Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BRADY CORP | form8-kearningsreleasex731.htm |

| EX-99.1 - FOURTH QUARTER FISCAL 2015 PRESS RELEASE - BRADY CORP | exhibit991-financials73115.htm |

| EX-99.2 - ADDITIONAL ANNOUNCEMENT - BRADY CORP | exhibit992-pressreleasediv.htm |

September 11, 2015 Brady Corporation F’15 Q4 Financial Results

2Forward-Looking Statements In this presentation, statements that are not reported financial results or other historic information are “forward-looking statements.” These forward-looking statements relate to, among other things, the Company's future financial position, business strategy, targets, projected sales, costs, earnings, capital expenditures, debt levels and cash flows, and plans and objectives of management for future operations. The use of words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “project” or “plan” or similar terminology are generally intended to identify forward-looking statements. These forward-looking statements by their nature address matters that are, to different degrees, uncertain and are subject to risks, assumptions, and other factors, some of which are beyond Brady's control, that could cause actual results to differ materially from those expressed or implied by such forward- looking statements. For Brady, uncertainties arise from: implementation of the healthcare strategy; implementation of the Workplace Safety strategy; future competition; Brady’s ability to develop and successfully market new products; future financial performance of major markets Brady serves, which include, without limitation, telecommunications, hard disk drive, manufacturing, electrical, construction, laboratory, education, governmental, public utility, computer, healthcare and transportation; technology changes and potential security violations to the Company's information technology system; fluctuations in currency rates versus the U.S. dollar; risks associated with international operations; difficulties associated with exports; risks associated with restructuring plans; risks associated with identifying, completing, and integrating acquisitions; changes in the supply of, or price for, parts and components; increased price pressure from suppliers and customers; Brady's ability to retain significant contracts and customers; risk associated with loss of key talent; risks associated with divestitures and businesses held for sale; risks associated with obtaining governmental approvals and maintaining regulatory compliance; risk associated with product liability claims; environmental, health and safety compliance costs and liabilities; potential write-offs of Brady's substantial intangible assets; risks associated with our ownership structure; unforeseen tax consequences; Brady's ability to maintain compliance with its debt covenants; increase in our level of debt; and numerous other matters of national, regional and global scale, including those of a political, economic, business, competitive, and regulatory nature contained from time to time in Brady's U.S. Securities and Exchange Commission filings, including, but not limited to, those factors listed in the “Risk Factors” section within Item 1A of Part I of Brady’s Form 10-K for the year ended July 31, 2014. These uncertainties may cause Brady's actual future results to be materially different than those expressed in its forward-looking statements. Brady does not undertake to update its forward-looking statements except as required by law.

