Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Ascent Capital Group, Inc. | a8kacg1192015poolcurve.htm |

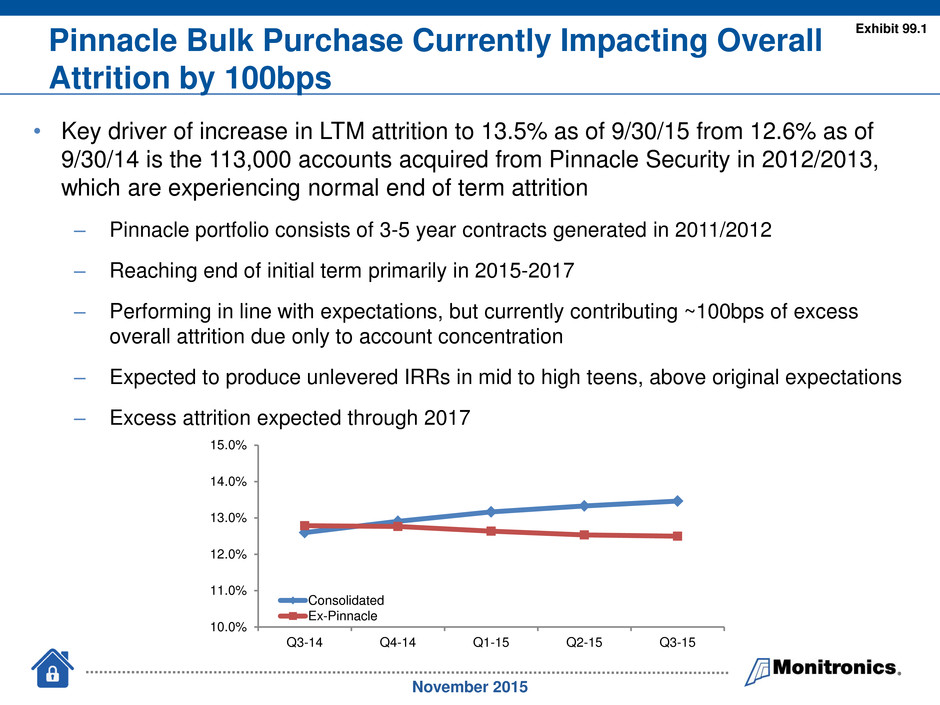

• Key driver of increase in LTM attrition to 13.5% as of 9/30/15 from 12.6% as of 9/30/14 is the 113,000 accounts acquired from Pinnacle Security in 2012/2013, which are experiencing normal end of term attrition ‒ Pinnacle portfolio consists of 3-5 year contracts generated in 2011/2012 ‒ Reaching end of initial term primarily in 2015-2017 ‒ Performing in line with expectations, but currently contributing ~100bps of excess overall attrition due only to account concentration ‒ Expected to produce unlevered IRRs in mid to high teens, above original expectations ‒ Excess attrition expected through 2017 Pinnacle Bulk Purchase Currently Impacting Overall Attrition by 100bps November 2015 10.0% 11.0% 12.0% 13.0% 14.0% 15.0% Q3-14 Q4-14 Q1-15 Q2-15 Q3-15 Consolidated Ex-Pinnacle Exhibit 99.1

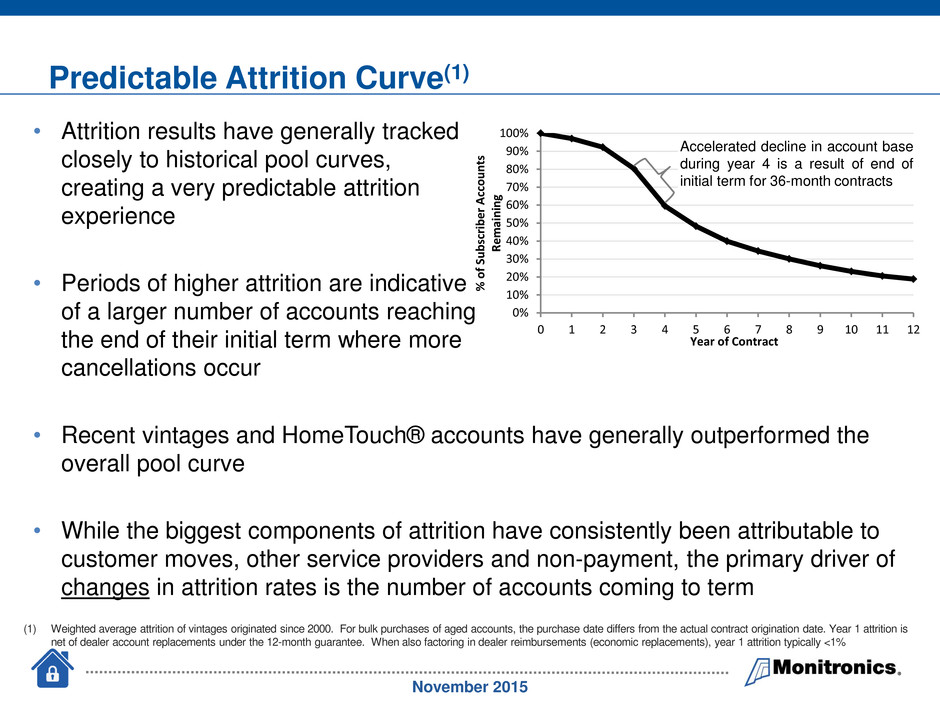

• Attrition results have generally tracked closely to historical pool curves, creating a very predictable attrition experience • Periods of higher attrition are indicative of a larger number of accounts reaching the end of their initial term where more cancellations occur • Recent vintages and HomeTouch® accounts have generally outperformed the overall pool curve • While the biggest components of attrition have consistently been attributable to customer moves, other service providers and non-payment, the primary driver of changes in attrition rates is the number of accounts coming to term Predictable Attrition Curve(1) (1) Weighted average attrition of vintages originated since 2000. For bulk purchases of aged accounts, the purchase date differs from the actual contract origination date. Year 1 attrition is net of dealer account replacements under the 12-month guarantee. When also factoring in dealer reimbursements (economic replacements), year 1 attrition typically <1% November 2015 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 0 1 2 3 4 5 6 7 8 9 10 11 12 % o f Su b sc ri b e r A cc o u n ts R e m ai n in g Year of Contract Accelerated decline in account base during year 4 is a result of end of initial term for 36-month contracts