Attached files

| file | filename |

|---|---|

| 8-K - 8-K - County Bancorp, Inc. | icbk-8k_20150930.htm |

Exhibit No. 99.1

FOR IMMEDIATE RELEASE

COUNTY BANCORP, INC. ANNOUNCES 7.6% LOAN GROWTH AND

THIRD QUARTER 2015 NET INCOME OF $3.3 MILLION

Q3 Highlights

|

|

· |

Net income of $3.3 million |

|

|

· |

Net loan growth of $49.7 million |

|

|

· |

Return on average assets of 1.63% |

|

|

· |

$867 thousand negative provision for loan losses |

Manitowoc, Wisconsin, October 21, 2015 – County Bancorp, Inc. (NASDAQ: ICBK) today reported third quarter 2015 net income of $3.3 million. This represents an increase of $1.0 million compared to the net income of the third quarter of 2014. Net income for the nine months ended September 30, 2015 was $8.1 million compared to $6.1 million for the same period in 2014. This represents a return on average assets of 1.36% for the nine months ended September 30, 2015 compared to 1.10% for the nine months ended September 30, 2014.

“We are very pleased with our third quarter results, which were highlighted by solid loan growth quarter-over-quarter and year-over-year, primarily in the agricultural space,” said Timothy J. Schneider, President of County Bancorp, Inc. and CEO of its wholly-owned bank subsidiary, Investors Community Bank. “Asset quality continues to improve and, despite growth in our loan portfolio, we were able to have a recovery of loan losses for the quarter. Additionally, in this highly competitive market, we have been able to improve our net interest margin. As a part of our strategic focus, we continue to seek talent in the business banking sector and evaluate acquisition opportunities.”

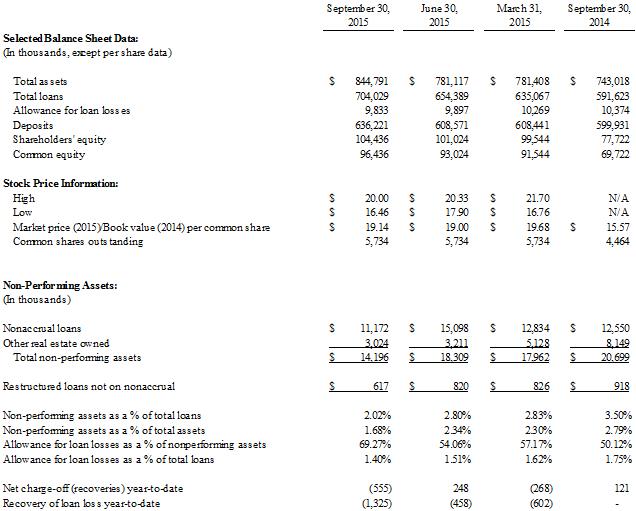

Total assets of $844.8 million at September 30, 2015 increased $63.7 million, or 8.2%, over total assets as of June 30, 2015 of $781.1 million. Total loans increased $49.6 million, or 7.6%, to $704.0 million at September 30, 2015 from $654.4 million at June 30, 2015.

Non-performing assets decreased 31.4% to $14.2 million at September 30, 2015 from $20.7 million at September 30, 2014, and decreased 22.5% from June 30, 2015 of $18.3 million. This improvement year-over-year was primarily due to other real estate owned, which declined from $8.1 million at September 30, 2014 to $3.0 million at September 30, 2015. The improvement over the previous quarter was the result of a 26.0% decrease in nonaccrual loans from $15.1 million at June 30, 2015, to $11.2 million at September 30, 2015.

