Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - Brooklyn ImmunoTherapeutics, Inc. | ntn_8k.htm |

Exhibit 99.1

Safe Harbor This presentation contains forward - looking statements which reflect management's current views of future events and operations, including but not limited to statements about our growth plans, product and platform development, new revenue, customer development, improved customer and consumer satisfaction and the number of locations, players and games. These statements are based on current expectations and assumptions that are subject to risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties include the risks of unsuccessful execution or launch of products, platforms or brands, risks associated with customer retention and growth plans, the impact of alternative entertainment options and technologies and competitive products, brands, technologies and pricing, adverse economic conditions, and the regulatory environment, failure of customer and/or player acceptance or demand for new or existing products, lower market acceptance or appeal of both existing and new products and services by particular demographic groups or audiences as a whole, termination of partnership and contractual relationships and technical problems or outages. Please see NTN Buzztime, Inc.'s recent filings with the Securities and Exchange Commission for information about these and other risks that may affect the Company. All forward - looking statements included in this presentation are based on information available to us on the date hereof. These statements speak only as of the date hereof, and except as required by law NTN Buzztime, Inc. does not undertake to publicly update or revise any of its forward - looking statements, even if experience or future changes show that the indicated results or events will not be realized.

30 YEARS IN HOSPITALITY 8MM REGISTERED PLAYERS 45,000 TABLETS DEPLOYED 80 MM GAMES PLAYED/YEAR

• Long standing company with strong player base • Multi Year investment in new platform, content, features • Now at >50% of installed base on new platform • Venue driven recurring revenue model • Independent locations • Experience focused chains • Accretive revenue from base • Improved m anagement profile & profit structure Key Investment Highlights

Delivering A Key Market Need Wait for table 5 m in Restaurant Example Wait to order 5 m in Wait for food 10 - 30 min Wait for check 5 min Wait for receipt 5 min Arrive Sit - 1min Order – 2min Eat – 10min Pay – 2min Leave – 1min WASTE VALUE ENGAGEMENT & LOYALTY FASTER TABLE TURN

Providing Network Effect T o Benefit Venues & Players Customers PLAYERS ~150K restaurants 11B guests/year $4 B Market Potential VENUES Value & Fun +175MM player potential

Market Growth Creating Buzztime Opportunity* 2005 2010 2015 2020 TABLET GROWTH * company estimates based on aggregated industry data 0 10K 200K 2 MM 5% MARKET PENETRATION Adoption

Market & Competitive L andscape Trivia , Music, Games Live entertainment DWELL ( Entertainment) Points, surveys, LOYALTY (Engagement) Mobile, Kiosk, Self - Service CONVENIENCE (Payment) Server hand - helds , Order ahead EFFICIENCY (Table Turn)

SUBSCRIPTION REVENUE PLAYERS DATA ENTERPRISE Chief Need: Order & Pay INDEPENDENT Chief Need: Increasing Value Get Profitable Drive Use Deliver Insights PHASE I Profitable g rowth PHASE II Player growth PHASE III Analytics growth Long - term Growth Strategy

Gaming Experts 2015 Launches Jackpot Trivia • Launched Feb . 2015 • #1 trivia game on network by Q315 Buzztime Sports: Football Edition™ • Attracting new players • Incorporating social & out of venue connection Academy of Football • Sponsored platform with desirable audience • Branded game with Pro Football Hall of Famer Emmett Smith, first sponsor Miller/Coors

• Email • Social Media • Website Leaderboard • Lead Gen S ends • Tablet Ads • Network Ads Promotional Impact OUTSIDE OF VENUE INSIDE OF VENUE

CREATING THE BUZZ CASE STUDY: SMARTEST BAR COMPETITION EVENTS DROVE 41% INCREASED GAMEPLAY • 1,674 participating locations across the country WINNING LOCATION INCREASED ENGAGEMENT • Gameplay =72% added 8% new players PATRONS HAD LONGER VISITS, GREATER SPEND • Players arrived 1.5 hours early and played long after competition ended

Dining Innovators Goal to Serve & Connect Higher Tips, Turns, and new insights collected Menu Launched in May 2015 Payment Launched in Oct 2015

