Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - County Bancorp, Inc. | d84728d8k.htm |

| EX-2.1 - EX-2.1 - County Bancorp, Inc. | d84728dex21.htm |

| EX-99.3 - EX-99.3 - County Bancorp, Inc. | d84728dex993.htm |

| EX-99.2 - EX-99.2 - County Bancorp, Inc. | d84728dex992.htm |

Acquisition of Fox River Valley Bancorp, Inc. November 20, 2015 Exhibit 99.1

FORWARD LOOKING STATEMENTS This presentation may contain certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, forward-looking statements can be identified by the use of words such as “may,” “might,” “will,” “would,” “should,” “could,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “probable,” “potential,” “possible,” “target,” “continue,” “look forward,” or “assume” and words of similar import. Forward-looking statements are not historical facts but instead express only management’s beliefs regarding future results or events, many of which, by their nature, are inherently uncertain and outside of management’s control. It is possible that actual results and events may differ, possibly materially, from the anticipated results or events indicated in these forward-looking statements. Forward-looking statements are not guarantees of future performance, and County cautions you not to place undue reliance on these statements. Forward-looking statements are made only as of the date of this presentation, and County undertakes no obligation to update any forward-looking statements contained in this report to reflect new information or events or conditions after the date hereof. Forward-looking statements are subject to certain risks, uncertainties and assumptions, including, but not limited to: expected synergies, cost savings and other financial or other benefits of the proposed transaction between County and Fox River Valley might not be realized within the expected timeframes or might be less than projected; the requisite shareholder and regulatory approvals for the proposed transaction between County and Fox River Valley might not be obtained; credit and interest rate risks associated with County’s and Fox River Valley’s respective businesses, customer borrowing, repayment, investment and deposit practices, and general economic conditions, either nationally or in the market areas in which County and Fox River Valley operate or anticipate doing business, may be less favorable than expected; new regulatory or legal requirements or obligations; and other risks, uncertainties and assumptions identified under the sections entitled “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” in County’s Annual Report on Form 10-K for the year ended December 31, 2014, as well as County’s subsequent filings made with the Securities and Exchange Commission (the “SEC”). However, these risks and uncertainties are not exhaustive. Other sections of such reports describe additional factors that could impact County’s business and financial performance and pending or consummated acquisition transactions, including the proposed acquisition of Fox River Valley. Additional Information for Shareholders The information contained herein does not constitute an offer to sell or a solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger of County and Fox River Valley, County will file a registration statement on Form S-4 with the SEC. The registration statement will include a proxy statement of Fox River Valley, which also will constitute a prospectus of County, that will be sent to the shareholders of Fox River Valley. Shareholders are advised to read the registration statement and proxy statement/prospectus when it becomes available because it will contain important information about County, Fox River Valley and the proposed transaction. When filed, this document and other documents relating to the transaction filed by County can be obtained free of charge from the SEC’s website at www.sec.gov. These documents also can be obtained free of charge by accessing County’s website at www.investorscommunitybank.com under the tab “Investor Relations” and then under “SEC Filings.” Alternatively, these documents can be obtained free of charge from County upon written request to County Bancorp, Inc., Attn: Secretary, 860 North Rapids Road, Manitowoc, Wisconsin 54221 or by calling (920) 686-9998, or from Fox River Valley upon written request to Fox River Valley Bancorp, Inc., Attn: Secretary, 5643 Waterford Lane, Appleton, Wisconsin 54913 or by calling (920) 739-2660.

