Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 USDP NOVEMBER 2015 INVESTOR PRESENTATION - USD Partners LP | usdpinvestorpresentationnov2.pdf |

| 8-K - 8-K ITEM 7.01 - USD Partners LP | a111815item701form8-k.htm |

November 2015 RBC Capital Markets MLP Conference

Cautionary Statements This presentation may contain forward-looking statements within the meaning of U.S. federal securities laws, including statements related to USD Partners LP’s (“USDP” or the “Partnership”) expected Adjusted EBITDA, yield and distribution growth in 2016, the stability and predictability of the Partnership’s cash flows, the Partnership’s financial flexibility, the intention of Energy Capital Partners to invest in our sponsor, Canadian oil sands growth expectations and pipeline capacity and timing, and expectations related to crude oil spreads and their impact on demand for crude by rail. These statements can be identified by the use of forward-looking terminology including “may,” “believe,” “will,” “expect,” “anticipate,” “estimate,” “continue,” or other similar words. These statements discuss future expectations, contain projections of results of operations or of financial condition, or state other “forward-looking” information. These forward-looking statements involve risks and uncertainties. When considering these forward- looking statements, you should keep in mind the risk factors and other cautionary statements in this presentation, which could cause our actual results to differ materially from those contained in any forward-looking statement. A forward-looking statement may include a statement of the assumptions or bases underlying the forward-looking statement. USDP believes that it has chosen these assumptions or bases in good faith and that they are reasonable. You are cautioned not to place undue reliance on any forward-looking statements. Except as required by law, USDP undertakes no obligation to revise or update any forward-looking statement. You should also understand that it is not possible to predict or identify all such factors and should not consider the following list to be a complete statement of all potential risks and uncertainties: Changes in general economic conditions; the effects of competitive conditions in our industry, in particular, by pipelines and other terminalling facilities; shut-downs or cutbacks at upstream production facilities, or refineries, petrochemical plants or other businesses to which we transport products; the supply of, and demand for, crude oil and biofuel rail terminalling services; our limited history as a separate public partnership; our ability to successfully implement our business plan; our ability to complete growth projects on time and on budget; operating hazards and other risks incidental to handling crude oil and biofuels that may not be fully covered by insurance; disruptions due to equipment interruption or failure at our facilities or third-party facilities on which our business is dependent; our ability to successfully identify and finance acquisitions and other growth opportunities; natural disasters, weather-related delays, casualty losses and other matters beyond our control; interest rates; labor relations; large customer defaults; change in availability and cost of capital; changes in tax status; changes in laws or regulations to which we are subject, including compliance with environmental and operational safety regulations that may increase our costs; changes in insurance markets impacting cost and the level and types of coverage available; disruptions due to equipment interruption or failure at our facilities or third-party facilities on which our business is dependent; the effects of future litigation; and the factors discussed in the “Risk Factors” section of the Partnership’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014, as updated by the Partnership’s subsequently filed Quarterly Reports on Form 10-Q, which are available to the public at the U.S. Securities and Exchange Commission’s website (www.sec.gov) and at the Partnership’s website (www.usdpartners.com). 2

Overview of USD Partners LP 3

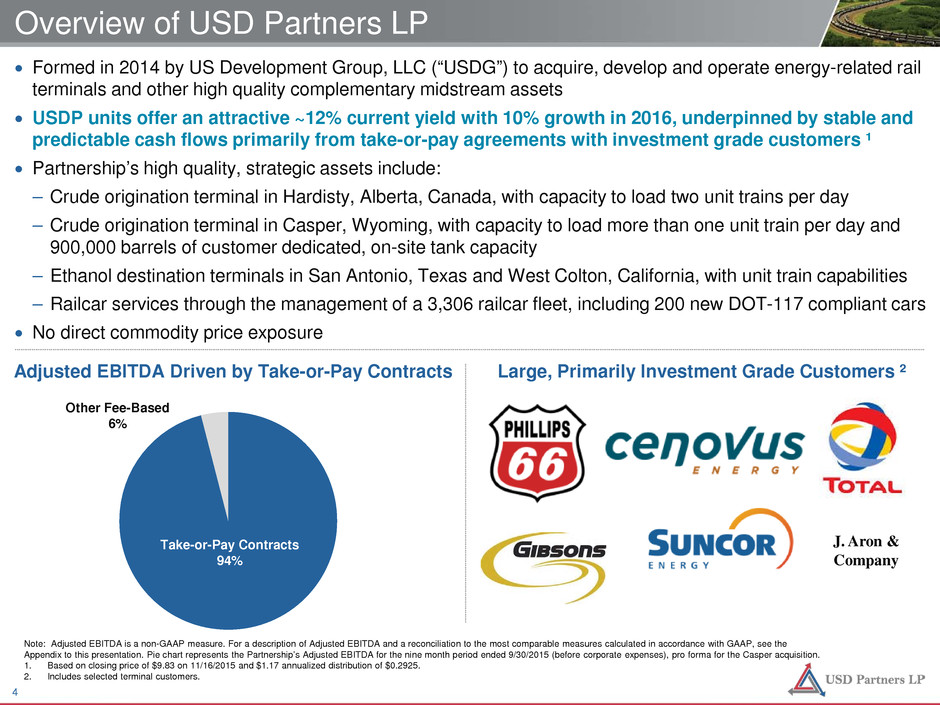

Overview of USD Partners LP • Formed in 2014 by US Development Group, LLC (“USDG”) to acquire, develop and operate energy-related rail terminals and other high quality complementary midstream assets • USDP units offer an attractive ~12% current yield with 10% growth in 2016, underpinned by stable and predictable cash flows primarily from take-or-pay agreements with investment grade customers ¹ • Partnership’s high quality, strategic assets include: – Crude origination terminal in Hardisty, Alberta, Canada, with capacity to load two unit trains per day – Crude origination terminal in Casper, Wyoming, with capacity to load more than one unit train per day and 900,000 barrels of customer dedicated, on-site tank capacity – Ethanol destination terminals in San Antonio, Texas and West Colton, California, with unit train capabilities – Railcar services through the management of a 3,306 railcar fleet, including 200 new DOT-117 compliant cars • No direct commodity price exposure Adjusted EBITDA Driven by Take-or-Pay Contracts Hardisty Crude Terminal 87% Note: Adjusted EBITDA is a non-GAAP measure. For a description of Adjusted EBITDA and a reconciliation to the most comparable measures calculated in accordance with GAAP, see the Appendix to this presentation. Pie chart represents the Partnership’s Adjusted EBITDA for the nine month period ended 9/30/2015 (before corporate expenses), pro forma for the Casper acquisition. 1. Based on closing price of $9.83 on 11/16/2015 and $1.17 annualized distribution of $0.2925. 2. Includes selected terminal customers. Large, Primarily Investment Grade Customers ² J. Aron & Company Other Fee-Based 6% Take-or-Pa ontracts 94% 4

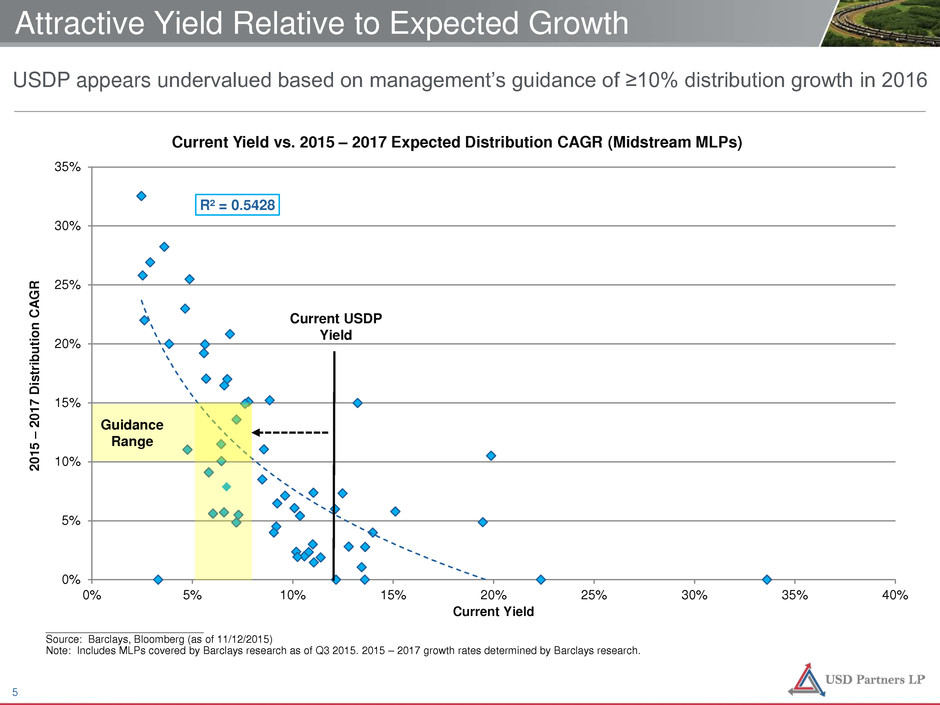

Current Yield vs. 2015 – 2017 Expected Distribution CAGR (Midstream MLPs) ___________________________ Source: Barclays, Bloomberg (as of 11/12/2015) Note: Includes MLPs covered by Barclays research as of Q3 2015. 2015 – 2017 growth rates determined by Barclays research. R² = 0.5428 0% 5% 10% 15% 20% 25% 30% 35% 0% 5% 10% 15% 20% 25% 30% 35% 40% 20 15 – 20 17 D is tr ib ut io n C A G R Current Yield USDP appears undervalued based on management’s guidance of ≥10% distribution growth in 2016 Attractive Yield Relative to Expected Growth Current USDP Yield Guidance Range 5

