Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Easterly Government Properties, Inc. | d30089d8k.htm |

| EX-99.1 - EX-99.1 - Easterly Government Properties, Inc. | d30089dex991.htm |

Supplemental Information Package Third Quarter 2015 Exhibit 99.2

Disclaimers Forward-looking Statement We make statements in this Supplemental Information Package that are considered “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which are usually identified by the use of words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “seeks,” “should,” “will,” and variations of such words or similar expressions. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and are including them in this Supplemental Information Package for purposes of complying with those safe harbor provisions. These forward-looking statements reflect our current views about our plans, intentions, expectations, strategies and prospects, which are based on the information currently available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects as reflected in or suggested by those forward-looking statements are reasonable, we can give no assurance that the plans, intentions, expectations or strategies will be attained or achieved. Furthermore, actual results may differ materially from those described in the forward-looking statements and will be affected by a variety of risks and factors that are beyond our control including, without limitation: risks associated with our dependence on the U.S. Government and its agencies for substantially all of our revenues; risks associated with ownership and development of real estate; decreased rental rates or increased vacancy rates; loss of key personnel; general volatility of the capital and credit markets and the market price of our common stock; the risk that the market price of our common stock may be negatively impacted by increased selling activity following the liquidation of certain private investment funds that contributed assets in our initial public offering; the risk we may lose one or more major tenants; failure of acquisitions or development projects to occur at anticipated levels or to yield anticipated results; risks associated with actual or threatened terrorist attacks; intense competition in the real estate market that may limit our ability to attract or retain tenants or re-lease space; insufficient amounts of insurance or exposure to events that are either uninsured or underinsured; uncertainties and risks related to adverse weather conditions, natural disasters and climate change; exposure to liability relating to environmental and health and safety matters; limited ability to dispose of assets because of the relative illiquidity of real estate investments and the nature of our assets; exposure to litigation or other claims; risks associated with breaches of our data security; risks associated with our indebtedness; and other risks and uncertainties detailed in the “Risk Factors” section of our Form 10-K for the year ended December 31, 2014 filed with the Securities and Exchange Commission. In addition, our anticipated qualification as a real estate investment trust involves the application of highly technical and complex provisions of the Internal Revenue Code of 1986, or the Code, and depends on our ability to meet the various requirements imposed by the Code through actual operating results, distribution levels and diversity of stock ownership. We assume no obligation to update publicly any forward looking statements, whether as a result of new information, future events or otherwise. Ratings Ratings are not recommendations to buy, sell or hold the Company’s securities. The following discussion related to the consolidated financial statements of the Company should be read in conjunction with the financial statements for the quarter ended September 30, 2015 that will be released on Form 10-Q to be filed on or about November 5, 2015.

Supplemental Definitions Annualized lease income is defined as the annualized contractual base rent for the last month in a specified period, plus the annualized straight line rent adjustments for the last month in such period and the annualized expense reimbursements earned by us for the last month in such period. Cash Available for Distribution (CAD), is a non-GAAP financial measure that is not intended to represent cash flow for the period and is not indicative of cash flow provided by operating activities as determined under GAAP. CAD is calculated in accordance with the current NAREIT definition as FFO minus normalized recurring real estate-related expenditures and other non-cash items and nonrecurring expenditures. CAD is presented solely as a supplemental disclosure with respect to liquidity because the Company believes it provides useful information regarding the Company’s ability to fund its dividends. Because all companies do not calculate CAD the same way, the presentation of CAD may not be comparable to similarly titled measures of other companies. EBITDA is calculated as the sum of net income (loss) before interest expense, income taxes, depreciation and amortization. EBITDA is not intended to represent cash flow for the period, is not presented as an alternative to operating income as an indicator of operating performance, should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP and is not indicative of operating income or cash provided by operating activities as determined under GAAP. EBITDA is presented solely as a supplemental disclosure with respect to liquidity because the Company believes it provides useful information regarding the Company's ability to service or incur debt. Because all companies do not calculate EBITDA the same way, the presentation of EBITDA may not be comparable to similarly titled measures of other companies. Fully diluted basis assumes the exchange of all outstanding common units representing limited partnership interests in the Company’s operating partnership, or common units, the full vesting of all restricted stock units, and the exchange of all earned and outstanding LTIP units in the Company’s operating partnership for shares of common stock on a one-for-one basis, which is not the same as the meaning of “fully diluted” under GAAP. Fully diluted basis does not include outstanding LTIP units in the Company’s operating partnership that are subject to performance criteria that have not yet been met. Funds From Operations (FFO) is generally defined by NAREIT as net income (loss), calculated in accordance with GAAP, excluding gains or losses from sales of property and impairment losses on depreciable real estate, plus real estate depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. FFO is a widely recognized measure of REIT performance. Although FFO is a non-GAAP financial measure, the Company believes that information regarding FFO is helpful to shareholders and potential investors. Funds From Operations, as Adjusted (FFO, as Adjusted) adjusts Funds From Operations (FFO) to present an alternative measure of our operating performance that we believe is useful to shareholders and potential investors, which, when applicable, excludes the impact of acquisition costs, straight-line rent, above-/below-market leases, non-cash interest and non-cash compensation. In the Future, we may also exclude other items from FFO, as Adjusted that we believe may help investors compare our results. Because all companies do not calculate FFO, as Adjusted in the same way, the presentation of FFO, as Adjusted may not be comparable to similarly titled measures of other companies. Net Operating Income (NOI) is calculated as total property revenues (rental income, tenant reimbursements and other income) less property operating expenses and real estate taxes from the properties owned by the Company. Cash NOI excludes from NOI straight-line rent and amortization of above-/below-market leases. NOI presented by the Company may not be comparable to NOI reported by other REITs that define NOI differently. NOI should not be considered an alternative to net income as an indication of our performance or to cash flows as a measure of the Company's liquidity or its ability to make distributions. Pro forma nine months ended September 30, 2015 (1) removes from the Company’s financial results for the period from February 11, 2015 (the date of the closing of the Company’s initial public offering) to September 30, 2015 the impact of one-time, non-recurring expenses related to its initial public offering, including legal and accounting fees and new entity formation costs and (2) reflects a full quarter of operations for the period from January 1, 2015 to March 31, 2015 on a pro forma basis based on the financial results of the 49 days of operations between February 11, 2015 and March 31, 2015.

Overview Corporate Information and Analyst Coverage 5 Executive Summary 6 Corporate Financials Balance Sheet 7 Income Statement 8 Net Operating Income 9 EBITDA, FFO and CAD 10 Debt Debt Schedules Debt Maturities Properties Property Overview Tenants Lease Expirations Table of Contents 11 12 13 14 15

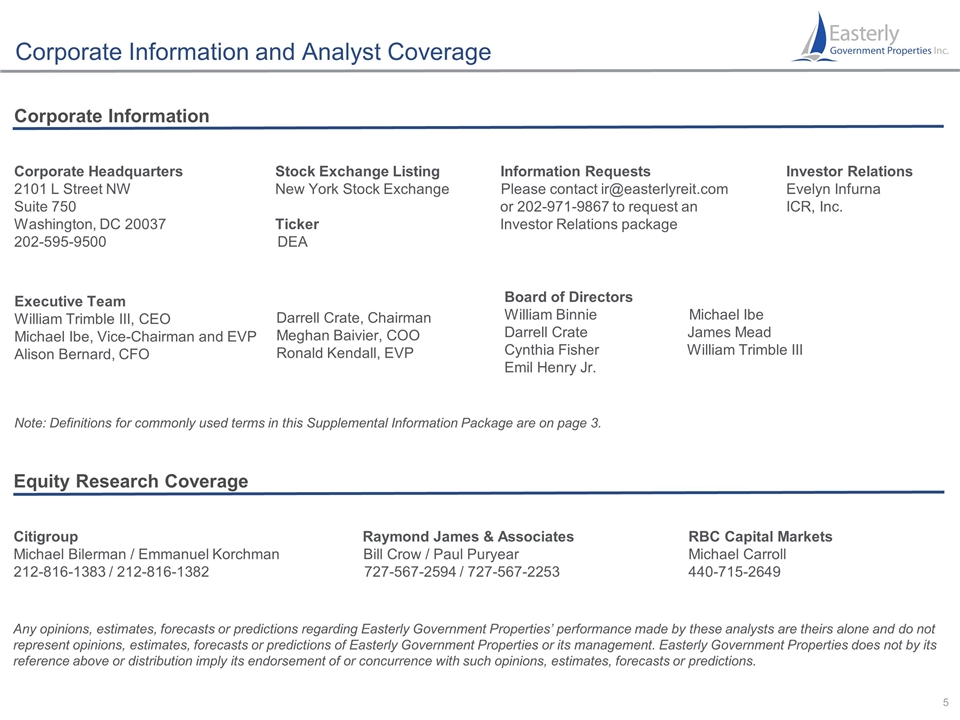

Corporate Information and Analyst Coverage Corporate Information Corporate Headquarters Stock Exchange Listing Information RequestsInvestor Relations 2101 L Street NW New York Stock Exchange Please contact ir@easterlyreit.comEvelyn Infurna Suite 750 or 202-971-9867 to request anICR, Inc. Washington, DC 20037 Ticker Investor Relations package 202-595-9500 DEA Equity Research Coverage Citigroup Raymond James & Associates RBC Capital Markets Michael Bilerman / Emmanuel Korchman Bill Crow / Paul Puryear Michael Carroll 212-816-1383 / 212-816-1382 727-567-2594 / 727-567-2253 440-715-2649 Any opinions, estimates, forecasts or predictions regarding Easterly Government Properties’ performance made by these analysts are theirs alone and do not represent opinions, estimates, forecasts or predictions of Easterly Government Properties or its management. Easterly Government Properties does not by its reference above or distribution imply its endorsement of or concurrence with such opinions, estimates, forecasts or predictions. Note: Definitions for commonly used terms in this Supplemental Information Package are on page 3. Executive Team William Trimble III, CEO Michael Ibe, Vice-Chairman and EVP Alison Bernard, CFO Board of Directors William Binnie Michael Ibe Darrell Crate James Mead Cynthia Fisher William Trimble III Emil Henry Jr. Darrell Crate, Chairman Meghan Baivier, COO Ronald Kendall, EVP