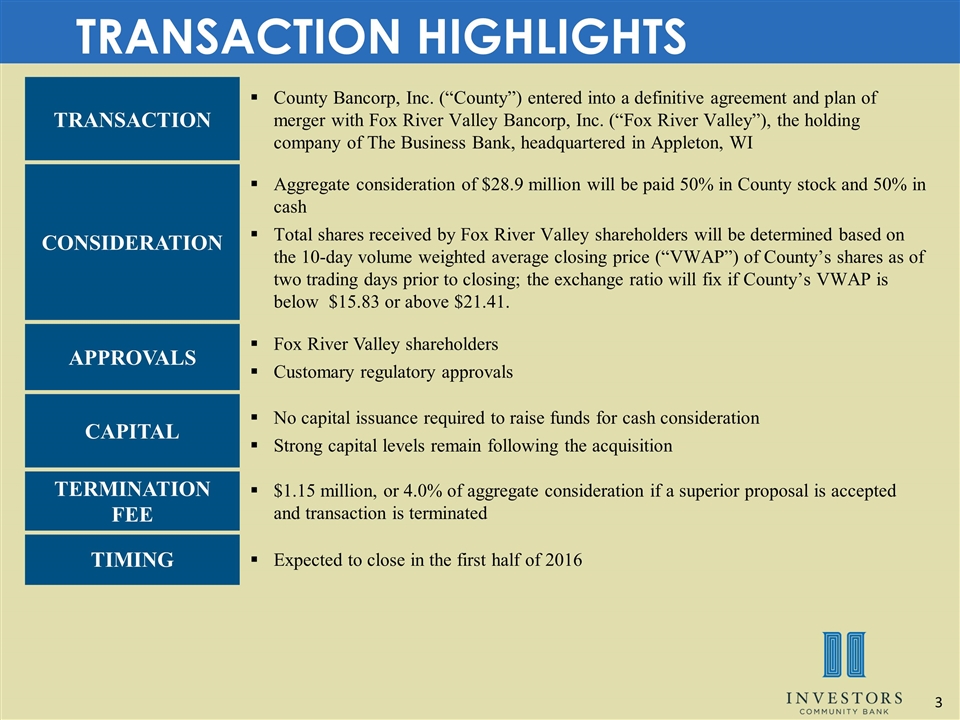

TRANSACTION County Bancorp, Inc. (“County”) entered into a definitive agreement and plan of merger with Fox River Valley Bancorp, Inc. (“Fox River Valley”), the holding company of The Business Bank, headquartered in Appleton, WI CONSIDERATION Aggregate consideration of $28.9 million will be paid 50% in County stock and 50% in cash Total shares received by Fox River Valley shareholders will be determined based on the 10-day volume weighted average closing price (“VWAP”) of County’s shares as of two trading days prior to closing; the exchange ratio will fix if County’s VWAP is below $15.83 or above $21.41. APPROVALS Fox River Valley shareholders Customary regulatory approvals CAPITAL No capital issuance required to raise funds for cash consideration Strong capital levels remain following the acquisition TERMINATION FEE $1.15 million, or 4.0% of aggregate consideration if a superior proposal is accepted and transaction is terminated TIMING Expected to close in the first half of 2016 TRANSACTION HIGHLIGHTS

