Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AVAYA INC | form8-k_4q15earningsrel.htm |

| EX-99.1 - EXHIBIT 99.1 - AVAYA INC | ex991earningsrelease4q15.htm |

Avaya Q4 and Fiscal Year 2015 Earnings Call November 11, 2015 Exhibit 99.2

© 2015 Avaya Inc. All rights reserved. 2 Forward Looking Statements Certain statements contained in this presentation are forward-looking statements, including statements regarding our future financial and operating performance, as well as statements regarding our future growth plans and drivers,. These statements may be identified by the use of forward-looking terminology such as "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "might," "plan," "potential," "predict," "should" or "will" or other similar terminology. We have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these expectations, assumptions, estimates and projections are reasonable, such forward looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond our control. These and other important factors may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. For a list and description of such risks and uncertainties, please refer to our filings with the SEC that are available at www.sec.gov and in particular, our 2014 Form 10-K filed with the SEC on November 26, 2014. We disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. This presentation should be read in conjunction with our Form 8-K filed with the SEC on November 16, 2015. Within this presentation, we refer to certain non‐GAAP financial measures that involve adjustments to GAAP measures. Reconciliations between our non-GAAP financial measures and GAAP financial measures are included on the last three slides of this presentation. These slides, as well as current and historical financial data are available on our web site at www.avaya.com/investors . None of the information included on the website is incorporated by reference in this presentation. Historical amounts presented reflect the sale of ITPS.

© 2015 Avaya Inc. All rights reserved. 3 Revenue of $1,008 million, up $12 million from the prior quarter in constant currency 1% higher sequentially and 5% lower than Q4 FY’14 on a normalized basis* Q4 ‘14 adjusted for recognition of aged backlog for professional services projects * – Software and Services accounted for over 72% of total revenue – Cloud and managed services revenues accounted for ~8% of total revenue Year-over-year growth in: – Cloud & Managed Services up 11% – Contact Center up 6%* – Networking up 5%* Gross margin of 62% – Record levels for product gross margin and services gross margin Operating income of $202 million and 20.0% operating margin Adjusted EBITDA of $246 million and 24.4% of revenue Cash balance of $323 million – Fiscal year 2015 Free Cash Flow was $91 million – Fiscal year 2015 Cash From Operations was $215 million * On a normalized basis; See slide 18 for Q4 FY’14 normalization calculation Fiscal Q4 2015 Financial Highlights (Amounts are non-GAAP, comparisons in constant currency)

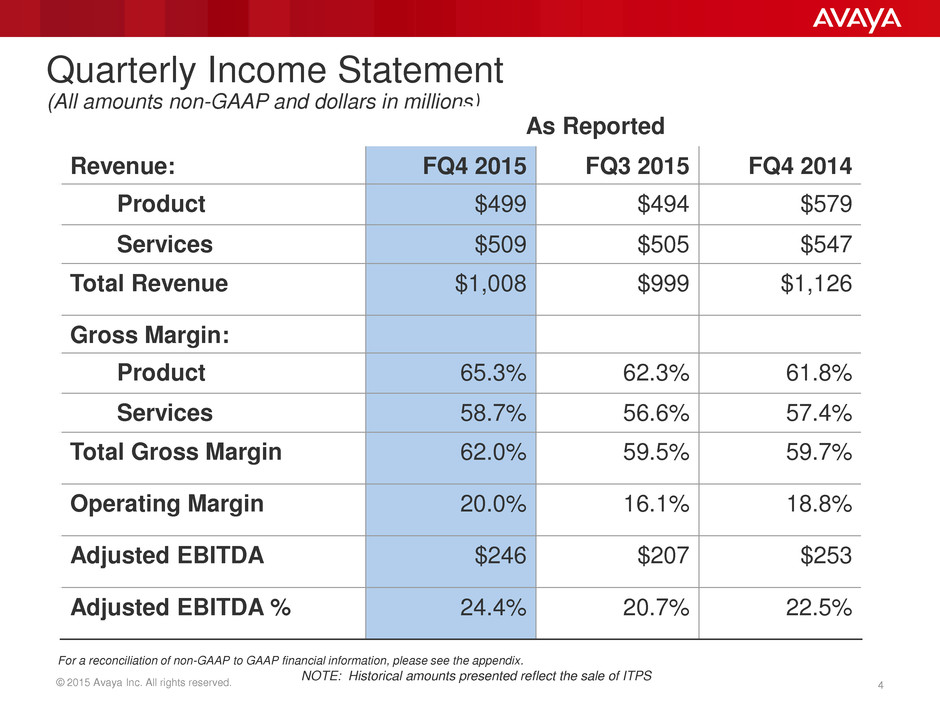

© 2015 Avaya Inc. All rights reserved. 4 Quarterly Income Statement (All amounts non-GAAP and dollars in millions) Revenue: FQ4 2015 FQ3 2015 FQ4 2014 Product $499 $494 $579 Services $509 $505 $547 Total Revenue $1,008 $999 $1,126 Gross Margin: Product 65.3% 62.3% 61.8% Services 58.7% 56.6% 57.4% Total Gross Margin 62.0% 59.5% 59.7% Operating Margin 20.0% 16.1% 18.8% Adjusted EBITDA $246 $207 $253 Adjusted EBITDA % 24.4% 20.7% 22.5% NOTE: Historical amounts presented reflect the sale of ITPS For a reconciliation of non-GAAP to GAAP financial information, please see the appendix. As Reported

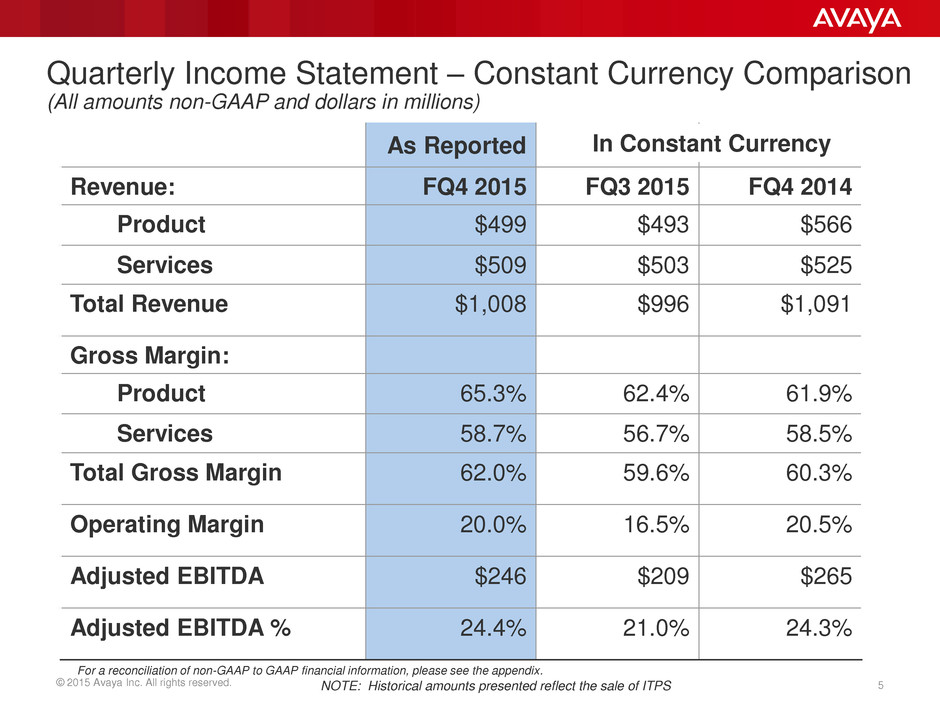

© 2015 Avaya Inc. All rights reserved. 5 Quarterly Income Statement – Constant Currency Comparison (All amounts non-GAAP and dollars in millions) As Reported Revenue: FQ4 2015 FQ3 2015 FQ4 2014 Product $499 $493 $566 Services $509 $503 $525 Total Revenue $1,008 $996 $1,091 Gross Margin: Product 65.3% 62.4% 61.9% Services 58.7% 56.7% 58.5% Total Gross Margin 62.0% 59.6% 60.3% Operating Margin 20.0% 16.5% 20.5% Adjusted EBITDA $246 $209 $265 Adjusted EBITDA % 24.4% 21.0% 24.3% NOTE: Historical amounts presented reflect the sale of ITPS For a reconciliation of non-GAAP to GAAP financial information, please see the appendix. In Constant Currency

