Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PERDOCEO EDUCATION Corp | ceco-8k_20151104.htm |

| EX-99.1 - EX-99.1 - PERDOCEO EDUCATION Corp | ceco-ex991_7.htm |

CAREER EDUCATION CORPORATION THIRD quarter 2015 investor conference call November 4, 2015 Dave Rawden Interim Chief Financial Officer Ashish Ghia Vice President, Finance Todd Nelson President & Chief Executive Officer Exhibit 99.2

This presentation contains “forward-looking statements,” as defined in Section 21E of the Securities Exchange Act of 1934, as amended, that reflect our current expectations regarding our future growth, results of operations, cash flows, performance and business prospects and opportunities, as well as assumptions made by (see, for example, Slide 7), and information currently available to, our management. We have tried to identify forward-looking statements by using words such as “believe,” “intend,” “will,” “expect,” “project,” “continue to,” “estimate” and similar expressions, but these words are not the exclusive means of identifying forward-looking statements. These statements are based on information currently available to us and are subject to various risks, uncertainties, and other factors, including, but not limited to, those discussed in Item 1A,“Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2014 and our subsequent filings with the Securities and Exchange Commission that could cause our actual growth, results of operations, financial condition, cash flows, performance and business prospects and opportunities to differ materially from those expressed in, or implied by, these statements. Except as expressly required by the federal securities laws, we undertake no obligation to update such factors or any of the forward-looking statements to reflect future events, developments, or changed circumstances or for any other reason. Certain financial information is presented on a non-GAAP basis. The Company believes it is useful to present non-GAAP financial measures which exclude certain significant items as a means to understand the performance of its ongoing operations. As a general matter, the Company uses non-GAAP financial measures in conjunction with results presented in accordance with GAAP to help analyze the performance of its core business, assist with preparing the annual operating plan, and measure performance for some forms of compensation. In addition, the Company believes that non-GAAP financial information is used by analysts and others in the investment community to analyze the Company's historical results and to provide estimates of future performance and that failure to report non-GAAP measures could result in a misplaced perception that the Company's results have underperformed or exceeded expectations. The most directly comparable GAAP information and a reconciliation between the non-GAAP and GAAP figures are provided at the end of this presentation, and this presentation (including the reconciliation) has been posted to our website. Cautionary Statements & Disclosures

Third Quarter Highlights Total University Group revenue of $136.1 million, up 3.0% year-over-year after adjusting for changes to accounting for student withdrawals University Group operating income of $20.3 million, an increase of 212.3% year-over-year Positive cash flow from operations of $5.6 million; first positive cash flow from operations in a 3rd quarter since 2012 Future cash flow from operations will still be subject to typical seasonality trends Adjusted EBITDA improved 157.6% year-over-year to $16.6 million Recently introduced John Kline and Andrew Hurst as Senior Vice Presidents responsible for AIU and CTU, respectively New leadership structure intends to enhance student outcomes, student retention and support responsible growth Company is engaging in exclusive discussions with one buyer for its Le Cordon Bleu Culinary campuses Expect a definitive agreement to be in place by the end of the year, with a transaction closing in early 2016, subject to regulatory approvals

