Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NewBridge Global Ventures, Inc. | cryptosign8k12012015.htm |

| EX-3.5 - EXHIBIT 3.5 - NewBridge Global Ventures, Inc. | ex35.htm |

| EX-3.4 - EXHIBIT 3.4 - NewBridge Global Ventures, Inc. | ex34.htm |

| EX-2.2 - EXHIBIT 2.2 - NewBridge Global Ventures, Inc. | ex22.htm |

| EX-10.1 - EXHIBIT 10.1 - NewBridge Global Ventures, Inc. | ex101.htm |

| EX-10.2 - EXHIBIT 10.2 - NewBridge Global Ventures, Inc. | ex102.htm |

| EX-99.2 - EXHIBIT 99.2 - NewBridge Global Ventures, Inc. | ex992.htm |

Exhibit 99.1

NABUFIT GLOBAL APS

TABLE OF CONTENTS

| Page | |

| Report of Independent Registered Public Accounting Firm | 2 |

| Financial Statements: | 3 |

| Balance Sheet as of September 30, 2015 | 3 |

| Statement of Operations and Comprehensive Loss for the Period from June 26, 2015

(Date of Inception) through September 30, 2015

|

4 |

| Statement of Shareholders’ Deficit for the Period from June 26, 2015

(Date of Inception) through September 30, 2015

|

5 |

| Statement of Cash Flows for the Period from June 26, 2015

(Date of Inception) through September 30, 2015

|

6 |

| Notes to Financial Statements | 7 |

F-1

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and shareholders

NABUfit Global ApS

We have audited the accompanying balance sheet of NABUfit Global ApS (“the Company”) as of September 30, 2015 and the related statements of operations and comprehensive loss, shareholders’ deficit and cash flows for the period from inception on June 26, 2015 through September 30, 2015. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion the financial statements referred to above present fairly, in all material respects, the financial position of NABUfit Global ApS as of September 30, 2015, and the results of its operations and cash flows for the period from inception on June 26, 2015 through September 30, 2015, in conformity with U.S. generally accepted accounting principles.

/s/ Sadler, Gibb & Associates, LLC

Salt Lake City, UT

November 30, 2015

F-2

|

NABUFIT GLOBAL APS

|

||||

|

BALANCE SHEET

|

||||

|

SEPTEMBER 30, 2015

|

||||

|

ASSETS

|

||||

|

Current Assets

|

||||

|

VAT receivable

|

$ | 10,567 | ||

|

Deposit

|

2,409 | |||

|

Total current assets

|

12,976 | |||

|

Long-term deposits

|

4,573 | |||

|

Total Assets

|

$ | 17,549 | ||

|

LIABILITIES AND SHAREHOLDERS' DEFICIT

|

||||

|

Current Liabilities

|

||||

|

Accounts payable

|

$ | 14,032 | ||

|

Accrued liabilities

|

16,622 | |||

|

Line of Credit

|

89,745 | |||

|

Total current liabilities

|

120,399 | |||

|

Total Liabilities

|

120,399 | |||

|

Commitments and Contengiencies

|

- | |||

|

SHAREHOLDERS' DEFICIT

|

||||

|

Share capital $0.1507; 50,000 shares authorized; 50,000 shares issued and outstanding

|

7,535 | |||

|

Accumulated other comprehensive loss

|

(1,172 | ) | ||

|

Accumulated deficit

|

(109,213 | ) | ||

|

Total shareholders' deficit

|

(102,850 | ) | ||

|

Total Liabilities and Shareholders' Deficit

|

$ | 17,549 | ||

The accompanying notes are an integral part of these financial statements.

F-3

|

NABUFIT GLOBAL APS

|

||||

|

STATEMENT OF OPERATIONS AND COMPREHENSIVE LOSS

|

||||

|

FROM JUNE 26, 2015 (DATE OF INCEPTION)

|

||||

|

THROUGH SEPTEMBER 30, 2015

|

||||

|

Revenue

|

$ | - | ||

|

Operating Expenses:

|

||||

|

Selling, general and administrative

|

35,739 | |||

|

Salaries

|

29,653 | |||

|

Professional fees

|

17,070 | |||

|

Travel and entertainment

|

23,298 | |||

|

Advertising

|

2,982 | |||

|

Total Operating Expenses

|

108,742 | |||

|

Loss from Operations

|

(108,742 | ) | ||

|

Other Expense:

|

||||

|

Interest expense

|

(471 | ) | ||

|

Total Other Expense

|

(471 | ) | ||

|

Net Loss

|

$ | (109,213 | ) | |

|

Comprehensive Loss:

|

||||

|

Net Loss

|

$ | (109,213 | ) | |

|

Other Comprehensive Loss

|

||||

|

Foreign currency translation adjustments

|

(1,172 | ) | ||

|

Total Comprehensive Loss

|

$ | (110,385 | ) | |

|

Net loss per common share:

|

||||

|

Net loss per common share - basic and diluted

|

$ | (2.18 | ) | |

|

Weighted average common shares outstanding - basic and diluted

|

50,000 | |||

The accompanying notes are an integral part of these financial statements.