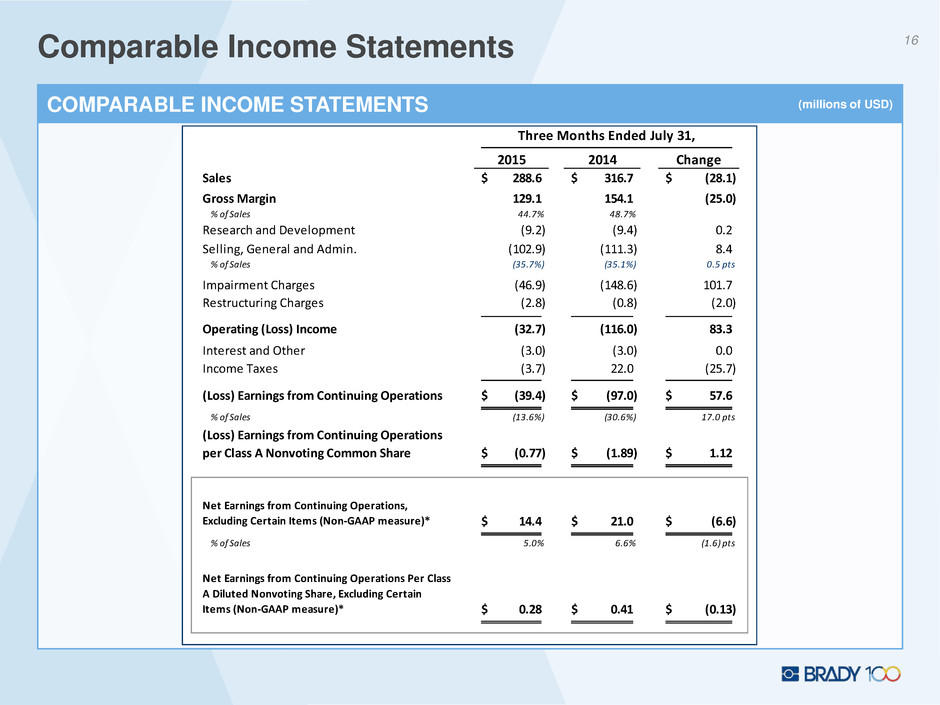

3Q4 F’15 Financial Summary • Sales down 8.9% to $288.6M in Q4 of F’15 vs. $316.7M in Q4 of F’14. – Organic sales declined 1.2% while foreign currency decreased sales by 7.7%. • Gross profit margin of 44.7% in Q4 of F’15, down from 48.6% in Q4 of F’14. • SG&A expense of $102.9M (35.7% of sales) in Q4 of F’15 vs. $111.3M (35.2% of sales) in Q4 of F’14. • Net loss from continuing operations of $(39.4M) in Q4 of F’15 vs. a loss of $(97.0M) in Q4 of F’14. – Non-GAAP Net Earnings from Continuing Operations* of $14.4M vs. $21.0M in Q4 of F’14. • Net loss from continuing operations per Class A Diluted Nonvoting Share of $(0.77) in Q4 of F’15 vs. $(1.89) in Q4 of F’14. – Non-GAAP Net Earnings from Continuing Operations per Class A Diluted Nonvoting Share* of $0.28 in Q4 of F’15 vs. $0.41 in Q4 of F’14. • Improved cash generation. Cash flow from operating activities of $40.6M in Q4 of F’15 vs. $17.6M in Q4 of F’14. * Net Earnings from Continuing Operations, Excluding Certain Items and Net Earnings from Continuing Operations Per Class A Diluted Nonvoting Share Excluding Certain Items, are non-GAAP measures. See appendix.

4Sales Overview • (1.2%) organic sales decline: • ID Solutions – Organic sales decline of (0.3%). • Workplace Safety – Organic sales decline of (3.2%). • (7.7%) decrease due to currency translation. Q4 F’15 SALES: • Organic sales in IDS negatively impacted by Brazil. • Overall, our European businesses in both IDS and WPS performed well, with organic growth in the fourth quarter of F’15. Q4 F’15 SALES COMMENTARY: $200 $225 $250 $275 $300 $325 Q1 F'13 (0.8%) Q2 F'13 (1.8%) Q3 F'13 (4.8%) Q4 F'13 (2.1%) Q1 F'14 (2.1%) Q2 F'14 (1.1%) Q3 F'14 2.5% Q4 F'14 1.1% Q1 F'15 2.4% Q2 F'15 1.4% Q3 F'15 1.7% Q4 F'15 (1.2%)Organic Sales Growth SALES (millions of USD)

Gross Profit Margin 5 • GPM of 44.7% in Q4 of F’15 compared to 48.6% in Q4 of F’14. • Facilities consolidated, but operating inefficiencies continue. • Excluding certain non-recurring items in our IDS business, Q4 F’15 GPM would have been 47.0%. GROSS PROFIT MARGIN COMMENTARY: $150 $142 $159 $158 $158 $143 $155 $154 $150 $138 $141 $129 55% 52% 53% 51% 51% 49% 50% 49% 48% 49% 49% 45% 25% 30% 35% 40% 45% 50% 55% 60% $100 $150 $200 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 Q3 F'15 Q4 F'15 GROSS PROFIT & GPM% (millions of USD)

