Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MEDICINES CO /DE | a15-24316_18k.htm |

Exhibit 99.1

Investor Presentation December 1, 2015

Legal notices Forward-looking statements Statements contained in this presentation about The Medicines Company (the “Company”), the Company’s products and product candidates, clinical trial results, regulatory submissions, indications, product launches, the Company’s future financial and operating results, and future opportunities for the Company that are not purely historical, and all other statements that are not purely historical, may be deemed to be forward-looking statements for purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995. Without limiting the foregoing, the words “believes," “anticipates," “plans," “expects," “intends," “potential," “estimates," “outlook” and similar expressions are intended to identify forward-looking statements. There are a number of important factors that could cause actual results or events to differ materially from those indicated by such forward looking statements, including the extent of the commercial success of our products; the Company's ability to develop its global operations and penetrate foreign markets; whether the Company’s patent and other litigation is resolved in a timely and satisfactory manner; whether the results of preclinical studies or early clinical trials will be indicative of the results of later clinical trials; whether the Company’s product candidates will advance in the clinical trials process on a timely basis or at all; whether the clinical trial results will warrant submission of applications for regulatory approval; whether the Company will make regulatory submissions for product candidates on a timely basis or at all; whether the Company’s product candidates will receive approvals from regulatory agencies on a timely basis or at all; whether the Company’s ongoing and planned commercial launches will be successful; whether physicians, patients and other key decision makers will accept clinical trial results, whether the Company successfully enters into strategic partnerships; and such other factors as are set forth in the risk factors detailed from time to time in the Company’s periodic reports filed with the Securities and Exchange Commission (“SEC”) including, without limitation, the risk factors detailed in the Company’s Form 10-Q filed with the SEC on November 9, 2015, which are incorporated herein by reference. The Company specifically disclaims any obligation to update these forward-looking statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. All forward-looking statements are qualified in their entirety by this cautionary statement.

The Medicines Company Today Cardiovascular disease Infectious disease Surgery and perioperative

The Medicines Company Today Cardiovascular disease Infectious disease Surgery and perioperative 4 potential blockbuster product candidates

The Medicines Company Today Cardiovascular disease Infectious disease Surgery and perioperative Marketed/ Approved Phase III Proof of concept Discovery MDCO-PCSsc (formerly ALN-PCSsc) Carbavance® ABP-700 MDCO-216

The Medicines Company Today Cardiovascular disease Infectious disease Surgery and perioperative Marketed/ Approved Phase III Proof of concept Discovery MDCO-PCSsc Carbavance® ABP-700 MDCO-216 3 recent key launches

The Medicines Company Today Cardiovascular disease Infectious disease Surgery and perioperative Marketed/ Approved Phase III Proof of concept Discovery MDCO-PCSsc Carbavance® ABP-700 Kengreal™ IONSYS® Orbactiv® MDCO-216

Cardiovascular disease Infectious disease Surgery and perioperative Marketed/ Approved Kengreal™ Orbactiv® IONSYS® Angiomax® Minocin IV® Recothrom® Cleviprex® Raplixa™ Argatroban RTU Preveleak™ Phase III Carbavance® Proof of concept MDCO-PCSsc ABP-700 MDCO-216 Discovery BLI program The Medicines Company Today

The Medicines Company A unique and high-potential pipeline. Large, addressable markets with high differentiation Focused strategy and plan for efficient capital deployment Proven development track record— 5 major development programs leading to 9 regulatory approvals in the last 16 months

Unlock shareholder value Identify sources of non-dilutive capital; divest non-core assets Optimize capital structure Prioritize investment in differentiated development assets that target large markets The Medicines Company Near-term value creation plan

Cardiovascular disease Infectious disease Surgery and perioperative Marketed/ Approved Phase III Carbavance® Proof of concept MDCO-PCSsc ABP-700 MDCO-216 Discovery 4 potential blockbuster product candidates

MDCO-PCSsc is an investigational agent not approved for commercial use in any market PCSK9 synthesis inhibitor through RNA interference In Phase II trials for treatment of hypercholesterolemia in patients who require additional LDL-C lowering Phase I data showed that a single, low volume subcutaneous injection of MDCO-PCSsc lowers LDL-C >50% for ~6 months Potential bi-annual dosing could align diagnostic and treatment cycle MDCO-PCSsc Summary

