Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WEYERHAEUSER CO | a910158-kinvestorpresentat.htm |

0 September 10, 2015 | New York, NY Patty Bedient, Executive Vice President & Chief Financial Officer WEYERHAEUSER UBS Global Paper & Forest Products Conference

1 FORWARD-LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES This presentation contains statements that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, with respect to future prospects, business strategies, markets for our products, revenues, earnings, liquidity and uses of cash, funds available for distribution, pricing, production, supply, dividend levels, share repurchases, business priorities, performance, cost reductions, operational excellence initiatives, demand drivers, housing markets, capital structure, credit ratings, capital expenditures, and debt levels. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. We may use words such as “expect,” “anticipate,” “believe,” “could,” would,” “will,” “forecast,” “estimate,” “outlook,” “goal,” “plan,” “target,” and similar terms and phrases, or we may refer to assumptions, goals or targets, to identify forward-looking statements. Forward-looking statements are made based on management’s current expectations and assumptions concerning future events. These are inherently subject to uncertainties and factors relating to our operations and business environment that are difficult to predict and often beyond the company’s control. Many factors could cause actual results to differ materially from those expressed or implied in these forward-looking statements. See the risk factors described in filings we make with the SEC, including in our annual report on Form 10-K for the year ended December 31, 2014. There is no guarantee that any of the anticipated events or results will occur or, if they occur, what effect they will have on the company’s operations or financial condition. The forward-looking statements contained herein apply only as of the date of this presentation and we do not undertake any obligation to update these forward-looking statements. Nothing on our website is included or incorporated by reference herein. Included in this presentation are certain non-GAAP financial measures which management believes complement the financial information presented in accordance with U.S. generally accepted accounting principles. Management believes such measures may be useful to investors. Our non-GAAP financial measures may not be comparable to similarly titled captions of other companies due to potential inconsistencies in the metrics of calculation. For a reconciliation of non-GAAP measures to GAAP measures see the appendices to this presentation.

2 DRIVING VALUE FOR SHAREHOLDERS Growing a Truly Great Company Portfolio: Focused Forest Products Company Performance: Operational Excellence Capital Allocation

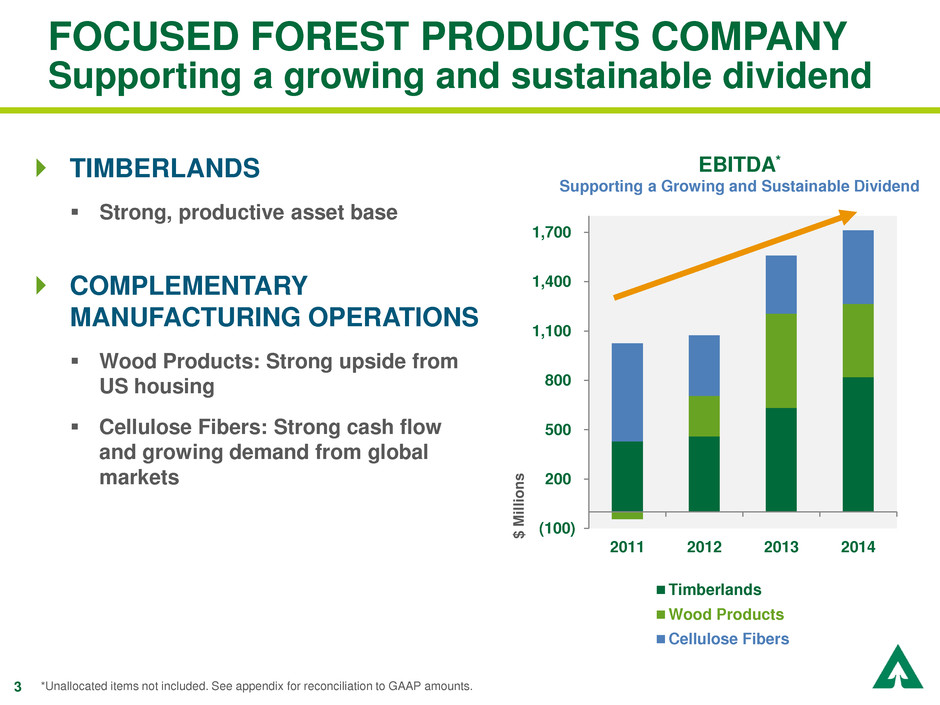

3 FOCUSED FOREST PRODUCTS COMPANY Supporting a growing and sustainable dividend TIMBERLANDS Strong, productive asset base COMPLEMENTARY MANUFACTURING OPERATIONS Wood Products: Strong upside from US housing Cellulose Fibers: Strong cash flow and growing demand from global markets (100) 200 500 800 1,100 1,400 1,700 2011 2012 2013 2014 $ M il li o n s Timberlands Wood Products Cellulose Fibers EBITDA* Supporting a Growing and Sustainable Dividend *Unallocated items not included. See appendix for reconciliation to GAAP amounts.

