S. joined the international community at the 21st Conference of the Parties of the United Nations Framework Convention on Climate Change in Paris, France that prepared an agreement requiring member countries to review and “represent a progression” in their intended nationally determined contributions, which set GHG emission reduction goals every five years beginning in 2020. This “Paris Agreement” was signed by the U.S. in April 2016 and entered into force in November 2016; however this agreement does not create any binding obligations for nations to limit their GHG emissions, but rather includes pledges to voluntarily limit or reduce future emissions.

The adoption and implementation of any international, federal or state legislation or regulations that require reporting of GHGs or otherwise restrict emissions of GHGs could result in increased compliance costs or additional operating restrictions. Finally, some scientists have concluded that increasing concentrations of GHG in the atmosphere may produce climate changes that have significant physical effects, such as increased frequency and severity of storms, droughts, and floods and other climate events.

Our natural gas transportation and storage operations are subject to extensive regulation by the FERC, including rules and regulations related to the rates we can charge for our services and our ability to construct or abandon facilities. The FERC's rate-making policies could limit our ability to recover the full cost of operating our pipelines, including earning a reasonable return.

Our natural gas transportation and storage operations are subject to extensive regulation by the FERC, including the types and terms of services we may offer to our customers, construction of new facilities, creation, modification or abandonment of services or facilities, recordkeeping and relationships with affiliated companies. An adverse FERC action in any of these areas could affect our ability to compete for business, construct new facilities, offer new services or recover the full cost of operating our pipelines. This regulatory oversight can result in longer lead times to develop and complete any future project than competitors that are not subject to the FERC's regulations. The FERC can also deny us the right to abandon certain facilities from service.

The FERC also regulates the rates we can charge for our natural gas transportation and storage operations. For our cost-based services, the FERC establishes both the maximum and minimum rates we can charge. The basic elements that the FERC considers are the costs of providing service, the volumes of gas being transported, the rate design, the allocation of costs between services, the capital structure and the rate of return a pipeline is permitted to earn. The FERC has issued a notice of inquiry concerning the inclusion of income taxes in the rates of an interstate pipeline that operates as a master limited partnership. The ultimate outcome of this proceeding could impact the maximum rates we can charge on our FERC-regulated pipelines. We may not be able to earn a return or recover all of our costs, including certain costs associated with pipeline integrity activities, through existing or future rates. The FERC or our customers can challenge the existing rates on any of our pipelines. Such a challenge against us could adversely affect our ability to charge rates that would cover future increases in our costs or even to continue to collect rates to maintain our current revenue levels that are designed to permit us a reasonable opportunity to recover current costs and depreciation and earn a reasonable return.

15

We may not continue making distributions to unitholders at the current distribution rate, or at all.

The amount of cash we have available to distribute to our unitholders depends upon the amount of cash we generate from our operations, financing activities, and the amount of cash we require, or determine to use, for other purposes, all of which fluctuate from quarter to quarter based on a number of factors, many of which are beyond our control. Some of the factors that influence the amount of cash we have available for distribution in any quarter include:

• | fluctuations in cash generated by our operations, which may be affected by the seasonality of our business, timing of payments, defaults, general business conditions and market conditions that impact contract renewals, pricing, basis spreads, time period price spreads, market rates and supply and demand for natural gas and our services; |

• | the level of capital expenditures we make or anticipate making, including for expansion, growth projects and acquisitions; |

• | the amount of cash necessary to meet current or anticipated debt service requirements and other liabilities; |

• | fluctuations in our working capital needs; |

• | our ability to borrow funds and/or access capital markets on acceptable terms to fund operations or capital expenditures, including acquisitions, and restrictions contained in our debt agreements; |

• | the cost and form of payment for pending or anticipated acquisitions and growth or expansion projects and the timing and commercial success of any such initiatives; and |

• | unanticipated costs to operate our business, such as for maintenance and regulatory compliance. |

There is no guarantee that unitholders will receive quarterly distributions from us. Our distributions are determined each quarter by the board of directors of our general partner based on the board’s consideration of our financial position, earnings, cash flow, current and future business needs and other relevant factors at the time when these decisions are made. We may reduce or eliminate distributions at any time our board determines that our cash reserves are insufficient or are otherwise required to fund current or anticipated future operations, capital expenditures, acquisitions, growth or expansion projects, debt repayment or other business needs.

A failure in our computer systems or a cybersecurity attack on any of our facilities, or those of third parties, may affect adversely our ability to operate our business.

We have become more reliant on technology to help increase efficiency in our business processes. Our businesses are dependent upon our operational and financial computer systems to process the data necessary to conduct almost all aspects of our business, including the operation of our pipeline and storage facilities and the recording and reporting of commercial and financial transactions. Any failure of our computer systems, or those of our customers, suppliers or others with whom we do business, could materially disrupt our ability to operate our business.