Decision resources, 2014CDC, 2014 Familial Hypercholesterolemia; US Census Data MDCO-PCSsc is an investigational agent not approved for commercial use in any market MDCO-PCSsc Estimated initial market opportunity1 ~74 million dyslipidemia patients in US, 2014 Initial population for PCSK9 inhibition is ~13 million patients Anticipated expansion after cardiovascular outcome trials Lipid lowering therapy ~43.1 M Primary Prevention ~19.2 M Secondary Prevention ~23.9 M High Risk (LDL-C >70%) ~7.82 M FH ~0.65M2 Statin intolerant ~4.4M

MDCO-PCSsc Phase 1 study results LDL-C lowering after a single injection Mean (+/- SEM) LDL-C Reduction Relative to Baseline Months Treatment 80 60 40 20 0 -20 0 1 2 3 4 5 6 Placebo 25 mg 100 mg 300 mg 500 mg 800 mg Day/Treatment combinations where N=1 not displayed Max LDL-C reduction of 78.1% with mean max of 59.3% (+/-5.0) Data presented at American Heart Association (AHA) conference November 2015 MDCO-PCSsc is an investigational agent not approved for commercial use in any market

MDCO-PCSsc Phase 1 study results Change in lipid parameters at day 84 after a single injection Dose group (N) Least square mean % change from baseline LP(a) Total Chol ApoB Non-HDL HDL-C Placebo (5) + 2.2 - 4.7 -15.0 -10.6 +12.7 25 mg (2) + 2.2 -16.8 -16.5 -23.5 + 8.0 100 mg (3) -20.2 -17.8 -26.9 -28.3 +18.6 300 mg (3) -44.7 -30.8** -47.3** -48.9*** +39.5 500 mg (3) -34.7 -26.1 -39.2 -36.3 + 6.9 800 mg (6) -24.5 -28.8** -37.5 -37.0* + 0.6 Max. reductions: LP(a) (-77%); Total-C (-48%); ApoB (-72%); Non-HDL (-68%) *, P < 0.05; **, P < 0.01; ***, P < 0.001 (pairwise comparisons vs. Placebo) LSMs and P values from baseline-adjusted ANCOVA model Data reported is from database transfer Sept. 24th 2015 MDCO-PCSsc is an investigational agent not approved for commercial use in any market

MDCO-PCSsc The Orion development program Estimated sequence of events 2015 2016 2017 2018 2019 2020 Anticipated critical path Anticipated non-critical path CMC Development (scale up, formulation, device, and supply) Phase I completion Phase II including HoFH & MAbs Non-clinical long-term toxicology (including repro and carc) Phase III LDL lowering NDA/MAA process Potential outcomes study Timelines are estimates based on current assumptions MDCO-PCSsc is an investigational agent not approved for commercial use in any market

MDCO-216 is an HDL-like particle containing recombinant ApoA-1 Milano which is being developed to regress atherosclerotic plaque burden Previously shown to regress atherosclerotic plaque burden in clinical studies as measured by IVUS in patients with ACS (Nissen, JAMA, 2003) Infusion of MDCO-216 has demonstrated in clinical studies to significantly increases ABCA1-mediated cholesterol efflux, a key marker of HDL function, and a lipid profile similar to carriers of the ApoA-I Milano variant MDCO-216 Summary MDCO-216 is an investigational agent not approved for commercial use in any market

ACS patients in the US & EU in 2014 ~3.03 million1 The US and EU target population for MDCO-216 is ~900,000 patients MDCO-216 Estimated initial market opportunity US Acute Coronary Syndrome prevalence ~1.13 million EU Acute Coronary Syndrome prevalence ~1.9 million Target Population (High risk ~30%) ~900,000 1. HCUP, NCI Primary Research MDCO-216 is an investigational agent not approved for commercial use in any market

In patients with CAD disease MDCO216 increased efflux up to four-fold compared to baseline The ApoA1-Milano lipid phenotype of low HDL-C and raised triglycerides was observed MDCO-216 was well tolerated at all doses MDCO-216 Cholesterol efflux as a therapeutic target Absolute change from baseline in ABCA1 efflux: CAD Patients Time (hr) Change of ABCA1 (% efflux/4h) MDCO-216 is an investigational agent not approved for commercial use in any market -4 -2 0 2 4 6 8 10 12 14 16 Cohort 6 (10 mg/kg) Cohort 7 (20 mg/kg) Cohort 8 (30 mg/kg) Cohort 9 (40 mg/kg) 0 0.5 2 4 8 24 48 144 696

