Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SEACOAST BANKING CORP OF FLORIDA | v423551_8k.htm |

| EX-99.2 - EXHIBIT 99.2 - SEACOAST BANKING CORP OF FLORIDA | v423551_ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - SEACOAST BANKING CORP OF FLORIDA | v423551_ex99-1.htm |

DD Acquisition of Floridian Financial Group, Inc. For more information, contact: Denny Hudson Chief Executive Officer Phone: 772 - 288 - 6086 Email: Denny.Hudson@SeacoastBank.com Steve Fowle Chief Financial Officer Phone: 772 - 463 - 8977 Email: Steve.Fowle@SeacoastBank.com November 3, 2015 Exhibit 99.3

Cautionary Statements 2 Important Information for Investors and Shareholders This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitati on of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualifica tio n under the securities laws of such jurisdiction. Seacoast Banking Corporation of Florida ("Seacoast") will file with the Securities and Exchange Commission (the "SEC") a registration sta tement on Form S - 4 containing a proxy statement of Floridian Financial Group, Inc. ("Floridian") and a prospectus of Seacoast, and Seacoast will file other documents with respe ct to the proposed merger. A definitive proxy statement/prospectus will be mailed to shareholders of Floridian. Investors and security holders of Floridian are urged to read the proxy statement/prospectus and other documents that will be filed with the SEC carefully and in their entirety when they become available because they will contai n i mportant information. Investors and security holders will be able to obtain free copies of the registration statement and the proxy statement/prospectus (when av ail able) and other documents filed with the SEC by Seacoast through the website maintained by the SEC at http://www.sec.gov . Copies of the documents filed with the SEC by Seacoast will be available free of charge on Seacoast's internet website or by contacting Seacoast. Seacoast, Floridian, their respective directors and executive officers and other members of management and employees may be c ons idered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Seacoast is set forth in its proxy statement for its 2015 annual meeting of shareholders, which was filed with the SEC on April 7, 2015 and its Current Reports on Form 8 - K. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy stateme nt/ prospectus and other relevant materials to be filed with the SEC when they become available. Cautionary Notice Regarding Forward - Looking Statements This communication contains "forward - looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Sec tion 21E of the Securities Exchange Act of 1934, and is intended to be protected by the safe harbor provided by the same. Forward - looking statements can be identified by the use of the words “anticipate,” “expect,” “intend,” “estimate,” “target,” and words of similar import. Forward - looking statements are not historical facts but instead express only management’s beliefs regarding future results or events, many of which, by their nature, are inherently uncertain and outside of management’s control. It is possible that actual results and outcomes may differ, possibly materially, from the anticipated results or outcomes indicated in these forward - looking statements. Risks and uncertainties to which these statements are subject include, but are not limited to, the following: failure to obtain the approval of shareholders of Floridian in connection with the merger; the timing to c ons ummate the proposed merger; the risk that a condition to closing of the proposed merger may not be satisfied; the risk that a regulatory approval that may be required for the propose d m erger is not obtained or is obtained subject to conditions that are not anticipated; the parties' ability to achieve the synergies and value creation contemplated by the pro pos ed merger; the parties' ability to promptly and effectively integrate the businesses of Seacoast and Floridian; the diversion of management time on issues related to the mer ger ; the failure to consummate or delay in consummating the merger for other reasons; changes in laws or regulations; and changes in general economic conditions. For ad dit ional information concerning factors that could cause actual conditions, events or results to materially differ from those described in the forward - looking statements, please r efer to the factors set forth under the headings "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Seacoast's most recen t F orm 10 - K report and to Seacoast's most recent Form 8 - K reports, which are available online at www.sec.gov . No assurances can be given that any of the events anticipated by the forward - looking statements will transpire or occur, or if any of them do so, what impact they will have on the results of operations or financial condition of Seacoast or Fl oridian. Forward - looking statements are made only as of the date of this communication, and neither Seacoast nor Floridian undertakes any obligation to update any forward - looking st atements contained herein to reflect events or conditions after the date hereof.