F-4

|

NABUFIT GLOBAL APS

|

||||||||||||||||||||||||

|

STATEMENT OF SHAREHOLDERS' DEFICIT

|

||||||||||||||||||||||||

|

Accumulated

|

||||||||||||||||||||||||

|

Additional

|

Other

|

|||||||||||||||||||||||

|

Share Capital

|

Paid-in

|

Accumulated

|

Comprehensive

|

|||||||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Deficit

|

Loss

|

Total

|

|||||||||||||||||||

|

Balance at June 26, 2015 (date of inception)

|

- | $ | - | $ | - | $ | - | $ | - | $ | - | |||||||||||||

| - | ||||||||||||||||||||||||

|

Common stock issued for cash

|

50,000 | 7,535 | - | - | - | 7,535 | ||||||||||||||||||

|

Foreign currency translation adjustments

|

- | - | - | - | (1,172 | ) | (1,172 | ) | ||||||||||||||||

|

Net loss

|

- | - | - | (109,213 | ) | - | (109,213 | ) | ||||||||||||||||

|

Balance at September 30, 2015

|

50,000 | $ | 7,535 | $ | - | $ | (109,213 | ) | $ | (1,172 | ) | $ | (102,850 | ) | ||||||||||

The accompanying notes are an integral part of these financial statements.

F-5

|

NABUFIT GLOBAL APS

|

||||

|

STATEMENT OF CASH FLOWS

|

||||

|

FROM JUNE 26, 2015 (DATE OF INCEPTION)

|

||||

|

THROUGH SEPTEMBER 30, 2015

|

||||

|

Cash Flows From Operating Activities

|

||||

|

Net loss

|

$ | (109,213 | ) | |

|

Adjustments to reconcile net loss to net cash used in

|

||||

|

operating activities:

|

||||

|

Changes in operating assets and liabilities:

|

||||

|

VAT receivable

|

(10,455 | ) | ||

|

Deposit

|

(6,908 | ) | ||

|

Accounts payable

|

13,883 | |||

|

Accrued liabilities

|

16,446 | |||

|

Net Cash Used in Operating Activities

|

(96,247 | ) | ||

|

Cash Flows From Investing Activities

|

- | |||

|

Cash Flows From Financing Activities

|

||||

|

Net proceeds from line of credit

|

88,792 | |||

|

Issuance of common shares for cash

|

7,455 | |||

|

Net Cash Provided by Financing Activities

|

96,247 | |||

|

Net Increase in Cash

|

- | |||

|

Cash at Beginning of Period

|

- | |||

|

Cash at End of Period

|

$ | - | ||

|

Cash paid for

|

||||

|

Interest

|

471 | |||

|

Taxes

|

- | |||

The accompanying notes are an integral part of these financial statements.

F-6

NABUFIT GLOBAL APS

NOTES TO FINANCIAL STATEMENTS

NOTE 1 — THE COMPANY AND BASIS OF PRESENTATION

Organization — The accompanying financial statements are presented in conformity with accounting principles generally accepted in the United States of America and include the operations and balances of NABUfit Global APS “NABUfit” or the “Company.” NABUfit was organized in Denmark on June 26, 2015.

Nature of Operations — The Company is developing an online fitness portal with the option of connecting monitoring devices. The online portal will provide health data that can be used in coaching and mentoring services. The Company also partners with famous sports stars to grow its market footprint. Customers will get access to NABUfit by buying a membership with a login for the homepage of the platform.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates – The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. Significant estimates include the VAT receivable.

Fair Value – The fair values of the Company’s financial assets and liabilities approximate their carrying amounts at the reporting date.

Foreign Currency Transactions and Translations – The functional currency of NABUfit is the Danish Krone (DKK), while the reporting currency is U.S. dollars (USD). The Company translates the assets and liabilities from the functional currency to U.S. dollars at the appropriate spot rates as of the balance sheet date. Equity balances are translated using historical exchange rates. Changes in the carrying value of these assets and liabilities attributable to fluctuations in spot rates are recognized in foreign currency translation adjustment, a component of accumulated other comprehensive income. Income statement accounts are translated using the average exchange rate during the period.

Monetary assets and liabilities denominated in a currency that is different from the functional currency must first be remeasured from the applicable currency to the functional currency. The effect of this remeasurement process is recognized in other expenses in our statement of comprehensive loss.

The Company had no foreign currency transaction gains or losses during the period from June 26, 2015 (date of inception) through September 30, 2015.

Cash and Cash Equivalents – The balance in cash and cash equivalents consists of cash reserves held in bank accounts.

Revenue Recognition – The Company recognizes revenue when persuasive evidence of an arrangement exists, performance of the service has occurred, the sales price charged is fixed or determinable, and collectability is reasonably assured. Revenue is net of taxes and discounts and is recorded on an accrual basis.

F-7

Software Development Costs – The Company expenses software development costs until the Company has a working business model for the software.

Advertising Costs – Advertising costs are expensed as incurred. Advertising costs were $2,982 for the period ended September 30, 2015.