4 PERFORMANCE

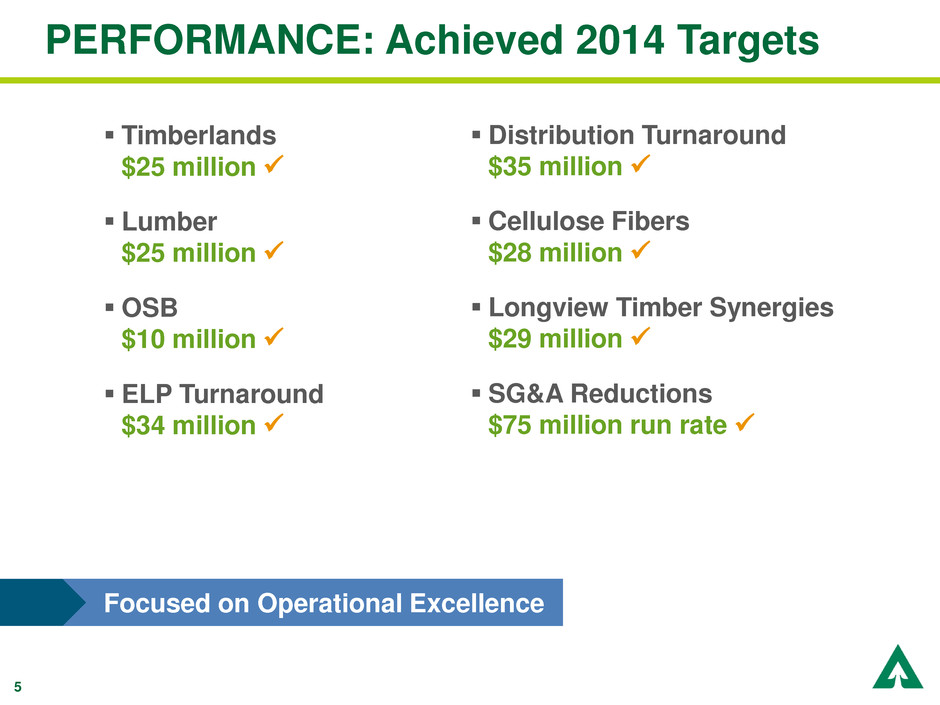

5 Distribution Turnaround $35 million Cellulose Fibers $28 million Longview Timber Synergies $29 million SG&A Reductions $75 million run rate PERFORMANCE: Achieved 2014 Targets Timberlands $25 million Lumber $25 million OSB $10 million ELP Turnaround $34 million Focused on Operational Excellence

6 TIMBERLANDS: OPX Performance OPERATIONAL EXCELLENCE 0 25 50 75 2014 2015 Goal EBITDA $ m il li o n s $50-70 MM $25 MM $20-30 MM 2015 INITIATIVES Log marketing and merchandising Cost efficiencies: harvesting, transportation, silviculture Non-timber revenue

7 TIMBERLANDS: Current Relative Performance EBITDA* / ACRE OWNED U.S. WEST EBITDA* / ACRE OWNED U.S. SOUTH Source for competitor data: public SEC filings, National Council of Real Estate Investment Fiduciaries (NCREIF). *See appendix for reconciliation to GAAP amounts. **Data for Rayonier as restated during 2014. 2011 data unavailable. ***Pope Resources results exclude significant land sales in 2014 Q3 and Q4. Including these sales, 2014 EBITDA/acre = $263. ****WY results include Longview Timber beginning in 2014. 50 100 150 200 250 2011 2012 2013 2014 2015 LTM NCREIF Rayonier** Pope Resources*** WY**** 0 20 40 60 80 2011 2012 2013 2014 2015 LTM NCREIF Rayonier** Deltic WY Plum Creek

