Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AMERICAN CAPITAL, LTD | acas8-k11x5x15.htm |

3 YEAR FORECASTS

© 2015 American Capital, Ltd. All Rights Reserved. NASDAQ : ACAS GLOBAL ALTERNATIVE ASSET MANAGER NOVEMBER 5, 2015

Nasdaq: ACAS As previously announced, American Capital, Ltd.’s (“American Capital,” “we,” “us,” and “our”) Board of Directors has approved a plan to transfer most of its existing investment assets to a newly-formed subsidiary, American Capital Income, Ltd. (“American Capital Income”), and distribute as a special tax-free dividend, all of the outstanding shares of common stock of American Capital Income to American Capital’s stockholders (the “spin-off”). The spin-off is subject to certain conditions, including the Securities and Exchange Commission (“SEC”) declaring the registration statement relating to the spin-off effective and the formal declaration of the distribution by our Board of Directors, and there can be no assurances that the spin-off will be complete on the terms described in this presentation or at all. Furthermore, the spin-off may not have the full or any of the strategic and financial benefits that we expect, or such benefits may be delayed or may not materialize at all. Unless otherwise noted, the information included in this presentation assumes the completion of the spin-off. The following slides contain summaries of certain financial and statistical information about American Capital. They should be read in conjunction with American Capital’s Preliminary Proxy Statement filed on September 30, 2015 (the “Preliminary Proxy Statement”), the American Capital Income Information Statement, filed as Exhibit I of the Preliminary Proxy Statement (the “Information Statement”) and periodic reports that are filed from time-to-time with the SEC, including American Capital’s annual report on Form 10-K for the year ended December 31, 2014, and the risk factors noted therein. Historical results discussed in this presentation are not indicative of future results. The terms of the spin-off and the Preliminary Proxy Statement and the Information Statement are subject to change. This presentation contains “forward-looking” statements as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements about future results, estimates, projected growth in earning assets under management, projected earning assets under management and growth in earning assets under management, projected cash from any single source of investment or fee stream and other revenues, projected expenses, market and industry trends, expected and weighted average return on equity, leverage, investment opportunities, capital raising, business conditions, asset mix and other matters, including the potential distribution of American Capital Income to American Capital’s shareholders, the expected financial results of the two companies after the separation, the risks relating to the spin-off, their ability to realize the benefits of the spin-off, the scalability of our infrastructure, the size and timing of offerings and actual capital raises and the actual management fee income derived from the funds that we sponsor and manage, the ability to refinance existing indebtedness and projected yields, rates of return and performance. Forward‐looking statements concern future circumstances and results and other statements that are not historical facts and are sometimes identified by the words “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,” “believe,” “could,” “project,” “predict,” “continue,” “target” or other similar words or expressions. Forward‐looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, contain projections of results of operations or of financial condition or state other forward‐looking information. 3 IMPORTANT NOTICE AND DISCLAIMER

Nasdaq: ACAS Our ability to predict results or the actual outcome of future plans or strategies is inherently uncertain. Although we believe that the expectations reflected in such forward‐looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements due to risks, uncertainties and other factors. Factors which could have a material adverse effect on the companies’ operations and future prospects include, but are not limited to: reductions in cash flows received from investments; the ability to raise and deploy capital accretively; changes in economic conditions generally and the loan and fixed income markets specifically; adverse changes in the capital markets which affect the ability to finance investments, uncertainties as to the timing of the spin-off or whether it will be completed, the possibility that various closing conditions for the spin-off may not be satisfied or may be waived, the impact of the spin-off on both companies and the availability and terms of financing. Economic, competitive, governmental and other factors and risks that may affect the forecast operations or financial results expressed in this presentation are discussed in the SEC filings of both companies as noted above. Readers are cautioned not to place undue reliance on any of these forward‐looking statements, which reflect our management’s views as of the date of this presentation. In all cases where historical performance is presented, please note that past performance is not a reliable indicator of future results and should not be relied upon as the basis for making an investment decision. We cannot guarantee the assumptions underlying such forward-looking statements are free from errors, or any future results, levels of activity, performance or achievements. Certain information contained in the presentation includes calculations or figures that have been prepared internally and have not been audited or verified by a third party. Use of different methods for preparing, calculating or presenting information may lead to different results and such differences may be material. We undertake no obligation to update or revise forward-looking statements after the date of this presentation to conform these statements to actual results, or to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time unless otherwise required by law. You are advised to consult any additional disclosures that we may make directly to you or through reports that we file with the SEC in the future, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. 4 IMPORTANT NOTICE AND DISCLAIMER - CONTINUED

Nasdaq: ACAS This presentation contains statements relating to a proposed spin-off of American Capital Income from American Capital that is the subject of a preliminary proxy statement filed with the SEC on September 30, 2015. This presentation is not a substitute for the proxy statement or any other document that American Capital has filed or may file with the SEC or that American Capital has sent or may send to its stockholders in connection with the spin-off and American Capital's board of directors' solicitation of proxies in connection therewith. INVESTORS AND STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ALL OTHER RELEVANT DOCUMENTS THAT HAVE BEEN OR MAY BE FILED WITH THE SEC OR SENT TO STOCKHOLDERS, INCLUDING THE FINAL PROXY STATEMENT, AS THEY BECOME AVAILABLE BECAUSE THEY CONTAIN AND WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED SPIN-OFF. Investors and stockholders will be able to obtain the documents (as available) free of charge at the SEC's website, www.sec.gov. Copies of the documents filed with the SEC by American Capital will also be available free of charge on American Capital’s website at www.AmericanCapital.com under the tab "Investor Relations". The information on American Capital’s website is not, and shall not be deemed to be, a part of this report or incorporated into other filings American Capital makes with the SEC. American Capital and certain of its directors, officers and affiliates may be deemed under the rules of the SEC to be participants in the solicitation of proxies from the stockholders of American Capital in connection with the spin-off. Information regarding the interests of these participants and other persons who may be deemed participants in the spin-off may be found in its respective annual reports and proxy statements previously filed with the SEC. This presentation does not constitute the solicitation of any vote, proxy or approval from any investor or security holder or an offer to sell or the solicitation of an offer to buy any securities. No such solicitation will be made except pursuant to a definitive proxy statement filed with the SEC. No information contained in this presentation constitutes an offer or invitation to acquire or dispose of any securities or investment advice in any jurisdiction. 5 IMPORTANT NOTICE AND DISCLAIMER - CONTINUED

Nasdaq: ACAS The forecast information in this presentation reflects our current expectations regarding future events and operating performance, speak only as of the respective dates of such information, and is based on certain assumptions that are subject to inherent risks and uncertainties, which may prove to be incorrect. See Forecast Assumptions and Glossary beginning on slide 24. Note: American Capital Income intends to apply to have its common stock listed on The NASDAQ Global Select Market under the trading symbol “ACAP”. It has also filed a notice of its intention to be regulated as a BDC with the SEC and is expected to be one of our public funds under management following the completion of the spin-off. AMERICAN CAPITAL LEADER IN ALTERNATIVE ASSET MANAGEMENT 6 Funds Under Management ♦ REITs American Capital Agency Corp. (NASDAQ: AGNC) American Capital Mortgage Investment Corp. (NASDAQ: MTGE) ♦ BDCs American Capital Senior Floating, Ltd. (NASDAQ: ACSF) American Capital Income, Ltd. (NASDAQ: [ACAP])(1) ♦ Private Funds Structured Products Private Debt Private Equity Strengths ♦ Primarily Permanent Capital Funds Under Management ♦ Predictable Fee-Related Revenues ♦ Attractive Margins ♦ Strong Cash Flow Generation ♦ Diverse Set of Funds Under Management Providing growth potential in most economic environments ♦ Balance Sheet Enables Potential Growth Through: Incubation of new funds Acquisition of other asset managers ♦ Structure Enables Potential Tax Efficient Acquisitions

