Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GT Advanced Technologies Inc. | gtat8-krevisedsettlementag.htm |

| EX-10.2 - EXHIBIT 10.2 - GT Advanced Technologies Inc. | exhibit102firstamendment.htm |

EXHIBIT 10.1 EXECUTION COPY IN RE GT ADVANCED TECHNOLOGIES INC. ET AL. (the “Company” or the “Debtors”) AMENDED TERMS OF RESOLUTION OF APPLE CLAIMS AND MESA LEASE ISSUES November 26, 2015 INTRODUCTION This amended agreement (the “Amended Agreement”) among the Debtor signatories hereto and Apple Inc. and certain of its affiliates (collectively, “Apple”) supersedes the Terms of Resolution of Apple Claims and Mesa Lease Issues dated November 2, 2015 and the Amended and Restated Adequate Protection and Settlement Agreement (the “Settlement Agreement”), subject to the surviving sections of the Settlement Agreement enumerated in Paragraph 14 of this Agreement, and amends the Amended and Restated Facility Lease Agreement (the “Mesa Lease”) both dated as of December 15, 2014, to the extent provided herein. All capitalized terms used herein and not otherwise defined will have the meanings ascribed to such terms in the Settlement Agreement and the Mesa Lease, as applicable. SETTLEMENT TERMS 1. The Amended Agreement will become effective as of the date on which both (i) the Amended Agreement is approved by the Bankruptcy Court (the “Effective Date”) pursuant to an order satisfactory to the parties hereto, and (ii) a waiver and amendment of the DIP Facility (as defined below) is consummated. 2. The Debtors will conduct an auction of the ASF Furnaces currently located in the Mesa Facility pursuant to procedures approved by the Debtors, Apple and the DIP Lenders and approved by the Bankruptcy Court pursuant to Bankruptcy Code section 363 (the “Sale Auction”). The Sale Auction shall take place on or prior to December 2, 2015. The Debtors shall have no obligation to sell any ASF Furnaces at the Sale Auction. 3. The Debtors shall receive 50% of the Net Proceeds of all ASF Furnaces sold in or before such Sale Auction (the “Sold Furnaces”), with the remaining 50% of Net Proceeds being distributed to Apple. For purposes of this Amended Agreement, “Net Proceeds” means the proceeds from the sale, lease or other transfer or disposition of ASF Furnaces or parts thereof to be received by the Debtors or the DIP Lenders (or any other party if such sale would benefit the Debtors or the DIP Lenders), net of all (a) reasonable costs associated with conducting the Sale Auction, including any applicable commission payments, (b) reasonable storage costs, (c) customary installation, logistics, or shipping charges, and (d) costs of any replacement parts required to be purchased as part of fulfilling the sale, in each case with respect to the ASF Furnaces sold. For the avoidance of doubt, Net Proceeds shall exclude any customary fees for support services, warranties, and post-sale services (all such fees being consistent with past practices and in amounts not to exceed those listed on Exhibit 1 hereto) provided by the Debtors to the buyer of ASF Furnaces and any items that may accompany the sale of ASF Furnaces (such as mezzanines and start-up kits). The Sold Furnaces shall be removed from the Mesa Facility by December 31, 2015.

