Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 EARNINGS RELEASE - YADKIN FINANCIAL Corp | q32015pressrelease.htm |

| 8-K - 8-K Q3 EARNINGS RELEASE - YADKIN FINANCIAL Corp | form8-kq32015pressrelease.htm |

2015 Q3 Earnings Call October 22, 2015

Forward Looking Statements Information in this presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties that could cause actual results to differ materially, including without limitation, reduced earnings due to larger than expected credit losses in the sectors of our loan portfolio secured by real estate due to economic factors, including declining real estate values, increasing interest rates, increasing unemployment, or changes in payment behavior or other factors; reduced earnings due to larger credit losses because our loans are concentrated by loan type, industry segment, borrower type, or location of the borrower or collateral; the rate of delinquencies and amount of loans charged-off; the adequacy of the level of our allowance for loan losses and the amount of loan loss provisions required in future periods; costs or difficulties related to the integration of the banks we acquired or may acquire may be greater than expected; factors relating to our proposed acquisition of NewBridge Bancorp (“NewBridge”), including our ability to consummate the transaction on a timely basis, if at all, our ability to effectively and timely integrate the operations of Yadkin and NewBridge, our ability to achieve the estimated synergies from this proposed transaction and once integrated, the effects of such business combination on our future financial condition, operating results, strategy and plans; results of examinations by our regulatory authorities, including the possibility that the regulatory authorities may, among other things, require us to increase our allowance for loan losses or writedown assets; the amount of our loan portfolio collateralized by real estate, and the weakness in the commercial real estate market; our ability to maintain appropriate levels of capital; adverse changes in asset quality and resulting credit risk-related losses and expenses; increased funding costs due to market illiquidity, increased competition for funding, and increased regulatory requirements with regard to funding; significant increases in competitive pressure in the banking and financial services industries; changes in political conditions or the legislative or regulatory environment, including the effect of recent financial reform legislation on the banking industry; general economic conditions, either nationally or regionally and especially in our primary service area, becoming less favorable than expected resulting in, among other things, a deterioration in credit quality; our ability to retain our existing customers, including our deposit relationships; changes occurring in business conditions and inflation; changes in monetary and tax policies; ability of borrowers to repay loans; risks associated with a failure in or breach of our operational or security systems or infrastructure, or those of our third party vendors and other service providers or other third parties, including as a result of cyber attacks, which could disrupt our businesses, result in the disclosure or misuse of confidential or proprietary information, damage our reputation, increase our costs and cause losses; changes in accounting principles, policies or guidelines; changes in the assessment of whether a deferred tax valuation allowance is necessary; our reliance on secondary sources such as Federal Home Loan Bank advances, sales of securities and loans, federal funds lines of credit from correspondent banks and out-of-market time deposits, to meet our liquidity needs; loss of consumer confidence and economic disruptions resulting from terrorist activities or other military actions; and changes in the securities markets. Additional factors that could cause actual results to differ materially are discussed in the Company’s filings with the Securities and Exchange Commission ("SEC"), including without limitation its Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q, and its Current Reports on Form 8-K. The forward-looking statements in this presentation speak only as of the date of the presentation, and the Company does not assume any obligation to update such forward-looking statements. Pro forma combined information which combines Yadkin and VantageSouth Banchares, Inc. contained in this presentation are used for illustrative purposes only. The pro forma information does nor purport to project our results of operations or financial condition for any future period or for any future date. Non‐GAAP Measures Statements included in this presentation include non‐GAAP measures and should be read along with the accompanying tables to the October 22, 2015 presentation and earnings release which provide a reconciliation of non‐GAAP measures to GAAP measures. Management believes that these non‐GAAP measures provide additional useful information that allows readers to evaluate the ongoing performance of the Company. Non‐GAAP measures should not be considered as an alternative to any measure of performance or financial condition as promulgated under GAAP, and investors should consider the Company's performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of the Company. Non‐GAAP measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the Company's results or financial condition as reported under GAAP. Important Information 2

