Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CST BRANDS, INC. | cst20153qform8-kearningsre.htm |

| EX-99.1 - EXHIBIT 99.1 - CST BRANDS, INC. | exhibit991cst3q2015earning.htm |

3Q 2015 Earnings Call November 4, 2015

Safe Harbor Statements Forward-Looking Statements Statements contained in this presentation that state the Company’s and Partnership’s or management’s expectations or predictions of the future are forward-looking statements and are intended to be covered by the safe harbor provisions of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. The words “believe,” “expect,” “should,” “intends,” “estimates,” and other similar expressions identify forward-looking statements. It is important to note that actual results could differ materially from those projected in such forward-looking statements. For more information concerning factors that could cause actual results to differ from those expressed or forecasted, see CST and CrossAmerica filings with the Securities and Exchange Commission (“SEC”), including the Risk Factors in our most recently filed Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q as filed with the SEC and available on CST Brand’s website at www.cstbrands.com and CrossAmerica’s website at www.crossamericapartners.com. If any of these risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may vary significantly from what we projected. Any forward-looking statement you see or hear during this presentation reflects our current views as of the date of this presentation with respect to future events. We assume no obligation to publicly update or revise these forward-looking statements for any reason, whether as a result of new information, future events, or otherwise. Non-GAAP Financial Measures To supplement our consolidated financial statements prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and to better reflect period-over-period comparisons, we use non-GAAP financial measures that either exclude or include amounts that are not normally excluded or included in the most directly comparable measure, calculated and presented in accordance with GAAP. Non-GAAP financial measures do not replace and are not superior to the presentation of GAAP financial results, but are provided to improve overall understanding of our current financial performance and our prospects for the future. We believe the non-GAAP financial results provide useful information to both management and investors regarding certain additional financial and business trends relating to financial condition and operating results. In addition, management uses these measures, along with GAAP information, for reviewing financial results and evaluating our historical operating performance. The non-GAAP adjustments for all periods presented are based upon information and assumptions available as of the date of this presentation. The non-GAAP information is not prepared in accordance with GAAP and may not be comparable to non-GAAP information used by other companies. Information regarding the non-GAAP financial measure referenced in this presentation, including the reconciliation to the nearest GAAP measure can be found in our financial results press releases, available on our web sites: www.cstbrands.com and www.crossamericapartners.com. 2

CST Business Overview Kim Lubel President, CEO and Chairman of the Board 3

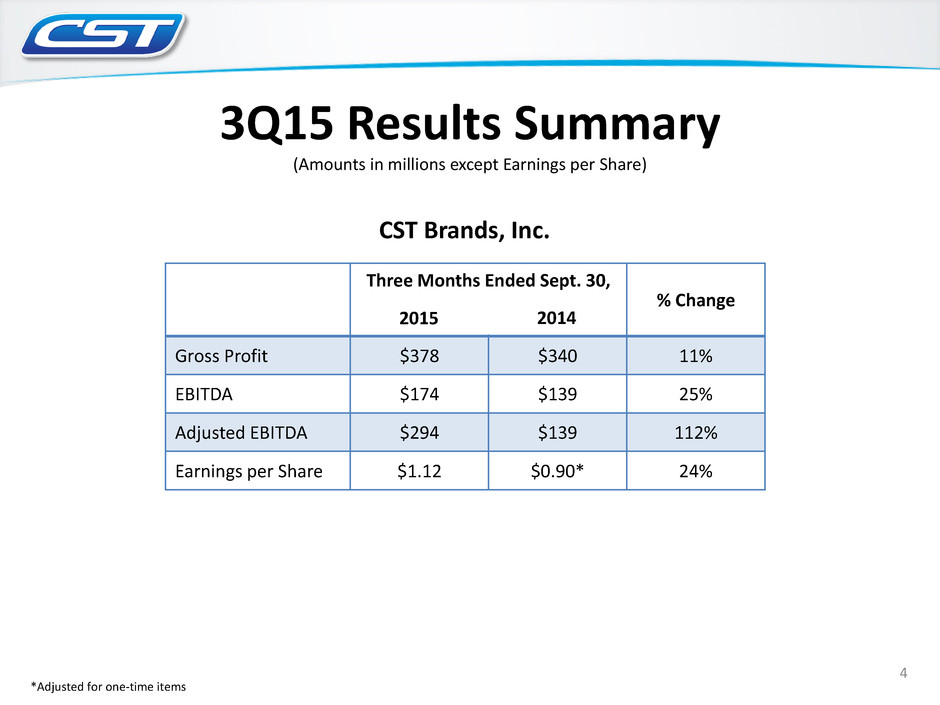

3Q15 Results Summary (Amounts in millions except Earnings per Share) Three Months Ended Sept. 30, % Change Gross Profit $378 $340 11% EBITDA $174 $139 25% Adjusted EBITDA $294 $139 112% Earnings per Share $1.12 $0.90* 24% CST Brands, Inc. 2015 2014 *Adjusted for one-time items 4

