Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Silver Bay Realty Trust Corp. | a8kq32015investorpresentat.htm |

SILVER BAY REALTY TRUST CORP. T h i r d Q u a r t e r 2 0 1 5 I n v e s t o r P r e s e n t a t i o n

2 S A F E H A R B O R S T A T E M E N T F O R W A R D - L O O K I N G S T A T E M E N T S This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results. Factors that could cause actual results to differ include: adverse economic or real estate developments in Silver Bay’s markets; defaults on, early terminations of or non-renewal of leases by residents; difficulties in identifying properties to acquire and completing acquisitions; increased time and/or expense to gain possession and renovate properties; increased vacancy, resident turnover, or turnover costs; Silver Bay’s ability to control or reduce operating expenses, including repairs and maintenance expense and other costs such as real estate taxes, homeowners’ association fees, insurance and other costs outside the Company’s control; Silver Bay’s failure to successfully operate its properties; Silver Bay’s ability to obtain financing arrangements; Silver Bay’s failure to meet the conditions to draw under the revolving credit facility; maintenance or capital improvement costs related to the portfolio acquired from The American Home (the “Portfolio”) that exceed Silver Bay's assumptions, defaults among residents of the Portfolio that exceed Silver Bay's assumptions, difficulties with successfully integrating the Portfolio into Silver Bay’s existing portfolio; the Company’s ability to hire and retain skilled managerial, investment, financial and operational personnel; the Company’s ability to perform under the covenants of its revolving credit facility and securitization loan; general volatility of the markets in which it participates; interest rates and the market value of Silver Bay’s assets; the impact of changes in governmental regulations, tax law and rates, and similar matters. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Silver Bay does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in Silver Bay’s most recent filings with the Securities and Exchange Commission (“SEC”). All subsequent written and oral forward looking statements concerning Silver Bay or matters attributable to Silver Bay or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above.

3 S I L V E R B A Y R E A L T Y T R U S T C O R P . First publicly traded single-family residential REIT formed in 2012 Mission of bringing institutional excellence to the single-family rental market Capitalize on generational opportunity created by dislocations in U.S. housing market − Acquire single-family properties at significant discount to replacement cost − Focus on markets with strong demographic and macroeconomic indicators − Satisfy growing demand for high quality home rentals Diversified portfolio of more than 9,000(1) single- family properties in Arizona, California, Florida, Georgia, Nevada, North Carolina, Ohio and Texas Estimated portfolio value of $1.4 billion as of the third quarter of 2015 Achieved 5.5% rental increases on new move-ins and maintained occupancy of 95% for the third quarter of 2015 (1) As of September 30, 2015, Silver Bay owned a portfolio of 9,074 single-family properties. Ticker NYSE: SBY Indices MSCI U.S. REIT Index, Russell Small-Cap 2000 Index, and Russell Small Cap Completeness Index Board Board with broad public company and real estate experience Management Seasoned team with extensive public company and investing knowledge as well as single-family residential and real estate experience Objective Focused on the acquisition, renovation, leasing and management of single-family properties for rental income and long-term capital appreciation

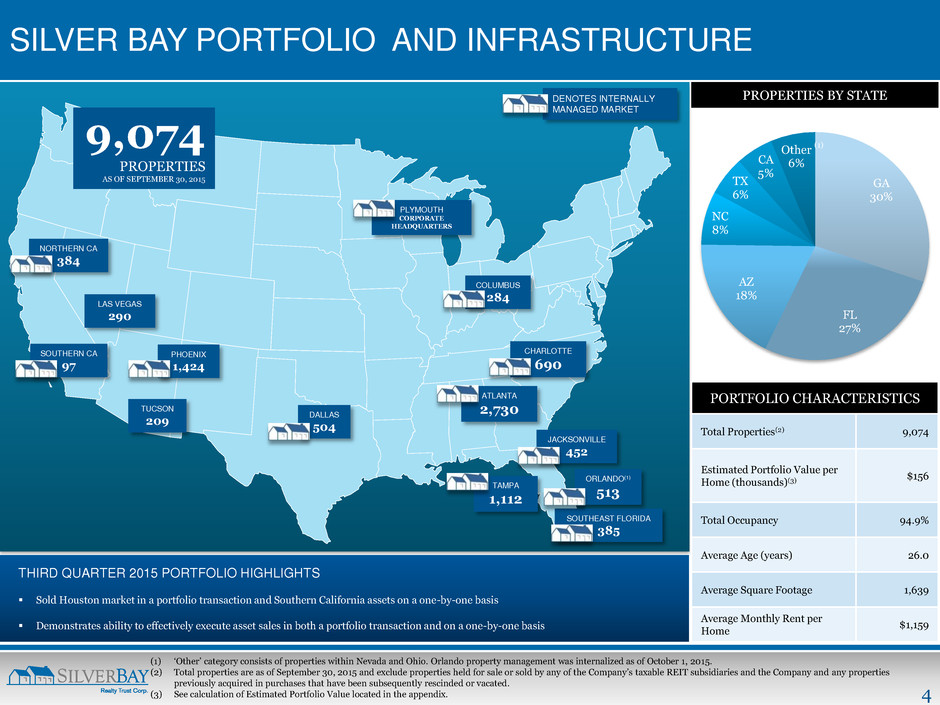

4 SILVER BAY PORTFOLIO AND INFRASTRUCTURE DENOTES INTERNALLY MANAGED MARKET NORTHERN CA 384 SOUTHERN CA 97 LAS VEGAS 290 PHOENIX 1,424 TUCSON 209 DALLAS 504 SOUTHEAST FLORIDA 385 JACKSONVILLE 452 COLUMBUS 284 PLYMOUTH CORPORATE HEADQUARTERS ATLANTA 2,730 CHARLOTTE 690 TAMPA 1,112 ORLANDO(1) 513 (1) ‘Other’ category consists of properties within Nevada and Ohio. Orlando property management was internalized as of October 1, 2015. (2) Total properties are as of September 30, 2015 and exclude properties held for sale or sold by any of the Company’s taxable REIT subsidiaries and the Company and any properties previously acquired in purchases that have been subsequently rescinded or vacated. (3) See calculation of Estimated Portfolio Value located in the appendix. GA 30% FL 27% AZ 18% NC 8% TX 6% CA 5% Other 6% (1) PORTFOLIO CHARACTERISTICS Total Properties(2) 9,074 Estimated Portfolio Value per Home (thousands)(3) $156 Total Occupancy 94.9% Average Age (years) 26.0 Average Square Footage 1,639 Average Monthly Rent per Home $1,159 PROPERTIES BY STATE 9,074 PROPERTIES AS OF SEPTEMBER 30, 2015 THIRD QUARTER 2015 PORTFOLIO HIGHLIGHTS Sold Houston market in a portfolio transaction and Southern California assets on a one-by-one basis Demonstrates ability to effectively execute asset sales in both a portfolio transaction and on a one-by-one basis