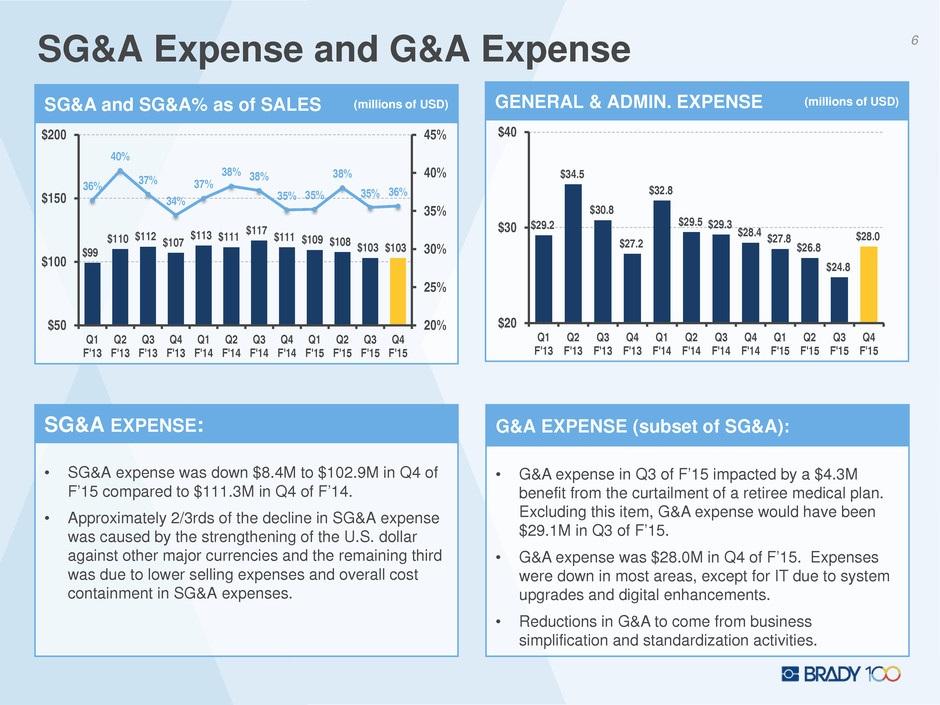

SG&A Expense and G&A Expense 6 • G&A expense in Q3 of F’15 impacted by a $4.3M benefit from the curtailment of a retiree medical plan. Excluding this item, G&A expense would have been $29.1M in Q3 of F’15. • G&A expense was $28.0M in Q4 of F’15. Expenses were down in most areas, except for IT due to system upgrades and digital enhancements. • Reductions in G&A to come from business simplification and standardization activities. G&A EXPENSE (subset of SG&A): • SG&A expense was down $8.4M to $102.9M in Q4 of F’15 compared to $111.3M in Q4 of F’14. • Approximately 2/3rds of the decline in SG&A expense was caused by the strengthening of the U.S. dollar against other major currencies and the remaining third was due to lower selling expenses and overall cost containment in SG&A expenses. SG&A EXPENSE: $29.2 $34.5 $30.8 $27.2 $32.8 $29.5 $29.3 $28.4 $27.8 $26.8 $24.8 $28.0 $20 $30 $40 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 Q3 F'15 Q4 F'15 GENERAL & ADMIN. EXPENSE (millions of USD) $99 $110 $112 $107 $113 $111 $117 $111 $109 $108 $103 $103 36% 40% 37% 34% 37% 38% 38% 35% 35% 38% 35% 36% 20% 25% 30% 35% 40% 45% $50 $100 $150 $200 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 Q3 F'15 Q4 F'15 SG&A and SG&A% as of SALES (millions of USD)

7Net Earnings & EPS From Continuing Operations – Non-GAAP* * Non-GAAP Net Earnings from Continuing Operations and Non-GAAP Net Earnings from Continuing Operations Per Class A Diluted Nonvoting Share are non-GAAP measures. See appendix. • Q4 F’15 Non-GAAP net earnings from continuing operations* were $14.4M compared to $21.0M in Q4 of F’14. • Decrease in earnings driven by reduced gross profit margins in IDS, lack of organic growth in WPS, and foreign currency translation. Q4 F’15 – Non-GAAP Net Earnings* • Q4 F’15 Non-GAAP diluted EPS from continuing operations* was $0.28 compared to $0.41 in Q4 of F’14. Q4 F’15 – Non-GAAP EPS* $0.51 $0.38 $0.55 $0.55 $0.43 $0.25 $0.43 $0.41 $0.36 $0.29 $0.34 $0.28 $0.00 $0.20 $0.40 $0.60 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 Q3 F'15 Q4 F'15 NET EARNINGS FROM CONTINUING OPERATIONS PER CLASS A DILUTED NONVOTING SHARE, EXCLUDING CERTAIN ITEMS* $26 $20 $29 $29 $23 $13 $22 $21 $18 $15 $18 $14 $0 $10 $20 $30 $40 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 Q3 F'15 Q4 F'15 NET EARNINGS FROM CONTINUING OPERATIONS, EXCLUDING CERTAIN ITEMS* (millions of USD)

8Cash Generation • Cash flow from operating activities of $40.6M in Q4 of F’15 compared to $17.6M in Q4 of F’14. • Free cash flow* of $37.5M in Q4 of F’15 compared to $4.0M in Q4 of F’14. • Returned $10.3M to our shareholders in the form of dividends. • Cash flow trends improving as we exit the period of heightened cash outflows from facility consolidation activities. CASH FLOWS IN Q4 OF F’15: $17 $8 $22 $4 $14 $(9) $24 $37 $(10) $- $10 $20 $30 $40 -$10 $0 $10 $20 $30 $40 $50 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 Q3 F'15 Q4 F'15 Cash Flow from Operating Activities and Free Cash Flow* (millions of USD) (millions of USD) 3 Mos. Ended Jul. 31, 2015 3 Mos. Ended Jul. 31, 2014 Cash Balance - Beginning of Period 100.5$ 78.7$ Net Cash Provided by Operating Activities 40.6 17.6 Capital Expenditures (3.1) (13.6) Proceeds from Sales of Businesses - 54.2 Dividends (10.3) (10.0) Debt (Repayments) Borrowings - Net (13.6) (32.6) Effect of Exchange Rate on Cash (4.4) (1.4) Other 4.8 (11.1) Cash Balance - End of Period 114.5$ 81.8$ * Free Cash Flow is calculated as Net Cash Provided by Operating Activities less Capital Expenditures.

