Attached files

| file | filename |

|---|---|

| EX-23 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - BRADY CORP | brc-2017731xex23.htm |

| EX-32.2 - SECTION 1350 CERTIFICATION - AARON J. PEARCE - BRADY CORP | brc-2017731xex322.htm |

| EX-32.1 - SECTION 1350 CERTIFICATION - J. MICHAEL NAUMAN - BRADY CORP | brc-2017731xex321.htm |

| EX-31.2 - RULE 13A-14(A)/15D-14(A) CERTIFICATION - AARON J. PEARCE - BRADY CORP | brc-2017731xex312.htm |

| EX-31.1 - RULE 13A-14(A)/15D-14(A) CERTIFICATION - J. MICHAEL NAUMAN - BRADY CORP | brc-2017731xex311.htm |

| EX-21 - SCHEDULE OF SUBSIDIARIES - BRADY CORP | brc-2017731xex21.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended July 31, 2017

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-14959

BRADY CORPORATION

(Exact name of registrant as specified in charter)

Wisconsin | 39-0178960 | |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

6555 West Good Hope Road, Milwaukee, WI | 53223 | |

(Address of principal executive offices) | (Zip Code) | |

(414) 358-6600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Class A Nonvoting Common Stock, Par Value $.01 per share | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ý | Accelerated filer | ¨ | Emerging growth company | ¨ | |||

Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ¨ | |||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No ý

The aggregate market value of the non-voting common stock held by non-affiliates of the registrant as of January 31, 2017, was approximately $1,632,463,306 based on the closing sale price of $36.35 per share on that date as reported for the New York Stock Exchange. As of September 11, 2017, there were 47,844,015 outstanding shares of Class A Nonvoting Common Stock (the “Class A Common Stock”), and 3,538,628 shares of Class B Common Stock. The Class B Common Stock, all of which is held by affiliates of the registrant, is the only voting stock.

INDEX

PART I | Page |

PART II | |

PART III | |

Outstanding Equity Awards at 2017 Fiscal Year End | |

PART IV | |

2

PART I

Item 1. Business

(a) General Development of Business

Brady Corporation (“Brady,” “Company,” “we,” “us,” “our”) was incorporated under the laws of the state of Wisconsin in 1914. The Company’s corporate headquarters are located at 6555 West Good Hope Road, Milwaukee, Wisconsin 53223, and the telephone number is (414) 358-6600.

Brady Corporation is a global manufacturer and supplier of identification solutions and workplace safety products that identify and protect premises, products and people. The ability to provide customers with a broad range of proprietary, customized and diverse products for use in various applications, along with a commitment to quality and service, a global footprint, and multiple sales channels, have made Brady a leader in many of its markets.

The Company’s primary objective is to build upon its market position and increase shareholder value by performance of the following key competencies:

• | Operational excellence — Continuous productivity improvement and process transformation. |

• | Customer service — Focus on the customer and understanding customer needs. |

• | Innovation advantage — Technologically advanced, internally developed products that drive growth and sustain gross profit margins. |

• | Global leadership position in niche markets. |

• | Digital capabilities. |

• | Compliance expertise. |

The long-term sales growth and profitability of our segments will depend not only on improved demand in end markets and the overall economic environment, but also on our ability to continuously improve operational excellence, focus on the customer, develop and market innovative new products, and to advance our digital capabilities. In our Identification Solutions ("ID Solutions" or "IDS") business, our strategy for growth includes an increased focus on key customers, industries and products and improving the efficiency and effectiveness of the research and development ("R&D") function. In our Workplace Safety ("WPS") business, our strategy for growth includes a focus on workplace safety critical industries, innovative new product offerings, compliance expertise, and improving our digital capabilities.

The following were key initiatives supporting the strategy in fiscal 2017:

• | Enhancing our innovation development process and the speed to deliver high-value, innovative products that align with our target markets. |

• | Driving operational excellence and providing our customers with the highest level of customer service. |

• | Performing comprehensive product reviews to optimize our product offerings. |

• | Expanding and enhancing our digital presence with a heightened focus on mobile technologies. |

• | Growing through focused sales and marketing actions in selected vertical markets and strategic accounts. |

• | Enhancing our global employee development process to attract and retain key talent. |

(b) Financial Information About Industry Segments

The information required by this Item is provided in Note 8 of the Notes to Consolidated Financial Statements contained in Item 8 - Financial Statements and Supplementary Data.

(c) Narrative Description of Business

Overview

The Company is organized and managed on a global basis within two reportable segments: Identification Solutions and Workplace Safety.

The IDS segment includes high-performance and innovative industrial and healthcare identification products that are manufactured under multiple brands, including the Brady brand. Industrial identification products are sold through distribution to a broad range of maintenance, repair, and operations ("MRO") and original equipment manufacturing ("OEM") customers and through other channels, including direct sales, catalog marketing, and digital. Healthcare identification products are sold direct and through distribution via group purchasing organizations ("GPO").

3

The WPS segment includes workplace safety and compliance products, which are sold under multiple brand names through catalog and digital channels to a broad range of MRO customers. Approximately half of the WPS business is derived from internally manufactured products and half is from externally sourced products.

Below is a summary of sales by reportable segments for the fiscal years ended July 31:

2017 | 2016 | 2015 | |||||||

IDS | 71.9 | % | 71.0 | % | 70.6 | % | |||

WPS | 28.1 | % | 29.0 | % | 29.4 | % | |||

Total | 100.0 | % | 100.0 | % | 100.0 | % | |||

ID Solutions

Within the ID Solutions segment, the primary product categories include:

• | Facility identification and protection, which includes safety signs, pipe markers, labeling systems, spill control products, lockout/tagout devices, and software and services for safety compliance auditing, procedure writing and training. |

• | Product identification, which includes materials and printing systems for product identification, brand protection labeling, work in process labeling, and finished product identification. |

• | Wire identification, which includes hand-held printers, wire markers, sleeves, and tags. |

• | People identification, which includes name tags, badges, lanyards, and access control software. |

• | Patient identification, which includes wristbands and labels used in hospitals for tracking and improving the safety of patients. |

• | Custom wristbands used in the leisure and entertainment industry such as theme parks, concerts and festivals. |

Approximately 65% of ID Solutions products are sold under the Brady brand. In the United States, identification products for the utility industry are marketed under the Electromark brand; spill-control products are marketed under the SPC brand; and security and identification badges and systems are marketed under the Identicard, PromoVision, and Brady People ID brands. Wire identification products are marketed under the Modernotecnica brand in Italy and lockout/tagout products are offered under the Scafftag brand in the U.K.; identification and patient safety products in the healthcare industry are available under the PDC Healthcare brand in the U.S. and Europe; and custom wristbands for the leisure and entertainment industry are available under the PDC brand in the U.S. and the B.I.G. brand in Europe.

The ID Solutions segment offers high quality products with rapid response and superior service to provide solutions to customers. The business markets and sells products through multiple channels including distributors, direct sales, catalog marketing, and digital. The ID Solutions sales force partners with end-users and distributors by providing technical application and product expertise.

This segment manufactures differentiated, proprietary products, most of which have been internally developed. These internally developed products include materials, printing systems, and software. IDS competes for business principally on the basis of price, customer support, product innovation, product offering, product quality, expertise, production capabilities, and for multinational customers, our global footprint. Competition is highly fragmented, ranging from smaller companies offering minimal product variety, to some of the world's largest major adhesive and electrical product companies offering competing products as part of their overall product lines.

ID Solutions serves customers in many industries, which include industrial manufacturing, electronic manufacturing, healthcare, chemical, oil, gas, automotive, aerospace, defense, mass transit, electrical contractors, leisure and entertainment and telecommunications, among others.

Workplace Safety

Within the Workplace Safety segment, the primary product categories include:

• | Safety and compliance signs, tags, and labels. |

• | Informational and architectural signage. |

• | Asset tracking labels. |

• | First aid products. |

• | Industrial warehouse and office equipment. |

• | Labor law compliance posters. |

4

Products within the Workplace Safety segment are sold under a variety of brands including: safety and facility identification products offered under the Seton, Emedco, Signals, Safety Signs, SafetyShop, Signs & Labels and Pervaco brands; first aid supplies under the Accidental Health and Safety, Trafalgar, and Securimed brands; warehouse supplies and industrial furniture under the Runelandhs brand; wire identification products marketed under the Carroll brand; and labor law compliance posters under the Personnel Concepts and Clement brands.