5 Q3 – 2015 HIGHLIGHTS Total revenue increased to $30.6 million, a 53% year-over-year quarterly increase Net operating income (“NOI”)(1) of $16.5 million Core Funds from Operations (“Core FFO”)(1) of $0.17 per share − Sequential quarter increase in property operating and maintenance expense similar to prior year and reflects increased repairs and maintenance and turnover due to seasonality − In addition, severe weather impacted third quarter 2015 Core FFO per share by approximately half a penny Maintained stabilized and aggregate occupancy of 95% Average monthly rent increased $10 from the prior quarter, to $1,159 per home − Increased rent across the portfolio without sacrificing occupancy Achieved rental increases of 5.5% on new move-ins and 3.7% on renewals Retained 77.5% of residents with turnover of 22.5% on 2,376 homes available for turn − Anticipated third quarter to have the highest amount of turnover due to greater number of residents moving during this time of year Estimated net asset value (“NAV”)(1) increased year-over-year 9.5% to $21.87 per share as of September 30, 2015 95% 94% 94% 96% 95% 95% 0% 20% 40% 60% 80% 100% Q2 - 2014 Q3 - 2014 Q4 - 2014 Q1 - 2015 Q2 - 2015 Q3 - 2015 $19.2 $20.0 $20.7 $22.3 $30.2 $30.6 $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 Q2 - 2014 Q3 - 2014 Q4 - 2014 Q1 - 2015 Q2 - 2015 Q3 - 2015 TOTAL REVENUE ($ IN MILLIONS) STABILIZED OCCUPANCY (1) NOI, Core FFO and NAV are non-GAAP financial measures. Core FFO per share amounts are based upon weighted average common shares and common units of the operating partnership for the respective periods. See the non-GAAP reconciliation included in the appendix. GAAP is defined as in accordance with accounting principles generally accepted in the United States.

6 FULLY INTEGRATED PLATFORM BUILT AROUND TECHNOLOGY KEY FUNCTION PERFORMED BY SBY? Corporate / Finance / Accounting / Legal Investment Strategy / Data Analytics Acquisitions Renovations Property Management ~95% In-house(1) Resident Management / Customer Relations / Call Center Repairs & Maintenance / Turnover Increasing % performed in- house IT Systems / Infrastructure Offices and workforce fully integrated and enabled through enterprise-level cloud infrastructure Real-time feedback through the entire lifecycle of a home (i.e. leasing performance providing data to investment strategy team) Flexibility to change with business, market and technology Ability to quickly scale and grow with the business Low and manageable costs to maintain SBY TECHNOLOGICAL BENEFITS (1) Orlando property management was internalized as of October 1, 2015, bringing the total internal property management to approximately 95%.

7 INVESTMENT OPPORTUNITY

8 COMMITMENT TO DELIVERING STOCKHOLDER VALUE (1) NOI, Core FFO and Estimated NAV are non-GAAP financial measures. Estimated NAV per share amounts are based upon common shares outstanding plus common units as of September 30, 2015. Non-GAAP reconciliations of these measures are included in the appendix. Disciplined approach to acquisitions is paramount to delivering attractive total returns Portfolio of homes located in the most desirable demographic markets Seasoned management team and institutional-grade infrastructure with a significant focus on technology to drive efficiencies STRONG INDUSTRY FUNDAMENTALS POSITIONED TO DELIVER ATTRACTIVE RETURNS Large asset class with very small institutional presence Macroeconomic and demographic trends support long-term industry outlook Historically low net additions to housing stock with rising demand Current capacity for asset growth combined with gains in occupancy and NOI(1) margins to increase cash flow Internalized advisory management structure, which resulted in increased Core FFO(1) Completed securitization and credit facility provides for reduced financing costs and capital structure optimization to increase ROE Commitment to increasing cash distributions to stockholders Compelling valuation based on Estimated NAV(1) of $21.87 per share as of September 30, 2015 SILVER BAY COMPETITIVE ADVANTAGE

9 SFR INDUSTRY OPPORTUNITY Institutional ownership estimated to be 2-3% of single-family rental sector(1) − Opportunity to capture market share from non-institutional operators Typical single-family residents are families who choose homes based on neighborhood safety, proximity to employment centers and quality of local schools − Lower turnover proving to be a characteristic of single-family rentals as families put down roots and are less inclined to move Potential for future rental increases − Residents less likely to leave schools and neighborhoods in which they have established a home − Higher relative moving costs compared to apartment living − Rising costs of home ownership − High resident income-to-rent ratios can support rental increases without significant resident income growth Silver Bay’s third quarter 2015 occupancy, new move-in rental increases and turnover results outperformed the average of the single-family rental industry peers SBY 28% SBY 95% Multi- family REITs 62% Multi- family REITs 96% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Turnover Occupancy Q3 – 2015 ANNUALIZED TURNOVER AND STABILIZED OCCUPANCY(2) (1) Sources: Based on estimates of Silver Bay. (2) Multi-family REITS that publish stabilized or same-store occupancy and were used in the calculation of this estimated average include ACC, AIV, AVB, CPT, ELS, ESS, EQR, MAA, PPS, SUI, and UDR. Source: Company filings. Multi-family REITS that publish annualized turnover and were used in the calculation of this estimated average include AVB, EQR, MAA and PPS. Source: Company filings. (3) Average of the following single-family rental industry peers: AMH, SWAY and ARPI. Source: public company earnings calls and public filings. Q3 - 2015 SBY SFR PEERS(3) Occupancy Stabilized 94.9% 94.5% Aggregate 94.9% 92.1% Rental Increases New Move-ins 5.5% 4.4% Renewals 3.7% 3.9% Turnover 27.6% 35.3%

10 $960 $980 $1,000 $1,020 $1,040 $1,060 $1,080 Q3 - 2014 Q4 - 2014 Q1 - 2015 Q2 - 2015 Q3 - 2015 M il li o n s PORTFOLIO VALUE CREATION CAPTURING VALUE: Q3 - 2014 PORTFOLIO, ONE YEAR LATER ESTIMATED VALUE OF REAL ESTATE ASSETS OWNED AT Q3-2014 INCREASED 7% YEAR-OVER-YEAR(1) Continued housing price appreciation in all Silver Bay markets Estimated portfolio value of $1.4 billion as of September 30, 2015 Acquired approximately 2,400 homes from The American Home in the second quarter of 2015, increasing the total number of homes owned to over 9,000 (1) Quarterly values based on 6,148 properties owned at both September 30, 2014 and September 30, 2015. (2) “MSA” means Metropolitan Statistical Areas, which is generally defined as one or more adjacent counties or county equivalents that have at least one urban core area of at least a 50,000-person population, plus adjacent territory that has a high degree of social and economic integration with the core as measured by commuting ties. Peak refers to highest historical home prices in a particular market prior to the start of the housing recovery. Trough refers to lowest home prices in a particular market since the peak. MSA used for Tampa is Tampa-St.Petersburg-Clearwater. MSA used for Dallas is Fort Worth-Arlington. MSA used for Southeast Florida is Fort Lauderdale-Pompano Beach-Deerfield Beach. MSA used for Northern California is Fairfield-Vallejo, which most closely approximates the geographic area in which we purchase homes in Northern California. This MSA is comprised of Solano County and the most populous cities in the MSA are Vallejo, Fairfield, Vacaville, Suisun and Benicia. MSA used for Southern California is Riverside-San Bernardino- Ontario. This MSA is comprised of Riverside and San Bernardino counties and the most populous cities in the MSA are Riverside, San Bernardino, Fontana and Moreno Valley. MSA HOME PRICE APPRECIATION (“HPA”)(2) SOURCE: CORELOGIC AS OF SEPTEMBER 2015 MARKET HPA (Peak to Trough)(2) HPA (Peak to Current) HPA (Prior 12 months) HPA (Prior 3 months) Atlanta, GA -33% -2% 6% 1% Phoenix, AZ -53% -25% 6% 1% Tampa, FL(2) -48% -30% 5% 0% Charlotte, NC -17% 5% 6% 0% Orlando, FL -55% -32% 6% 2% Dallas, TX(2) -13% 15% 8% 3% Jacksonville, FL -40% -25% 5% 0% Southeast FL(2) -53% -31% 7% 1% Northern CA(2) -58% -28% 8% 2% Las Vegas, NV -60% -34% 7% 1% Columbus, OH -18% 4% 5% 1% Tucson, AZ -42% -29% 2% 0% Southern CA(2) -53% -27% 6% 1% NATIONAL -32% -7% 6% 2%