Carbavance® (meropenem/RPX7009) is the combination of a novel investigational beta-lactamase inhibitor paired with the established carbapenem antibiotic meropenem. This product is being developed for the treatment of seriously-ill patients with documented or suspected resistant gram-negative bacteria, particularly carbapenem-resistant Enterobacteriaceae (CRE). Carbavance® has been designed to have a unique in vitro and PK-PD profile to address certain gram-negative bacteria such as CRE. Gram-negative infections are the most common hospital-acquired infections. Carbavance® Summary Carbavance® is an investigational agent not approved for commercial use in any market

Carbavance® (meropenem/RPX7009) Estimated initial market opportunity1 Resistance strains susceptible2 to Carbavance®: ~90% US and ~80% EU Potential target market opportunity for Carbavance® is ~1 million patients Decision Resources; Company primary and secondary research. In vitro data do not necessarily correlate to clinical efficacy. Carbavance® is an investigational agent not approved for commercial use in any market Enterobacteriaceae infections worldwide ~7.5 million Carbapenem resistant ~750,000 Target Population ~700,000 Pseudomonal infections worldwide ~900,000 Carbapenem resistant ~270,000 Target Population ~250,000

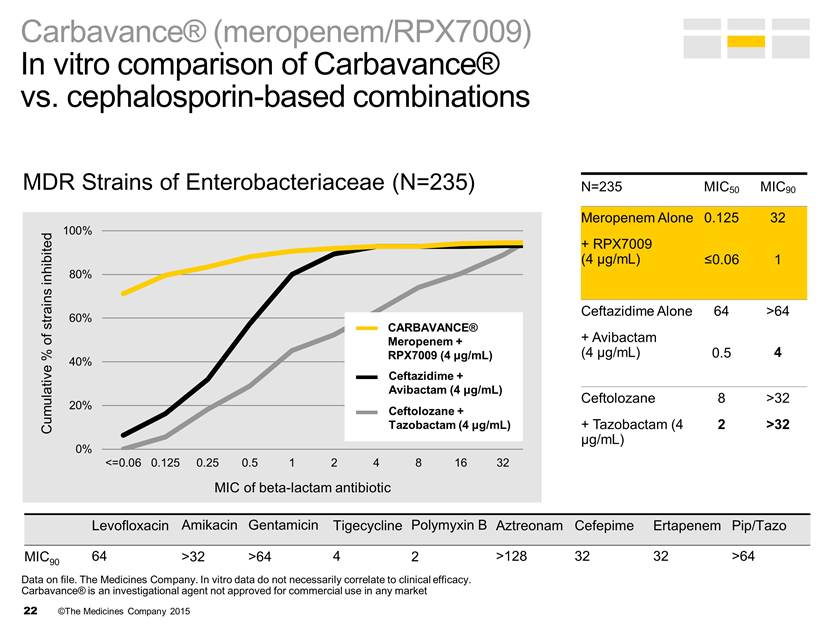

MDR Strains of Enterobacteriaceae (N=235) Levofloxacin Amikacin Gentamicin Tigecycline Polymyxin B Aztreonam Cefepime Ertapenem Pip/Tazo MIC90 64 >32 >64 4 2 >128 32 32 >64 Ceftolozane + Tazobactam (4 μg/mL) Ceftazidime + Avibactam (4 μg/mL) CARBAVANCE® Meropenem + RPX7009 (4 μg/mL) N=235 MIC50 MIC90 Meropenem Alone + RPX7009 (4 μg/mL) 0.125 <0.06 32 1 Ceftazidime Alone + Avibactam (4 μg/mL) 64 0.5 >64 4 Ceftolozane + Tazobactam (4 μg/mL) 8 2 >32 >32 Carbavance® (meropenem/RPX7009) In vitro comparison of Carbavance® vs. cephalosporin-based combinations Data on file. The Medicines Company. In vitro data do not necessarily correlate to clinical efficacy. Carbavance® is an investigational agent not approved for commercial use in any market 0% 20% 40% 60% 80% 100% <=0.06 0.125 0.25 0.5 1 2 4 8 16 32 >32 64 >64 Cumulative % of strains i nhibited MIC of b eta - lactam a ntibiotic