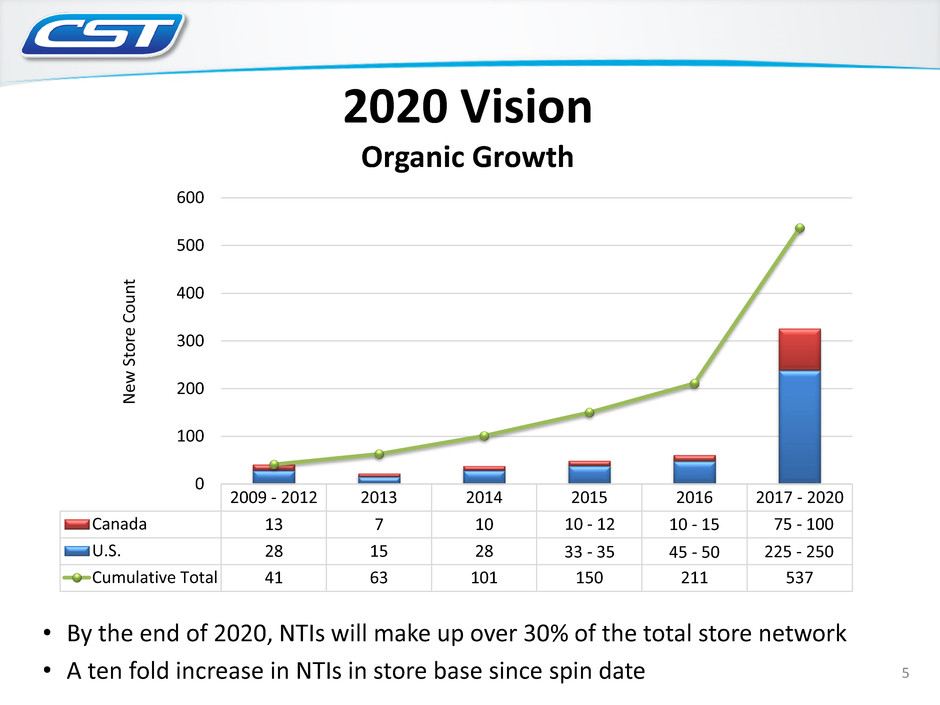

2020 Vision Organic Growth 5 2009 - 2012 2013 2014 2015 2016 2017 - 2020 Canada 13 7 10 11 13 88 U.S. 28 15 28 38 48 238 Cumulative Total 41 63 101 150 211 537 0 100 200 300 400 500 600 N ew S to re C ou n t 75 - 100 225 - 250 10 - 15 45 - 50 10 - 12 33 - 35 • By the end of 2020, NTIs will make up over 30% of the total store network • A ten fold increase in NTIs in store base since spin date

2020 Vision Inside Store Growth Today 3Q15 2020 52% 48% Fuel Non-Fuel 30% 70% Fuel Non-Fuel 66% 34% Fuel Non-Fuel 50% 50% Fuel Non-Fuel U.S. Canada Note: Non-fuel includes Merchandise and “Other” Categories 6 Leads to Significant Shift in Gross Profit Mix Gross Profit Gross Profit Gross Profit Gross Profit

