Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 3, 2015

CRYPTOSIGN, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

0-11730

|

84-1089377

|

||

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification Number)

|

626 East 1820 North

Orem, UT 84097

(Address of Principal Executive Offices)

801-362-2115

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

1

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 3 |

| EXPLANATORY NOTE | 5 |

| ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT | 7 |

| ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS | 10 |

| DESCRIPTION OF BUSINESS | 11 |

| RISK FACTORS | 24 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 41 |

| PROPERTIES | 48 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 49 |

| DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS | 52 |

| EXECUTIVE COMPENSATION | 60 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 62 |

| MARKET PRICE OF AND DIVIDENDS ON COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | 64 |

| DESCRIPTION OF SECURITIES | 66 |

| LEGAL PROCEEDINGS | 69 |

| ITEM 3.02 UNREGISTERED SALES OF EQUITY SECURITIES | 70 |

| ITEM 3.03 MATERIAL MODIFICATION TO RIGHTS OF SECURITY HOLDERS. | 72 |

| ITEM 5.01 CHANGES IN CONTROL OF REGISTRANT | 73 |

| ITEM 5.02 DEPARTURE OF DIRECTORS OR PRINCIPAL OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF PRINCIPAL OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS. | 74 |

| ITEM 5.03 AMENDMENTS TO ARTICLES OF INCORPORATION OR BYLAWS | 75 |

| ITEM 5.06 CHANGES IN SHELL COMPANY STATUS. | 76 |

| ITEM 5.07 SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS | 77 |

| ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS | 78 |

| SIGNATURES | 79 |

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K, or this Report, contains forward-looking statements, including, without limitation, in the sections captioned “Description of Business,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Plan of Operations,” and elsewhere. Any and all statements contained in this Report that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this Report may include, without limitation, statements regarding (i) the plans and objectives of management for future operations, including plans or objectives relating to the development of commercially viable products, (ii) a projection of income (including income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii) our future financial performance, including any such statement contained in a discussion and analysis of financial condition by management or in the results of operations included pursuant to the rules and regulations of the SEC and (iv) the assumptions underlying or relating to any statement described in points (i), (ii) or (iii) above.

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation:

|

•

|

market acceptance of our products and services;

|

|

•

|

competition from existing technologies or products or new technologies and products that may emerge;

|

|

•

|

the implementation of our business model and strategic plans for our business and our products;

|

|

•

|

the scope of protection we are able to establish and maintain for intellectual property rights covering our products;

|

|

•

|

estimates of our future revenue, expenses, capital requirements and our need for additional financing;

|

|

•

|

our financial performance;

|

|

•

|

developments relating to our competitors; and

|

|

•

|

other risks and uncertainties, including those listed under the section titled “Risk Factors.”

|

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in this Report to reflect any new information or future events or circumstances or otherwise, except as required by law.

3

Readers should read this Report in conjunction with the discussion under the caption “Risk Factors,” our financial statements and the related notes thereto in this Report, and other documents which we may file from time to time with the Securities and Exchange Commission, or the SEC.

[Remainder of Page Left Blank]

4

CryptoSign, Inc., a Delaware Corporation (“CryptoSign” or the “Company,” formerly StrategaBiz, Inc., Agricon Global Corporation and BayHill Capital Corporation) was incorporated in May 1983 in the State of Colorado and re-incorporated in the State of Delaware in April 2008. The Company was formed for the purpose of pursuing a business combination through the acquisition of, or merger with, an operating business. Previously, the Company’s business activities consisted of organizing the Company and acquiring all the shares of Canola Property Ghana Limited (“CPGL”), and Agricon SH Ghana Limited (“ASHG”), both Ghanaian companies, and locating appropriate land that might be leased for cultivating and harvesting agricultural products in Ghana. In December 2013 all operations in CPGL were transferred to ASHG and thereafter all business operations of CPGL ceased. Effective June 20, 2014 the Company sold ASHG to Ghana Journeys Limited, a company owned by Stephen Abu, a former Vice President of the Company. Since that time, the Company has continued to pursue opportunities for additional strategic business combinations.

On November 30, 2015, we consummated the transaction evidenced by an Agreement and Plan of Share Exchange (the "Share Exchange Agreement") dated October 8, 2015 by and among the Company, NABUfit Global ApS, a Danish company (“NABUfit Denmark”) and Mads H. Frederiksen and Ulrik Møll (“Shareholder Representatives”), as the representatives of the shareholders holding one hundred percent (100%) of the issued and outstanding capital stock of NABUfit Denmark (collectively, the “NABUfit Shareholders” and each a “NABUfit Shareholder”), pursuant to which the Company acquired from the NABUfit Shareholders all of the issued and outstanding equity interests of NABUfit Denmark in exchange for 15,500,000 shares of the Company (the “Share Exchange”). As a result of the Share Exchange, the NABUfit Shareholders, as the former shareholders of NABUfit Denmark, became the controlling shareholders of the Company and NABUfit Denmark became a subsidiary of the Company. The Share Exchange was accounted for as a reverse merger/recapitalization effected by a share exchange, wherein NABUfit Denmark is considered the acquirer for accounting and financial reporting purposes. The capital, share price, and earnings per share amount in the pro forma financial statements for the period prior to the reverse merger were restated to reflect the recapitalization in accordance with the exchange ratio established in the merger.

As a result of the Share Exchange, we discontinued our pre-exchange business, acquired the business of NABUfit Denmark and will continue the existing business operations of NABUfit Denmark as a publicly traded company under the name “NABUfit Global, Inc.” upon the effectiveness of the currently filed Certificate of Amendment to the Company’s Amended and Restated Certificate of Incorporation, on or after December 10, 2015.

In accordance with “reverse merger” or “reverse acquisition” accounting treatment, our historical financial statements as of period ends, and for periods ended, prior to the Share Exchange will be replaced with the historical financial statements of NABUfit Denmark, prior to the Share Exchange, in all future filings with the SEC.

As used in this Report henceforward, unless otherwise stated or the context clearly indicates otherwise, the terms the “Company,” the “Registrant,” “we,” “us” and “our” refer to CryptoSign, Inc., incorporated in Delaware, after giving effect to the Share Exchange.

This Report contains summaries of the material terms of various agreements executed in connection with the transactions described herein. The summaries of these agreements are subject to, and are qualified in their entirety by, reference to these agreements, which are filed as exhibits hereto and incorporated herein by reference.

5

This Report is being filed in connection with a series of transactions consummated by the Company and certain related events and actions taken by the Company.

This Report responds to the following Items in Form 8-K:

|

Item 1.01

|

|

Entry into a Material Definitive Agreement

|

|

Item 2.01

|

|

Completion of Acquisition or Disposition of Assets

|

|

Item 3.02

|

|

Unregistered Sales of Equity Securities

|

|

Item 3.03

|

|

Material Modification to Rights of Security Holders

|

|

Item 5.01

|

|

Changes in Control of Registrant

|

|

Item 5.02

|

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

|

|

Item 5.03

|

|

Amendments to Articles of Incorporation or Bylaws

|

|

Item 5.06

|

|

Change in Shell Company Status

|

|

Item 5.07

|

|

Submission of Matters to a Vote of Security Holders

|

|

Item 9.01

|

|

Financial Statements and Exhibits

|

Prior to the Exchange, we were a “shell company” (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act). As a result of the Exchange, we have ceased to be a “shell company”. The information contained in this Report, together with the information contained in our Annual Report on Form 10-K for the fiscal year ended June 30, 2015, and our subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as filed with the SEC, constitute the current “Form 10 information” necessary to satisfy the conditions contained in Rule 144(i)(2) under the Securities Act of 1933, as amended, or the Securities Act.

