Attached files

| file | filename |

|---|---|

| 8-K - 8-K INVESTER PRESENTATION NOV 18-19 2015 - POTLATCHDELTIC CORP | a8-kpresentationnov18x1920.htm |

November 2015 Investor Presentation Mike Covey Chairman & Chief Executive Officer Jerry Richards Vice President & Chief Financial Officer

Forward-Looking Statement & Non-GAAP Measures FORWARD-LOOKNG STATEMENTS This presentation contains certain forward-looking statements within the meaning of the Private Litigation Reform Act of 1995 as amended, including without limitation, statements about long-term economic fundamentals and future company performance, the company’s business model, performance of mills after 2015 high-return capital spending, opportunity to sell timberlands at high private market value and repurchase shares at a deep discount, annual production of lumber and plywood, direction of markets and the economy, forecast of U.S. housing starts, forecast U.S. lumber consumption, forecast U.S. lumber supply, ability to increase or decrease harvest volume to meet market conditions, expectation that incremental lumber production will come from the South; manufacturer investments in the South, effect of increased manufacturing in the South on lumber prices, effect of increased sawlog prices on EBITDDA in the North and South regions, effect of increased lumber prices on EBITDDA, expected harvest level range over the next 15 years and beyond, forecast North American log and lumber exports to China, log, lumber and panel price trends, effect of mountain pine beetle and allowable cut on Canadian supply, forecast of Canadian lumber production, expectation that will sell 20,000 acres of real estate annually, debt maturities, refinancing of 2015 and 2016 debt maturities, cash flows, management of timberlands to maximize net present value and while maintaining sustainability over the long-term, real estate value opportunities, real estate business potential and land development potential, and similar matters. These forward-looking statements are based on current expectations, estimates, assumptions and projections that are subject to change, and actual results may differ materially from the forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, changes in timberland values; changes in timber harvest levels on the company’s lands; changes in timber prices; changes in policy regarding governmental timber sales; changes in the United States and international economies; changes in U.S. job growth; changes in U.S. bank lending practices; changes in the level of domestic construction activity; changes in international tariffs, quotas and trade agreements involving wood products; changes in domestic and international demand for wood products; changes in production and production capacity in the forest products industry; competitive pricing pressures for the company’s products; unanticipated manufacturing disruptions; changes in general and industry-specific environmental laws and regulations; unforeseen environmental liabilities or expenditures; weather conditions; changes in fuel and energy costs; changes in raw material and other costs; the ability to satisfy complex rules in order to remain qualified as a REIT; changes in tax laws that could reduce the benefits associated with REIT status; and other risks and uncertainties described from time to time in the company’s public filings with the Securities and Exchange Commission. All forward-looking statements are made as of the date of this presentation, and the company does not undertake to update any forward-looking statements. NON-GAAP MEASURES This presentation presents non-U.S. GAAP financial information. A reconciliation of those numbers to U.S. GAAP is included in this presentation which is available on the company’s website at www.potlatchcorp.com. Investor Presentation 2

Potlatch Highlights Investor Presentation 3 Timber REIT best positioned to capitalize on the housing recovery • Highest leverage to lumber prices of timber REITs • Long-term economic fundamentals are positive Geographically diverse, high-quality timberlands • Largest private landowner in Idaho • Southern timberlands well positioned to supply incremental wood needed as housing recovers Low-risk, high-margin, real estate sales • Sell non-core timberlands at attractive multiples • Core activity is sale of undeveloped rural, recreational real estate Top 10 U.S. lumber manufacturer • Mills are well positioned as a result of high-return capital spending in 2015 Return cash to shareholders • Dividend has grown over 20% in last 2 years and currently yields 4.5%(1) • Opportunity to sell timberlands at high private market values and repurchase shares at deep discount (1) Based on November 9, 2015 closing stock price of $33.08 per share

Potlatch Portfolio Investor Presentation 4 • We’ve grown our dividend 20% the last two years • Our current dividend yield is 4.8% We own ~ 1.6 million acres of certified timberland and are a top 10 lumber manufacturer in the U.S. Idaho 791,000 Arkansas 413,000 Minnesota 170,000 Mississippi 100,000 Alabama 99,000 TOTAL: 1,573,000 Timberlands