11 WHAT IS THE TOTAL RETURN OPPORTUNITY? UNLEVERED CASH FLOW MULTI-FACETED OPPORTUNITY TO MAXIMIZE THE COMPANY’S TOTAL RETURN ATTRACTIVE LEVERAGE HOME PRICE APPRECIATION CONTINUED GROWTH OPPORTUNITIES Ongoing buying opportunities with less competition Homes available at significant discounts to replacement cost Value creation through renovation process Numerous consolidation opportunities Stabilized in-place cash flow Achieved recent rental increases of 5.5% on new move- ins Continued NOI margin improvement Translates into strong organic NOI growth In-place securitization at attractive levels Strong balance sheet and securitization financing market Enhancement to levered cash-on-cash returns Value recovery lagging other real estate asset classes Closing replacement cost gap in 5 years would require 5.7%- 8.4% HPA per year Macro fundamentals and credit easing should support HPA

12 $130 $150 $170 $190 $210 $230 $250 B U Y I N G B E L O W R E P L A C E M E N T C O S T S S U G G E S T S L O N G - T E R M A P P R E C I AT I O N P O T E N T I A L (1) (1) The information presented in this chart represents illustrative appreciation for residential real properties and assumes that property prices in each scenario revert to replacement cost. The estimated increases in property values and the related returns are provided for illustrative purposes only and do not represent Silver Bay’s actual or predicted future performance. You should not rely on this information as actual results may differ materially. Amounts as of September 30, 2015. (2) Estimated current replacement cost is calculated by utilizing the National Association of Home Builders’, or NAHB, 2013 total construction cost and average property square foot to estimate average construction cost per square foot. This estimate, in addition to NAHB’s average finished lot cost, is applied to Silver Bay’s portfolio of single-family homes. SBY AVERAGE COST BASIS PER HOME $134K SBY ESTIMATED PORTFOLIO VALUE PER HOME $156K ESTIMATED CURRENT REPLACEMENT COST(2) ~$206K ESTIMATED 5-YEAR REPLACEMENT COST ASSUMES 2.5% INFLATION ~$233K 5.7% Compounding Over 5 Years 8.4% Compounding Over 5 Years

13 FOCUS ON CASH FLOW GENERATION (1) NOI and Core FFO are non-GAAP financial measures. The non-GAAP reconciliations of these measures are included in the appendix. (2) On August 12, 2014, the Company completed a $313 million securitization transaction with a blended effective interest rate of LIBOR plus 192 basis points. Subsequent to closing, the Company used the proceeds from the securitization to pay down the balance on the Company’s credit facility and reduced the size of the credit facility to $200 million. On February 18, 2015, Silver Bay executed an amendment to its credit facility that increased its borrowing capacity to $400.0 million. The Company utilized the credit facility to fund the American Home transaction on April 1, 2015. The amended revolving credit facility bears interest at a varying rate of the London Interbank Offered Rate (“LIBOR”) plus 300 basis points and with a LIBOR floor of 0.0%. Acquisition and integration of The American Home portfolio was accretive to FFO by adding approximately 2,400 properties to Silver Bay’s established operating platform Benefit from lower cost of debt as a result of favorable terms on the upsized credit facility and completed securitization(2) Target 2015 rent growth of 3.0-3.5% Seek to enhance operational efficiency to continue to improve NOI margin − Internalize service and repairs and maintenance crews in our largest markets to allow for greater savings and cost control − Improve customer service to drive resident retention and limit turnover FINANCIAL OVERVIEW (AMOUNTS IN THOUSANDS EXCEPT FOR PER SHARE DATA) AT OR FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2015 AT OR FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2014 Total Revenue $30,617 $19,974 Net Operating Income(1) $16,497 $9,973 NOI Margin 53.9% 49.9% Core FFO(1) $6,432 $2,995 Core FFO per share $0.17 $0.08 Investments in Real Estate, gross $1,211,563 $878,793 Total Assets $1,254,702 $960,429 Outstanding Borrowings Under Securitization and Credit Facility(2) $648,279 $310,590 Total Liabilities $686,636 $337,112 2015 KEY DRIVERS OF FFO EXPANSION

14 N O I E X PA N S I O N O P P O R T U N I T Y REVENUE OPTIMIZATION STRATEGY Reduce turnover time between tenants from ~54 days in Q3 Rental increases of 3.0-3.5 % on renewals in 2015 OVERVIEW IMPACT Increases time generating revenue Increases rental rates BRINGING R&M / TURNOVER IN- HOUSE Currently implementing strategy of bringing R&M and turnover resources in-house, rather than outsourcing Significant benefits from reducing direct labor and materials costs Reduce annual R&M direct costs Reduce turnover costs Reduce turn times PREVENTATIVE MAINTENANCE Implement periodic preventative maintenance property inspection Allows SBY to reduce the number of R&M calls as well as reduce the number and scope of repairs / turnover costs by addressing potential issues early Reduce annual R&M per property Reduce annual capex ENHANCE CRITICAL MASS Efficiencies within local markets can be optimized from enhancing critical mass to spread local personnel across a greater number of properties Potential to reduce current property management costs of ~10% of revenue Translates into reduced annual expense per home

