Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Bluerock Residential Growth REIT, Inc. | v424955_8k.htm |

Exhibit 99.1

November 17, 2015

Forward - Looking Statements - 2 - The information in this presentation has been prepared solely for informational purposes by Bluerock Residential Growth REIT, Inc . (“BRG”) and does not constitute an offer to sell or the solicitation of an offer to purchase any securities . This presentation is not, and should not be assumed to be, complete . This presentation has been prepared to assist interested parties in making their own evaluation of BRG and does not purport to contain all of the information that may be relevant . In all cases, interested parties should conduct their own investigation and analysis of BRG and the data set forth in this presentation and other information provided by or on behalf of BRG . In addition, certain of the information contained herein may be derived from information provided by industry sources . BRG believes that such information is accurate and that the sources from which it has been obtained are reliable . BRG cannot guarantee the accuracy of such information, however, and has not independently verified such information . The information presented herein remains subject to change . Statements in this presentation are made as of the date of this presentation unless stated otherwise . This presentation also contains statements that, to the extent they are not recitations of historical fact, constitute “forward - looking statements . ” Forward - looking statements are typically identified by the use of terms such as “may,” “should,” “expect,” “could,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “predict,” “potential” or the negative of such terms and other comparable terminology . The forward - looking statements included herein are based upon BRG’s current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties . Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond BRG’s control . Although BRG believes that the expectations reflected in such forward - looking statements are based on reasonable assumptions, BRG’s actual results and performance and the value of its securities could differ materially from those set forth in the forward - looking statements due to the impact of many factors including, but not limited to, the uncertainties of real estate development, acquisition and disposition activity, the ability of our joint venture partners to satisfy their obligations, the costs and availability of financing, the effects of local economic and market conditions, the effects of acquisitions and dispositions, the impact of newly adopted accounting principles on BRG’s accounting policies and on period - to - period comparisons of financial results, regulatory changes and other risks and uncertainties detailed in the “Risk Factors” in Item 1 . A . Risk Factors section of the Company’s Annual Report on Form 10 - K filed with the U . S . Securities and Exchange Commission on March 4 , 2015 , and other discussions of risk factors contained in BRG’s periodic filings . BRG claims the safe harbor protection for forward looking statements contained in the Private Securities Litigation Reform Act of 1995 . BRG undertakes no obligation to update or revise any such information for any reason after the date of this presentation, unless required by law .

- 3 - Company Highlights ▪ Differentiated Value Creation Strategy » Building a Class A portfolio in growth markets targeting renters by choice » Partner Network enables Best in Class Sourcing and Execution across markets / strategies » Creating value thru focus on complex, off - market transactions ▪ Deep, Experienced Management Team with 27+ Years Average Experience ▪ Young and Productive Class A Portfolio, plus Robust Accretive Pipeline ▪ Attractive Metrics Relative to Peers » Trading at 29% discount to net asset value (NAV) (1) » 10.3% dividend yield supported by portfolio (2) Fox Hill, Austin Resort - Style Pool, Lansbrook, Tampa Sky Deck, MDA Apartments, Chicago ( 1 ) See disclosure on slide 14 related to NAV estimates ( 2 ) Dividend yield as of 11/13/15 close on NYSE MKT Notes - 3 -

Management Team with 25 - 30 Years Experience Ramin Kamfar Chairman, CEO & President of BRG James G. Babb, III Chief Investment Officer of BRGM Jordan Ruddy President of BRGM Gary Kachadurian Vice Chairman of BRGM Director - Chair of Investment Committee ▪ Co - Founder of Bluerock Real Estate – 2002 ▪ Acquisition of close to 10,000 apartment units and 2.5 million square feet of office space ▪ 27 years in real estate, private equity, investment banking ▪ Previously, Lehman Brothers ▪ 27 years experience in real estate ▪ Previously, Starwood Capital – Founding Member; Co - Managed Starwood Multifamily and Office effort for 12 years ▪ Involved in creation of Equity Residential; Starwood Hotels; iStar Financial ▪ Co - Founder of Bluerock Real Estate – 2002 ▪ 27 years experience in real estate, capital markets ▪ Previously, Bank of America, JP Morgan Chase, Smith Barney ▪ 37 years experience in real estate ▪ Previously, RREEF / Deutsche Bank – Head of National Acquisitions and Multifamily Value - Add & Development Groups; Member of Investment and Policy Committees ▪ Previously, Lincoln Property Company – Partner, Chairman - NMHC - 4 - “BRGM” refers to BRG Manager, LLC Notes