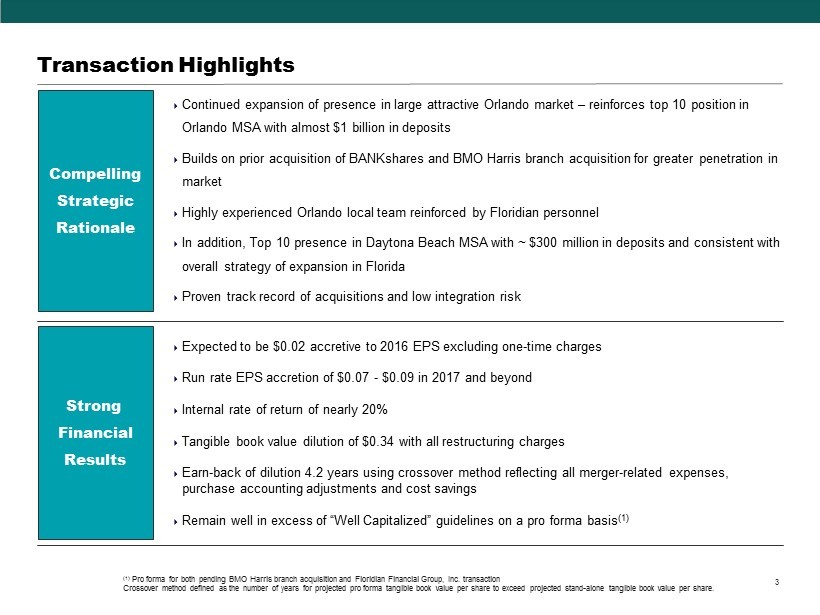

Transaction Highlights 3 Compelling Strategic Rationale Strong Financial Results Continued expansion of presence in large attractive Orlando market – reinforces top 10 position in Orlando MSA with almost $1 billion in deposits Builds on prior acquisition of BANKshares and BMO Harris branch acquisition for greater penetration in market Highly experienced Orlando local team reinforced by Floridian personnel In addition, Top 10 presence in Daytona Beach MSA with ~ $300 million in deposits and consistent with overall strategy of expansion in Florida Proven track record of acquisitions and low integration risk Expected to be $0.02 accretive to 2016 EPS excluding one - time charges Run rate EPS accretion of $0.07 - $0.09 in 2017 and beyond Internal rate of return of nearly 20% Tangible book value dilution of $0.34 with all restructuring charges Earn - back of dilution 4.2 years using crossover method reflecting all merger - related expenses, purchase accounting adjustments and cost savings Remain well in excess of “Well Capitalized” guidelines on a pro forma basis (1) (1) Pro forma for both pending BMO Harris branch acquisition and Floridian Financial Group, Inc. transaction Crossover method defined as the number of years for projected pro forma tangible book value per share to exceed projected sta nd - alone tangible book value per share.