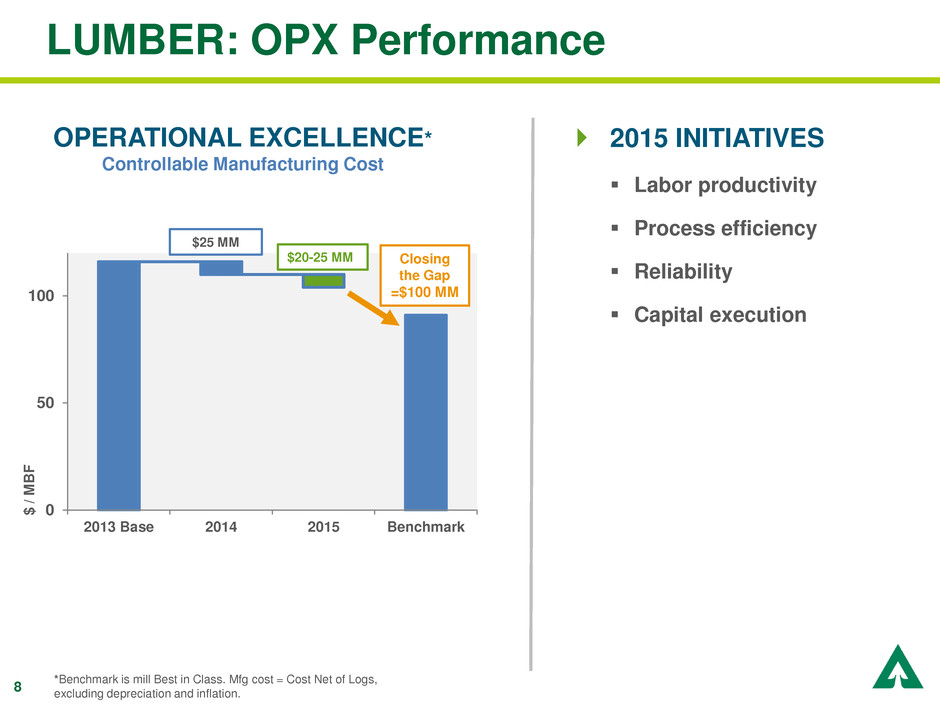

8 LUMBER: OPX Performance 2015 INITIATIVES Labor productivity Process efficiency Reliability Capital execution OPERATIONAL EXCELLENCE* Controllable Manufacturing Cost *Benchmark is mill Best in Class. Mfg cost = Cost Net of Logs, excluding depreciation and inflation. 0 50 100 2013 Base 2014 2015 Benchmark Closing the Gap =$100 MM $25 MM $20-25 MM $ / M B F

9 LUMBER: Current Relative Performance EBITDA MARGIN* Source for competitor data: public SEC filings *See appendix for reconciliation to GAAP amounts. -5% 0% 5% 10% 15% 20% 2011 2012 2013 2014 2015 YTD Q2 Canfor Lumber Interfor Lumber West Fraser Lumber WY Lumber

10 OSB: OPX Performance 2015 INITIATIVES Reliability Automation Enhanced product mix Transportation OPERATIONAL EXCELLENCE* 40 55 70 2013 Base 2014 2015 Goal *Reliability benchmark is mill Best in Class. 2013 Base = Q3 2013 YTD. % V a lu e A d d e d P rod u c t 70 85 100 2013 Base 2014 2015 Benchmark GOAL: $60 MM Improve Product Mix Improve Reliability & Controllable Cost % R e li a b il it y 2014: $10 MM 2015: $10-15 MM

11 OSB: Current Relative Performance EBITDA MARGIN* Source for competitor data: public SEC filings *See appendix for reconciliation to GAAP amounts. -10% 0% 10% 20% 30% 40% 2011 2012 2013 2014 2015 YTD Q2 Ainsworth OSB LPX OSB Norbord OSB WY OSB

12 ELP: Turnaround Performance 2015 INITIATIVES Reliability Veneer recovery Supply chain performance ELP TURNAROUND 0 50 100 150 2013 2014 2015 Continue EBITDA Improvement* $ m il li o n s $15-20 MM *See appendix for reconciliation to GAAP amounts. $34 MM improvement vs. 2013

13 ELP: Current Relative Performance EBITDA MARGIN* Source for competitor data: public SEC filings *See appendix for reconciliation to GAAP amounts. -3% 0% 3% 6% 9% 12% 15% 18% 2011 2012 2013 2014 2015 YTD Q2 Boise Wood Products LPX ELP WY ELP