Go - to - Market F ocus #1 Targeting experience - focused chain brands • Higher volume per deal • Longer sales cycle to get initial pilots w up to 6 month pilots • Greater upside through monetization +1100 +11 +45 +100 LOCATIONS CHAINS

Go - to - Market Focus #2 Growing independent channel • Shorter sales cycles • Drives player funnel • Increases network footprint

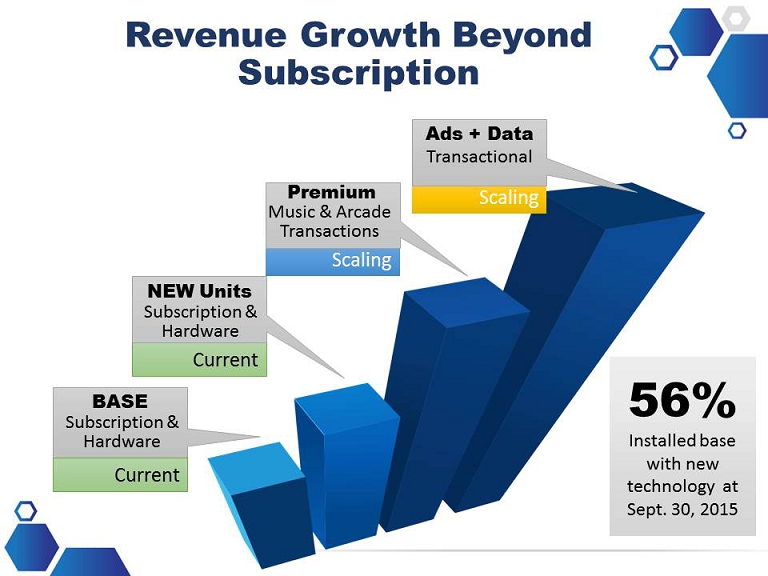

Subscription & Hardware BASE Scaling Ads + Data Transactional Scaling Premium Music & Arcade Transactions Current Subscription & Hardware NEW Units Current Revenue Growth Beyond Subscription 56% Installed base with new technology at Sept. 30, 2015

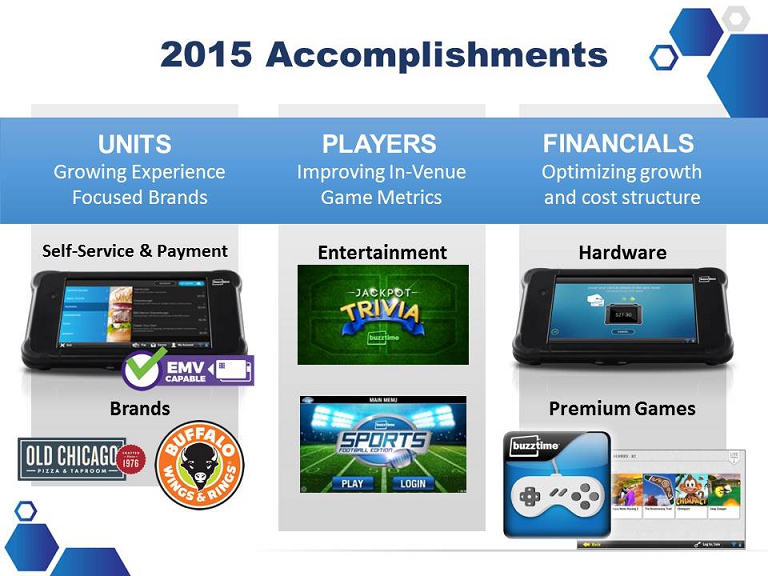

2015 Accomplishments FINANCIALS PLAYERS UNITS Improving In - Venue Game Metrics Growing Experience Focused Brands Optimizing growth and cost structure Hardware Self - Service & Payment Premium Games Brands Entertainment

VENUES 2,952 as of 9/30 Experienced - f ocused chains complemented by independent bars & restaurants 10K+ QUARTERLY REVENUE $6.1M Increasing ARPU & network monetization $20M GROSS MARGIN 47.5% Improving production , supply chain & efficiency +60% OPERATING MARGIN - 22% Scalable infrastructure and positive ROI on customer acquisition metrics +10% Financial Highlights 5 YEAR TARGET Q3 2015 INITIATIVES

Thank you