Current/LOI Property Target Market ▪ Targeting Class A assets generally built post - 2000 in $25 - $50 MM size range » Modern and efficient structures and layouts » Highly amenitized ‘Lifestyle’ product – a place to live, play, interact, socialize » One of youngest portfolios of REIT peers, among highest average rents in our markets Source: Bureau of Labor Statistics Statistics for the Year Ended September 30, 2015 ▪ Targeting markets with long t erm e mployment g rowth drivers among top 40 primary markets (excluding coastal 6) » Target industries include healthcare , education, technology, finance, trade, entertainment, energy » Younger / more educated demographic with higher disposable income Selected Bluerock Target MSAs – Employment Growth Cheshire Bridge Targeting attractive, growing renter by choice demographic Building a Class A Portfolio in Growth Markets - 5 - Rendering 3.7% 3.7% 3.2% 3.2% 3.0% 2.9% 2.6% 2.6% 2.3% 2.3% 2.2% 1.2% 0.0% 1.0% 2.0% 3.0% 4.0%

Network Strategy Extensive Experience – 200,000+ Total Units Under Management - 6 - ▪ Deep relationships to access proprietary off - market deals » 2014 Partner transaction activity of $3+ billion ▪ Deep intellectual capital / track record of success for best in class underwriting » Proprietary information from 200,000+ units ▪ Extensive operational infrastructure across strategies and markets » Best - in - class execution without cost / logistical burdens ▪ Substantial Capital to Invest Alongside for Alignment of Interests » Generally 10% Pari Passu Partner with leading owner/operators to for best - in - class sourcing and execution

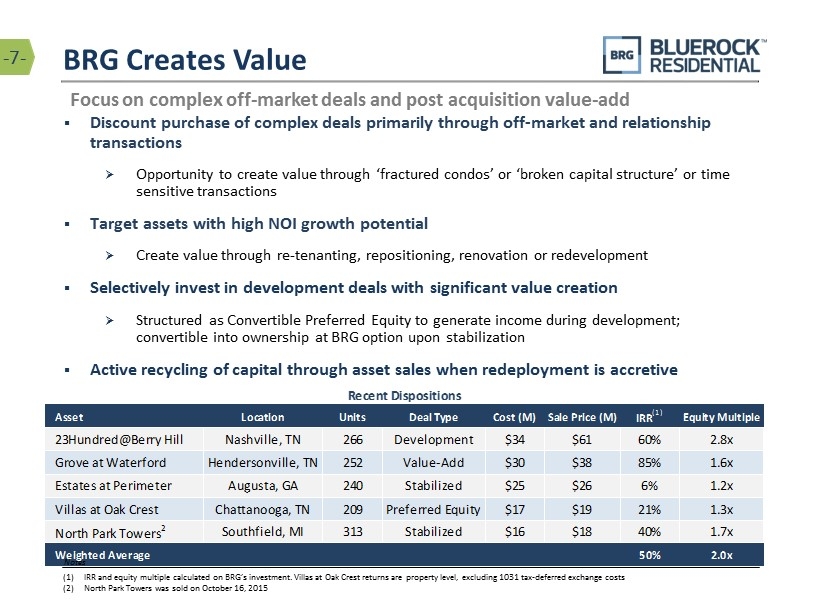

Asset Location Units Deal Type Cost (M) Sale Price (M) IRR (1) Equity Multiple 23Hundred@Berry Hill Nashville, TN 266 Development $34 $61 60% 2.8x Grove at Waterford Hendersonville, TN 252 Value-Add $30 $38 85% 1.6x Estates at Perimeter Augusta, GA 240 Stabilized $25 $26 6% 1.2x Villas at Oak Crest Chattanooga, TN 209 Preferred Equity $17 $19 21% 1.3x North Park Towers 2 Southfield, MI 313 Stabilized $16 $18 40% 1.7x Weighted Average 50% 2.0x Recent Dispositions BRG Creates Value ▪ Discount purchase of complex deals primarily through off - market and relationship transactions » Opportunity to create value through ‘fractured condos’ or ‘broken capital structure’ or time sensitive transactions ▪ Target assets with high NOI growth potential » Create value through re - tenanting, repositioning, renovation or redevelopment ▪ Selectively invest in development deals with significant value creation » Structured as Convertible Preferred Equity to generate income during development; convertible into ownership at BRG option upon stabilization ▪ Active recycling of capital through asset sales when redeployment is accretive Focus on complex off - market deals and post acquisition value - add - 7 - (1) IRR and equity multiple calculated on BRG’s investment. Villas at Oak Crest returns are property level, excluding 1031 tax - deferred exchange costs (2) North Park Towers was sold on October 16, 2015 Notes