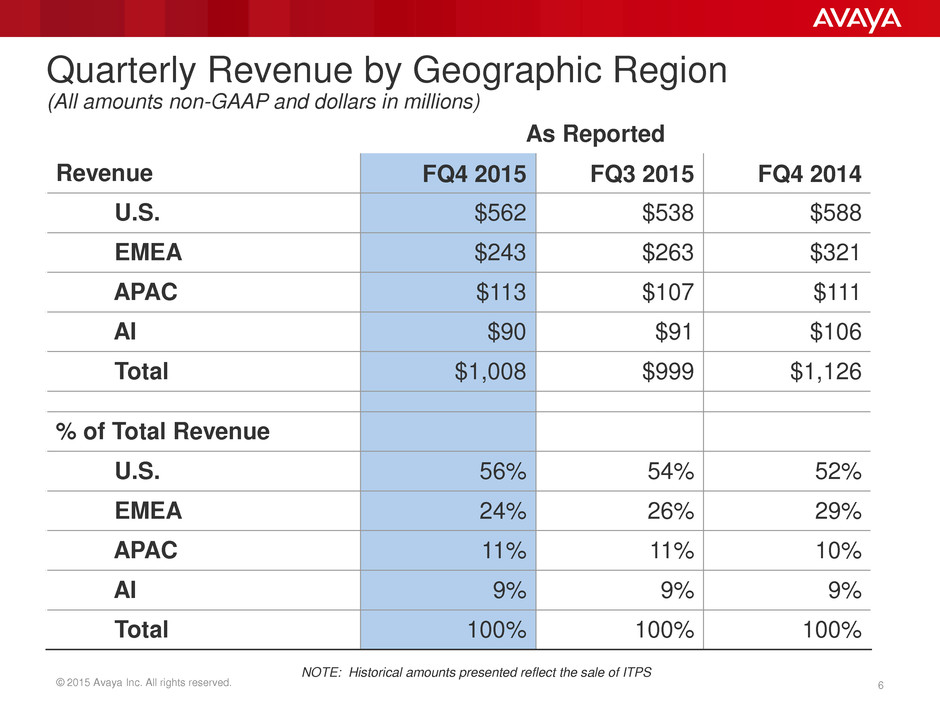

© 2015 Avaya Inc. All rights reserved. 6 Quarterly Revenue by Geographic Region (All amounts non-GAAP and dollars in millions) Revenue FQ4 2015 FQ3 2015 FQ4 2014 U.S. $562 $538 $588 EMEA $243 $263 $321 APAC $113 $107 $111 AI $90 $91 $106 Total $1,008 $999 $1,126 % of Total Revenue U.S. 56% 54% 52% EMEA 24% 26% 29% APAC 11% 11% 10% AI 9% 9% 9% Total 100% 100% 100% NOTE: Historical amounts presented reflect the sale of ITPS As Reported

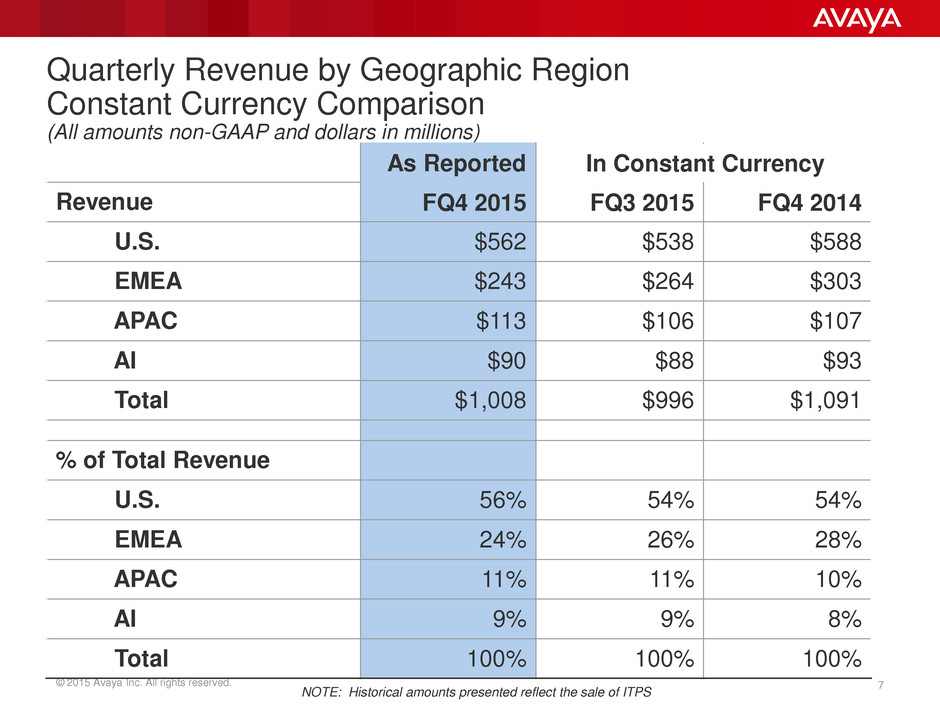

© 2015 Avaya Inc. All rights reserved. 7 Quarterly Revenue by Geographic Region Constant Currency Comparison (All amounts non-GAAP and dollars in millions) As Reported Revenue FQ4 2015 FQ3 2015 FQ4 2014 U.S. $562 $538 $588 EMEA $243 $264 $303 APAC $113 $106 $107 AI $90 $88 $93 Total $1,008 $996 $1,091 % of Total Revenue U.S. 56% 54% 54% EMEA 24% 26% 28% APAC 11% 11% 10% AI 9% 9% 8% Total 100% 100% 100% NOTE: Historical amounts presented reflect the sale of ITPS In Constant Currency