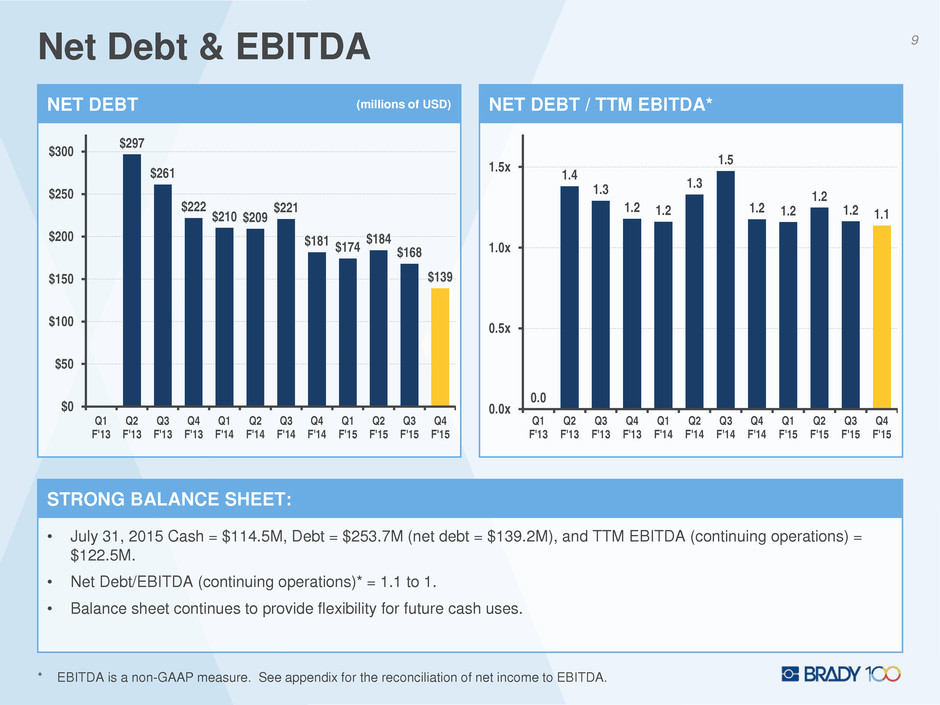

Net Debt & EBITDA 9 0.0 1.4 1.3 1.2 1.2 1.3 1.5 1.2 1.2 1.2 1.2 1.1 0.0x 0.5x 1.0x 1.5x Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 Q3 F'15 Q4 F'15 NET DEBT / TTM EBITDA* • July 31, 2015 Cash = $114.5M, Debt = $253.7M (net debt = $139.2M), and TTM EBITDA (continuing operations) = $122.5M. • Net Debt/EBITDA (continuing operations)* = 1.1 to 1. • Balance sheet continues to provide flexibility for future cash uses. STRONG BALANCE SHEET: * EBITDA is a non-GAAP measure. See appendix for the reconciliation of net income to EBITDA. $297 $261 $222 $210 $209 $221 $181 $174 $184 $168 $139 $0 $50 $100 $150 $200 $250 $300 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 Q3 F'15 Q4 F'15 NET DEBT (millions of USD)

10F’16 Guidance F’16 Diluted EPS $1.10 to $1.30 Guidance Assumptions – Continuing Operations: • Organic sales ranging from approximately flat to low single-digit growth, with accelerating growth in the 2nd half of the year. • Exchange rates consistent with those as of July 31, 2015. • Full-year depreciation and amortization expense of approximately $40M. • Full-year tax rate in the upper 20% range. • Full-year capital expenditures of approximately $25M.

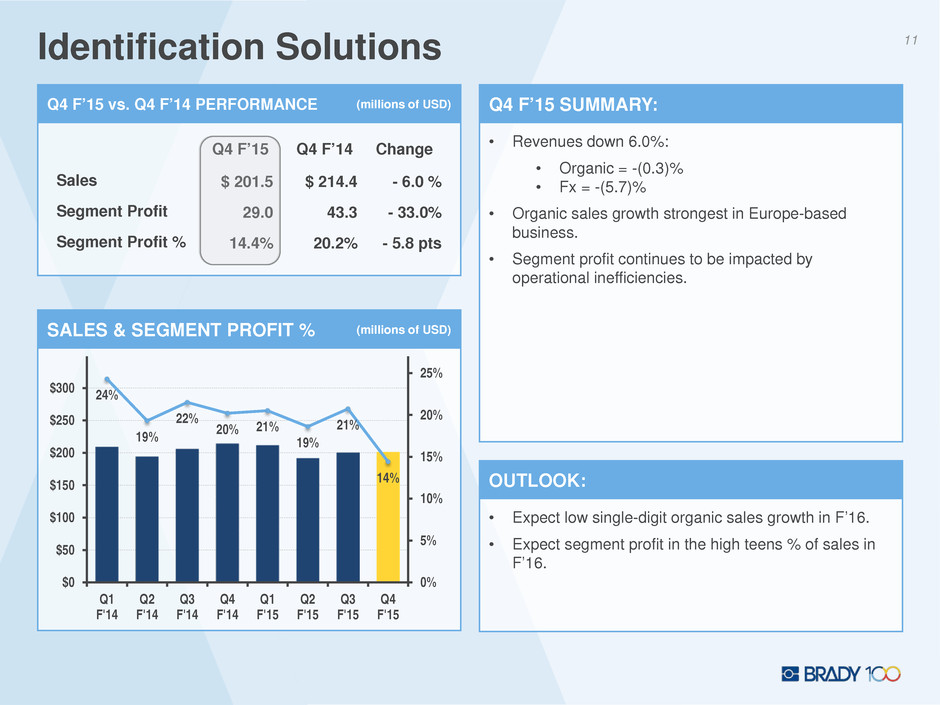

Q4 F’15 vs. Q4 F’14 PERFORMANCE (millions of USD) 11Identification Solutions • Revenues down 6.0%: • Organic = -(0.3)% • Fx = -(5.7)% • Organic sales growth strongest in Europe-based business. • Segment profit continues to be impacted by operational inefficiencies. Q4 F’15 SUMMARY: • Expect low single-digit organic sales growth in F’16. • Expect segment profit in the high teens % of sales in F’16. OUTLOOK: Q4 F’15 Q4 F’14 Change Sales $ 201.5 $ 214.4 - 6.0 % Segment Profit 29.0 43.3 - 33.0% Segment Profit % 14.4% 20.2% - 5.8 pts 24% 19% 22% 20% 21% 19% 21% 14% 0% 5% 10% 15% 20% 25% $0 $50 $100 $150 $200 $250 $300 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 Q3 F'15 Q4 F'15 SALES & SEGMENT PROFIT % (millions of USD)