2 4. The Debtors shall have the option, with the consent of the lenders (the “DIP Lenders”) under that certain Senior Secured Superpriority Debtor-in-Possession Credit Agreement, dated as of July 27, 2015, to retain any number of the ASF Furnaces currently located at the Mesa Facility (the “Retained Furnaces”); provided, however, that the Debtors may only retain in excess of 364 Retained Furnaces (such excess, the “Surplus Retained Furnaces”) to the extent (x) the Debtors believe, in good faith, that they will be able to sell such Surplus Retained Furnaces and (y) have such furnaces removed from the Mesa Facility, by January 31, 2016. The proceeds, if any, from the scrapping of Retained Furnaces, net of the costs of such scrapping, shall be distributed 50% to the Debtors and 50% to Apple. For all purposes herein Surplus Retained Furnaces shall be deemed Retained Furnaces. The Debtors shall choose which ASF Furnaces are Retained Furnaces by close of business on December 3, 2015 and shall promptly begin removing such Retained Furnaces from the Mesa Facility. If the Debtors or the DIP Lenders (or any other party if such sale would benefit the Debtors or the DIP Lenders) sell or otherwise dispose of, on or before December 15, 2018, any Retained Furnaces or any ASF Furnaces currently in inventory at the Debtors’ other facilities, the Debtors shall retain 50% of the Net Proceeds of such sale or disposition, with the remaining 50% of Net Proceeds being distributed to Apple; provided, however, that if GT Advanced Technologies Limited (“GT HK”) sells any of its ASF Furnaces, GTAT Corporation (“GTAT Corp.”) shall pay Apple 50% of the Net Proceeds of such sale instead of GT HK. For the avoidance of doubt, (i) ASF Furnaces not currently in existence shall not be subject to the sharing of Net Proceeds in this Paragraph and (ii) GTAT’s obligation under this Paragraph to make distributions to Apple on account of the sale or disposition of Retained Furnaces or any ASF Furnaces currently in inventory at the Debtors’ other facilities terminates on December 15, 2018. The Debtors agree not to sell any ASF Furnaces not currently in existence until after all ASF Furnaces currently in the Debtors’ inventory have been sold or scrapped. The Debtors are not having any current discussions, negotiations, and have not reached any understandings or agreements with any existing or prospective customers to sell ASF Furnaces not currently in existence. The Debtors shall provide to Apple and the Collateral Agent a quarterly report regarding the sales of any ASF Furnaces, including the number sold and sale prices, and Apple shall have the right to conduct an audit of such sales and prices. 5. On December 3, 2015, title to any ASF Furnaces located at the Mesa Facility other than the Sold Furnaces and the Retained Furnaces (such other ASF Furnaces, the “Excess Furnaces”) shall immediately and automatically for no consideration and without need for further order of the court transfer to Apple, free and clear of all liens, claims, encumbrances and interests, including, without limitation, liens granted to secure the DIP Facility and any Priming Financing. In the event the Sale Auction does not take place on or prior to December 2, 2015, all ASF Furnaces located at the Mesa Facility other than the Retained Furnaces shall be deemed Excess Furnaces and title to such ASF Furnaces shall immediately and automatically for no consideration and without the need for further

