Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Aleris Corp | a8kcertaininformationnotpr.htm |

DEUTSCHE BANK LEVERAGED FINANCE CONFERENCE September 29, 2015

1 FORWARD-LOOKING AND OTHER INFORMATION IMPORTANT INFORMATION This information is current only as of its date and may have changed. We undertake no obligation to update this information in light of new information, future events or otherwise. This information contains certain financial projections and forecasts and other forward looking information concerning our business, prospects, financial condition and results of operations, and we are not making any representation or warranty that this information is accurate or complete. See “Forward-Looking Information” below. BASIS OF PRESENTATION We have recently completed the sale of our recycling and specification alloys and extrusions businesses. We have reported these businesses as discontinued operations for all periods presented, and reclassified the results of operations of these businesses as discontinued operations. Except as otherwise indicated, the discussion of the Company’s business and financial information throughout this presentation refers to the Company’s continuing operations and the financial position and results of operations of its continuing operations. FORWARD-LOOKING INFORMATION Certain statements contained in this presentation are “forward-looking statements” within the meaning of the federal securities laws. Statements about our beliefs and expectations and statements containing the words “may,” “could,” “would,” “should,” “will,” “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project,” “look forward to,” “intend” and similar expressions intended to connote future events and circumstances constitute forward-looking statements. Forward-looking statements include statements about, among other things, future costs and prices of commodities, production volumes, industry trends, anticipated cost savings, anticipated benefits from new products, facilities, acquisitions or divestitures, projected results of operations, achievement of production efficiencies, capacity expansions, future prices and demand for our products and estimated cash flows and sufficiency of cash flows to fund capital expenditures. Forward-looking statements involve known and unknown risks and uncertainties, which could cause actual results to differ materially from those contained in or implied by any forward-looking statement. Some of the important factors that could cause actual results to differ materially from those expressed or implied by forward-looking statements include, but are not limited to, the following: (1) our ability to successfully implement our business strategy; (2) the success of past and future acquisitions and divestitures; (3) the cyclical nature of the aluminum industry, material adverse changes in the aluminum industry or our end-use segments, such as global and regional supply and demand conditions for aluminum and aluminum products, and changes in our customers’ industries; (4) our ability to enter into effective metal, energy and other commodity derivatives or arrangements with customers to manage effectively our exposure to commodity price fluctuations and changes in the pricing of metals, especially London Metal Exchange-based aluminum prices; (5) increases in the cost of raw materials and energy; (6) our ability to generate sufficient cash flows to fund our capital expenditure requirements and to meet our debt service obligations; (7) our ability to fulfill our substantial capital investment requirements; (8) our ability to retain the services of certain members of our management; (9) our internal controls over financial reporting and our disclosure controls and procedures may not prevent all possible errors that could occur; (10) the loss of order volumes from any of our largest customers; (11) our ability to retain customers, a substantial number of whom do not have long-term contractual arrangements with us; (12) competitor pricing activity, competition of aluminum with alternative materials and the general impact of competition in the industry segments we serve; (13) risks of investing in and conducting operations on a global basis, including political, social, economic, currency and regulatory factors; (14) variability in general economic conditions on a global or regional basis; (15) current environmental liabilities and the cost of compliance with and liabilities under health and safety laws; (16) labor relations (i.e., disruptions, strikes or work stoppages) and labor costs; (17) our levels of indebtedness and debt service obligations, including changes in our credit ratings, material increases in our cost of borrowing or the failure of financial institutions to fulfill their commitments to us under committed credit facilities; (18) our ability to access the credit and capital markets; (19) the possibility that we may incur additional indebtedness in the future; (20) limitations on operating our business as a result of covenant restrictions under our indebtedness, and our ability to pay amounts due under the Senior Notes; and (21) other factors discussed in our filings with the Securities and Exchange Commission, including the sections entitled “Risk Factors” contained therein. Investors, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. We undertake no obligation to publicly update or revise any forward- looking statements, whether in response to new information, futures events or otherwise, except as otherwise required by law. NON-GAAP INFORMATION The non-GAAP financial measures contained in this presentation (including, without limitation, EBITDA, Adjusted EBITDA, commercial margin, and variations thereof) are not measures of financial performance calculated in accordance with U.S. GAAP and should not be considered as alternatives to net income and loss attributable to Aleris Corporation or any other performance measure derived in accordance with GAAP or as alternatives to cash flows from operating activities as a measure of our liquidity. Non-GAAP measures have limitations as analytical tools and should be considered in addition to, not in isolation or as a substitute for, or as superior to, our measures of financial performance prepared in accordance with GAAP. Management believes that certain non-GAAP performance measures may provide investors with additional meaningful comparisons between current results and results in prior periods. Management uses non-GAAP financial measures as performance metrics and believes these measures provide additional information commonly used by the holders of our senior debt securities and parties to the 2015 ABL Facility with respect to the ongoing performance of our underlying business activities, as well as our ability to meet our future debt service, capital expenditures and working capital needs. These adjustments are based on currently available information and certain adjustments that we believe are reasonable and are presented as an aid in understanding our operating results. They are not necessarily indicative of future results of operations that may be obtained by the Company. INDUSTRY INFORMATION Information regarding market and industry statistics contained in this presentation is based on information from third party sources as well as estimates prepared by us using certain assumptions and our knowledge of these industries. Our estimates, in particular as they relate to our general expectations concerning the aluminum industry, involve risks and uncertainties and are subject to changes based on various factors, including those discussed under “Risk Factors” in our filings with the Securities and Exchange Commission.

