Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BROCADE COMMUNICATIONS SYSTEMS INC | brcd-8keprxfy15q4.htm |

| EX-99.1 - PRESS RELEASE - BROCADE COMMUNICATIONS SYSTEMS INC | brcd-8keprxfy15q4xex991.htm |

|

Q4 FY 2015 Earnings

Prepared Comments and Slides

November 23, 2015

Michael Iburg

Investor Relations

Phone: 408-333-0233

miburg@Brocade.com

Ed Graczyk

Public Relations

Phone: 408-333-1836

egraczyk@Brocade.com

NASDAQ: BRCD

Brocade Q4 FY 2015 Earnings 11/23/2015

Prepared comments provided by Michael Iburg, Investor Relations

Thank you for your interest in Brocade’s Q4 fiscal year 2015 earnings presentation, which includes prepared remarks, cautionary statements and disclosures, slides, and a press release detailing fiscal fourth quarter and fiscal year 2015 results. The press release, along with these prepared comments and slides, has been furnished to the SEC on Form 8-K and has been made available on the Brocade Investor Relations website at www.brcd.com. The press release will be issued subsequently via Marketwired.

© 2015 Brocade Communications Systems, Inc. Page 2 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

© 2015 Brocade Communications Systems, Inc. Page 3 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

Today’s prepared comments include remarks by Lloyd Carney, Brocade CEO, regarding the company’s quarterly and full-year results, its strategy, and a review of operations, as well as industry trends and market/technology drivers related to its business; and by Dan Fairfax, Brocade CFO, who will provide a financial review.

A management discussion and live question and answer conference call will be webcast at

2:30 p.m. PT on November 23 at www.brcd.com and will be archived on the Brocade Investor Relations website.

© 2015 Brocade Communications Systems, Inc. Page 4 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

Prepared comments provided by Lloyd Carney, CEO

© 2015 Brocade Communications Systems, Inc. Page 5 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

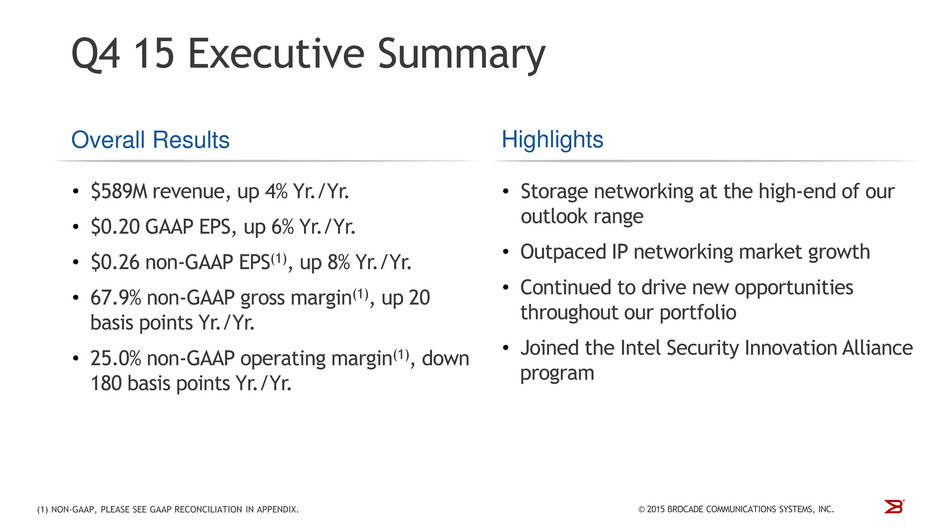

FY15 was a productive year in which we achieved many important milestones. We delivered annual revenue growth of 2%, with a year-over-year increase in each fiscal quarter. We expanded both our gross and operating margins over the prior year, and grew non-GAAP EPS by 12%. We generated strong free cash flow, allowing us to increase our dividend and repurchase more than $340M of common stock. And finally, Brocade delivered more than a dollar per share of non-GAAP earnings for the first time in our history.