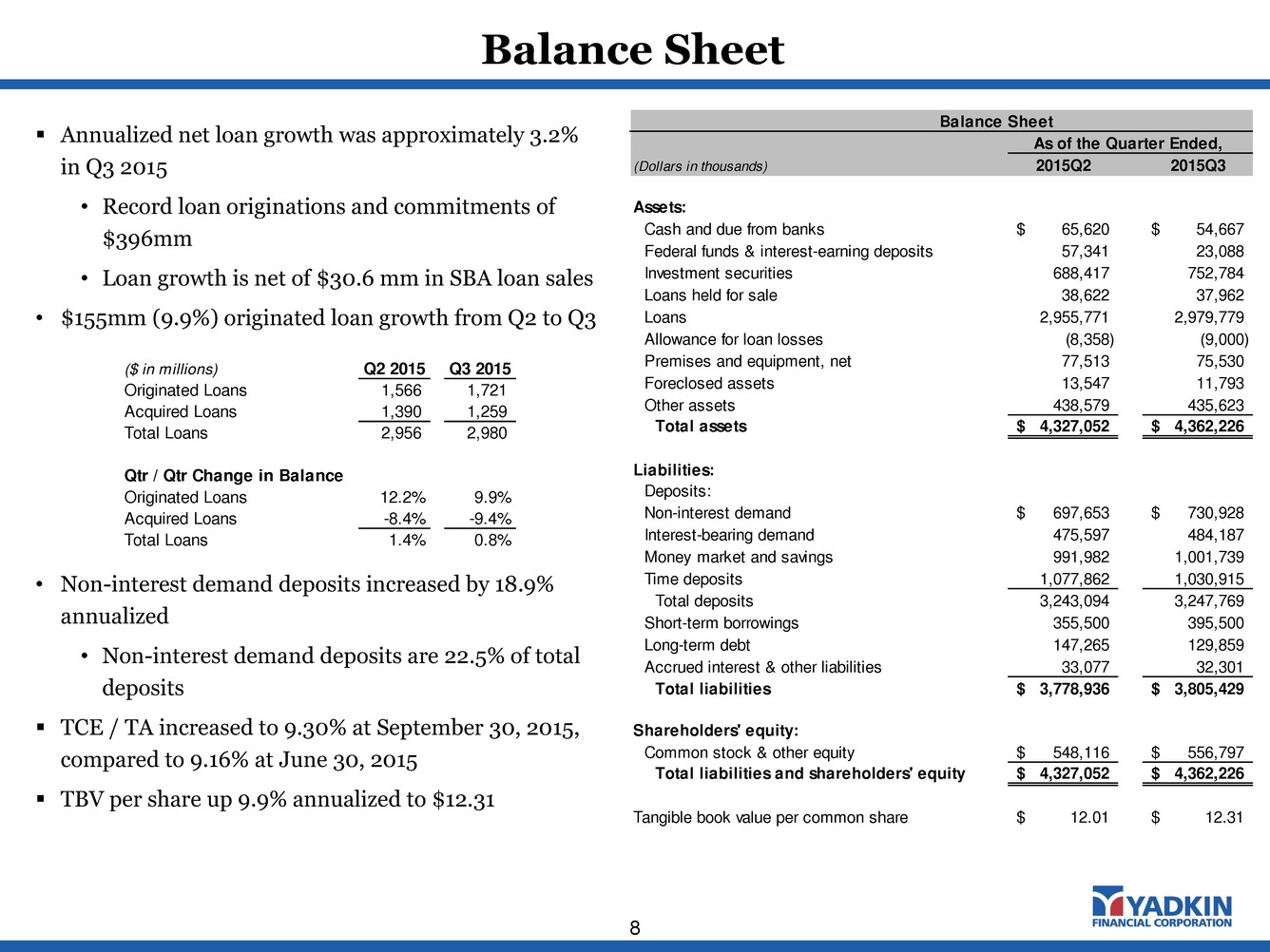

Q3 2015 Highlights 3 Record net operating EPS to common shareholders of $0.40, or $12.5 million, a 20.9% annualized growth over Q2 2015 Annualized net operating ROATCE of 13.85% and net operating ROAA of 1.15% in Q3 2015, compared to 13.35% and 1.14% in Q2 2015 Operating efficiency ratio declined to 57.3% in Q3 2015 from 60.0% in Q2 2015 Record loan originations and commitments of $396mm drove originated loan growth of 9.9% from Q2 to Q3 Non-interest demand deposits increased at an annualized rate of 18.9% from Q2 to Q3 Tangible book value per share increased from $12.01 in Q2 to $12.31 in Q3 Announced quarterly cash dividend of $0.10 per share payable on November 19 to shareholders of record as of November 5