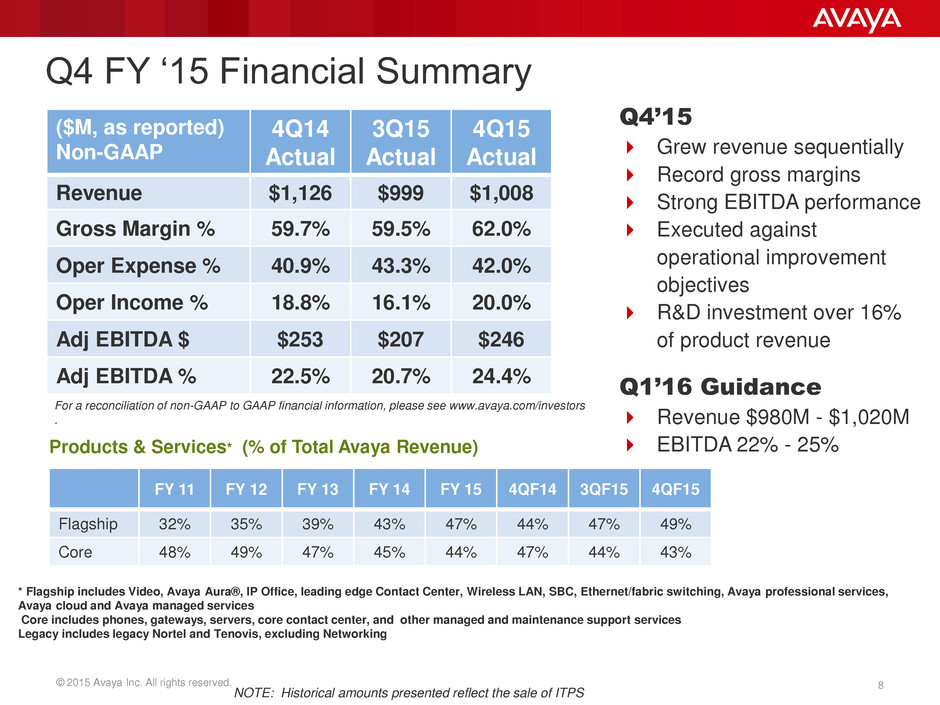

© 2015 Avaya Inc. All rights reserved. 8 Q4 FY ‘15 Financial Summary ($M, as reported) Non-GAAP 4Q14 Actual 3Q15 Actual 4Q15 Actual Revenue $1,126 $999 $1,008 Gross Margin % 59.7% 59.5% 62.0% Oper Expense % 40.9% 43.3% 42.0% Oper Income % 18.8% 16.1% 20.0% Adj EBITDA $ $253 $207 $246 Adj EBITDA % 22.5% 20.7% 24.4% Q4’15 Grew revenue sequentially Record gross margins Strong EBITDA performance Executed against operational improvement objectives R&D investment over 16% of product revenue Q1’16 Guidance Revenue $980M - $1,020M EBITDA 22% - 25% FY 11 FY 12 FY 13 FY 14 FY 15 4QF14 3QF15 4QF15 Flagship 32% 35% 39% 43% 47% 44% 47% 49% Core 48% 49% 47% 45% 44% 47% 44% 43% Products & Services* (% of Total Avaya Revenue) For a reconciliation of non-GAAP to GAAP financial information, please see www.avaya.com/investors . NOTE: Historical amounts presented reflect the sale of ITPS * Flagship includes Video, Avaya Aura®, IP Office, leading edge Contact Center, Wireless LAN, SBC, Ethernet/fabric switching, Avaya professional services, Avaya cloud and Avaya managed services Core includes phones, gateways, servers, core contact center, and other managed and maintenance support services Legacy includes legacy Nortel and Tenovis, excluding Networking

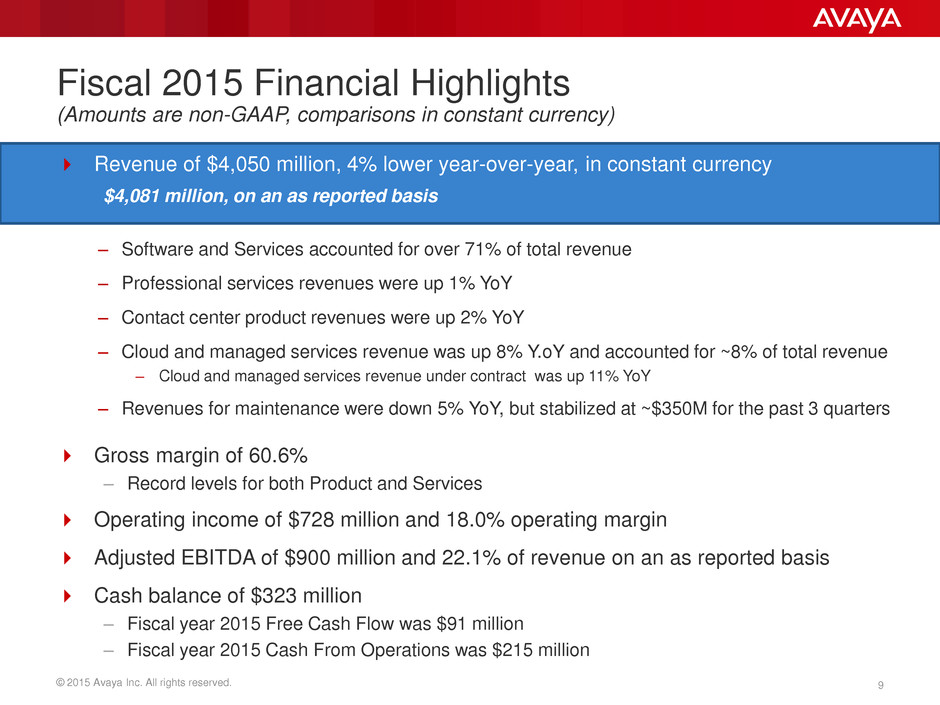

© 2015 Avaya Inc. All rights reserved. 9 Revenue of $4,050 million, 4% lower year-over-year, in constant currency $4,081 million, on an as reported basis – Software and Services accounted for over 71% of total revenue – Professional services revenues were up 1% YoY – Contact center product revenues were up 2% YoY – Cloud and managed services revenue was up 8% Y.oY and accounted for ~8% of total revenue – Cloud and managed services revenue under contract was up 11% YoY – Revenues for maintenance were down 5% YoY, but stabilized at ~$350M for the past 3 quarters Gross margin of 60.6% – Record levels for both Product and Services Operating income of $728 million and 18.0% operating margin Adjusted EBITDA of $900 million and 22.1% of revenue on an as reported basis Cash balance of $323 million – Fiscal year 2015 Free Cash Flow was $91 million – Fiscal year 2015 Cash From Operations was $215 million Fiscal 2015 Financial Highlights (Amounts are non-GAAP, comparisons in constant currency)

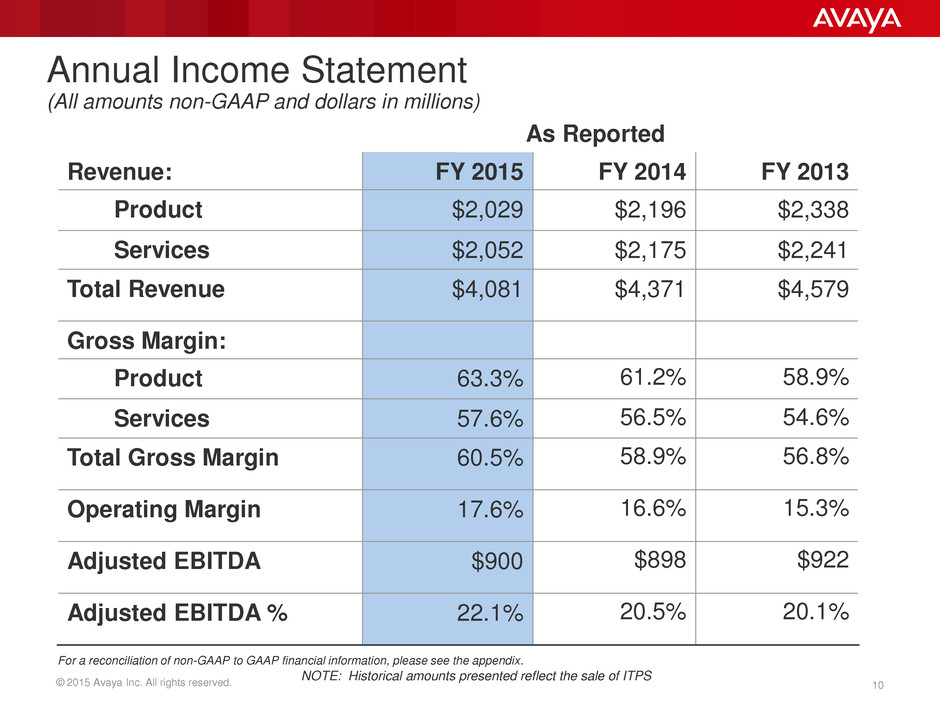

© 2015 Avaya Inc. All rights reserved. 10 Annual Income Statement (All amounts non-GAAP and dollars in millions) Revenue: FY 2015 FY 2014 FY 2013 Product $2,029 $2,196 $2,338 Services $2,052 $2,175 $2,241 Total Revenue $4,081 $4,371 $4,579 Gross Margin: Product 63.3% 61.2% 58.9% Services 57.6% 56.5% 54.6% Total Gross Margin 60.5% 58.9% 56.8% Operating Margin 17.6% 16.6% 15.3% Adjusted EBITDA $900 $898 $922 Adjusted EBITDA % 22.1% 20.5% 20.1% NOTE: Historical amounts presented reflect the sale of ITPS For a reconciliation of non-GAAP to GAAP financial information, please see the appendix. As Reported