From a market perspective, FY15 was a year of both challenges and opportunities for Brocade. For the year, our SAN revenue declined 2%, largely the result of weakness in our Fibre Channel switch and embedded switch sales. As we noted at our Investor Day in September, this is an area of focus for us, and in Q4 we saw encouraging signs of progress. At the same time, our IP Networking product revenue grew 14% for the full year and exceeded our two-year target model of 8% - 12% annual growth.

With the proliferation of cloud services as a growing element in enterprise IT platforms, channel models continued to evolve significantly in FY15. Increasingly, business solutions are being delivered to customers by a myriad of interdependent partner alliances. This is a great trend for Brocade, as we have been building our company and our reputation on strong partnerships for more than 20 years. During FY15, we both expanded our ecosystem and deepened many of our relationships with key partners across all of our major product areas.

On the product and technology front, we were awarded 86 patents and delivered more than two dozen hardware and major software releases. Among them, a full portfolio of IP storage products and capabilities, a new analytics platform for our Brocade Gen 5 Fibre Channel technology, the expansion of our Brocade VDX® product family with new software-defined networking (SDN) and cloud orchestration capabilities, and several SDN applications, optimized for our Brocade MLX® product family.

During the year, we continued to expand our software-centric capabilities for New IP architectures through both technology innovation and strategic acquisitions. We acquired and integrated Connectem (virtual evolved packet core (vEPC)) and Riverbed’s SteelApp™ product line (virtual application delivery controller (vADC)) further strengthening our software portfolio in key areas. These acquisitions complement our broad portfolio of SDN and network functions virtualization (NFV) technologies, including our industry-leading Brocade SDN controller, virtual router, firewall, and VPN products, as well as our network visibility and analytics solutions.

© 2015 Brocade Communications Systems, Inc. Page 6 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

Turning to our fourth quarter results, storage networking revenue was at the high-end of our outlook, underscoring the continued importance of Fibre Channel connectivity in both traditional and flash-based storage networking environments. We also achieved record IP networking sales, outpacing industry growth rates with broad-based strength across most of our key markets.

Throughout the year, we have invested strategically in the expansion of our hardware and software portfolio, and are beginning to see these investments create new opportunities throughout our portfolio.

We also continue to optimize our solutions to lead in the industry transition to New IP architectures. In particular, the growth of cloud-based services will have major implications for data security. During Q4, we were pleased to join the Intel Security Innovation Alliance program, announcing our intention to integrate Intel security products and technologies with Brocade solutions. This will enable enterprises to deploy a more pervasive and fully integrated security layer as they migrate to Brocade’s cloud-ready New IP architectures.

© 2015 Brocade Communications Systems, Inc. Page 7 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