[Remainder of Page Left Blank]

6

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

Agreement and Plan of Share Exchange

On November 30, 2015, CryptoSign, Inc. (“CryptoSign” or the “Company”) consummated the transactions contemplated by that certain Agreement and Plan of Share Exchange, dated October 8, 2015 (the "Share Exchange Agreement"), by and among the Company, NABUfit Global ApS, a Danish Company (“NABUfit Denmark”) and Mads H. Frederiksen and Ulrik Møll, as the representatives of the owners (the “NABUfit Shareholders”) of all of the issued and outstanding equity interests of NABUfit Denmark (the “NABUfit Shares”), pursuant to which the NABUfit Shareholders agreed to exchange an aggregate of 50,000 equity interests of NABUfit Denmark for 15,500,000 shares of common stock of CryptoSign (the “Share Exchange”) and as a result of which CryptoSign would become the parent of NABUfit Denmark. Following the closing of the Share Exchange, in accordance with Section 70 of the Danish Companies Act and the Articles of Association of NABUfit Denmark, CryptoSign will offer to any NABUfit Denmark shareholder that has not consented to the Share Exchange (the “Non-Consenting Shareholders”) and therefore has not exchanged such NABUfit Denmark shareholder’s equity interests in NABUfit Denmark for shares of common stock of CryptoSign, the pro rata portion of the number of shares of common stock of CryptoSign such Non-Consenting Shareholder would have been entitled to if such Non-Consenting Shareholder had consented to the Share Exchange. Any remaining shares of common stock of CryptoSign that have not been issued to the NABUfit Shareholders at the Closing, or to the Non-Consenting Shareholders following the closing, shall be distributed pro rata among the shareholders of NABUfit Denmark that have received shares of common stock of CryptoSign based on the number of shares of common stock of CryptoSign issued to such holders in connection with the Share Exchange and the Share Exchange Agreement.

As a result of the Share Exchange, we changed our management and reconstituted our board of directors. As of the effective time of the Share Exchange, Brian Palm Svaneeneg Mertz resigned as a director and Chief Executive Officer of CryptoSign Inc. and Mads H. Frederiksen, Simon Brandt, Morten Albæk, Morten Krarup and Ulrik Moll were elected by the board to serve as officers and directors of CryptoSign. In addition, as of the effective time of the Share Exchange, Mads H. Fredericksen was appointed to serve as the Chairman of the Board of Directors and Ulrik Moll was appointed to serve as the Chief Executive Officer. Robert Bench was retained as the President and Chief Financial Officer and Soren Jonassen and Ole Sigetty were retained as directors.

As a result of the closing of the Share Exchange, CryptoSign owns all of the outstanding equity interests of NABUfit Denmark. Prior to the consummation of the Share Exchange, CryptoSign was not engaged in any trade or business and NABUfit Denmark was engaged in developing its NABUfit virtual training and fitness products and services. Accordingly, following the Share Exchange, the business of NABUfit Denmark constitutes the only operations of the Company.

Based on the fact that after the Share Exchange: (i) the former stockholders of NABUfit Denmark control us, (ii) we will change our name to reflect the corporate identity of NABUfit Global, Inc. (effective on or after December 10, 2015) and (iii) our only business is the business that had been previously conducted by NABUfit Denmark, for accounting purposes, NABUfit Denmark is treated as the acquirer. As a result, the historical financial statements of NABUfit Denmark have become our historical financial statements and are the historical financial statements appearing elsewhere in this Report.

7

Lock-up Agreements and Other Restrictions

In connection with the Share Exchange, certain NABUfit Shareholders, holding at the Closing Date an aggregate of 13,508,870 shares of our Common Stock, entered into lock-up agreements, or the “Lock-Up Agreements,” whereby they are restricted for a period of twelve months after the Share Exchange, or the Restricted Period, from certain sales or dispositions (including pledge) of all of our Common Stock held by (or issuable to) them, such restrictions together referred to as the Lock-Up.

In addition, each Restricted Holder agreed, for a period of 18 months following the Closing Date, that it will not, directly or indirectly, effect or agree to effect any short sale (as defined in Rule 200 under Regulation SHO of the Exchange Act), whether or not against the box, establish any “put equivalent position” (as defined in Rule 16a-1(h) under the Exchange Act) with respect to the Common Stock, borrow or pre-borrow any shares of Common Stock, or grant any other right (including, without limitation, any put or call option) with respect to the Common Stock or with respect to any security that includes, relates to or derives any significant part of its value from the Common Stock or otherwise seek to hedge its position in the Common Stock.

Pro Forma Ownership

Immediately after giving effect to the Share Exchange, there were 19,437, 236 shares of our Common Stock issued and outstanding as of the Closing Date, as follows:

|

•

|

the stockholders of CryptoSign prior to the Exchange hold 3,937,236 shares of our Common Stock; and

|

|

•

|

the stockholders of the NABUfit Denmark prior to the Exchange hold 15,500,000 shares of our Common Stock;

|

In addition,

|

•

|

300,000 shares of our Common Stock were reserved for issuance under the 2008 Stock Incentive Plan as future incentive awards to executive officers, employees, consultants and directors, as of the Closing Date. In connection with the Share Exchange, the 2008 Stock Incentive Plan was terminated, however, the Company anticipates that an equal number of shares will be reserved for issuance under a future plan.

|

No other securities convertible into or exercisable or exchangeable for our Common Stock are outstanding.

Our Common Stock is quoted on the QB tier of OTC Markets under the symbol “CPSN”.

Accounting Treatment; Change of Control

The Exchange is being accounted for as a “reverse merger,” “reverse re-capitalization” or “reverse acquisition,” and NABUfit Denmark is deemed to be the acquirer in the reverse merger. Consequently, the assets and liabilities and the historical operations that will be reflected in the financial statements prior to the Exchange will be those of NABUfit, and will be recorded at the historical cost basis of NABUfit, and the consolidated financial statements after completion of the Exchange will include the assets and liabilities of NABUfit, historical operations of NABUfit, and operations of the Company and its subsidiaries from the closing date of the Exchange. As a result of the issuance of the shares of our Common Stock pursuant to the Exchange, a change in control of the Company occurred as of the date of consummation of the Exchange. Except as described in this Report, no arrangements or understandings exist among present or former controlling stockholders with respect to the election of members of our Board of Directors and, to our knowledge, no other arrangements exist that might result in a change of control of the Company.

8

We continue to be a “smaller reporting company,” as defined under the Exchange Act, and an “emerging growth company” under the Jumpstart Our Business Startups Act, or the JOBS Act, following the Exchange. We believe that as a result of the Exchange we have ceased to be a “shell company” (as such term is defined in Rule 12b-2 under the Exchange Act).

The foregoing description is only a summary and is qualified in its entirety by reference to the Share Exchange Agreement, a copy of which is attached as Exhibit 2.1 to this Form 8-K.

[Remainder of Page Left Blank]

9

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

Reference is made to the disclosure made under Item 1.01 of this Report, which is incorporated herein by reference.