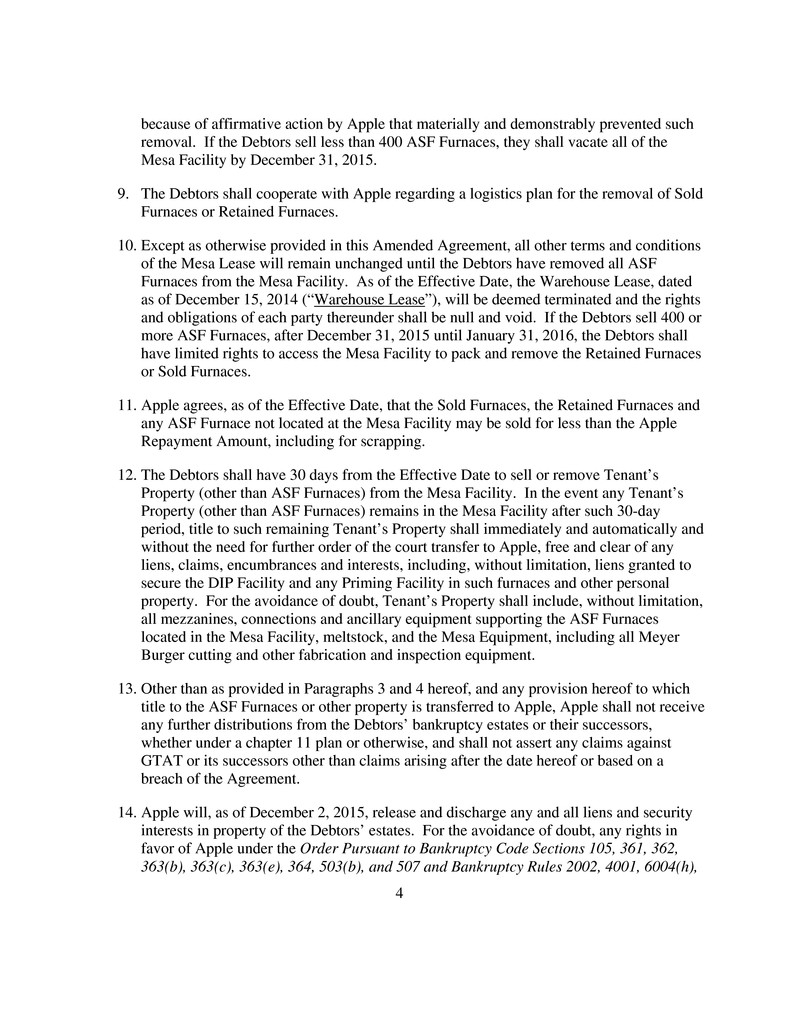

3 order of the court transfer to Apple, free and clear of any and all liens, claims, encumbrances and interests, including, without limitation, liens granted to secure the DIP Facility and any Priming Financing. 6. Apple agrees that it will scrap all of the Excess Furnaces and any other ASF Furnaces to which it obtains title pursuant to this Amended Agreement at its own cost and expense. For the avoidance of doubt, Apple shall only be permitted to scrap the Excess Furnaces and any other furnace to which it obtains title pursuant to this Amended Agreement and shall not be permitted to use the Excess Furnaces or sell or transfer the Excess Furnaces except as part of the scrapping process. The proceeds, if any, from the scrapping of Excess Furnaces, net of the costs of such scrapping, shall be distributed 50% to the Debtors and 50% to Apple. 7. As of December 3, 2015, the Mesa Lease will be deemed amended without the need for any further agreement to provide that (a) the Debtors’ obligation to pay Additional Rent (as defined in the Mesa Lease) and for the cost of security at the Mesa Facility shall terminate, (b) the Debtors shall have no further obligations to make any other payments in connection with the Mesa Lease, including without limitation, any obligations to clean, repair or refurbish the Mesa Facility or make utility payments with respect to the Mesa Facility, and (c) Apple shall have no obligation to repair any portion of the Mesa Facility that may have been damaged in the May 26, 2015 fire (the “Mesa Fire”). For the avoidance of doubt, the Debtors shall be entitled to any and all insurance proceeds from insurance the Debtors maintain and for which the Debtors are the beneficiaries. The Debtors shall be required to maintain Minimum Insurance Requirements as set forth in the Mesa Lease until such time as the Debtors have completely vacated the Mesa Facility. 8. If the Debtors sell 400 or more ASF Furnaces, the Debtors (a) shall remove all Sold Furnaces and Retained Furnaces from the areas of the Mesa Facility marked Mod 1, Mod 2 or “Quick Start,” and Pilot Line on the diagram attached hereto as Exhibit 2 (the “Excluded Space”) by December 31 2015, (b) may keep such Sold Furnaces and Retained Furnaces in areas of the Mesa Facility other than the Excluded Space, and (c) must vacate all of the Mesa Facility by January 31, 2016. On December 31, 2015, the Debtors shall completely vacate and remove all property from the Excluded Space and leave the Excluded Space in broom clean condition. For the avoidance of doubt, broom clean condition shall include having all safe off work performed and all mezzanines and other parts/pieces/equipment out of the Excluded Space. Any ASF Furnaces remaining in the Excluded Space on December 31, 2015 or in the Mesa Facility on January 31, 2016 shall be deemed Excess Furnaces and title to such ASF Furnaces shall immediately and automatically for no consideration and without the need for further order of the court transfer to Apple, free and clear of any and all liens, claims, encumbrances and interests, including, without limitation, liens granted to secure the DIP Facility and any Priming Financing, unless such Sold Furnaces or Retained Furnaces were prevented from removal