2 CONTENTS Aleris Overview Key Highlights Financial Overview

3 Aleris Overview

4 ALERIS WELL POSITIONED IN ALUMINUM VALUE CHAIN Metal price pass through business model

5 ALERIS’ TRANSFORMATION STRATEGY IS COMPLETE Overview of the New Aleris 32% 29% 38% North America Europe Asia Pacific Discontinued Ops Divestitures enhance flexibility and focus Singularly focused global leader in rolled products 2014 Revenues by segment Adjusted EBITDA per ton1 Divestitures (closed Feb 2015) create singular focus on rolled products Enhanced liquidity; $500M+ in aggregate cash proceeds Strengthened balance sheet Supports Lewisport ABS investment 1Excludes slab and billet sales from Voerde and Koblenz cast houses of 0.4 kT in 1H14 (including discontinued operations), 18 kT in 1H14 (continuing operations) and 10 kT in 1H15 (continuing operations). 2Excludes slab and billet sales from Voerde and Koblenz cast houses of 6kT in LTM 6/30/15 $119 $201 $281 1H14 incl. discontinued operations 1H14 continuing operations 1H15 continuing operations ($ per metric ton) Leader in Aerospace, Automotive and B&C aluminum rolled products with presence on 3 continents Divestitures of non-core assets complete Key strategic investments for future growth in place Global blue-chip customer base Financial performance gaining momentum − LTM Revenues: $3.1B − LTM Adjusted EBITDA: $209M − LTM Shipments: 828 kT2

6 Two world-class aerospace plate facilities Two sites on the forefront of the automotive transformation Largest, most flexible network serving the U.S. B&C industry A leading position in key regional industries Strategic growth platform in China KEY FACILITIES ON THREE CONTINENTS

7 Switzerland GermanyBelgium Koblenz Voerde Duffel China Zhenjiang Shanghai MULTI-CONTINENT BEST-IN-CLASS CAPABILITIES North America Europe Asia Pacific Lewisport Auto transformation underway Leading Continuous Cast network Leading scrap processing capabilities Leading positions in: B&C Trucker Trailer Distribution Two world-class facilities Leading positions in: Aerospace plate and sheet ABS Brazing Heat Exchangers Zhenjiang, a state-of-the-art rolling mill in China 1st plate mill in China with Western OEM Aerospace qualifications Significant optionality with uncommitted hot mill capacity CONFIDENTIAL Corporate office OH IA NJ VA WV IL KY AL Uhrichsville Richmond Lincolnshire Lewisport Davenport (2) Clayton Buckhannon Ashville Cleveland

8 Key Highlights

9 KEY HIGHLIGHTS Flexible capital structure with ample liquidity Significant growth investments underpin future performance Well-positioned to benefit from economic recovery and growth in aluminum consumption Company-wide focus on best-in-class performance

10 Significant opportunities for growth in aluminum consumption CURRENT GLOBAL ALUMINUM TRENDS MOBILITY GLOBAL RECOVERY SUSTAINABILITY Aerospace growth Lightweight revolution in automotive Housing, industrial growth in U.S. Europe beginning to improve Recyclability Lightweight

11 2,536 3,639 2014 2019E ATTRACTIVE DEMAND IN TARGET END USES 2,177 3,695 2014 2019E 5.2% 16.0% 3.6% (Metric ton in thousands) North America Western Europe China CONFIDENTIAL 11.2% 2,146 2,733 2014 2019E 1.4% 9.1% 1.6% (Metric ton in thousands) 4.9% 5.1% 11.5% 7.3% (Metric ton in thousands) Automotive, Aerospace & Transportation B&C Industrial CAGR 14-19E 7.5% Aleris well-positioned to capture industry growth, led by transportation Source: CRU Aluminum Outlook Quarterly Report February 2015.