The Workplace Safety segment manufactures a broad range of stock and custom identification products, and also sells a broad range of related resale products. Historically, both the Company and many of our competitors focused their businesses on catalog marketing, often with varying product niches. However, the competitive landscape has changed with the continued evolution of digital channels. Many of our competitors extensively utilize e-commerce to promote the sale of their products. A consequence of this shift is price transparency, as prices on non-proprietary products can be easily compared. Therefore, to compete effectively, we continue to focus on developing dynamic pricing capabilities, enhancing customer experience, and providing compliance expertise as these are critical to convert customers from traditional catalog channels to digital. Workplace Safety primarily sells to businesses and serves many industries, including manufacturers, process industries, government, education, construction, and utilities.

Discontinued Operations

Discontinued operations include the Asia Die-Cut and European Die-Cut businesses ("Die-Cut"), which were announced as held for sale in the third and fourth quarters of fiscal 2013, respectively. In fiscal 2014, the Company entered into an agreement with LTI Flexible Products, Inc. (d/b/a Boyd Corporation) for the sale of Die-Cut. The first phase of the divestiture closed in the fourth quarter of fiscal 2014 and the second phase of the divestiture closed in the first quarter of fiscal 2015. The operating results of the Die-Cut, businesses were reflected as discontinued operations in the consolidated statements of earnings for the year ended July 31, 2015 for the second phase of the divestiture.

The Die-Cut business consisted of the manufacture and sale of precision converted products such as gaskets, meshes, heat-dissipation materials, antennaes, dampers, filters, and similar products sold primarily to the electronics industry with a concentration in the mobile-handset and hard-disk drive industries.

Research and Development

The Company focuses its research and development ("R&D") efforts on pressure sensitive materials, printing systems and software, and it mainly supports the IDS segment. Material development involves the application of surface chemistry concepts for top coatings and adhesives applied to a variety of base materials. Systems design integrates materials, embedded software and a variety of printing technologies to form a complete solution for customer applications. In addition, the research and development team supports production and marketing efforts by providing application and technical expertise.

The Company owns patents and tradenames relating to certain products in the United States and internationally. Although the Company believes that patents are a significant driver in maintaining its position for certain products, technology in the areas covered by many of the patents continues to evolve and may limit the value of such patents. The Company's business is not dependent on any single patent or group of patents. Patents applicable to specific products extend for up to 20 years according to the date of patent application filing or patent grant, depending upon the legal term of patents in the various countries where patent protection is obtained. The Company's tradenames are valid ten years from the date of registration, and are typically renewed on an ongoing basis.

The Company spent $39.6 million, $35.8 million, and $36.7 million on its R&D activities during the fiscal years ended July 31, 2017, 2016, and 2015, respectively. The increase in R&D spending in fiscal 2017 compared to the prior year was due to increased spending on new product development, as well as increased headcount. As of July 31, 2017, 234 employees were engaged in R&D activities for the Company, an increase from 210 as of July 31, 2016.

Operations

The materials used in the products manufactured consist of a variety of plastic and synthetic films, paper, metal and metal foil, cloth, fiberglass, inks, dyes, adhesives, pigments, natural and synthetic rubber, organic chemicals, polymers, and solvents for consumable identification products in addition to electronic components, molded parts and sub-assemblies for printing systems. The Company operates coating facilities that manufacture bulk rolls of label stock for internal and external customers. In addition, the Company purchases finished products for resale.

The Company purchases raw materials, components and finished products from many suppliers. Overall, we are not dependent upon any single supplier for our most critical base materials or components; however, we have chosen in certain situations to sole source, or limit the sources of materials, components, or finished items for design or cost reasons. As a result, disruptions in supply could have an impact on results for a period of time, but we believe any disruptions would simply require qualification of new

5

suppliers and the disruption would be modest. In certain instances, the qualification process could be more costly or take a longer period of time and in rare circumstances, such as a global shortage of critical materials or components, the financial impact could be material. The Company currently operates 39 manufacturing and distribution facilities globally.

The Company carries working capital mainly related to accounts receivable and inventory. Inventory consists of raw materials, work in process and finished goods. Generally, custom products are made to order while an on-hand quantity of stock product is maintained to provide customers with timely delivery. Normal and customary payment terms range from net 10 to 90 days from date of invoice and varies by geographies.

The Company has a broad customer base, and no individual customer is 10% or more of total net sales.

Average delivery time for customer orders varies from same-day delivery to one month, depending on the type of product, customer request, and whether the product is stock or custom-designed and manufactured. The Company's backlog is not material, does not provide significant visibility for future business and is not pertinent to an understanding of the business.

Environment

Compliance with federal, state and local environmental protection laws during fiscal 2017 did not have a material impact on the Company’s business, financial condition or results of operations.

Employees

As of July 31, 2017, the Company employed approximately 6,300 individuals. Brady has never experienced a material work stoppage due to a labor dispute and considers its relations with employees to be good.

(d) Financial Information About Foreign and Domestic Operations and Export Sales

The information required by this Item is provided in Note 8 of the Notes to Consolidated Financial Statements contained in Item 8 — Financial Statements and Supplementary Data.

(e) Information Available on the Internet

The Company’s Corporate Internet address is www.bradycorp.com. The Company makes available, free of charge, on or through its Internet website copies of its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to all such reports as soon as reasonably practicable after such reports are electronically filed with or furnished to the SEC. The Company is not including the information contained on or available through its website as part of, or incorporating such information by reference into, this Annual Report on Form 10-K.

Item 1A. Risk Factors

Investors should carefully consider the risks set forth below and all other information contained in this report and other documents we file with the SEC. The risks and uncertainties described below are those that we have identified as material, but are not the only risks and uncertainties facing us. Our business is also subject to general risks and uncertainties that affect many other companies, such as market conditions, geopolitical events, changes in laws or accounting rules, fluctuations in interest rates, terrorism, wars or conflicts, major health concerns, natural disasters or other disruptions of expected economic or business conditions. Additional risks and uncertainties not currently known to us or that we currently believe are immaterial also may impair our business and financial results.

Business Risks

Failure to compete effectively or to successfully execute our strategy may have a negative impact on our business and financial results.

We actively compete with companies that produce and market the same or similar products, and in some instances, with companies that sell different products that are designed for the same end user. Competition may force us to reduce prices or incur additional costs to remain competitive in an environment in which business models are changing rapidly. We compete on the basis of price, customer support, product innovation, product offering, product quality, expertise, digital capabilities, production capabilities, and for multinational customers, our global footprint. Present or future competitors may develop and introduce new and enhanced products, offer products based on alternative technologies and processes, accept lower profit, have greater financial, technical or other resources, or have lower production costs or other pricing advantages. Any of these could put us at a disadvantage by threatening our share of sales or reducing our profit margins, which could adversely impact our business and financial results.

6

Additionally, throughout our global business, distributors and customers may seek lower cost sourcing opportunities, which could result in a loss of business that may adversely impact our business and financial results.

Our strategy is to expand into higher-growth adjacent product categories and markets with technologically advanced new products, as well as to grow our sales generated through the digital channel. While traditional direct marketing channels such as catalogs are an important means of selling our products, an increasing number of customers are purchasing products on the internet. Our strategy to increase sales through the digital channel is an investment in our internet sales capabilities. There is a risk that we may not continue to successfully implement this strategy, or if successfully implemented, not realize its expected benefits due to the continued levels of increased competition and pricing pressure brought about by the internet. Our failure to successfully implement our strategy could adversely impact our business and financial results.

Failure to develop technologically advanced products that meet customer demands, including price expectations, could adversely impact our business and financial results.