14 DISTRIBUTION: Turnaround Performance 2015 INITIATIVES Warehouse efficiency Delivery cost Growth in excess of market DISTRIBUTION TURNAROUND Continue EBITDA Improvement* (50) 0 50 2013 2014 2015 $20-30 MM $ m il li o n s *See appendix for reconciliation to GAAP amounts. $35 MM improvement vs. 2013

15 DISTRIBUTION: Current Relative Performance EBITDA MARGIN* Source for competitor data: public SEC filings *See appendix for reconciliation to GAAP amounts. -10% -8% -6% -4% -2% 0% 2% 4% 2011 2012 2013 2014 2015 YTD Q2 Boise Distribution Blue Linx Distribution WY Distribution

16 CELLULOSE FIBERS: OPX Performance 2015 INITIATIVES Energy cost Reliability: predictive, preventive maintenance Liquid packaging board cost and quality OPERATIONAL EXCELLENCE 0 50 100 2014 2015 Goal Reduce Controllable Cost* $ m il li o n s $100 MM *Cost of Goods Sold, excluding inflation. $28 MM $30-35 MM

17 CELLULOSE FIBERS: Current Relative Performance EBITDA MARGIN* Source for competitor data: public SEC filings *See appendix for reconciliation to GAAP amounts. **Rayonier reflects Rayonier Performance Fibers segment for 2011-2013 and Rayonier Advanced Materials for 2014. 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 2011 2012 2013 2014 2015 YTD Q2 Canfor Mercer Rayonier** WY CF

18 CAPITAL ALLOCATION

19 CAPITAL ALLOCATION PRIORITIES Return cash to shareholders Invest in our businesses Maintain appropriate capital structure

20 QUARTERLY DIVIDEND Increased by 7% to $0.31 per common share effective 2015 Q3 Up 107% since 2011 PAYOUT GUIDELINE 75% of Funds Available for Distribution (FAD) over the cycle* RETURNING CASH TO SHAREHOLDERS: Sustainable and Growing Dividend *Funds Available for Distribution: cash flow before major acquisitions and dispositions and financing activities including dividends INCREASING QUARTERLY DIVIDEND PER SHARE +13% +18% +10% +32% +7% $ $0.15 $0.17 $0.20 $0.22 $0.29 $0.31 2011 Q1 2012 Q4 2013 Q2 2013 Q3 2014 Q3 2015 Q3

21 $1.2 BILLION APPROVED OUR PROGRESS AUG 2014 → 2Q 2015 $700 MILLION PROGRAM Authorized August 2014 $610 MILLION Over 18 million shares repurchased ADDITIONAL $500 MILLION Authorized August 2015 RETURNING CASH TO SHAREHOLDERS: Share Repurchase

22 INVESTING IN OUR BUSINESSES Disciplined capital investment Focus: reduce cost structure and improve EBITDA 2015 CapEx approximating DD&A (approx. $500 million) Opportunistic growth through acquisition Targeted, value-creating opportunities Responsible stewards of capital

23 MAINTAIN APPROPRIATE CAPITAL STRUCTURE Liquidity Long-term debt of approximately $4.9 billion as of 2015 Q2 Investment grade rating

24 SUMMARY Focused forest products company Improving performance Delivering on priorities for capital allocation Growing earnings and shareholder value

25 APPENDIX

26 TIMBERLANDS: Ownership PACIFIC NORTHWEST Largest timberland holder in region 2.6 million acres west of Cascade mountains Douglas fir domestic and export value U.S. SOUTH More than four million acres Primarily Southern yellow pine URUGUAY More than 300,000 acres Loblolly pine and eucalyptus Scale, Expertise and Geographic Diversity Create Competitive Advantage U.S. SOUTH U.S. WEST

27 WOOD PRODUCTS 18 LUMBER MILLS 4.7 billion board feet capacity 6 OSB MILLS 3.0 billion square feet capacity 6 ELP MILLS 21 DISTRIBUTION CENTERS 3 VENEER / PLYWOOD SUPPLY FACILITIES