Upon consummation of the Share Exchange, NABUfit Denmark became the subsidiary of CryptoSign. Item 2.01(f) of Form 8-K states that if the registrant was a “shell” company, as CryptoSign was immediately before the Share Exchange, then the registrant must disclose in a Current Report on Form 8-K the information that would be required if the registrant were filing a general form for registration of securities on Form 10. Accordingly, this Report includes all of the information that would be included in a Form 10. Please note that unless indicated otherwise, the information provided below relates to us after the Share Exchange. Information relating to periods prior to the date of the Share Exchange only relate to the party specifically indicated.

The following information is being provided with respect to CryptoSign after giving effect to the Share Exchange pursuant to the requirements of Item 2.01 of Form 8-K and Form 10.

[Remainder of Page Left Blank]

10

DESCRIPTION OF BUSINESS

Immediately following the Share Exchange, the business of NABUfit Denmark became our business.

Corporate Information

As described above, we were incorporated in Colorado in May 1983 and reincorporated in Delaware in April 2008. The Company was formed for the purpose of pursuing a business combination through the acquisition of, or merger with, an operating business. Previously, Company’s business activities consisted of organizing the Company and acquiring all the shares of Canola Property Ghana Limited (“CPGL”), and Agricon SH Ghana Limited (“ASHG”), both Ghanaian companies and locating appropriate land that might be leased for cultivating and harvesting agricultural products in Ghana. In December 2013, all operations in CPGL were transferred to ASHG and thereafter all business operations of CPGL ceased. Effective June 20, 2014, the Company sold ASHG to Ghana Journeys Limited, a company owned by Stephen Abu, a former Vice President of the Company. Since that time, the Company has continued to pursue opportunities for additional strategic business combinations.

As a result of the Share Exchange, we have acquired the business of NABUfit Global ApS, a Danish company (“NABUfit Denmark”). NABUfit Denmark commenced operations as a Danish company on June 26, 2015.

Our authorized capital stock currently consists of 100,000,000 shares of Common Stock, and 400,000 shares of the preferred stock. Our Common Stock is quoted on the OTC Markets (OTCQB) under the symbol “CPSN”, but we anticipate changing the symbol in connection with the changing of our name.

Our principal executive offices are located at 626 East 1820 North, Orem, UT 84097. Our telephone number is (801) 362-2115. Our website address is www.nabufitglobal.com. (The information contained on, or that can be accessed through, our website is not a part of this Report.)

Company Overview

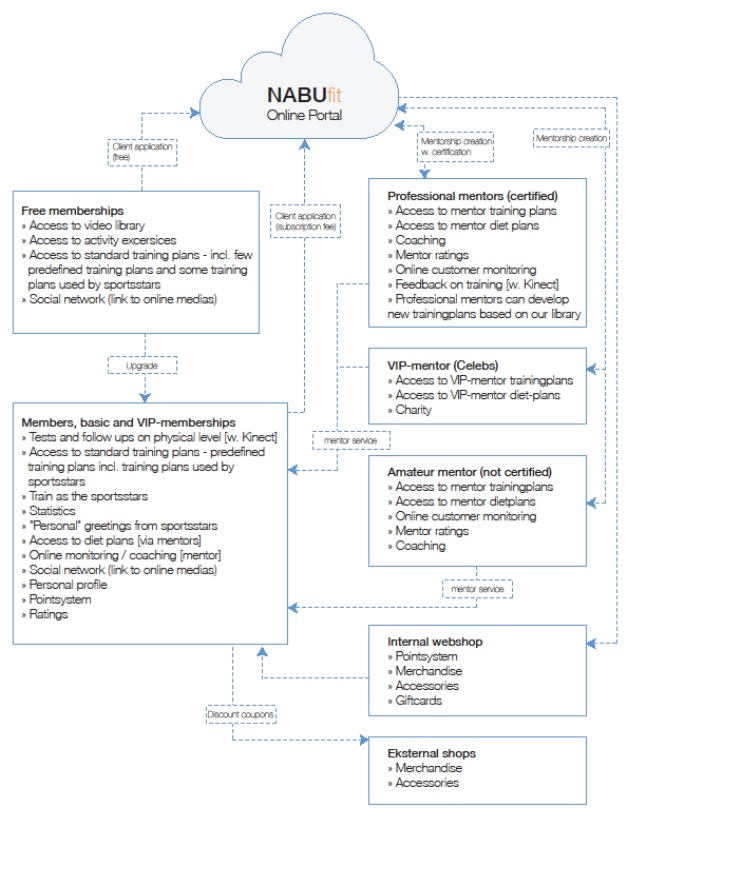

We design, manufacture and market the NABUfit virtual training and fitness products and services, a state-of-the-art online fitness portal (“NABUfit” or, the “Product”) with the option of connecting existing and future monitoring devices (wearables, etc.) to the Product. The Product incorporates interaction and input through Microsoft® Kinect® and other technologies and the option for personal data collection, coaching and teaching through mentor services.

Customers obtain access to the Product through the purchase of monthly or annual memberships and the downloading of the software or mobile device application. The Product provides custom designed training plans, diet plans and access to mentors and coaching.

Through Microsoft® Kinect®, the NABUfit technology collects data and measures each exercise relatively to a set standard and past performances. Based on the data collection and registration in the Kinect® module the user will receive immediate feedback, e.g. as a percentage, a graphic or an emoticon depending on how well the exercise has been performed. This provides a unique quality assurance ensuring maximum effect of the training. The quick feedback will also reduce the risk of injuries and streamline time spent on training. Users can access training data, statistics and results online or through mobile device applications.

11

Membership of the portal will be divided into two levels – a basic membership and a VIP membership. The difference between the levels of membership will be primarily based upon the access to features and to mentors.

The portal also offers a social forum for its users, where users can interact with like-minded members and train with them virtually. Some people will experience increased motivation by being part of a group. The member can allow others to see all or part of his profile. The personal profiles of the members can be matched, so the portal will suggest network and training mates, and thereby helping to ensure the optimum composition. It will be possible to do real-time training with training mates by sharing the screen in a videoconference on the portal.

The Portal Structure

Users gain access to the product through the online portal or through the mobile device application. Without a membership, visitors will be able to access the portal and view a limited number of features and training plans. Users who subscribe will gain full access to all features and training plans.

Upon subscription, users create a profile and can take an optional physical test to establish a baseline. Users set goals based on their profile and custom training plans and diets designed to help reach set goals.

