Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT FORM 8-K - CES Synergies, Inc. | f8k100815_cessynergiesinc.htm |

A Full Service Environmental, Asbestos Abatement and Demolition Company Investor Presentation – September 2015 John Tostanoski, CEO OTC:CESX

Safe Harbor Statement OTC:CESX 2 This presentation may contain “forward - looking statements” that are made pursuant to the “safe harbor” provisions as defined within the Private Securities Litigation Reform Act of 1995 . Forward - looking statements may be identified by words including “anticipates,” “believes,” “intends,” “estimates,” and similar expressions . These statements are based upon management’s current expectations as of the date of this presentation . Such forward - looking statements may include statements regarding the Company’s future financial performance or results of operations, including expected revenue growth, cash flow growth, future expenses and other future or expected performances . The Company cautions readers there may be events in the future that the Company is not able to accurately predict or control and the information contained in the forward - looking statements is inherently uncertain and subject to a number of risks that could cause actual results to differ materially from those indicated in the forward - looking statements . Further information on these and other potential factors that could affect the Company’s financial results is included in the Company’s filings with the SEC under the “Risk Factors” sections and elsewhere in those filings .

Company Overview • CES Synergies is an Environmental Contracting , Demolition and Remediation Services Company – Asbestos, lead and hazardous / regulated material removal – Commercial demolition/mold abatement • Geographic footprint in 13 States • Unique industry expertise - m arket differentiator • $20M annual revenue OTC:CESX 3 Mission To become one of the largest environmental services companies in the U.S.A. through vertical and horizontal acquisition and expansion

Diverse Customer Base OTC:CESX 4 Federal Agencies State, County, Municipal Industrial Commercial

Geographic Footprint

Market Opportunity • State and local infrastructure spending is increasing • U.S. housing construction up significantly over the past years – As older buildings come down or are renovated, CES’ services are necessary for a safe transition • Increasing regulations driving demand – EPA’s NESHAP (National Emission Standards for Hazardous Air Pollutants) regulations drive demand for CES’ services • High barriers to entry – R egulatory expertise, certifications, and industry experience OTC:CESX 6

Future Plan of Operations 1. Expand regional presence – organic growth and acquisitions 2. Broaden g eographic footprint – e xpand into additional states 3. Grow government business – t hrough GSA & Federal IDIQ opportunities 4. Acquire c omplementary businesses – t argeted to enhance footprint 5. Expand vertically and horizontally – w aste management, landfill, environmental OTC:CESX 7 * Revenue for future periods estimated

