Attached files

Exhibit 10.56

AMENDMENT NO. 2 TO LEASE

This Amendment No. 2 to Lease (this “Amendment”) dated as of September 15, 2015, is made between THE CONNELL COMPANY, a New Jersey corporation (“Landlord”), and AUTHENTIDATE HOLDING CORP., a Delaware corporation (“Tenant”).

WHEREAS, Landlord and Tenant are parties to a lease dated as of July 5, 2005, which was amended by Amendment No. 1 to Lease dated as of February 12, 2010 (as amended, the “Lease”; capitalized terms used herein and not otherwise defined having the meaning set forth in the Lease) pursuant to which Tenant is leasing certain space specified therein from Landlord;

WHEREAS, Landlord and Tenant desire to have the entire portion of the Demised Premises originally subject to the Lease (consisting of 19,695 rentable square feet located on the fifth floor of the Building) terminate prior to its originally scheduled expiration date, and contemporaneously with such termination, have Tenant lease new space in the Building (consisting of 5,188 rentable square feet located on the first floor of the Building), for a period of six (6) years, on the terms set forth herein; and

WHEREAS, Landlord and Tenant desire to reflect such termination and lease of new space and amend certain portions of the Lease to reflect the same;

NOW, THEREFORE, in consideration of the foregoing and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

SECTION 1. Termination with respect to the Initial Demised Premises.

Subject to Section 3 of this Amendment, on the Replacement Effective Date (as defined below) the Lease shall automatically terminate with respect to the Initial Demised Premises (as defined in Section 1.02 of the Lease (as amended by this Amendment)) only, with such termination having the same force and effect as if the Replacement Effective Date were the originally scheduled expiration date of the Lease with respect to the Initial Demised Premises. For purposes of clarification, it is understood and agreed that the Lease shall continue on and after the Replacement Effective Date in full force and effect with respect to the New Demised Premises (as defined in Section 1.02 of the Lease (as amended by this Amendment)). For purposes of clarification, it is also understood and agreed that Tenant shall be required to quit and surrender the Initial Demised Premises on the Replacement Effective Date in the condition and manner required by Section 7.06 of the Lease and Section 1.13 of Amendment No. 1 to Lease. The “Replacement Effective Date” shall have the meaning assigned thereto in clause (qq) of Section 2.01 of the Lease (as amended by this Amendment).

SECTION 2. AMENDMENTS TO THE LEASE.

2.1. Subject to Section 3 hereof, the Lease is hereby amended as set forth in the remaining portions of Section 2 hereof.

2.2. Section 1.02 of the Lease is amended by deleting such Section 1.02 in its entirety (other than the heading “Section 1.02. Demised Premises”), and inserting in its place the following:

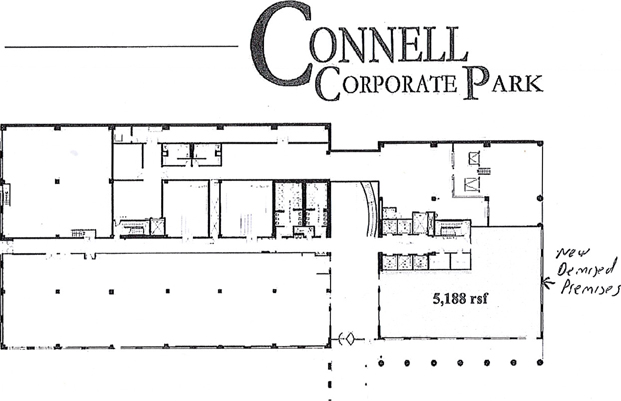

The phrase “Demised Premises” shall have a different definition for different phases of the Term of this Lease. (A) Prior to the Replacement Effective Date, the “Demised Premises” shall mean the portion of the Building leased to Tenant, consisting of 16,078 usable square feet of floor area converted to 19,695 rentable square feet of floor area by multiplying the usable square feet by 122.5%, and located on the fifth floor and designated as “Initial Demised Premises” on the “Rental Plan” (which is attached hereto as Exhibit B; such space also being referred to herein sometimes as the “Initial Demised Premises”). (B) Effective as of the Replacement Effective Date and thereafter, the “Demised Premises” shall mean the portion of the Building leased to Tenant, consisting of 4,235 usable square feet of floor area converted to 5,188 rentable square feet of floor area by multiplying the usable square feet by 122.5%, and located on the first floor and designated as “New Demised Premises” on the “Rental Plan” (which is attached hereto as Exhibit B-l; such space sometimes also being referred to herein as the “New Demised Premises”). The Demised Premises includes any alterations, additions, improvements or repairs of any nature made thereto. The computations of rentable square footage set forth above shall be binding and conclusive on the parties and their successors and assigns.