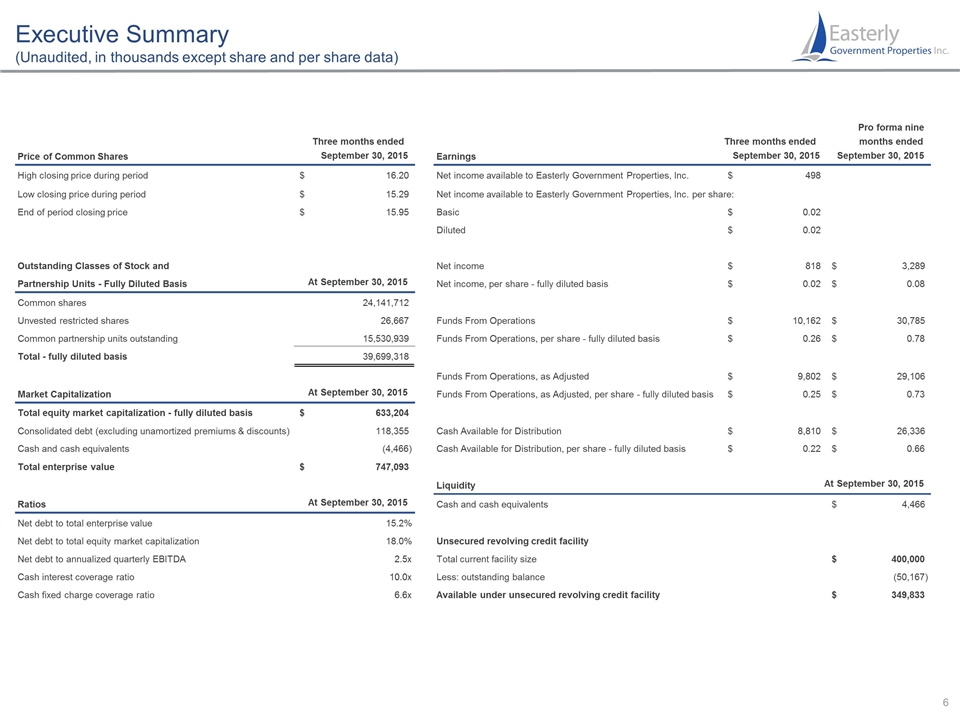

Executive Summary (Unaudited, in thousands except share and per share data) Price of Common Shares Three months ended September 30, 2015 Earnings Three months ended September 30, 2015 Pro forma nine months ended September 30, 2015 High closing price during period 16.20 $ Net income available to Easterly Government Properties, Inc. 498 $ Low closing price during period 15.29 $ Net income available to Easterly Government Properties, Inc. per share: End of period closing price 15.95 $ Basic 0.02 $ Diluted 0.02 $ Outstanding Classes of Stock and Net income 818 $ 3,289 $ Partnership Units - Fully Diluted Basis At September 30, 2015 Net income, per share - fully diluted basis 0.02 $ 0.08 $ Common shares 24,141,712 Unvested restricted shares 26,667 Funds From Operations 10,162 $ 30,785 $ Common partnership units outstanding 15,530,939 Funds From Operations, per share - fully diluted basis 0.26 $ 0.78 $ Total - fully diluted basis 39,699,318 Funds From Operations, as Adjusted 9,802 $ 29,106 $ Market Capitalization At September 30, 2015 Funds From Operations, as Adjusted, per share - fully diluted basis 0.25 $ 0.73 $ Total equity market capitalization - fully diluted basis 633,204 $ Consolidated debt (excluding unamortized premiums & discounts) 118,355 Cash Available for Distribution 8,810 $ 26,336 $ Cash and cash equivalents (4,466) Cash Available for Distribution, per share - fully diluted basis 0.22 $ 0.66 $ Total enterprise value 747,093 $ Liquidity At September 30, 2015 Ratios At September 30, 2015 Cash and cash equivalents 4,466 $ Net debt to total enterprise value 15.2% Net debt to total equity market capitalization 18.0% Unsecured revolving credit facility Net debt to annualized quarterly EBITDA 2.5x Total current facility size 400,000 $ Cash interest coverage ratio 10.0x Less: outstanding balance (50,167) Cash fixed charge coverage ratio 6.6x Available under unsecured revolving credit facility 349,833 $

