Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CCUR Holdings, Inc. | v423733_8k.htm |

Exhibit 99.1

Exhibit 99.1

POWERING BRIGHTER IDEAS Passionate about technology. Obsessed with quality. Driven to perform. LINUX STORAGE CONTENT DELIVERY REAL - TIME NEEDHAM NEXT - GEN STORAGE/NETWORKING CONFERENCE DEREK ELDER, CEO 11.05.15

CERTAIN STATEMENTS MADE OR INCORPORATED BY REFERENCE IN THIS PRE SENTATION MAY CONSTITUTE “FORWARD - LOOKING STATEMENTS” WITHIN THE MEANING OF THE FEDERAL S ECURITIES LAWS. THESE STATEMENTS ARE MADE PURSUANT TO THE SAFE HARBOR PROVISION OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. STATEMENTS REGARDING FUTURE EVENTS AND DEVEL OPMENTS AND OUR FUTURE PERFORMANCE, AS WELL AS OUR EXPECTATIONS, BELIEFS, PLANS, ESTIMA TES, OR PROJECTIONS RELATING TO THE FUTURE, ARE FORWARD - LOOKING STATEMENTS WITHIN THE MEANING OF THESE LAWS. ALL FORWARD - LOOKING STATEMENTS ARE SUBJECT TO CERTAIN RISKS AND UNCERTAINTIE S THAT COULD CAUSE ACTUAL EVENTS TO DIFFER MATERIALLY FROM THOSE PROJECTED. IMPORTANT RISK FACTORS RELATED TO OUR BUSINESS ARE DISCUSSED IN OUR FORM 1 0 - K FILED WITH THE SECURITIES AND EXCHANGE COMMISSION (“SEC”) ON AUGUST 26, 2015, AND MAY BE DISCUSSED IN SUBSEQUENT FILINGS WITH THE SEC. THE RISK FACTORS DISCUSSED IN SUCH FORM 10 - K UNDER THE HEADING “RISK FACTORS” ARE SPECIFICALLY INCORPORATED BY REFERENCE IN THIS PRESENTATION. OUR FORWARD - LOOKING STATEMENTS ARE BASED ON CURRENT EXPECTATIONS AND SPEAK ONLY AS O F THE DATE OF THIS PRESENTATION. WE UNDERTAKE NO OBLIGATION TO PUBLICLY UPDATE OR R EVISE ANY FORWARD - LOOKING STATEMENT, WHETHER AS A RESULT OF FUTURE EVENTS, NEW INFORMATION , OR OTHERWISE. FORWARD - LOOKING STATEMENTS

MEDIA & TELECOMMUNICATIONS AUTOMOTIVE & TRANSPORTATION AEROSPACE & DEFENSE MANUFACTURING & ENERGY We are a Global S oftware Company Our Heritage is in Mission - Critical S olutions ~260 Employees Worldwide Headquartered in Atlanta, GA NASDAQ: CCUR FYE 6/30, Shares Outstanding 9.49M* *As of August 21 st , 2015

CORE LINUX & STORAGE TECHNOLOGY IDEAL FOR LOW - LATENCY APPLICATIONS DELIVERS EXTREMELY PRECISE BEHAVIOR TUNABLE FOR OPTIMIZED PERFORMANCE TUNABLE HIGH - PERFORMANCE LINUX FOR STORAGE HIGH - PERFORMANCE SCALE - OUT STORAGE SOLUTION IDEAL FOR HIGH GROWTH APPLICATIONS DELIVERS FAST, PRECISE DEPLOYMENTS TUNABLE FOR MULTIPLE WORKLOADS

” Software defined platforms will continue to grow faster than any other market segment in the file and object - based storage market. This growth will primarily be driven by a rich and diverse set of data - intensive use cases across multiple industries and geographies” – IDC IDC 2014 – Global Software Defined Storage Market SOFTWARE DEFINED STORAGE MARKET SOFTWARE DEFINED STORAGE DELIVERS THE FULL RANGE OF STORAGE SERVICES USING A SOFTWARE STACK THAT RUNS ON COMMERCIAL OFF - THE - SHELF HARDWARE COMPONENTS ~11B TAM (Today) ~40B TAM (by 2020) 25% CAGR

MARKET DRIVERS FOR SOFTWARE STORAGE YOY GROWTH RATES FOR UNSTRUCTURED DATA: ORGANIC SCALING MULTI - WORKLOAD UNIFIED DATA STORE COST REDUCTION REQUIRED FEATURES SOFTWARE STORAGE x x x x TRADITIONAL STORAGE x STEP FUNCTIONS x SINGLE PURPOSE x DATA SILOS x EXPENSIVE *IDC 40 % - 50 %*