2,3. Section 1.03 of the Lease is amended by deleting such Section 1.03 in its entirety (other than the heading “Section 1,03. Base Rent”), and inserting in its place the following:

“Base Rent” in the applicable period of the Term of the Lease shall equal the applicable amount set forth below:

| (i) | From (and including) Commencement Date up to (and including) January 31, 2006: $0.00 per month ($0.00 per rentable square foot of the Initial Demised Premises per annum); |

| (ii) | From (and including) February 1, 2006 up to (and including) March 31, 2006: $33,754.50 per month, which amount equals the sum of the following amounts: |

| (a) | $26.00 per rentable square foot per annum on 15,579 rentable square feet of the Initial Demised Premises ($33,754.50 per month), plus |

| (b) | $0.00 per rentable square foot per annum on 4,116 rentable square feet of the Initial Demised Premises ($0.00 per month); |

| (iii) | From (and including) April 1, 2006 up to (and including) January 31, 2009: $42,672.50 per month ($26.00 per rentable square foot of the Initial Demised Premises per annum); |

| (iv) | From (and including) February 1, 2009 up to (and including) January 31, 2010: $45,134.38 per month ($27.50 per rentable square foot of the Initial Demised Premises per annum); |

| (v) | From (and including) February 1, 2010 up to (but not including) the Replacement Effective Date: $42,672.50 per month ($26.00 per rentable square foot of the Initial Demised Premises per annum); |

| (vi) | From (and including) the Replacement Effective Date up to (but not including) the date which is one (1) year after the Replacement Effective Date (the “One Year Anniversary Date”): $11,240.67 per month ($26.00 per rentable square foot of the New Demised Premises per annum); |

2

| (vii) | From (and including) the One Year Anniversary Date up to (but not including) the date which is two (2) years after the Replacement Effective Date (the “Two Year Anniversary Date”): $11,456.83 per month ($26.50 per rentable square foot of the New Demised Premises per annum); |

| (viii) | From (and including) the Two Year Anniversary Date up to (but not including) the date which is three (3) years after the Replacement Effective Date (the “Three Year Anniversary Date”): $11,673.00 per month ($27.00 per rentable square foot of the New Demised Premises per annum); |

| (ix) | From (and including) the Three Year Anniversary Date up to (but not including) the date which is four (4) years after the Replacement Effective Date (the “Four Year Anniversary Date”): $11,889.17 per month ($27.50 per rentable square foot of the New Demised Premises per annum); |

| (x) | From (and including) the Four Year Anniversary Date up to (but not including) the date which is five (5) years after the Replacement Effective Date (the “Five Year Anniversary Date”): $12,105.33 per month ($28.00 per rentable square foot of the New Demised Premises per annum); and |

| (xi) | From (and including) the Five Year Anniversary Date up to (but not including) the date which is six (6) years after the Replacement Effective Date (the “Six Year Anniversary Date”): $12,321.50 per month ($28.50 per rentable square foot of the New Demised Premises per annum); |

In all cases Base Rent during any renewal term shall be governed by Section 4.01 hereof. Base Rent shall be payable per Section 5.01 hereof (it being understood that payment for electricity per Section 8.02 hereof is an amount in addition to Base Rent).

2.4. Section 1.04(c) of the Lease is amended by deleting such Section 1.04(c) in its entirety, and inserting in its place the following:

(c) “Required Letter of Credit Amount” shall mean an amount equal to (i) in the case of any period prior to February 1, 2010, $512,070.00 and (ii) in the case of any period on or after February 1, 2010 but prior to the Replacement Effective Date, $256,035.00 and (iii) in the case of any period on or after the Replacement Effective Date, $134,888.00.

2.5. Section 1.05 of the Lease is amended by deleting such Section 1.05 in its entirety (other than the heading “Section 1.05. Term”), and inserting in its place the following:

The “Term” of this Lease shall commence on the Commencement Date and shall continue thereafter until the date which is six (6) years after the Replacement Effective Date, unless sooner terminated or renewed in accordance with the provisions of this Lease. For purposes of clarification, the Term of this Lease with respect to the Initial Demised Premises shall expire on the Replacement Effective Date.

