Attached files

| file | filename |

|---|---|

| 8-K - SHENANDOAH TELECOMMUNICATIONS COMPANY 8-K 9-10-2015 - SHENANDOAH TELECOMMUNICATIONS CO/VA/ | form8k.htm |

Shenandoah Telecommunications CompanyDrexel Hamilton ConferenceSeptember 10, 2015 NASDAQ: SHEN Exhibit 99.1

Safe Harbor Statement This presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, regarding, among other things, our business strategy, our prospects and our financial position. These statements can be identified by the use of forward-looking terminology such as “believes,” “estimates,” “expects,” “intends,” “may,” “will,” “should,” “could,” or “anticipates” or the negative or other variation of these similar words, or by discussions of strategy or risks and uncertainties. These statements are based on current expectations of future events. If underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could vary materially from the Company’s expectations and projections. Important factors that could cause actual results to differ materially from such forward-looking statements include, without limitation, risks related to the following: Increasing competition in the communications industry; andA complex and uncertain regulatory environment.A further list and description of these risks, uncertainties and other factors can be found in the Company’s SEC filings which are available online at www.sec.gov, www.shentel.com or on request from the Company. The Company does not undertake to update any forward-looking statements as a result of new information or future events or developments.

Use of Non-GAAP Financial Measures Included in this presentation are certain non-GAAP financial measures that are not determined in accordance with US generally accepted accounting principles. These financial performance measures are not indicative of cash provided or used by operating activities and exclude the effects of certain operating, capital and financing costs and may differ from comparable information provided by other companies, and they should not be considered in isolation, as an alternative to, or more meaningful than measures of financial performance determined in accordance with US generally accepted accounting principles. These financial performance measures are commonly used in the industry and are presented because Shentel believes they provide relevant and useful information to investors. Shentel utilizes these financial performance measures to assess its ability to meet future capital expenditure and working capital requirements, to incur indebtedness if necessary, return investment to shareholders and to fund continued growth. Shentel also uses these financial performance measures to evaluate the performance of its businesses and for budget planning purposes.

Company Overview Diverse Revenue Streams 3 complementary revenue streams: Wireless, Cable and Wireline All divisions are OIBDA positiveTower Leasing Business Provides Steady Recurring Cash FlowWe own 154 towers with an average of 2.3 tenants each Fiber We control 4,429 route miles of fiberWriting $1.9 million of fiber revenue contracts monthly over the TTM Provide a broad range of diversified telecommunications services to customers in the Mid-Atlantic United States and the exclusive personal communications service ("PCS") Affiliate of Sprint in portions of Pennsylvania, Maryland, Virginia and West Virginia.

External Revenues by Segment ($ in thousands) Annualized based on YTD actuals disclosed in Q2’15 earnings releases for Shentel and nTelos (Western Markets). For illustrative purposes only. Not indicative of future results.

Net Income ($ in millions) Annualized based on YTD actuals disclosed in Q2’15 earnings releases for Shentel and nTelos (Western Markets). For illustrative purposes only. Not indicative of future results.

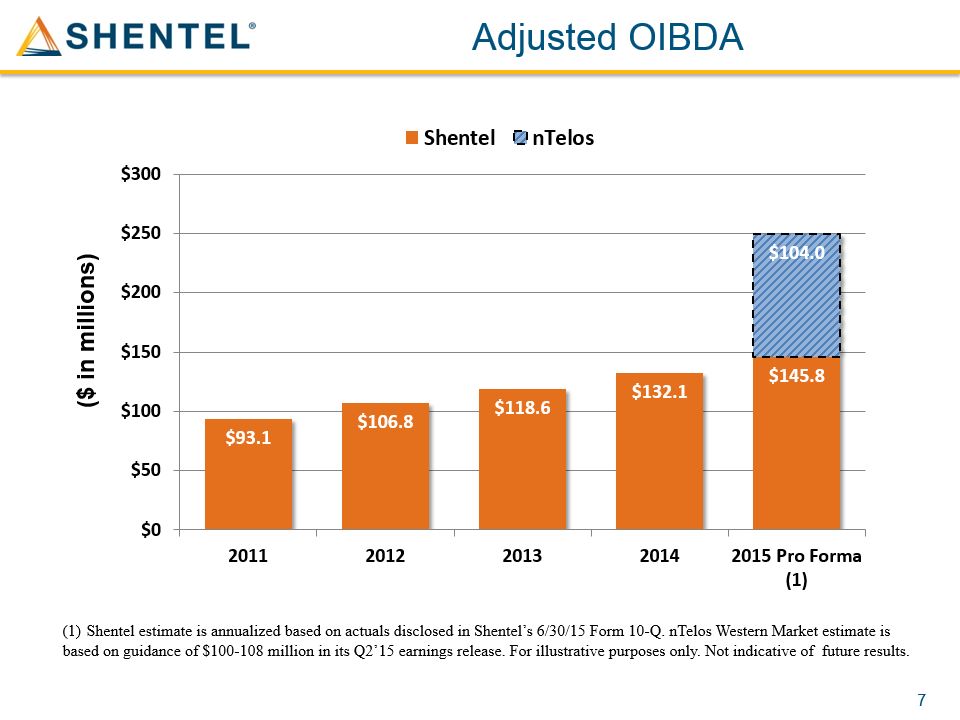

Adjusted OIBDA ($ in millions) Shentel estimate is annualized based on actuals disclosed in Shentel’s 6/30/15 Form 10-Q. nTelos Western Market estimate is based on guidance of $100-108 million in its Q2’15 earnings release. For illustrative purposes only. Not indicative of future results.