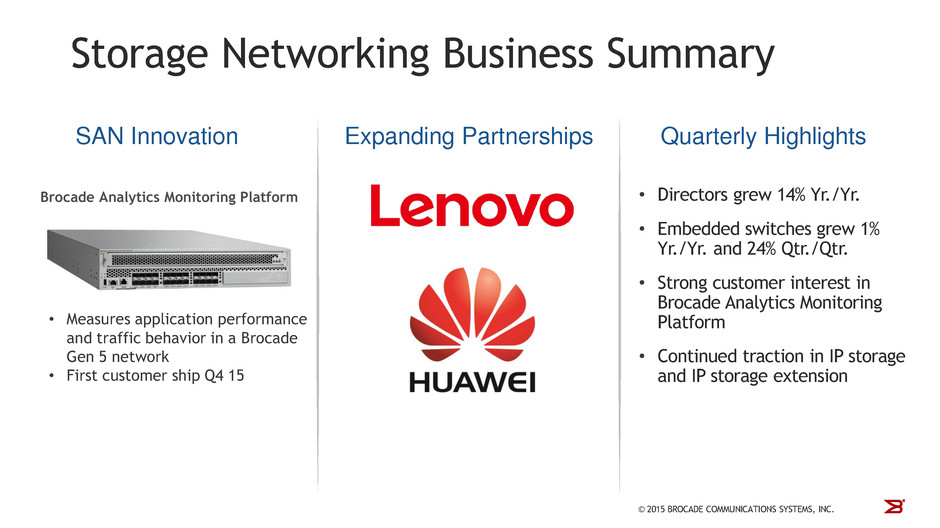

Our storage networking product revenue this quarter was at the high-end of our outlook range, primarily driven by a recovery in our embedded business. We continue to expand our engagements with our traditional global systems partners, as well as a number of new partners in emerging storage technologies, such as all-flash storage arrays. This is enabling us to maximize our business opportunities and diversify our revenues more broadly across our partner base.

During Q4, we were pleased to announce the expansion of two key partnerships in China: Huawei and Lenovo. Huawei is one of the world’s largest telecommunications and networking equipment providers, and its server business is one of the fastest growing in the world. Lenovo is one of the world’s largest technology companies and has significantly increased its enterprise IT infrastructure offerings. The expansion of these partnerships gives Brocade greater access to China’s dynamic economy, which is emerging as a growth market for Fibre Channel storage networking.

During the quarter, we launched the Brocade Analytics Monitoring Platform, an innovative new SAN solution that represents an incremental offering to our sizable installed base of Fibre Channel customers. This offering allows organizations to achieve a greater return on investment and reduced operating expenses by providing non-disruptive monitoring and analytics between servers and storage.

Similarly, we continue to drive new sales opportunities with our purpose-built IP storage and IP storage extension solutions. These solutions deliver predictable performance for business critical workloads, provide security for storage data flows between data centers, and enable efficient data replication. Our differentiated approach stems from decades of leadership in building mission-critical storage networks, and we are successfully leveraging longstanding partnerships to achieve greater market penetration.

© 2015 Brocade Communications Systems, Inc. Page 8 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

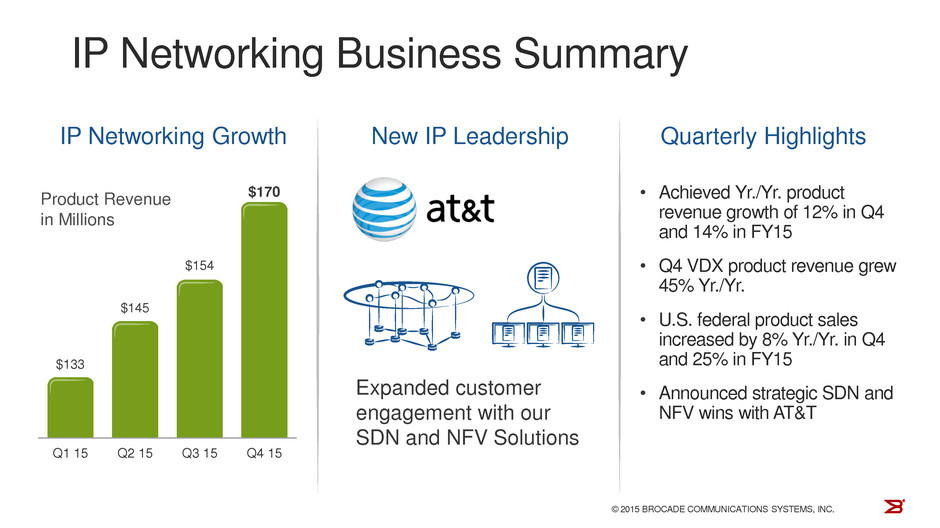

With broad-based strength across most key markets, we delivered fourth quarter IP Networking product revenue at the high end of our fourth quarter outlook, resulting in growth for fiscal year 2015 of 14%. We had several significant data center IP wins in the quarter, including one of the largest Brocade VDX deals in our history with a major automotive manufacturer.

The fourth quarter concluded a successful year for our campus switching business, with continued traction in enterprise, education, healthcare, and government. In particular, solid execution by our U.S. Federal team in Q4 resulted in a full-year increase in our U.S. federal product sales of more than 25% over the prior year.