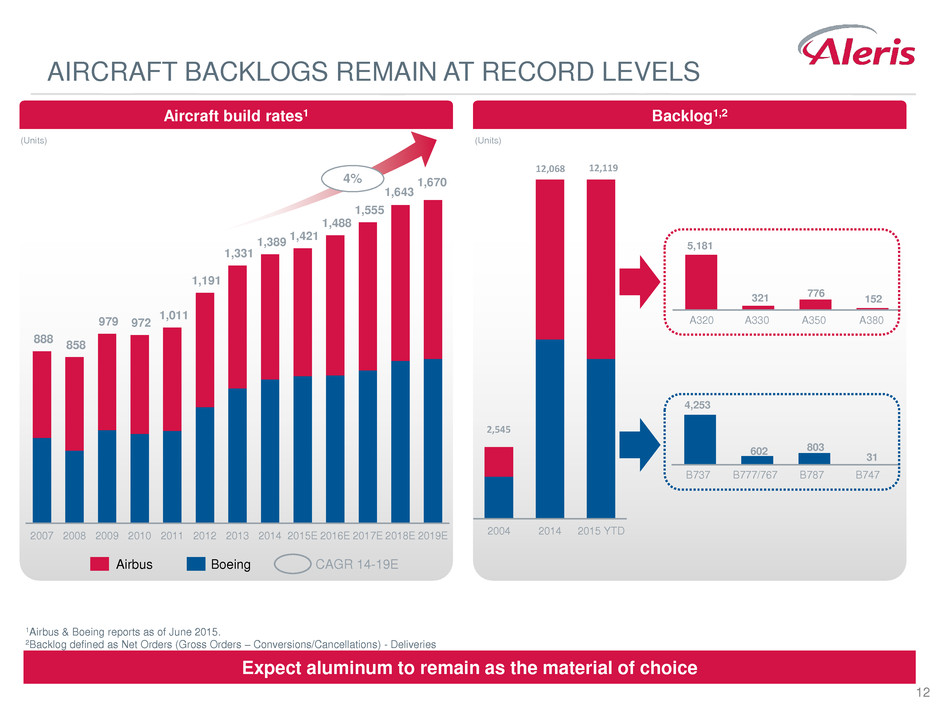

12 AIRCRAFT BACKLOGS REMAIN AT RECORD LEVELS 1Airbus & Boeing reports as of June 2015. 2Backlog defined as Net Orders (Gross Orders – Conversions/Cancellations) - Deliveries Expect aluminum to remain as the material of choice 321 776 152 A380 A350 A330 A320 5,181 602 803 31 B747 B787 B777/767 B737 4,253 888 858 979 972 1,011 1,191 1,331 1,389 1,421 1,488 1,555 1,643 1,670 2007 2008 2009 2010 2011 2012 2013 2014 2015E 2016E 2017E 2018E 2019E 2004 2014 2015 YTD 12,068 2,545 Aircraft build rates1 Backlog1,2 4% (Units) (Units) Airbus Boeing CAGR 14-19E 12,119

13 AUTO BODY SHEET – GLOBAL TRANSFORMATION OPPORTUNITY 2013 2014 2015E 2016E 2017E 2018E 2019E 2,015 1,744 632 1,542 1,282 951 Europe1 China North America1 Opportunity for China ABS – 215 kT of untapped hot mill capacity with full coil / CALP potential Committed two CALP lines in Lewisport – Production expected to begin in 2017 Strong presence in Europe with one CALP line in Duffel – Ample hot mill capacity to support a 2nd CALP (Metric ton in thousands) Global ABS industry demand Aleris Position 1Ducker International / Aluminum Association, 2014. 2McKinsey, 2015. Aleris has been a leader for more than a decade; significant global partnerships 26% CAGR 14-19E 450 2