One of only 2 Sprint affiliates 2.2 million covered POPs442k total subscribers20% penetration of covered POPs546 base stations Existing Wireless Network Overview 4G LTE Depth: 2nd carrier 3rd carrier November 2013 - 527 sites 0% 0% December 2014 - 538 sites 92% 22% June 2015 - 546 sites 94% 30%

Pro Forma Network Following nTelos Acquisition Shentel Coverage Overlap Coverage NTELOS Coverage Shentel Cable Coverage 4.3 million covered POPs1 million total subscribers24% penetration of covered POPs1,408 base stations after elimination of 148 redundant sites

Postpaid Settlement through 12/31/15 SPRINT PROVIDES Net Service FeeBilling/CollectionsCustomer CareLong DistanceTravel/RoamingNational DistributionEquipment FinancingPayment = 14% of Net Billings Management FeeSpectrumBrandNational PlatformAccess to Sprint vendorsPayment = 8% of Net Billings SHENTEL PROVIDES Network (Towers, Cell Sites, Backhaul, Local Switch)Local Sales and ServiceLocal Advertising & PromotionsPayment = 78% of Net Billings

Attractive Contract With Sprint (rates effective 1/1/16) Initial contract term extended from 2024 to 2029Two 10-year renewalsPayment at termination from 80% of EBV to 90%Postpaid Sprint fees down from 22% to 16.6% Fee (Management: 8%; Service: 8.6%), with a cap of 18% for 2017. Could increase should the net actual costs change by more than 1% ; Items formerly in the Net Service Fee to be billed/credited as incurred:Commissions to National and Regional distributorsNet Handset Subsidies (cost of the handset net of payment received) through Web, National and Regional distributionTravel – $1.5 million net payment to Shentel per month for the first 36 months. Reset for subsequent 3 year periods using non-reciprocal rates.Wholesale – Sprint will pass through fees collected from MVNO’s for usage of the Shentel network

Wireless Subscriber Growth

Expansion of Wireless Subscriber Base With nTelos and Sprint’s subscribers Shentel will:Increase its wireless subscriber base by more than 2.3xThe combined business is expected to have a wireless customer mix of:70% Postpaid30% PrepaidThe transactions position Shentel as the 6th largest public wireless company in the United States Run-Rate Wireless Subscribers1 (‘000) As of June 30, 2015, excluding approximately 8,000 nTelos subscribers expected to be transferred to Sprint at closing.

Net Transaction Consideration As of June 30, 2015 (1)

Planned Operational Initiatives Network Complete the wind down of nTelos’ Eastern MarketsComplete the 4G LTE build-out and deploy 800 MHz spectrum for voice and LTERemove 148 duplicate sitesAdd 150 coverage sitesDeploy 2.5 GHz spectrumLeverage Shentel fiber network for backhaul Customer Service Migrate nTelos subscribers to Sprint’s billing and customer service platforms within 90 days of closeRebrand 38 nTelos Stores & integrate 7 Sprint Stores

Financing Details Financing Structure Purchase price fully funded by $960 million in committed debt financing including:$485 million five-year Term Loan A-1 with amortization of 5% in year 1, 10% in years 2 to 4 and 15% in the final year $400 million seven-year Delayed Draw Term Loan A-2 ($325 million drawn at closing), two years of interest only$75 million Revolving Credit Facility (undrawn at closing)$150 million accordion featureSubject to customary closing conditions2016 pro forma leverage ratio of approximately 3.0x (1) Calculated as Total Debt / TTM Combined Adjusted EBITDA

172K Video Homes Passed*172K Internet Homes Passed169K Voice Homes Passed WV VA MD PA Cable Network * Excludes 16,000 homes passed in Shenandoah County, VA which are included in the wireline segment

Cable - RGU Growth Customers 67,093 68,553 68,385 69,538 71,298 71,469 RGU's/Customer 1.43 1.52 1.58 1.64 1.71 1.73 Chart excludes Video only customers in Shenandoah County, VA

Increasing Average Monthly Cable Revenue Average Monthly Revenue per RGU Average Monthly Revenue per Customer

Investing in the Future Capex Spending ($ millions) * Accounts payable at December 31, 2013 and 2012 included $6.5 million and $24.7 million associated with PCS Network Vision capital expenditures.

Q&A