Routing revenue in the fourth quarter was down 20% year-over-year as we shipped fewer next-generation line cards into our installed base. We began a line-card refresh cycle in the fourth quarter of 2014, and this contributed to the 13% router revenue growth we saw in fiscal year 2015. Looking forward, we expect the revenue benefits from this upgrade cycle to moderate through the course of FY 16.

In the fourth quarter, we further extended our software leadership in open source SDN with the announcement of the Brocade SDN Controller 2.0, as well as two new SDN applications. Brocade’s product strategy is driven by our early traction and close collaboration with leading telco, cloud, and enterprise customers. This has enabled us to deliver unique, high-value, software-based networking solutions that are being deployed today in a number of the most advanced networking environments in the world.

For example, during the fourth quarter, we were pleased that AT&T, one of the most aggressive adopters of New IP architectures, announced it is using our SDN and NFV technologies as part of its software-centric Network on Demand. The deployment of the Brocade SDN and NFV solutions underscores AT&T’s continued progress in virtualizing the majority of its network over the next five years.

We continue to focus on the expansion of our vADC revenue and customer base. Cloud providers were among the first to virtualize application delivery within their software-based networks. But today, enterprise customers are also deploying virtualized ADCs to substantially reduce infrastructure costs without having to make major architectural changes. As enterprise workloads extend to the cloud, vADC software is becoming a key enabler for cloud-optimized networks. We now have more than 400 customers deploying our vADC solution.

© 2015 Brocade Communications Systems, Inc. Page 9 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

In closing, our fourth quarter achievements conclude another solid year of execution for Brocade. We continue to invest strategically in our product and technology roadmap, through both internal development and M&A. We are pleased that these investments are beginning to open up incremental opportunities across our portfolio.

Brocade remains committed to returning cash to our shareholders and, as such, leveraged our strong cash flow during the year to increase our dividend and continue to aggressively execute on our stock repurchase program.

I want to extend my sincere thanks to Brocade employees around the world whose dedication to our mission made our achievements in the past year possible. I also want to thank our shareholders, customers, and partners for their continued support.

© 2015 Brocade Communications Systems, Inc. Page 10 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

Prepared comments provided by Dan Fairfax, CFO

© 2015 Brocade Communications Systems, Inc. Page 11 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