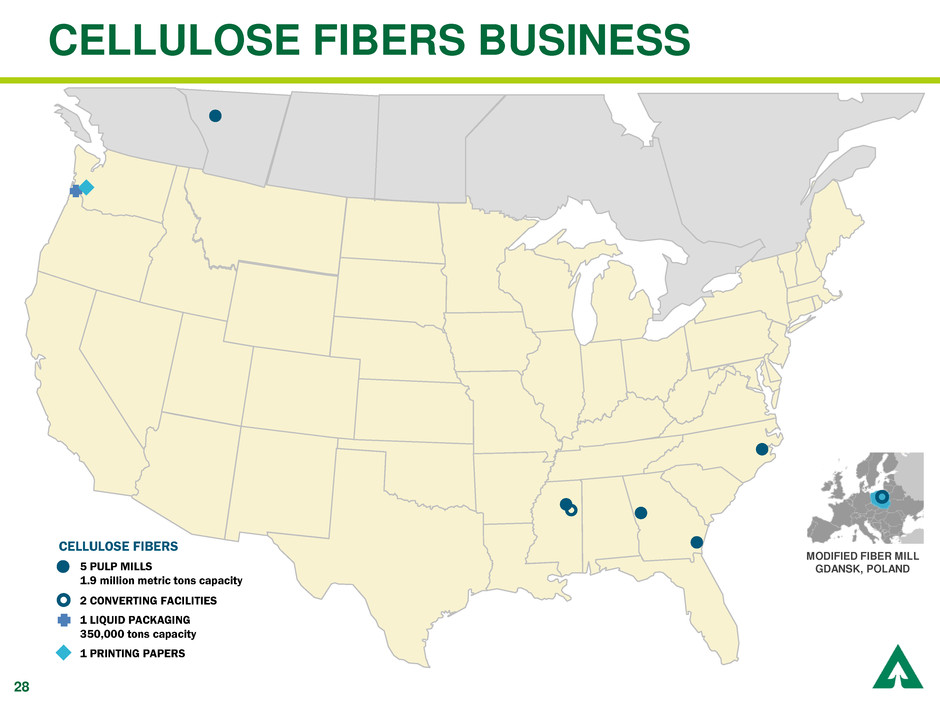

28 CELLULOSE FIBERS BUSINESS 5 PULP MILLS 1.9 million metric tons capacity 2 CONVERTING FACILITIES 1 LIQUID PACKAGING 350,000 tons capacity 1 PRINTING PAPERS CELLULOSE FIBERS MODIFIED FIBER MILL GDANSK, POLAND

29 SIGNIFICANT RUNWAY AHEAD US housing market improving Anticipate approximately 1.1 million starts in 2015 Single-family recovery underway US housing starts remain well below trend Demand for logs and wood products rises as housing strengthens Growing global demand for fluff products driven primarily by emerging countries

30 HOUSING RECOVERS TO TREND 0.0 0.5 1.0 1.5 2.0 2.5 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 *RISI *John Burns *Global Insight Total U.S. Housing Starts (Seasonally Adjusted Annual Rate) Source: Census Forecast* The Harvard Joint Center for Housing Studies forecasts trend (2018 and beyond) housing starts ranging between 1.5 and 1.7 million units Million Units Quarterly

31 CANADIAN SUPPLY CONSTRAINTS: Benefit for Southern Lumber & Logs Anticipate decline in Canadian share of U.S. lumber market as demand recovers and Canadian production is constrained Southern pine lumber expanding Southern log price recovery still ahead US LUMBER SUPPLY SOURCES SOUTHERN LOG PRICE DELIVERED SOUTHERN AVERAGE PINE SAWLOG 0.0 5.0 10.0 15.0 20.0 25.0 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 US South Lumber Production Canadian Shipments to US B B F o f L u m b er Source: Census, WWPA, COFI Annual 20 30 40 50 60 70 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 $/ G re en T on Annual Forecast* Source: Timber Mart-South, *FEA, *RISI FEA RISI

32 0 50 100 150 200 250 1998 2000 2002 2004 2006 2008 2010 2012 2014 Single-family Multi-family (Seasonally Adjusted Annual Rate) T h o u sa n d s QuarterlySource: Bureau of Census WESTERN LOG PRICES: Positive Outlook WESTERN LOG PRICE DELIVERED DOUGLAS FIR #2 RESIDENTIAL BUILDING PERMITS FOR CALIFORNIA California: Single-family housing starts 60% below normalized levels China: Increasing demand for industrial and interior wood driven by urbanization & rising wealth Japan & Korea: Long-term demand for wood-based housing 0 100 200 300 400 500 600 700 800 900 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 $/ M B F Annual Forecast* Source: Log Lines, *FEA, *RISI FEA RISI