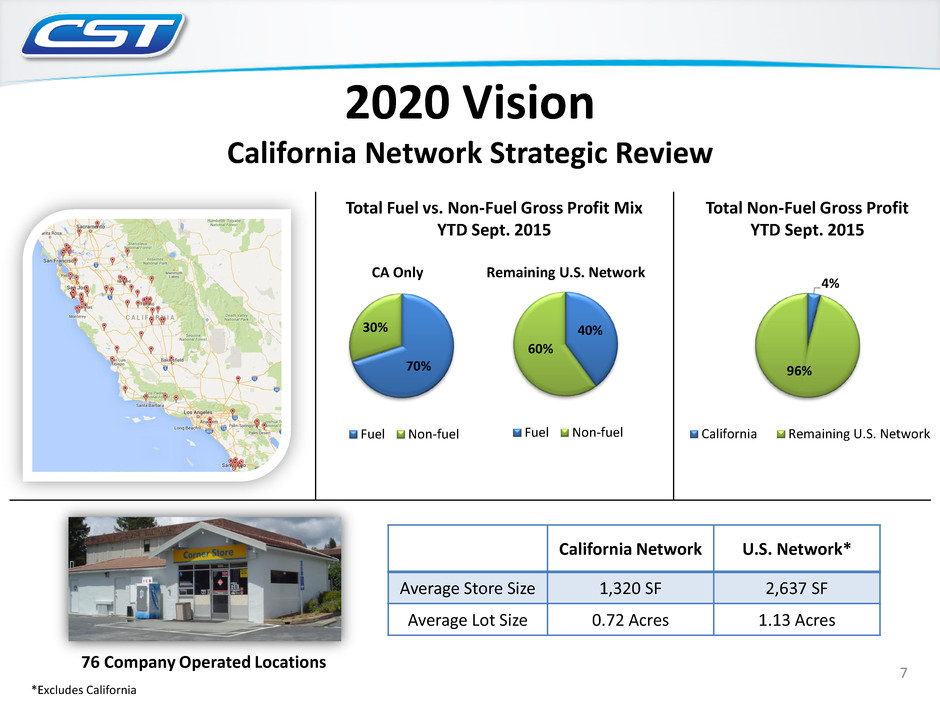

7 Total Non-Fuel Gross Profit YTD Sept. 2015 4% 96% California Remaining U.S. Network Total Fuel vs. Non-Fuel Gross Profit Mix YTD Sept. 2015 70% 30% Fuel Non-fuel *Excludes California 2020 Vision California Network Strategic Review 76 Company Operated Locations California Network U.S. Network* Average Store Size 1,320 SF 2,637 SF Average Lot Size 0.72 Acres 1.13 Acres 40% 60% Fuel Non-fuel CA Only Remaining U.S. Network

• 164 convenience stores with Flash Foods-branded fuel • Georgia and Florida markets • 21 branded Quick Service Restaurants • 90,000 SF merchandise distribution center in Alma, GA • 290 million gallons in fuel supply including leased storage and a transportation fleet • Strong customer-focused team culture 8 2020 Vision Continued Acquisition Growth Flash Foods

Financial Overview Clay Killinger EVP and Chief Financial Officer 9

CST Key Metrics Gross Profit (mm) Three Months Ended Sept. 30, % Change Motor Fuel $150 $117 28% Merchandise $121 $107 13% Other $15 $13 15% Key Metrics Three Months Ended Sept. 30, % Change Core Stores (EOP) 1,027 1,046 (2%) Motor Fuel Gallons Sold (PSPD) 5,226 4,921 6% Motor Fuel CPG (net of CC) $0.314 $0.246 28% Merchandise Sales (PSPD) $4,129 $3,686 12% Merchandise Margin* (net of CC) 30.8% 30.2% 60 bps U.S. Retail (USD) *Merchandise margin excludes other revenue margin 2015 2014 2015 2014 10

