Attached files

| file | filename |

|---|---|

| 8-K - NEULION, INC. | s831508k.htm |

Exhibit 99.1

3Q 2015 Conference Call November 5, 2015 NeuLion empowers the world's top players to deliver and monetize next generation video experiences on any device

Safe Harbor Statements Forward Looking StatementsCertain statements herein are forward-looking statements and represent NeuLion’s current intentions in respect of future activities. Forward-looking statements can be identified by the use of the words “will,” “expect,” “seek,” “anticipate,” “believe,” “plan,” “estimate,” “expect,” and “intend” and statements that an event or result “may,” “will,” “can,” “should,” “could,” or “might” occur or be achieved and other similar expressions. These statements, in addressing future events and conditions, involve inherent risks and uncertainties. Although the forward-looking statements contained in this presentation are based upon what management believes to be reasonable assumptions, NeuLion cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this presentation and NeuLion assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law. Many factors could cause NeuLion’s actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including: our ability to derive anticipated benefits from the acquisition of DivX; our ability to successfully integrate the operations of DivX; our ability to realize some or all of the anticipated benefits of our partnerships; general economic and market segment conditions; our customers’ subscriber levels and financial health; our ability to pursue and consummate acquisitions in a timely manner; our continued relationships with our customers; our ability to negotiate favorable terms for contract renewals; competitor activity; product capability and acceptance rates; technology changes; regulatory changes; foreign exchange risk; interest rate risk; and credit risk. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. A more detailed assessment of the risks that could cause actual results to materially differ from current expectations is contained in the “Risk Factors” section of NeuLion’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014, which is available on www.sec.gov and filed on www.sedar.com. Use of Non-GAAP Financial MeasuresIn addition to our U.S. GAAP results, this presentation also includes disclosure on certain non-GAAP financial measures, as such term is used by the SEC. The Company defines Non-GAAP revenues as GAAP revenues before purchase price accounting adjustments as a result of an acquisition. The Company defines Non-GAAP Adjusted EBITDA as consolidated net income (loss) before interest, income taxes, depreciation and amortization, purchase price accounting adjustments, stock-based compensation, acquisition-related expenses, gain on revaluation of convertible note derivative, and foreign exchange loss. Non-GAAP Adjusted EBITDA is a key measure used by management to evaluate the Company’s results and make strategic decisions about the Company, including potential acquisitions. Management believes this measure is useful to investors because it is an indicator of operational performance. Because not all companies use identical calculations, the Company’s presentation of Non-GAAP Adjusted Revenue and EBITDA may not be comparable to similarly titled measures of other companies. This measure does not have any standardized meaning prescribed by U.S. GAAP and therefore is unlikely to be comparable to the calculation of similar measures used by other companies, and should not be viewed as an alternative to measures of financial performance or changes in cash flows calculated in accordance with U.S. GAAP.

Agenda Opening remarksQ3 Financial Highlights and ReviewQ3 Operational HighlightsNHL DisclosureOngoing Growth InitiativesQ&A Kanaan JemiliChief Executive Officer Chris Wagner Executive Vice President Tim AlavathilSenior Vice President Finance Roy ReichbachGeneral Counsel & Corporate Secretary

3Q Revenue Highlights 80% gain in GAAP revenue versus prior year’s levelNeuLion Digital Platform growth 17%NeuLion Digital Platform growth largely driven by new customers, fixed license fees110% gain in non-GAAP revenue versus prior year’s level 2012 2013 2014 2015 $/MM 33% CAGR 25% CAGR 28% CAGR 38% CAGR 40% CAGR 25% CAGR 35% CAGR 45% CAGR $/MM

3Q EBITDA Highlights Further benefits of scale - 500 bps cost of revenue improvement driven primarily by acquisition of DivXOperating expenses higher primarily due to acquisition of DivXSG&A expense, including stock-based compensation, increased 76%R&D expense more than tripledOrganic Adjusted EBITDA improved 68% from $1.3 million to $2.2 millionDivX Adjusted EBITDA was $2.8 million $/MM 2012 2013 2014 2015

3Q Income Statement (in $000) 3Q 2015 3Q 2014 Revenue 21,901 12,177 Cost of revenue, excluding depreciation & amortization 3,863 2,813 SG&A, including stock-based compensation 11,150 6,330 R&D 6,588 2,104 Depreciation & amortization 2,046 680 Operating income (loss) (1,746) 250 Other income (expense) (133) (29) Net and comprehensive income (loss) before income taxes (1,879) 221 Income taxes (1,241) 28 Net and comprehensive income (loss) (3,120) 249 Net income (loss) per weighted average share (0.01) 0.00 Weighted average shares 244,325 217,163