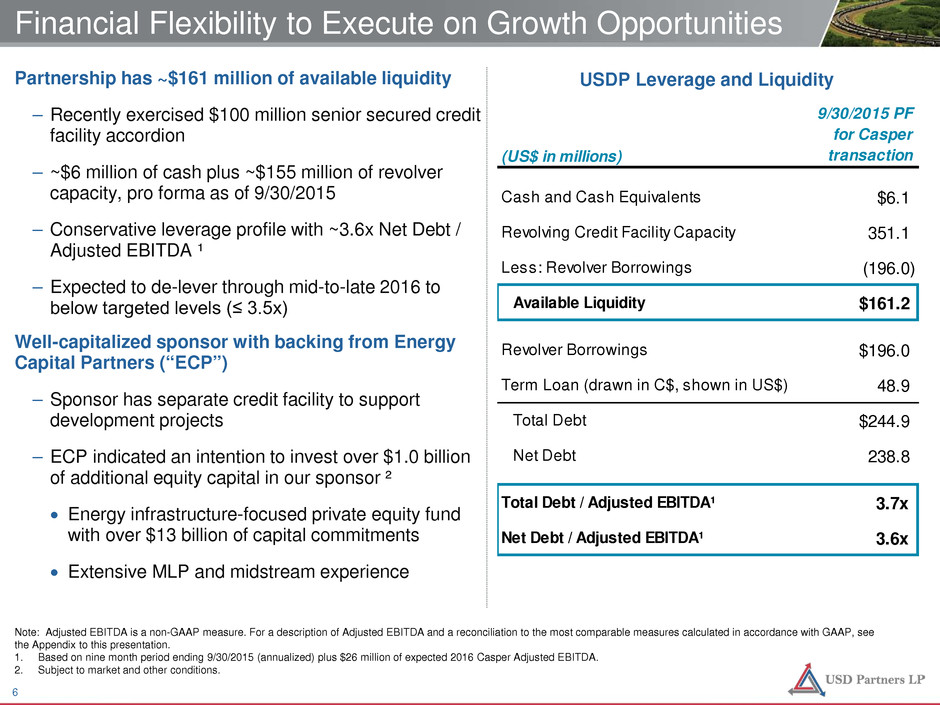

Partnership has ~$161 million of available liquidity – Recently exercised $100 million senior secured credit facility accordion – ~$6 million of cash plus ~$155 million of revolver capacity, pro forma as of 9/30/2015 – Conservative leverage profile with ~3.6x Net Debt / Adjusted EBITDA ¹ – Expected to de-lever through mid-to-late 2016 to below targeted levels (≤ 3.5x) Well-capitalized sponsor with backing from Energy Capital Partners (“ECP”) – Sponsor has separate credit facility to support development projects – ECP indicated an intention to invest over $1.0 billion of additional equity capital in our sponsor ² • Energy infrastructure-focused private equity fund with over $13 billion of capital commitments • Extensive MLP and midstream experience Financial Flexibility to Execute on Growth Opportunities USDP Leverage and Liquidity Note: Adjusted EBITDA is a non-GAAP measure. For a description of Adjusted EBITDA and a reconciliation to the most comparable measures calculated in accordance with GAAP, see the Appendix to this presentation. 1. Based on nine month period ending 9/30/2015 (annualized) plus $26 million of expected 2016 Casper Adjusted EBITDA. 2. Subject to market and other conditions. (US$ in millions) 9/30/2015 PF for Casper transaction Cash and Cash Equivalents $6.1 Revolving Credit Facility Capacity 351.1 Less: Revolver Borrowings (196.0) Available Liquidity $161.2 Revolver Borrowings $196.0 Term Loan (drawn in C$, shown in US$) 48.9 Total Debt $244.9 Net Debt 238.8 Total Debt / Adjusted EBITDA¹ 3.7x Net Debt / Adjusted EBITDA¹ 3.6x 6

Overview of Canadian Crude Oil Market 7

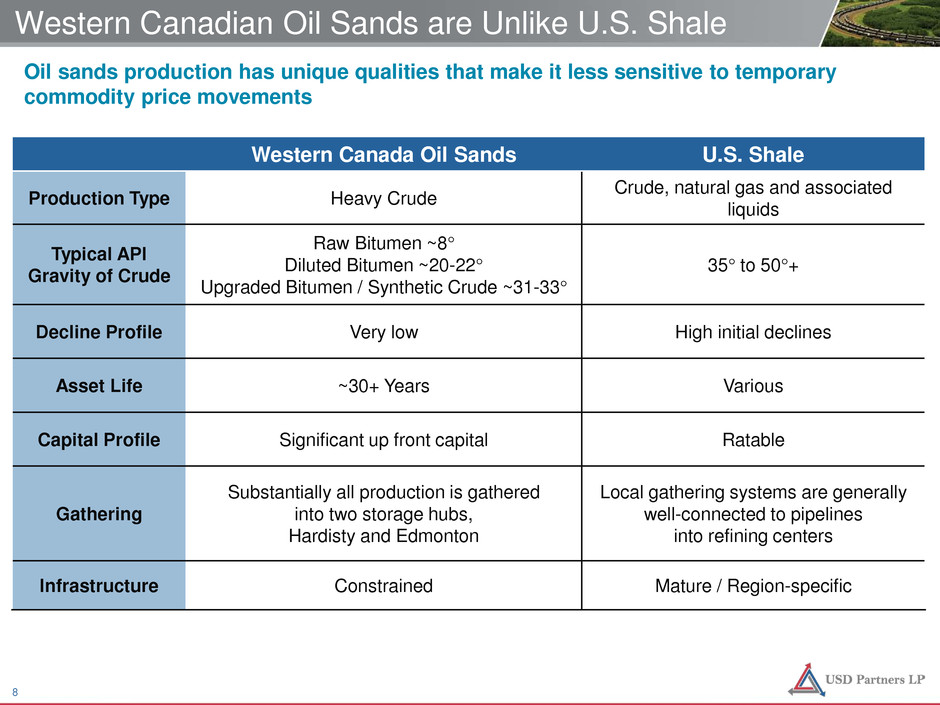

Western Canada Oil Sands U.S. Shale Production Type Heavy Crude Crude, natural gas and associated liquids Typical API Gravity of Crude Raw Bitumen ~8° Diluted Bitumen ~20-22° Upgraded Bitumen / Synthetic Crude ~31-33° 35° to 50°+ Decline Profile Very low High initial declines Asset Life ~30+ Years Various Capital Profile Significant up front capital Ratable Gathering Substantially all production is gathered into two storage hubs, Hardisty and Edmonton Local gathering systems are generally well-connected to pipelines into refining centers Infrastructure Constrained Mature / Region-specific Western Canadian Oil Sands are Unlike U.S. Shale Oil sands production has unique qualities that make it less sensitive to temporary commodity price movements 8