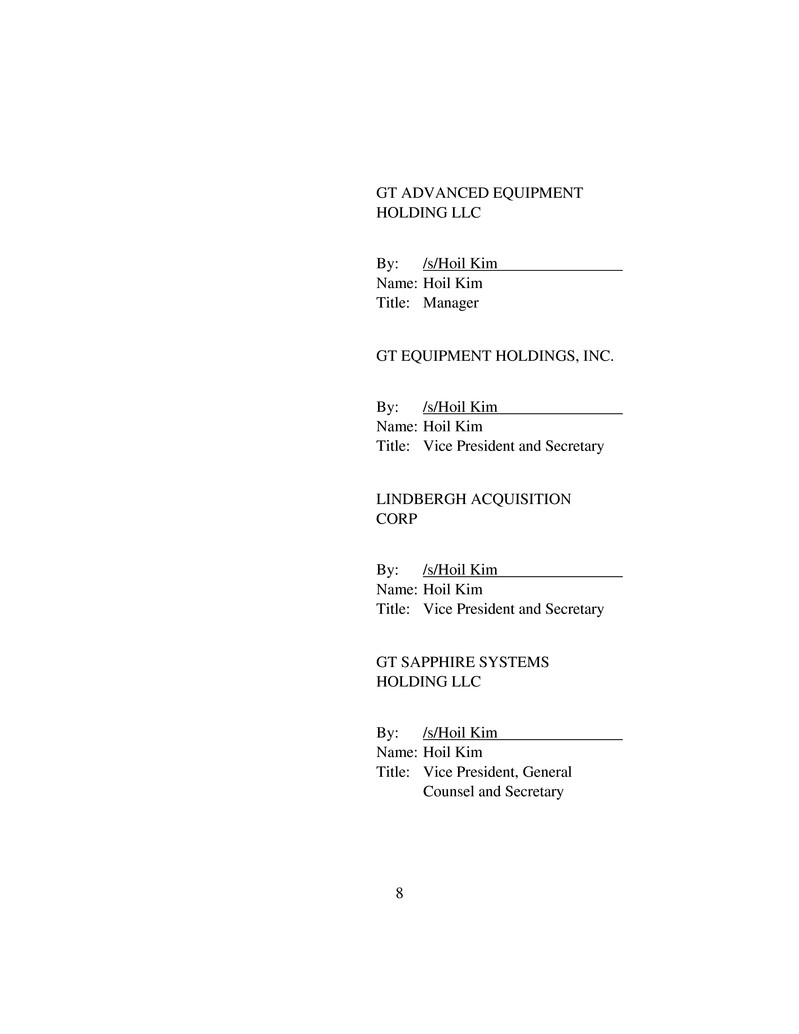

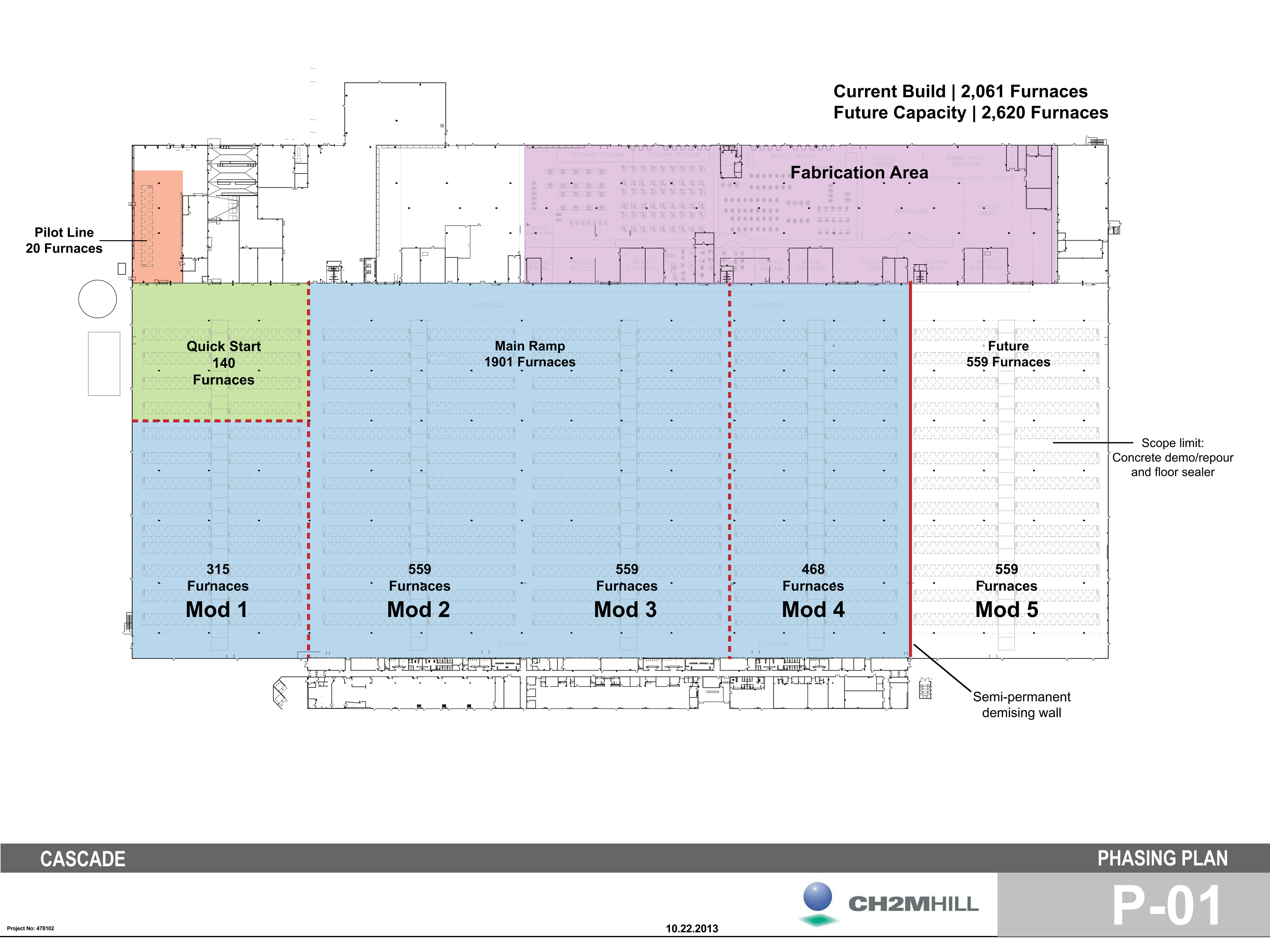

4 because of affirmative action by Apple that materially and demonstrably prevented such removal. If the Debtors sell less than 400 ASF Furnaces, they shall vacate all of the Mesa Facility by December 31, 2015. 9. The Debtors shall cooperate with Apple regarding a logistics plan for the removal of Sold Furnaces or Retained Furnaces. 10. Except as otherwise provided in this Amended Agreement, all other terms and conditions of the Mesa Lease will remain unchanged until the Debtors have removed all ASF Furnaces from the Mesa Facility. As of the Effective Date, the Warehouse Lease, dated as of December 15, 2014 (“Warehouse Lease”), will be deemed terminated and the rights and obligations of each party thereunder shall be null and void. If the Debtors sell 400 or more ASF Furnaces, after December 31, 2015 until January 31, 2016, the Debtors shall have limited rights to access the Mesa Facility to pack and remove the Retained Furnaces or Sold Furnaces. 11. Apple agrees, as of the Effective Date, that the Sold Furnaces, the Retained Furnaces and any ASF Furnace not located at the Mesa Facility may be sold for less than the Apple Repayment Amount, including for scrapping. 12. The Debtors shall have 30 days from the Effective Date to sell or remove Tenant’s Property (other than ASF Furnaces) from the Mesa Facility. In the event any Tenant’s Property (other than ASF Furnaces) remains in the Mesa Facility after