Memberships

Users can subscribe to basic or VIP membership to the Product. A basic membership will give access to:

|

|

a.

|

Physical test – users are given access to multiple different physical tests which can be carried out at home, at the workplace or with the assistance of one or more of the NABUfit authorized business partners

|

|

|

b.

|

Standard training plans – users receive access to predefined training plans in video library and in the Kinect module including access to plans made by professional athletes

|

|

|

c.

|

Standard diet plans – users receive access to predefined diet plans including access to plans made by professional athletes

|

|

|

d.

|

Individual training plans according to personal goals – users receive assistance in creating training plans based upon personal preference and goals e.g. weight loss, increased muscle mass, increased fitness level etc.

|

|

|

e.

|

Special training plans for practitioners of specific sports – users receive customized training plans and assistance based upon specific sports and disciplines such as running, cycling, cross-fit, boxing, tennis, table tennis, swimming etc.

|

|

|

f.

|

Mentoring- users receive access to mentoring and feedback from professional mentors and athletes and the option to engage such mentors for one-on-one training at an additional cost.

|

|

|

g.

|

Prevention of overtraining – user receives information on the portal and personal notifications about how to properly train and prevent injuries

|

|

|

h.

|

Kinect module – by using the Kinect module, users can record data and receive feedback giving users the opportunity to see training results, training history and system analysis

|

|

|

i.

|

Sharing of training results – users can share training results and information on the portal and through social media and in social forums with other users

|

|

|

j.

|

Points system – users can score points by carrying out a certain number of training plans, by attracting new members to the portal etc. Points can be used in the web shop for purchasing devices, clothing etc.

|

|

|

k.

|

Ratings – users will receive ratings based upon efforts and results – and some of these ratings will also release points and personal greetings from professional mentors.

|

12

In addition to the basic membership, a VIP membership will give Users access to special and limited offers only for VIP members. Focus will be on unique experiences and events with professional athletes offered with limited access.

|

|

a)

|

Special events with professional mentors and sports stars – special NABUfit initiatives for the VIP´s

|

|

|

b)

|

Try the latest NABUfit features as the first persons – free trial giving feedback

|

|

|

c)

|

Special editions offered – special produced and limited editions of training clothes and shoes, gadgets etc. with NABUfit VIP logo will be available for purchase in a special web shop

|

|

|

d)

|

Access to a panel of sports stars – the sports stars will offer different services and products for the VIP´s e.g. webinars and personal coaching

|

Mentors

Users of the portal can purchase personalized training programs and diet plans from one or more of the Company’s professional mentors. The platform will facilitate the contact between mentors and members. The member will pay the mentor through the portal for the services provided by the mentor. The portal will charge a small transaction fee related to the fees charged by the mentor for the services or the plan. In addition, users can receive mentoring services from other members and those members may charge fees in connection with those services, for which the Company will charge a small transaction fee.

The mentors are divided into two groups:

|

|

·

|

Amateur mentors: Members of the portal can choose to let other members get access to his training and diet plans or his coaching in exchange for a fee. Members using and paying for these services can subsequently rate the mentor and his services. This allows members to develop expertise as mentor, to develop training programs, to share their expertise and training programs and to be compensated in the process. The portal will not be involved in certifying or approving the mentor and his services letting the members to evaluate and express their experiences.

|

|

|

·

|

Professional mentors: The portal will provide access to training programs and services provided by professional trainers and athletes. In addition to a team of selected professional mentors, trainers and athletes, members and other providers of training with documented professional competencies can be certified and approved to offer professional training- and diet plans and coaching through the portal. Pro-mentors will be charged a fee for the certification. Pro-mentors will offer their professional online support based on the member’s personal profile, physical tests and training statistics from the system. The pro-mentor can create and edit plans, change exercises and severity with the purpose to customize the level of training and diets to the member’s level, development and goal.

|

Web Shop

The portal will collect user data with the purpose to generate added sales and sell new products through direct marketing and the web shop.

13

Sales will take place from the web shop for members and will feature tools for training (rubber bands, weights etc.) books about diet and training, branded training clothes with print, pulse watches and other monitoring devices, other types of memberships etc.

[Remainder of Page Left Blank]

14

15

Our Strategy

Our objective is to make NABUfit the premier online fitness and training platform in key markets, beginning with China, Europe and North America. To achieve this goal, we intend to do the following:

|

|

·

|

Concentrate on Key Markets, beginning with China, Europe and North America.

|

|

|

·

|

Coordinate with strategic partners in each of the target markets for marketing and distribution.

|

|

|

·

|

Market NABUfit with the help of professional and notable athletes.

|

|

|

·

|

Use Social Media and Online Marketing.

|

|

|

·

|

Maintain our competitive lead through continued innovation.

|

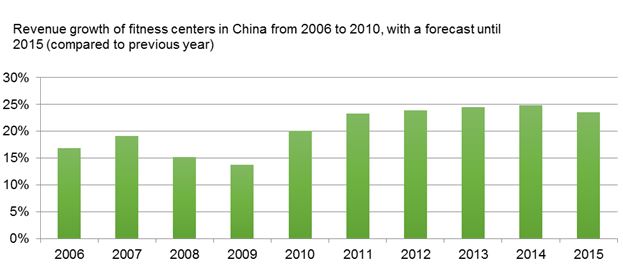

The Company will initially market its products and services in China, Europe and North America. China has a current population of approximately 1.4 billion people1 of which approximately 14% (189 million people) belong to the upper middle class and 50% (779,000,000) are living in urban areas. Growth of the e-commerce market in China is growing rapidly.2 E-commerce in 2012 generated more than 1 trillion yuan of transactions (45% for B2C and 55% for B2B) (source: iResearch) and the number of online shoppers in China has grown from 160 million in 2010 to 360 million in 2014.3 Experts expect that e-commerce will continue to rise4. The mainland's middle-income class grew by 203 million people in the 10 years after 2001, a Pew Research Centre report found - evidence, it said, of a "pivot to the east". 5 This rising population will struggle with life style diseases, lack of time and increased need for healthy diet and physical training.

1 http://www.worldometers.info/world-population/china-population/

2 http://www.chinainternetwatch.com/tag/e-commerce/

3 http://www.statista.com/statistics/277391/number-of-online-buyers-in-china/

4 http://www.mckinsey.com/insights/asia-pacific/china_e-tailing

5 http://www.scmp.com/news/china/article/1835527/chinas-middle-class-grew-203-million-10-years-report

16

In the U.S., three-quarters of online consumers (75%) owned some kind of health and fitness technology product in 2013, up from 61 percent in 2012, according to CEA6. Pedometers (37%) rank as the most popular fitness technologies owned by Americans according to CEA, followed by fitness video games (26%) and portable heart rate monitors (21%)7. CEA stats show consumer ownership of health and fitness aps more than doubled from 8% in 2012 to 20% in 2013 as developers created more user-friendly apps for smartphones and other mobile devices8. Consumer ownership of dedicated wearable health and fitness devices worldwide tripled from three percent in 2013 to nine percent in 2013 as new wearable’s were introduced and existing products gained greater adoption, according to CEA9. Some 90 million wearable devices were shipped worldwide in 2014, driven largely by the popularity of health and fitness applications, according to ABI Research10. The number of wearable health and fitness devices shipped annually around the world will climb as high as 170 million by 2017, an annual growth rate of 41%, according to ABI Research11. The global market for wearable wireless devices will reach USD 6 billion in revenues by 2016 despite such limiting factors as lack of suitable technology, poor user compliance, and lack of an overall enhanced experience, according to IMS Research12.

The dynamic growth of mobile devices will continue to drive the sale of related accessories, giving manufacturers and retailers a wealth of opportunities – along with an equal amount of challenges – to increase revenue, margin and customer traffic in-store and online which NABUfit expect to gain from. By most, if not, all accounts, 2014 was a breakout year for health and fitness technology gadgets, software apps and other products. As more Americans turn to calorie trackers, fitness video games, pedometers, heart rate monitors, fitness trackers, digital weight scales, lab counters, smart watches, motion sensors in sports gear sleep trackers, blood pressure monitors, accelerometers and smartphone apps for assistance with their daily health and fitness routines, these digital tech products are going mainstream.