Nasdaq: ACAS The forecast information in this presentation reflects our current expectations regarding future events and operating performance, speak only as of the respective dates of such information, and is based on certain assumptions that are subject to inherent risks and uncertainties, which may prove to be incorrect. See Forecast Assumptions and Glossary beginning on slide 24. REITs ACAS FUNDS OVERVIEW(2) Note: Pro forma total fee EAUM is based on our various assumptions described in the endnotes beginning on slide 24. The actual total fee EAUM may differ materially. See “Disclaimer.” * American Capital Income intends to apply to have its common stock listed on The NASDAQ Global Select Market under the trading symbol “ACAP”. It has also filed a notice of its intention to be regulated as a BDC with the SEC and is expected to be one of our public funds under management following the completion of the spin-off. $21 B OF PRO FORMA FEE EARNING ASSETS UNDER MANAGEMENT AS OF SEPTEMBER 30, 2015 7 Private Funds Total Fee EAUM: $4.6 B Private Equity ACE I, II & III EAUM: $850 MM Total Fee EAUM: $10.2 B EAUM: $9.1 B NASDAQ: AGNC EAUM: $1.1 B NASDAQ: MTGE ECAS UK SME Debt EAUM: $12 MM ECAS Private Debt EAUM: $138 MM 8 ACAS CLOs EAUM: $3.2 B ACAS CLO Fund I(3) EAUM: $448 MM BDCs EAUM: $5.7 B NASDAQ: [ACAP] EAUM: $274 MM NASDAQ: ACSF Pro Forma Total Fee EAUM: $6.0 B Public Private *

Nasdaq: ACAS The forecast information in this presentation reflects our current expectations regarding future events and operating performance, speak only as of the respective dates of such information, and is based on certain assumptions that are subject to inherent risks and uncertainties, which may prove to be incorrect. See Forecast Assumptions and Glossary beginning on slide 24. STEADY GROWTH ACROSS OUR ASSET MANAGEMENT SEGMENTS Note: The forecast CAGR in ACAS fee EAUM is a forward-looking statement and is based on our various assumptions described in the endnotes beginning on slide 24. The actual CAGR in ACAS fee EAUM may differ materially. See “Disclaimer.” * Fee EAUM is presented as of the applicable year-end. $1.6 $6.3 $10.9 $10.4 $10.5 $10.2 $10.0 $11.4 $12.9 $5.3 $4.7 $4.4 $4.2 $5.9 $6.0 $5.6 $6.2 $6.5 $1.3 $1.2 $1.5 $2.2 $3.6 $4.6 $6.5 $7.7 $8.8 $8.2 $12.2 $16.8 $16.8 $20.0 $20.8 $22.1 $25.3 $28.2 $- $5 $10 $15 $20 $25 $30 $35 2010 2011 2012 2013 2014 9/30/2015 Year 1 Year 2 Year 3 $ in Billions REITs BDCs Private Funds 8 ACAS FEE EARNING ASSETS UNDER MANAGEMENT* Forecast CAGR: 10%(2) Actual CAGR: 22%

Nasdaq: ACAS The forecast information in this presentation reflects our current expectations regarding future events and operating performance, speak only as of the respective dates of such information, and is based on certain assumptions that are subject to inherent risks and uncertainties, which may prove to be incorrect. See Forecast Assumptions and Glossary beginning on slide 24. FORECAST ACAS FEE EAUM(2) $ in Millions 9 Forecast Fee EAUM Growth Endnote(s) Year 1 Year 2 Year 3 REITs – Equity Capital 4 $ – $ 1,400 $ 1,500 BDCs – Leverage (Decrease) Increase 5 (429) 436 159 BDCs – Net Realized Gains and Unrealized Appreciation 5 71 34 27 BDCs – Equity Capital 5 – 89 143 Private Funds – Managed CLOs, Net of Realizations 6 1,276 538 420 Private Funds – Equity Capital, Net of Realizations 7 700 657 629 Total $ 1,618 $ 3,154 $ 2,878 Forecast Fee EAUM Balances* Endnote(s) 9/30/2015 Year 1 Year 2 Year 3 REITs 4 $10,170 $10,005 $11,405 $12,905 BDCs 5 5,994 5,627 6,186 6,515 Private Funds 6,7 4,661 6,501 7,696 8,745 Total $20,825 $22,133 $25,287 $28,165 % Permanent Capital 78% 71% 70% 69% Note 1: Forecast ACAS fee EAUM and capital raising are forward-looking statements and are based on our various assumptions described under the endnotes beginning on slide 24. Actual ACAS fee EAUM and capital raising may differ materially. See “Disclaimer.” Note 2: Forecast assumes that the REITs and BDCs are trading above NAV per share for forecast equity capital raises, the CLO equity spreads remain favorable for issuing new CLO equity and that economic conditions remain favorable for private capital raises. * Forecast fee EAUM is presented as of the applicable year-end.

Nasdaq: ACAS The forecast information in this presentation reflects our current expectations regarding future events and operating performance, speak only as of the respective dates of such information, and is based on certain assumptions that are subject to inherent risks and uncertainties, which may prove to be incorrect. See Forecast Assumptions and Glossary beginning on slide 24. FORECAST ACAS FEES & INVESTMENT TEAM EXPENSES(2) 10 REITs Endnote(s) Year 1 Year 2 Year 3 Management Fees 4 $127 $137 $156 Investment Team Expenses 8 25 27 29 Margins ($, %) $102 80% $110 80% $127 81% BDCs Endnote(s) Year 1 Year 2 Year 3 Management Fees 9 $ 74 $ 91 $116 Incentive Fees 10 22 53 67 Subtotal 96 144 183 Investment Team Expenses 8,11 24 19 21 Margins ($, %) $ 72 75% $125 87% $162 89% Private Funds Endnote(s) Year 1 Year 2 Year 3 Management Fees 12 $ 50 $ 57 $ 68 Incentive Fees 13 20 – – Subtotal 70 57 68 Investment Team Expenses 8 43 43 44 Margins ($, %) $ 27 39% $ 14 25% $ 24 35% BY SEGMENT $ in Millions Note: Forecast ACAS fees, investment team expenses and margins are forward-looking statements and are based on our various assumptions described under the endnotes beginning on slide 24. Actual forecast fees, direct expenses and margins may differ materially. See “Disclaimer.”

Nasdaq: ACAS The forecast information in this presentation reflects our current expectations regarding future events and operating performance, speak only as of the respective dates of such information, and is based on certain assumptions that are subject to inherent risks and uncertainties, which may prove to be incorrect. See Forecast Assumptions and Glossary beginning on slide 24. 11 ACAS CONSOLIDATED INCOME STATEMENTS(14) $ in Millions Endnote(s) Pro Forma Forecast(2) 2014 YTD Q2 2015 Year 1 Year 2 Year 3 Management fees 4,9,12 $249 $127 $233 $264 $319 Incentive fees 10,13 37 14 42 53 67 Expense reimbursements 15 43 21 49 46 48 Interest and dividend income 16 44 8 9 10 11 Management fees – CLO funds 14 11 7 18 20 21 Interest income – CLO funds 14,17 31 22 32 35 38 Total Operating Revenue 415 199 383 428 504 Salaries, bonuses and benefits 8,11 171 90 132 122 125 Stock-based and other incentive compensation 8,18 146 18 37 35 42 General and administrative 19 95 45 75 76 78 Severance and non-recurring costs 20 24 10 25 12 – Total Operating Expenses 436 163 269 245 245 Net Operating (Loss) Income (21) 36 114 183 259 Other (expense) income 21 (50) 42 30 56 71 Tax benefit (provision) 22 107 (48) (35) (74) (101) Net Income 36 30 109 165 229 Non-controlling interest 23 13 8 7 – – Net Income Attributable to American Capital $ 23 $ 22 $102 $165 $229 Note: Forecast ACAS consolidated income statements are forward-looking statements and are based on our various assumptions described under the endnotes beginning on slide 24. Actual ACAS income statements may differ materially. See “Disclaimer.”