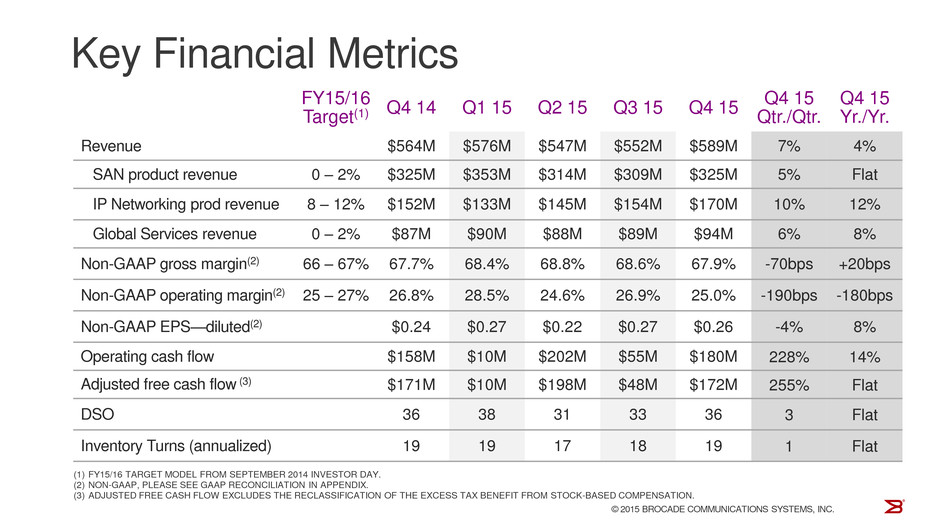

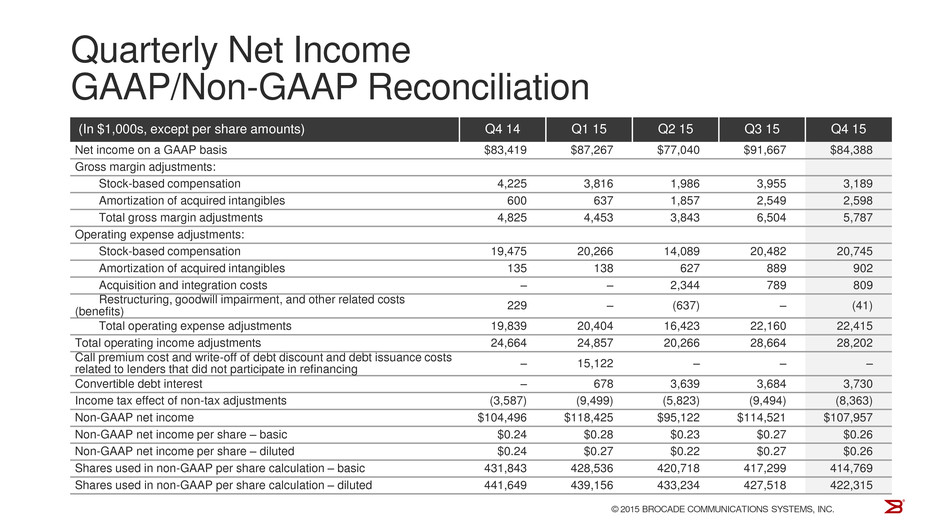

Q4 15 revenue of $589M grew 4% Yr./Yr. primarily driven by increased IP Networking revenue. SAN product revenue was flat Yr./Yr. as the growth in director sales of 14% was offset by a 12% decline in switch sales, and embedded sales were up 1%. IP Networking product revenue was up 12% Yr./Yr. due to stronger Ethernet switch and software sales, partially offset by lower router sales.

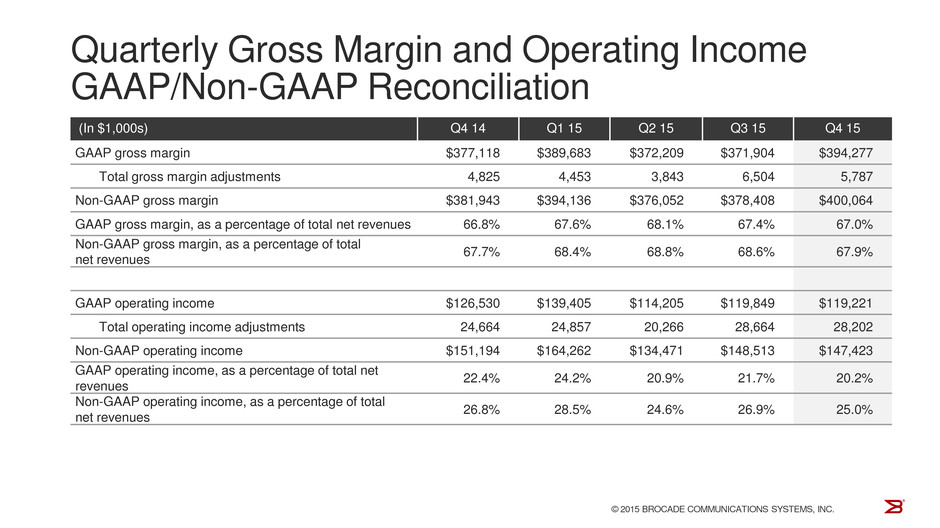

Non-GAAP gross margin was 67.9% in Q4 15, up approximately 20 basis points year-over-year due primarily to lower product costs and favorable customer and product mix within our SAN and IP Networking product families. Non-GAAP operating margin was 25.0% in Q4 15, down 180 basis points from Q4 14 primarily due to higher operating expenses from increased headcount and related expenses, including acquisitions.