Strength in Acquisition Metrics - 8 - Note: Photographs of EOS, Alexan CityCentre , Alexan Southside and Cheshire Bridge are renderings. Values associated with properties represent total purchase price or projected development cost (1) Based on sales of comparable assets; Management estimates Notes Post IPO Acquisitions: consistently generating spread between stabilized cap rate and market cap rate (1) Lansbrook Village Tampa, FL $59 million Grandewood Orlando, FL $43 million EOS Orlando, FL $37 million Park & Kingston Charlotte, NC $31 million Whetstone Durham, NC $36 million Alexan CityCentre Houston, TX $82 million Enders Place Orlando, FL $37 million Fox Hill Austin, TX $38 million Cheshire Bridge Atlanta, GA $48 million Alexan Southside Houston, TX $49 million Ashton I Charlotte, NC $45 million ARIUM Palms Orlando, FL $37 million Dallas Portfolio Dallas, TX $100 million

- $0.48 $0.13 $0.22 $0.19 $0.13 $0.23 $0.22 $0.29 $0.34 $0.32 ($0.50) ($0.30) ($0.10) $0.10 $0.30 $0.50 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 51.0% 56.7% 57.4% 57.2% 57.2% 58.3% 59.4% 50% 52% 54% 56% 58% 60% Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 $3.3 $7.8 $9.6 $9.8 $9.0 $10.5 $11.6 $3 $5 $7 $9 $11 $13 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 - 9.4% 7.6% 5.7% 13.8% 19.2% 10.3% 8.7% -20% -10% 0% 10% 20% Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 $156 $344 $338 $346 $451 $517 $571 $0 $100 $200 $300 $400 $500 $600 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Same Store NOI Growth Revenues ($M) Asset Size ($M) Operating Margins AFFO per Share Delivering Strength in Operational Metrics - 9 - (1) Q3 2015 Pro Forma AFFO per share of $0.32. For a reconciliation to GAAP measures and a discussion of pro forma assumptions, s ee BRG’s Q3 2015, Q2 2015, Q1 2015, Q4 2014, Q3 2014 and Q2 2014 Earnings Supplements and BRG’s 10 - Q for the quarter ended September 30, 2015 (2) Excluding the impact of the Company’s May follow - on offering (i.e. increase in cash and shares), AFFO was $0.23 per share vs. th e Company’s AFFO guidance of $0.15 to $0.16 per share. AFFO pro forma for the investment of cash from the Company’s January follow - on offering (Pro Forma AFFO), was $0.34 per s hare for the second quarter of 2015 vs. guidance of $0.26 to $0.28 per share. Notes (2) IPO IPO IPO IPO IPO (2) Dividend: $0.29 per share (1)

Property Name Location Units Year Built / Renovated Monthly Rent Occupancy Sourcing MDA Apartments Chicago, IL 190 2006 (2) $2,244 96% off-market Alexan CityCentre (3) Houston, TX 340 Est. 2017 2,144 - off-market Alexan Southside (3) Houston, TX 269 Est. 2017 2,019 - off-market Cheshire Bridge (3) Atlanta, GA 285 Est. 2017 1,559 - off-market Enders Place at Baldwin Park Orlando, FL 220 2003 1,563 97% relationship Whetstone Durham, NC 204 2015 1,325 Lease-Up off-market Dallas Portfolio Dallas, TX 674 2014 1,265 Lease-Up off-market EOS (4) Orlando, FL 296 2015 1,211 Lease-Up off-market Park & Kingston (5) Charlotte, NC 153 2014 1,195 98% relationship Ashton I Charlotte, NC 322 2012 1,022 91% off-market Fox Hill Austin, TX 288 2010 1,093 99% relationship ARIUM Grandewood Orlando, FL 306 2005 1,169 96% off-market Lansbrook Village Palm Harbor, FL 601 1998-2004 1,167 93% auction/relat. Village Green Ann Arbor Ann Arbor, MI 520 1989-1992 / 2013 1,159 95% off-market ARIUM Palms (6) Orlando, FL 252 2007 1,156 92% off-market Springhouse at Newport News Newport News, VA 432 1985 826 95% off-market 3,958 $1,202 95% 5,352 $1,327 95% Letter of Intent - Charlotte Property (3) Charlotte, NC 283 Est. 2017 $1,601 - relationship Letter of Intent - Dallas Property (3) Garland, TX 300 Est. 2017 $1,425 - off-market Letter of Intent - Raleigh Property (3) Raleigh, NC 242 Est. 2016/17 1,402 - off-market Under Contract - Ashton II Charlotte, NC 151 2015 1,207 Lease-Up off-market 976 $1,437 - 6,328 $1,344 95% Sub-Total (Current) Sub-Total (Pro Forma) (7) Sub-Total (Pipeline) Total (8) Current Portfolio (1) - 10 - (1) Based on information as of September 30, 2015 unless otherwise noted (2) MDA was built in 1929 as an office building and underwent a gut rehabilitation in 2006 (3) This property is under development. Rent figures are projected or reflect current leasing estimates (4) EOS leasing began April, 2015, rental rate based on budget (5) Phase II (15 units) to be acquired at c/o; estimated 4Q 2015 (6) Monthly rent excludes cable and garage income (7) Pro Forma includes Alexan Southside, Alexan CityCentre , Whetstone, Cheshire Bridge and EOS projected units and rents; occupancy excludes properties under development or lease - up (8) Total includes pipeline properties and projected rents / units for development properties; occupancy excludes properties unde r d evelopment or lease - up Notes