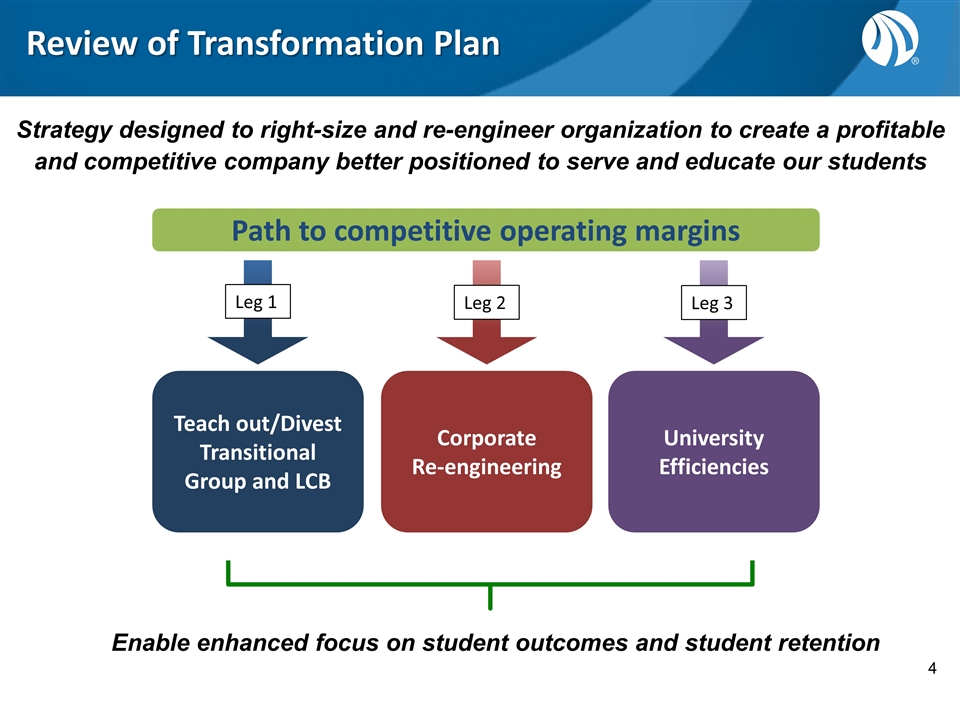

Strategy designed to right-size and re-engineer organization to create a profitable and competitive company better positioned to serve and educate our students Path to competitive operating margins Teach out/Divest Transitional Group and LCB Corporate Re-engineering University Efficiencies Leg 1 Leg 2 Leg 3 Review of Transformation Plan Enable enhanced focus on student outcomes and student retention