Net income available to common shareholders totaled $11.8mm or $0.37 per share during Q3 2015, compared to $10.6mm or $0.33 per share during Q2 2015 Net operating earnings available to common shareholders totaled $12.5mm, or $0.40 per share, in Q3 2015, compared to $11.9mm or $0.38 per share in Q2 2015 Annualized net operating ROAA of 1.15% in Q3 2015, compared to 1.14% in Q2 2015 Annualized net operating ROATCE 13.85% in Q3 2015, compared to 13.35% in Q2 2015 Provision increased to $1.6mm in Q3 due to an increase in reserve build on originated loans Income tax expense increased to $7.9mm, including a $0.65mm one-time charge to revalue DTA as the 2016 NC income tax rate will decline from 5% to 4% Operating efficiency ratio improved to 57.3% in Q3 2015, compared to 60.0% in Q2 2015 (1) Prefered stock was initially issued in connection with the TARP Capital Purchase Program. (2) Excludes securities gains and losses, branch sale gain, merger and conversion costs, and restructuring charges. Earnings Profile 4 For the Quarters Ending ($ in thousands) 2015Q2 2015Q3 Net interest income 39,327$ 39,305$ Provision for loan losses 994 1,576 Net interest income after provision for loan losses 38,333 37,729 Operating non-interest income 10,716 10,798 Operating non-interest expense 30,047 28,694 Operating income before taxes & M&A costs 19,002$ 19,833$ Gain (loss) on sales of available for sale securities 84 - Merger and conversion costs (25) 104 Restructuring charges 2,294 50 Income before income taxes 16,817 19,679 Income tax expense 6,076 7,891 Net income 10,741 11,788 Preferred stock dividends(1) 183 - Net income to common shareholders 10,558 11,788 Pre-tax, pre-provision operating earnings (Non-GAAP)(2) 19,996 21,409

Net Interest Income 5 4.68% 4.43% 4.33% 4.29% 4.19% 4.46% 4.25% 4.23% 4.12% 4.09% 3.72% 3.77% 3.74% 3.77% 3.77% 3.50% 3.75% 4.00% 4.25% 4.50% 4.75% Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 GAAP NIM (FTE) Adjusted NIM (Less Accelerated Loan Accretion, Includes Scheduled Accretion & Amortization) Core NIM (Excludes All Purchase Accounting Impacts) Combined Net Interest Margin (%) Continued loan pricing pressure weighed on earning asset yields and NIM and core NIM (non-GAAP) Impact of acquisition accounting on net interest margin is declining Focus remains on disciplined loan pricing and low-cost, core deposits Average Yields and Rates For the Quarter Ended, 2015Q2 2015Q3 Loans 5.47% 5.36% Securities 2.35% 2.35% Other earning assets 0.37% 0.34% Total earning assets 4.83% 4.72% Interest bearing deposits (0.48%) (0.48%) Borrowed funds (1.61%) (1.59%) Total interest bearing liabilities (0.65%) (0.66%) Net interest margin (FTE) 4.29% 4.19% Cost of funds 0.53% 0.53%

Diverse Drivers of Non-Interest Income Growth 6 $1,885 $2,133 $1,390 $1,911 $2,492 $1,520 $1,002 $1,322 $1,633 $1,731 $2,072 $2,917 $2,873 $3,677 $3,009 $3,265 $3,506 $3,253 $3,495 $3,566 $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Other Mortgage SBA Service charges & fees on deposits accounts Combined Operating Non-Interest Income Composition1 ($000) $8,742 $9,558 Operating non-interest income totaled $10.8mm in the Q3 2015, a 23.5% increase from Q3 2014 Record SBA production of $43.5mm in Q3 as pipeline strengthened but gain on sale declined, product mix included more 504 loans, and the proportion of multi-funding loans increased Mortgage revenue increased to $1.7mm, benefiting from a 5% annualized production increase over Q2 2015 and despite a $0.1mm MSR impairment compared to a $0.2mm MSR recovery in Q2 (1) Excludes securities gains and losses and branch sale gain. $8,838 $10,716 $10,798 Change from Q3 2014 to Q3 2015 9.2% 45.2% 13.9% 32.2%