33 SIGNIFICANT LEVERAGE TO PRICING TIMBERLANDS Western logs: $10/MBF ≈ $15 million Southern sawlogs: $5/ton ≈ $40 million WOOD PRODUCTS Lumber: $10/MBF ≈ $40 million OSB: $10/M3/8” ≈ $30 million CELLULOSE FIBERS $10/ADMT ≈ $20 million

34

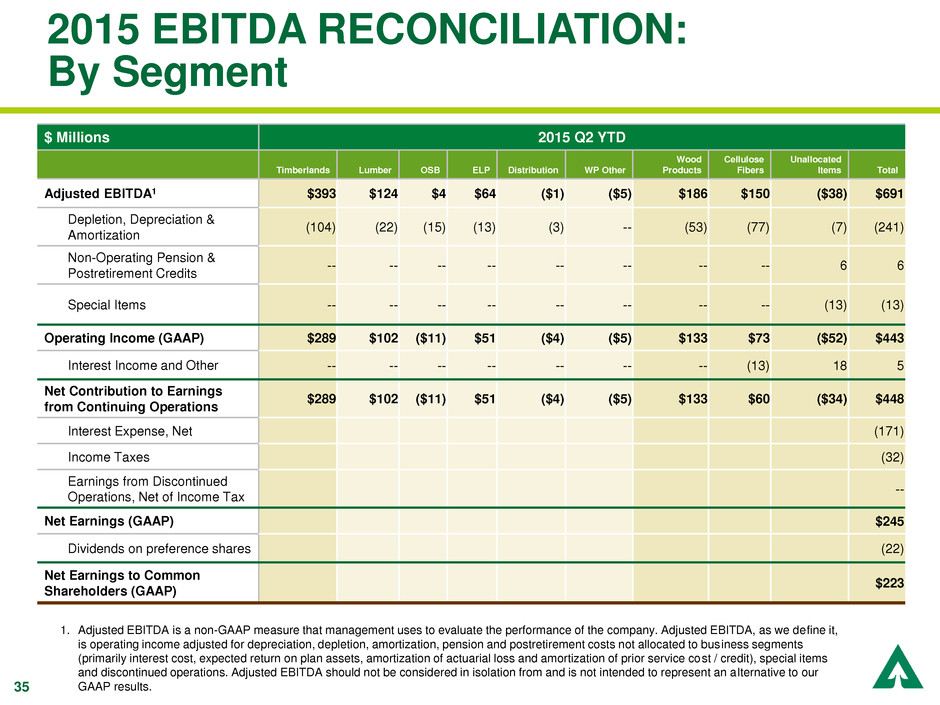

35 $ Millions 2015 Q2 YTD Timberlands Lumber OSB ELP Distribution WP Other Wood Products Cellulose Fibers Unallocated Items Total Adjusted EBITDA1 $393 $124 $4 $64 ($1) ($5) $186 $150 ($38) $691 Depletion, Depreciation & Amortization (104) (22) (15) (13) (3) -- (53) (77) (7) (241) Non-Operating Pension & Postretirement Credits -- -- -- -- -- -- -- -- 6 6 Special Items -- -- -- -- -- -- -- -- (13) (13) Operating Income (GAAP) $289 $102 ($11) $51 ($4) ($5) $133 $73 ($52) $443 Interest Income and Other -- -- -- -- -- -- -- (13) 18 5 Net Contribution to Earnings from Continuing Operations $289 $102 ($11) $51 ($4) ($5) $133 $60 ($34) $448 Interest Expense, Net (171) Income Taxes (32) Earnings from Discontinued Operations, Net of Income Tax -- Net Earnings (GAAP) $245 Dividends on preference shares (22) Net Earnings to Common Shareholders (GAAP) $223 2015 EBITDA RECONCILIATION: By Segment 1. Adjusted EBITDA is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization, pension and postretirement costs not allocated to business segments (primarily interest cost, expected return on plan assets, amortization of actuarial loss and amortization of prior service cost / credit), special items and discontinued operations. Adjusted EBITDA should not be considered in isolation from and is not intended to represent an alternative to our GAAP results.