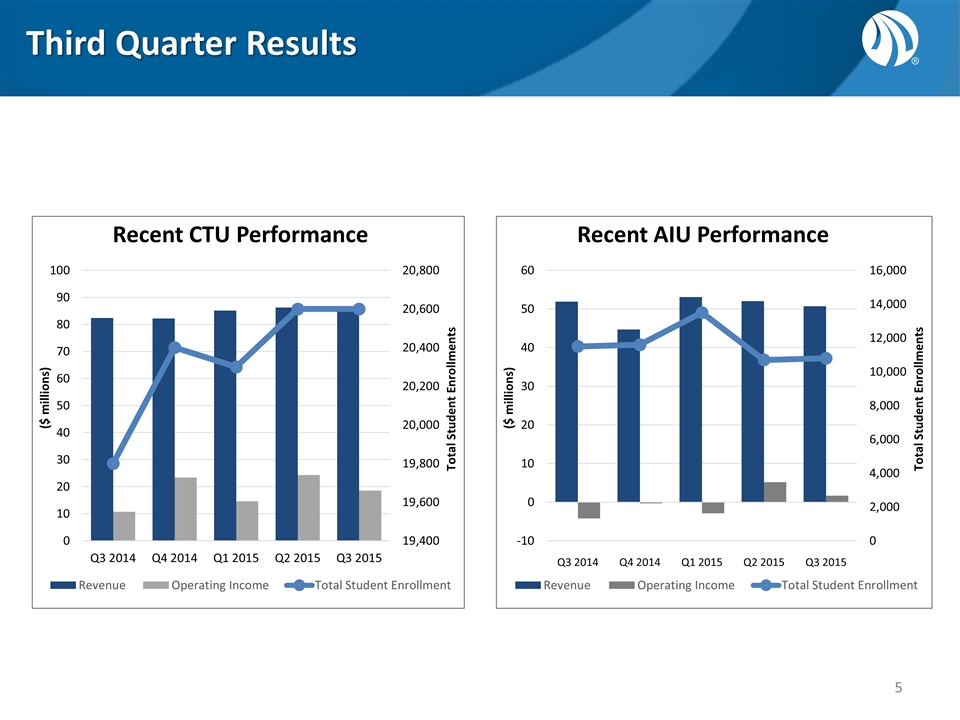

Third Quarter Results

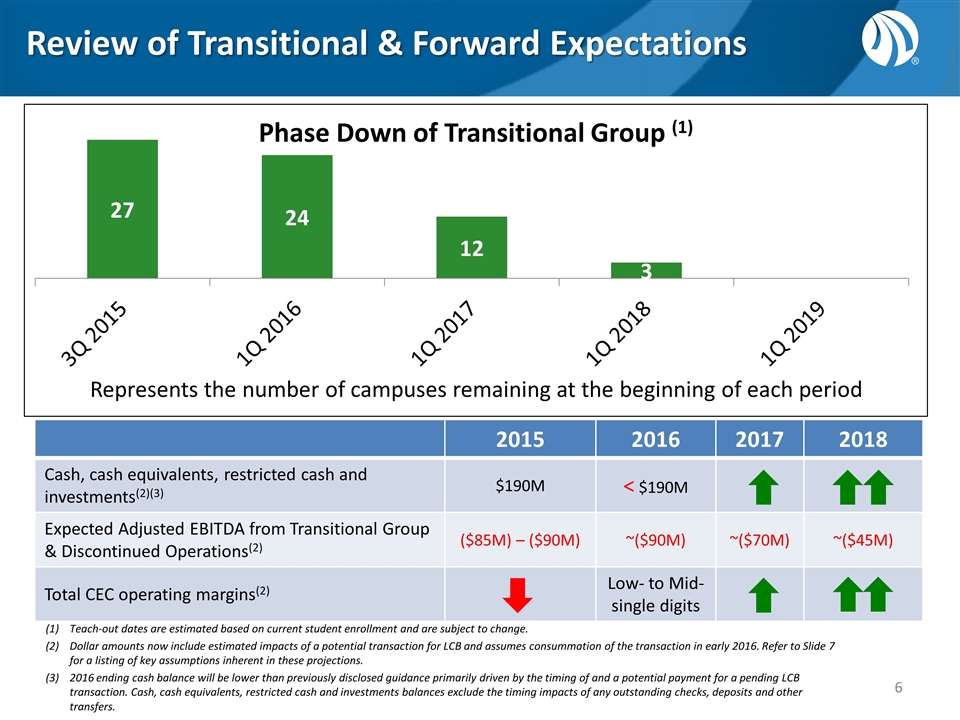

Review of Transitional & Forward Expectations Teach-out dates are estimated based on current student enrollment and are subject to change. Dollar amounts now include estimated impacts of a potential transaction for LCB and assumes consummation of the transaction in early 2016. Refer to Slide 7 for a listing of key assumptions inherent in these projections. 2016 ending cash balance will be lower than previously disclosed guidance primarily driven by the timing of and a potential payment for a pending LCB transaction. Cash, cash equivalents, restricted cash and investments balances exclude the timing impacts of any outstanding checks, deposits and other transfers. 2015 2016 2017 2018 Cash, cash equivalents, restricted cash and investments(2)(3) $190M < $190M Expected Adjusted EBITDA from Transitional Group & Discontinued Operations(2) ($85M) – ($90M) ~($90M) ~($70M) ~($45M) Total CEC operating margins(2) Low- to Mid-single digits

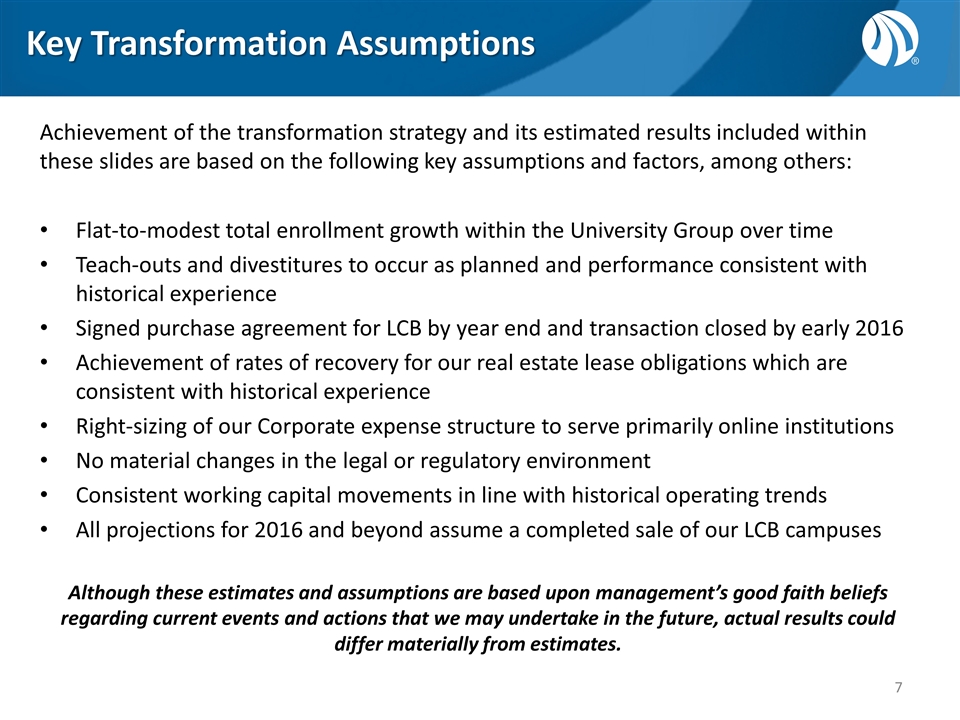

Key Transformation Assumptions Achievement of the transformation strategy and its estimated results included within these slides are based on the following key assumptions and factors, among others: Flat-to-modest total enrollment growth within the University Group over time Teach-outs and divestitures to occur as planned and performance consistent with historical experience Signed purchase agreement for LCB by year end and transaction closed by early 2016 Achievement of rates of recovery for our real estate lease obligations which are consistent with historical experience Right-sizing of our Corporate expense structure to serve primarily online institutions No material changes in the legal or regulatory environment Consistent working capital movements in line with historical operating trends All projections for 2016 and beyond assume a completed sale of our LCB campuses Although these estimates and assumptions are based upon management’s good faith beliefs regarding current events and actions that we may undertake in the future, actual results could differ materially from estimates.