Q4 15 non-GAAP diluted EPS was $0.26, up from $0.24 in Q4 14 due to higher revenue and lower number of shares outstanding as a result of our share repurchase program.

Operating cash flow and adjusted free cash flow were above the forecasted ranges of $140M-$155M and $130M-$145M, respectively, as DSOs were lower than we expected but higher quarter-over-quarter.

Inventory turns were flat year-over-year, but increased slightly sequentially.

Our channels to market have remained stable year-over-year, with total OEM revenue remaining at 62% of total revenue.

© 2015 Brocade Communications Systems, Inc. Page 12 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

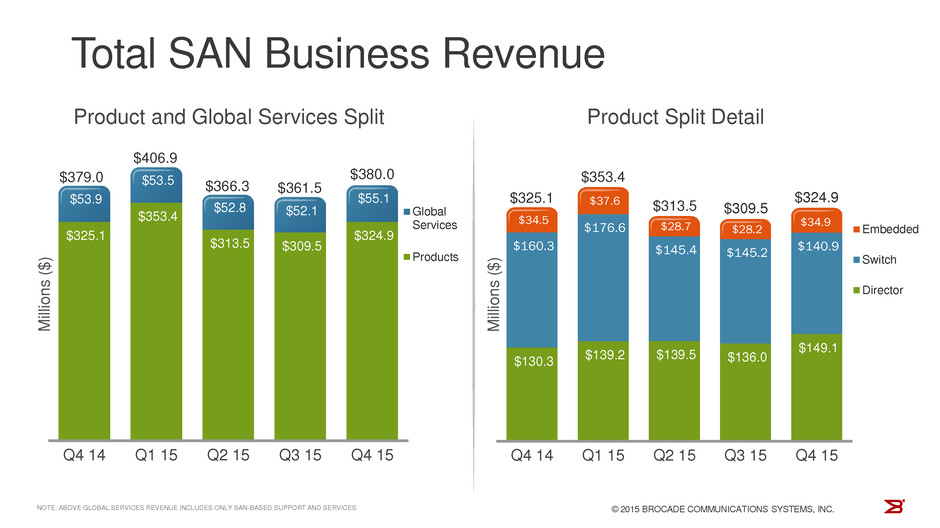

Revenue from our total SAN business, including hardware products and SAN-based support and services, in Q4 15 was $380M, up slightly from Q4 14 as overall product revenue was flat and global service revenue was up 2% year-over-year.

Our SAN product revenue was $325M in the quarter, flat Yr./Yr. as director revenue was up 14%, but was offset by a 12% reduction in switch revenue, while our embedded revenue was up 1% year-over-year.

SAN-based global services revenue was $55M, up 2% Yr./Yr., and included several million dollars of catch-up support renewals. The timing and magnitude of the support contracts may cause quarter-over-quarter fluctuations in our revenue.

© 2015 Brocade Communications Systems, Inc. Page 13 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

Revenue from our total IP Networking business, including hardware and IP-based support and services, was $209M, up 13% Yr./Yr.

Q4 15 IP Networking product revenue was a record $170M, up 12% Yr./Yr., and at the high end of our two-year target model for IP revenue growth. The Yr./Yr. revenue improvement was broad based across most geographies with EMEA up 41%, APAC up 17%, and Japan up 39%. The Americas region was up slightly year-over-year as the growth in U.S. federal was offset by lower routing sales due to pent-up demand in Q4 2014 for the next-generation line cards. From a product perspective, in Q4 15 we experienced strong year-over-year growth in switches, up 28%, while routers were down 20%. The routing decline was primarily due to a more normalized volume of next-generation line cards.

IP-based Global Services revenue was $39M, up 16% Yr./Yr. due to the higher volume of IP Networking product shipments and the incremental maintenance revenue associated with the recently acquired virtual application delivery software business we acquired in Q2 FY15.