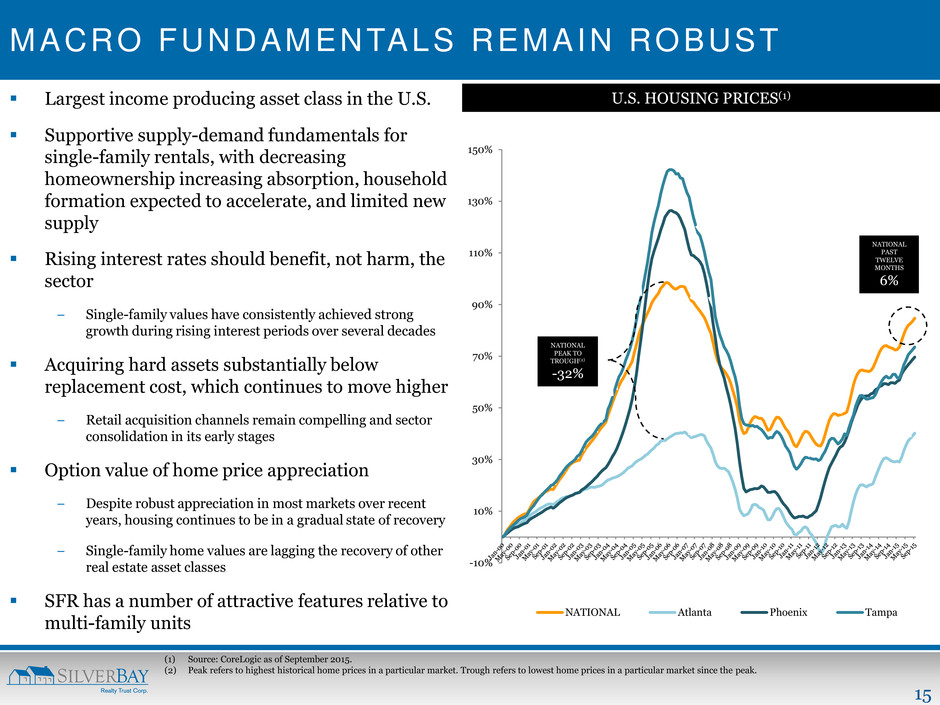

15 MACRO FUNDAMENTALS REMAIN ROBUST Largest income producing asset class in the U.S. Supportive supply-demand fundamentals for single-family rentals, with decreasing homeownership increasing absorption, household formation expected to accelerate, and limited new supply Rising interest rates should benefit, not harm, the sector − Single-family values have consistently achieved strong growth during rising interest periods over several decades Acquiring hard assets substantially below replacement cost, which continues to move higher − Retail acquisition channels remain compelling and sector consolidation in its early stages Option value of home price appreciation − Despite robust appreciation in most markets over recent years, housing continues to be in a gradual state of recovery − Single-family home values are lagging the recovery of other real estate asset classes SFR has a number of attractive features relative to multi-family units -10% 10% 30% 50% 70% 90% 110% 130% 150% NATIONAL Atlanta Phoenix Tampa U.S. HOUSING PRICES(1) (1) Source: CoreLogic as of September 2015. (2) Peak refers to highest historical home prices in a particular market. Trough refers to lowest home prices in a particular market since the peak. NATIONAL PEAK TO TROUGH(2) -32% NATIONAL PAST TWELVE MONTHS 6%

16 MACROECONOMIC AND DEMOGRAPHIC INDICATORS SUPPORT LONG-TERM RENTAL DEMAND Muted single-family starts Lagging construction volumes not keeping pace with demand from new households Obsolescence of older housing stock Lower supply of existing homes on market Rising home prices Improving job growth Homeownership rate declines: down to 63.7% in the third quarter of 2015 Credit availability continues to be tight Shift in preference towards renting for increased mobility Increase in household formation and constricted available supply for purchase has created more renters LONG-TERM DEMAND FOR SINGLE- FAMILY RENTAL HOMES HOUSING STARTS (IN MILLIONS)(1) MONTHLY SUPPLY OF HOMES(2) (1) Source: U.S. Census Bureau. (2) Source: FRED, Federal Reserve Economic Data, Federal Reserve Bank of St. Louis: Monthly Supply of Homes in the United States; U.S. Department of Commerce: Census Bureau; http://research.stlouisfed.org/fred2/series/MSACSR; accessed November 19, 2015. INCREASING DEMAND 5.8 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 0 5 10 15 20 25 14.6 11.6 6.6 5.3 14.9 13.7 15.4 4.8 - 2.0 4.0 6.0 8.0 10.0 12.0 14.0 16.0 18.0 1980-1990 1990-2000 2000-2010 2010-2015 Household Formations (Millions) Housing Starts (Millions) 63.7% 7.3% 0% 4% 8% 12% 60% 65% 70% Homeownership Rate Rental Vacancy Rate CONSTRUCTION VOLUMES LAGGING DEMAND(1) LOW HOMEOWNERSHIP AND RENTAL VACANCY(1) Delta = 0.5 Million LIMITED HOUSING SUPPLY

17 0 50 100 150 200 250 300 350 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 1986 1989 1992 1995 1998 2001 2004 2007 2010 2013 Period of Rising Interest Rates US 10 Yr. Treasury Yield Indexed Single Family Home Values RISING INTEREST RATES IN THE SFR SECTOR SINGLE-FAMILY HOME VALUES VS. 10 YEAR US TREASURY RATES(1) Periods of rising interest rates are generally correlated with economic growth and expanding access to consumer credit. Given these factors, single-family home prices tend to appreciate during periods of rising interest rates. PERIODS OF RISING INTEREST RATES Aug-86 - Oct-87 Oct-93 - Nov-94 Oct-98 - Jan-00 Jun-03 - Jun-07 10y UST Increase 172 bp 257 bp 214 bp 161 bp Home Price CAGR 7% 2% 8% 7% (1) Source: U.S. Department of the Treasury and Freddie Mac House Price Index.

18 PLATFORM POISED FOR PORTFOLIO GROWTH OVERVIEW Silver Bay’s platform has ongoing ability of efficiently identifying and integrating large acquisitions with limited incremental G&A CASE STUDY: THE AMERICAN HOME ACQUISITION Acquired more than 2,400 properties from The American Home Increased homes owned by 35% and expanded presence in Atlanta, Charlotte, Tampa and Orlando Smooth and rapid integration process (substantially completed within 30 days of closing) with immediate cash flow benefits Minimal increase in G&A load − Cost increases almost exclusively at the Property Management level (maintenance technicians, project managers, etc.) Rent optimization when rolled into SBY’s platform Enhanced scale has flow-on benefits for optimizing efficiencies for SBY’s existing portfolio Silver Bay’s platform can support significant portfolio growth with limited incremental G&A Growth would allow Silver Bay to spread its existing G&A load over a larger number of properties with the potential to significantly increase its per property cash flow Scalability of Silver Bay systems allow for easy integration of large numbers of new homes

19 O P E R AT I O N S O V E R V I E W

20 BUSINESS OBJECTIVES O B J E C T I V E S : Provide high quality rental homes with best-in-class customer service to create a long-term sustainable business Achieve attractive total return combining capital appreciation with rental cash flow yields ACQUISITIONS RENOVATIONS P R O P E R T Y MANAGEMENT A C H I E V E EFFICIENCIES Disciplined growth through rigorous asset selection Dedicated focus on properties exhibiting attractive total return profile Selection of high- quality homes in resident preferred locations High-quality up-front initial renovations to minimize future ongoing maintenance expenses Standardized fit and finish maximizes longevity and cost savings as well as resident satisfaction Rigorous resident screening process ensures quality residents with increased likelihood of long term tenancy Excellence in customer service to provide resident satisfaction and establish lasting relationships Expand operating platform and capture efficiencies of scale Establish brand as preferred manager within single-family rental community Leverage G&A, reduce per unit operating expenses and lower cost of capital

21 ACQUISITION STRATEGY AND ASSET SELECTION PROCESS TARGETED MSA EVALUATION NEIGHBORHOOD EVALUATION RIGOROUS PROPERTY DILIGENCE AND ASSESSMENT RENOVATION ASSESSMENT COMPREHENSIVE RENTAL AND RESIDENT EVALUATION Macroeconomic and demographic factors including population growth, unemployment and median income Analyze a variety of local market trends Supply of available assets at discount to replacement cost Physical visits to properties − Comprehensive on-site assessment for broker and bulk sourced properties − Drive-by inspection for auction sourced properties Review title Vintage and location; price vs. estimated replacement costs Property and home characteristics that are suitable for rental Proximity to key employment centers and other properties in portfolio, ease of transportation and commute, school districts, and low crime neighborhoods, etc. Renovation required vs. acquisition price Focus on attractive risk-adjusted net rental yields and minimizing future maintenance Assessment of rental rates and potential resident pool availability − Collaborative effort with local partners − Leverage public databases and exclusive relationships − Rental growth assumption not reflected in underwriting − Assumption to own property for indefinite period of time Comprehensive initial renovation assumption Annual repairs reflects full property life cycle Estimates of time to stabilize and vacancy cost

22 New appliance package Cabinet refresh, including new hardware or total cabinet replacement, if needed New flooring New light fixtures RENOVATIONS B E F O R E A F T E R Landscaping and yard cleanup Paint or exterior wash Driveway cleaning Roof replacement, if necessary New carpet or refinished flooring Paint all interior walls including molding and trim All mechanical systems in the house are inspected and repaired or replaced, if necessary Safety items (smoke detectors, GFCI outlets, etc.) are in good working order or replaced/installed B E F O R E A F T E R B E F O R E A F T E R KITCHEN RENOVATION MAY INCLUDE: INTERIOR RENOVATION MAY INCLUDE: EXTERIOR WORK MAY INCLUDE:

23 Centralized call center for service work orders allows for standardized communications and troubleshooting problems over the phone without dispatching contractors where possible Customer portal where residents can pay rent, enter work orders online and receive communications regarding their house Resident guide for new residents which details specifics about their house, how to contact the company for service, utility providers, local amenities and how to care for their home Move-in inspection to demonstrate the house and the different functions – where the electric panel is located, how to shut off the water, how to change furnace filters, etc. Quarterly newsletters which give information about new ways to pay such as walk-in payments through retailers and credit card payments and useful home information like how to keep your house cool in the summer as well as general updates and seasonal items of note RESIDENT CENTRIC PROPERTY MANAGEMENT ( 1 ) CUSTOMER SERVICE AND COMMUNICATION LEASING Prospective residents are directed to a national call center (locally in third-party markets) to schedule showings for homes that best meet their needs Online rental application process for resident convenience and increased processing speed Resident screening process critical to reducing evictions, future turnover and associated costs and includes a review of a prospect’s credit, criminal background, residential history and verification of minimum income of 3 times the monthly rent Managers submit renewal correspondence to quality residents at least 60 days prior to their lease expiration By keeping residents in our properties, we are able to maximize occupancy, minimize turnover, and drive cash flow generation (1) Representative of marketing and leasing processes for Silver Bay internal markets. Third-party partners are contracted to adhere to Silver Bay corporate guidelines, which may be modified to conform to local market conventions.

24 TARGET RESIDENTS SUPPORT CASH FLOW SBY designed its acquisition strategy to build a portfolio of properties that appeal to a large segment of U.S. households that have attractive characteristics as single-family renters Average rent of ~$1,160 reflects a portfolio of properties that are especially desirable to residents with household income levels at 100-150% of local median household income of approximately $55,000 - $80,000 annually. This population base: − Comprises a significant proportion of the total renter population, which should support long-term demand − Is believed to have a greater propensity to remain long-term renters than other income groups, which in turn: › Reduces costs associated with turnover (most notably improvement costs, downtime and leasing costs); and › Should enhance stability of cash flow, particularly through economic cycles, similar to class B multifamily assets − Generates minimal bad debt expense − Represents a segment of the single-family market in which new supply is less likely to be a factor, enhancing the demand-supply dynamics which should support long-term cash flow

25 SILVER BAY INTEGRATED BUSINESS SYSTEMS & DATA Custom cloud-based system managing acquisitions and projects (renovations/turns) Centralized monitoring on a real-time basis from mobile devices Fully secured between local markets and external partners Provides real-time reports at a property level across all markets and managers Oversight of acquisitions, project vendors, bids, timelines and expenses Management of properties - stabilizing, move- ins/outs, turnovers, expenses/charges, etc. Integrated accounting automation Work Order Processing and Management Marketing Resident Portal Document & Workflow Management System HR Systems Automated Valuation Modeling Enterprise Reporting and Business Intelligence Centralized Help Desk and Call Center Enterprise corporate accounting system All property management/accounting systems electronically feed into central corporate system Corporate GL and Fixed Asset Accounting Full set of integrated data between all systems and business areas Self-service and ad hoc reporting capabilities Industry leading business intelligence and reporting technology platform Yardi Acquisitions and Stabilization Other Business Systems Property Management Internal Corporate Accounting Integration Hub SQL Server Integration Services Data Staging/Integration Data Validation /Cleansing Reporting & Analytics Data Exports Data Warehouse (SQL Server Analysis Services) Consolidated Data DAILY MONTHLY DAILY DAILY DAILY DAILY Yardi Property Management Third-Party AVM ON DEMAND BUSINESS INTELLIGENCE AND REPORTING OTHER BUSINESS SYSTEMS CORPORATE ACCOUNTING SYSTEM PROPERTY MANAGEMENT SYSTEM ACQUISITIONS & PROJECT MANAGEMENT SYSTEM

26 A P P E N D I X

27 FORMATION AND HISTORY Provident Entities(1) commenced acquisition of single- family properties in 2009 Completed IPO of 15.2 million common shares for net proceeds of $263 million, inclusive of over-allotment Simultaneously, combined portfolios of single-family homes owned by Two Harbors(2) and Provident Entities(1) Launched with diverse portfolio of more than 3,300 homes Successfully completed internalization of advisory manager on September 30, 2014 Acquired The American Home Portfolio for approximately $263 million in cash on April 1, 2015 SEPTEMBER 2009: PROVIDENT ENTITIES BEGINS ACQUIRING SFRS FEBRUARY 2012: TWO HARBORS BEGINS ACQUIRING SFRS DECEMBER 19, 2012: SBY COMPLETES ITS FORMATION TRANSACTIONS AND IPO (1) Silver Bay acquired five limited liability companies managed by Provident Real Estate Advisors LLC that the Company refer to as the Provident Entities. (2) Silver Bay acquired Silver Bay Property Investment LLC (formerly Two Harbors Property Investment LLC), a wholly owned subsidiary of Two Harbors Investment Corp. The Company refers to Silver Bay Property Investment LLC as its Predecessor. MARCH 28-29 2013: ADDED TO THE RUSSELL 2000 INDEX AND MSCI REIT INDEX MAY 10, 2013: SECURES A $200 MILLION REVOLVING CREDIT FACILITY JANUARY 16, 2014: INCREASES CREDIT FACILITY BY $150 MILLION DECEMBER 4, 2013: LAWRENCE B. SHAPIRO APPOINTED AS COO MARCH 13, 2014: ANNOUNCES FIRST INCREASE OF DIVIDEND TO $0.03 PER SHARE AUGUST 12, 2014: CLOSED $313 MILLION SECURITIZATION TRANSACTION SEPTEMBER 30, 2014: COMPLETED INTERNALIZATION OF MANAGEMENT SEPTEMBER 4, 2014: ANNOUNCES SECOND INCREASE OF DIVIDEND TO $0.04 PER SHARE APRIL 1, 2015: COMPLETED ACQUISITION OF THE AMERICAN HOME PORTFOLIO AND TOTAL HOMES EXCEED 9,000 MARCH 25, 2015: ANNOUNCES FOURTH INCREASE OF DIVIDEND TO $0.09 PER SHARE DECEMBER 18, 2014: ANNOUNCES THIRD INCREASE OF DIVIDEND TO $0.06 PER SHARE FEBRUARY 18, 2015: ANNOUNCES ACQUISITION OF THE AMERICAN HOME PORTFOLIO AND AMENDED CREDIT FACILITY TO $400 MILLION JUNE 17, 2015: ANNOUNCES FIFTH INCREASE OF DIVIDEND TO $0.12 PER SHARE

