Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Nuance Communications, Inc. | d94929d8k.htm |

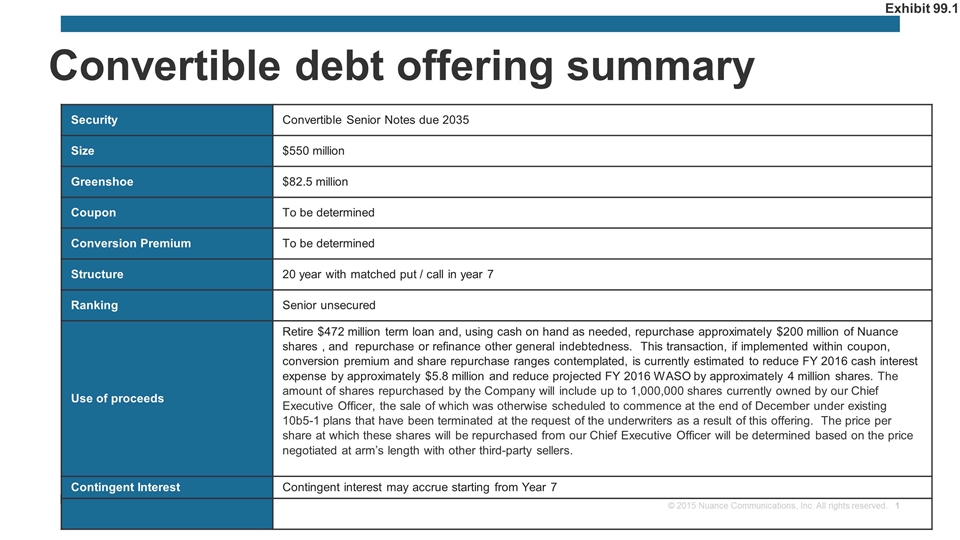

Convertible debt offering summary Security Convertible Senior Notes due 2035 Size $550 million Greenshoe $82.5 million Coupon To be determined Conversion Premium To be determined Structure 20 year with matched put / call in year 7 Ranking Senior unsecured Use of proceeds Retire $472 million term loan and, using cash on hand as needed, repurchase approximately $200 million of Nuance shares , and repurchase or refinance other general indebtedness. This transaction, if implemented within coupon, conversion premium and share repurchase ranges contemplated, is currently estimated to reduce FY 2016 cash interest expense by approximately $5.8 million and reduce projected FY 2016 WASO by approximately 4 million shares. The amount of shares repurchased by the Company will include up to 1,000,000 shares currently owned by our Chief Executive Officer, the sale of which was otherwise scheduled to commence at the end of December under existing 10b5-1 plans that have been terminated at the request of the underwriters as a result of this offering. The price per share at which these shares will be repurchased from our Chief Executive Officer will be determined based on the price negotiated at arm’s length with other third-party sellers. Contingent Interest Contingent interest may accrue starting from Year 7 Exhibit 99.1