such 30-day period, title to such remaining Tenant’s Property shall immediately and automatically and without the need for further order of the court transfer to Apple, free and clear of any liens, claims, encumbrances and interests, including, without limitation, liens granted to secure the DIP Facility and any Priming Facility in such furnaces and other personal property. For the avoidance of doubt, Tenant’s Property shall include, without limitation, all mezzanines, connections and ancillary equipment supporting the ASF Furnaces located in the Mesa Facility, meltstock, and the Mesa Equipment, including all Meyer Burger cutting and other fabrication and inspection equipment. 13. Other than as provided in Paragraphs 3 and 4 hereof, and any provision hereof to which title to the ASF Furnaces or other property is transferred to Apple, Apple shall not receive any further distributions from the Debtors’ bankruptcy estates or their successors, whether under a chapter 11 plan or otherwise, and shall not assert any claims against GTAT or its successors other than claims arising after the date hereof or based on a breach of the Agreement. 14. Apple will, as of December 2, 2015, release and discharge any and all liens and security interests in property of the Debtors’ estates. For the avoidance of doubt, any rights in favor of Apple under the Order Pursuant to Bankruptcy Code Sections 105, 361, 362, 363(b), 363(c), 363(e), 364, 503(b), and 507 and Bankruptcy Rules 2002, 4001, 6004(h),