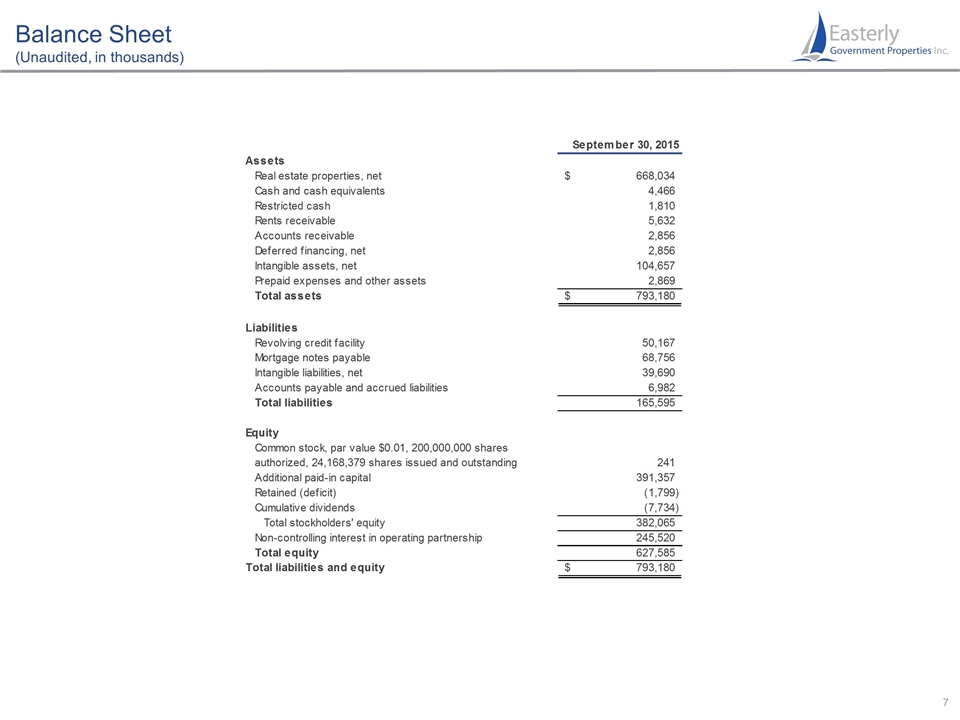

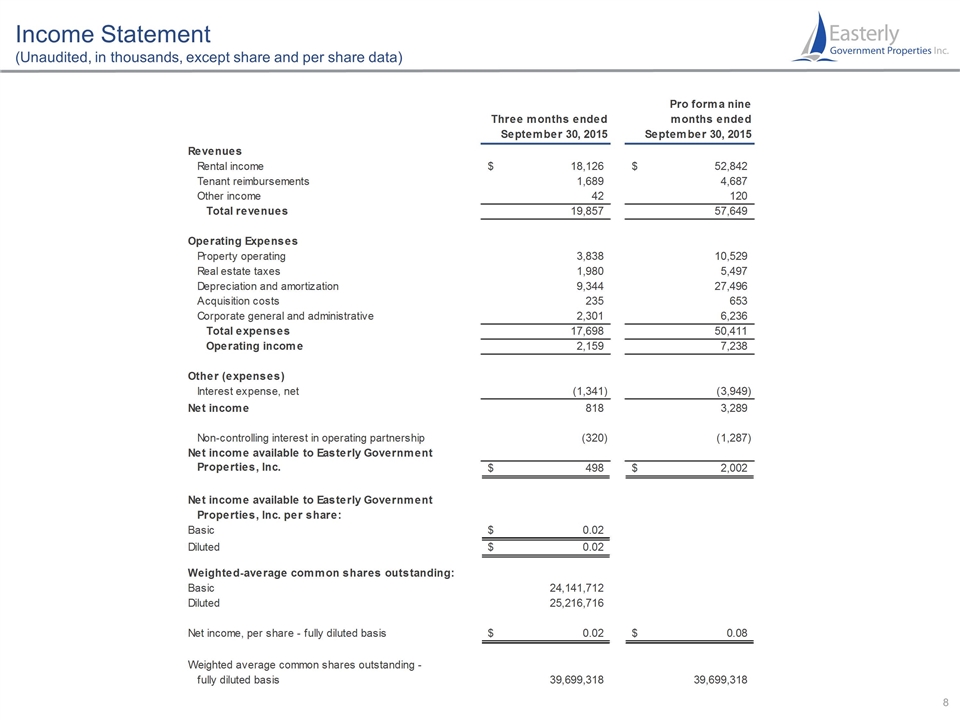

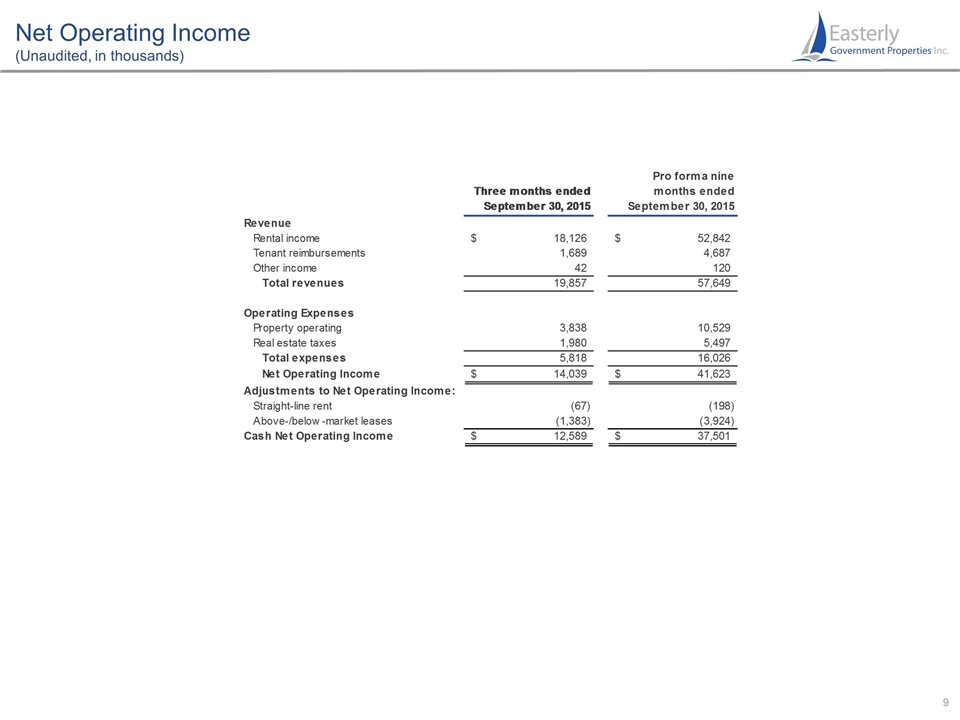

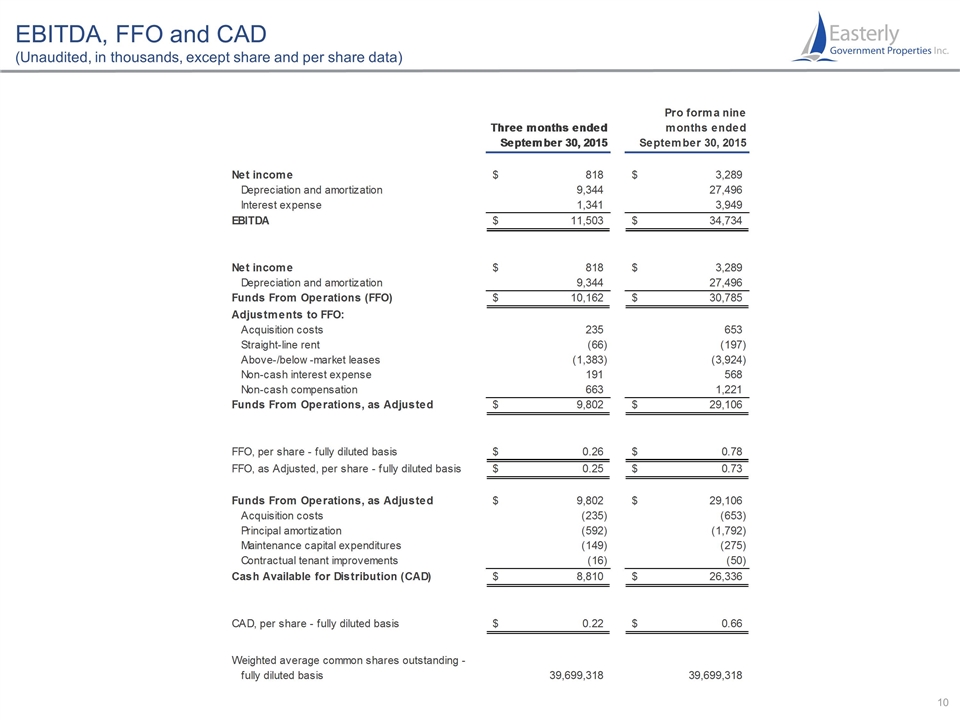

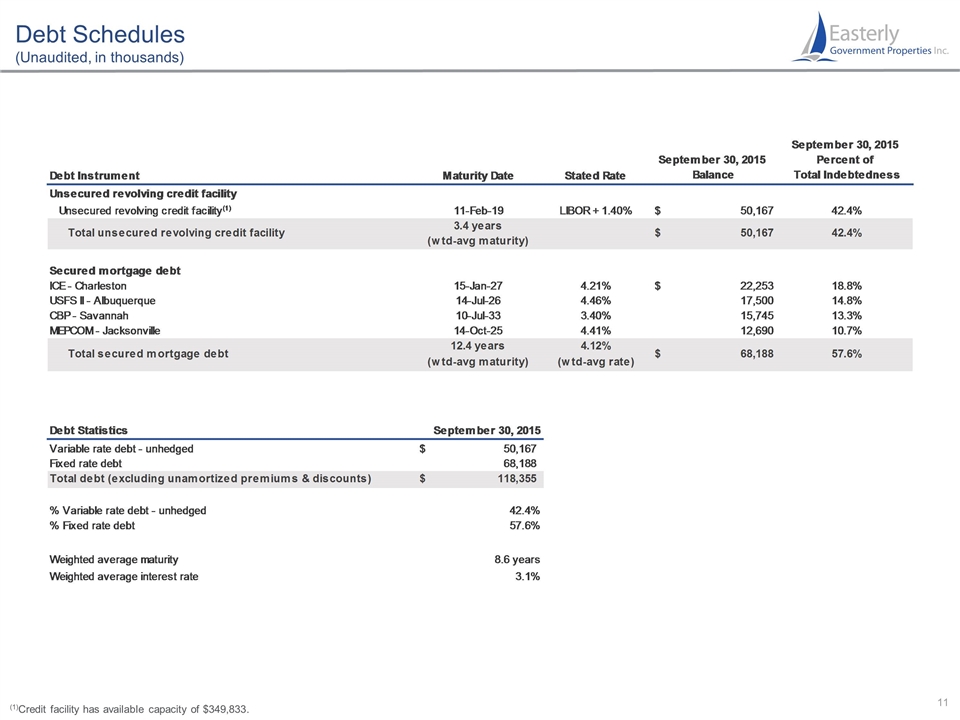

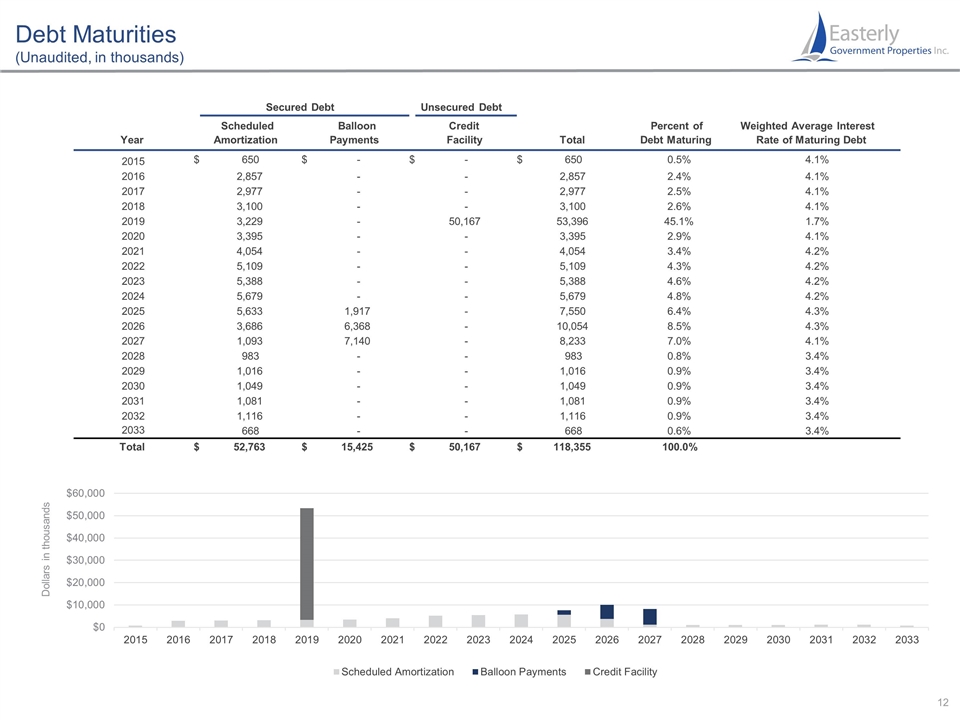

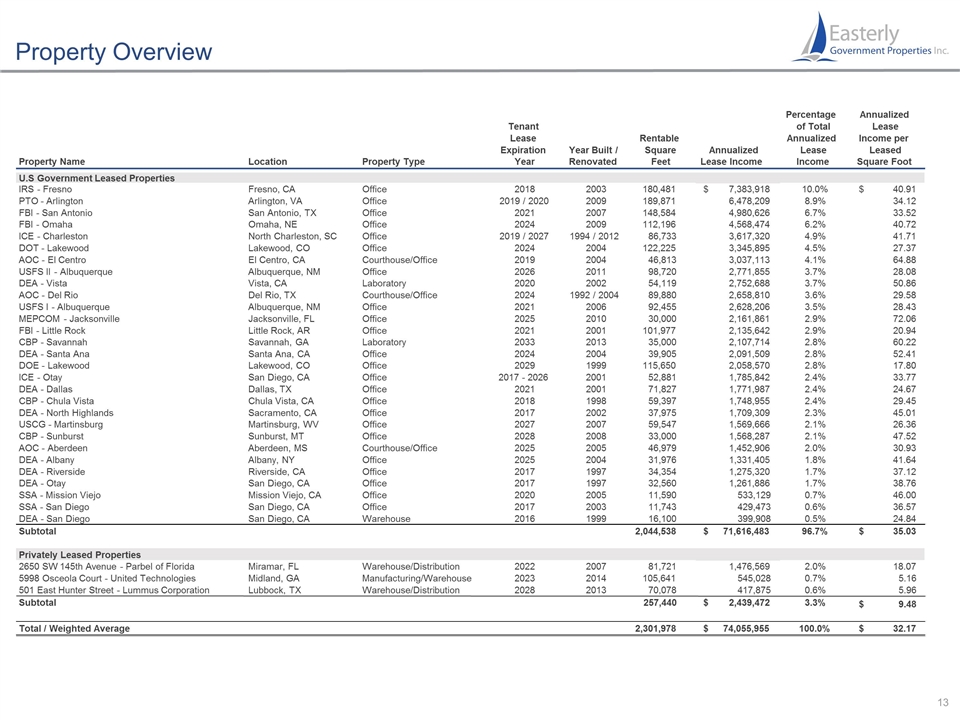

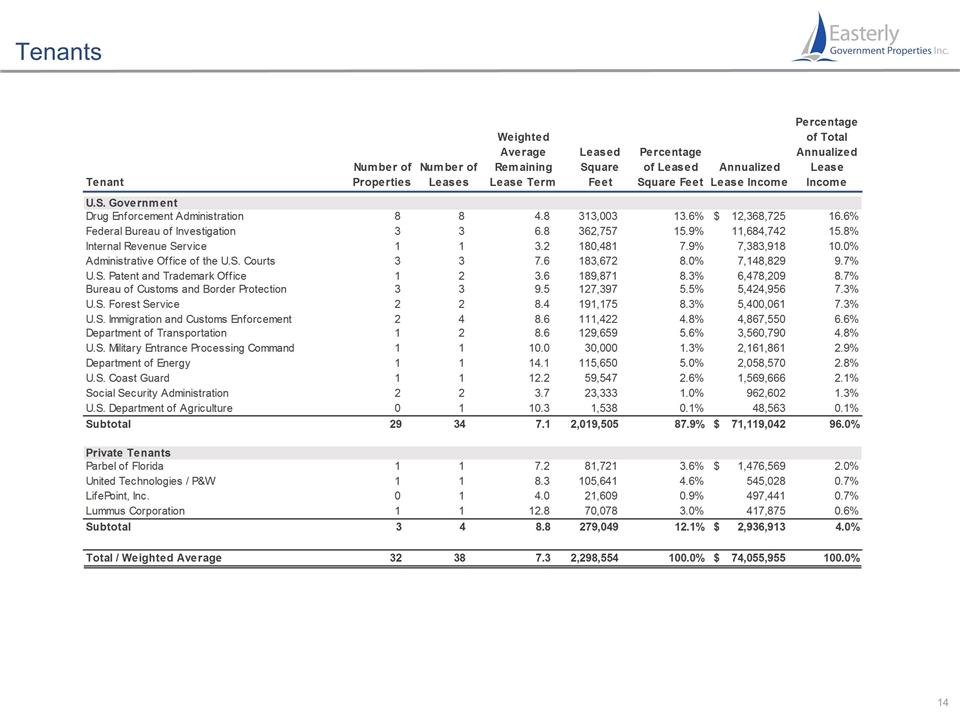

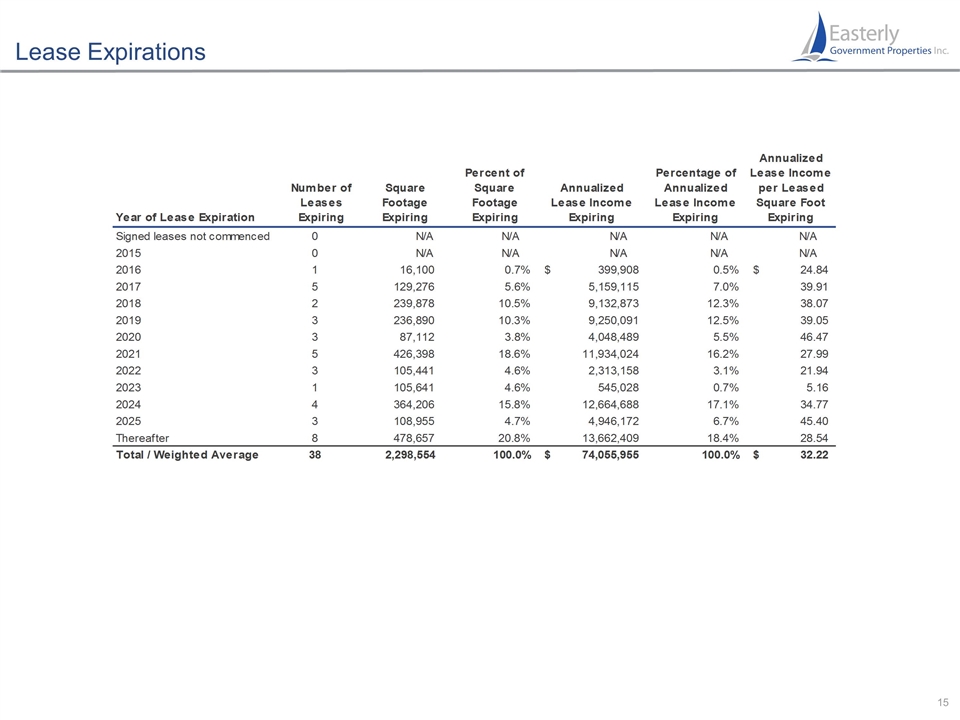

Balance Sheet (Unaudited, in thousands) Debt Schedules (Unaudited, in thousands) Date 42277 Debt Instrument Maturity Date Stated Rate September 30, 2015 Balance September 30, 2015 Percent of Total Indebtedness Debt Inputs Credit Facility Availability Unsecured revolving credit facility ICE - Charleston 22,253,318.390000001 Total Credit Facility ,400,000 Unsecured revolving credit facility(1) 43507 LIBOR + 1.40% $50,167 0.42386886908030924 USFS II - Albuquerque 17,500,000 Used Capacity ,-50,167.330399999999 Total unsecured revolving credit facility 3.4 years $50,167 0.42386886908030924 CBP - Savannah 15,745,000 Remaining Capacity ,349,832.66960000002 (wtd-avg maturity) MEPCOM - Jacksonville 12,690,392.359999999 Maturity of Debt Calculation Secured mortgage debt Credit Facility Rate Outstanding 0.42386793198346173 1.4283768666839944 ICE - Charleston 46402 4.2099999999999999E-2 $22,253 0.18801909509526424 Piece 1 1.5900000000000001E-2 2,500,000 0.18802013123940992 2.1248850448289476 USFS II - Albuquerque 46217 4.4600000000000001E-2 17,500 0.14786025093996874 Piece 2 1.5900000000000001E-2 20,000,000 0.14785895024843859 1.5960664766543784 CBP - Savannah 48770 3.4000000000000002E-2 15,745 0.13303198005998901 Piece 3 1.5900000000000001E-2 10,917,330.4 0.13303080980923804 2.3664905427161167 MEPCOM - Jacksonville 45944 4.41E-2 12,690 0.10721980482446876 Piece 4 1.6E-2 2,500,000 0.10722217671945171 1.0772156767951491 Total secured mortgage debt 12.4 years 4.1243498760460143E-2 $68,188 0.57613113091969081 Piece 5 1.61E-2 14,250,000 (wtd-avg maturity) (wtd-avg rate) 50,167,330.399999999 Weighted Debt Maturity 8.593034607678586 Total Debt ,118,356,041.15000001 0.32634901210535061 3.6881908902317022 Debt Statistics September 30, 2015 0.25664072259937837 2.7703135535384953 Variable rate debt - unhedged $50,167 Weighted Interest of Debt 0.23090332441869785 4.107548727261932 Fixed rate debt 68,188 Credit Facility 800.76055336000002 0.18610694087657317 1.869737403272312 Total debt (excluding unamortized premiums & discounts) $,118,355 ICE - Charleston 936.86470421900003 USFS II - Albuquerque 780.5 Weighted Secured Debt Maturity 12.435790574304441 % Variable rate debt - unhedged 0.42386886908030924 CBP - Savannah 535.33000000000004 % Fixed rate debt 0.57613113091969081 MEPCOM - Jacksonville 559.64630307599998 Total 3,613.101560655 Weighted average maturity 8.6 years Weighted average interest rate 3.5% Weighted Avg. Interest Rate 3.0527394508539626E-2 Weighted Avg. Interest Rate of Secured Debt 4.1243498760460143E-2 *Credit facility has available capacity of $349832.6696 Tenant Number of Properties Number of Leases Weighted Average Remaining Lease Term Leased Square Feet Percentage of Leased Square Feet Annualized Lease Income Percentage of Total Annualized Lease Income Percentage of Leased Square Feet Percentage of Total Annualized Lease Income U.S. Government Drug Enforcement Administration 8 8 4.8176538112746865 ,313,003 0.13600000000000001 $12,368,725.43058969 0.16600000000000001 0.13600000000000001 0.16600000000000001 Federal Bureau of Investigation 3 3 6.8189029366841698 ,362,757 0.159 11,684,742 0.158 0.159 0.158 Internal Revenue Service 1 1 3.1698630136986301 ,180,481 7.9% 7,383,918 0.1 7.9% 0.1 Administrative Office of the U.S. Courts 3 3 7.6010882114454166 ,183,672 0.08 7,148,829 9.7% 0.08 9.7% U.S. Patent and Trademark Office 1 2 3.5884606585451708 ,189,871 8.3% 6,478,209 8.7% 8.3% 8.7% Bureau of Customs and Border Protection 3 3 9.4745482168189383 ,127,397 5.5% 5,424,956 7.3% 5.5% 7.3% U.S. Forest Service 2 2 8.3635330893483157 ,191,175 8.3% 5,400,061 7.3% 8.3% 7.3% U.S. Immigration and Customs Enforcement 2 4 8.5596935063363944 ,111,422 4.8% 4,867,549.9569410319 6.6% 4.8% 6.6% Department of Transportation 1 2 8.5856002684385935 ,129,659 5.6% 3,560,790 4.8% 5.6% 4.8% U.S. Military Entrance Processing Command 1 1 10.002739726027396 30,000 1.3% 2,161,861 2.9% 1.3% 2.9% Department of Energy 1 1 14.106849315068493 ,115,650 0.05 2,058,570 2.8% 0.05 2.8% U.S. Coast Guard 1 1 12.210958904109589 59,547 2.6% 1,569,666 2.1% 2.6% 2.1% Social Security Administration 2 2 3.6791513459977017 23,333 0.01 ,962,602 1.3% 0.01 1.3% U.S. Department of Agriculture 0 1 10.263013698630138 1,538 1.1% 48,563 1.1% 1.1% 1.1% Subtotal 29 34 7.063244712787851 2,019,505 0.87900000000000023 $71,119,042 0.96 0.87900000000000023 0.96 0.0% 0.0% Private Tenants Parbel of Florida 1 1 7.1726027397260275 81,721 3.6% $1,476,569 1.9938558620977882 3.6% 0.02 United Technologies / P&W 1 1 8.257534246575343 ,105,641 4.6% ,545,028 .7% 4.6% .7% LifePoint, Inc. 0 1 4.0027397260273974 21,609 .9% ,497,441 .7% .9% .7% Lummus Corporation 1 1 12.843835616438357 70,078 3.5% ,417,875 .6% 0.03 .6% Subtotal 3 4 8.7620882314722852 ,279,049 0.12140197706906168 $2,936,913 3.9658026150631645 0.12099999999999998 0.04 40197706906169861.4% .