14 2.2 2.0 1.8 1.6 1.4 1.2 1.0 0.8 0.6 0.4 0.2 0.0 1.20 1.60 2018E 2010 2000 1990 1980 1970 Housing starts Housing formation demand Total demand for new houses Forecast Projected US population trends to support solid long term growth fundamentals 1National Association of Home Builders; Wells Fargo; Freddie Mac; Fannie Mae; LCM; John Burns 2Moody’s analytics forecast North America housing starts1 US historical & projected total housing starts by source (Units in thousands) Demand for new houses2 (Million units per year) B&C FUNDAMENTALS ARE STRONG 1,812 2007 1,710 2006 1,854 2014 2005 2004 2008 2001 2002 2003 2010 2009 1,601 2011 2012 2013 2015E 2016E 1,950 2,073 554 587 1,355 905 608 781 925 1,050 1,100 1,250 Multi-Family Single Family 1,082 1,220 1,003 1,135 1,398 2014 2015E 2016E

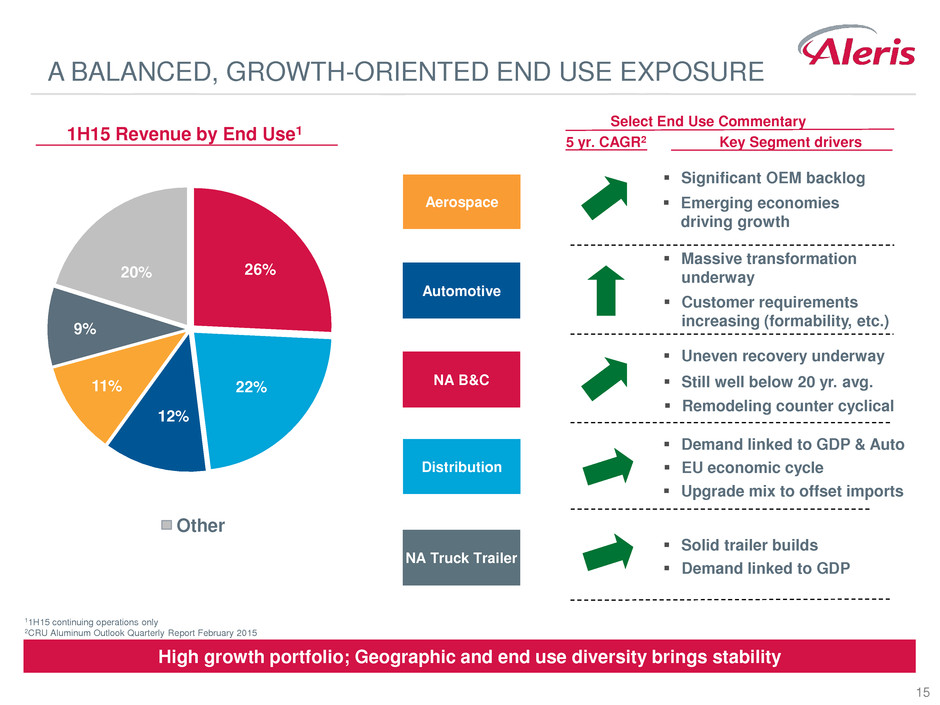

15 A BALANCED, GROWTH-ORIENTED END USE EXPOSURE 22% 20% 13% 24% 6% 15% Other Automotive NA B&C Key Segment drivers Aerospace Distribution NA Truck Trailer Significant OEM backlog Emerging economies driving growth Massive transformation underway Customer requirements increasing (formability, etc.) 5 yr. CAGR2 1H15 Revenue by End Use 1 Select End Use Commentary Solid trailer builds Demand linked to GDP Demand linked to GDP & Auto EU economic cycle Uneven recovery underway Still well below 20 yr. avg. Remodeling counter cyclical High growth portfolio; Geographic and end use diversity brings stability 11H15 continuing operations only 2CRU Aluminum Outlook Quarterly Report February 2015 26% 22% 12% 11% 9% 20% Upgrade mix to offset imports

16 Aerospace growth and shift in demand to Asia Western OEM aerospace qualifications in place Achieved break-even Adj. EBITDA in 2Q15 Aerospace volume ramping DUFFEL $70M NICHOLS ACQUISITION $110M CHINA $350M Capturing transformative shift in auto Global customer base Widest ABS capabilities in Europe Well-timed to benefit from housing recovery Comparable asset base; similar technologies Realizing significant synergies NA AUTO BODY SHEET $350M Capturing transformative shift in auto Upgrading Lewisport facility and product mix Leverages global leading ABS capabilities KEY INVESTMENTS – FOUNDATION FOR GROWTH IN PLACE % CapEx Spent LTM Adj. EBITDA as % of Run Rate Significant capital investments committed to support growth; future benefits to be realized