5 and 9014: (I) Authorizing Debtors to Obtain Postpetition Financing; (II) Granting Liens and Super-Priority Claims; (III) Authorizing Debtors to Pay Put Option Premium and Expense Reimbursement; (IV) Approving Information Sharing Obligations and Indemnity Thereunder; and (V) Granting Related Relief [Docket No. 2122] (the “DIP Order”), or the “DIP Documents” (as defined in the DIP Order) shall be terminated. 15. Except as otherwise provided herein and with respect to enforcement of this Amended Agreement, each party shall, as of the Effective Date, release and forever discharge the other for any and all claims, losses, liabilities, damages and causes of action, whether known or unknown, relating to the Settlement Agreement, the Mesa Lease, including, without limitation, the Mesa Fire, the Warehouse Lease, the Apple Contracts and any other aspect of their business relationship; provided, however, that nothing herein releases any party hereto from any liability to the other for claims arising after the date hereof; provided further, however, that sections 1(a), 1(b), 1(c), 4(a), 4(b), 4(d), 4(e), 4(f), 5, 6 and 9 of the Settlement Agreement shall not be affected by the foregoing release, and all other provisions of the Settlement Agreement will be deemed terminated and shall be of no force and effect commencing on the Effective Date. 16. After title to the Excess Furnaces passes to Apple, the Debtors may cancel any property insurance policies related to the Excess Furnaces, after title to any Tenant’s Property (other than ASF Furnaces) passes to Apple, the Debtors may cancel any property insurance policies related to any Tenant’s Property (other than ASF Furnaces) that remains on the Mesa Facility after 30 days after the Effective Date. 17. For the avoidance of doubt, the transfer of title of Excess Furnaces and any other assets to Apple under this Amended Agreement is to facilitate disposal of such assets and not in repayment of debt. 18. Apple’s non-recourse claim in the amount of $439 million pursuant to the Settlement Agreement shall be deemed satisfied and expunged as of the Effective Date in exchange for the right of Apple, under this Amended Agreement, to receive 50% of the Net Proceeds from Sold Furnaces and future sales or dispositions of the Retained Furnaces or any ASF Furnaces currently in inventory at the Debtors’ other facilities. 19. The Amended Agreement shall be binding on any chapter 7 trustee appointed for the Debtors. 20. 34 of the Retained Furnaces shall be held by the Debtors subject to the contingent interest granted to Tera Xtal Technology Corp. (“TXT”) in paragraph 13 of the Order Pursuant to Bankruptcy Code Sections 105, 361, 363(b), 364, and 365 and Bankruptcy Rule 9019 Approving the Terms of and Authorizing Debtors to Enter Into Adequate Protection and Settlement Agreement with Apple [Docket No. 819]. Therefore, until and unless the Bankruptcy Court holds that TXT has no interest in such ASF Furnaces, the sale of such