Resource: Segment Overview • Increased EBITDDA driven by recovery of Northern sawlog prices • Southern pine sawlog prices have not yet recovered • Increase in Southern sawlog averages prices are result of increased mix of hardwood • At current volumes, a $10/ton change in sawlog prices ~ • $20 million in annual EBITDDA in North • $10 million in annual EBITDDA in South (1) Non-GAAP measure – see slide 21 for reconciliation (2) Delivered basis Investor Presentation 5 $77 $66 $92 $103 $110 $73 $75 $85 $91 $90 $42 $42 $43 $46 $45 2011 2012 2013 2014 LTM EBITDDA in millions(1) Northern Sawlog price per ton(2) Southern Sawlog price per ton(2) Resource is a stable & significant source of cash RESOURCE PERFORMANCE

Resource: Long-Term Harvest Profile Investor Presentation 6 3.6 3.7 3.6 4.5 2012A 2013A 2014A 2015F 4.0 Min. 4.0 Min. 4.0 Min. 4.1 Min. 4.5 Min.4.8 Max. 4.8 Max. 4.8 Max. 4.9 Max. 5.5 Max. 2016-2019 2020-2024 2025-2029 2030-2064 Long-Term Potential (2065+) ANNUAL HARVEST (millions of tons) PROJECTED AVERAGE ANNUAL HARVEST RANGE (millions of tons) Our strategy is to maximize net present value while managing our timberlands sustainability over the long-term

Real Estate Business Part of our ownership is worth more for uses other than growing trees. Parcels are segmented by product, then competitively marketed for sale at the highest overall price. We expect to sell about 20,000 acres annually. Investor Presentation 7 2015 Land Base Value Optimization Strategic Management / Long- Term Ownership Sell Parcels for Values Greater than Timberland Values HBU Development 80,000 acres Rural Real Estate 140,000 acres Non-Strategic Timberlands 80,000 acres $2,100* / acre $1,200* / acre $800* / acre CORE Timberland 1.3 million acres * Historical average of the last two years