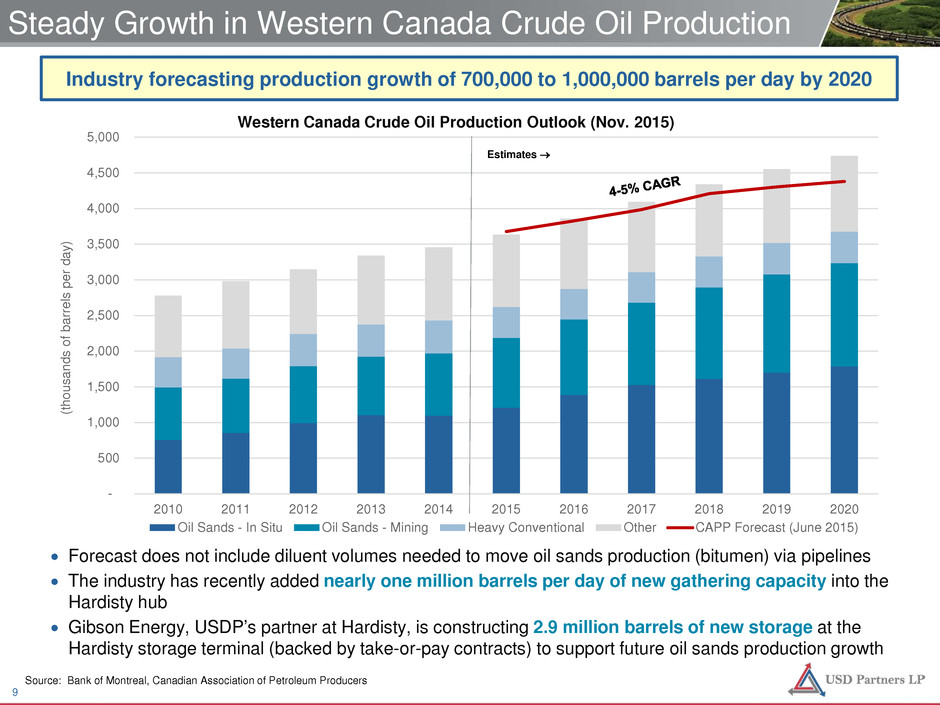

Steady Growth in Western Canada Crude Oil Production - 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 5,000 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 (th ou sa nd s of b ar re ls p er d ay ) Oil Sands - In Situ Oil Sands - Mining Heavy Conventional Other CAPP Forecast (June 2015) Source: Bank of Montreal, Canadian Association of Petroleum Producers Estimates → Industry forecasting production growth of 700,000 to 1,000,000 barrels per day by 2020 Western Canada Crude Oil Production Outlook (Nov. 2015) • Forecast does not include diluent volumes needed to move oil sands production (bitumen) via pipelines • The industry has recently added nearly one million barrels per day of new gathering capacity into the Hardisty hub • Gibson Energy, USDP’s partner at Hardisty, is constructing 2.9 million barrels of new storage at the Hardisty storage terminal (backed by take-or-pay contracts) to support future oil sands production growth 9

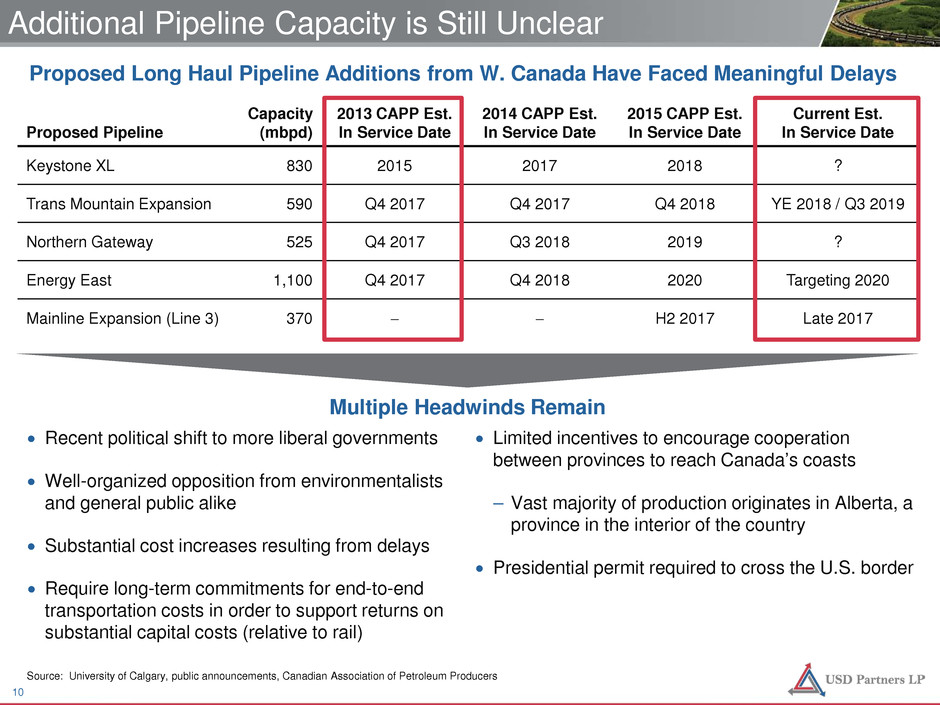

Additional Pipeline Capacity is Still Unclear Proposed Pipeline Capacity (mbpd) 2013 CAPP Est. In Service Date 2014 CAPP Est. In Service Date 2015 CAPP Est. In Service Date Current Est. In Service Date Keystone XL 830 2015 2017 2018 ? Trans Mountain Expansion 590 Q4 2017 Q4 2017 Q4 2018 YE 2018 / Q3 2019 Northern Gateway 525 Q4 2017 Q3 2018 2019 ? Energy East 1,100 Q4 2017 Q4 2018 2020 Targeting 2020 Mainline Expansion (Line 3) 370 − − H2 2017 Late 2017 Proposed Long Haul Pipeline Additions from W. Canada Have Faced Meaningful Delays Source: University of Calgary, public announcements, Canadian Association of Petroleum Producers • Recent political shift to more liberal governments • Well-organized opposition from environmentalists and general public alike • Substantial cost increases resulting from delays • Require long-term commitments for end-to-end transportation costs in order to support returns on substantial capital costs (relative to rail) Multiple Headwinds Remain • Limited incentives to encourage cooperation between provinces to reach Canada’s coasts – Vast majority of production originates in Alberta, a province in the interior of the country • Presidential permit required to cross the U.S. border 10

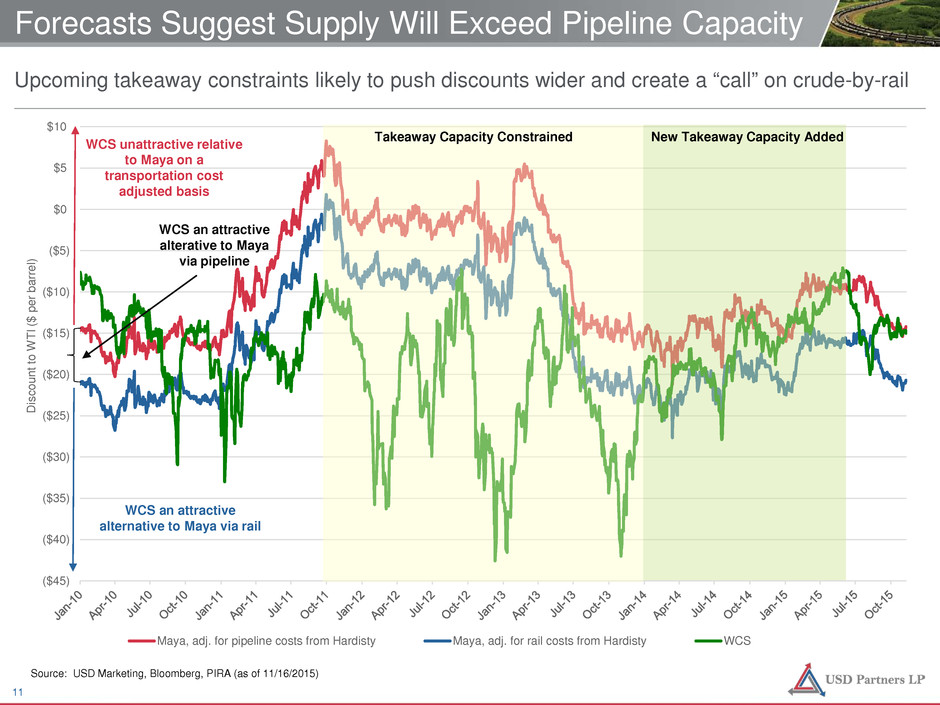

($45) ($40) ($35) ($30) ($25) ($20) ($15) ($10) ($5) $0 $5 $10 D is co un t t o W TI ($ p er b ar re l) Maya, adj. for pipeline costs from Hardisty Maya, adj. for rail costs from Hardisty WCS Forecasts Suggest Supply Will Exceed Pipeline Capacity Source: USD Marketing, Bloomberg, PIRA (as of 11/16/2015) Upcoming takeaway constraints likely to push discounts wider and create a “call” on crude-by-rail Takeaway Capacity Constrained New Takeaway Capacity Added WCS an attractive alterative to Maya via pipeline WCS an attractive alternative to Maya via rail WCS unattractive relative to Maya on a transportation cost adjusted basis 11