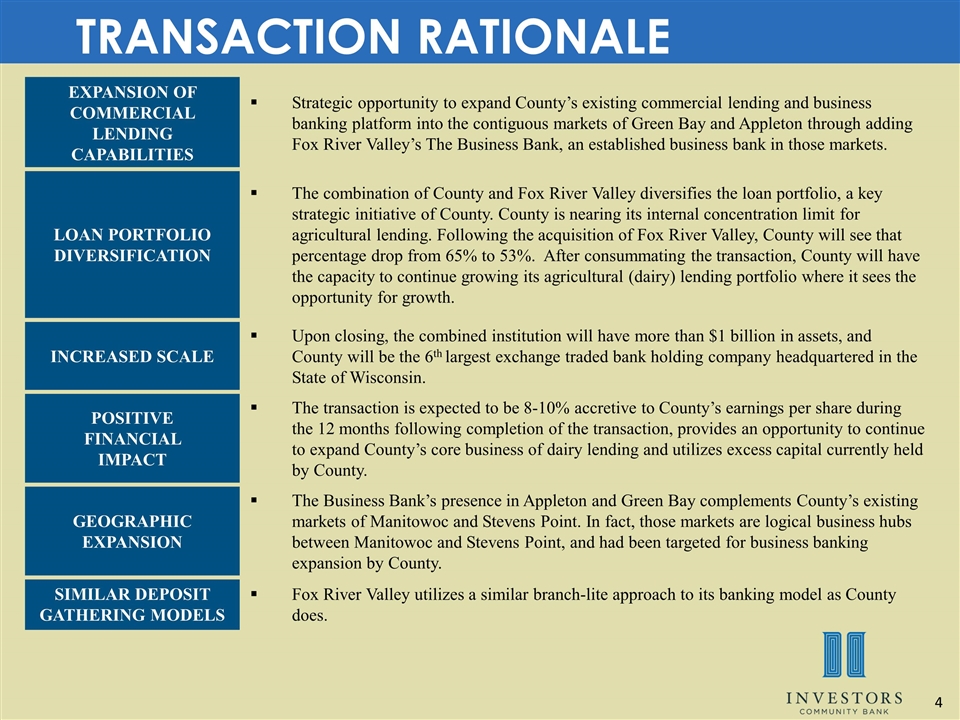

TRANSACTION RATIONALE EXPANSION OF COMMERCIAL LENDING CAPABILITIES Strategic opportunity to expand County’s existing commercial lending and business banking platform into the contiguous markets of Green Bay and Appleton through adding Fox River Valley’s The Business Bank, an established business bank in those markets. LOAN PORTFOLIO DIVERSIFICATION The combination of County and Fox River Valley diversifies the loan portfolio, a key strategic initiative of County. County is nearing its internal concentration limit for agricultural lending. Following the acquisition of Fox River Valley, County will see that percentage drop from 65% to 53%. After consummating the transaction, County will have the capacity to continue growing its agricultural (dairy) lending portfolio where it sees the opportunity for growth. INCREASED SCALE Upon closing, the combined institution will have more than $1 billion in assets, and County will be the 6th largest exchange traded bank holding company headquartered in the State of Wisconsin. POSITIVE FINANCIAL IMPACT The transaction is expected to be 8-10% accretive to County’s earnings per share during the 12 months following completion of the transaction, provides an opportunity to continue to expand County’s core business of dairy lending and utilizes excess capital currently held by County. GEOGRAPHIC EXPANSION The Business Bank’s presence in Appleton and Green Bay complements County’s existing markets of Manitowoc and Stevens Point. In fact, those markets are logical business hubs between Manitowoc and Stevens Point, and had been targeted for business banking expansion by County. SIMILAR DEPOSIT GATHERING MODELS Fox River Valley utilizes a similar branch-lite approach to its banking model as County does.