36 EBITDA RECONCILIATION: Timberlands $ Millions 2011 2012 2013 2014 2015 Q2 LTM West1 $273 $250 $361 $556 $491 South 214 218 225 262 277 Other1 (15) (8) 46 2 8 Adjusted EBITDA2 $472 $460 $632 $820 $776 Depletion, Depreciation & Amortization (137) (142) (166) (207) (208) Special Items 152 -- -- -- -- Operating Income (GAAP) $487 $318 $466 $613 $568 Interest Income and Other 4 3 4 -- -- Loss Attributable to Non- Controlling Interest -- 1 -- -- -- Net Contribution to Earnings $491 $322 $470 $613 $568 1. Results from Longview Timber are included with Western Timberlands for 2014. For 2013, results from Longview Timber are included in Other due to acquisition in July 2013. Other also includes results from international operations and certain administrative charges. 2. Adjusted EBITDA is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization and special items. Adjusted EBITDA should not be considered in isolation from and is not intended to represent an alternative to our GAAP results.

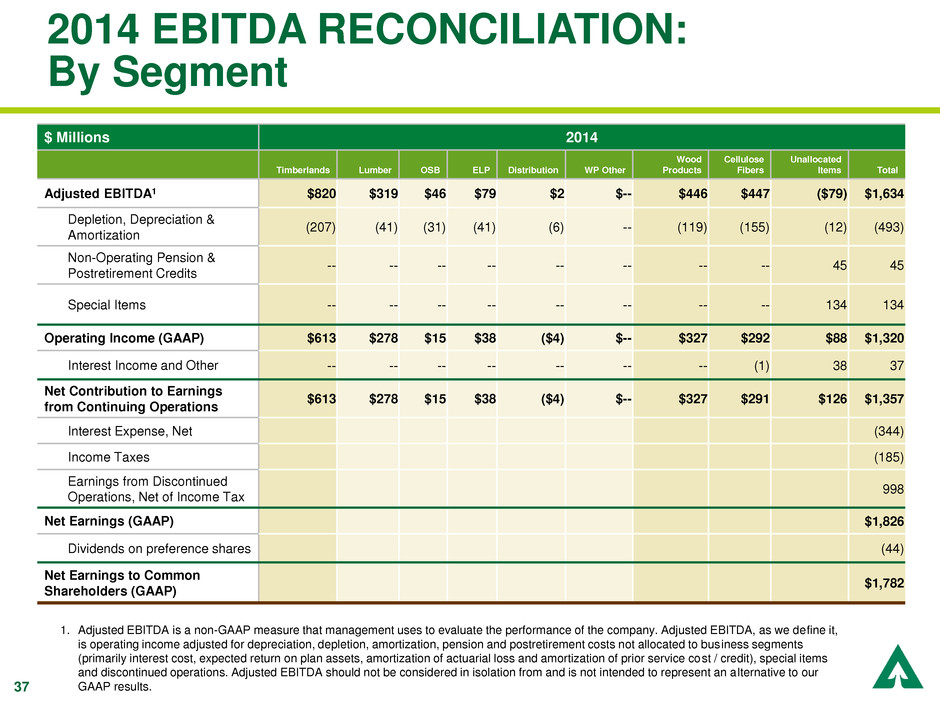

37 $ Millions 2014 Timberlands Lumber OSB ELP Distribution WP Other Wood Products Cellulose Fibers Unallocated Items Total Adjusted EBITDA1 $820 $319 $46 $79 $2 $-- $446 $447 ($79) $1,634 Depletion, Depreciation & Amortization (207) (41) (31) (41) (6) -- (119) (155) (12) (493) Non-Operating Pension & Postretirement Credits -- -- -- -- -- -- -- -- 45 45 Special Items -- -- -- -- -- -- -- -- 134 134 Operating Income (GAAP) $613 $278 $15 $38 ($4) $-- $327 $292 $88 $1,320 Interest Income and Other -- -- -- -- -- -- -- (1) 38 37 Net Contribution to Earnings from Continuing Operations $613 $278 $15 $38 ($4) $-- $327 $291 $126 $1,357 Interest Expense, Net (344) Income Taxes (185) Earnings from Discontinued Operations, Net of Income Tax 998 Net Earnings (GAAP) $1,826 Dividends on preference shares (44) Net Earnings to Common Shareholders (GAAP) $1,782 2014 EBITDA RECONCILIATION: By Segment 1. Adjusted EBITDA is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization, pension and postretirement costs not allocated to business segments (primarily interest cost, expected return on plan assets, amortization of actuarial loss and amortization of prior service cost / credit), special items and discontinued operations. Adjusted EBITDA should not be considered in isolation from and is not intended to represent an alternative to our GAAP results.