3Q Balance Sheet (in $000) 9/30/2015 12/31/2014 Cash & Equivalents 59,064 25,898 Receivables 15,980 8,056 Total Current Assets 80,239 36,287 Payables 22,931 14,362 Deferred Revenue 11,596 9,602 Total Current Liabilities 43,960 29,212 Working Capital 36,279 7,075 Other Long-Term Liabilities 6,761 2,673 Total Redeemable Preferred Stock 14,977 14,955 Total Equity 59,452 5,099 Total Liabilities and Equity 125,150 51,938

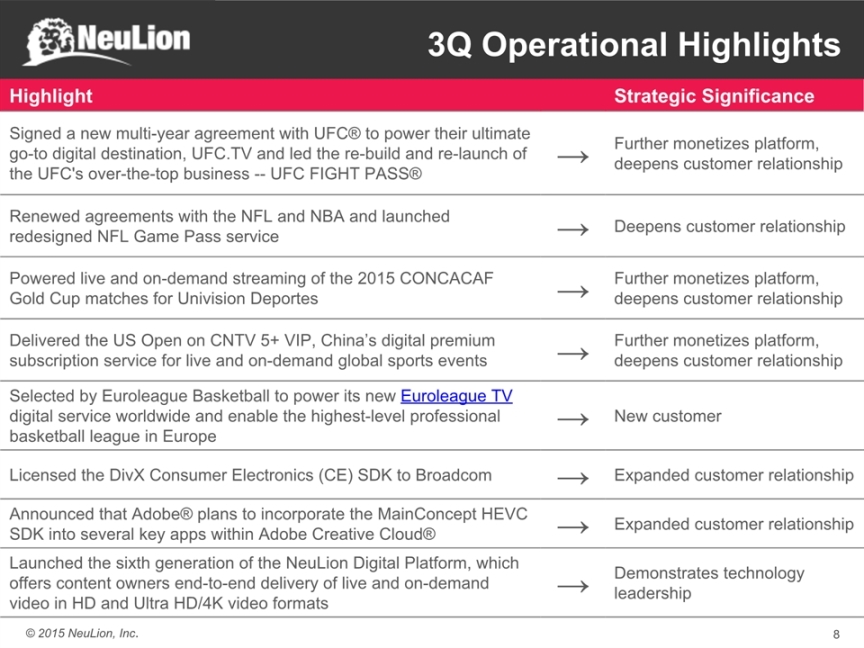

Highlight Strategic Significance Signed a new multi-year agreement with UFC® to power their ultimate go-to digital destination, UFC.TV and led the re-build and re-launch of the UFC's over-the-top business -- UFC FIGHT PASS® → Further monetizes platform, deepens customer relationship Renewed agreements with the NFL and NBA and launched redesigned NFL Game Pass service → Deepens customer relationship Powered live and on-demand streaming of the 2015 CONCACAF Gold Cup matches for Univision Deportes → Further monetizes platform, deepens customer relationship Delivered the US Open on CNTV 5+ VIP, China’s digital premium subscription service for live and on-demand global sports events → Further monetizes platform, deepens customer relationship Selected by Euroleague Basketball to power its new Euroleague TV digital service worldwide and enable the highest-level professional basketball league in Europe → New customer Licensed the DivX Consumer Electronics (CE) SDK to Broadcom → Expanded customer relationship Announced that Adobe® plans to incorporate the MainConcept HEVC SDK into several key apps within Adobe Creative Cloud® → Expanded customer relationship Launched the sixth generation of the NeuLion Digital Platform, which offers content owners end-to-end delivery of live and on-demand video in HD and Ultra HD/4K video formats → Demonstrates technology leadership 3Q Operational Highlights

NHL Disclosure On November 3, 2015, NeuLion signed a letter of intent (“LOI”) with the NHL to provide transition services and support for the NHL’s digital properties, including NHL GameCenter LIVE™, for the 2015-16 NHL season. Terms of the LOI include:The value for the 2015-16 NHL season is in excess of $11 million. NeuLion will render consulting services to the NHL regarding digital media and technology issues for four years beginning on October 1, 2016. The value of the consulting services for the four years is $4 million. The LOI is subject to the negotiation and execution of a definitive agreement.