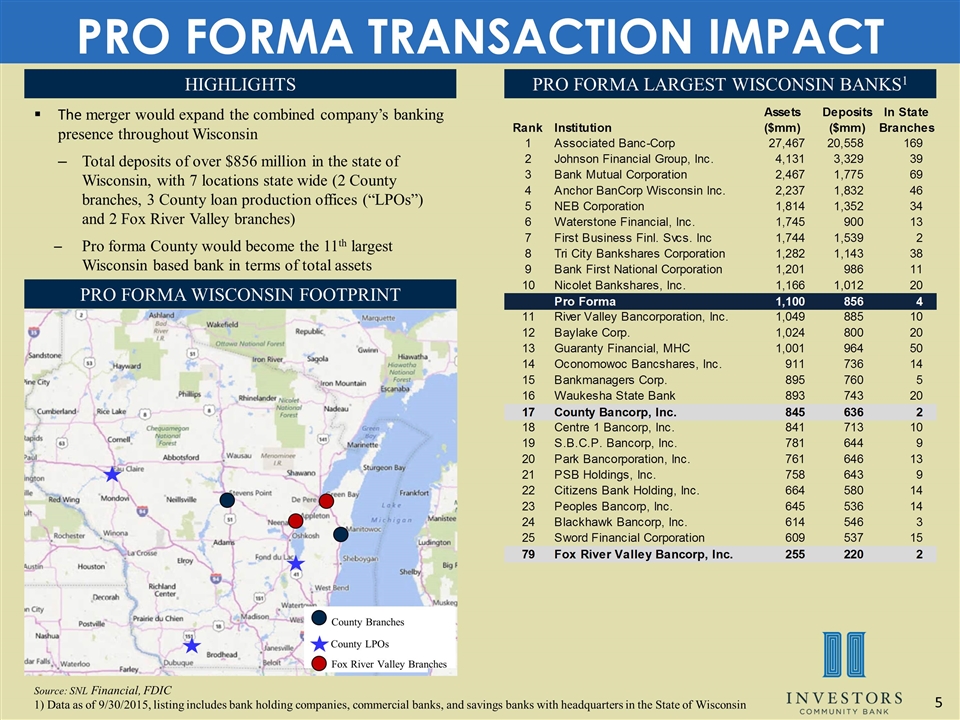

The merger would expand the combined company’s banking presence throughout Wisconsin Total deposits of over $856 million in the state of Wisconsin, with 7 locations state wide (2 County branches, 3 County loan production offices (“LPOs”) and 2 Fox River Valley branches) Pro forma County would become the 11th largest Wisconsin based bank in terms of total assets HIGHLIGHTS PRO FORMA WISCONSIN FOOTPRINT PRO FORMA LARGEST WISCONSIN BANKS1 Source: SNL Financial, FDIC 1) Data as of 9/30/2015, listing includes bank holding companies, commercial banks, and savings banks with headquarters in the State of Wisconsin County Branches Fox River Valley Branches County LPOs PRO FORMA TRANSACTION IMPACT

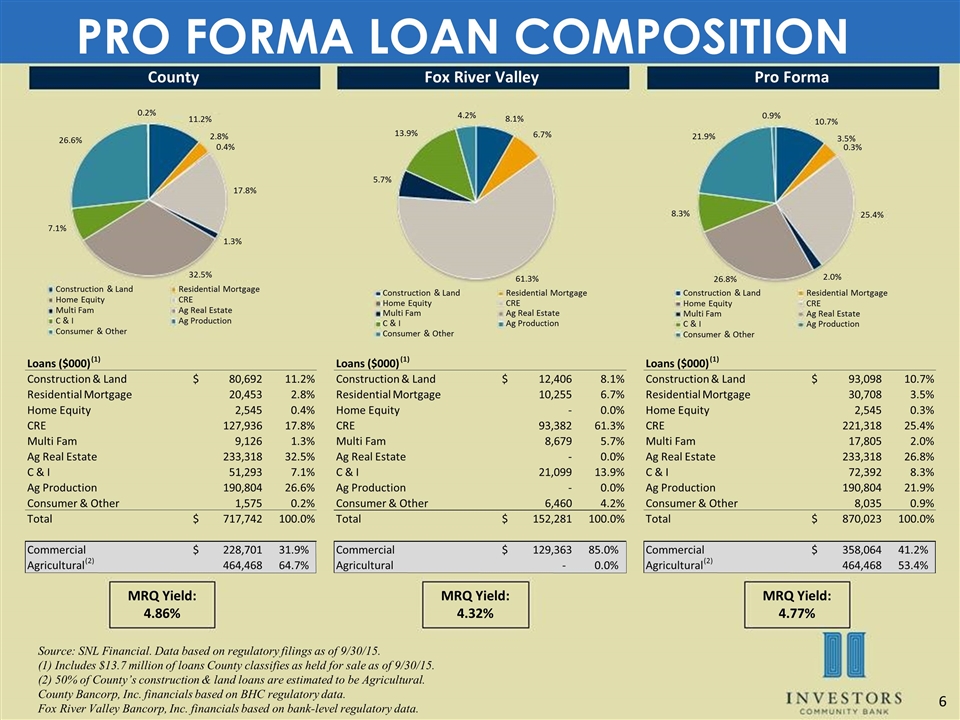

MRQ Yield: 4.86% MRQ Yield: 4.32% MRQ Yield: 4.77% Source: SNL Financial. Data based on regulatory filings as of 9/30/15. (1) Includes $13.7 million of loans County classifies as held for sale as of 9/30/15. (2) 50% of County’s construction & land loans are estimated to be Agricultural. County Bancorp, Inc. financials based on BHC regulatory data. Fox River Valley Bancorp, Inc. financials based on bank-level regulatory data. PRO FORMA LOAN COMPOSITION Loans ($000) (1) Loans ($000) (1) Loans ($000) (1) Construction & Land 80,692 $ 11.2% Construction & Land 12,406 $ 