While such relatively low-tech devices as pedometers still account for the biggest share of the market, more advanced tech products like fitness video games and portable heart rate monitors are now making inroads, giving rise to such popular consumer brands as Fitbit, Nike, FuelBand, Adidas, miCoach, Philip Activa, Samsung MyFit and Jawbone13.

6http://content.ce.org/PDF/2014DigitalAmerica_abridged.pdf#page=11 (page 43)

7 http://content.ce.org/PDF/2014DigitalAmerica_abridged.pdf#page=11 (page 43)

8 http://content.ce.org/PDF/2014DigitalAmerica_abridged.pdf#page=11 (page 43)

9 http://content.ce.org/PDF/2014DigitalAmerica_abridged.pdf#page=11 (page 43)

10 http://content.ce.org/PDF/2014DigitalAmerica_abridged.pdf#page=11 (page 43)

11 http://content.ce.org/PDF/2014DigitalAmerica_abridged.pdf#page=11 (page 43)

12 http://content.ce.org/PDF/2014DigitalAmerica_abridged.pdf#page=11 (page 43)

13 http://content.ce.org/PDF/2014DigitalAmerica_abridged.pdf#page=11 (page 43)

17

Likewise, the European fitness industry enjoyed a dramatic increase during 2014 according to the European Health & Fitness Market Report14, published by EuropeActive, the European fitness trade association and Deloitte.

In 2014, there were 50.1 million members in European wellness and fitness centers, which is an increase for 9% compared to 201315. This is also reflected in the sales of fitness related products, online videos and wearables.

Customers

|

|

·

|

NABUfit Members:

|

|

|

o

|

Persons becoming members of the NABUfit portal (Basic and VIP) and buying training modules, diet programs, other programs and features offered on the portal

|

|

|

·

|

Amateur and professional mentors and others offering their training and diet modules and plans on the portal:

|

|

|

o

|

The Company will receive a percentage of fees charged by professional and amateur mentors; and

|

|

|

o

|

The Company will charge a fee to mentors to become licensed on the portal.

|

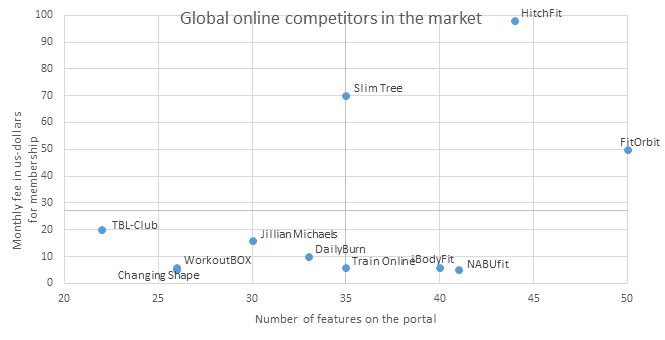

Sources of Income and Pricing

The basic membership is priced at $5 USD per month, which is less than or comparable with other virtual or online training programs and is generally less than most gym memberships. We anticipate that a VIP membership will be priced at $10 USD per month. In addition, users will be able to purchase additional products, access to additional programs, personal access to mentors and their training programs and other additional options. NABUfit will receive membership fees, a percentage of additional purchases, transaction fees and revenue from sales of other products, goods and services offered on the portal.

Monthly membership fee:

Members will pay a monthly fee for a basic or a VIP membership of NABUfit. Access to professional and amateur mentoring and other offers on the portal can be purchases separately.

Certification fee:

Members of the portal can offer training and diet plans to other members on the portal and achieve certification as an amateur mentor. Certification by a member as an amateur mentor requires payment of a certification fee.

In addition, the portal will offer professional trainers and athletes the opportunity to be certified as a pro- mentor for a certification fee. Professional mentors may offer and sell their training and diet programs and offer ongoing services.

14 https://www2.deloitte.com/content/dam/Deloitte/pl/Documents/Press/pl_PRESS_RELEASE_EuropeActive.pdf

15 https://www2.deloitte.com/content/dam/Deloitte/pl/Documents/Press/pl_PRESS_RELEASE_EuropeActive.pdf

18

Transaction fee:

The portal is a total solution connecting members with all providers of training on the portal. The Company anticipates charging a transaction fee of approximately 15% on all transactions on the portal taking place between mentors and members.

Top ranking fee

The top ranking is a feature offered to mentors for them to buy a higher ranking as compared to other mentors on the portal. This can be introduced when the portal reaches a higher number of members – expectedly during year 2. Both professional and amateur mentors can use top rankings to promote their products and services. Top ranking is connected to rating so that a mentor can only buy top ranking within the rating he has achieved.

Web shop

Finally, there will be income connected to the sale of products in the web shop, where members can use cash or earned points to purchase items.

Competition

Exercise and fitness programs, mentoring and coaching designed to help individuals achieve health and fitness through diet and training is not a new or revolutionary concept in itself. There are many products and programs in this market, including many providers of online solutions. But offering a portal that includes mentoring and programs offered by professional athletes and trainers with customized diet and training programs and real time interaction and feedback through monitoring system is certainly revolutionary.

19

To our knowledge, there are no companies offering products with all of the features of NABUfit in the target markets of China, Europe and the United States and those companies with similar products do not have Chinese versions of their platforms.

China will be the first market area for the portal, followed by North America and Europe. The portal will be developed in Denmark and technology transferred to China, North America and throughout Europe, with local teams in the target markets assisting in the translation and further development and operation according to market potential and needs.

Sales and Marketing

The Company will place a large emphasis on social media for the marketing and advancement of the portal. For instance, the population of China is unusually frequent users of social media. A new survey of 5,700 Internet users in China has found that 95 percent of those living in Tier 1, Tier 2, and Tier 3 cities are registered on a social-media site16; in addition, the country has by far the world’s most active social-media population, with 91 percent of respondents saying they visited a social-media site in the previous six months, compared with 30 percent in Japan, 67 percent in the United States, and 70 percent in South Korea17.

16 http://www.mckinsey.com/insights/marketing_sales/chinas_social-media_boom

17 http://www.mckinsey.com/insights/marketing_sales/chinas_social-media_boom

20

While messaging and sharing photos is as popular in China as in other regions, one aspect of usage in the country stands out: social media has a greater influence on purchasing decisions for consumers in China than for those anywhere else in the world18. Chinese consumers are more likely to consider buying a product if they see it mentioned on a social-media site and more likely to purchase a product or service if a friend or acquaintance recommends it on a social-media site.

Chinese consumers rely heavily upon peer-to-peer recommendations over general mass advertising. In general, the Chinese populace is skeptical of information from news sources and advertising and rely more on word-of-mouth from friends, family, and key opinion leaders, many of whom share information on social media. 19

Due to the widespread use of social media in China and North America, the Company will focus its marketing efforts on this medium. The Company will be present with its own social media site on the largest Chinese social media platforms and be linked to the sites of sports stars and their profiles on the social media. Sale of memberships, products and services will take place on the portal. With regards to North America and European Market, we anticipate employing a similar strategy.

With professional help and knowledge about Chinese conditions a digital strategy for SEO, social media marketing in China will be produced to initiate the optimal on line marketing. As a part of this an introductory video will be produced and flash mobs will be initiated and recorded to be disseminated on the social media.

Then the presence has to be cared for and maintained with a high level of activity, relevant content, news, competitions, highlighting of individual members etc.