Development of technologically advanced new products is targeted as a driver of our organic growth and profitability. Technology is changing rapidly and our competitors are innovating quickly. If we do not keep pace with developing technologically advanced products, we risk product commoditization, deterioration of the value of our brand, and reduced ability to effectively compete. We must continue to develop innovative products, as well as acquire and retain the necessary intellectual property rights in these products. If we fail to make innovations, or we launch products with quality problems, or if customers do not accept our products, then our business and financial results could be adversely affected.

Our failure or the failure of third-party service providers to protect our sites, networks and systems against security breaches, or otherwise to protect our confidential information, could adversely affect our business and financial results.

Our business systems collect, maintain, transmit and store data about our customers, vendors and others, including credit card information and personally identifiable information, as well as other confidential and proprietary information. We also employ third-party service providers that store, process and transmit proprietary, personal and confidential information on our behalf. We rely on encryption and authentication technology licensed from third parties in an effort to securely transmit confidential and sensitive information, including credit card numbers. Our security measures, and those of our third-party service providers, may not detect or prevent all attempts to hack our systems, denial-of-service attacks, viruses, malicious software, break-ins, phishing attacks, social engineering, security breaches or other attacks and similar disruptions that may jeopardize the security of information stored in or transmitted by our sites, networks and systems or that we or our third-party service providers otherwise maintain.

We and our service providers may not have the resources or technical sophistication to anticipate or prevent all types of attacks, and techniques used to obtain unauthorized access to or sabotage systems change frequently and may not be known until launched against us or our third-party service providers. In addition, security breaches can also occur as a result of non-technical issues, including intentional or inadvertent breaches by our employees or by persons with whom we have commercial relationships. Although we maintain privacy, data breach and network security liability insurance, we cannot be certain that our coverage will be adequate or cover liabilities actually incurred, or that insurance will continue to be available to us on economically reasonable terms, or at all. Any compromise or breach of our security measures, or those of our third-party service providers, could adversely impact our ability to conduct business, violate applicable privacy, data security and other laws, and cause significant legal and financial exposure, adverse publicity, and a loss of confidence in our security measures, which could have an adverse effect on our business and financial results.

Demand for our products may be adversely affected by numerous factors, some of which we cannot predict or control. This could adversely affect our business and financial results.

Numerous factors may affect the demand for our products, including:

• | Future economic conditions of major markets served. |

• | Consolidation in the marketplace allowing competitors and customers to be more efficient and more price competitive. |

• | Future competitors entering the marketplace. |

• | Decreasing product life cycles. |

• | Changes in customer preferences. |

If any of these factors occur, the demand for our products could suffer, and this could adversely impact our business and financial results.

7

The loss of large customers or a significant reduction in sales to large customers could adversely affect our business and financial results.

While we have a broad customer base and no individual customer represents 10% or more of total sales, we conduct business with several large customers and distribution companies. Our dependence on these customers makes relationships with them important. We cannot guarantee that these relationships will be retained in the future. Because these large customers account for a significant portion of sales, they may possess a greater capacity to negotiate reduced prices. If we are unable to provide products to our customers at the quality and prices acceptable to them, some of our customers may shift their business to competitors or may substitute another manufacturer's products. If one of our large customers consolidates, is acquired, or loses market share, the result of that event may have an adverse impact on our business. The loss of or reduction of business from one or more of these large customers could have an adverse impact on our business and financial results.

We are a global company headquartered in the United States. We are subject to extensive regulations by U.S. and non-U.S. governmental and self-regulatory entities at various levels of the governing bodies. Failure to comply with laws and regulations could adversely affect our business and financial results.

Our operations are subject to the risks of doing business domestically and globally, including the following:

• | Delays or disruptions in product deliveries and payments in connection with international manufacturing and sales. |

• | Political and economic instability and disruptions. |

• | Imposition of duties and tariffs. |

• | Import, export and economic sanction laws. |

• | Current and changing governmental policies, regulatory, and business environments. |

• | Disadvantages from competing against companies from countries that are not subject to U.S. laws and regulations including the Foreign Corrupt Practices Act. |

• | Local labor market conditions. |

• | Regulations relating to climate change, air emissions, wastewater discharges, handling and disposal of hazardous materials and wastes. |

• | Regulations relating to health, safety and the protection of the environment. |

• | Specific country regulations where our products are manufactured or sold. |

• | Laws and regulations that apply to companies doing business with the government, including audit requirements of government contracts related to procurement integrity, export control, employment practices, and the accuracy of records and recording of costs. |

Further, these laws and regulations are constantly evolving and it is difficult to accurately predict the effect they may have upon our business and financial results.

We cannot provide assurance that our internal controls and compliance systems will always protect us from acts committed by employees, agents or business partners that would violate U.S. and/or non-U.S. laws, including the laws governing payments to government officials, bribery, fraud, anti-kickback and false claims rules, competition, export and import compliance, money laundering and data privacy. Any such improper actions could subject us to civil or criminal investigations in the U.S. and in other jurisdictions, lead to substantial civil or criminal, monetary and non-monetary penalties and related lawsuits by shareholders and others, damage our reputation, and adversely impact our business and financial results.

Failure to execute facility consolidations or maintain acceptable operational service metrics may adversely impact our business and financial results.

In prior fiscal years, we incurred unplanned operating costs related to the consolidation of certain facilities and we experienced a deterioration in key customer service metrics. We continually assess our global footprint and expect to implement additional measures to reduce our cost structure, simplify our business, and standardize our processes, and these actions could result in unplanned operating costs and business disruptions in the future. In addition, the Company is reliant upon certain suppliers for certain raw or finished products. If we experience service disruptions with these suppliers, or if we fail to successfully address these inefficiencies, their effects could adversely impact our business and financial results.

8

We are subject to litigation, including product liability claims that could adversely impact our business, financial results, and reputation.

We are a party to litigation that arises in the normal course of our business operations, including product warranty, product liability and recall (strict liability and negligence) claims, patent and trademark matters, contract disputes and environmental, employment and other litigation matters. We face an inherent business risk of exposure to product liability and warranty claims in the event that the use of our products is alleged to have resulted in injury or other damage. In addition, we face an inherent risk that our competitors will allege that aspects of our products infringe their intellectual property or that our intellectual property is invalid, such that we could be prevented from manufacturing and selling our products or prevented from stopping others from manufacturing and selling competing products. To date, we have not incurred material costs related to these types of claims. However, while we currently maintain insurance coverage in amounts that we believe are adequate, we cannot be sure that we will be able to maintain this insurance on acceptable terms or that this insurance will provide sufficient coverage against potential liabilities that may arise. Any claims brought against us, with or without merit, may have an adverse effect on our business, financial results and reputation as a result of potential adverse outcomes. The expenses associated with defending such claims and the diversion of our management’s resources and time may have an adverse effect on our business and financial results.

We depend on key employees and the loss of these individuals could have an adverse effect on our business and financial results.

Our success depends to a large extent upon the continued services of our key executives, managers and other skilled employees. We cannot ensure that we will be able to retain our key executives, managers and employees. The departure of key personnel without adequate replacement could disrupt our business operations. Additionally, we need qualified managers and skilled employees with technical and industry experience to operate our business successfully. If we are unable to attract and retain qualified individuals or our costs to do so increase significantly, our business and financial results could be adversely affected.

Divestitures, contingent liabilities from divested businesses and the failure to properly identify, integrate and grow acquired companies could adversely affect our business and financial results.

We continually assess the strategic fit of our existing businesses and may divest businesses that we determine do not align with our strategic plan, or that are not achieving the desired return on investment. For example, during fiscal years 2014 and 2015, we divested our Asian Die-Cut and European Die-Cut businesses. Divestitures pose risks and challenges that could negatively impact our business. When we decide to sell a business or assets, we may be unable to do so on satisfactory terms and within our anticipated time-frame, and even after reaching a definitive agreement to sell a business, the sale is typically subject to pre-closing conditions which may not be satisfied. In addition, the impact of the divestiture on our revenue and net earnings may be larger than projected, which could distract management, and disputes may arise with buyers. We have retained responsibility for and have agreed to indemnify buyers against certain contingent liabilities related to a number of businesses that we have sold. The resolution of these contingencies has not had a material adverse impact on our financial results, but we cannot be certain that this favorable pattern will continue.