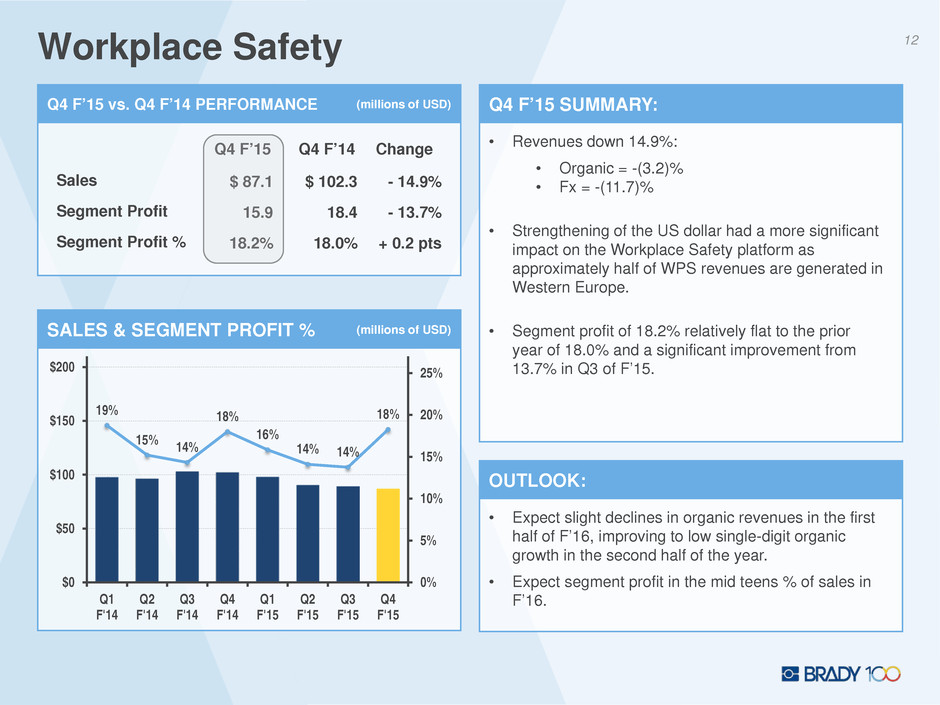

Q4 F’15 vs. Q4 F’14 PERFORMANCE (millions of USD) 12Workplace Safety • Revenues down 14.9%: • Organic = -(3.2)% • Fx = -(11.7)% • Strengthening of the US dollar had a more significant impact on the Workplace Safety platform as approximately half of WPS revenues are generated in Western Europe. • Segment profit of 18.2% relatively flat to the prior year of 18.0% and a significant improvement from 13.7% in Q3 of F’15. Q4 F’15 SUMMARY: • Expect slight declines in organic revenues in the first half of F’16, improving to low single-digit organic growth in the second half of the year. • Expect segment profit in the mid teens % of sales in F’16. OUTLOOK: Q4 F’15 Q4 F’14 Change Sales $ 87.1 $ 102.3 - 14.9% Segment Profit 15.9 18.4 - 13.7% Segment Profit % 18.2% 18.0% + 0.2 pts 19% 15% 14% 18% 16% 14% 14% 18% 0% 5% 10% 15% 20% 25% $0 $50 $100 $150 $200 Q1 F'14 Q2 F'14 Q3 F'14 Q4 F'14 Q1 F'15 Q2 F'15 Q3 F'15 Q4 F'15 SALES & SEGMENT PROFIT % (millions of USD)

13Future Financial Performance GDP+ • Unrivaled customer service • Renewed R&D focus. • Integrated Solutions and embedded technologies creating smarter products. • E-business / Digital Below GDP Organic Growth Organic Sales Growth Organic Revenue Drivers: • Minimize inefficiencies in our manufacturing facilities. • Product rationalization and business simplification. Gross Margin Drivers: F’15 Exiting F’18 Organic Sales Growth (+200 - +300 bps) 47.7% GPM GPM • Decentralized operating philosophy, with standardized processes. • Simplified and streamlined organization. • Reduced G&A structure. • Cost structure alignment of under-performing businesses. SG&A Drivers: (-200 - -300 bps) 36.1% of sales SG&A SG&A • Double-digit net earnings CAGR. • Superior cash flow, and disciplined cash deployment expected to enhance shareholder value through dividends and share buybacks. EPS Drivers: $2.00/share$1.27/share EPS EPS

14Investor Relations Brady Contact: Ann Thornton Investor Relations 414-438-6887 Ann_Thornton@bradycorp.com See our web site at www.bradycorp.com

Appendix 15

COMPARABLE INCOME STATEMENTS (millions of USD) 16Comparable Income Statements 2015 2014 Change Sales 288.6$ 316.7$ (28.1)$ Gross Margin 129.1 154.1 (25.0) % of Sales 44.7% 48.7% Research and Development (9.2) (9.4) 0.2 Selling, General and Admin. (102.9) (111.3) 8.4 % of Sales (35.7%) (35.1%) 0.5 pts Impairment Charges (46.9) (148.6) 101.7 Restructuring Charges (2.8) (0.8) (2.0) Operating (Loss) Income (32.7) (116.0) 83.3 Interest and Other (3.0) (3.0) 0.0 Income Taxes (3.7) 22.0 (25.7) (Loss) Earnings from Continuing Operations (39.4)$ (97.0)$ 57.6$ % of Sales (13.6%) (30.6%) 17.0 pts (Loss) Earnings from Continuing Operations per Class A Nonvoting Common Share (0.77)$ (1.89)$ 1.12$ Net Earnings from Continuing Operations, Excluding Certain Items (Non-GAAP measure)* 14.4$ 21.0$ (6.6)$ % of Sales 5.0% 6.6% (1.6) pts Net Earnings from Continuing Operations Per Class A Diluted Nonvoting Share, Excluding Certain Items (Non-GAAP measure)* 0.28$ 0.41$ (0.13)$ Three Months Ended July 31,