6 34 ASF Furnaces shall not trigger the application of the sharing formula in Paragraphs 3 and 4 hereof; provided that the Debtors will endeavor to sell such 34 ASF Furnaces after any ASF Furnace on which TXT does not have a contingent interest. 21. The Debtors will amend the Intercompany Settlement Agreement, dated as of July 20, 2015, by and among GT HK, GTAT Corp., and GT Advanced Equipment Holding LLC, and the ancillary documents and exhibits related thereto (collectively, the “Intercompany Settlement Agreement”) to reflect this Amended Agreement prior to the Effective Date of this Amended Agreement, which amendment shall be in form and substance acceptable to the Required Lenders as provided under the DIP Documents. 22. The Debtors shall pay to Apple its share of the Net Proceeds from the sale of each ASF Furnace in accordance with this Amended Agreement within three (3) business days of the receipt of the proceeds of such sale. Payments of 50% of the proceeds from the scrapping of ASF Furnaces (net of the costs of such scrapping), as specified in this Amended Agreement, shall be made to the party entitled thereto promptly after receipt of such net proceeds by the party arranging for such scrapping. 23. This Amended Agreement and the rights and obligations of the parties will be governed and construed and enforced in accordance with the laws of the State of New York, without regard to conflicts of law principles. 24. This Amended Agreement may not be amended except as agreed to in writing by all parties. 25. The terms of this Amended Agreement shall be incorporated into a motion and proposed order to be submitted as soon as possible to the Bankruptcy Court. Such motion and proposed order shall be in form and substance satisfactory to the parties to this Agreement.

7 IN WITNESS WHEREOF, the parties hereto have caused this Amended Agreement to be duly executed as of the date first written above. APPLE INC. By: Illegible Name: Illegible Title: Illegible PLATYPUS DEVELOPMENT LLC By: /s/Gene Daniel Levoff Name: Gene Daniel Levoff Title: Authorized Person GTAT CORPORATION By: /s/Hoil Kim Name: Hoil Kim Title: Vice President, Chief Administrative Officer, General Counsel and Secretary GT ADVANCED TECHNOLOGIES INC. By: /s/Hoil Kim Name: Hoil Kim Title: Vice President, Chief Administrative Officer, General Counsel and Secretary

8 GT ADVANCED EQUIPMENT HOLDING LLC By: /s/Hoil Kim Name: Hoil Kim Title: Manager GT EQUIPMENT HOLDINGS, INC. By: /s/Hoil Kim Name: Hoil Kim Title: Vice President and Secretary LINDBERGH ACQUISITION CORP By: /s/Hoil Kim Name: Hoil Kim Title: Vice President and Secretary GT SAPPHIRE SYSTEMS HOLDING LLC By: /s/Hoil Kim Name: Hoil Kim Title: Vice President, General Counsel and Secretary

9 GT ADVANCED CZ LLC By: /s/Hoil Kim Name: Hoil Kim Title: Vice President, General Counsel and Secretary GT SAPPHIRE SYSTEMS GROUP LLC By: /s/Hoil Kim Name: Hoil Kim Title: Vice President, General Counsel and Secretary

Exhibit 1 – Exclusions from Net Proceeds 1) Installation charges of up to $25,000 per ASF Furnace. 2) Warranty service charges of up to (a) $20,000 per ASF Furnace currently located in Mesa, Arizona, and (b) $10,000 per ASF Furnace currently located in the Debtors’ other facilities. 3) Shipping charges of up to (a) $10,000 per ASF Furnace currently located in the United States, and (b) up to $5,000 per ASF Furnace currently located in the Debtors’ other facilities. 4) Reasonable commissions, if any, to be paid to third parties to facilitate the sale of ASF Furnaces.

11 Exhibit 2 – Excluded Space

10.22.2013 PHASING PLAN Project No: 478102 CASCADE P-01 Pilot Line 20 Furnaces Main Ramp 1901 Furnaces Future 559 Furnaces 315 Furnaces 559 Furnaces 559 Furnaces 559 Furnaces 468 Furnaces Mod 1 Semi-permanent demising wall Scope limit: Concrete demo/repour and floor sealer Fabrication Area Current Build | 2,061 Furnaces Future Capacity | 2,620 Furnaces Quick Start 140 Furnaces Mod 2 Mod 3 Mod 4 Mod 5