17 NORTH AMERICA AUTOMOTIVE BODY SHEET UPDATE $350M investment to add ABS in Lewisport Aleris’ first automotive mill in North America Positions Aleris to meet significant demand growth Lewisport ABS Investment Working with key OEM’s Leverages technology and expertise of Duffel facility On target to begin shipping to customers in 2017

18 NORTH AMERICAN AUTOMOTIVE ALUMINUM OPPORTUNITY Tremendous aluminum growth expected in North America automotive sector Source: Ducker Worldwide, 2014 By 2025… 27% of all body and closure parts for light vehicles in North America will be made of aluminum Aluminum hood penetration will reach 85%; doors will reach 46% Use of aluminum sheet for vehicle bodies to increase to 4 billion lbs (200 million in 2012) 18% Number of vehicles with complete aluminum body structures (<1% today) 7 out of 10 Pickup trucks will be aluminum bodied

19 132 1,142 1,852 1,649 2,324 2,809 3,806 3,872 5,141 5,441 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 Highlights Plant World class rolling mill initially targeting value added heat-treat plate applications, including Aerospace Meeting customer Aerospace requirements Growth opportunities in various high value end uses Significant embedded optionality for growth (>200kT uncommitted hot mill capacity) Shipments by Quarter (Metric tons) ASIA PACIFIC WELL POSITIONED FOR PROFITABLE GROWTH Cash Conversion Cost per ton Index 0.4x 0.5x 0.5x 0.5x 0.7x 1.0x 2Q15 1Q15 4Q14 3Q14 2Q14 1Q14

20 ALERIS OPERATING SYSTEM The Aleris Operating System is a global common approach of principles, practices, and tools that engage our employees Overview Company-wide focus on continuous improvement