-34197384936835579 Total / Weighted Average 32 38 7.2694876746871024 2,298,554 1.000401977069062 $74,055,955 0.9996580261506316 September 30, 2015 Assets Real estate properties, net $,668,034 Cash and cash equivalents 4,466 Restricted cash 1,810 Rents receivable 5,632 Accounts receivable 2,856 Deferred financing, net 2,856 Intangible assets, net ,104,657 Prepaid expenses and other assets 2,869 Total assets $,793,180 Liabilities Revolving credit facility 50,167 Mortgage notes payable 68,756 Intangible liabilities, net 39,690 Accounts payable and accrued liabilities 6,982 Total liabilities ,165,595 Equity Common stock, par value $0.01, 200,000,000 shares authorized, 24,168,379 shares issued and outstanding 241 Additional paid-in capital ,391,357 Retained (deficit) -1,799 Cumulative dividends -7,734 Total stockholders' equity ,382,065 Non-controlling interest in operating partnership ,245,520 Total equity ,627,585 Total liabilities and equity $,793,180 Property Name Location Property Type Tenant Lease Expiration Year Year Built / Renovated Rentable Square Feet Annualized Lease Income Percentage of Total Annualized Lease Income Annualized Lease Income per Leased Square Foot Percentage of Total Annualized Lease Income U.S Government Leased Properties IRS - Fresno Fresno, CA Office 2018 2003 ,180,481 $7,383,918 0.1 $40.912439536571718 0.1 PTO - Arlington Arlington, VA Office 2019 / 2020 2009 ,189,871 6,478,209 8.9% 34.11900184862354 8.9% FBI - San Antonio San Antonio, TX Office 2021 2007 ,148,584 4,980,626 6.7% 33.52060787164163 6.7% FBI - Omaha Omaha, NE Office 2024 2009 ,112,196 4,568,474 6.2% 40.718688723305647 6.2% ICE - Charleston North Charleston, SC Office 2019 / 2027 1994 / 2012 86,733 3,617,320 4.9% 41.706386265896484 4.9% DOT - Lakewood Lakewood, CO Office 2024 2004 ,122,225 3,345,895 4.5% 27.374882389036614 4.5% AOC - El Centro El Centro, CA Courthouse/Office 2019 2004 46,813 3,037,113 4.1% 64.877555379915833 4.1% USFS II - Albuquerque Albuquerque, NM Office 2026 2011 98,720 2,771,855 3.7% 28.07794773095624 3.7% DEA - Vista Vista, CA Laboratory 2020 2002 54,119 2,752,688 3.7% 50.863615366137587 3.7% AOC - Del Rio Del Rio, TX Courthouse/Office 2024 1992 / 2004 89,880 2,658,810 3.6% 29.581775700934578 3.6% USFS I - Albuquerque Albuquerque, NM Office 2021 2006 92,455 2,628,206 3.5% 28.426867124547076 3.5% MEPCOM - Jacksonville Jacksonville, FL Office 2025 2010 30,000 2,161,861 2.9% 72.062033333333332 2.9% FBI - Little Rock Little Rock, AR Office 2021 2001 ,101,977 2,135,642 2.9% 20.942388970061877 2.9% CBP - Savannah Savannah, GA Laboratory 2033 2013 35,000 2,107,714 2.8% 60.220399999999998 2.8% DEA - Santa Ana Santa Ana, CA Office 2024 2004 39,905 2,091,509 2.8% 52.412203984463098 2.8% DOE - Lakewood Lakewood, CO Office 2029 1999 ,115,650 2,058,570 2.8% 17.8 2.8% ICE - Otay San Diego, CA Office 2017 - 2026 2001 52,881 1,785,842 2.4% 33.770957432726313 2.4% DEA - Dallas Dallas, TX Office 2021 2001 71,827 1,771,987 2.4% 24.670207582107007 2.4% CBP - Chula Vista Chula Vista, CA Office 2018 1998 59,397 1,748,955 2.4% 29.445173998686801 2.4% DEA - North Highlands Sacramento, CA Office 2017 2002 37,975 1,709,309 2.3% 45.011428571428574 2.3% USCG - Martinsburg Martinsburg, WV Office 2027 2007 59,547 1,569,666 2.1% 26.360118897677467 2.1% CBP - Sunburst Sunburst, MT Office 2028 2008 33,000 1,568,287 2.1% 47.523848484848486 2.1% AOC - Aberdeen Aberdeen, MS Courthouse/Office 2025 2005 46,979 1,452,906 0.02 30.926711935119947 0.02 DEA - Albany Albany, NY Office 2025 2004 31,976 1,331,405 1.8% 41.637634475856892 1.8% DEA - Riverside Riverside, CA Office 2017 1997 34,354 1,275,320 1.7% 37.122896897013447 1.7% DEA - Otay San Diego, CA Office 2017 1997 32,560 1,261,886 1.7% 38.755712530712529 1.7% SSA - Mission Viejo Mission Viejo, CA Office 2020 2005 11,590 ,533,129 .7% 45.999050905953411 .7% SSA - San Diego San Diego, CA Office 2017 2003 11,743 ,429,473 .6% 36.572681597547472 .6% DEA - San Diego San Diego, CA Warehouse 2016 1999 16,100 ,399,908 .5% 24.839006211180124 .5% Subtotal 2,044,538 $71,616,483 0.9670000000000003 $35.028198546566507 0.9670000000000003 0.0% Privately Leased Properties 2650 SW 145th Avenue - Parbel of Florida Miramar, FL Warehouse/Distribution 2022 2007 81,721 1,476,569 0.02 18.068415707100989 0.02 5998 Osceola Court - United Technologies Midland, GA Manufacturing/Warehouse 2023 2014 ,105,641 ,545,028 .7% 5.1592468833123499 .7% 501 East Hunter Street - Lummus Corporation Lubbock, TX Warehouse/Distribution 2028 2013 70,078 ,417,875 .6% 5.9629983732412457 .6% Subtotal ,257,440 $2,439,472 3.3% $9.4758856432566816 3.3% 0.0% Total / Weighted Average 2,301,978 $74,055,955 1.0000000000000002 $32.170574610183067 1.0000000000000002 0.0% Price of Common Shares Three months ended September 30, 2015 Earnings Three months ended September 30, 2015 Pro forma nine months ended September 30, 2015 High closing price during period $16.2 Net income available to Easterly Government Properties, Inc. $498 Interest Expense (Not including Deferred Financing) Low closing price during period $15.29 Net income available to Easterly Government Properties, Inc. per share: Total per Income Statement $1,341 End of period closing price $15.95 Basic $1.9634067376828952E-2 Less: Non-Cash Interest $191 Diluted $1.8797055096309922E-2 Interest Total $1,150 Outstanding Classes of Stock and Net income $818 $3,289 Partnership Units - Fully Diluted Basis At September 30, 2015 Net income, per share - fully diluted basis $2.0604888025319134E-2 $8.2847771045568008E-2 Common shares 24,141,712 Unvested restricted shares 26,667 Funds From Operations $10,162 $30,785 Common partnership units outstanding 15,530,938.89946384 Funds From Operations, per share - fully diluted basis $0.25597417128764427 $0.77545412941253 Total - fully diluted basis 39699317.89946384 Funds From Operations, as Adjusted $9,803 $29,107 Market Capitalization At September 30, 2015 Funds From Operations, as Adjusted, per share - fully diluted basis $0.24693119475819494 $0.73318640067599516 Total equity market capitalization - fully diluted basis $,633,204.12049644813 Consolidated debt (excluding unamortized premiums & discounts) ,118,355 Cash Available for Distribution $8,811 $26,337 Cash and cash equivalents -4,466 Cash Available for Distribution, per share - fully diluted basis $0.22194335989130426 $0.6634119021061492 Total enterprise value $,747,093.12049644813 Cash Balance per TB Liquidity At September 30, 2015 4,465,747.1499999994 Ratios At September 30, 2015 Cash and cash equivalents $4,466 Net debt to total enterprise value 0.15244284397147176 Net debt to total equity market capitalization 0.17986143221984741 Unsecured revolving credit facility Net debt to annualized quarterly EBITDA 2.4752021211857778 Total current facility size $,400,000 Cash interest coverage ratio 10.002608695652174 Less: outstanding balance ,-50,167 Cash fixed charge coverage ratio 6.6033295063145809 Available under unsecured revolving credit facility $,349,833 Three months ended September 30, 2015 Pro forma six months ended 6/30/15* Pro forma