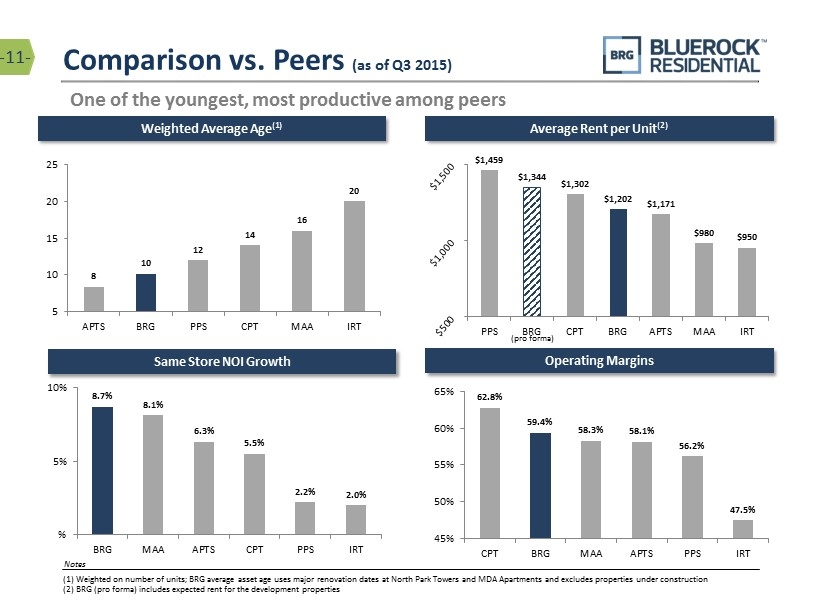

$1,459 $1,344 $1,302 $1,202 $1,171 $980 $950 PPS BRG CPT BRG APTS MAA IRT (pro forma) 62.8% 59.4% 58.3% 58.1% 56.2% 47.5% 45% 50% 55% 60% 65% CPT BRG MAA APTS PPS IRT 8.7% 8.1% 6.3% 5.5% 2.2% 2.0% % 5% 10% BRG MAA APTS CPT PPS IRT Same Store NOI Growth Weighted Average Age (1) Average Rent per Unit (2) One of the youngest, most productive among peers Comparison vs. Peers (as of Q3 2015) - 11 - (1) Weighted on number of units; BRG average asset age uses major renovation dates at North Park Towers and MDA Apartments and excludes properties under construction (2) BRG (pro forma) includes expected rent for the development properties Notes Operating Margins 8 10 12 14 16 20 5 10 15 20 25 APTS BRG PPS CPT MAA IRT

Ashton II Charlotte Property Dallas Property Raleigh Property Acquisition Status Under Contract Under LOI Under LOI Under LOI Location Charlotte, NC Charlotte, NC Garland, TX Raleigh, NC Year Built 2015 2017 2017 2016/2017 Units 151 283 300 245 Anticipated Cost $22 million $54 million $44 million $38 million Sourcing Strategy Off-Market Relationship Off-Market Off-Market Investment Strategy Discount Purchase / Core- Plus Invest-to-Own Invest-to-Own Invest-to-Own BRG Equity (Est) $7 million $10 million $9 million $17 million Purchase Price or Development Cost/ Unit $144,500 $188,500 $147,000 $157,500 Market Price / Unit $160,000 $250,000 $170,000 $200,000 4 Class A properties with 979 units and total BRG equity of $43 million (1) Assets Under Contract or LOI - 12 - (1) Based on information currently available to Management. Other than Ashton II, Management does not deem these investments to be probable as of the date of this presentation. The consummation of these transactions may not occur on the terms described herein, or at all . Notes