Our historical growth has included acquisitions, and our future growth strategy may include acquisitions. If our future growth strategy includes a focus on acquisitions, we may not be able to identify acquisition targets or successfully complete acquisitions due to the absence of quality companies in our target markets, economic conditions, or price expectations from sellers. Acquisitions place significant demands on management, operational, and financial resources. Future acquisitions will require integration of operations, sales and marketing, information technology, and administrative operations, which could decrease the time available to focus on our other growth strategies. We cannot assure that we will be able to successfully integrate acquisitions, that these acquisitions will operate profitably, or that we will be able to achieve the desired sales growth or operational success. Our business and financial results could be adversely affected if we do not successfully integrate the newly acquired businesses, or if our other businesses suffer due to the increased focus on the acquired businesses.

Financial/Ownership Risks

The global nature of our business exposes us to foreign currency fluctuations that could adversely affect our business and financial results.

Approximately 45% of our sales are derived outside the United States. Sales and purchases in currencies other than the U.S. dollar expose us to fluctuations in foreign currencies relative to the U.S. dollar, and may adversely affect our financial results. Increased strength of the U.S. dollar will increase the effective price of our products sold in currencies other than U.S. dollars into other countries. Decreased strength of the U.S. dollar could adversely affect the cost of materials, products, and services purchased overseas. Our sales and expenses are translated into U.S. dollars for reporting purposes, and the strengthening or weakening of

9

the U.S. dollar could result in unfavorable translation effects, which occurred during fiscal years 2015, 2016 and 2017. In addition, certain of our subsidiaries may invoice customers in a currency other than its functional currency or may be invoiced by suppliers in a currency other than its functional currency, which could result in unfavorable translation effects on our business and financial results.

Changes in tax legislation or tax rates could adversely affect results of operations and financial statements. Additionally, audits by taxing authorities could result in tax payments for prior periods.

We are subject to income taxes in the U.S. and in many non-U.S. jurisdictions. As such, our earnings are subject to risk due to changing tax laws and tax rates around the world. At any point in time, there are a number of tax proposals at various stages of legislation throughout the globe. While it is impossible for us to predict whether some or all of these proposals will be enacted, it likely would have an impact on our earnings.

Our tax filings are subject to audit by U.S. federal, state and local tax authorities and by non-U.S. tax authorities. If these audits result in payments or assessments that differ from our reserves, our future net earnings may be adversely impacted.

We review the probability of the realization of our deferred tax assets quarterly based on forecasts of taxable income in both the U.S. and foreign jurisdictions. As part of this review, we utilize historical results, projected future operating results, eligible carry-forward periods, tax planning opportunities, and other relevant considerations. Adverse changes in profitability and financial outlook in both the U.S. and/or foreign jurisdictions, or changes in our geographic footprint may require changes in the valuation allowances for deferred tax assets. Such changes could result in a material impact on earnings. Our annual cash needs could require us to repatriate cash to the U.S. from foreign jurisdictions, which may result in tax charges. Potential tax reform discussed by the U.S. administration, such as reducing the corporate income tax rate, adopting a border-adjustability tax system, or changing the repatriation and taxation of foreign earnings, may impact income tax expenses, deferred tax assets in the U.S. and tax liability balances.

Failure to execute our strategies could result in impairment of goodwill or other intangible assets, which may negatively impact earnings and profitability.

We have goodwill of $437.7 million and other intangible assets of $53.1 million as of July 31, 2017, which represents 46.7% of our total assets. In fiscal year 2015, the Company recorded impairment charges of approximately $46.9 million primarily related to the goodwill and other intangible assets of multiple reporting units. We evaluate goodwill and other intangible assets for impairment on an annual basis, or more frequently if impairment indicators are present, based upon the fair value of each respective asset. These valuations include management's estimates of sales, profitability, cash flow generation, capital structure, cost of debt, interest rates, capital expenditures, and other assumptions. Significant negative industry or economic trends, disruptions to our business, inability to achieve sales projections or cost savings, inability to effectively integrate acquired businesses, unexpected significant changes or planned changes in use of the assets or in entity structure, and divestitures may adversely impact the assumptions used in the valuations. If the estimated fair value of our goodwill or other intangible assets change in future periods, we may be required to record an impairment charge, which would reduce the earnings in such period.

Substantially all of our voting stock is controlled by members of the Brady family, while our public investors hold non-voting stock. The interests of the voting and non-voting shareholders could differ, potentially resulting in decisions that unfavorably affect the value of the non-voting shares.

Substantially all of our voting stock is controlled by Elizabeth P. Bruno, one of our Directors, and William H. Brady III, both of whom are descendants of the Company's founder. All of our publicly traded shares are non-voting. Therefore, Ms. Bruno and Mr. Brady have control in most matters requiring approval or acquiescence by shareholders, including the composition of our Board of Directors and many corporate actions. Such concentration of ownership may discourage a potential acquirer from making a purchase offer that our public shareholders may find favorable, which in turn could adversely affect the market price of our common stock or prevent our shareholders from realizing a premium over our stock price. Certain mutual funds and index sponsors have implemented rules restricting ownership, or excluding from indices, companies with non-voting publicly traded shares. Furthermore, this concentration of voting share ownership may adversely affect the trading price for our non-voting common stock because investors may perceive disadvantages in owning stock in companies whose voting stock is controlled by a limited number of shareholders.

10

Failure to meet certain financial covenants required by our debt agreements may adversely affect our business and financial results.

As of July 31, 2017, we had $107.8 million in outstanding indebtedness. In addition, based on the availability under our credit facilities as of July 31, 2017, we had the ability to borrow an additional $244.6 million under our revolving credit agreement. Our current revolving credit agreement and long-term debt obligations also impose certain restrictions on us. Refer to Management's Discussion and Analysis of Financial Condition and Results of Operations ("MD&A") within Item 7 for more information regarding our credit agreement and long-term debt obligations. If we breach any of these restrictions or covenants and do not obtain a waiver from the lenders then, subject to applicable cure periods, the outstanding indebtedness and any other indebtedness with cross-default provisions could be declared immediately due and payable, which could adversely affect our financial results.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

The Company currently operates 39 manufacturing and distribution facilities across the globe and are split by reporting segment as follows:

IDS: Thirty manufacturing and distribution facilities are used for our IDS business. Five are located in the United States; four each in Belgium and China; three each in Mexico and the United Kingdom; two in Brazil; and one each in Canada, Germany, Hong Kong, India, Japan, Malaysia, Netherlands, Singapore, and South Africa.

WPS: Nine manufacturing and distribution facilities are used for our WPS business. Three are located in France; two are located in Australia; and one each in Germany, Sweden, the United Kingdom, and the United States.

The Company’s present operating facilities contain a total of approximately 2.1 million square feet of space, of which approximately 1.5 million square feet is leased. The Company believes that its equipment and facilities are modern, well maintained, and adequate for present needs.

Item 3. Legal Proceedings

The Company is, and may in the future be, party to litigation arising in the normal course of business. The Company is not currently a party to any material pending legal proceedings in which management believes the ultimate resolution would have a material effect on the Company’s consolidated financial statements.

Item 4. Mine Safety Disclosures

Not applicable.

11

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

(a) | Market Information |

Brady Corporation Class A Nonvoting Common Stock trades on the New York Stock Exchange under the symbol BRC. The following table sets forth the range of high and low daily closing sales prices for the Company’s Class A stock as reported on the New York Stock Exchange for each of the quarters in the fiscal years ended July 31:

2017 | 2016 | 2015 | ||||||||||||||||||||||

High | Low | High | Low | High | Low | |||||||||||||||||||

4th Quarter | $ | 39.80 | $ | 33.05 | $ | 32.68 | $ | 26.29 | $ | 26.76 | $ | 23.15 | ||||||||||||

3rd Quarter | $ | 39.75 | $ | 35.10 | $ | 27.82 | $ | 21.13 | $ | 28.91 | $ | 26.03 | ||||||||||||

2nd Quarter | $ | 39.45 | $ | 32.55 | $ | 26.39 | $ | 20.84 | $ | 27.56 | $ | 23.50 | ||||||||||||

1st Quarter | $ | 35.36 | $ | 31.86 | $ | 24.29 | $ | 19.52 | $ | 27.07 | $ | 21.19 | ||||||||||||

There is no trading market for the Company’s Class B Voting Common Stock.