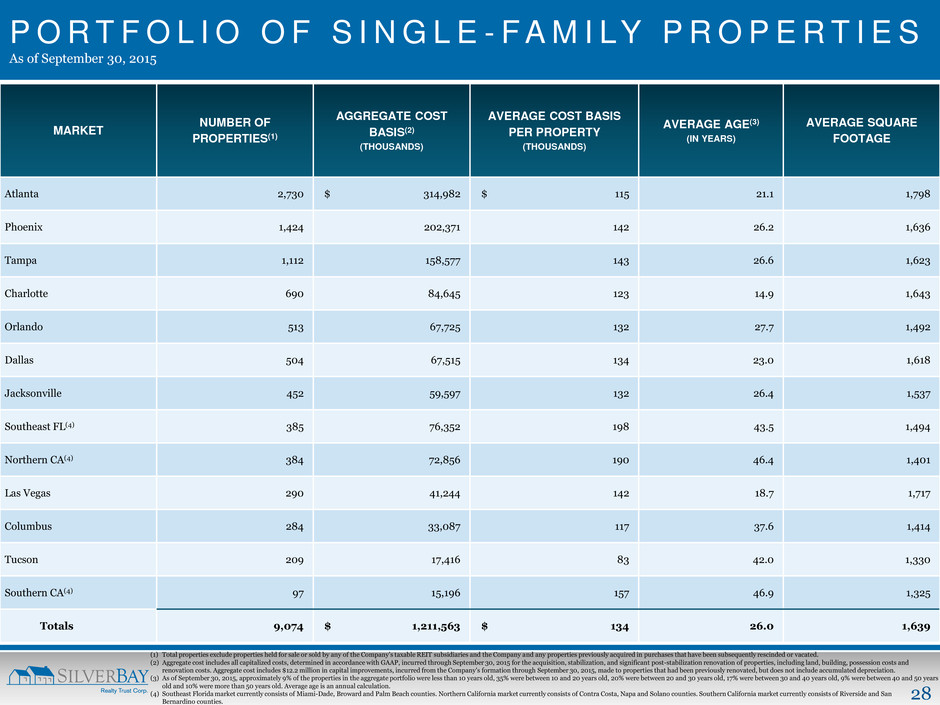

28 P O R T F O L I O O F S I N G L E - F A M I LY P R O P E R T I E S As of September 30, 2015 MARKET NUMBER OF PROPERTIES(1) AGGREGATE COST BASIS(2) (THOUSANDS) AVERAGE COST BASIS PER PROPERTY (THOUSANDS) AVERAGE AGE(3) (IN YEARS) AVERAGE SQUARE FOOTAGE Atlanta 2,730 $ 314,982 $ 115 21.1 1,798 Phoenix 1,424 202,371 142 26.2 1,636 Tampa 1,112 158,577 143 26.6 1,623 Charlotte 690 84,645 123 14.9 1,643 Orlando 513 67,725 132 27.7 1,492 Dallas 504 67,515 134 23.0 1,618 Jacksonville 452 59,597 132 26.4 1,537 Southeast FL(4) 385 76,352 198 43.5 1,494 Northern CA(4) 384 72,856 190 46.4 1,401 Las Vegas 290 41,244 142 18.7 1,717 Columbus 284 33,087 117 37.6 1,414 Tucson 209 17,416 83 42.0 1,330 Southern CA(4) 97 15,196 157 46.9 1,325 Totals 9,074 $ 1,211,563 $ 134 26.0 1,639 (1) Total properties exclude properties held for sale or sold by any of the Company’s taxable REIT subsidiaries and the Company and any properties previously acquired in purchases that have been subsequently rescinded or vacated. (2) Aggregate cost includes all capitalized costs, determined in accordance with GAAP, incurred through September 30, 2015 for the acquisition, stabilization, and significant post-stabilization renovation of properties, including land, building, possession costs and renovation costs. Aggregate cost includes $12.2 million in capital improvements, incurred from the Company's formation through September 30, 2015, made to properties that had been previously renovated, but does not include accumulated depreciation. (3) As of September 30, 2015, approximately 9% of the properties in the aggregate portfolio were less than 10 years old, 35% were between 10 and 20 years old, 20% were between 20 and 30 years old, 17% were between 30 and 40 years old, 9% were between 40 and 50 years old and 10% were more than 50 years old. Average age is an annual calculation. (4) Southeast Florida market currently consists of Miami-Dade, Broward and Palm Beach counties. Northern California market currently consists of Contra Costa, Napa and Solano counties. Southern California market currently consists of Riverside and San Bernardino counties.

29 MARKET NUMBER OF PROPERTIES NUMBER OF STABILIZED PROPERTIES(1) PROPERTIES LEASED PROPERTIES VACANT AGGREGATE PORTFOLIO OCCUPANCY RATE STABILIZED OCCUPANCY RATE AVERAGE MONTHLY RENT(2) Atlanta 2,730 2,729 2,551 179 93.4% 93.5% $ 1,053 Phoenix 1,424 1,424 1,378 46 96.8% 96.8% 1,095 Tampa 1,112 1,112 1,036 76 93.2% 93.2% 1,289 Charlotte 690 689 633 57 91.7% 91.9% 1,053 Orlando 513 513 503 10 98.1% 98.1% 1,139 Dallas 504 504 479 25 95.0% 95.0% 1,287 Jacksonville 452 452 446 6 98.7% 98.7% 1,130 Southeast FL 385 381 357 28 92.7% 93.7% 1,648 Northern CA 384 384 380 4 99.0% 99.0% 1,573 Las Vegas 290 290 284 6 97.9% 97.9% 1,181 Columbus 284 284 273 11 96.1% 96.1% 1,066 Tucson 209 209 201 8 96.2% 96.2% 842 Southern CA 97 97 89 8 91.8% 91.8% 1,226 Totals 9,074 9,068 8,610 464 94.9% 94.9% $ 1,159 PORTFOLIO SUMMARY OF LEASING STATUS OF PROPERTIES As of September 30, 2015 (1) The Company considers a property stabilized at the earlier of (a) its first authorized occupancy or (b) 90 days after the renovations for such property are complete regardless of whether the property is leased. Properties acquired with in-place leases are considered stabilized even though such properties may require future renovation to meet our standards and may have existing residents who would not otherwise meet our resident screening requirements. (2) Average monthly rent for leased properties was calculated as the average of the contracted monthly rent for all leased properties as of September 30, 2015 and reflects rent concessions amortized over the life of the related lease.