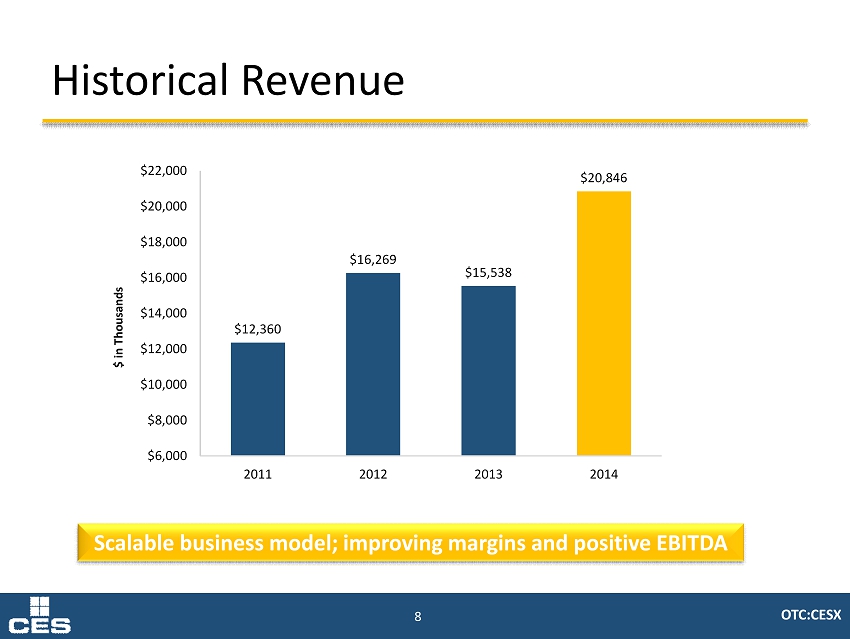

Historical Revenue OTC:CESX 8 $12,360 $16,269 $15,538 $20,846 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 $18,000 $20,000 $22,000 2011 2012 2013 2014 $ in Thousands Scalable business model; improving margins and positive EBITDA

Acquisition & Growth Strategy OTC:CESX 9 Acquire: Asbestos Abatement Co Acquire: • Florida Waste Transfer Station • Two Additional Abatement Co’s Year 1 Year 2 Year 3 • Expands Footprint into three States • Opportunity to double revenue with demolition * Estimated Annual Revenue Increase. Subject to availability of funds and acquisition targets $3 Million + Gross Revenue* • Provide additional r evenue s treams through transfer s tation • Expand abatement into Mid - West and Southern States $11 Million + Gross Revenue* Acquire: • Four Additional Abatement Co’s • Continue to Leverage Economies of Scale • Continue expansion into Mid - Atlantic and Southwest • Leverage economies of scale to reduce expenses/increase m argins $23 Million + Gross Revenue*

Expanding Revenue Streams OTC:CESX 10 • RFP oriented • Direct negotiation with customer Direct to Customer Federal & Government Contracts • GSA Environmental Schedule Contract. Enables gov’t agencies to contract with CES without further procurement activities. United Nations member countries may use the contract. • IDIQ contracts with several districts of Florida Dept. of Transportation, turnpike authority, school boards and various counties. Set - Aside Designation • CES has strategic agreements with Set - Aside disciplines including: 8(a); Service Connected Disabled Veteran Firms; Economically Disadvantaged Woman Owned Business and Total Small Business Historical Revenue Stream Emerging Revenue Streams

Recent Contract Awards OTC:CESX 11 Contract Awarded Amount Project Description Maryville, Michigan Q4 2014 $3.5 Mil Former Detroit Edison Power Plant located on the St. Claire River. Scope of services included the removal of asbestos containing materials plant wide. Corvias Military Housing Q1 2015 $7.1 Mil 1170 enlisted housing units to have demolition and asbestos abatement. Name Withheld: International Speedway Q4 2014 Not disclosed Demolition of existing grandstands subsequent to construction of the new ones. Project scope also includes the demolition of service level and elevated buildings, 112 minor stairs and four major stairways, removal of concrete elevated walkways, handicap elevator and shaft, as well as removal of signage. Naval Air Station Jacksonville Q1 2015 $700,000+ Demolition and abatement of Building 11 Asbestos abatement and demolition include 80,300 sf. Fort Benning Q1 2015 $1.1 Mil Project scope of services includes asbestos abatement and demolition of three former dormitories. Florida State University Q1 2015 $800,000 Scope of services entails the demolition of two nine story structures that served as dormitories.

Case Study: Corvias Military Housing OTC:CESX 12 Performance Dates: June 2015 through June 2018 Client: Department of Air Force Location: Eglin Air Force Base Project Value: Approximately $7,100,000 • Corvias Military Housing is currently privatizing military accommodations at Eglin Air Force Base and Hulbert Field. Their scope of services includes the removal of existing military housing units subsequent to the construction of new units. • CES has executed master service agreements for both installations that include the asbestos removal and demolition. • Current task order includes 81 units. • Overall number of units expected is 1,170. This work will be phased over three years and our initial pricing totals $7,100,000. Project Details