Non-Interest Expense 7 $6,980 $7,354 $7,127 $7,313 $6,913 $1,255 $1,959 $1,888 $1,929 $1,851 $4,856 $5,009 $4,799 $4,637 $4,641 $845 $861 $815 $777 $761 $16,800 $16,787 $15,202 $15,391 $14,528 $0 $7,000 $14,000 $21,000 $28,000 $35,000 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Combined Non-Interest Expense Composition1 ($000) Operating efficiency ratio declined to 57.3% for the second quarter • Reduced operating non-interest expenses 10.2% since Q4 2014 peak • Comfortably reached the previously announced operating efficiency goal of sub 60% before the end of 2015 Total Non-Interest Expense $48,187 $33,592 $30,958 $32,316 $28,848 One-time charges ($17,450) ($1,622) ($1,127) ($2,485) ($154) Operating Non-Interest Expense $30,737 $31,970 $29,831 $30,047 $28,694 $2,884 $4,687 $4,569 $4,376 $4,006 $644 $1,075 $1,105 $1,096 $1,030 $1,547 $2,408 $2,497 $2,600 $2,636 $5,991 $11,009 $10,034 $9,452 $9,014 $0 $4,000 $8,000 $12,000 $16,000 $20,000 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Other Data Processing Occupancy & Equipment Salaries & Benefits $2,884 $4,687 $4,569 $4,376 $4,006 $644 $1,075 $1,105 $1,096 $1,030 $1,547 $2,408 $2,497 $2,600 $2,636 $5,991 $11,009 $10,034 $9,452 $9,014 $0 $4,000 $8,000 $12,000 $16,000 $20,000 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Other Data Processing Occupancy & Equipment Salaries & Benefits $2,884 $4,687 $4,569 $4,376 $4,006 $644 $1,075 $1,105 $1,096 $1,030 $1,547 $2,408 $2,497 $2,600 $2,636 $5,991 $11,009 $10,034 $9,452 $9,014 $0 $4,000 $8,000 $12,000 $16,000 $20,000 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Other Data Processing Occupancy & Equipment Salaries & Benefits $30,737 $31,970 $29,831 (1) Excludes merger and conversion costs and restructuring charges. $2,884 $4,687 $4,569 $4,376 $4,006 $644 $1,075 $1,105 $1,096 $1,030 $1,547 $2,408 $2,497 $2,600 $2,636 $5,991 $11,009 $10,034 $9,452 $9,014 $0 $4,000 $8,000 $12,000 $16,000 $20,000 Q1 2013 Q2 2 13 Q3 2 13 Q4 2013 Q1 2014 Other Data Processing Occupancy & Equipment Salaries & Benefits n Core Deposit Intangible Amortization $30,047 $28,694

Balance Sheet 8 Annualized net loan growth was approximately 3.2% in Q3 2015 • Record loan originations and commitments of $396mm • Loan growth is net of $30.6 mm in SBA loan sales • $155mm (9.9%) originated loan growth from Q2 to Q3 • Non-interest demand deposits increased by 18.9% annualized • Non-interest demand deposits are 22.5% of total deposits TCE / TA increased to 9.30% at September 30, 2015, compared to 9.16% at June 30, 2015 TBV per share up 9.9% annualized to $12.31 Balance Sheet As of the Quarter Ended, (Dollars in thousands) 2015Q2 2015Q3 Assets: Cash and due from banks 65,620$ 54,667$ Federal funds & interest-earning deposits 57,341 23,088 Investment securities 688,417 752,784 Loans held for sale 38,622 37,962 Loans 2,955,771 2,979,779 Allowance for loan losses (8,358) (9,000) Premises and equipment, net 77,513 75,530 Foreclosed assets 13,547 11,793 Other assets 438,579 435,623 Total assets 4,327,052$ 4,362,226$ Liabilities: Deposits: Non-interest demand 697,653$ 730,928$ Interest-bearing demand 475,597 484,187 Money market and savings 991,982 1,001,739 Time deposits 1,077,862 1,030,915 Total deposits 3,243,094 3,247,769 Short-term borrowings 355,500 395,500 Long-term debt 147,265 129,859 Accrued interest & other liabilities 33,077 32,301 Total liabilities 3,778,936$ 3,805,429$ Shareholders' equity: Common stock & other equity 548,116$ 556,797$ Total liabilities and shareholders' equity 4,327,052$ 4,362,226$ Tangible book value per common share 12.01$ 12.31$ ($ in millions) Q2 2015 Q3 2015 Originated Loans 1,566 1,721 Acquire Loans 1,390 1,259 Total Loans 2,956 2,980 Qtr / Qtr Change in Balance Originated Loans 12.2% 9.9% Acquired Loans -8.4% -9.4% Total Loans 1.4% 0.8%