At the same time, the U.S. government has issued public warnings that indicate that energy assets might be specific targets of cybersecurity threats. Our technologies, systems and networks, and those of our vendors, suppliers and other business partners, may become the target of cyberattacks or information security breaches that could result in the unauthorized release, gathering, monitoring, misuse, loss or destruction of proprietary and other information, or other disruption of operations. In addition, certain cyber-incidents may remain undetected for an extended period. As cyber-incidents continue to evolve, we will likely be required to expend additional resources to continue to modify or enhance our protective measures or to investigate and remediate any vulnerability to cyber-incidents. Our insurance coverage for cyberattacks may not be sufficient to cover all the losses we may experience as a result of such cyberattacks. Any cyberattacks that affect our facilities, or those of our customers, suppliers or others with whom we do business could have a material adverse effect on our business, cause us a financial loss and/or damage our reputation.

16

We may not be successful in executing our strategy to grow and diversify our business.

We rely primarily on the revenues generated from our natural gas long-haul transportation and storage services. Negative developments in these services have significantly greater impact on our financial condition and results of operations than if we maintained more diverse assets. We are pursuing a strategy of growing and diversifying our business through acquisition and development of assets in complementary areas of the midstream energy sector, such as liquids transportation and storage assets. Our ability to grow, diversify and increase distributable cash flows will depend, in part, on our ability to expand our existing business lines and to close and execute on accretive acquisitions. We may not be successful in acquiring or developing such assets or may do so on terms that ultimately are not profitable. Any such transactions involve potential risks that may include, among other things:

• | the diversion of management's and employees' attention from other business concerns; |

• | inaccurate assumptions about volume, revenues and project costs, including potential synergies; |

• | a decrease in our liquidity as a result of our using available cash or borrowing capacity to finance the acquisition or project; |

• | a significant increase in our interest expense or financial leverage if we incur additional debt to finance the acquisition or project; |

• | inaccurate assumptions about the overall costs of equity or debt; |

• | an inability to hire, train or retain qualified personnel to manage and operate the acquired business and assets or the developed assets; |

• | unforeseen difficulties operating in new product areas or new geographic areas; and |

• | changes in regulatory requirements or delays of regulatory approvals. |

Additionally, acquisitions also contain the following risks:

• | an inability to integrate successfully the businesses we acquire; |

• | the assumption of unknown liabilities for which we are not indemnified, for which our indemnity is inadequate or for which our insurance policies may exclude from coverage; |

• | limitations on rights to indemnity from the seller; and |

• | customer or key employee losses of an acquired business. |

Our ability to replace expiring gas storage contracts at attractive rates or on a long-term basis and to sell short-term services at attractive rates or at all are subject to market conditions.

We own and operate substantial natural gas storage facilities. The market for the storage and PAL services that we offer is impacted by the factors and market conditions discussed above for our transportation services, and is also impacted by natural gas price differentials between time periods, such as winter to summer (time period price spreads), and the volatility in time period price spreads. When market conditions cause a narrowing of time period price spreads and a decline in the price volatility of natural gas, these factors adversely impact the rates we can charge for our storage and PAL services.

Failure to comply with environmental or worker safety laws and regulations or an accidental release of pollutants into the environment may cause us to incur significant costs and liabilities.

Our operations are subject to federal, regional, state and local laws and regulations relating to protection of worker safety or the environment. These laws include, for example, the CAA, the Clean Water Act, CERCLA, the Resource Conservation and Recovery Act, OSHA and analogous state laws. These laws and regulations may restrict or impact our business activities, including requiring the acquisition or renewal of permits or other approvals to conduct regulated activities, restricting the manner in which we handle or dispose of wastes, imposing remedial obligations to remove or mitigate contamination resulting from a spill or other release, requiring capital expenditures to comply with pollution control requirements and imposing safety and health criteria

17

addressing worker protection. Failure to comply with these laws and regulations may trigger a variety of administrative, civil and criminal enforcement measures, including the assessment of monetary penalties, the imposition of remedial requirements, the occurrence of delays in the permitting or performance or expansion of projects and the issuance of orders enjoining future operations in a particular area. Under certain of these environmental laws and regulations, we could be subject to joint and several or strict liability for the removal or remediation of previously released pollutants or property contamination regardless of whether we were responsible for the release or contamination or if our operations were not in compliance with all laws. We may not be able to recover some or any of the costs incurred from insurance. Stricter environmental or worker safety laws, regulations or enforcement policies could significantly increase our operational or compliance costs and compliance with new or more stringent environmental legal requirements could delay or prohibit our ability to obtain permits for operations or require us to install additional pollution control equipment.

Our operations are subject to catastrophic losses, operational hazards and unforeseen interruptions for which we may not be adequately insured.