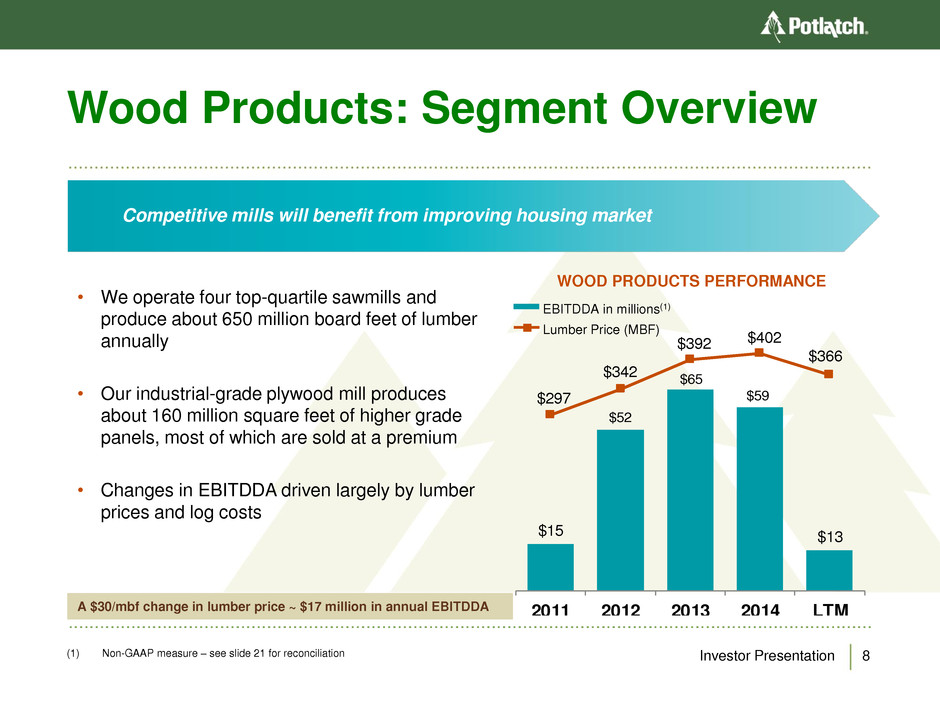

Wood Products: Segment Overview • We operate four top-quartile sawmills and produce about 650 million board feet of lumber annually • Our industrial-grade plywood mill produces about 160 million square feet of higher grade panels, most of which are sold at a premium • Changes in EBITDDA driven largely by lumber prices and log costs A $30/mbf change in lumber price ~ $17 million in annual EBITDDA (1) Non-GAAP measure – see slide 21 for reconciliation Investor Presentation 8 $15 $52 $65 $59 $13 $297 $342 $392 $402 $366 2011 2012 2013 2014 LTM EBITDDA in millions(1) Lumber Price (MBF) Competitive mills will benefit from improving housing market WOOD PRODUCTS PERFORMANCE

0 500 1,000 1,500 2,000 2,500 00 02 04 06 08 10 12 14 16 U.S. Housing Starts & Lumber Demands are Increasing (1) Source: U.S. Census Bureau (2) Forecast based on average of 8 different economic forecasting firms Investor Presentation 9 Forecast(2) Actual(1) 0 5 10 15 20 25 30 35 40 45 00 03 06 09 12 15 South Coast Inland Other • U.S. housing starts are recovering to long-term trend • The incremental wood needed to supply increasing demand will come from the U.S. South U.S. HOUSING STARTS (in thousands) U.S. LUMBER SUPPLY – RISI (billion board feet) Average Starts Since 1970: 1.5 million Forecast

Southern Sawlog Price Source: USDA, WWPA, Timber Mart-South Investor Presentation 10 $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 0 2 4 6 8 10 12 14 16 18 20 P in e S a w ti m b e r S tu m p a g e , $ /t o n ( n o m in a l) L u m b e r P ro d u c tio n , B ill io n B o a rd Fe e t US South Soft Lumber Production US South Pine Sawtimber Price Southern sawlog prices are well below trend levels SOUTHERN PINE SAWTIMBER STUMPAGE PRICE VS. LUMBER PRODUCTION

INCREASING Investments in our Southern Wood Baskets Investor Presentation 11 Manufacturers are investing in our Southern wood baskets, which will translate to higher sawlog prices. Our Southern wood baskets have more price upside than other parts of the South. Source: Forest2Market Source: Public Announcements & Internal Research PINE SAWLOG PRICE CHANGE (2010 TO 2014) Substantial Price Decrease Substantial Price Increase Change Descriptions