(‘000s of USD) 17Debt Structure July 31, 2015 Balance July 31, 2014 Balance Revolver Borrowings (due Feb. 2017): USD-denominated (L+1.125) 1.27% Variable 102,000$ 42,000$ China Borrowings: USD & CNY-denominated notes payable 4.18% Variable 10,411 19,423 Private Placements: USD-denominated 2006 Series 5.30% Fixed 26,143 52,285 USD-denominated 2007 Series 5.33% Fixed 32,743 49,114 EUR-denominated 2010 Series (7-yr.) 3.71% Fixed 32,960 40,164 EUR-denominated 2010 Series (10-yr.) 4.24% Fixed 49,442 60,246 TOTAL DEBT 253,699$ 263,232$ Interest Rate

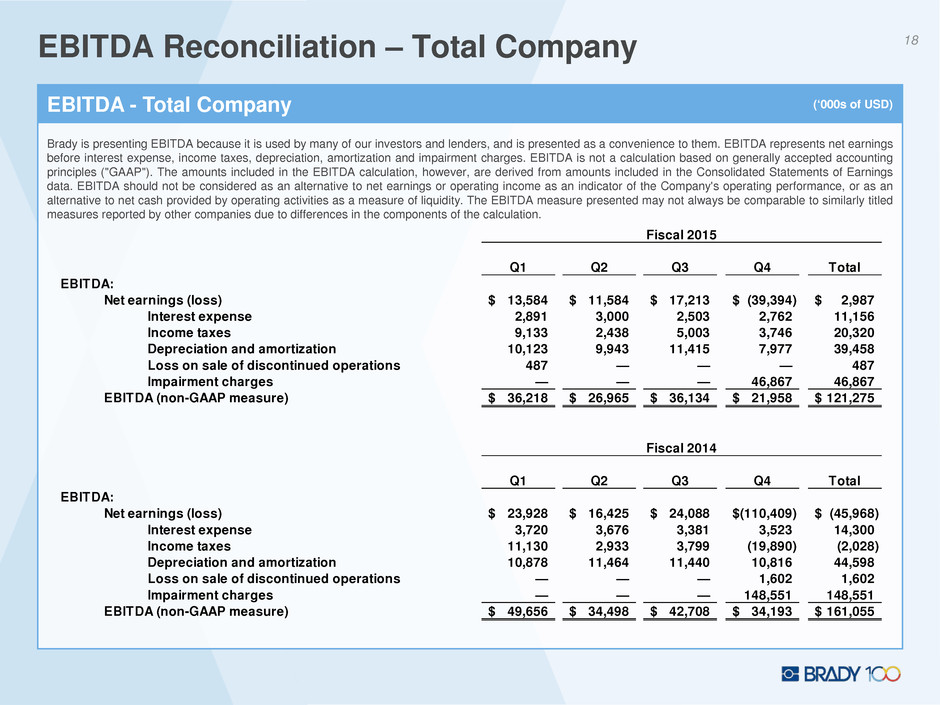

Brady is presenting EBITDA because it is used by many of our investors and lenders, and is presented as a convenience to them. EBITDA represents net earnings before interest expense, income taxes, depreciation, amortization and impairment charges. EBITDA is not a calculation based on generally accepted accounting principles ("GAAP"). The amounts included in the EBITDA calculation, however, are derived from amounts included in the Consolidated Statements of Earnings data. EBITDA should not be considered as an alternative to net earnings or operating income as an indicator of the Company's operating performance, or as an alternative to net cash provided by operating activities as a measure of liquidity. The EBITDA measure presented may not always be comparable to similarly titled measures reported by other companies due to differences in the components of the calculation. EBITDA - Total Company (‘000s of USD) 18EBITDA Reconciliation – Total Company Q1 Q2 Q3 Q4 Total 13,584$ 11,584$ 17,213$ (39,394)$ 2,987$ Interest expense 2,891 3,000 2,503 2,762 11,156 Income taxes 9,133 2,438 5,003 3,746 20,320 Depreciation and amortization 10,123 9,943 11,415 7,977 39,458 Loss on sale of discontinued operations 487 — — — 487 Impairment charges — — — 46,867 46,867 36,218$ 26,965$ 36,134$ 21,958$ 121,275$ Q1 Q2 Q3 Q4 Total 23,928$ 16,425$ 24,088$ (110,409)$ (45,968)$ Interest expense 3,720 3,676 3,381 3,523 14,300 Income taxes 11,130 2,933 3,799 (19,890) (2,028) Depreciation and amortization 10,878 11,464 11,440 10,816 44,598 Loss on sale of discontinued operations — — — 1,602 1,602 Impairment charges — — — 148,551 148,551 49,656$ 34,498$ 42,708$ 34,193$ 161,055$ Net earnings (loss) EBITDA (non-GAAP measure) Fiscal 2015 EBITDA: Net earnings (loss) EBITDA (non-GAAP measure) Fiscal 2014 EBITDA:

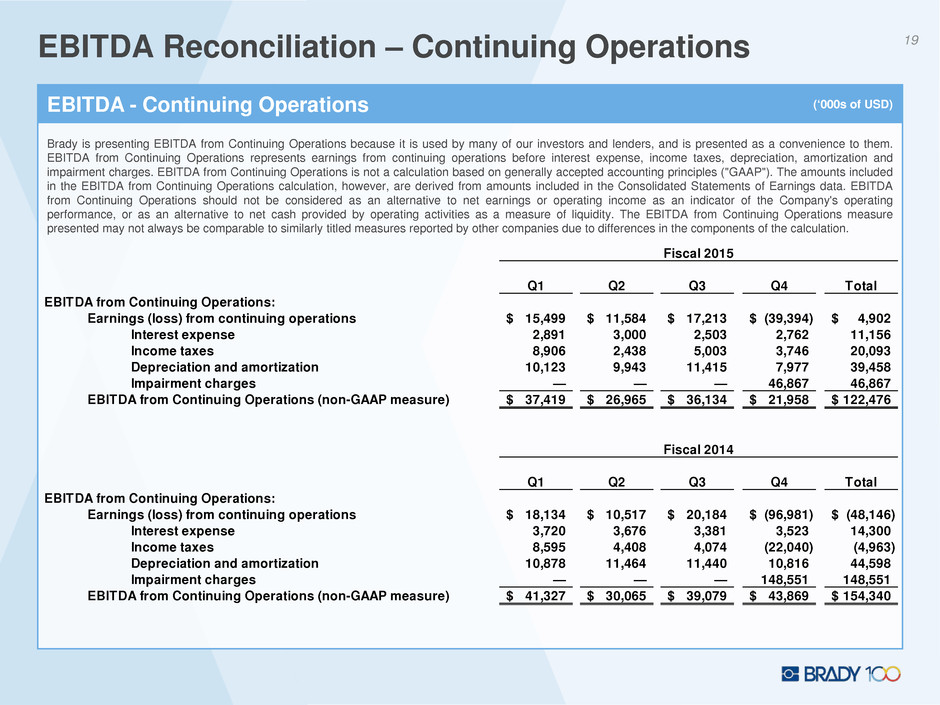

Brady is presenting EBITDA from Continuing Operations because it is used by many of our investors and lenders, and is presented as a convenience to them. EBITDA from Continuing Operations represents earnings from continuing operations before interest expense, income taxes, depreciation, amortization and impairment charges. EBITDA from Continuing Operations is not a calculation based on generally accepted accounting principles ("GAAP"). The amounts included in the EBITDA from Continuing Operations calculation, however, are derived from amounts included in the Consolidated Statements of Earnings data. EBITDA from Continuing Operations should not be considered as an alternative to net earnings or operating income as an indicator of the Company's operating performance, or as an alternative to net cash provided by operating activities as a measure of liquidity. The EBITDA from Continuing Operations measure presented may not always be comparable to similarly titled measures reported by other companies due to differences in the components of the calculation. EBITDA - Continuing Operations (‘000s of USD) 19EBITDA Reconciliation – Continuing Operations Q1 Q2 Q3 Q4 Total 15,499$ 11,584$ 17,213$ (39,394)$ 4,902$ Interest expense 2,891 3,000 2,503 2,762 11,156 Income taxes 8,906 2,438 5,003 3,746 20,093 Depreciation and amortization 10,123 9,943 11,415 7,977 39,458 Impairment charges — — — 46,867 46,867 37,419$ 26,965$ 36,134$ 21,958$ 122,476$ Q1 Q2 Q3 Q4 Total 18,134$ 10,517$ 20,184$ (96,981)$ (48,146)$ Interest expense 3,720 3,676 3,381 3,523 14,300 Income taxes 8,595 4,408 4,074 (22,040) (4,963) Depreciation and amortization 10,878 11,464 11,440 10,816 44,598 Impairment charges — — — 148,551 148,551 41,327$ 30,065$ 39,079$ 43,869$ 154,340$ EBITDA from Continuing Operations (non-GAAP measure) Earnings (loss) from continuing operations Fiscal 2015 EBITDA from Continuing Operations: Earnings (loss) from continuing operations EBITDA from Continuing Operations (non-GAAP measure) Fiscal 2014 EBITDA from Continuing Operations:

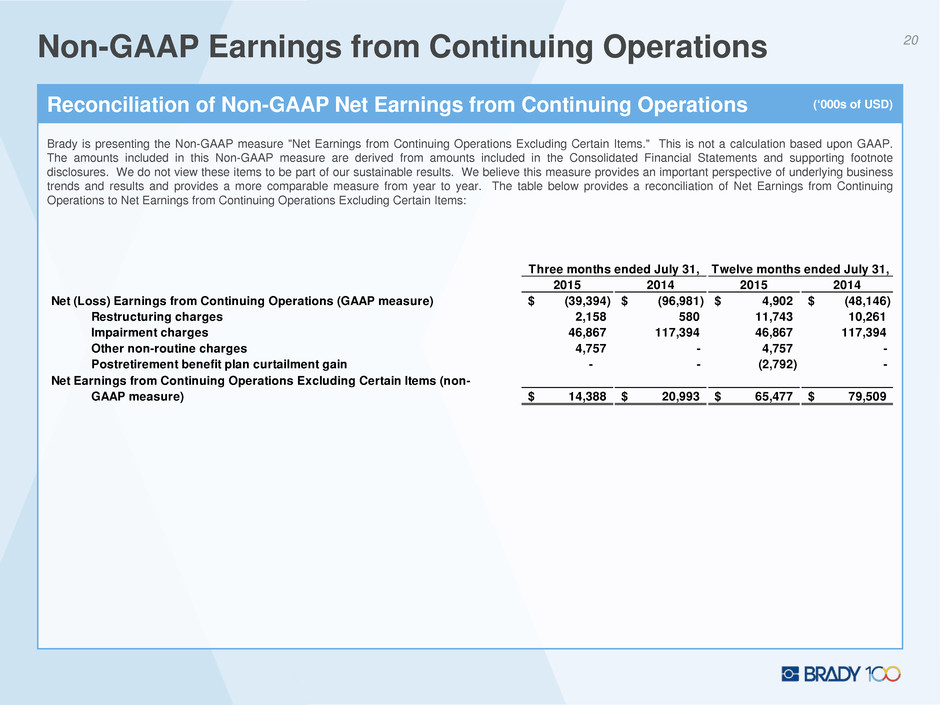

Brady is presenting the Non-GAAP measure "Net Earnings from Continuing Operations Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this Non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our sustainable results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of Net Earnings from Continuing Operations to Net Earnings from Continuing Operations Excluding Certain Items: Reconciliation of Non-GAAP Net Earnings from Continuing Operations (‘000s of USD) 20Non-GAAP Earnings from Continuing Operations 2015 2014 2015 2014 (39,394)$ (96,981)$ 4,902$ (48,146)$ Restructuring charges 2,158 580 11,743 10,261 Impairment charges 46,867 117,394 46,867 117,394 Other non-routine charges 4,757 - 4,757 - Postretirement benefit plan curtailment gain - - (2,792) - 14,388$ 20,993$ 65,477$ 79,509$ Three months ended July 31, Twelve months ended July 31, Net (Loss) Earnings from Continuing Operations (GAAP measure) Net Earnings from Continuing Operations Excluding Certain Items (non- GAAP measure)

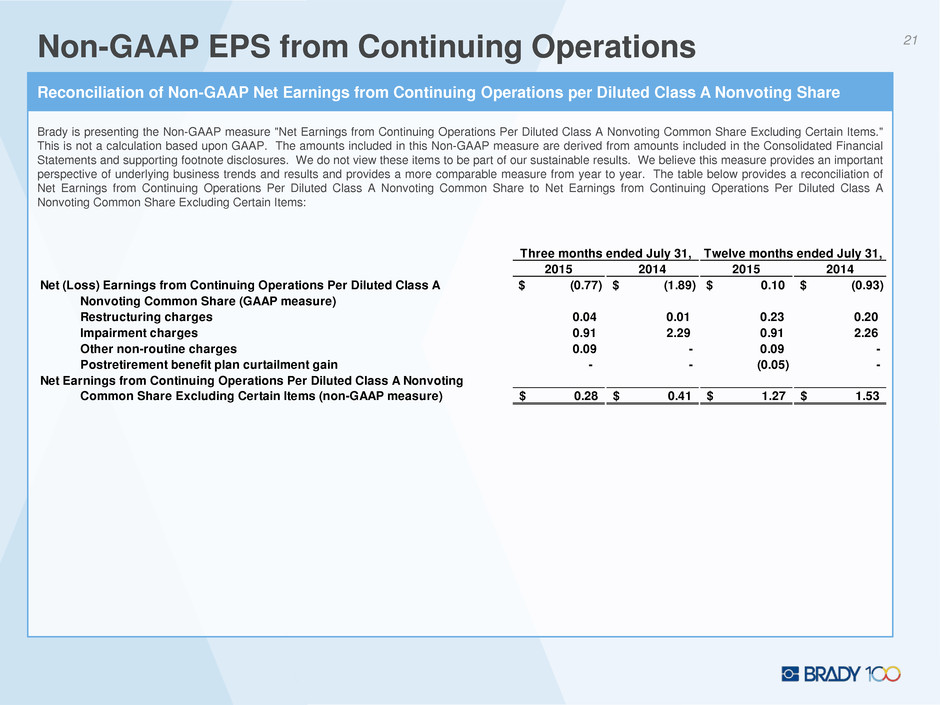

Brady is presenting the Non-GAAP measure "Net Earnings from Continuing Operations Per Diluted Class A Nonvoting Common Share Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this Non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our sustainable results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of Net Earnings from Continuing Operations Per Diluted Class A Nonvoting Common Share to Net Earnings from Continuing Operations Per Diluted Class A Nonvoting Common Share Excluding Certain Items: Reconciliation of Non-GAAP Net Earnings from Continuing Operations per Diluted Class A Nonvoting Share 21Non-GAAP EPS from Continuing Operations 2015 2014 2015 2014 $ (0.77) $ (1.89) $ 0.10 $ (0.93) Restructuring charges 0.04 0.01 0.23 0.20 Impairment charges 0.91 2.29 0.91 2.26 Other non-routine charges 0.09 - 0.09 - Postretirement benefit plan curtailment gain - - (0.05) - Common Share Excluding Certain Items (non-GAAP measure) 0.28$ 0.41$ 1.27$ 1.53$ Nonvoting Common Share (GAAP measure) Net Earnings from Continuing Operations Per Diluted Class A Nonvoting Three months ended July 31, Twelve months ended July 31, Net (Loss) Earnings from Continuing Operations Per Diluted Class A