Carbavance® (meropenem/RPX7009) Development program Estimated sequence of events 2015 2016 2017 2018 2019 2020 Anticipated critical path Anticipated non-critical path TANGO Phase 3 data NDA Prep CMC Registration Program BARDA Cost-share Contract NDA File FDA Review, Approval and Launch Phase 3b/4 Clinical Studies Timelines are estimates based on current assumptions. Carbavance® is an investigational agent not approved for commercial use in any market

ABP-700 is a novel, intravenous anesthetic being developed for the rapid induction of and emergence from anesthesia In clinical studies, at doses achieving light, moderate and deep sedation, respiratory status is preserved Potential to show no adrenal suppression with long term infusions The agent has a promising safety and tolerability profile in clinical studies ABP-700 Summary ABP-700 is an investigational agent not approved for commercial use in any market

US and EU procedures total ~184 million ABP-700 Estimated initial market opportunity1 Procedural sedation ~121.2 million US ~61.7 million EU ~59.5 million Patient acuity & risk Intubation risk Anesthesiologist ~26%1 EU ~9.7 million US ~11.2 million Procedures <1 hour ASA 1-3 1. Source: NCI interviews, CDC, JCAHO (2004); Simpao et al (2012); Cohen et al (2006); Hassan et al (2012); Mahmoodpoor et al (2013); OCED, HSCIC, NCBI, NIH, NLM, ABP-700 is an investigational agent not approved for commercial use in any market General anesthesia ~62.8 million (US: ~37.3 million EU: ~25.5 million) MP 1-2 ASA 3-4 ~27% MP 3-4 ASA 3-4 ~3% MP 3-4 ASA 1-2 ~7% MP 1-2 ASA 1-2 ~63%

ABP-700 Escalating bolus doses in human subjects Dose-dependent depth and duration of anesthesia BIS score Minutes Awake Light - moderate sedation General anesthesia Deep hypnotic sleep n = 5 per group placebo Bolus dose ABP-700 is an investigational agent not approved for commercial use in any market 100 95 90 85 80 75 70 65 60 55 50 45 40 0 5 10 15 20 25

Awake Light to moderate sedation General anesthesia Deep hypnotic sleep 0 5 10 15 20 25 30 35 40 45 Minutes ABP-700 is an investigational agent not approved for commercial use in any market ABP-700 Infusion in human subjects Even after deep sedation ABP-700 recovery is rapid BIS score for subjects on propofol and ABP-700 infusions 100 95 90 85 80 75 70 65 60 55 50 45 40 35 30 25

ABP-700 Development program Estimated sequence of events 2015 2016 2017 2018 2019 2020 Anticipated critical path Anticipated non-critical path CMC Development Phase II Program Phase III Non-clinical long-term toxicology (including repro and carc) NDA FILE FDA Review, Approval and launch Phase I Timelines are estimates based on current assumptions ABP-700 is an investigational agent not approved for commercial use in any market

3 KEY LAUNCHES

3 key launches On plan Cardiovascular disease Infectious disease Surgery and perioperative care Marketed/ Approved Kengreal™ Orbactiv® IONSYS® Phase III Proof of concept Discovery

IONSYS® is indicated for the short-term management of acute postoperative pain for adult patients in the hospital1 Provides pre-programed doses of fentanyl through a small credit card sized system, with no needles, IV lines, or pumps required Patient controlled system delivering a 40 mcg dose of fentanyl with the double press of a button Expected to potentially reduce the number of opioid related adverse events, pump and programming errors and improves hospital efficiency and nurse satisfaction IONSYS® Summary 1. Ionsys© Prescribing Information: http://www.accessdata.fda.gov/drugsatfda_docs/label/2006/021338lbl.pdf

IONSYS® Early launch progressing IONSYS® was approved mid 2015 in the US and late 2015 in the EU Availability through a single distributor in the US starting in mid July, additional distributors initiated in mid November Stepwise process of adoption, can include evaluation period Initial selling resources 65 Initial account targeted 705 Accounts in process of evaluation 20