THE GENESIS OF AQUARI ™ LEGACY TV CONTENT Ideal for Block Storage HIGH DEF MPEG - 2 FILE (2 HOUR MOVIE) STANDARD DEF MPEG - 2 FILE (2 HOUR MOVIE) INTERNET VIDEO CONTENT Not suitable for Block Storage TIME 400 kbps 800 kbps 1.2 Mbps 2.4 Mbps 4.8 Mbps File 1a .006 GB File 2a .006 GB File 3a .006 GB File 4a .006 GB File 5a .006 GB File 1b .003 GB File 2b .003 GB File 3b .003 GB File 4b .003 GB File 5b .003 GB File 1c .0015 GB File 2c .0015 GB File 3c .0015 GB File 4c .0015 GB File 5c .0015 GB File 1d .001 GB File 2d .001 GB File 3d .001 GB File 4d .001 GB File 5d .001 GB File 1e .0005 GB File 2e .0005 GB File 3e .0005 GB File 4e .0005 GB File 5e .0005 GB 10 sec. 10 sec. 10 sec. 10 sec. 10 sec. FILE SIZE: GIGABYTES FULL MOVIE FILES: LARGE BLOCKS FILE SIZE: MEGABYTES OR KILOBYTES “CHUNKED” VIDEO FILES: SMALL OBJECTS ~15 GB ~3.7 GB

PERFORMANCE OPTIMIZED SOFTWARE STORAGE PERFORMANCE DRIVES STORAGE CHOICE NON - CRITICAL BUSINESS - CRITICAL MISSION - CRITICAL BACK - UP ARCHIVAL HOSTING E - MAIL VM INFRASTRUCTURE SYNC - N - SHARE DATA ANALYTICS ERP TRANSACTION PROCESSING OPEN SOFTWARE STORAGE PROPRIETARY TRADITIONAL STORAGE COST - OPTIMIZED PRICE/PERFORMANCE PERFORMANCE INTENSIVE SCALE - OUT STORAGE SYSTEM

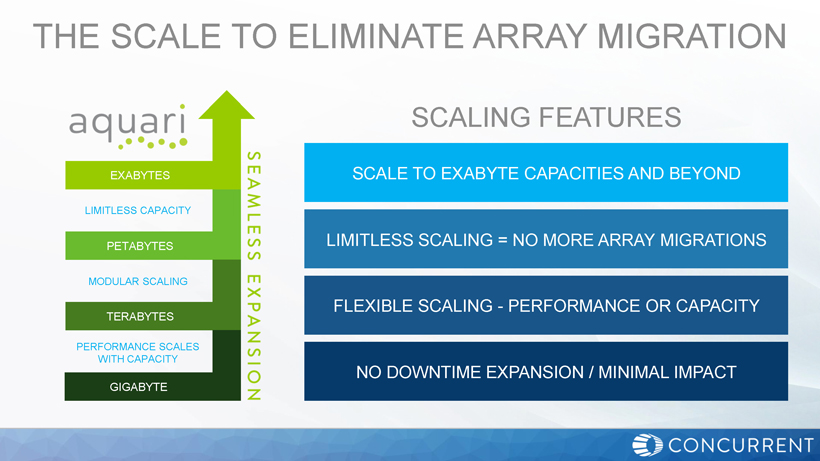

THE SCALE TO ELIMINATE ARRAY MIGRATION TERABYTES PETABYTES EXABYTES GIGABYTE NO DOWNTIME EXPANSION / MINIMAL IMPACT LIMITLESS SCALING = NO MORE ARRAY MIGRATIONS SCALE TO EXABYTE CAPACITIES AND BEYOND FLEXIBLE SCALING - PERFORMANCE OR CAPACITY MODULAR SCALING PERFORMANCE SCALES WITH CAPACITY LIMITLESS CAPACITY SCALING FEATURES

OPTIMIZED FOR MULTI - WORKLOAD MIX - AND - MATCH CONFIGURATIONS FOR FOR EACH AND EVERY APPLICATION STORAGE TECHNOLOGIES DATA PROTECTION BUSINESS POLICIES ACCESS CONTROLS VIRTUALIZATION INTEGRATION Solid State Drives Erasure Coding Automated Tiering Administration OpenStack Hard Disk Drives Replication Encryption Security Profiles KVM VM Infrastructure Video Sync & Share Content Repository Collaboration Tech Apps Storage a s a Service App Retirement Data Analytics MULTIPLE WORKLOADS Business Processing Email HPC App Dev Web Content Online Archive

AQUARI STORAGE ENTRY LEVEL SYSTEM 120 TB • 3 x 40TB 2U performance data nodes configured for 2x replication • Data protection configurable for 2x or 3x replication • Full Support for native RADOS object and block interfaces • Data - in - place, non - disruptive upgrade to any capacity and performance UNIFIED STORAGE SYSTEM 200 TB • 3 x 24TB high performance data nodes configured for 3x replication • 5 x 40TB performance data nodes configured for erasure coding • 2 x File and object services nodes licensed for CIFS, NFS, Swift, and S3 • Full support for native RADOS object and block interfaces • Data - in - place, non - disruptive upgrade to any capacity and performance VIDEO STORAGE SYSTEM 540 TB • 9 x 60TB 2U performance data nodes configured for erasure coding • Full support for native RADOS object and block interfaces • Data - in - place, non - disruptive upgrade to any capacity and performance • Optional upgrade to File and Content Services node for CIFS, NFS, Swift, and S3 support OPENSTACK SYSTEM 900 TB • 3 x 24TB high performance data nodes • 5 x 180TB capacity data nodes • Full support for native RADOS object and block interfaces • Data - in - place, non - disruptive upgrade to any capacity and performance NODE TYPES • PERFORMANCE DATA NODE • HIGH PERFORMANCE DATA NODE • CAPACITY DATA NODE • FILE AND OBJECT SERVICE NODE PRE - CONFIGURED STORAGE SYSTEMS FOR EVERY APPLICATION