(b) | Holders |

As of August 31, 2017, there were 1,091 Class A Common Stock shareholders of record and approximately 9,000 beneficial shareholders. There are three Class B Common Stock shareholders.

(c) | Issuer Purchases of Equity Securities |

The Company has a share repurchase program of the Company’s Class A Nonvoting Common Stock. The plan may be implemented by purchasing shares in the open market or in privately negotiated transactions, with repurchased shares available for use in connection with the Company’s stock-based plans and for other corporate purposes. The Company did not repurchase any shares during the three months ended July 31, 2017. As of July 31, 2017, there were 2,000,000 shares authorized to purchase in connection with this share repurchase program.

(i) | Dividends |

The Company has historically paid quarterly dividends on outstanding common stock. Before any dividend may be paid on the Class B Common Stock, holders of the Class A Common Stock are entitled to receive an annual, noncumulative cash dividend of $0.01665 per share (subject to adjustment in the event of future stock splits, stock dividends or similar events involving shares of Class A Common Stock). Thereafter, any further dividend in that fiscal year must be paid on all shares of Class A Common Stock and Class B Common Stock on an equal basis. The Company believes that based on its historic dividend practice, this requirement will not impede it in following a similar dividend practice in the future.

During the two most recent fiscal years and for the first quarter of fiscal 2018, the Company declared the following dividends per share on its Class A and Class B Common Stock for the years ended July 31:

2018 | 2017 | 2016 | ||||||||||||||||||||||||||||||||||

1st Qtr | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | ||||||||||||||||||||||||||||

Class A | $ | 0.2075 | $ | 0.2050 | $ | 0.2050 | $ | 0.2050 | $ | 0.2050 | $ | 0.2025 | $ | 0.2025 | $ | 0.2025 | $ | 0.2025 | ||||||||||||||||||

Class B | 0.19085 | 0.18835 | 0.2050 | 0.2050 | 0.2050 | 0.18585 | 0.2025 | 0.2025 | 0.2025 | |||||||||||||||||||||||||||

12

(e) | Common Stock Price Performance Graph |

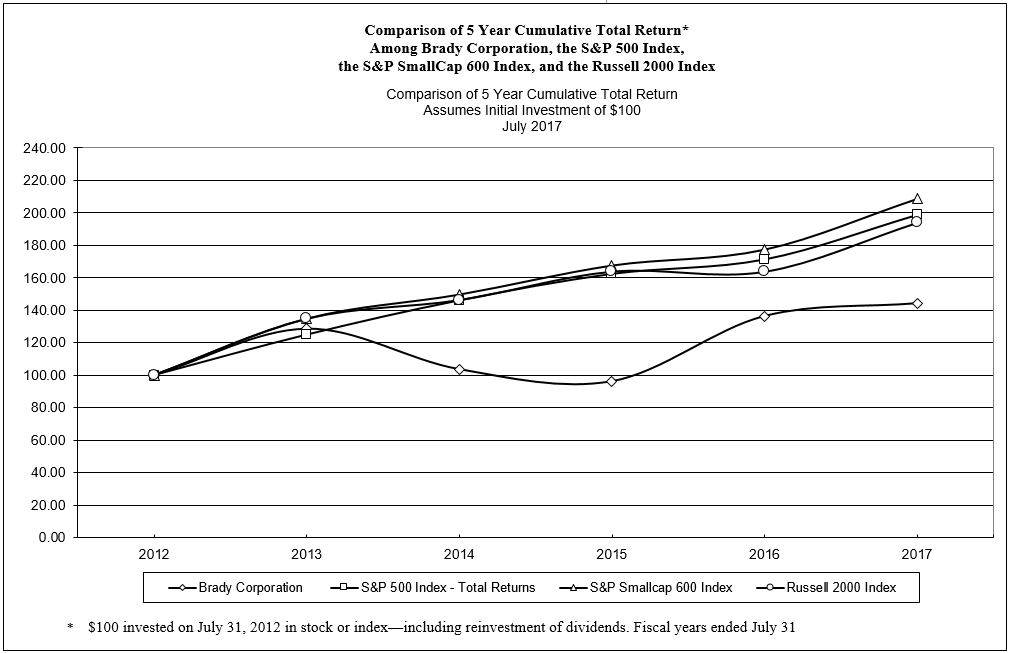

The graph below shows a comparison of the cumulative return over the last five fiscal years had $100 been invested at the close of business on July 31, 2012, in each of Brady Corporation Class A Common Stock, the Standard & Poor’s (S&P) 500 Index, the Standard and Poor’s SmallCap 600 Index, and the Russell 2000 Index.

2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |||||||||||||||||||

Brady Corporation | $ | 100.00 | $ | 128.44 | $ | 103.69 | $ | 96.32 | $ | 136.20 | $ | 144.05 | ||||||||||||

S&P 500 Index | 100.00 | 125.00 | 146.17 | 162.55 | 171.46 | 198.97 | ||||||||||||||||||

S&P SmallCap 600 Index | 100.00 | 134.78 | 149.65 | 167.57 | 177.38 | 208.71 | ||||||||||||||||||

Russell 2000 Index | 100.00 | 134.76 | 146.30 | 163.89 | 163.79 | 194.01 | ||||||||||||||||||

Copyright (C) 2017, Standard & Poor’s, Inc. and Russell Investments. All rights reserved.

13

Item 6. Selected Financial Data

CONSOLIDATED STATEMENTS OF INCOME AND SELECTED FINANCIAL DATA

Years Ended July 31, 2013 through 2017

2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||

(In thousands, except per share amounts) | ||||||||||||||||||||

Operating data (1) | ||||||||||||||||||||

Net sales | $ | 1,113,316 | $ | 1,120,625 | $ | 1,171,731 | $ | 1,225,034 | $ | 1,157,792 | ||||||||||

Gross margin | 558,292 | 558,773 | 558,432 | 609,564 | 609,348 | |||||||||||||||

Operating expenses: | ||||||||||||||||||||

Research and development | 39,624 | 35,799 | 36,734 | 35,048 | 33,552 | |||||||||||||||

Selling, general and administrative | 387,653 | 405,096 | 422,704 | 452,164 | 427,858 | |||||||||||||||

Restructuring charges (2) | — | — | 16,821 | 15,012 | 26,046 | |||||||||||||||

Impairment charges (3) | — | — | 46,867 | 148,551 | 204,448 | |||||||||||||||

Total operating expenses | 427,277 | 440,895 | 523,126 | 650,775 | 691,904 | |||||||||||||||

Operating income (loss) | 131,015 | 117,878 | 35,306 | (41,211 | ) | (82,556 | ) | |||||||||||||

Other income (expense): | ||||||||||||||||||||

Investment and other income (expense) —net | 1,121 | (709 | ) | 845 | 2,402 | 3,523 | ||||||||||||||

Interest expense | (5,504 | ) | (7,824 | ) | (11,156 | ) | (14,300 | ) | (16,641 | ) | ||||||||||

Net other expense | (4,383 | ) | (8,533 | ) | (10,311 | ) | (11,898 | ) | (13,118 | ) | ||||||||||

Earnings (loss) from continuing operations before income taxes | 126,632 | 109,345 | 24,995 | (53,109 | ) | (95,674 | ) | |||||||||||||

Income tax expense (benefit) (4) | 30,987 | 29,235 | 20,093 | (4,963 | ) | 42,583 | ||||||||||||||

Earnings (loss) from continuing operations | $ | 95,645 | $ | 80,110 | $ | 4,902 | $ | (48,146 | ) | $ | (138,257 | ) | ||||||||

(Loss) Earnings from discontinued operations, net of income taxes (5) | — | — | (1,915 | ) | 2,178 | (16,278 | ) | |||||||||||||