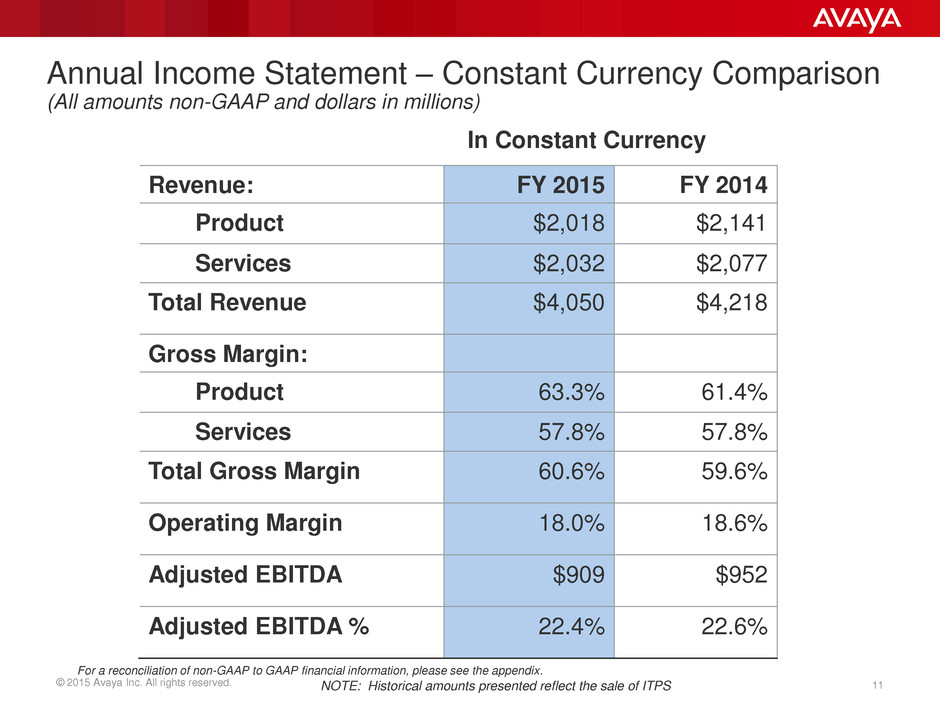

© 2015 Avaya Inc. All rights reserved. 11 Annual Income Statement – Constant Currency Comparison (All amounts non-GAAP and dollars in millions) Revenue: FY 2015 FY 2014 Product $2,018 $2,141 Services $2,032 $2,077 Total Revenue $4,050 $4,218 Gross Margin: Product 63.3% 61.4% Services 57.8% 57.8% Total Gross Margin 60.6% 59.6% Operating Margin 18.0% 18.6% Adjusted EBITDA $909 $952 Adjusted EBITDA % 22.4% 22.6% NOTE: Historical amounts presented reflect the sale of ITPS For a reconciliation of non-GAAP to GAAP financial information, please see the appendix. In Constant Currency

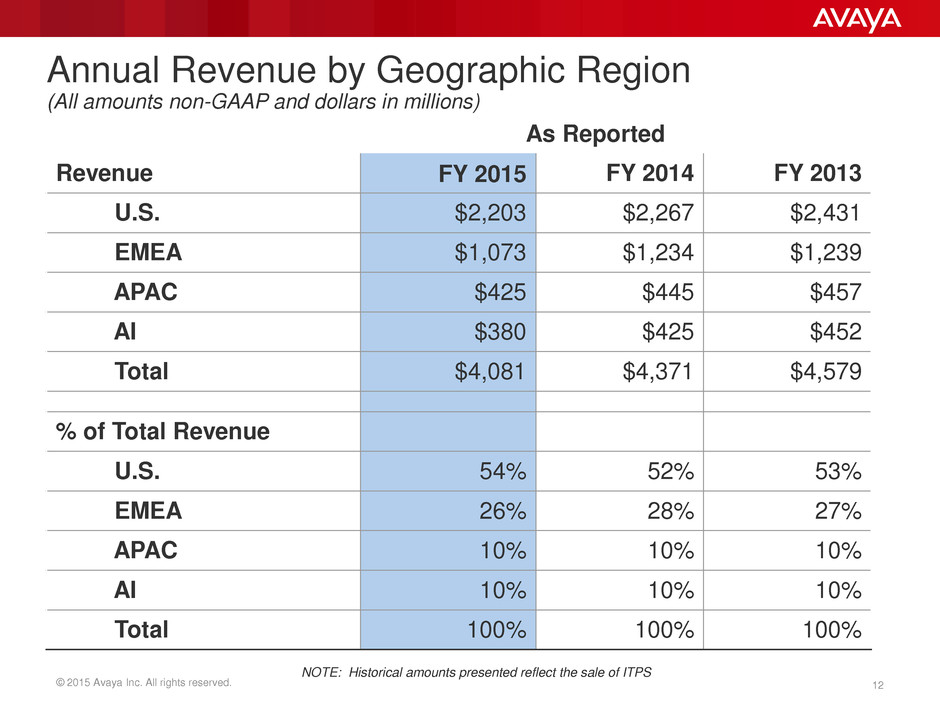

© 2015 Avaya Inc. All rights reserved. 12 Annual Revenue by Geographic Region (All amounts non-GAAP and dollars in millions) Revenue FY 2015 FY 2014 FY 2013 U.S. $2,203 $2,267 $2,431 EMEA $1,073 $1,234 $1,239 APAC $425 $445 $457 AI $380 $425 $452 Total $4,081 $4,371 $4,579 % of Total Revenue U.S. 54% 52% 53% EMEA 26% 28% 27% APAC 10% 10% 10% AI 10% 10% 10% Total 100% 100% 100% NOTE: Historical amounts presented reflect the sale of ITPS As Reported

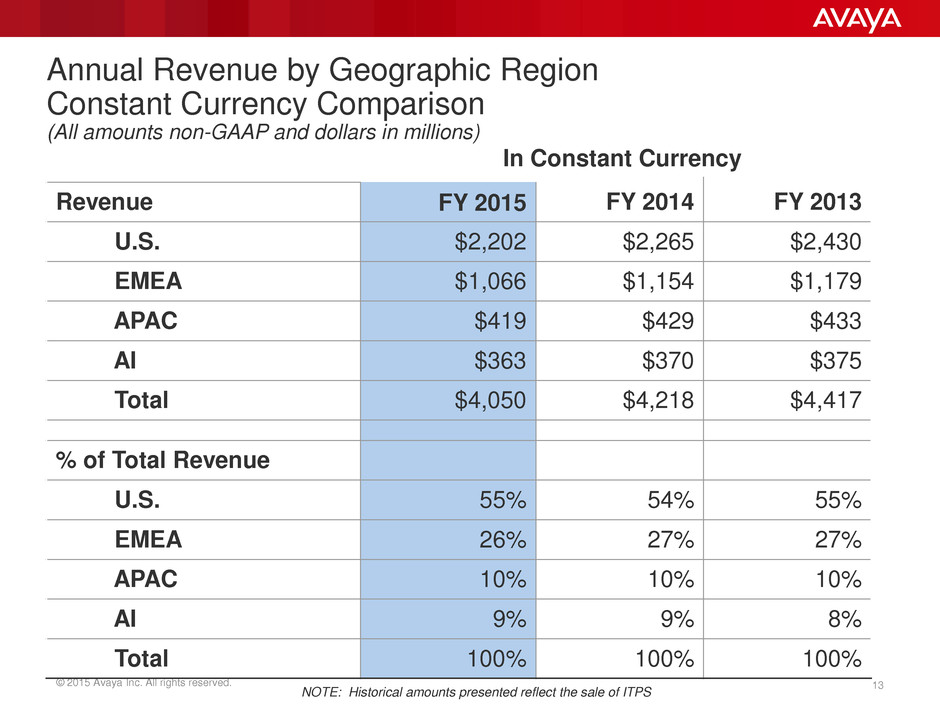

© 2015 Avaya Inc. All rights reserved. 13 Annual Revenue by Geographic Region Constant Currency Comparison (All amounts non-GAAP and dollars in millions) Revenue FY 2015 FY 2014 FY 2013 U.S. $2,202 $2,265 $2,430 EMEA $1,066 $1,154 $1,179 APAC $419 $429 $433 AI $363 $370 $375 Total $4,050 $4,218 $4,417 % of Total Revenue U.S. 55% 54% 55% EMEA 26% 27% 27% APAC 10% 10% 10% AI 9% 9% 8% Total 100% 100% 100% NOTE: Historical amounts presented reflect the sale of ITPS In Constant Currency