Income Taxes – The Company accounts for income taxes pursuant to Accounting Standards Codification (ASC) 740, Income Taxes, which requires the use of the asset and liability method of accounting for deferred income taxes. We recognize deferred tax liabilities and assets based on the differences between the tax basis of assets and liabilities and their reported amounts in the financial statements that will result in taxable or deductible amounts in future years.

All allowances against deferred income tax assets are recorded in whole or in part, when it is more likely than not those deferred income tax assets will not be realized. Deferred tax assets and liabilities are measured using enacted tax rates expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

A valuation allowance is required to the extent it is more-likely-than-not that a deferred tax asset will not be realized. ASC 740 also requires reporting of taxes based on tax positions that meet a more-likely-than-not standard and are measured at the amount that is more-likely-than-not to be realized. Differences between financial and tax reporting which do not meet this threshold are required to be recorded as unrecognized tax benefits. All tax years remain subject to examination since the Company was just recently formed in 2015.

Basic and Diluted Loss Per Share – Basic loss per common share is calculated by dividing net loss by the weighted-average number of common shares outstanding during the period. Diluted loss per common share is calculated by dividing net loss by the weighted-average number of common shares outstanding during the period giving effect to potentially dilutive common stock equivalents. As of September 30, 2015, the Company had no common stock equivalents outstanding.

New Accounting Pronouncements – The Company does not expect the adoption of any recent accounting pronouncements to have a material effect on the financial statements.

NOTE 2 – LEASES

The Company leases office space in Denmark for 5,039 DKK ($762) per month. There is no escalation clause. The Company can terminate the lease with six months’ notice but not before October 1, 2017. The lease start date was September 16, 2015. The Company paid a deposit of 30,238 DKK ($4,573).

On September 30, 2015, the Company assumed the short-term auto lease of a member of management that ends January 8, 2016. Monthly payments are 2,975 DKK ($448) and the deposit was 15,983 DKK ($2,409).

As of September 30, 2015, total lease deposits are $6,982. Rent expense was $377 for the period ended September 30, 2015. Minimum lease payments are $10,940, which are all due within one year.

NOTE 3 – LINE OF CREDIT

On September 15, 2015, the Company entered into a 600,000 DKK (approximately $90,000) line of credit agreement with a bank. The agreement bears interest at a variable rate of 6.021%, which is renegotiated annually on June 1. The line of credit is unsecured. Default interest rate of 19% goes into effect from the first late payment and is calculated on the balance of the outstanding debt. As of September 30, 2015, the Company had utilized 595,518 DKK ($89,745) of the credit line and paid $471 in interest.

F-8

NOTE 4 – SHAREHOLDERS’ DEFICIT

The Company's capitalization is 50,000 shares authorized, with a par value of 1 DKK ($0.15 per share). At September 30, 2015, the Company had 50,000 shares outstanding. The 50,000 shares were issued for cash of 50,000 DKK ($7,535) as part of the initial capital contribution on June 26, 2015.

NOTE 5 – RELATED PARTY TRANSACTIONS

As discussed in Note 2, the Company assumed the auto lease of its CEO on September 30, 2015.

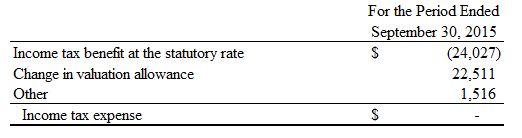

NOTE 6 – INCOME TAXES

Operating loss for the period ended September 30, 2015 was $108,742 related to foreign operations.

The Company had $20,565 of net operating loss carry forwards as of September 30, 2015 related to its operations in Denmark, which do not expire. The Denmark corporate tax rate for 2016 is 22%.

The temporary differences and carry forwards which give rise to the deferred income tax assets are as follows:

A reconciliation of income taxes at the federal statutory rate to actual income tax expense is as follows:

NOTE 7 – SUBSEQUENT EVENTS

Effective October 8, 2015, the Company entered into an agreement and plan of share exchange with CryptoSign, Inc. (“CryptoSign”). The share exchange will be accounted for under United States Generally Accepted Accounting Principles (“US GAAP”) as a reverse acquisition. The Company shareholders desire to exchange the issued and outstanding equity interests of the Company for up to an aggregate of 15,500,000 shares of the common stock, par value $0.0001 of CryptoSign. As soon as possible following the closing, the name of CryptoSign, Inc. shall be changed to “NABUfit Global Inc.”

F-9

On October 8, 2015, the Company acquired the remaining 9,536 shares of one shareholder for DKK 2,500,000 ($377,250). At the same time, the Company issued 6,303 shares of NABUfit common stock to investors for 11,900,000 DKK ($1,794,953). The remaining 3,233 shares were issued ratably to the existing shareholders, keeping the total shares outstanding at 50,000. DKK 150,000 ($22,635) was retained by the law firm to cover future expenses.

On November 30, 2015, we consummated the transaction evidenced by the agreement and plan of share exchange dated October 8, 2015 pursuant to which CryptoSign acquired from the NABUfit shareholders all of the issued and outstanding capital stock of NABUfit in exchange for 15,500,000 shares of CryptoSign.

F-10