Nasdaq: ACAS The forecast information in this presentation reflects our current expectations regarding future events and operating performance, speak only as of the respective dates of such information, and is based on certain assumptions that are subject to inherent risks and uncertainties, which may prove to be incorrect. See Forecast Assumptions and Glossary beginning on slide 24. 12 ACAS ECONOMIC NET INCOME RECONCILIATION(41) $ in Millions Endnote(s) Pro Forma Forecast(2) 2014 YTD Q2 2015 Year 1 Year 2 Year 3 Net income attributable to American Capital $ 23 $ 22 $102 $165 $229 Add back: Non-cash stock-based compensation 24 66 18 20 13 20 Non-cash income tax (benefit) provision 22 (107) 48 35 74 101 Net unrealized (appreciation) depreciation on active investments 21 (25) (37) (26) (49) (70) Depreciation and amortization, net 16 7 10 10 10 Severance and non-recurring costs 20 24 10 25 12 – Economic Net (Loss) Income $ (3) $ 68 $166 $225 $290 Note: Forecast ACAS ENI is a forward-looking statement and is based on our various assumptions described under the endnotes beginning on slide 24. Actual ACAS ENI may differ materially. See “Disclaimer.”

Nasdaq: ACAS The forecast information in this presentation reflects our current expectations regarding future events and operating performance, speak only as of the respective dates of such information, and is based on certain assumptions that are subject to inherent risks and uncertainties, which may prove to be incorrect. See Forecast Assumptions and Glossary beginning on slide 24. 13 ACAS CONSOLIDATED BALANCE SHEETS(14) Forecast(2) $ in Millions Endnote(s) Pro Forma As of each year end Q2 2015 Year 1 Year 2 Year 3 Cash and cash equivalents 25 $ 3 $ 89 $ 109 $ 313 Restricted cash and cash equivalents 37 55 55 55 Management and incentive fee receivable 4,9,10,12,13 105 48 48 48 Investments at fair value 26 255 549 716 833 CLO co-investments, at fair value 14,26 215 246 309 338 Fund incubation assets 27 39 – – – Other assets 28 134 172 172 172 Deferred tax asset, net 22 473 197 123 22 Total Assets 1,261 1,356 1,532 1,781 Revolving credit facility 29 – – – – Other liabilities 30 127 163 163 163 Total Liabilities 127 163 163 163 Total Shareholders' Equity 1,134 1,193 1,369 1,618 Non-controlling interest 23 28 – – – Total Shareholders’ Equity Attributable to American Capital $1,106 $1,193 $1,369 $1,618 Note: Forecast ACAS consolidated balance sheets are forward-looking statements and are based on our various assumptions described under the endnotes beginning on slide 24. Actual ACAS balance sheets may differ materially. See “Disclaimer.”

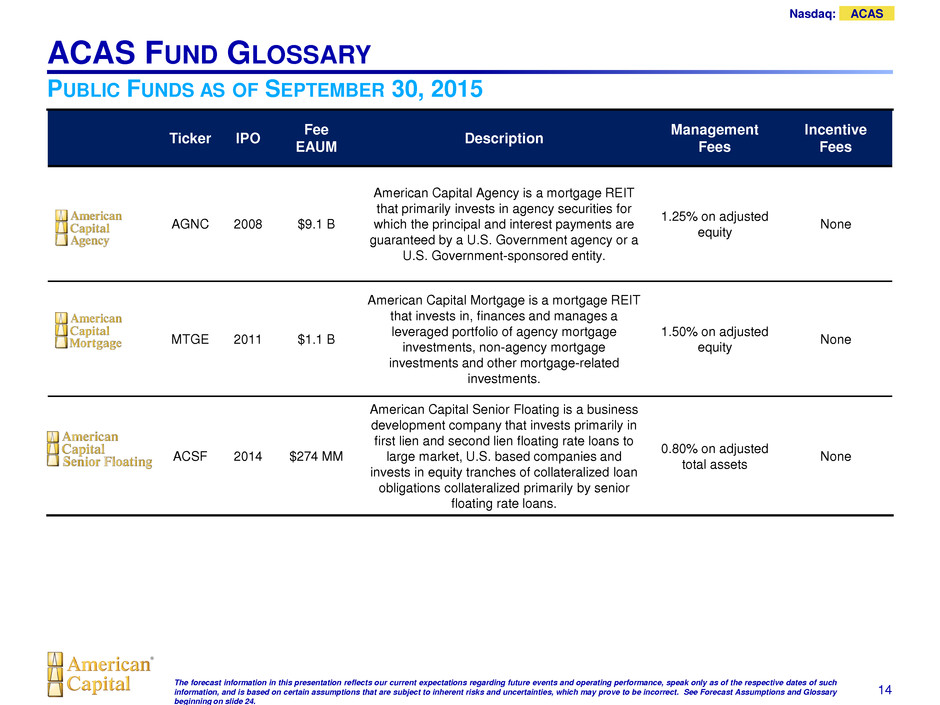

Nasdaq: ACAS The forecast information in this presentation reflects our current expectations regarding future events and operating performance, speak only as of the respective dates of such information, and is based on certain assumptions that are subject to inherent risks and uncertainties, which may prove to be incorrect. See Forecast Assumptions and Glossary beginning on slide 24. ACAS FUND GLOSSARY Ticker IPO Fee EAUM Description Management Fees Incentive Fees AGNC 2008 $9.1 B American Capital Agency is a mortgage REIT that primarily invests in agency securities for which the principal and interest payments are guaranteed by a U.S. Government agency or a U.S. Government-sponsored entity. 1.25% on adjusted equity None MTGE 2011 $1.1 B American Capital Mortgage is a mortgage REIT that invests in, finances and manages a leveraged portfolio of agency mortgage investments, non-agency mortgage investments and other mortgage-related investments. 1.50% on adjusted equity None ACSF 2014 $274 MM American Capital Senior Floating is a business development company that invests primarily in first lien and second lien floating rate loans to large market, U.S. based companies and invests in equity tranches of collateralized loan obligations collateralized primarily by senior floating rate loans. 0.80% on adjusted total assets None PUBLIC FUNDS AS OF SEPTEMBER 30, 2015 14

Nasdaq: ACAS The forecast information in this presentation reflects our current expectations regarding future events and operating performance, speak only as of the respective dates of such information, and is based on certain assumptions that are subject to inherent risks and uncertainties, which may prove to be incorrect. See Forecast Assumptions and Glossary beginning on slide 24. ACAS FUND GLOSSARY Formation Date(s) Fee EAUM Description Management Fees Incentive Fees 2007, 2012, 2013, 2014, 2015 $3.2 B American Capital CLOs invest in and manage a portfolio of broadly syndicated senior secured loans. As of November 1, 2015, American Capital had 8 CLO funds under management. 0.42% to 0.68% on assets 20% subject to hurdles 2015 $448 MM ACAS CLO Fund I is a fund focused on investing in equity tranches of third-party managed CLOs. Customary Customary 2006, 2007, 2014 $850 MM American Capital Equity I, II and III are private equity funds that primarily invest in change of control equity transactions across the U.S. middle-market. 1.25% to 2.00% on assets/commitments 10% to 35% subject to certain hurdles 2015 $138 MM European Capital private debt is a fund focused on investing in private debt of middle market companies in Western and Northern Europe with enterprise values between €50 and €500 million. 1.50% on assets Up to 15% subject to certain hurdles 2014 $12 MM European Capital UK SME Debt is a fund focused on providing debt finance in small and medium sized companies in the UK with revenues of up to £100 million. 1.50% on assets Up to 15% subject to certain hurdles PRIVATE FUNDS AS OF SEPTEMBER 30, 2015 15