10.4x 10.7x 18.8x 10.9x 23.6x 21.9x 18.3x 17.9x 19.0x 19.4x 22.3x 24.8x 23.4x 24.9x 0.0 5.0 10.0 15.0 20.0 25.0 30.0x 0 5,000 10,000 15,000 20,000 $25,000 BRG APTS TSRE IRT AEC PPS HME MAA AIV CPT UDR ESS AVB EQR Small Cap Large Cap AFFO Multiple Correlated to Market Cap - 13 - Notes * Indicates companies that have recently been acquired or are being acquired: TSRE was acquired by IRT on September 17, 2015. AEC was acquired by Brookfield Asset Management on August 7 th , 2015. Lone Star Funds announced its acquisition of HME on June 22, 2015, the acquisition has not closed. Source : SNL Financial as of 11/13/2015 ; AFFO metrics based solely on third party estimates. Company management expresses no opinion on the accuracy of such estimates and is not providing valuation or earnings guidance. BRG Price/ 2015E AFFOx based on annualized mid - point of 4Q pro forma AFFO guidance of $0.26 - $0.28 per share. * * Acquisition Target Market Cap AFFO Multiple *

Ticker Market Cap ($M) Avg. Unit Rent Wtd. Avg. Property Age Dividend Yield Price/ NAV (est.) Price/ 2015E AFFOx CPT $6,457 $1,302 14 Yrs 3.8% 87% 19.4 MAA $6,346 $980 17 Yrs 3.7% 98% 17.9 PPS $3,091 $1,459 12 Yrs 3.1% 90% 21.9 AEC (1) $1,668 $1,296 16 Yrs 2.9% 126% 23.6 IRT (2) $344 $950 20 Yrs 9.8% 69% 10.9 TSRE (1) $245 $1,034 12 Yrs 5.7% 91% 18.8 APTS $235 $1,171 8 Yrs 7.3% 76% 10.7 Average $2,627 $1,170 14 Yrs 4.8% 73% 17.6 BRG $220 $1,344 10 Yrs 10.3% 69% 10.4 Trading at Attractive Metrics Relative to Peers - 14 - Notes Source: SNL Financial as of 11/13/2015 ; company filings; BRG Price/ 2015E AFFOx based on annualized mid - point of 4Q pro forma AFFO guidance of $ 0.26 - $0.28 per share; BRG avg. unit rent is pro forma for pipeline acquisitions. 1) AEC and TSRE were acquired by Brookfield and IRT, respectively. Data no longer available. Trading metrics as of July 21, 2 015 and September 11, 2015. 2) IRT completed its acquisition of TSRE on September 17, 2015. IRT metrics are pro forma for this acquisition. Note : NAV and AFFO metrics are based on estimates. Company management expresses no opinion in this presentation on the accuracy o f s uch estimates and is not providing valuation or earnings guidance, including without limitation any update to previously rendered earnings guidance; 2015 AFFO metrics are pr o forma and do not reflect actual or anticipated performance results. Readers should refer to the Company’s earnings supplement for the three months ended September 30, 2015 for assumptions underlying pro forma AFFO .

10.3% 9.8% 7.3% 3.8% 3.7% 3.1% .0% 4.0% 8.0% 12.0% BRG IRT APTS CPT MAA PPS 10.4 10.7 10.9 17.9 19.4 21.9 10.0 15.0 20.0 25.0 BRG APTS IRT MAA CPT PPS - 29% - 27% - 24% - 13% - 10% - 2% -40% -30% -20% -10% % BRG IRT APTS CPT PPS MAA x Portfolio primed for internal growth » BRG’s strategy is continuing to produce outsized returns: newer, class A assets, growth markets, renters by choice » Value embedded in existing portfolio: fractured condo deal, value - add programs and development projects x Robust pipeline of accretive transactions » Active pipeline exceeds 6,000 units / $1 billion » Ability to grow asset base through transactions accretive to AFFO and NAV x Attractive metrics relative to peers » Trading at 29% discount to NAV » Discount AFFO multiple relative to peers » Dividend yield of 10.3% versus peer average of 5.5% NAV Portfolio Poised for Growth Premium Dividend – As of 11/13/15 Discount to NAV Attractive 2015 AFFO Multiple - 15 -