Case Study: Fort Benning OTC:CESX 13 Performance Dates: June 2015 - Current Client: All Phase Services Location: Columbus, Georgia Project Value: $1,100,000 • Scope entails dormitory demolition and asbestos abatement as well as the removal of universal waste, including PCB oil containing ballasts, florescent tubes, and mercury containing devices. • The contract, along with CES practices requires recycling and reuse. In the case of these building, our forces will capture all the ferrous and non - ferrous metals and concrete. These items will be manifested for recycling. Project Details

Case Study: FDOT Parcel 106 OTC:CESX 14 Performance Dates: April through December 2014 Client: Florida Department of Transportation Location: Pompano Beach, Florida Project Value: $1,485,000 • Scope of services included the design, permitting, demolition and subsequent construction of components at an existing warehouse. Permitting phase included complete architectural plans, detailed shoring plan, and a detailed geotechnical design for the retaining wall. • Tasks included concrete removal at the dock height level, design and construction of a chemical grout secant wall, temporary wall construction, saw cutting and severing the building, demolition of a portion of the building, and construction of the temporary wall. • Project duration was three months and project budget was $1,500,000. Project Details

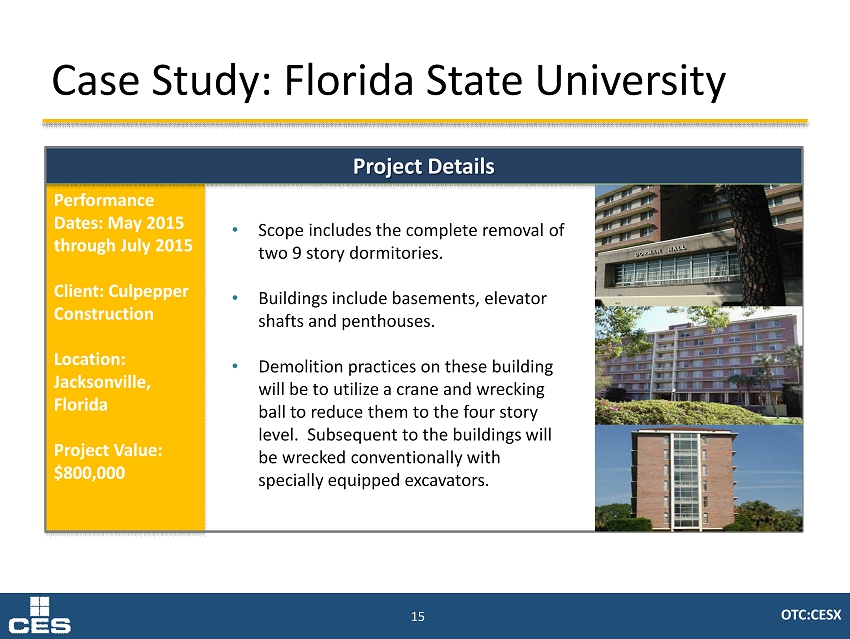

Case Study: Florida State University OTC:CESX 15 Performance Dates: May 2015 through July 2015 Client: Culpepper Construction Location: Jacksonville, Florida Project Value: $800,000 • Scope includes the complete removal of two 9 story dormitories. • Buildings include basements, elevator shafts and penthouses. • Demolition practices on these building will be to utilize a crane and wrecking ball to reduce them to the four story level. Subsequent to the buildings will be wrecked conventionally with specially equipped excavators. Project Details