© 2015 American Capital Income, Ltd. All Rights Reserved. PROPOSED NEW BDC TO BE SPUN-OUT OF AMERICAN CAPITAL AS A SPECIAL TAX-FREE DIVIDEND TO SHAREHOLDERS

The forecast information in this presentation reflects our current expectations regarding future events and operating performance, speak only as of the respective dates of such information, and is based on certain assumptions that are subject to inherent risks and uncertainties, which may prove to be incorrect. See Forecast Assumptions and Glossary beginning on slide 24. AMERICAN CAPITAL INCOME (NASDAQ: [ACAP](1)) 17 THE COMPANY ♦ American Capital Income intends to elect to be regulated as a BDC that provides capital across the middle- market and large-market through sponsor finance debt investments, senior floating rate loans, structured products and special situations investments ♦ ACAP intends to elect to be taxed as a Regulated Investment Company ♦ Will be externally managed by a subsidiary of American Capital INVESTMENT OBJECTIVE ♦ Provide investors with attractive dividends by producing risk-adjusted total returns over the long-term, primarily through current income, while also seeking to preserve its capital STRENGTHS ♦ Proven and experienced management team ♦ An established platform ♦ Large capital base ♦ Broad syndications capability ♦ Disciplined approach to portfolio management ♦ Extensive experience investing in U.S. middle-market and large-market companies FEE STRUCTURE ♦ Management fee of 2.0% on assets Management fee on senior floating rate loans waived in its entirety for first two years ♦ Incentive fee on income of 20% Computed over three years and subject to certain hurdles and a cap ♦ Incentive fee on net capital gains of 20% Computed over five years

The forecast information in this presentation reflects our current expectations regarding future events and operating performance, speak only as of the respective dates of such information, and is based on certain assumptions that are subject to inherent risks and uncertainties, which may prove to be incorrect. See Forecast Assumptions and Glossary beginning on slide 24. FORECAST ACAP(1) CONSOLIDATED BALANCE SHEETS 18 Forecast(2) $ in Millions Endnote(s) As of each year end Year 1 Year 2 Year 3 Senior floating rate loans, at fair value 31 $1,562 $ 521 $ – Sponsor Finance portfolio, at fair value 31 2,490 3,673 4,241 Special situations portfolio, at fair value 31 159 257 305 CLO equity portfolio, at fair value 31 688 1,047 1,142 Other investments, at fair value 32 412 221 109 Cash and cash equivalents 26 26 27 Total Assets $5,337 $5,745 $5,824 Senior floating rate Loan debt facilities 34 1,163 388 – Secured term loan and/or revolving credit facility 33,35 808 1,950 2,382 Total Debt Outstanding $1,971 $2,338 $2,382 Net Asset Value $3,366 $3,407 $3,442 Leverage 33 0.59x 0.69x 0.69x Note: Forecast ACAP consolidated balance sheets are forward-looking statements and are based on our various assumptions described under the endnotes beginning on slide 24. Actual ACAP balance sheets may differ materially. See “Disclaimer.”

The forecast information in this presentation reflects our current expectations regarding future events and operating performance, speak only as of the respective dates of such information, and is based on certain assumptions that are subject to inherent risks and uncertainties, which may prove to be incorrect. See Forecast Assumptions and Glossary beginning on slide 24. FORECAST ACAP(1) CONSOLIDATED TOTAL ASSETS BY BUSINESS LINE AT FORECAST FAIR VALUES(2) 19 Note: Forecast ACAP consolidated total assets are forward-looking statements and are based on our various assumptions described under endnotes beginning on slide 24. Actual ACAP consolidated total assets may differ materially. See “Disclaimer.” $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 Year 1 Year 2 Year 3 $412 $221 $109 $688 $1,047 $1,142 $159 $257 $305 $2,490 $3,673 $4,241 $1,562 $521 $26 $26 $27 $5,337 $5,745 $5,824 $ in Millions Cash and Cash Equivalents Senior Floating Rate Loans Sponsor Finance Portfolio Special Situations Portfolio CLO Equity Other Investments

The forecast information in this presentation reflects our current expectations regarding future events and operating performance, speak only as of the respective dates of such information, and is based on certain assumptions that are subject to inherent risks and uncertainties, which may prove to be incorrect. See Forecast Assumptions and Glossary beginning on slide 24. FORECAST ACAP(1) CONSOLIDATED TOTAL ASSETS BY TYPE OF SECURITY AT FORECAST FAIR VALUES(2) 20 Note: Forecast ACAP consolidated total assets are forward-looking statements and are based on our various assumptions described under endnotes beginning on slide 24. Actual ACAP consolidated total assets may differ materially. See “Disclaimer.” $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 Year 1 Year 2 Year 3 $180 $130 $106 $688 $1,047 $1,142 $203 $224 $236 $2,678 $3,797 $4,313 $1,562 $521 $26 $26 $27 $5,337 $5,745 $5,824 $ in Millions Cash and Cash Equivalents Senior Floating Rate Loans Senior Debt and Revolving Credit Facilities Mezzanine Debt Structured Products Equity

The forecast information in this presentation reflects our current expectations regarding future events and operating performance, speak only as of the respective dates of such information, and is based on certain assumptions that are subject to inherent risks and uncertainties, which may prove to be incorrect. See Forecast Assumptions and Glossary beginning on slide 24. FORECAST ACAP(1) CONSOLIDATED INCOME STATEMENTS 21 $ in Millions Endnote(s) Forecast(2) Year 1 Year 2 Year 3 Senior floating rate loans 31 $ 86 $ 68 $ 4 Sponsor finance portfolio 31 169 304 408 Special situations portfolio 31 15 24 32 CLO equity portfolio 31 72 113 144 Other investments 32 92 22 16 Total Interest Income 434 531 604 Fee income 36 19 26 17 Total interest expense 33,34,35 (83) (111) (129) Net Investment Income 370 446 492 Management fees 9 73 90 113 Direct expenses 37 11 11 11 Expense reimbursements 38 28 28 28 Total Expenses 112 129 152 Net Operating Income before Incentive Fees 258 317 340 Incentive fees based on NOI 39 15 47 67 Incentive fees based on realized gains 40 7 5 – Net Operating Income $236 $265 $273 NOI Return on Equity 7.0% 7.8% 7.9% Note: Forecast ACAP consolidated income statements are forward-looking statements and are based on our various assumptions described under the endnotes beginning on slide 24. Actual ACAP income statements may differ materially. See “Disclaimer.”

The forecast information in this presentation reflects our current expectations regarding future events and operating performance, speak only as of the respective dates of such information, and is based on certain assumptions that are subject to inherent risks and uncertainties, which may prove to be incorrect. See Forecast Assumptions and Glossary beginning on slide 24. FORECAST ACAP(1) TOTAL OPERATING REVENUE BY BUSINESS LINE(2) 22 Year 1 Year 2 Year 3 21% 4% 3% 17% 21% 24% 3% 5% 5% 39% 57% 67% 20% 13% 1% Senior Floating Rate Loans Sponsor Finance Portfolio Special Situations Portfolio CLO Equity Other Investments Note: Forecast ACAP total operating revenue by business line are forward-looking statements and are based on our various assumptions described under endnotes beginning on slide 24. Actual ACAP total operating revenue by business line may differ materially. See “Disclaimer.”