The split of our IP Networking business based on customer use cases is an important measurement of the progress we are making on our data center strategy. Although it is difficult to identify all end users and their specific network deployments due to our two-tier distribution channel, we are providing estimates of the split of our IP Networking business by data center use case. Our data center customers(1) represented approximately 60% of IP Networking revenue in Q4 15, compared to 58% in Q4 14 and 52% in Q3 15.

(1) The estimated percentage of revenue coming from data center IP Networking customers primarily varies due to the timing of large data center customer transactions, minor changes to classification from improved visibility of actual customer deployments, as well as the seasonality of the public sector, including federal. Other use cases, such as enterprise campus and carrier networks (MAN/WAN) represent the balance of the business.

© 2015 Brocade Communications Systems, Inc. Page 14 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

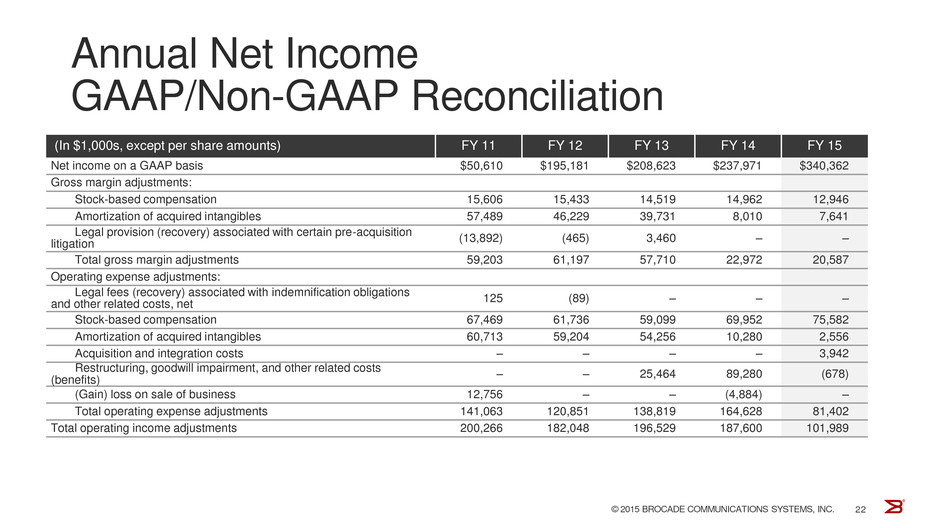

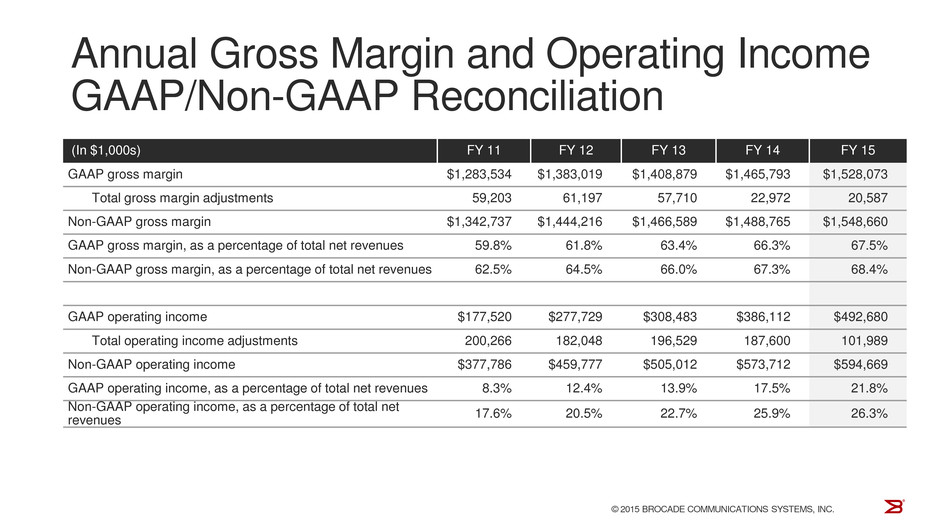

FY 15 was another year in which we continued to improve our financial performance resulting in record full-year non-GAAP gross margin, non-GAAP operating margin, and non-GAAP EPS.