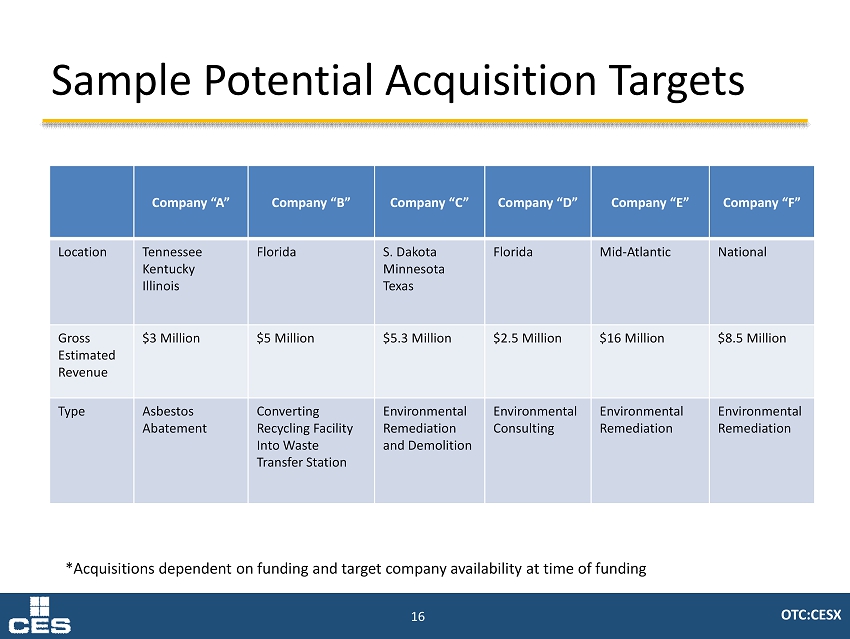

Sample Potential Acquisition Targets OTC:CESX 16 Company “A” Company “B” Company “C” Company “D” Company “E” Company “F” Location Tennessee Kentucky Illinois Florida S. Dakota Minnesota Texas Florida Mid - Atlantic National Gross Estimate d Revenue $3 Million $5 Million $5.3 Million $2.5 Million $16 Million $8.5 Million Type Asbestos Abatement Converting Recycling Facility Into Waste Transfer Station Environmental Remediation and Demolition Environmental Consulting Environmental Remediation Environmental Remediation *Acquisitions dependent on funding and target company availability at time of funding

Corporate Summary x One of the largest full - service environmental, asbestos abatement and demolition firms in the State of Florida – Licensed in 13 states – Established track record with 20+ years operation x High barriers to entry x Growing revenues and positive EBITDA – Diversified revenue streams x Scalable business model; capacity to support expansion and improved profitability x Solid balance sheet and clean capital structure with no warrants, preferred or convertible shares outstanding OTC:CESX 17

Experienced Management Team and Board Clyde A. Biston, Chairman and President • Founded CES in 1988 and grew the business to be the largest environmental contracting, demolition and remediation firm in Florida • 40 years experience in the general construction and asbestos abatement industry John Tostanoski, Chief Executive Officer and Director • Over 40 years of contracting and consulting experience in the environmental services industry • Served as principal environmental consultant to several Fortune 500 companies Sharon Rosenbauer, Chief Financial Officer and Treasurer • Over 20 years of experience as lead accounting officer • Designed current job costing system Jeff Chartier, Director • Over 30 years of experience in the financial industry • His former positions include: Senior Vice President at Morgan Stanley, President of Green EnviroTech Holdings Corp., an innovative technology company, founder of Chartier Financial, a full - service retail brokerage firm, and public markets consultant Luisa Ingargiola, Director – Over 20 years experience in financial industry – CFO of MagneGas , a NASDAQ listed Waste to Energy Company – Successfully raised over $30 million from capital markets OTC:CESX 18

Key Capital Market Statistics Ticker: CESX Exchange: OTCBB Share price (as of 9/4/2015 ): $0.99 Common shares outstanding: 46.9 M Market Capitalization: $46.4 M Total shareholder’s equity (6/30/2015 ): $345,760 Fiscal year - end: December 31 Insider ownership: 89.5% OTC:CESX 19

A Full Service Environmental, Asbestos Abatement and Demolition Company Company: Investor Relations: John Tostanoski, CEO Natalya Rudman CES Synergies, Inc. Crescendo Communications, LLC (813) 783 - 1688 (212) 671 - 1020 Ext. 304 jt@crossenv.com nrudman@crescendo - ir.com Thank You