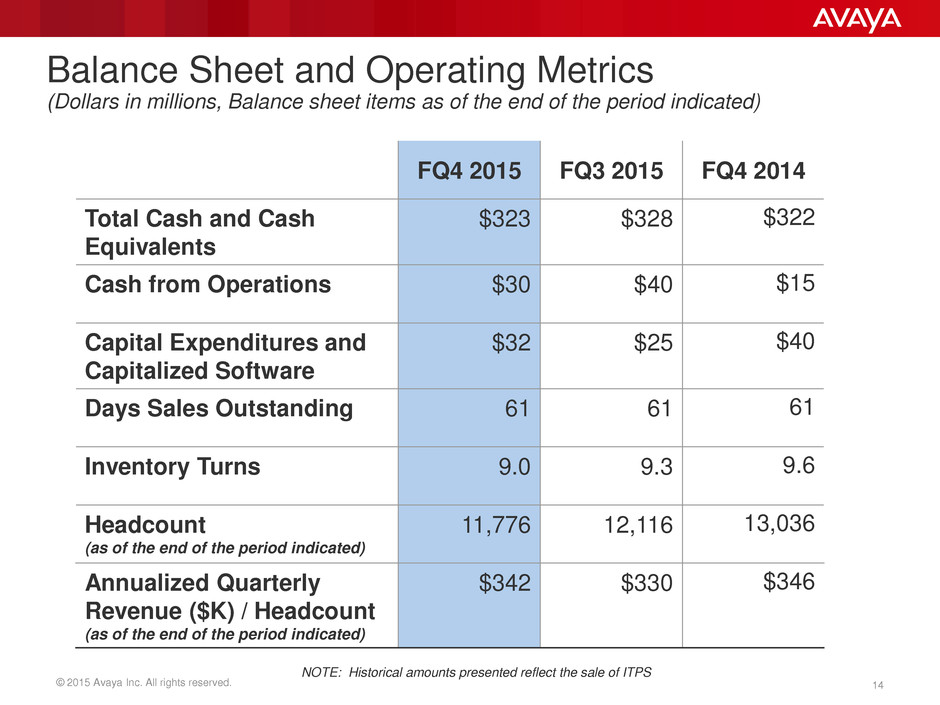

© 2015 Avaya Inc. All rights reserved. 14 Balance Sheet and Operating Metrics (Dollars in millions, Balance sheet items as of the end of the period indicated) FQ4 2015 FQ3 2015 FQ4 2014 Total Cash and Cash Equivalents $323 $328 $322 Cash from Operations $30 $40 $15 Capital Expenditures and Capitalized Software $32 $25 $40 Days Sales Outstanding 61 61 61 Inventory Turns 9.0 9.3 9.6 Headcount (as of the end of the period indicated) 11,776 12,116 13,036 Annualized Quarterly Revenue ($K) / Headcount (as of the end of the period indicated) $342 $330 $346 NOTE: Historical amounts presented reflect the sale of ITPS

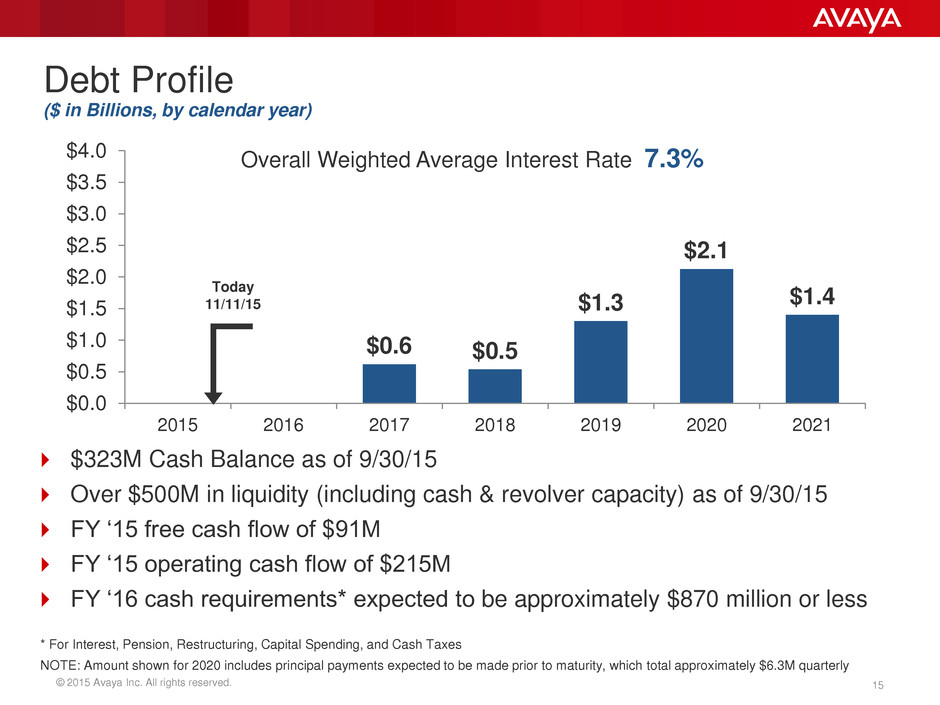

© 2015 Avaya Inc. All rights reserved. 15 Debt Profile ($ in Billions, by calendar year) $323M Cash Balance as of 9/30/15 Over $500M in liquidity (including cash & revolver capacity) as of 9/30/15 FY ‘15 free cash flow of $91M FY ‘15 operating cash flow of $215M FY ‘16 cash requirements* expected to be approximately $870 million or less * For Interest, Pension, Restructuring, Capital Spending, and Cash Taxes NOTE: Amount shown for 2020 includes principal payments expected to be made prior to maturity, which total approximately $6.3M quarterly $0.6 $0.5 $1.3 $2.1 $1.4 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 2015 2016 2017 2018 2019 2020 2021 Overall Weighted Average Interest Rate 7.3% Today 11/11/15