Net earnings (loss) | $ | 95,645 | $ | 80,110 | $ | 2,987 | $ | (45,968 | ) | $ | (154,535 | ) | ||||||||

Earnings (loss) from continuing operations per Common Share— (Diluted): | ||||||||||||||||||||

Class A nonvoting | $ | 1.84 | $ | 1.58 | $ | 0.10 | $ | (0.93 | ) | $ | (2.70 | ) | ||||||||

Class B voting | $ | 1.83 | $ | 1.56 | $ | 0.08 | $ | (0.95 | ) | $ | (2.71 | ) | ||||||||

(Loss) Earnings from discontinued operations per Common Share - (Diluted): | ||||||||||||||||||||

Class A nonvoting | $ | — | $ | — | $ | (0.04 | ) | $ | 0.04 | $ | (0.32 | ) | ||||||||

Class B voting | $ | — | $ | — | $ | (0.04 | ) | $ | 0.05 | $ | (0.32 | ) | ||||||||

Cash Dividends on: | ||||||||||||||||||||

Class A common stock | $ | 0.82 | $ | 0.81 | $ | 0.80 | $ | 0.78 | $ | 0.76 | ||||||||||

Class B common stock | $ | 0.80 | $ | 0.79 | $ | 0.78 | $ | 0.76 | $ | 0.74 | ||||||||||

Balance Sheet at July 31: | ||||||||||||||||||||

Total assets | $ | 1,050,223 | $ | 1,043,964 | $ | 1,062,897 | $ | 1,253,665 | $ | 1,438,683 | ||||||||||

Long-term obligations, less current maturities | 104,536 | 211,982 | 200,774 | 159,296 | 201,150 | |||||||||||||||

Stockholders’ investment | 700,140 | 603,598 | 587,688 | 733,076 | 830,797 | |||||||||||||||

Cash Flow Data: | ||||||||||||||||||||

Net cash provided by operating activities | $ | 144,032 | $ | 138,976 | $ | 93,348 | $ | 93,420 | $ | 143,503 | ||||||||||

Net cash (used in) provided by investing activities | (15,253 | ) | (15,416 | ) | (14,365 | ) | 10,207 | (325,766 | ) | |||||||||||

Net cash used in financing activities | (136,241 | ) | (99,576 | ) | (32,152 | ) | (115,387 | ) | (33,060 | ) | ||||||||||

Depreciation and amortization | 27,303 | 32,432 | 39,458 | 44,598 | 48,725 | |||||||||||||||

Capital expenditures | (15,167 | ) | (17,140 | ) | (26,673 | ) | (43,398 | ) | (35,687 | ) | ||||||||||

14

(1) | Operating data has been impacted by the reclassification of the Die-Cut businesses into discontinued operations in fiscal years 2013, 2014, and 2015. The Company has elected to not separately disclose the cash flows related to discontinued operations. Refer to Note 13 within Item 8 for further information on discontinued operations. The operating data is also impacted by acquisitions with one acquisition being completed in the fiscal year ended July 31, 2013. There were no acquisitions in fiscal years 2017, 2016, 2015, or 2014. |

(2) | During fiscal 2013, the Company executed a business simplification project which included various measures to address its cost structure and resulted in restructuring charges during fiscal 2013 and into fiscal 2014. In addition, in fiscal 2014, the Company approved a plan to consolidate facilities in the Americas, Europe, and Asia in order to enhance customer service, improve efficiency of operations, and reduce operating expenses. This plan resulted in restructuring charges during fiscal 2014 and fiscal 2015. |

(3) | The Company recognized impairment charges of $46.9 million, $148.6 million, and $204.4 million during the fiscal years ended July 31, 2015, 2014, and 2013, respectively. The impairment charges primarily related to the following reporting units: WPS Americas and WPS APAC in fiscal 2015; People ID in fiscal 2014; and WPS Americas and IDS APAC in fiscal 2013. |

(4) | Fiscal 2015 was significantly impacted by the impairment charges of $46.9 million, of which $39.8 million was non-deductible for income tax purposes. Fiscal 2014 was significantly impacted by the impairment charges of $148.6 million, of which $61.1 million was non-deductible for income tax purposes. Fiscal 2013 was significantly impacted by the impairment charges of $204.4 million, of which $168.9 million was non-deductible for income tax purposes, as well as a tax charge of $26.6 million associated with the funding of the Precision Dynamics Corporation ("PDC") acquisition. |

(5) | The Die-Cut business was sold in two phases. The first phase closed in the fourth quarter of fiscal 2014 and the second and final phase closed in the first quarter of fiscal 2015. The loss from discontinued operations in fiscal 2015 includes a $0.4 million net loss on the sale of the Die-Cut business, recorded during the three months ended October 31, 2014. The earnings from discontinued operations in fiscal 2014 include a $1.2 million net loss on the sale of the Die-Cut business recorded during the three months ended July 31, 2014. The loss from discontinued operations in fiscal 2013 was primarily attributable to a $15.7 million write-down of the Die-Cut business to its estimated fair value less costs to sell. Refer to Note 13 within Item 8 for further information regarding discontinued operations. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

We are a global manufacturer and supplier of identification solutions and workplace safety products that identify and protect premises, products and people. The IDS segment is primarily involved in the design, manufacture, and distribution of high-performance and innovative identification and healthcare products. The WPS segment provides workplace safety and compliance products, half of which are internally manufactured and half are externally sourced. Approximately 45% of our total sales are derived outside of the United States. Foreign sales within the IDS and WPS segments are approximately 35% and 65%, respectively.

The ability to provide customers with a broad range of proprietary, customized and diverse products for use in various applications across multiple customers and geographies, along with a commitment to quality and service, have made Brady a leader in many of its markets. The long-term sales growth and profitability of our segments will depend not only on improved demand in end markets and the overall economic environment, but also on our ability to continuously improve operational excellence, focus on the customer, develop and market innovative new products, and to advance our digital capabilities. In our IDS business, our strategy for growth includes an increased focus on key customers, industries and products and improving the efficiency and effectiveness of the research and development ("R&D") function. In our WPS business, our strategy for growth includes a focus on workplace safety critical industries, innovative new product offerings, compliance expertise, and improving our digital capabilities.

15

Results of Operations

A comparison of results of operating income from continuing operations for the fiscal years ended July 31, 2017, 2016, and 2015 is as follows:

(Dollars in thousands) | 2017 | % Sales | 2016 | % Sales | 2015 | % Sales | |||||||||||||||

Net sales | $ | 1,113,316 | $ | 1,120,625 | $ | 1,171,731 | |||||||||||||||

Gross margin | 558,292 | 50.1 | % | 558,773 | 49.9 | % | 558,432 | 47.7 | % | ||||||||||||

Operating expenses: | |||||||||||||||||||||

Research and development | 39,624 | 3.6 | % | 35,799 | 3.2 | % | 36,734 | 3.1 | % | ||||||||||||

Selling, general & administrative | 387,653 | 34.8 | % | 405,096 | 36.1 | % | 422,704 | 36.1 | % | ||||||||||||

Restructuring charges | — | — | % | — | — | % | 16,821 | 1.4 | % | ||||||||||||

Impairment charges | — | — | % | — | — | % | 46,867 | 4.0 | % | ||||||||||||

Total operating expenses | 427,277 | 38.4 | % | 440,895 | 39.3 | % | 523,126 | 44.6 | % | ||||||||||||

Operating income | $ | 131,015 | 11.8 | % | $ | 117,878 | 10.5 | % | $ | 35,306 | 3.0 | % | |||||||||

References in this Form 10-K to “organic sales” refer to sales from continuing operations calculated in accordance with U.S. GAAP, excluding the impact of foreign currency translation. The Company’s organic sales disclosures exclude the effects of foreign currency translation as foreign currency translation is subject to volatility that can obscure underlying business trends. Management believes that the non-GAAP financial measure of organic sales is meaningful to investors as it provides them with useful information to aid in identifying underlying sales trends in our businesses and facilitating comparisons of our sales performance with prior periods.