3

2.6. Section 1.06 of the Lease is amended by (i) inserting the words “(a) prior to the Replacement Effective Date,” before the words “Tenant’s Pro Rata Share” in the third line of such Section 1.06, and (ii) inserting the following after the word “8.066%” in the fifth line of such Section 1.06:

and (b) effective as of the Replacement Effective Date (and thereafter), Tenant’s Pro Rata Share shall be 2.125%, calculated as follows: Demised Premises of 5,188 rentable sq. ft. divided by the rental Area of Building of 244,179 sq. ft. = 0.02125 x 100 = 2.125%.

2.7. Section 2.01(d) of the Lease is amended by deleting such Section 2.01(d) in its entirety, and inserting in its place the following:

“Base Tax Rate” shall mean the real estate tax rate in effect for (i) in the case of periods prior to February 1, 2010, the calendar year 2006, (ii) in the case of periods on and after February 1, 2010 but prior to the Replacement Effective Date, the calendar year 2010 and (iii) in the case of periods from and after the Replacement Effective Date, the calendar year 2016.

2.8. Section 2.01(v) of the Lease is amended by deleting such Section 2.01(v) in its entirety, and inserting in its place the following:

“Operating Year” shall mean any calendar year. The “First Operating Year “ shall mean (i) in the case of periods prior to February 1, 2010, the calendar year 2006, (ii) in the case of periods on and after February 1, 2010 but prior to the Replacement Effective Date, the calendar year 2010 and (iii) in the case of periods from and after the Replacement Effective Date, the calendar year 2016.

2.9. Section 2.01 of the Lease is amended by inserting the following new clauses at the end of such Section 2.01:

(mm) “Amendment No. 2 to Lease” means Amendment No. 2 to Lease dated as of September 15, 2015 between Landlord and Tenant.

(nn) “Initial Demised Premises” shall have the meaning set forth in Section 1.02 of this Lease.

(oo) “New Demised Premises” shall have the meaning set forth in Section 1.02 of this Lease.

(pp) “New Demised Premises Work” shall have the meaning set forth in Section 3.08 of this Lease.

(qq) “Replacement Effective Date” shall be the earlier of (i) day on which Landlord shall have completed the New Demised Premises Work, or (ii) the day on which Tenant commences to do business in the New Demised Premises. Promptly following the Replacement Effective Date, Landlord and Tenant shall execute a Replacement Effective Date Addendum in the form attached hereto as Exhibit G which shall confirm the Replacement Effective Date (it being agreed that the failure of either party to execute the Replacement Effective Date Addendum shall not in any way affect the Replacement Effective Date or any other terms of this Lease).

4

2.10. The Lease is amended by inserting the following new Section 3.08 immediately after Section 3.07 of the Lease:

Section 3.08. Certain Additional Work in connection with Amendment No. 2 to Lease.

(a) The parties agree that the provisions of this Section 3.08 shall apply to certain work that Landlord will perform to the New Demised Premises in connection with the parties entering into Amendment No. 2 to Lease (it being understood that none of the work described herein shall occur until after the Work Start Date). The “Work Start Date” means the later to occur of (i) the date Amendment No. 2 to Lease is fully executed and delivered and (ii) the date the Axtria Conditions (as defined in Section 3 of Amendment No. 2 to Lease) have been satisfied.

(b) The parties agree that Landlord, at Landlord’s sole cost and expense, shall perform the following work for the New Demised Premises (such work being referred to herein as the “New Demised Premises Work”): (i) provide and install a new 6-ton supplemental air conditioning system, as described on Exhibit H attached hereto, for the New Demised Premises, (ii) provide and install new carpet for the New Demised Premises at Tenant’s choice of color, (iii) paint the New Demised Premises at Tenant’s choice of color, (iv) replace damaged ceiling tile in the New Demised Premises, (v) replace non-working light bulbs (if any) and/or ballasts within the New Demised Premises and (vi) replace the damaged window blinds within the New Demised Premises. The parties agree that the New Demised Premises have been inspected by Tenant as of date the parties entered into Amendment No. 2 to Lease, and on the Replacement Effective Date are accepted by Tenant in its “AS, IS” condition (other than for Landlord performing the New Demised Premises Work in accordance with the terms of this Section 3.08). Landlord shall use reasonable efforts to have the New Demised Premises Work completed by the date which is thirty (30) days after the Work Start Date. Notwithstanding the foregoing, Landlord shall cause, as of the Replacement Effective Date, all Building systems to be operational and in good condition and repair.

(c) All materials for the New Demised Premises Work shall be in accordance with Building standards. Landlord shall cause the New Demised Premises Work to be completed in a good and workman-like manner and in conformance with all applicable building codes and laws.