Major Western social media outlets such as Facebook, YouTube, Twitter and Google search engine are blocked in China and can only be used in very few places with VPN. On the other hand, China has a wide range of its own social media with a very large number of users.

Twitter-like media:

• Sina Weibo: the most popular platform with 600 million registered users and about 300 million active users.

• Tencent Weibo: about 230 million registered users

Facebook-like media:

• RenRen (Xiaonei): about 194 million registered users, 54 million active users per month

• Kaixin 001: about 113 million users

• Pengyou (Tencent): about 259 million registered users + Tencent QQ network (messenger) with 784 million users

Yelp-like media:

• Dianping.com: 170 million active users per month

MySpace-like media:

• DOUBAN: more than 100 million users

18 http://www.mckinsey.com/insights/marketing_sales/chinas_social-media_boom

19 http://www.mckinseychina.com/chinas-social-media-boom-2/#sthash.Bcv1swAL.dpuf

21

Google-like search engine:

• Baidu (largest)

Manufacturing

The Company does not at this time engage in any manufacturing but may engage in manufacturing of products to be sold on the Company’s website in the future.

Intellectual Property

As a company primarily focused on fitness and training platforms with interactive interfacing technologies, we expect that our intellectual property constitutes a significant part of our assets. Protection of our intellectual property is being pursued in Denmark, China and the United States, along with, common-law trademarks, trade secrets and know-how protection.

Research and Development

Certain modules of the NABUfit product are based upon the Microsoft technology platform, which the Company believes provides optimal scalability at this time. The Company has a very good relationship with Microsoft and continues to work with Microsoft towards the development of its products. Microsoft sees the NABUfit value proposition to customers, and as such Microsoft has agreed to grant the Company the necessary Microsoft licenses, at a value of USD $20,000, for free.

The Company has identified a strong in-house development team headed by experienced individuals with significant experience in driving larger, complex products, including products for one of the largest providers of Energy in Denmark.

The Company is driving the development based on SCRUM, which is a well-known software development tool securing full transparency of the development. SCRUM provides a vast visual picture of how far development is according to the original plan.

Additional members of the in-house development team will be added as required.

Government Regulation

To the Company’s knowledge, there are no legal issues in selling the Company’s products or services in the expected markets and regions.

Employees

At November 30, 2015, we had 8 full-time employees. Within our workforce at November 30, 2015, 3 employees are engaged in research and development and 5 employees in business development, finance, human resources, facilities, information technology and general management and administration. We expect the number of employees to rise to more than 25 in 2016. We have no collective bargaining agreements with our employees, and we have not experienced any work stoppages. We consider our relations with our employees to be good.

22

Properties

Our corporate headquarters are located in Frederica, Denmark and our U.S. mailing address is 626 East 1820 North, Orem, Utah 84097. The Company does not own any properties, but currently leases office space in Denmark for $762 (DKK 5,039) per month, without annual escalation. The term of the lease is five years, however, the Company can terminate the lease with six months’ notice but not before October 1, 2017.

Legal Proceedings

From time to time, we may be involved in litigation relating to claims arising out of our operations in the normal course of business. We are not currently a party to in any legal proceeding that we believe would have a material adverse effect on our business, financial condition or operating results.

[Remainder of Page Left Blank]

23

RISK FACTORS

You should consider carefully the risks and uncertainties described below, together with all of the other information in this Current Report on Form 8-K. If any of the following risks are realized, our business, financial condition, results of operations and prospects could be materially and adversely affected. The risks described below are not the only risks facing the Company. Risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition and results of operations and/or prospects.

Risks Related to Our Business and Strategy

The Company lacks an established operating history on which to evaluate its business and determine if it will be able to execute our business plan, and can give no assurance that operations will result in profits.

On November 30, 2015, the Company acquired 100% of the outstanding capital stock of NABUfit Global ApS, a Danish company (“NABUfit Denmark”) for the purpose of executing the business plan of NABUfit Denmark. NABUfit Denmark was incorporated in Denmark on June 26, 2015 and operates an online fitness and training platform. NABUfit Denmark has a limited operating history that makes it difficult to evaluate its business. NABUfit Denmark has recently begun its operations, and cannot say with certainty when it will begin to generate revenue or achieve profitability. No assurance can be made that the Company will ever become profitable.

As a rapidly growing company with a relatively limited operating history at our current scale, we face increased risks, uncertainties, expenses and difficulties.

We have a limited operating history at our current scale, and we have encountered and will continue to encounter risks, uncertainties, expenses and difficulties, including:

• developing and launching the NABUfit portal ("NABUfit") and gaining market acceptance and penetration;

• attracting customers

• entering into new markets and introducing new loan products;

• continuing to develop, maintain and scale our platform;

• effectively using limited personnel and technology resources;

• effectively maintaining and scaling our financial and risk management controls and procedures;

• maintaining the security of our platform and the confidentiality of the information provided and utilized across our platform; and

• attracting, integrating, and retaining an appropriate number of qualified employees.

If we are not able to timely and effectively address these requirements, our business and results of operations may be harmed.

We have incurred significant losses since our inception and anticipate that we will continue to incur significant losses for the foreseeable future.

24

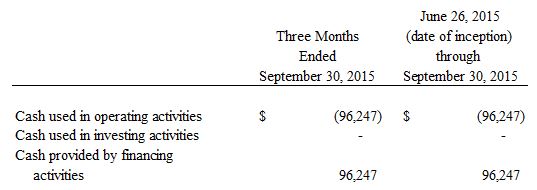

We have historically incurred substantial net losses, including net losses of $109,213 during the three months ended September 30, 2015 and $109,213 during the period from inception (June 26, 2015 through September 30, 2015). We expect our net losses to continue as a result of ongoing expansion of our commercial operations, including increased manufacturing, sales and marketing costs. These net losses have had, and will continue to have, a negative impact on our working capital, total assets and stockholders’ equity. Because of the numerous risks and uncertainties associated with our commercialization efforts, we are unable to predict when we will become profitable, and we may never become profitable. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our inability to achieve and then maintain profitability could harm our business, financial condition, results of operations and cash flows.

Further, the net losses we incur may fluctuate significantly from quarter-to-quarter and year-to-year, such that a period-to-period comparison of our results of operations may not be a good indication of our future performance quarter-to-quarter and year-to-year, due to factors including the execution of collaboration, licensing or other agreements and the timing of any payments we make or receive thereunder.

In that the Company only recently commenced business operations, the Company relied on loans and on sales of its debt and equity securities to continue operations. If the Company is unable to raise funds through sales of its securities, there can be no assurance that the Company will be able to implement its business plan, generate sustainable revenue or ever achieve profitable operations. The Company expects to have operating losses until such time as it develops a substantial and stable revenue base. The Company cannot assure you that it can achieve or sustain profitability on a quarterly or annual basis in the future.

If we do not obtain adequate financing, our business will fail.

If we are not successful in earning revenues once we have started our business activities, we may require additional financing to sustain business operations. Currently, we do not have any arrangements for financing and can provide no assurance to investors that we will be able to obtain financing when required. Obtaining additional financing would be subject to a number of factors, including the company's ability to attract customers. These factors may have an effect on the timing, amount, terms or conditions of additional financing and make such additional financing unavailable to us.

No assurance can be given that the Company will obtain access to capital markets in the future or that financing, adequate to satisfy the cash requirements of implementing our business strategies, will be available on acceptable terms. The inability of the Company to gain access to capital markets or obtain acceptable financing could have a material adverse effect upon the results of its operations and upon its financial conditions.