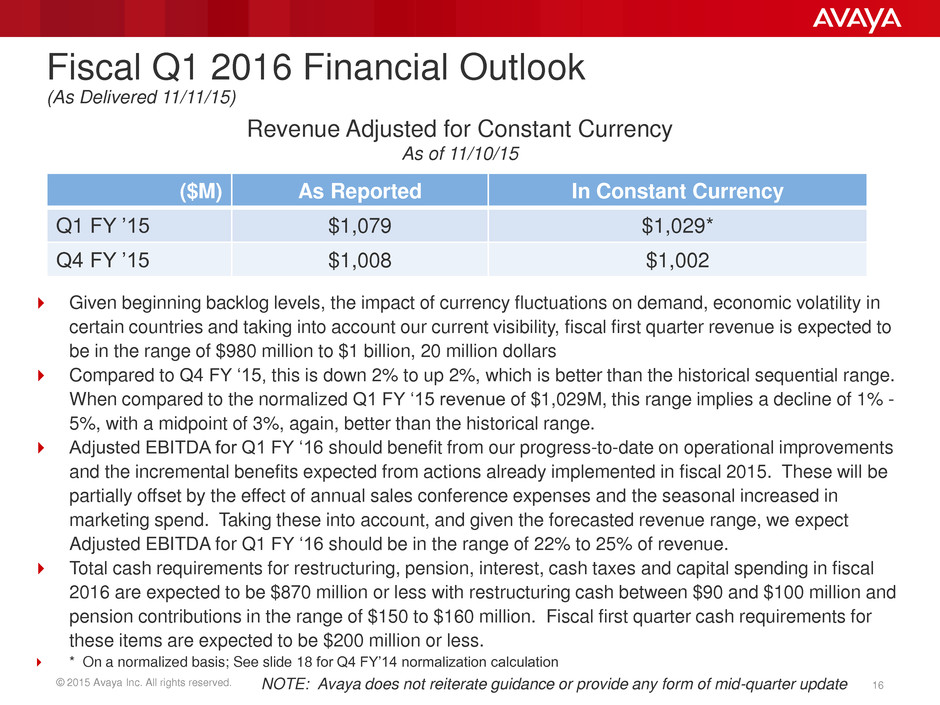

© 2015 Avaya Inc. All rights reserved. 16 Fiscal Q1 2016 Financial Outlook (As Delivered 11/11/15) Given beginning backlog levels, the impact of currency fluctuations on demand, economic volatility in certain countries and taking into account our current visibility, fiscal first quarter revenue is expected to be in the range of $980 million to $1 billion, 20 million dollars Compared to Q4 FY ‘15, this is down 2% to up 2%, which is better than the historical sequential range. When compared to the normalized Q1 FY ‘15 revenue of $1,029M, this range implies a decline of 1% - 5%, with a midpoint of 3%, again, better than the historical range. Adjusted EBITDA for Q1 FY ‘16 should benefit from our progress-to-date on operational improvements and the incremental benefits expected from actions already implemented in fiscal 2015. These will be partially offset by the effect of annual sales conference expenses and the seasonal increased in marketing spend. Taking these into account, and given the forecasted revenue range, we expect Adjusted EBITDA for Q1 FY ‘16 should be in the range of 22% to 25% of revenue. Total cash requirements for restructuring, pension, interest, cash taxes and capital spending in fiscal 2016 are expected to be $870 million or less with restructuring cash between $90 and $100 million and pension contributions in the range of $150 to $160 million. Fiscal first quarter cash requirements for these items are expected to be $200 million or less. * On a normalized basis; See slide 18 for Q4 FY’14 normalization calculation NOTE: Avaya does not reiterate guidance or provide any form of mid-quarter update ($M) As Reported In Constant Currency Q1 FY ’15 $1,079 $1,029* Q4 FY ’15 $1,008 $1,002 Revenue Adjusted for Constant Currency As of 11/10/15

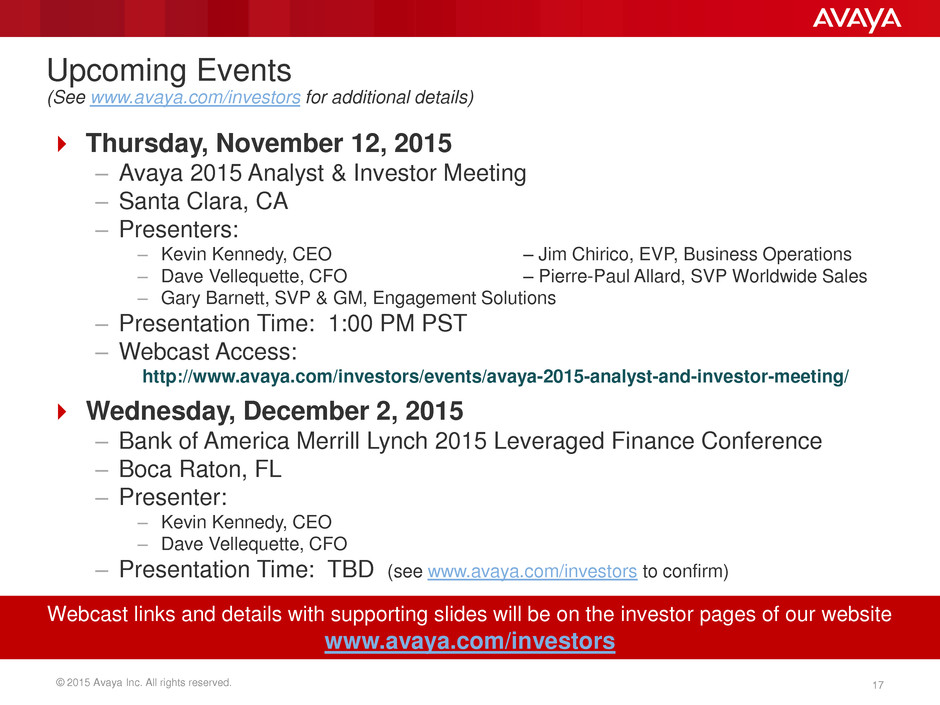

© 2015 Avaya Inc. All rights reserved. 17 Upcoming Events (See www.avaya.com/investors for additional details) Thursday, November 12, 2015 – Avaya 2015 Analyst & Investor Meeting – Santa Clara, CA – Presenters: – Kevin Kennedy, CEO – Jim Chirico, EVP, Business Operations – Dave Vellequette, CFO – Pierre-Paul Allard, SVP Worldwide Sales – Gary Barnett, SVP & GM, Engagement Solutions – Presentation Time: 1:00 PM PST – Webcast Access: http://www.avaya.com/investors/events/avaya-2015-analyst-and-investor-meeting/ Wednesday, December 2, 2015 – Bank of America Merrill Lynch 2015 Leveraged Finance Conference – Boca Raton, FL – Presenter: – Kevin Kennedy, CEO – Dave Vellequette, CFO – Presentation Time: TBD (see www.avaya.com/investors to confirm) Webcast links and details with supporting slides will be on the investor pages of our website www.avaya.com/investors

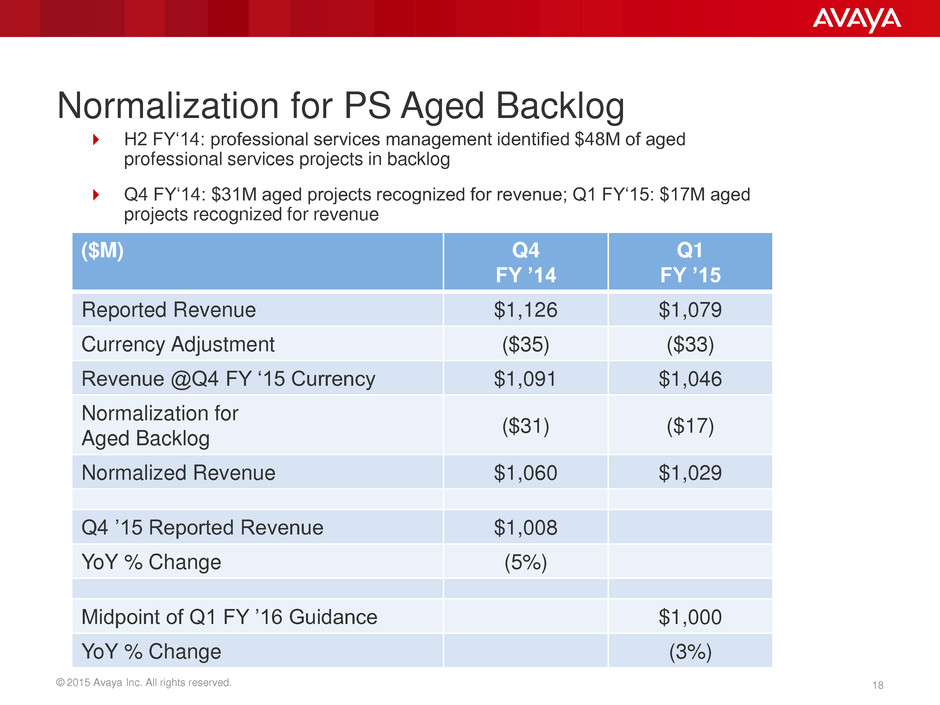

© 2015 Avaya Inc. All rights reserved. 18 Normalization for PS Aged Backlog ($M) Q4 FY ’14 Q1 FY ’15 Reported Revenue $1,126 $1,079 Currency Adjustment ($35) ($33) Revenue @Q4 FY ‘15 Currency $1,091 $1,046 Normalization for Aged Backlog ($31) ($17) Normalized Revenue $1,060 $1,029 Q4 ’15 Reported Revenue $1,008 YoY % Change (5%) Midpoint of Q1 FY ’16 Guidance $1,000 YoY % Change (3%) H2 FY‘14: professional services management identified $48M of aged professional services projects in backlog Q4 FY‘14: $31M aged projects recognized for revenue; Q1 FY‘15: $17M aged projects recognized for revenue