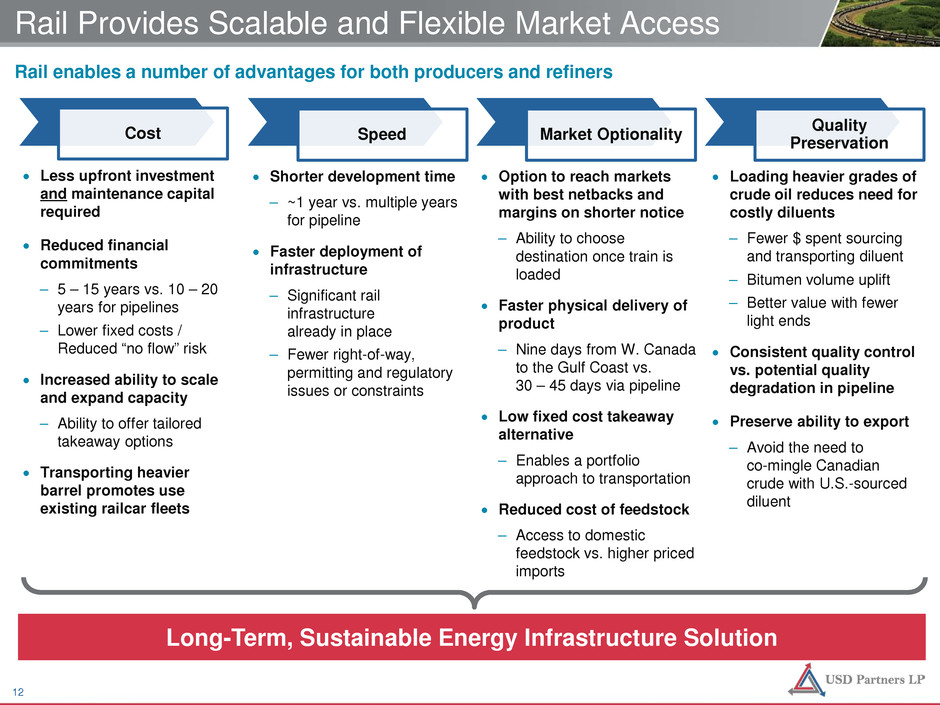

Rail enables a number of advantages for both producers and refiners Rail Provides Scalable and Flexible Market Access Long-Term, Sustainable Energy Infrastructure Solution Cost Speed Market Optionality Quality Preservation • Less upfront investment and maintenance capital required • Reduced financial commitments – 5 – 15 years vs. 10 – 20 years for pipelines – Lower fixed costs / Reduced “no flow” risk • Increased ability to scale and expand capacity – Ability to offer tailored takeaway options • Transporting heavier barrel promotes use existing railcar fleets • Shorter development time – ~1 year vs. multiple years for pipeline • Faster deployment of infrastructure – Significant rail infrastructure already in place – Fewer right-of-way, permitting and regulatory issues or constraints • Option to reach markets with best netbacks and margins on shorter notice – Ability to choose destination once train is loaded • Faster physical delivery of product – Nine days from W. Canada to the Gulf Coast vs. 30 – 45 days via pipeline • Low fixed cost takeaway alternative – Enables a portfolio approach to transportation • Reduced cost of feedstock – Access to domestic feedstock vs. higher priced imports • Loading heavier grades of crude oil reduces need for costly diluents – Fewer $ spent sourcing and transporting diluent – Bitumen volume uplift – Better value with fewer light ends • Consistent quality control vs. potential quality degradation in pipeline • Preserve ability to export – Avoid the need to co-mingle Canadian crude with U.S.-sourced diluent 12

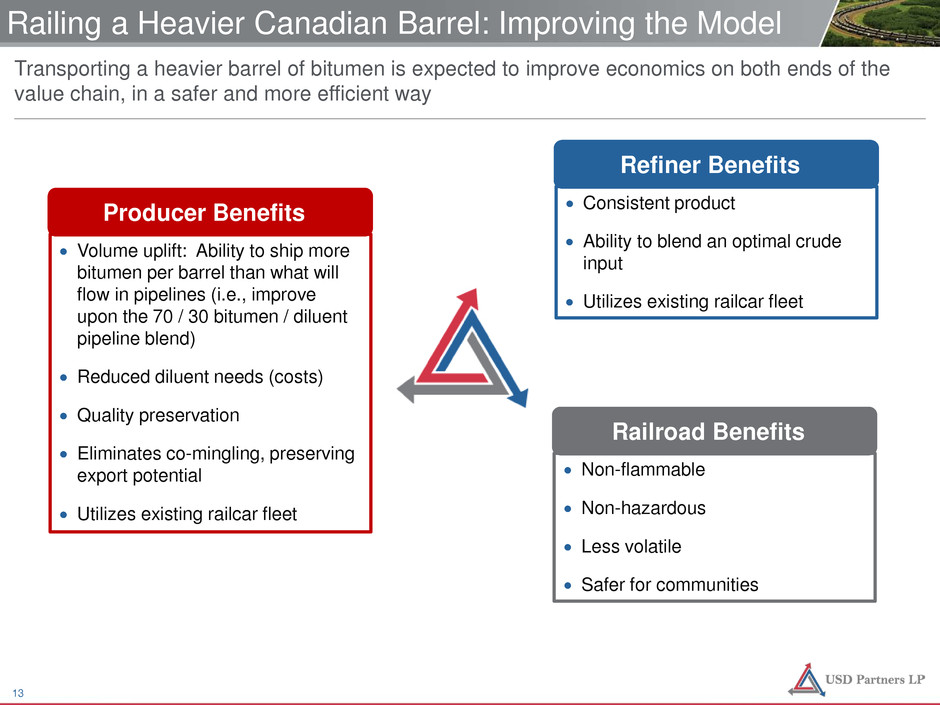

Railing a Heavier Canadian Barrel: Improving the Model Producer Benefits • Volume uplift: Ability to ship more bitumen per barrel than what will flow in pipelines (i.e., improve upon the 70 / 30 bitumen / diluent pipeline blend) • Reduced diluent needs (costs) • Quality preservation • Eliminates co-mingling, preserving export potential • Utilizes existing railcar fleet Railroad Benefits • Non-flammable • Non-hazardous • Less volatile • Safer for communities Refiner Benefits • Consistent product • Ability to blend an optimal crude input • Utilizes existing railcar fleet Transporting a heavier barrel of bitumen is expected to improve economics on both ends of the value chain, in a safer and more efficient way 13

Overview of USDP Assets 14

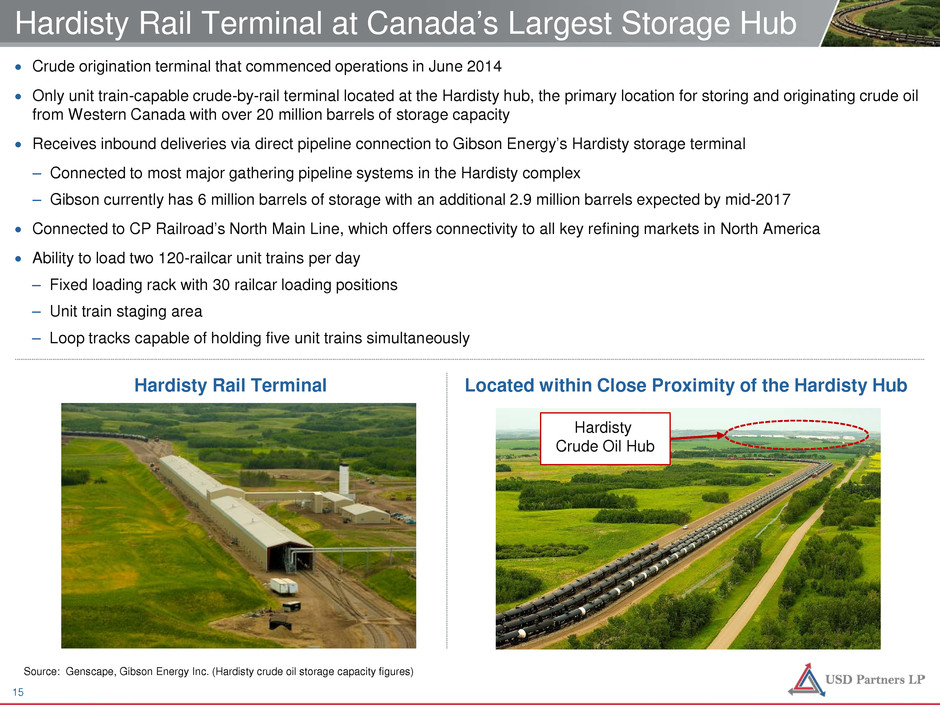

Hardisty Rail Terminal at Canada’s Largest Storage Hub • Crude origination terminal that commenced operations in June 2014 • Only unit train-capable crude-by-rail terminal located at the Hardisty hub, the primary location for storing and originating crude oil from Western Canada with over 20 million barrels of storage capacity • Receives inbound deliveries via direct pipeline connection to Gibson Energy’s Hardisty storage terminal – Connected to most major gathering pipeline systems in the Hardisty complex – Gibson currently has 6 million barrels of storage with an additional 2.9 million barrels expected by mid-2017 • Connected to CP Railroad’s North Main Line, which offers connectivity to all key refining markets in North America • Ability to load two 120-railcar unit trains per day – Fixed loading rack with 30 railcar loading positions – Unit train staging area – Loop tracks capable of holding five unit trains simultaneously Hardisty Rail Terminal Located within Close Proximity of the Hardisty Hub Hardisty Crude Oil Hub Source: Genscape, Gibson Energy Inc. (Hardisty crude oil storage capacity figures) 15