2.11. Section 4.01(a) of the Lease is amended by inserting the following at the end of such Section 4.01(a):

For purposes of clarification, the parties agree that the provisions of this Section 4.01(a) shall apply to the New Demised Premises (and not the Initial Demised Premises).

5

2.12. Section 4.02 of the Lease is amended by deleting such Section 4.02 in its entirety, and inserting in its place the following.

Section 4.02. Termination Option. (a) Tenant shall have one option to terminate this Lease (the “18-Month Termination Option”) with respect to all (but not less than all) of the Demised Premises (for purposes of clarification, the Demised Premises meaning the New Demised Premises), with such termination being effective on the date which is eighteen (18) months after the Replacement Effective Date (the “18-Month Termination Date”), provided that (i) there has been no Event of Default (or event or condition which, with the passage of time or giving of notice, or both, would constitute an Event of Default) that has occurred and is continuing at the time of exercise of the option and (ii) Tenant pays Landlord, at least thirty (30) days before the 18-Month Termination Date, an amount equal to the 18- Month Termination Amount. In the event Tenant desires to elect the 18- Month Termination Option, Tenant shall give Landlord written notice of its exercise of the 18-Month Termination Option at least nine (9) months prior to the 18-Month Termination Date (the date which is nine (9) months prior to the 18-Month Termination Date is referred to herein as the “18-Month Termination Notice Final Date”). If Tenant fails to timely notify Landlord of its exercise of the 18-Month Termination Option by the 18-Month Termination Notice Final Date, then the 18-Month Termination Option shall expire. The termination of the Lease pursuant to this Section 4.02(a) shall have the same force and effect as if the 18-Month Termination Date were the originally scheduled Expiration Date of this Lease and as used elsewhere in this Lease, the term Expiration Date shall be interpreted to include the 18- Month Termination Date where applicable (it being understood for purposes of clarification that Tenant’s obligation to pay Landlord the 18-Month Termination Amount shall survive the termination and expiration of this Lease). The term “18-Month Termination Amount” means an amount equal to $100,000.00.

(b) Tenant shall also have one option to terminate this Lease (the “27- Month Termination Option”) with respect to all (but not less than all) of the Demised Premises (for purposes of clarification, the Demised Premises meaning the New Demised Premises), with such termination being effective on the date which is twenty-seven (27) months after the Replacement Effective Date (the “27-Month Termination Date”), provided that (i) there has been no Event of Default (or event or condition which, with the passage of time or giving of notice, or both, would constitute an Event of Default) that has occurred and is continuing at the time of exercise of the option and (ii) Tenant pays Landlord, at least thirty (30) days before the 27-Month Termination Date, an amount equal to the 27-Month Termination Amount. In the event Tenant desires to elect the 27-Month Termination Option, Tenant shall give Landlord written notice of its exercise of the 27-Month Termination Option at least nine (9) months prior to the 27-Month Termination Date (the date which is nine (9) months prior to the 27-Month Termination Date is referred to herein as the “27-Month Termination Notice Final Date”). If Tenant fails to timely notify Landlord of its exercise of the 27-Month Termination Option by the 27-Month Termination Notice Final Date, then the 27-Month Termination Option shall expire. The termination of the Lease pursuant to this Section 4.02(b) shall have the same force and effect as if the 27-Month Termination Date were the originally scheduled Expiration Date of this Lease and as used elsewhere in this Lease, the term

6

Expiration Date shall be interpreted to include the 27-Month Termination Date where applicable (it being understood for purposes of clarification that Tenant’s obligation to pay Landlord the 27-Month Termination Amount shall survive the termination and expiration of this Lease). The term “27- Month Termination Amount” means an amount equal to $85,000.00,