25

Our operating results may prove unpredictable

Our operating results are likely to fluctuate significantly in the future due to a variety of factors, many of which we have no control. Factors that may cause our operating results to fluctuate significantly include our ability to generate enough working capital from future equity sales; the level of commercial acceptance by the market of our product; fluctuations in the demand; the amount and timing of operating costs and capital expenditures relating to expansion of our business, operations, infrastructure and general economic conditions.

If realized, any of these risks could have a material adverse effect on our business, financial condition and operating results.

We require additional funding to develop our business as planned, over the next 24 months. If we do not secure this funding, we may not be able to develop our business and distribute our product, which will prevent us from generating revenues and achieving profitability.

We anticipate that we will require additional funding of at least $3,000,000 over the next 24 months in order to develop our business. Our failure to raise such additional capital or generate the cash flows necessary to finance our business could force us to limit or cease our operations. Our business plan contemplates that we will further develop our website, commence product marketing and enter into agreements with a number of personal trainers. Accordingly, we will need to raise additional funds, and we may not be able to obtain additional debt or equity financing on favorable terms, if at all.

If we raise additional equity financing, our stockholders may experience significant dilution of their ownership interests, and the per-share value of our common stock could decline. If we engage in debt financing, we may be required to accept terms that restrict our ability to incur additional indebtedness and force us to maintain specified liquidity or other ratios. If we need additional capital and cannot raise it on acceptable terms, we may not be able to, among other things, distribute and market our products, which would negatively impact our business and our ability to generate revenues and achieve profitability.

Our business model is not proven and our services may not be attractive to consumers.

The concept of personal training is strongly established with medium and high-end health clubs generating significant revenue. However, our business concept revolves around a virtual “gym” with online training and plans being provided through our portal and personal trainers and mentors working with a client remotely, without the aid of facilities provided by a health club. Though we believe that this is an attractive alternative for clients who are not able to make it to a health club, especially in target markets such as China, or simply find it inconvenient to leave their home to work out, this business model is not yet established in the industry and we will have to convince our customers that remote personal training can be an effective way to maintain a healthy lifestyle.

We believe that we will be successful in marketing our services, but there can be no assurance that we will be able to attract sufficient consumers to achieve profitability or even generate anything but minimal revenues. If our services are not accepted by consumers, we will fail.

We will rely on third party teleconferencing systems and there can be no assurance that such systems will perform effectively and consistently. If we are not able to find a consistent third party teleconferencing system, we may not be able to secure long-term customers and our revenues will suffer.

26

We could incur significant expenses, lost revenue, and reputational harm if we fail to detect or effectively address such issues of communication between the mentors, personal trainers and the users.

Our stand-alone software products also may experience quality or reliability problems. The software we license or develop may contain bugs and other defects that interfere with its intended operation. Any defects we do not detect and fix could result in reduced sales and revenue, damage to our reputation, repair or remediation costs, or legal liability. If our customers face continuing difficulties with communicating with their personal trainers, they may discontinue using our service and we will not be able to generate revenues.

Since we are a new company and lack an operating history, we face a high risk of business failure, which would result in the loss of your investment.

We have only a limited operating history upon which an evaluation of its prospects can be made. NABUfit Denmark was incorporated in June 2015 and to date we have been involved primarily in the creation of our business plan, development and we have transacted no business operations. Thus, there is no internal or industry-based historical financial data upon which to estimate the company's planned operating expenses.

We expect that our results of operations may also fluctuate significantly in the future as a result of a variety of market factors, including, among others, the dominance of other companies offering similar product, the entry of new competitors into the online fitness industry, our ability to attract, retain and motivate qualified personnel, the initiation, renewal or expiration of our customer base, pricing changes by the company or its competitors, specific economic conditions in the fitness industry and general economic conditions. Accordingly, our future revenue and operating results are difficult to forecast.

As of the date of this report, we have earned no revenue. Failure to generate revenue will cause us to go out of business, which will result in the complete loss of your investment.

We may be unable to gain any significant market acceptance for our products and services or establish a significant market presence.

Our growth strategy is substantially dependent upon our ability to market our product successfully to prospective clients in the target markets, which shall initially be China, Europe and the United States. This requires that we heavily rely upon our development and marketing partners in the target markets. Failure to select the right development and marketing partners in the target markets and other target markets will significantly delay or prohibit our ability to develop the products and services, market the products and gain market acceptance. Our products and services may not achieve significant acceptance. Such acceptance, if achieved, may not be sustained for any significant period of time. Failure of our services to achieve or sustain market acceptance could have a material adverse effect on our business, financial conditions and the results of our operations.

Because the industry is dependent upon general economic conditions and uncertainties, future developments could result in a material adverse effect on our business.

27

The amount of money people spend on health and fitness is subject to economic changes and periodical fluctuations. Prolonged declines in the economy and/or a recession could have a material adverse effect on our business. The economies of our target markets are generally affected by numerous factors and conditions, all of which are beyond our control, including (a) interest rates; (b) inflation; (c) employment levels; (d) changes in disposable income; (e) financing availability; (f) federal and state income tax policies; and (g) consumer confidence.

If we do not compete effectively in our target markets, our operating results could be harmed.

The online fitness and training market is highly competitive and evolving. We will compete with gyms, fitness centers, fitness equipment providers, other virtual trainers and training programs provided by more established companies with better name recognition and stronger capitalization.

Many of our competitors operate with different business models, have different cost structures or participate selectively in different market segments. Most of our current or potential competitors have significantly more financial, technical, marketing, and other resources than we do and may be able to devote greater resources to the development, promotion, sale and support of their products, platforms and distribution channels. Our competitors also have longer operating histories, more extensive customer bases, greater brand recognition and brand loyalty and broader customer and partner relationships than we have. For example, more established companies that possess large, existing customer bases, substantial financial resources and established distribution channels exist in the market. Additionally, a current or potential competitor may acquire one of our existing competitors or form a strategic alliance with one of our competitors. Our competitors may be better at developing new products, responding quickly to new technologies and undertaking more extensive marketing campaigns. If we are unable to compete with such companies and meet the need for innovation in our industry, the demand for our products and services could stagnate or substantially decline, we could experience reduced revenue or our marketplace could fail to achieve or maintain more widespread market acceptance, any of which could harm our business.

If potential users within the target markets do not widely adopt online or virtual training or NABUfit fails to achieve and sustain sufficient market acceptance, we will not generate sufficient revenue and our growth prospects, financial condition and results of operations could be harmed.

NABUfit may never gain significant acceptance in the marketplace and, therefore, may never generate substantial revenue or allow us to achieve or maintain profitability. Widespread adoption of virtual and online training portals in the target markets depends on many factors, including acceptance by users that such systems and methods are more convenient or superior to going to a gym or other option other options. Our ability to achieve commercial market acceptance for NABUfit or any other future products also depends on the strength of our sales, marketing and distribution organizations.

We require our clients to have and maintain adequate technology equipment.

Users of the NABUfit portal are required to have personal computers and mobile devices with adequate internet access. In addition, some features of our products require input from the Microsoft X-Box ® Kinect ®. Potential users who do not have such equipment will not be able to access the portal without first purchasing such items. This additional cost may discourage potential clients from purchasing our products and services.