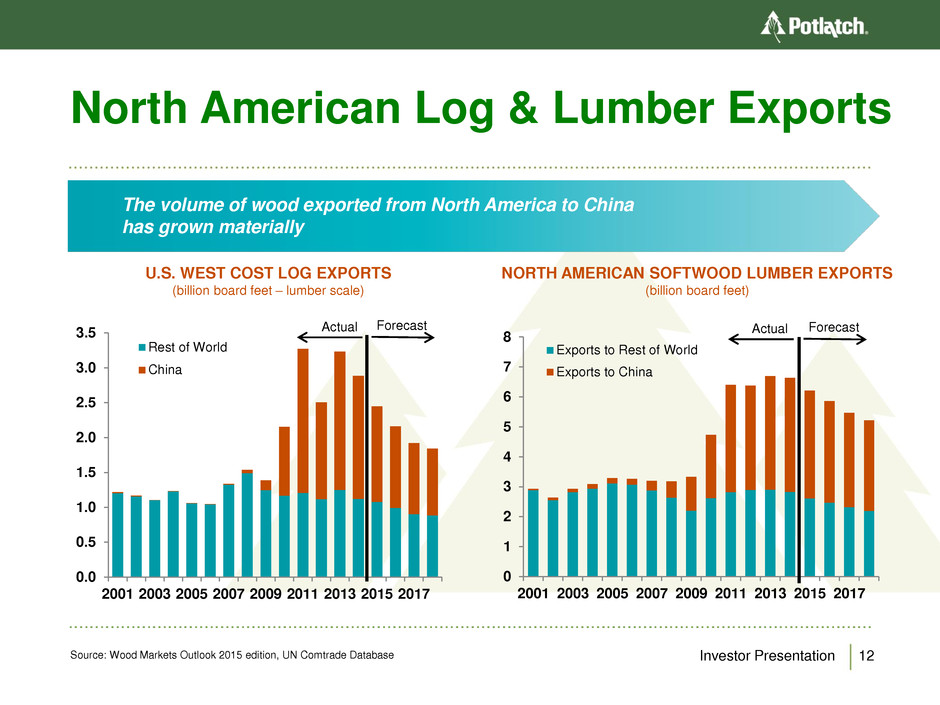

0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 2001 2003 2005 2007 2009 2011 2013 2015 2017 Rest of World China 0 1 2 3 4 5 6 7 8 2001 2003 2005 2007 2009 2011 2013 2015 2017 Exports to Rest of World Exports to China North American Log & Lumber Exports Source: Wood Markets Outlook 2015 edition, UN Comtrade Database Investor Presentation 12 The volume of wood exported from North America to China has grown materially U.S. WEST COST LOG EXPORTS (billion board feet – lumber scale) NORTH AMERICAN SOFTWOOD LUMBER EXPORTS (billion board feet) Forecast Actual Forecast Actual

Canada’s Ability to Supply Lumber is Constrained Source: Wood Markets Outlook 2015 edition Investor Presentation 13 0 5 10 15 20 25 30 35 40 2000 2002 2004 2006 2008 2010 2012 2014 2016F 2018F British Columbia Rest of Canada Actual Forecast ≈10 billion board feet Canadian supply has declined about 10 billion board feet due to the mountain pine beetle and a reduction in allowable cut CANADA SOFTWOOD LUMBER PRODUCTION (billion board feet)

Capital Structure Investor Presentation 14 Amounts as of September 30, 2015: Unaudited, $ in millions Market capitalization(1) $1,346 Net debt(2) 629 Enterprise Value $1,975 Net debt to enterprise value 32% Consolidated leverage ratio(3) 25% Interest coverage ratio(4) 3.86 Weighted average cost of debt(5) 4.2% (1) Market capitalization is as of November 9, 2015 (2) Net debt is reconciled on slide 22 and defined on slide 23 (3) Consolidated leverage ratio is defined on slide 23 and is limited to 40% (4) Interest coverage ratio is defined on slide 23 and is required to be at least 3.00x (5) Weighted average cost of debt is net of income taxes • $234 million is available on our revolver • Maturity: February 2020 • Accordion: $250 million • We have flexibility within loan covenants • We plan to refinance the 2015 and 2016 maturities at attractive rates $23 $5 $11 $14 $190 2015 2016 2017 2018 2019 DEBT MATURITIES FOR THE NEXT FIVE YEARS (in millions)

Dividend History Investor Presentation 15 (1) The dividend was increased in 13% in Q4 2013 and 7% in Q4 2014 (2) Based on November 9, 2015 closing stock price of $33.08 per share (3) Funds Available for Distribution is reconciled on slide 22 and defined on slide 23 (4) Dividend is reflected at current annual rate of $1.50 per share, not an LTM basis $53 $77 $98 $55 $50 $52 $58 $61 2012 2013 2014 LTM FAD Dividend Distribution FUNDS AVAILABLE FOR DISTRIBUTION(3) (in millions) $1.24 $1.28 $1.425 $1.475 2012 2013 2014 LTM DIVIDEND PAID PER SHARE (dollar per share) • We’ve grown our dividend 20% the last two years(1) • Our current dividend yield is 4.5%(2) (4) (4)

Share Repurchase Source: RISI Timberland Sales database; ERA – Timberland Transactions; Timber Mart-South; Industry Intelligence. Investor Presentation 16 The current dislocation between private and public market valuation of timberlands makes repurchasing our shares compelling. The value implied in our current stock price is about $1,000 per acre. 44.00 42.00 40.00 38.00 36.00 34.00 32.00 30.00 28.00 PCH 33.08 POTLATCH STOCK PRICE CHART PRIVATE TIMBERLAND TRANSACTIONS m ill io n a c re s