(c) Tenant shall also have one option to terminate this Lease (the “3- Year Termination Option”) with respect to all (but not less than all) of the Demised Premises (for purposes of clarification, the Demised Premises meaning the New Demised Premises), with such termination being effective on the date which is three (3) years after the Replacement Effective Date (the “3-Year Termination Date”), provided that (i) there has been no Event of Default (or event or condition which, with the passage of time or giving of notice, or both, would constitute an Event of Default) that has occurred and is continuing at the time of exercise of the option and (ii) Tenant pays Landlord, at least thirty (30) days before the 3-Year Termination Date, an amount equal to the 3-Year Termination Amount. In the event Tenant desires to elect the 3-Year Termination Option, Tenant shall give Landlord written notice of its exercise of the 3-Year Termination Option at least nine (9) months prior to the 3-Year Termination Date (the date which is nine (9) months prior to the 3-Year Termination Date is referred to herein as the “3- Year Termination Notice Final Date”). If Tenant fails to timely notify Landlord of its exercise of the 3-Year Termination Option by the 3-Year Termination Notice Final Date, then the 3-Year Termination Option shall expire. The termination of the Lease pursuant to this Section 4.02(c) shall have the same force and effect as if the 3-Year Termination Date were the originally scheduled Expiration Date of this Lease and as used elsewhere in this Lease, the term Expiration Date shall be interpreted to include the 3- Year Termination Date where applicable (it being understood for purposes of clarification that Tenant’s obligation to pay Landlord the 3-Year Termination Amount shall survive the termination and expiration of this Lease). The term “3-Year Termination Amount” means an amount equal to $70,000.00.

2.13. Section 8.01(c) of the Lease is amended by inserting the following at the end of such Section 8.01(c):

Notwithstanding the foregoing, effective as of the Replacement Effective Date and thereafter, access to the parking in the Parking Area shall be granted 4 cars per each 1,000 rentable square feet (i.e. 21 cars for 5,188 rentable square feet) and of the number of parking spaces to which Tenant is granted access pursuant to this sentence, Landlord will designate 4 spaces as “reserved” for Tenant.

2.14. Exhibit B to the Lease is amended by inserting the word “Initial” before the words “Demised Premises” each time the words “Demised Premises” appear in such Exhibit B.

2.15. The Lease is amended by inserting, after Exhibit B to the Lease and as a new Exhibit B-l to the Lease, Exhibit B-l attached hereto.

2.16. The Lease is amended by inserting, after Exhibit F to the Lease and as new Exhibits G and H to the Lease, Exhibits G and H attached hereto.

7

SECTION 3. AXTRIA LEASE.

The parties acknowledge that as of the date hereof Landlord and Axtria, Inc. (“Axtria”) are currently in discussions to enter into a lease for the Initial Demised Premises, plus certain additional space in the building located at 400 Connell Drive. Notwithstanding anything contained herein, the parties agree that the termination of the Lease with respect to the Initial Demised Premises described in Section 1 hereof and the amendments to the Lease set forth in Section 2 hereof are each subject to, by a date no later than 5:00 p.m. on November 1, 2015 (the “Cut-Off Date”) (i) Landlord having entered into (and having received a fully executed copy of), a lease agreement or lease agreements with Axtria (or an affiliate of Axtria) in form and substance (including, without limitation, the rental rate, lease term and rent commencement date) satisfactory to Landlord in its sole discretion (the “Axtria Lease”), pursuant to which Axtria (or an affiliate of Axtria) will lease from Landlord the space described herein as the Initial Demised Premises and certain space in the building located at 400 Connell Drive and (ii) all of the conditions set forth in the Axtria Lease relating to Axtria obtaining the New Jersey State incentives have been satisfied (or waived by Axtria) (the conditions described in clauses (i) and (ii) being collectively referred to as the “Axtria Conditions”). In the event that the Axtria Conditions have not been satisfied by the Cut-Off Date, then on the Cut-Off Date (x) this Amendment shall automatically terminate and be null and void and of no force or effect whatsoever, and the Lease shall continue with the same force and effect as if Landlord and Tenant never entered into this Amendment. Landlord shall provide Tenant with prompt written notice when and if the Axtria Conditions are satisfied (and prompt written notice if they are not satisfied by the Cut-Off Date). Tenant acknowledges and agrees that Landlord does not and shall not make any representation or warranty of any kind that the Axtria Conditions will be satisfied, and Landlord shall not have any liability to Tenant in the event the Axtria Conditions are not satisfied.

SECTION 4. BROKER

Tenant and Landlord each represents that there was no broker other than the Extension Broker (which is Cushman & Wakefield of New Jersey, Inc.) responsible for bringing about or negotiating this Amendment (including the lease of the New Demised Premises). Each party agrees to defend, indemnify, and hold the other party harmless against any claims for brokerage commission or compensation with regard to the lease of the New Demised Premises reflected in this Amendment by any other broker claiming or alleging to have acted on behalf of or to have dealt with such party. Landlord, at Landlord’s sole cost and expense, will pay any fees or commissions due the Extension Broker pursuant to a separate written agreement previously entered into between Landlord and the Extension Broker.

SECTION 5. MISCELLANEOUS.