21 Financial Overview

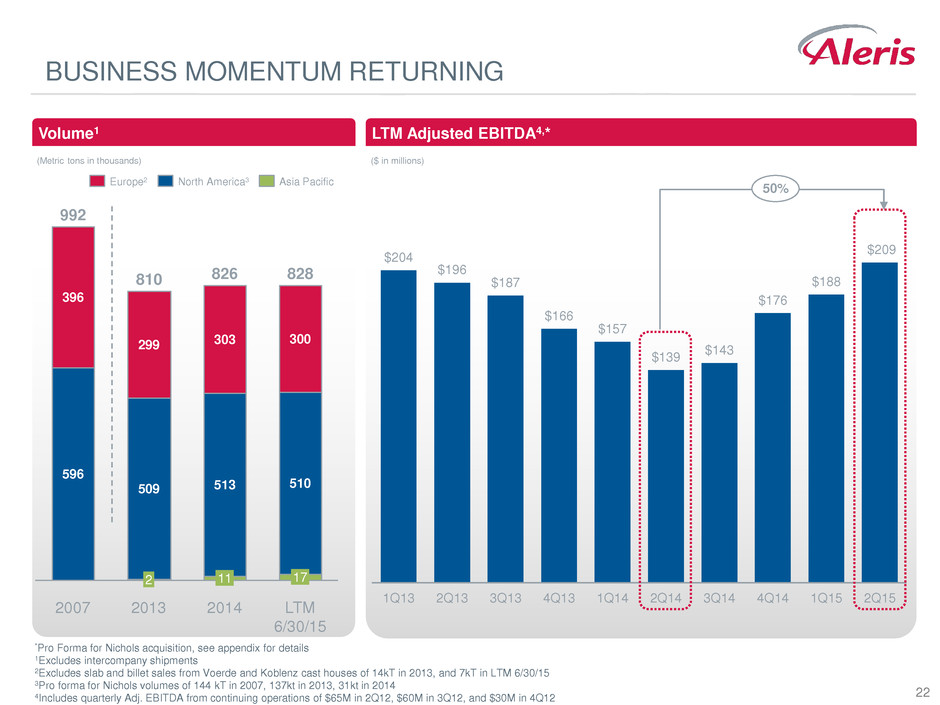

22 $204 $196 $187 $166 $157 $139 $143 $176 $188 $209 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 LTM Adjusted EBITDA4,* Volume1 *Pro Forma for Nichols acquisition, see appendix for details 1Excludes intercompany shipments 2Excludes slab and billet sales from Voerde and Koblenz cast houses of 14kT in 2013, and 7kT in LTM 6/30/15 3Pro forma for Nichols volumes of 144 kT in 2007, 137kt in 2013, 31kt in 2014 4Includes quarterly Adj. EBITDA from continuing operations of $65M in 2Q12, $60M in 3Q12, and $30M in 4Q12 BUSINESS MOMENTUM RETURNING (Metric tons in thousands) ($ in millions) 50% 396 LTM 6/30/15 828 510 300 2014 826 513 303 2013 810 509 299 2007 992 596 11 17 2 North America3 Europe2 Asia Pacific

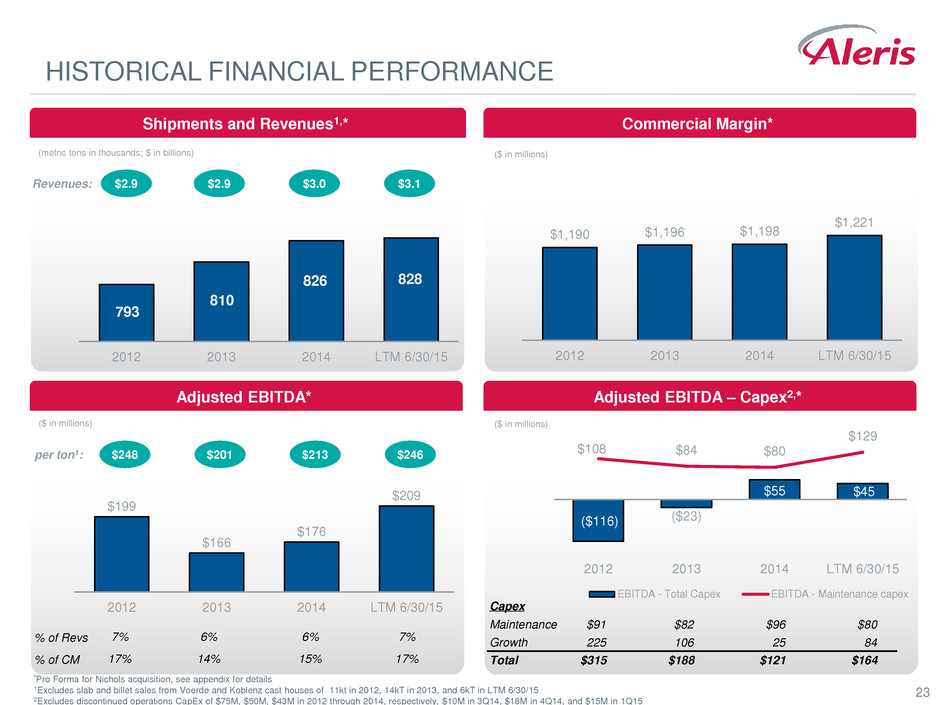

23 $199 $166 $176 $209 2012 2013 2014 LTM 6/30/15 HISTORICAL FINANCIAL PERFORMANCE Shipments and Revenues1,* Adjusted EBITDA* Adjusted EBITDA – Capex2,* Commercial Margin* ($116) ($23) $55 $45 $108 $84 $80 $129 2012 2013 2014 LTM 6/30/15 EBITDA - Total Capex EBITDA - Maintenance capex $1,190 $1,196 $1,198 $1,221 2012 2013 2014 LTM 6/30/15 *Pro Forma for Nichols acquisition, see appendix for details 1Excludes slab and billet sales from Voerde and Koblenz cast houses of 11kt in 2012, 14kT in 2013, and 6kT in LTM 6/30/15 2Excludes discontinued operations CapEx of $75M, $50M, $43M in 2012 through 2014, respectively, $10M in 3Q14, $18M in 4Q14, and $15M in 1Q15 ($ in millions) ($ in millions) (metric tons in thousands; $ in billions) ($ in millions) 2012 2013 2014 LTM 6/30/15 Adj. EBITDA – total capex Adj. EBITDA – maintenance capex $2.9 $2.9 $3.0 $3.1 Revenues: $248 $201 $213 $246 per ton1: % of revs 8% 6% 6% 7% per ton $261 $194 $214 $264 % of Revs 7% 6% 6% 7% % of CM 17% 14% 15% 17% Capex Maintenance $91 $82 $96 $80 Growth 225 106 25 84 Total $315 $188 $121 $164 793 810 826 828