SUPPLEMENTAL INFORMATION

24 FORECAST ASSUMPTIONS* Endnote Assumption 1 American Capital Income intends to apply to have its common stock listed on The NASDAQ Global Select Market under the trading symbol “ACAP”. It has also filed a notice of its intention to be regulated as a BDC with the SEC and is expected to be one of our public funds under management following the completion of the spin-off. The ACAP management agreement has not been finalized and is subject to approval by the ACAP Board of Directors and ACAS stockholders. The terms of the management agreement included in this presentation are subject to change. 2 The forecast financial information contained in this presentation (including without limitation fee EAUM, fee EAUM growth rates, capital raising, revenues, expenses, asset mix, leverage ratio, operating revenues by security type and business line, among others) are forward-looking statements. These forward-looking statements are based on our various assumptions, including those described under the Forecast Assumptions on slides 24-29 of this presentation, such as assumptions regarding our and our managed funds’ ability to raise additional capital, favorable economic conditions, an annual GDP growth rate of at least 2.5%, relatively low loans defaults and losses and a forward LIBOR curve. We have also assumed that Year 1 represents the first full 12 months after the date of the spin-off. Actual results may differ materially from the forecasts. See “Disclaimer”. 3 ACAS CLO Fund I closed on November 2, 2015. 4 The forecast growth in fee EAUM reflects our current expectations and assumptions regarding future capital raising and net investment gains and losses, distributions and buybacks. The ability of the REITs under management to raise equity capital and to borrow are based on a number of factors, most of which are out of their control, including the quality and income producing capacity of their assets, the current conditions in the banking and financial services industry, capital markets and the economy and whether their stock prices are trading above their respective net asset values per share. There can be no assurance that they will be able to raise equity capital or to borrow in the amounts assumed in the forecasts or at all. Actual results may differ materially from the forecasts. 5 The forecast growth in fee EAUM reflects our current expectations and assumptions regarding future capital raising, leverage and net investment gains and appreciation and distributions. The ability of the BDCs under management to raise equity capital and to borrow are based on a number of factors, most of which are out of their control, including the quality and income producing capacity of their assets, current conditions in the banking and financial services industry, capital markets and the economy and whether their stock prices are trading above their respective net asset value per share. There can be no assurance that they will be able to raise equity capital or to borrow in the amounts assumed in the forecasts or at all. Forecast fee EAUM at the BDCs assume that approximately 100% of NOI, subject to RIC requirements, will be distributed as a dividend and that there will be no stock buybacks. Actual results may differ materially from the forecasts. 6 The forecast increase in Private Funds – Managed CLOs fee EAUM reflects our current expectations and assumptions regarding our ability to raise additional managed CLOs in the future. The ability to raise additional CLOs is subject to a number of factors, most of which are out of our control, including the quality and income producing capacity of CLO assets that can be originated at the time, the CLO spreads being favorable for issuing new CLO equity at the time and the current conditions of the banking and financial services industry, capital markets and the economy. There can be no assurance that we will be able to raise additional managed CLOs in the amounts assumed in the forecasts or at all. Actual results may differ materially from the forecasts. * Does not necessarily list all of our assumptions used in the forecasts.

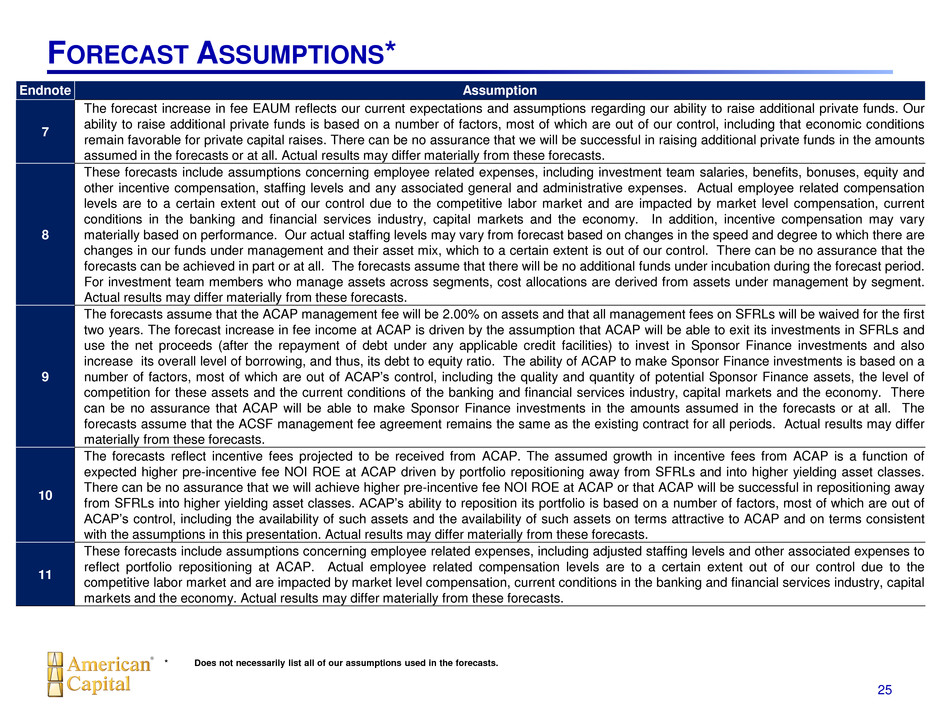

25 FORECAST ASSUMPTIONS* Endnote Assumption 7 The forecast increase in fee EAUM reflects our current expectations and assumptions regarding our ability to raise additional private funds. Our ability to raise additional private funds is based on a number of factors, most of which are out of our control, including that economic conditions remain favorable for private capital raises. There can be no assurance that we will be successful in raising additional private funds in the amounts assumed in the forecasts or at all. Actual results may differ materially from these forecasts. 8 These forecasts include assumptions concerning employee related expenses, including investment team salaries, benefits, bonuses, equity and other incentive compensation, staffing levels and any associated general and administrative expenses. Actual employee related compensation levels are to a certain extent out of our control due to the competitive labor market and are impacted by market level compensation, current conditions in the banking and financial services industry, capital markets and the economy. In addition, incentive compensation may vary materially based on performance. Our actual staffing levels may vary from forecast based on changes in the speed and degree to which there are changes in our funds under management and their asset mix, which to a certain extent is out of our control. There can be no assurance that the forecasts can be achieved in part or at all. The forecasts assume that there will be no additional funds under incubation during the forecast period. For investment team members who manage assets across segments, cost allocations are derived from assets under management by segment. Actual results may differ materially from these forecasts. 9 The forecasts assume that the ACAP management fee will be 2.00% on assets and that all management fees on SFRLs will be waived for the first two years. The forecast increase in fee income at ACAP is driven by the assumption that ACAP will be able to exit its investments in SFRLs and use the net proceeds (after the repayment of debt under any applicable credit facilities) to invest in Sponsor Finance investments and also increase its overall level of borrowing, and thus, its debt to equity ratio. The ability of ACAP to make Sponsor Finance investments is based on a number of factors, most of which are out of ACAP’s control, including the quality and quantity of potential Sponsor Finance assets, the level of competition for these assets and the current conditions of the banking and financial services industry, capital markets and the economy. There can be no assurance that ACAP will be able to make Sponsor Finance investments in the amounts assumed in the forecasts or at all. The forecasts assume that the ACSF management fee agreement remains the same as the existing contract for all periods. Actual results may differ materially from these forecasts. 10 The forecasts reflect incentive fees projected to be received from ACAP. The assumed growth in incentive fees from ACAP is a function of expected higher pre-incentive fee NOI ROE at ACAP driven by portfolio repositioning away from SFRLs and into higher yielding asset classes. There can be no assurance that we will achieve higher pre-incentive fee NOI ROE at ACAP or that ACAP will be successful in repositioning away from SFRLs into higher yielding asset classes. ACAP’s ability to reposition its portfolio is based on a number of factors, most of which are out of ACAP’s control, including the availability of such assets and the availability of such assets on terms attractive to ACAP and on terms consistent with the assumptions in this presentation. Actual results may differ materially from these forecasts. 11 These forecasts include assumptions concerning employee related expenses, including adjusted staffing levels and other associated expenses to reflect portfolio repositioning at ACAP. Actual employee related compensation levels are to a certain extent out of our control due to the competitive labor market and are impacted by market level compensation, current conditions in the banking and financial services industry, capital markets and the economy. Actual results may differ materially from these forecasts. * Does not necessarily list all of our assumptions used in the forecasts.