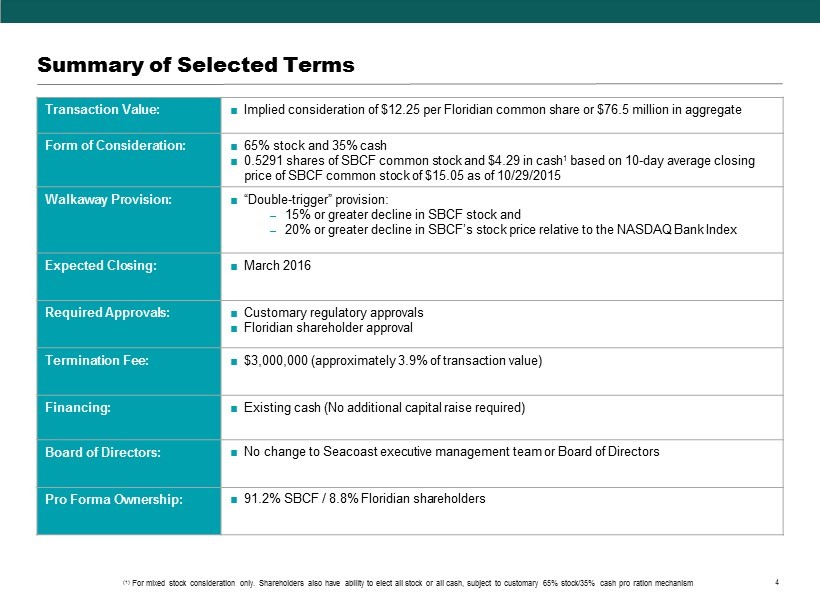

Floridian Bank Summary of Selected Terms 4 Transaction Value: Implied consideration of $12.25 per Floridian common share or $76.5 million in aggregate Form of Consideration: 65% stock and 35% cash 0.5291 shares of SBCF common stock and $4.29 in cash 1 based on 10 - day average closing price of SBCF common stock of $15.05 as of 10/29/2015 Walkaway Provision: “Double - trigger” provision : – 15% or greater decline in SBCF stock and – 20% or greater decline in SBCF’s stock price relative to the NASDAQ Bank Index Expected Closing: March 2016 Required Approvals: Customary regulatory approvals Floridian shareholder approval Termination Fee: $3,000,000 (approximately 3.9% of transaction value) Financing: Existing cash (No additional capital raise required) Board of Directors: No change to Seacoast executive management team or Board of Directors Pro Forma Ownership: 91.2% SBCF / 8.8% Floridian shareholders (1) For mixed stock consideration only. Shareholders also have ability to elect all stock or all cash, subject to customary 65% s to ck/35% cash pro ration mechanism

Floridian Bank Overview of Floridian Financial 5 Loan & Deposit Composition 1 - 4 Family 12.4% Multi - Family 2.0% C&D 14.5% C&I 12.3% CRE - Owner - Occupied 36.7% CRE - Non - Owner - Occupied 21.2% Consumer 1.1% Transaction Accounts, 33.1% Savings & Money Mkt, 39.0% Retail CDs, 25.7% Jumbo CDs, 2.1% Key Financial Metrics Loan and deposit data and key financial metrics as of 9/30/15 . Deposit market share data from SNL Financial as of 6/30/15. Source: SNL Financial Deposit Market Distribution MSA Branches Deposits ($000s) % of Total Franchise Daytona Beach 4 234,929 62 Orlando 6 145,123 38 Retail Footprint ($ s in 000s) Assets: 426,409 Loans: 288,838 Deposits: 360,884 Tangible Equity: 54,441 TCE / TA: 12.77% NPAs / Assets: 0.49% Efficiency Ratio: 78.58% Net Interest Margin: 3.77%

Floridian Bank Pro Forma Retail Franchise With BMO Harris Branch and Floridian Financial Acquisitions 6 Floridian Financial (10 branches ) BMO Harris (14 branches) SBCF ( 45 branches) Orlando, 26.4% Port St. Lucie, 32.4% Miami - West Palm, 12.8% Vero Beach, 6.6% Palm Bay, 5.4% Top 5 Pro Forma SBCF MSAs ‣ Excellent fit with Seacoast existing franchise