KENGREAL™ is the only intravenous P2Y12 platelet inhibitor indicated as an adjunct to percutaneous coronary intervention for reducing the risk of periprocedural myocardial infarction, repeat coronary revascularization, and stent thrombosis in patients who have not been treated with a P2Y12 platelet inhibitor and are not being given a glycoprotein IIb/IIIa inhibitor1 KENGREAL™ is a direct fast-acting, rapid offset P2Y12 receptor antagonist that blocks ADP-induced platelet activation and aggregation KENGREAL™ potentially offers hospitals: Improved procedural outcomes Flexibility in treatment options & control over platelet inhibition Pathway alignment and cost reduction in CAD patients undergoing a revascularization procedure 70% of patients are not pre-treated with oral P2Y12 inhibitors2 Kengreal™ (cangrelor) for Injection Summary KengrealTM Prescribing Information: http://www.accessdata.fda.gov/drugsatfda_docs/label/2015/204958lbl.pdf Cerner Healthfacts Database, Kansas City, MO. Data on File, The Medicines Company

Kengreal™ (cangrelor) for Injection Early launch progressing Launched in July 2015 Deployed 100 US customer facing professionals (commercial, scientific and market access) Leveraged MDCO’s highly experienced CV front line More than 150 upcoming formulary reviews are scheduled in the next 90 days Kengreal™ New Accounts Ordering - 20 40 60 80 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Kengreal™ Formulary Approvals - 20 40 60 80 100 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15

ORBACTIV® is the only single dose treatment for adult patients with ABSSSI caused by or suspected to be caused by susceptible isolates of certain gram-positive pathogens, including MRSA1 May provide patients, clinicians and payers the ability to avoid hospitalization or reduce the length of stay when treating ABSSSI infections as compared to today’s standard of care The single dose treatment helps insure compliance in treating ABSSSI. No dosage adjustment is required in patients with mild to moderate renal or hepatic impairment or in patients with differing weight, age, race, or gender ORBACTIV® does not require monitoring of drug levels as required by other antibiotics Orbactiv® (oritavancin) for Injection Summary Orbactiv® Prescribing Information: http://www.accessdata.fda.gov/drugsatfda_docs/label/2014/206334s000lbl.pdf

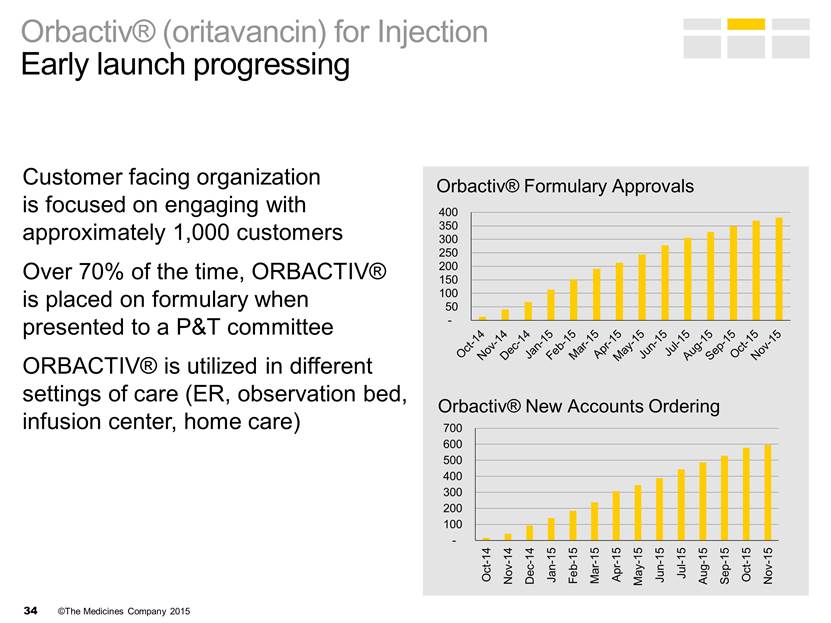

Orbactiv® (oritavancin) for Injection Early launch progressing Customer facing organization is focused on engaging with approximately 1,000 customers Over 70% of the time, ORBACTIV® is placed on formulary when presented to a P&T committee ORBACTIV® is utilized in different settings of care (ER, observation bed, infusion center, home care) Orbactiv® New Accounts Ordering - 100 200 300 400 Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Orbactiv® Formulary Approvals - 100 200 300 400 500 600 700 Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15