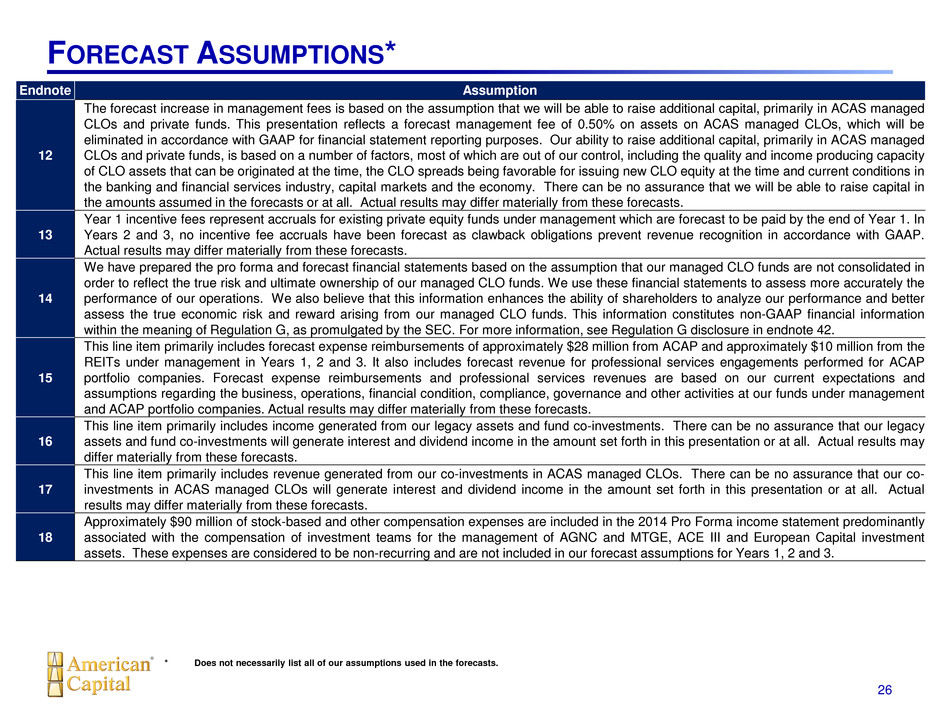

26 FORECAST ASSUMPTIONS* Endnote Assumption 12 The forecast increase in management fees is based on the assumption that we will be able to raise additional capital, primarily in ACAS managed CLOs and private funds. This presentation reflects a forecast management fee of 0.50% on assets on ACAS managed CLOs, which will be eliminated in accordance with GAAP for financial statement reporting purposes. Our ability to raise additional capital, primarily in ACAS managed CLOs and private funds, is based on a number of factors, most of which are out of our control, including the quality and income producing capacity of CLO assets that can be originated at the time, the CLO spreads being favorable for issuing new CLO equity at the time and current conditions in the banking and financial services industry, capital markets and the economy. There can be no assurance that we will be able to raise capital in the amounts assumed in the forecasts or at all. Actual results may differ materially from these forecasts. 13 Year 1 incentive fees represent accruals for existing private equity funds under management which are forecast to be paid by the end of Year 1. In Years 2 and 3, no incentive fee accruals have been forecast as clawback obligations prevent revenue recognition in accordance with GAAP. Actual results may differ materially from these forecasts. 14 We have prepared the pro forma and forecast financial statements based on the assumption that our managed CLO funds are not consolidated in order to reflect the true risk and ultimate ownership of our managed CLO funds. We use these financial statements to assess more accurately the performance of our operations. We also believe that this information enhances the ability of shareholders to analyze our performance and better assess the true economic risk and reward arising from our managed CLO funds. This information constitutes non-GAAP financial information within the meaning of Regulation G, as promulgated by the SEC. For more information, see Regulation G disclosure in endnote 42. 15 This line item primarily includes forecast expense reimbursements of approximately $28 million from ACAP and approximately $10 million from the REITs under management in Years 1, 2 and 3. It also includes forecast revenue for professional services engagements performed for ACAP portfolio companies. Forecast expense reimbursements and professional services revenues are based on our current expectations and assumptions regarding the business, operations, financial condition, compliance, governance and other activities at our funds under management and ACAP portfolio companies. Actual results may differ materially from these forecasts. 16 This line item primarily includes income generated from our legacy assets and fund co-investments. There can be no assurance that our legacy assets and fund co-investments will generate interest and dividend income in the amount set forth in this presentation or at all. Actual results may differ materially from these forecasts. 17 This line item primarily includes revenue generated from our co-investments in ACAS managed CLOs. There can be no assurance that our co- investments in ACAS managed CLOs will generate interest and dividend income in the amount set forth in this presentation or at all. Actual results may differ materially from these forecasts. 18 Approximately $90 million of stock-based and other compensation expenses are included in the 2014 Pro Forma income statement predominantly associated with the compensation of investment teams for the management of AGNC and MTGE, ACE III and European Capital investment assets. These expenses are considered to be non-recurring and are not included in our forecast assumptions for Years 1, 2 and 3. * Does not necessarily list all of our assumptions used in the forecasts.

27 FORECAST ASSUMPTIONS* Endnote Assumption 19 This line item includes historical general and administrative expenses of approximately $9 million and $7 million in 2014 and the first half of 2015, respectively, related to new funds raised. The forecast amounts do not include any additional general and administrative expenses associated with new fund raising initiatives. Further, in light of expected staffing adjustments and portfolio repositioning, associated general and administrative expense reductions are included in the forecast amounts. Actual employee related expenses are to a certain extent out of our control due to the competitive labor market and are impacted by market level compensation, the current conditions in the banking and financial services industry, capital markets and the economy. Actual general and administrative expenses may differ materially from these forecasts. 20 This line item reflects forecast severance and other related non-recurring costs associated with staffing adjustments. Actual employee related expenses are to a certain extent out of our control due to the competitive labor market and are impacted by market level compensation, the current conditions in the banking and financial services industry, capital markets and the economy. Actual severance and other related costs associated with staffing adjustments may differ materially from these forecasts. 21 Years 1, 2 and 3 include forecast net unrealized appreciation on active investments, including co-investments, based on our current expectations and assumptions. Our ability to make co-investments and the performance of such investments are based on a number of factors, many of which are outside our control. Pro forma periods include transaction related fees associated with legacy assets exited in 2014 and the first half of 2015. The projections do not include any transaction related or other fees associated with the remaining investment portfolio. Actual net unrealized appreciation (depreciation) on active investments may differ materially from these forecasts. 22 The forecast tax provision is generally calculated using a 39% tax rate applied against pretax net income, excluding certain capital items. The forecast tax provision is primarily non-cash, due to the ability to offset current period taxable income against existing net operating losses retained by ACAS. Our actual tax provision and effective tax rate may differ materially from these forecasts. 23 This line item reflects a pro rata allocation of the pro forma and forecast incentive fee accruals attributable to the minority limited partners of the general partner for American Capital Equity III, LP. The forecast decrease of incentive fee accruals in Years 2 and 3 is driven by certain clawback obligations of the general partner that prevent revenue recognition in accordance with GAAP. Actual results may differ materially from these forecasts. 24 This line item represents the portion of stock-based compensation not settled in cash. It primarily relates to stock-based compensation associated with public vehicles. Forecast non-cash stock-based compensation is based on a number of assumptions, including assumptions related to the performance of our funds, primarily our public vehicles. The performance of our funds is based on a number of factors, many of which are outside of our control. Actual non-cash stock-based compensation may differ materially from these forecasts. 25 The forecast increase in cash and cash equivalents is primarily due to the retention of net cash provided by operating activities. We have assumed that available cash will not be used for acquisitions, share repurchases or dividends, even though these events may occur. Our forecast cash and cash equivalents are based on our current expectations and assumptions regarding the future performance of our business. The future performance of our business is based on a number of factors, many of which are outside our control. Actual cash and cash equivalents may differ materially from these forecasts. * Does not necessarily list all of our assumptions used in the forecasts.