Floridian Bank Rank Institution Deposits ($MM) Market Share 1 EverBank Financial 16,601 3.4% 2 BankUnited Inc. 12,510 2.6% 3 FCB Financial Holdings Inc. 4,470 0.9% 4 CenterState Banks 3,885 0.8% 5 Seacoast (pro forma BMO Harris & Floridian) 3,535 0.7% 5 Seacoast 2,800 0.6% 6 Ocean Bankshares Inc. 2,765 0.6% 7 Capital Bank Finl Corp. 2,216 0.5% 8 Stonegate Bank 1,932 0.4% 9 USAmeriBancorp Inc. 1,909 0.4% 10 Capital City Bank Group Inc. 1,852 0.4% 2015 Acquisition of Floridian Continues Expansion in Attractive Orlando MSA 7 Seacoast Deposit Market Share in Orlando MSA Top Florida - Based Banks by Florida Deposit Market Share Orlando presents a strong commercial banking market Opportunity to cross - sell and build brand (1) Pro forma deposits calculated using SBCF 6/30/15 deposits per SNL Financial, $355 MM in deposits from BMO Harris branch acqui sit ion and $145 MM in deposits in Orlando MSA per SNL Financial as of 6/30/15 from Floridian Financial acquisition. (2) Pro forma deposits calculated using SBCF 6/30/15 deposits per SNL Financial, $355 MM in deposits from BMO Harris branch acqui sit ion and $380 MM in deposits per SNL Financial as of 6/30/15 from Floridian Financial acquisition. SNL financial deposit data as of 6/30/15. Rank Institution Deposits ($MM) Market Share 1 SunTrust Banks Inc. 9,736 22.8% 2 Bank of America Corp. 9,560 22.4% 3 Wells Fargo & Co. 6,330 14.8% 4 JPMorgan Chase & Co. 2,949 6.9% 5 Fifth Third Bancorp 1,765 4.1% 6 BB&T Corp. 1,740 4.1% 7 Regions Financial Corp. 1,671 3.9% 8 IBERIABANK Corp. 1,172 2.8% 9 Seacoast (pro forma BMO Harris & Floridian) 934 2.2% 10 PNC Financial Services Group 683 1.6% … 15 Seacoast 434 1.0% 2015 (1) (2)

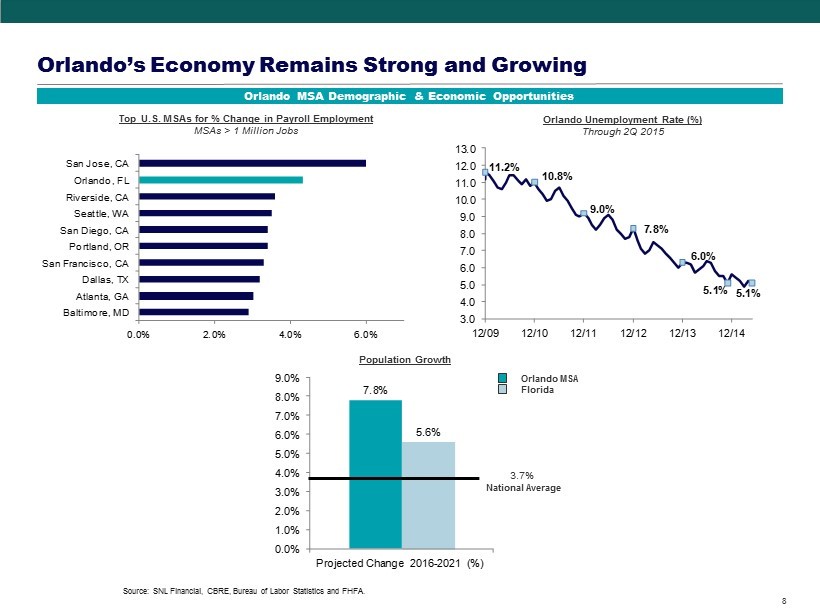

Floridian Bank 0.0% 2.0% 4.0% 6.0% Baltimore, MD Atlanta, GA Dallas, TX San Francisco, CA Portland, OR San Diego, CA Seattle, WA Riverside, CA Orlando, FL San Jose, CA 7.8% 5.6% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% Projected Change 2016 - 2021 (%) 11.2% 10.8% 9.0% 7.8% 6.0% 5.1% 5.1% 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 11.0 12.0 13.0 12/09 12/10 12/11 12/12 12/13 12/14 Orlando’s Economy Remains Strong and Growing 8 Source: SNL Financial, CBRE, Bureau of Labor Statistics and FHFA. Orlando Unemployment Rate (%) Through 2Q 2015 Population Growth Orlando MSA Florida National Average 3.7% Orlando MSA Demographic & Economic Opportunities Top U.S. MSAs for % Change in Payroll Employment MSAs > 1 Million Jobs