24 $58 $39 $60 2Q13 2Q14 2Q15 Adjusted EBITDA: 1H vs. 2H 2Q Adjusted EBITDA Business and Earnings Drivers SECOND QUARTER 2015 PERFORMANCE 2Q15 Adjusted EBITDA of $60M Global automotive volumes up 23% Global aerospace volumes up 13% Improved North American performance driven by higher margins, scrap spreads and productivity Strong U.S. dollar positively impacted Europe profitability Asia Pacific achieved break-even Adjusted EBITDA $109 $57 $82 $94 $115 First Half Second Half 2013 2014 1H 2015 Momentum returned in 2H14 and continues into 2015 ($ in millions) ($ in millions)

25 ADJUSTED EBITDA BRIDGE June 2014 YTD – June 2015 YTD Adjusted EBITDA bridge ($ in millions) $83 $115 $1 $12 $2 $8 $20 ($11) June 14 YTD Volume / Mix Price Margin / Scrap Spreads Base Inflation Productivity Currency & Translation June 15 YTD

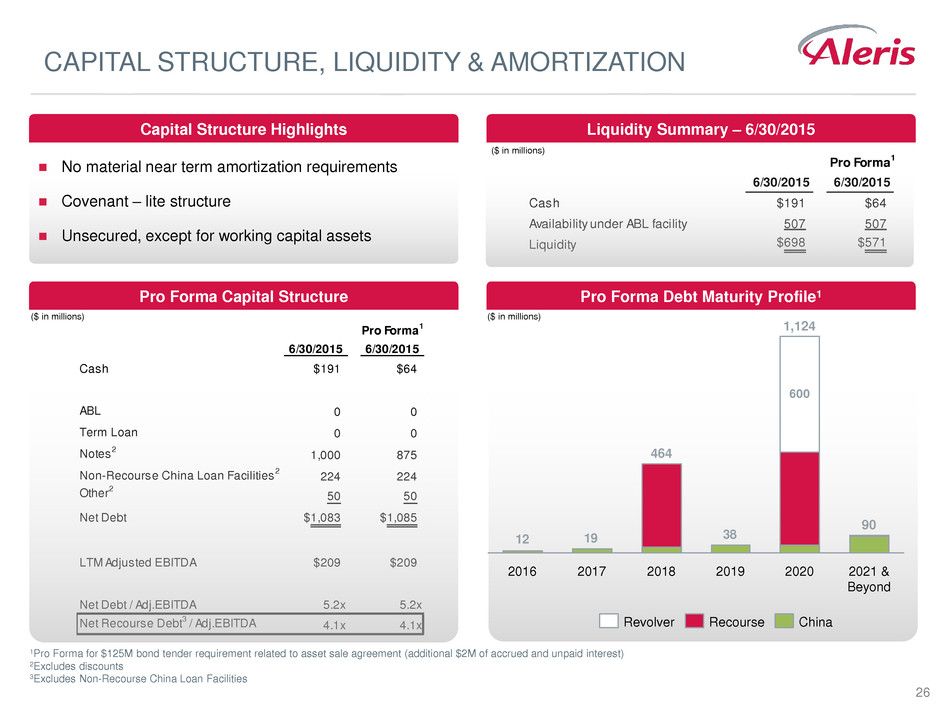

26 Pro Forma 1 6/30/2015 6/30/2015 Cash $191 $64 ABL 0 0 Term Loan 0 0 Notes 2 1,000 875 Non-Recourse China Loan Facilities 2 224 224 Other 2 50 50 Net Debt $1,083 $1,085 LTM Adjusted EBITDA $209 $209 Net Debt / Adj.EBITDA 5.2x 5.2x Net Recourse Debt 3 / Adj.EBITDA 4.1x 4.1x Pro Forma 1 6/30/2015 6/30/2015 Cash $191 $64 Availability under ABL facility 507 507 Liquidity $698 $571 CAPITAL STRUCTURE, LIQUIDITY & AMORTIZATION No material near term amortization requirements Covenant – lite structure Unsecured, except for working capital assets Cash $205 Availability under ABL Facility 369 Liquidity $574 Capital Structure Highlights Pro Forma Capital Structure Debt Maturity Profile 3/1/2015 ($M)3 Liquidity Summary – 3/1/2015 ($M) 1Pro Forma for $125M bond tender requirement related to asset sale agreement (additional $2M of accrued and unpaid interest) 2Excludes discounts 3Excludes Non-Recourse China Loan Facilities Liquidity Summary – 6/30/2015 Pro Forma Debt Maturity Profile1 ($ in millions) ($ in millions) ($ in millions) 3/1/2015 Cash $205 ABL 0 Notes (2) 1,000 Non-Recourse China Loan Facilities (2) 217 Other (2) 5 Net Debt $1,017 2014 Adjusted EBITDA $176 2015E Adjusted EBITDA $220 2014 Net Debt / Adj.EBITDA 5.8x 2014 Net Recourse Debt (2) / Adj. EBITDA 4.5x 2015E Net Debt / Adj.EBITDA 4.6x 2015E Net Recourse Debt (2) / Adj. EBITDA 3.6x 381912 600 2021 & Beyond 90 2020 1,124 2019 2018 464 2017 2016 China Recourse Revolver