nine months ended September 30, 2015 *Tied back to 2015 Q2 Supplement Net income $818 $2,471 $3,289 Depreciation and amortization 9,344 18,152 27,496 Interest expense 1,341 2,608 3,949 EBITDA $11,503 23,231 $34,734 Net income $818 $2,471 $3,289 Depreciation and amortization 9,344 18,152 27,496 Funds From Operations (FFO) $10,162 $20,623 $30,785 Adjustments to FFO: Acquisition costs 235 418 653 Straight-line rent -66 -,131 -,197 SLR includes corporate Above-/below-market leases -1,382 -2,541 -3,923 Non-cash interest expense 191 377 568 Non-cash compensation 663 558 1,221 Funds From Operations, as Adjusted $9,803 $19,304 $29,107 FFO, per share - fully diluted basis $0.25597417128764427 $0.51947995812488568 $0.77545412941253 FFO, as Adjusted, per share - fully diluted basis $0.24693119475819494 $0.48625520591780019 $0.73318640067599516 Funds From Operations, as Adjusted $9,803 $19,304 $29,107 Acquisition costs -,235 -,418 -,653 Principal amortization -,592 -1,200 -1,792 Maintenance capital expenditures -,149 -,126 -,275 Contractual tenant improvements -16 -34 -50 Cash Available for Distribution (CAD) $8,811 $17,526 $26,337 CAD, per share - fully diluted basis $0.22194335989130426 $0.44146854221484488 $0.6634119021061492 Weighted average common shares outstanding - fully diluted basis 39,699,318 39,699,318 Three months ended September 30, 2015 Pro forma six months ended 6/30/15* Pro forma nine months ended September 30, 2015 *Tied back to 2015 Q2 Supplement Revenue Rental income $18,126 $34,716 $52,842 Tenant reimbursements 1,689 2,998 4,687 Other income 42 78 120 Total revenues 19,857 $37,792 57,649 Operating Expenses Property operating 3,838 6,691 10,529 Real estate taxes 1,980 3,517 5,497 Total expenses 5,818 10,208 16,026 Net Operating Income $14,039 27,584 $41,623 Adjustments to Net Operating Income: Straight-line rent -67 -,131 -,198 SLR for properties only Above-/below-market leases -1,382 -2,541 -3,923 Cash Net Operating Income $12,590 $24,912 $37,502 Three months ended September 30, 2015 Pro forma six months ended 6/30/15* Pro forma nine months ended September 30, 2015 *Tied back to 2015 Q2 Supplement Revenues Rental income $18,126 $34,716 $52,842 Tenant reimbursements 1,689 2,998 4,687 Other income 42 78 120 Total revenues 19,857 $37,792 57,649 No. of Shares Operating Expenses Entity OPUs Shares Total Property operating 3,838 6,691 10,529 0.39121425164911411 0.60878574835088595 Real estate taxes 1,980 3,517 5,497 Depreciation and amortization 9,344 18,152 27,496 Acquisition costs 235 418 653 Corporate general and administrative 2,301 3,935 6,236 Total expenses 17,698 32,713 50,411 Operating income 2,159 5,079 7,238 Other (expenses) Interest expense, net -1,341 -2,608 -3,949 Net income 818 2,471 3,289 Non-controlling interest in operating partnership -,320 -,967 -1,287 Net income available to Easterly Government Properties, Inc. $498 $1,504 $2,002 Net income available to Easterly Government Properties, Inc. per share: Basic $1.9634067376828952E-2 Diluted $1.8797055096309922E-2 Weighted-average common shares outstanding: Basic 24,141,712 Diluted 25,216,716 Net income, per share - fully diluted basis $2.0604888025319134E-2 0 6.2242883020248871E-2 $8.2847771045568008E-2 Weighted average common shares outstanding - fully diluted basis 39,699,318 39,699,318 Dividends Variance Check Three months ended September 30, 2015 Numerator Net Income (loss) 818 Less: Non-controlling interest in predecessor 0 Less: Non-controlling interest in operating partnership -,320 Net Income (loss) available to Easterly Government Properties, Inc. 498 Less: Dividends on participating securities -24 Income available to common stockholders $474 Denominator for basic EPS 24,141,712 Dilutive effect of share-based compensation awards 12,072 Dilutive effect of LTIP units 1,062,932 Denominator for basic and diluted EPS 25,216,716 Basic EPS $1.9634067376828952E-2 Diluted EPS $1.8797055096309922E-2 Variance $0 Debt Maturities (Unaudited, in thousands) Secured Debt Unsecured Debt Year Scheduled Amortization Balloon Payments Credit Facility Total Percent of Debt Maturing Weighted Average Interest Rate of Maturing Debt 2015 $ 650 $ - $ - $ 650 .5% 4.1% 2016 2857 - - 2857 2.4% 4.1% 2017 2977 - - 2977 2.5% 4.1% 2018 3100 - - 3100 2.6% 4.1% 2019 3229 - 50167 53396 0.45100000000000001 1.7% 2020 3395 - - 3395 2.9% 4.1% 2021 4054 - - 4054 3.4% 4.2% 2022 5109 - - 5109 4.3% 4.2% 2023 5388 - - 5388 4.6% 4.2% 2024 5679 - - 5679 4.8% 4.2% 2025 5633 1917 - 7550 6.4% 4.3% 2026 3686 6368 - 10054 8.5% 4.3% 2027 1093 7140 - 8233 7.7% 4.1% 2028 983 - - 983 .8% 3.4% 2029 1016 - - 1016 .9% 3.4% 2030 1049 - - 1049 .9% 3.4% 2031 1081 - - 1081 .9% 3.4% 2032 1116 - - 1116 .9% 3.4% 2033 668 - - 668 .6% 3.4% Total $ 52763 $ 15425 $ 50167 $ 118355 100.0% Year of Lease Expiration Number of Leases Expiring Square Footage Expiring Percent of Square Footage Expiring Annualized Lease Income Expiring Percentage of Annualized Lease Income Expiring Annualized Lease Income per Leased Square Foot Expiring Percent of Portfolio Square Footage of Leases Expiring Percentage of Total Annualized Lease Income Signed leases not commenced 0 N/A N/A N/A N/A N/A 2015 0 N/A N/A N/A N/A N/A 2016 1 16,100 0.7 $,399,908 0.5 $24.839006211180124 0.7 0.5 2017 5 ,129,276 5.6 5,159,115 700.000000000000000000000000000000000000% 39.907755499860762 5.6 700.000000000000000000000000000000000000% 2018 2 ,239,878 10.5 9,132,873 12.3 38.072991270562532 10.5 12.3 2019 3 ,236,890 10.3 9,250,091 12.5 39.048043395668877 10.3 12.5 2020 3 87,112 3.8 4,048,489 5.5 46.47452704564239 3.8 5.5 2021 5 ,426,398 18.600000000000001 11,934,024 16.2 27.987992438988925 18.600000000000001 16.2 2022 3 ,105,441 4.5999999999999996 2,313,158 3.1 21.937936855682324 4.5999999999999996 3.1 2023 1 ,105,641 4.5999999999999996 ,545,028 0.7 5.1592468833123499 4.5999999999999996 0.7 2024 4 ,364,206 15.8 12,664,688 17.100000000000001 34.773419438449672 15.8 17.100000000000001 2025 3 ,108,955 4.7 4,946,172 6.7 45.396466431095405 4.7 6.7 Thereafter 8 ,478,657 20.8 13,662,409 18.399999999999999 28.543213616430972 20.8 18.399999999999999 Total / Weighted Average 38 2,298,554 