38 2013 EBITDA RECONCILIATION: By Segment $ Millions 2013 Timberlands Lumber OSB ELP Distribution WP Other Wood Products Cellulose Fibers Unallocated Items Total Adjusted EBITDA1 $632 $317 $247 $45 ($33) ($2) $574 $353 ($61) $1,498 Depletion, Depreciation & Amortization (166) (40) (31) (46) (5) (1) (123) (156) (13) (458) Non-Operating Pension & Postretirement (Costs) Credits -- -- -- -- -- -- -- -- (40) (40) Special Items -- -- -- (10) -- -- (10) -- (356) (366) Operating Income (GAAP) $466 $277 $216 ($11) ($38) ($3) $441 $197 ($470) $634 Interest Income and Other 4 -- -- -- -- -- -- 3 48 55 Net Contribution to Earnings from Continuing Operations $470 $277 $216 ($11) ($38) ($3) $441 $200 ($422) $689 Interest Expense, Net (369) Income Taxes 171 Earnings from Discontinued Operations, Net of Income Tax 72 Net Earnings (GAAP) $563 Dividends on preference shares (23) Net Earnings to Common Shareholders (GAAP) $540 1. Adjusted EBITDA is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization, pension and postretirement costs not allocated to business segments (primarily interest cost, expected return on plan assets, amortization of actuarial loss and amortization of prior service cost / credit), special items and discontinued operations. Adjusted EBITDA should not be considered in isolation from and is not intended to represent an alternative to our GAAP results.

39 2012 EBITDA RECONCILIATION: By Segment 1. Adjusted EBITDA is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization, pension and postretirement costs not allocated to business segments (primarily interest cost, expected return on plan assets, amortization of actuarial loss and amortization of prior service cost / credit), special items and discontinued operations. Adjusted EBITDA should not be considered in isolation from and is not intended to represent an alternative to our GAAP results. $ Millions 2012 Timberlands Lumber OSB ELP Distribution WP Other Wood Products Cellulose Fibers Unallocated Items Total Adjusted EBITDA1 $460 $130 $143 $17 ($29) ($15) $246 $368 ($78) $996 Depletion, Depreciation & Amortization (142) (45) (31) (51) (5) (1) (133) (150) (19) (444) Non-Operating Pension & Postretirement (Costs) Credits -- -- -- -- -- -- -- -- (29) (29) Special Items -- -- -- -- -- 6 6 -- 89 95 Operating Income (GAAP) $318 $85 $112 ($34) ($34) ($10) $119 $218 ($37) $618 Interest Income and Other 3 -- -- -- -- 1 1 5 39 48 Loss Attributable to Non- Controlling Interest 1 -- -- -- -- -- -- -- -- 1 Net Contribution to Earnings from Continuing Operations $322 $85 $112 ($34) ($34) ($9) $120 $223 $2 $667 Interest Expense, Net (344) Income Taxes (10) Earnings from Discontinued Operations, Net of Income Tax 72 Net Earnings to Common Shareholders (GAAP) $385

40 2011 EBITDA RECONCILIATION: By Segment $ Millions 2011 Timberlands Lumber OSB ELP Distribution WP Other Wood Products Cellulose Fibers Unallocated Items Total Adjusted EBITDA1 $472 ($7) ($4) $6 ($37) ($1) ($43) $597 ($108) $918 Depletion, Depreciation & Amortization (137) (47) (34) (61) (6) (3) (151) (147) (28) (463) Non-Operating Pension & Postretirement (Costs) Credits -- -- -- -- -- -- -- -- (26) (26) Special Items 152 (5) (4) (26) (1) (16) (52) -- -- 100 Operating Income (GAAP) $487 ($59) ($42) ($81) ($44) ($20) ($246) $450 ($162) $529 Interest Income and Other 4 -- -- 1 -- 2 3 2 35 44 Net Contribution to Earnings from Continuing Operations $491 ($59) ($42) ($80) ($44) ($18) ($243) $452 ($127) $573 Interest Expense, Net (389) Income Taxes 86 Earnings from Discontinued Operations, Net of Income Tax 61 Net Earnings to Common Shareholders (GAAP) $331 1. Adjusted EBITDA is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization, pension and postretirement costs not allocated to business segments (primarily interest cost, expected return on plan assets, amortization of actuarial loss and amortization of prior service cost / credit), special items and discontinued operations. Adjusted EBITDA should not be considered in isolation from and is not intended to represent an alternative to our GAAP results.