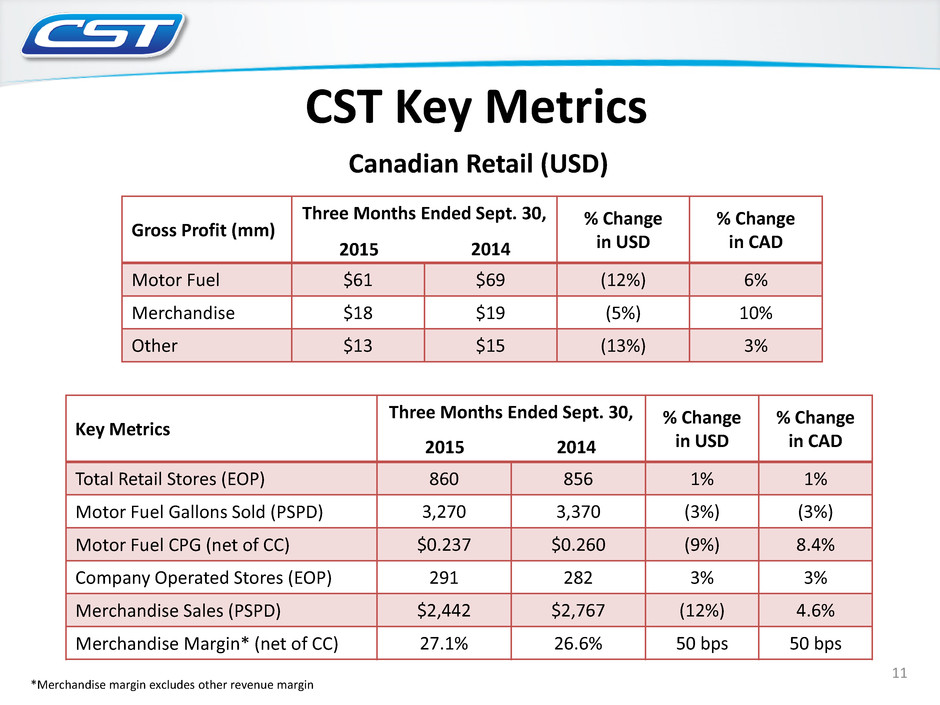

Key Metrics Three Months Ended Sept. 30, % Change in USD % Change in CAD Total Retail Stores (EOP) 860 856 1% 1% Motor Fuel Gallons Sold (PSPD) 3,270 3,370 (3%) (3%) Motor Fuel CPG (net of CC) $0.237 $0.260 (9%) 8.4% Company Operated Stores (EOP) 291 282 3% 3% Merchandise Sales (PSPD) $2,442 $2,767 (12%) 4.6% Merchandise Margin* (net of CC) 27.1% 26.6% 50 bps 50 bps Gross Profit (mm) Three Months Ended Sept. 30, % Change in USD % Change in CAD Motor Fuel $61 $69 (12%) 6% Merchandise $18 $19 (5%) 10% Other $13 $15 (13%) 3% Canadian Retail (USD) *Merchandise margin excludes other revenue margin 2015 2014 2015 2014 CST Key Metrics 11

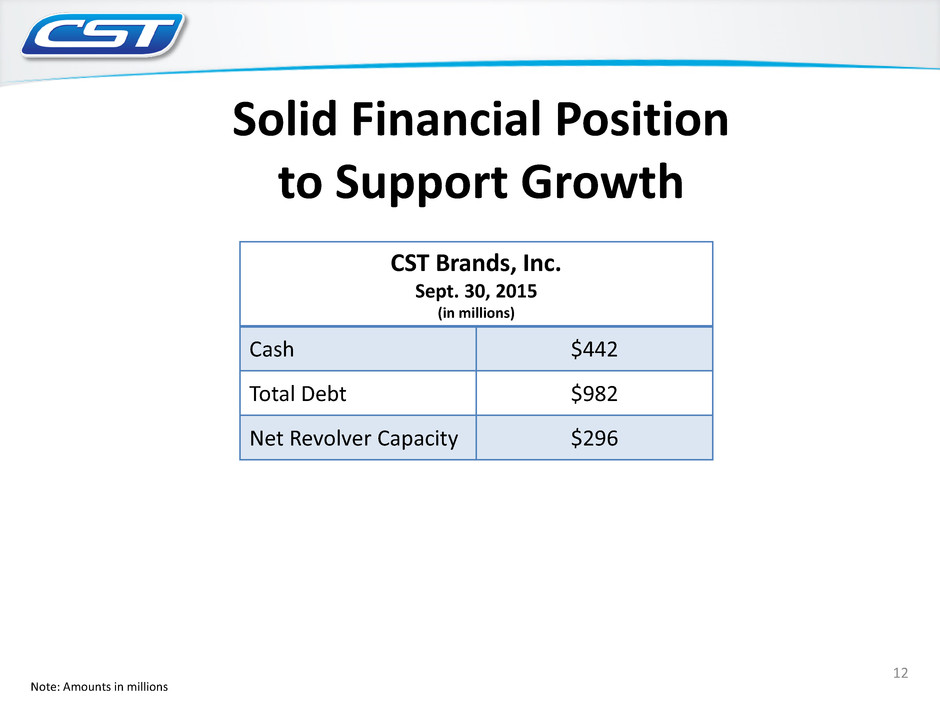

Solid Financial Position to Support Growth CST Brands, Inc. Sept. 30, 2015 (in millions) Cash $442 Total Debt $982 Net Revolver Capacity $296 Note: Amounts in millions 12

CST Guidance (in USD) Retail Segment Gallons (PSPD) 4,950 to 5,050 4,902 3,150 to 3,250 3,185 Merchandise Sales (PSPD) $3,750 to $3,850 $3,490 $2,050 to $2,150 $2,336 Merchandise Gross Margin (%) 30.5% to 31.5% 30.5% 25.5% to 26.5% 26.5% U.S. Canada Category Ranges (mm) Operating Expenses $178 to $182 General & Administrative Expenses $34 to $36 Depreciation & Amortization $33 to $35 4th Quarter 2015 4Q15 Guidance 4Q14 Actual 4Q15 Guidance 4Q14 Actual 13