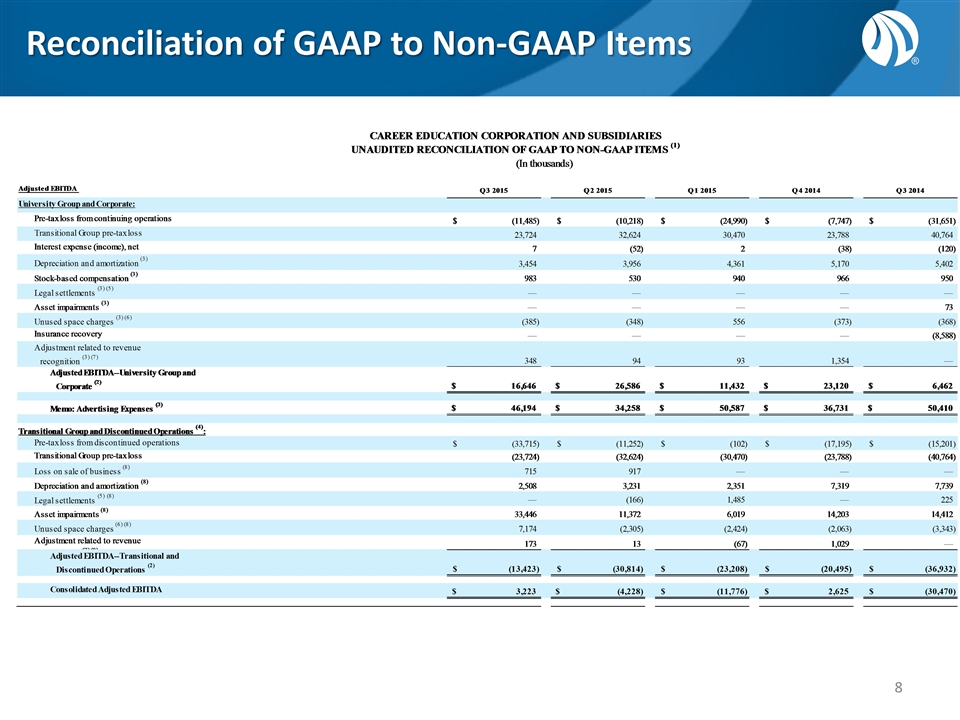

Reconciliation of GAAP to Non-GAAP Items

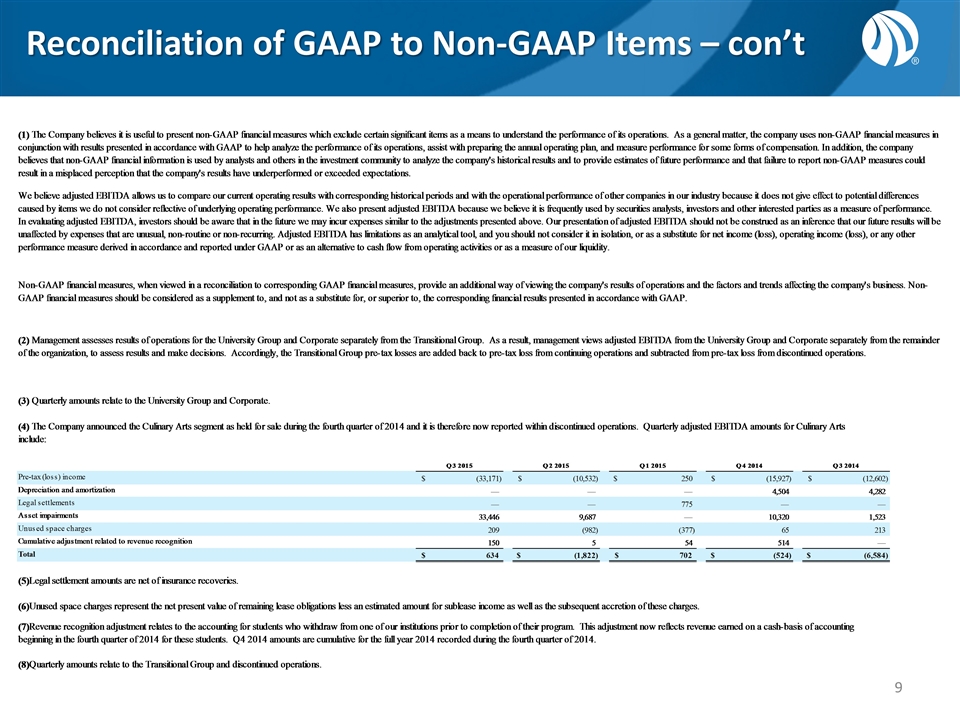

Reconciliation of GAAP to Non-GAAP Items – con’t

End of Presentation