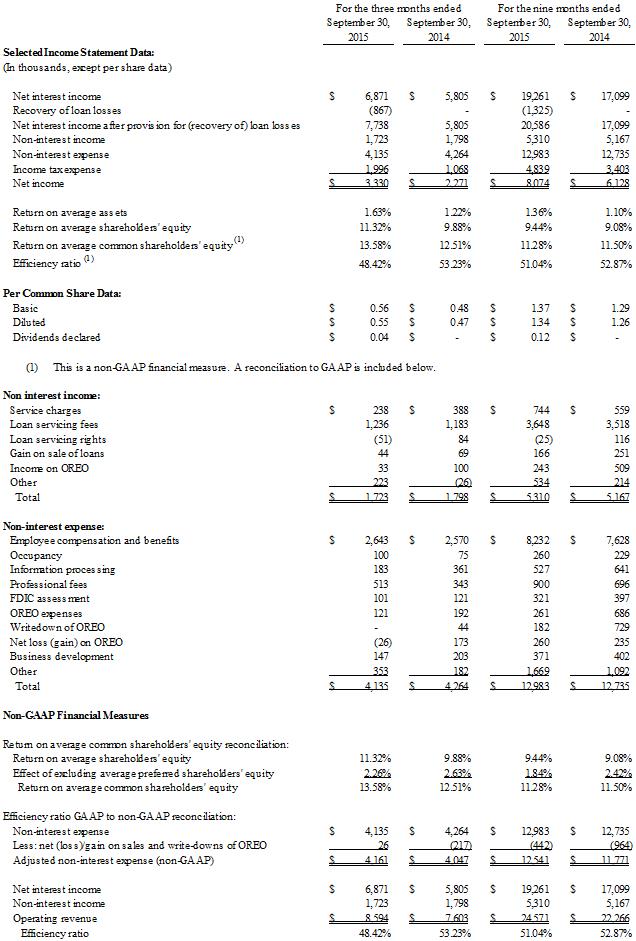

Net income for the quarters ended September 30, 2015 and 2014 was $3.3 million and $2.3 million, respectively. The increase in net income of $1.0 million between the third quarters of 2014 and 2015 is primarily the result of $0.9 million recovery of loan losses recognized as a credit to income during the third quarter of 2015. As the result of that recovery and increased net interest income, diluted earnings per share increased to $0.55 for the three months ended September 30, 2015 from $0.47 for the three months ended September 30, 2014. Return on average assets was 1.63% for the three months ended September 30, 2015 compared to 1.22% for the three months ended September 30, 2014. Net interest margin increased to 3.49% for the three months ended September 30, 2015 compared to 3.27% for the three months ended September 30, 2014.

Net income for the nine months ended September 30, 2015 was $8.1 million compared to $6.1 million for the nine months ended September 30, 2014. This represents year-over-year growth of 31.8% which was primarily driven by a $2.2 million increase in net interest income and a $1.3 million recovery of loan losses, which was partially offset by an increase in income tax expense.

About County Bancorp, Inc.

County Bancorp, Inc., a Wisconsin corporation and registered bank holding company founded in May 1996, and our wholly-owned subsidiary Investors Community Bank, a Wisconsin-chartered bank, are headquartered in Manitowoc, Wisconsin. The state of Wisconsin is often referred to as “America’s Dairyland,” and one of the niches we have developed is providing financial services to agricultural businesses statewide, with a primary focus on dairy-related lending. We also serve business and retail customers throughout Wisconsin, with a focus on Northeastern and Central Wisconsin. Our customers are served from our full-service locations in Manitowoc and Stevens Point and our loan production offices in Darlington, Eau Claire, and Fond du Lac.

Forward-Looking Statements

This press release includes "forward-looking statements” within the meaning of such term in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be beyond our control. We caution you that the forward-looking information presented in this press release is not a guarantee of future events, and that actual events may differ materially from those made in or suggested by the forward-looking information contained in this press release. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as "may," "plan," "seek," "comfortable with," "will," "expect," "intend," "estimate," "anticipate," "believe" or "continue" or the negative thereof or variations thereon or similar terminology. Factors that may cause actual results to differ materially from those made or suggested by the forward-looking information contained in this press release include those identified in County Bancorp, Inc.’s most recent annual report on Form 10-K and subsequent SEC filings. Any forward-looking information presented herein is made only as of the date of this press release, and we do not undertake any obligation to update or revise any forward-looking information to reflect changes in assumptions, the occurrence of unanticipated events, or otherwise.

###

Investor Relations Contact

Timothy J. Schneider

CEO, Investors Community Bank

Phone: (920) 686-5604

Email: tschneider@investorscommunitybank.com

County Bancorp, Inc.

Consolidated Financial Summary (Unaudited)