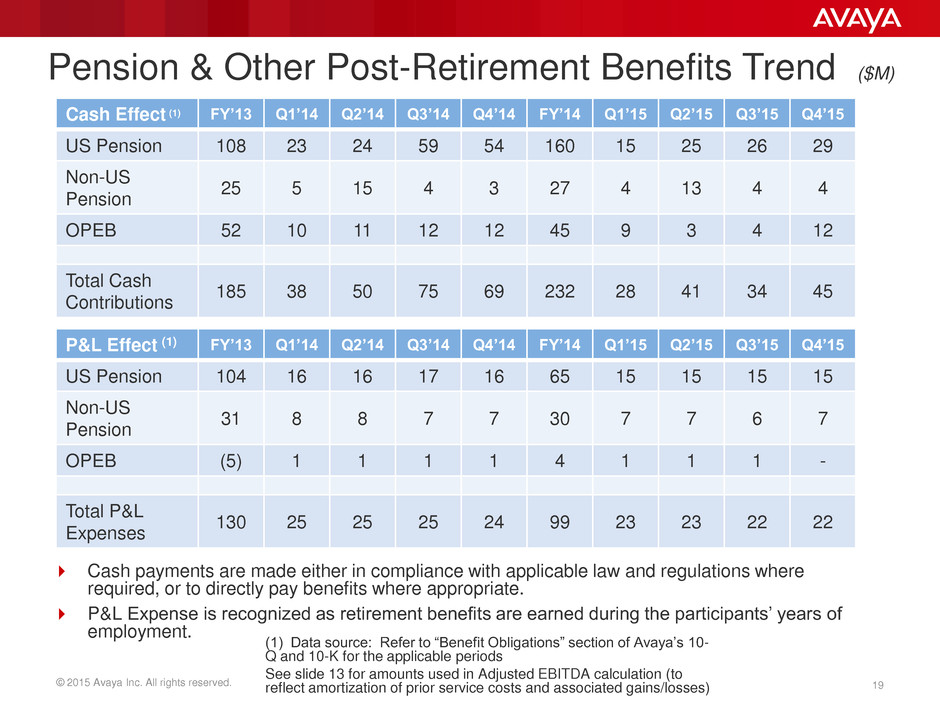

© 2015 Avaya Inc. All rights reserved. 19 Pension & Other Post-Retirement Benefits Trend ($M) Cash payments are made either in compliance with applicable law and regulations where required, or to directly pay benefits where appropriate. P&L Expense is recognized as retirement benefits are earned during the participants’ years of employment. Cash Effect (1) FY’13 Q1’14 Q2’14 Q3’14 Q4’14 FY’14 Q1’15 Q2’15 Q3’15 Q4’15 US Pension 108 23 24 59 54 160 15 25 26 29 Non-US Pension 25 5 15 4 3 27 4 13 4 4 OPEB 52 10 11 12 12 45 9 3 4 12 Total Cash Contributions 185 38 50 75 69 232 28 41 34 45 P&L Effect (1) FY’13 Q1’14 Q2’14 Q3’14 Q4’14 FY’14 Q1’15 Q2’15 Q3’15 Q4’15 US Pension 104 16 16 17 16 65 15 15 15 15 Non-US Pension 31 8 8 7 7 30 7 7 6 7 OPEB (5) 1 1 1 1 4 1 1 1 - Total P&L Expenses 130 25 25 25 24 99 23 23 22 22 (1) Data source: Refer to “Benefit Obligations” section of Avaya’s 10- Q and 10-K for the applicable periods See slide 13 for amounts used in Adjusted EBITDA calculation (to reflect amortization of prior service costs and associated gains/losses)

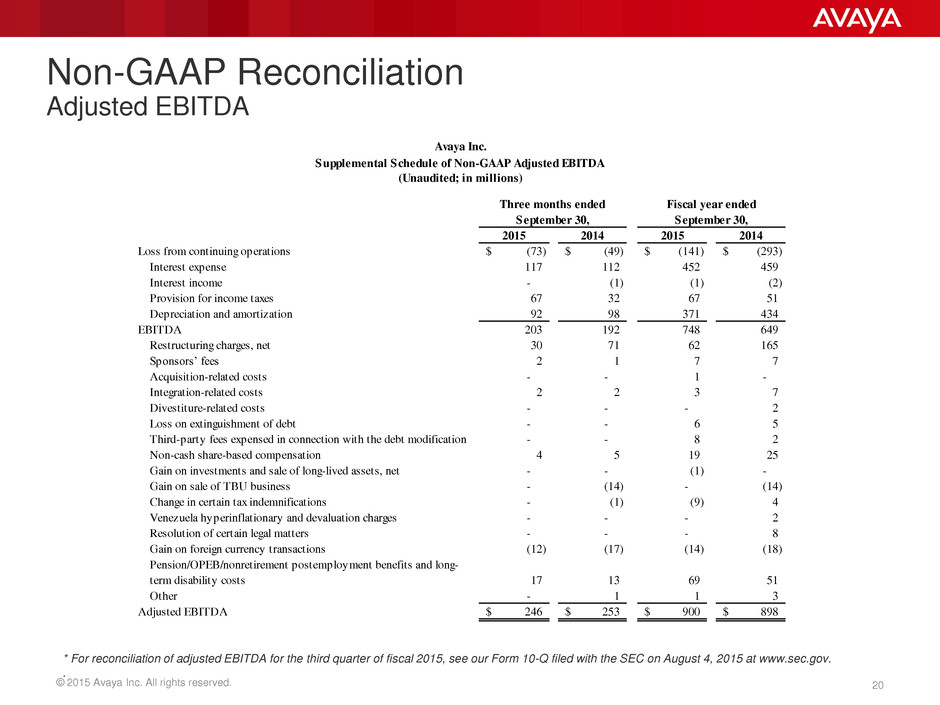

© 2015 Avaya Inc. All rights reserved. 20 Non-GAAP Reconciliation Adjusted EBITDA * For reconciliation of adjusted EBITDA for the third quarter of fiscal 2015, see our Form 10-Q filed with the SEC on August 4, 2015 at www.sec.gov. . 2015 2014 2015 2014 Loss from continuing operations (73)$ (49)$ (141)$ (293)$ Interest expense 117 112 452 459 Interest income - (1) (1) (2) Provision for income taxes 67 32 67 51 Depreciation and amortization 92 98 371 434 203 192 748 649 Restructuring charges, net 30 71 62 165 Sponsors’ fees 2 1 7 7 Acquisition-related costs - - 1 - Integration-related costs 2 2 3 7 Divestiture-related costs - - - 2 Loss on extinguishment of debt - - 6 5 Third-party fees expensed in connection with the debt modification - - 8 2 Non-cash share-based compensation 4 5 19 25 Gain on investments and sale of long-lived assets, net - - (1) - Gain on sale of TBU business - (14) - (14) Change in certain tax indemnifications - (1) (9) 4 Venezuela hyperinflationary and devaluation charges - - - 2 Resolution of certain legal matters - - - 8 Gain on foreign currency transactions (12) (17) (14) (18) Pension/OPEB/nonretirement postemployment benefits and long- term disability costs 17 13 69 51 Other - 1 1 3 Adjusted EBITDA 246$ 253$ 900$ 898$ EBITDA Three months ended September 30, Avaya Inc. Supplemental Schedule of Non-GAAP Adjusted EBITDA (Unaudited; in millions) Fiscal year ended September 30,