There are a variety of operating risks inherent in transporting and storing natural gas, ethylene and NGLs, such as leaks and other forms of releases, explosions, fires, cyber-attacks and mechanical problems, some of which could have catastrophic consequences. Additionally, the nature and location of our business may make us susceptible to catastrophic losses from hurricanes or other named storms, particularly with regard to our assets in the Gulf Coast region, windstorms, earthquakes, hail, and severe winter weather. Any of these or other similar occurrences could result in the disruption of our operations, substantial repair costs, personal injury or loss of human life, significant damage to property, environmental pollution, impairment of our operations and substantial financial losses. The location of pipelines in HCAs, which includes populated areas, residential areas, commercial business centers and industrial sites, could significantly increase the level of damages resulting from some of these risks.

We currently possess property, business interruption, cyber threat and general liability insurance, but proceeds from such insurance coverage may not be adequate for all liabilities or expenses incurred or revenues lost. Moreover, such insurance may not be available in the future at commercially reasonable costs and terms. The insurance coverage we do obtain may contain large deductibles or fail to cover certain events, hazards or all potential losses.

Our business requires the retention and recruitment of a skilled workforce and the loss of such workforce could result in the failure to implement our business plans.

Our operations and management require the retention and recruitment of a skilled executive team and workforce including engineers, technical personnel and other professionals. In addition, many of our current employees are approaching retirement age and have significant institutional knowledge that must be transferred to other employees. If we are unable to (a) retain our current employees, (b) successfully complete the knowledge transfer and/or (c) recruit new employees of comparable knowledge and experience, our business could be negatively impacted.

Our business is highly competitive.

The principal elements of competition among pipeline systems are availability of capacity, rates, terms of service, access to gas supplies, flexibility and reliability of service. Additionally, the FERC's policies promote competition in natural gas markets by increasing the number of natural gas transportation options available to our customer base. Increased competition could reduce the volumes of product we transport or store or, in instances where we do not have long-term contracts with fixed rates, could cause us to decrease the transportation or storage rates we can charge our customers. Competition could intensify the negative impact of factors that adversely affect the demand for our services, such as adverse economic conditions, weather, higher fuel costs and taxes or other regulatory actions that increase the cost, or limit the use, of products we transport and store.

Possible terrorist activities or military actions could adversely affect our business.

The continued threat of terrorism and the impact of retaliatory military and other action by the U.S. and its allies might lead to increased political, economic and financial market instability and volatility in prices for natural gas, which could affect the markets for our natural gas transportation and storage services. While we are taking steps that we believe are appropriate to increase the security of our assets, we may not be able to completely secure our assets or completely protect them against a terrorist attack.

18

Partnership Structure Risks

Our general partner and its affiliates own a controlling interest in us, have conflicts of interest and owe us only limited fiduciary duties, which may permit them to favor their own interests.

BPHC, a wholly-owned subsidiary of Loews, owns approximately 51% of our equity interests, excluding the IDRs, and owns and controls our general partner, which controls us. Although our general partner has a fiduciary duty to manage us in a manner beneficial to us and our unitholders, the directors and officers of our general partner have a fiduciary duty to manage our general partner in a manner beneficial to BPHC. Furthermore, certain directors and officers of our general partner are also directors or officers of affiliates of our general partner. Conflicts of interest may arise between BPHC and its subsidiaries, including our general partner, on the one hand, and us and our unitholders, on the other hand. In resolving these conflicts, our general partner may favor its own interests and the interests of its affiliates over the interests of our unitholders. These potential conflicts include, among others, the following situations:

• | BPHC and its affiliates may engage in competition with us; |

• | neither our partnership agreement nor any other agreement requires BPHC or its affiliates (other than our general partner) to pursue a business strategy that favors us. Directors and officers of BPHC and its affiliates have a fiduciary duty to make decisions in the best interest of BPHC shareholders, which may be contrary to our interests; |

• | our general partner is allowed to take into account the interests of parties other than us, such as BPHC and its affiliates, in resolving conflicts of interest, which has the effect of limiting its fiduciary duty to our unitholders; |

• | some officers of our general partner who provide services to us may devote time to affiliates of our general partner and may be compensated for services rendered to such affiliates; |

• | our partnership agreement limits the liability and reduces the fiduciary duties of our general partner and the remedies available to our unitholders for actions that, without these limitations, might constitute breaches of fiduciary duty. By purchasing common units, unitholders are consenting to some actions and conflicts of interest that might otherwise constitute a breach of fiduciary or other duties under applicable law; |

• | our general partner determines the amount and timing of asset purchases and sales, borrowings, repayments of indebtedness, issuances of additional partnership securities and cash reserves, each of which can affect the amount of cash that is available for distribution to our unitholders; |