Summary • High quality, well managed portfolio of assets • Long-term industry trends are very favorable • U.S. housing starts recovering to long-term trend • North American exports to China tension U.S. market • Canadian lumber supply is diminished • Lumber and Southern sawlog prices will recover • Current stock price and dividend yield provides attractive entry point • Returning cash to shareholders is the top capital allocation priority • Sustainable and growing dividend • Repurchase shares at deep discount Investor Presentation 17

Appendix

Southern Sawlog Demand by State 0 2 4 6 8 10 12 14 2006 2007 2008 2009 2010 2011 2012 2013 2014 De ma nd Vo lum e, ton s Mi llio ns TX FL GA NC LA SC AL VA AR MS OK GA AR NC MS AL LA SC VA FL OK TX Comparison of historical sawlog demand across 11 southern states. Several states (GA, NC, TX, SC) have sawlog demand approaching prerecession levels. Demand is still relatively sluggish in our wood baskets in AR, AL, and MS (dotted lines). Source: Wood Demand Report, Center for Forest Business, University of Georgia, Q4 2014 report received January 30, 3015 & Timber Mart-South, Q4 2014 price report received January 7, 2015 Investor Presentation 19

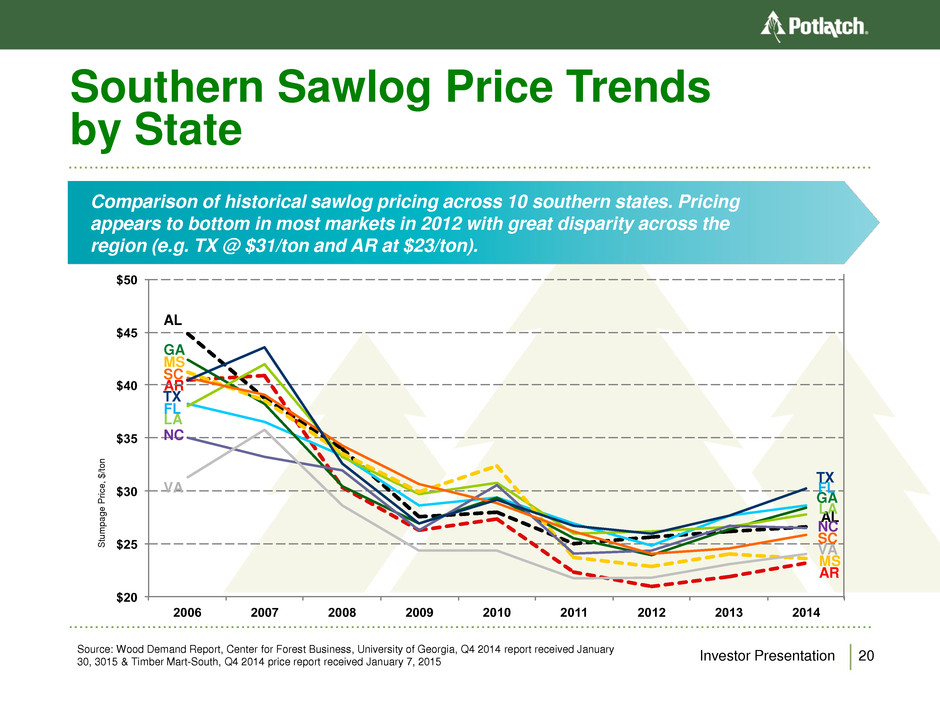

Southern Sawlog Price Trends by State Source: Wood Demand Report, Center for Forest Business, University of Georgia, Q4 2014 report received January 30, 3015 & Timber Mart-South, Q4 2014 price report received January 7, 2015 Investor Presentation 20 AR MS $20 $25 $30 $35 $40 $45 $50 2006 2007 2008 2009 2010 2011 2012 2013 2014 Stu mp ag e P rice , $ /to n GA AL FL LA NC AR SC MS TX VA GA AL SC FL LA TX VA NC Comparison of historical sawlog pricing across 10 southern states. Pricing appears to bottom in most markets in 2012 with great disparity across the region (e.g. TX @ $31/ton and AR at $23/ton).