28 FORECAST ASSUMPTIONS* Endnote Assumption 26 The forecast increase in investments at fair value is based on our assumption that we will be able to make co-investments in new and existing funds under management. Our forecast CLO co-investments are based on our current expectations and assumptions regarding co-investments. Our ability to make co-investments and the performance of such investments are based on a number of factors, many of which are outside our control. Actual co-investment activity may differ materially from these forecasts. 27 The forecasts assume that we will not be required to acquire and incubate additional assets on our balance sheets prior to launching new fund initiatives. 28 This line item includes other receivables, deferred financing costs, fixed assets and other non-investment assets. We have assumed that the balances will remain static for Years 1, 2 and 3. Our actual other assets may differ materially from these forecasts. 29 This line item reflects our assumption that ACAS will have a revolving credit facility in place on the date of the spin-off through Year 3. In addition, we have assumed that there will be no draws under the facility based on forecast cash availability. 30 This line item includes accounts payable, accrued bonuses, deferred expenses and other non-debt liabilities. We have assumed that the balances will remain static for Years 1, 2 and 3. Actual other liabilities may differ materially. 31 The forecasts assume a shift in allocation from SFRLs by the end of Year 3 to Sponsor Finance and CLO equity investments. We have assumed that the Sponsor Finance portfolio will have a weighted average interest rate of approximately LIBOR plus 7.50% with a 1% floor and that 3-5% of loans in the portfolio are on non-accrual. CLO equity is forecast to be originated at a 13% yield. We have also assumed a forward LIBOR curve. The breakdown by business line on slides 18 and 19 are intended to show the currently anticipated allocation among investment strategies and not to project the acquisition or disposition of any particular investment, which will be made by ACAP’s manager based on then applicable market conditions and all other relevant factors at the time of any particular investment. There can be no guarantee that desired investments will be available or that they will have the terms described herein. Actual investment balances at fair value may differ materially from these forecasts. 32 This line item primarily represents legacy investment assets. The forecast amounts assume that the majority of legacy investment assets are exited by the end of Year 3. Actual other investment balances may differ materially from these forecasts. 33 There can be no guarantee that any leverage will be available or available on favorable terms. 34 The forecasts assume that ACAS is able to transfer its existing SFRL debt facilities to ACAP without any changes in their terms and conditions, and that such terms and conditions remain the same throughout the forecast periods. We have also assumed a forward LIBOR curve. There can be no assurance that such leverage will be available or available on favorable terms. 35 These forecasts assume that the weighted average cost of such debt will be approximately LIBOR plus 3% and that there will be a 1% floor during the forecast periods. We have also assumed a forward LIBOR curve. 36 This line item includes origination and transaction fees forecast to be generated from portfolio investments. Actual origination and transaction fees may differ materially from these forecasts. 37 This line item represents forecast direct third-party general and administrative expenses associated with being a public company including audit fees, insurance, and Board of Director fees. We have assumed that the balance will remain static in Years 1, 2 and 3. Actual direct expenses may differ materially from these forecasts. * Does not necessarily list all of our assumptions used in the forecasts.

29 FORECAST ASSUMPTIONS* Endnote Assumption 38 This line item represents forecast expense reimbursements to ACAS pursuant to an Administration Agreement for non-investment management services associated with the administration of ACAP. We have assumed that the balance will remain static in Years 1, 2 and 3. Actual expense reimbursements may differ materially from these forecasts. 39 This line item represents forecast incentive fees based on NOI paid to ACAP’s manager in excess of a 2% quarterly NOI hurdle rate, or (8% annually); full catch-up provision up to 2.5% quarterly (10% annually); thereafter, 20% of NOI in excess. Additionally, we have assumed a 20% incentive fee cap on the trailing 12 quarter cumulative net return. Full calculation and definition defined in the Management Agreement. The ACAP management agreement has not been finalized and is subject to approval by the ACAP Board of Directors and ACAS stockholders. The assumed terms of the management agreement are subject to change. 40 This line item represents forecast incentive fees based on realized gains to be paid to ACAP’s manager on 20% of net realized gains, net of any unrealized depreciation. The ACAP management agreement has not been finalized and is subject to approval by the ACAP Board of Directors and ACAS stockholders. The assumed terms of the management agreement are subject to change. * Does not necessarily list all of our assumptions used in the forecasts.

30 REGULATION G DISCLOSURES Endnote 41 We have supplemented the GAAP presentation of ACAS’ and ACAP’s forecast financial statements herein with certain non-GAAP forecast financial information, which has been adjusted to exclude certain costs, charges, expenses and losses. We believe that these non-GAAP financial measures, when considered together with the GAAP financial measures, provide information that is useful to investors in understanding period-over-period results separate and apart from items that may, or could, have a disproportionately positive or negative impact on the forecast results in any particular period. We also believe that these non-GAAP financial measures enhance the ability of investors to analyze our current expectations and assumptions regarding ACAS’ and ACAP’s business trends and forecast performance. We believe that economic net income, or ENI, provides investors and management with a meaningful indicator of operating performance. We also use ENI, in addition to other measures, to evaluate profitability. We believe that ENI is useful because it adjusts net income (loss) attributable to American Capital for a variety of non-cash, one-time and certain non-recurring items. We calculate ENI by subtracting from, or adding to, net income (loss) attributable to American Capital the following items: non-cash stock-based compensation, non-cash income tax (benefit) provision, net unrealized (appreciation) depreciation on active investments, depreciation and amortization, net and severance and non-recurring costs. In future periods, such adjustments may include other one-time events pursuant to changes in GAAP and certain other non-recurring items. ENI should not be considered as an alternative to net income (loss) attributable to American Capital, determined in accordance with GAAP, as an indicator of operating performance. In addition, our methodology for calculating ENI may differ from the methodologies used by other comparable companies when calculating the same or similar supplemental financial measures and may not be comparable with these companies. Any analysis of non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP. A reconciliation of these non-GAAP financial measures with the most directly comparable financial measures calculated in accordance with GAAP is shown on slide 12.

31 GLOSSARY Term Definition Fee EAUM Fee Earning Assets Under Management REITs Real estate investment trusts. Comprised of American Capital Agency Corp. (NASDAQ: AGNC) and American Capital Mortgage Investment Corp. (NASDAQ: MTGE) BDCs Business Development Company. Comprised of American Capital Senior Floating, Ltd., a publicly-traded BDC (NASDAQ: ACSF), and assumes American Capital Income, Ltd. (“ACAP”) was in existence as of January 1, 2014 Private Funds Comprised of the following: American Capital Equity I, LLC (“ACE I”), American Capital Equity II, LP (“ACE II”), American Capital Equity III, LP (“ACE III”), European Capital UK SME Debt LP, European Capital private debt fund, American Capital CLO Fund I, LP (“ACAS CLO Fund I”), ACAS CLO 2007-1, Ltd., ACAS CLO 2012-1, Ltd., ACAS CLO 2013-1, Ltd., ACAS CLO 2013-2, Ltd., ACAS CLO 2014-1, Ltd., ACAS CLO 2014-2, Ltd., ACAS CLO 2015-1, Ltd. and ACAS CLO 2015-2, Ltd. CAGR Compound Annual Growth Rate ENI Economic Net Income RIC Regulated Investment Company NOI Net Operating Income ROE Return on Equity ACAS American Capital, Ltd. ACAP American Capital Income, Ltd. ECAS European Capital, Ltd. BDC Business Development Company ACAS CLOs Comprised of the following: ACAS CLO 2007-1, Ltd., ACAS CLO 2012-1, Ltd., ACAS CLO 2013-1, Ltd., ACAS CLO 2013-2, Ltd., ACAS CLO 2014-1, Ltd., ACAS CLO 2014-2, Ltd., ACAS CLO 2015-1, Ltd. and ACAS CLO 2015-2, Ltd. GAAP Accounting principles generally accepted in the United States