Investor Update November 2015 3Q 2015 Earnings Call Jeremy Bergeron, President

3Q15 Results Summary (in thousands, except for per unit amounts) KEY METRICS Three Months ended Sept. 30, 2015 2014 % Change Gross Profit $47.8 $36.3 32% Adjusted EBITDA $31.0 $18.8 65% Distributable Cash Flow $25.1 $13.7 83% Weighted Avg. Diluted Units 33,094 19,359 71% DCF per LP Unit $0.7591 $0.7053 8% Distribution Paid per LP Unit $0.5625 $0.5225 8% Distribution Coverage 1.35x 1.35x - 15

3Q15 Segment Results (in thousands, except for number of sites and per gallon amounts) WHOLESALE SEGMENT Three Months ended Sept. 30, 2015 2014 % Change Total Volume of Gallons Distributed 284,089 264,242 8% Fuel Margin per Gallon $0.061 $0.073 (16%) Rental Income $13,696 $9,468 45% Total Motor Fuel Sites (period avg.) 1,094 1,024 7% Segment Adjusted EBITDA $29,101 $22,439 30% RETAIL SEGMENT Three Months ended Sept. 30, 2015 2014 % Change Total Volume of Gallons Distributed 61,624 46,486 33% Fuel Margin per Gallon $0.129 $0.053 143% Site Count (period avg.) 229 156 47% Segment Adjusted EBITDA $7,286 $1,379 428% 16

3Q14 vs 3Q15 Adjusted EBITDA Performance (in thousands) $30,963 $18,830 $17,424 $88 ($2,597) ($1,245) ($2,299) $762 Acquisitions(1) Impact of Dealer- Tank-Wagon Pricing Impact of Supplier Terms Discounts Divestments(2) Q3 2014 Adjusted EBITDA Q3 2015 Adjusted EBITDA Net, Misc. Increase in G&A Expenses, Excluding Acquisition Cost (1) Acquisitions include third party acquisitions (since Q2 2014) in addition to fuel and real estate drops from CST. (2) See page 100 from the 2014 10-K filing. 17

2Q15 vs 3Q15 Adjusted EBITDA Performance (in thousands) $30,963 $19,060 $8,554 $1,944 ($479) $0 $2,253 ($369) Acquisitions(1) Impact of Dealer- Tank-Wagon Pricing Impact of Supplier Terms Discounts Divestments(2) Q2 2015 Adjusted EBITDA Q3 2015 Adjusted EBITDA Net, Misc. Decrease in G&A Expenses, Excluding Acquisition Cost (1) Acquisitions include third party acquisitions (since Q2 2014) in addition to fuel and real estate drops from CST. (2) See page 100 from the 2014 10-K filing. 18

Strong Financial Position • Declared third quarter distribution of $0.5775 per unit – 1.5 cent per unit increase over second quarter – Continue to target 2015 annual per unit distribution growth of 7-9% – Expect 2015 annual Coverage Ratio over 1.0x, with continued long-term target of 1.1x or higher • Continue to maintain adequate borrowing capacity on our revolving credit facility to be able to fund growth opportunities – Net revolver capacity of $125 million, as of September 30, 2015 19 IPO MQD* 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 $0.4375 $0.4525 $0.4775 $0.5025 $0.5125 $0.5125 $0.5225 $0.5325 $0.5425 $0.5475 $0.5625 $0.5775 *Incomplete period associated with IPO. Actual 4Q12 distribution per unit was $0.2948.

• Continue to execute on core competencies – Strong wholesale and real estate business units – Continue pursuit of acquisitive growth at accretive multiples • With CST, can structure transactions in numerous ways to ensure optimal value accretion • Leverage expertise and systems to recognize synergies and improve EBITDA • Continue accretive growth in CST Fuel Supply – Targeting 10-12% in additional acquisition of CST Fuel Supply in 2016 – With CST’s NTI growth plan, CrossAmerica will benefit from this growing fuel supply – By 2020, CAPL ownership is expected to grow to over 75% • Rate of growth will be dependent upon market conditions and third party acquisition opportunities TODAY 1.9 billion gallons 17.5% CAPL Ownership Strategic Vision 2020 2+ billion gallons 75%+ CAPL Ownership 20

Q&A Session