27 STRONG CREDIT MOMENTUM IN THE BUSINESS Doubled liquidity since year end; ~$600M today ABL refinancing increased liquidity by >$100M Year-over-year Adjusted EBITDA improvement of >50% Successful outcomes on divestitures; $500M+ cash proceeds Net debt / EBITDA down from 5.5x1 at 2014YE to 5.2x at 6/30/2015 . . . North America and Europe positioned well for continued improvement . Momentum in Asia Pacific with positive EBITDA expected in 2H 2015 . Strong credit momentum in the business; EBITDA improvement driving lower leverage 1Includes discontinued operations

28 KEY HIGHLIGHTS Significant growth investments underpin future performance Well-positioned to benefit from economic recovery and growth in aluminum consumption Company-wide focus on best-in-class performance Flexible capital structure with ample liquidity

29

30 HISTORICAL FINANCIAL PERFORMANCE RECONCILIATION 1Excludes slab and billet sales from Voerde and Koblenz cast houses of 11kt in 2012, 14kT in 2013, and 6kT in LTM 6/30/15 2Aleris estimate 1Q12 2Q12 3Q12 4Q12 2012 1Q13 2Q13 3Q13 4Q13 2013 1Q14 2Q14 3Q14 4Q14 2014 1Q15 2Q15 LTM 6/30/2015 Volume (kt) Total Aleris volume excluding shipments to discontinued operations 1 171 177 174 155 676 169 181 167 157 673 165 213 223 193 795 200 211 828 Nichols 2 25 33 32 27 117 35 34 38 30 137 31 0 0 0 31 0 0 0 Pro Forma Total Aleris Volume 196 210 206 181 793 203 215 204 187 810 197 213 223 193 826 200 211 828 Revenue ($M) Total Aleris excluding discontinued operations $648 $674 $641 $589 $2,552 $641 $672 $626 $581 $2,521 $591 $749 $809 $733 $2,882 $746 $774 $3,062 Nichols 2 80 107 96 85 368 109 105 112 88 414 92 0 0 0 92 0 0 0 Pro Forma Total Aleris Revenue $728 $781 $737 $674 $2,920 $751 $777 $738 $670 $2,935 $683 $749 $809 $733 $2,974 $746 $774 $3,062 Commercial Margin ($M) Total Aleris excluding discontinued operations $261 $269 $273 $248 $1,051 $265 $284 $261 $241 $1,052 $257 $300 $316 $294 $1,167 $302 $309 $1,221 Nichols 2 32 34 37 37 139 42 27 40 34 144 32 0 0 0 32 0 0 $0 Pro Forma Total Aleris Commecial Margin $293 $303 $309 $285 $1,190 $307 $312 $302 $275 $1,196 $289 $300 $316 $294 $1,198 $302 $309 $1,221 Adjusted EBITDA ($M) Total Aleris excluding discontinued operations $51 $65 $60 $30 $207 $48 $58 $44 $7 $157 $43 $39 $55 $39 $176 $55 $60 $209 Nichols 2 (5) 1 (1) (2) (8) 3 (0) 7 (1) 9 (1) (0) (0) 0 (1) 0 0 0 Pro Forma Total Aleris Adjusted EBITDA $47 $66 $59 $28 $199 $51 $58 $51 $6 $166 $43 $39 $55 $39 $176 $55 $60 $209