Investor Presentation 21 (1) Interest expense includes amortization of bond discounts and deferred loan fees EBITDDA & Segment EBITDDA Reconciliation ($ in millions) Fiscal Year 2011 2012 2013 2014 LTM CONSOLIDATED Net income $40 $43 $71 $90 $48 Adjustments: Income tax (benefit) provision 4 17 14 20 (4) Interest expense (1) 28 26 23 23 31 Depreciation, depletion and amortization 26 23 25 25 34 Basis of real estate sold 14 5 4 9 5 Non-cash eliminations (2) - (1) - 1 Consolidated EBITDDA $110 $114 $136 $167 $115 RESOURCE Operating income $60 $50 $74 $85 $84 Depreciation, depletion and amortization 17 16 18 18 26 Resource Segment EBITDDA $77 $66 $92 $103 $110 WOOD PRODUCTS Operating income $7 $45 $59 $53 $5 Depreciation and non-cash impairments & eliminations 8 7 6 6 8 Wood Products Segment EBITDDA $15 $52 $65 $59 $13 REAL ESTATE Operating income $31 $28 $18 $27 $16 Basis of real estate sold and depreciation 14 5 4 9 5 Real Estate Segment EBITDDA $45 $33 $22 $36 $21

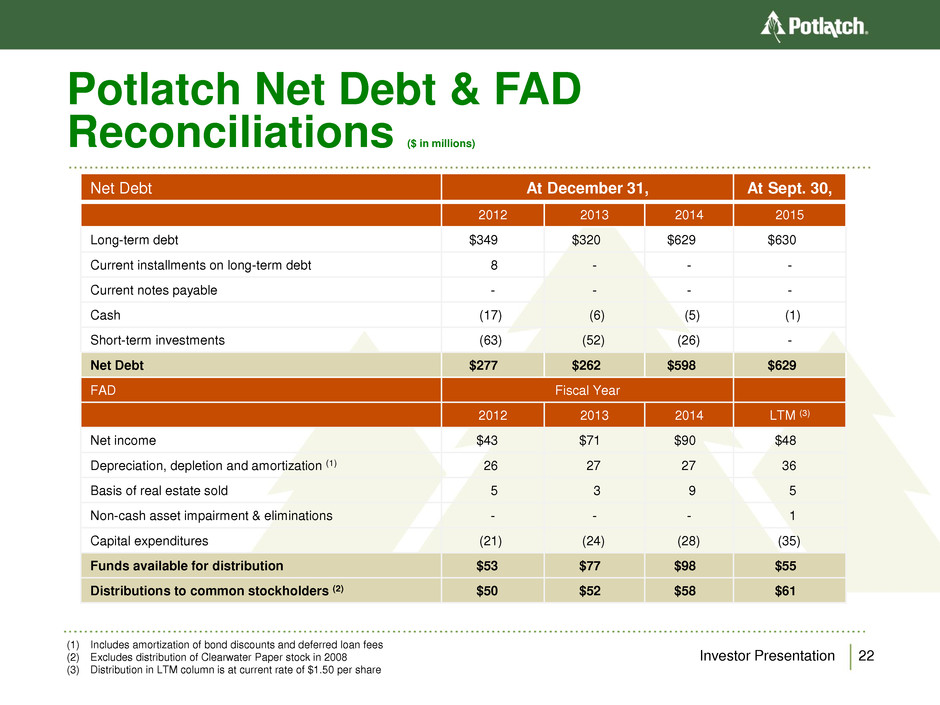

Potlatch Net Debt & FAD Reconciliations ($ in millions) Investor Presentation 22 (1) Includes amortization of bond discounts and deferred loan fees (2) Excludes distribution of Clearwater Paper stock in 2008 (3) Distribution in LTM column is at current rate of $1.50 per share Net Debt At December 31, At Sept. 30, 2012 2013 2014 2015 Long-term debt $349 $320 $629 $630 Current installments on long-term debt 8 - - - Current notes payable - - - - Cash (17) (6) (5) (1) Short-term investments (63) (52) (26) - Net Debt $277 $262 $598 $629 FAD Fiscal Year 2012 2013 2014 LTM (3) Net income $43 $71 $90 $48 Depreciation, depletion and amortization (1) 26 27 27 36 Basis of real estate sold 5 3 9 5 Non-cash asset impairment & eliminations - - - 1 Capital expenditures (21) (24) (28) (35) Funds available for distribution $53 $77 $98 $55 Distributions to common stockholders (2) $50 $52 $58 $61