10000.000000000000000000000000000000000000% $74,055,955 10000.000000000000000000000000000000000000% $32.218496933289366 10000.000000000000000000000000000000000000% 10000.000000000000000000000000000000000000% 0 0 Debt Schedules (Unaudited, in thousands) Date 42277 Debt Instrument Maturity Date Stated Rate September 30, 2015 Balance September 30, 2015 Percent of Total Indebtedness Debt Inputs Credit Facility Availability Unsecured revolving credit facility ICE - Charleston 22,253,318.390000001 Total Credit Facility ,400,000 Unsecured revolving credit facility(1) 43507 LIBOR + 1.40% $50,167 0.42386886908030924 USFS II - Albuquerque 17,500,000 Used Capacity ,-50,167.330399999999 Total unsecured revolving credit facility 3.4 years $50,167 0.42386886908030924 CBP - Savannah 15,745,000 Remaining Capacity ,349,832.66960000002 (wtd-avg maturity) MEPCOM - Jacksonville 12,690,392.359999999 Maturity of Debt Calculation Secured mortgage debt Credit Facility Rate Outstanding 0.42386793198346173 1.4283768666839944 ICE - Charleston 46402 4.2099999999999999E-2 $22,253 0.18801909509526424 Piece 1 1.5900000000000001E-2 2,500,000 0.18802013123940992 2.1248850448289476 USFS II - Albuquerque 46217 4.4600000000000001E-2 17,500 0.14786025093996874 Piece 2 1.5900000000000001E-2 20,000,000 0.14785895024843859 1.5960664766543784 CBP - Savannah 48770 3.4000000000000002E-2 15,745 0.13303198005998901 Piece 3 1.5900000000000001E-2 10,917,330.4 0.13303080980923804 2.3664905427161167 MEPCOM - Jacksonville 45944 4.41E-2 12,690 0.10721980482446876 Piece 4 1.6E-2 2,500,000 0.10722217671945171 1.0772156767951491 Total secured mortgage debt 12.4 years 4.1243498760460143E-2 $68,188 0.57613113091969081 Piece 5 1.61E-2 14,250,000 (wtd-avg maturity) (wtd-avg rate) 50,167,330.399999999 Weighted Debt Maturity 8.593034607678586 Total Debt ,118,356,041.15000001 0.32634901210535061 3.6881908902317022 Debt Statistics September 30, 2015 0.25664072259937837 2.7703135535384953 Variable rate debt - unhedged $50,167 Weighted Interest of Debt 0.23090332441869785 4.107548727261932 Fixed rate debt 68,188 Credit Facility 800.76055336000002 0.18610694087657317 1.869737403272312 Total debt (excluding unamortized premiums & discounts) $,118,355 ICE - Charleston 936.86470421900003 USFS II - Albuquerque 780.5 Weighted Secured Debt Maturity 12.435790574304441 % Variable rate debt - unhedged 0.42386886908030924 CBP - Savannah 535.33000000000004 % Fixed rate debt 0.57613113091969081 MEPCOM - Jacksonville 559.64630307599998 Total 3,613.101560655 Weighted average maturity 8.6 years Weighted average interest rate 3.5% Weighted Avg. Interest Rate 3.0527394508539626E-2 Weighted Avg. Interest Rate of Secured Debt 4.1243498760460143E-2 *Credit facility has available capacity of $349832.6696 Tenant Number of Properties Number of Leases Weighted Average Remaining Lease Term Leased Square Feet Percentage of Leased Square Feet Annualized Lease Income Percentage of Total Annualized Lease Income Percentage of Leased Square Feet Percentage of Total Annualized Lease Income U.S. Government Drug Enforcement Administration 8 8 4.8176538112746865 ,313,003 0.13600000000000001 $12,368,725.43058969 0.16600000000000001 0.13600000000000001 0.16600000000000001 Federal Bureau of Investigation 3 3 6.8189029366841698 ,362,757 0.159 11,684,742 0.158 0.159 0.158 Internal Revenue Service 1 1 3.1698630136986301 ,180,481 7.9% 7,383,918 0.1 7.9% 0.1 Administrative Office of the U.S. Courts 3 3 7.6010882114454166 ,183,672 0.08 7,148,829 9.7% 0.08 9.7% U.S. Patent and Trademark Office 1 2 3.5884606585451708 ,189,871 8.3% 6,478,209 8.7% 8.3% 8.7% Bureau of Customs and Border Protection 3 3 9.4745482168189383 ,127,397 5.5% 5,424,956 7.3% 5.5% 7.3% U.S. Forest Service 2 2 8.3635330893483157 ,191,175 8.3% 5,400,061 7.3% 8.3% 7.3% U.S. Immigration and Customs Enforcement 2 4 8.5596935063363944 ,111,422 4.8% 4,867,549.9569410319 6.6% 4.8% 6.6% Department of Transportation 1 2 8.5856002684385935 ,129,659 5.6% 3,560,790 4.8% 5.6% 4.8% U.S. Military Entrance Processing Command 1 1 10.002739726027396 30,000 1.3% 2,161,861 2.9% 1.3% 2.9% Department of Energy 1 1 14.106849315068493 ,115,650 0.05 2,058,570 2.8% 0.05 2.8% U.S. Coast Guard 1 1 12.210958904109589 59,547 2.6% 1,569,666 2.1% 2.6% 2.1% Social Security Administration 2 2 3.6791513459977017 23,333 0.01 ,962,602 1.3% 0.01 1.3% U.S. Department of Agriculture 0 1 10.263013698630138 1,538 1.1% 48,563 1.1% 1.1% 1.1% Subtotal 29 34 7.063244712787851 2,019,505 0.87900000000000023 $71,119,042 0.96 0.87900000000000023 0.96 0.0% 0.0% Private Tenants Parbel of Florida 1 1 7.1726027397260275 81,721 3.6% $1,476,569 1.9938558620977882 3.6% 0.02 United Technologies / P&W 1 1 8.257534246575343 ,105,641 4.6% ,545,028 .7% 4.6% .7% LifePoint, Inc. 0 1 4.0027397260273974 21,609 .9% ,497,441 .7% .9% .7% Lummus Corporation 1 1 12.843835616438357 70,078 3.5% ,417,875 .6% 0.03 .6% Subtotal 3 4 8.7620882314722852 ,279,049 0.12140197706906168 $2,936,913 3.9658026150631645 0.12099999999999998 0.04 40197706906169861.4% .-34197384936835579 Total / Weighted Average 32 38 7.2694876746871024 2,298,554 1.000401977069062 $74,055,955 0.9996580261506316 September 30, 2015 Assets Real estate properties, net $,668,034 Cash and cash equivalents 4,466 Restricted cash 1,810 Rents receivable 5,632 Accounts receivable 2,856 Deferred financing, net 2,856 Intangible assets, net ,104,657 Prepaid expenses and other assets 2,869 Total assets $,793,180 Liabilities Revolving credit facility 50,167 Mortgage notes payable 68,756 Intangible liabilities, net 39,690 Accounts payable and accrued liabilities 6,982 Total liabilities ,165,595 Equity Common stock, par value $0.01, 200,000,000 shares authorized, 24,168,379 shares issued and outstanding 241 Additional paid-in capital ,391,357 Retained (deficit) -1,799 Cumulative dividends -7,734 Total stockholders' equity ,382,065 Non-controlling interest in operating partnership ,245,520 Total equity ,627,585 Total liabilities and equity $,793,180 Property Name Location Property Type Tenant Lease Expiration Year Year Built / Renovated Rentable Square Feet Annualized Lease Income Percentage of Total Annualized Lease