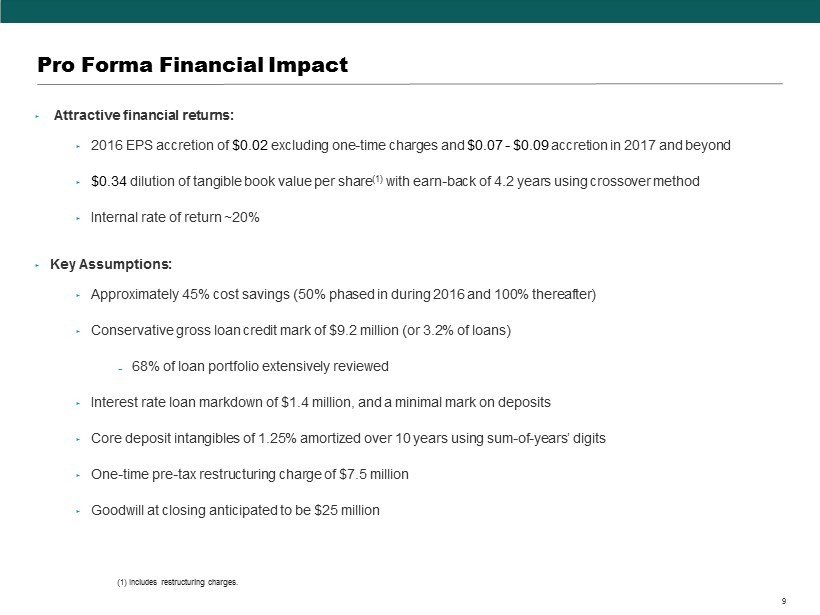

Floridian Bank Pro Forma Financial Impact 9 ‣ Attractive financial returns: ‣ 2016 EPS accretion of $0.02 excluding one - time charges and $0.07 - $0.09 accretion in 2017 and beyond ‣ $0.34 dilution of tangible book value per share (1) with earn - back of 4.2 years using crossover method ‣ Internal rate of return ~20% ‣ Key Assumptions: ‣ Approximately 45% cost savings (50% phased in during 2016 and 100% thereafter) ‣ Conservative gross loan credit mark of $9.2 million (or 3.2% of loans) ̵ 68% of loan portfolio extensively reviewed ‣ Interest rate loan markdown of $1.4 million, and a minimal mark on deposits ‣ Core deposit intangibles of 1.25% amortized over 10 years using sum - of - years’ digits ‣ One - time pre - tax restructuring charge of $7.5 million ‣ Goodwill at closing anticipated to be $25 million (1) Includes restructuring charges.

Floridian Bank Attractive Pricing to Florida Market Deals 10 Deal Metrics Deal Value $76.4 $89.6 Price/ Book 1.40x 1.46x Price/ Tangible Book 1.40x 1.51x Target Financials (MM) Total Assets $426 $524 Total Deposits $361 $426 Peer Florida Deals (1) (1) Peer median consists of whole bank and thrift M&A in Florida announced since 12/31/2013 with deal values greater than $40.0 million. Source: SNL Financial data as of 9/30/2015.

Floridian Bank Summary 11 ‣ Strategic continued expansion into Orlando for deeper penetration ‣ Strengthens overall franchise in Florida ‣ Floridian Financial franchise complements Seacoast footprint with similar disciplined credit culture and customer focus ‣ History of successful consolidations with a seasoned management team, technology/back office support and capital/liquidity strength ‣ Strong financial results