8.1% Construction & Land 93,098 $ 10.7% Residential Mortgage 20,453 2.8% Residential Mortgage 10,255 6.7% Residential Mortgage 30,708 3.5% Home Equity 2,545 0.4% Home Equity - 0.0% Home Equity 2,545 0.3% CRE 127,936 17.8% CRE 93,382 61.3% CRE 221,318 25.4% Multi Fam 9,126 1.3% Multi Fam 8,679 5.7% Multi Fam 17,805 2.0% Ag Real Estate 233,318 32.5% Ag Real Estate - 0.0% Ag Real Estate 233,318 26.8% C & I 51,293 7.1% C & I 21,099 13.9% C & I 72,392 8.3% Ag Production 190,804 26.6% Ag Production - 0.0% Ag Production 190,804 21.9% Consumer & Other 1,575 0.2% Consumer & Other 6,460 4.2% Consumer & Other 8,035 0.9% Total 717,742 $ 100.0% Total 152,281 $ 100.0% Total 870,023 $ 100.0% Commercial 228,701 $ 31.9% Commercial 129,363 $ 85.0% Commercial 358,064 $ 41.2% Agricultural (2) 464,468 64.7% Agricultural - 0.0% Agricultural (2) 464,468 53.4% County Fox River Valley Pro Forma 11.2% 2.8% 0.4% 17.8% 1.3% 32.5% 7.1% 26.6% 0.2% Construction & Land Residential Mortgage Home Equity CRE Multi Fam Ag Real Estate C & I Ag Production Consumer & Other 8.1% 6.7% 61.3% 5.7% 13.9% 4.2% Construction & Land Residential Mortgage Home Equity CRE Multi Fam Ag Real Estate C & I Ag Production Consumer & Other 10.7% 3.5% 0.3% 25.4% 2.0% 26.8% 8.3% 21.9% 0.9% Construction & Land Residential Mortgage Home Equity CRE Multi Fam Ag Real Estate C & I Ag Production Consumer & Other