Income Annualized Lease Income per Leased Square Foot Percentage of Total Annualized Lease Income U.S Government Leased Properties IRS - Fresno Fresno, CA Office 2018 2003 ,180,481 $7,383,918 0.1 $40.912439536571718 0.1 PTO - Arlington Arlington, VA Office 2019 / 2020 2009 ,189,871 6,478,209 8.9% 34.11900184862354 8.9% FBI - San Antonio San Antonio, TX Office 2021 2007 ,148,584 4,980,626 6.7% 33.52060787164163 6.7% FBI - Omaha Omaha, NE Office 2024 2009 ,112,196 4,568,474 6.2% 40.718688723305647 6.2% ICE - Charleston North Charleston, SC Office 2019 / 2027 1994 / 2012 86,733 3,617,320 4.9% 41.706386265896484 4.9% DOT - Lakewood Lakewood, CO Office 2024 2004 ,122,225 3,345,895 4.5% 27.374882389036614 4.5% AOC - El Centro El Centro, CA Courthouse/Office 2019 2004 46,813 3,037,113 4.1% 64.877555379915833 4.1% USFS II - Albuquerque Albuquerque, NM Office 2026 2011 98,720 2,771,855 3.7% 28.07794773095624 3.7% DEA - Vista Vista, CA Laboratory 2020 2002 54,119 2,752,688 3.7% 50.863615366137587 3.7% AOC - Del Rio Del Rio, TX Courthouse/Office 2024 1992 / 2004 89,880 2,658,810 3.6% 29.581775700934578 3.6% USFS I - Albuquerque Albuquerque, NM Office 2021 2006 92,455 2,628,206 3.5% 28.426867124547076 3.5% MEPCOM - Jacksonville Jacksonville, FL Office 2025 2010 30,000 2,161,861 2.9% 72.062033333333332 2.9% FBI - Little Rock Little Rock, AR Office 2021 2001 ,101,977 2,135,642 2.9% 20.942388970061877 2.9% CBP - Savannah Savannah, GA Laboratory 2033 2013 35,000 2,107,714 2.8% 60.220399999999998 2.8% DEA - Santa Ana Santa Ana, CA Office 2024 2004 39,905 2,091,509 2.8% 52.412203984463098 2.8% DOE - Lakewood Lakewood, CO Office 2029 1999 ,115,650 2,058,570 2.8% 17.8 2.8% ICE - Otay San Diego, CA Office 2017 - 2026 2001 52,881 1,785,842 2.4% 33.770957432726313 2.4% DEA - Dallas Dallas, TX Office 2021 2001 71,827 1,771,987 2.4% 24.670207582107007 2.4% CBP - Chula Vista Chula Vista, CA Office 2018 1998 59,397 1,748,955 2.4% 29.445173998686801 2.4% DEA - North Highlands Sacramento, CA Office 2017 2002 37,975 1,709,309 2.3% 45.011428571428574 2.3% USCG - Martinsburg Martinsburg, WV Office 2027 2007 59,547 1,569,666 2.1% 26.360118897677467 2.1% CBP - Sunburst Sunburst, MT Office 2028 2008 33,000 1,568,287 2.1% 47.523848484848486 2.1% AOC - Aberdeen Aberdeen, MS Courthouse/Office 2025 2005 46,979 1,452,906 0.02 30.926711935119947 0.02 DEA - Albany Albany, NY Office 2025 2004 31,976 1,331,405 1.8% 41.637634475856892 1.8% DEA - Riverside Riverside, CA Office 2017 1997 34,354 1,275,320 1.7% 37.122896897013447 1.7% DEA - Otay San Diego, CA Office 2017 1997 32,560 1,261,886 1.7% 38.755712530712529 1.7% SSA - Mission Viejo Mission Viejo, CA Office 2020 2005 11,590 ,533,129 .7% 45.999050905953411 .7% SSA - San Diego San Diego, CA Office 2017 2003 11,743 ,429,473 .6% 36.572681597547472 .6% DEA - San Diego San Diego, CA Warehouse 2016 1999 16,100 ,399,908 .5% 24.839006211180124 .5% Subtotal 2,044,538 $71,616,483 0.9670000000000003 $35.028198546566507 0.9670000000000003 0.0% Privately Leased Properties 2650 SW 145th Avenue - Parbel of Florida Miramar, FL Warehouse/Distribution 2022 2007 81,721 1,476,569 0.02 18.068415707100989 0.02 5998 Osceola Court - United Technologies Midland, GA Manufacturing/Warehouse 2023 2014 ,105,641 ,545,028 .7% 5.1592468833123499 .7% 501 East Hunter Street - Lummus Corporation Lubbock, TX Warehouse/Distribution 2028 2013 70,078 ,417,875 .6% 5.9629983732412457 .6% Subtotal ,257,440 $2,439,472 3.3% $9.4758856432566816 3.3% 0.0% Total / Weighted Average 2,301,978 $74,055,955 1.0000000000000002 $32.170574610183067 1.0000000000000002 0.0% Price of Common Shares Three months ended September 30, 2015 Earnings Three months ended September 30, 2015 Pro forma nine months ended September 30, 2015 High closing price during period $16.2 Net income available to Easterly Government Properties, Inc. $498 Interest Expense (Not including Deferred Financing) Low closing price during period $15.29 Net income available to Easterly Government Properties, Inc. per share: Total per Income Statement $1,341 End of period closing price $15.95 Basic $1.9634067376828952E-2 Less: Non-Cash Interest $191 Diluted $1.8797055096309922E-2 Interest Total $1,150 Outstanding Classes of Stock and Net income $818 $3,289 Partnership Units - Fully Diluted Basis At September 30, 2015 Net income, per share - fully diluted basis $2.0604888025319134E-2 $8.2847771045568008E-2 Common shares 24,141,712 Unvested restricted shares 26,667 Funds From Operations $10,162 $30,785 Common partnership units outstanding 15,530,938.89946384 Funds From Operations, per share - fully diluted basis $0.25597417128764427 $0.77545412941253 Total - fully diluted basis 39699317.89946384 Funds From Operations, as Adjusted $9,803 $29,107 Market Capitalization At September 30, 2015 Funds From Operations, as Adjusted, per share - fully diluted basis $0.24693119475819494 $0.73318640067599516 Total equity market capitalization - fully diluted basis $,633,204.12049644813 Consolidated debt (excluding unamortized premiums & discounts) ,118,355 Cash Available for Distribution $8,811 $26,337 Cash and cash equivalents -4,466 Cash Available for Distribution, per share - fully diluted basis $0.22194335989130426 $0.6634119021061492 Total enterprise value $,747,093.12049644813 Cash Balance per TB Liquidity At September 30, 2015 4,465,747.1499999994 Ratios At September 30, 2015 Cash and cash equivalents $4,466 Net debt to total enterprise value 0.15244284397147176 Net debt to total equity market capitalization 0.17986143221984741 Unsecured revolving credit facility Net debt to annualized quarterly EBITDA 2.4752021211857778 Total current facility size $,400,000 Cash interest coverage ratio 10.002608695652174 Less: outstanding balance ,-50,167 Cash fixed charge coverage ratio 6.6033295063145809 Available under unsecured revolving credit facility $,349,833 Three months ended September 30, 2015 Pro forma six months ended 6/30/15* Pro forma nine months ended September 30, 2015 *Tied back to 2015 Q2 Supplement Net income $818 $2,471 $3,289 Depreciation and amortization 9,344 18,152 27,496 Interest expense 1,341 2,608 3,949 EBITDA $11,503 23,231 $34,734 Net income $818 $2,471 $3,289 Depreciation and amortization 9,344 18,152 27,496 Funds From Operations (FFO) $10,162 $20,623 $30,785 Adjustments to FFO: Acquisition costs 235 418 653 Straight-line rent -66 -,131 -,197 SLR includes corporate Above-/below-market leases -1,382 -2,541 -3,923 Non-cash interest expense 191 377 568 Non-cash compensation 663 558 1,221 Funds From Operations, as Adjusted $9,803 $19,304 $29,107 FFO, per share - fully diluted basis $0.25597417128764427 $0.51947995812488568 $0.77545412941253 FFO, as Adjusted, per share - fully diluted basis $0.24693119475819494 $0.48625520591780019 $0.73318640067599516 Funds From Operations, as Adjusted $9,803 $19,304 $29,107 Acquisition costs -,235 -,418 -,653 Principal amortization -,592 -1,200 -1,792 Maintenance capital expenditures -,149 -,126 -,275 Contractual tenant improvements -16 -34 -50 Cash Available for Distribution (CAD) $8,811 $17,526 $26,337 CAD, per share - fully diluted basis $0.22194335989130426 $0.44146854221484488 $0.6634119021061492 Weighted average common shares outstanding - fully diluted basis 39,699,318 39,699,318 Three months ended September 30, 2015 Pro forma six months ended 6/30/15* Pro forma nine months ended September 30, 2015 *Tied back to 2015 Q2 Supplement Revenue Rental income $18,126 $34,716 $52,842 Tenant reimbursements 1,689 2,998 4,687 Other income 42 78 120 Total revenues 19,857 $37,792 57,649 Operating Expenses Property operating 3,838 6,691 10,529 Real estate taxes 1,980 3,517 5,497 Total expenses 5,818 10,208 16,026 Net Operating Income $14,039 27,584 $41,623 Adjustments to Net Operating Income: Straight-line rent -67 -,131 -,198 SLR for properties only Above-/below-market leases -1,382 -2,541 -3,923 Cash Net Operating Income $12,590 $24,912 $37,502 Three months ended September 30, 2015 Pro forma six months ended 6/30/15* Pro forma nine months ended September 30, 2015 *Tied back to 2015 Q2 Supplement Revenues Rental income $18,126 $34,716 $52,842 Tenant reimbursements 1,689 2,998 4,687 Other income 42 78 120 Total revenues 19,857 $37,792 57,649 No. of Shares Operating Expenses Entity OPUs Shares Total Property operating 3,838 6,691 10,529 0.39121425164911411 0.60878574835088595 Real estate taxes 1,980 3,517 5,497 Depreciation and amortization 9,344 18,152 27,496 Acquisition costs 235 418 653 Corporate general and administrative 2,301 3,935 6,236 Total expenses 17,698 32,713 50,411 Operating income 2,159 5,079 7,238 Other (expenses) Interest expense, net -1,341 -2,608 -3,949 Net income 818 2,471 3,289 Non-controlling interest in operating partnership -,320 -,967 -1,287 Net income available to Easterly Government Properties, Inc. $498 $1,504 $2,002 Net income available to Easterly Government Properties, Inc. per share: Basic $1.9634067376828952E-2 Diluted $1.8797055096309922E-2 Weighted-average common shares outstanding: Basic 24,141,712 Diluted 25,216,716 Net income, per share - fully diluted basis $2.0604888025319134E-2 0 6.2242883020248871E-2 $8.2847771045568008E-2 Weighted average common shares outstanding - fully diluted basis 39,699,318 39,699,318 Dividends Variance Check Three months ended September 30, 2015 Numerator Net Income (loss) 818 Less: Non-controlling interest in predecessor 0 Less: Non-controlling interest in operating partnership -,320 Net Income (loss) available to Easterly Government Properties, Inc. 498 Less: Dividends on participating securities -24 Income available to common stockholders $474 Denominator for basic EPS 24,141,712 Dilutive effect of share-based compensation awards 12,072 Dilutive effect of LTIP units 1,062,932 Denominator for basic and diluted EPS 25,216,716 Basic EPS $1.9634067376828952E-2 Diluted EPS $1.8797055096309922E-2 Variance $0 Debt Maturities (Unaudited, in thousands) Secured Debt Unsecured Debt Year Scheduled Amortization Balloon Payments Credit Facility Total Percent of Debt Maturing Weighted Average Interest Rate of Maturing Debt 2015 $ 650 $ - $ - $ 650 .5% 4.1% 2016 2857 - - 2857 2.4% 4.1% 2017 2977 - - 2977 2.5% 4.1% 2018 3100 - - 3100 2.6% 4.1% 2019 3229 - 50167 53396 0.45100000000000001 1.7% 2020 3395 - - 3395 2.9% 4.1% 2021 4054 - - 4054 3.4% 4.2% 2022 5109 - - 5109 4.3% 4.2% 2023 5388 - - 5388 4.6% 4.2% 2024 5679 - - 5679 4.8% 4.2% 2025 5633 1917 - 7550 6.4% 4.3% 2026 3686 6368 - 10054 8.5% 4.3% 2027 1093 7140 - 8233 7.7% 4.1% 2028 983 - - 983 .8% 3.4% 2029 1016 - - 1016 .9% 3.4% 2030 1049 - - 1049 .9% 3.4% 2031 1081 - - 1081 .9% 3.4% 2032 1116 - - 1116 .9% 3.4% 2033 668 - - 668 .6% 3.4% Total $ 52763 $ 15425 $ 50167 $ 118355 100.0% Year of Lease Expiration Number of Leases Expiring Square Footage Expiring Percent of Square Footage Expiring Annualized Lease Income Expiring Percentage of Annualized Lease Income Expiring Annualized Lease Income per Leased Square Foot Expiring Percent of Portfolio Square Footage of Leases Expiring Percentage of Total Annualized Lease Income Signed leases not commenced 0 N/A N/A N/A N/A N/A 2015 0 N/A N/A N/A N/A N/A 2016 1 16,100 0.7 $,399,908 0.5 $24.839006211180124 0.7 0.5 2017 5 ,129,276 5.6 5,159,115 700.000000000000000000000000000000000000% 39.907755499860762 5.6 700.000000000000000000000000000000000000% 2018 2 ,239,878 10.5 9,132,873 12.3 38.072991270562532 10.5 12.3 2019 3 ,236,890 10.3 9,250,091 12.5 39.048043395668877 10.3 12.5 2020 3 87,112 3.8 4,048,489 5.5 46.47452704564239 3.8 5.5 2021 5 ,426,398 18.600000000000001 11,934,024 16.2 27.987992438988925 18.600000000000001 16.2 2022 3 ,105,441 4.5999999999999996 2,313,158 3.1 21.937936855682324 4.5999999999999996 3.1 2023 1 ,105,641 4.5999999999999996 ,545,028 0.7 5.1592468833123499 4.5999999999999996 0.7 2024 4 ,364,206 15.8 12,664,688 17.100000000000001 34.773419438449672 15.8 17.100000000000001 2025 3 ,108,955 4.7 4,946,172 6.7 45.396466431095405 4.7 6.7 Thereafter 8 ,478,657 20.8 13,662,409 18.399999999999999 28.543213616430972 20.8 18.399999999999999 Total / Weighted Average 38 2,298,554 10000.000000000000000000000000000000000000% $74,055,955 10000.000000000000000000000000000000000000% $32.218496933289366 10000.000000000000000000000000000000000000% 10000.000000000000000000000000000000000000% 0 0