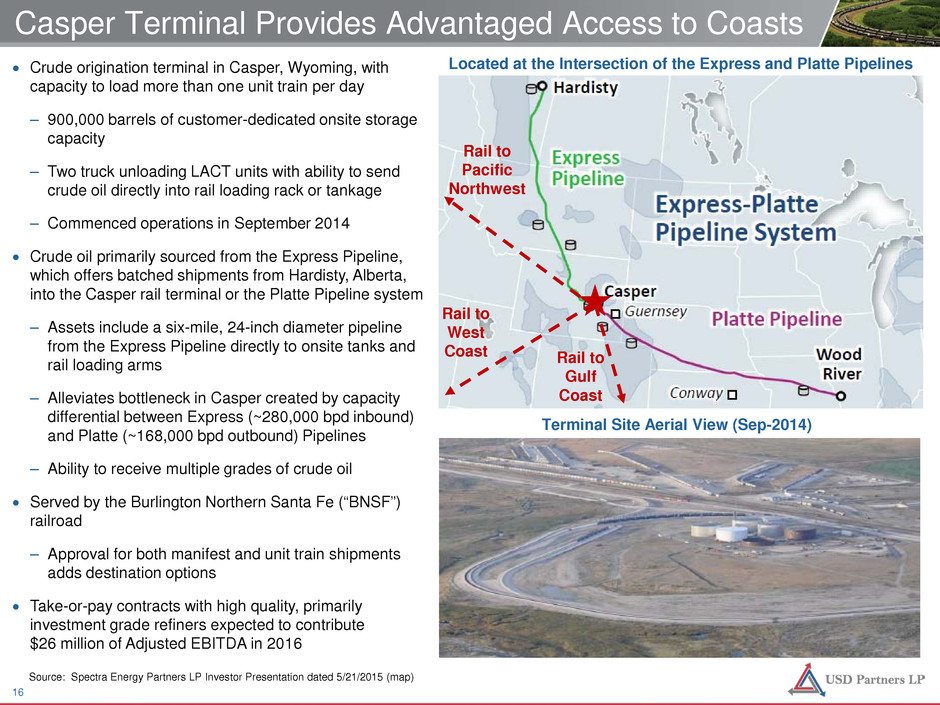

Casper Terminal Provides Advantaged Access to Coasts • Crude origination terminal in Casper, Wyoming, with capacity to load more than one unit train per day – 900,000 barrels of customer-dedicated onsite storage capacity – Two truck unloading LACT units with ability to send crude oil directly into rail loading rack or tankage – Commenced operations in September 2014 • Crude oil primarily sourced from the Express Pipeline, which offers batched shipments from Hardisty, Alberta, into the Casper rail terminal or the Platte Pipeline system – Assets include a six-mile, 24-inch diameter pipeline from the Express Pipeline directly to onsite tanks and rail loading arms – Alleviates bottleneck in Casper created by capacity differential between Express (~280,000 bpd inbound) and Platte (~168,000 bpd outbound) Pipelines – Ability to receive multiple grades of crude oil • Served by the Burlington Northern Santa Fe (“BNSF”) railroad – Approval for both manifest and unit train shipments adds destination options • Take-or-pay contracts with high quality, primarily investment grade refiners expected to contribute $26 million of Adjusted EBITDA in 2016 Located at the Intersection of the Express and Platte Pipelines Terminal Site Aerial View (Sep-2014) Source: Spectra Energy Partners LP Investor Presentation dated 5/21/2015 (map) Rail to West Coast Rail to Gulf Coast Rail to Pacific Northwest 16

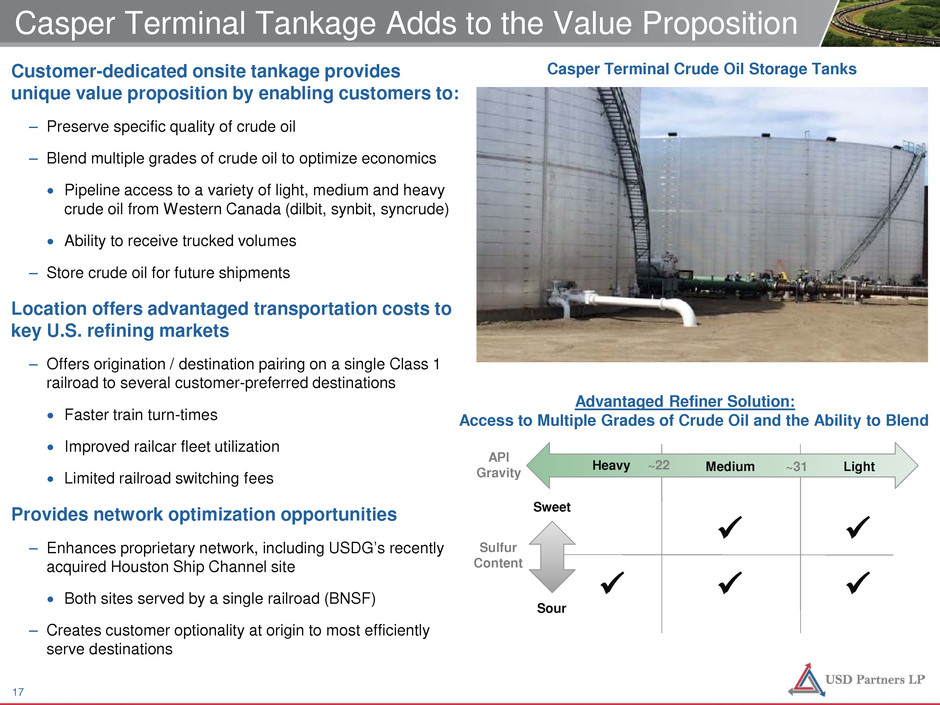

Customer-dedicated onsite tankage provides unique value proposition by enabling customers to: – Preserve specific quality of crude oil – Blend multiple grades of crude oil to optimize economics • Pipeline access to a variety of light, medium and heavy crude oil from Western Canada (dilbit, synbit, syncrude) • Ability to receive trucked volumes – Store crude oil for future shipments Location offers advantaged transportation costs to key U.S. refining markets – Offers origination / destination pairing on a single Class 1 railroad to several customer-preferred destinations • Faster train turn-times • Improved railcar fleet utilization • Limited railroad switching fees Provides network optimization opportunities – Enhances proprietary network, including USDG’s recently acquired Houston Ship Channel site • Both sites served by a single railroad (BNSF) – Creates customer optionality at origin to most efficiently serve destinations Casper Terminal Tankage Adds to the Value Proposition Advantaged Refiner Solution: Access to Multiple Grades of Crude Oil and the Ability to Blend Casper Terminal Crude Oil Storage Tanks ~22 ~31 API Gravity Heavy Medium Light Sulfur Content Sweet Sour 17

Selected Sponsor Development Projects 18

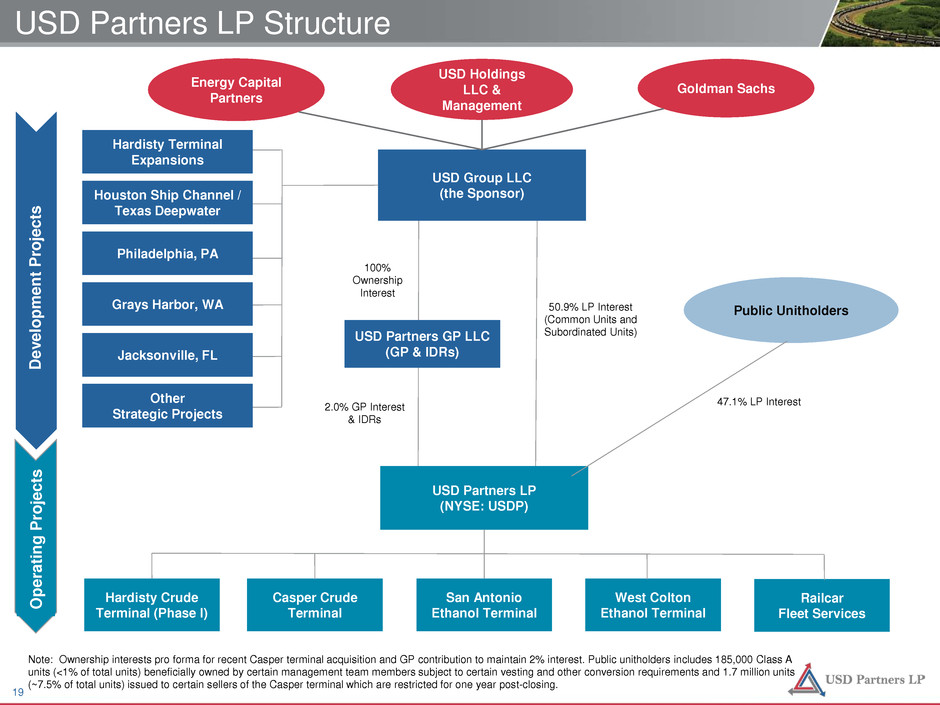

USD Partners LP Structure USD Group LLC (the Sponsor) USD Partners GP LLC (GP & IDRs) Public Unitholders Hardisty Crude Terminal (Phase I) San Antonio Ethanol Terminal West Colton Ethanol Terminal Railcar Fleet Services Hardisty Terminal Expansions 100% Ownership Interest 2.0% GP Interest & IDRs USD Partners LP (NYSE: USDP) Other Strategic Projects Energy Capital Partners USD Holdings LLC & Management Goldman Sachs 50.9% LP Interest (Common Units and Subordinated Units) Casper Crude Terminal D ev el op m en t P ro je ct s O pe ra tin g P ro je ct s Note: Ownership interests pro forma for recent Casper terminal acquisition and GP contribution to maintain 2% interest. Public unitholders includes 185,000 Class A units (<1% of total units) beneficially owned by certain management team members subject to certain vesting and other conversion requirements and 1.7 million units (~7.5% of total units) issued to certain sellers of the Casper terminal which are restricted for one year post-closing. Houston Ship Channel / Texas Deepwater Philadelphia, PA Grays Harbor, WA Jacksonville, FL 47.1% LP Interest 19