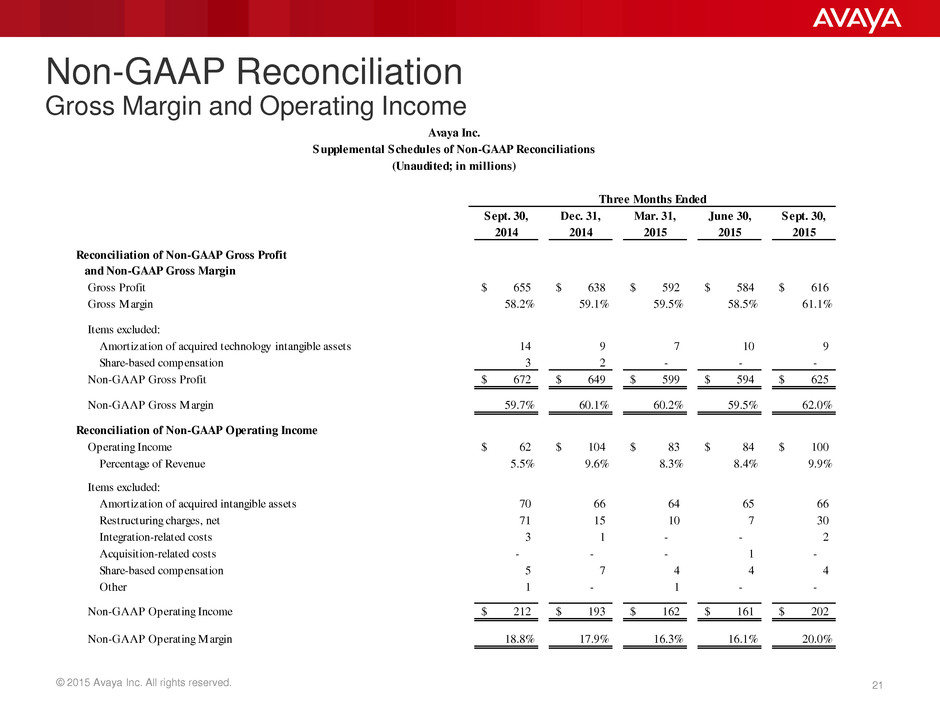

© 2015 Avaya Inc. All rights reserved. 21 Non-GAAP Reconciliation Gross Margin and Operating Income Sept. 30, Dec. 31, Mar. 31, June 30, Sept. 30, 2014 2014 2015 2015 2015 Gross Profit 655$ 638$ 592$ 584$ 616$ Gross Margin 58.2% 59.1% 59.5% 58.5% 61.1% Items excluded: Amortization of acquired technology intangible assets 14 9 7 10 9 Share-based compensation 3 2 - - - Non-GAAP Gross Profit 672$ 649$ 599$ 594$ 625$ Non-GAAP Gross Margin 59.7% 60.1% 60.2% 59.5% 62.0% Reconciliation of Non-GAAP Operating Income Operating Income 62$ 104$ 83$ 84$ 100$ Percentage of Revenue 5.5% 9.6% 8.3% 8.4% 9.9% Items excluded: Amortization of acquired intangible assets 70 66 64 65 66 Restructuring charges, net 71 15 10 7 30 Integration-related costs 3 1 - - 2 Acquisition-related costs - - - 1 - Share-based compensation 5 7 4 4 4 Other 1 - 1 - - Non-GAAP Operating Income 212$ 193$ 162$ 161$ 202$ Non-GAAP Operating Margin 18.8% 17.9% 16.3% 16.1% 20.0% Avaya Inc. Supplemental Schedules of Non-GAAP Reconciliations (Unaudited; in millions) Three Months Ended Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin

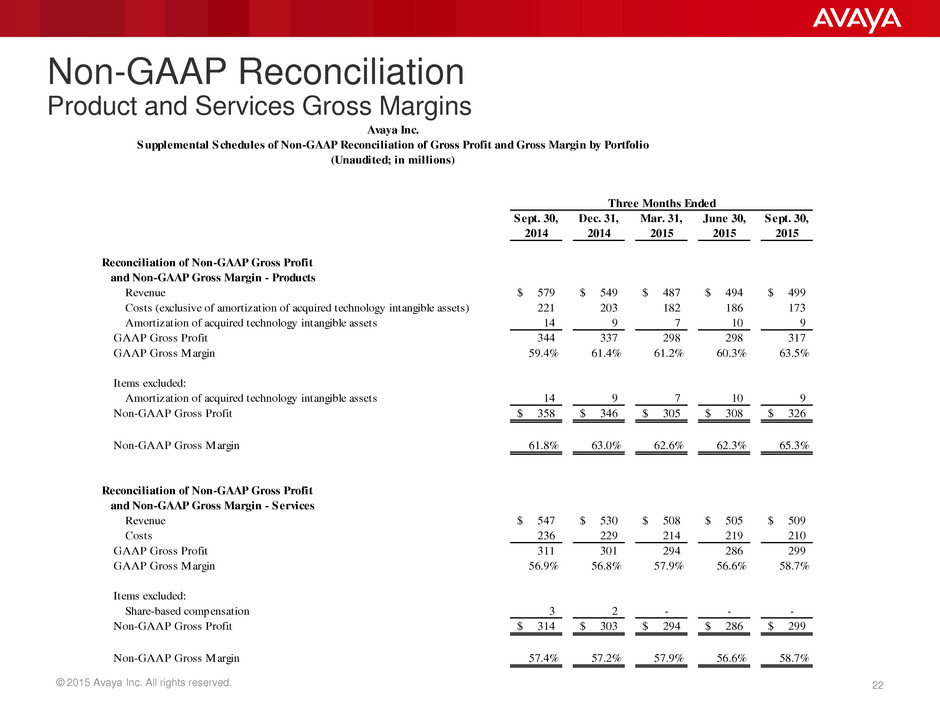

© 2015 Avaya Inc. All rights reserved. 22 Non-GAAP Reconciliation Product and Services Gross Margins Sept. 30, Dec. 31, Mar. 31, June 30, Sept. 30, 2014 2014 2015 2015 2015 Revenue 579$ 549$ 487$ 494$ 499$ Costs (exclusive of amortization of technology intangible assets)ts (exclusive of amortization of acquired technology intangible assets) 221 203 182 186 173 Amortization of technology intangible assetsortiz tion of acquired technology intangible a sets 14 9 7 10 9 GAAP Gross Profit 344 337 298 298 317 GAAP Gross Margin 59.4% 61.4% 61.2% 60.3% 63.5% Items excluded: Amortization of acquired technology intangible assets 14 9 7 10 9 Non-GAAP Gross Profit 358$ 346$ 305$ 308$ 326$ Non-GAAP Gross Margin 61.8% 63.0% 62.6% 62.3% 65.3% Revenue 547$ 530$ 508$ 505$ 509$ Costs 236 229 214 219 210 GAAP Gross Profit 311 301 294 286 299 GAAP Gross Margin 56.9% 56.8% 57.9% 56.6% 58.7% Items excluded: Share-based compensation 3 2 - - - Non-GAAP Gross Profit 314$ 303$ 294$ 286$ 299$ Non-GAAP Gross Margin 57.4% 57.2% 57.9% 56.6% 58.7% Avaya Inc. (Unaudited; in millions) Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin - Services Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin - Products Supplemental Schedules of Non-GAAP Reconciliation of Gross Profit and Gross Margin by Portfolio Three Months Ended