WHY ? HERITAGE OF HIGH PERFORMANCE DEEP STORAGE AND LINUX EXPERTISE PROVEN CREDENTIALS IN MISSION - CRITICAL APPLICATIONS INTELLIGENT STORAGE FOUNDED ON CDN EXPERIENCE ALREADY HAVING SUCCESS: LAUNCHED IN APRIL 2015 NEW CUSTOMER WINS 4

FINANCIAL HIGHLIGHTS (IN THOUSANDS, EXCEPT FOR PER SHARE DATA) Balance Sheet Highlights As of September 30, 2015 As of June 30, 2015 Cash $24,462 $25,451 Current Assets $40,822 $41,213 Total Assets $58,208 $57,780 Current Liabilities $12,997 $14,682 Debt No Outstanding No Outstanding Equity $38,731 $36,557 Working Capital $27,825 $26,531 Income Statement Highlights Q1 FY - 2016 Q1 FY - 2015 Quarter Ending September 30, 2015 Quarter Ending September 30, 2014 Total Revenue $13,351 $17,540 Gross Margin $7,857 $9,698 Operating Expenses* $4,893 $8,849 Operating Income $2,964 $849 Net Income $3,207 $387 Earnings Per Share - Diluted $0.35 $0.04 Adjusted EBITDA (Non - GAAP) $(554) $1,156 BALANCE SHEET INCOME STATEMENT *Includes gains on sale of assets ($4,116 in Q1 FY - 2016 and $339 in Q1 FY - 2015)

TO SUPPLEMENT THE COMPANY’S CONDENSED CONSOLIDATED FINANCIAL STATEMENTS PREPARED IN ACCORDANCE WITH U.S. GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (“GAAP”), THIS SLIDE DECK PROVIDES INFORMATION CONCERNING THE COMPANY’S ADJUSTED EBITDA, A NON - GAAP FINANCIAL MEASURE. NON - GAAP FINANCIAL MEASURES (IN THOUSANDS) Q1 FY - 2016 Q1 FY - 2015 Quarter Ending September 30, 2015 Quarter Ending September 30, 2014 Net income $3,207 $387 Addback (deduct): Other (income) expense, net (126) 285 Income tax provision (benefit) (117) 177 Depreciation 395 375 Amortization 36 45 Share - based compensation 167 226 Gain on sale of assets, net (4,116) (339) Adjusted EBITDA $(554) $1,156

THE COMPANY CONSIDERS ADJUSTED EBITDA IMPORTANT TO UNDERSTANDING ITS HISTORICAL RESULTS AND IDENTIFYING CURRENT AND FUTURE TRENDS IMPACTING ITS BUSINESS . MANAGEMENT USES ADJUSTED EBITDA TO COMPARE THE COMPANY’S PERFORMANCE TO THAT OF PRIOR PERIODS AND EVALUATE THE COMPANY’S FINANCIAL AND OPERATING RESULTS ON A CONS ISTENT BASIS FROM PERIOD TO PERIOD. THE COMPANY ALSO BELIEVES THIS MEASURE, WHEN VIEWED I N COMBINATION WITH THE COMPANY’S FINANCIAL RESULTS PREPARED IN ACCORDANCE WITH GAAP, PR OVIDES USEFUL INFORMATION TO INVESTORS TO EVALUATE ONGOING OPERATING RESULTS A ND TRENDS. THE ADJUSTMENTS TO THE COMPANY’S GAAP RESULTS ARE MADE WITH THE INTE NT OF PROVIDING BOTH MANAGEMENT AND INVESTORS A MORE COMPLETE UNDERSTANDING OF THE CO MPANY’S UNDERLYING OPERATIONAL RESULTS, TRENDS AND PERFORMANCE. THE PRESENTATION OF ADJUSTED EBITDA IS NOT MEANT TO BE CONSIDERED IN ISOLATION OR AS A SUBSTITUTE FOR OR SUPERIOR TO THE COMPANY’S FINANCIAL RESULTS DE TERMINED IN ACCORDANCE WITH GAAP. IN ADDITION, THE COMPANY’S PRESENTATION OF ADJUSTED E BITDA MAY NOT BE COMPUTED IN THE SAME MANNER AS SIMILARLY TITLED MEASURES USED BY OTHER CO MPANIES, INCLUDING OTHER COMPANIES IN OUR INDUSTRY. NON - GAAP FINANCIAL MEASURES

THANK YOU