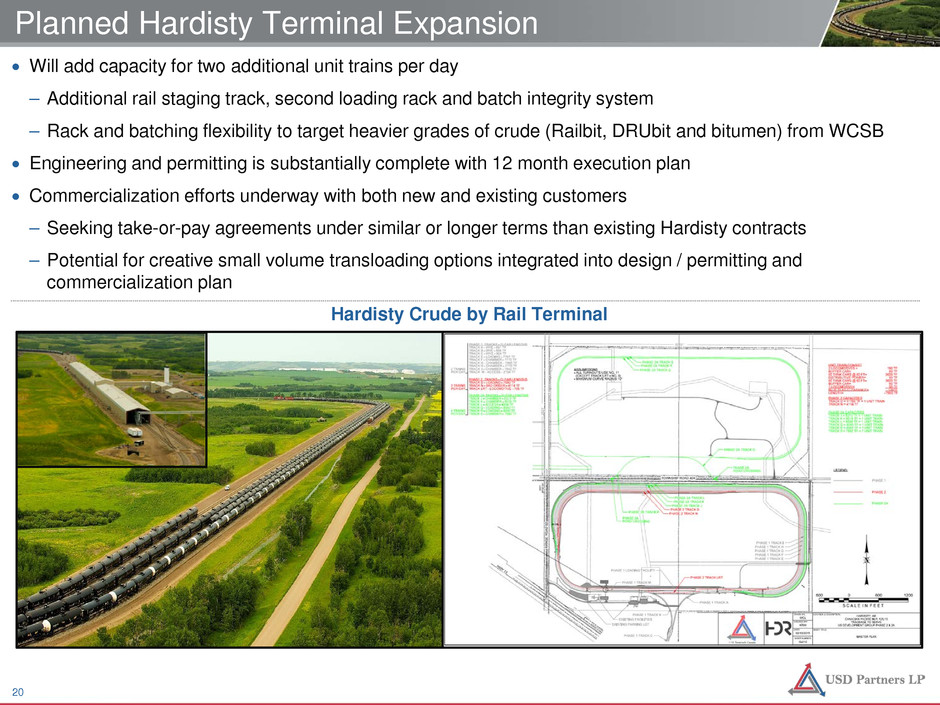

Planned Hardisty Terminal Expansion • Will add capacity for two additional unit trains per day – Additional rail staging track, second loading rack and batch integrity system – Rack and batching flexibility to target heavier grades of crude (Railbit, DRUbit and bitumen) from WCSB • Engineering and permitting is substantially complete with 12 month execution plan • Commercialization efforts underway with both new and existing customers – Seeking take-or-pay agreements under similar or longer terms than existing Hardisty contracts – Potential for creative small volume transloading options integrated into design / permitting and commercialization plan Hardisty Crude by Rail Terminal 20

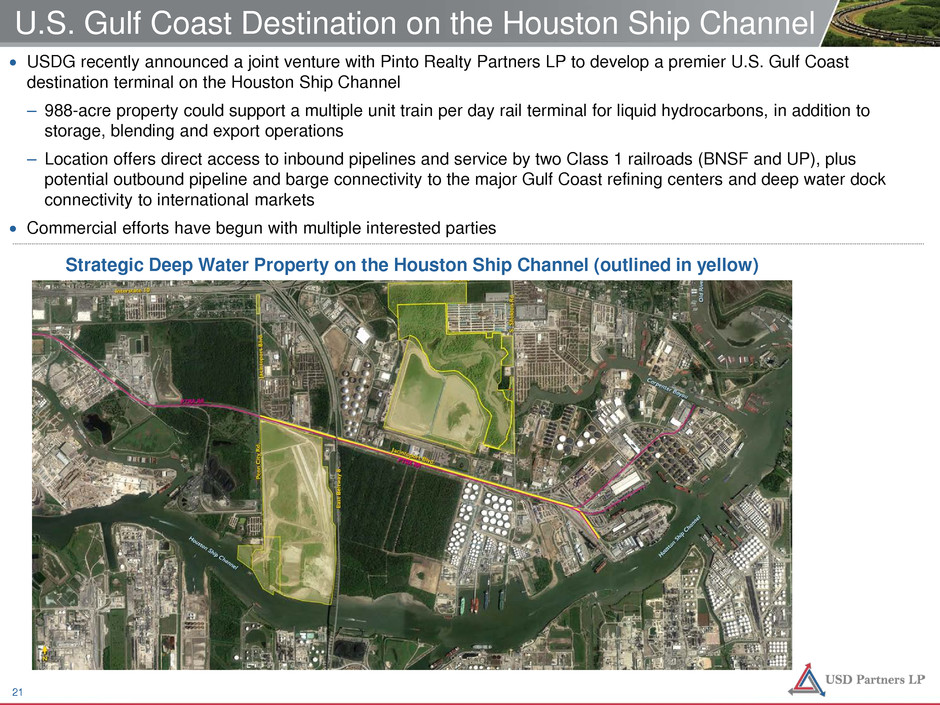

U.S. Gulf Coast Destination on the Houston Ship Channel Strategic Deep Water Property on the Houston Ship Channel (outlined in yellow) • USDG recently announced a joint venture with Pinto Realty Partners LP to develop a premier U.S. Gulf Coast destination terminal on the Houston Ship Channel – 988-acre property could support a multiple unit train per day rail terminal for liquid hydrocarbons, in addition to storage, blending and export operations – Location offers direct access to inbound pipelines and service by two Class 1 railroads (BNSF and UP), plus potential outbound pipeline and barge connectivity to the major Gulf Coast refining centers and deep water dock connectivity to international markets • Commercial efforts have begun with multiple interested parties 21

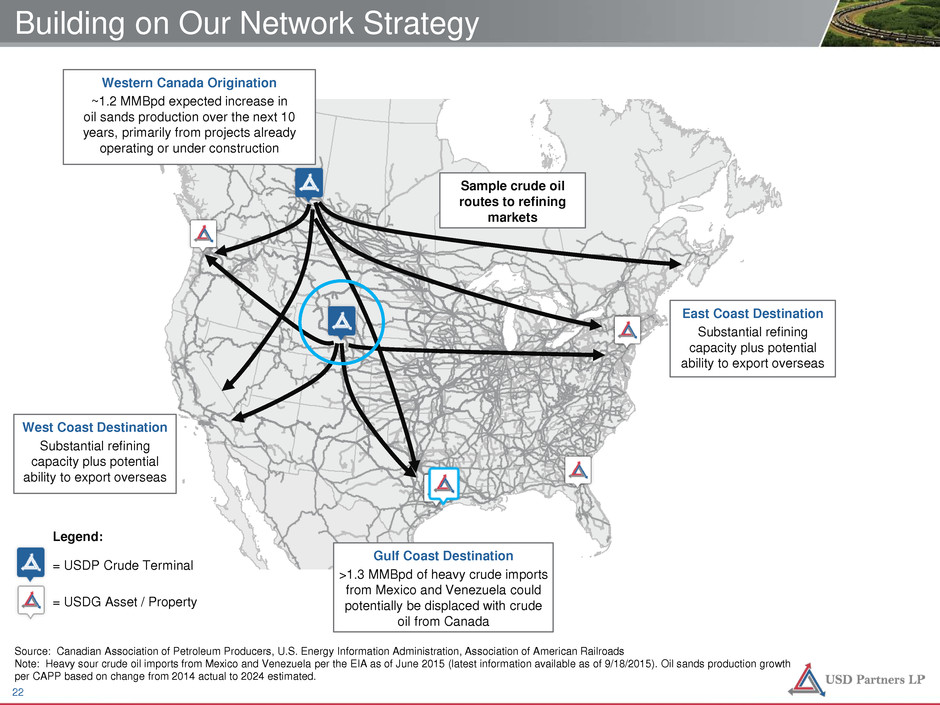

Building on Our Network Strategy Source: Canadian Association of Petroleum Producers, U.S. Energy Information Administration, Association of American Railroads Note: Heavy sour crude oil imports from Mexico and Venezuela per the EIA as of June 2015 (latest information available as of 9/18/2015). Oil sands production growth per CAPP based on change from 2014 actual to 2024 estimated. Western Canada Origination ~1.2 MMBpd expected increase in oil sands production over the next 10 years, primarily from projects already operating or under construction East Coast Destination Substantial refining capacity plus potential ability to export overseas West Coast Destination Substantial refining capacity plus potential ability to export overseas Gulf Coast Destination >1.3 MMBpd of heavy crude imports from Mexico and Venezuela could potentially be displaced with crude oil from Canada Legend: = USDP Crude Terminal = USDG Asset / Property Sample crude oil routes to refining markets 22