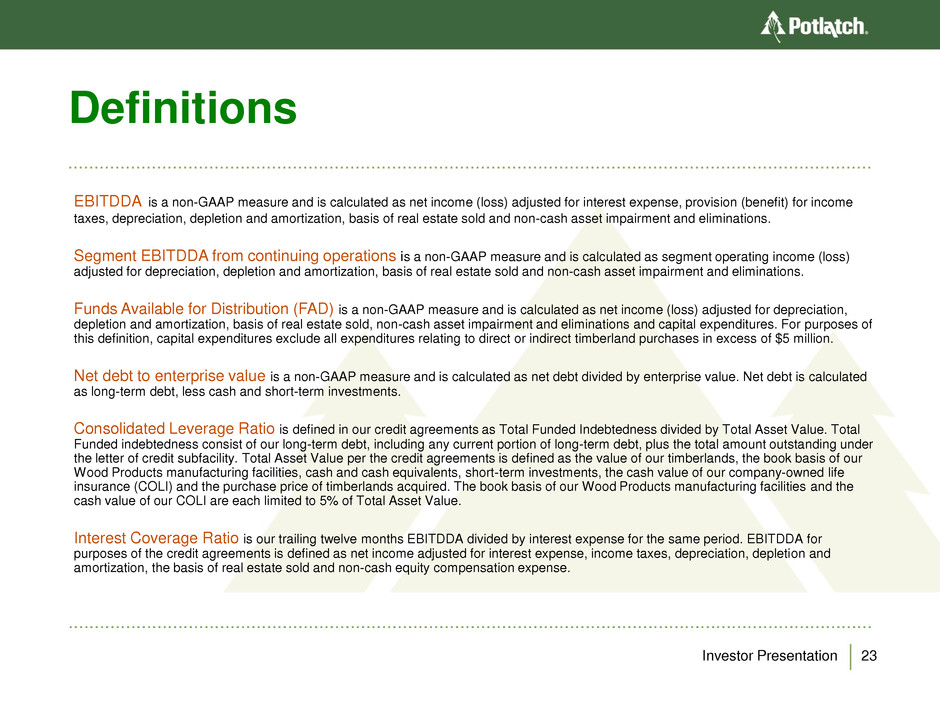

Definitions EBITDDA is a non-GAAP measure and is calculated as net income (loss) adjusted for interest expense, provision (benefit) for income taxes, depreciation, depletion and amortization, basis of real estate sold and non-cash asset impairment and eliminations. Segment EBITDDA from continuing operations is a non-GAAP measure and is calculated as segment operating income (loss) adjusted for depreciation, depletion and amortization, basis of real estate sold and non-cash asset impairment and eliminations. Funds Available for Distribution (FAD) is a non-GAAP measure and is calculated as net income (loss) adjusted for depreciation, depletion and amortization, basis of real estate sold, non-cash asset impairment and eliminations and capital expenditures. For purposes of this definition, capital expenditures exclude all expenditures relating to direct or indirect timberland purchases in excess of $5 million. Net debt to enterprise value is a non-GAAP measure and is calculated as net debt divided by enterprise value. Net debt is calculated as long-term debt, less cash and short-term investments. Consolidated Leverage Ratio is defined in our credit agreements as Total Funded Indebtedness divided by Total Asset Value. Total Funded indebtedness consist of our long-term debt, including any current portion of long-term debt, plus the total amount outstanding under the letter of credit subfacility. Total Asset Value per the credit agreements is defined as the value of our timberlands, the book basis of our Wood Products manufacturing facilities, cash and cash equivalents, short-term investments, the cash value of our company-owned life insurance (COLI) and the purchase price of timberlands acquired. The book basis of our Wood Products manufacturing facilities and the cash value of our COLI are each limited to 5% of Total Asset Value. Interest Coverage Ratio is our trailing twelve months EBITDDA divided by interest expense for the same period. EBITDDA for purposes of the credit agreements is defined as net income adjusted for interest expense, income taxes, depreciation, depletion and amortization, the basis of real estate sold and non-cash equity compensation expense. Investor Presentation 23