28

We may not be able to generate sufficient revenue from the commercialization of NABUfit to achieve and maintain profitability.

We rely solely on the commercialization of NABUfit to generate revenue, and we expect to generate substantially all of our revenue in the future from subscriptions to the NABUfit portal and the sale of products and services on such Portal. To date, we have not generated any revenue from subscriptions or sales. We cannot assure you that we will be able to generate such income, achieve, or maintain profitability. If we fail to successfully commercialize NABUfit, we may never receive a return on the substantial investments in product development, sales and marketing we have made, as well as further investments we intend to make, which may cause us to fail to generate revenue and gain economies of scale from such investments.

In addition, potential customers may decide not to purchase NABUfit, or our customers may decide to cancel subscriptions.

If NABUfit does not perform as expected, or if we are unable to satisfy customers’ demands for additional product features, our reputation, business and results of operations will suffer.

Our success depends on the market’s confidence that NABUfit can develop and provide a reliable, high-quality fitness experience. We currently do not have a completed product and therefore, we have no way to predict the success, efficacy or reliability of NABUfit. We believe that our customers are likely to be particularly sensitive to poor design, functionality, product defects and errors. In addition, our customers are technologically well informed and may have specific demands or requests for additional functionality. If we are unable to meet those demands through the development of new features for NABUfit or future products, those new features or products do not function at the level that our customers expect, we are unable to increase throughput as expected or we are unable to obtain regulatory clearance or approval of those new features or products, where applicable, our reputation, business and results of operations could be harmed.

We may not be able to attract qualified trainers, mentors or professional athletes, which will decrease the value of our product offering and may make it difficult to differentiate NABUfit from other online training programs.

Our strategy includes developing relationships with professional trainers and athletes that can act as mentors to our clients and provide one-on-one virtual training programs. If we are unable to establish relationships with these trainers and athletes or if these mentors determine that NABUfit is not effective or that alternative products are more effective, or if we encounter difficulty promoting adoption or establishing NABUfit as a standard, our ability to achieve market acceptance of NABUfit could be significantly limited.

We have no experience in marketing and selling NABUfit, and if we are unable to adequately address our customers’ needs, it could negatively impact sales and market acceptance of NABUfit and we may never generate sufficient revenue to achieve or sustain profitability.

We have no experience in marketing and selling NABUfit. NABUfit is a new product and our future sales will largely depend on our ability to establish our marketing efforts in the target markets and adequately address our customers’ needs. We believe it is necessary to establish a strong marketing campaign through social media and other outlets. Due to the fact we are small and do not have much capital, we must limit our marketing activities and may not be able to make our product known to potential customers. Because we will be limiting our marketing activities, we may not be able to attract enough customers to operate profitably. If we are unable to adequately market our products, it will negatively impact sales and market acceptance of NABUfit and we may never generate sufficient revenue to achieve or sustain profitability.

29

The payment structure we use in our customer arrangements may lead to unpredictable revenue

Users of the NABUfit portal will become members through a monthly subscription model. Subscribers will provide credit card or ACH information and monthly payments will be made automatically. However, subscribers may cancel their memberships at any time, which may result in unpredictable revenue streams and fluctuations in operating cash flows. Therefore, we cannot rely upon our operating results in any particular period as an indication of future performance.

We may not be able to develop new products or enhance the capabilities of NABUfit to keep pace with our industry’s rapidly changing technology and customer requirements.

Our industry is characterized by rapid technological changes, new product introductions, enhancements, and evolving industry standards. Our business prospects depend on our ability to develop new products and applications for our technology in new markets that develop as a result of technological and scientific advances, while improving the performance and cost-effectiveness of NABUfit portal. New technologies, techniques or products could emerge that might offer better combinations of price and performance than NABUfit systems. The market for online or virtual fitness is characterized by rapid innovation and advancement in technology. It is important that we anticipate changes in technology and market demand. If we do not successfully innovate and introduce new technology into our anticipated product lines or effectively manage the transitions of our technology to new product offerings, our business, financial condition and results of operations could be harmed.

We may acquire other businesses, form joint ventures or make investments in other companies or technologies that could negatively affect our operating results, dilute our stockholders’ ownership, increase our debt or cause us to incur significant expense.

We may pursue acquisitions of businesses and assets. We also may pursue strategic alliances and joint ventures that leverage our proprietary technology and industry experience to expand our offerings or distribution. We have no experience with acquiring other companies and limited experience with forming strategic partnerships. We may not be able to find suitable partners or acquisition candidates, and we may not be able to complete such transactions on favorable terms, if at all. If we make any acquisitions, we may not be able to integrate these acquisitions successfully into our existing business, and we could assume unknown or contingent liabilities. Any future acquisitions also could result in the incurrence of debt, contingent liabilities or future write-offs of intangible assets or goodwill, any of which could have a negative impact on our cash flows, financial condition and results of operations. Integration of an acquired company also may disrupt ongoing operations and require management resources that we would otherwise focus on developing our existing business. We may experience losses related to investments in other companies, which could harm our financial condition and results of operations. We may not realize the anticipated benefits of any acquisition, strategic alliance or joint venture.

Foreign acquisitions involve unique risks in addition to those mentioned above, including those related to integration of operations across different cultures and languages, currency risks and the particular economic, political and regulatory risks associated with specific countries.

30

To finance any acquisitions or joint ventures, we may choose to issue shares of common stock as consideration, which could dilute the ownership of our stockholders. Additional funds may not be available on terms that are favorable to us, or at all. If the price of our Common Stock is low or volatile, we may not be able to acquire other companies or fund a joint venture project using our stock as consideration.

Risks Related to Our Reliance on Third Parties

We will depend on third-parties to market NABUfit in international markets.

We will depend on a number of third parties to market and sell NABUfit internationally. We may not be able to successfully identify marketing and distribution partners and even if we do, such parties may not be able to successfully market and sell NABUfit and may not devote sufficient time and resources to support the marketing and selling efforts that enable the product to develop, achieve or sustain market acceptance. Any of these factors could reduce our revenue from affected international markets, increase our costs in those markets or damage our reputation. In addition, if we are unable to attract additional international distributors, our international revenue may not grow.

We depend on third-parties technologies.

Certain modules of our NABUfit product is built upon Microsoft technologies and as such we are dependent upon licenses from Microsoft and others. In the event that such licenses are terminated, the Company will not be able to operate its technologies or conduct its business.

Risks Related to Being a Public Company

We incur significant costs as a result of operating as a public company and our management expects to devote substantial time to public company compliance programs.

As a public company, we incur significant legal, accounting and other expenses due to our compliance with regulations and disclosure obligations applicable to us, including compliance with the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, as well as rules implemented by the Securities and Exchange Commission, or SEC, and the OTC Markets. Stockholder activism, the current political environment and the current high level of government intervention and regulatory reform may lead to substantial new regulations and disclosure obligations, which may lead to additional compliance costs and impact, in ways we cannot currently anticipate, the manner in which we operate our business. Our management and other personnel devote a substantial amount of time to these compliance programs and monitoring of public company reporting obligations and as a result of the new corporate governance and executive compensation related rules, regulations and guidelines prompted by the Dodd-Frank Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act, and further regulations and disclosure obligations expected in the future, we will likely need to devote additional time and costs to comply with such compliance programs and rules. These rules and regulations cause us to incur significant legal and financial compliance costs and make some activities more time-consuming and costly.

31