In fiscal 2017, sales decreased 0.7% to $1,113.3 million, compared to $1,120.6 million in fiscal 2016, which consisted of organic sales growth of 0.5% and a negative foreign currency impact of 1.2% due to the strengthening of the U.S. dollar against certain other major currencies during the year. Organic sales grew 1.6% in the IDS segment and declined 2.0% in the WPS segment. The IDS segment realized sales growth in the Product ID and Wire ID product lines, partially offset by sales declines in the Healthcare ID product line. Catalog sales in the WPS segment declined, but were partially offset by sales growth in the digital channel.

During fiscal 2016, net sales decreased 4.4% from fiscal 2015, which consisted of an organic sales decline of 0.7% and a negative currency impact of 3.7% due to the strengthening of the U.S. dollar against certain other major currencies during the year. Organic sales declined in both the IDS and WPS segments in fiscal 2016 compared to fiscal 2015. The IDS segment experienced sales declines in the Wire ID and Safety and Facility ID product lines, which were partially offset by sales growth in the Product ID and Healthcare ID product lines. Catalog sales in the WPS segment declined, but were partially offset by sales growth in the digital channel.

Gross margin declined 0.1% to $558.3 million in fiscal 2017 from $558.8 million in fiscal 2016. As a percentage of sales, gross margin increased to 50.1% in fiscal 2017 from 49.9% in fiscal 2016. The increase in gross margin percentage was primarily due to our on-going efforts to streamline manufacturing processes and drive operational efficiencies in manufacturing facilities. These efforts resulted in reduced material and labor costs compared to the same periods in the prior year.

Gross margin increased 0.1% to $558.8 million in fiscal 2016 from $558.4 million in fiscal 2015. As a percentage of sales, gross margin increased to 49.9% in fiscal 2016 from 47.7% in fiscal 2015. In fiscal 2015 we incurred on-going costs related to facility consolidation activities primarily in our Americas region which reduced our gross margin percentage to below historical normal levels. These facility consolidation activities were completed during fiscal 2015, therefore the increase in gross margin percentage in 2016 was primarily due to our on-going efforts to enhance operational efficiencies in the newly consolidated facilities.

Research and development expenses increased to $39.6 million in fiscal 2017 from $35.8 million in fiscal 2016. The increase in R&D spending in fiscal 2017 compared to the prior year was primarily due to the hiring of R&D personnel as well as increased spending on printing and software solutions projects within our IDS businesses.

Research and development expenses decreased to $35.8 million in fiscal 2016 from $36.7 million in fiscal 2015. The decrease in R&D spending in fiscal 2016 compared to the prior year was primarily due to efficiency gains within the R&D function and the strengthening of the U.S. dollar, which were partially offset by an increase in our investment in new product development within the IDS segment to drive organic growth.

16

Selling, general and administrative expenses ("SG&A") include selling costs directly attributed to the IDS and WPS segments, as well as certain other expenses including finance, information technology, human resources, and other administrative expenses. SG&A expenses decreased 4.3% to $387.7 million in fiscal 2017 compared to $405.1 million in fiscal 2016. The decrease in SG&A expense from the prior year was primarily due to reduced selling expenses from efficiency gains, continued efforts to control general and administrative costs, and foreign currency translation. These reductions were partially offset by increases in incentive-based compensation.

SG&A expense decreased to $405.1 million in fiscal 2016 compared to $422.7 million in fiscal 2015. The decrease in SG&A expense from the prior year was primarily due to reduced selling expenses from efficiency gains, continued efforts to control general and administrative costs, and foreign currency translation. These reductions were partially offset by increases in incentive-based compensation.

In fiscal 2014, the Company announced a restructuring plan to consolidate facilities in the Americas, Europe and Asia. The Company implemented this restructuring plan to enhance customer service, improve efficiency of our operations and reduce operating expenses. Restructuring activities related to facility consolidation activities extended into fiscal 2015 and were complete at the end of the fiscal year.

In connection with this plan, the Company incurred restructuring charges of $16.8 million in fiscal 2015. These charges consisted of $5.4 million of employee separation costs, $5.2 million of facility closure related costs, $2.0 million of contract termination costs, and $4.2 million of non-cash asset write-offs. The charges for employee separation costs consisted of severance pay, outplacement services, medical and other benefits. Non-cash asset write-offs consisted mainly of fixed assets written off in conjunction with facility consolidations. Of the $16.8 million recognized in fiscal 2015, $12.1 million was incurred within the IDS segment and $4.7 million was incurred within the WPS segment.

The Company performed its annual goodwill impairment assessment on May 1, 2017 and 2016, and subsequently concluded that the fair value of the goodwill was substantially in excess of its carrying value at 20% or greater for all of the reporting units. No impairment charges were recorded in fiscal 2017 or 2016. In conjunction with the goodwill impairment analysis, management also concluded that no other long-lived assets were impaired.

The Company's annual goodwill impairment assessment performed in fiscal 2015 indicated the WPS Americas and WPS APAC reporting units were impaired. In conjunction with the goodwill impairment analysis, management concluded that other long-lived assets were impaired. Impairment charges were $46.9 million in fiscal 2015, which consisted of $37.1 million in goodwill impairment charges associated with the WPS Americas and WPS APAC reporting units and $9.8 million related to the impairment of certain other long-lived assets.

Operating income increased to $131.0 million in fiscal 2017 compared to $117.9 million in 2016. The increase of $13.1 million in operating income was primarily due to reduced SG&A expense in both the IDS and WPS segments, as well as reductions due to foreign currency translation. The decrease in SG&A leading to the increase in operating income in fiscal 2017 was partially offset by an increase in R&D spending.

The Company generated operating income of $117.9 million in fiscal 2016. Operating income from continuing operations was $35.3 million in fiscal 2015; excluding impairment charges of $46.9 million and restructuring charges of $16.8 million, the Company generated operating income from continuing operations of $99.0 million in 2015. The increase of $18.9 million in operating income was due to the improvement in gross profit margin primarily in the IDS segment as well as reduced SG&A primarily in the WPS segment. The increase was partially offset by the negative impact of currency fluctuations.

17

OPERATING INCOME TO NET EARNINGS

(Dollars in thousands) | 2017 | % Sales | 2016 | % Sales | 2015 | % Sales | |||||||||||||||

Operating income | $ | 131,015 | 11.8 | % | $ | 117,878 | 10.5 | % | $ | 35,306 | 3.0 | % | |||||||||

Other income and (expense): | |||||||||||||||||||||

Investment and other income (expense) | 1,121 | 0.1 | % | (709 | ) | (0.1 | )% | 845 | 0.1 | % | |||||||||||

Interest expense | (5,504 | ) | (0.5 | )% | (7,824 | ) | (0.7 | )% | (11,156 | ) | (1.0 | )% | |||||||||

Earnings from continuing operations before income taxes | 126,632 | 11.4 | % | 109,345 | 9.8 | % | 24,995 | 2.1 | % | ||||||||||||

Income taxes | 30,987 | 2.8 | % | 29,235 | 2.6 | % | 20,093 | 1.7 | % | ||||||||||||

Earnings from continuing operations | 95,645 | 8.6 | % | 80,110 | 7.1 | % | 4,902 | 0.4 | % | ||||||||||||

Loss from discontinued operations, net of income taxes | — | — | % | — | — | % | (1,915 | ) | (0.2 | )% | |||||||||||

Net earnings | $ | 95,645 | 8.6 | % | $ | 80,110 | 7.1 | % | $ | 2,987 | 0.3 | % | |||||||||

Investment and Other Income

Investment and other income was $1.1 million in fiscal 2017 compared to expense of $0.7 million in fiscal 2016 and income of $0.8 million in fiscal 2015. The increase in income in 2017 compared to 2016 was primarily due to an increase in the market value of securities held in executive deferred compensation plans. The increase in expense in 2016 compared to 2015 was primarily due to a decrease in the gain on market value of securities held in deferred compensation plans and an increase in foreign currency exchange losses.

Interest Expense

Interest expense decreased to $5.5 million in fiscal 2017 compared to $7.8 million in fiscal 2016 and $11.2 million in fiscal 2015. The decline since 2015 was due to the Company's declining principal balance under its outstanding debt agreements.