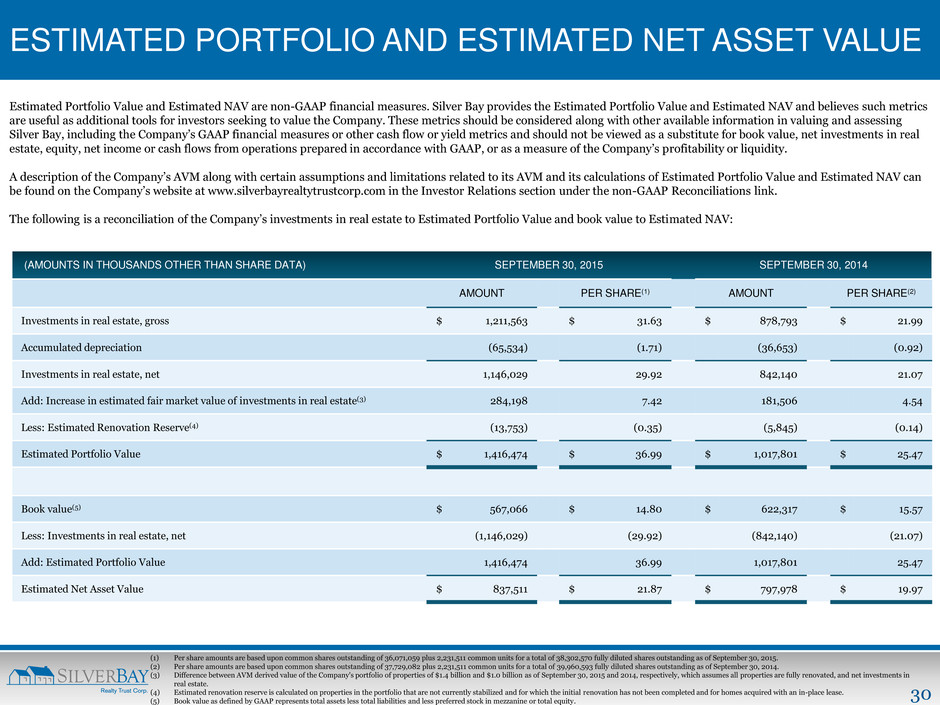

30 ESTIMATED PORTFOLIO AND ESTIMATED NET ASSET VALUE Estimated Portfolio Value and Estimated NAV are non-GAAP financial measures. Silver Bay provides the Estimated Portfolio Value and Estimated NAV and believes such metrics are useful as additional tools for investors seeking to value the Company. These metrics should be considered along with other available information in valuing and assessing Silver Bay, including the Company’s GAAP financial measures or other cash flow or yield metrics and should not be viewed as a substitute for book value, net investments in real estate, equity, net income or cash flows from operations prepared in accordance with GAAP, or as a measure of the Company’s profitability or liquidity. A description of the Company’s AVM along with certain assumptions and limitations related to its AVM and its calculations of Estimated Portfolio Value and Estimated NAV can be found on the Company’s website at www.silverbayrealtytrustcorp.com in the Investor Relations section under the non-GAAP Reconciliations link. The following is a reconciliation of the Company’s investments in real estate to Estimated Portfolio Value and book value to Estimated NAV: (1) Per share amounts are based upon common shares outstanding of 36,071,059 plus 2,231,511 common units for a total of 38,302,570 fully diluted shares outstanding as of September 30, 2015. (2) Per share amounts are based upon common shares outstanding of 37,729,082 plus 2,231,511 common units for a total of 39,960,593 fully diluted shares outstanding as of September 30, 2014. (3) Difference between AVM derived value of the Company's portfolio of properties of $1.4 billion and $1.0 billion as of September 30, 2015 and 2014, respectively, which assumes all properties are fully renovated, and net investments in real estate. (4) Estimated renovation reserve is calculated on properties in the portfolio that are not currently stabilized and for which the initial renovation has not been completed and for homes acquired with an in-place lease. (5) Book value as defined by GAAP represents total assets less total liabilities and less preferred stock in mezzanine or total equity. (AMOUNTS IN THOUSANDS OTHER THAN SHARE DATA) SEPTEMBER 30, 2015 SEPTEMBER 30, 2014 AMOUNT PER SHARE(1) AMOUNT PER SHARE(2) Investments in real estate, gross $ 1,211,563 $ 31.63 $ 878,793 $ 21.99 Accumulated depreciation (65,534) (1.71) (36,653) (0.92) Investments in real estate, net 1,146,029 29.92 842,140 21.07 Add: Increase in estimated fair market value of investments in real estate(3) 284,198 7.42 181,506 4.54 Less: Estimated Renovation Reserve(4) (13,753) (0.35) (5,845) (0.14) Estimated Portfolio Value $ 1,416,474 $ 36.99 $ 1,017,801 $ 25.47 Book value(5) $ 567,066 $ 14.80 $ 622,317 $ 15.57 Less: Investments in real estate, net (1,146,029) (29.92) (842,140) (21.07) Add: Estimated Portfolio Value 1,416,474 36.99 1,017,801 25.47 Estimated Net Asset Value $ 837,511 $ 21.87 $ 797,978 $ 19.97

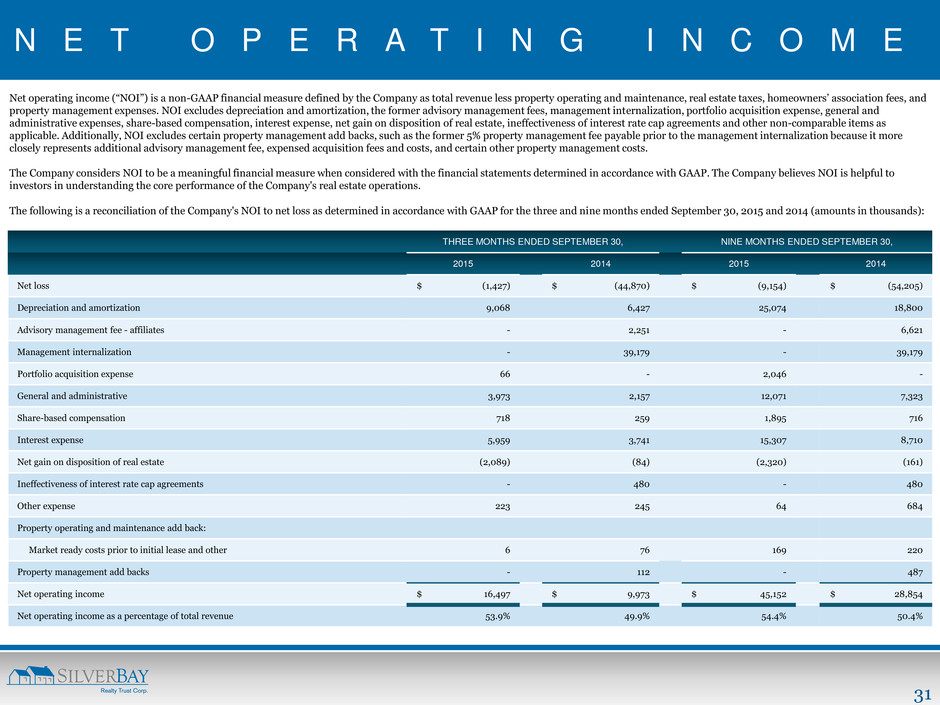

31 N E T O P E R A T I N G I N C O M E Net operating income (“NOI”) is a non-GAAP financial measure defined by the Company as total revenue less property operating and maintenance, real estate taxes, homeowners’ association fees, and property management expenses. NOI excludes depreciation and amortization, the former advisory management fees, management internalization, portfolio acquisition expense, general and administrative expenses, share-based compensation, interest expense, net gain on disposition of real estate, ineffectiveness of interest rate cap agreements and other non-comparable items as applicable. Additionally, NOI excludes certain property management add backs, such as the former 5% property management fee payable prior to the management internalization because it more closely represents additional advisory management fee, expensed acquisition fees and costs, and certain other property management costs. The Company considers NOI to be a meaningful financial measure when considered with the financial statements determined in accordance with GAAP. The Company believes NOI is helpful to investors in understanding the core performance of the Company's real estate operations. The following is a reconciliation of the Company's NOI to net loss as determined in accordance with GAAP for the three and nine months ended September 30, 2015 and 2014 (amounts in thousands): THREE MONTHS ENDED SEPTEMBER 30, NINE MONTHS ENDED SEPTEMBER 30, 2015 2014 2015 2014 Net loss $ (1,427) $ (44,870) $ (9,154) $ (54,205) Depreciation and amortization 9,068 6,427 25,074 18,800 Advisory management fee - affiliates - 2,251 - 6,621 Management internalization - 39,179 - 39,179 Portfolio acquisition expense 66 - 2,046 - General and administrative 3,973 2,157 12,071 7,323 Share-based compensation 718 259 1,895 716 Interest expense 5,959 3,741 15,307 8,710 Net gain on disposition of real estate (2,089) (84) (2,320) (161) Ineffectiveness of interest rate cap agreements - 480 - 480 Other expense 223 245 64 684 Property operating and maintenance add back: Market ready costs prior to initial lease and other 6 76 169 220 Property management add backs - 112 - 487 Net operating income $ 16,497 $ 9,973 $ 45,152 $ 28,854 Net operating income as a percentage of total revenue 53.9% 49.9% 54.4% 50.4%