Loan Loss Reserves Breakdown ($ in thousands) Non- Purchased Impaired Purchased Impaired (SOP 03-3) Total ALLL balance at 6/30/15 7,000$ 1,358$ 8,358$ Net charge-offs (934) 0 (934) Provision for loan losses 1,536 40 1,576 ALLL balance at 9/30/15 7,602 1,398 9,000 Remaining credit mark 19,685 11,749 31,434 Remaining interest rate mark 3,526 8,135 11,661 Total effective reserve 30,813$ 21,282$ 52,095$ Loan balances 2,820,118$ 159,661$ 2,979,779$ ALLL percentage 0.27% 0.88% 0.30% Remaining credit mark percentage 0.70% 7.36% 1.05% Remaining interest rate mark percentage 0.13% 5.10% 0.39% Effective reserve percentage 1.09% 13.33% 1.75%21.2% 21.9% 20.4% 21.0% 23.3% 10.0% 20.0% 30.0% 40.0% Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Strong Asset Quality 9 Effective Reserve of 1.75% or $52.1mm Classified Asset Ratio (1) – Bank Level (1) Classified Asset Ratio = Classified Assets / (Tier 1 Capital + Loan Loss Reserves) Net charge-offs - 12bps Remaining mark declined by $4.1mm in Q3 2015 Q3 increase driven by one credit; not systemic as 30-89 days past due loans are at lowest point since merger completion

Delivering on Yadkin-VantageSouth MOE Potential 10 Notes: - Market capitalizations are calculated using the final closing stock price of the quarter. Q2 2014 combined market capitalization is as of Jan 24, 2014, the final trading day prior to the Yadkin-VSB merger announcement. This market capitalization is also adjusted to include the VantageSouth common equity raised at the same time. - Q2 2014 represents pro forma combination of Yadkin Financial Corporation and VantageSouth Bancshares, Inc. results. Q2 and Q3 2015 represent actual results. All periods exclude securities gains and losses, merger and conversion costs, and restructuring charges. - Results from Q2 2014 do not include any acquisition accounting impact from the Yadkin-VantageSouth merger. Q2 2014 Combined Q2 2015 Q3 2015 % Change Q3 2015 vs Q2 2014 Operating EPS $0.31 $0.38 $0.40 29% Operating Pre-Tax, Pre-Provision Income ($mm) $15.1 $20.0 $21.4 42% Operating Efficiency Ratio 65.9% 60.0% 57.3% (13.1%) Operating ROAA 1.01% 1.14% 1.15% 14% Operating ROTCE 10.93% 12.83% 13.35% 22% Net Interest Margin (FTE) 4.06% 4.29% 4.19% 3% Annualized Qtr / Qtr Loan Growth 3.4% 5.8% 3.2% (4.5%) Net Charge-Offs / Avg. Loans (Annualized) (0.08%) 0.12% 0.12% NM Market Capitalization ($000s) $532,304 $664,387 $681,489 28%

NewBridge Transaction Rationale 11 Low Risk Profile Experienced management team with a proven track record of integrating acquisitions Comprehensive due diligence process and thorough review of loan portfolio Supplemented with experienced 3rd party vendors Compatible cultures with familiar customer base Financially Attractive Positions franchise for top tier financial performance Enhances business model economies of scale EPS accretion of approximately 10% After full realization of expense savings Minimal dilution to tangible book value TBV accretive in approximately 2.5 years IRR in excess of 20% Strong pro forma capital position Strategically Compelling Strengthens YDKN’s leading position as the largest community bank in North Carolina Over $7 billion in assets with #1 market share among community banks Statewide presence serving North Carolina’s premier markets Adds significant scale in the Piedmont Triad Complements existing footprint in Raleigh, Charlotte and Wilmington Bolsters long-term growth potential Broadens and deepens competitive strengths

Overview of Pro Forma Franchise 12 Source: SNL Financial and MapInfo Professional Note: Projected population growth from 2016 to 2021 Note: Community Bank defined as an institution with less than or equal to $25 billion in total assets (1) Figures reflect balance sheet data as of 6/30/2015; Market capitalization based on YDKN stock price of $22.79 as of 10/12/15 YDKN (70) NBBC (42) YDKN County NBBC County County of Overlap Legend Charlotte Comm. Bank Rank: #2 Deposits: $784mm Market Tot: $216.2bn Pop. Growth: 7.0% Piedmont Triad Comm. Bank Rank: #2 Deposits: $1.6bn Market Tot: $46.3bn Pop. Growth: 3.7% Raleigh / Durham- Chapel Hill Comm. Bank Rank: #1 Deposits: $1.2bn Market Tot: $32.2bn Pop. Growth: 7.8% Wilmington Comm. Bank Rank: #2 Deposits: $366mm Market Tot: $5.1bn Pop. Growth: 6.9% Pro Forma Financial Highlights (1) Branches: 112 Assets: $7.1 billion Loans: $5.0 billion Deposits: $5.2 billion Market Cap: $1.2 billion