Tenant agrees that it shall immediately pay Landlord any undisputed past due amounts owed by Tenant to Landlord as of the date this Amendment is fully executed and delivered.

This Amendment shall be governed by and construed in accordance with the laws of the State of New Jersey. Any and all notices, requests, certificates and other documents executed and delivered concurrently with or after the delivery of this Amendment may refer to the Lease without making specific reference to this Amendment, but nevertheless all such references shall be deemed to include this Amendment unless the context shall otherwise require. The Lease shall remain in full force and effect in accordance with its terms as modified and amended by this Amendment, and, as so modified and amended, is in all respects ratified, confirmed and approved by the parties hereto. To the extent there are any inconsistencies or ambiguities between the specific subject matter of this Amendment and the Lease, the terms of this Amendment shall be controlling. This Amendment supersedes all prior arrangements and understandings between the parties, either written or oral, with respect to its subject matter.

8

This Amendment may be executed in two or more identical counterparts, all of which shall be considered one and the same agreement and shall become effective when counterparts have been signed by each party and delivered to the other party. In the event that any signature is delivered by facsimile transmission or by an e-mail which contains a portable document format (.pdf) file of an executed signature page, such signature page shall create a valid and binding obligation of the party executing (or on whose behalf such signature is executed) with the same force and effect as if such signature page were an original thereof.

IN WITNESS WHEREOF, the parties have caused this Amendment to be duly executed as of the day and year first above written.

| THE CONNELL COMPANY | WITNESS OR ATTEST: | |||||

| By: |

|

| ||||

| Name: |

Duane Connell |

Richard Bartok | ||||

| Title: | Executive Vice President | Assistant Secretary | ||||

| AUTHENTIDATE HOLDING CORP. | WITNESS OR ATTEST: | |||||

| By: |

|

| ||||

| Name: |

Ian C. Bonnet |

William A. Marshall | ||||

| Title: | CEO | CFO | ||||

9

| STATE OF |

) | |||||||

| ) | SS.: | |||||||

| COUNTY OF |

) |

On this day of , 2015, before me personally appeared to me known, who, being by me duly sworn, did depose and say that (s)he is the of AUTHENTIDATE HOLDING CORP., the corporation described in and which executed the foregoing Amendment; that (s)he knows the seal of said corporation, that the seal affixed to said instrument is such corporate seal, that it was so affixed by authorization of the board of directors of said corporation, and that (s)he signed his name thereto by like authorization.

IN WITNESS WHEREOF, I hereunto set my hand and official seal.

|

|

||||

| Notary Public |

| STATE OF NEW JERSEY |

) | |||||||

| ) | SS.: | |||||||

| COUNTY OF UNION |

) |

On this 23 day of September, 2015, before me personally appeared Duane Connell to me known, who, being by me duly sworn, did depose and say that (s)he is the Executive Vice President of THE CONNELL COMPANY, the corporation described in and which executed the foregoing Amendment; that (s)he knows the seal of said corporation, that the seal affixed to said instrument is such corporate seal, that it was so affixed by authorization of the board of directors of said corporation, and that (s)he signed his name thereto by like authorization.

IN WITNESS WHEREOF, I hereunto set my hand and official seal.

|

||||

|

Notary Public |

||||

| CHRISTOPHER O. JEGEDE NOTARY PUBLIC OF NEW JERSEY REGISTERED IN UNION COUNTY My Commission Expires June 19, 2018 |

||||

10

Exhibit B-1

Rental Plan Showing New Demised Premises

300 Connell Drive

First Floor Plan

EXHIBIT G

REPLACEMENT EFFECTIVE DATE ADDENDUM

Reference is made to the Lease dated as of July 5, 2005, which was amended as of February 12, 2010 and as of September 15, 2015 (as amended, the “Lease”) between The Connell Company (“Landlord”) and Authentidate Holding Corp. (“Tenant”). Pursuant to Section 2.01(qq) of the Lease, Landlord and Tenant are entering into this addendum to the Lease to confirm the date of the Replacement Effective Date under the Lease.

Landlord and Tenant hereby confirm that the Replacement Effective Date of the Lease is .

The parties agree that this addendum is intended solely to confirm the Replacement Effective Date, and this addendum shall not in any way affect or modify any of the terms of the Lease.

| THE CONNELL COMPANY | ||

| By: |

| |

| Name: |

| |

| Title: |

| |

| Date: |

| |

| AUTHENTIDATE HOLDING CORP. | ||

| By: |

| |

| Name: |

| |

| Title: |

| |

| Date: |

| |