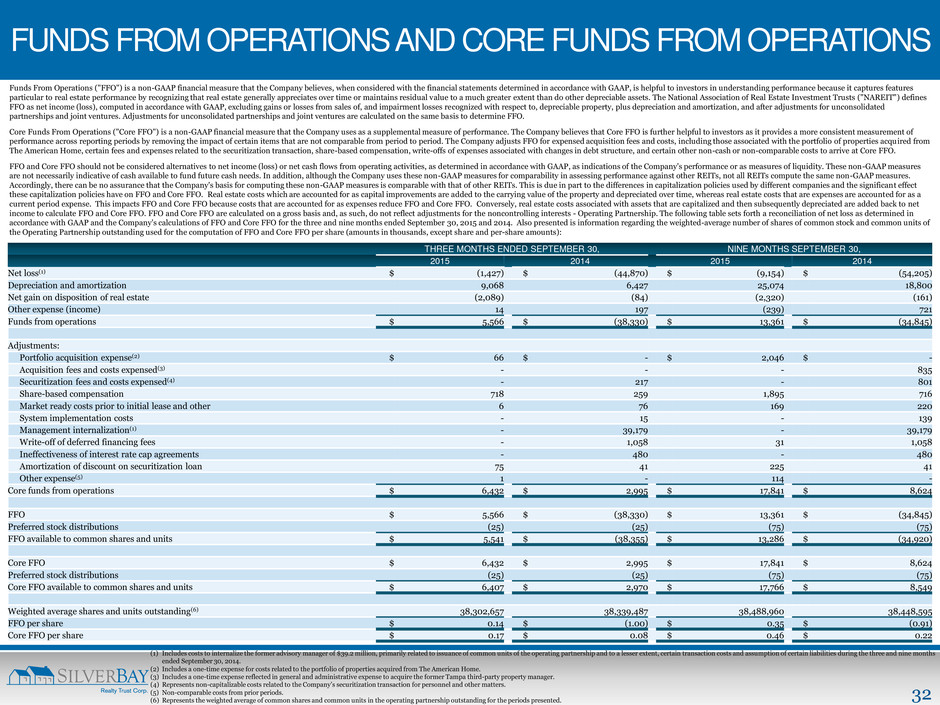

32 FUNDS FROM OPERATIONS AND CORE FUNDS FROM OPERATIONS Funds From Operations ("FFO") is a non-GAAP financial measure that the Company believes, when considered with the financial statements determined in accordance with GAAP, is helpful to investors in understanding performance because it captures features particular to real estate performance by recognizing that real estate generally appreciates over time or maintains residual value to a much greater extent than do other depreciable assets. The National Association of Real Estate Investment Trusts ("NAREIT") defines FFO as net income (loss), computed in accordance with GAAP, excluding gains or losses from sales of, and impairment losses recognized with respect to, depreciable property, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures are calculated on the same basis to determine FFO. Core Funds From Operations ("Core FFO") is a non-GAAP financial measure that the Company uses as a supplemental measure of performance. The Company believes that Core FFO is further helpful to investors as it provides a more consistent measurement of performance across reporting periods by removing the impact of certain items that are not comparable from period to period. The Company adjusts FFO for expensed acquisition fees and costs, including those associated with the portfolio of properties acquired from The American Home, certain fees and expenses related to the securitization transaction, share-based compensation, write-offs of expenses associated with changes in debt structure, and certain other non-cash or non-comparable costs to arrive at Core FFO. FFO and Core FFO should not be considered alternatives to net income (loss) or net cash flows from operating activities, as determined in accordance with GAAP, as indications of the Company's performance or as measures of liquidity. These non-GAAP measures are not necessarily indicative of cash available to fund future cash needs. In addition, although the Company uses these non-GAAP measures for comparability in assessing performance against other REITs, not all REITs compute the same non-GAAP measures. Accordingly, there can be no assurance that the Company's basis for computing these non-GAAP measures is comparable with that of other REITs. This is due in part to the differences in capitalization policies used by different companies and the significant effect these capitalization policies have on FFO and Core FFO. Real estate costs which are accounted for as capital improvements are added to the carrying value of the property and depreciated over time, whereas real estate costs that are expenses are accounted for as a current period expense. This impacts FFO and Core FFO because costs that are accounted for as expenses reduce FFO and Core FFO. Conversely, real estate costs associated with assets that are capitalized and then subsequently depreciated are added back to net income to calculate FFO and Core FFO. FFO and Core FFO are calculated on a gross basis and, as such, do not reflect adjustments for the noncontrolling interests - Operating Partnership. The following table sets forth a reconciliation of net loss as determined in accordance with GAAP and the Company's calculations of FFO and Core FFO for the three and nine months ended September 30, 2015 and 2014. Also presented is information regarding the weighted-average number of shares of common stock and common units of the Operating Partnership outstanding used for the computation of FFO and Core FFO per share (amounts in thousands, except share and per-share amounts): THREE MONTHS ENDED SEPTEMBER 30, NINE MONTHS SEPTEMBER 30, 2015 2014 2015 2014 Net loss(1) $ (1,427) $ (44,870) $ (9,154) $ (54,205) Depreciation and amortization 9,068 6,427 25,074 18,800 Net gain on disposition of real estate (2,089) (84) (2,320) (161) Other expense (income) 14 197 (239) 721 Funds from operations $ 5,566 $ (38,330) $ 13,361 $ (34,845) Adjustments: Portfolio acquisition expense(2) $ 66 $ - $ 2,046 $ - Acquisition fees and costs expensed(3) - - - 835 Securitization fees and costs expensed(4) - 217 - 801 Share-based compensation 718 259 1,895 716 Market ready costs prior to initial lease and other 6 76 169 220 System implementation costs - 15 - 139 Management internalization(1) - 39,179 - 39,179 Write-off of deferred financing fees - 1,058 31 1,058 Ineffectiveness of interest rate cap agreements - 480 - 480 Amortization of discount on securitization loan 75 41 225 41 Other expense(5) 1 - 114 - Core funds from operations $ 6,432 $ 2,995 $ 17,841 $ 8,624 FFO $ 5,566 $ (38,330) $ 13,361 $ (34,845) Preferred stock distributions (25) (25) (75) (75) FFO available to common shares and units $ 5,541 $ (38,355) $ 13,286 $ (34,920) Core FFO $ 6,432 $ 2,995 $ 17,841 $ 8,624 Preferred stock distributions (25) (25) (75) (75) Core FFO available to common shares and units $ 6,407 $ 2,970 $ 17,766 $ 8,549 Weighted average shares and units outstanding(6) 38,302,657 38,339,487 38,488,960 38,448,595 FFO per share $ 0.14 $ (1.00) $ 0.35 $ (0.91) Core FFO per share $ 0.17 $ 0.08 $ 0.46 $ 0.22 (1) Includes costs to internalize the former advisory manager of $39.2 million, primarily related to issuance of common units of the operating partnership and to a lesser extent, certain transaction costs and assumption of certain liabilities during the three and nine months ended September 30, 2014. (2) Includes a one-time expense for costs related to the portfolio of properties acquired from The American Home. (3) Includes a one-time expense reflected in general and administrative expense to acquire the former Tampa third-party property manager. (4) Represents non-capitalizable costs related to the Company’s securitization transaction for personnel and other matters. (5) Non-comparable costs from prior periods. (6) Represents the weighted average of common shares and common units in the operating partnership outstanding for the periods presented.

33 3300 FERNBROOK LANE NORTH | SUITE 210 | PLYMOUTH | MN | 55447 P: 952.358.4400 | E: INVES TO RS@ SILVERBAYMGMT .C OM