Income Taxes

The Company’s effective income tax rate was 24.5% in fiscal 2017. The effective income tax rate was reduced from the statutory tax rate of 35.0% due to the generation of foreign tax credits from cash repatriations that occurred during the year and geographic profit mix, partially offset by adjustments to the reserve for uncertain tax positions.

The Company’s effective income tax rate was 26.7% in fiscal 2016. The effective income tax rate was reduced from the statutory tax rate of 35.0% due to certain adjustments to tax accruals and reserves, the generation of foreign tax credit carryforwards, research and development tax credits and the section 199 manufacturer’s deduction.

The Company’s effective income tax rate was 80.4% in fiscal 2015. The effective income tax rate was significantly impacted by impairment charges of $46.9 million recognized during the period, as $39.8 million of these charges were nondeductible for income tax purposes. The effective income tax rate was further impacted by the generation of $5.0 million of foreign tax credit carry-forwards from the fiscal 2014 income tax return and increases in uncertain tax positions recognized in fiscal 2015.

Loss from Discontinued Operations

Discontinued operations include the Asia Die-Cut and European Die-Cut businesses ("Die-Cut"), of which a portion was divested in the fourth quarter of fiscal 2014 and the remainder was divested in the first quarter of fiscal 2015. The loss from discontinued operations net of income taxes of $1.9 million in fiscal 2015 primarily related to professional fees associated with the divestiture and a $0.4 million loss on the sale of Die-Cut, recorded during the three months ended October 31, 2014.

There was no depreciation or amortization expense recognized within discontinued operations for fiscal 2015 as the Die-Cut business was reported as held for sale beginning in the third quarter of fiscal 2013, at which point the fixed assets and intangible assets of these businesses were no longer depreciated or amortized in accordance with applicable U.S. GAAP.

Business Segment Operating Results

The Company is organized and managed on a global basis within two reportable segments: ID Solutions and Workplace Safety. Effective August 1, 2016, the Company changed its internal measure of segment profit and loss that is reported to the chief operating

18

decision maker for purposes of making decisions about allocating resources to the segments and assessing its performance. Prior to August 1, 2016, administrative costs were excluded from the measure of segment profit and loss. Effective August 1, 2016, a portion of these administrative costs have been included within the IDS and WPS segments, which includes the cost of finance, information technology, human resources, and certain other administrative costs. Interest expense, investment and other income (expense), income tax expense, and certain corporate administrative expenses continue to be excluded when evaluating segment performance.

Also effective August 1, 2016, the Company realigned certain businesses between the WPS and IDS reportable segments, resulting in increased revenues and segment profit in the IDS segment and equal and offsetting declines in revenues and segment profit in the WPS segment. The Company's accompanying segment information has been restated to reflect the change in measurement of segment profit and loss and the realignment of businesses.

Following is a summary of segment information for the fiscal years ended July 31:

(Dollars in thousands) | 2017 | 2016 | 2015 | |||||||||

SALES | ||||||||||||

ID Solutions | $ | 800,392 | $ | 795,511 | $ | 826,824 | ||||||

Workplace Safety | 312,924 | 325,114 | 344,907 | |||||||||

Total | $ | 1,113,316 | $ | 1,120,625 | $ | 1,171,731 | ||||||

SALES GROWTH INFORMATION | ||||||||||||

ID Solutions | ||||||||||||

Organic | 1.6 | % | (0.7 | )% | 1.7 | % | ||||||

Currency | (1.0 | )% | (3.1 | )% | (4.2 | )% | ||||||

Total | 0.6 | % | (3.8 | )% | (2.5 | )% | ||||||

Workplace Safety | ||||||||||||

Organic | (2.0 | )% | (0.7 | )% | (0.4 | )% | ||||||

Currency | (1.7 | )% | (5.0 | )% | (8.0 | )% | ||||||

Total | (3.7 | )% | (5.7 | )% | (8.4 | )% | ||||||

Total Company | ||||||||||||

Organic | 0.5 | % | (0.7 | )% | 1.0 | % | ||||||

Currency | (1.2 | )% | (3.7 | )% | (5.4 | )% | ||||||

Total | (0.7 | )% | (4.4 | )% | (4.4 | )% | ||||||

SEGMENT PROFIT | ||||||||||||

ID Solutions | $ | 130,572 | $ | 112,276 | $ | 89,392 | ||||||

Workplace Safety | 25,554 | 30,792 | 29,344 | |||||||||

Total | $ | 156,126 | $ | 143,068 | $ | 118,736 | ||||||

SEGMENT PROFIT AS A PERCENT OF SALES | ||||||||||||

ID Solutions | 16.3 | % | 14.1 | % | 10.8 | % | ||||||

Workplace Safety | 8.2 | % | 9.5 | % | 8.5 | % | ||||||

Total | 14.0 | % | 12.8 | % | 10.1 | % | ||||||

NET EARNINGS RECONCILIATION | Years ended: | |||||||||||

(Dollars in thousands) | July 31, 2017 | July 31, 2016 | July 31, 2015 | |||||||||

Total profit from reportable segments | $ | 156,126 | $ | 143,068 | $ | 118,736 | ||||||

Unallocated costs: | ||||||||||||

Administrative costs | 25,111 | 25,190 | 19,742 | |||||||||

Restructuring charges | — | — | 16,821 | |||||||||

Impairment charges | — | — | 46,867 | |||||||||

Investment and other (income) expense | (1,121 | ) | 709 | (845 | ) | |||||||

Interest expense | 5,504 | 7,824 | 11,156 | |||||||||

Earnings from continuing operations before income taxes | $ | 126,632 | $ | 109,345 | $ | 24,995 | ||||||

19

ID Solutions

Fiscal 2017 vs. 2016

Approximately 70% of net sales in the ID Solutions segment were generated in the Americas region, 20% in EMEA, and 10% in APAC. IDS sales increased 0.6% to $800.4 million in fiscal 2017, compared to $795.5 million in fiscal 2016. Organic sales increased 1.6% and foreign currency fluctuations decreased sales by 1.0% due to the strengthening of the U.S. dollar against certain other major currencies in fiscal 2017 compared to fiscal 2016.

The IDS business in the Americas realized low-single digit organic sales growth in fiscal 2017 compared to fiscal 2016. The increase was primarily due to growth in the Wire ID product line due to increased sales of printer consumables, which were partially offset by a sales decline in the Healthcare ID product lines due to pricing pressures within certain product categories from the consolidation of group purchasing organizations. Organic sales grew in the mid-single digits in Canada, low-single digits in Mexico and Brazil, and grew slightly in the United States.

The IDS business in EMEA realized low-single digit organic sales growth in fiscal 2017 as compared to fiscal 2016. Organic sales growth in 2017 was primarily due to sales increases in the Product ID and Safety and Facility ID product lines. Organic sales growth in Western Europe was partially offset by organic sales declines in certain emerging markets due to weak demand in the oil and gas industry.

Organic sales in Asia grew in the high-single digits in fiscal 2017 compared to fiscal 2016. The IDS Asia region realized organic sales growth in both the OEM and MRO product categories in 2017 due to several new customer and project wins along with a general increase in activity within our existing customer base. Organic sales increased within all countries in the Asia region in 2017.

Segment profit increased to $130.6 million in fiscal 2017 from $112.3 million in fiscal 2016, an increase of $18.3 million or 16.3%. As a percent of sales, segment profit increased to 16.3% in fiscal 2017, compared to 14.1% in the prior year. The increase in segment profit was primarily driven by operational efficiencies in our manufacturing processes in all regions, as well as a reduction in SG&A expense due to ongoing process improvement activities.

Fiscal 2016 vs. 2015

Approximately 70% of net sales in the ID Solutions segment were generated in the Americas region, 20% in EMEA, and 10% in APAC. IDS sales decreased 3.8% to $795.5 million in fiscal 2016, compared to $826.8 million in fiscal 2015. Organic sales decreased 0.7% and currency fluctuations decreased sales by 3.1% due to the strengthening of the U.S. dollar against certain other major currencies in fiscal 2016 compared to fiscal 2015.