Partnership Highlights Relationship with Sponsor & ECP Strategically Located Assets Stable and Predictable Cash Flows Multiple Growth Levers Financial Flexibility 23

Appendix 24

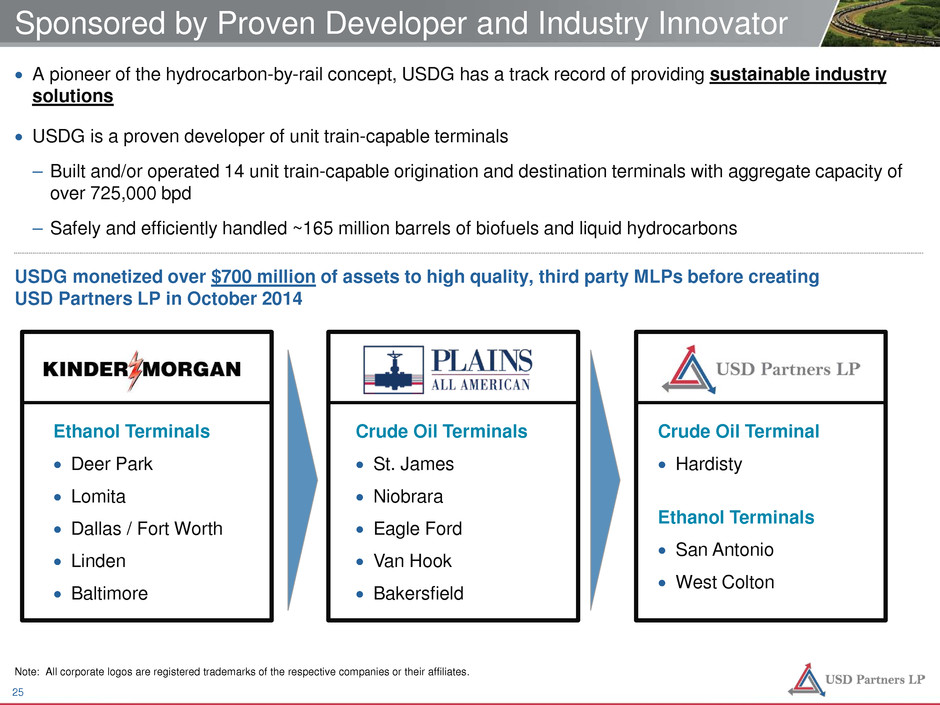

• A pioneer of the hydrocarbon-by-rail concept, USDG has a track record of providing sustainable industry solutions • USDG is a proven developer of unit train-capable terminals – Built and/or operated 14 unit train-capable origination and destination terminals with aggregate capacity of over 725,000 bpd – Safely and efficiently handled ~165 million barrels of biofuels and liquid hydrocarbons Sponsored by Proven Developer and Industry Innovator USDG monetized over $700 million of assets to high quality, third party MLPs before creating USD Partners LP in October 2014 Ethanol Terminals • Deer Park • Lomita • Dallas / Fort Worth • Linden • Baltimore Crude Oil Terminals • St. James • Niobrara • Eagle Ford • Van Hook • Bakersfield Crude Oil Terminal • Hardisty Ethanol Terminals • San Antonio • West Colton Note: All corporate logos are registered trademarks of the respective companies or their affiliates. 25

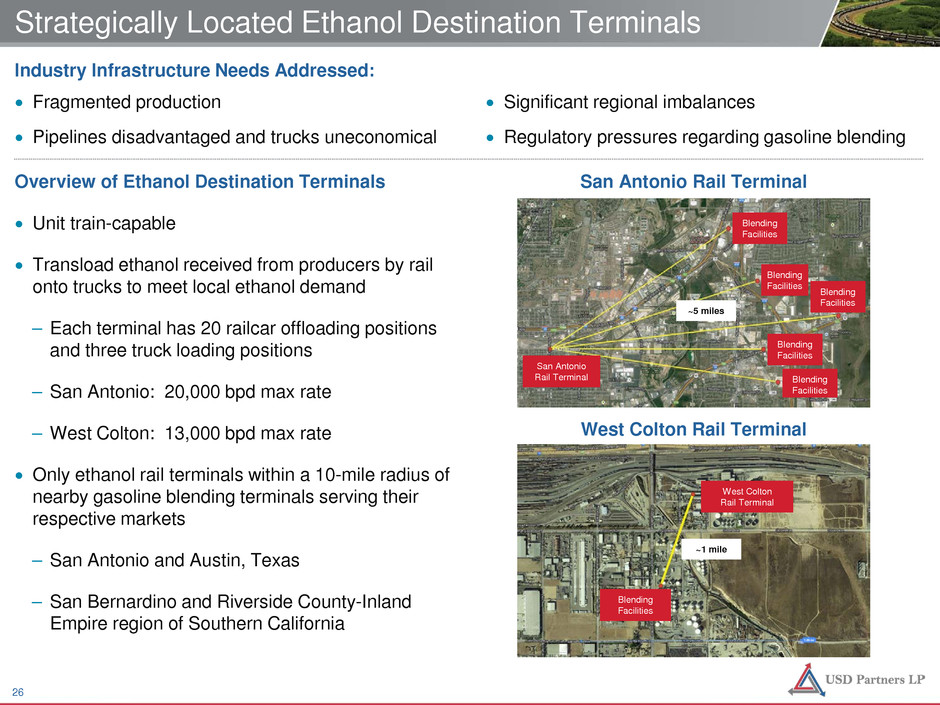

West Colton Rail Terminal Blending Facilities Strategically Located Ethanol Destination Terminals Industry Infrastructure Needs Addressed: • Fragmented production • Pipelines disadvantaged and trucks uneconomical • Significant regional imbalances • Regulatory pressures regarding gasoline blending Overview of Ethanol Destination Terminals • Unit train-capable • Transload ethanol received from producers by rail onto trucks to meet local ethanol demand – Each terminal has 20 railcar offloading positions and three truck loading positions – San Antonio: 20,000 bpd max rate – West Colton: 13,000 bpd max rate • Only ethanol rail terminals within a 10-mile radius of nearby gasoline blending terminals serving their respective markets – San Antonio and Austin, Texas – San Bernardino and Riverside County-Inland Empire region of Southern California San Antonio Rail Terminal San Antonio Rail Terminal Blending Facilities Blending Facilities Blending Facilities Blending Facilities Blending Facilities West Colton Rail Terminal ~1 mile ~5 miles 26

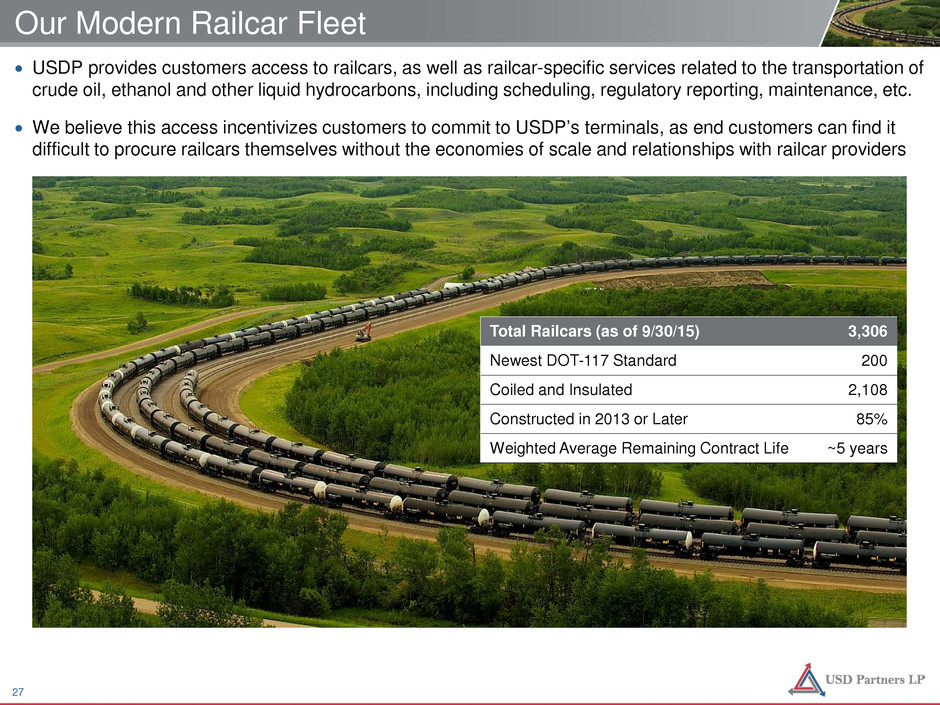

• USDP provides customers access to railcars, as well as railcar-specific services related to the transportation of crude oil, ethanol and other liquid hydrocarbons, including scheduling, regulatory reporting, maintenance, etc. • We believe this access incentivizes customers to commit to USDP’s terminals, as end customers can find it difficult to procure railcars themselves without the economies of scale and relationships with railcar providers Our Modern Railcar Fleet Total Railcars (as of 9/30/15) 3,306 Newest DOT-117 Standard 200 Coiled and Insulated 2,108 Constructed in 2013 or Later 85% Weighted Average Remaining Contract Life ~5 years 27