Non-GAAP gross margin for the full year continued to improve with FY 15 margin up 110 basis points over FY 14 due to higher revenue volumes and a more favorable customer and product mix within our SAN and IP Networking product families, coupled with lower excess and obsolete inventory charges and lower manufacturing overhead.

Non-GAAP operating margin reached 26.3% for FY 15, up 30 basis points over the prior year. The improvement was primarily due to higher gross margins offset by increased operating expenses primarily driven by acquisitions and other software investments.

We delivered $1.01 in non-GAAP EPS. The 12% Yr./Yr. non-GAAP EPS growth was attributed to higher revenue, improved profitability, lower tax rate, and reduced shares outstanding due to our regular share repurchase program.

Through our dividend and share repurchases, we returned $411M to shareholders during FY 15, a 12% increase over FY 14. This represents a 96% return of adjusted free cash flow to our shareholders, above the 60% minimum Company commitment.

© 2015 Brocade Communications Systems, Inc. Page 15 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

• | Looking forward to Q1 16, we considered a number of factors, including the following, in setting our outlook: |

• | Our Q4 15 Global Services revenue included several large catch-up billings which contributed a one-time benefit of approximately $3M |

• | The next-gen line-card product cycle that benefitted our router business in FY15 has begun to moderate |

• | For Q1 16, we expect SAN product revenue to be flat to up 3% Qtr./Qtr. as we typically see stronger buying patterns from our OEM partners in our fiscal Q1. |

• | We expect our Q1 16 IP Networking revenue to be down 16% to down 22% Qtr./Qtr. principally driven by U.S. federal seasonality and lower router sales. |

• | We expect our Global Services revenue to be down 2% Qtr./Qtr. due to the approximate $3 million one-time catch-up benefit realized in Q4 15. |

• | We expect Q1 16 non-GAAP gross margin to be between 67.0% to 67.5%, and non-GAAP operating margin to be between 24.0% to 25.5%. |

• | At the end of Q4 15, OEM inventory was approximately 1.3 weeks of supply based on SAN business revenue. We expect inventory to be between one to two weeks in Q1 16. |

© 2015 Brocade Communications Systems, Inc. Page 16 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

Prepared comments provided by Michael Iburg, Investor Relations

That concludes Brocade’s prepared comments. At 2:30 p.m. Pacific Time on November 23, Brocade will host a webcast conference call at www.brcd.com.

Thank you for your interest in Brocade.

© 2015 Brocade Communications Systems, Inc. Page 17 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

© 2015 Brocade Communications Systems, Inc. Page 18 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

© 2015 Brocade Communications Systems, Inc. Page 19 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

Additional Financial Information:

Q4 14 | Q3 15 | Q4 15 | ||||

GAAP product gross margin | 68.3 | % | 68.9 | % | 68.5 | % |

Non-GAAP product gross margin | 68.9 | % | 69.8 | % | 69.3 | % |

GAAP services gross margin | 58.6 | % | 59.7 | % | 58.8 | % |

Non-GAAP services gross margin | 61.0 | % | 62.3 | % | 60.7 | % |

© 2015 Brocade Communications Systems, Inc. Page 20 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

© 2015 Brocade Communications Systems, Inc. Page 21 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

© 2015 Brocade Communications Systems, Inc. Page 22 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

© 2015 Brocade Communications Systems, Inc. Page 23 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

© 2015 Brocade Communications Systems, Inc. Page 24 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

© 2015 Brocade Communications Systems, Inc. Page 25 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

© 2015 Brocade Communications Systems, Inc. Page 26 of 27

Brocade Q4 FY 2015 Earnings 11/23/2015

|

© 2015 Brocade Communications Systems, Inc. Page 27 of 27