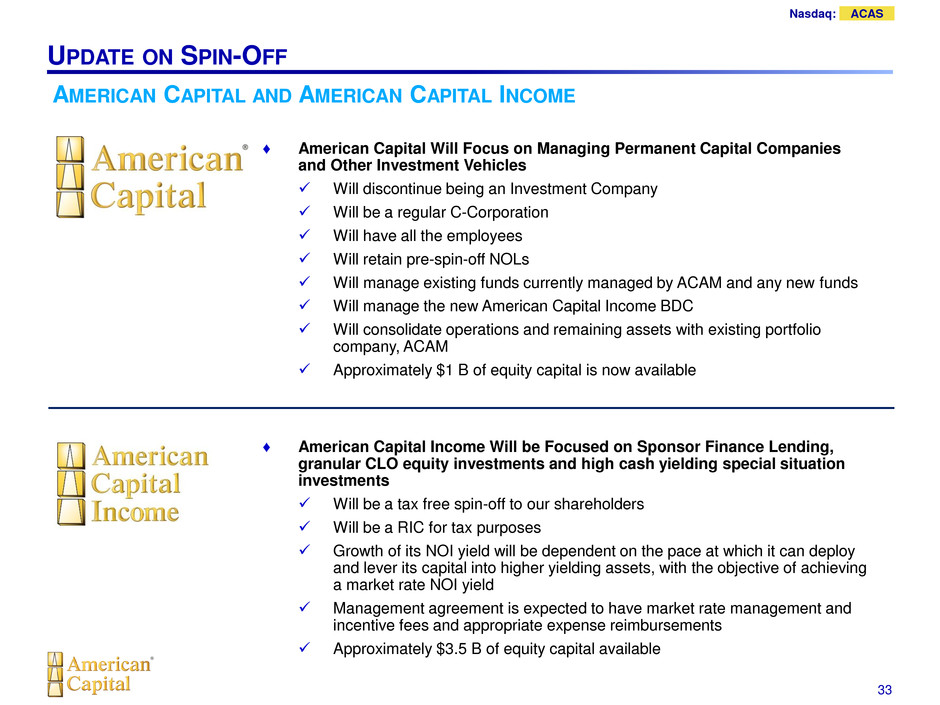

Nasdaq: ACAS UPDATE ON SPIN-OFF OF AMERICAN CAPITAL INCOME ♦ We have Concluded that Regulatory Relief Will Not Likely be Needed ♦ We Plan to Spin-off to Shareholders One New BDC, American Capital Income, with American Capital Continuing Primarily in the Asset Management Business ♦ American Capital Income Will Have ~$3.5 B of Equity ♦ American Capital Income Will Use its Large Capital Base to Expand its Sponsor Finance Business into Leading and Syndicating Large Middle Market Transactions This will include unitranche, second lien and mezzanine lending Underwriting up to $400 MM and generally holding up to $150 MM ♦ We Filed American Capital’s Proxy and ACAP’s Registration Statement on September 30, 2015 ♦ We Received the IRS Private Letter Ruling for Tax-free Nature of the Spin-off ♦ In Addition, We Continue to Make Progress Adjusting our Assets so that: ACAP should have a higher NOI return on equity than American Capital has today The asset composition of ACAP will meet statutory requirements ACAS’ asset management business will continue its growth 32

Nasdaq: ACAS UPDATE ON SPIN-OFF 33 AMERICAN CAPITAL AND AMERICAN CAPITAL INCOME ♦ American Capital Will Focus on Managing Permanent Capital Companies and Other Investment Vehicles Will discontinue being an Investment Company Will be a regular C-Corporation Will have all the employees Will retain pre-spin-off NOLs Will manage existing funds currently managed by ACAM and any new funds Will manage the new American Capital Income BDC Will consolidate operations and remaining assets with existing portfolio company, ACAM Approximately $1 B of equity capital is now available ♦ American Capital Income Will be Focused on Sponsor Finance Lending, granular CLO equity investments and high cash yielding special situation investments Will be a tax free spin-off to our shareholders Will be a RIC for tax purposes Growth of its NOI yield will be dependent on the pace at which it can deploy and lever its capital into higher yielding assets, with the objective of achieving a market rate NOI yield Management agreement is expected to have market rate management and incentive fees and appropriate expense reimbursements Approximately $3.5 B of equity capital available

Nasdaq: ACAS IMPACT OF SPIN-OFF ON EMPLOYEE OPTIONS ♦ Dividend of American Capital Income Shares Eliminates Most of the Value of Unexercised ACAS Employee Options ACAS option holders cannot be issued American Capital Income options to compensate for the value of the dividend spin-off Economically impractical to adjust ACAS options to offset value lost through the dividend spin-off ♦ Unvested Options will Vest on the Following Schedule (in millions): ♦ Outstanding Shares will Increase as Options are Exercised and NAV will Decrease Approximate $(1.29) pro forma impact to NAV per share if all In-the-Money options were exercised as of September 30, 2015 Repurchases of shares through the Share Repurchase Program has offsetting effect * In and Out-of-the-Money determinations are based on the September 30, 2015 ACAS closing price of $12.16 per share. 34 In-the-Money* Out-of-the-Money* V s ed Options 23.4 5.6 Unvest d Options 5.9 1.3 Exercisable Options Assuming Vesting Acceleration 29.3 6.9 Exercisable Options Assu ing Vesting Acceleration - Adjusted (1) 26.4 N/A (i milli ) As of September 30, 2015 (1) Adjusted to assume that 30% of employees exercise options via a 'cash-less ' exercise. A 42.5% tax witholding is assumed. Out-of-the-Money options are not assumed exercised. Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Thereafter Total 1.4 1.6 1.5 0.4 0.5 1.8 7.2 . .4 .3 . . 0.9 5.9 0 0.2 0.2 0 0 . 1.3 Total In-the-Money Out-of-the-Money

Nasdaq: ACAS IMPACT OF SPIN-OFF ON EMPLOYEE OPTIONS – CONTINUED DILUTIVE IMPACT ON NET ASSET VALUE PER SHARE 35 Total Options Out-of-the- Money Options In-the-Money Options September 30, 2015 Shareholders' Equity $ 5,307 $ 5,307 $ 5,307 September 30, 2015 Shares Outstanding 259.6 259.6 259.6 September 30, 2015 NAV per Share $ 20.44 $ 20.44 $ 20.44 Cash Proceeds from Option Exercises $ 348 $ 125 $ 223 Additional Shares Issued from Option Exercises 36.2 6.9 29.3 Deferred Tax Asset Recognized on Option Exercises $ 4 $ - $ 4 September 30, 2015 Shareholders' Equity - Pro Forma $ 5,659 $ 5,432 $ 5,534 September 30, 2015 Shares Outstanding - Pro Forma 295.8 266.5 288.9 September 30, 2015 NAV per Share - Pro Forma $ 19.13 $ 20.38 $ 19.16 Dilutive Impact of Option Exercises to September 30, 2015 NAV per Share $ (1.31) $ (0.06) $ (1.29) Dilutive Impact of Option Exercises and $300 MM of Share Repurchases at September 30, 2015 Stock Price of $12.16 per Share $ (0.68) Dilutive Impact of Option Exercises and $600 MM of Share Repurchases at September 30, 2015 Stock Price of $12.16 per Share $ 0.08 Note: Amounts may not foot due to rounding. ($'s and shares in millions) Assumptions: - All unvested options are assumed vested as of September 30, 2015. - All outstanding options are assumed exercised as of September 30, 2015 at the closing share price of $12.16. - Weighted average option exercise price equals approximately $9.61 and $9.63 for Total Options and In-the-Money Options, respectively. - New shares are issued for options exercised. - Deferred tax asset calculated using a 39% tax rate. - Additional incremental tax savings related to option exercises will be realized in the future.