We are committed to safe, efficient and reliable operations that comply with environmental and safety regulations • All USDP facilities meet or exceed all government health and safety regulations • USDG has been nationally recognized by the National Safety Council for having an outstanding safety record for the last nine years • USDG has won numerous safety awards from Class 1 railroads • USDG has loaded and / or handled ~165 MMbbls of biofuels and liquid hydrocarbons without a DOT/PHMSA recordable spill at any of its facilities • There has not been a “lost time injury” at any USDP facility for the past seven years • All USDP facilities have achieved a total recordable injury rate of zero for the past two years Strong Safety Record Distinguishes USD in the Marketplace 28

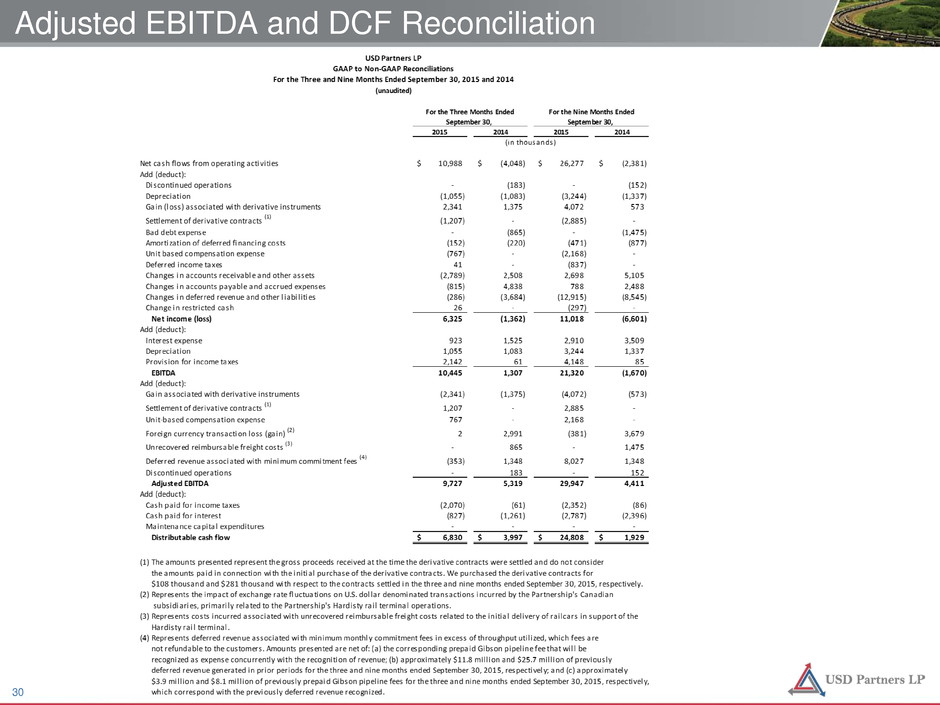

Non-GAAP Measures We define Adjusted EBITDA as net income before depreciation and amortization, interest and other income, interest and other expense, unrealized gains and losses associated with derivative instruments, foreign currency transaction gains and losses, income taxes, non-cash expense related to our equity compensation programs, discontinued operations, adjustments related to deferred revenue associated with minimum monthly commitment fees and other items which management does not believe reflect the underlying performance of our business. We define Distributable Cash Flow as Adjusted EBITDA less net cash paid for interest, income taxes and maintenance capital expenditures. Distributable Cash Flow does not reflect changes in working capital balances. Adjusted EBITDA and Distributable Cash Flow are both non-GAAP, supplemental financial measures used by management and by external users of our financial statements, such as investors and commercial banks, to assess: • our operating performance as compared to those of other companies in the midstream sector, without regard to financing methods, historical cost basis or capital structure; • the ability of our assets to generate sufficient cash flow to make distributions to our partners; • our ability to incur and service debt and fund capital expenditures; and • the viability of acquisitions and other capital expenditure projects and our ability to generate incremental cash flows from these opportunities. We believe that the presentation of Adjusted EBITDA and Distributable Cash Flow provides information useful to investors in assessing our financial condition and results of operations. We believe that the presentation of Adjusted EBITDA and Distributable Cash Flow information also enhances investor understanding of our business’ ability to generate cash for payment of distributions and other purposes. The GAAP measures most directly comparable to Adjusted EBITDA are Net Income and Cash Flow from Operating Activities. Adjusted EBITDA should not be considered an alternative to Net Income, Cash Flow from Operating Activities or any other measure of financial performance or liquidity presented in accordance with GAAP. Adjusted EBITDA excludes some, but not all, items that affect Net Income, and these measures may vary among other companies. As a result, Adjusted EBITDA and Distributable Cash Flow may not be comparable to similarly titled measures of other companies. 29

Adjusted EBITDA and DCF Reconciliation 30

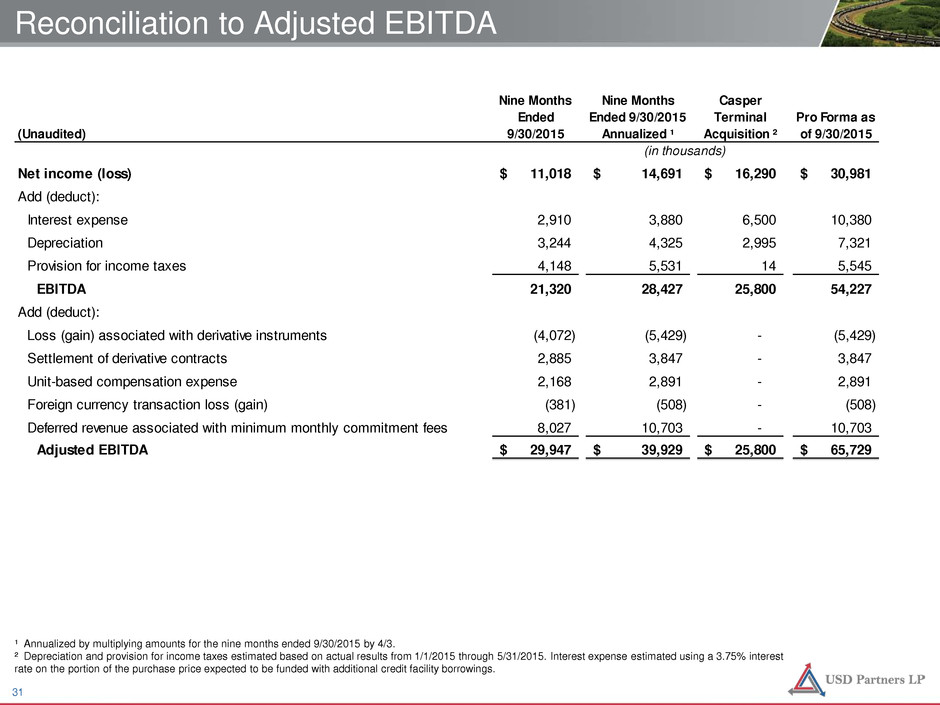

Reconciliation to Adjusted EBITDA ¹ Annualized by multiplying amounts for the nine months ended 9/30/2015 by 4/3. ² Depreciation and provision for income taxes estimated based on actual results from 1/1/2015 through 5/31/2015. Interest expense estimated using a 3.75% interest rate on the portion of the purchase price expected to be funded with additional credit facility borrowings. (Unaudited) Nine Months Ended 9/30/2015 Nine Months Ended 9/30/2015 Annualized ¹ Casper Terminal Acquisition ² Pro Forma as of 9/30/2015 Net income (loss) 11,018$ 14,691$ 16,290$ 30,981$ Add (deduct): Interest expense 2,910 3,880 6,500 10,380 Depreciation 3,244 4,325 2,995 7,321 Provision for income taxes 4,148 5,531 14 5,545 EBITDA 21,320 28,427 25,800 54,227 Add (deduct): Loss (gain) associated with derivative instruments (4,072) (5,429) - (5,429) Settlement of derivative contracts 2,885 3,847 - 3,847 Unit-based compensation expense 2,168 2,891 - 2,891 Foreign currency transaction loss (gain) (381) (508) - (508) Deferred revenue associated with minimum monthly commitment fees 8,027 10,703 - 10,703 Adjusted EBITDA 29,947$ 39,929$ 25,800$ 65,729$ (in thousands) 31