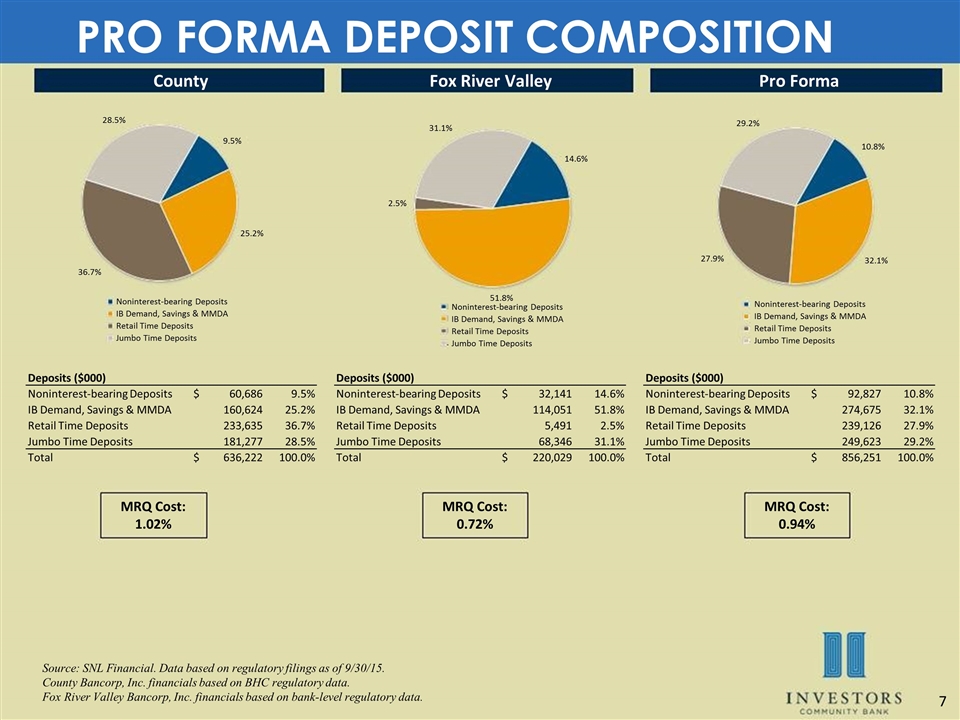

MRQ Cost: 1.02% MRQ Cost: 0.72% MRQ Cost: 0.94% Source: SNL Financial. Data based on regulatory filings as of 9/30/15. County Bancorp, Inc. financials based on BHC regulatory data. Fox River Valley Bancorp, Inc. financials based on bank-level regulatory data. PRO FORMA DEPOSIT COMPOSITION Deposits ($000) Deposits ($000) Deposits ($000) Noninterest-bearing Deposits 60,686 $ 9.5% Noninterest-bearing Deposits 32,141 $ 14.6% Noninterest-bearing Deposits 92,827 $ 10.8% IB Demand, Savings & MMDA 160,624 25.2% IB Demand, Savings & MMDA 114,051 51.8% IB Demand, Savings & MMDA 274,675 32.1% Retail Time Deposits 233,635 36.7% Retail Time Deposits 5,491 2.5% Retail Time Deposits 239,126 27.9% Jumbo Time Deposits 181,277 28.5% Jumbo Time Deposits 68,346 31.1% Jumbo Time Deposits 249,623 29.2% Total 636,222 $ 100.0% Total 220,029 $ 100.0% Total 856,251 $ 100.0% County Fox River Valley Pro Forma 9.5% 25.2% 36.7% 28.5% Noninterest-bearing Deposits IB Demand, Savings & MMDA Retail Time Deposits Jumbo Time Deposits 14.6% 51.8% 2.5% 31.1% Noninterest-bearing Deposits IB Demand, Savings & MMDA Retail Time Deposits Jumbo Time Deposits 10.8% 32.1% 27.9% 29.2% Noninterest-bearing Deposits IB Demand, Savings & MMDA Retail Time Deposits Jumbo Time Deposits

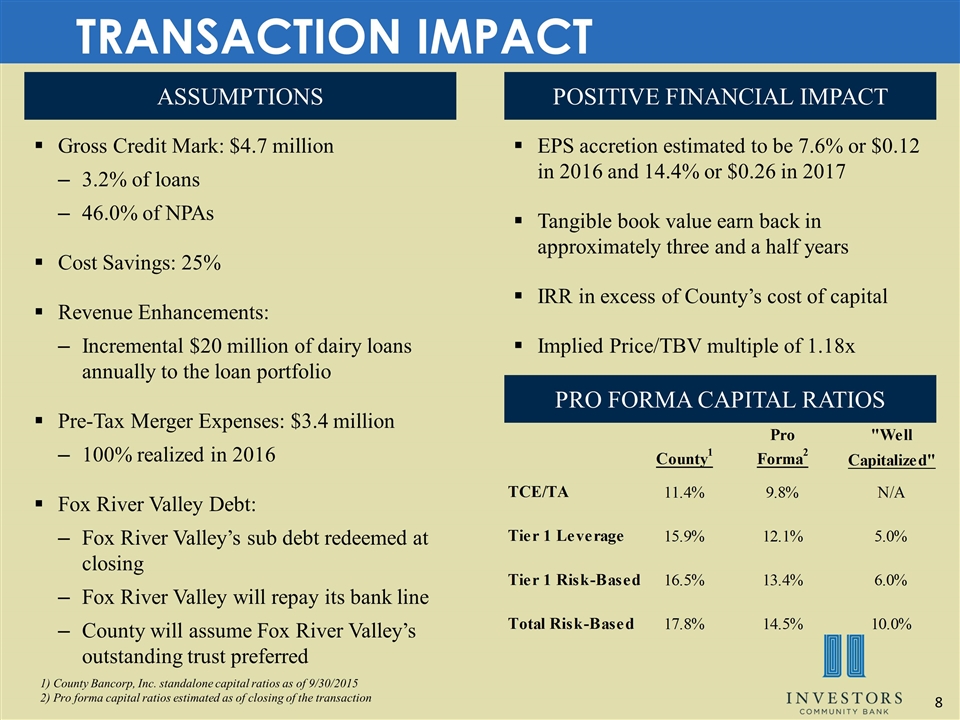

ASSUMPTIONS PRO FORMA CAPITAL RATIOS POSITIVE FINANCIAL IMPACT Gross Credit Mark: $4.7 million 3.2% of loans 46.0% of NPAs Cost Savings: 25% Revenue Enhancements: Incremental $20 million of dairy loans annually to the loan portfolio Pre-Tax Merger Expenses: $3.4 million 100% realized in 2016 Fox River Valley Debt: Fox River Valley’s sub debt redeemed at closing Fox River Valley will repay its bank line County will assume Fox River Valley’s outstanding trust preferred EPS accretion estimated to be 7.6% or $0.12 in 2016 and 14.4% or $0.26 in 2017 Tangible book value earn back in approximately three and a half years IRR in excess of County’s cost of capital Implied Price/TBV multiple of 1.18x 1) County Bancorp, Inc. standalone capital ratios as of 9/30/2015 2) Pro forma capital ratios estimated as of closing of the transaction TRANSACTION IMPACT