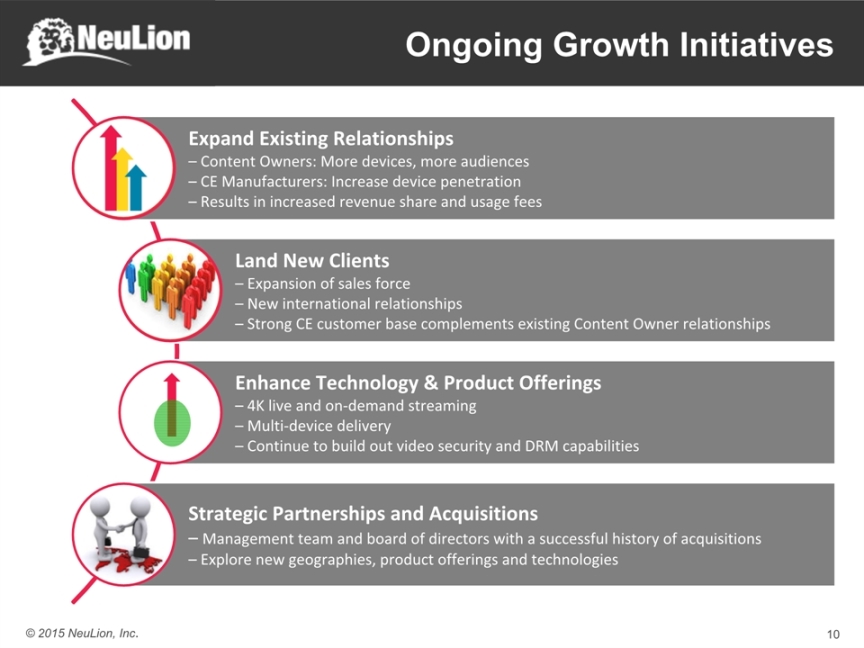

Ongoing Growth Initiatives

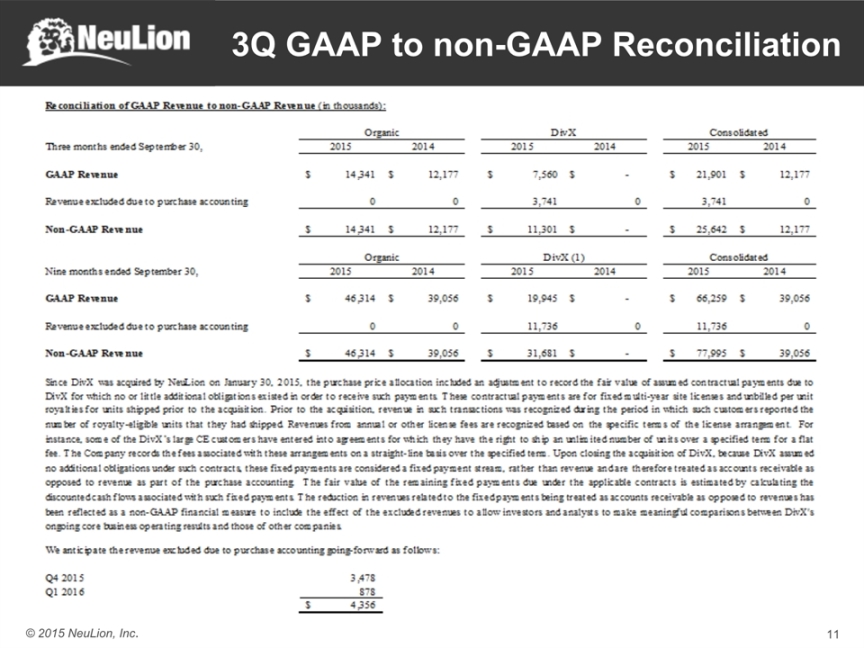

3Q GAAP to non-GAAP Reconciliation

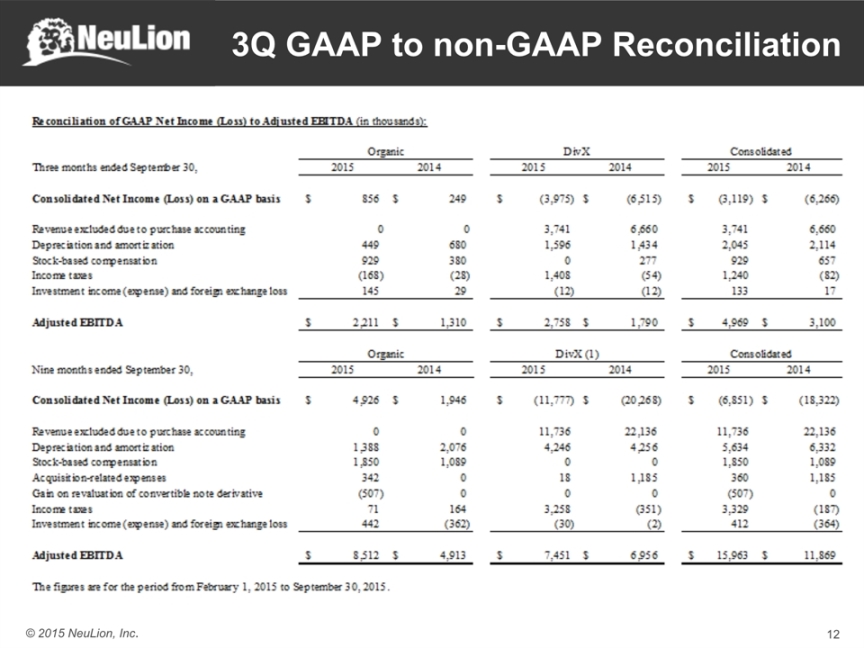

3Q GAAP to non-GAAP Reconciliation