Transaction Assumptions 13 Earnings estimates based on First Call consensus Gross credit mark of 1.3%, $25.7 million Reversal of existing credit mark of $11.7 million Net transaction-related credit mark of $14.0 million Reversal of existing ALLL Mark up of pension liability of $5 million One-time merger related expenses of $29 million (pre-tax) Approximately 30% realized at close Cost savings expected to be 33.5% of estimated NBBC expense base 37.5% realized in 2016, 100% realized by year-end 2017 Branch consolidations of approximately 10% of the combined company No revenue synergies included in modeling Core deposit intangible of 1.0% of non-time deposits, amortized sum-of-years digits over 8 years TRUPS mark of $11.4 million Anticipate special dividend of $0.50 per share to YDKN shareholders prior to close Both YDKN and NBBC to continue paying current quarterly dividends Estimated close in early Q2 2016

Pro Forma Analysis 14 Sources: SNL Financial Note: Comparable Transactions include nationwide transactions announced since 12/31/2013 with deal values greater than $250 million (1) Based on YDKN First Call consensus estimates of $1.85 for 2017 and NBBC First Call consensus estimates of $0.78 for 2017; reflects fully phased-in cost savings 9.7% 10.0% YDKN / NBBC Comparable Transactions Earnback Period (Years) 2.5 3.8 YDKN / NBBC Comparable Transactions EPS Accretion (%) (1) Capital Ratios at Close 8.9% 9.2% 10.3% 10.6% 11.6% TCE / TA Tier 1 Leverage Tier 1 Common Tier 1 Capital Total RBC

Contact: Terry Earley (919) 659-9015 terry.earley@yadkinbank.com

Additional Information About the Proposed Transaction and Where to Find It This communication is being made in respect of the proposed transaction involving Yadkin and NewBridge. This material is not a solicitation of any vote or approval of Yadkin’s or NewBridge’s shareholders and is not a substitute for the joint proxy statement/prospectus or any other documents which Yadkin and NewBridge may send to their respective shareholders in connection with the proposed merger. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities. In connection with the proposed transaction, Yadkin intends to file with the Securities and Exchange Commission (“SEC”) a Registration Statement on Form S-4 that will include a joint proxy statement of Yadkin and NewBridge and a prospectus of Yadkin, as well as other relevant documents concerning the proposed transaction. Investors and security holders are also urged to carefully review and consider each of Yadkin’s and NewBridge’s public filings with the SEC, including but not limited to their Annual Reports on Form 10-K, their proxy statements, their Current Reports on Form 8-K and their Quarterly Reports on Form 10-Q. Both NewBridge and Yadkin will mail the joint proxy statement/prospectus to their respective shareholders. BEFORE MAKING ANY VOTING OR INVESTMENT DECISIONS, INVESTORS AND SHAREHOLDERS OF YADKIN AND NEWBRIDGE ARE URGED TO CAREFULLY READ THE ENTIRE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain a free copy of the proxy statement/prospectus (when available) and other filings containing information about Yadkin and NewBridge at the SEC’s website at www.sec.gov. The joint proxy statement/prospectus (when available) and the other filings may also be obtained free of charge at Yadkin’s website at www.yadkinbank.com, or at NewBridge’s website at www.newbridgebank.com. Yadkin, NewBridge and certain of their respective directors and executive officers, under the SEC’s rules, may be deemed to be participants in the solicitation of proxies of Yadkin’s and NewBridge’s shareholders in connection with the proposed transaction. Information about the directors and executive officers of Yadkin and their ownership of Yadkin common stock is set forth in the proxy statement for Yadkin’s 2015 Annual Meeting of Shareholders, as filed with the SEC on Schedule 14A on April 10, 2015. Information about the directors and executive officers of NewBridge and their ownership of NewBridge’s common stock is set forth in the proxy statement for NewBridge’s 2015 Annual Meeting of Shareholders, as filed with the SEC on a Schedule 14A on April 2, 2015. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the joint proxy statement/prospectus regarding the proposed transaction when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. Important Information 16